Patterns of Learning in Dynamic Technological System Lifecycles—What Automotive Managers Can Learn from the Aerospace Industry?

Abstract

:1. Introduction

2. Materials and Methods

3. Learning and Organizational Knowledge Bases

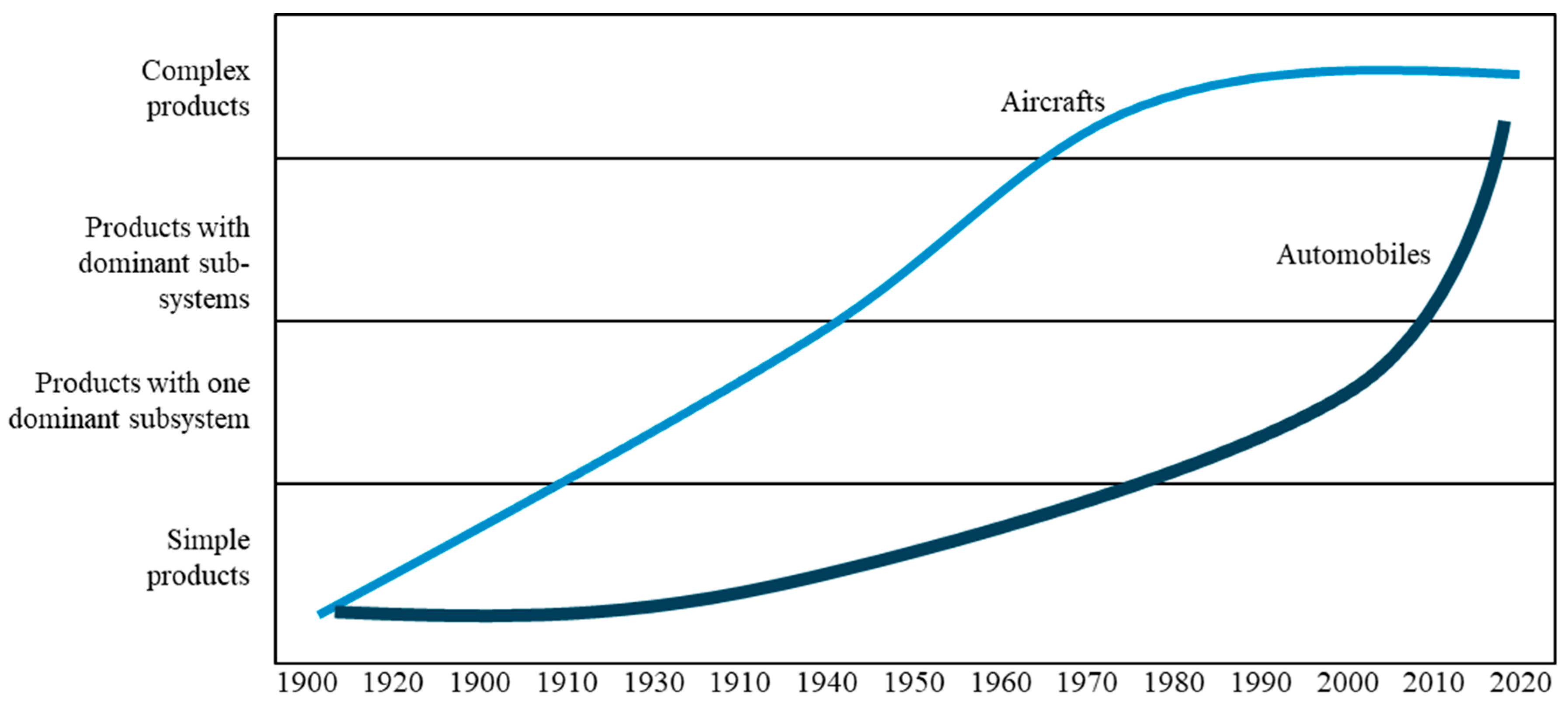

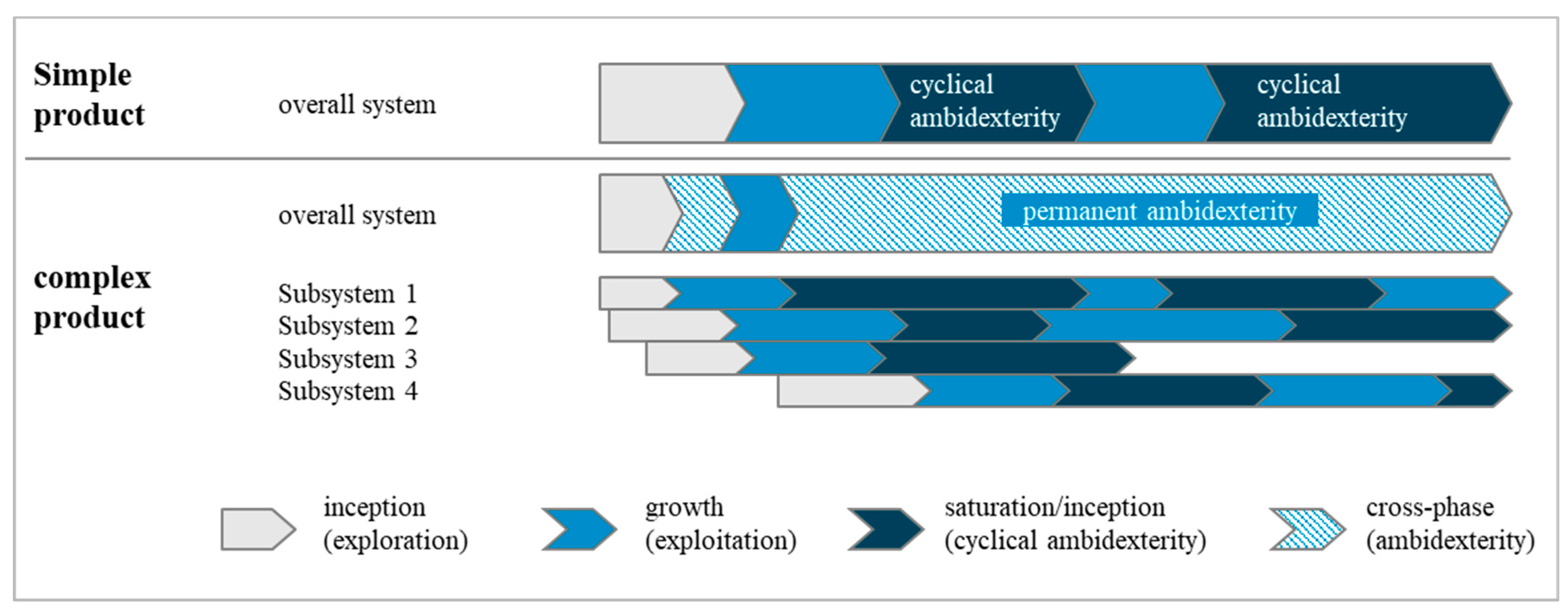

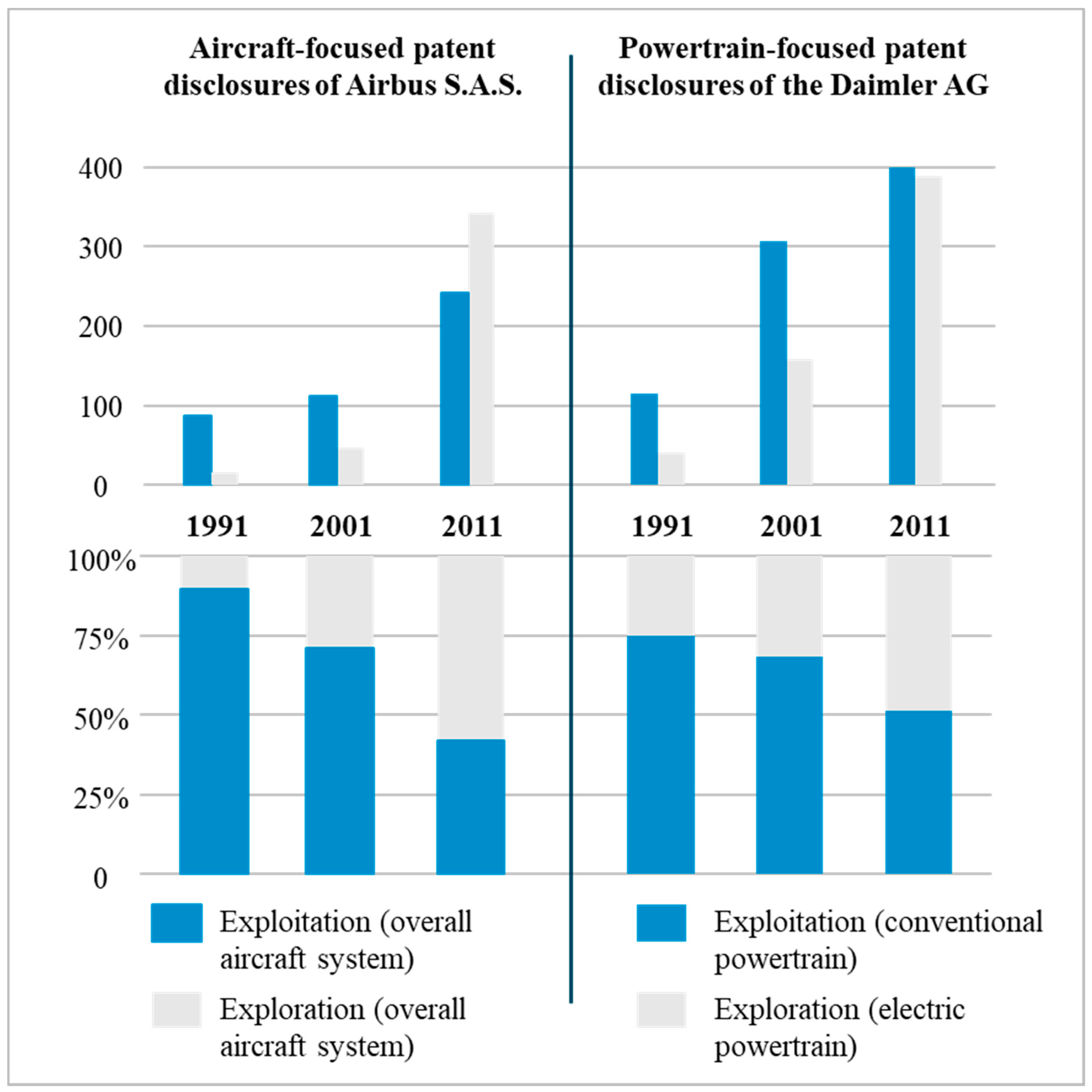

4. Technological Systems and Dynamics

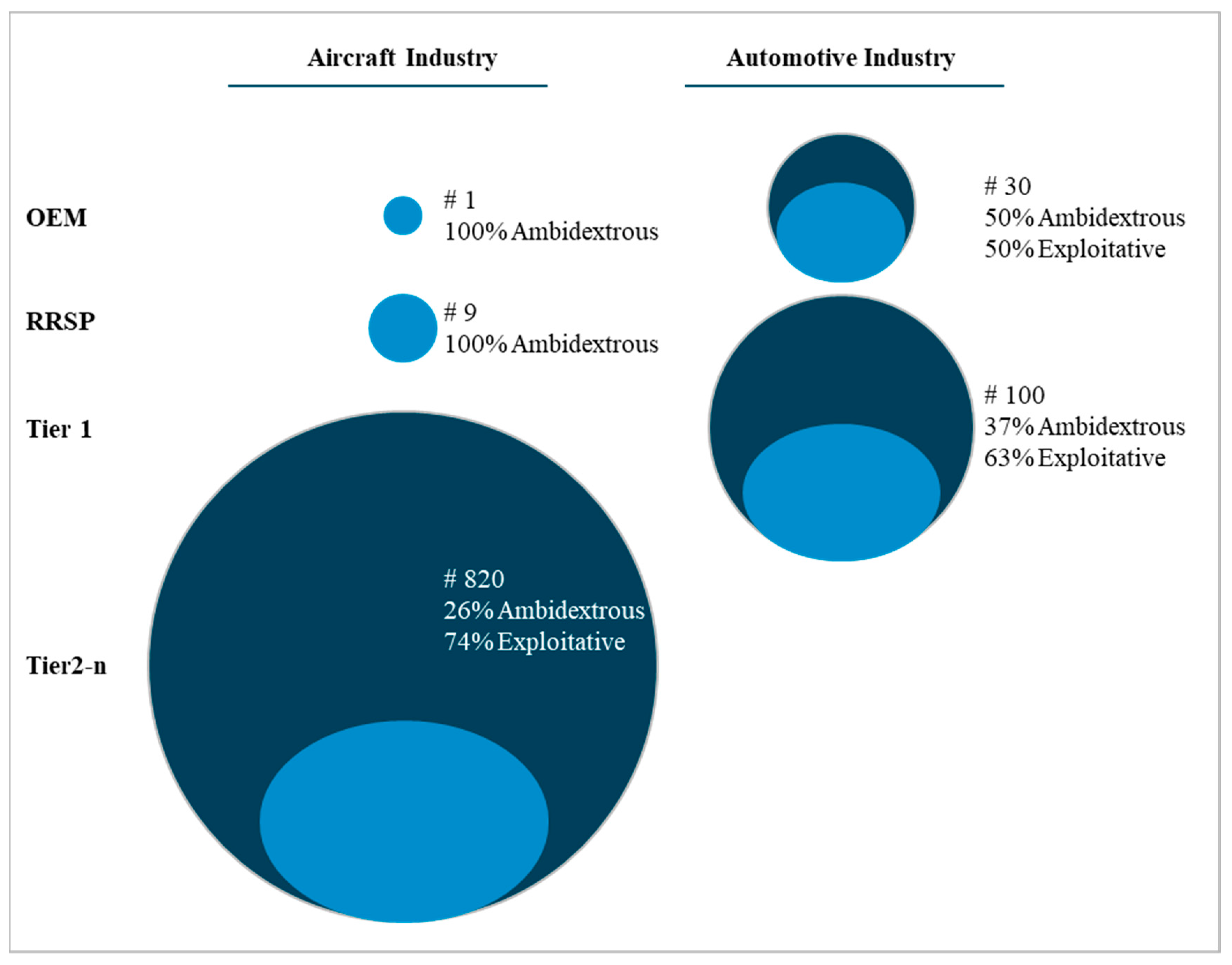

5. Learning Patterns Due to Technological Complexity and Dynamics

6. Discussion of Results: What Automotive Managers Can Learn from the Aerospace Industry

7. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Guffarth, D.; Kirbeci, M.; Hennes, Ch.; Schott, S. Business between Heaven and Earth—Assessing the Market Potential of Vertical Mobility, Horváth & Partners; Study Series: Stuttgart, Germany, 2019. [Google Scholar]

- Knappe, M. Kooperation als Strategie Technologischen Paradigmenwechsels: Eine Nachhaltigkeitsbasierte Untersuchung der Elektrifizierung des Automobils; Springer: Wiesbaden, Germany, 2015. [Google Scholar]

- Guffarth, D.; Barber, M.J. The European aerospace R&D collaboration network. In FZID Discussion Papers; No. 84; University of Hohenheim: Stuttgart-Hohenheim, Germany, 2013. [Google Scholar]

- Guffarth, D.; Barber, M.J. Network evolution, success, and regional development in the European aerospace industry. In FZID-Discussion Papers; No. 96; University of Hohenheim: Stuttgart-Hohenheim, Germany, 2014. [Google Scholar]

- Meusburger, P. Bildungsgeographie: Wissen und Ausbildung in der Räumlichen Dimension; Spektrum Akad. Verlag: Heidelberg/Berlin, Germany, 1998. [Google Scholar]

- Pohle, H. Wissen als strategischer Faktor in der Regionalentwicklung in einer globalisierten Welt. In Schädlich/Stangl (Hg.): Regionalentwicklung in der Wissensgesellschaft. Chancen für Sachsen, Sachsen-Anhalt und Thüringen; Akademie für Raumforschung und Landesplanung: Hannover, Germany, 2013; p. 19. [Google Scholar]

- Willke, H. Organisierte Wissensarbeit. Zeitschrift für Soziologie 1998, 27, 161–177. [Google Scholar] [CrossRef]

- Nelson, R.R.; Winter, S.G. An Evolutionary Theory of Economic Change; The Belknap Press of Harvard University Press: Cambridge, UK, 1982. [Google Scholar]

- Pyka, A. Der Kollektive Innovationsprozeß—Eine Theoretische Analyse Informeller Netzwerke und Absorptiver Fähigkeiten; Volkswirtschaftliche Schriften, Duncker and Humblot: Berlin, Germany, 1999; Volume 498. [Google Scholar]

- Nonaka, I. The Knowledge-Creating Company. Harvard Bus. Rev. 1991, 69, 96–104. [Google Scholar]

- Erkut, B. The Emergence of the ERP Software Market between Product Innovation and Market Shaping. J. Open Innov. Technol. Market Complex. 2018, 4, 23. [Google Scholar] [CrossRef]

- Saviotti, P.P.; de Looze, M.; Maupertuis, M.A. Knowledge Dynamics, Firm Strategy, Mergers and Acquisitions in the Biotechnology Based Sectors. Econ. Innov. New Technol. 2015, 14, 103–124. [Google Scholar] [CrossRef]

- Witt, U. Imagination and leadership—The neglected dimension of an evolutionary theory of the firm. J. Econ. Behav. Org. 1998, 35, 161–177. [Google Scholar] [CrossRef]

- Van Den Bosch, F.A.; Volberda, H.W.; De Boer, M. Coevolution of firm absorptive capacity and knowledge environment: Organizational forms and combinative capabilities. Org. Sci. 1999, 10, 551–568. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Innovation and learning: The two faces of R&D. Econ. J. 1989, 99, 569–596. [Google Scholar]

- Zahra, S.A.; George, G. Absorptive capacity: A review, reconceptualization, and extension. Acad. Manag. Rev. 2002, 27, 185–203. [Google Scholar] [CrossRef]

- Matusik, S.F.; Heeley, M.B. Absorptive capacity in the software industry: Identifying dimensions that affect knowledge and knowledge creation activities. J. Manag. 2005, 31, 549–572. [Google Scholar] [CrossRef]

- Chesbrough, H.W. The Era of Open Innovation. MIT Sloan Manag. Rev. 2003, 44, 35–41. [Google Scholar]

- Chesbrough, H.; Van Haverbeke, V.; West, J. Open Innovation. Researching a New Paradigm; Oxford University Press: Oxford, UK, 2006. [Google Scholar]

- Teece, D.; Pisano, G. The dynamic capabilities of firms: An introduction. Ind. Corp. Chang. 1994, 3, 537–556. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef] [Green Version]

- Eisenhardt, K.M.; Martin, J.A. Dynamic capabilities: What are they? Strateg. Manag. J. 2002, 21, 1105–1121. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Levitt, B.; March, J.G. Organizational learning. Annu. Rev. Social. 1988, 14, 319–338. [Google Scholar] [CrossRef]

- Jensen, M.B.; Johnson, B.; Lorenz, E.; Lundvall, B.Å. Forms of knowledge and modes of innovation. Res. Policy 2007, 36, 680–693. [Google Scholar] [CrossRef]

- March, J.G. Exploration and exploitation in organizational learning. Org. Sci. 1991, 2, 71–87. [Google Scholar] [CrossRef]

- An Overview of Innovation. Available online: https://www.worldscientific.com/doi/abs/10.1142/9789814273596_0009 (accessed on 21 December 2018).

- Kogut, B.; Zander, U. Knowledge of the firm, combinative capabilities, and the replication of technology. Org. Sci. 1992, 3, 383–397. [Google Scholar] [CrossRef]

- Sydow, J. Management von Netzwerkorganisationen—Zum Stand der Forschung. In Management von Netzwerkorganisationen; Gabler Verlag: Wiesbaden, Germany, 2003; pp. 293–354. [Google Scholar]

- Wollersheim, J.; Carduck, C.; Barthel, E. Do innovations only concern highly innovative companies? A qualitative inquiry. In Towards New Challenges for Innovative Management Practices; ERIMA: Pfullingen, Germany, 2010; Volume 3, p. 58. [Google Scholar]

- Levinthal, D.; March, J.G. A Model of Adaptive Organizational Search. J. Econ. Behav. Org. 1981, 2, 307–333. [Google Scholar] [CrossRef]

- Leonard-Barton, D. Core capabilities and core rigidities: A paradox in managing new product development. Strateg. Manag. J. 1992, 13, 111–125. [Google Scholar] [CrossRef]

- Gann, D.M.; Salter, A.J. Innovation in project-based, service enhanced firms: The construction of complex products and systems. Res. Policy 2000, 29, 955–972. [Google Scholar] [CrossRef]

- Guffarth, D. Ambidextrie in Netzwerken Komplexer Produkte: Exploration und Exploitation in der Luftfahrtindustrie; Springer: Wiesbaden, Germany, 2016. [Google Scholar]

- Grupp, H. Messung und Erklärung des Technischen Wandels: Grundzüge einer Empirischen Innovationsökonomik; Springer: Berlin, Germany, 1997. [Google Scholar]

- Schuh, G.; Klappert, S.; Schubert, J.; Nollau, S. Grundlagen zum Technologiemanagement. In Technologiemanagement—VDI Handbuch Produktion und Management, 2nd ed.; Schuh, G., Klappert, S., Eds.; Springer: Berlin/Heidelberg, Germany, 2011. [Google Scholar]

- Strothmann, K.-H. Innovationsmarketing—Herausforderung für Theorie und Praxis. Planung und Analyse 1987, 14, 60–66. [Google Scholar]

- Hobday, M. Product Complexity, Innovation and Industrial Organisation. Res. Policy 1998, 26, 689–710. [Google Scholar] [CrossRef]

- Rycroft, R.W.; Kash, D.E. The Complexity Challenge: Technological Innovation for the 21st Century; Cengage Learning EMEA: London, UK, 1999. [Google Scholar]

- Hobday, M.; Rush, H.; Joe, T. Innovation in complex products and systems. Res. Policy 2000, 29, 793–804. [Google Scholar] [CrossRef]

- Teece, D.J. Transactions cost economics and the multinational enterprise an Assessment. J. Econ. Behav. Org. 1986, 7, 21–45. [Google Scholar] [CrossRef]

- Haberfellner, R. Ethnische Ökonomien als (potenzielle) Arbeitgeberbetriebe; AMS Report No. 82–83; AMS: Vienna, Austria, 2012. [Google Scholar]

- Schuh, G.; Friedli, T.; Kurr, M.A. Kooperationsmanagement; Hanser: München, Germany, 2005. [Google Scholar]

- Höft, U. Lebenszykluskonzepte: Grundlage für das Strategische Marketing-und Technologiemanagement; Erich Schmidt Verlag GmbH & Co KG: Berlin, Germany, 1992; Volume 46. [Google Scholar]

- Dosi, G. Technological paradigms and technological trajectories—A suggested interpretation of the determinants and directions of technical change. Res. Policy 1982, 11, 147–162. [Google Scholar] [CrossRef]

- Tushman, M.L.; Anderson, P.C.; O’Reilly, C. Technology cycles, innovation streams, and ambidextrous organizations: Organization renewal through innovation streams and strategic change. In Managing Strategic Innovation and Change; Oxford University Press: New York, NY, USA, 1997; pp. 3–23. [Google Scholar]

- Perez, C. Technological revolutions and technoeconomic paradigms. Camb. J. Econ. 2010, 34, 185–202. [Google Scholar] [CrossRef]

- Dosi, G. Sources, procedures, and microeconomic effects of innovation. J. Econ. Lit. 1998, 26, 1120–1171. [Google Scholar]

- Klepper, S.; Simons, K.L. Industry shakeouts and technological change. Int. J. Ind. Org. 2005, 23, 23–43. [Google Scholar] [CrossRef] [Green Version]

- Suarez, F.F. Battles for technological dominance: An integrative framework. Res. Policy 2004, 33, 271–286. [Google Scholar] [CrossRef]

- Tushman, M.L.; Smith, W. Organizational technology. Companion Org. 2002, 386, 414. [Google Scholar]

- Benner, M.J.; Tushman, M.L. Exploitation, exploration, and process management: The productivity dilemma revisited. Acad. Manag. Rev. 2003, 28, 238–256. [Google Scholar] [CrossRef]

- Jansen, J.J.; Van Den Bosch, F.A.; Volberda, H.W. Exploratory innovation, exploitative innovation, and performance: Effects of organizational antecedents and environmental moderators. Manag. Sci. 2006, 52, 1661–1674. [Google Scholar] [CrossRef]

- Rothaermel, F.T.; Deeds, D.L. Exploration and exploitation alliances in biotechnology: A system of new product development. Strateg. Manag. J. 2004, 25, 201–221. [Google Scholar] [CrossRef]

- Leana, C.R.; Barry, B. Stability and change as simultaneous experiences in organizational life. Acad. Manag. Rev. 2000, 25, 753–759. [Google Scholar] [CrossRef]

- Tushman, M.L.; Romanelli, E. Organizational evolution: A metamorphosis model of convergence and reorientation. Res. Org. Behav. 1985, 7, 171–222. [Google Scholar]

- Volberda, H.W. Toward the flexible form: How to remain vital in hypercompetitive environments. Org. Sci. 1996, 7, 359–374. [Google Scholar] [CrossRef]

- Tushman, M.L.; O’Reilly, C.A., III. Ambidextrous organizations: Managing evolutionary and revolutionary change. Calif. Manag. Rev. 1996, 38, 8–29. [Google Scholar] [CrossRef]

- Meyer, C.B.; Stensaker, I.G. Developing capacity for change. J. Chang. Manag. 2006, 6, 217–231. [Google Scholar] [CrossRef]

- Sheremata, W.A. Centrifugal and centripetal forces in radical new product development under time pressure. Acad. Manag. Rev. 2000, 25, 389–408. [Google Scholar] [CrossRef]

- Thompson, J.D. Organizations in Action; McGrawHill: New York, NY, USA, 1967. [Google Scholar]

- Burns, T.; Stalker, G.M. The Management of Innovation; Tavistock: London, UK, 1961. [Google Scholar]

- Duncan, R.B. The ambidextrous organization: Designing dual structures for innovation. Manag. Org. 1976, 1, 167–188. [Google Scholar]

- Gupta, A.K.; Smith, K.G.; Shalley, C.E. The interplay between exploration and exploitation. Acad. Manag. J. 2006, 49, 693–706. [Google Scholar] [CrossRef]

- Rosenkopf, L.; Nerkar, A. Beyond local search: Boundary-spanning, exploration, and impact in the optical disk industry. Strateg. Manag. J. 2001, 22, 287–306. [Google Scholar] [CrossRef]

- Vassolo, R.S.; Anand, J.; Folta, T.B. Non-additivity in portfolios of exploration activities: A real options-based analysis of equity alliances in biotechnology. Strateg. Manag. J. 2004, 25, 1045–1061. [Google Scholar] [CrossRef]

- Vermeulen, F.; Barkema, H. Learning through acquisitions. Acad. Manag. J. 2001, 44, 457–476. [Google Scholar]

- Baum, J.A.; Li, S.X.; Usher, J.M. Making the next move: How experiential and vicarious learning shape the locations of chains’ acquisitions. Admin. Sci. Q. 2000, 45, 766–801. [Google Scholar] [CrossRef]

- Senge, P. The Fifth Discipline: The Art and Science of the Learning Organization; Currency Doubleday: New York, NY, USA, 1990. [Google Scholar]

- Argyris, C.; Schön, D.A. Organizational Learning, Readings; Addison-Wesley: Boston, MA, USA, 1978; Volume 344. [Google Scholar]

- Levinthal, D.A. Adaptation on rugged landscapes. Manag. Sci. 1997, 43, 934–950. [Google Scholar] [CrossRef]

- McKee, D. An organizational learning approach to product innovation. J. Prod. Innov. Manag. 1992, 9, 232–245. [Google Scholar] [CrossRef]

- Burgelman, R.A. Strategy as vector and the inertia of co-evolutionary lock-in. Admin. Sci. Q. 2002, 47, 325–357. [Google Scholar] [CrossRef]

- Ghemawat, P.; Ricart Costa, J.E.I. The organizational tension between static and dynamic efficiency. Strateg. Manag. J. 1993, 14, 59–73. [Google Scholar] [CrossRef]

- Volberda, H.W.; Baden-Fuller, C.; Van Den Bosch, F.A. Mastering strategic renewal: Mobilising renewal journeys in multi-unit firms. Long Range Plan. 2001, 34, 159–178. [Google Scholar] [CrossRef]

- Felin, T.; Foss, N.J. Organizational routines and capabilities: Historical drift and a course-correction toward microfoundations. Scand. J. Manag. 2009, 25, 157–167. [Google Scholar] [CrossRef]

- Lavie, D.; Stettner, U.; Tushman, M.L. Exploration and Exploitation Within and Across Organizations. Acad. Manag. Ann. 2010, 4, 109–155. [Google Scholar] [CrossRef]

- Levinthal, D.A.; March, J.G. The myopia of learning. Strateg. Manag. J. 1993, 14, 95–112. [Google Scholar] [CrossRef]

- Gibson, C.B.; Birkinshaw, J. The Antecedents, Consequences, and Mediating Role of Organizational Ambidexterity. Acad. Manag. J. 2004, 47, 209–226. [Google Scholar] [Green Version]

- Huy, Q.N. Emotional balancing of organizational continuity and radical change: The contribution of middle managers. Admin. Sci. Q. 2002, 47, 31–69. [Google Scholar] [CrossRef]

- Gilbert, C.G. Unbundling the structure of inertia: Resource versus routine rigidity. Acad. Manag. J. 2005, 48, 741–763. [Google Scholar] [CrossRef]

- Lavie, D.; Rosenkopf, L. Balancing exploration and exploitation in alliance formation. Acad. Manag. J. 2006, 49, 797–818. [Google Scholar] [CrossRef]

- Koza, M.P.; Levin, A.Y. The co-evolution of strategic alliances. Org. Sci. 1998, 9, 255–264. [Google Scholar] [CrossRef]

- Simsek, Z.; Heavey, C.; Veiga, J.F.; Souder, D. A typology for aligning organizational ambidexterity’s conceptualizations, antecedents, and outcomes. J. Manag. Stud. 2009, 46, 864–894. [Google Scholar] [CrossRef]

- Stöckmann, C. Exploration und Exploitation in adoleszenten Unternehmen; Springer Fachmedien: Wiesbaden, Germany, 2010. [Google Scholar]

- Siggelkow, N.; Levinthal, D.A. Temporarily divide to conquer: Centralized, decentralized, and reintegrated organizational approaches to exploration and adaptation. Org. Sci. 2003, 14, 650–669. [Google Scholar] [CrossRef]

- Venkatraman, N.; Lee, C.H.; Iyer, B. Strategic Ambidexterity and Sales Growth: A Longitudinal Test in the Software Sector, Unpublished Manuscript. 2007.

- Keller, T. Verhalten Zwischen Exploration und Exploitation. Ein Beitrag zur Ambidextrieforschung auf der organisationalen Mikroebene. Ph.D. Thesis, FernUniversität in Hagen, Hagen, Germany, 2012. [Google Scholar]

- Chen, E.L.; Katila, R. Rival interpretations of balancing exploration and exploitation: Simultaneous or sequential. In Handbook of Technology and Innovation Management; Shane, S., Ed.; John Wiley & Sons: Chichester, UK, 2008. [Google Scholar]

- Adler, P.S.; Goldoftas, B.; Levine, D.I. Flexibility versus efficiency? A case study of model changeovers in the Toyota production system. Org. Sci. 1999, 10, 43–68. [Google Scholar] [CrossRef]

- Smith, D.; Ibrahim, G. Cluster dynamics: Corporate strategy, industry evolution and technology trajectories—A case study of the East Midlands aerospace cluster. Local Econ. 2006, 21, 362–377. [Google Scholar] [CrossRef]

- Floyd, S.W.; Lane, P.J. Strategizing throughout the organization: Managing role conflict in strategic renewal. Acad. Manag. Rev. 2000, 25, 154–177. [Google Scholar] [CrossRef]

- Utterbach, J.M. Master the Dynamics of Innovation, How Companies can Seize Opportunities in the Face of Technological Change; Harvard Business School Press: Boston, MA, USA, 1994. [Google Scholar]

- Gort, M.; Klepper, S. Time paths in the diffusion of product innovations. Econ. J. 1982, 92, 630–653. [Google Scholar] [CrossRef]

- Klepper, S. Entry, exit, growth, and innovation over the product life cycle. Am. Econ. Rev. 1996, 86, 562–583. [Google Scholar]

- Esposito, E.; Raffa, L. Evolution of the supply chain in the aircraft industry. In Proceedings of the IPSERA Conference, San Diego, CA, USA, 6–8 April 2006. [Google Scholar]

- Vazquez-Barquero, A.; Alfonso-Gil, J. Diffusion of innovation within high technology clusters: New governance and policy recommendations. In Proceedings of the ERSA 47th Congress, Paris, France, 29 August–2 September 2007; Volume 29. [Google Scholar]

- Guffarth, D.; Hartley, K. The political economy of aerospace industries: A key driver of growth and international competitiveness? J. Evolut. Econ. 2015, 25, 537–539. [Google Scholar] [CrossRef]

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Guffarth, D.; Knappe, M. Patterns of Learning in Dynamic Technological System Lifecycles—What Automotive Managers Can Learn from the Aerospace Industry? J. Open Innov. Technol. Mark. Complex. 2019, 5, 1. https://doi.org/10.3390/joitmc5010001

Guffarth D, Knappe M. Patterns of Learning in Dynamic Technological System Lifecycles—What Automotive Managers Can Learn from the Aerospace Industry? Journal of Open Innovation: Technology, Market, and Complexity. 2019; 5(1):1. https://doi.org/10.3390/joitmc5010001

Chicago/Turabian StyleGuffarth, Daniel, and Mathias Knappe. 2019. "Patterns of Learning in Dynamic Technological System Lifecycles—What Automotive Managers Can Learn from the Aerospace Industry?" Journal of Open Innovation: Technology, Market, and Complexity 5, no. 1: 1. https://doi.org/10.3390/joitmc5010001

APA StyleGuffarth, D., & Knappe, M. (2019). Patterns of Learning in Dynamic Technological System Lifecycles—What Automotive Managers Can Learn from the Aerospace Industry? Journal of Open Innovation: Technology, Market, and Complexity, 5(1), 1. https://doi.org/10.3390/joitmc5010001