2.1. Global Medical Device Industry

The global medical device industry is highly driven by a few big markets such as the US, Japan, Germany, and China. In 2019, the US had the world’s largest medical device market, with the size of

$172.9 billion [

21]. It was followed by three major markets; Japan (

$28.9 billion), Germany (

$28.5 billion), and China (

$27.3 billion) [

22]. Though the US will maintains its status as the world’s largest medical device market, other regions such as Asia Pacific and the EU, will continue their growth at a faster pace over the next few years [

9]. With regard to the five-year compound annual growth rate (hereafter, CAGR) from 2014 to 2019, China has the highest CAGR (9.3%) and the US has also shown a solid growth, with a CAGR of 5.4% [

23].

The medical device industry is characterized by a unique mixture of both large established companies and thousands of small companies [

24]. While the large companies take the lead in terms of revenue, the small companies play a critical role as the source of innovation in the earlier stages of R&D [

9]. There are two reasons why the medical device industry has the important role of the small companies. First, medical devices are a very heterogeneous group of products compared to drugs, regarding aspects such as design, use, and purpose [

9]. The fact that there are about 1700 different types of medical devices explains this heterogeneity [

9]. Second, the medical device industry has a highly knowledgeable group of users, who are mostly physicians. As the small medical device companies are generally more receptive to change, this characteristic can support the knowledge transfer from users [

25]. These users are motivated to learn the unmet needs they have figured out in a hospital setting [

26,

27]. Thus, the users are in the forefront of product development through their complex interaction with medical device companies [

28]. The feedback from users allows medical devices to continue their gradual improvement [

29,

30]. The users also work as the apparent source of innovation and launch a new product along with their smaller start-ups. In other words, the opinions of users allow medical device companies to further innovate [

31].

2.3. Open Innovation in the Medical Device Industry

The concept of open innovation is no longer foreign to most stakeholders in the medical device industry. Due to the chronic challenges associated with R&D efficiency, the pharmaceutical industry has already attempted to make a transition to the concept of open innovation in earlier years [

16]. This transition has also occurred in the medical device industry in recent years.

As the medical device industry faces a higher level of competition in the market, it has become more critical for medical device companies to secure a competitive advantage which allows them to compete with others for sustained growth. Given the fiercely competitive environment, the Resource-Based View (RBV) is known to provide the firms with an important framework to better understand how a competitive advantage can be achieved and how such an advantage can last in a sustainable manner [

8]. Resources that are rare and non-substitutable can play a pivotal role in offering a sustained competitive advantage over others [

39]. When it comes to the resources for medical device companies, they include both tangible and intangible resources such as IP, fund, quality certificate, and others. While most medical device companies strive to be equipped with internal capabilities for their sustained growth, some resources can be better obtained from external sources [

8]. Researchers have theorized that dynamic capabilities are strategic processes to access external knowledge with the purpose of implementing value-creating strategies [

8].

Multiple strategy scholars have underlined the importance of knowledge management processes to better explore or exploit knowledge in pursuing open innovation. The important work of Cohen and Levinthal [

40] discussed the absorptive capacity to explain the stage of acquiring external knowledge and assimilating it. As firms are increasingly focusing on interactive knowledge transactions to broaden their knowledge base, scholars began paying attention to the concept of knowledge exploitation [

15]. In an effort to build an integrative view of knowledge management in open innovation, Lichtenthaler [

15] came up with a framework for managing both internal and external knowledge. The framework proposes six knowledge capacities: incentive capacity, transformative capacity, and innovative capacity are for internal knowledge management and absorptive capacity, connective capacity, and desorptive capacity are for external knowledge management. In the context of open innovation processes, firms which plan an outward knowledge transfer require desorptive capacity and firms which drive the acquisition of knowledge need absorptive capacity [

15,

41].

One of the most widely recognized open innovation processes has the following archetypes: outside-in, inside-out, and coupled [

10]. Among the three archetypes, outside-in has been playing a key role in helping large medical device companies to diversify their sources of knowledge. The criticality of external knowledge to the innovation process supports the role of outside-in practice [

40]. Multiple papers on open innovation have also proved that outside-in processes are the most popular choices by firms [

42].

In the past, large medical device companies have relied on internal R&D projects to build their product portfolios [

43]. Their key technological knowledge was mostly developed in-house [

11,

43]. Based on the argument of Lichtenthaler [

12], this traditional approach belongs to the category of closed innovators with limited external technology. While the large medical device companies continue to focus on internal product development, they are also leveraging external partnerships and M&As as a tool to further bet on bolder innovation [

2]. M&As allow these companies to diversify their technological portfolio a lot faster than their internal development [

44]. Mikus et al. [

45] also argued that companies can pursue their own R&D projects, but there are occasions when they do not have the knowledge and the technology which they need. The fact that the acquisition of new knowledge and technology from external parties was proven to be a more efficient approach also supports this transition [

45]. This change in their innovation strategy is tightly related to the current challenges which they are faced with: the pressure to both improve efficiency and reduce costs in an effort to cope with the ever more competitive market environment [

43]. In addition, the ever-shorter product life cycles caused by competition require a faster development cycle-time by exploiting external sources [

46].

Small medical device companies which are generally equipped with unique technological strengths pay more attention to inside-out open innovation opportunities. As the medical device industry is more technology-centric than before, these technological strengths enable the small medical device companies to attempt to execute the inside-out open innovation strategy more actively [

47]. In these inside-out processes, companies exploit their own knowledge by taking ideas to the market or selling IP [

42]. A common example of this strategy is a technology licensing agreement aiming at additional revenue [

11]. By this type of licensing agreement, the companies attempt to generate more revenue and achieve the strategic direction of actively commercializing knowledge [

12].

The open innovation strategies which allow the companies to execute external collaborations include M&As, joint ventures, joint research, and partnerships [

11].

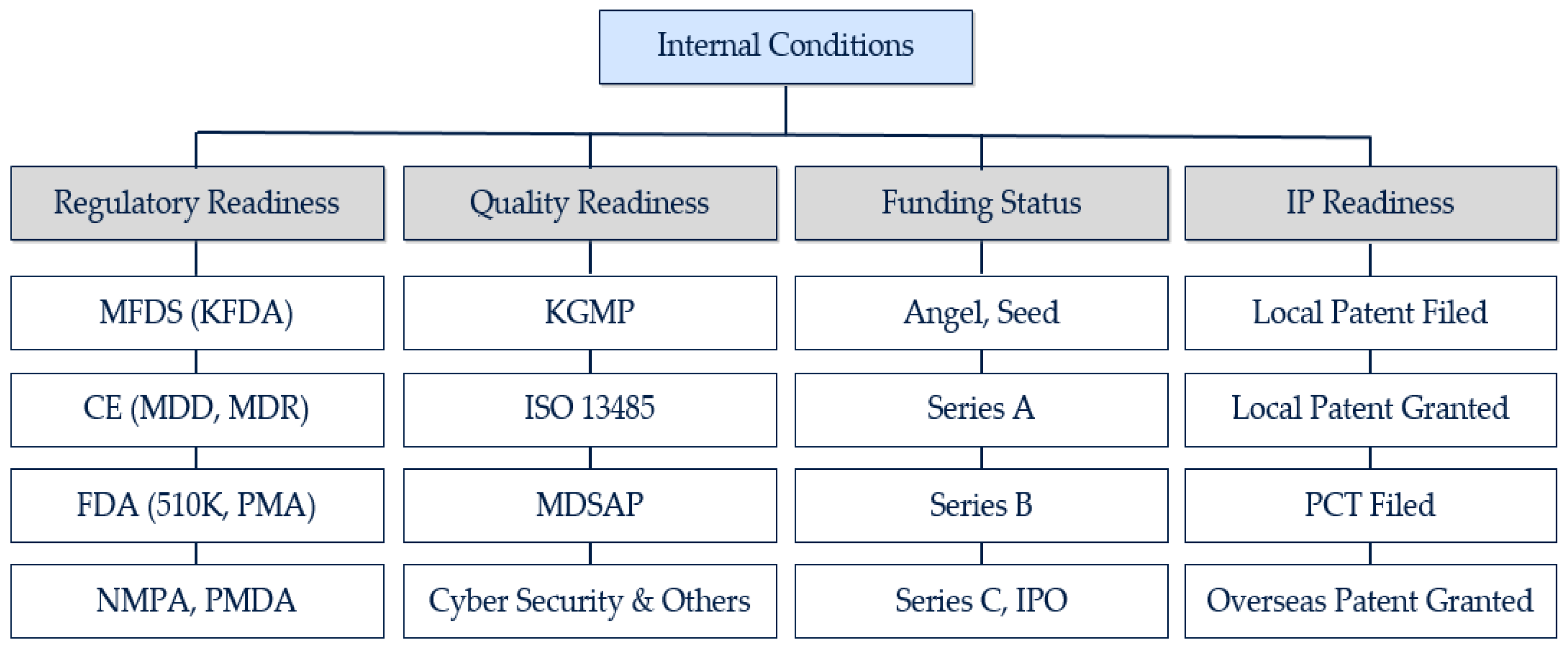

2.4. Research Framework and Variables

To derive the main criteria for each AHP analysis, this study conducted a literature review. While previous studies took the fragmentary approach to the success factors of partnership, this study pursues a comprehensive approach by taking both internal conditions and external conditions into consideration. The main criteria of internal conditions are (1) regulatory readiness, (2) quality readiness, (3) funding status, and (4) IP readiness.

First, as an increasing number of medical device companies are exploring the regulatory approval of products in multiple jurisdictions and the process is a critical pathway in the medical device development, regulatory approval works as a critical factor for the readiness assessment [

5,

37,

48]. The fundamental nature of a partnership deal with a global medical device company requires a certificate in each target country [

9]. A survey with R&D leaders at leading medical device companies also confirmed that 95% of respondents identified global regulatory requirements as a top challenge in the coming years [

43]. In line with the four largest medical device markets (the US, Japan, Germany, and China), this research came up with three sub-categories: Food and Drug Administration (hereafter, FDA), CE (Conformité Européenne, hereafter CE), and National Medical Products Administration (hereafter, NMPA)/Pharmaceuticals and Medical Devices Agency (hereafter, PMDA) [

23]. Then, the Ministry of Food and Drug Safety (hereafter, MFDS) for Korea was added as it is a certificate for most Korean medical device companies.

Second, while obtaining regulatory approval is a key task in the medical device development, establishing a quality system is also important as a medical device can have a direct impact on the health of a patient [

49,

50]. Due to this importance, the production and use of a medical device is firmly regulated by both local laws and international certificate systems [

9]. As Korean Good Manufacturing Practice (hereafter, KGMP) is a mandatory certificate for any product to be sold in Korea, the certificate is selected as a sub-category for the quality readiness category [

51]. International Standard Organization 13485 (hereafter, ISO 13485) is a well-established Quality Management System standard for the medical device industry [

52]. Most medical device companies which plan to enter overseas markets are advised to be equipped with ISO 13485. In an effort to seek consistency among regulatory bodies across the world, the Medical Device Single Audit Program (hereafter, MDSAP) was implemented by an alliance of five regulatory partners (Australia, Brazil, Canada, Japan, and the US). As the program meets the regulatory needs of the participating countries, it can significantly reduce the burden of multiple inspections by producing a harmonized single audit [

32]. Lastly, the sub-category of cyber-security is selected due to the increasing emphasis on the prevention of cyber-attacks against connected medical devices, especially against personal medical devices [

53].

Third, Lee [

54,

55] argued that one of the success factors for medical device start-ups is funding (funding capacity and available funds), and this selection is also aligned with the fact that the medical device industry is quite R&D-intensive, along with the needs for investment [

24]. As firm size and age have an influence on a firm’s knowledge strategies, it is meaningful to have sub-categories which can represent each funding stage [

47]. The earliest funding stage begins with angel financing by business angels [

56]. Then, multiple rounds of funding will generally follow, and this study came up with the following sub-categories: Angel/seed, Series A, Series B, and Series C/Initial Public Offering (hereafter, IPO).

Fourth, in the highly R&D-intensive medical device industry, patents play an important role in a firm’s innovation capabilities [

24,

57]. Patents enable a firm to maintain technological advantages and work as the appropriate indicator of different innovation capabilities [

11]. In addition, the R&D staff finds the existence of patents quite important as the process works as a pre-requisite to pursue further product development [

58,

59]. The development of medical devices requires the review of the IP landscape, and the pursuit of the specific development project can be determined based on the results of a risk management capability assessment [

50]. The internal policy of global medical device companies also requires a potential partner to be equipped with a patent to prevent any latent allegation [

60]. The filing of a local patent is an initial step for intellectual property management, and the Korean Intellectual Property Office (hereafter, KIPO) grants a local patent if a specific technology meets all the requirements [

61]. The Patent Cooperation Treaty (hereafter, PCT), an efficient solution for acquiring patent protection in most member countries, is widely selected by local medical device companies [

59,

62]. This system serves as the tool for entry barriers in the overseas markets [

63]. The PCT helps a device company to protect its information through a lead time over potential competitors [

64]. While the processes of filing and granting are highly interrelated, this paper separated the two stages as it takes at least multiple months to move from the status of filed patent to the status of granted patent. In accordance with the local and international patent system, this research could have the following sub-categories: Local Patent Filed, Local Patent Granted, PCT Filed, and Overseas Patent Granted.

Hence, the research derived the following criteria for the internal conditions (candidate’s readiness) analysis: regulatory readiness, quality readiness, funding status, and intellectual property readiness (

Figure 1).

An AHP analysis of external conditions is used to understand what type of deal structure is preferred by global medical device companies. While the internal conditions (candidate’s readiness) focus on the requirements, the external conditions lay out prioritized criteria which could have a major impact on a partnership agreement. The main criteria of external conditions are (1) type of partnership, (2) targeted geography, (3) choice of brand, and (4) investment type.

First, in line with the objective of the analysis for external conditions, the question of which type of partnership to pursue is one of the main criteria for this analysis. The common practices of open innovation include outsourcing, M&A, and others [

65]. Contract manufacturing lets a partner company manufacture a global medical device company’s product, and it is an apparent case of outsourcing [

66]. Lichtenthaler [

67] stressed the increasing trend of the external exploitation of knowledge, and a licensing deal was one of the options. While a licensing deal aims at utilizing the R&D capabilities of a potential partner through a contractual arrangement, a distribution deal focuses directly on the sales and marketing of a certain product [

68]. In case of a distribution deal, a global medical device company works as a distributor for certain geographies. Mergers and Acquisitions (hereafter, M&A) pursues the full control of a partner company along with the significant amount of capital investment. Despite the need for the investment, larger firms are motivated to acquire a full entity as the key capabilities which are embedded in a target can be better obtained [

69]. Thus, the following sub-categories are derived in the type of partnership category: contract manufacturing, distribution deal, licensing deal, and M&A.

Second, considering that this study covers a partnerships with global medical device companies, which geography to target is an important consideration factor to be discussed. Most licensing contracts define the territory for a deal, and the choice of a cross-border deal is not uncommon [

70]. This factor is known to be critical for a global medical device company, as the choice of market relates to its registration strategy and marketing plan. On top of the home market (Korea), the largest targetable geography is added: the global market. Then, based on both the maturity of a market and the level of technology to be preferred, the emerging market (including China) and developed market (including the US and EU) are derived. The emerging market sub-category includes countries such as Brazil, India, Russia, Indonesia, and China [

71]. The average growth rates of those markets are well above those of developed markets. The EU, a trading bloc, remains the largest importer of US medical devices and is a clear representative of the developed market along with the US [

21]. Hence, the selected sub-categories are Korea, emerging market, developed market, and global (market).

Third, brand is another major factor in external conditions as it has a direct association with regulatory approval and product reputation [

72]. As the contractual arrangement of the Original Equipment Manufacturer (hereafter, OEM) is perceived as a favorable tool for a firm’s business expansion, the brand of a global medical device company is one of the preferred choices in a partnership deal [

73]. While the choice of Multinational Corporation (hereafter, MNC) brand remains as a common option, the increasing emphasis on the brand equity of an individual firm makes a manufacturer become more interested in the choice of its own brand. In this study, the choice of a manufacturer’s own brand will be called partner brand as it explores the possibility of partnering with a global medical device company. While these two choices are relatively common, this study also paid attention to two emerging choices: revised brand and new brand. Revised brand is a hybrid choice as it is based on the brand of a manufacturer but has the flavor of a global medical device company along with any symbol or word representing the global company. New brand refers to a case when a whole new brand is created for a specific partnership deal. The sub-categories in the brand category are as follows: partner brand, MNC Brand, revised brand, and new brand.

Some open innovation strategies, such as M&A and technology acquisition, require monetary investment, but for others, such as distribution agreement, monetary investment is optional [

35,

74]. The type of investment mainly defines the timing of an investment and is a critical decision item for any global medical device company, given its nature as a listed company (in most cases). While a non-investment deal is known as the lightest choice for any company, some companies do consider investment options such as early-stage investment or minority equity investment. Early-stage investment is generally considered when a target company needs to improve its quality standard or be equipped with an additional manufacturing facility. Minority equity investment is executed when a global medical device company finds a deal quite successful and wants to support the capacity expansion of a target company. While minority equity investment by a Private Equity (hereafter, PE) firm generally focuses on a firm performance improvement, global medical device companies focus on how such an investment could support the specific partnership deal [

75]. M&A is a preferred choice, but it is also true that such an investment is considered when the level of certainty is meaningfully high [

13]. Consequently, the following sub-categories are derived: non-investment deal, early-stage investment, minority equity investment, and acquisition.

Therefore, the following criteria for the external conditions are obtained: type of partnership, targeted geography, brand, and type of investment (

Figure 2).