Abstract

This paper investigates the effectiveness of machine learning algorithms in enhancing the accuracy and reliability of predicting financial distress. The dataset includes Altman Z-Scores and Corporate Governance Compliance (CGC) indicators calculated for manufacturing firms listed on the Bucharest Stock Exchange (BSE) from 2016 to 2022. Leveraging Signaling Theory, the study analyzes financial and governance data for 60 non-financial firms, comprising 420 firm-year observations. Financial distress is classified into three categories: no distress, moderate distress, and severe distress. The study employs a Random Forest classification model, leveraging artificial intelligence techniques to identify critical predictive variables and evaluate their combined effectiveness in signaling financial distress. The findings reveal that machine learning algorithms significantly improve the predictive accuracy and reliability of financial distress classifications, effectively distinguishing between different distress levels by integrating financial ratios and corporate governance variables. These results emphasize the advantages of involving artificial intelligence and advanced analytics in financial distress prediction models, enhancing transparency and strengthening investor confidence. The research contributes to the literature on digital transformation in financial analysis and corporate governance, offering practical implications for investors, managers, creditors, and policymakers in emerging market environments.

1. Introduction

Considering the widespread global interest in predictive models and the rapidly evolving use of artificial intelligence, integrating machine learning techniques into predictive analysis has become essential for significantly enhancing the accuracy and reliability of financial distress predictions. Financial distress prediction is crucial for investors, creditors, regulators, and policymakers aiming to mitigate risks and maintain market stability. Various models have been developed to assess corporate financial health, notably the Altman Z-Score, introduced by Edward Altman [1], which remains among the most widely validated quantitative tools. Integrating several financial ratios, this model quantitatively evaluates the probability of a firm’s financial distress [1,2].

In addition to financial variables, corporate governance plays a critical role in determining firm performance, risk management, and financial resilience. Companies exhibiting robust governance structures demonstrate higher accountability, transparency, and adaptability to economic challenges [3,4]. Thus, incorporating governance indicators into financial distress prediction models can enhance the comprehensiveness and accuracy of risk assessment.

Previous research acknowledges the predictive effectiveness of Altman Z-Scores and recognizes the complementary value provided by governance measures in refining distress predictions [5,6]. However, existing studies predominantly focus on developed financial markets, revealing a knowledge gap in emerging economies with evolving governance frameworks. Limited attention has been given to the combined predictive potential of these indicators using machine learning technology in emerging markets like Romania, analyzed by machine learning technology. Addressing this gap, this study investigates whether machine learning-enhanced analysis of Altman Z-Scores and Corporate Governance Compliance (CGC) indicators effectively signals financial distress in manufacturing firms listed on the Bucharest Stock Exchange (BSE).

Therefore, the research question of the study is “To what extent can machine learning techniques, specifically Random Forest Regression, improve the accuracy and reliability of Altman Z-Scores and Corporate Governance Compliance as signals for predicting financial distress among manufacturing firms listed on the Bucharest Stock Exchange?”.

Building upon Signaling Theory, the study explores how digitally assessed financial and governance signals influence market perception and predict financial distress. Utilizing a Random Forest classification model developed by Leo Breiman [7] and further implemented by Andy Liaw and Matthew Wiener [8], our research analyzes digitally collected financial and governance data for 60 manufacturing firms listed on the BSE over seven years (2016–2022) for 420 firm-year observations. Financial distress is classified into three categories: no distress, moderate distress, and severe distress. Digital technologies and advanced analytics, through Random Forest, allow a nuanced identification of critical predictive variables, enhancing the reliability and predictive accuracy of these combined indicators.

This study is structured to first highlight the significance of digitally measured Altman Z-Scores in financial distress prediction, followed by an examination of Corporate Governance Compliance signals. Ultimately, the analysis confirms that integrating digital measurement techniques with advanced machine learning approaches significantly enhances the predictive capability of combined financial and governance indicators. By evaluating the interaction between financial health and governance compliance indicators, the research provides actionable insights for strengthening corporate governance practices and enhancing financial stability within Romania’s manufacturing sector, contributing to more comprehensive guidelines and risk management frameworks suited for emerging markets.

2. Theoretical Framework: Signaling Theory in Financial Distress Prediction

2.1. Overview of Signaling Theory

Signaling Theory, introduced by Michael Spence [9], explains how market participants convey information to reduce information asymmetry. In financial markets, firms use observable indicators to signal their stability, governance quality, and overall financial health to investors, creditors, and regulators. The accuracy and reliability of these signals influence capital allocation, investment decisions, and risk assessment [10]. The signaling process consists of three key components: signalers, signals, and receivers.

Researchers have utilized Signaling Theory in various contexts to understand the impact of financial and governance signals on market perceptions. For instance, Stephen A. Ross [11] applied the theory to explain how corporate financial disclosures serve as signals to mitigate information asymmetry between managers and investors. Similarly, other authors [12] explored how firms use governance structures to signal their credibility and reduce agency conflicts.

In addition to financial indicators, Corporate Governance Compliance serves as a qualitative signal of management integrity and accountability. The Corporate Governance Compliance Index (CGC Index) reflects a firm’s adherence to governance principles, including board structure, shareholder rights, and transparency in financial disclosures. A high CGC Index signals strong governance practices, reducing perceived investment risk, while a low index raises concerns about potential mismanagement and financial instability [12,13].

Governance quality is particularly relevant in emerging markets, where institutional frameworks are still evolving. Investors often rely on governance signals to assess firm credibility in environments where financial data may be lacking [4]. Thus, firms with strong governance compliance are more likely to secure investor confidence and financial stability, reinforcing the importance of governance as a market signal.

While financial and governance indicators can independently signal financial distress risk, their combined effect enhances predictive accuracy. When both Z-Scores and CGC Indexes align—indicating strong financial health and high governance compliance—firms benefit from better credit access, lower capital costs, and increased investor trust [13,14]. However, inconsistencies between these signals (e.g., high Z-Scores but low CGC Indexes) may create uncertainty, leading investors to question a firm’s governance risks despite financial strength [10,12].

2.2. Z-Scores as Financial Distress Signals

The Altman Z-Score, developed by Edward Altman in the late 1960s, has become a widely recognized and influential model for predicting the likelihood of a company’s financial distress or bankruptcy. The Altman Z-Score is calculated as a weighted sum of five financial ratios, including profitability, leverage, liquidity, and activity measures, representing a quantitative measure, a score, which provides a comprehensive assessment of a firm’s financial health and its ability to meet its financial obligations [14].

While the original Altman Z-Score model has been widely adopted and applied, researchers have highlighted certain limitations in its application, particularly in the context of the banking industry and emerging economies [15]. Alternatives to Z-Score measures and alternative methodologies have been developed over time to address these limitations, for instance, measures that use exponentially weighted moments or multivariate Logit approaches that provide more accurate probability estimates of financial distress. A “regulatory capital Z-Score” that incorporates the capital–asset ratio outperforms traditional Z-Score measures in assessing bank insolvency risk in both the US and Europe [16]. Another study suggested that discretionary accruals quality can predict early financial distress in a firm’s decline phase, offering new insights into the interplay between earnings management and the firm life cycle [17].

Overall, the Altman Z-Score continues to be a useful tool for assessing the financial health of a business and predicting the probability of financial difficulty, but its application necessitates carefully evaluating the particular context and possible limitations. The model’s accuracy and effectiveness in various kinds of financial and business contexts are constantly enhanced through ongoing research and model improvements.

The Altman Z-Scoreremains an influential and widely employed financial tool for signaling corporate financial distress. A low Z-Score signals potential insolvency risks, triggering caution from investors and creditors, while a high Z-Score signal financial stability, increasing investor confidence and creditworthiness. Its effectiveness derives from its ability to integrate multiple financial health indicators into a single predictive measure. Empirical evidence consistently supports its predictive power, confirming its role as an effective early-warning indicator of insolvency risk [18], reinforcing its role as a critical market signal.

Despite widespread use, researchers acknowledge specific contextual limitations, particularly in banking and emerging market contexts, prompting the development of alternative methodologies, such as regulatory capital Z-Scores [16], and discretionary accrual measures [17]. These improvements reflect ongoing efforts to enhance the predictive accuracy and adaptability of financial distress models across diverse business environments.

From a Signaling Theory perspective, the Z-Score’s observability and associated financial performance costs reinforce its reliability as a credible market signal [12]. Z-Scores are highly observable, as they are derived from publicly available financial statements. Additionally, Z-Scores have a cost implication: maintaining a high Z-Score requires sustained profitability and financial performance, making it difficult for distressed firms to engage in false signaling.

Consequently, the Z-Score remains a critical tool for managing financial risk, enhancing market transparency, and reducing information asymmetry between firms and stakeholders, thereby underscoring its ongoing relevance and importance in financial distress prediction.

2.3. Corporate Governance Compliance Indexes as Financial Distress Signals

In the past decade, corporate governance has gained significance in academic investigations, public debates, and governmental agendas worldwide. The global financial crisis in 2007 raised even more attention to how important good corporate governance is to maintain the reliability and resilience of the financial system [19]. Corporate governance is essential for listed companies because of its role in enhancing accountability, overseeing executive decisions, and protecting the interests of investors [20]. A good corporate governance emphasizes the importance of disclosure and transparency.

Corporate governance codes outline recommended practices for the management and oversight of organizations [21]. The Romanian regulatory environment has been improved since the development of the Corporate Governance Code for guiding listed companies on the Bucharest Stock Exchange (BSE) [22]. The “Apply or Explain” approach to corporate governance was introduced by the 1992 Cadbury Report and promotes voluntary adherence to a set of best-practice principles while requiring mandatory disclosure of compliance or justified non-compliance. This flexible framework acknowledges the diversity of companies and avoids imposing uniform regulations, relying instead on transparency and market oversight to encourage good governance [23].

A comprehensive examination of Romanian listed firms’ annual reports reveals an irregular picture of their compliance with corporate governance regulations. While some businesses have achieved significant progress in enhancing their disclosure and transparency, others still fall short [24]. Despite progresses having been made in aligning with global corporate governance standards, especially concerning transparency and disclosure, sustained efforts are required in Romania to achieve uniform compliance and successful implementation for complete benefits associated with good corporate governance [24]. Because it could be difficult to implement the Romanian Governance Code’s recommendations, Romanian companies still do not prioritize them as much as they should [25]. However, the extent to which businesses effectively apply these governance principles and the consequences of non-compliance remain the subject of study.

Previous studies have indicated that incorporating corporate governance elements with financial metrics could improve the accuracy of financial distress prediction models [6]. A way to evaluate companies’ compliance with corporate governance is to use their disclosures which are made in “Apply or Explain” statements [25]. As a result, Corporate Governance Compliance functions as a qualitative signal of managerial integrity and transparency. The Corporate Governance Compliance (CGC) Index reflects a firm’s adherence to governance principles, including board composition, shareholder rights, and disclosure practices. Firms with high CGC Index values signal strong governance, which reassures investors about management credibility and reduces perceived financial risk [12,13]. However, corporate governance signals are more challenging to observe compared to financial indicators like Z-Scores. Investors often rely on governance reports and “Apply or Explain” statements to interpret governance quality. Furthermore, maintaining high governance standards incurs costs, as firms must invest in compliance mechanisms, internal controls, and transparent reporting. These costs deter false signaling, ensuring that only firms genuinely committed to strong governance can maintain a high CGC Index [10].

2.4. The Interplay of Altman Z-Scores and Corporate Governance as Financial Distress Signals

A company is considered healthy if its financial ratios according to the Altman model are high. This information can help investors make decisions about which companies to invest in and is reflected in stock prices [26].

Existing research suggests that the interplay between Corporate Governance Compliance and financial distress is a complex and multifaceted phenomenon, and good prediction models should combine financial variables with corporate governance variables [6]. First, there have been uncertainties about Altman Z-Scores’ accuracy in identifying financial distress, especially in emerging economies, like Romania. The model may not accurately capture the complex financial dynamics and unique risk factors inherent in such a context [17].

Furthermore, the relationship between corporate governance and financial distress is not so straightforward [27]. A good corporate governance environment works as a catalyst to reduce the risk of financial distress [28]. In addition, another study [29] suggests that a comprehensive model for predicting financial distress should consider both financial ratios and corporate governance indicators, as well as measures of a firm’s leverage and default risk.

There are differences in the impact of corporate governance on the likelihood of financial distress. While external auditor quality has a strong negative correlation with financial distress, audit committee size and independence may have an important and useful influence. Some studies indicated a strong negative link between board size and CEO control among board governance characteristics, while duality was shown to be negatively connected with financial distress. With the sole exception of ownership concentration, which has a positive correlation with financial distress, ownership structure characteristics significantly correlate negatively with financial distress [30].

According to specific research, companies which had stronger corporate governance environments, like efficient risk management systems and executive compensation based on long-term performance, were more likely to deal with the financial crisis [31]. However, several studies have shown that the advantages of good governance may not always materialize into better financial results, particularly in uncertain markets [32].

These opposite findings highlight the need for a more nuanced understanding of the relationship between Corporate Governance Compliance and financial distress. Factors such as firm size, industry, growth opportunities, and institutional investor influence have been found to have a significant impact on a company’s financial performance and resilience [33]. Furthermore, the macroeconomic and regulatory landscape as a whole, in addition to the particular governance practices used by individual companies, may have an impact on how effective corporate governance is [19].

In emerging economies, legislative frameworks are often weaker, shareholders’ rights are less safeguarded, and financial markets are more uncertain; achieving effective corporate governance faces particularly significant challenges. As a result, the implementation and enforcement of governance codes become critical, as poor corporate governance has been identified as a contributing factor to financial crises in various regions [34].

The interplay between financial ratios and corporate governance scores has been studied in relation to financial distress prediction in previous research, offering a more comprehensive and nuanced explanation of this relationship [17,35]. By examining the interplay between Altman Z-Scores and Corporate Governance Compliance, we offer insights that can inform both theoretical and practical approaches to financial distress prediction. While financial and governance indicators can independently signal financial distress risk, their combined effect enhances predictive accuracy. When both signals align—a high Z-Score alongside a high CGC Index—investors perceive a firm as financially stable and well managed, increasing trust and market value. Conversely, a high Z-Score but a low CGC Index may raise concerns about governance deficiencies, while a low Z-Score but a high CGC Index suggests that good governance may not be enough to prevent financial distress.

An effective signal must influence receiver behavior, meaning that strong financial and governance signals should prompt investors to increase firm valuation and reduce risks [10]. Furthermore, incorporating Corporate Governance Compliance alongside Altman Z-Scores substantially enhances predictive accuracy, underscoring the complementary relationship between financial health indicators and governance practices [6,35,36]. Thus, a robust signaling framework integrating financial stability and governance compliance can significantly improve stakeholders’ ability to anticipate and manage financial distress.

This study examines how these dual signals function within the signaling environment of emerging markets, where financial transparency and governance practices vary significantly. By integrating both financial health indicators and governance quality, this research provides a comprehensive view of how firms signal stability and how investors interpret these signals in decision-making.

3. Materials and Methods

3.1. Data Collection and Variables

The data for this study were extracted from the Orbis database, compiled by Bureau Van Dijk, targeting all 85 companies listed on the Bucharest Stock Exchange (BSE) as of 2023. The selection criteria included non-financial companies, and they had continuous listings on the BSE from 2016 to 2022, resulting in a sample of 60 manufacturing firms and a total of 420 observations. This sample size is comparable to that of the original study conducted by Altman in 1968. The starting year of 2016 was chosen because the last significant revision of the Corporate Governance Code in Romania was implemented that year, while 2022 was selected as the endpoint due to the availability of financial information for analysis. The dataset encompasses financial statements and Corporate Governance Compliance reports.

By integrating core accounting variables with machine learning techniques, financial forecasting evolves from static analysis into an adaptive and intelligent process, capable of learning from data patterns and providing more relevant, insightful predictions in today’s dynamic financial environment [37].

To contextualize financial distress in emerging markets, this study builds on previous research that has examined how corporate governance influences firm performance and risk during periods of crisis in developing economies [38]. Recent research has extensively examined financial distress within emerging markets [39], focusing on identifying key predictors and enhancing predictive models by using machine learning techniques [40,41].

In our model, the dependent variable is “Financial Distress” (FD), categorized as “No Financial Distress” (1), “Moderate Financial Distress” (2), and “Severe Financial Distress” (3). Independent variables are the Altman Z-Score (ZS) and the Corporate Governance Compliance Index (CGC).

The Altman Z-Score is calculated according to the following specific formula:

where = Working Capital/Total Assets, = Retained Earnings/Total Assets, = Earnings Before Interest and Taxes/Total Assets, = Market Value of Equity/Book Value of Total Liabilities, and = Sales/Total Assets.

The resulting Z-Scores were used to categorize companies’ financial health: a score above 2.99 indicated a low probability of financial distress, and, as a result, the company in question was rated as not being financially distressed or being “safe”; with a score between 1.81 and 2.99, a company was rated as having moderate financial distress or being in the “gray area” of potential distress; and with a score below 1.81, a company was rated as having a severe likelihood of financial distress or being “distressed”.

The primary data used to determine Corporate Governance Compliance Indexes were manually collected from the official websites of the companies listed on the Bucharest Stock Exchange (BSE). Data were extracted from the mandatory “Apply or Explain” statements, as required by the Romanian Corporate Governance Code (RCGC). For each company, we recorded the number of governance principles explicitly marked as “applied” in the statement.

The 34 principles of the RCGC are grouped into four thematic categories as structured in the Code, as resulting from Table 1:

Table 1.

Principles of the Romanian Corporate Governance Code (2016).

Each of the 34 principles of the RCGC was evaluated using a binary scoring system: “1” was assigned if the company explicitly stated compliance with a principle (i.e., “Apply”) and “0” was assigned if the company either failed to apply the principle or provided an “Explain” justification for deviation. This yes/no (binary) coding approach was adopted for its clarity, reproducibility, and alignment with the BSE’s governance monitoring criteria. While this method does not account for degrees of partial compliance, it ensures objectivity by focusing solely on what is declared and verifiable.

For each company, the CGC Index was calculated as the ratio between the total number of principles marked as “applied” and the total number of applicable principles (34) using the following formula:

Thus, the CGC Index ranges from 0 (no compliance) to 1 (full compliance). This simple proportional score enables cross-sectional comparison between firms while avoiding subjective interpretation of compliance quality. To strengthen validity and consistency, a sample of 10% of the firms was double coded independently by a second reviewer. Inter-coder agreement exceeded 95%, and discrepancies were discussed and resolved, reinforcing the reliability of the coding procedure. This approach provides a transparent, replicable, and empirically grounded measure of Corporate Governance Compliance suitable for machine learning models, including Random Forest analysis.

In order to investigate the determinants of financial distress and the predictive power of Corporate Governance Compliance, a Random Forest classification model was employed. The variables included in the model were selected based on their theoretical and empirical relevance and are summarized in Table 2, along with their definitions and data sources. Each variable was categorized (numerical or categorical) and matched with its respective data source to ensure transparency and replicability.

Table 2.

Variable and source of data.

The dependent variable is Financial Distress (FD), a categorical construction derived from the Altman Z-Score model, which classifies firms into three distinct categories: (1) No Financial Distress (Safe Zone); (2) Moderate Financial Distress (Gray Zone); (3) Severe Financial Distress (Distress Zone). The classification is grounded in the thresholds originally proposed by Altman [1] and adapted to the industrial profile of the sample. The Z-Scores were calculated based on data retrieved from the ORBIS commercial financial database, developed by Bureau van Dijk. In addition to the Z-Score and its derivative classification, the Corporate Governance Compliance Index (CGC Index) is included as a core explanatory variable. This numerical index captures the quality of a firm’s governance practice and serves as a proxy for internal control, accountability, and transparency.

This structured set of variables enables the application of machine learning classification techniques to explore complex, non-linear interactions between governance practices and financial health. The inclusion of both quantitative financial indicators and qualitative governance compliance enhances the explanatory power and robustness of the Random Forest model.

3.2. Model Description and Hypothesis Development

To examine the predictive relationship between financial distress measured by Altman Z-Scores and Corporate Governance Compliance (CGC) Indexes, a Random Forest classification model was implemented using the XLSTAT Advanced statistical software package. Random Forest [7] is particularly suitable due to its robustness in handling complex, non-linear relationships; overfitting multicollinearity; effectively managing categorical data; and significantly enhancing predictive accuracy over traditional methods such as logistic regression or discriminant analysis. Comparative analysis of machine learning models for bankruptcy prediction indicated that Random Forests provided superior predictive accuracy compared to traditional models like logistic regression and discriminant models and even artificial neural networks and support vector machines [42,43].

The Random Forest model is specified as follows:

where denotes the financial distress status of firm at time represents the calculated Z-Score of firm at time , signifies the Corporate Governance Compliance assessed for firm at time , and represents the error term capturing unexplained variability.

For implementing machine learning algorithms, hyperparameter tuning options were set based on prior literature and empirical testing within the software capabilities. The number of trees in the forest (n_estimators) was set to 200, as this value provided a good balance between performance stability and computational time. The maximum tree depth and minimum number of observations per leaf were left at their default XLSTAT settings, which were internally optimized to prevent overfitting. The number of variables considered at each split was set automatically by XLSTAT based on the square root of the number of predictors, which is consistent with best practices for classification tasks. Model performance was evaluated using standard metrics, including accuracy, precision, recall, F1-score, and the area under the ROC curve (AUC). A confusion matrix was also generated to visualize the classification quality across the three financial distress categories. Additionally, XLSTAT provided a variable importance chart, which was used to assess the relative contribution of the Corporate Governance Compliance Index and financial indicators to the classification outcomes.

The relationship between corporate governance characteristics and financial distress was analyzed by employing both Logit and Random Forest models, and the results showed that corporate governance variables enhanced the predictive accuracy of the Random Forest model, underscoring the model’s ability to identify and rank influential predictors, thereby aiding in the turnaround process of distressed companies [44].

Our research emphasizes emerging markets, particularly Romania, due to their distinct institutional frameworks, influencing the effectiveness of governance mechanisms and financial health indicators. The study investigated the combined impact of Altman Z-Scores and Corporate Governance Compliance on predicting financial distress among manufacturing companies listed on the Bucharest Stock Exchange (Figure 1).

Figure 1.

Independent variables (Z-Scores and Corporate Governance Compliance) discriminate dependent variable (Financial Distress). Source: Authors’ projection.

The model’s performance was assessed through stratified sampling and cross-validation techniques during the Random Forest implementation in XLSTAT. Furthermore, to ensure the stability of the results, we verified the model’s predictive power across multiple folds and evaluated key performance metrics (accuracy, precision, recall, and AUC). The consistency of variable importance rankings across these folds reinforced the reliability of our findings.

Based on the literature reviewed and Signaling Theory, the following hypotheses were formulated:

H0 (null):

Digitally measured Altman Z-Scores and Corporate Governance Compliance indicators do not significantly enhance differentiation between financial distress categories among Romanian listed manufacturing companies.

H1 (alternative):

Digitally measured Altman Z-Scores and Corporate Governance Compliance indicators significantly enhance differentiation between financial distress categories among Romanian listed manufacturing companies.

The hypotheses were tested using Random Forest analysis, with the model’s predictive performance assessed through accuracy metrics, variable importance analysis, and confusion matrices.

4. Results and Discussion

4.1. Descriptive Statistics and Random Forest Regression

Descriptive statistics for the Altman Z-Scores (ZSs) and Corporate Governance Compliance (CGC) Indexes across the three financial distress categories are summarized in Table 3.

Table 3.

Descriptive statistics of ZSs and CGC.

Firms classified as safe exhibit the highest mean Z-Score values (4575), signaling robust financial health, and these firms also maintain a moderate level of Corporate Governance Compliance (mean CGC = 0.683). Companies facing moderate financial distress have lower Z-Scores (mean ZS = 2.349), but they demonstrate higher governance compliance (mean CGC = 0.752). This might reflect strategic signaling behavior, where firms experiencing moderate distress proactively enhance governance transparency to reassure stakeholders. Firms in severe distress exhibit both poor financial health (negative mean Z-Score = −0.705) and lower compliance with governance standards (mean CGC = 0.475), indicating significant managerial and financial challenges. These findings suggest that while financial health and governance compliance generally move together, firms under moderate distress appear more proactive in adopting governance measures, possibly as a strategy to mitigate perceived financial instability.

The overall mean Z-Score for the sample (2.388) suggests moderate risk of financial distress within the Romanian manufacturing sector. Meanwhile, the mean CG score of 0.651 (65%) highlights a relatively high level of adherence to good corporate governance practices. In fact, these results are consistent with previous research by Achim et al. [24], who reported similar compliance levels (around 60%) a decade ago, suggesting limited improvements since then.

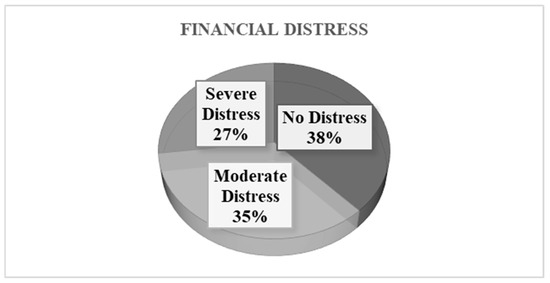

Figure 2 displays the firm distribution across distress categories from 2016 to 2022, illustrating that only 38% of firms remained financially stable during the observed period. In contrast, 62% experienced varying degrees of distress (35% moderate and 27% severe), highlighting considerable vulnerability within the sector. These findings underscore the need for enhanced corporate strategies and policy interventions.

Figure 2.

Distribution of financial distress levels of companies for 2016 to 2022. Source: Authors’ own creation.

This significant portion of distressed firms highlights the importance of close monitoring by investors, creditors, and policymakers, emphasizing the need for strategic interventions and preventive actions to reduce the likelihood of business failures. The distribution demonstrates a balanced representation among the three categories, ensuring adequate variation in the multinomial logistic regression model for discrimination between firms at various financial distress levels. As a result, an effective predictive model that can generalize effectively across all categories is aided by the distribution’s relative consistency.

Table 4 provides the summary statistics generated by the Random Forest model, a foundation for understanding the distribution of Z-Scores and CGC Indexes and their potential impact on financial distress levels.

Table 4.

Overall descriptive statistics.

The overall descriptive statistics further confirm considerable variability in financial stability across the sample, with Z-Scores ranging from highly negative (−18.16) to strongly positive (14.58) and a high standard deviation (3.120). In contrast, lower variability in CGC scores suggests consistent adherence to the Romanian Governance Code.

Table 5 displays a moderate positive correlation coefficient between Z-Scores and Corporate Governance Compliance Indexes (0.337), demonstrating that higher financial stability generally aligns with better governance practices, though it provides unique and complementary signaling information.

Table 5.

Correlation matrix.

4.2. Random Forest Regressor Analysis

The Random Forest analysis performed in this study was a classification forest type, applying the bagging method for data sampling. The sampling was performed randomly with replacement from a sample size of 420 observations. The analysis constructed a total of 100 decision trees to ensure robust predictive performance. Randomness was controlled by setting a seed value to allow the replicability of results.

The Random Forest analysis achieved a notably low Out-of-Bag (OOB) misclassification rate of only 1.7%, demonstrating an exceptional predictive accuracy of 98.3%. The results of the confusion matrix underscore this precision and are summarized in Table 6.

Table 6.

Confusion Matrix (OOB sample).

The confusion matrix shows strong classification accuracy across all categories, notably near-perfect accuracy for severe distress. The Altman Z-Score is clearly the dominant predictor, significantly outperforming Corporate Governance Compliance indicators in predicting financial distress. Corporate Governance Compliance still contributes, but its impact is relatively minor. Variable importance metrics demonstrate the dominant predictive role of financial health indicators and are provided in Table 7.

Table 7.

Variable importance (mean decrease in accuracy).

The mean decrease in accuracy highlights the contribution of each predictor variable to the Random Forest model’s predictive accuracy. The Z-Score exhibits a significantly higher importance (170.303) compared to the Corporate Governance Compliance (CGC) score (3.070), underlining its dominant predictive strength. Specifically, the Z-Score demonstrates substantial predictive accuracy across all financial distress categories (No Distress: 93.480, Moderate Distress: 97.847, Severe Distress: 113.121). In contrast, CGC scores contribute minimally, with negligible predictive power for severe distress (0.000) and limited predictive strength for moderate (1.976) and no distress (2.800) scenarios.

These results confirm Z-Scores as the most reliable signals for predicting financial distress, while CGC scores provide useful supplementary insights. CGC scores show marginal significance in moderate and severe distress scenarios, highlighting their limited predictive capability, aligning with the findings of other studies [5]. This finding aligns with signaling theory, reinforcing Z-Scores’ reliability as critical predictors, while suggesting a secondary, yet complementary, role for governance compliance indicators.

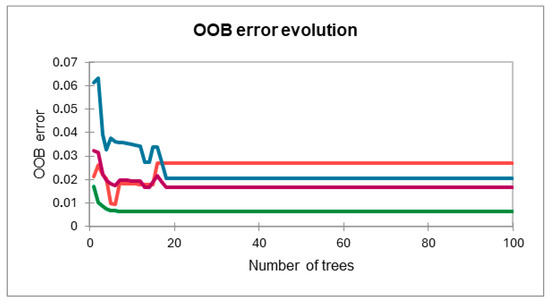

The evolution of the Out-of-Bag (OOB) error rate (Figure 3) further supports the robustness of the Random Forest model. In the graph, each curve corresponds to a class in the classification problem, displaying how the OOB error for that class decreases as more trees are added, as result safe firms are represented in blue, moderate in magenta, distressed in red, and overall stabilization, in green. Initially, the OOB error decreases rapidly, indicating substantial model improvement as more trees are added. After approximately 20–30 trees, the error rate stabilizes, suggesting minimal additional accuracy gains beyond this point. The relatively flat lines from around 30 to 100 trees confirm the model’s optimal performance, highlighting its stability. Practically, this indicates that employing 100 trees effectively balances computational efficiency with predictive accuracy, reinforcing the reliability and robustness of the chosen Random Forest methodology.

Figure 3.

Graph of OOB Error Evolution. Source: XLSTAT Advanced software processing.

The Random Forest classifier demonstrates strong predictive capability, effectively classifying companies into financial distress categories primarily based on Z-Scores and, to a lesser extent, CGC indicators. The robustness of the Z-Score as a financial health signal highlights its pivotal role in predicting distress, while Corporate Governance Compliance plays a complementary but secondary role. The exceptionally low OOB error rate and high classification accuracy indicate substantial practical utility for stakeholders, facilitating early identification of at-risk firms and enhancing strategic decision-making and risk management. These findings clearly underscore the value of integrating digital technologies in financial distress prediction models, aligning effectively with the research objectives.

The results strongly support the alternative hypothesis (H1). Z-Scores were highly significant predictors, clearly differentiating firms based on financial distress levels. Although CGC Indexes exhibited marginal significance for moderate distress scenarios, their overall predictive role remains complementary rather than independently decisive.

The interplay between CG compliance and financial distress is both structural and dependent by context; acting as a selective signal, its benefits are more pronounced in areas where accountability and resource allocation efficiency are directly observable [45]. This nuanced perspective adds explanatory power to the Random Forest results and highlights the importance of integrated analytical approaches when assessing corporate viability.

5. Conclusions

This study demonstrates the applicability and robustness of the Random Forest classification model in signaling and predicting financial distress among manufacturing companies listed on the Bucharest Stock Exchange from 2016 to 2022. Consistent with Signaling Theory, the findings confirm that digitally measured Altman Z-Scores and Corporate Governance Compliance (CGC) indicators provide critical signals for stakeholders to identify potential financial distress effectively.

The Altman Z-Score emerged as a dominant, clear, and highly effective quantitative predictor, significantly contributing to accurate distress classification. Firms presenting higher Z-Scores effectively signal financial stability, thereby lowering perceived investment risk. This aligns with the theoretical notion that reliable signaling requires sustained operational excellence, making deceptive signals unlikely.

Conversely, the CGC indicator functioned primarily as a secondary, qualitative governance signal, exhibiting limited predictive strength compared to the Z-Score. While CGC showed modest predictive capability, particularly regarding moderate distress, it nonetheless provided complementary information valuable in scenarios characterized by informational asymmetry. Robust governance mechanisms, such as board independence, board size, and institutional ownership, were found to mitigate the tendency of financially distressed firms to increase leverage [46]; as a result, governance acts as a stabilizing force, promoting more conservative and disciplined financial decisions during periods of volatility.

The Random Forest model exhibited exceptional predictive accuracy, with an overall accuracy of 98.3%, demonstrating particular strength in correctly classifying no distress (97.32%), moderate distress (97.96%), and severe distress scenarios (99.38%). The low Out-of-Bag (OOB) misclassification rate (1.7%) underscores the reliability and practical utility of the chosen analytical approach. Random Forest models offer a stable and resilient alternative to traditional Logit models in default prediction [46], with advantages such as tolerance to multicollinearity, omitted variable bias, and non-linearity, characteristics also confirmed in our analysis.

From a signaling perspective, the considerable importance of Z-Scores, supported by their high variable importance measures, highlights the essential role of clear, quantitative financial signals in distress prediction. Meanwhile, the limited contribution of CGC signals suggests the need for firms to enhance qualitative governance indicators for improved signaling effectiveness.

Practically, the analysis highlights persistent financial distress within a significant portion of the manufacturing sector, despite relatively good governance compliance levels (approximately 65%). This underscores the need for proactive, integrated signaling strategies involving both robust financial performance and strong governance practices to enhance financial resilience.

This research addresses the central research question by confirming the importance of digital financial and governance signals in financial distress prediction. The results emphasize the necessity for firms to strategically manage and communicate both financial and governance health to stakeholders. Investors, creditors, and policymakers can leverage these findings to improve risk assessment methodologies, strengthen financial stability, and promote enhanced corporate governance within Romania’s manufacturing sector.

Recent studies in the literature emphasize how global economic shocks, particularly the COVID-19 pandemic, have exposed weaknesses in corporate risk management frameworks, revealing that firms with strong governance attributes are less exposed to corporate risk and better equipped to navigate systemic crises, demonstrating that Corporate Governance Compliance not only predicts financial distress but also operates as a selective yet powerful signal of financial resilience [47].

Our findings reflect the regulatory, economic, and governance environment characteristic of the context of Romanian listed manufacturing companies subject to the Romanian Corporate Governance Code during the selected reporting period. While the results offer valuable insights into the relationship between governance compliance and financial distress within this setting, we acknowledge that caution is required when extrapolating these findings to other industries, jurisdictions, or time periods. Differences in governance frameworks, financial disclosure requirements, or macroeconomic conditions may affect model performance and variable importance.

Nevertheless, this study acknowledges certain other limitations, including potential measurement errors due to the manual data collection of Corporate Governance Compliance information and the simplistic binary approach to governance assessment. The lack of more nuanced qualitative governance measures, such as managerial expertise and strategic decision-making quality, further limits comprehensiveness. Future research could address these gaps by incorporating detailed governance metrics, employing advanced machine learning techniques, and exploring additional qualitative signals.

The study provides a direct and robust response to the research question, underlining the critical role of both financial and corporate governance signals in predicting financial distress. By employing the Random Forest model, its high predictive accuracy, and its ability to rank variable importance, the analysis offers deeper insights into the complex interplay between firm performance and governance structures; its methodological advantage enhances interpretability, making the findings not only statistically sound but also highly actionable.

The results underscore the strategic importance for companies to actively manage both financial health and governance quality, thereby sending consistent signals of stability and resilience to market participants. For investors and creditors, the model’s ability to highlight key risk drivers supports more refined and data-informed risk assessment frameworks. Likewise, policymakers can leverage these insights to design targeted regulations and policies that strengthen financial stability and promote better compliance with corporate governance standards, particularly within the Romanian manufacturing sector, where such measures can have significant economic impact.

In conclusion, by improving signaling practices across financial and governance dimensions and by utilizing machine learning techniques, firms can more effectively communicate their financial health, mitigate information asymmetries, and foster greater financial stability within emerging markets.

Author Contributions

Conceptualization, N.B. and D.D.; methodology, N.B. and D.D.; literature review, A.F.P., D.N.S., and C.A.S.; validation, N.B., D.D., and A.F.P.; formal analysis, C.A.S.; investigation, A.F.P.; resources, D.N.S.; writing—original draft preparation, D.D.; writing—review and editing, A.F.P.; visualization, C.A.S.; supervision, N.B.; project administration, D.N.S.; funding acquisition, N.B. All authors have read and agreed to the published version of the manuscript.

Funding

This article was partially supported by the UVT 1000 Develop Fund of the West University of Timisoara.

Data Availability Statement

The data used in this study are publicly available from Orbis database, compiled by Bureau Van Dijk, under license on behalf of West University of Timisoara.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Altman, E.I. Financial Ratios, Discriminant Analysis and the Prediction of Corporate Bankruptcy. J. Financ. 1968, 23, 589–609. [Google Scholar] [CrossRef]

- Campbell, J.Y.; Hilscher, J.; Szilagyi, J. In Search of Distress Risk. J. Financ. 2008, 63, 2899–2939. [Google Scholar] [CrossRef]

- Bravo-Urquiza, F.; Moreno-Ureba, E. Does compliance with corporate governance codes help to mitigate financial distress? Res. Int. Bus. Financ. 2021, 55, 101344. [Google Scholar] [CrossRef]

- Claessens, S.; Yurtoglu, B. Corporate Governance in Emerging Markets: A survey. Emerg. Mark. Rev. 2013, 15, 1–33. [Google Scholar] [CrossRef]

- Li, Z.; Crook, J.; Andreeva, G.; Tang, Y. Predicting the risk of financial distress using corporate governance measures. Pac. Basin Financ. J. 2021, 68, 101334. [Google Scholar] [CrossRef]

- Chen, C.; Chen, C.; Lien, D. Financial distress prediction model: The effects of corporate governance indicators. Wiley 2020, 39, 1238–1252. [Google Scholar] [CrossRef]

- Breiman, L. Random Forests. Mach. Learn. 2001, 45, 5–32. [Google Scholar] [CrossRef]

- Liaw, A.; Wiener, M. Classification and Regression by Random Forest. R News 2002, 2, 18–22. Available online: https://journal.r-project.org/articles/RN-2002-022/RN-2002-022.pdf (accessed on 3 April 2025).

- Spence, M. Job Market Signaling. Q. J. Econ. 1973, 87, 355–374. [Google Scholar] [CrossRef]

- Connelly, B.L.; Certo, S.T.; Ireland, R.D.; Reutzel, C.R. Signaling theory: A review and Assessment. J. Manag. 2011, 37, 39–67. [Google Scholar] [CrossRef]

- Ross, S.A. The determination of financial structure: The incentive-signalling approach. Bell J. Econ. 1977, 8, 23–40. [Google Scholar] [CrossRef]

- Gompers, P.A.; Ishii, J.L.; Metrick, A. Corporate Governance Equity Prices. Q. J. Econ. 2003, 118, 107–155. [Google Scholar] [CrossRef]

- La Porta, R.; Lopez-de-Silanes, F.; Shleifer, A. Corporate Ownership Around the World. J. Financ. 1998, 54, 471–517. [Google Scholar] [CrossRef]

- Altman, E.I. Applications of Distress Prediction Models: What Have We Learned After 50 Years from the Z-Score Models? Int. J. Financ. Stud. 2018, 6, 70. [Google Scholar] [CrossRef]

- Altman Edward, I.; Iwanicz-Drozdowska, M.; Laitinen, E.K.; Suvas, A. Distressed Firm and Bankruptcy Prediction in an International Context: A Review and Empirical Analysis of Altman’s Z-Score Model. 2014. Available online: https://ssrn.com/abstract=2536340 (accessed on 15 February 2025).

- Bouvatier, V.; Lepetit, L.; Rehault, P.N.; Strobel, F. Bank Insolvency Risk and Z-Score Measures: Caveats and Best Practice (No. hal-01937929). Available online: https://unilim.hal.science/hal-01937929/ (accessed on 13 April 2025).

- Chhillar, P.; Lellapalli, R.V. Role of earnings management and capital structure in signalling early stages of financial distress: A firm life cycle perspective. Cogent Econ. Financ. 2022, 10, 2106634. [Google Scholar] [CrossRef]

- Shumway, T. Forecasting Bankruptcy More Accurately: A Simple Hazard Model. J. Bus. 2001, 74, 101–124. [Google Scholar] [CrossRef]

- Sun, W.; Stewart, J.; Pollard, D. Introduction: Rethinking corporate governance—lessons from the global financial crisis. In Corporate Governance and the Global Financial Crisis: International Perspectives; Sun, W., Stewart, J., Pollard, D., Eds.; Cambridge University Press: Cambridge, UK, 2011; pp. 1–22. [Google Scholar]

- Bajpai, A.; Mehta, M. Empirical Study of Board and Corporate Governance Practices in Indian Corporate Sector: Analysis of CG Practices of ITC and ONGC. Procedia Econ. Financ. 2014, 11, 42–48. [Google Scholar] [CrossRef]

- Jhunjhunwala, S.; Bavirishetty, S. Corporate Governance—Codes and Reports of different Countries. Indian J. Corp. Gov. 2009, 2, 183–207. [Google Scholar] [CrossRef]

- Tiron Tudor, A. Disclosure and Transparency of Romanian Listed Companies. 2006. Available online: https://ssrn.com/abstract=920580 (accessed on 6 April 2025).

- Arcot, S.; Bruno, V.; Faure-Grimaud, A. Corporate governance in the UK: Is the comply or explain approach working? Int. Rev. Law Econ. 2010, 30, 193–201. [Google Scholar] [CrossRef]

- Achim, M.V.; Borlea, S.N.; Mare, C. Corporate Governance and Business Performance: Evidence for the Romanian Economy. J. Bus. Econ. Manag. Taylor Fr. J. 2016, 17, 458–474. [Google Scholar] [CrossRef]

- Alexie, A.M. Trends in Corporate Governance Practices at the Level of Companies Listed on the Bucharest Stock Exchange. Rev. Stud. Financ. 2022, 12, 25–37. Available online: https://www.ceeol.com/search/article-detail?id=1046201 (accessed on 9 March 2025). [CrossRef]

- Pernamasari, R.; Purwaningsih, S.; Tanjung, J.; Rahayu, D.P. Good Corporate Governance and Prediction of Financial Distress to Stock Prices: Atman Z Score Approach. SSRG Int. J. Econ. Manag. Stud. (SSRG-IJEMS) 2019, 6, 56–62. [Google Scholar] [CrossRef]

- Yousaf, U.B.; Jebran, K.; Ullah, I. Corporate governance and financial distress: A review of the theoretical and empirical literature. Int. J. Financ. Econ. 2024, 29, 1627–1679. [Google Scholar] [CrossRef]

- Younas, N.; Uddin, S.; Awan, T.; Khan, M.Y. Corporate governance and financial distress: Asian emerging market perspective. Corp. Gov. 2021, 21, 702–715. [Google Scholar] [CrossRef]

- Bargagli-Stoffi, F.J.; Incerti, F.; Riccaboni, M.; Rungi, A. Machine Learning for Zombie Hunting: Predicting Distress from Firms’ Accounts and Missing Values. arXiv 2023, arXiv:2306.08165. [Google Scholar] [CrossRef]

- Farooq, M.; Noor, A.; Ali, S. The impact of corporate governance on financial distress likelihood: Empirical evidence. City Univ. Res. J. 2020, 10, 614–634. [Google Scholar]

- Alshehhi, S.A.R.S. Risk Management Governance and Sustainable Financial Performance. Saudi J. Bus. Manag. Stud. 2023, 8, 178–185. [Google Scholar] [CrossRef]

- Kirkpatrick, G. The Corporate Governance Financial Crisis. Financ. Mark. Trends 2009, 2009, 61–87. [Google Scholar] [CrossRef]

- Tam, O.K.; Tan, M. Ownership, Governance and Firm Performance in Malaysia. Wiley-Blackwell 2007, 15, 208–222. [Google Scholar] [CrossRef]

- Refakar, M.; Ravaonorohanta, N. The effectiveness of governance mechanisms in emerging markets: A review. Corp. Ownersh. Control 2020, 17, 8–26. [Google Scholar] [CrossRef]

- Habib, A.; Costa, M.D.; Huang, H.J.; Bhuiyan, M.B.U.; Sun, L. Determinants and consequences of financial distress: Review of empirical literature. Wiley-Blackwell 2018, 60 (Suppl. S1), 1023–1075. [Google Scholar] [CrossRef]

- Moridu, I. The Role Corporate Governance in Managing Financial Risk: A Qualitative Study on Listed Companies. ES Account. Financ. 2023, 1, 176–183. [Google Scholar] [CrossRef]

- Artene, A.E.; Domil, A.E. Neural Networks in Accounting: Bridging Financial Forecasting and Decision Support Systems. Electronics 2025, 14, 993. [Google Scholar] [CrossRef]

- Mitton, T. A Cross-Firm Analysis of the Impact of Corporate Governance on the East Asian Financial Crisis. J. Financ. Econ. 2002, 64, 215–241. [Google Scholar] [CrossRef]

- Elbannan, M. On the prediction of financial distress in emerging markets: What matters more? Empirical evidence from Arab spring countries. Emerg. Mark. Rev. 2021, 47, 100806. [Google Scholar] [CrossRef]

- Nguyen, M.; Thanh, N.; Nguyen, B.; Sukhwa, H. Using Machine Learning and Counterfactual Explanations for Financial Distress Prediction. 2024. Available online: https://ssrn.com/abstract=5032226 (accessed on 12 March 2025).

- Dhamo, Z.; Gjeçi, A.; Zibri, A.; Prendi, X. Business Distress Prediction in Albania: An Analysis of Classification Methods. J. Risk Financ. Manag. 2025, 18, 118. [Google Scholar] [CrossRef]

- Máté, D.; Raza, H.; Ahmad, I. Comparative Analysis of Machine Learning Models for Bankruptcy Prediction in the Context of Pakistani Companies. Risks 2023, 11, 176. [Google Scholar] [CrossRef]

- Tran, K.L.; Le, H.A.; Nguyen, T.H.; Nguyen, D.T. Explainable Machine Learning for Financial Distress Prediction: Evidence from Vietnam. Data 2022, 7, 160. [Google Scholar] [CrossRef]

- Tron, A.; Dallocchio, M.; Ferri, S.; Colantoni, F. Corporate governance and financial distress: Lessons learned from an unconventional approach. J. Manag. Gov. 2023, 27, 425–456. [Google Scholar] [CrossRef]

- Noja, G.G.; Thalassinos, E.; Cristea, M.; Grecu, I.M. The Interplay between Board Characteristics, Financial Performance, and Risk Management Disclosure in the Financial Services Sector: New Empirical Evidence from Europe. J. Risk Financ. Manag. 2021, 14, 79. [Google Scholar] [CrossRef]

- Balboula, M.Z.; Shemes, M.A. The impact of financial distress on capital structure following Egypt’s currency flotation: The moderating role of board characteristics and ownership structure. J. Appl. Account. Res. 2025, 26, 756–784. [Google Scholar] [CrossRef]

- Kalia, A.; Gill, S. Corporate governance and risk management: A systematic review and synthesis for future research. J. Adv. Manag. Res. 2023, 20, 161–185. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).