Stock Market Reaction to COVID-19: Evidence in Customer Goods Sector with the Implication for Open Innovation

Abstract

1. Introduction

2. Theoretical Framework and Hypothesis Development

2.1. Efficient Market Hypothesis (EMH)

- Efficient in weak formA market is classified as a weak form if stock price fully reflects all information based on price, sales volume, and historical profit. Past stock prices cannot be used to predict stock price in the future.

- Efficient in mid-strong formA market is classified as mid-strong if all provided public information is reflected in the market price. Information can include past price, company fundamental data, profit forecasting, and accounting practices. If an investor receives public information, it will be reflected in the market price.

- Efficient in strong formA market is classified as strong form if the price fully reflects all information, including historical data, public information, and private information.

2.2. Relationship between an Event and Stock Price

2.3. Hypothesis Development

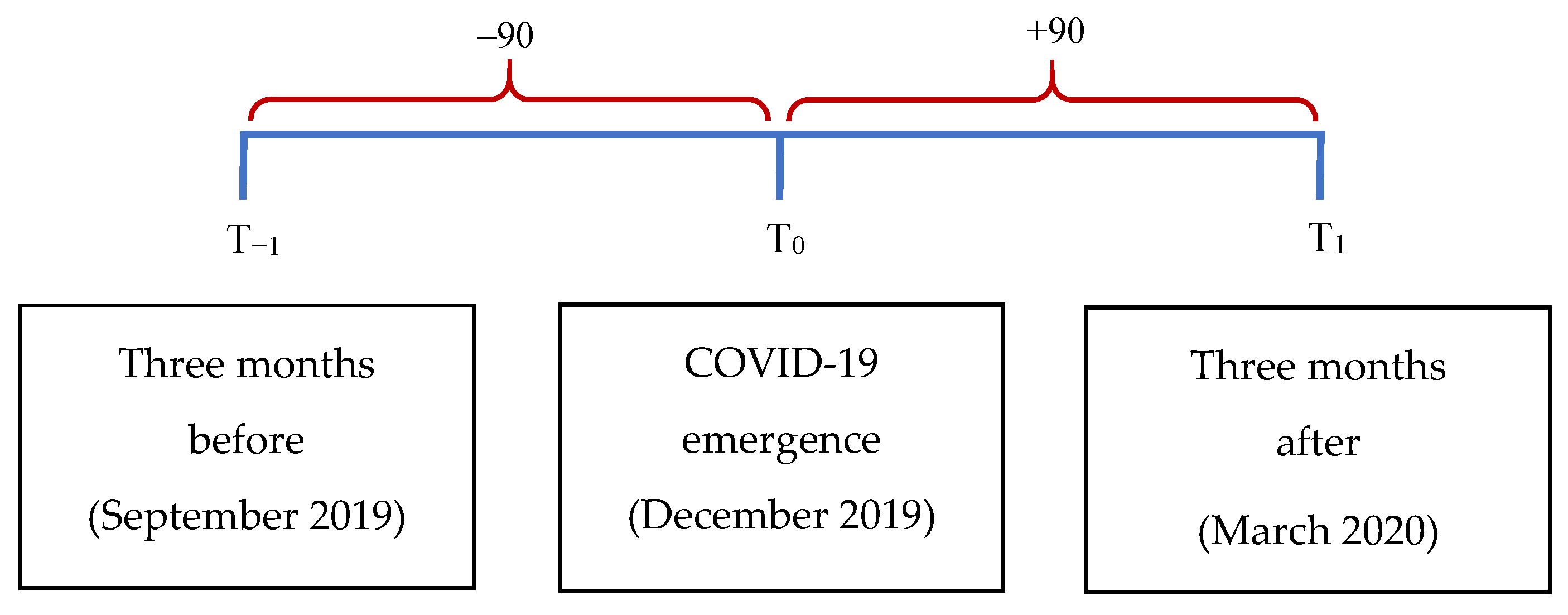

3. Research Method

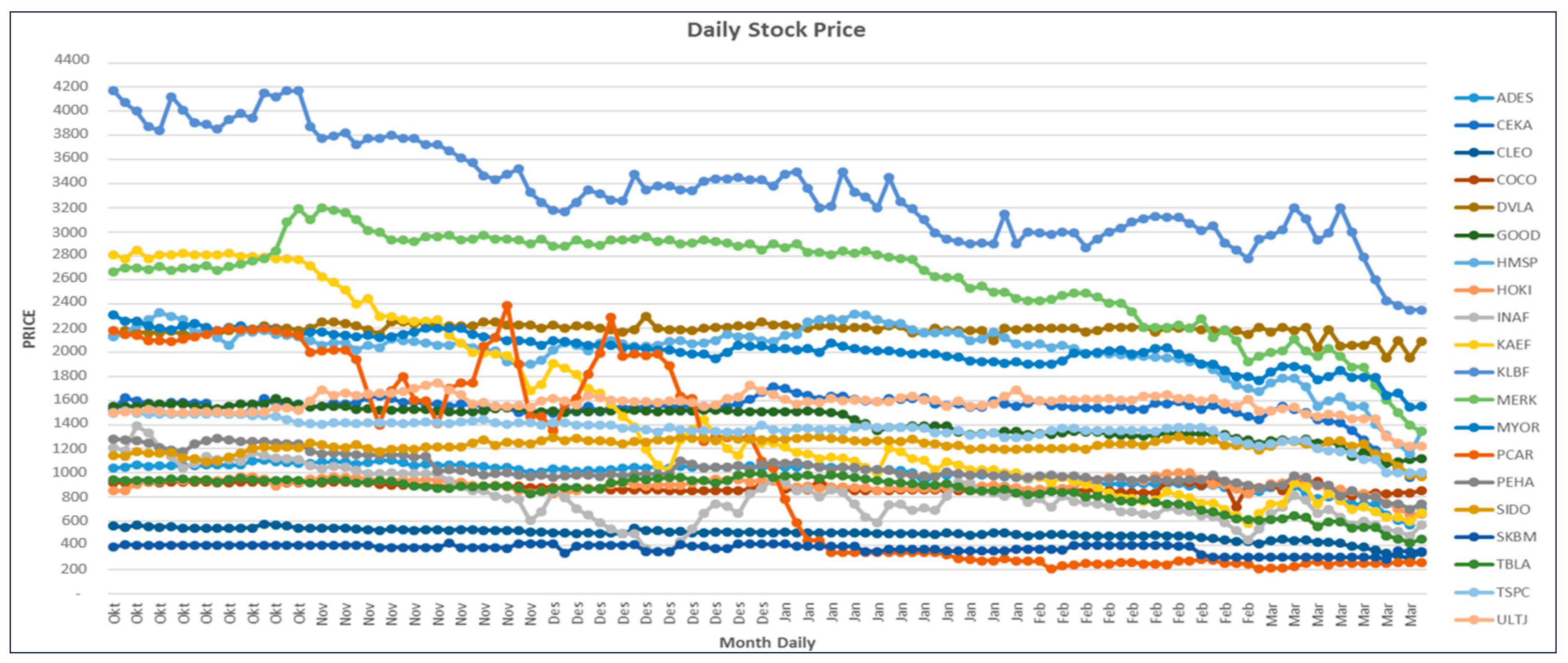

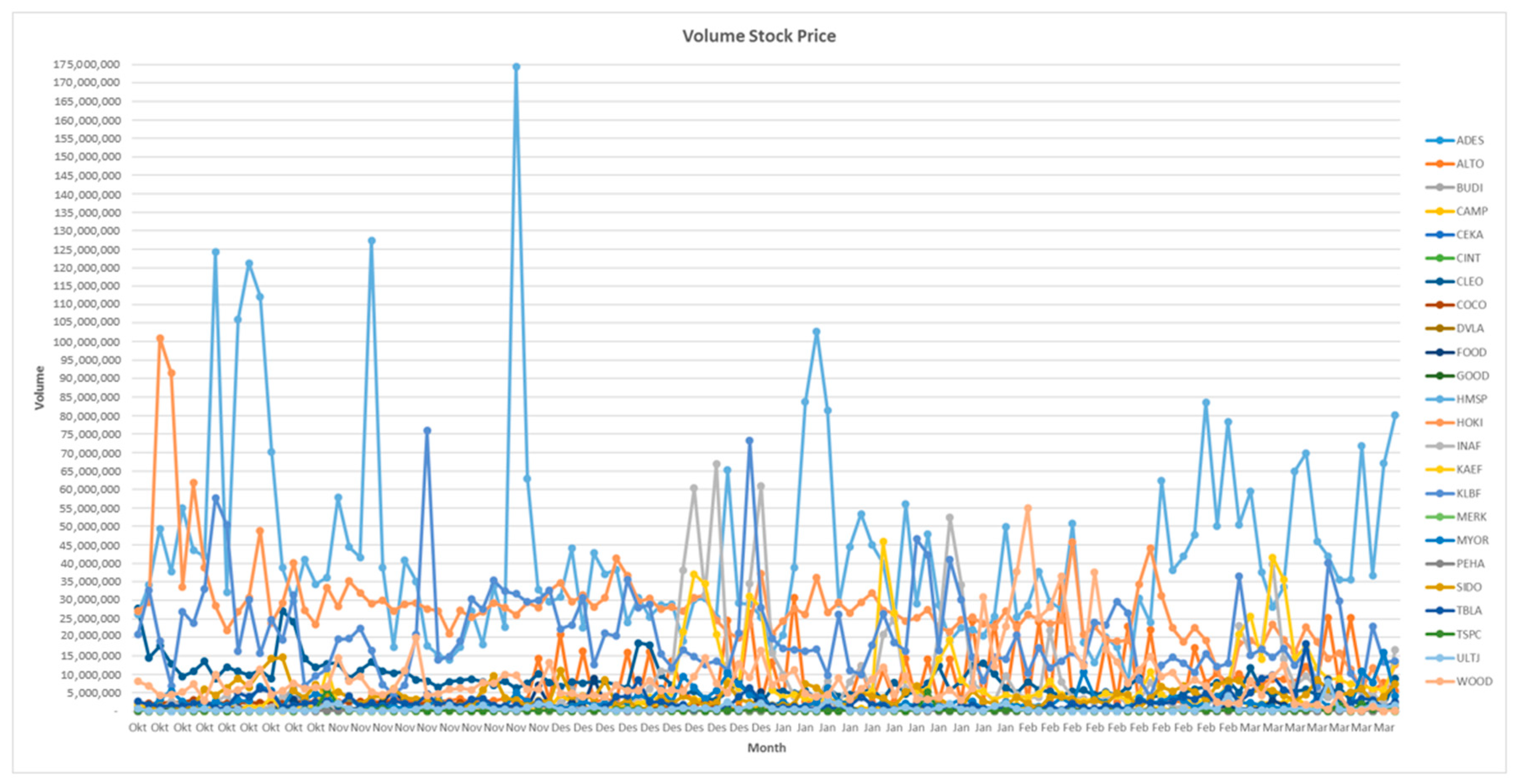

4. Result and Discussion

5. Conclusions

5.1. Implication for Open Innovation

5.2. Conclusions

5.3. Limits and Future Research Topic

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Ali, S.; Lu, W.; Wang, W. Comparison of entrepreneurial intentions among college students in China and Pakistan. Int. J. Plur. Econ. Educ. 2013, 4, 51–60. [Google Scholar] [CrossRef]

- Fama, E.F. Efficient capital markets: A review of theory and empirical work. J. Financ. 1970, 25, 383–417. [Google Scholar] [CrossRef]

- Bacha, O.I. The efficiency of trading halts: Emerging market evidence. Int. J. Bank. Financ. 2020, 5, 125–148. Available online: http://e-journal.uum.edu.my/index.php/ijbf/article/view/8372 (accessed on 27 April 2020). [CrossRef]

- Ramelli, S.; Wagner, A.F. Feverish Stock Price Reactions to COVID-19. Rev. Corp. Financ. Stud. 2020, cfaa012. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3550274 (accessed on 27 April 2020).

- Adhikari, S.P.; Meng, S.; Wu, Y.-J.; Mao, Y.-P.; Ye, R.-X.; Wang, Q.-Z.; Sun, C.; Sylvia, S.; Rozelle, S.; Raat, H.; et al. Epidemiology, causes, clinical manifestation and diagnosis, prevention and control of coronavirus disease (COVID-19) during the early outbreak period: A scoping review. Infect. Dis. Poverty 2020, 9, 1–12. [Google Scholar] [CrossRef] [PubMed]

- Sansa, N.A. The impact of the COVID-19 on the financial markets: Evidence from China and USA. Electron. Res. J. Soc. Sci. Humanit. 2020, 2. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3567901 (accessed on 27 April 2020).

- Toda, A.A. Susceptible-infected-recovered (sir) dynamics of COVID-19 and economic impact. arXiv 2020, arXiv:2003.11221. Available online: https://www.semanticscholar.org/paper/Susceptible-Infected-Recovered-(SIR)-Dynamics-of-Toda/da2656c9717e39f06b7a2f7b042e9e9495717d2c (accessed on 27 April 2020).

- Yilmazkuday, H. COVID-19 Effects on the s&p 500 Index. 2020. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3555433 (accessed on 30 April 2020).

- Alfaro, L.; Chari, A.; Greenland, A.N.; Schott, P.K. Aggregate and Firm-Level Stock Returns during Pandemics, in Real Time; NBER Working Paper No. 26950; National Bureau of Economic Research: Cambridge, MD, USA, 2020. [Google Scholar] [CrossRef]

- Ru, H.; Yang, E.; Zou, K. What Do We Learn from SARS-CoV-1 to SARS-CoV-2: Evidence from Global Stock Markets. 2020. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3569330 (accessed on 2 May 2020).

- Gerding, F.; Martin, T.; Nagler, F. The Value of Fiscal Capacity in the Face of a Rare Disaster. 2020. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3572839 (accessed on 2 May 2020).

- Ozili, P.K.; Arun, T. Spillover of COVID-19: Impact on the Global Economy. 2020. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3562570 (accessed on 2 May 2020).

- Cookson, J.A.; Engelberg, J.; Mullins, W. Does partisanship shape investor beliefs? evidence from the COVID-19 pandemic. Rev. Asset Pricing Stud. 2020. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3621067 (accessed on 31 August 2020). [CrossRef]

- McKibbin, W.J.; Fernando, R. The Global Macroeconomic Impacts of COVID-19: Seven Scenarios. CAMA Working Paper No. 19, 2020. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3547729 (accessed on 27 April 2020).

- Xin Hua. China financial market remains stable amid COVID-19 impact. China Daily-Hong Kong. 22 March 2020. Available online: https://www.chinadailyhk.com/article/125145 (accessed on 27 April 2020).

- Marston, F. Difference in information and common stock return: Estimation risk or unequal distribution of information? Financ. Rev. 1996, 31, 831–857. [Google Scholar] [CrossRef]

- Ederington, L.H.; Jae, H.L. How markets process information: News releasean volatility. J. Financ. 1993, 48, 1161–1191. [Google Scholar] [CrossRef]

- Harvey, C.R.; Roger, D.H. Volatility in the foreign currency futures market. Rev. Financ. Stud. 1991, 4, 543–569. [Google Scholar] [CrossRef]

- Frech, K.; Richard, R. Stock return variances: The arrival of new information and the reaction of traders. J. Financ. Econ. 1996, 17, 5–26. [Google Scholar] [CrossRef]

- Schwert, G.W. The adjusment of stock prices to information about inflation. J. Financ. 1981, 36, 15–29. [Google Scholar] [CrossRef]

- Torben, G.A. Return volatility and trading volume: An information flow interpretation of stochastic volatility. J. Financ. 1996, 51, 169–204. [Google Scholar]

- Houlthousen, R.; Verrechia, R. The effect of informedness and consensus on price and trading volume behavior. Account. Rev. 1990, 65, 191–208. [Google Scholar]

- Kim, O.; Verrechia, R.E. Trading volume and price reaction to public announcement. J. Account. 1991, 29, 302–321. [Google Scholar] [CrossRef]

- Syifaudin, A.; Yusuf, Y.; Mulyatno, R.; Dhevyanto, B. Fundamental Financial Information as a Signal of Company Value. Paper presented at the 1st International Conference on Accounting, Management and Entrepreneurship (ICAMER 2019). Adv. Econ. Bus. Manag. Res. 2020, 123, 22–24. [Google Scholar]

- Collins, D.W.; Dent, W.T. A comparison of alternative testing methodologies used in capital market research. J. Account. Res. 1984, 22, 48–84. [Google Scholar] [CrossRef]

- Dyckman, T.; Philbrick, D.; Stephan, J. A comparison of event study methodologies using daily stock returns: A asimulation approach. J. Account. Res. 1984, 22, 1–30. [Google Scholar] [CrossRef]

- Brown, S.J.; Warner, J.B. Using daily stock returns: The case of event studies. J. Financ. Econ. 1985, 14, 3–31. [Google Scholar] [CrossRef]

- Kothari, S.; Lewellen, J.; Warner, J.B. Stock return aggregate earnings surprises and behavioral finance. J. Financ. Econ. 2006, 79, 537–568. [Google Scholar] [CrossRef]

- Marshall, E.; Boggis, E. The Statistics Tutor’s Quick Guide to Commonly Used Statistical Tests. Statstutor Community Project. 2016, pp. 1–57. Available online: https://www.sheffield.ac.uk/polopoly_fs/1.587112!/file/Pocket_guide_to_statistics_resources_1.0.pdf (accessed on 27 April 2020).

- Ho, R. Handbook of Univariate and Multivariate Data Analysis and Interpretation with SPSS; CRC Press: Boca Raton, FL, USA, 2006. [Google Scholar]

- Mazur, M.; Dang, M.; Vega, M. COVID-19 and the march 2020 stock market crash. Evidence from S&P 1500. Financ. Res. Lett. 2020. [Google Scholar] [CrossRef]

- Ashraf, B.N. Stock markets’ reaction to COVID-19: Cases or fatalities? Res. Int. Bus. Financ. 2020, 54, 101249. [Google Scholar] [CrossRef]

- Sharif, A.; Aloui, C.; Yoravaya, L. COVID-19 pandemic, oil prices, stock market, geopolitical risk and policy uncertainty nexus in the US economy: Fresh evidence from the wavelet-based approach. Int. Rev. Financ. Anal. 2020, 70, 101496. [Google Scholar] [CrossRef]

- You, X.; Jia, S.; Dou, J.; Su, E. Is organizational slack honey or poison? Experimental research based on external investors’ perception. Emerg. Mark. Rev. 2020. [Google Scholar] [CrossRef]

- Badawy, M.K. “Is open innovation a field of study or a communication barrier to theory development?” A perspective. Technovation 2011, 1, 65–67. [Google Scholar] [CrossRef]

- Yun, J.J.; Zhao, X.; Jung, K.H.; Yigitcanlar, T. The culture for open innovation dynamics. Sustainability 2020, 12, 5076. [Google Scholar] [CrossRef]

- Yun, J.J.; Won, D.; Park, K. Entrepreneurial cyclical dynamics of open innovation. J. Evol. Econ. 2018, 28, 1151–1174. [Google Scholar] [CrossRef]

- Chiaroni, D.; Chiesa, V.; Frattini, F. Unravelling the process from Closed to Open Innovation: Evidence from mature, asset-intensive industries. R&D Manag. 2010, 40, 222–245. [Google Scholar] [CrossRef]

- Yun, J.J.; Liu, Z. Micro-and macro-dynamics of open innovation with a quadruple-helix model. Sustainability 2019, 11, 3301. [Google Scholar] [CrossRef]

| N | Mean Rank | Sum of Ranks | ||

|---|---|---|---|---|

| Post Stock Price—Pre Stock Price | Negative Ranks | 228 a | 254.64 | 58,057.00 |

| Positive Ranks | 2442 b | 1436.42 | 3,507,728.00 | |

| Ties | 0 c | |||

| Total | 2670 | |||

| Post Stock Volume—Pre Stock Volume | Negative Ranks | 279 d | 288.49 | 80,489.50 |

| Positive Ranks | 2390 e | 1457.17 | 3,482,625.50 | |

| Ties | 1 f | |||

| Total | 2670 | |||

| Post Stock Price—Pre Stock Price | Post Stock Volume—Pre Stock Volume | |

|---|---|---|

| Z | −43.296 a | −42.724 b |

| Asymptotic significance (2-tailed) | 0.000 | 0.000 |

| N | Mean Rank | Sum of Ranks | Post Stock—Pre Stock | Post Volume—Pre Volume | ||

|---|---|---|---|---|---|---|

| Pharmacy | ||||||

| Post Stock Price—Pre Stock Price | Negative Ranks | 53 a | 33.22 | 1760.5 | ||

| Positive Ranks | 403 b | 254.18 | 102,435.5 | |||

| Ties | 0 c | |||||

| Total | 456 | |||||

| Post Stock Volume—Pre Stock Volume | Negative Ranks | 45 d | 43.37 | 1951.5 | ||

| Positive Ranks | 411 e | 248.77 | 102,244.5 | |||

| Ties | 0 f | |||||

| Total | 456 | |||||

| Z | −17.878 b | −17.810 b | ||||

| Asymptotic significance (2-tailed) | 0 | 0 | ||||

| Cosmetic and Household Goods | ||||||

| Post Stock Price—Pre Stock Price | Negative Ranks | 8 a | 7.69 | 61.5 | ||

| Positive Ranks | 220 b | 118.38 | 26,044.5 | |||

| Ties | 0 c | |||||

| Total | 228 | |||||

| Post Stock Volume—Pre Stock Volume | Negative Ranks | 6 d | 14.67 | 88 | ||

| Positive Ranks | 222 e | 117.2 | 26,018 | |||

| Ties | 0 f | |||||

| Total | 228 | |||||

| Z | −13.029 b | −13.003 b | ||||

| Asymptotic significance (2-tailed) | 0 | 0 | ||||

| Food and Beverage | ||||||

| Post Stock Price—Pre Stock Price | Negative Ranks | 127 a | 140.65 | 17,862.5 | ||

| Positive Ranks | 1175 b | 706.72 | 830,390.5 | |||

| Ties | 0 c | |||||

| Total | 1302 | |||||

| Post Stock Volume—Pre Stock Volume | Negative Ranks | 158 d | 163.28 | 25,797.5 | ||

| Positive Ranks | 1143 e | 718.42 | 821,153.5 | |||

| Ties | 1 f | |||||

| Total | 1302 | |||||

| Z | −29.939 b | −29.340 b | ||||

| Asymptotic significance (2-tailed) | 0 | 0 | ||||

| Household Tools | ||||||

| Post Stock Price—Pre Stock Price | Negative Ranks | 29 a | 19.5 | 565.5 | ||

| Positive Ranks | 199 b | 128.34 | 25,540.5 | |||

| Ties | 0 c | |||||

| Total | 228 | |||||

| Post Stock Volume—Pre Stock Volume | Negative Ranks | 41 d | 27.76 | 1138 | ||

| Positive Ranks | 187 e | 133.52 | 24,968 | |||

| Ties | 0 f | |||||

| Total | 228 | |||||

| Z | −12.524 b | −11.950 b | ||||

| Asymptotic significance (2-tailed) | 0 | 0 | ||||

| Cigarettes | ||||||

| Post Stock Price—Pre Stock Price | Negative Ranks | 11 a | 7.64 | 84 | ||

| Positive Ranks | 274 b | 148.43 | 40,671 | |||

| Ties | 0 c | |||||

| Total | 285 | |||||

| Post Stock Volume—Pre Stock Volume | Negative Ranks | 27 d | 18.07 | 488 | ||

| Positive Ranks | 258 e | 156.07 | 40,267 | |||

| Ties | 0 f | |||||

| Total | 285 | |||||

| Z | −14.573 b | −14.283 b | ||||

| Asymptotic significance (2-tailed) | 0 | 0 | ||||

| Others | ||||||

| Post Stock Price—Pre Stock Price | Negative Ranks | 0 a | 0 | 0 | ||

| Positive Ranks | 171 b | 86 | 14,706 | |||

| Ties | 0 c | |||||

| Total | 171 | |||||

| Post Stock Volume—Pre Stock Volume | Negative Ranks | 2 d | 1.5 | 3 | ||

| Positive Ranks | 169 e | 87 | 14,703 | |||

| Ties | 0 f | |||||

| Total | 171 | |||||

| Z | −11.341 b | −11.337 b | ||||

| Asymptotic significance (2-tailed) | 0 | 0 | ||||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Machmuddah, Z.; Utomo, S.D.; Suhartono, E.; Ali, S.; Ali Ghulam, W. Stock Market Reaction to COVID-19: Evidence in Customer Goods Sector with the Implication for Open Innovation. J. Open Innov. Technol. Mark. Complex. 2020, 6, 99. https://doi.org/10.3390/joitmc6040099

Machmuddah Z, Utomo SD, Suhartono E, Ali S, Ali Ghulam W. Stock Market Reaction to COVID-19: Evidence in Customer Goods Sector with the Implication for Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity. 2020; 6(4):99. https://doi.org/10.3390/joitmc6040099

Chicago/Turabian StyleMachmuddah, Zaky, St. Dwiarso Utomo, Entot Suhartono, Shujahat Ali, and Wajahat Ali Ghulam. 2020. "Stock Market Reaction to COVID-19: Evidence in Customer Goods Sector with the Implication for Open Innovation" Journal of Open Innovation: Technology, Market, and Complexity 6, no. 4: 99. https://doi.org/10.3390/joitmc6040099

APA StyleMachmuddah, Z., Utomo, S. D., Suhartono, E., Ali, S., & Ali Ghulam, W. (2020). Stock Market Reaction to COVID-19: Evidence in Customer Goods Sector with the Implication for Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity, 6(4), 99. https://doi.org/10.3390/joitmc6040099