Detecting and Analyzing Fraudulent Patterns of Financial Statement for Open Innovation Using Discretization and Association Rule Mining

Abstract

1. Introduction

2. Materials and Proposed Methods

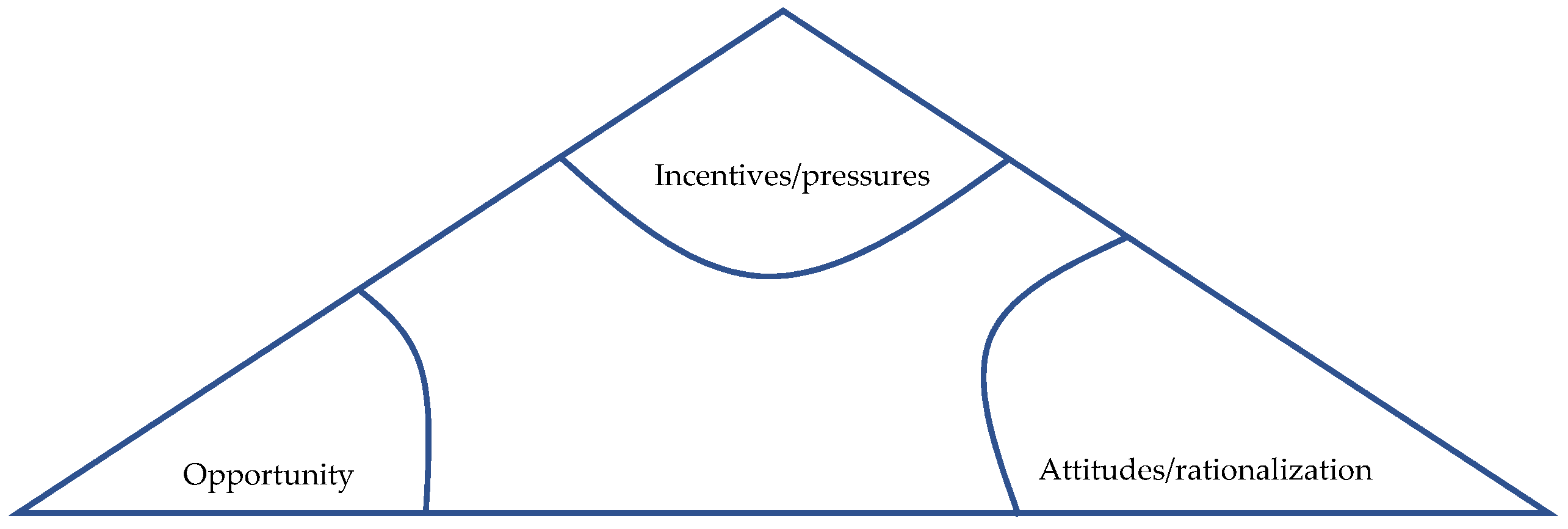

2.1. Fraud Detection

2.1.1. Liquidity Ratios

- The current ratio is the ratio between current assets and current liabilities. It measures the ability to pay short-term obligations.

- The quick ratio, or acid test, is the adjusted version of the current ratio. The calculation does not include inventory with current assets, e.g., cash, accounts receivable, and marketable assets. Therefore, the quick ratio measures the ability to pay debts better than the current ratio.

- The cash ratio measures the liquidity of an entity.

- Accounts receivable turnover is the number of times that an entity collects cash from sales. Therefore, this ratio gives information about policies of giving credit to debtors.

- The collection period is the amount of time it takes for an entity to receive cash from sales in terms of the accounts receivable.

- Inventory turnover measures the performance of the ability to sell goods.

- The holding period is the number of times an entity is able to sell its inventories.

- The cash conversion cycle is the number of days that an entity will receive cash from its operations.

2.1.2. Efficiency Ratios

- The total asset turnover measures how well asset management is used to turn sales or sales revenue over to an entity.

- The net fixed asset turnover ratio shows the efficiency of an operation. It determines whether an entity is performing effectively in a given accounting period.

2.1.3. Profitability Ratios

- The gross profit margin shows the sales and profitability performance after deducting the costs of goods sold, where a higher gross profit margin is better.

- The operating profit margin measures the profitability of an investment after the total price has been calculated.

- The net profit margin presents the profitability of an entity as a percentage of the sales.

- The return on assets (ROA) shows the ability to make a profit from assets. It shows what an entity can do with its assets and how much income comes from asset control.

- The return on equity (ROE) shows the return on investment in the equity of operation.

2.1.4. Debt Management

- The debt-to-asset ratio compares an entity’s debts and assets.

- The debt-to-equity ratio (D/E) shows which assets are borrowed and which come from the capital of the entity.

- The interest coverage ratio compares the operating profit with interest expenses.

2.2. Association Rule Mining

{i,k}→{j},

{j,k}→{i},

{i}→{j,k},

{j}→{i,k},

{k}→{i,j}.

2.3. Frequent Pattern Growth (FP-Growth) Algorithm

| Algorithm 1. FP-Growth Algorithm |

| Input: FP tree Output: The complete set of frequent patterns Method: Call FP-Growth (FP tree, null) Procedure FP-Growth () { (1) if contains a single path (2) then for each combination (denoted as ) of the nodes in the path do (3) generate pattern with support = minimum support of nodes in ; (4) else for each in the header of do { (5) generate pattern with ; (6) construct ‘s conditional pattern base and then ‘s conditional FP tree (7) if (8) then call FP-Growth () } } |

2.4. Discretization

2.4.1. Binning with Equal Width

- (1)

- Sort the data of continuous characteristic values .

- (2)

- Calculate the minimum value of each characteristic .

- (3)

- Calculate the maximum value of each characteristic .

- (4)

- Obtain the range or number of layers using Equations (18) and (19):

2.4.2. Binning with Equal Frequency

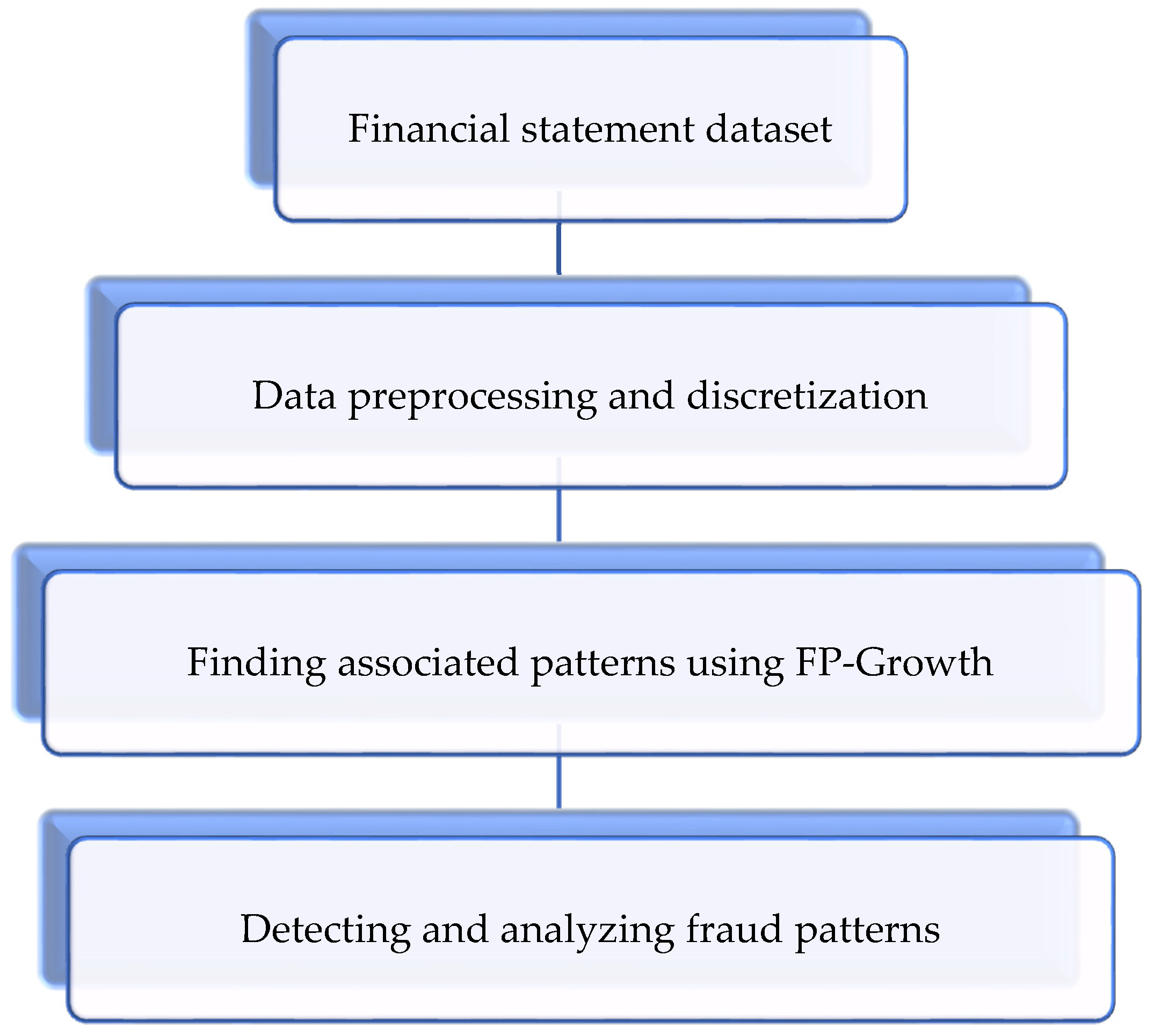

2.5. Proposed Method

2.5.1. Step 1: Data Preprocessing and Discretization

2.5.2. Step 2: Finding Associated Patterns Using FP-Growth

2.5.3. Step 3: Detecting and Analyzing Fraud Patterns

3. Experimental Setup and Results

3.1. Data Description

3.2. Ethical Consideration

3.3. Data Preprocessing and Discretization

3.4. Finding Associated Patterns Using FP-Growth and Analysis

4. Discussion for Open Innovation

The Proposed Solutions from the Research Questions and Detecting Fraud Patterns

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Yao, J.; Pan, Y.; Yang, S.; Chen, Y.; Li, Y. Detecting Fraudulent Financial Statements for the Sustainable Development of the Socio-Economy in China: A Multi-Analytic Approach. Sustainability 2019, 11, 1579. [Google Scholar] [CrossRef]

- Ravisankar, P.; Ravi, V.; Rao, G.R.; Bose, I. Detection of financial statement fraud and feature selection using data mining techniques. Decis. Support Syst. 2011, 50, 491–500. [Google Scholar] [CrossRef]

- The Securities and Exchange Commission, Thailand. Available online: https://www.sec.or.th/EN/Pages/Home.aspx (accessed on 14 July 2020).

- Lin, C.C.; Chiu, A.A.; Huang, S.Y.; Yen, D.C. Detecting the financial statement fraud: The analysis of the differences between data mining techniques and experts’ judgments. Knowl. Based Syst. 2015, 89, 459–470. [Google Scholar] [CrossRef]

- Fanning, K.; Coggor, K.O.; Srivastana, R. Detection of management fraud: A neural network approach. In Proceedings of the IEEE Conference on Artificial Intelligence for Applications, Los Angeles, CA, USA, 20–23 February 1995; pp. 220–223. [Google Scholar]

- Beasley, M.S. An Empirical Analysis of the Relation between the Board of Director Composition and Financial Statement Fraud. Account. Rev. 1996, 71, 443–465. [Google Scholar]

- Bell, T.; Carcello, J. A Decision Aid for Assessing the Likelihood of Fraudulent Financial Reporting. Audit. J. Pract. Theor. 2000, 19, 169–184. [Google Scholar] [CrossRef]

- Spathis, C.; Doumpos, M.; Zopounidis, C. Detecting falsified financial statements: A comparative study using multicriteria analysis and multivariate statistical techniques. Eur. Account. Rev. 2002, 11, 509–535. [Google Scholar] [CrossRef]

- Uzun, H.; Szewczyk, S.; Varma, R. Board Composition and Corporate Fraud. Financ. Anal. J. 2004, 60, 33–43. [Google Scholar] [CrossRef]

- Chen, C.H. Application of grey forecast theory and logit equation in financial crisis warning model from the pre-event control viewpoint. Commer. Manag. Q. 2005, 6, 655–676. [Google Scholar]

- Chen, S. Detection of fraudulent financial statements using the hybrid data mining approach. SpringPlus 2016, 5, 89. [Google Scholar] [CrossRef] [PubMed]

- Song, R.; Huang, L.; Cui, W.; Óskarsdóttir, M.; Vanthienen, J. Fraud Detection of Bulk Cargo Theft in Port Using Bayesian Network Models. Appl. Sci. 2020, 10, 1056. [Google Scholar] [CrossRef]

- Jan, C.-L. An Effective Financial Statements Fraud Detection Model for the Sustainable Development of Financial Markets: Evidence from Taiwan. Sustainability 2018, 10, 513. [Google Scholar] [CrossRef]

- Cressy, D.R. Other People’s Money: A Study in the Social Psychology of Embezzlement; Wadsworth Pub. Co.: Belmont, CA, USA, 1971. [Google Scholar]

- Ramos Montesdeoca, M.; Sánchez Medina, A.J.; Blázquez Santana, F. Research Topics in Accounting Fraud in the 21st Century: A State of the Art. Sustainability 2019, 11, 1570. [Google Scholar] [CrossRef]

- Gozman, D.; Currie, W. The role of Investment Management Systems in regulatory compliance: A Post-Financial Crisis study of displacement mechanisms. J. Inf. Technol. 2014, 29, 44–58. [Google Scholar] [CrossRef]

- Morales, J.; Gendron, Y.; Guénin-Paracini, H. The construction of the risky individual and vigilant organization: A genealogy of the fraud triangle. Account. Organ. Soc. 2014, 39, 170–194. [Google Scholar] [CrossRef]

- Machado, M.R.R.; Gartner, I.R. The Cressey hypothesis (1953) and an investigation into the occurrence of corporate fraud: An empirical analysis conducted in Brazilian banking institutions. Rev. Contab. Financ. 2017, 29, 60–81. [Google Scholar] [CrossRef]

- Lokanan, M.E. Challenges to the fraud triangle: Questions on its usefulness. Account. Forum 2015, 39, 201–224. [Google Scholar] [CrossRef]

- Zainudin, E.F.; Hashim, H.A. Detecting fraudulent financial reporting using financial ratio. J. Financ. Report. Account. 2016, 14, 266–278. [Google Scholar] [CrossRef]

- Kanapickienė, R.; Grundienė, Z. The Model of Fraud Detection in Financial Statements by Means of Financial Ratios. Procedia Soc. Behav. Sci. 2015, 213, 321–327. [Google Scholar] [CrossRef]

- Kourtis, E.; Kourtis, G.; Curtis, P. An Integrated Financial Ratio Analysis as a Navigation Compass through the Fraudulent Reporting Conundrum: A Case Study. Int. J. Financ. Insur. Risk Manag. 2019, 9, 3–20. [Google Scholar]

- Climent, F.; Momparler, A.; Carmona, P. Anticipating bank distress in the Eurozone: An Extreme Gradient Boosting approach. J. Bus. Res. 2019, 101, 885–896. [Google Scholar] [CrossRef]

- De Luca, F.; Meschieri, E. Financial Distress Pre-Warning Indicators: A Case Study on Italian Listed Companies. J. Credit Risk 2017, 13, 73–94. [Google Scholar] [CrossRef]

- Jiang, Y.; Jones, S. Corporate distress prediction in China: A machine learning approach. Account. Financ. 2018, 58, 1063–1109. [Google Scholar] [CrossRef]

- Zhao, L.; Hao, F.; Xu, T.; Dong, X. Positive and Negative Association Rules Mining for Mental Health Analysis of College Students. EURASIA J. Math. Sci. Technol. Educ. 2017, 13, 5577–5587. [Google Scholar] [CrossRef]

- Park, J.; Cha, Y.; Jassmi, H.A.; Han, S.; Hyun, C. Identification of Defect Generation Rules among Defects in Construction Projects Using Association Rule Mining. Sustainability 2020, 12, 3875. [Google Scholar] [CrossRef]

- Han, J.; Pei, J.; Yin, Y.; Mao, R. Mining Frequent Patterns without Candidate Generation: A Frequent-Pattern Tree Approach. Data Min. Knowl. Discov. 2004, 8, 53–87. [Google Scholar] [CrossRef]

- Wong, A.K.C.; Chiu, D.K.Y. Synthesizing Statistical Knowledge from Incomplete Mixed-Mode Data. IEEE Trans. Pattern Anal. Mach. Intell. 1987, 6, 796–805. [Google Scholar] [CrossRef] [PubMed]

- Federation of Accounting Professions, Thailand. Available online: https://www.tfac.or.th/Article/Detail/102613 (accessed on 14 July 2020).

- Rapidminer. Available online: https://rapidminer.com/ (accessed on 5 December 2020).

- Garcia, S.; Luengo, J.; Saez, A.; Lopez, V.; Herrera, F. A Survey of Discretization Techniques: Taxonomy and Empirical Analysis in Supervised Learning. IEEE Trans. Knowl. Data Eng. 2011, 25, 734–750. [Google Scholar] [CrossRef]

- Dalnial, H.; Kamaluddin, A.; Sanusi, Z.M.; Khairuddin, K. Detecting Fraudulent Financial Reporting through Financial Statement Analysis. J. Adv. Manag. Sci. 2014, 2, 17–22. [Google Scholar] [CrossRef][Green Version]

- Rist, M.; Pizzica, A.J.; LLC, P. Financial Ratios for Executives: How to Assess Company Strength, Fix Problems, and Make Better Decisions, 1st ed.; Apress: New York, NY, USA, 2014; pp. 7–21. [Google Scholar]

| No. | Financial Items |

|---|---|

| 1 | Debt |

| 2 | Total assets |

| 3 | Gross profit |

| 4 | Net profit |

| 5 | Primary business income |

| 6 | Cash and deposits |

| 7 | Accounts receivable |

| 8 | Inventory/Primary business income |

| 9 | Inventory/Total assets |

| 10 | Gross profit/Total assets |

| 11 | Net profit/Total assets |

| 12 | Current assets/Total assets |

| 13 | Net profit/Primary business income |

| 14 | Accounts receivable/Primary business income |

| 15 | Primary business income/Total assets |

| 16 | Current assets/Current liabilities |

| 17 | Primary business income/Fixed assets |

| 18 | Cash/Total assets |

| 19 | Inventory/Current liabilities |

| 20 | Total debt/Total equity |

| 21 | Long-term debt/Total assets |

| 22 | Net profit/Gross profit |

| 23 | Total debt/Total assets |

| 24 | Total assets/Capital and reserves |

| 25 | Long-term debt/Total capital and reserves |

| 26 | Fixed assets/Total assets |

| 27 | Deposits and cash/Current assets |

| 28 | Capital and reserves/Total debt |

| 29 | Accounts receivable/Total assets |

| 30 | Gross profit/Primary business profit |

| 31 | Undistributed profit/Net profit |

| 32 | Primary business profit/Last year’s primary business profit |

| 33 | Primary business income/Last year’s primary business income |

| 34 | Accounts receivable/Last year’s accounts receivable |

| 35 | Total assets/Last year’s total assets |

| Financial Items | Company 1 | Company 2 | Company 3 |

|---|---|---|---|

| 1. Debt (Baht) | 1,690,430.58 | 716,485.53 | 11,568,073.34 |

| 2. Total assets (Baht) | 33,057,234.15 | 19,326,761.01 | 29,429,665.83 |

| 3. Gross profit (Baht) | 1,124,880.67 | 701,426.80 | 2,008,596.55 |

| 4. Net profit (Baht) | 2,687,916.34 | 1,609,474.03 | 1,026,928.34 |

| 5. Primary business income (Baht) | 6,586,040.08 | 6,047,604.92 | 16,846,748.28 |

| 6. Cash and deposits (Baht) | 2,912,253.04 | 1,267,881.86 | 1,879,587.46 |

| 7. Accounts receivable (Baht) | 1,051,601.39 | 690,322.79 | 5,515,889.69 |

| 8. Inventory/Primary business income | 0.03 | 0.02 | 0.08 |

| 9. Inventory/Total assets | 0.00 | 0.01 | 0.05 |

| 10. Gross profit/Total assets | 0.03 | 0.04 | 0.07 |

| 11. Net profit/Total assets | 0.08 | 0.08 | 0.03 |

| 12. Current assets/Total assets | 0.14 | 0.12 | 0.48 |

| 13. Net profit/Primary business income | 0.41 | 0.27 | 0.06 |

| 14. Accounts receivable/Primary business income | 0.16 | 0.11 | 0.33 |

| 15. Primary business income/Total assets | 0.20 | 0.31 | 0.57 |

| 16. Current assets/Current liabilities | 4.84 | 3.16 | 1.14 |

| 17. Primary business income/Fixed assets | 0.24 | 0.37 | 11.87 |

| 18. Cash/Total assets | 0.09 | 0.07 | 0.06 |

| 19. Inventory/Current liabilities | 0.17 | 0.20 | 0.11 |

| 20. Total debt/Total equity | 2.88 | 2.28 | 1.75 |

| 21. Long-term debt/Total assets | 0.59 | 0.56 | 0.21 |

| 22. Net profit/Gross profit | 2.39 | 2.29 | 0.51 |

| 23. Total debt/Total assets | 0.74 | 0.69 | 0.64 |

| 24. Total assets/Capital and reserves | 8.08 | 4.72 | 4.88 |

| 25. Long-term debt/Total capital and reserves | 4.79 | 2.64 | 1.05 |

| 26. Fixed assets/Total assets | 0.83 | 0.84 | 0.05 |

| 27. Deposits and cash/Current assets | 0.64 | 0.56 | 0.13 |

| 28. Capital and reserves/Total debt | 0.17 | 0.30 | 0.32 |

| 29. Accounts receivable/Total assets | 0.03 | 0.04 | 0.19 |

| 30. Gross profit/Primary business profit | 0.17 | 0.12 | 0.12 |

| 31. Undistributed profit/Net profit | 1.00 | 1.00 | 1.00 |

| 32. Primary business profit/Last year’s primary business profit | 1.60 | 1.46 | 0.90 |

| 33. Primary business income/Last year’s primary business income | 1.67 | 5.99 | 0.99 |

| 34. Accounts receivable/Last year’s accounts receivable | 1.52 | 1.31 | 1.27 |

| 35. Total assets/Last year’s total assets | 1.71 | 1.69 | 1.64 |

| Bins = 3 | Bins = 5 | Bins = 10 | |||

|---|---|---|---|---|---|

| No. | Debt Range | No. | Debt Range | No. | Debt Range |

| 1 | range1 [−∞, 0] | 1 | range1 [−∞, 0] | 1 | range1 [−∞, 0] |

| 2 | range11 [0, 5775.475] | 2 | range7 [0, 5775.475] | 2 | range4 [0, 18,276] |

| 3 | range12 [5775.475, 16,125.735] | 3 | range8 [5775.475, 18,276] | 3 | range5 [18,276, 108,441.965] |

| 4 | range13 [16,125.735, 18,874.330] | 4 | range9 [18,276, 48,767.140] | 4 | range6 [108,441.965, 218,665.525] |

| 5 | range14 [18,874.330, 35,008.140] | 5 | range10 [48,767.140, 108,441.965] | 5 | range7 [218,665.525, 358,176.500] |

| 6 | range15 [35,008.140, 69,789.795] | 6 | range11 [108,441.965, 170,233.180] | 6 | range8 [358,176.500, 564,336.500] |

| 7 | range16 [69,789.795, 108,441.965] | 7 | range12 [170,233.180, 218,665.525] | 7 | range9 [564,336.500, 1,383,460.165] |

| 8 | range17 [108,441.965, 143,453.215] | 8 | range13 [218,665.525, 278,100] | 8 | range10 [1,383,460.165, 1,791,158.825] |

| 9 | range18 [143,453.215, 187,749.960] | 9 | range14 [278,100, 358,176.500] | 9 | range11 [1,791,158.825, 3,316,991.900] |

| 10 | range19 [187,749.960, 214,246.395] | 10 | range15 [358,176.500, 397,512.500] | 10 | range12 [3,316,991.900, 5,881,181] |

| 11 | range20 [214,246.395, 240,716] | 11 | range16 [397,512.500, 564,336.500] | 11 | range13 [5,881,181, 11,589,184.040] |

| 12 | range21 [240,716, 278,100] | 12 | range17 [564,336.500, 896,004.940] | 12 | range14 [11,589,184.040, ∞] |

| 13 | range22 [278,100, 345,000] | 13 | range18 [896,004.940, 1,383,460.165] | ||

| 14 | range23 [345,000, 366,635.690] | 14 | range19 [1,383,460.165, 1,591,559.500] | ||

| 15 | range24 [366,635.690, 397,512.500] | 15 | range20 [1,591,559.500, 1,791,158.825] | ||

| 16 | range25 [397,512.500, 432,611.240] | 16 | range21 [1,791,158.825, 2,098,418.640] | ||

| 17 | range26 [432,611.240, 564,336.500] | 17 | range22 [2,098,418.640, 3,316,991.900] | ||

| 18 | range27 [564,336.500, 787,242.765] | 18 | range23 [3,316,991.900, 4,013,489.555] | ||

| 19 | range28 [787,242.765, 928,245.435] | 19 | range24 [4,013,489.555, 5,881,181] | ||

| 20 | range29 [928,245.435, 1,245,381.955] | 20 | range25 [5,881,181, 8,862,674.645] | ||

| 21 | range30 [1,245,381.955, 1,538,010.670] | 21 | range26 [8,862,674.645, 11,589,184.040] | ||

| 22 | range31 [1,538,010.670, 1,591,559.500] | 22 | range27 [11,589,184.040, 13,703,104.500] | ||

| 23 | range32 [1,591,559.500, 1,670,215.290] | 23 | range28 [13,703,104.500, ∞] | ||

| 24 | range33 [1,670,215.290, 1,839,577.725] | ||||

| 25 | range34 [1,839,577.725, 2,030,884] | ||||

| 26 | range35 [2,030,884, 2,277,762.730] | ||||

| 27 | range36 [2,277,762.730, 3,316,991.900] | ||||

| 28 | range37 [3,316,991.900, 3,923,544.565] | ||||

| 29 | range38 [3,923,544.565, 4,129,893.265] | ||||

| 30 | range39 [4,129,893.265, 5,548,494] | ||||

| 31 | range40 [5,548,494, 6,719,824] | ||||

| 32 | range41 [6,719,824, 8,862,674.645] | ||||

| 33 | range42 [8,862,674.645, 10,418,841.195] | ||||

| 34 | range43 [10,418,841.195, 12,068,668.200] | ||||

| 35 | range44 [12,068,668.200, 13,571,391.735] | ||||

| 36 | range45 [13,571,391.735, 17,755,478.080] | ||||

| 37 | range46 [17,755,478.080, ∞] | ||||

| Bins = 3 | Bins = 5 | Bins = 8 | |||

|---|---|---|---|---|---|

| No. | Debt Range | No. | Debt Range | No. | Debt Range |

| 1 | range1 [−∞–77,166.845] | 1 | range1 [−∞–241.710] | 1 | range1 [−∞–241.710] |

| 2 | range2 [77,166.845–1,591,559.500] | 2 | range2 [241.710–195,492] | 2 | range2 [241.710–11,398.880] |

| 3 | range3 [1,591,559.500–∞] | 3 | range3 [195,492–870,004.940] | 3 | range3 [11,398.880–143,453.215] |

| 4 | range4 [870,004.940–3,662,379.995] | 4 | range4 [143,453.215–366,635.690] | ||

| 5 | range5 [3,662,379.995–∞] | 5 | range5 [366,635.690–1,163,525.125] | ||

| 6 | range6 [1,163,525.125–2,098,418.640] | ||||

| 7 | range7 [2,098,418.640–6,719,824] | ||||

| 8 | range8 [6,719,824–∞] | ||||

| No. | Antecedent | Consequent |

|---|---|---|

| 1 | Cash and deposits = range25 [7,075,491.695, 8,719,642.390] | Debt = range1 [−∞, 0] |

| 2 | Deposits and cash/Current assets = range19 [0.317, 0.357] | Debt = range1 [−∞, 0] |

| 3 | Net profit/Gross profit = range23 [0.766, 0.849] | Debt = range1 [−∞, 0] |

| 4 | Total assets = range24 [70,621,902.480, 97,901,347.495] | Capital and reserves/Total debt = range28 [19.932, ∞] |

| 5 | Accounts receivable/Primary business income = range28 [0.791, ∞] | Capital and reserves/Total debt = range28 [19.932, ∞] |

| 6 | Accounts receivable/Primary business income = range28 [0.791, ∞] | Gross profit/Primary business profit = range28 [0.777, ∞] |

| 7 | Capital and reserves/Total debt = range24 [1.873, 2.314] | Gross profit = range4 [56,867.525, 107,366.280] |

| 8 | Capital and reserves/Total debt = range28 [19.932, ∞] | Gross profit/Primary business profit = range28 [0.777, ∞] |

| 9 | Gross profit = range28 [16,622,993, ∞] | Total assets = range28 [217,583,855, ∞] |

| 10 | Long-term debt/Total assets = range2 [0.002, 0.008] | Long-term debt/Total capital and reserves = range2 [0.001, 0.016] |

| 11 | Primary business income = range28 [150,193,704, ∞] | Primary business income/Total assets = range28 [2.450, ∞] |

| 12 | Total debt/Total assets = range10 [0.334, 0.367] | Total debt/Total equity = range10 [0.502, 0.579] |

| 13 | Total debt/Total assets = range11 [0.367, 0.398] | Total debt/Total equity = range11 [0.579, 0.662] |

| 14 | Total debt/Total assets = range12 [0.398, 0.417] | Total debt/Total equity = range12 [0.662, 0.717] |

| 15 | Total debt/Total assets = range13 [0.417, 0.454] | Total debt/Total equity = range13 [0.717, 0.832] |

| 16 | Total debt/Total assets = range14 [0.454, 0.472] | Total debt/Total equity = range14 [0.832, 0.895] |

| 17 | Total debt/Total assets = range15 [0.472, 0.492] | Total debt/Total equity = range15 [0.895, 0.967] |

| 18 | Total debt/Total assets = range16 [0.492, 0.515] | Total debt/Total equity = range16 [0.967, 1.061] |

| 19 | Total debt/Total assets = range17 [0.515, 0.530] | Total debt/Total equity = range17 [1.061, 1.129] |

| 20 | Total debt/Total assets = range18 [0.530, 0.545] | Total debt/Total equity = range18 [1.129, 1.196] |

| 21 | Total debt/Total assets = range19 [0.545, 0.557] | Total debt/Total equity = range19 [1.196, 1.258] |

| 22 | Total debt/Total assets = range2 [0.013, 0.097] | Total debt/Total equity = range2 [0.013, 0.108] |

| 23 | Total debt/Total assets = range20 [0.557, 0.568] | Total debt/Total equity = range20 [1.258, 1.315] |

| 24 | Total debt/Total assets = range23 [0.624, 0.648] | Total debt/Total equity = range23 [1.657, 1.840] |

| 25 | Total debt/Total assets = range24 [0.648, 0.673] | Total debt/Total equity = range24 [1.840, 2.061] |

| 26 | Total debt/Total assets = range25 [0.673, 0.700] | Total debt/Total equity = range25 [2.061, 2.335] |

| 27 | Total debt/Total assets = range26 [0.700, 0.711] | Total debt/Total equity = range26 [2.335, 2.460] |

| 28 | Total debt/Total assets = range27 [0.711, 0.738] | Total debt/Total equity = range27 [2.460, 2.813] |

| 29 | Total debt/Total assets = range28 [0.738, ∞] | Total debt/Total equity = range28 [2.813, ∞] |

| 30 | Total debt/Total assets = range3 [0.097, 0.118] | Total debt/Total equity = range3 [0.108, 0.133] |

| 31 | Total debt/Total assets = range4 [0.118, 0.141] | Total debt/Total equity = range4 [0.133, 0.165] |

| 32 | Total debt/Total assets = range5 [0.141, 0.168] | Total debt/Total equity = range5 [0.165, 0.202] |

| 33 | Total debt/Total assets = range6 [0.168, 0.238] | Total debt/Total equity = range6 [0.202, 0.312] |

| 34 | Total debt/Total assets = range7 [0.238, 0.272] | Total debt/Total equity = range7 [0.312, 0.375] |

| 35 | Total debt/Total assets = range8 [0.272, 0.306] | Total debt/Total equity = range8 [0.375, 0.440] |

| 36 | Total debt/Total assets = range9 [0.306, 0.334] | Total debt/Total equity = range9 [0.440, 0.502] |

| 37 | Accounts receivable/Primary business income = range28 [0.791, ∞] | Capital and reserves/Total debt = range28 [19.932, ∞], Gross profit/Primary business profit = range28 [0.777, ∞] |

| 38 | Capital and reserves/Total debt = range28 [19.932, ∞] | Accounts receivable/Primary business income = range28 [0.791, ∞], Gross profit/Primary business profit = range28 [0.777, ∞] |

| No. | Antecedent | Consequent |

|---|---|---|

| 5 | Accounts receivable/Primary business income = range28 [0.791, ∞] | Capital and reserves/Total debt = range28 [19.932, ∞] |

| 6 | Accounts receivable/Primary business income = range28 [0.791, ∞] | Gross profit/Primary business profit = range28 [0.777, ∞] |

| 7 | Capital and reserves/Total debt = range24 [1.873, 2.314] | Gross profit = range4 [56,867.525, 107,366.280] |

| 8 | Capital and reserves/Total debt = range28 [19.932, ∞] | Gross profit/Primary business profit = range28 [0.777, ∞] |

| 9 | Gross profit = range28 [16,622,993, ∞] | Total assets = range28 [217,583,855, ∞] |

| 10 | Long-term debt/Total assets = range2 [0.002, 0.008] | Long-term debt/Total capital and reserves = range2 [0.001, 0.016] |

| 11 | Primary business income = range28 [150,193,704, ∞] | Primary business income/Total assets = range28 [2.450, ∞] |

| 37 | Accounts receivable/Primary business income = range28 [0.791, ∞] | Capital and reserves/Total debt = range28 [19.932, ∞], Gross profit/Primary business profit = range28 [0.777, ∞] |

| 38 | Capital and reserves/Total debt = range28 [19.932, ∞] | Accounts receivable/Primary business income = range28 [0.791, ∞], Gross profit/Primary business profit = range28 [0.777, ∞] |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sawangarreerak, S.; Thanathamathee, P. Detecting and Analyzing Fraudulent Patterns of Financial Statement for Open Innovation Using Discretization and Association Rule Mining. J. Open Innov. Technol. Mark. Complex. 2021, 7, 128. https://doi.org/10.3390/joitmc7020128

Sawangarreerak S, Thanathamathee P. Detecting and Analyzing Fraudulent Patterns of Financial Statement for Open Innovation Using Discretization and Association Rule Mining. Journal of Open Innovation: Technology, Market, and Complexity. 2021; 7(2):128. https://doi.org/10.3390/joitmc7020128

Chicago/Turabian StyleSawangarreerak, Siriporn, and Putthiporn Thanathamathee. 2021. "Detecting and Analyzing Fraudulent Patterns of Financial Statement for Open Innovation Using Discretization and Association Rule Mining" Journal of Open Innovation: Technology, Market, and Complexity 7, no. 2: 128. https://doi.org/10.3390/joitmc7020128

APA StyleSawangarreerak, S., & Thanathamathee, P. (2021). Detecting and Analyzing Fraudulent Patterns of Financial Statement for Open Innovation Using Discretization and Association Rule Mining. Journal of Open Innovation: Technology, Market, and Complexity, 7(2), 128. https://doi.org/10.3390/joitmc7020128