Effects of Emerging-Economy Firms’ Knowledge Acquisition from an Advanced International Joint Venture Partner on Their Financial Performance Based on the Open Innovation Perspective

Abstract

1. Introduction

2. Theoretical Background

2.1. E-E Firms’ Knowledge Acquisition for Open Innovation from an Advanced IJV Partner

2.2. Financial Performance

2.3. Innovation Performance and Mediation Role

2.4. Absorptive Capacity and Moderated Mediation Role

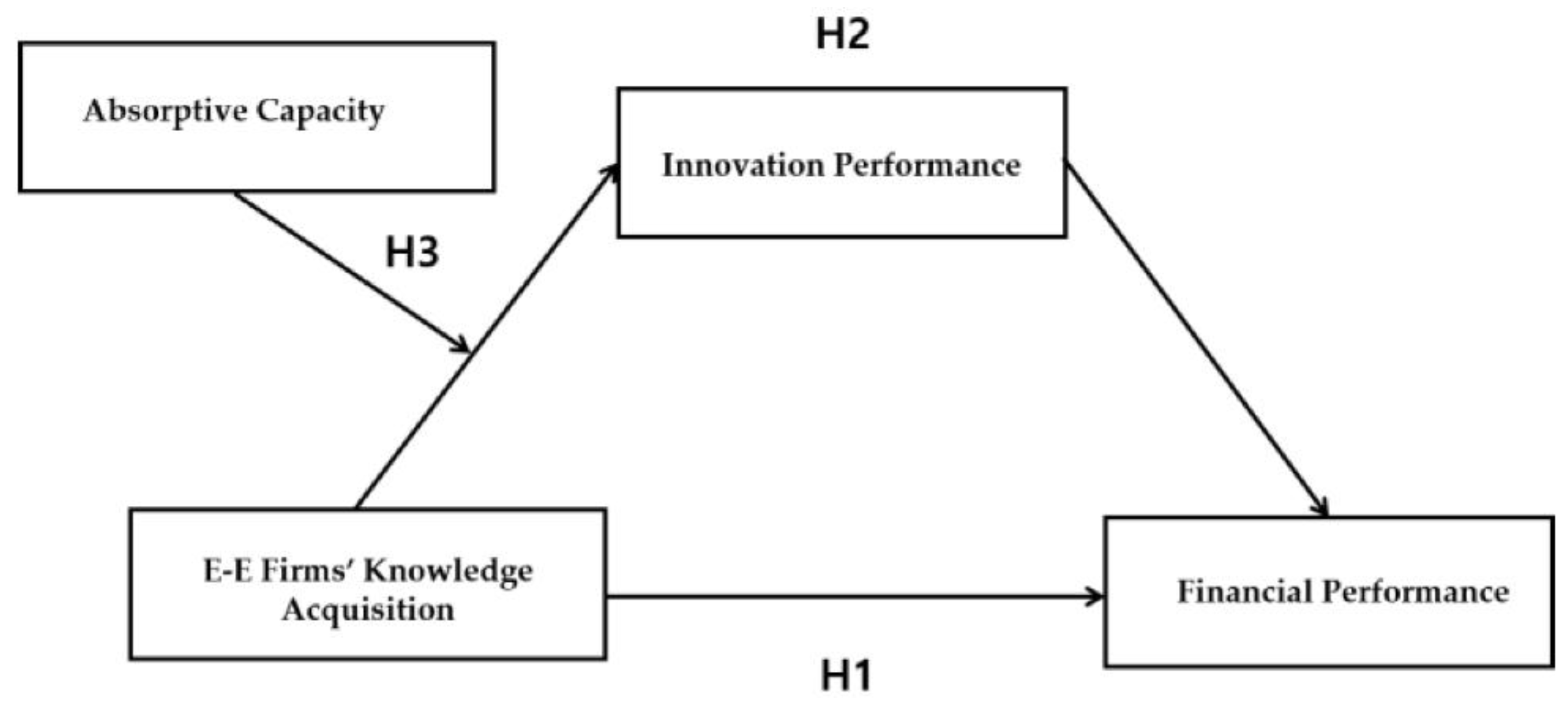

3. Model and Hypotheses

3.1. E-E Firms’ Knowledge Acquisition from an Advanced IJV Partner and Their Financial Performance

3.2. Mediation Effect of Innovation Performance

3.3. Moderated Mediation Effect of Absorptive Capacity

4. Research Method

4.1. Sample and Data Collection

4.2. Measurement

4.2.1. Dependent Variable: Financial Performance

4.2.2. Independent Variable: Knowledge Acquisition

4.2.3. Mediation Variable: Innovation Performance

4.2.4. Moderation Variable: Absorptive Capacity

4.2.5. Control Variables

5. Results

5.1. Method of Analysis

5.2. Validity and Reliability Tests

5.3. Descriptive Statistics and Correlations

5.4. Tests of Hypotheses

5.4.1. Mediation Analysis

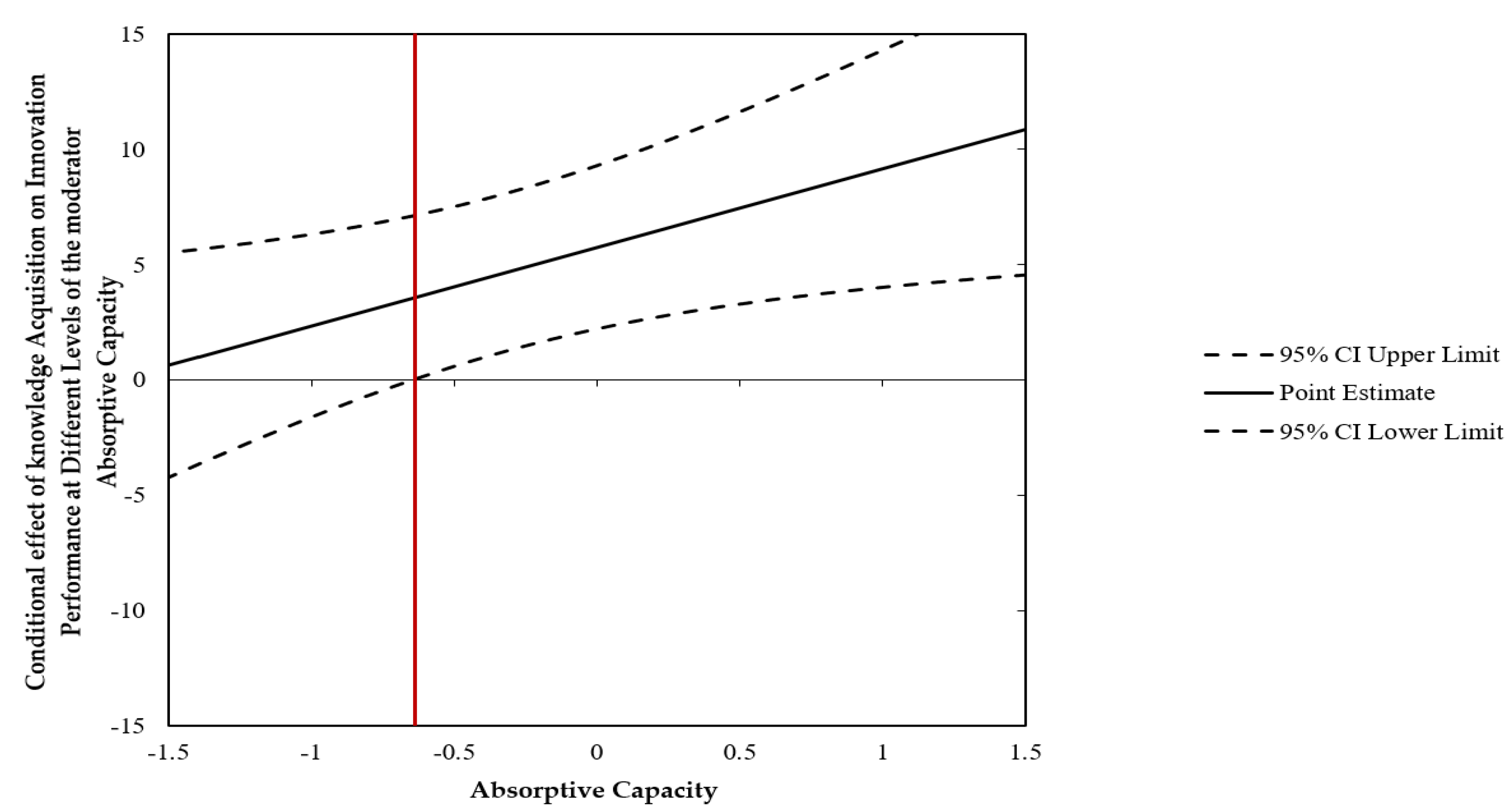

5.4.2. Moderated Mediation Analysis

6. Conclusions and Discussions

6.1. Conclusions

6.2. Implications

6.3. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variables | Return on Sales | Innovation Performance | Return on Sales | |||

|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | |

| B | B | B | B | B | B | |

| Firm size (log)) | 2.114 † (1.267) | 1.852 † (1.026) | 1.645 (1.015) | 0.855 (3.143) | −0.778 (2.672) | 1.794 † (1.008) |

| Firm age | −0.103 (0.073) | −0.061 (0.059) | −0.069 (0.058) | −0.114 (0.181) | −0.174 (0.154) | −0.054 (0.058) |

| Industry Type | −0.072 (1.259) | −0.013 (1.019) | −0.105 (1.008) | 1.533 (3.112) | 0.869 (2.654) | −0.116 (1.002) |

| IJV Experience | 9.379 *** (1.832) | 0.910 (1.816) | 0.272 (2.040) | 7.759 (5.566) | 3.350 (5.371) | 0.388 (1.799) |

| Knowledge Acquisition | 4.734 *** (0.586) | 4.156 *** (0.678) | 10.090 *** (1.794) | 5.753 ** (1.785) | 4.054 *** (0.647) | |

| Innovation Performance | 0.067 * (0.029) | |||||

| Absorptive Capacity | 1.428 * (0.647) | 10.985 *** (1.703) | ||||

| Knowledge Acquisition x Absorptive Capacity | 0.395 (0.560) | 3.404 * (1.474) | ||||

| F-Statistics | 8.607 *** | 23.555 *** | 18.149 *** | 13.300 *** | 20.382 *** | 21.221 *** |

| R2 | 0.220 | 0.493 | 0.516 | 0.355 | 0.545 | 0.515 |

| Adjusted R2 | 0.195 | 0.472 | 0.488 | 0.328 | 0.518 | 0.491 |

| Changes in R2 | 0.273 *** | 0.023 † | 0.191 *** | |||

| Path | Effect (b) | Boot SE | Boot 95% CI | |

|---|---|---|---|---|

| LLCI | ULCI | |||

| Total Effect of knowledge acquisition on return on sales | 4.734 | 0.586 | 3.573 | 5.894 |

| Direct Effect of knowledge acquisition on return on sales | 4.054 | 0.647 | 2.773 | 5.335 |

| Indirect Effect of knowledge acquisition on return on sales (knowledge acquisition–innovation performance–return on sales) | 0.680 | 0.287 | 0.201 | 1.362 |

| Mediator | Moderator (Absorptive Capacity) | Conditional Indirect Effects | Boot SE | Boot LLCI | Boot ULCI |

|---|---|---|---|---|---|

| Innovation Performance | −1.000 (−1 SD) | 0.158 | 0.125 | −0.009 | 0.491 |

| 0.000 (mean) | 0.387 | 0.202 | 0.094 | 0.925 | |

| 1.000 (+1 SD) | 0.616 | 0.328 | 0.148 | 1.527 |

References

- Chesbrough, H.W. Open Innovation: The New Imperative for Creating and Profiting from Technology; Harvard Business School Press: Boston, MA, USA, 2003. [Google Scholar]

- Laursen, K.; Salter, A. Open for innovation: The role of openness in explaining innovation performance among U.K. manufacturing firms. Strateg. Manag. J. 2006, 27, 131–150. [Google Scholar] [CrossRef]

- Huber, G.P. Organizational learning: The contributing processes and the literatures. Organ. Sci. 1998, 2, 1–147. [Google Scholar] [CrossRef]

- Soto-Acosta, P.; Popa, S.; Palacios-Marqués, D. Social web knowledge sharing and innovation performance in knowledge-intensive manufacturing SMEs. J. Tech. Tran. 2017, 42, 425–440. [Google Scholar] [CrossRef]

- Dyer, J.H.; Singh, H. The relational view: Cooperative strategy and sources of interorganizational competitive advantage. Acad. Manag. Rev. 1998, 23, 660. [Google Scholar] [CrossRef]

- Inkpen, A.C. Learning Through Joint Ventures: A Framework of Knowledge Acquisition. J. Manag. Stud. 2000, 37, 1019–1044. [Google Scholar] [CrossRef]

- Inkpen, A.C.; Dinur, A. Knowledge management processes and international joint ventures. Organ. Sci. 1998, 9, 454–468. [Google Scholar] [CrossRef]

- Inkpen, A.; Minbaeva, D.; Tsang, E.W.K. Unintentional, unavoidable, and beneficial knowledge leakage from the multinational enterprise. J. Int. Bus. Stud. 2019, 50, 250–260. [Google Scholar] [CrossRef]

- Lane, P.; Lubatkin, M. Relative absorptive capacity and interorganizational learning. Strateg. Manag. J. 1998, 19, 461–477. [Google Scholar] [CrossRef]

- Simonin, B.L. Ambiguity and the process of knowledge transfer in strategic alliances. Strateg. Manag. J. 1999, 20, 595–623. [Google Scholar] [CrossRef]

- Simonin, B.L. An Empirical Investigation of the Process of Knowledge Transfer in International Strategic Alliances. J. Int. Bus. Stud. 2004, 35, 407–427. [Google Scholar] [CrossRef]

- Yun, J.J.; Lee, M.; Park, K.; Zhao, X. Open Innovation and Serial Entrepreneurs. Sustainability 2019, 11, 5055. [Google Scholar] [CrossRef]

- Yun, J.J.; Jeong, E.; Zhao, X.; Hahm, S.D.; Kim, K. Collective Intelligence: An Emerging World in Open Innovation. Sustainability 2019, 11, 4495. [Google Scholar] [CrossRef]

- Yun, J.; Won, D.; Park, K. Entrepreneurial cyclical dynamics of open innovation. J. Evol. Econ. 2018, 28, 1151–1174. [Google Scholar] [CrossRef]

- Hameduddin, T.; Fernandez, S.; Demircioglu, M.A. Conditions for open innovation in public organizations: Evidence from Challenge.gov. Asia Pac. J. Publ. Adm. 2020, 42, 111–131. [Google Scholar] [CrossRef]

- Heimstädt, M.; Reischauer, G. Framing innovation practices in interstitial issue fields: Open innovation in the NYC administration. Innov. Organ. Manag. 2018, 21, 1–23. [Google Scholar] [CrossRef]

- Loukis, E.Y.; Charalabidis, Y.; Androutsopoulou, A. Promoting Open Innovation in the Public Sector through Social Media Monitoring. Gov. Inf. Q. 2017, 34, 99–109. [Google Scholar] [CrossRef]

- Kogut, B. Joint ventures: Theoretical and empirical perspectives. Strateg. Manag. J. 1988, 9, 319–332. [Google Scholar] [CrossRef]

- Mowery, D.C.; Oxley, J.E.; Silverman, B.S. Strategic alliances and interfirm knowledge transfer. Strateg. Manag. J. 1996, 17, 77–91. [Google Scholar] [CrossRef]

- Song, J. Technological Catch-up and Knowledge Sourcing of Latecomers from Emerging Economies. AIB Insights 2016, 16, 15–17. [Google Scholar] [CrossRef]

- Evangelista, F. Acquiring tacit and explicit marketing knowledge from foreign partners in IJVs. J. Bus. Res. 2007, 60, 1152–1165. [Google Scholar]

- Park, C.; Vertinsky, I.; Becerra, M. Transfers of tacit vs. explicit knowledge and performance in international joint ventures: The role of age. Int. Bus. Rev. 2015, 24, 89–101. [Google Scholar] [CrossRef]

- Liu, J.; Cui, Z.; Feng, Y.; Perera, S.; Han, J. Impact of culture differences on performance of international construction joint ventures: The moderating role of conflict management. Eng. Constr. Archit. Manag. 2020, 27, 2353–2377. [Google Scholar] [CrossRef]

- Ado, A.; Su, Z.; Wanjiru, R. Learning and Knowledge Transfer in Africa-China JVs: Interplay between Informalities, Culture, and Social Capital. J. Int. Manag. 2016, 23, 166–179. [Google Scholar] [CrossRef]

- Lane, P.J.; Salk, J.E.; Lyles, M.A. Absorptive capacity, learning, and performance in international joint ventures. Strateg. Manag. J. 2001, 22, 1139–1161. [Google Scholar] [CrossRef]

- Lin, X. Local partner acquisition of managerial knowledge in international joint ventures: Focusing on foreign management control. Manag. Int. Rev. 2005, 45, 219–237. [Google Scholar]

- Pak, Y.S.; Park, Y.R. A framework of knowledge transfer in cross-border joint ventures: An empirical test of the Korean context. Manag. Int. Rev. 2004, 44, 417–434. [Google Scholar]

- Lin, Y.; Wu, L.-Y. Exploring the role of dynamic capabilities in firm performance under the resource-based view framework. J. Bus. Res. 2014, 67, 407–413. [Google Scholar] [CrossRef]

- Shenkar, O.; Li, J. Knowledge Search in International Cooperative Ventures. Organ. Sci. 1999, 10, 134–143. [Google Scholar] [CrossRef]

- Szulanski, G. Exploring internal stickiness: Impediments to the transfer of best practices within the firm. Strateg. Manag. J. 1996, 17, 27–43. [Google Scholar] [CrossRef]

- Tsang, E.W.K. A Preliminary Typology of Learning in International Strategic Alliances. J. World Bus. 1999, 34, 211–229. [Google Scholar] [CrossRef]

- Dhanaraj, C.; Lyles, M.A.; Steensma, H.K.; Tihanyi, L. Managing tacit and explicit knowledge transfer in IJVs: The role of relational embeddedness and the impact on performance. J. Int. Bus. Stud. 2004, 35, 428–443. [Google Scholar] [CrossRef]

- Mahmood, I.P.; Zheng, W. Whether and how: Effects of international joint ventures on local innovation in an emerging economy. Res. Policy 2009, 38, 1489–1503. [Google Scholar] [CrossRef]

- Petti, C.; Tang, Y.; Margherita, A. Technological innovation vs. technological backwardness patterns in latecomer firms: An absorptive capacity perspective. J. Eng. Technol. Manag. 2019, 51, 10–20. [Google Scholar] [CrossRef]

- Triki, D.; Mayrhofer, U. Do initial characteristics influence IJV longevity? Evidence from the Mediterranean region. Int. Bus. Rev. 2016, 25, 795–805. [Google Scholar] [CrossRef]

- Seo, E.; Kang, H.; Song, J. Blending talents for innovation: Team composition for cross-border R&D collaboration within multinational corporations. J. Int. Bus. Stud. 2020, 51, 851–885. [Google Scholar]

- Wu, X.; Ma, R.; Xu, G. Accelerating secondary innovation through organizational learning: A case study and theoretical analysis. Ind. Innov. 2009, 16, 389–409. [Google Scholar] [CrossRef]

- Wu, X.; Ma, R.; Shi, Y. How do latecomer firms capture value from disruptive technologies. A secondary business-model innovation perspective. IEEE T. Eng. Manag. 2010, 57, 51–62. [Google Scholar] [CrossRef]

- Sinha, U.B. Imitative innovation and international joint ventures: A dynamic analysis. Int. J. Ind. Organ. 2001, 19, 1527–1562. [Google Scholar] [CrossRef]

- Lane, P.J.; Koka, B.R.; Pathak, S. The reification of absorptive capacity: A critical review and rejuvenation of the construct. Acad. Manag. Rev. 2006, 31, 833–863. [Google Scholar] [CrossRef]

- Cohen, W.; Levinthal, D. Innovation and learning: The two faces of R&D. Econ. J. 1989, 99, 569–596. [Google Scholar]

- Zahra, S.A.; George, G. Absorptive capacity: A review, reconceptualization, and extension. Acad. Manag. Rev. 2002, 27, 185–203. [Google Scholar] [CrossRef]

- Grant, R.M. Toward a knowledge-based theory of the firm. Strateg. Manag. J. 1996, 17, 109–122. [Google Scholar] [CrossRef]

- Hobday, M. East Asian latecomer firms: Learning the technology of electronics. World Dev. 1995, 23, 1171–1193. [Google Scholar] [CrossRef]

- Tsang, E.W.K. Acquiring Knowledge by Foreign Partners from International Joint Ventures in a Transition Economy: Learning-by-Doing and Learning Myopia. Strateg. Manag. J. 2002, 23, 835–854. [Google Scholar] [CrossRef]

- Nonaka, I.A. Dynamic Theory of Organizational Knowledge Creation. Organ. Sci. 1994, 5, 14–37. [Google Scholar] [CrossRef]

- Zander, U.; Kogut, B. Knowledge and the Speed of the Transfer and Imitation of Organizational Capabilities: An Empirical Test. Organ. Sci. 1995, 6, 76–92. [Google Scholar] [CrossRef]

- Inkpen, A.C. Knowledge transfer and international joint ventures: The case of NUMMI and General motors. Strateg. Manag. J. 2008, 29, 447–453. [Google Scholar] [CrossRef]

- Gupta, A.K.; Govindarajan, V. Knowledge flows within multinational cor-porations. Strateg. Manag. J. 2000, 21, 473–496. [Google Scholar] [CrossRef]

- Mathrani, S.; Edwards, B. Knowledge-Sharing Strategies in Distributed Collaborative Product Development. J. Open Innov. Technol. Mark. Complex. 2020, 6, 194. [Google Scholar] [CrossRef]

- Kale, P.; Singh, H.; Perlmutter, H. Learning and protection of proprietary assets in strategic alliances: Building relational capital. Strateg. Manag. J. 2000, 21, 217–237. [Google Scholar] [CrossRef]

- Gulati, R.; Singh, H. The architecture of cooperation: Managing coordination costs and appropriation concerns in strategic alliances. Adm. Sci. Q. 1998, 43, 781–814. [Google Scholar] [CrossRef]

- Birkinshaw, J.; Nobel, R.; Ridderstråle, J. Knowledge as a contingency variable: Do the characteristics of knowledge predict organization structure? Organ. Sci. 2002, 13, 274–289. [Google Scholar] [CrossRef]

- Bowea, M.; Golesorkhib, S.; Yamin, M. Explaining equity shares in international joint ventures: Combining the influence of asset characteristics, culture and institutional differences. Res. Int. Bus. Financ. 2014, 31, 212–233. [Google Scholar] [CrossRef]

- Rothaermel, F.T.; Alexandre, M.T. Ambidexterity in technology sourcing: The moderating role of absorptive capacity. Organ. Sci. 2009, 20, 759–780. [Google Scholar] [CrossRef]

- Osland, G. Successful Operating Strategies in the Performance of U.S.-China Joint Ventures. J. Int. Mark. 1994, 2, 53–78. [Google Scholar]

- Teece, D.J. Firm organization, industrial structure, and technological innovation. J. Econ. Behav. Organ. 1996, 31, 193–224. [Google Scholar] [CrossRef]

- Jiménez-Jiménez, D.; Sanz-Valle, R. Innovation, organizational learning, and performance. J. Bus. Res. 2011, 64, 408–417. [Google Scholar] [CrossRef]

- Chandy, R.K.; Tellis, G.J. The incumbent’s curse? Incumbency, size, and radical product innovation. J. Mark. 2000, 64, 1–17. [Google Scholar]

- Si, S.X.; Bruton, G.D. Knowledge acquisition, cost savings, and strategic positioning: Effects on Sino-American IJV performance. J. Bus. Res. 2005, 58, 1465–1473. [Google Scholar] [CrossRef]

- Cullen, J.B.; Johnson, J.L.; Sakano, T. Success through commitment and trust: The soft side of strategic alliance management. J. World Bus. 2000, 35, 223–240. [Google Scholar] [CrossRef]

- Avalos-Quispe, G.A.; Hernández-Simón, L.M. Open Innovation in SMEs: Potential and Realized Absorptive Capacity for Interorganizational Learning in Dyad Collaborations with Academia. J. Open Innov. Technol. Mark. Complex. 2019, 5, 72. [Google Scholar] [CrossRef]

- Kim, J.; Choi, S.O. A Comparative Analysis of Corporate R&D Capability and Innovation: Focused on the Korean Manufacturing Industry. J. Open Innov. Technol. Mark. Complex. 2020, 6, 100. [Google Scholar]

- Hill, C.W.; Jones, G.R.; Schilling, M.A. Strategic Management: An Integrated Approach, 11th ed.; Cengage Learning: Boston, MA, USA, 2015. [Google Scholar]

- Porter, M.E. Competitive Strategy; The Free Press: New York, NY, USA, 1980. [Google Scholar]

- Porter, M.E. Competitive Advantage; A Division of Macmillan, Inc.: New York, NY, USA, 1985. [Google Scholar]

- Banker, R.D.; Mashruwala, R.; Tripathy, A. Does a differentiation strategy lead to more sustainable financial performance than a cost leadership strategy? Manag. Decis. 2014, 52, 872–896. [Google Scholar] [CrossRef]

- Kim, L. Crisis Construction and Organizational Learning: Capability Building in Catching-up at Hyundai Motors. Organ. Sci. 1998, 9, 506–521. [Google Scholar] [CrossRef]

- Utterback, J.M.; Suárez, F.F. Innovation, competition, and industry structure. Res. Policy 1993, 22, 1–21. [Google Scholar] [CrossRef]

- Nonaka, I.; Takeuchi, H. The Knowledge-Creating Company: How Japanese Companies Create the Dynamics of Innovation; Oxford University Press: New York, NY, USA, 1995. [Google Scholar]

- Nunnally, J.C. Bychometric Theory, 2nd ed.; McGrow Hill: New York, NY, USA, 1978. [Google Scholar]

- Bodlaj, M.; Cater, B. The Impact of Environmental Turbulence on the Perceived Importance of Innovation and Innovativeness in SMEs. J. Small Bus. Manag. 2019, 57, 417–435. [Google Scholar] [CrossRef]

- Kim, K.; Park, J.H.; Prescott, J.E. The global integration of business functions: A study of multinational businesses in integrated global industries. J. Int. Bus. Stud. 2003, 34, 327–344. [Google Scholar] [CrossRef]

- Morrison, A.J.; Roth, K. A taxonomy of business-level strategies in global industries. Strateg. Manag. J. 1992, 13, 399–418. [Google Scholar] [CrossRef]

- Lichtenthaler, U. Absorptive capacity, environmental turbulence, and the complementarity of organizational learning processes. Acad. Manag. J. 2009, 52, 822–846. [Google Scholar] [CrossRef]

- Sidhu, J.S.; Commandeur, H.R.; Volberda, H.W. The multifaceted nature of exploration and exploitation: Value of supply, demand, and spatial search for innovation. Organ. Sci. 2007, 18, 20–38. [Google Scholar] [CrossRef]

- Alexandrova, M. Entrepreneurship in transition economy: The impact of environment on entrepreneurial orientation. Probl. Perspect. Manag. 2004, 2, 140–148. [Google Scholar]

- Lubatkin, M.H.; Simsek, Z.; Ling, Y.; Veiga, J.F. Ambidexterity and performance in small-to medium-sized firms: The pivotal role of top management team behavioral integration. J. Manag. 2006, 32, 646–672. [Google Scholar] [CrossRef]

- Sorensen, J.; Stuart, T. Aging, Obsolescence, and Organizational Innovation. Adm. Sci. Q. 2000, 45, 81–112. [Google Scholar] [CrossRef]

- Turulja, L.; Bajgoric, N. Innovation, firms’ performance and environmental turbulence: Is there a moderator or mediator? Eur. J. Innov. Manag. 2019, 22, 213–232. [Google Scholar] [CrossRef]

- Le, H. Foreign Parent Firm Contributions, Experiences, and International Joint Venture Control and Performance. Int. J. Manag. Rev. 2009, 5, 55–69. [Google Scholar]

- IBM Corporation. IBM SPSS Advanced Statistics 24; IBM Corporation: Armonk, NY, USA, 2016. [Google Scholar]

- Hayes, A.F. Introduction to Mediation, Moderation, and Conditional Process Analysis: A Regression-Based Approach, 2nd ed.; Guilford Press: New York, NY, USA, 2017. [Google Scholar]

- Preacher, K.J.; Rucker, D.D.; Hayes, A.F. Addressing moderated mediation hypotheses: Theory, methods, and prescriptions. Multivar. Behav. Res. 2007, 42, 185–227. [Google Scholar] [CrossRef] [PubMed]

- Gelman, A. Scaling regression inputs by dividing by two standard deviations. Statist. Med. 2008, 27, 2865–2873. [Google Scholar] [CrossRef] [PubMed]

- Anderson, J.C.; Gerbing, D.W. Structural equation modeling in practice: A review and recommended two step approach. Psychol. Bull. 1988, 103, 411–423. [Google Scholar] [CrossRef]

- Bagozzi, R.P.; Yi, Y. On the evaluation of structural equation models. J. Acad. Mark. Sci. 1988, 16, 74–94. [Google Scholar] [CrossRef]

- Muller, D.; Judd, C.M.; Yzerbyt, V.Y. When moderation is mediated and mediation is moderated. J. Pers. Soc. Psychol. 2005, 89, 852–863. [Google Scholar] [CrossRef]

- James, L.R.; Brett, J.M. Mediators, moderators, and tests for mediation. J. Appl. Psychol. 1984, 69, 307–321. [Google Scholar] [CrossRef]

- Bauer, D.J.; Curran, P.J. Probing interactions in fixed and multilevel regression: Inferential and graphical techniques. Multivar. Behav. Res. 2005, 40, 373–400. [Google Scholar] [CrossRef]

- Caloghirou, Y.; Kastelli, I.; Tsakanikas, A. Internal capabilities and external knowledge sources: Complements or substitutes for innovative performance? Technovation 2004, 24, 29–39. [Google Scholar] [CrossRef]

- Cassiman, B.; Veugelers, R. In search of complementarity in innovation strategy: Internal R and D and external knowledge acquisition. Manag. Sci. 2006, 52, 68–82. [Google Scholar] [CrossRef]

- Davide, C.; Vittorio, C.; Federico, F. The Open Innovation Journey: How Firms Dynamically Implement the Emerging Innovation Management Paradigm. Technovation 2011, 31, 34–43. [Google Scholar]

- Davide, C.; Vittorio, C.; Federico, F. Unravelling the Process from Closed to Open Innovation: Evidence from Mature, Asset-Intensive Industries. R D Manag. 2010, 40, 222–245. [Google Scholar]

- Kim, C.Y.; Lim, M.S.; Yoo, J.W. Ambidexterity in External Knowledge Search Strategies and Innovation Performance: Mediating Role of Balanced Innovation and Moderating Role of Absorptive Capacity. Sustainability 2019, 11, 5111. [Google Scholar] [CrossRef]

| Variables | Mean | SD | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Sales Growth | 9.61 | 8.47 | 1 | ||||||||

| 2. Return on Sales | 7.02 | 7.29 | 0.965 ** | 1 | |||||||

| 3. Knowledge Acquisition | 0.00 | 1.00 | 0.763 ** | 0.689 ** | 1 | ||||||

| 4. Innovation Performance | 24.27 | 19.79 | 0.603 ** | 0.529 ** | 0.585 ** | 1 | |||||

| 5. Absorptive Capacity | 0.00 | 1.00 | 0.627 ** | 0.562 ** | 0.647 ** | 0.698 ** | 1 | ||||

| 6. Firm size(log) | 7.07 | 0.47 | 0.228 * | 0.218 * | 0.146 | 0.114 | 0.180 * | 1 | |||

| 7. Firm age | 10.59 | 8.22 | −0.027 | −0.022 | 0.042 | −0.005 | 0.120 | 0.096 | 1 | ||

| 8. Industry Type | 0.66 | 0.48 | −0.051 | −0.078 | −0.101 | −0.032 | −0.064 | −0.125 | −0.148 | 1 | |

| 9. IJV Experience | 0.87 | 0.33 | 0.519 ** | 0.437 ** | 0.589 ** | 0.420 ** | 0.571 ** | 0.212 * | 0.187 * | −0.171 | 1 |

| Variables | Sales Growth | Innovation Performance | Sales Growth | |||

|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | |

| B | B | B | B | B | B | |

| Firm size (log) | 2.405 † (1.392) | 2.082 * (1.047) | 1.830 † (1.026) | 0.855 (3.143) | −0.778 (2.672) | 2.002 * (1.009) |

| Firm age | −0.136 † (0.080) | −0.085 (0.060) | −0.094 (0.059) | −0.114 (0.181) | −0.174 (0.154) | −0.074 (0.058) |

| Industry Type | 0.635 (1.383) | 0.707 (1.040) | 0.598 (1.019) | 1.533 (3.112) | 0.869 (2.654) | 0.563 (1.003) |

| IJV Experience | 13.266 *** (2.013) | 2.854 (1.855) | 2.099 (2.062) | 7.759 (5.566) | 3.350 (5.371) | 2.123 (1.801) |

| Knowledge Acquisition | 5.820 *** (0.599) | 5.122 *** (0.685) | 10.103 *** (1.796) | 5.753 ** (1.785) | 4.869 *** (0.648) | |

| Innovation Performance | 0.094 ** (0.029) | |||||

| Absorptive Capacity | 1.735 * (0.654) | 10.985 *** (1.703) | ||||

| Knowledge Acquisition x Absorptive Capacity | 0.495 (0.566) | 3.404 * (1.474) | ||||

| F-Statistics | 13.274 *** | 37.674 *** | 29.487 *** | 13.300 *** | 20.382 *** | 35.571 *** |

| R2 | 0.303 | 0.609 | 0.634 | 0.355 | 0.545 | 0.640 |

| Adjusted R2 | 0.280 | 0.593 | 0.613 | 0.328 | 0.518 | 0.622 |

| Changes in R2 | 0.306 *** | 0.025 * | 0.191 *** | |||

| Path | Effect (b) | Boot SE | Boot 95% CI | |

|---|---|---|---|---|

| LLCI | ULCI | |||

| Total Effect of knowledge acquisition on sales growth | 5.820 | 0.599 | 4.635 | 7.005 |

| Direct Effect of knowledge acquisition on sales growth | 4.869 | 0.648 | 3.587 | 6.151 |

| Indirect Effect of knowledge acquisition on sales growth (knowledge acquisition–innovation performance–Sales Growth) | 0.951 | 0.296 | 0.446 | 1.613 |

| Mediator | Moderator (Absorptive Capacity) | Conditional Indirect Effects | Boot SE | Boot LLCI | Boot ULCI |

|---|---|---|---|---|---|

| Innovation Performance | −1.000 (−1 SD) | 0.221 | 0.164 | −0.047 | 0.620 |

| 0.000 (mean) | 0.542 | 0.235 | 0.162 | 1.087 | |

| 1.000 (+1 SD) | 0.862 | 0.379 | 0.263 | 1.786 |

| Hypothesis | Expected Sign | Empirical Conclusions |

|---|---|---|

| Hypothesis 1.E-E firms’ knowledge acquisition from an advanced IJV partner will have a positive effect on their financial performance. | + | Supported |

| Hypothesis 1-1.E-E firms’ knowledge acquisition from an advanced IJV partner will have a positive effect on their growth. | + | Supported |

| Hypothesis 1-2.E-E firms’ knowledge acquisition from an advanced IJV partner will have a positive effect on their profitability. | + | Supported |

| Hypothesis 2.E-E firms’ innovation performance will mediate the positive effect of their knowledge acquisition from an advanced IJV partner on their financial performance. | + | Supported |

| Hypothesis 2-1.E-E firms’ innovation performance will mediate the positive effect of their knowledge acquisition from an advanced IJV partner on their growth. | + | Supported |

| Hypothesis 2-2.E-E firms’ innovation performance will mediate the positive effect of their knowledge acquisition from an advanced IJV partner on their profitability. | + | Supported |

| Hypothesis 3.The positive effect of E-E firms’ knowledge acquisition from an advanced IJV partner on their financial performance through innovation performance will be stronger for E-E firms with higher absorptive capacity than for those with lower absorptive capacity. | + | Supported |

| Hypothesis 3-1.The positive effect of E-E firms’ knowledge acquisition from an advanced IJV partner on their growth through innovation performance will be stronger for E-E firms with higher absorptive capacity than for those with lower absorptive capacity. | + | Supported |

| Hypothesis 3-2.The positive effect of E-E firms’ knowledge acquisition from an advanced IJV partner on their profitability through innovation performance will be stronger for E-E firms with higher absorptive capacity than for those with lower absorptive capacity. | + | Supported |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, C.Y.; Seo, E.-H.; Booranabanyat, C.; Kim, K. Effects of Emerging-Economy Firms’ Knowledge Acquisition from an Advanced International Joint Venture Partner on Their Financial Performance Based on the Open Innovation Perspective. J. Open Innov. Technol. Mark. Complex. 2021, 7, 67. https://doi.org/10.3390/joitmc7010067

Kim CY, Seo E-H, Booranabanyat C, Kim K. Effects of Emerging-Economy Firms’ Knowledge Acquisition from an Advanced International Joint Venture Partner on Their Financial Performance Based on the Open Innovation Perspective. Journal of Open Innovation: Technology, Market, and Complexity. 2021; 7(1):67. https://doi.org/10.3390/joitmc7010067

Chicago/Turabian StyleKim, Choo Yeon, Eun-Hwa Seo, Canisha Booranabanyat, and Kwangsoo Kim. 2021. "Effects of Emerging-Economy Firms’ Knowledge Acquisition from an Advanced International Joint Venture Partner on Their Financial Performance Based on the Open Innovation Perspective" Journal of Open Innovation: Technology, Market, and Complexity 7, no. 1: 67. https://doi.org/10.3390/joitmc7010067

APA StyleKim, C. Y., Seo, E.-H., Booranabanyat, C., & Kim, K. (2021). Effects of Emerging-Economy Firms’ Knowledge Acquisition from an Advanced International Joint Venture Partner on Their Financial Performance Based on the Open Innovation Perspective. Journal of Open Innovation: Technology, Market, and Complexity, 7(1), 67. https://doi.org/10.3390/joitmc7010067