A Mismatch between External Debt Finances and Consumption Cost in Nigeria

Abstract

:1. Introduction

2. Literature Review

2.1. Theoretical Review

2.1.1. Crowding-Out Effect Theory

2.1.2. Dual Gap Theory

2.2. Empirical Review

2.2.1. Confirmatory Studies that Foreign Commitment Improves Fiscal Progress

2.2.2. Studies Substantiating that External Debt is Harmful to Fiscal Progression

3. Research Methods

3.1. Investigation Strategy and Data Gathering

3.2. Model Specification

- CPI = Consumer Price Index;

- EXD = external debt;

- DTS = debt servicing;

- XGR = exchange rate;

- β0 = constant; β1−β3 = regression coefficients; µ = error term.

- A priori, we expect β1 > 0, β2 > 0, β3 > 0.

4. Data Analysis and Interpretation

5. Conclusions and Recommendation

5.1. Conclusions

5.2. Recommendation

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Model | Dimension | Eigenvalue | Condition Index | Variance Proportions | |||

|---|---|---|---|---|---|---|---|

| (Constant) | EXD | DTS | XGR | ||||

| 1 | 1 | 3.979 | 1.000 | 0.00 | 0.00 | 0.00 | 0.00 |

| 2 | 0.012 | 18.554 | 0.00 | 0.28 | 0.06 | 0.00 | |

| 3 | 0.009 | 20.548 | 0.01 | 0.06 | 0.11 | 0.00 | |

| 4 | 0.000 | 173.291 | 0.99 | 0.66 | 0.83 | 0.99 | |

Appendix B

| Minimum | Maximum | Mean | Std. Deviation | N | |

|---|---|---|---|---|---|

| Predicted Value | 1.4750259 | 2.2958882 | 1.9435530 | 0.26336665 | 19 |

| Residual | −0.08253891 | 0.11242338 | 0.00000000 | 0.05220454 | 19 |

| Std. Predicted Value | −1.779 | 1.338 | 0.000 | 1.000 | 19 |

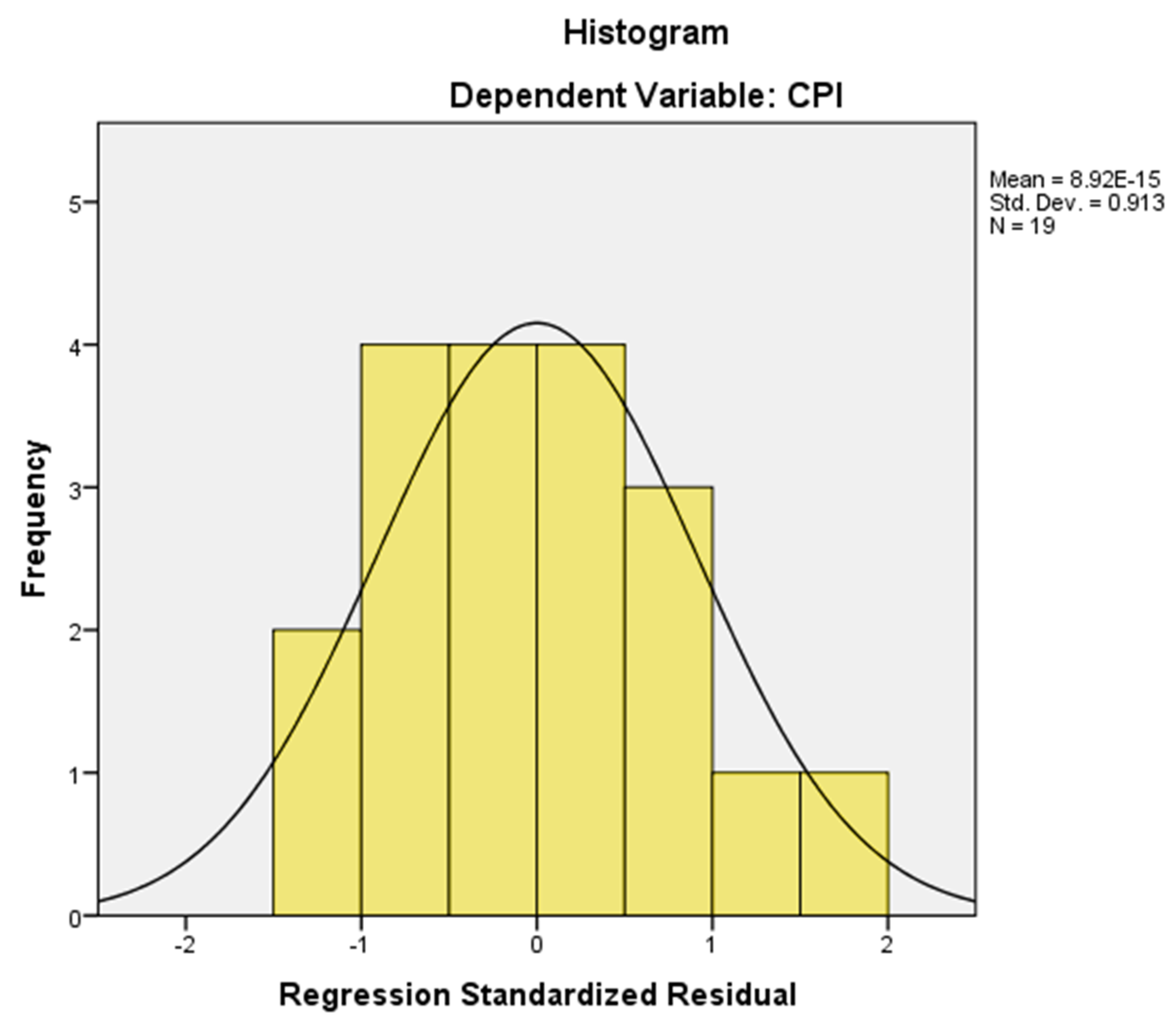

| Std. Residual | −1.443 | 1.966 | 0.000 | 0.913 | 19 |

Appendix C

| Mean | Std. Deviation | N | |

|---|---|---|---|

| CPI | 1.9435530 | 0.26849079 | 19 |

| EXD | 3.2537700 | 0.40495365 | 19 |

| DTS | 2.6782890 | 0.36951207 | 19 |

| XGR | 1.9796258 | 0.08284279 | 19 |

Appendix D

References

- AL-Tamimi, K.A.M.; Jaradat, M.S. Impact of external debt on economic growth in Jordan for the period (2010–2017). Int. J. Econ. Financ. 2019, 11, 114–118. [Google Scholar] [CrossRef] [Green Version]

- Afolabi, B.; Laoye, A.; Kolade, A.R.; Enaholo, J. The nexus between external debt and economic growth in Nigeria. Br. J. Econ. Financ. Manag. Sci. 2017, 14, 1–17. [Google Scholar]

- Omodero, C.O. External debt financing and public investment in Nigeria: A critical Evaluation. Econ. Bus. 2019, 33, 111–126. [Google Scholar] [CrossRef] [Green Version]

- Omodero, C.O.; Alpheaus, O.E. The effect of foreign debt on the economic growth of Nigeria. Manag. Dyn. Knowl. Econ. 2019, 7, 291–306. [Google Scholar] [CrossRef]

- Senadza, B.; Fiagbe, A.K.; Quartey, P. The effect of external debt on economic growth In Sub-Saharan Africa. Int. J. Bus. Econ. Sci. Appl. Res. 2017, 2, 61–69. [Google Scholar]

- Shahzad, F.; Zia, A.; Ahmed, N.; Fareed, Z.; Zulfiqar, B. Impact of external debt on economic growth: A case study of Pakistan. Eur. Res. 2014, 89, 2133–2140. [Google Scholar]

- Shkolnyk, I.; Koilo, V. The relationship between external debt and economic growth: Empirical evidence from Ukraine and other emerging economies. Invest. Manag. Financ. Innov. 2018, 15, 387–400. [Google Scholar] [CrossRef] [Green Version]

- Siddique, A.; Selvanathan, E.A.; Selvanathan, S. The Impact of External Debt on Economic Growth: Empirical Evidence from Highly Indebted Poor Countries; Discussion Paper 15.10; The University of Western Australia: Crawley, WA, Australia, 2015. [Google Scholar]

- Udeh, S.N.; Ugwu, J.I.; Onwuka, I.O. External debt and economic growth: The Nigeria experience. Eur. J. Account. Audit. Financ. Res. 2016, 4, 33–48. [Google Scholar]

- Ijirshar, V.U.; Joseph, F.; Godoo, M. The relationship between external Debt and Economic growth in Nigeria. Int. J. Econ. Manag. Sci. 2016, 6, 1–5. [Google Scholar] [CrossRef]

- Matuka, A.; Asafo, S.S. External Debt and Economic Growth in Ghana: A Co-Integration and a Vector Error Correction Analysis; Munich Personal RePEc Archive: Munich, Germany, 2018; Available online: https://mpra.ub.uni_muenchen.de/904631 (accessed on 13 May 2020).

- Ndubuisi, P. Analysis of the impact of external debt on economic growth in an emerging economy: Evidence from Nigeria. Afr. Res. Rev. 2017, 11, 156–173. [Google Scholar] [CrossRef] [Green Version]

- Odubuasi, A.C.; Uzoka, P.U.; Anichebe, A.S. External debt and economic growth in Nigeria. J. Account. Financ. Manag. 2018, 4, 98–108. [Google Scholar]

- Focus Economics. External Debt (% of GDP). Available online: https://www.focus-economics.com/economic-indicator/external-debt (accessed on 9 June 2019).

- Business Dictionary. Foreign Debt. 2019. Available online: http://www.businessdictionary.com/definition/foreign-debt.html (accessed on 9 June 2019).

- Business Dictionary Debt Service. 2019. Available online: http://www.businessdictionary.com/definition/debt-service.html (accessed on 9 June 2019).

- IMF. External Debt Statistics: Guide for Compilers and Users; Appendix 111, Glossary; IMF: Washington, DC, USA, 2003; Available online: http://www.imf.org/external/pubs/ft/eds/Eng/Guide/index.htm (accessed on 5 June 2019).

- Merriam-Webster. Definition of Debt Service. 2019. Available online: https://www.merriam-webster.com/dictionary/debt%20service (accessed on 5 June 2019).

- Cambridge Dictionary. Foreign Debt. 2019. Available online: https://dictionary.cambridge.org/ (accessed on 9 June 2019).

- Kimberly, A. Consumer Price Index and How It Measures Inflation. 2019. Available online: https://www.thebalance.com/consumer-price-index-cpi-index-definition-and-calculation-3305735 (accessed on 20 December 2019).

- The Economic Times. Definition of ‘Consumer Price Index’. 2019. Available online: https://economictimes.indiatimes.com/definition/consumer-price-index (accessed on 20 December 2019).

- Chen, J. Consumer Price Index. 2019. Available online: https://www.investopedia.com/terms/c/consumerpriceindex.asp (accessed on 20 December 2019).

- Serieux, J.; Yiagadeesen, S. The Debt Service Burden and Growth: Evidence from Low Income Countries; The North-South Institute: Ottawa, ON, Canada; Available online: http://www.researchgate.net/publication (accessed on 13 May 2020).

- Diaz-Alejandro, C.F. South cone stabilization plans. In Economic Stabilization in Developing Countries; Cline, W.R., Weintraub, S., Eds.; Brookings Institution: Washington, DC, USA, 1981. [Google Scholar]

- Taylor, L. Structuralist Macroeconomics: Applicable Models for the Third World; Basic Books: New York, NY, USA, 1983. [Google Scholar]

- Panizza, U.; Presbitero, A.F. Public debt and economic growth: Is there a causal effect? J. Macroecon. 2014, 41, 21–41. [Google Scholar] [CrossRef] [Green Version]

- Todaro, P.M.; Smith, S.C. Economic Development, 9th ed.; Pearson Education: Harlow, UK; Washington, DC, USA, 2006. [Google Scholar]

- Adedoyin, L.I.; Babalola, B.M.; Otekinri, A.O.; Adeoti, J.O. External debt and economic growth: Evidence from Nigeria. Acta Univ. Danub. Oeconomica 2016, 12, 179–194. [Google Scholar]

- Abuzaid, L.E.M. External Debt, Economic Growth and Investment in Egypt, Morocco and Tunisia. Ph.D. Thesis, University of Gloucestershire, Gloucestershire, UK, 2011. [Google Scholar]

- Sulaiman, L.A.; Azeez, B.A. Effect of external debt on economic growth of Nigeria. J. Econ. Sustain. Dev. 2012, 3, 71–79. [Google Scholar]

- Kasidi, F.; Said, M. Impact of external debt on economic growth: A case study of Tanzania. Adv. Manag. Appl. Econ. 2013, 3, 59–82. [Google Scholar]

- Shehu, U.H.; Aliyu, M. External debt and economic growth: Evidence from Nigeria. J. Econ. Sustain. Dev. 2014, 5, 1–9. [Google Scholar]

- Zaman, R.; Arslan, M. The role of external debt on economic growth: Evidence from Pakistan economy. J. Econ. Sustain. Dev. 2014, 5, 140–147. [Google Scholar]

- Mahmoud, L.O.M. The role of external debt on economic growth: Evidence from Mauritania. Int. J. Econ. Manag. Sci. 2015, 4, 1–6. [Google Scholar] [CrossRef] [Green Version]

- Monogbe, T.G. Intergenerational effect of external debt on performance of the Nigeria Economy. Ng-J. Soc. Dev. 2016, 5, 51–65. [Google Scholar]

- Elwasila, S.E.M. Effect of external debt on economic growth of Sudan: Empirical analysis (1969–2015). J. Econ. Coop. Dev. 2018, 39, 39–62. [Google Scholar]

- Ajayi, L.B.; Oke, M.O. Effect of external debt on economic growth and development of Nigeria. Int. J. Bus. Soc. Sci. 2012, 3, 297–304. [Google Scholar]

- Rifaqat, A.; Usman, M. External debt accumulation and its impact on economic growth In Pakistan. Pak. Dev. Rev. 2012, 51, 79–96. [Google Scholar]

- Mukui, G.K. Effect of External Public Debt on Economic Growth in Kenya. Master’s Thesis, School of Economics, University of Nairobi, Nairobi, Kenya, 2013. [Google Scholar]

- Ejigayehu, D.A. The Effect of External Debt on Economic Growth; Sodertorns Hogskola/Department of Economics, Magisteruppsats 30hp/Varterminen Soderton University: Stockholm, Sweden, 2013. [Google Scholar]

- Zouhaier, H.; Fatma, M. Debt and economic growth. Int. J. Econ. Financ. Issues 2014, 4, 440–448. [Google Scholar]

- AL-Refai, M.F. Debt and economic growth in developing countries: Jordan as a case Study. Int. J. Econ. Financ. 2015, 7, 134–143. [Google Scholar] [CrossRef] [Green Version]

- Halima, I. Effect of External Public Debt on Economic Growth: An Empirical Analysis of East African Countries. Master’s Thesis, University of Nairobi, Nairobi, Kenya, 2015. [Google Scholar]

- Munzara, A.T. Impact of foreign debt on economic growth in Zimbabwe. IOSR J. Econ. Financ. 2015, 6, 87–91. [Google Scholar]

- Saxena, S.P.; Shanker, I. External debt and economic growth in India. Soc. Sci. Asia 2015, 4, 15–25. [Google Scholar]

- Mbah, S.A.; Agu, O.C.; Umunna, G. Impact of external debt on economic growth in Nigeria: An ARDL bound testing approach. J. Econ. Sustain. Dev. 2016, 7, 16–26. [Google Scholar]

- Onakoya, A.B.; Ogunade, A.O. External debt and Nigerian economic growth Connection: Evidence from autoregressive distributed lag approach. J. Econ. Dev. Stud. 2017, 5, 66–78. [Google Scholar]

- AL-Kharusi, S.; Mbah, S.A. External debt and economic growth: The case of emerging economy. J. Econ. Integr. 2018, 33, 1141–1157. [Google Scholar]

- Kothari, C. Research Methodology: Methods & Techniques, 2nd ed.; Newage International Publishers: New Delhi, India, 2004. [Google Scholar]

- Gujarati, D.N.; Porter, D.C. Basic Econometrics, 5th ed.; McGraw-Hill Irwin: Boston, MA, USA, 2009. [Google Scholar]

| Model | R | R2 | Adjusted R2 | Std. Error of the Estimate | Durbin–Watson |

|---|---|---|---|---|---|

| 1 | 0.981 | 0.962 | 0.955 | 0.05718721 | 1.952 |

| Model | Sum of Squares | Df | Mean Square | F | Sig. | |

|---|---|---|---|---|---|---|

| 1 | Regression | 1.249 | 3 | 0.416 | 127.255 | 0.000 |

| Residual | 0.049 | 15 | 0.003 | |||

| Total | 1.298 | 18 | ||||

| Model | Unstandardized Coefficients | Standardized Coefficients | T | Sig. | Collinearity Statistics | |||

|---|---|---|---|---|---|---|---|---|

| B | Std. Error | Beta | Tolerance | VIF | ||||

| 1 | (Constant) | −0.404 | 0.739 | −0.547 | 0.592 | |||

| EXD | −0.148 | 0.056 | −0.224 | −2.658 | 0.018 | 0.355 | 2.816 | |

| DTS | 0.629 | 0.097 | 0.866 | 6.465 | 0.000 | 0.140 | 7.120 | |

| XGR | 0.579 | 0.417 | 0.179 | 1.387 | 0.186 | 0.152 | 6.579 | |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Omodero, C.O.; Egbide, B.-C.; Madugba, J.U.; Ehikioya, B.I. A Mismatch between External Debt Finances and Consumption Cost in Nigeria. J. Open Innov. Technol. Mark. Complex. 2020, 6, 58. https://doi.org/10.3390/joitmc6030058

Omodero CO, Egbide B-C, Madugba JU, Ehikioya BI. A Mismatch between External Debt Finances and Consumption Cost in Nigeria. Journal of Open Innovation: Technology, Market, and Complexity. 2020; 6(3):58. https://doi.org/10.3390/joitmc6030058

Chicago/Turabian StyleOmodero, Cordelia Onyinyechi, Ben-Caleb Egbide, Joseph Ugochukwu Madugba, and Benjamin Ighodalo Ehikioya. 2020. "A Mismatch between External Debt Finances and Consumption Cost in Nigeria" Journal of Open Innovation: Technology, Market, and Complexity 6, no. 3: 58. https://doi.org/10.3390/joitmc6030058

APA StyleOmodero, C. O., Egbide, B.-C., Madugba, J. U., & Ehikioya, B. I. (2020). A Mismatch between External Debt Finances and Consumption Cost in Nigeria. Journal of Open Innovation: Technology, Market, and Complexity, 6(3), 58. https://doi.org/10.3390/joitmc6030058