Investment Models for Enterprise Architecture (EA) and IT Architecture Projects within the Open Innovation Concept

Abstract

1. Introduction

- Evolution-based development and management of business architecture;

- An integral picture of the enterprise;

- Higher capitalization of the enterprise;

- Harmonization of operating activities and IT with the business strategy;

- Improved coordination of activities with business partners;

- Customer-centered orientation;

- Improved and standardized business processes, harmonization (leveling) of business operations and IT;

- Greater efficiency of using data and information, more effective decision making;

- Improved innovation management, risk management, personnel management, asset management, change management;

- Improved IT investment management and more opportunities for replicating and scaling architectural solutions;

- More efficient operating activities, significant quality improvements, more stable business operations, cost savings, shorter solution adoption, and product manufacturing cycles.

- The transparency of operations ensured by the business architecture model allows both efficient management of the organization, in the short run, and timely reaction to changes in the external environment by restructuring its activities;

- The agility provided by EA makes it possible for the organization to shift smoothly and effectively from one technology to another, from one business model to a new one.

- Supervisory control and data acquisition (SCADA) systems;

- Management information systems (MIS);

- Enterprise resource planning (ERP);

- Business intelligence (BI) systems;

- Information technologies;

- Infrastructure (communication, control, and automation shops, in-house personnel, labs, services, etc.).

- Forecasting investments for integral IT architecture design and implementation projects to make automation projects more efficient by ensuring the integrity of the created architectural model;

- More precise investment and assessment models of enterprise creation project cost by including IT costs;

- Shortening the investment cycle of putting created/upgraded works into operation by synchronizing the creation of an enterprise with its IT architecture;

- The operationalization of these IT inclusive investment models through adequate quantitative software-specific measures.

2. Related Work

- Total Cost of Ownership—TCO;

- Internal business efficiency—Cost-Effectiveness Analysis (CEA): cutting costs of business processes including automation and optimization;

- External efficiency: expanding the market share and penetrating new markets through efficient marketing and logistics;

- Overall business value: increasing business value through the availability of an efficient IT infrastructure.

3. Theoretical Background

3.1. Total Cost of Ownership (TCO)

- (a)

- Explicit factors: such as hardware, license buying, and license payments, personnel, expenses on the adoption of software and equipment, maintenance and support, development of user apps, upgrading, and power supply;

- (b)

- Indirect factors: such as system idle periods in terms of lost opportunities and capacity, territorial attachment, changes in platforms and technology, availability of nonstandard configurations, and training of new users.

3.2. Total Value of Ownership (TVO)

3.3. Internal Business Efficiency: Cost Effectiveness Analysis (CEA)

- On the one hand, automation lowers the process costs by cutting their execution time and consumption of particular resources (for example, manpower and hard-copy paperwork), as well as improving the precision of decision making;

- On the other hand, automation transfers the cost of using IT to the process cost;

- The traditional limitations of CEA include:

- An expensive and highly complex collection of the data necessary for cost assessment of the process steps. This is especially true for management processes where the main part of the cost structure is staff working hours. Since decisions on integrating information systems are mostly related to changing management processes, this flaw affects the application of CEA for assessing the efficiency of projects for developing IT architecture and its elements;

- Consideration of permanent costs as a variable. Similar to other approaches of transferring costs to their origin centers (processes, products, services), CEA treats fixed costs as if they were variable and, therefore, provides an inaccurate picture that may lead to wrong decisions. Thus, the transfer of the IT system cost to individual processes may lead to a refusal to implement them, even though this refusal will negatively affect the business in general;

- The difficulty of the allocation of the overhead costs to the process steps;

- The approach helps calculate each process cost, but it is difficult to determine the automation impact on the process cost, and especially difficult to evaluate the cost and cost effectiveness of integrated process automation.

3.4. Business Value

- The quality of key task performance. Although delegated to the company managers, it is defined by the business owners and the most informative performance indicator for them is the prosperity of the organization, i.e., increase of the business value;

- The traditional enterprise cost-effectiveness indices (net surplus, operational margin, etc.), as well as economic efficiency indices of investment projects (net present value, payback time), do not allow adequate assessments of the effect of strategic managerial decisions in the long run. The recommended index of the long-term financial effect of investments or managerial decisions is business value;

- Assessment centered on profit improvements ignores working conditions and other non-monetary factors that may have no negative effect on operating profits but may have a potentially negative effect on future activities.

- Discounted cash flow (DCF, NPV): this model is broadly used in practice because it is based on inbound and outbound cash flows, not on accounting income. This parameter is informative for strategic analysis but is not fit for historical evaluation. At the same time, this model is based on a historical evaluation for the return on investment (ROI) through the weighted average capital cost (WACC). This index must be enriched with strategic and operational factors of business value;

- Economic profits: this model helps to determine whether the company generates enough profit for reimbursing its capital cost. Similar to the first model, it takes into account future operating income flows against the weighted average capital cost (WACC);

- Adjusted present value (APV): this model is calculated as the discounted cash flow but on the assumption that the project is fully paid for by means of the organization’s funds, which mainly carries tax benefits;

- Free cash flow on equity (FCFE): this model shows the cash flows that can be distributed as dividends among the shareholders after all expenses and reinvestments are made and debts paid. While the dividends are the cash flows paid to the shareholders, the FCFE is the cash flow available to them. It is usually calculated as part of the DCF evaluation. This index is rarely used for business assessment because in this model the operating performance and the structure of capital in the cash flow are mixed, which may lead to errors in business value assessment [45].

4. Results

- Integral IT architecture design and implementation project assessment: making automation projects more efficient by ensuring the integrity of the created architectural model;

- More precise investment and assessment models of enterprise creation projects costs by including IT costs;

- Shortening the investment cycle of putting created/upgraded works into operation by synchronizing the creation of an enterprise with its IT architecture.

4.1. Investment Model for Integral IT Architecture Design and Implementation Projects

4.1.1. Integrated Investment Model

- is the aggregate cost of creating the IT architecture and its supporting IT infrastructure;

- is the cost of developing subsystem i of the IT architecture;

- is the cost of developing component j of the IT infrastructure.

4.1.2. Patchwork Investment Model

- is the aggregate cost of creating the IT architecture and its supporting IT infrastructure;

- is the cost of developing subsystem i of the IT architecture;

- is the cost of developing component j of the IT infrastructure;

- is the additional cost of information system integration, including the need for new IT infrastructure objects (capacities);

- is the alternative cost related to adopting information systems within an ongoing operational enterprise.

4.2. More Precise EA Project Investment and Assessment Model

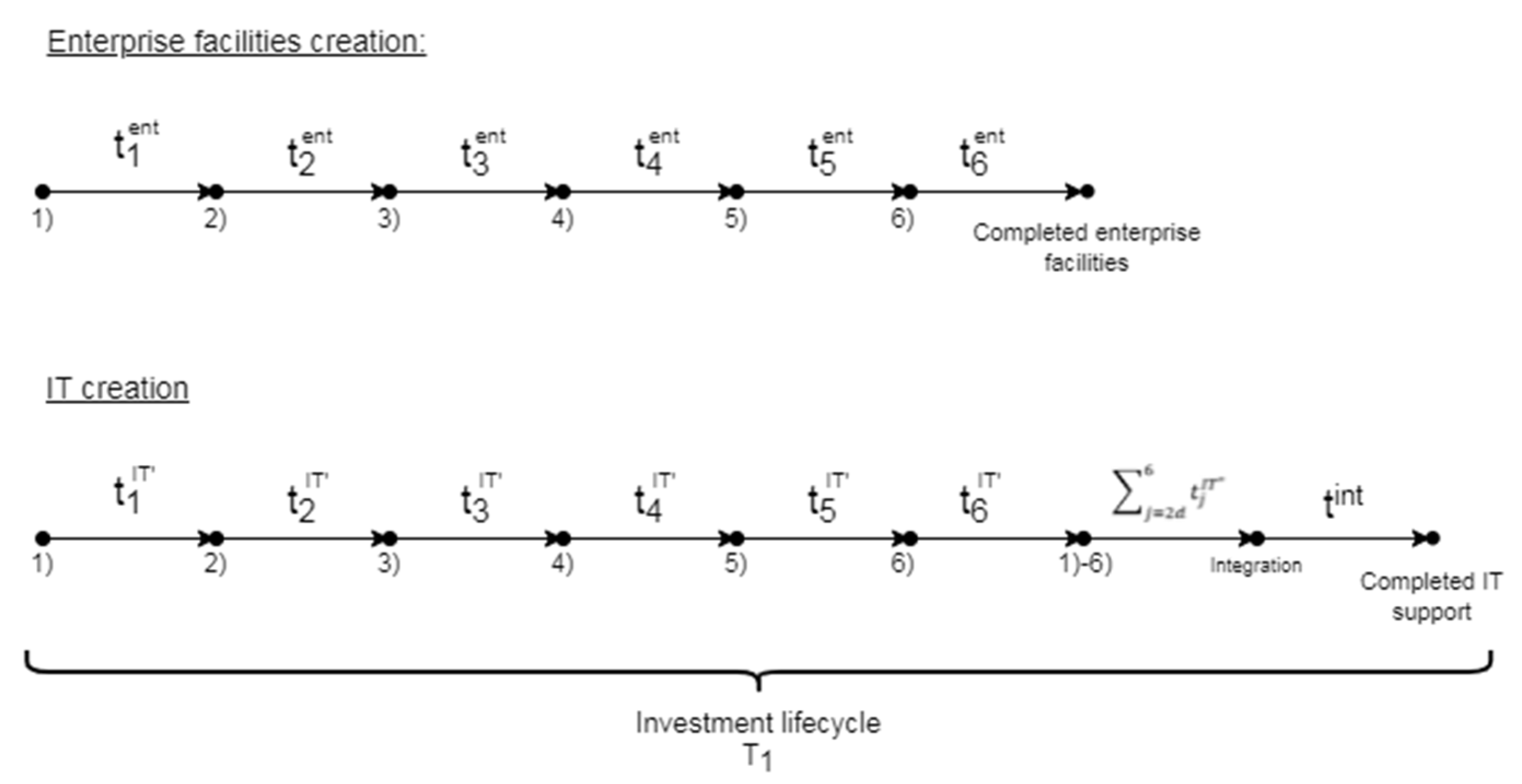

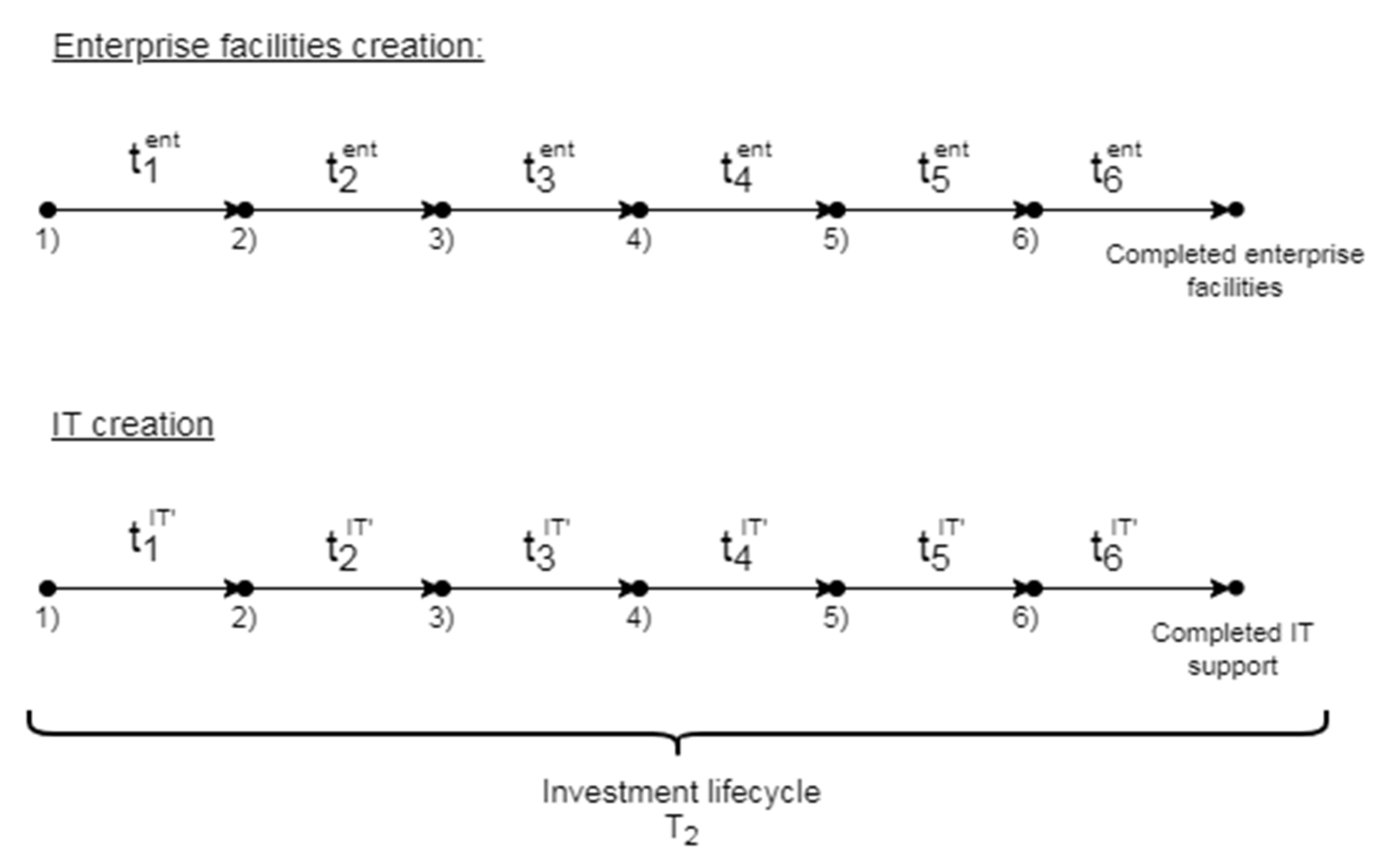

4.3. A Model for Shortening the EA and IT Investment Cycle

4.4. Quantitative Operationalization of the Investment Models for the EA Software Components

- The measures and measuring instruments for the physical infrastructure and the hardware components of the IT infrastructure must not only be available but also quite mature. All the measures of the physical components must be based on a universally accepted and well-described international system of units (IS), all of which have been verified extensively based on widely accepted criteria defined in the metrology domain [47];

- The fundamental concepts and models for measuring these costs must be based upon the widely accepted accounting bodies of knowledge.

5. Discussion

5.1. Discussion: Investment Models for IT and EA Projects

- They are mostly focused on the needs of infrastructure-intensive enterprises in the context of the ongoing digital transformation. For those enterprises where physical facilities do not play such an essential role in producing the key products (i.e., for operating key processes), parallel designing and implementation of physical infrastructure and IT cannot be the sensitive issue and the complex automation approach using EA concepts can show less illustrative effect. However, this effect will still occur. Further work is needed to explore how to tailor these models to other types of enterprises, from small to much larger ones. There is also the issue of scalability to various business and engineering domains, from a small to very large organizational scale;

- The investment models proposed here are tackling more in regards to the situation of greenfield establishment of the enterprise and its IT architecture, while in practice reengineering and modernization projects occur more often. Models (6) and (7) need a certain adoption to the reengineering or modernization projects situation: in this context, the unnecessary summands should be eliminated from the formulas.

- A posteriori to calculate the IT intensity index for various industries and assess development projects performance;

- A priori by transforming them into scalability ratios to be used a priori in investment models.

5.2. Discussion: EA and IT to Motivate Open Innovations

- Enterprise architecture as a model of the enterprise, which gives an idea of its structure and the relationship between elements and the external environment, is a mandatory prerequisite for enterprises, following the path of open innovation. As such, the value of the architectural model (and the IT architecture as an integral part of it) is to explicitly describe the architectural areas that are elements of enterprise innovation and are open to external participants in the transfer of knowledge and technology. The architectural model will allow the following: a. correctly and consistently separate the open and closed areas of the enterprise, including the areas of data, knowledge, technology, personnel; b. describe the channels of interaction (including channels of information exchange) of the enterprise with the innovation environment;

- Enterprise architecture and individual architectural solutions (in particular, IT solutions) themselves can be an object of innovation, which can be shared. Architectural models are of particular interest for enterprises within the same industry or related industries. Effective and innovative architectural solutions can be de facto industry standards or best practices for business management.

6. Conclusions

- EA elements implementation leads to large re-engineering projects with significant investments, which do not seem attractive in the short term;

- Existing investment models for creating an enterprise and its parts include the costs of creating the physical infrastructure facilities related to the primary activity technology but typically ignore automation-related costs;

- Investment models for EA and IT are especially relevant to enterprises with a complex production infrastructure that requires automatic controls or digital devices for collecting and processing primary data on engineering and production processes.

- Ability to calculate the effect of the integral approach to adopting IT solutions vs. their patchwork deployment development;

- More precise calculation of investment project costs by considering the cost of IT systems in the costs of integrated architectural solutions;

- Shortening of the investment cycle of developing and implementing architectural solutions, including the physical and IT components;

- Using an international standard of software measurement (e.g., COSMIC-ISO 19761) to operationalize in practice the selected investment model.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Kotkova Striteska, M.; Prokop, V. Dynamic innovation strategy model in practice of innovation leaders and followers in CEE countries—a prerequisite for building innovative ecosystems. Sustainability 2020, 12, 3918. [Google Scholar] [CrossRef]

- Aldea, A.; Iacob, M.-E.; Wombacher, A.; Hiralal, M.; Franck, T. Enterprise Architecture 4.0–A vision, an approach and software tool support. In Proceedings of the 2018 IEEE 22nd International Enterprise Distributed Object Computing Conference (EDOC), Stockholm, Sweden, 16–19 October 2018; pp. 1–10. [Google Scholar]

- Levina, A.I.; Borremans, A.D.; Burmistrov, A.N. Features of enterprise architecture designing of infrastructure-intensive companies. In Innovation Management and Education Excellence through Vision, Proceedings of the 29th Innovation Management and Education Excellence through Vision Conference, Vienna, Austria, 3–4 May 2018; Curran Associates, Inc.: Red Hook, NY, USA, 2020; pp. 4643–4651. [Google Scholar]

- Gampfer, F.; Jürgens, A.; Müller, M.; Buchkremer, R. Past, current and future trends in enterprise architecture–A view beyond the horizon. Comput. Ind. 2018, 100, 70–84. [Google Scholar] [CrossRef]

- CIO Council. Federal Enterprise Architecture Framework Version 1.1. Available online: http://www.enterprise-architecture.info/Images/Documents/Feàderal%20EA%20Framework.pdf (accessed on 1 January 2021).

- CIO U.S. Department of Defense. The DoDAF Architecture Framework Version 2.02. Available online: https://dodcio.defense.gov/library/dod-architecture-framework (accessed on 18 March 2020).

- Dragon1. Enterprise Architecture Benefits. Available online: https://www.dragon1.com/resources/enterprise-architecture-benefits (accessed on 15 May 2020).

- Lankhorst, M. Enterprise Architecture at Work. Modelling, Communication, Analysis, 3rd ed.; Springer: Berlin, Germany, 2013. [Google Scholar]

- Niemi, E. Enterprise Architecture Benefits: Perceptions from Literature and Practice, Proceedings of the 7th IBIMA Conference Internet & Information Systems in the Digital Age, Brescia, Italy, 14–16 December 2006; IBIMA Publishing: King of Prussia, PA, USA, 2006. [Google Scholar]

- Op’t Land, M.; Proper, H.A.; Waage, M.; Cloo, J.; Steghuis, C. Enterprise Architecture. Creating Value by Informed Governance; Springer: Berlin/Heidelberg, Germany, 2009. [Google Scholar]

- Lapalme, J.; Gerber, A.; Van der Merwe, A.; Zachman, J.; DeVries, M.; Hinkelmann, K. Exploring the future of enterprise architecture: A Zachman perspective. Comput. Ind. 2016, 79, 103–113. [Google Scholar] [CrossRef]

- Nardello, M.; Han, S.; Møller, C.; Gøtze, J. Incorporating process and data heterogeneity in enterprise architecture: Extended AMA4EA in an international manufacturing company. Comput. Ind. 2020, 115, 103178. [Google Scholar] [CrossRef]

- Pour, M.J.; Fallah, M.R. How enterprise architecture influences strategic alignment maturity: Structural equation modelling. Int. J. Bus. Excell. 2019, 17, 189. [Google Scholar] [CrossRef]

- Shanks, G.; Gloet, M.; Asadi Someh, I.; Frampton, K.; Tamm, T. Achieving benefits with enterprise architecture. J. Strateg. Inf. Syst. 2018, 27, 139–156. [Google Scholar] [CrossRef]

- Dewangan, V.M. Godse towards a holistic enterprise innovation performance measurement system. Technovation 2014, 34, 536–545. [Google Scholar] [CrossRef]

- Anaya, L.; Dulaimi, M.; Abdallah, S. An investigation into the role of enterprise information systems in enabling business innovation. Bus. Process Manag. J. 2015, 21, 771–790. [Google Scholar] [CrossRef]

- Cui, T.R.; Ye, H.; Teo, H.H.; Li, J.Z. Information technology and open innovation: A strategic alignment perspective. Inf. Manag. 2015, 52, 348–358. [Google Scholar] [CrossRef]

- Missah, Y.M. Business innovation with enterprise architecture. Int. J. Comput. Appl. 2015, 120, 12–15. [Google Scholar]

- Kleis, L.; Chwelos, P.; Ramirez, R.V.; Cockburn, I. Information technology and intangible output: The impact of IT investment on innovation productivity. Inf. Syst. Res. 2012, 23, 42–59. [Google Scholar] [CrossRef]

- Yun, J.J.; Zhao, X. Business model innovation through a rectangular compass: From the perspective of open innovation with mechanism design. J. Open Innov. Technol. Mark. Complex. 2020, 6, 131. [Google Scholar] [CrossRef]

- Van den Berg, M.; Slot, R.; van Steenbergen, M.; Faasse, P.; van Vliet, H. How enterprise architecture improves the quality of IT investment decisions. J. Syst. Softw. 2019, 152, 134–150. [Google Scholar] [CrossRef]

- Liao, Y.-W.; Wang, Y.-M.; Wang, Y.-S.; Tu, Y.-M. Understanding the dynamics between organizational IT investment strategy and market performance: A system dynamics approach. Comput. Ind. 2015, 71, 46–57. [Google Scholar] [CrossRef]

- Resolution of the Gosstroy of the Russian Federation of 08/07/2002 N 102; On the Approval of General Instructions for the Use of Reference Books of Reference Prices for Design Work for Construction. Available online: http://www.consultant.ru/document/cons_doc_LAW_40451/70b18cbc04eb3f0ca8a9c857de67b3147fd71584/ (accessed on 10 January 2021).

- Ammar, A.; Abran, A.; Abdallah, B. Towards the Adoption of International Standards in Enterprise Architecture Measurement. In Proceedings of the Second International Conference on Data Science, E-Learning and Information Systems, DATA ’19, Dubai, United Arab Emirates, 2–5 December 2019; p. 24. [Google Scholar]

- Andersen, P.; Carugati, A. Enterprise Architecture Evaluation: A Systematic Literature Review, Proceedings of the 8th Mediterranean Conference on Information Systems, Verona, Italy, 3–5 September 2014; Mola, L., Carugati, A., Kokkinaki, A., Pouloudi, N., Eds.; Association for Information System: Atlanta, GA, USA, 2014. [Google Scholar]

- Bonnet, M.J.A. Measuring the Effectiveness of Enterprise Architecture Implementation. Master’s Thesis, Delft University of Technology, Delft, The Netherlands, 2009. [Google Scholar]

- Gong, Y.; Janssen, M. The value of and myths about enterprise architecture. Int. J. Inf. Manag. 2019, 46, 1–9. [Google Scholar] [CrossRef]

- González-Rojas, O.; López, A.; Correal, D. Multilevel complexity measurement in enterprise architecture models. Int. J. Comput. Integr. Manuf. 2017, 30, 1280–1300. [Google Scholar] [CrossRef]

- Kurek, E.; Johnson, J.; Mulder, H. Measuring the value of enterprise architecture on IT projects with chaos research. J. Syst. Cybern. Inf. 2017, 15, 13–18. [Google Scholar]

- Morganwalp, J.M.; Sage, A.P. Enterprise architecture measures of effectiveness. Int. J. Technol. Policy Manag. 2004, 4, 81–94. [Google Scholar] [CrossRef]

- Plessius, H.; Slot, R.; Pruijt, L. On the categorization and measurability of enterprise architecture benefits with the enterprise architecture value framework. In Trends in Enterprise Architecture Research and Practice-Driven Research on Enterprise Transformation; PRET 2012, TEAR 2012; Aier, S., Ekstedt, M., Matthes, F., Proper, E., Sanz, J.L., Eds.; Springer: Berlin/Heidelber, Germany, 2012; Volume 131, pp. 79–92. [Google Scholar]

- Rico, D.F. A framework for measuring ROI of enterprise architecture. J. Organ. End User Comput. 2006, 18, 1–12. [Google Scholar]

- AlMuhayfith, S.; Shaiti, H. The Impact of enterprise resource planning on business performance: With the discussion on its relationship with open innovation. J. Open Innov. Technol. Mark. Complex. 2020, 6, 87. [Google Scholar] [CrossRef]

- Ellram, L.M. Total cost of ownership. Int. J. Phys. Distrib. Logist. Manag. 1995, 25, 4–23. [Google Scholar] [CrossRef]

- Uyar, M. A research on total cost of ownership and firm profitability. Res. J. Financ. Account. 2014, 5, 9–16. [Google Scholar]

- Gartner Group. IT Glossary. Available online: http://www.gartner.com/it-glossary (accessed on 25 November 2020).

- Hoffmann, T. TCO: Flawed But Useful. Computerworld. 2002. Available online: https://www.computerworld.com/article/2578032/it-management/tco--flawed-but-useful.html (accessed on 25 August 2018).

- Wouters, M.J.F.; Anderson, J.C.; Wynstra, F. The adoption of total cost of ownership for sourcing decisions-A structural equations analysis. Account. Organ. Soc. 2004, 30, 167–191. [Google Scholar] [CrossRef]

- Cooper, R. The rise of activity-based costing–part one: What is an activity-based cost system? J. Cost Manag. 1988, 2, 45–54. [Google Scholar]

- Cooper, R.S.; Kaplan, R.S. Measure cost right: Make the right decisions. Harv. Bus. Rev. 1988, 66, 96–103. [Google Scholar]

- Business Studio. Available online: http://www.businessstudio.ru (accessed on 1 January 2021).

- Lientz, B.P.; Larssen, L. Manage IT as a Business: How to Achieve Alignment and Add Value to the Company; Butterworth-Heinemann: Oxford, UK, 2004; p. 302. [Google Scholar]

- McLaughlin, S. Managing Technology for Business Value; Cambridge Scholars Publishing: Newcastle upon Tyne, UK, 2020; p. 565. [Google Scholar]

- Harris, M.D.S. The Business Value of Software; CRC Press/Auerbach Publications: Boca Raton, FL, USA, 2018; p. 239. [Google Scholar]

- Moro-Visconti, R. The Valuation of Digital Intangibles; Palgrave Macmillan: Cham, Switzerland, 2020. [Google Scholar]

- Ruexpert. Large-Scale Russian Projects [Krupnyye Rossiyskiy Proyekty]. Available online: https://ruxpert.ru/%D0%9A%D1%80%D1%83%D0%BF%D0%BD%D1%8B%D0%B5_%D1%80%D0%BE%D1%81%D1%81%D0%B8%D0%B9%D1%81%D0%BA%D0%B8%D0%B5_%D0%BF%D1%80%D0%BE%D0%B5%D0%BA%D1%82%D1%8B (accessed on 12 June 2020).

- International Vocabulary of Metrology–Basic and General Concepts and Associated Terms (VIM); ISO/IEC Guide 99; International Organization for Standardization–ISO: Geneva, Switzerland, 2007.

- Abran, A. Software Metrics and Software Metrology; Wiley & IEEE-CS Press: Hoboken, NJ, USA, 2010. [Google Scholar]

- Ammar, A.; Lapalme, J.; Abran, A. Enterprise Architecture Measurement: A Systematic Mapping Study. In Proceedings of the 4th International Conference on Enterprise Systems: Advances in Enterprise Systems, Melbourne, Australia, 2–3 November 2016; pp. 13–20. [Google Scholar]

- Ammar, A. Analysis of Limitations and Metrology Weaknesses of Enterprise Architecture (EA) Measurement Solutions & Proposal of a COSMIC-Based Approach to EA Measurement. Ph.D. Thesis, Ecole de Technologie Superieure–Université du Québec, Quebec, QC, Canada, 2019. [Google Scholar]

- Ammar, A.; Abran, A. Enterprise architecture measurement: An extended systematic mapping study. Int. J. Comput. Sci. Inf. Technol. Adv. Res. 2019, 11, 9–19. [Google Scholar] [CrossRef][Green Version]

- ISO 19761. Software Engineerin –COSMIC: A Functional Size Measurement Method. 2011. Available online: https://www.iso.org/obp/ui/#iso:std:iso-iec:19761:ed-2:v1:en (accessed on 15 February 2021).

- Abran, A. Software Project Estimation–The Fundamentals for Providing High Quality Information to Decision Makers; Wiley & IEEE-CS Press: Hoboken, NJ, USA, 2015. [Google Scholar]

- Abran, A.; Vogelezang, F. (Eds.) Early Software Sizing with COSMIC: Practitioners Guide, COSMIC Organization. 2020. Available online: https://cosmic-sizing.org/publications/early-software-sizing-with-cosmic-practitioners-guide/ (accessed on 15 February 2021).

- Chen, P.S.; Yen, D.C.; Lin, S.-C.; Chou, C.S. Toward an IT investment decision support model for global enterprises. Comput. Stand. Interfaces 2018, 59, 130–140. [Google Scholar] [CrossRef]

- Dahlander, L.; Wallin, M. Why Now Is the Time for “Open Innovation”. Harvard Business Review. Available online: https://hbr.org/2020/06/why-now-is-the-time-for-open-innovation (accessed on 15 February 2021).

- Deichmann, D.; Rozentale, I.; Barnhoorn, R. Open Innovation Generates Great Ideas, So Why Aren’t Companies Adopting Them? Harvard Business Review. Available online: https://hbr.org/2017/12/open-innovation-generates-great-ideas-so-why-arent-companies-adopting-them?ab=at_art_art_1x1 (accessed on 15 February 2021).

- Linåker, J.; Munir, H.; Wnuk, K.; Mols, C.E. Motivating the contributions: An Open Innovation perspective on what to share as Open Source Software. J. Syst. Softw. 2018, 135, 17–36. [Google Scholar] [CrossRef]

- Ilin, I.; Levina, A.; Abran, A.; Iliashenko, O. Measurement of Enterprise Architecture (EA) from an IT Perspective: Research Gaps and Measurement Avenues; Part F131936; ACM International Conference Proceeding Series: New York, NY, USA, 2017; pp. 232–243. [Google Scholar]

| No. | Facility | Cost, Million EUR |

|---|---|---|

| 1 | Baltic NPP | 3200 |

| 2 | Fourth generating unit at Beloyarsk Nuclear Power Station | 2200 |

| 3 | Third generating unit at Berezovskaya Thermal Power Station | 700 |

| 4 | Big Bratsk pulp-and-paper mill | 600 |

| 5 | First phase of the Budyonnovskiy gas chemical facility | 2000 |

| 6 | Vancor field | 5370 |

| 7 | Gremyachinskiy mining and concentrating mill | 1670 |

| 8 | Yamal LNG plant | 23,570 |

| 9 | Fourth generating unit at Kalinin NPP | 1400 |

| 10 | Zapsibneftekhim petrochemical facility | 8285 |

| 11 | JSC Taneco, a group of petroleum processing and petrochemical plants | 3357 |

| 12 | Vostochny Cosmodrome, phase one | (estimated) 21,000 |

| 13 | Kursk NPP-2 | 2850 |

| 14 | Prirazlomnaya marine stationary sleet-proof platform | 940 |

| 15 | Natalka mining and concentrating mill | 1000 |

| 16 | Sakhalin-2 petroleum and gas development | 9570 |

| 17 | Ust-Luga port | 4070 |

| 18 | Taman’ port | 2850 |

| 19 | Talakanskoe petroleum and gas condensate field | 3100 |

| 20 | Ammonium chemical complex | (estimated) 1420 |

| Investment Cycle Phases | Index | Notes |

|---|---|---|

| Enterprise creation | ||

| - | |

| - | |

| - | |

| - | |

| - | |

| - | |

| IT architecture creation | ||

| , where is the phase duration as to IAS is the phase duration as to other subsystems | |

| , where is the phase duration as to IAS is the phase duration as to other subsystems | |

| , where is the phase duration as to IAS is the phase duration as to other subsystems | |

| , where is the phase duration as to IAS is the phase duration as to other subsystems | |

| , where is the phase duration as to IAS is the phase duration for other subsystems | |

| , where is the phase duration as to IAS is the phase duration as to other subsystems | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ilin, I.V.; Levina, A.I.; Dubgorn, A.S.; Abran, A. Investment Models for Enterprise Architecture (EA) and IT Architecture Projects within the Open Innovation Concept. J. Open Innov. Technol. Mark. Complex. 2021, 7, 69. https://doi.org/10.3390/joitmc7010069

Ilin IV, Levina AI, Dubgorn AS, Abran A. Investment Models for Enterprise Architecture (EA) and IT Architecture Projects within the Open Innovation Concept. Journal of Open Innovation: Technology, Market, and Complexity. 2021; 7(1):69. https://doi.org/10.3390/joitmc7010069

Chicago/Turabian StyleIlin, Igor V., Anastasia I. Levina, Alissa S. Dubgorn, and Alain Abran. 2021. "Investment Models for Enterprise Architecture (EA) and IT Architecture Projects within the Open Innovation Concept" Journal of Open Innovation: Technology, Market, and Complexity 7, no. 1: 69. https://doi.org/10.3390/joitmc7010069

APA StyleIlin, I. V., Levina, A. I., Dubgorn, A. S., & Abran, A. (2021). Investment Models for Enterprise Architecture (EA) and IT Architecture Projects within the Open Innovation Concept. Journal of Open Innovation: Technology, Market, and Complexity, 7(1), 69. https://doi.org/10.3390/joitmc7010069