The Role of Green Innovation between Green Market Orientation and Business Performance: Its Implication for Open Innovation

Abstract

1. Introduction

2. Literature Review

2.1. Effect of Green Market Orientation on Business Performance

2.2. Effect of Green Market Orientation on Green Innovation

2.3. Effect of Green Innovation on Business Performance

2.4. Mediating Effect of Green Innovation on Green Market Orientation–Business Performance Relationship

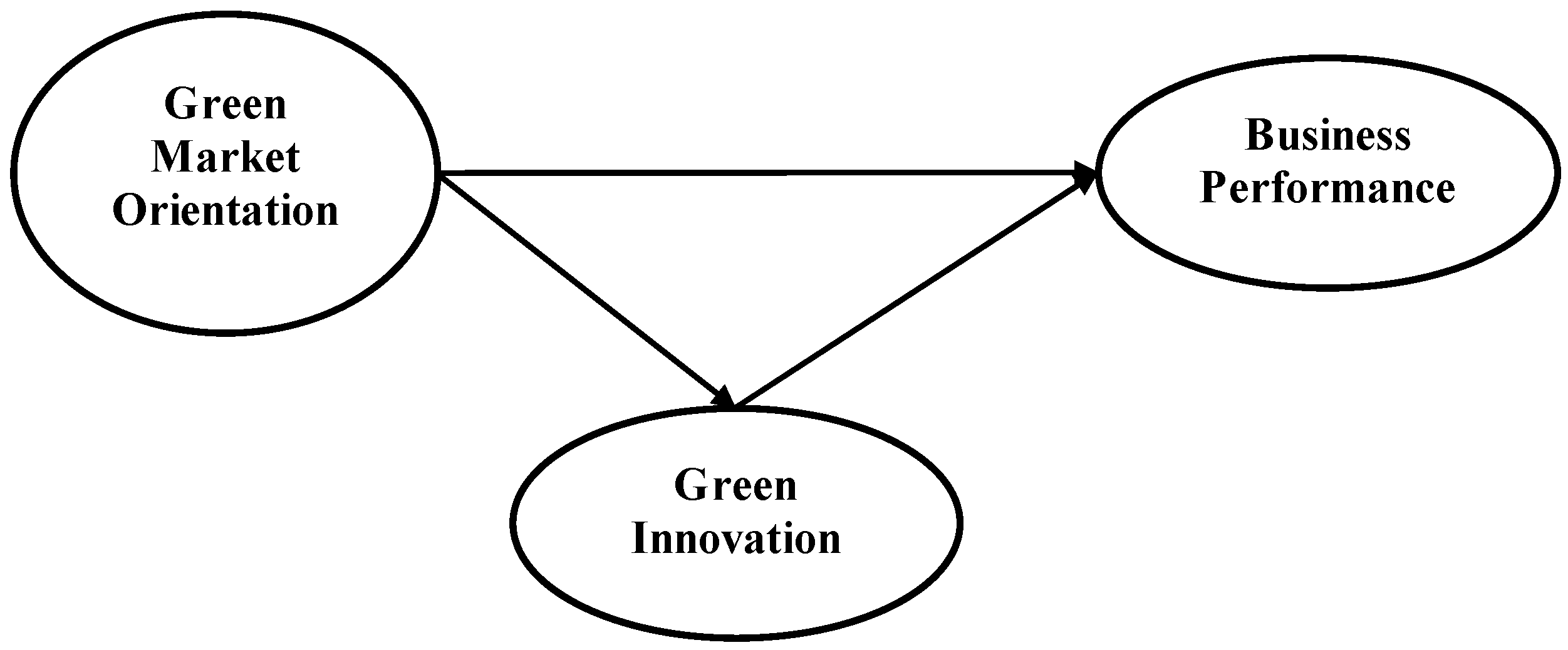

2.5. Research Framework

3. Methodology

3.1. Research Design

3.2. Data Collection

3.3. Definitions and Measurements

3.3.1. Green Market Orientation

- (1)

- Customer satisfaction encourages my company to run an environmentally friendly business.

- (2)

- My company always commits and serves environmentally friendly customers.

- (3)

- My company provides employees and customers with information on environmentally friendly products and services.

- (4)

- My company’s competitive advantage is determined by environmentally friendly customer-oriented knowledge.

- (5)

- My company always measures customer satisfaction through environmentally friendly products and services attributes.

- (6)

- My company has a customer service that operates regularly.

- (7)

- My company invests more in environmentally friendly products and services than those of competitors.

- (8)

- My company believes that this business exists to serve environmentally friendly customers.

- (9)

- My company provides information for customers to assess quality of environmentally friendly products and services.

- (10)

- My company communicates customer satisfaction data to all employees regularly.

3.3.2. Green Innovation

- (1)

- My company has selected environmentally friendly raw materials in product development.

- (2)

- My company has used energy-efficient raw materials in product development.

- (3)

- My company has carried out efficiency of raw materials for the production process in product development.

- (4)

- My company has evaluated that the product is easy to reuse, recycle, and decompose.

- (5)

- My company has effectively reduced the emission of hazardous substances or waste in the production process.

- (6)

- My company has effectively recycled waste and emissions in the production process.

- (7)

- My company has effectively reduced the consumption of water, electricity, or oil in the production process.

- (8)

- My company has effectively made innovations to reduce the use of raw materials in the production process.

3.3.3. Business Performance

- (1)

- The company’s sales tend to increase.

- (2)

- My company has succeeded in making various efforts for cost efficiency.

- (3)

- My company’s profit tends to increase.

- (4)

- My company is able to sell quality products at affordable prices and deliver them on time.

- (5)

- Customer complaints tend to decrease.

- (6)

- My company has been able to build an image and reputation so that loyal customers have increased.

- (7)

- My company has been able to improve the quality of production and services.

- (8)

- My company has been able to acquire new customers and retain old customers.

- (9)

- My company has been able to innovate on products.

- (10)

- Employees’ skills tend to improve.

- (11)

- The ability to process information using computer tends to improve.

- (12)

- Cooperation among employees tends to be better.

4. Results/Findings

4.1. Characteristics of Respondents

4.2. Descriptive Statistics

4.3. Measurement Model Analysis

4.4. Structural Model Analysis

5. Discussion on Open Innovation in MSMEs: Trend, Motives, and Management Challenge

6. Conclusions

6.1. Contribution to Theory

6.2. Contribution to Practice

6.3. Contribution to Society

7. Research Limitations

Author Contributions

Funding

Conflicts of Interest

References

- Chang, N.-J.; Fong, C.-M. Green product quality, green corporate image, green customer satisfaction, and green customer loyalty. Afr. J. Bus. Manag. 2010, 4, 2836–2844. [Google Scholar]

- Weng, H.-H.R.; Chen, J.-S.; Chen, P.-C. Effects of green innovation on environmental and corporate performance: A stakeholder perspective. Sustainability 2015, 7, 4997–5026. [Google Scholar] [CrossRef]

- Li, H.; Zhang, J.; Osei, E.; Yu, M. Sustainable development of China’s industrial economy: An empirical study of the period 2001–2011. Sustainability 2018, 10, 764. [Google Scholar] [CrossRef]

- Chan, H.K.; Yee, R.W.; Dai, J.; Lim, M.K. The moderating effect of environmental dynamism on green product innovation and performance. Int. J. Prod. Econ. 2016, 181, 384–391. [Google Scholar] [CrossRef]

- Dangelico, R.M.; Pujari, D. Mainstreaming green product innovation: Why and how companies integrate environmental sustainability. J. Bus. Ethics 2010, 95, 471–486. [Google Scholar] [CrossRef]

- Environmental Pillar: Indicator of Sustainable Development. 2018. Available online: https://www.bps.go.id/publication/2018/12/07/436ef7afce66e6828f3ff7c3/pilar-lingkungan--indikator-pembangunan-berkelanjutan-2018.html (accessed on 14 February 2019).

- Kumar, P.; Ghodeswar, B.M. Factors affecting consumers’ green product purchase decisions. Mark. Intell. Plan. 2015, 33, 330–347. [Google Scholar] [CrossRef]

- Fatoki, O. Green Marketing Orientation and Environmental and Social Performance of Hospitality Firms in South Africa. Found. Manag. 2019, 11, 277–290. [Google Scholar] [CrossRef]

- DeBoer, J.; Panwar, R.; Rivera, J. Toward a place-based understanding of business sustainability: The role of green competitors and green locales in firms’ voluntary environmental engagement. Bus. Strategy Environ. 2017, 26, 940–955. [Google Scholar] [CrossRef]

- Soewarno, N.; Tjahjadi, B.; Fithrianti, F. Green innovation strategy and green innovation. Manag. Decis. 2019, 57, 3061–3078. [Google Scholar] [CrossRef]

- Tseng, S.-C.; Hung, S.-W. A framework identifying the gaps between customers’ expectations and their perceptions in green products. J. Clean. Prod. 2013, 59, 174–184. [Google Scholar] [CrossRef]

- Zhou, Y. The role of green customers under competition: A mixed blessing? J. Clean. Prod. 2018, 170, 857–866. [Google Scholar] [CrossRef]

- Papadas, K.; Avlonitis, G.; Carrigan, M. Green marketing orientation: Conceptualization, scale development and validation. J. Bus. Res. 2017, 80, 236–246. [Google Scholar] [CrossRef]

- Vilkaite-Vaitone, N.; Skackauskiene, I. Green marketing orientation: Evolution, conceptualization and potential benefits. Open Econ. 2019, 2, 53–62. [Google Scholar] [CrossRef]

- Costantini, V.; Crespi, F.; Marin, G.; Paglialunga, E. Eco-innovation, sustainable supply chains and environmental performance in European industries. J. Clean. Prod. 2017, 155, 141–154. [Google Scholar] [CrossRef]

- Tariq, A.; Badir, Y.; Chonglerttham, S. Green innovation and performance: Moderation analyses from Thailand. Eur. J. Innov. Manag. 2019, 22, 446–467. [Google Scholar] [CrossRef]

- Fauzi, H.; Svensson, G.; Rahman, A.A. “Triple bottom line” as “Sustainable corporate performance”: A proposition for the future. Sustainability 2010, 2, 1345–1360. [Google Scholar] [CrossRef]

- Goyal, P.; Rahman, Z.; Kazmi, A.A. Corporate sustainability performance and firm performance research. Manag. Decis. 2013, 51, 361–379. [Google Scholar] [CrossRef]

- Svensson, G.; Wagner, B. Implementing and managing economic, social and environmental efforts of business sustainability. Manag. Environ. Qual. 2015, 26, 195–213. [Google Scholar] [CrossRef]

- Braccini, A.M.; Margherita, E.G. Exploring organizational sustainability of industry 4.0 under the triple bottom line: The case of a manufacturing company. Sustainability 2019, 11, 36. [Google Scholar] [CrossRef]

- Horbach, J.; Rammer, C.; Rennings, K. Determinants of eco-innovations by type of environmental impact—The role of regulatory push/pull, technology push and market pull. Ecol. Econ. 2012, 78, 112–122. [Google Scholar] [CrossRef]

- Lin, R.-J.; Chen, R.-H.; Huang, F.-H. Green innovation in the automobile industry. Ind. Manag. Data Syst. 2014, 114, 886–903. [Google Scholar] [CrossRef]

- Khurana, S.; Haleem, A.; Mannan, B. Determinants for integration of sustainability with innovation for Indian manufacturing enterprises: Empirical evidence in MSMEs. J. Clean. Prod. 2019, 229, 374–386. [Google Scholar] [CrossRef]

- Aghion, P.; Festré, A. Schumpeterian growth theory, Schumpeter, and growth policy design. J. Evol. Econ. 2017, 27, 25–42. [Google Scholar] [CrossRef]

- González-Pernía, J.L.; Jung, A.; Peña, I. Innovation-driven entrepreneurship in developing economies. Entrep. Reg. Dev. 2015, 27, 555–573. [Google Scholar] [CrossRef]

- Kirca, A.H.; Jayachandran, S.; Bearden, W.O. Market Orientation: A Meta-Analytic Review and Assessment of its Antecedents and Impact on Performance. J. Mark. 2005, 69, 24–41. [Google Scholar] [CrossRef]

- Lee, Y.-K.; Kim, S.-H.; Seo, M.-K.; Hight, S.K. Market orientation and business performance: Evidence from franchising industry. Int. J. Hosp. Manag. 2015, 44, 28–37. [Google Scholar] [CrossRef]

- Salehzadeh, R.; Pool, J.K.; Tabaeeian, R.A.; Amani, M.; Mortazavi, M. The impact of internal marketing and market orientation on performance: An empirical study in restaurant industry. Meas. Bus. Excell. 2017, 21, 273–290. [Google Scholar] [CrossRef]

- Länsiluoto, A.; Joensuu-Salo, S.; Varamäki, E.; Viljamaa, A.; Sorama, K. Market orientation and performance measurement system adoption impact on performance in SMEs. J. Small Bus. Manag. 2018, 57, 1027–1043. [Google Scholar] [CrossRef]

- Uzkurt, C.; Kimzan, H.S.; Yılmaz, C. A case study of the mediating role of innovation on the relationship between environmental uncertainty, market orientation, and firm performance. Int. J. Innov. Technol. Manag. 2016, 13, 1750003. [Google Scholar] [CrossRef]

- Ho, K.L.P.; Nguyen, C.N.; Adhikari, R.; Miles, M.P.; Bonney, L. Exploring market orientation, innovation, and financial performance in agricultural value chains in emerging economies. J. Innov. Knowl. 2017, 3, 154–163. [Google Scholar] [CrossRef]

- D’Souza, C.; Taghian, M.; Sullivan-Mort, G.; Gilmore, A. An evaluation of the role of green marketing and a firm’s internal practices for environmental sustainability. J. Strateg. Mark. 2015, 23, 600–615. [Google Scholar] [CrossRef]

- Ahmadzadeh, M.; Eidi, F.; Kagopour, M. Studying the effects of environmental commitments on green marketing strategies. Int. J. Econ. Perspect. 2017, 11, 816–823. [Google Scholar]

- Chen, Y.-S.; Lai, S.-B.; Wen, C.-T. The influence of green innovation performance on corporate advantage in Taiwan. J. Bus. Ethics 2006, 67, 331–339. [Google Scholar] [CrossRef]

- Song, W.; Yu, H. Green innovation strategy and green innovation: The roles of green creativity and green organizational identity. Corp. Soc. Responsib. Environ. Manag. 2017, 25, 135–150. [Google Scholar] [CrossRef]

- Chiou, T.-Y.; Chan, H.K.; Lettice, F.; Chung, S.H. The influence of greening the suppliers and green innovation on environmental performance and competitive advantage in Taiwan. Transp. Res. Part E Logist. Transp. Rev. 2011, 47, 822–836. [Google Scholar] [CrossRef]

- Singh, M.P.; Chakraborty, A.; Roy, M. The link among innovation drivers, green innovation and business performance: Empirical evidence from a developing economy. World Rev. Sci. Technol. Sustain. Dev. 2016, 12, 316–334. [Google Scholar] [CrossRef]

- El-Kassar, A.-N.; Singh, S.K. Green innovation and organizational performance: The influence of big data and the moderating role of management commitment and HR practices. Technol. Forecast. Soc. Chang. 2018, 144, 483–498. [Google Scholar] [CrossRef]

- Kaplan, R.S.; Norton, D.P. Strategy Maps: Converting Intangible Assets into Tangible Outcomes; Hadvard Business Press: Brighton, UK, 2004. [Google Scholar]

- Wang, Y.; Bhanugopan, R.; Lockhart, P. Examining the quantitative determinants of organizational performance: Evidence from China. Meas. Bus. Excell. 2015, 19, 23–41. [Google Scholar] [CrossRef]

- Muthuveloo, R.; Shanmugam, N.; Teoh, A.P. The impact of tacit knowledge management on organizational performance: Evidence from Malaysia. Asia Pac. Manag. Rev. 2017, 22, 192–201. [Google Scholar] [CrossRef]

- Cheng, C.C.; Yang, C.-L.; Sheu, C. The link between eco-innovation and business performance: A Taiwanese industry context. J. Clean. Prod. 2014, 64, 81–90. [Google Scholar] [CrossRef]

- Huang, J.-W.; Li, Y.-H. Green innovation and performance: The view of organizational capability and social reciprocity. J. Bus. Ethics 2015, 145, 309–324. [Google Scholar] [CrossRef]

- Bagur-Femenias, L.; Llach, J.; del Mar Alonso-Almeida, M. Is the adoption of environmental practices a strategical decision for small service companies? Manag. Decis. 2013, 51, 41–62. [Google Scholar] [CrossRef]

- Industri Kecil Menengah Serap 78 Persen Tenaga Kerja di Jatim. Available online: http://kominfo.jatimprov.go.id/read/umum/industri-kecil-menengah-serap-78-persen-tenaga-kerja-di-jatim (accessed on 14 February 2019).

- Indicators of Indonesia’s 2019 Sustainable Development Goals (TPB). Available online: https://www.bps.go.id/publication/2019/12/25/7ac89aed4ab8a22260d63ceb/indikator-tujuan-pembangunan-berkelanjutan--tpb--indonesia-2019.html (accessed on 14 February 2019).

- Hansmann, R.; Mieg, H.A.; Frischknecht, P. Principal sustainability components: Empirical analysis of synergies between the three pillars of sustainability. Int. J. Sustain. Dev. World Ecol. 2012, 19, 451–459. [Google Scholar] [CrossRef]

- Strezov, V.; Evans, A.; Evans, T.J. Assessment of the economic, social and environmental dimensions of the indicators for sustainable development. Sustain. Dev. 2016, 25, 242–253. [Google Scholar] [CrossRef]

- Azevedo, S.G.; Carvalho, H.; Duarte, S.; Cruz-Machado, V. Influence of green and lean upstream supply chain management practices on business sustainability. IEEE Trans. Eng. Manag. 2012, 59, 753–765. [Google Scholar] [CrossRef]

- Jabareen, Y. A new conceptual framework for sustainable development. Environ. Dev. Sustain. 2008, 10, 179–192. [Google Scholar] [CrossRef]

- Barkemeyer, R.; Holt, D.; Preuss, L.; Tsang, S. What happened to the ‘development’in sustainable development? Business guidelines two decades after Brundtland. Sustain. Dev. 2014, 22, 15–32. [Google Scholar] [CrossRef]

- Chang, R.-D.; Zuo, J.; Zhao, Z.-Y.; Zillante, G.; Gan, X.-L.; Soebarto, V. Evolving theories of sustainability and firms: History, future directions and implications for renewable energy research. Renew. Sustain. Energy Rev. 2017, 72, 48–56. [Google Scholar] [CrossRef]

- Elkington, J. Cannibals with Forks: The Triple Bottom Line of 21st Century Business; Capstone: Oxford, UK, 1997. [Google Scholar]

- Coffman, M.; Umemoto, K. The triple-bottom-line: Framing of trade-offs in sustainability planning practice. Environ. Dev. Sustain. 2010, 12, 597–610. [Google Scholar] [CrossRef]

- Markley, M.J.; Davis, L. Exploring future competitive advantage through sustainable supply chains. Int. J. Phys. Distrib. Logist. Manag. 2007, 37, 763–774. [Google Scholar] [CrossRef]

- Gimenez, C.; Sierra, V.; Rodon, J. Sustainable operations: Their impact on the triple bottom line. Int. J. Prod. Econ. 2012, 140, 149–159. [Google Scholar] [CrossRef]

- Narver, J.C.; Slater, S.F. The Effect of a Market Orientation on Business Profitability. J. Mark. 1990, 54, 20–35. [Google Scholar] [CrossRef]

- Chabowski, B.R.; Mena, J.A. A Review of Global Competitiveness Research: Past Advances and Future Directions. J. Int. Mark. 2017, 25, 1–24. [Google Scholar] [CrossRef]

- Masa’deh, R.E.; Al-Henzab, J.; Tarhini, A.; Obeidat, B.Y. The associations among market orientation, technology orientation, entrepreneurial orientation and organizational performance. Benchmarking 2018, 25, 3117–3142. [Google Scholar] [CrossRef]

- Glavič, P.; Lukman, R. Review of sustainability terms and their definitions. J. Clean. Prod. 2007, 15, 1875–1885. [Google Scholar] [CrossRef]

- Moravcikova, D.; Krizanova, A.; Kliestikova, J.; Rypakova, M. Green marketing as the source of the competitive advantage of the business. Sustainability 2017, 9, 2218. [Google Scholar] [CrossRef]

- Fraj, E.; Martínez, E.; Matute, J. Green marketing strategy and the firm’s performance: The moderating role of environmental culture. J. Strateg. Mark. 2011, 19, 339–355. [Google Scholar] [CrossRef]

- Amegbe, H.; Owino, J.O.; Nuwasiima, A. Green Marketing Orientation (GMO) and Performance of SMEs in Ghana. Am. J. Manag. 2017, 11, 99–109. [Google Scholar]

- Lu, L.; Bock, D.; Joseph, M. Green marketing: What the Millennials buy. J. Bus. Strateg. 2013, 34, 3–10. [Google Scholar] [CrossRef]

- Sarkar, A. Green branding and eco-innovations for evolving a sustainable green marketing strategy. Asia-Pac. J. Manag. Res. Innov. 2012, 8, 39–58. [Google Scholar] [CrossRef]

- Block, J.H.; Fisch, C.O.; Van Praag, M. The Schumpeterian entrepreneur: A review of the empirical evidence on the antecedents, behaviour and consequences of innovative entrepreneurship. Ind. Innov. 2016, 24, 61–95. [Google Scholar] [CrossRef]

- Beck, L.; Janssens, W.; Debruyne, M.; Lommelen, T. A study of the relationships between generation, market orientation, and innovation in family firms. Fam. Bus. Rev. 2011, 24, 252–272. [Google Scholar] [CrossRef]

- Nasution, H.N.; Mavondo, F.T.; Matanda, M.J.; Ndubisi, N.O. Entrepreneurship: Its relationship with market orientation and learning orientation and as antecedents to innovation and customer value. Ind. Mark. Manag. 2011, 40, 336–345. [Google Scholar] [CrossRef]

- Song, J.; Wei, Y.S.; Wang, R. Market orientation and innovation performance: The moderating roles of firm ownership structures. Int. J. Res. Mark. 2015, 32, 319–331. [Google Scholar] [CrossRef]

- Kammerer, D. The effects of customer benefit and regulation on environmental product innovation.: Empirical evidence from appliance manufacturers in Germany. Ecol. Econ. 2009, 68, 2285–2295. [Google Scholar] [CrossRef]

- Kopnina, H. Sustainability: New strategic thinking for business. Environ. Dev. Sustain. 2015, 19, 27–43. [Google Scholar] [CrossRef]

- Porter, M.E.; van der Linde, C. Green and competitive: Ending the stalemate. Harv. Bus. Rev. 1995, 73, 120–134. [Google Scholar]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Hair, J.; Ringle, C.; Sarstedt, M. PLS-SEM: Indeed a silver bullet. J. Mark. Theory Pract. 2011, 19, 139–151. [Google Scholar] [CrossRef]

- Chin, W.W. Issues and opinion on SEM. MIS Q. 1998, 51, 1173–1182. [Google Scholar]

- Chin, W.W. The partial least squares approach to structural equation modelling. In Modern Methods for Business Research; Marcoulides, G.A., Ed.; Lawrence Erlbaum Associates Publisher: London, UK, 1998; pp. 295–336. [Google Scholar]

- Nitzl, C. The use of partial least squares structural equation modelling (PLS-SEM) in management accounting research: Directions for future theory development. J. Account. Lit. 2016, 37, 19–35. [Google Scholar] [CrossRef]

- Deshpandé, R.; Farley, J.U. Measuring market orientation: Generalization and synthesis. J. Mark. Focused Manag. 1998, 2, 213–232. [Google Scholar] [CrossRef]

- Kock, N. Advantages of nonlinear over segmentation analyses in path models. Int. J. E-Collab. 2016, 12, 1–6. [Google Scholar] [CrossRef]

- Nunnaly, J.C. Psychometric Theory; McGraw-Hill: New York, NY, USA, 1967. [Google Scholar]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis, 7th ed.; illustrated and revised; Pearson Education Limited: Harlow, UK, 2013. [Google Scholar]

- Vandenbosch, M.B. Confirmatory compositional approaches to the development of product spaces. Eur. J. Mark. 1996, 30, 23–46. [Google Scholar] [CrossRef]

- Hulland, J. Use of partial least squares (PLS) in strategic management research: A review of four recent studies. Strateg. Manag. J. 1999, 20, 195–204. [Google Scholar] [CrossRef]

- Hartmann, F.; Slapničar, S. How formal performance evaluation affects trust between superior and subordinate managers. Account. Organ. Soc. 2009, 34, 722–737. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Luft, J.; Shields, M.D. Mapping management accounting: Graphics and guidelines for theory-consistent empirical research. Account. Organ. Soc. 2003, 28, 169–249. [Google Scholar] [CrossRef]

- Sholihin, M.; Ratmono, D. Analisis SEMPLS Dengan WarpPLS 3.0 Untuk Hubungan Nonlinier Dalam Penelitian Sosial dan Bisnis; Andi Offset: Yogyakarta, India, 2013; p. 81. [Google Scholar]

- Hair, J.F.; Black, W.C.; Barry, J.; Rolph, E.A. Multivariate Data Analysis, 7th ed.; Prentice Hall International: New York, NY, USA, 2010; p. 746. [Google Scholar]

- Rakthai, T.; Aujirapongpan, S.; Suanpong, K. Innovative Capacity and the Performance of Businesses Incubated in University Incubator Units: Empirical Study from Universities in Thailand. J. Open Innov. Technol. Mark. Complex. 2019, 5, 33. [Google Scholar] [CrossRef]

| Classification | Description | Frequency | |

|---|---|---|---|

| Total | Percentage | ||

| Experience | ≤5 years | 107 | 61 |

| 6–10 years | 45 | 26 | |

| 11–15 years | 10 | 6 | |

| >15 years | 13 | 7 | |

| Total | 175 | 100 | |

| Products | Food and Beverages | 85 | 49 |

| Crafts and Accessories | 32 | 18 | |

| Dress/Fashion | 8 | 5 | |

| Traditional Batik | 23 | 13 | |

| Bag | 5 | 3 | |

| Shoes | 3 | 2 | |

| Others | 19 | 11 | |

| Total | 175 | 100 | |

| Average Annual Revenue | ≤Rp300 million rupiah | 154 | 88 |

| >Rp300 million–Rp2.5 billion | 14 | 8 | |

| >Rp2.5 billion–Rp50 billion | 7 | 4 | |

| Total | 175 | 100 | |

| Number of employees | 1–4 people | 127 | 73 |

| 5–19 people | 41 | 23 | |

| 20–99 people | 7 | 4 | |

| Total | 175 | 100 | |

| Construct | Mean | Category | ||||

|---|---|---|---|---|---|---|

| Green Market Orientation | 4.3 | Strongly agree | ||||

| Green Innovation | 4.2 | Strongly agree | ||||

| Business Performance | 4.1 | Agree | ||||

| Indicators | Mean | SD | Min | Max | Median | Mode |

| GMO 1 | 4.6 | 0.7 | 1.0 | 5.0 | 5.0 | 5.0 |

| GMO 2 | 4.5 | 0.7 | 1.0 | 5.0 | 5.0 | 5.0 |

| GMO 3 | 4.5 | 0.7 | 1.0 | 5.0 | 5.0 | 5.0 |

| GMO 4 | 4.3 | 0.8 | 1.0 | 5.0 | 4.0 | 4.0 |

| GMO 5 | 4.3 | 0.8 | 1.0 | 5.0 | 4.0 | 5.0 |

| GMO 6 | 3.8 | 1.1 | 1.0 | 5.0 | 4.0 | 4.0 |

| GMO 7 | 4.1 | 0.8 | 1.0 | 5.0 | 4.0 | 4.0 |

| GMO 8 | 4.3 | 0.8 | 1.0 | 5.0 | 4.0 | 5.0 |

| GMO 9 | 4.2 | 0.8 | 1.0 | 5.0 | 4.0 | 5.0 |

| GMO 10 | 4.0 | 0.9 | 1.0 | 5.0 | 4.0 | 4.0 |

| GI 1 | 4.5 | 0.7 | 1.0 | 5.0 | 5.0 | 5.0 |

| GI 2 | 4.4 | 0.7 | 1.0 | 5.0 | 5.0 | 5.0 |

| GI 3 | 4.4 | 0.8 | 1.0 | 5.0 | 4.0 | 5.0 |

| GI 4 | 3.9 | 1.1 | 1.0 | 5.0 | 4.0 | 5.0 |

| GI 5 | 4.5 | 0.7 | 1.0 | 5.0 | 5.0 | 5.0 |

| GI 6 | 4.0 | 1.1 | 1.0 | 5.0 | 4.0 | 5.0 |

| GI 7 | 4.2 | 0.9 | 1.0 | 5.0 | 4.0 | 5.0 |

| GI 8 | 4.0 | 1.0 | 1.0 | 5.0 | 4.0 | 5.0 |

| BP 1 | 3.8 | 1.0 | 1.0 | 5.0 | 4.0 | 4.0 |

| BP 2 | 4.0 | 0.9 | 1.0 | 5.0 | 4.0 | 4.0 |

| BP 3 | 3.7 | 1.0 | 1.0 | 5.0 | 4.0 | 4.0 |

| BP 4 | 4.1 | 0.8 | 1.0 | 5.0 | 4.0 | 4.0 |

| BP 5 | 4.1 | 0.9 | 1.0 | 5.0 | 4.0 | 4.0 |

| BP 6 | 4.4 | 0.7 | 1.0 | 5.0 | 4.0 | 5.0 |

| BP 7 | 4.3 | 0.7 | 1.0 | 5.0 | 4.0 | 4.0 |

| BP 8 | 4.3 | 0.8 | 1.0 | 5.0 | 4.0 | 5.0 |

| BP 9 | 4.3 | 0.7 | 1.0 | 5.0 | 4.0 | 5.0 |

| BP 10 | 4.2 | 0.8 | 1.0 | 5.0 | 4.0 | 4.0 |

| BP 11 | 4.1 | 0.9 | 1.0 | 5.0 | 4.0 | 4.0 |

| BP 12 | 4.2 | 0.7 | 1.0 | 5.0 | 4.0 | 4.0 |

| Construct | Loading | p-Values |

|---|---|---|

| Green Market Orientation (Composite Reliability = 0.948; AVE = 0.648) | ||

| GMO 1 | 0.726 | <0.001 |

| GMO 2 | 0.823 | <0.001 |

| GMO 3 | 0.810 | <0.001 |

| GMO 4 | 0.847 | <0.001 |

| GMO 5 | 0.849 | <0.001 |

| GMO 6 | 0.647 | <0.001 |

| GMO 7 | 0.779 | <0.001 |

| GMO 8 | 0.862 | <0.001 |

| GMO 9 | 0.869 | <0.001 |

| GMO 10 | 0.808 | <0.001 |

| Business Performance (Composite Reliability = 0.955; AVE = 0.661) | ||

| BP 1 | 0.758 | <0.001 |

| BP 2 | 0.776 | <0.001 |

| BP 3 | 0.744 | <0.001 |

| BP 4 | 0.824 | <0.001 |

| BP 6 | 0.873 | <0.001 |

| BP 7 | 0.864 | <0.001 |

| BP 8 | 0.831 | <0.001 |

| BP 9 | 0.846 | <0.001 |

| BP 10 | 0.833 | <0.001 |

| BP 11 | 0.728 | <0.001 |

| BP 12 | 0.851 | <0.001 |

| Green Innovation (Composite Reliability = 0.909; AVE = 0.557) | ||

| GI 1 | 0.784 | <0.001 |

| GI 2 | 0.803 | <0.001 |

| GI 3 | 0.818 | <0.001 |

| GI 4 | 0.712 | <0.001 |

| GI 5 | 0.761 | <0.001 |

| GI 6 | 0.702 | <0.001 |

| GI 7 | 0.695 | <0.001 |

| GI 8 | 0.683 | <0.001 |

| Green Market Orientation | Business Performance | Green Innovation | |

|---|---|---|---|

| Green Market Orientation | 0.805 | 0.662 | 0.678 |

| Business Performance | 0.662 | 0.813 | 0.619 |

| Green Innovation | 0.678 | 0.619 | 0.747 |

| Panel A (before Including Green Innovation as the Mediating Variable) | ||

|---|---|---|

| Hypotheses | β Coefficient | Decision |

| Green Market Orientation > Business Performance | 0.67 *** | Supported |

| Panel B (after including green innovation as the mediating variable) | ||

| Hypotheses | β Coefficient | Decision |

| Green Market Orientation > Business Performance | 0.43 *** | Supported |

| Green Market Orientation > Green Innovation | 0.70 *** | Supported |

| Green Innovation > Business Performance | 0.33 *** | Supported |

| Hypotheses | VAF | Decision |

| Green Market Orientation > Green Innovation > Business Performance | 25.64 percent | Partial Mediation, Supported |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tjahjadi, B.; Soewarno, N.; Hariyati, H.; Nafidah, L.N.; Kustiningsih, N.; Nadyaningrum, V. The Role of Green Innovation between Green Market Orientation and Business Performance: Its Implication for Open Innovation. J. Open Innov. Technol. Mark. Complex. 2020, 6, 173. https://doi.org/10.3390/joitmc6040173

Tjahjadi B, Soewarno N, Hariyati H, Nafidah LN, Kustiningsih N, Nadyaningrum V. The Role of Green Innovation between Green Market Orientation and Business Performance: Its Implication for Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity. 2020; 6(4):173. https://doi.org/10.3390/joitmc6040173

Chicago/Turabian StyleTjahjadi, Bambang, Noorlailie Soewarno, Hariyati Hariyati, Lina Nasihatun Nafidah, Nanik Kustiningsih, and Viviani Nadyaningrum. 2020. "The Role of Green Innovation between Green Market Orientation and Business Performance: Its Implication for Open Innovation" Journal of Open Innovation: Technology, Market, and Complexity 6, no. 4: 173. https://doi.org/10.3390/joitmc6040173

APA StyleTjahjadi, B., Soewarno, N., Hariyati, H., Nafidah, L. N., Kustiningsih, N., & Nadyaningrum, V. (2020). The Role of Green Innovation between Green Market Orientation and Business Performance: Its Implication for Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity, 6(4), 173. https://doi.org/10.3390/joitmc6040173