Examining Perceived Entrepreneurial Stress: A Causal Interpretation through Cross-Lagged Panel Study

Abstract

:1. Introduction

Theoretical Background

2. Review of Literature and Hypothesis Development

2.1. Personal Stressor: Capability Gap

2.2. Social Stressor: Social Life Gap

2.3. Occupational Stressor: Stability Gap

2.4. Psychological Capital

2.5. Gaps in the Existing Literature

3. Materials and Methods

3.1. Measures and Questionnaire Development

3.2. Participants

3.3. Analytical Procedure

4. Results

4.1. Measurement and Structural Models

4.2. Assessment of Competing Models and Hypotheses Testing

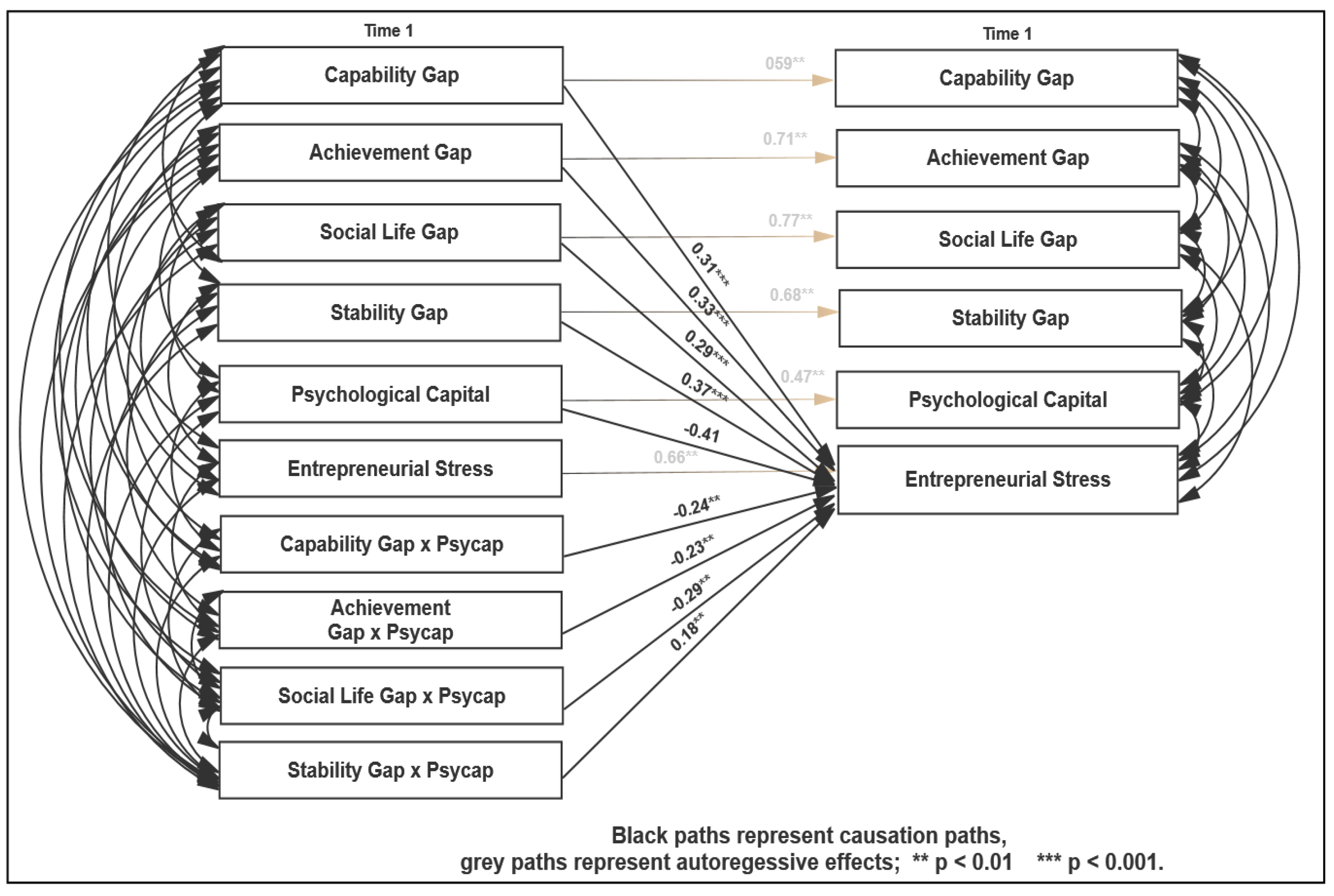

4.3. Examination of the Moderating Effects of Psychological Capital

5. Discussion

5.1. Contributions to Theory

5.2. Practical Implications of the Study

6. Conclusions

7. Limitations and Directions for Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Bliese, P.D.; Edwards, J.R.; Sonnentag, S. Stress and Wellbeing at Work: A Century of Empirical Trends Reflecting Theoretical and Societal Influences. J. Appl. Psychol. 2017, 102, 389–402. [Google Scholar] [CrossRef] [PubMed]

- Cohen, S.; Janicki-Deverts, D. Who’s stressed? Distributions of psychological stress in the United States in probability samples from 1983, 2006, and 2009. J. Appl. Soc. Psychol. 2012, 42, 1320–1334. [Google Scholar] [CrossRef]

- Gorgievski, M.J.; Stephan, U. Advancing the Psychology of Entrepreneurship: A Review of the Psychological Literature and an Introduction. Appl. Psychol. 2020, 65, 437–468. [Google Scholar] [CrossRef]

- Eager, B.; Grant, S.; Maritz, A. Entrepreneurs and the stress-coping-strain process: How relevant are existing theoretical frameworks? In Proceedings of the Australian Centre for Entrepreneurship Research Exchange, ACERE 2015, Adelaide, Australia, 3–6 February 2015; pp. 251–265. [Google Scholar]

- Shepherd, D.A. A Psychological Approach to Entrepreneurship: Selected Essays of Dean A. Shepherd; Edward Elgar Publishing: Cheltenham, UK, 2014. [Google Scholar]

- Harkness, K.L.; Hayden, E.P. (Eds.) The Oxford Handbook of Stress and Mental Health; Oxford University Press: New York, NY, USA, 2020. [Google Scholar]

- Lerman, M.P.; Munyon, T.P.; Williams, D.A. The (not so) Dark Side of Entrepreneurship: A Meta-Analysis of the Well-being and Performance Consequences of Entrepreneurial Stress. Strateg. Entrep. J. Spec. Issue 2020. [Google Scholar] [CrossRef]

- Lazarus, R.S.; Folkman, S. Stress, Appraisal and Coping; Springer: New York, NY, USA, 1984. [Google Scholar]

- Grant, S.; Ferris, K. Identifying Sources of Occupational Stress in Entrepreneurs for Measurement. Int. J. Entrep. Ventur. 2012, 4, 351–373. [Google Scholar] [CrossRef]

- Prottas, D.J.; Thompson, C.A. Stress Satisfaction and Family Life Interface: A Comparison of Self-employed Business Owners, Independents, and Organizational Employees. J. Occup. Health Psychol. 2006, 11, 366–378. [Google Scholar] [CrossRef]

- Wiklund, J.; Nikolaev, B.; Shir, N.; Foo, M.D.; Bradley, S. Entrepreneurship and wellbeing: Past, Present, and Future. J. Bus. Ventur. 2019, 34, 579–588. [Google Scholar] [CrossRef]

- Shim, I.; Shin, K. Financial Stress in Lender Countries and Capital Outflows from Emerging Market Economies. Bank Int. Settl. Work. Pap. 2018, 745, 1–42. [Google Scholar]

- Sharma, V. Forecasting Stock Index Volatility with GARCH Models: International Evidence. Stud. Econ. Financ. 2015, 32, 445–463. [Google Scholar] [CrossRef]

- Kortum, E.; Leka, S.; Cox, T. Psychosocial Risks and Work-Related Stress in Developing Countries: Health Impact, Priorities, Barriers, and Solutions. Int. J. Occup. Med. Environ. Health 2010, 23, 225–238. [Google Scholar] [CrossRef] [Green Version]

- Clough, D.R.; Fang, T.P.; Vissa, B.; Wu, A. Turning Lead Into Gold: How do Entrepreneurs Mobilize Resources to Exploit Opportunities? Acad. Manag. Ann. 2019, 13, 240–271. [Google Scholar] [CrossRef]

- Kariv, D. The Relationship between Stress and Business Performance among Men and Women Entrepreneurs. J. Small Bus. Entrep. 2008, 21, 449–476. [Google Scholar] [CrossRef]

- Su, X.; Liu, S.; Zhang, S.; Liu, L. To be Happy: A Case Study of Entrepreneurial Motivation and Entrepreneurial Process from the Perspective of Positive Psychology. Sustainability 2020, 12, 584. [Google Scholar] [CrossRef] [Green Version]

- Wincent, J.; Örtqvist, D. A comprehensive model of entrepreneur role stress antecedents and consequences. J. Bus. Psychol. 2009, 24, 225–243. [Google Scholar] [CrossRef]

- Hobfoll, S.E.; Halbesleben, J.; Neveu, J.P.; Westman, M. Conservation of Resources in the Organization Context: The Reality of Resources and their Consequences. Annu. Rev. Organ. Psychol. Organ. Behav. 2018, 5, 103–128. [Google Scholar] [CrossRef] [Green Version]

- Cardon, M.S.; Patel, P.C. Is Stress Worth it? Stress-related Health and Wealth Trade-offs for Entrepreneurs. Appl. Psychol. 2015, 64, 379–420. [Google Scholar] [CrossRef]

- Uy, M.A.; Foo, M.D.; Song, Z. Joint Effects of Prior Start-Up Experience and Coping Strategies on Entrepreneurs’ Psychological Well-Being. J. Bus. Ventur. 2013, 28, 583–597. [Google Scholar] [CrossRef]

- Desa, G.; Basu, S. Optimization or bricolage? Overcoming resource constraints in global social entrepreneurship. Strateg. Entrep. J. 2013, 7, 26–49. [Google Scholar] [CrossRef]

- Naik, B.A. Entrepreneurial Role Stress among Women Working in Mahila Bachat Gat (Women self-help group). Gold. Res. Thoughts 2012, 1, 1–10. [Google Scholar]

- Barney, J.B. Is the Resource-based “View” a Useful Perspective for Strategic Management Research? Yes. Acad. Manag. Rev. 2001, 26, 41–56. [Google Scholar]

- Nason, R.S.; Wiklund, J. An Assessment of Resource-based Theorizing on Firm Growth and Suggestions for the Future. J. Manag. 2018, 44, 32–60. [Google Scholar] [CrossRef]

- Frese, M. Stress at work and psychometric complaints: A causal interpretation. J. Appl. Psychol. 1983, 70, 314–328. [Google Scholar] [CrossRef]

- Tahseen, A.A.; Burns, P. Designing an Organization for Innovation in Emerging Economies: The Mediating Role of Readiness for Innovation. Organ. Mark. Emerg. Econ. 2019, 10, 31–56. [Google Scholar]

- Nazlioglu, S.; Soytas, U.; Gupta, R. Oil Prices and Financial Stress: A Volatility Spill-over Analysis. Energy Policy 2015, 82, 278–288. [Google Scholar] [CrossRef] [Green Version]

- Kumar, R.; Raj, T. Role of Entrepreneurship in Boosting Economic Growth and Employment in India. SEDME Small Enterp. Dev. Manag. Ext. J. 2019, 46, 273–281. [Google Scholar]

- Saberi, M.; Hamdan, A. The Moderating Role of Governmental Support in the Relationship between Entrepreneurship and Economic Growth: A Study on the GCC Countries. J. Entrep. Emerg. Econ. 2019, 11, 200–216. [Google Scholar] [CrossRef]

- Barney, J.B.; Ketchen, D.J.; Wright, M. The Future of Resource-Based Theory. J. Manag. 2011, 37, 1299–1315. [Google Scholar] [CrossRef]

- Barney, J.B. Measuring Firm Performance in a Way that Is Consistent with Strategic Management Theory. Acad. Manag. Discov. 2020, 6, 5–7. [Google Scholar] [CrossRef]

- Morris, M.H.; Kuratko, D.F.; Allen, J.W.; Ireland, R.D.; Schindehutte, M. Resource Acceleration: Extending Resource-based Theory in Entrepreneurial Ventures. J. Appl. Manag. Entrep. 2010, 15, 4–25. [Google Scholar]

- Collins, C.J. Expanding the resource-based view model of strategic human resource management. Int. J. Hum. Resour. Manag. 2020, 1–28. [Google Scholar] [CrossRef]

- Sameera, K.P. Do resource-based view spur firm performance: A literature review. Int. J. Nov. Res. Humanit. Soc. Sci. 2020, 7, 45–51. [Google Scholar] [CrossRef]

- Barney, J.B.; Arikan, A.M. The Resource-Based View: Origins and Implications. In The Blackwell Handbook of Strategic Management; Blackwell Publishers: Oxford, UK, 2001. [Google Scholar]

- Crook, T.R.; Ketchen, D.J., Jr.; Combs, J.G.; Todd, S.Y. Strategic Resources and Performance: A Meta-analysis. Strateg. Manag. J. 2008, 29, 1141–1154. [Google Scholar] [CrossRef]

- Alonso, D. Exploring a developing tourism industry: A resource-based view approach. Tour. Recreat. Res. 2017, 42, 45–48. [Google Scholar]

- Perry-Rivers, P. Stratification, Economic Adversity, and Entrepreneurial Launch: The Effect of Resource Position on Entrepreneurial Strategy: ET&P. Entrep. Theory Pract. 2016, 40, 685–712. [Google Scholar]

- Rauch, A.; Fink, M.; Hatak, I. Stress Processes: An Essential Ingredient in the Entrepreneurial Process. Acad. Manag. Perspect. 2018, 32, 340–357. [Google Scholar] [CrossRef] [Green Version]

- Stephan, U. Entrepreneurs’ Mental Health and Well-being: A Review and Research Agenda. Acad. Manag. Perspect. 2018, 32, 290–322. [Google Scholar] [CrossRef] [Green Version]

- Monroe, S.M.; Slavich, G.M. Psychological Stressors: Overview, in Stress: Concepts, Cognition, Emotion, and Behaviour, 1st ed.; Fink, G., Ed.; Academic Press: Cambridge, MA, USA, 2016; pp. 109–115. [Google Scholar]

- Aure, P.A.H.; Dui, R.P.; Jimenez, S.V.; Daradar, D.D.; Gutierrez, A.N.A.; Blasa, A.C.; Sy-Changco, J. Understanding social entrepreneurial intention through social cognitive career theory: A partial least squares structural equation modeling approach. Organ. Mark. Emerg. Econ. 2019, 10, 92–110. [Google Scholar] [CrossRef]

- Tran, A.T.; Von Korflesch, H. A Conceptual Model of Social Entrepreneurial Intention Based on the Social Cognitive Career Theory. Asia Pac. J. Innov. Entrep. 2016, 10, 17–38. [Google Scholar] [CrossRef]

- Tahir, U. Entrepreneurial Stress in SMEs. J. Resour. Dev. Manag. 2016, 18, 51–64. [Google Scholar]

- Ebbers, J.J.; Wijnberg, N.M. Betwixt and Between Role Conflict, Role Ambiguity and Role Definition in Project-Based Dual-Leadership Structures. Hum. Relat. 2017, 70, 1342–1365. [Google Scholar] [CrossRef]

- Baikadi, S.B. Ordered Thinking Versus Disordered Doing: A study of Entrepreneurial Role Stress in the Ethiopian Business Environment. J. Econ. Dev. Manag. ITFinanc. Mark. 2016, 8, 24. [Google Scholar]

- Mathias, B.D.; Williams, D.W. Giving up the hats? Entrepreneurs’ Role Transitions and Venture Growth. J. Bus. Ventur. 2018, 33, 261–277. [Google Scholar] [CrossRef]

- Lechat, T.; Torrès, O. Stressors and satisfactors in entrepreneurial activity: An event-based, mixed methods study predicting small business owners’ health. Int. J. Entrep. Small Bus. 2017, 32, 537–569. [Google Scholar] [CrossRef]

- Wincent, J.; Örtqvist, D. Role Stress and Entrepreneurship Research. Int. Entrep. Manag. J. 2009, 5, 1–22. [Google Scholar] [CrossRef]

- McMullen, J.S.; Shepherd, D.A. Entrepreneurial Action and the Role of Uncertainty in the Theory of the Entrepreneur. Acad. Manag. Rev. 2006, 31, 132–152. [Google Scholar] [CrossRef] [Green Version]

- Mol, E.; Ho, V.T.; Pollack, J.M. Predicting Entrepreneurial Burnout in a Moderated Mediated Model of Job Fit. J. Small Bus. Manag. 2018, 56, 392–411. [Google Scholar] [CrossRef]

- Cardon, M.S.; Gregoire, D.A.; Stevens, C.E.; Patel, P.C. Measuring Entrepreneurial Passion: Conceptual Foundations and Scale Validation. J. Bus. Ventur. 2013, 28, 373–396. [Google Scholar] [CrossRef]

- Burns, P. Entrepreneurship and Small Business; Palgrave McMillan: London, UK, 2018. [Google Scholar]

- Jayawarna, D.; Rouse, J.; Kitching, J. Entrepreneur Motivations and Life Course. Int. Small Bus. J. 2013, 31, 34–56. [Google Scholar] [CrossRef]

- McGowan, P.; Redeker, C.L.; Cooper, S.Y.; Greenan, K. Female Entrepreneurship and the Management of Business and Domestic Roles: Motivations, Expectations and Realities. Entrep. Reg. Dev. 2012, 24, 53–72. [Google Scholar] [CrossRef] [Green Version]

- Chan, C. Border Crossing: Work-Life Balance Issues with Chinese Entrepreneurs in New Zealand. Ph.D. Thesis, Auckland University of Technology, Auckland, New Zealand, 2008. [Google Scholar]

- Cocker, F.; Martin, A.; Scott, J.; Venn, A.; Sanderson, K. Psychological distress, related work attendance, and productivity loss in small-to-medium enterprise owner/managers. Int. J. Environ. Res. Public Health 2013, 10, 5062–5082. [Google Scholar] [CrossRef]

- Fernet, C.; Austin, S.; Trépanier, S.G.; Dussault, M. How do job characteristics contribute to burnout? Exploring the distinct mediating roles of perceived autonomy, competence, and relatedness. Eur. J. Work Organ. Psychol. 2013, 22, 123–137. [Google Scholar] [CrossRef]

- Wakker, P.P. Prospect Theory: For Risk and Ambiguity; University Press: Cambridge, UK, 2010. [Google Scholar]

- Toyin, A.A.; Gbadamosi, G.; Mordi, T.; Mordi, C. In Search of Perfect Boundaries? Entrepreneurs’ Work-life Balance. Pers. Rev. 2019, 48, 1634–1651. [Google Scholar]

- Helmle, J.R.; Botero, I.C.; Seibold, D.R. Factors that Influence Perceptions of Work-life Balance in Owners of Copreneurial Firms. J. Fam. Bus. Manag. 2014, 4, 110–132. [Google Scholar] [CrossRef]

- Keyes, C.L. Subjective Wellbeing in Mental health and Human Development Research Worldwide: An Introduction. Soc. Indic. Res. 2006, 77, 1–10. [Google Scholar] [CrossRef]

- Overla, M.D. The Explanatory Relationship between Work-Life Balance and Non-Work Factors of Entrepreneurs. Ph.D. Thesis, Capella University, Minneapolis, MN, USA, 2017. [Google Scholar]

- Koe, W.L. The Motivation to Adopt E-Commerce among Malaysian Entrepreneurs. Organ. Mark. Emerg. Econ. 2020, 11, 189–202. [Google Scholar]

- Semerci, A.B. The Effect of Social Support on Job Stress of Entrepreneurs. Acad. Entrep. J. 2016, 22, 41. [Google Scholar]

- Nguyen, H.; Sawang, S. Juggling or Struggling? Work and Family Interface and its Buffers among Small Business Owners. Entrep. Res. J. 2016, 6, 207–246. [Google Scholar] [CrossRef] [Green Version]

- Spicka, J. Socio-demographic drivers of the risk-taking propensity of micro farmers: Evidence from the Czech Republic. J. Entrep. Emerg. Econ. 2020, 12, 569–590. [Google Scholar] [CrossRef]

- Fernet, C.; Torrès, O.; Austin, S.; St-Pierre, J. The psychological costs of owning and managing an SME: Linking job stressors, occupational loneliness, entrepreneurial orientation, and burnout. Burn. Res. 2016, 3, 45–53. [Google Scholar] [CrossRef] [Green Version]

- Gardoni, P.; Murphy, C. A Scale of Risk. Risk Anal. 2014, 34, 1208–1227. [Google Scholar] [CrossRef]

- Omrane, A.; Kammoun, A.; Seaman, C. Entrepreneurial Burnout: Causes, Consequences and Way Out. FIIB Bus. Rev. 2018, 7, 28–42. [Google Scholar] [CrossRef] [Green Version]

- Barney, J. Gaining Sustainable Competitive Advantage; Prentice-Hall: Upper Saddle River, NJ, USA, 2007. [Google Scholar]

- Bogodistov, Y.; Wohlgemuth, V. Enterprise risk management: A capability-based perspective. J. Risk Financ. 2017, 18, 234–251. [Google Scholar] [CrossRef]

- Rabenu, E.; Yaniv, E.; Elizur, D. The relationship between psychological capital, coping with stress, wellbeing, and performance. Curr. Psychol. 2017, 36, 875–887. [Google Scholar] [CrossRef]

- Baron, R.A.; Franklin, R.J.; Hmieleski, K.M. Why entrepreneurs often experience low, not high, levels of stress: The joint effects of selection and psychological capital. J. Manag. 2016, 42, 742–768. [Google Scholar] [CrossRef]

- Jensen, S.M. Psychological Capital: Key to Understanding Entrepreneurial Stress. Econ. Bus. J. Inq. Perspect. 2012, 4, 44–55. [Google Scholar]

- Peterson, S.J.; Luthans, F.; Avolio, B.J.; Walumbwa, F.O.; Zhang, Z. Psychological Capital and Employee Performance: A Latent Growth Modelling Approach. Pers. Psychol. 2011, 64, 427–450. [Google Scholar] [CrossRef] [Green Version]

- Avey, J.B.; Luthans, F.; Jensen, S.M. Psychological Capital: A Positive Resource for Combating Employee Stress and turnover. Hum. Resour. Manag. 2009, 48, 677–693. [Google Scholar] [CrossRef]

- Luthans, F.; Avolio, B.J.; Avey, J.B.; Norman, S.M. Positive psychological capital: Measurement and relationship with performance and satisfaction. Pers. Psychol. 2007, 60, 541–572. [Google Scholar] [CrossRef] [Green Version]

- Kamal, S.; Daoud, Y.S. Do country level constructs affect the relation between self-efficacy and fear of failure? J. Entrep. Emerg. Econ. 2020, 12, 545–568. [Google Scholar] [CrossRef]

- Salisu, I.; Hashim, N.; Mashi, M.S.; Aliyu, H.G. Perseverance of effort and consistency of interest for entrepreneurial career success: Does resilience matter? J. Entrep. Emerg. Econ. 2020, 12, 279–304. [Google Scholar] [CrossRef]

- Reivich, K.; Shatté, A. The Resilience Factor: 7 Essential Skills for Overcoming Life’s Inevitable Obstacles; Random House: New York, NY, USA, 2002. [Google Scholar]

- Heilbrunn, S. Against all Odds: Refugees Bricoleuring in the Void. Int. J. Entrep. Behav. Res. 2019, 25, 1045–1064. [Google Scholar] [CrossRef]

- Welter, F.; Xheneti, M.; Smallbone, D. Entrepreneurial Resourcefulness in Unstable Institutional Contexts: The Example of European Union Borderlands. Strateg. Entrep. J. 2018, 12, 23–53. [Google Scholar] [CrossRef]

- Hair, J.F.; Anderson, R.E.; Babin, B.J.; Black, W.C. Multivariate Data Analysis: A Global Perspective, 7th ed.; MacMillan: New York, NY, USA, 2010. [Google Scholar]

- Rosseel, Y. Lavaan: An R Package for Structural Equation Modelling and more. Version 0.5–12 (BETA). J. Stat. Softw. 2012, 48, 1–36. [Google Scholar] [CrossRef] [Green Version]

- Cohen, S.; Kamarck, T.; Mermelstein, R. A global measure of perceived stress. J. Health Soc. Behav. 1983, 24, 386–396. [Google Scholar] [CrossRef]

- Lang, J.W.; Fries, S. A revised 10-item version of the Achievement Motives Scale. Eur. J. Psychol. Assess. 2006, 22, 216–224. [Google Scholar] [CrossRef]

- Hammer, L.B.; Kossek, E.E.; Yragui, N.L.; Bodner, T.E.; Hanson, G.C. Development and validation of a multidimensional measure of family supportive supervisor behaviours (FSSB). J. Manag. 2009, 35, 837–856. [Google Scholar]

- Luthans, F.; Avolio, B.J.; Avey, J.B. Psychological Capital Questionnaire: Manual Development, Applications, and Research; Mind Garden Inc.: Menlo Park, CA, USA, 2014. [Google Scholar]

- Baruch, Y.; Holtom, B.C. Survey Response Rate Levels and Trends in Organizational Research. Hum. Relat. 2008, 61, 1139–1160. [Google Scholar] [CrossRef] [Green Version]

- Hakanen, J.J.; Schaufeli, W.B.; Ahola, K. The Job Demands-Resources model: A Three-Year Cross-Lagged Study of Burnout, Depression, Commitment, and Work Engagement. Work Stress 2008, 22, 224–241. [Google Scholar] [CrossRef]

- Draugalis, J.R.; Coons, S.J.; Plaza, C.M. Best Practices for Survey Research Reports: A Synopsis for Authors and Reviewers. Am. J. Pharm. Educ. 2008, 72, 11–12. [Google Scholar] [CrossRef]

- Selig, J.P.; Little, T.D. Autoregressive and Cross-Lagged Panel Analysis for Longitudinal Data. In Handbook of Developmental Research Methods; Laursen, B., Little, T.D., Card, N.A., Eds.; The Guilford Press: New York, NY, USA, 2012; pp. 265–278. [Google Scholar]

- Baron, R.M.; Kenny, D.A. The Moderator-Mediator Variable Distinction in Social Psychological Research: Conceptual, Strategic, and Statistical Considerations. J. Personal. Soc. Psychol. 1986, 51, 1173. [Google Scholar] [CrossRef]

- Hu, L.T.; Bentler, P.M. Cutoff Criteria for fit Indexes in Covariance Structure Analysis: Conventional Criteria Versus New Alternatives. Struct. Equ. Model. Multidiscip. J. 1999, 1, 1–55. [Google Scholar] [CrossRef]

- Kenny, D.A.; Kaniskan, B.; McCoach, D.B. The Performance of RMSEA in Models with Small Degrees of Freedom. Sociol. Methods Res. 2015, 44, 486–507. [Google Scholar] [CrossRef]

- Tabachnick, B.G.; Fidell, L.S.; Ullman, J.B. Using Multivariate Statistics; Pearson: Boston, MA, USA, 2007; Volume 5, pp. 481–498. [Google Scholar]

- Hamsici, O.C.; Martinez, A.M. Spherical-Homoscedastic Distributions: The Equivalency of Spherical and Normal Distributions in Classification. J. Mach. Learn. Res. 2007, 8, 1583–1623. [Google Scholar]

- Holgado-Tello, F.; Chacón-Moscoso, S.; Sanduvete-Chaves, S.; Pérez-Gil, J.A. A simulation study of threats to validity in quasi-experimental designs: Interrelationship between design, measurement, and analysis. Front. Psychol. 2016, 7, 897. [Google Scholar] [CrossRef] [Green Version]

- Kline, R.B. Principles and Practice of Structural Equation Modelling; Guilford Publications: New York, NY, USA, 2015. [Google Scholar]

- Preacher, K.J.; Curran, P.J.; Bauer, D.J. Computational tools for probing interactions in multiple linear regression, multilevel modelling, and latent curve analysis. J. Educ. Behav. Stat. 2006, 31, 437–448. [Google Scholar] [CrossRef]

- Tang, K. A reciprocal interplay between psychological stressors and worker wellbeing: A systematic view of reversed effects. Scand. J. Work Environ. Health 2014, 40, 451–456. [Google Scholar] [CrossRef]

- Qazi, K. Making competitiveness more meaningful-A practice approach. In Proceedings of the British Academy of Management (BAM), Annual Conference: Thriving in Turbulent Times, Newcastle University, Newcastle upon Tyne, UK, 6–8 September 2016. [Google Scholar]

- Cox, R.H. Sports Psychology—Concepts and Applications; McGraw-Hill: New York, NY, USA, 2007. [Google Scholar]

- Boohene, R.; Gyimah, R.A.; Osei, M.B. Social capital and SME performance: The moderating role of emotional intelligence. J. Entrep. Emerg. Econ. 2019, 12, 79–99. [Google Scholar] [CrossRef]

- Fatoki, O. Entrepreneurial Stress, Burnout, Intention to Quit, and Performance of an Immigrant-Owned Small Business in South Africa. Int. J. Entrep. 2019, 23, 1–15. [Google Scholar]

- Sonnentag, S.; Fritz, C. Recovery from Job Stress: The Stressor-Detachment Model as an Integrative Framework. J. Organ. Behav. 2015, 36, 72–103. [Google Scholar] [CrossRef]

- Siqueira, A.C.O.; Bruton, G.D. High-technology Entrepreneurship in Emerging Economies: Firm Informality and Contextualization of Resource-Based Theory. IEEE Trans. Eng. Manag. 2010, 57, 39–50. [Google Scholar] [CrossRef]

- Vuong, Q.H.; Do, T.H.; Vuong, T.T. Resources, experience, and perseverance in entrepreneurs’ perceived likelihood of success in an emerging economy. J. Innov. Entrep. 2016, 5, 1–24. [Google Scholar] [CrossRef] [Green Version]

- Shan, B.; Cai, L.; Hatfield, D.E.; Tang, S. The Relationship Between Resources and Capabilities of New Ventures in Emerging Economies. Inf. Technol. Manag. 2014, 15, 99–108. [Google Scholar] [CrossRef]

| Stressor Category | Stressor | Items | Adapted From | Alpha |

|---|---|---|---|---|

| Personal stressors | Capability gap | 7 | Perceived stress scale [2,87] | (α = 0.79) |

| Achievement gap | 5 | Achievement motivation scale [88] | (α = 0.71) | |

| Social stressors | Social life gap | 6 | Social wellbeing scale [63] satisfaction with life-scale [89] | (α = 0.81) |

| Occupational stressor | Stability gap | 6 | Risk scale [70] | (α = 0.84) |

| Psychological capital | (moderator) | 5 | Psychological capital questionnaire [90] | (α = 0.87) |

| Age | Gender | Education | Income (USD) | Industry |

|---|---|---|---|---|

| 20–29 years-47% | Male 83% | Primary-6% | <20,000-41% | Trading-37% |

| 30–39 years-28% | Female | Secondary-7% | 21,000–30,000-32% | Hospitality-18% |

| 40–49 years-17% | 17% | Higher Secondary-42% | 31,000–40,000-17% | Pharmaceuticals-10% |

| Real estate-8% | ||||

| Construction-12% | ||||

| Food-10% | ||||

| 50–59 years-8% | Graduation-38% | >41,000-10% | Transport-5% | |

| Post-Graduation-7% |

| Variable | Time | Mean | Std Dev | CPG | AHG | SLG | STG | PES | Psycap |

|---|---|---|---|---|---|---|---|---|---|

| CPG | T1 | 3.916 | 0.723 | ||||||

| T2 | 3.842 | 0.789 | — | ||||||

| AHG | T1 | 4.094 | 0.693 | 0.081 | — | ||||

| T2 | 4.081 | 0.714 | 0.079 | — | |||||

| SLG | T1 | 4.013 | 0.705 | 0.128 ** | 0.105 | — | |||

| T2 | 4.010 | 0.771 | 0.119 ** | 0.114 | — | ||||

| STG | T1 | 3.977 | 0.805 | 0.148 * | 0.032 | 0.059 | — | ||

| T2 | 3.912 | 0.824 | 0.147 * | 0.031 | 0.057 | — | |||

| PES | T1 | 4.040 | 0.766 | 0.119 * | 0.059 | 0.122 ** | 0.196 ** | — | |

| T2 | 4.035 | 0.775 | 0.116 * | 0.059 | 0.222 ** | 0.195 ** | — | ||

| Psycap | T1 | 3.709 | 0.818 | −0.031 | −0.036 | −0.064 | 0.035 | −0.330 ** | — |

| T2 | 3.804 | 0.804 | −0.030 | −0.036 | −0.061 | 0.034 | −0.327 ** | — |

| Items Used in the Questionnaire | Factor Score | Standard Alpha | The Average Variance Extracted |

|---|---|---|---|

Capability gap

| 0.78 (0.75) | 0.5215 (0.5314) | |

| 0.69 (0.66) | |||

| 0.60 (0.64) | |||

| 0.63 (0.59) | |||

Achievement gap

| 0.82 (0.79) | 0.5458 (0.5625) | |

| 0.61 (0.56) | |||

| 0.64 (0.57) | |||

| 0.68 (0.67) | |||

| 0.69 (0.64) | |||

Social life gap

| 0.78 (0.76) | 0.5724 (0.5614) | |

| 0.68 (0.69) | |||

| 0.69 (0.70) | |||

| 0.71 (0.69) | |||

| 0.67 (0.71) | |||

| 0.71 (0.73) | |||

Stability gap

| 0.86 (0.84) | 0.5825 (0.5722) | |

| 0.64 (0.62) | |||

| 0.70 (0.67) | |||

| 0.68 (0.62) | |||

| 0.74 (0.70) | |||

| 0.76 (0.71) | |||

Psychological Capital

| 0.92 (0.85) | 0.6171 (0.5823) | |

| 0.74 (0.74) | |||

| 0.73 (0.76) | |||

| 0.76 (0.74) | |||

| 0.77 (0.79) |

| # | Model | χ2 | df | CFI | TLI | RMSEA | Model Comparison | Δχ2 | Δdf |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Stability model | 27.43 | 12 | 0.973 | 0.952 | 0.046 | |||

| 2 | Causality model | 11.45 | 9 | 0.992 | 0.988 | 0.044 | 1 vs. 2 | 26.91 ** | 3 |

| 3 | Reversed model | 18.82 | 9 | 0.983 | 0.956 | 0.089 | 1 vs. 3 | 21.57 ** | 3 |

| 4 | Reciprocal model | 4.19 | 6 | 1.000 | 1.000 | 0.000 | 1 vs. 4 | 8.58 * | 6 |

| 2 vs. 3 | 7.31 * | 0 | |||||||

| 2 vs. 4 | 7.81 * | 3 | |||||||

| 3 vs. 4 | 13.77 ** | 3 | |||||||

| Model 2: Causality Model | Model 5: Moderation Model | |||

|---|---|---|---|---|

| γ | SE | γ | SE | |

| Autoregressive effects | ||||

| Capability gap | 0.59 ** | 0.05 | 0.71 ** | 0.03 |

| Achievement gap | 0.71 ** | 0.03 | 0.77 ** | 0.02 |

| Social life gap | 0.77 ** | 0.02 | 0.68 ** | 0.04 |

| Stability gap | 0.68 ** | 0.04 | 0.47 ** | 0.06 |

| Psycap | 0.47 ** | 0.06 | 0.66 ** | 0.05 |

| Perceived entrepreneurial stress | 0.66 ** | 0.05 | 0.59 ** | 0.05 |

| Predicting entrepreneurial stress (T2) | ||||

| Capability gap (T1) | 0.28 ** | 0.05 | 0.59 ** | 0.05 |

| Achievement gap (T1) | 0.34 ** | 0.03 | 0.71 ** | 0.03 |

| Social life gap (T1) | 0.27 ** | 0.02 | 0.77 ** | 0.02 |

| Stability gap (T1) | 0.35 ** | 0.04 | 0.68 ** | 0.04 |

| Psycap (T1) | −0.39 ** | 0.06 | 0.47 ** | 0.06 |

| Capability Gap × Psycap (T1) | −0.19 ** | 0.05 | ||

| Achievement Gap × Psycap (T1) | −0.26 ** | 0.04 | ||

| Social Life Gap × Psycap (T1) | −0.39 ** | 0.05 | ||

| Stability Gap × Psycap (T1) | −0.14 ** | 0.02 | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Arshi, T.; Kamal, Q.; Burns, P.; Tewari, V.; Rao, V. Examining Perceived Entrepreneurial Stress: A Causal Interpretation through Cross-Lagged Panel Study. J. Open Innov. Technol. Mark. Complex. 2021, 7, 1. https://doi.org/10.3390/joitmc7010001

Arshi T, Kamal Q, Burns P, Tewari V, Rao V. Examining Perceived Entrepreneurial Stress: A Causal Interpretation through Cross-Lagged Panel Study. Journal of Open Innovation: Technology, Market, and Complexity. 2021; 7(1):1. https://doi.org/10.3390/joitmc7010001

Chicago/Turabian StyleArshi, Tahseen, Qazi Kamal, Paul Burns, Veena Tewari, and Venkoba Rao. 2021. "Examining Perceived Entrepreneurial Stress: A Causal Interpretation through Cross-Lagged Panel Study" Journal of Open Innovation: Technology, Market, and Complexity 7, no. 1: 1. https://doi.org/10.3390/joitmc7010001

APA StyleArshi, T., Kamal, Q., Burns, P., Tewari, V., & Rao, V. (2021). Examining Perceived Entrepreneurial Stress: A Causal Interpretation through Cross-Lagged Panel Study. Journal of Open Innovation: Technology, Market, and Complexity, 7(1), 1. https://doi.org/10.3390/joitmc7010001