2.2. Value Creation and Global Growth Strategy of Born Startups

The ecosystem creation and support of born startups is a global trend in which born startups with the possibility of high growth and high profits are becoming more and more popular in national economies.

Recently, startups are characterized by the creation of high value-added products through the convergence of industries and technologies in accordance with the advent of the Fourth Industrial Revolution. As the world-famous unicorn born startups, led by Silicon Valley in the United States, have been steadily produced, they have become the economic growth engines of major countries [

5].

The economic impact of startups can be measured in terms of their ecosystem value. Ecosystem value in this context refers to newborn growth companies that create high added value in the global competitive environment through new technology innovation and convergence. These startups represent the world’s innovative growth companies, which are generally concentrated in Silicon Valley and venture towns of major cities around the world.

Silicon Valley accounts for 1.2% of the California area, 7.8% of the California population, 10.4% of the California GDP, and 9.6% of the California jobs, but labor productivity in Silicon Valley has risen by 31.3% in 15 years, showing steep growth (by 2017, overall labor productivity in the U.S. was 19.3%).

Currently, the born startup ecosystem is rapidly expanding in developed countries such as the U.S. and Europe. According to the 2017 Global Startup Ecosystem Report published by the U.S. Born Startup Genome Project [

12], major cities of the U.S. (e.g., Silicon Valley, New York, Boston) and Europe (e.g., London, Berlin, Paris, Stockholm) dominated the top 20 global startup ecosystems.

The value creation breakdown and global growth strategies by the region are as follows.

2.2.1. North America

Silicon Valley: It has the world’s best capital, talent, and investors, and has strengths in the fields such as artificial intelligence (AI), big data, fintech, and biotech. Investment and sales strategies are active in the biotech field, with 25% of the world’s venture investment coming from Silicon Valley. As of 2017, the ecosystem value of startups reached USD 264 billion, showing an overwhelming difference.

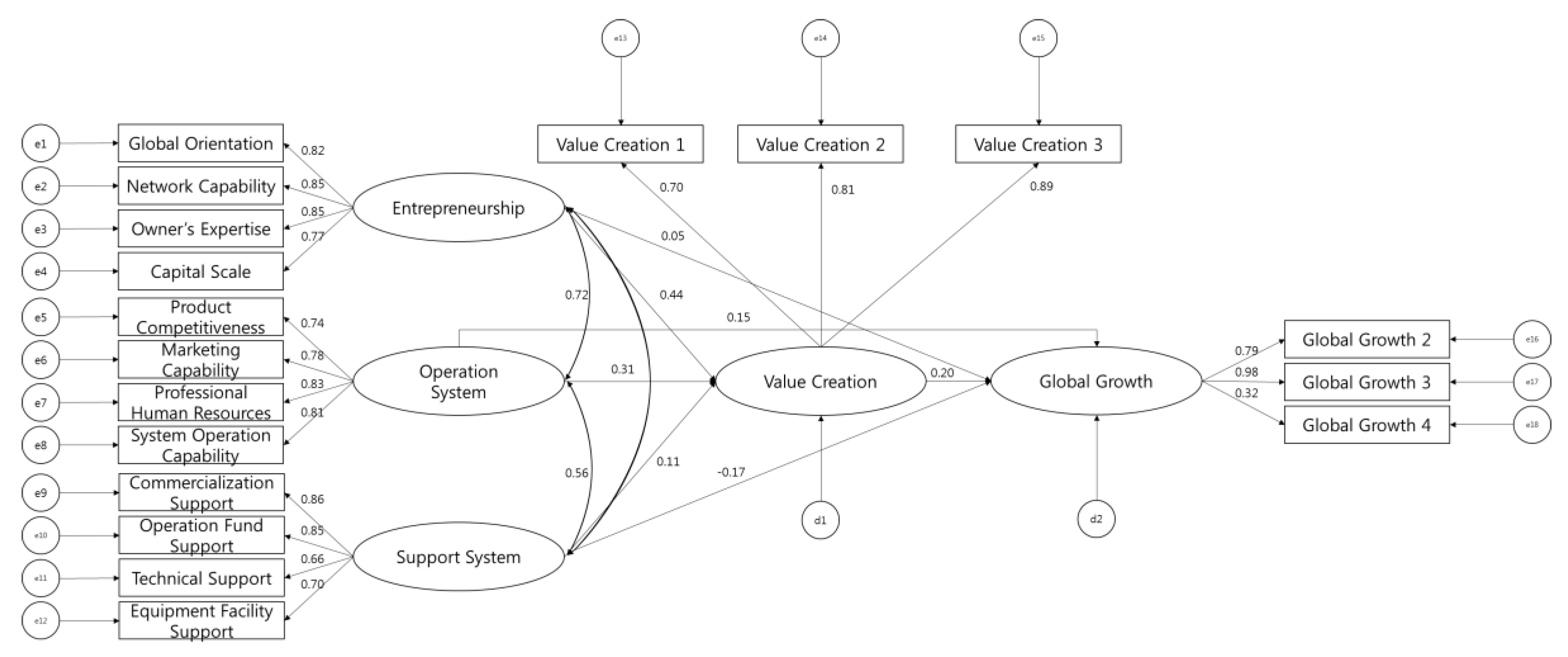

New York: It is the world’s second-largest startup city in which major technologies and industries in the leading field are expanding the global market with strengths in advanced manufacturing and robotics such as cyber security, bio/health and 3D printing. As shown in

Figure 1, the ecosystem value of startups ranks third with USD 71 billion after Silicon Valley and Beijing.

2.2.2. Europe and the Middle East

London: It is bringing about the best results of European startup ecosystems, driving the growth of the European digital economy, and is forming a great part of the economy, with more than 80,000 jobs in the region. The ecosystem value of startups in London is fourth globally, with USD 44 billion.

Paris: President Macron has decided to invest USD 11 billion in Paris to make France the “country of unicorns” and has been actively implementing startup support policies such as La French Tech. It has strengths in fields such as edutech, fintech, and bio/health.

Tel Aviv: It has the largest number of startups per person in the world, fueled by government-led innovation policy, and has strengths in fields such as cybersecurity and autonomous cars. As dependence on software and information technology is growing in the autonomous car field, Tel Aviv is emerging as the center of the world’s autotech field, with a triple-increase in investment over the past three years. The ecosystem value of startups in Tel Aviv is 7th, with USD 22 billion.

2.2.3. Asia

Beijing: In 2017, the total venture investment in China was USD 40 billion. Currently, it has 40 unicorns, and it has strengths in fields such as AI, big data, edutech, and blockchain. In the AI field, it is developing an area that can attract nearly 400 companies, led by the government. The startup value stands at USD 131 billion after Silicon Valley, ranking second overall.

Hong Kong: It is highly accessible in terms of talent, technology, and resource supply, in close proximity to Shenzhen, China, and has strengths in fields such as fintech, bio/health, and IoT consumer electronics.

Singapore: The government-led startup support policy, including R&D expenditure of 1% of GDP, is active. It has strengths in the fields of fintech, digital media, and big data. The startup value is 10th, with USD 11 billion.

Korea: Startups in Korea are growing very rapidly but are still far below the global startup ecosystems such as Silicon Valley, London, and Singapore. The startup value stands at USD 2.4 billion, ranking 12th overall.

Overall, a recent Global Startup Ecosystem ranking showed that Silicon Valley, New York, and London were ranked 1st, 2nd, and 3rd, respectively. Beijing (4th), Shanghai (8th), and Stockholm (14th) were included in the new ranking, while Seoul was not ranked in the top 20, reflecting the limit [

10].

Figure 1 illustrates a comparison of Seoul with other selected major cities ranked in that study.

Meanwhile, in connection with external ecosystems, domestic and foreign startups are important not only for getting mentoring or investment for the early stage of growth but also for scaling-up afterwards. The Waterloo Startup Ecosystem Report [

12] showed that startups aimed at overseas consumers from the initial stage grew 2.1 times faster than non-startups.

2.3. Competitive Strategy and the Growth Engine of Global Born Startups

2.3.1. Global Startup Investment Scale

Since startups have the inherent characteristics of high risk and high growth, it is important to create an environment where promising startups can be invested in in a timely manner.

Currently, global private investment in startups worldwide has risen 3.6 times from USD 45.3 billion in 2012 to USD 164.4 billion in 2017. In particular, thanks to the rapid progress of startups in China, the center of global startups is moving quickly from North America to Asia [

32].

Startups have a particularly high-risk and high-growth nature in that they start from the beginning with the aim of scale expansion and world market entry, unlike the conventional small- and medium-sized companies which do not significantly expand their scale after business startup. Paul Graham, co-founder of the famous accelerator Y Combinator emphasized, “making startups into startups is only growth; not the fact that they started a new business, or that they were funded by venture capital”, suggesting the importance of this [

33].

2.3.2. Growth Engine of Global Born Startups

Silicon Valley, which focuses on AI technology as a future innovation engine, is preemptively promoting the AI startup ecosystem, including investment in AI startups and expansion of mergers and acquisitions, strengthening of industry–university cooperation, and improvement in data accessibility.

Amidst China’s rapid ascent, a virtuous circle (investment→startup growth→investment fund recovery→reinvestment) between global IT companies and startups in Silicon Valley provides a foothold for continued competitive advantage in the AI field. To preoccupy the competitive advantage of AI that emerged as a future core technology, Silicon Valley is leading the global market by rapidly promoting research and industrialization from source technology to application service development.

As the AI technology in the introduction stage develops into the commercialization stage, it is expected that the industrial structure will be reorganized and the new market will be opened through technology innovation. The global market size of AI is expected to reach USD 52.2 billion in 2021 from USD 7.81 billion in 2016, according to an IDC [

34] report.

In particular, the U.S. is dominating rival countries, ranking first in all aspects such as the number of most influential AI researchers, the top-level AI research and special research papers, AI research capability, technology level, and investment amounts [

35].

Simultaneously, as China is actively investing in AI technology; it is emerging as a competitor of a two-way race with the U.S. There is a prospect that China will overtake the U.S. in the future as its AI capacity is rapidly being strengthened [

36].

The Chinese government is leading the development of AI technology, with the aim of fostering a market of 1 trillion yuan (about 180 trillion won) in the AI core industry and 10 trillion yuan in related industries by 2030.

At present, the AI technology capacity of the U.S. is twice that of China because its competitive advantage is expected to remain for a while. Here, China holds a dominant position only in “data” of the four fields: “hardware,” “data,” “algorithm,”, and “commercialization.” It is known to fall significantly behind the U.S. in the remaining three fields. In the field of AI hardware, the U.S. accounts for half of the world market in terms of semiconductor production and investment in manufacturing enterprises, overtaking China with a one-digit market share.

2.3.3. Survival Rate of the Global Born Startup

Technology-based startups have contributed to the increase in the number of high-tech companies worldwide, rising 47% from 116,000 in 2007 to 171,000 in 2016. During the same period, the number of companies having more than 10 years’ experience jumped 40%, indicating that the participation and growth rate of technology-based startups has remained high. The survival rate of technology-based startups is somewhat lower than that of general startups. The 5-year survival rate (41%) of technology-based startups was lower than that of general startups (48.2%). From 1998 to 2015, 78% of technology-based startups survived more than 1 year, of which only 41% survived longer than 5 years.

2.3.4. Wage Scale and Industry Weight

Technology-based startups maintain high pay levels compared with small-scale employment. Although technology-based startups accounted for only 2.8% and 1.2% of the U.S. companies and workers, respectively, they accounted for 2.7% of the entire U.S. wage pool. Sixty percent of job growth in born startups comprised the majority of technology-based startups, which created 1.2, 1.1, and 1.5 M jobs in 2007, 2011, and 2016, respectively. This is a 25% rise in jobs over the past decade. During the same period, the number of jobs in companies having more than 10 years’ employment rose 9% from 2.8 (2007) to 3 M (2016). The percentage of technology-based startup workers in the high-tech industry rose from 31% to 33%. The percentage of startup workers was only 19% in the entire U.S. economy, and the percentage of technology-based startup workers in the high-tech industry was 33% (2016).

The job growth of technology-based startups was more than twice as much as that of general startups. Ian Hathaway at the Kauffman Foundation [

37] analyzed the job growth effect for technology-based startups in 14 industries from 1990 to 2011.

(1st- to 5th-year startups) The employment growth rate of technology-based startups (12%) was twice that of general startups (6%) (6th to 10th-year startups). The employment growth rate of technology-based startups tripled from that of general startups, and the effect of technology-based startups on other industrial jobs was very significant. According to an analysis by economist Enrico Moretti [

38], five additional jobs were created in other industries for every one job created in technology-based startups.

As a result of the wage contribution of technology-based startups, the annual salary of technology-based startups was 2.13 times higher than the U.S. average and 2.76 times that of general startups. When compared with the entire industry, the annual salary of technology-based startups in 2016 was $102,000, 2.13 times the U.S. average annual salary of $48,000.

The job and wage status of the top five high-tech industries showed that job creation and wage growth were prominent in the computer system design services industry, computer and electronics manufacturing, research and development, pharmaceuticals, and semiconductor machinery, among the top 10 technology-based sub-industries.

The number of startups in the computer system design industry rose to 56% from 48,000 in 2007 to 75,000 in 2016. The employment of startups in the computer system design industry rose to 28% over the past 10 years, from 340,000 to 440,000. By 2016, startups in the computer system design industry were close to the average annual salary (i.e., $100,000) of the computer system design industry with an average annual salary of $99,000. Wages in the top five high-tech industries were relatively high.