The Situation of Technology Companies in Industry 4.0 and the Open Innovation

Abstract

:1. Introduction

- Research Question 1: What is the status of implementation of Industry 4.0 technologies among the technology companies in Malaysia?

- Research Question 2: What are the main insights of Industry 4.0 technologies in comparison with company size (small, medium and large)?

- Research Question 3: What are the main insights of Industry 4.0 technologies in contrast with company type (manufacturing and services)?

2. Theoretical Background

2.1. Industry 4.0 Technologies

2.2. Impact of Industry 4.0 Technologies

2.3. Unified Theory of Acceptance and Use of Technology (UTAUT)

3. Methods

3.1. Data Collection and Sampling

3.2. Measurement and Scale

4. Results

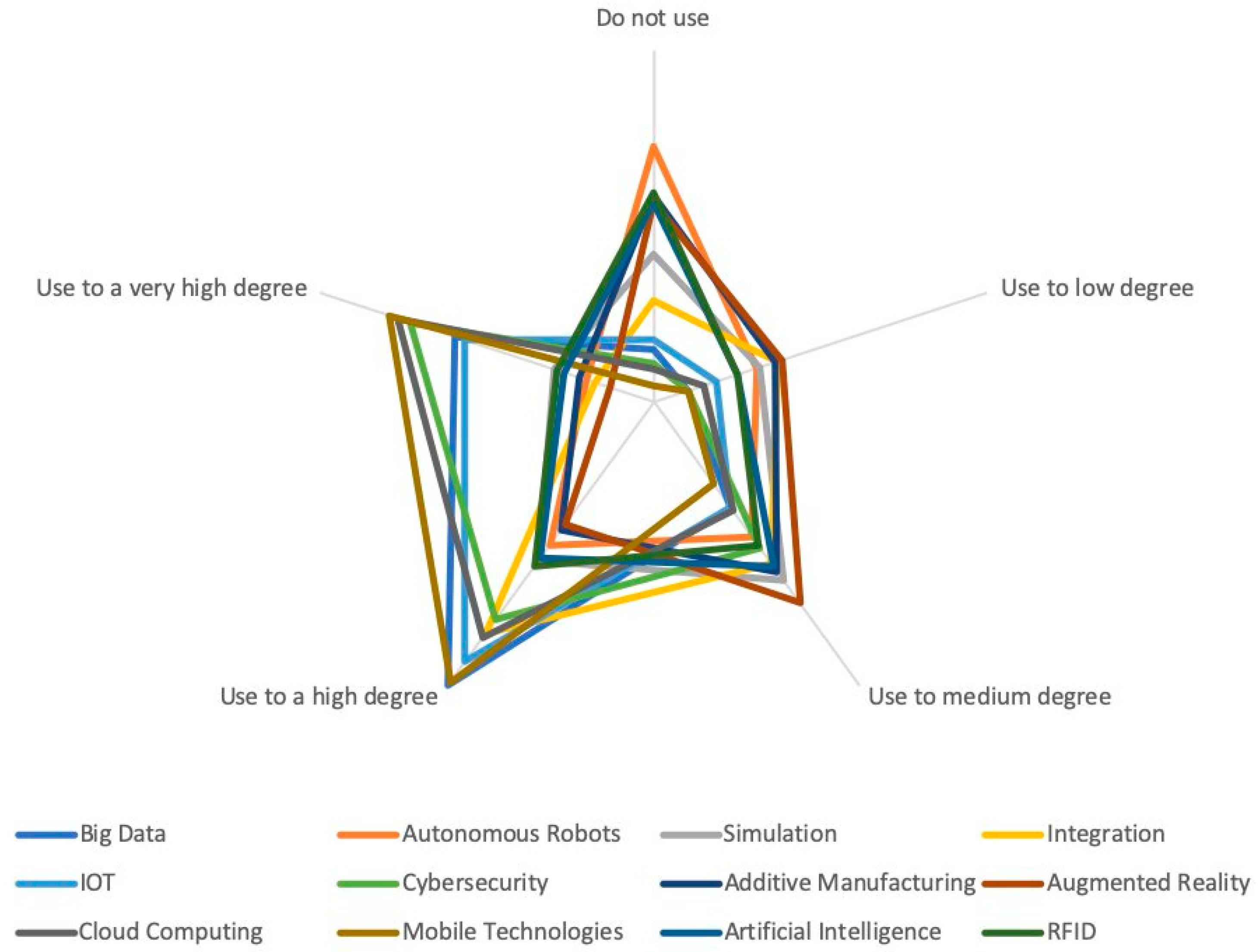

4.1. Status of Implementation of Industry 4.0 Technologies

4.2. Industry 4.0 Technologies in Comparison with Company Size

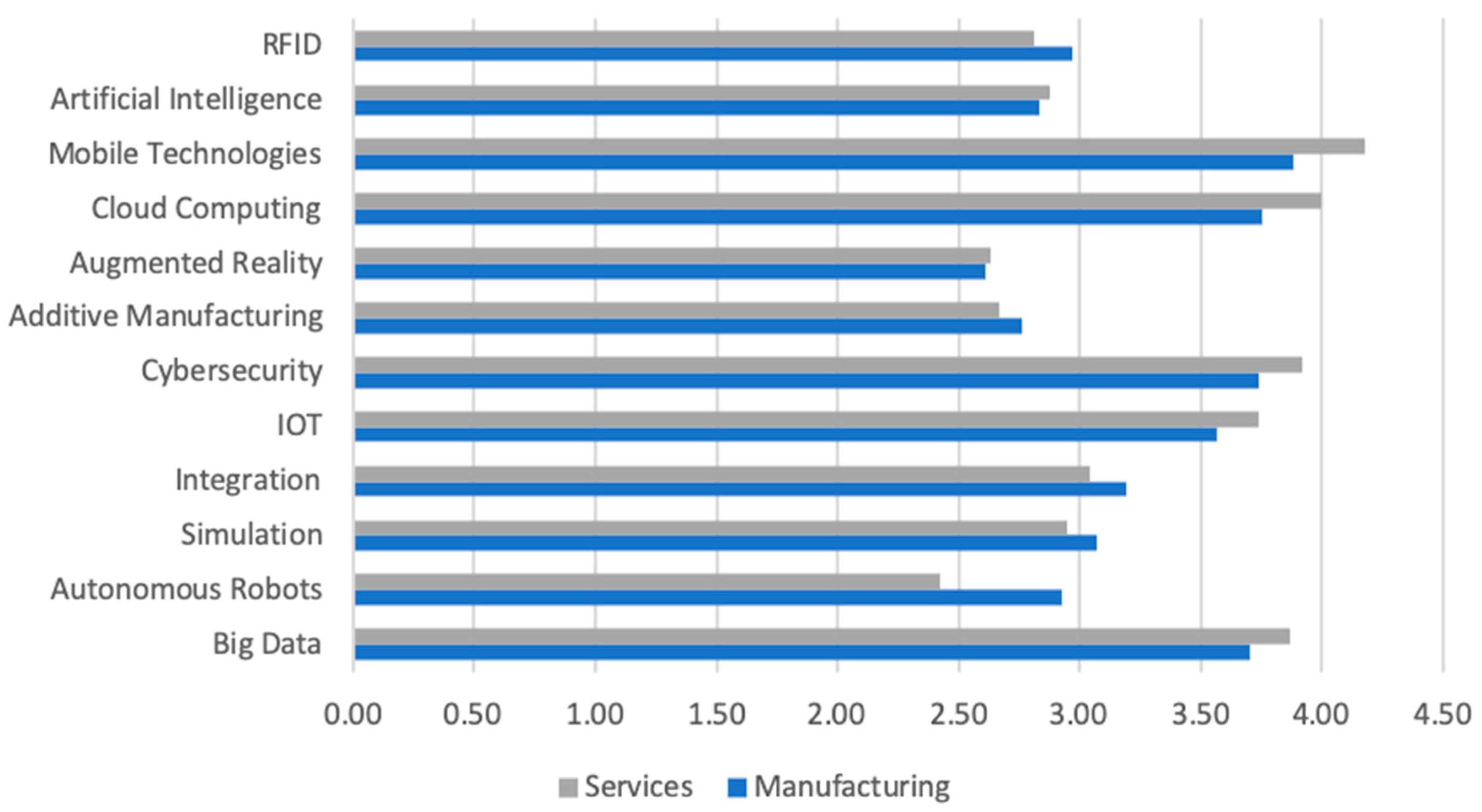

4.3. Industry 4.0 Technologies in Contrast with Company Type

- Research Question 1: What is the status of implementation of Industry 4.0 technologies among the technology companies in Malaysia?

- Research Question 2: What are the main insights of Industry 4.0 technologies in comparison with company size (small, medium, and large)?

- Research Question 3: What are the main insights of Industry 4.0 technologies in contrast with company type (manufacturing and services)?

5. Discussion: Industry 4.0 and the Open Innovation of Technology Firms

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Botha, A.P. Rapidly Arriving Futures: Future Readiness for Industry 4.0. S. Afr. J. Ind. Eng. 2018, 29, 148–160. [Google Scholar] [CrossRef] [Green Version]

- Saucedo-Martínez, J.A.; Pérez-Lara, M.; Marmolejo-Saucedo, J.A.; Salais-Fierro, T.E.; Vasant, P. Industry 4.0 framework for management and operations: A review. J. Ambient Intell. Humaniz. Comput. 2018, 9, 789–801. [Google Scholar] [CrossRef]

- Bahrin, M.A.K.; Othman, M.F.; Azli, N.H.N.; Talib, M.F. Industry 4.0: A review on industrial automation and robotic. J. Teknol. 2016, 78, 137–143. [Google Scholar]

- Fayyaz, A.; Chaudhry, B.N.; Fiaz, M. Upholding Knowledge Sharing for Organization Innovation Efficiency in Pakistan. J. Open Innov. Technol. Mark. Complex. 2021, 7, 4. [Google Scholar] [CrossRef]

- Skordoulis, M.; Ntanos, S.; Kyriakopoulos, G.L. Environmental Innovation, Open Innovation Dynamics and Competitive Advantage of Medium and Large-Sized Firms. J. Open Innov. Technol. Mark. Complex. 2020, 6, 195. [Google Scholar] [CrossRef]

- Neugebauer, R.; Hippmann, S.; Leis, M.; Landherr, M. Industrie 4.0—From the Perspective of Applied Research. Procedia CIRP 2016, 57, 2–7. [Google Scholar] [CrossRef]

- Schwab, K. The Fourth Industrial Revolution; Crown: New York, NY, USA, 2016; Volume 91. [Google Scholar]

- Sharma, S.; Gandhi, P.J. Journey Readiness of Industry 4.0 from Revolutionary Idea to Evolutionary Implementation: A Lean Management Perspective. Int. J. Inf. Commun. Sci. 2018, 3, 96–103. [Google Scholar] [CrossRef] [Green Version]

- Fatorachian, H.; Kazemi, H. A critical investigation of Industry 4.0 in manufacturing: Theoretical operationalisation framework. Prod. Plan. Control 2018, 29, 633–644. [Google Scholar] [CrossRef]

- Sony, M. Key ingredients for evaluating Industry 4.0 readiness for organizations: A literature review. Benchmarking Int. J. 2019, 27, 2213–2232. [Google Scholar] [CrossRef]

- Dillman, D.A. Moving Survey Methodology Forward in Our Rapidly Changing World: A Commentary. J. Rural Soc. Sci. 2016, 31, 8. [Google Scholar]

- Sanders, A.; Elangeswaran, C.; Wulfsberg, J. Industry 4.0 implies lean manufacturing: Research activities in industry 4.0 function as enablers for lean manufacturing. J. Ind. Eng. Manag. 2016, 9, 811–833. [Google Scholar] [CrossRef] [Green Version]

- Imran, M.; Hameed, W.U.; Haque, A.U. Influence of Industry 4.0 on the Production and Service Sectors in Pakistan: Evidence from Textile and Logistics Industries. Soc. Sci. 2018, 7, 246. [Google Scholar] [CrossRef] [Green Version]

- Vaidya, S.; Ambad, P.; Bhosle, S. Industry 4.0—A Glimpse. Procedia Manuf. 2018, 20, 233–238. [Google Scholar] [CrossRef]

- Dirican, C. The Impacts of Robotics, Artificial Intelligence On Business and Economics. Procedia Soc. Behav. Sci. 2015, 195, 564–573. [Google Scholar] [CrossRef] [Green Version]

- Xiang, Z. Information and Communication Technologies in Tourism 2014; Springer: Berlin/Heidelberg, Germany, 2014; pp. 553–564. [Google Scholar]

- Majeed, M.A.A.; Rupasinghe, T.D. Internet of things (IoT) embedded future supply chains for industry 4.0: An assessment from an ERP-based fashion apparel and footwear industry. Int. J. Supply Chain Manag. 2017, 6, 25–40. [Google Scholar]

- Gilchrist, A. Industry 4.0, The Industrial Internet of Things (Getting from Here to There); Apress: New York, NY, USA, 2016; Volume 146. [Google Scholar]

- Ochs, T.; Riemann, U. Industry 4.0: How to Manage Transformation as the New Normal. In The Palgrave Handbook of Managing Continuous Business Transformation; Palgrave Macmillan: London, UK, 2016; pp. 1–610. [Google Scholar]

- Hofmann, E.; Rüsch, M. Industry 4.0 and the current status as well as future prospects on logistics. Comput. Ind. 2017, 89, 23–34. [Google Scholar] [CrossRef]

- Kang, H.S.; Lee, J.Y.; Choi, S.; Kim, H.; Park, J.H.; Son, J.Y.; Kim, B.H.; Do Noh, S. Smart manufacturing: Past research, present findings, and future directions. Int. J. Precis. Eng. Manuf. Green Technol. 2016, 3, 111–128. [Google Scholar] [CrossRef]

- Roblek, V.; Meško, M.; Krapež, A. A Complex View of Industry 4.0. Sage Open 2016, 6, 1–11. [Google Scholar] [CrossRef] [Green Version]

- Nagy, J.; Oláh, J.; Erdei, E.; Máté, D.; Popp, J. The role and impact of industry 4.0 and the internet of things on the business strategy of the value chain-the case of Hungary. Sustainability 2018, 10, 3491. [Google Scholar] [CrossRef] [Green Version]

- Huang, Y.; Leu, M.C.; Mazumder, J.; Donmez, A. Additive Manufacturing: Current State, Future Potential, Gaps and Needs, and Recommendations. J. Manuf. Sci. Eng. 2015, 137, 014001. [Google Scholar] [CrossRef] [Green Version]

- Wang, Y.; Wang, G.; Anderl, R. Generic Procedure Model to Introduce Industrie 4.0 in Small and Medium-sized Enterprises. In Proceedings of the world congress on engineering and computer science, London, UK, 29 June–1 July 2016; pp. 971–976. [Google Scholar]

- Telukdarie, A.; Buhulaiga, E.; Bag, S.; Gupta, S.; Luo, Z. Industry 4.0 implementation for multinationals. Process Saf. Environ. Prot. 2018, 118, 316–329. [Google Scholar] [CrossRef]

- Uckelmann, D. A definition approach to smart logistics. In Lecture Notes in Computer Science (Including Subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics); Springer: Berlin/Heidelberg, Germany, 2008. [Google Scholar]

- Fuchs, C. Industry 4.0: The digital German ideology. TripleC 2018, 16, 280–289. [Google Scholar] [CrossRef]

- Sood, A.; Tellis, G.J. Demystifying disruption: A new model for understanding and predicting disruptive technologies. Mark. Sci. 2011, 30, 339–354. [Google Scholar] [CrossRef] [Green Version]

- Bekar, E.T.; Skoogh, A.; Cetin, N. Prediction of Industry 4.0’s Impact on Total Productive Maintenance Using a Real Manufacturing Case. In The International Symposium for Production Research; Springer: Berlin/Heidelberg, Germany, 2018; pp. 136–149. [Google Scholar]

- Bayram, B.; İnce, G. Advances in Robotics in the Era of Industry 4.0. In Industry 4.0: Managing The Digital Transformation; Springer: Berlin/Heidelberg, Germany, 2018; pp. 187–200. [Google Scholar]

- Rojko, A. Industry 4.0 Concept: Background and Overview. ECPE Eur. Cent. Power Electron. 2017, 11, 3–38. [Google Scholar] [CrossRef] [Green Version]

- Akdil, K.Y.; Ustundag, A.; Cevikcan, E. Maturity and Readiness Model for Industry 4.0 Strategy Implementation of Industry 4.0 Strategies Require Wide Applications in Companies; Springer International Publisher: Berlin/Heidelberg, Germany, 2018. [Google Scholar]

- Leyh, C.; Martin, S.; Sch, T. Analyzing Industry 4.0 Models with Focus on Lean Production Aspects. In Information Technology for Management. Ongoing Research and Development; Springer: Berlin/Heidelberg, Germany, 2018; Volume 311, pp. 114–130. [Google Scholar]

- Haddara, M.; Elragal, A. The Readiness of ERP Systems for the Factory of the Future. Procedia Comput. Sci. 2015, 64, 721–728. [Google Scholar] [CrossRef] [Green Version]

- Wichmann, R.L.; Eisenbart, B.; Gericke, K. The Direction of Industry: A Literature Review on Industry 4.0. In Proceedings of the Design Society: International Conference on Engineering Design; Cambridge University Press: Cambridge, UK, 2019; Volume 1, pp. 2129–2138. [Google Scholar]

- Awa, H.O.; Ukoha, O.; Igwe, S.R. Revisiting technology-organization-environment (T-O-E) theory for enriched applicability. Bottom Line 2017, 30, 2–22. [Google Scholar] [CrossRef]

- Venkatesh, V.; Zhang, X. Unified theory of acceptance and use of technology: U.S. vs. China. J. Glob. Inf. Technol. Manag. 2010, 13, 5–27. [Google Scholar] [CrossRef]

- Venkatesh, V.; Bala, H. Adoption and impacts of interorganizational business process standards: Role of partnering synergy. Inf. Syst. Res. 2012, 23, 1131–1157. [Google Scholar] [CrossRef] [Green Version]

- Hizam-Hanafiah, M.; Soomro, M.A.; Abdullah, N.L. Industry 4.0 Readiness Models: A Systematic Literature Review of Model Dimensions. Information 2020, 11, 364. [Google Scholar] [CrossRef]

- Hofstede, G. Dimensionalizing Cultures: The Hofstede Model in Context. Online Read. Psychol. Cult. 2011, 2, 8. [Google Scholar] [CrossRef]

- Soomro, M.A.; Hizam-Hanafiah, M.; Abdullah, N.L. Digital readiness models: A systematic literature review. Compusoft 2020, 9, 3596–3605. [Google Scholar]

- Sekaran, U.; Bougie, R. Research Methods for Business: A Skill-Building Approach/Uma Sekaran and Roger Bougie; John Wiley & Sons: Hoboken, NY, USA, 2016. [Google Scholar]

- Rachinger, M.; Rauter, R.; Müller, C.; Vorraber, W.; Schirgi, E. Digitalization and its influence on business model innovation. J. Manuf. Technol. Manag. 2019, 30, 1143–1160. [Google Scholar] [CrossRef]

- Steenhuis, H.J.; de Bruijn, E.J. High technology revisited: Definition and position. In Proceedings of the 2006 IEEE International Conference on Management of Innovation and Technology, Singapore, 21–23 June 2006; Volume 2, pp. 1080–1084. [Google Scholar]

- Anuar, A.; Yusuff, R.M. Manufacturing best practices in Malaysian small and medium enterprises (SMEs). Benchmarking Int. J. 2011, 18, 324–341. [Google Scholar] [CrossRef]

- Adil, M.S. Impact of Leader’s Change-Promoting Behavior on Readiness for Change: A Mediating Role of Organizational Culture. J. Manag. Sci. 2014, 1, 113–150. [Google Scholar]

- Hanna, N.K.; Knight, P.T. Why National e-Transformation Strategies? Springer: Berlin/Heidelberg, Germany, 2012. [Google Scholar]

- Stentoft, J.; Wickstrøm, K.A.; Philipsen, K.; Haug, A. Drivers and barriers for Industry 4.0 readiness and practice: Empirical evidence from small and medium-sized manufacturers. Prod. Plan. Control 2020. [Google Scholar] [CrossRef]

- Kim, K. Likert Scale. Korean J. Fam. Med. 2011, 32, 1–2. [Google Scholar] [CrossRef]

- Basl, J. Companies on the Way to Industry 4.0 and their Readiness. J. Syst. Integr. 2018, 3, 3. [Google Scholar]

- Stăncioiu, A. The Fourth Industrial Revolution ‘Industry 4.0’. Fiabilitate Durabilitate 2017, 1, 74–78. [Google Scholar]

- Sibel, Y. Industry 4.0 and Turkey: A Financial Perspective. In Strategic Design and Innovative Thinking in Business Operations; Springer: Berlin/Heidelberg, Germany, 2018; pp. 273–291. [Google Scholar]

- Visconti, R.M.; Morea, D. Healthcare digitalization and pay-for-performance incentives in smart hospital project financing. Int. J. Environ. Res. Public Health 2020, 17, 2318. [Google Scholar] [CrossRef] [Green Version]

- Visconti, R.M.; Martiniello, L.; Morea, D.; Gebennini, E. Can public-private partnerships foster investment sustainability in smart hospitals? Sustainability 2019, 11, 1–19. [Google Scholar]

- Oztemel, E.; Gursev, S. Literature review of Industry 4.0 and related technologies. J. Intelligent Manuf. 2020, 31, 127–182. [Google Scholar] [CrossRef]

- Uygun, Y. Human Resources Requirements for Industry 4.0. 2018, pp. 1–20. Available online: http://iciee.untirta.ac.id/ICIEE-2018_Uygun.pdf (accessed on 10 January 2021).

- Myrtveit, M.; Bean, M. Business Modelling and Simulation. Wirtschaftsinformatik 2000, 42, 156–160. [Google Scholar] [CrossRef]

- Mourtzis, D.; Vlachou, E.; Dimitrakopoulos, G.; Zogopoulos, V. Cyber-Physical Systems and Education 4.0-The Teaching Factory 4.0 Concept. Procedia Manuf. 2018, 23, 129–134. [Google Scholar] [CrossRef]

- Bibby, L.; Dehe, B. Defining and assessing industry 4.0 maturity levels–case of the defence sector. Prod. Plan. Control 2018, 29, 1030–1043. [Google Scholar] [CrossRef]

- Kim, H.M.; Laskowski, M. Toward an ontology-driven blockchain design for supply-chain provenance. Intell. Syst. Accounting, Financ. Manag. 2018, 25, 8–27. [Google Scholar] [CrossRef]

- Zhou, K.; Liu, T.; Zhou, L. Industry 4.0: Towards future industrial opportunities and challenges. In Proceedings of the 2015 12th International Conference on Fuzzy Systems and Knowledge Discovery, FSKD 2015, Zhangjiajie, China, 15–17 August 2015. [Google Scholar]

- Visconti, R.M.; Morea, D. Big data for the sustainability of healthcare project financing. Sustainability 2019, 11, 3748. [Google Scholar] [CrossRef] [Green Version]

- Zheng, P.; Sang, Z.; Zhong, R.Y.; Liu, Y.; Liu, C.; Mubarok, K.; Yu, S.; Xu, X. Smart manufacturing systems for Industry 4.0: A conceptual framework, scenarios and future perspectives. Front. Mech. Eng. 2017, 13, 137–150. [Google Scholar] [CrossRef]

- Wan, J.; Xia, M. Cloud-Assisted Cyber-Physical Systems for the Implementation of Industry 4.0. Mob. Netw. Appl. 2017, 22, 1157–1158. [Google Scholar] [CrossRef] [Green Version]

- Silva, F.; Resende, D.; Amorim, M.; Borges, M. A field study on the impacts of implementing concepts and elements of industry 4.0 in the biopharmaceutical sector. J. Open Innov. Technol. Mark. Complex. 2020, 6, 175. [Google Scholar] [CrossRef]

- Hermann, M.; Pentek, T.; Otto, B. Design principles for industrie 4.0 scenarios. In Proceedings of the 2016 49th Hawaii International Conference on System Sciences (HICSS), Koloa, HI, USA, 5–8 January 2016; pp. 3928–3937. [Google Scholar]

- Tvenge, N.; Martinsen, K. Integration of digital learning in industry 4.0. Procedia Manuf. 2018, 23, 261–266. [Google Scholar] [CrossRef]

- Schlingensiepen, J.; Nemtanu, F.; Mehmood, R. Autonomic Transport Management Systems—Enabler for Smart Cities, Personalized Medicine, Participation and Industry Grid/Industry 4.0; Springer: Berlin/Heidelberg, Germany, 2016; Volume 32. [Google Scholar]

- Pessl, E. Roadmap Industry 4.0—Implementation Guideline for Enterprises. Int. J. Sci. Technol. Soc. 2017, 5, 193. [Google Scholar] [CrossRef]

- Kagermann, H.; Wahlster, W.; Helbig, J. Recommendations for Implementing the Strategic Initiative Industrie 4.0; acatech: Munich, Germany, 2013. [Google Scholar]

- Prause, G. Sustainable Business Models and Structures for Industry 4.0. J. Secur. Sustain. Issues 2015, 5, 159–169. [Google Scholar] [CrossRef] [Green Version]

- Füller, J.; Bartl, M.; Ernst, H.; Mühlbacher, H. Community based innovation: How to integrate members of virtual communities into new product development. Electron. Commer. Res. 2006, 6, 57–73. [Google Scholar] [CrossRef]

- Van de Vrande, V.; de Jong, J.P.J.; Vanhaverbeke, W.; de Rochemont, M. Open innovation in SMEs: Trends, motives and management challenges. Technovation 2009, 29, 423–437. [Google Scholar] [CrossRef] [Green Version]

- Prause, G.; Atari, S. On sustainable production networks for industry 4.0. Entrep. Sustain. Issues 2017, 4, 421–431. [Google Scholar] [CrossRef]

- Yun, J.J. Business Model Design Compass; Springer: Singapore, 2017. [Google Scholar]

- Chesbrough, H. GE’s ecomagination Challenge: An experiment in open innovation. Calif. Manag. Rev. 2012, 54, 140–154. [Google Scholar] [CrossRef] [Green Version]

- Zhu, X.; Xiao, Z.; Dong, M.C.; Gu, J. The fit between firms’ open innovation and business model for new product development speed: A contingent perspective. Technovation 2019, 86, 75–85. [Google Scholar] [CrossRef]

- Yun, J.J.; Zhao, X.; Park, K.B.; Shi, L. Sustainability condition of open innovation: Dynamic growth of Alibaba from SME to large enterprise. Sustainability 2020, 12, 4379. [Google Scholar] [CrossRef]

- Weking, J.; Stöcker, M.; Kowalkiewicz, M.; Böhm, M.; Krcmar, H. Archetypes for Industry 4.0 Business Model Innovations. In Proceedings of the 24th Americas Conference on Information Systems, New Orleans, LA, USA, 16–18 August 2018. [Google Scholar]

- Von Hippel, E. Democratizing innovation: The evolving phenomenon of user innovation. J. Betr. 2005, 55, 63–78. [Google Scholar] [CrossRef]

- Yun, J.H.J.; Liu, Z. Micro- and macro-dynamics of Open Innovation with a Quadruple-Helix model. Sustainability 2019, 11, 3301. [Google Scholar] [CrossRef] [Green Version]

| Manufacturing | Services | |

|---|---|---|

| Large | Sales turnover: Above 50 mil Or Employees: More than 200 | Sales turnover: Above 20 mil Or Employees: More than 75 |

| Medium | Sales turnover: RM15 mil ≤ RM50 mil Or Employees: From 75 to ≤ 200 | Sales turnover: RM3 mil ≤ RM20 mil Or Employees: From 30 to ≤ 75 |

| Small | Sales turnover: RM300,000 < RM15 mil Or Employees: From 5 to < 75 | Sales turnover: RM300,000 < RM3 mil Or Employees: From 5 to < 30 |

| To Which Degree on a 1–5 Scale, Do You Apply the Following Industry 4.0 Technologies in Your Organization? (1 Do Not Use, 5 Use to a Very High Degree) | |

|---|---|

| No. | Industry 4.0 Technologies |

| 1 | Big Data and Analytics |

| 2 | Autonomous Robots |

| 3 | Simulation |

| 4 | Horizontal and Vertical System Integration |

| 5 | Internet of Things (IoT) |

| 6 | Cybersecurity |

| 7 | Additive Manufacturing |

| 8 | Augmented Reality |

| 9 | Cloud Computing |

| 10 | Mobile Technologies |

| 11 | Artificial Intelligence |

| 12 | Radio-Frequency Identification (RFID) |

| Items | Frequency | Percentage (%) |

|---|---|---|

| Manufacturing Large | 45 | 18.9 |

| Manufacturing Medium | 22 | 9.2 |

| Manufacturing Small | 22 | 9.2 |

| Services Large | 73 | 30.7 |

| Services Medium | 49 | 20.6 |

| Services Small | 27 | 11.3 |

| Total | 238 | 100 |

| No. | Industry 4.0 Technologies | Mean | Standard Deviation | Adoption Percentage |

|---|---|---|---|---|

| 1 | Big Data and Analytics | 3.81 | 1.093 | 93% |

| 2 | Autonomous Robots | 2.62 | 1.381 | 67% |

| 3 | Simulation | 3 | 1.302 | 81% |

| 4 | Horizontal and Vertical System Integration | 3.1 | 1.171 | 87% |

| 5 | Internet of Things (IoT) | 3.68 | 1.176 | 92% |

| 6 | Cybersecurity | 3.85 | 1.087 | 95% |

| 7 | Additive Manufacturing | 2.71 | 1.323 | 74% |

| 8 | Augmented Reality | 2.63 | 1.222 | 74% |

| 9 | Cloud Computing | 3.91 | 1.077 | 96% |

| 10 | Mobile Technologies | 4.07 | 0.927 | 98% |

| 11 | Artificial Intelligence | 2.87 | 1.365 | 74% |

| 12 | Radio-Frequency Identification (RFID) | 2.87 | 1.401 | 73% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hizam-Hanafiah, M.; Soomro, M.A. The Situation of Technology Companies in Industry 4.0 and the Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 34. https://doi.org/10.3390/joitmc7010034

Hizam-Hanafiah M, Soomro MA. The Situation of Technology Companies in Industry 4.0 and the Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity. 2021; 7(1):34. https://doi.org/10.3390/joitmc7010034

Chicago/Turabian StyleHizam-Hanafiah, Mohd, and Mansoor Ahmed Soomro. 2021. "The Situation of Technology Companies in Industry 4.0 and the Open Innovation" Journal of Open Innovation: Technology, Market, and Complexity 7, no. 1: 34. https://doi.org/10.3390/joitmc7010034