Framework for Integrating Generative AI in Developing Competencies for Accounting and Audit Professionals

Abstract

:1. Introduction

2. Literature Review

2.1. Generative Artificial Intelligence

2.2. New Competencies Requirements for Accounting Professionals and Auditors in the AI-Integrating Context

2.2.1. Insights from the Academic Literature

2.2.2. Professional Accounting Bodies Perspective

2.3. Risks of Using AI in the Accounting and Auditing Professions

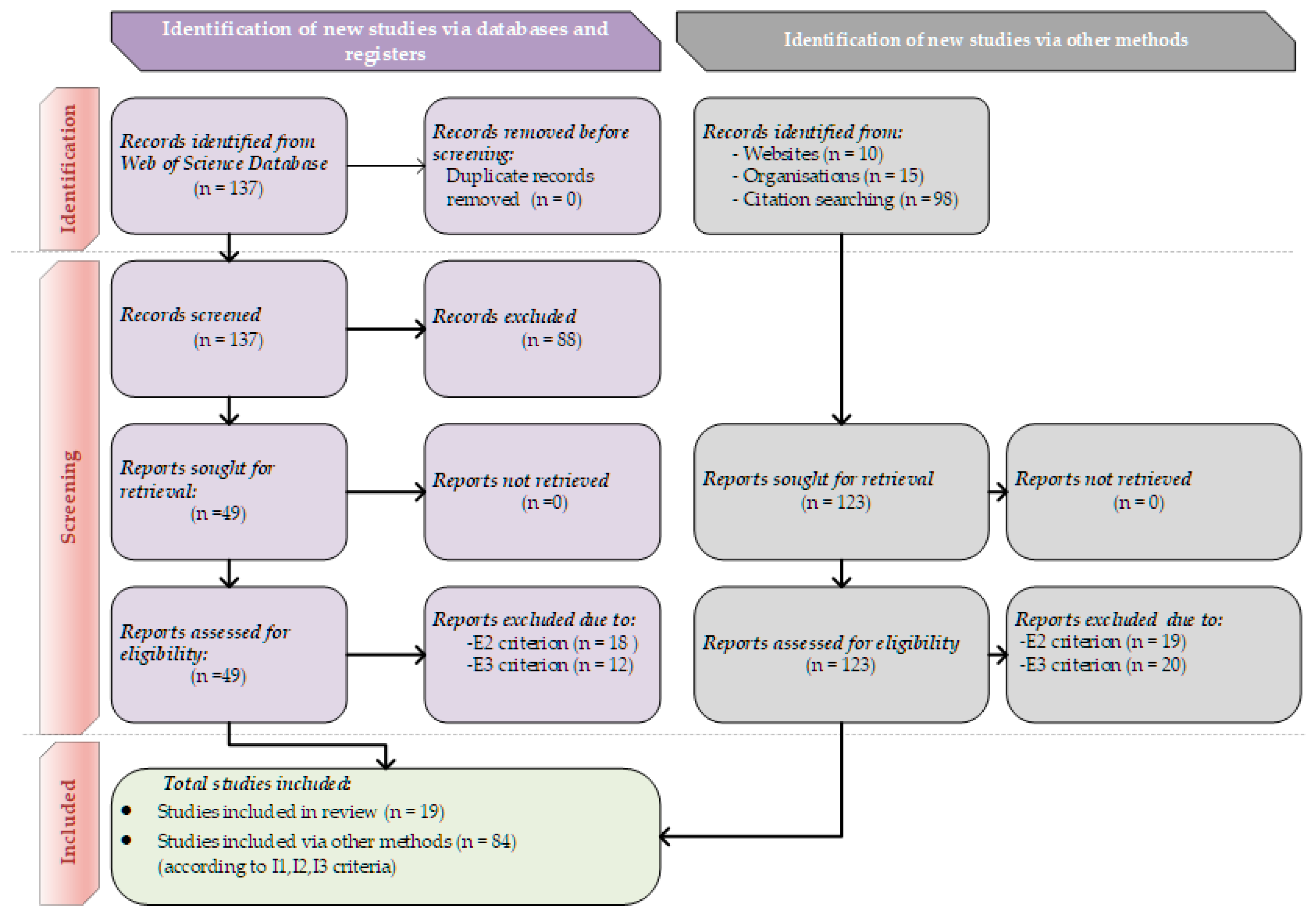

3. Materials and Methods

4. Results

- Cross-disciplinary skills:

- -

- -

- -

- Profession-specific competencies:

- -

- transformation of accounting science on report creation, interpretation and authentication [6];

- -

- analysing historical internal structured data, collecting and selecting the data used for valuation [78];

- -

- forecasting and making audit decisions [25];

- -

- risk identification, risk assessment and risk mitigation [78];

- -

- the preparation of reporting elements; good accounting and business ethics knowledge; understanding of how the AI makes its decisions; supporting the management team in strategic planning and investment decisions [78].

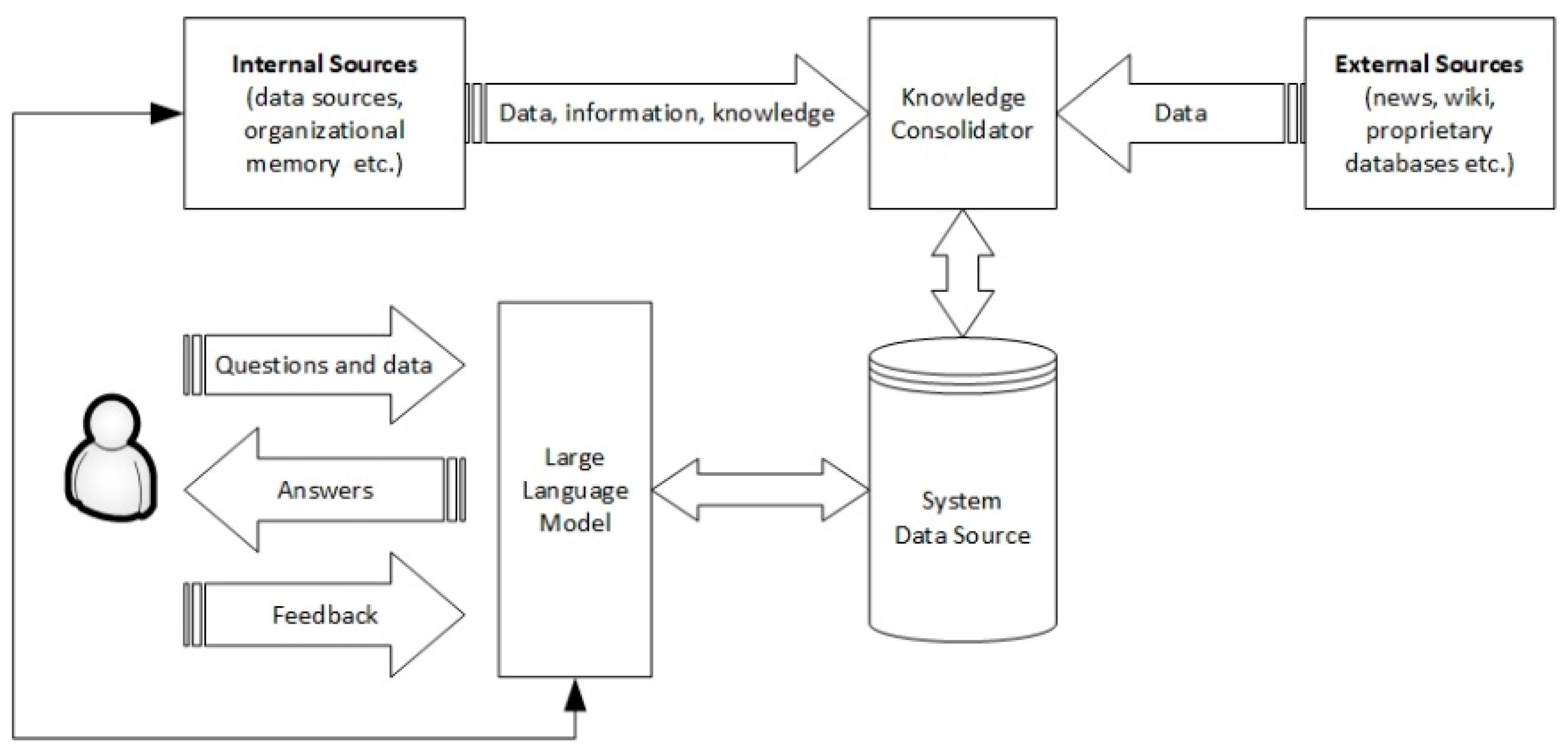

4.1. Framework for Integrating LLM-Based Internal GenAI System

- The user addresses a question or requests an action to be performed and, if necessary, provides additional data to refine the context.

- The system processes the text from the request and analyses any data provided to identify what the user wants or needs to do.

- If applicable, the system queries internal sources based on the requirements/requests and data provided by the user.

- Based on the processed text and data provided by the user or information obtained from internal sources using System Data Source, the system generates and displays a response or performs the requested action.

- The user provides feedback on the system’s response or action, which is used to learn and improve the internal GenAI system’s performance over time by adjusting the processes of understanding, generating responses or taking the required action.

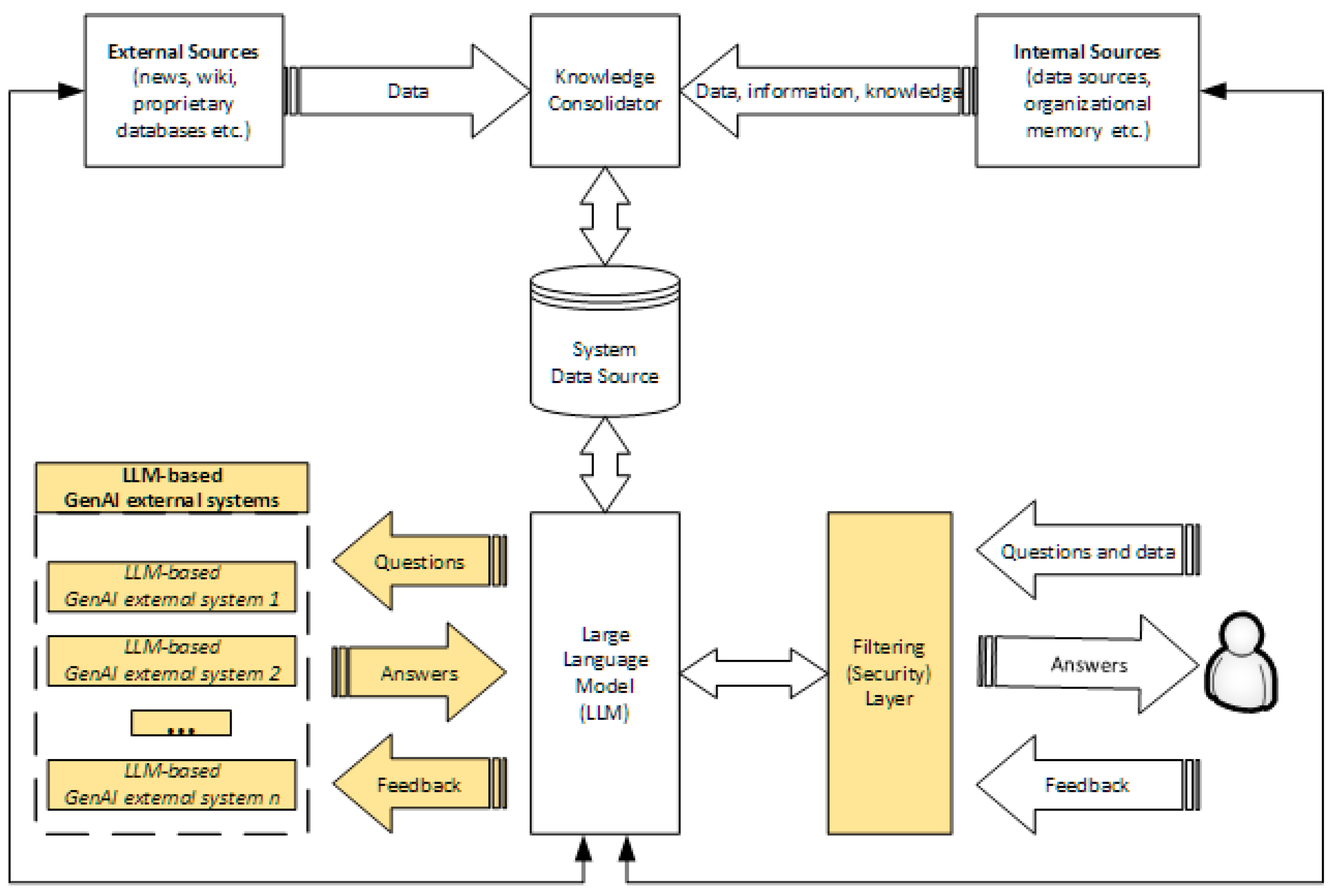

4.2. Extended LLM-Based Internal GenAI System

- The Filtering (Security) Layer, whose main role is to ensure the security and confidentiality of internal data and not to allow data and information to be transmitted externally by filtering queries and data transmitted outside the organisation. Considering that a significant part of the data managed by accountants and auditors is sensitive or confidential, it is mandatory to implement a filtering layer that prevents intentional or accidental transmission outside the internal system.

- Continuous interaction with other LLM-based GenAI systems to improve the quality of the provided answers. This interaction enriches and extends the System Data Source by incorporating data from these systems.

- The user addresses a question or requests an action to be performed, possibly providing data to the system.

- The system processes the user request and any related data.

- The Filtering (Security) Layer performs filtering of it and of data provided by the user, sending to the LLM component two requests:

- (i)

- a prompt containing the request and the data submitted by the user that will be used to consult the system’s data sources as well as internal and external sources;

- (ii)

- a prompt in which any confidential elements and data provided by the user have been removed from the request.

- To understand the context of the user’s request, the extended LLM-based internal GenAI system analyses related data provided by several advanced techniques.

- If necessary, the system formulates a request to internal or external sources based on the requirements and data provided by the user.

- The system consults in parallel:

- (i)

- System Data Source based on processed text and user-supplied data.

- (ii)

- Internal or external sources.

- (iii)

- Other external LLM-based GenAI systems based on text processed and filtered by the Filtering (Security) Layer component. These systems can be public or non-public. Non-public systems can be accessed based on an inter-organisational cooperation agreement and represent a component of the learning process through exchanging knowledge, experience and resources.

- The system generates and displays a response or performs the requested action.

- The user provides feedback on the response received from the system or the undertaken action, which is used for learning and improving the performance of the internal system over time by adjusting the processes of understanding, generating responses or taking the required action. Depending on the organisation’s policy, the system may also provide feedback to the consulted external LLM-based GenAI systems.

5. Discussion

5.1. An Explanatory Scenario

5.2. Benefits of Integrating LLM-Based GenAI Systems in Developing Competencies for Accounting and Audit Professionals

5.2.1. Redefining How AA Professionals Can Acquire New Knowledge and Develop Necessary Skills

- Preparation of learning materials by reviewing a significant volume of internal and external resources and selecting those relevant to each employee [106].

- Virtual coaching and mentoring throughout the learning process (interactive conversations and simulations that allow employees to practice and hone their skills) [109,110]. In 2012, the McKinsey Global Institute (MGI) estimated that knowledge workers spent about 20% of their time to search and to gather information [95]. GenAI’s support can drastically reduce this time, followed by a significant increase in employee efficiency and effectiveness.

5.2.2. Assisting Current Activities and Decision-Making Processes

- (i).

- Information retrieval and synthesis based on employee’s expertise and requirements [110].

- (ii).

- (iii).

- Collaboration and communication across the organisation, fostering a collaborative environment [116].

- (iv).

- Automation and support for routine/repetitive tasks, assistance, recommendations and suggestions [111].

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Al-Hattami, H.M. University Accounting Curriculum, IT, and Job Market Demands: Evidence From Yemen. Sage Open 2021, 11, 215824402110071. [Google Scholar] [CrossRef]

- Tavares, M.C.; Azevedo, G.; Marques, R.P.; Bastos, M.A. Challenges of Education in the Accounting Profession in the Era 5.0: A Systematic Review. Cogent Bus. Manag. 2023, 10, 2220198. [Google Scholar] [CrossRef]

- Grosu, V.; Cosmulese, C.G.; Socoliuc, M.; Ciubotariu, M.-S.; Mihaila, S. Testing Accountants’ Perceptions of the Digitization of the Profession and Profiling the Future Professional. Technol. Forecast. Soc. Chang. 2023, 193, 122630. [Google Scholar] [CrossRef]

- Jackson, D.; Michelson, G.; Munir, R. Developing Accountants for the Future: New Technology, Skills, and the Role of Stakeholders. Account. Educ. 2023, 32, 150–177. [Google Scholar] [CrossRef]

- Zhao, J.; Wang, X. Unleashing Efficiency and Insights: Exploring the Potential Applications and Challenges of ChatGPT in Accounting. J. Corp. Account. Financ. 2024, 35, 269–276. [Google Scholar] [CrossRef]

- Friedrich, M.P.A.; Zanievicz, M.; Cadorna Venturini, J.; Eduardo Schuster, W. Epistemological thinking about accounting in the era of artificial intelligence. Rev. Gestão Organ. 2022, 15, 180–197. [Google Scholar] [CrossRef]

- Munoko, I.; Brown-Liburd, H.L.; Vasarhelyi, M. The Ethical Implications of Using Artificial Intelligence in Auditing. J. Bus. Ethics 2020, 167, 209–234. [Google Scholar] [CrossRef]

- Kommunuri, J. Artificial Intelligence and the Changing Landscape of Accounting: A Viewpoint. Pac. Account. Rev. 2022, 34, 585–594. [Google Scholar] [CrossRef]

- Fotoh, L.E.; Lorentzon, J.I. The Impact of Digitalization on Future Audits. J. Emerg. Technol. Account. 2021, 18, 77–97. [Google Scholar] [CrossRef]

- Mordor Intelligence. AI In Accounting Market Size & Share Analysis—Growth Trends & Forecasts (2024–2029); 2024. Available online: https://www.mordorintelligence.com/industry-reports/artificial-intelligence-in-accounting-market (accessed on 20 March 2024).

- Vasarhelyi, M.A.; Moffitt, K.C.; Stewart, T.; Sunderland, D. Large Language Models: An Emerging Technology in Accounting. J. Emerg. Technol. Account. 2023, 20, 1–10. [Google Scholar] [CrossRef]

- Rawashdeh, A. A Deep Learning-Based SEM-ANN Analysis of the Impact of AI-Based Audit Services on Client Trust. J. Appl. Account. Res. 2023, 25, 594–622. [Google Scholar] [CrossRef]

- Han, H.; Shiwakoti, R.K.; Jarvis, R.; Mordi, C.; Botchie, D. Accounting and Auditing with Blockchain Technology and Artificial Intelligence: A Literature Review. Int. J. Account. Inf. Syst. 2023, 48, 100598. [Google Scholar] [CrossRef]

- Zhang, C.; Zhu, W.; Dai, J.; Wu, Y.; Chen, X. Ethical Impact of Artificial Intelligence in Managerial Accounting. Int. J. Account. Inf. Syst. 2023, 49, 100619. [Google Scholar] [CrossRef]

- Aldredge, M.; Rogers, C.; Smith, J. The Strategic Transformation of Accounting into a Learned Profession. Ind. High. Educ. 2021, 35, 83–88. [Google Scholar] [CrossRef]

- Vărzaru, A.A. Assessing Artificial Intelligence Technology Acceptance in Managerial Accounting. Electron. 2022, 11, 2256. [Google Scholar] [CrossRef]

- Nguyen, T.-M.; Malik, A. Impact of Knowledge Sharing on Employees’ Service Quality: The Moderating Role of Artificial Intelligence. Int. Mark. Rev. 2022, 39, 482–508. [Google Scholar] [CrossRef]

- Korzynski, P.; Mazurek, G.; Altmann, A.; Ejdys, J.; Kazlauskaite, R.; Paliszkiewicz, J.; Wach, K.; Ziemba, E. Generative Artificial Intelligence as a New Context for Management Theories: Analysis of ChatGPT. Cent. Eur. Manag. J. 2023, 31, 3–13. [Google Scholar] [CrossRef]

- Al-Htaybat, K.; von Alberti-Alhtaybat, L.; Alhatabat, Z. Educating Digital Natives for the Future: Accounting Educators’ Evaluation of the Accounting Curriculum. Account. Educ. 2018, 27, 333–357. [Google Scholar] [CrossRef]

- Rodgers, W.; Al-Shaikh, S.; Khalil, M. Protocol Analysis Data Collection Technique Implemented for Artificial Intelligence Design. IEEE Trans. Eng. Manag. 2024, 71, 6842–6853. [Google Scholar] [CrossRef]

- Chen, B.; Wu, Z.; Zhao, R. From Fiction to Fact: The Growing Role of Generative AI in Business and Finance. J. Chin. Econ. Bus. Stud. 2023, 21, 471–496. [Google Scholar] [CrossRef]

- Al Naqbi, H.; Bahroun, Z.; Ahmed, V. Enhancing Work Productivity through Generative Artificial Intelligence: A Comprehensive Literature Review. Sustainability 2024, 16, 1166. [Google Scholar] [CrossRef]

- OECD Recommendation of the Council on OECD Legal Instruments Artificial Intelligence. 2019. Available online: https://oecd.ai/en/ai-principles (accessed on 10 June 2024).

- Arrieta, A.B.; Díaz-Rodríguez, N.; Del Ser, J.; Bennetot, A.; Tabik, S.; Barbado, A.; Garcia, S.; Gil-Lopez, S.; Molina, D.; Benjamins, R.; et al. Explainable Artificial Intelligence (XAI): Concepts, Taxonomies, Opportunities and Challenges toward Responsible AI. Inf. Fusion 2020, 58, 82–115. [Google Scholar] [CrossRef]

- Li, Q.; Liu, J. Development of an Intelligent NLP-Based Audit Plan Knowledge Discovery System. J. Emerg. Technol. Account. 2020, 17, 89–97. [Google Scholar] [CrossRef]

- Jovanovic, M.; Campbell, M. Generative Artificial Intelligence: Trends and Prospects. Computer 2022, 55, 107–112. [Google Scholar] [CrossRef]

- Yu, P.; Xu, H.; Hu, X.; Deng, C. Leveraging Generative AI and Large Language Models: A Comprehensive Roadmap for Healthcare Integration. Healthcare 2023, 11, 2776. [Google Scholar] [CrossRef] [PubMed]

- Lim, W.M.; Gunasekara, A.; Pallant, J.L.; Pallant, J.I.; Pechenkina, E. Generative AI and the Future of Education: Ragnarök or Reformation? A Paradoxical Perspective from Management Educators. Int. J. Manag. Educ. 2023, 21, 100790. [Google Scholar] [CrossRef]

- Dwivedi, Y.K.; Kshetri, N.; Hughes, L.; Slade, E.L.; Jeyaraj, A.; Kar, A.K.; Baabdullah, A.M.; Koohang, A.; Raghavan, V.; Ahuja, M.; et al. Opinion Paper: “So What If ChatGPT Wrote It?” Multidisciplinary Perspectives on Opportunities, Challenges and Implications of Generative Conversational AI for Research, Practice and Policy. Int. J. Inf. Manag. 2023, 71, 102642. [Google Scholar] [CrossRef]

- Sahoo, S.; Kumar, S.; Abedin, M.Z.; Lim, W.M.; Jakhar, S.K. Deep Learning Applications in Manufacturing Operations: A Review of Trends and Ways Forward. J. Enterp. Inf. Manag. 2023, 36, 221–251. [Google Scholar] [CrossRef]

- Victor, B.G.; Sokol, R.L.; Goldkind, L.; Perron, B.E. Recommendations for Social Work Researchers and Journal Editors on the Use of Generative AI and Large Language Models. J. Soc. Soc. Work Res. 2023, 14, 563–577. [Google Scholar] [CrossRef]

- Ooi, K.-B.; Tan, G.W.-H.; Al-Emran, M.; Al-Sharafi, M.A.; Capatina, A.; Chakraborty, A.; Dwivedi, Y.K.; Huang, T.-L.; Kar, A.K.; Lee, V.-H.; et al. The Potential of Generative Artificial Intelligence Across Disciplines: Perspectives and Future Directions. J. Comput. Inf. Syst. 2023, 1–32. [Google Scholar] [CrossRef]

- Khan, M.S.; Umer, H. ChatGPT in Finance: Applications, Challenges, and Solutions. Heliyon 2024, 10, e24890. [Google Scholar] [CrossRef]

- Dowling, M.; Lucey, B. ChatGPT for (Finance) Research: The Bananarama Conjecture. Financ. Res. Lett. 2023, 53, 103662. [Google Scholar] [CrossRef]

- Lv, K.; Yang, Y.; Liu, T.; Gao, Q.; Guo, Q.; Qiu, X. Full Parameter Fine-Tuning for Large Language Models with Limited Resources. arXiv 2023, arXiv:2306.09782. [Google Scholar] [CrossRef]

- Trad, F.; Chehab, A. Prompt Engineering or Fine-Tuning? A Case Study on Phishing Detection with Large Language Models. Mach. Learn. Knowl. Extr. 2024, 6, 367–384. [Google Scholar] [CrossRef]

- White, J.; Fu, Q.; Hays, S.; Sandborn, M.; Olea, C.; Gilbert, H.; Elnashar, A.; Spencer-Smith, J.; Schmidt, D.C. A Prompt Pattern Catalog to Enhance Prompt Engineering with ChatGPT. arXiv 2023, arXiv:2302.11382. [Google Scholar] [CrossRef]

- Căliman, A.; Pop, M. Today Software Magazine; 2024. Available online: https://www.todaysoftmag.ro/article/4038/strategii-pentru-o-inginerie-eficienta-a-prompturilor (accessed on 10 June 2024).

- Kong, A.; Zhao, S.; Chen, H.; Li, Q.; Qin, Y.; Sun, R.; Zhou, X.; Wang, E.; Dong, X. Better Zero-Shot Reasoning with Role-Play Prompting. arXiv 2023, arXiv:2308.07702. [Google Scholar] [CrossRef]

- Wei, J.; Wang, X.; Schuurmans, D.; Bosma, M.; Ichter, B.; Xia, F.; Chi, E.; Le, Q.; Zhou, D. Chain-of-Thought Prompting Elicits Reasoning in Large Language Models. arXiv 2022, arXiv:2201.11903. [Google Scholar] [CrossRef]

- Miao, J.; Thongprayoon, C.; Suppadungsuk, S.; Krisanapan, P.; Radhakrishnan, Y.; Cheungpasitporn, W. Chain of Thought Utilization in Large Language Models and Application in Nephrology. Med (B Aires) 2024, 60, 148. [Google Scholar] [CrossRef] [PubMed]

- Masikisiki, B.; Marivate, V.; Hlophe, Y. Investigating the Efficacy of Large Language Models in Reflective Assessment Methods through Chain of Thought Prompting. In Proceedings of the 4th African Human Computer Interaction Conference, East London South Africa, 27 November 2023; ACM: New York, NY, USA, 2023; pp. 44–49. [Google Scholar]

- Floridi, L. AI as Agency Without Intelligence: On ChatGPT, Large Language Models, and Other Generative Models. Philos. Technol. 2023, 36, 15. [Google Scholar] [CrossRef]

- Piktus, A. Online Tools Help Large Language Models to Solve Problems through Reasoning. Nature 2023, 618, 465–466. [Google Scholar] [CrossRef]

- Cardy, R.L.; Selvarajan, T.T. Competencies: Alternative Frameworks for Competitive Advantage. Bus. Horiz. 2006, 49, 235–245. [Google Scholar] [CrossRef]

- McClelland, D.C. Testing for Competence Rather than for “Intelligence”. Am. Psychol. 1973, 28, 1–14. [Google Scholar] [CrossRef]

- Boyatzis, R. The Competent Manager; Wiley: Hoboken, NJ, USA, 1982. [Google Scholar]

- The Alan Turing Institute. AI Skills for Business Competency Framework Https://Www.Turing.Ac.Uk/Skills/Collaborate/Ai-Skills-Business-Framework; The Alan Turing Institute: London, UK, 2023. [Google Scholar]

- Andreassen, R.-I. Digital Technology and Changing Roles: A Management Accountant’s Dream or Nightmare? J. Manag. Control 2020, 31, 209–238. [Google Scholar] [CrossRef]

- Ng, C. Teaching Advanced Data Analytics, Robotic Process Automation, and Artificial Intelligence in a Graduate Accounting Program. J. Emerg. Technol. Account. 2023, 20, 223–243. [Google Scholar] [CrossRef]

- Moore, W.B.; Felo, A. The Evolution of Accounting Technology Education: Analytics to STEM. J. Educ. Bus. 2022, 97, 105–111. [Google Scholar] [CrossRef]

- Meredith, K.; Blake, J.; Baxter, P.; Kerr, D. Drivers of and Barriers to Decision Support Technology Use by Financial Report Auditors. Decis. Support. Syst. 2020, 139, 113402. [Google Scholar] [CrossRef]

- Salijeni, G.; Samsonova-Taddei, A.; Turley, S. Big Data and Changes in Audit Technology: Contemplating a Research Agenda. Account. Bus. Res. 2019, 49, 95–119. [Google Scholar] [CrossRef]

- Mathisen, A.; Nerland, M. The Pedagogy of Complex Work Support Systems: Infrastructuring Practices and the Production of Critical Awareness in Risk Auditing. Pedagog. Cult. Soc. 2012, 20, 71–91. [Google Scholar] [CrossRef]

- Mancini, D.; Lombardi, R.; Tavana, M. Four Research Pathways for Understanding the Role of Smart Technologies in Accounting. Meditari Account. Res. 2021, 29, 1041–1062. [Google Scholar] [CrossRef]

- Noordin, N.A.; Hussainey, K.; Hayek, A.F. The Use of Artificial Intelligence and Audit Quality: An Analysis from the Perspectives of External Auditors in the UAE. J. Risk Financ. Manag. 2022, 15, 339. [Google Scholar] [CrossRef]

- Mat Ridzuan, N.I.; Said, J.; Razali, F.M.; Abdul Manan, D.I.; Sulaiman, N. Examining the Role of Personality Traits, Digital Technology Skills and Competency on the Effectiveness of Fraud Risk Assessment among External Auditors. J. Risk Financ. Manag. 2022, 15, 536. [Google Scholar] [CrossRef]

- Plumlee, R.D.; Rixom, B.A.; Rosman, A.J. Training Auditors to Perform Analytical Procedures Using Metacognitive Skills. Account. Rev. 2015, 90, 351–369. [Google Scholar] [CrossRef]

- Andiola, L.M.; Downey, D.H.; Earley, C.E.; Jefferson, D. Wealthy Watches Inc.: The Substantive Testing of Accounts Receivable in the Evolving Audit Environment. Issues Account. Educ. 2022, 37, 37–51. [Google Scholar] [CrossRef]

- Jemine, G.; Puyou, F.-R.; Bouvet, F. Technological Innovation and the Co-Production of Accounting Services in Small Accounting Firms. Account. Audit. Account. J. 2024, 37, 280–305. [Google Scholar] [CrossRef]

- Westermann, K.D.; Bedard, J.C.; Earley, C.E. Learning the “Craft” of Auditing: A Dynamic View of Auditors’ On-the-Job Learning. Contemp. Account. Res. 2015, 32, 864–896. [Google Scholar] [CrossRef]

- Aldemİr, C.; Uçma Uysal, T. AI COMPETENCIES FOR INTERNAL AUDITORS IN THE PUBLIC SECTOR. Edpacs 2024, 69, 3–21. [Google Scholar] [CrossRef]

- Norzelan, N.A.; Mohamed, I.S.; Mohamad, M. Technology Acceptance of Artificial Intelligence (AI) among Heads of Finance and Accounting Units in the Shared Service Industry. Technol. Forecast. Soc. Change 2024, 198, 123022. [Google Scholar] [CrossRef]

- Cardon, P.; Fleischmann, C.; Logemann, M.; Heidewald, J.; Aritz, J.; Swartz, S. Competencies Needed by Business Professionals in the AI Age: Character and Communication Lead the Way. Bus. Prof. Commun. Q. 2023, 27, 223–246. [Google Scholar] [CrossRef]

- Dean, S.A.; East, J.I. Soft Skills Needed for the 21st-Century Workforce. Int. J. Appl. Manag. Technol. 2019, 18, 17–32. [Google Scholar] [CrossRef]

- Duff, A.; Hancock, P.; Marriott, N. The Role and Impact of Professional Accountancy Associations on Accounting Education Research: An International Study. Br. Account. Rev. 2020, 52, 100829. [Google Scholar] [CrossRef]

- Timpson, M.; Bayerlein, L. Accreditation without Impact: The Case of Accreditation by Professional Accounting Bodies in Australia. Aust. Account. Rev. 2021, 31, 22–34. [Google Scholar] [CrossRef]

- IFAC. 2024. Available online: https://www.ifac.org/who-we-are/our-purpose (accessed on 10 June 2024).

- Andon, P.; Clune, C. Governance of Professional Accounting Bodies: A Comparative Analysis. Account. Audit. Account. J. 2021, 34, 1769–1801. [Google Scholar] [CrossRef]

- ICAEW; ACA. Qualification Professional Development Ladders. 2018. Available online: https://www.icaew.com/-/media/corporate/files/for-current-aca-students/training-agreement/professional-development-overview.ashx (accessed on 10 June 2024).

- ACCA. ACCA Competency Framework. 2020. Available online: https://www.accaglobal.com/content/dam/ACCA_Global/qual/competencyframework/ACCA-competency-framework-how-and-when-to-use-2020.pdf (accessed on 10 June 2024).

- AICPA; CIMA; CGMA. Competency Framework. 2022. Available online: https://us.aicpa.org/content/dam/cgma/resources/tools/downloadabledocuments/cgma-competency-framework.pdf (accessed on 10 June 2024).

- ICAS. ICAS Mapping Our New Competencies. 2023. Available online: https://www.icas.com/__data/assets/pdf_file/0005/617018/RPE-Timeline-and-Competencies_21-08-23.pdf (accessed on 10 June 2024).

- IMA. IMA Management Accounting Competency Framework. 2023. Available online: https://prodcm.imanet.org/-/media/IMA/Files/Home/Career-Resources/Management-Accounting-Competencies/IMA-Framework-11-28-23.ashx (accessed on 10 June 2024).

- Thottoli, M.M. Leveraging Information Communication Technology (ICT) and Artificial Intelligence (AI) to Enhance Auditing Practices. Account. Res. J. 2024, 37, 134–150. [Google Scholar] [CrossRef]

- Burns, M.B.; Igou, A. “Alexa, Write an Audit Opinion”: Adopting Intelligent Virtual Assistants in Accounting Workplaces. J. Emerg. Technol. Account. 2019, 16, 81–92. [Google Scholar] [CrossRef]

- Kroon, N.; do Céu Alves, M.; Martins, I. The Impacts of Emerging Technologies on Accountants’ Role and Skills: Connecting to Open Innovation—A Systematic Literature Review. J. Open Innov. Technol. Mark. Complex. 2021, 7, 163. [Google Scholar] [CrossRef]

- Leitner-Hanetseder, S.; Lehner, O.M.; Eisl, C.; Forstenlechner, C. A Profession in Transition: Actors, Tasks and Roles in AI-Based Accounting. J. Appl. Account. Res. 2021, 22, 539–556. [Google Scholar] [CrossRef]

- Uscov, S.; Groza, A. Cât de inteligent este Artificial Intelligence Act? Curierul Judic. 2022, 2, 70–83. [Google Scholar]

- Schwartz, R.; Vassilev, A.; Greene, K.; Perine, L.; Burt, A.; Hall, P. Towards a Standard for Identifying and Managing Bias in Artificial Intelligence; Special Publication (NIST SP); National Institute of Standards and Technology: Gaithersburg, MD, USA, 2022. [Google Scholar] [CrossRef]

- Kirk, H.; Jun, Y.; Iqbal, H.; Benussi, E.; Volpin, F.; Dreyer, F.A.; Shtedritski, A.; Asano, Y.M. Bias Out-of-the-Box: An Empirical Analysis of Intersectional Occupational Biases in Popular Generative Language Models. arXiv 2021, arXiv:2102.04130. [Google Scholar] [CrossRef]

- Arnold, V.; Collier, P.A.; Leech, S.A.; Rose, J.M.; Sutton, S.G. Can Knowledge Based Systems Be Designed to Counteract Deskilling Effects? Int. J. Account. Inf. Syst. 2023, 50, 100638. [Google Scholar] [CrossRef]

- Samiolo, R.; Spence, C.; Toh, D. Auditor Judgment in the Fourth Industrial Revolution. Contemp. Account. Res. 2024, 41, 498–528. [Google Scholar] [CrossRef]

- Zhu, C.; Guan, Y. The Risks and Countermeasures of Accounting Artificial Intelligence. In Proceedings of the 2022 3rd International Conference on Electronic Communication and Artificial Intelligence (IWECAI), Zhuhai, China, 14–16 January 2022; IEEE: Piscataway, NJ, USA, 2022; pp. 358–361. [Google Scholar]

- Koreff, J.; Baudot, L.; Sutton, S.G. Exploring the Impact of Technology Dominance on Audit Professionalism through Data Analytic-Driven Healthcare Audits. J. Inf. Syst. 2023, 37, 59–80. [Google Scholar] [CrossRef]

- Mökander, J. Auditing of AI: Legal, Ethical and Technical Approaches. Digit. Soc. 2023, 2, 49. [Google Scholar] [CrossRef]

- Chen, W.; He, W.; Shen, J.; Tian, X.; Wang, X. Systematic Analysis of Artificial Intelligence in the Era of Industry 4.0. J. Manag. Anal. 2023, 10, 89–108. [Google Scholar] [CrossRef]

- Massaro, M.; Dumay, J.; Guthrie, J. On the Shoulders of Giants: Undertaking a Structured Literature Review in Accounting. Account. Audit. Account. J. 2016, 29, 767–801. [Google Scholar] [CrossRef]

- Page, M.J.; McKenzie, J.E.; Bossuyt, P.M.; Boutron, I.; Hoffmann, T.C.; Mulrow, C.D.; Shamseer, L.; Tetzlaff, J.M.; Akl, E.A.; Brennan, S.E.; et al. The PRISMA 2020 Statement: An Updated Guideline for Reporting Systematic Reviews. BMJ 2021, 372, n71. [Google Scholar] [CrossRef]

- Donthu, N.; Kumar, S.; Mukherjee, D.; Pandey, N.; Lim, W.M. How to Conduct a Bibliometric Analysis: An Overview and Guidelines. J. Bus. Res. 2021, 133, 285–296. [Google Scholar] [CrossRef]

- Ndlovu, S.G. Private Label Brands vs National Brands: New Battle Fronts and Future Competition. Cogent Bus. Manag. 2024, 11, 2321877. [Google Scholar] [CrossRef]

- Tiron-Tudor, A.; Deliu, D. Big Data’s Disruptive Effect on Job Profiles: Management Accountants’ Case Study. J. Risk Financ. Manag. 2021, 14, 376. [Google Scholar] [CrossRef]

- Wölfel, M.; Shirzad, M.B.; Reich, A.; Anderer, K. Knowledge-Based and Generative-AI-Driven Pedagogical Conversational Agents: A Comparative Study of Grice’s Cooperative Principles and Trust. Big Data Cogn. Comput. 2023, 8, 2. [Google Scholar] [CrossRef]

- Dong, Y.; Ding, S.; Ito, T. An Automated Multi-Phase Facilitation Agent Based on LLM. IEICE Trans. Inf. Syst. 2024, 107, 426–433. [Google Scholar] [CrossRef]

- McKinsey The Economic Potential of Generative AI: The Next Productivity Frontier. 2023. Available online: https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/the-economic-potential-of-generative-ai-the-next-productivity-frontier (accessed on 10 June 2024).

- Nazir, A.; Wang, Z. A Comprehensive Survey of ChatGPT: Advancements, Applications, Prospects, and Challenges. Meta-Radiol. 2023, 1, 100022. [Google Scholar] [CrossRef]

- Roumeliotis, K.I.; Tselikas, N.D. ChatGPT and Open-AI Models: A Preliminary Review. Future Internet 2023, 15, 192. [Google Scholar] [CrossRef]

- Bansal, G.; Chamola, V.; Hussain, A.; Guizani, M.; Niyato, D. Transforming Conversations with AI—A Comprehensive Study of ChatGPT. Cogn. Comput. 2024. [Google Scholar] [CrossRef]

- Seo, J.; Oh, D.; Eo, S.; Park, C.; Yang, K.; Moon, H.; Park, K.; Lim, H. PU-GEN: Enhancing Generative Commonsense Reasoning for Language Models with Human-Centered Knowledge. Knowl. Based Syst. 2022, 256, 109861. [Google Scholar] [CrossRef]

- Sumbal, M.S.; Amber, Q. ChatGPT: A Game Changer for Knowledge Management in Organizations. Kybernetes 2024. [Google Scholar] [CrossRef]

- Aksamija, A.; Yue, K.; Kim, H.; Grobler, F.; Krishnamurti, R. Integration of Knowledge-Based and Generative Systems for Building Characterization and Prediction. Artif. Intell. Eng. Des. Anal. Manuf. 2010, 24, 3–16. [Google Scholar] [CrossRef]

- Orlova, E. Dynamic Regimes for Corporate Human Capital Development Used Reinforcement Learning Methods. Mathematics 2023, 11, 3916. [Google Scholar] [CrossRef]

- Mathew, R.; Stefaniak, J.E. A Needs Assessment to Support Faculty Members’ Awareness of Generative AI Technologies to Support Instruction. TechTrends 2024. [Google Scholar] [CrossRef]

- Mazzullo, E.; Bulut, O.; Wongvorachan, T.; Tan, B. Learning Analytics in the Era of Large Language Models. Analytics 2023, 2, 877–898. [Google Scholar] [CrossRef]

- Lucas, H.C.; Upperman, J.S.; Robinson, J.R. A Systematic Review of Large Language Models and Their Implications in Medical Education. Med. Educ. 2024. [Google Scholar] [CrossRef]

- Borah, A.R.; Nischith, T.N.; Gupta, S. Improved Learning Based on GenAI. In Proceedings of the 2024 2nd International Conference on Intelligent Data Communication Technologies and Internet of Things (IDCIoT), Bengaluru, India, 4–6 January 2024; IEEE: Piscataway, NJ, USA, 2024; pp. 1527–1532.

- Shimizu, I.; Kasai, H.; Shikino, K.; Araki, N.; Takahashi, Z.; Onodera, M.; Kimura, Y.; Tsukamoto, T.; Yamauchi, K.; Asahina, M.; et al. Developing Medical Education Curriculum Reform Strategies to Address the Impact of Generative AI: Qualitative Study. JMIR Med. Educ. 2023, 9, e53466. [Google Scholar] [CrossRef] [PubMed]

- Salinas-Navarro, D.E.; Vilalta-Perdomo, E.; Michel-Villarreal, R.; Montesinos, L. Designing Experiential Learning Activities with Generative Artificial Intelligence Tools for Authentic Assessment. Interact. Technol. Smart Educ. 2024. [Google Scholar] [CrossRef]

- Hemachandran, K.; Verma, P.; Pareek, P.; Arora, N.; Rajesh Kumar, K.V.; Ahanger, T.A.; Pise, A.A.; Ratna, R. Artificial Intelligence: A Universal Virtual Tool to Augment Tutoring in Higher Education. Comput. Intell. Neurosci. 2022, 2022, 1410448. [Google Scholar] [CrossRef] [PubMed]

- Kramer, L.L.; ter Stal, S.; Mulder, B.C.; de Vet, E.; van Velsen, L. Developing Embodied Conversational Agents for Coaching People in a Healthy Lifestyle: Scoping Review. J. Med. Internet Res. 2020, 22, e14058. [Google Scholar] [CrossRef] [PubMed]

- Hendriksen, C. Artificial Intelligence for Supply Chain Management: Disruptive Innovation or Innovative Disruption? J. Supply Chain. Manag. 2023, 59, 65–76. [Google Scholar] [CrossRef]

- Cui, Y.G.; van Esch, P.; Phelan, S. How to Build a Competitive Advantage for Your Brand Using Generative AI. Bus. Horiz. 2024, in press. [Google Scholar] [CrossRef]

- Perera Molligoda Arachchige, A.S. Large Language Models (LLM) and ChatGPT: A Medical Student Perspective. Eur. J. Nucl. Med. Mol. Imaging 2023, 50, 2248–2249. [Google Scholar] [CrossRef] [PubMed]

- Singh, K.; Chatterjee, S.; Mariani, M. Applications of Generative AI and Future Organizational Performance: The Mediating Role of Explorative and Exploitative Innovation and the Moderating Role of Ethical Dilemmas and Environmental Dynamism. Technovation 2024, 133, 103021. [Google Scholar] [CrossRef]

- Ferrara, E. Fairness and Bias in Artificial Intelligence: A Brief Survey of Sources, Impacts, and Mitigation Strategies. Sci 2023, 6, 3. [Google Scholar] [CrossRef]

- Makridakis, S.; Petropoulos, F.; Kang, Y. Large Language Models: Their Success and Impact. Forecasting 2023, 5, 536–549. [Google Scholar] [CrossRef]

| Professional Body | Classes of Competencies |

|---|---|

| ICAEW (2018) | Ethics and professionalism; communication; teamwork; decision-making; problem-solving; adding value; technical competence [70] |

| ACCA (2020) | Ethics and professionalism; data, digital and technology; strategy and innovation; leadership and management; stakeholder relationship management; governance, risk and control; corporate and business reporting; financial management; management accounting; taxation; audit and assurance; advisory and consultancy [71] |

| AICPA & CIMA (2022) | Technical skills; business skills; people skills; leadership skills; digital skills [72] |

| ICAS (2023) | Ethics and integrity; communications; teamwork and leadership; personal effectiveness; problem-solving and decision-making; technical competence [73] |

| IMA (2023) | Strategy, planning and performance; reporting and control; business acumen and operations; technology and analytics; leadership; professional ethics and values [74] |

| Criteria Type | Reason for Inclusion/Exclusion |

|---|---|

| Inclusion Criteria | (I1) The paper focuses on the need for the AA professional’s competencies in AI/GenAI area (expected or required by the market). (I2) The paper focuses on the risks regarding AI/GenAI inclusion in AA domain. (I3) The paper focuses on GenAI/LLM in AA domain. (I4) The paper is a journal article, conference article or book chapter. (I5) The paper is published in English. (I6) The paper is published between 2018 and 2024. |

| Exclusion Criteria | (E1) No full text available. (E2) The paper does not address/focus on AA professional’s competencies in relation to adopted AI technologies. (E3) The paper is only loosely related to AI/GenAI competencies for AA domain. |

| Year | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | Total |

|---|---|---|---|---|---|---|---|---|

| Papers Number | 4 | 5 | 14 | 26 | 29 | 45 | 14 | 137 |

| Reference | Article Title | Publication | Main Findings |

|---|---|---|---|

| Samiolo, et al., 2024 [83] | Auditor Judgment in the Fourth Industrial Revolution | Contemporary Accounting Research | Skills-related risks |

| Norzelan, et al., 2024 [63] | Technology Acceptance of Artificial Intelligence (AI) among Heads of Finance and Accounting Units in the Shared Service Industry | Technological Forecasting and Social Change | AI acceptance in finance and accounting; risk assessment |

| Arnold, et al., 2023 [82] | Can Knowledge Based Systems Be Designed to Counteract Deskilling Effects? | International Journal of Accounting Information Systems | Risks of deskilling; knowledge-based systems implications in supporting accounting professionals |

| Rawashdeh, 2024 [12] | A Deep Learning-Based SEM-ANN Analysis of the Impact of AI-Based Audit Services on Client Trust | Journal of Applied Accounting Research | AI-based audit services, perceived quality, value, attitude, satisfaction and trust |

| Munoko, et al., 2020 [7] | The Ethical Implications of Using Artificial Intelligence in Auditing | Journal of Business Ethics | Accounting and auditing industry interest in AI adoption |

| Thottoli, 2024 [75] | Leveraging information communication technology (ICT) and artificial intelligence (AI) to enhance auditing practices | Accounting Research Journal | Potential benefits and risks associated with AI and information communication technology (ICT) adoption in auditing |

| Jemine, et al., 2024 [60] | Technological innovation and the co-production of accounting services in small accounting firms | Accounting Auditing & Accountability Journal | Impact of emerging information technologies onto small accounting firms and professionals’ competencies |

| Grosu, et al., 2023 [3] | Testing accountants’ perceptions of the digitization of the profession and profiling the future professional | Technological Forecasting and Social Change | Challenges, knowledge and skills required to face technological evolution |

| Rodgers, et al., 2023 [20] | Protocol Analysis Data Collection Technique Implemented for Artificial Intelligence Design | IEEE Transactions on Engineering Management | Impact of the lack of an AI framework, IFRS knowledge, and legislation conflict on AA standards implementation; AI-based support for protocol analysis, benefits and designed features |

| Koreff, et al., 2023 [85] | Exploring the Impact of Technology Dominance on Audit Professionalism through Data Analytic-Driven Healthcare Audits | Journal of Information Systems | Potential of AI-enabled data analytic-driven audits tools to alter audit missions and derived concerns for their uncontrolled use by novice-level auditors |

| Ng, 2023 [50] | Teaching Advanced Data Analytics, Robotic Process Automation, and Artificial Intelligence in a Graduate Accounting Program | Journal of Emerging Technologies in Accounting | Reshaping skill sets needed in the accounting profession by designing courses that incorporate RPA and AI at a public university (USA) |

| Kommunuri, 2022 [8] | Artificial Intelligence and the Changing Landscape of Accounting: A Viewpoint | Pacific Accounting Review | The impact of AI and ML on the accounting skills environment |

| Andiola, et al., 2022 [59] | Wealthy Watches Inc.: The Substantive Testing of Accounts Receivable in the Evolving Audit Environment | Issues in Accounting Education | Awareness of technologies used in audit practice; the case of students practicing scepticism and applying professional judgment using AI and RPA tools |

| Friedrich, et al., 2022 [6] | Epistemological Thinking about Accounting in the Era of Artificial Intelligence | Revista Gestao Organizacional | Links between accounting science and disruptive technologies; transformation of accounting science on report creation, interpretation and authentication |

| Fotoh and Lorentzon, 2021 [9] | The Impact of Digitalization on Future Audits | Journal of Emerging Technologies in Accounting | Competitivity framework for audit profession; need for new capabilities, skills and business models incorporating digital technologies |

| Mancini, et al., 2021 [55] | Four Research Pathways for Understanding the Role of Smart Technologies in Accounting | Meditari Accountancy Research | Mapping KSAs required to manage decision-supporting information by leveraging AI and other new technologies. |

| Leitner-Hanetseder, et al., 2021 [78] | Profession in Transition: Actors, Tasks and Roles in AI-Based Accounting | Journal of Applied Accounting Research | Changes for competencies for accounting professions and “core” roles; AI-based accounting context (mixed AI and human accounting teams). |

| Kirk, et al., 2021 [81] | Bias Out-of-the-Box: An Empirical Analysis of Intersectional Occupational Biases in Popular Generative Language Models | Advances in neural information processing systems | Risks of producing unethical, racist and sexist comments |

| Andreassen, 2020 [49] | Digital Technology and Changing Roles: A Management Accountant’s Dream or Nightmare? | Journal of Management Control | Accountant new skills |

| Li and Liu, 2020 [25] | Development of an Intelligent NLP-Based Audit Plan Knowledge Discovery System | Journal of Emerging Technologies in Accounting | Generative Artificial Intelligence overview |

| Plumlee, et al., 2015 [58] | Training Auditors to Perform Analytical Procedures Using Metacognitive Skills | The Accounting Review | New skills required for auditors |

| Reference | Article Title | Publication | Main Findings |

|---|---|---|---|

| Wölfel, et al., 2024 [93] | Knowledge-Based and Generative-AI-Driven Pedagogical Conversational Agents: A Comparative Study of Grice’s Cooperative Principles and Trust | Big Data and Cognitive Computing | Generative Language Models (GLMs), PEdagogical conversational Tutor with generative AI component and adaptation |

| Dong, et al., 2024 [94] | An Automated Multi-Phase Facilitation Agent Based on LLM | IEICE Transactions on Information and Systems | LLM-based agent implementation; large-scale discussion support systems |

| Trad and Chehab, 2024 [36] | Prompt Engineering or Fine-Tuning? A Case Study on Phishing Detection with Large Language Models | Machine Learning and Knowledge Extraction | Prompt Engineering process; tailoring LLM to particular tasks |

| White, et al., 2023 [37] | A Prompt Pattern Catalog to Enhance Prompt Engineering with ChatGPT | ArXiv | ChatGPT; Prompt Engineering |

| Floridi, 2023 [43] | AI as Agency Without Intelligence: On ChatGPT, Large Language Models, and Other Generative Models. | Philosophy & Technology | AI systems, AI2AI interoperability; “Confederated AI” |

| Piktus, 2023 [44] | Online Tools Help Large Language Models to Solve Problems through Reasoning | Nature | LLM-based systems and external data sources; how to improve LLMs’ output |

| Wei, et al., 2022 [40] | Chain-of-Thought Prompting Elicits Reasoning in Large Language Models | International Review of Economics & Finance | Chain-of-Thoughts (CoT) prompting-requesting and providing the reasoning steps. |

| Reference | Article Title | Organisation Name | Main Findings |

|---|---|---|---|

| IMA, 2023 [74] | IMA Management Accounting Competency Framework | Core competencies considered by each professional body; analysing the gap associated with newly emerging requirements for accountants’ and auditors’ competencies generated by the integration of AI/GenAI/LLM solutions | |

| ICAS, 2023 [73] | ICAS Mapping Our New Competencies | ||

| AICPA & CIMA, 2022 [72] | CGMA Competency Framework | ||

| ACCA, 2020 [71] | ACCA Competency Framework | ||

| ICAEW, 2018 [70] | ACA Qualification Professional Development Ladders | ||

| Mordor Intelligence, 2024 [10] | AI In Accounting Market Size & Share Analysis—Growth Trends & Forecasts (2024–2029) | Mordor Intelligence | Analysis of the AI in the accounting services market |

| McKinsey, 2023 [95] | The economic potential of generative AI: The next productivity frontier | McKinsey | The impact of GenAI on productivity |

| Alan Turing Institute, 2023 [48] | AI Skills for Business Competency Framework | Alan Turing Institute | Developing strategies to upskill staff using AI solutions |

| Schwartz, et al., 2022 [80] | Towards a Standard for Identifying and Managing Bias in Artificial Intelligence | National Institute of Standards and Technology | Technical biases and discrimination instances attributed to AI |

| OECD, 2019 [23] | Principles for trustworthy AI | OECD | Cooperation governments-stakeholders so that people hold the necessary competencies to interact effectively with AI tools |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Anica-Popa, I.-F.; Vrîncianu, M.; Anica-Popa, L.-E.; Cișmașu, I.-D.; Tudor, C.-G. Framework for Integrating Generative AI in Developing Competencies for Accounting and Audit Professionals. Electronics 2024, 13, 2621. https://doi.org/10.3390/electronics13132621

Anica-Popa I-F, Vrîncianu M, Anica-Popa L-E, Cișmașu I-D, Tudor C-G. Framework for Integrating Generative AI in Developing Competencies for Accounting and Audit Professionals. Electronics. 2024; 13(13):2621. https://doi.org/10.3390/electronics13132621

Chicago/Turabian StyleAnica-Popa, Ionuț-Florin, Marinela Vrîncianu, Liana-Elena Anica-Popa, Irina-Daniela Cișmașu, and Cătălin-Georgel Tudor. 2024. "Framework for Integrating Generative AI in Developing Competencies for Accounting and Audit Professionals" Electronics 13, no. 13: 2621. https://doi.org/10.3390/electronics13132621

APA StyleAnica-Popa, I.-F., Vrîncianu, M., Anica-Popa, L.-E., Cișmașu, I.-D., & Tudor, C.-G. (2024). Framework for Integrating Generative AI in Developing Competencies for Accounting and Audit Professionals. Electronics, 13(13), 2621. https://doi.org/10.3390/electronics13132621