E-Money Payment: Customers’ Adopting Factors and the Implication for Open Innovation

Abstract

1. Introduction

2. Methodology

3. Construct and Indicator

4. Model Evaluation and Discussion

4.1. Demography

4.2. Model Evaluation

5. Conclusions and Recommendation

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Dávid, V. Fintech, the new era of financial services. Vez.-Bp. Manag. Rev. 2017, 48, 22–32. [Google Scholar] [CrossRef]

- Engert, W.; Fung, B.S.C.; Hendry, S. Is a Cashless Society Problematic? Bank of Canada: Toronto, ON, Canada, 2018. [Google Scholar]

- Gofe, T.; Tulu, D. Determinants of Customers E-Payment Utilization in Commercial Bank of Ethiopia the Case of Nekemte Town. Int. J. Econ. Bus. Manag. Stud. 2019, 6, 378–391. [Google Scholar] [CrossRef]

- Jain, P.; Singhal, S. Digital Wallet Adoption: A Literature Review. Int. J. Manag. Stud. 2019, 6. [Google Scholar] [CrossRef]

- Ayudya, A.C.; Wibowo, A. The Intention to Use E-Money using Theory of Planned Behavior and Locus of Control. J. Keuang. Perbank. 2018, 22, 335–349. [Google Scholar] [CrossRef]

- Lin, X. Factors Influencing the Chinese Customers’ Usage Intention of Korean Mobile Payment. In Proceedings of the 2019 3rd International Conference on E-commerce, E-Business and E-Government—ICEEG 2019, Lyon, France, 18–21 June 2019; pp. 40–44. [Google Scholar] [CrossRef]

- Shanthini, J.S.; Nallathmbi, J.I. A Study On Customer’s Perception Regarding Cashless Transaction in Peikulam Area. Int. J. Bus. Adm. Res. Rev. 2018, 21, 101–108. [Google Scholar]

- Sivasakthi, N.R.D.; Nandhini, M. Cashless transaction: Modes, advantages and disadvantages. Int. J. Appl. Res. 2017, 3, 122–125. [Google Scholar]

- Hu, Z.; Ding, S.; Li, S.; Chen, L.; Yang, S. Adoption Intention of Fintech Services for Bank Users: An Empirical Examination with an Extended Technology Acceptance Model. Symmetry 2019, 11, 340. [Google Scholar] [CrossRef]

- Sarika, P.; Vasantha, S. Impact of mobile wallets on cashless transaction. Int. J. Recent Technol. Eng. 2019, 7, 1164–1171. [Google Scholar]

- Roy, S.; Sinha, I. Factors affecting Customers’ adoption of Electronic Payment: An Empirical Analysis. IOSR J. Bus. Manag. 2017, 19, 76–90. [Google Scholar] [CrossRef]

- Moslehi, F.; Haeri, A.; Gholamian, M.r. Investigation of effective factors in expanding electronic payment in Iran using datamining techniques. J. Ind. Syst. Eng. 2019, 12, 61–94. [Google Scholar]

- Coppolino, L.; Romano, L.; D’Antonio, S.; Formicola, V.; Massei, C. Use of the dempster-shafer theory for fraud detection: The mobile money transfer case study. In Intelligent Distributed Computing VIII; Springer: Cham, Switzerland, 2015; pp. 465–474. [Google Scholar]

- Yun, J.H.J.; Zhao, X.; Wu, J.; Yi, J.C.; Park, K.B.; Jung, W.Y. Business model, open innovation, and sustainability in car sharing industry-Comparing three economies. Sustainability 2020, 12, 1883. [Google Scholar] [CrossRef]

- Yun, J.J.; Kim, D.; Yan, M.R. Open innovation engineering—Preliminary study on new entrance of technology to market. Electronics 2020, 9, 791. [Google Scholar] [CrossRef]

- Marques, J.P.C. Closed versus Open Innovation: Evolution or Combination? Int. J. Bus. Manag. 2014, 9. [Google Scholar] [CrossRef]

- West, J.; Salter, A.; Vanhaverbeke, W.; Chesbrough, H. Open innovation: The next decade. Res. Policy 2014, 43, 805–811. [Google Scholar] [CrossRef]

- Ortiz, J.; Ren, H.; Li, K.; Zhang, A. Construction of open innovation ecology on the internet: A case study of Xiaomi (China) using institutional logic. Sustainability 2019, 11, 3225. [Google Scholar] [CrossRef]

- Taherdoost, H. A review of technology acceptance and adoption models and theories. Procedia Manuf. 2018, 22, 960–967. [Google Scholar] [CrossRef]

- Momani, A.; Jamous, M. The Evolution of Technology Acceptance Theories. Int. J. Contemp. Comput. Res. 2017, 1, 51–58. [Google Scholar]

- Friadi, H.; Sumarwan, U. Kirbrandoko Integration of Technology Acceptance Model and Theory of Planned Behaviour of Intention to Use Electronic Money. Int. J. Sci. Res. 2018, 7. [Google Scholar] [CrossRef]

- Lee, W. Understanding Customer Acceptance of Fintech Service: An Extension of the TAM Model to Understand Bitcoin. IOSR J. Bus. Manag. 2018, 20, 34–37. [Google Scholar] [CrossRef]

- Hussain, M.; Mollik, A.T.; Johns, R.; Rahman, M.S. M-payment adoption for bottom of pyramid segment: An empirical investigation. Int. J. Bank Mark. 2019, 37, 362–381. [Google Scholar] [CrossRef]

- Sobti, N. Impact of demonetization on diffusion of mobile payment service in India: Antecedents of behavioral intention and adoption using extended UTAUT model. J. Adv. Manag. Res. 2019, 16, 472–497. [Google Scholar] [CrossRef]

- Lee, J.M.; Lee, B.; Rha, J.Y. Determinants of mobile payment usage and the moderating effect of gender: Extending the UTAUT model with privacy risk. Int. J. Electron. Commer. Stud. 2019, 10, 43–64. [Google Scholar] [CrossRef]

- Junadi, S. A Model of Factors Influencing Customer’s Intention to Use E-payment System in Indonesia. Procedia Comput. Sci. 2015, 59, 214–220. [Google Scholar] [CrossRef]

- Oktariyana, M.D.; Ariyanto, D.; Ratnadi, N.M.D. Implementation of UTAUT and D&M Models for Success Assessment of Cashless System. Res. J. Financ. Account. 2019, 10, 127–137. [Google Scholar] [CrossRef]

- Andre, G.V.; Baptista, P.T.; Setiowati, R. The Determinants Factors of Mobile Payment Adoption in DKI Jakarta. J. Res. Mark. 2019, 10, 823–831. [Google Scholar]

- Pool, J.K.; Kazemi, R.V.; Amani, M.; Lashaki, J.K. An extension of the technology acceptance model for the E-Repurchasing of sports match tickets. Int. J. Manag. Bus. Res. 2016, 6, 1–12. [Google Scholar]

- Liébana-Cabanillas, F.; Muñoz-Leiva, F.; Sánchez-Fernández, J. A global approach to the analysis of user behavior in mobile payment systems in the new electronic environment. Serv. Bus. 2018, 12, 25–64. [Google Scholar] [CrossRef]

- Acheampong, P.; Zhiwen, L.; Antwi, H.A.; Akai, A.; Otoo, A.; Mensah, W.G. Hybridizing an Extended Technology Readiness Index with Technology Acceptance Model (TAM) to Predict E-Payment Adoption in Ghana. Am. J. Multidiscip. Res. 2017, 5, 172–184. [Google Scholar]

- Bailey, A.A.; Pentina, I.; Mishra, A.S.; Mimoun, M.S.B. Mobile payments adoption by US customers: An extended TAM. Int. J. Retail Distrib. Manag. 2017, 45, 626–640. [Google Scholar] [CrossRef]

- Safeena, R.; Date, H.; Hundewale, N.; Kammani, A. Combination of TAM and TPB in Internet Banking Adoption. Int. J. Comput. Theory Eng. 2013, 146–150. [Google Scholar] [CrossRef]

- Wisdom, J.P.; Suite, E.S.; Horwitz, S.M. Innovation Adoption: A Review of Theories and Constructs Jennifer. Adm. Policy Ment. Health 2014, 41, 480–502. [Google Scholar] [CrossRef]

- Pal, A.; Herath, T.; Rao, H.R. A review of contextual factors affecting mobile payment adoption and use. J. Bank. Financ. Technol. 2019, 3, 43–57. [Google Scholar] [CrossRef]

- Lai, P. the Literature Review of Technology Adoption Models and Theories for the Novelty Technology. J. Inf. Syst. Technol. Manag. 2017, 14, 21–38. [Google Scholar] [CrossRef]

- Lim, S.H.; Kim, D.J.; Hur, Y.; Park, K. An Empirical Study of the Impacts of Perceived Security and Knowledge on Continuous Intention to Use Mobile Fintech Payment Services. Int. J. Hum. Comput. Interact. 2019, 35, 886–898. [Google Scholar] [CrossRef]

- Sivathanu, B. Adoption of digital payment systems in the era of demonetization in India: An empirical study. J. Sci. Technol. Policy Manag. 2019, 10, 143–171. [Google Scholar] [CrossRef]

- Shao, Z.; Zhang, L.; Li, X.; Guo, Y. Antecedents of trust and continuance intention in mobile payment platforms: The moderating effect of gender. Electron. Commer. Res. Appl. 2019, 33, 100823. [Google Scholar] [CrossRef]

- Alademomi, R.O.; Rufai, O.H.; Teye, E.T.; Sunguh, K.K.; Ashu, H.A.; Oludu, V.O.; Mbugua, C.W. Usage of E-Payment on Bus Rapid Transit (BRT): An Empirical Test, Public Acceptance and Policy Implications in Lagos, Nigeria. Int. J. Bus. Soc. Sci. 2019, 10, 115–126. [Google Scholar] [CrossRef]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to use and how to report the results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]

- Hamid, M.R.A.; Sami, W.; Sidek, M.H.M. Discriminant Validity Assessment: Use of Fornell & Larcker criterion versus HTMT Criterion. J. Phys. Conf. Ser. 2017, 890. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2014, 43, 115–135. [Google Scholar] [CrossRef]

- Ilham, S.; Nik, N.M.K. Examining a Theory of Planned Behavior (TPB) and Technology Acceptance Model (TAM) in Internetpurchasing Using Structural Equation Modeling. Int. Ref. Res. J. 2012, 2, 62–77. [Google Scholar]

- Widayat, W. E-Consumer Behavior: The Roles of Attitudes, Risk Perception on Shopping Intention-Behavior; Atlantis Press: Amsterdam, The Netherland, 2018. [Google Scholar] [CrossRef][Green Version]

- Xu, Y.; Ghose, A.; Xiao, B. Mobile Payment Adoption: An Empirical Investigation on Alipay. Manag. Sci. 2018, 1–52. [Google Scholar] [CrossRef]

- Salimon, G.M.; Goronduste, H.A.; Abdullah, H. User adoption of Smart Homes Technology in Malaysia: Integration TAM 3,TPB, UTAUT 2 and extension of their constructs for a better prediction. J. Bus. Manag. 2018, 20, 60–69. [Google Scholar] [CrossRef]

- Giri, R.R.W.; Apriliani, D.; Sofia, A. Behavioral Intention Analysis on E-Money Services in Indonesia: Using the modified UTAUT model. In Proceedings of the 1st International Conference on Economics, Business, Entrepreneurship, and Finance (ICEBEF 2018), Bandung, Indonesia, 19 September 2018. [Google Scholar]

- Meuthia, R.; Ananto, R.; Afni, Z.; Setiawan, L. Understanding Millenials’ Intention to Use E-Money: A Study of Students’ University in Padang. ICO-ASCNITY 2019 2020. [Google Scholar] [CrossRef]

- Venkatesh, V.; Thong, J.Y.L.; Xu, X. Unified Theory of Acceptance and Use of Technology: A Synthesis and the Road Ahead. J. Assoc. Inf. Syst. 2016, 17, 328–376. [Google Scholar] [CrossRef]

- Ajzen, I. Customer attitudes and behavior: The theory of planned behavior applied to food consumption decisions. Ital. Rev. Agric. Econ. 2015, 70, 121–138. [Google Scholar] [CrossRef]

- Yu, C.S. Factors affecting individuals to adopt mobile banking: Empirical evidence from the UTAUT model. J. Electron. Commer. Res. 2012, 13, 105–121. [Google Scholar]

- Khatimah, H.; Halim, F. The Intention to Use E-Money Transaction In Indonesia: Conceptual Framework. In Proceedings of the Conference on Business Management Research 2013, Sintok, Malaysia, 11 December 2013. [Google Scholar]

- de Abrahão, R.S.; Moriguchi, S.N.; Andrade, D.F. Intention of adoption of mobile payment: An analysis in the light of the Unified Theory of Acceptance and Use of Technology (UTAUT). RAI Rev. Adm. Inovação 2016, 13, 221–230. [Google Scholar] [CrossRef]

- Paul, J.; Modi, A.; Patel, J. Predicting green product consumption using theory of planned behavior and reasoned action. J. Retail. Consum. Serv. 2016, 29, 123–134. [Google Scholar] [CrossRef]

- Chiemeke, S.C.; Evwiekpaefe, A.E. A conceptual framework of a modified unified theory of acceptance and use of technology (UTAUT) Model with Nigerian factors in E-commerce adoption. Int. Res. J. Rev. 2011, 2, 1719–1726. [Google Scholar]

- Larasati, I.; Havidz, H.; Aima, M.H.; Ali, H.; Iqbal, M.K. Intention to adopt WeChat mobile payment innovation toward Indonesia citizenship based in China. Int. J. Appl. Innov. Eng. Manag. 2018, 7, 105–117. [Google Scholar]

- Mat Shafie, I.S.; Mohd Yusof, Y.L.; Mahmood, A.N.; Mohd Ishar, N.I.; Jamal, H.Z.; Abu Kasim, N.H.A. Factors Influencing the Adoption of E-Payment: An Empirical Study in Malaysia. Adv. Bus. Res. Int. J. 2018, 4, 53–62. [Google Scholar] [CrossRef]

| Latent Variable | Operationalization and Measurement Item (Code) | |

|---|---|---|

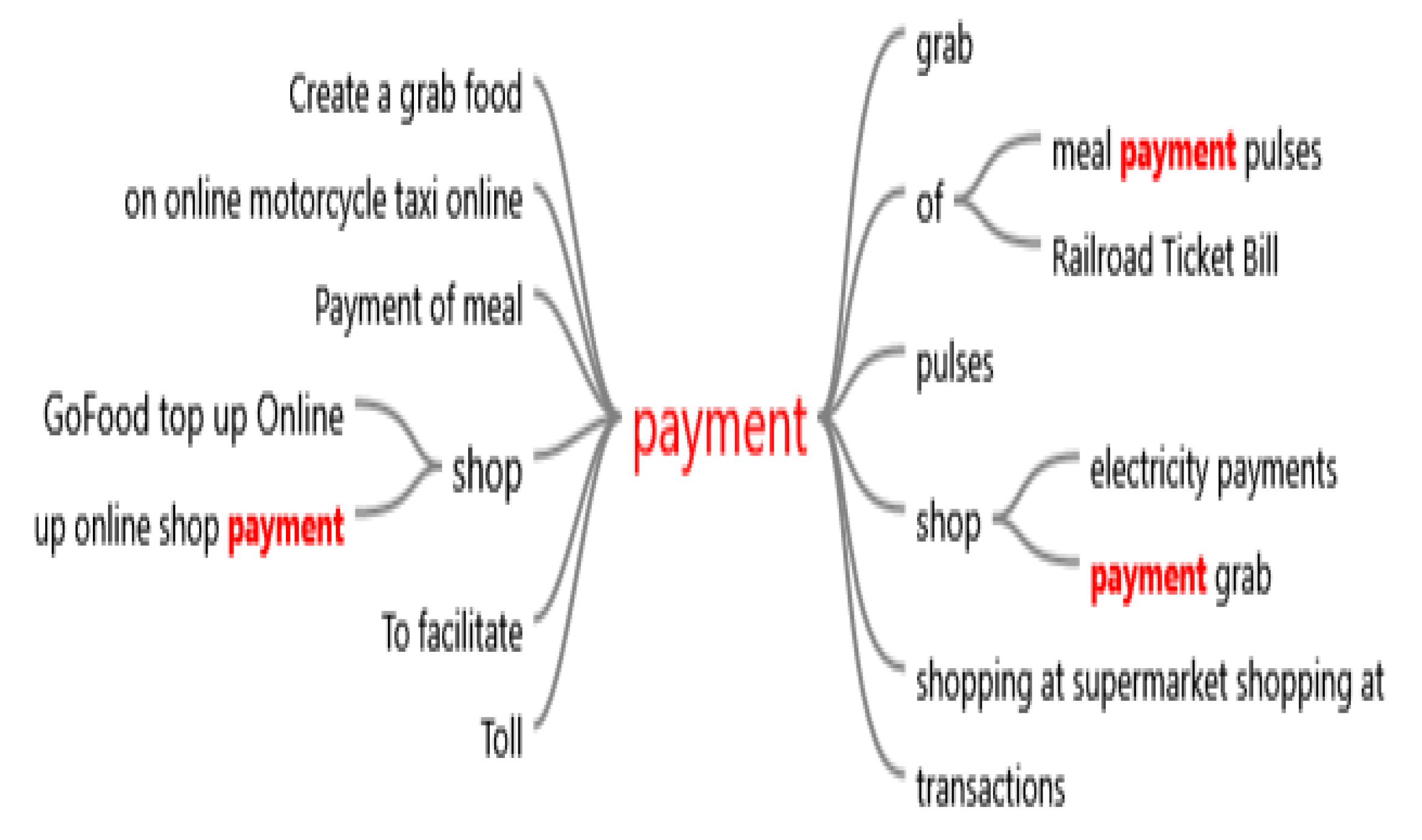

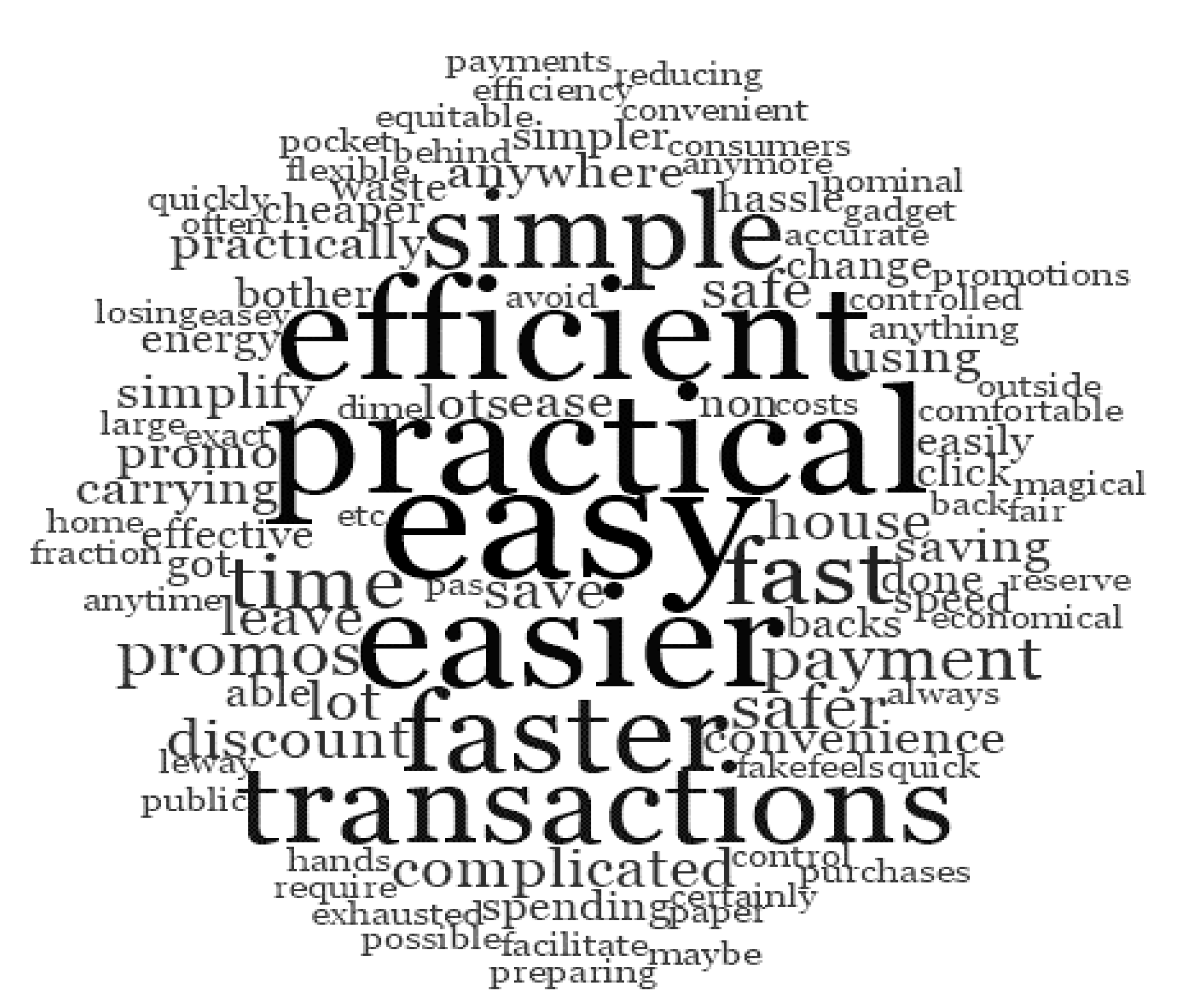

| E-Money Usage reason | The reason that customers use the e-money payment in the transaction. | The open-ended question, “What are the advantages and disadvantages, and why use e-money in your transaction?” |

| Facilitating Conditions [25,35,37,38] | The degree to which the customer believes that technical infrastructure exists to support the adoption of the e-money payment, measured by the perception of being able to access required resources, as well as to obtain knowledge and the necessary support to use e-money. Assessed using closed-ended five-point-scale questions. |

|

| Effort Expectancy (EE) [25,39] | The degree of ease associated with the use of the e-money payment system, measured by the perceptions of the ease of use of e-money services, as well as the ease of learning how to use these services. Assessed using closed-ended five-point-scale questions. |

|

| Social Factors (SF) [23,25,38] | The degree to which peers influence the use of the system, whether positively or negatively, measured by the perception of how peers affect customers’ use of e-money payment. Assessed using closed-ended five-point-scale questions. |

|

| E-Money Attitude | Attitude is a mental or neural state of readiness, organized through experience, exerting a directive or dynamic influence on the individual’s response to e-money and related matters. Assessed using closed-ended five-point-scale questions. |

|

| E-Money Intention Behavior [23,24,38,40] | Actions to continue to use e-money, recommend it to other parties, and maintain features of the associated technology on devices. Assessed using closed-ended five-point-scale questions. |

|

| Variables | Cronbach’s Alpha | Rho-A | Composite Reliability | Average Variance Extracted (AVE) |

|---|---|---|---|---|

| E-Money Attitude | 0.821 | 0.834 | 0.875 | 0.585 |

| E-Money Behavior | 0.867 | 0.877 | 0.901 | 0.605 |

| Effort Expectancy | 0.912 | 0.915 | 0.930 | 0.656 |

| Facilitating Conditions | 0.881 | 0.885 | 0.910 | 0.630 |

| Social Factors | 0.835 | 0.843 | 0.876 | 0.542 |

| Latent Variable | E-Money Attitude | E-Money Behavior | Effort Expectancy | Facilitating Conditions | Social Factors |

|---|---|---|---|---|---|

| E-Money Attitude | - | - | - | - | - |

| E-Money Behavior | 0.877 | - | - | - | |

| Effort Expectancy | 0.770 | 0.739 | - | - | - |

| Facilitating Conditions | 0.779 | 0.663 | 0.740 | - | - |

| Social Factors | 0.704 | 0.646 | 0.567 | 0.570 | - |

| Measurement Item | E-Money Attitude | E-Money Behavior | Effort Expectancy | Facilitating Conditions | Social Factors |

|---|---|---|---|---|---|

| A-Att1 | 0.822 | 0.589 | 0.686 | 0.625 | 0.465 |

| A-Att2 | 0.835 | 0.619 | 0.617 | 0.600 | 0.480 |

| A-Att4 | 0.756 | 0.577 | 0.466 | 0.496 | 0.529 |

| A-Att5 | 0.760 | 0.582 | 0.473 | 0.488 | 0.398 |

| A-Att6 | 0.635 | 0.474 | 0.309 | 0.318 | 0.485 |

| BIH-1 | 0.650 | 0.751 | 0.520 | 0.414 | 0.482 |

| BIH-2 | 0.616 | 0.834 | 0.560 | 0.554 | 0.444 |

| BIH-3 | 0.544 | 0.806 | 0.538 | 0.431 | 0.447 |

| BIH-4 | 0.548 | 0.755 | 0.452 | 0.414 | 0.448 |

| BIH-5 | 0.647 | 0.855 | 0.586 | 0.558 | 0.490 |

| BIH-6 | 0.438 | 0.646 | 0.406 | 0.321 | 0.361 |

| EE_1 | 0.567 | 0.513 | 0.845 | 0.569 | 0.443 |

| EE_2 | 0.613 | 0.565 | 0.834 | 0.578 | 0.505 |

| EE_3 | 0.507 | 0.508 | 0.727 | 0.483 | 0.351 |

| EE_4 | 0.510 | 0.498 | 0.810 | 0.524 | 0.475 |

| EE_5 | 0.594 | 0.559 | 0.855 | 0.532 | 0.454 |

| EE_6 | 0.486 | 0.517 | 0.761 | 0.556 | 0.391 |

| EE_7 | 0.579 | 0.580 | 0.827 | 0.520 | 0.396 |

| FC_1 | 0.486 | 0.445 | 0.478 | 0.707 | 0.402 |

| FC_2 | 0.487 | 0.472 | 0.420 | 0.717 | 0.510 |

| FC_3 | 0.535 | 0.432 | 0.511 | 0.840 | 0.378 |

| FC_4 | 0.548 | 0.472 | 0.591 | 0.856 | 0.372 |

| FC_5 | 0.594 | 0.513 | 0.587 | 0.869 | 0.437 |

| FC_6 | 0.546 | 0.447 | 0.556 | 0.757 | 0.383 |

| SF_1 | 0.485 | 0.460 | 0.379 | 0.414 | 0.784 |

| SF_2 | 0.297 | 0.312 | 0.244 | 0.211 | 0.733 |

| SF_3 | 0.283 | 0.316 | 0.194 | 0.208 | 0.705 |

| SF_4 | 0.603 | 0.512 | 0.585 | 0.501 | 0.688 |

| SF_5 | 0.409 | 0.409 | 0.428 | 0.422 | 0.711 |

| SF_6 | 0.477 | 0.437 | 0.370 | 0.396 | 0.791 |

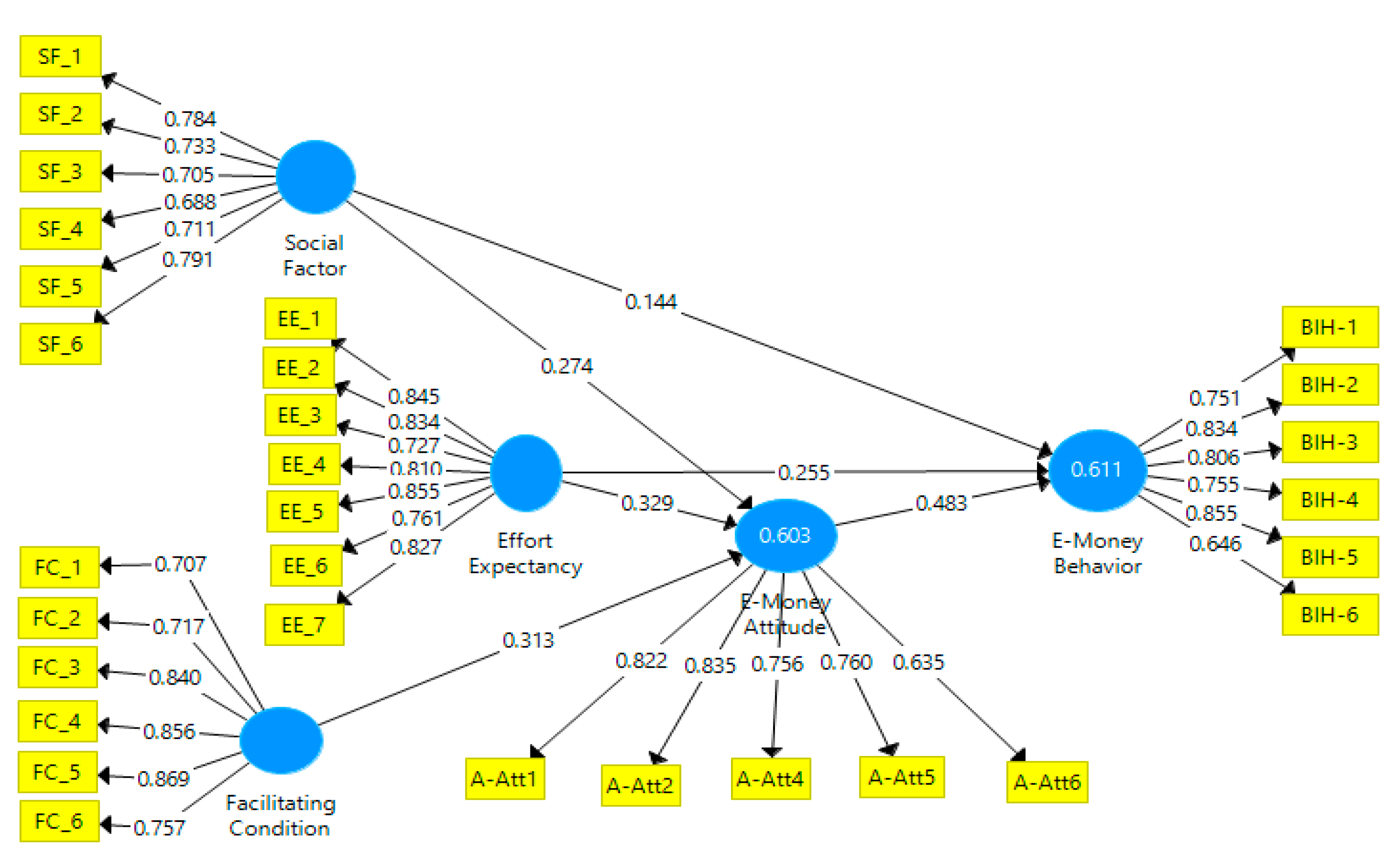

| Latent Variables | R-Squared | Adjusted R-Squared |

|---|---|---|

| E-Money Attitude | 0.603 | 0.596 |

| E-Money Behavior | 0.611 | 0.604 |

| Latent Variable | E-Money Attitude | E-Money Behavior |

|---|---|---|

| E-Money Attitude | 2.233 | |

| Effort Expectancy | 1.959 | 1.952 |

| Social Factors | 1.499 | 1.665 |

| Facilitating Conditions | 1.918 |

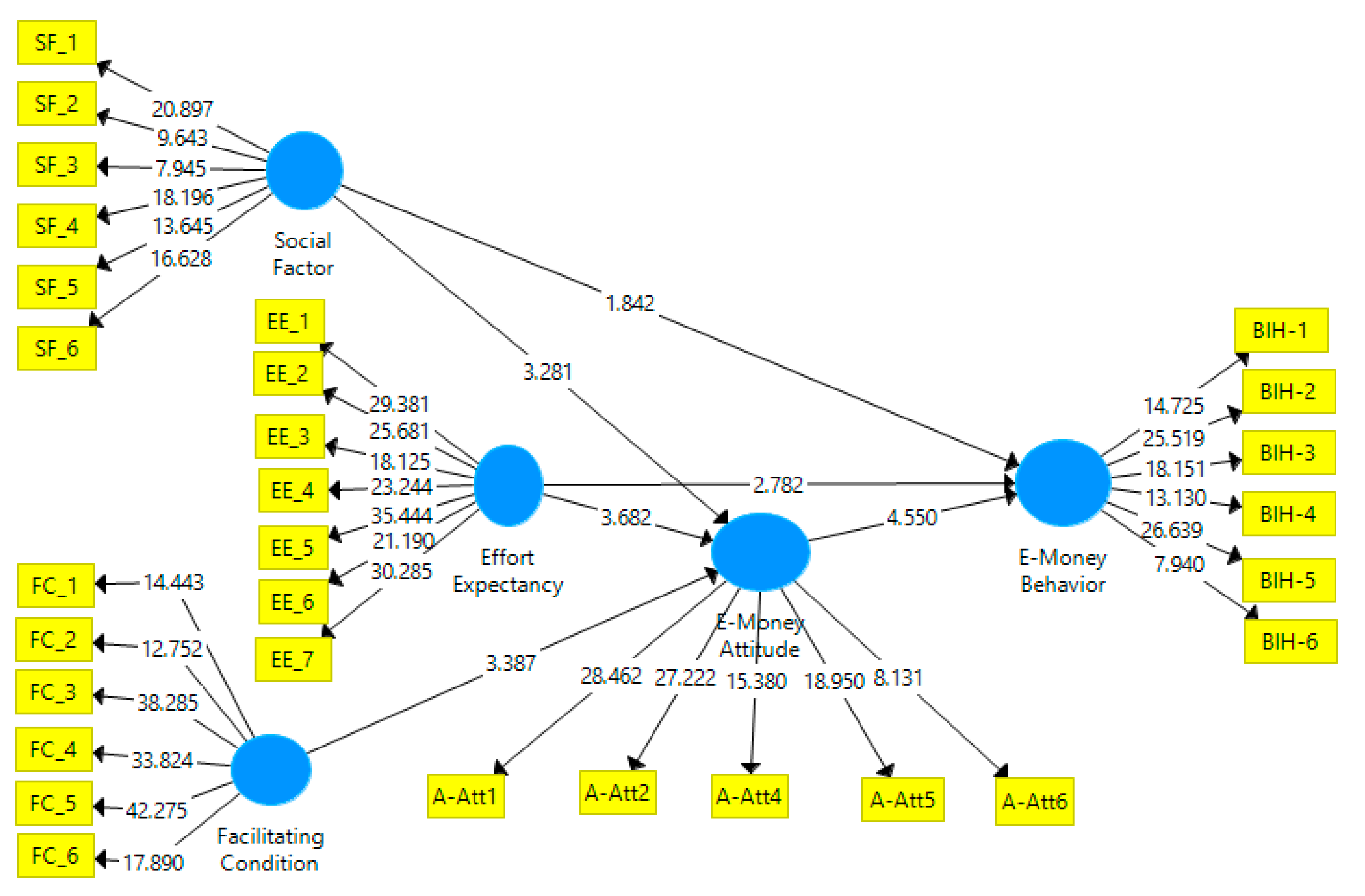

| Path | Original Sample (O) | Sample Mean (M) | Standard Deviation (STDEV) | T-Statistics (|O/STDEV|) | p-Values |

|---|---|---|---|---|---|

| E-Money Attitude → E-Money Behavior | 0.483 | 0.494 | 0.101 | 4.758 | 0.000 |

| Effort Expectancy → E-Money Behavior | 0.255 | 0.249 | 0.098 | 2.591 | 0.010 |

| Social Factors → E-Money Behavior | 0.144 | 0.140 | 0.078 | 1.861 (*) | 0.064 |

| Effort Expectancy → E-Money Attitude | 0.329 | 0.326 | 0.080 | 4.106 | 0.000 |

| Facilitating Conditions → E-Money Attitude | 0.313 | 0.315 | 0.085 | 3.674 | 0.000 |

| Social Factors → E-Money Attitude | 0.274 | 0.276 | 0.078 | 3.525 | 0.001 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Widayat, W.; Masudin, I.; Satiti, N.R. E-Money Payment: Customers’ Adopting Factors and the Implication for Open Innovation. J. Open Innov. Technol. Mark. Complex. 2020, 6, 57. https://doi.org/10.3390/joitmc6030057

Widayat W, Masudin I, Satiti NR. E-Money Payment: Customers’ Adopting Factors and the Implication for Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity. 2020; 6(3):57. https://doi.org/10.3390/joitmc6030057

Chicago/Turabian StyleWidayat, Widayat, Ilyas Masudin, and Novita Ratna Satiti. 2020. "E-Money Payment: Customers’ Adopting Factors and the Implication for Open Innovation" Journal of Open Innovation: Technology, Market, and Complexity 6, no. 3: 57. https://doi.org/10.3390/joitmc6030057

APA StyleWidayat, W., Masudin, I., & Satiti, N. R. (2020). E-Money Payment: Customers’ Adopting Factors and the Implication for Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity, 6(3), 57. https://doi.org/10.3390/joitmc6030057