Antecedents of Technological Diversification: A Resource Dependence Logic

Abstract

1. Introduction

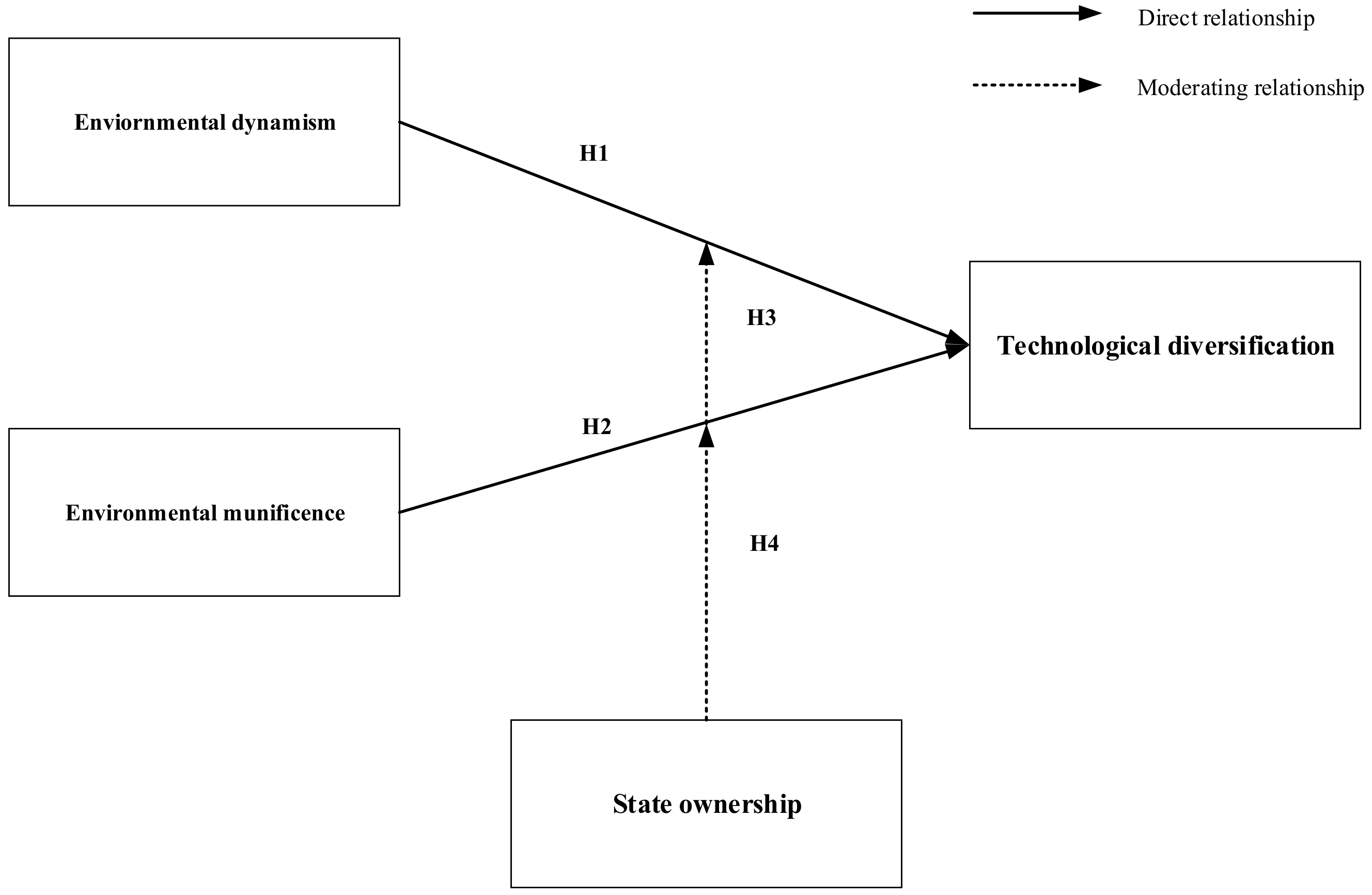

2. Theory and Hypothesis

2.1. Diversification through the Lens of RDT

2.2. Ownership as a Boundary Condition

2.3. Hypothesis

2.3.1. Antecedents of Technological Diversification Through Firm-Environment Interdependence

2.3.2. Boundary Conditions of Ownership

3. Data and Method

3.1. Sample Collection

3.2. Variable Definitions

3.2.1. Dependent Variable

3.2.2. Independent Variables

3.2.3. Moderating Variable

3.2.4. Control Variables

3.3. Estimation Methods

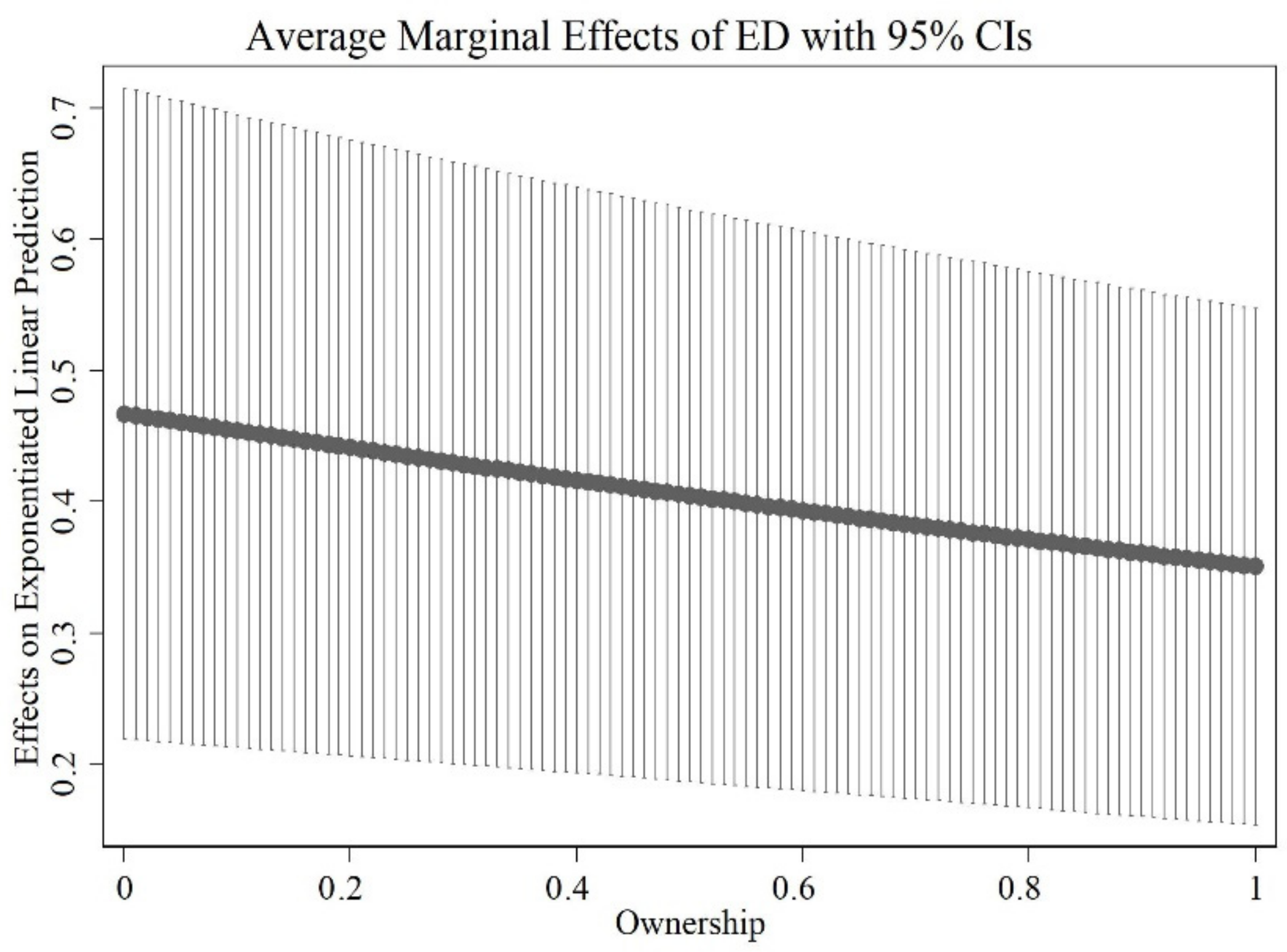

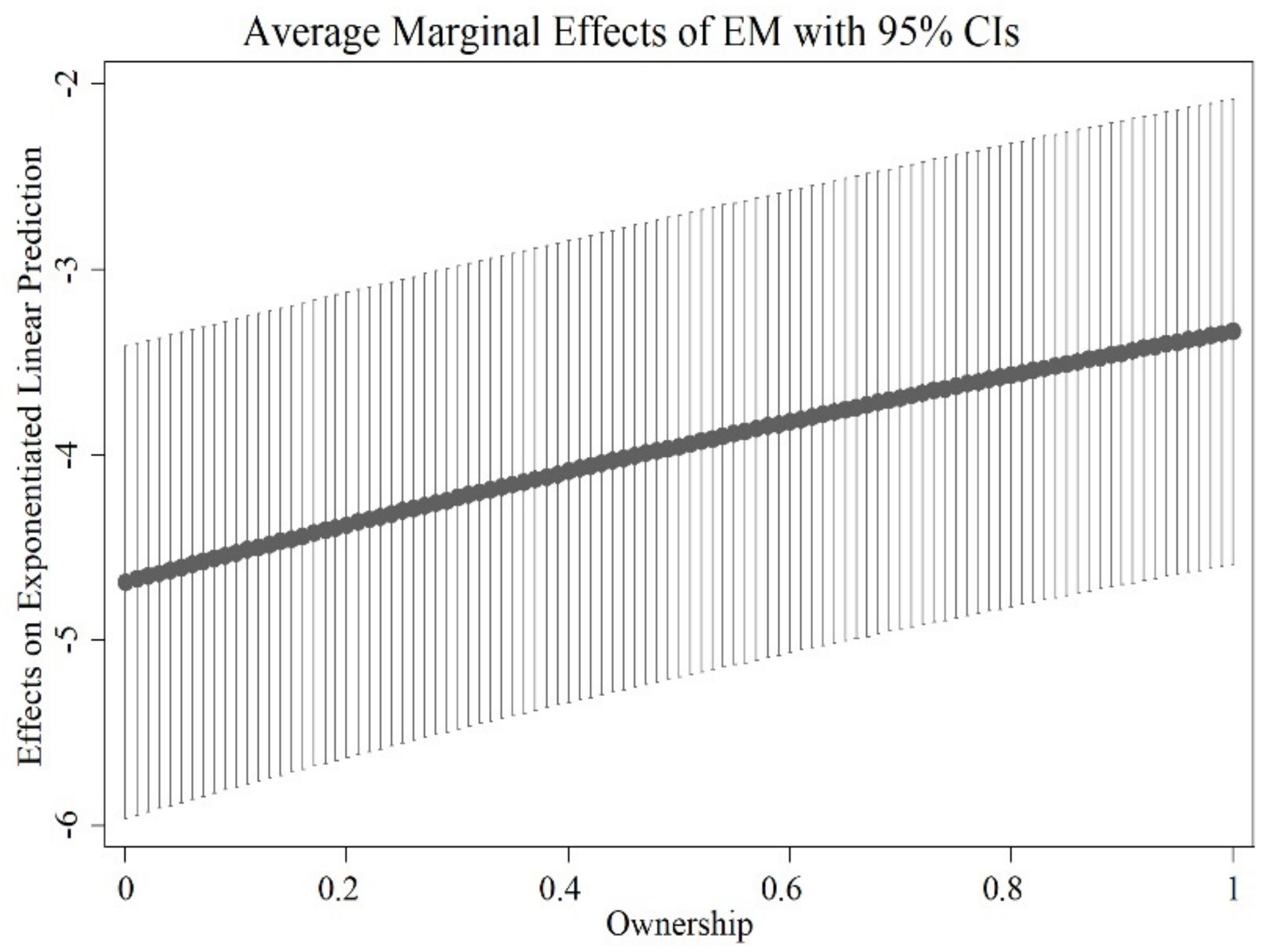

3.4. Statistical Interpretation

4. Results

5. Discussion

5.1. Implications for RDT

5.2. Implications for Diversification Research

5.3. Implications for Open Innovation

6. Conclusions

Funding

Conflicts of Interest

Appendix A

| Classification | Name |

|---|---|

| A | Human necessities |

| B | Performing operations; Transporting |

| C | Chemistry; Metallurgy |

| D | Textiles; Paper |

| E | Fixed constructions |

| F | Mechanical Engineering; Lighting; Heating; Weapons; Blasting |

| G | Physics |

| H | Electricity |

References

- Pfeffer, J.; Salancik, G.R. The External Control of Organizations: A Resource Dependence Perspective; Haper Row Publishers: London, UK, 1978. [Google Scholar]

- Gulati, R.; Sytch, M. Dependence asymmetry and joint dependence in interorganizational relationships: Effects of embeddedness on a manufacturer’s performance in procurement relationships. Adm. Sci. Q. 2007, 52, 32–69. [Google Scholar] [CrossRef]

- Rogan, M.; Greve, H.R. Resource dependence dynamics: Partner reactions to mergers. Organ. Sci. 2015, 26, 239–255. [Google Scholar] [CrossRef]

- Hillman, A.J.; Withers, M.C.; Collins, B.J. Resource dependence theory: A review. J. Manag. 2009, 35, 1404–1427. [Google Scholar] [CrossRef]

- Zona, F.; Gomez-Mejia, L.R.; Withers, M.C. Board interlocks and firm performance: Toward a combined agency–resource dependence perspective. J. Manag. 2018, 44, 589–618. [Google Scholar] [CrossRef]

- Xia, J.; Ma, X.; Lu, J.W.; Yiu, D.W. Outward foreign direct investment by emerging market firms: A resource dependence logic. Strateg. Manag. J. 2014, 35, 1343–1363. [Google Scholar] [CrossRef]

- Dyer, J.H.; Singh, H. The relational view: Cooperative strategy and sources of interorganizational competitive advantage. Acad. Manag. Rev. 1998, 23, 660–679. [Google Scholar] [CrossRef]

- Davis, G.F.; Adam Cobb, J. Resource dependence theory: Past and future. In Stanford’s Organization Theory Renaissance, 1970–2000; Schoonhoven, C.B., Dobbin, F., Eds.; Emerald Group Publishing Limited: Amsterdam, The Netherlands, 2010; pp. 21–42. [Google Scholar]

- Pfeffer, J. Beyond management and the worker: The institutional function of management. Acad. Manag. Rev. 1976, 1, 36–46. [Google Scholar] [CrossRef]

- Dess, G.G.; Beard, D.W. Dimensions of organizational task environments. Adm. Sci. Q. 1984, 29, 52–73. [Google Scholar] [CrossRef]

- Drees, J.M.; Heugens, P.P.M.A.R. Synthesizing and extending resource dependence theory: A meta-analysis. J. Manag. 2013, 39, 1666–1698. [Google Scholar] [CrossRef]

- Emerson, R.M. Power-dependence relations. Am. Sociol. Rev. 1962, 27, 31–41. [Google Scholar] [CrossRef]

- Kamps, J.; Pólos, L. Reducing uncertainty: A formal theory of Organizations in Action. Am. J. Sociol. 1999, 104, 1776–1812. [Google Scholar] [CrossRef]

- Willer, D. Power-at-a-distance. Soc. Forces 2003, 81, 1295–1334. [Google Scholar] [CrossRef]

- Jacobs, D. Dependency and vulnerability: An exchange approach to the control of organizations. Adm. Sci. Q. 1974, 19, 45–59. [Google Scholar] [CrossRef]

- Casciaro, T.; Piskorski, M.J. Power imbalance, mutual dependence, and constraint absorption: A closer look at resource dependence theory. Adm. Sci. Q. 2005, 50, 167–199. [Google Scholar] [CrossRef]

- Volberda, H.W.; Weerdt, N.V.D.; Verwaal, E.; Stienstra, M.; Verdu, A.J. Contingency fit, institutional fit, and firm performance: A metafit approach to organization–environment relationships. Organ. Sci. 2012, 23, 1040–1054. [Google Scholar] [CrossRef]

- Nienhüser, W. Resource dependence theory-How well does it explain behavior of organizations? Manag. Rev. 2008, 19, 9–32. [Google Scholar] [CrossRef]

- Oliver, C. Network relations and loss of organizational autonomy. Hum. Relat. 1991, 44, 943–961. [Google Scholar] [CrossRef]

- Hillman, A.J.; Cannella, A.A.; Paetzold, R.L. The resource dependence role of corporate directors: Strategic adaptation of board composition in response to environmental change. J. Manag. Stud. 2000, 37, 235–256. [Google Scholar] [CrossRef]

- Finkelstein, S. Interindustry merger patterns and resource dependence: A replication and extension of Pfeffer (1972). Strateg. Manag. J. 1997, 18, 787–810. [Google Scholar] [CrossRef]

- Pfeffer, J. Size and composition of corporate boards of directors: The organization and its environment. Adm. Sci. Q. 1972, 17, 218–228. [Google Scholar] [CrossRef]

- Katila, R.; Rosenberger, J.D.; Eisenhardt, K.M. Swimming with sharks: Technology ventures, defense mechanisms and corporate relationships. Adm. Sci. Q. 2008, 53, 295–332. [Google Scholar] [CrossRef]

- Pfeffer, J. Merger as a response to oganizational interdependence. Adm. Sci. Q. 1972, 17, 382–394. [Google Scholar] [CrossRef]

- Biniari, M.G.; Simmons, S.A.; Monsen, E.W.; Pizarro Moreno, M.I. The configuration of corporate venturing logics: An integrated resource dependence and institutional perspective. Small Bus. Econ. 2015, 45, 351–367. [Google Scholar] [CrossRef]

- Peng, M.W.; Bruton, G.D.; Stan, C.V.; Huang, Y. Theories of the (state-owned) firm. Asia Pac. J. Manag. 2016, 33, 293–317. [Google Scholar] [CrossRef]

- Liang, H.; Ren, B.; Sun, S.L. An anatomy of state control in the globalization of state-owned enterprises. J. Int. Bus. Stud. 2015, 46, 223–240. [Google Scholar] [CrossRef]

- Bruton, G.D.; Peng, M.W.; Ahlstrom, D.; Stan, C.; Xu, K. State-owned enterprises around the world as hybrid organizations. Acad. Manag. Perspect. 2015, 29, 92–114. [Google Scholar] [CrossRef]

- Peng, M.W.; Chen, H. Strategic responses to domestic and foreign institutional pressures. J. Manag. Org. 2011, 41, 88–105. [Google Scholar] [CrossRef]

- Luo, L.; Yang, Y.; Luo, Y.; Liu, C. Export, subsidy and innovation: China’s state-owned enterprises versus privately-owned enterprises. Econ. Pol. Stud. 2016, 4, 137–155. [Google Scholar] [CrossRef]

- Yigitcanlar, T.; Sabatini-Marques, J.; Costa, E.; Kamruzzaman, M.; Ioppolo, G. Stimulating technological innovation through incentives: Perceptions of Australian and Brazilian firms. Technol. Forecast. Soc. Chang. 2019, 146, 403–412. [Google Scholar] [CrossRef]

- Tajeddini, K.; Trueman, M. Environment-strategy and alignment in a restricted, transitional economy: Empirical research on its application to Iranian state-owned enterprises. Long Range Plan. 2016, 49, 570–583. [Google Scholar] [CrossRef]

- Scott, W.R.; Davis, G.F. Organizations and Organizing: Rational, Natural and Open Systems Perspectives; Routledge: London, UK, 2007. [Google Scholar]

- Duncan, R.B. Characteristics of organizational environments and perceived environmental uncertainty. Adm. Sci. Q. 1972, 17, 313–327. [Google Scholar] [CrossRef]

- Baum, J.A.C.; Oliver, C. Toward an institutional ecology of organizational founding. Acad. Manag. J. 1996, 39, 1378–1427. [Google Scholar]

- Peng, M.W.; Lee, S.-H.; Wang, D.Y.L. What determines the scope of the firm over time? A focus on institutional relatedness. Acad. Manag. Rev. 2005, 30, 622–633. [Google Scholar] [CrossRef]

- Lin, C.; Chang, C.-C. The effect of technological diversification on organizational performance: An empirical study of S&P 500 manufacturing firms. Technol. Forecast. Soc. Chang. 2015, 90, 575–586. [Google Scholar]

- Aldrich, H.E. Organizations and Environments; Stanford University Press: Redwood City, CA, USA, 1979. [Google Scholar]

- Su, Z.; Xie, E.; Li, Y. Organizational slack and firm performance during institutional transitions. Asia Pac. J. Manag. 2009, 26, 75–91. [Google Scholar] [CrossRef]

- Peng, M.W.; Zhang, S.; Li, X. CEO duality and firm Performance during China’s institutional transitions. Manag. Organ. Rev. 2007, 3, 205–225. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Furr, N.R.; Bingham, C.B. CROSSROADS—Microfoundations of performance: Balancing efficiency and flexibility in dynamic environments. Organ. Sci. 2010, 21, 1263–1273. [Google Scholar] [CrossRef]

- Goll, I.; Rasheed, A.A. The moderating effect of environmental munificence and dynamism on the relationship between discretionary social responsibility and firm performance. J. Bus. Ethics 2004, 49, 41–54. [Google Scholar] [CrossRef]

- Schilke, O. On the contingent value of dynamic capabilities for competitive advantage: The nonlinear moderating effect of environmental dynamism. Strateg. Manag. J. 2014, 35, 179–203. [Google Scholar] [CrossRef]

- Kim, H.; Hoskisson, R.E.; Wan, W.P. Power dependence, diversification strategy, and performance in keiretsu member firms. Strateg. Manag. J. 2004, 25, 613–636. [Google Scholar] [CrossRef]

- Amezcua, A.S.; Grimes, M.G.; Bradley, S.W.; Wiklund, J. Organizational sponsorship and founding environments: A contingency view on the survival of business-incubated firms, 1994–2007. Acad. Manag. J. 2013, 56, 1628–1654. [Google Scholar] [CrossRef]

- Wan, W.P.; Yiu, D.W. From crisis to opportunity: Environmental jolt, corporate acquisitions, and firm performance. Strateg. Manag. J. 2009, 30, 791–801. [Google Scholar] [CrossRef]

- Tang, J. Environmental munificence for entrepreneurs: Entrepreneurial alertness and commitment. Int. J. Entrep. Behav. Res. 2008, 14, 128–151. [Google Scholar] [CrossRef]

- Titus, V.K.; Anderson, B.S. Firm structure and environment as contingencies to the corporate venture capital–parent firm value relationship. Entrepreneursh. Theory Pract. 2018, 42, 498–522. [Google Scholar] [CrossRef]

- Li, Y.; Wei, Z.; Zhao, J.; Zhang, C.; Liu, Y. Ambidextrous organizational learning, environmental munificence and new product performance: Moderating effect of managerial ties in China. Int. J. Prod. Econ. 2013, 146, 95–105. [Google Scholar] [CrossRef]

- Wan, W.P. Country resource environments, firm capabilities, and corporate diversification strategies. Manag. Stud. 2005, 42, 161–182. [Google Scholar] [CrossRef]

- La Porta, R.; Lopez-De-Silanes, F.; Shleifer, A. Government ownership of banks. J. Financ. 2002, 57, 265–301. [Google Scholar] [CrossRef]

- Santos, F.M.; Eisenhardt, K.M. Organizational boundaries and theories of organization. Organ. Sci. 2005, 16, 491–508. [Google Scholar] [CrossRef]

- Meyer, K.E.; Estrin, S.; Bhaumik, S.K.; Peng, M.W. Institutions, resources, and entry strategies in emerging economies. Strateg. Manag. J. 2009, 30, 61–80. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Peng, M.W.; Luo, Y. Managerial ties and firm performance in a transition economy: The nature of a micro-macro link. Acad. Manag. J. 2000, 43, 486–501. [Google Scholar]

- Peng, M.W. Outside directors and firm performance during institutional transitions. Strateg. Manag. J. 2004, 25, 453–471. [Google Scholar] [CrossRef]

- Lebedev, S.; Peng, M.W.; Xie, E.; Stevens, C.E. Mergers and acquisitions in and out of emerging economies. J. World Bus. 2015, 50, 651–662. [Google Scholar] [CrossRef]

- Meyer, K.E.; Ding, Y.; Li, J.; Zhang, H. Overcoming distrust: How state-owned enterprises adapt their foreign entries to institutional pressures abroad. J. Int. Bus. Stud. 2014, 45, 1005–1028. [Google Scholar] [CrossRef]

- Connelly, B.L.; Hoskisson, R.E.; Tihanyi, L.; Certo, S.T. Ownership as a form of corporate governance. J. Manag. Stud. 2010, 47, 1561–1589. [Google Scholar] [CrossRef]

- Meyer, K.E.; Peng, M.W. Theoretical foundations of emerging economy business research. J. Int. Bus. Stud. 2016, 47, 3–22. [Google Scholar] [CrossRef]

- Stevens, C.E.; Xie, E.; Peng, M.W. Toward a legitimacy-based view of political risk: The case of Google and Yahoo in China. Strateg. Manag. J. 2016, 37, 945–963. [Google Scholar] [CrossRef]

- Zhang, Y.; Qu, H. The impact of CEO succession with gender change on firm performance and successor early departure: Evidence from China’s publicly listed companies in 1997–2010. Acad. Manag. J. 2016, 59, 1845–1868. [Google Scholar] [CrossRef]

- Marquis, C.; Qian, C. Corporate social responsibility reporting in China: Symbol or substance? Org. Sci. 2014, 25, 127–148. [Google Scholar] [CrossRef]

- Gambardella, A.; Torrisi, S. Does technological convergence imply convergence in markets? Evidence from the electronics industry. Res. Policy 1998, 27, 445–463. [Google Scholar] [CrossRef]

- Cantwell, J.; Vertova, G. Historical evolution of technological diversification. Res. Policy 2004, 33, 511–529. [Google Scholar] [CrossRef]

- Zander, I. Technological diversification in the multinational corporation—Historical evolution and future prospects. Res. Policy 1997, 26, 209–227. [Google Scholar] [CrossRef]

- Jacquemin, A.P.; Berry, C.H. Entropy measure of diversification and corporate growth. J. Ind. Econ. 1979, 27, 359–369. [Google Scholar] [CrossRef]

- Gemba, K.; Kodama, F. Diversification dynamics of the Japanese industry. Res. Policy 2001, 30, 1165–1184. [Google Scholar] [CrossRef]

- Wang, Y.; Pan, X.; Li, J.; Ning, L. Does technological diversification matter for regional innovation capability? Evidence from China. Technol. Anal. Strat. 2016, 28, 323–334. [Google Scholar] [CrossRef]

- Wang, Y.; Sutherland, D.; Ning, L.; Pan, X. The evolving nature of China’s regional innovation systems: Insights from an exploration–exploitation approach. Technol. Forecast. Soc. Chang. 2015, 100, 140–152. [Google Scholar] [CrossRef]

- Wei, Z.; Varela, O. State equity ownership and firm market performance: Evidence from China’s newly privatized firms. Glob. Financ. J. 2003, 14, 65–82. [Google Scholar] [CrossRef]

- Attig, N.; Guedhami, O.; Mishra, D. Multiple large shareholders, control contests, and implied cost of equity. J. Corp. Financ. 2008, 14, 721–737. [Google Scholar] [CrossRef]

- Cheung, Y.-L.; Kong, D.; Tan, W.; Wang, W. Being good when being international in an emerging economy: The case of China. J. Bus. Ethics 2015, 130, 805–817. [Google Scholar] [CrossRef]

- Hardin, J.W.; Hilbe, J.M. Generalized Estimating Equations. In Wiley Encyclopedia of Clinical Trials; John Wiley Sons Inc.: Hoboken, NJ, USA, 2007. [Google Scholar]

- Liang, K.-Y.; Zeger, S.L. Longitudinal data analysis using generalized linear models. Biometrika 1986, 73, 13–22. [Google Scholar] [CrossRef]

- Zelner, B.A. Using simulation to interpret results from logit, probit, and other nonlinear models. Strateg. Manag. J. 2009, 30, 1335–1348. [Google Scholar] [CrossRef]

- Wiersema, M.F.; Bowen, H.P. The use of limited dependent variable techniques in strategy research: Issues and methods. Strateg. Manag. J. 2009, 30, 679–692. [Google Scholar] [CrossRef]

- Bowen, H.P. Testing moderating hypotheses in limited dependent variable and other nonlinear models: Secondary versus total interactions. J. Manag. 2012, 38, 860–889. [Google Scholar] [CrossRef]

- Tabachnick, B.G.; Fidell, L.S. Using Multivariate Statistics, 6th ed.; Pearson: New York, NY, USA, 2012. [Google Scholar]

- Kleinbaum, D.G.; Kupper, L.L.; Nizam, A.; Muller, K.E. Applied Regression Analysis and Other Multivariate Methods, 4th ed.; Duxbury Press: Belmont, CA, USA, 2007. [Google Scholar]

- Pan, X.; Chen, X.; Ning, L. Why do inconsistencies occur? Detangling the relationship between technological diversification and performance in Chinese firms. Asian J. Technol. Innov. 2017, 25, 407–427. [Google Scholar] [CrossRef]

- Pan, X.; Chen, X.; Ning, L. Exploitative technological diversification, environmental contexts, and firm performance. Manag. Decis. 2018, 56, 1613–1629. [Google Scholar] [CrossRef]

- Chen, Y.-M.; Yang, D.-H.; Lin, F.-J. Does technological diversification matter to firm performance? The moderating role of organizational slack. J. Bus. Res. 2013, 66, 1970–1975. [Google Scholar] [CrossRef]

- Davis, G.F. Celebrating organization theory: The after-party. J. Manag. Stud. 2015, 52, 309–319. [Google Scholar] [CrossRef]

- Aldieri, L.; Carlucci, F.; Vinci, C.; Yigitcanlar, T. Environmental innovation, knowledge spillovers and policy implications: A systematic review of the economic effects literature. J. Clean. Prod. 2019, 239, 118051. [Google Scholar] [CrossRef]

| Variable | Mean | SD | VIF | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Diversity | 0.57 | 0.47 | |||||||||||

| 2 | EM | 0.03 | 0.02 | 1.07 | −0.045 | |||||||||

| 3 | ED | 0 | 0.09 | 1.11 | 0.055 | −0.243 | ||||||||

| 4 | Ownership | 0.13 | 0.22 | 1.32 | 0.008 | 0.010 | 0.056 | |||||||

| 5 | Size | 7.63 | 1.17 | 1.18 | 0.222 | −0.041 | 0.140 | 0.197 | ||||||

| 6 | Age | 10.89 | 4.8 | 1.14 | 0.077 | 0.016 | 0.055 | −0.183 | 0.146 | |||||

| 7 | Shrz | 18.06 | 47.52 | 1.21 | 0.033 | −0.009 | 0.024 | 0.285 | 0.137 | −0.009 | ||||

| 8 | Shrhfd3 | 0.19 | 0.13 | 1.42 | 0.088 | −0.014 | 0.050 | 0.421 | 0.207 | −0.220 | 0.382 | |||

| 9 | Rndintensity | 0.06 | 0.09 | 1.13 | −0.046 | 0.007 | −0.053 | −0.130 | −0.053 | 0.050 | −0.071 | −0.086 | ||

| 10 | Leverage | 0.43 | 0.29 | 1.21 | 0.052 | 0.050 | 0.120 | 0.116 | 0.228 | 0.145 | 0.070 | 0.007 | 0.265 | |

| 11 | Ownership | 0.13 | 0.22 | 1.32 | 0.008 | 0.010 | 0.056 | 1.000 | 0.197 | −0.183 | 0.285 | 0.421 | −0.130 | 0.116 |

| DV:Tobin’s Q | Model 1a | Model 1b | Model 2a | Model 2b | Model 3a | Model 3b | Model 4a | Model 4b | Model 5a | Model 5b |

|---|---|---|---|---|---|---|---|---|---|---|

| Coefficient | Marginal Effect at Variable Means | Coefficient | Marginal Effect at Variable Means | Coefficient | Marginal Effect at Variable Means | Coefficient | Marginal Effect at Variable Means | Coefficient | Marginal Effect at Variable Means | |

| Size | 0.122 *** | 0.062 *** | 0.118 *** | 0.060 *** | 0.119 *** | 0.061 *** | 0.108 *** | 0.054 *** | 0.104 *** | 0.052 *** |

| (7.06) | (7.02) | (4.72) | (4.65) | (6.73) | (6.69) | (6.29) | (6.25) | (6.23) | (6.18) | |

| Age | 0.029 *** | 0.015 *** | 0.028 *** | 0.015 *** | 0.030 *** | 0.015 *** | 0.026 *** | 0.013 *** | 0.028 *** | 0.014 *** |

| (8.66) | (8.68) | (5.03) | (5.02) | (8.77) | (8.79) | (8.05) | (8.00) | (8.59) | (8.52) | |

| Shrz | −0.000 | 0.000 | −0.000 | 0.000 | −0.000 | 0.000 | −0.000 | 0.000 | −0.000 | 0.000 |

| (−0.99) | (−0.99) | (−0.57) | (−0.57) | (−1.02) | (−1.02) | (−0.92) | (−0.92) | (−0.40) | (−0.40) | |

| Shrhfd3 | 0.214 | 0.110 | 0.199 | 0.102 | 0.219 | 0.112 | 0.071 | 0.036 | 0.026 | 0.013 |

| (1.44) | (1.44) | (0.80) | (0.81) | (1.47) | (1.47) | (0.47) | (0.47) | (0.17) | (0.17) | |

| Rndintensity | −0.294 * | −0.151 * | −0.266 | −0.136 | −0.313 * | −0.161 * | −0.164 | −0.083 | −0.326 * | −0.164 * |

| (−1.69) | (−1.68) | (−0.92) | (−0.92) | (−1.77) | (−1.77) | (−0.94) | (−0.94) | (−1.73) | (−1.73) | |

| Leverage | −0.114 | −0.059 | −0.139 | −0.071 | −0.103 | −0.053 | −0.176 ** | −0.089 * | −0.114 | −0.057 |

| (−1.53) | (−1.53) | (−1.27) | (−1.27) | (−1.35) | (−1.35) | (−2.41) | (−2.42) | (−1.47) | (−1.48) | |

| Ownership | −0.335 *** | −0.172 *** | −0.341 *** | −0.175 *** | −0.326 *** | −0.168 *** | −0.287 *** | −0.145 *** | −0.340 *** | −0.171 *** |

| (−4.39) | (−4.47) | (−3.21) | (−3.22) | (−4.31) | (−4.38) | (−3.05) | (−3.09) | (−3.62) | (−3.65) | |

| ED | 0.836 ** | 0.428 ** | 0.857 *** | 0.432 *** | ||||||

| (2.24) | (2.24) | (3.68) | (3.70) | |||||||

| EM | −4.570 *** | −2.349 *** | −8.499 *** | −4.271 *** | ||||||

| (−5.22) | (−5.28) | (−6.93) | (−7.24) | |||||||

| ED*Ownership | −0.197 *** | −0.099 *** | ||||||||

| (−6.54) | (−6.69) | |||||||||

| EM*Ownership | 0.171 *** | 0.086 *** | ||||||||

| (7.51) | (7.93) | |||||||||

| Cons | −1.842 *** | −1.788 *** | −1.683 *** | −1.634 *** | −1.387 *** | |||||

| (−14.63) | (−9.64) | (−12.79) | (−12.86) | (−9.02) | ||||||

| chi2 | 229.394 | 108.271 | 260.932 | 314.364 | 315.943 | |||||

| chi2_dev | 2111.787 | 2103.512 | 2129.053 | 3195.694 | 3368.652 | |||||

| p | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, X. Antecedents of Technological Diversification: A Resource Dependence Logic. J. Open Innov. Technol. Mark. Complex. 2019, 5, 80. https://doi.org/10.3390/joitmc5040080

Chen X. Antecedents of Technological Diversification: A Resource Dependence Logic. Journal of Open Innovation: Technology, Market, and Complexity. 2019; 5(4):80. https://doi.org/10.3390/joitmc5040080

Chicago/Turabian StyleChen, Xuanjin. 2019. "Antecedents of Technological Diversification: A Resource Dependence Logic" Journal of Open Innovation: Technology, Market, and Complexity 5, no. 4: 80. https://doi.org/10.3390/joitmc5040080

APA StyleChen, X. (2019). Antecedents of Technological Diversification: A Resource Dependence Logic. Journal of Open Innovation: Technology, Market, and Complexity, 5(4), 80. https://doi.org/10.3390/joitmc5040080