Abstract

The motivation for study derives from the requirements imposed by the European Union Corporate Sustainability Reporting Directive, which increases the sustainability reporting scope and the need for companies to use emerging digital technologies. The research aim is to evaluate the digital transformation impact of the European Union companies on sustainability reporting expressed through three sustainable performance indicators (economic, social, and ecological) based on a conceptual model. The data were collected from Eurostat for 2011–2021. The study proposes a framework for sustainable performance analysis through linear regression models and structural equations. Additionally, a hierarchy of digitization indicators is created by modeling structural equations, depending on their impact on sustainability performance indicators, which is validated using neural networks. The results indicate that the company’s digital transformation indicators positively influence economic and social performance and lead to an improved environmental protection (a decrease in pollution), proving the established hypotheses’ validity. The proposed model can be the basis for companies to create their dashboards for analyzing and monitoring sustainable performance. This research can be the basis of other studies, having a significant role in establishing economic and environmental strategies to stimulate an increase of companies that carry out sustainability reporting.

1. Introduction

The COVID-19 crisis has emphasized the need for a response that brings long-term benefits to European society and competitiveness, with sustainability becoming an increasingly important dimension for companies and society. Consequently, companies are pushed to implement sustainability-oriented practices and report on financial and social performance and environmental aspects.

After 2015, at the European Union (EU) level, a higher emphasis was placed on non-financial (sustainable) reporting [1]. Given that climate change is increasingly visible and the impact of the COVID-19 crisis on companies was powerful, a new directive of the European Union, the Corporate Sustainability Reporting Directive (CSRD) [2], established that companies should publish more information related to sustainability, with a particular emphasis on the connectivity between financial and sustainability statements. Thus, companies must make significant changes in the reporting way due to the impact of their activities on the environment and society. In achieving these objectives, companies rely on modern technologies that increase their transparency and also identify risks and opportunities for long-term business development. Thus, by the digital compass for 2030 [3], the EU establishes the companies to benefit from and use the latest digital technologies to ensure Europe’s recovery and regain a competitive position in the global economy.

Technology and digital infrastructure have further highlighted their need in business environments with the COVID-19 pandemic to communicate, work, and respond to current environmental issues. Along with the digitalization of companies, the strong positive impact of the digitalization of financial-accounting reporting systems on the quality of information was demonstrated [4,5,6,7,8]. The COVID-19 pandemic required the rapid reorganization and digitization of all management and decision-making processes, with financial-accounting reporting occupying, in this approach, a central place [9,10].

Digitalization creates opportunities to exploit information more efficiently and enables the centralization of data at the EU and countries’ member levels in an open and accessible format that facilitates knowledge and comparison of data. In this context, the digital transformation of economic entities and usage tools specific to Industry 4.0. outlines a new vision for the reporting environment [11].

Following the research of the specialized literature regarding the role of digitization in the activity of sustainable reporting both at the company level and at the country or regional level, we found that such information is missing. Consequently, the paper’s purpose is to evaluate the extent to which digitalization influences the sustainable reporting process of European Union companies. The motivation for carrying out this study derives from the requirements imposed by the EU [2], which increase the scope of sustainability reporting, thus highlighting the need of companies to use emerging digital technologies for reporting efficiency.

This research proposes a conceptual model, created on the example of the EU, to evaluate the impact of digitization (through a series of digital technology indicators) on sustainable reporting expressed through three categories of sustainability performance indicators (economic, social, and ecological). Each category indicator was established based on the existence of information; it was collected for the EU for 2011–2021. The study is a subject of great interest both from a scientific and political point of view to take effective and sustainable economic policy measures both at the EU level and at the level of each member country for the integration of digital technologies to companies for effective sustainability reporting.

The study is structured in two parts. In the first part, the existence of causal relationships between the indicators of sustainable performance and those of digitalization proposed in the model is investigated and the significance of these relationships is estimated through linear regression models and structural equation models (SEM). The second part makes a hierarchy of digitalization indicators according to their impact on sustainability reporting indicators by structural equation modeling (SEM). The obtained results are validated using neural networks (ANN). The research novelty consists of a conceptual model created by the authors for evaluating the relationship between sustainable reporting and digitalization and using an SEM-ANN model for the digitalization indicators ranking on sustainable reporting, according to their impact.

The results indicate that digital transformation indicators of companies positively influence economic and social performance. At the same time, the implementation of digitization leads to an increase in the protection of the environment, respectively, a decrease in pollution. The model proposed in the paper can become a framework for creating dashboards at the macro or microeconomic level with indicators that are the basis of sustainability reporting. In conclusion, it is clear that in an interconnected world, EU states need to implement the latest digital technologies at the level of their entities to enable citizens and companies to take advantage of the potential of digital transformation and contribute to creating a healthier, more prosperous, and more ecological society.

The article is structured in five sections. After the introduction and the specialized literature review in the third section, the conceptual model indicators and the research methodology are presented. Next, the research findings and discussions based on them are presented in Section 4. Finally, Section 5 concludes the study findings and outlines the research limitations and directions for future research.

2. Theoretical Background and Development of Hypotheses

2.1. The Digitization Role in Sustainability Reporting

The significant importance given to ensuring a sustainable environment led to a global initiative accomplishment, “Transforming our world: The 2030 Agenda for Sustainable Development” [12], whose objectives had in mind the three dimensions of sustainable development: economic, social, and environmental. The objective achievement is based on the joint action of all society entities, especially companies, through the implementation of sustainable strategies [13].

Through sustainability reporting, companies are more transparent about the risks and opportunities they face. Thus, companies involved in sustainability reporting must determine what information and indicators they report and how to communicate them [14].

A general framework for the company’s sustainability reporting was made [15], which includes reliable and valid universal measurement standards of environmental, social, and governance variables, thus increasing transparency on their contribution to society’s durable development variables. At the European level, a published sustainability report measures how well companies integrate these elements into their practices. These are effective means of allowing companies to respond in a single document to a wide variety of issues raised by stakeholders (for example, investors). At the same time, the EU reporting standards impose a digital taxonomy on sustainability to allow the rigorous collection of information on environmental factors (climate change, pollution, water and marine sources, resources, and circular economy, biodiversity, and ecosystems), social factors (own workforce, workers in the value chain, affected communities, consumers, and end users), and governance factors (governance, risk management, and internal control, business conduct) [2].

The crisis caused by the COVID-19 pandemic has had a significant impact on the extent to which companies have taken steps toward digital transformation to easily manage the threats and opportunities in their transformation [16].

Analyzing the relationship between digitalization and sustainability reporting is particularly important because understanding digitalization and sustainability determines how different actors (including managers and policymakers) act [17]. Some studies find that digitalization has a significant impact on ecological and economic sustainability and a less significant effect on social sustainability [18].

At the EU level, the digital transformation of businesses is one of the main pillars of the digital compass, and by 2030, 75% of companies will have to use emergent technologies (cloud computing, big data, and artificial intelligence services) [3]. In this way, by building and deploying the technological capabilities that allow companies to take advantage of the potential of digital transformation, the EU will contribute to sustainable society creation.

The Fourth Industrial Revolution (Industry 4.0) is the basis for implementing business model innovation strategies and transformation by ensuring sustainable business performance [19]. Industry 4.0 technologies have guided the companies reporting to achieve sustainable reporting [20,21] and the era of Industry 5.0. will continue to excel in the perspective of digital sustainability reporting [22]. The use of Industry 4.0 and 5.0 for the digitalization of companies involves the use of emergent technologies (artificial intelligence, blockchain, intelligent data analysis and cyber security, cloud computing, big data, Internet of Things, Internet of Everything, and augmented reality) that contribute to the remodeling of companies’ businesses [23]. At the same time, modern technologies offer real-time connectivity to company-specific processes and information, facilitating the decision-making process and contributing to the efficiency of employees’ work [24].

The digitalization process requires, in addition to a well-organized implementation plan, a specialization of the human factor, which changes the role of professionals. It is found that the digitalization of financial-accounting activity is not only a modern solution imposed by technological progress, but it is necessary and timely to anticipate the uncertain economic and social context [25,26].

In the EU, the need for the fastest possible integration of modern technologies at the level of companies has required states to invest in digital infrastructure to stimulate Europe’s competitiveness and green transition [27].

The need to achieve sustainability reporting at the company and institutional level to ensure sustainable development at the regional level [28] has required paying more attention to the reporting area of companies [21,29], highlighting the opportunities and benefits of integrating social and environmental components in financial accounting, in order to provide the information needed to increase investment [30].

2.2. Conectivity

The main characteristic of digitization and globalization is digital connectivity, linking companies across the world despite extreme uncertainties and disruptions. Global connectivity connects nations, industries, companies, and individuals around the world through flows of data, information, ideas, and knowledge, and through flows of goods, services, investment, and capital that are digitally enabled and supported [31,32].

The increased demand for the integration of information and communication technologies at the level of companies’ activity shows a tendency to automate and achieve the exchange of information through new technologies (artificial intelligence, the Internet of Things, software robots, and cyber security) [33,34]. The dominant business models carried out on the Internet have the connectivity-content-context-commerce typology [35]. Thus, connectivity plays a fundamental role by introducing telecommunications in the I4.0 context, ensuring secure data exchange and transparent communication [36]. Good connectivity can be achieved by implementing advanced technologies (the fifth generation of mobile networks—5G) that meet the requirements for high-traffic volume real-time communications [37].

The new connectivity in digital form is an essential characteristic for companies to face the uncertainties in the modern world (pandemics, crises), to lead to organizational resilience improvement and to protect the environment [38]. The COVID-19 pandemic has made a possible radical shift to digital connectivity. Rapidly, companies have intensified their use of digital technologies, and digital business models and virtualized businesses have proven to be scalable and have a great contribution to reducing pollution [31]. At the same time, the implications of the digital divide [39], both on the capacities of small and medium-sized companies (SMEs) to operate in difficult economic times and the gap between levels of digital connectivity were evident [40]. Investments in infrastructure have led to improved digital connectivity providing a range of opportunities for access to broadband and high-speed services, which have narrowed the digital divide [41,42].

Most studies so far have interpreted digital connectivity in terms of connectivity technologies (ICT, cloud services, IoT, AI, and data analytics) that really serve as the foundation for connection with corporate members and the business community. However, digital connectivity goes beyond the usability of these technologies and encourages innovation, increasing efficiency through new business model use, simplified processes, intelligent decision-making, and adding value through customer experience [38,43]. It is obvious that a company that has greater connectivity can more easily enter new markets, encourages creativity, and offers a high capacity for reaction and adaptability in the organization of activities [44].

Based on the specialized literature that analyzed the factors that make connectivity the fundamental element for carrying out the activities of companies in the digital age, to determine the role in sustainable reporting, we formulated the following hypothesis:

Hypothesis 1 (H1).

Connectivity (CO) has a significant favorable influence on economic (EP) and social performance (SP) and an indirect influential on environmental indicators (NP).

2.3. Websites and Use of Social Media

The progress made by information and communication technologies has made companies invest more and more in digitalization, from simple websites to the integration of technology in all sectors of a business [45]. Through the Internet, by implementing websites, companies can make their brand known, support online and offline business promotion, generate contests and promote events, make direct sales, and discover community members interested in their products and services [46,47]. Stakeholder communication on websites is of better quality for larger companies due to their more significant resources [48,49]. Websites, social networks, and electronic commerce have a significant contribution to marketing activity, making the activity of companies more efficient [50,51,52,53]. Marketers must carefully coordinate the use of different digital tools to ensure that they reach their target market in an adequate manner [54]. Companies use social media to promote their products, services, and brands, build a brand image, and manage customer relationships [55]. Advances in Web 2.0 technologies and growing applications of social networks have revolutionized business models and operations, leading them to sustainable development and environmental protection [56,57,58,59]. The current trend is for companies to see social networks as an optimal way to improve lasting and valuable relationships with other companies [60]. Discrepancies between business sectors in online activity and engagement trends suggest a low social media presence of SME activity [61].

The analysis of the factors that make the use of the Web and social networks a compelling experience for companies in the process of collecting information for the achievement of sustainable reporting led to the formulation of the following hypothesis:

Hypothesis 2 (H2).

Websites and the use of social media (WS) have a significant favorable influence on economic (EP) and social (SP) performance and a significant inverse influence on environmental performance (NP).

2.4. Information Management

Sustainability reporting promotes transparency. This imposes the need for quality information collection to measure corporate sustainability progress [62]. Thus, an information system implementation based on modern technologies has a positive and significant effect on the quality of reporting [9,63,64].

The digital transformation in reporting activity (blockchain, big data), supported by cloud-based analytical tools and artificial intelligence, brings new challenges and opportunities to finance and accounting services [65,66], automating the decision-making process on a large scale [67,68].

Industry 4.0 offers enormous potential to the field of reporting, a series of routine tasks can be automated, and people are being replaced by robots. Thus, people allocate more time to enriching their creativity and bringing added value to companies [66,69].

The impact of information technology on the financial-accounting reporting system improves the quality and performance of reporting transparently and securely; the integrity and quality of reporting information is a challenge that comes with technological evolution [70].

At the level of companies, the most used technical tool that manages and facilitates the flow of information is Enterprise Resource Planning (ERP) because it provides accurate and timely information for decision-makers [38], allowing companies to make effective strategic decisions and increase productivity [71,72]. The dynamic development of technology and changing needs of companies have resulted in the evolution of ERP systems [73], and the expansion of some ERP capabilities to bring more value to the company [74] and greater user satisfaction [75,76].

The incorporation of blockchain technology (BT) into ERP systems is the next generation in business technology, which will transform business operations and the functionality of companies in a new and modern way, enabling real data interoperability for various commercial and banking services (online payments, trade, contract management facilities, finance, and accounting) [77]. At the same time, BT integration with ERP can considerably improve the business process productivity, speed, flexibility, and quality [78,79].

Digitalization is transforming the work of tax administrators and increasing their ability to collect, process, and monitor tax information. Thus, electronic invoicing (e-invoicing) allows the automatic transfer of invoicing information between companies and the tax authority, better integration of invoicing and payment systems, improved accuracy and security of information, and easier access to collection operations/payments, replacing cumbersome paper processes [80,81].

The COVID-19 pandemic had a massive negative impact on marketing processes [82]. Thus, to facilitate interactions with customers, along with ERP, companies had to implement customer relationship management (CRM) applications [83], which, apart from their promotion role, also constitute a strategic social responsibility initiative [84].

CRM is efficient for a favorable brand image and attitude by increasing purchase intention, increasing sales [67], achieving higher profits, and adding shareholder value [85]. With CRM implementation, the company considers factors that can reduce skepticism and increase customer satisfaction [86,87], improving the company–customer relationship [88,89] and helping the company to respond and adapt its activity according to customer requirements [36,90].

Taking into account the research findings regarding the importance of IT systems in sustainable reporting, the following hypothesis is formulated:

Hypothesis 3 (H3).

Information management (IM) has a positive and significant impact on economic (EP) and social (SP) indicators and an indirect influence on environmental indicators (NP).

2.5. Electronic Commerce

The COVID-19 pandemic has forced an increase in the popularity of e-commerce in all EU member states due to the need to carry out transactions and interactions at a distance. At the same time, the pandemic had damaging effects on many companies, but those with strong e-commerce channels maintained their activity during the crisis and at least compensated for some of the losses from physical sales points [91].

The acceleration of digital transformation has given companies agility in making decisions; electronic commerce has become a condition for business development and establishing optimal relationships with customers [92], innovative marketing strategies adopted, and new business models [93,94]. At the company level, e-commerce optimizes the supply chain, automates internal processes, and provides real-time information on inventory, production, sales, and distribution, bringing added value to products and services [95], resulting in financial gains and access to a wide range of markets, and also provides improved customer service [96].

The studies carried out on customer satisfaction regarding the use of electronic commerce during the pandemic have shown that if they are satisfied, they will continue to use this type of commerce in the long term, which will produce a significant transformation from a technological, social, and economic point of view [97].

Electronic commerce implementation is essential for the adaptation of companies to the digital era to increase sustainable performance, which is why we formulated the following hypothesis:

Hypothesis 4 (H4).

Electronic commerce (EC) positively and significantly influences economic performance (EP) and social performance (SP) and has a significant inverse influence on environmental performance (NP).

2.6. E-Government

The COVID-19 pandemic has forced a rapid change in how companies interact with each other and with state institutions, with social media sites becoming the main tool to face these challenges [98].

In moving to e-government, states had to consider several factors to overcome the difficulties of infrastructure, and cultural, political, technical, and social aspects [99]. However, adequate infrastructure provision alone is not sufficient to ensure the success of e-government [100]. An increase in the quality of information [101] and cyber security is needed so that companies stimulate the acceptance and use of e-government services [102]. At the same time, by knowing the companies’ perceptions of the use of electronic services, it will be possible to increase their quality through total digitization, alignment with the companies’ requirements, and periodic data updating [103].

The study of the link between e-government and sustainable performance for European states demonstrated the positive impact of e-government [104].

Following the literature research, the following hypothesis emerges for investigating the effect of governance services on sustainable reporting:

Hypothesis 5 (H5).

E-Government (EG) has a significant positive impact on economic (EP) and social (SP) indicators, and on environmental indicators, it exerts an influence in the opposite direction but is significant (NP).

2.7. Other Uses of ICTs

Digital transformation in the reporting activity is supported by analytical tools based on cloud technology [68] which have contributed to sustainable business performance improvement. The adoption of cloud technology by companies [105] allows access to financial-accounting data from anywhere, which will be able to track and streamline processes in real time, with beneficial effects on communication with all actors involved [106].

Cloud computing allows companies to manage large volumes of data without their own data center and manage business information in an integrated way, which leads to end-user satisfaction, and increased information quality and interaction between information technology and managerial decisions [107].

With cloud computing technology, companies can increase their operational efficiency by implementing systemic risk assessments and creating effective policies and risk response plans [108]. At the same time, cloud technology is an element of technological progress in the relationship with state administrations (through electronic invoicing) [67].

Blockchain (access to distributed ledgers) and big data technologies supported by cloud-based analytics tools can significantly improve financial visibility and enable more prompt intervention [109]. Blockchain is used to ensure financial security and cyber security in financial accounting through ledger technology use and as a tracking system for financial irregularities [110].

Based on these findings, the following hypothesis is issued:

Hypothesis 6 (H6).

Modern information technology (IT) significantly positively influences economic (EP) and social (SP) performance and negatively influences the environmental performance (NP).

2.8. ICT Skills

The use of cloud technology allows openness to remote work for employees and customers, which is a significant advantage for companies [106]. Moreover, digitalization will contribute to a reorganization of social contact between people and the business environment, with significant differences between professionals educated in the analog era and those born in the digital era. This requires continuous education and specialization in using emerging technologies [5]. For the companies’ digitalization to bring benefits, it is necessary to have professionals behind the new technologies used, that can advise entrepreneurs along the way of implementation practices [111].

Remote work for employees and customers requires the adoption of measures involving implementation policies for their development and structuring, and staff training is very significant [108]. Using intelligent applications, employees will become more efficient, and they can have the opportunity to serve more clients to whom they can provide real-time reports [67,112]. Thus, companies want employees who know how to use new technologies (artificial intelligence, the Internet of Things, blockchain, etc.) to integrate them as quickly as possible into their activities [68].

Research demonstrates that digital intelligence and organizational support are coupled in a company’s ability to carry out its activities in a flexible mode, be open to implementing new ideas, and protect the environment [39,113].

Based on researched studies on the need for continuous qualification of ICT employees and the need for companies to hire professionals to increase sustainable performance, we formulated the following hypothesis:

Hypothesis 7 (H7).

Hiring staff with ICT skills (IS) positively influences economic (EP) and social (SP) performance and negatively influences the environmental indicators (NP).

2.9. Sustainable Performance Indicators

Following the COVID-19 pandemic, it was found that the role of companies is crucial in the event of disruptive events (crises, pandemics), and the pursuit of profit growth for shareholders is no longer the sole objective of business, but sustainability performance (environmental, social, and governance) [114]. In this context, the corporate reporting activities’ primary role should be oriented towards highlighting the role of companies in achieving sustainable growth in the medium and long term [115].

The introduction of modern technologies in the reporting process helps achieve sustainable development goals [116,117] by the accounting of economic, environmental, and social factors to protect business assets and society’s interests [118].

Adoption of digital technologies can significantly contribute to a firm’s short- and long-term competitive advantages [119], and creating a comprehensive reporting model presents a real challenge for companies [120]. At the same time, technology plays a decisive role in the entrepreneurial process, especially for small and poor firms in maintaining themselves in a particularly dynamic global market [121].

Accountability information should be highlighted in the reporting process so that stakeholders can accurately manage the risks associated with their investments in the firm’s financial and non-financial resources [122]. Thus, there must exist a convergence between sustainability reporting standards to provide relevant, comparable, and reliable financial and non-financial information [123].

Prosperous economic and financial performance is crucial for sustainable company growth and survival in the long term, so companies must link the relevance of sustainability reporting to company performance [124].

A series of studies analyzed the impact of economic–financial performance indicators on the sustainable development of companies [125], demonstrating that digitalization has had a significantly influence [126]. At the same time, the increase in the performance of companies is also determined by the quality of the labor force, and a specialized labor force causes an increase in personnel costs, but this does not necessarily mean lower profitability [127].

Companies enter into a series of interactions with the environment and society [128], thus having to carry out a series of sustainability actions and reporting these actions and their results [129,130]. Thus, companies have broadened their perspective on accounting and social responsibility regarding the impact of companies on sustainability, linking sustainability with accounting [17,131].

Sustainability reporting acts as a corporate accountability tool by highlighting a company’s performance on climate change and human rights issues [132].

Digitalization and ecological performance, as well as the transformations it imposes on the business environment and, implicitly, on organizational results, will contribute to the efficiency of technological processes to increase the speed of information transmission and the development of processing [133].

The need for sustainable development at the global level makes companies modernize their businesses to protect the environment and reduce gas emissions to reduce pollution. At the same time, due to the increased interest of investors in ensuring social and environmental protection, companies must review their sustainability reporting mechanisms [134,135].

The environmental performance assessment allows an assessment of environmental risks, the approach of solutions to reduce the impact on the environment, and the development of long-term company activity development plans [136].

To identify the effects of environmental strategies on the company’s performance, some studies have analyzed gas emissions (GHG) as an environmental performance indicator that effectively measures the company’s efforts in mitigating the impacts related to its processes and products [137].

Analysis of the relationship between firms’ financial performance and environmental performance [138,139,140] shows that there is a great emphasis on the ability of companies to self-adjust their environmental performance, with investors pressing to be compensated for policy risks related to climate change, as without evidence of improved financial performance achieving environmental goals could be perceived as costly and economically inefficient [141,142,143].

3. Data, Models, and Methodology

3.1. Data Collection

For the research, a series of macroeconomic indicators at the EU level were used, which manage to quantify the indicators of digital transformation and those of sustainable reporting, taken from the Eurostat Database for the period 2011–2021 [144]. The data series were extracted through SDMX-SOAP (Statistical Data and Metadata Exchange-Simple Object Access Protocol) web services, using a series of queries to retrieve data according to specific criteria and transfer them to the data processing software systems used.

The connectivity quantification (CO) considered the connectivity and remote access of businesses and workers, and used as indicators:

- Enterprises with (fixed/mobile) broadband, expressed as a percentage of total enterprises—CO1;

- Persons employed with access to the internet for business purposes, expressed as a percentage of total employment—CO2;

- Persons employed, which were provided a portable device that allows a mobile connection to the internet for business use, expressed as a percentage of total employment—CO3.

To quantify the management of websites and the use of social networks (WS) by companies, the following variables were taken into account:

- Enterprises having a website, expressed as a percentage of total enterprises)—WS1;

- Use of social media: social networks, blogs, file sharing, and wikis, expressed as a percentage of total enterprises—WS2.

To identify the role of the main information management tools (IM) (ERP, CRM, electronic invoicing) in the companies’ activities, the following indicators were used:

- Enterprises using ERP software, expressed as a percentage of total enterprises—IM1;

- Enterprises using CRM software, expressed as a percentage of total enterprises—IM2;

- Enterprises receiving e-invoices, expressed as a percentage of total invoices and enterprises—IM3;

- Enterprises sending e-invoices, expressed as a percentage of total invoices and enterprises—IM4.

The quantification of the role and relevance of electronic commerce (EC) at the company level was achieved through the following indicators:

- Enterprises with web sales (via websites, apps, or marketplaces), expressed as a percentage of total enterprises—EC1;

- Enterprises with web sales—B2B and B2G, expressed as a percentage of total enterprises—EC2;

- Enterprises with web sales—B2C, expressed as a percentage of total enterprises—EC3.

As an indicator of the use of ICT tools by companies in their interaction with public authorities (EG), the following was chosen:

- Use of the internet to interact with public authorities expressed as a percentage of total enterprises—EG1.

More indicators show the use of information technology (IT) at the level of companies (cloud computing, big data, artificial intelligence, the Internet of Things), but unfortunately there was not reported information about their use until 2021. The only indicator which has information reported is the use of cloud technology expressed by:

- Buying cloud computing services used over the internet, expressed as a percentage of total enterprises—IT1.

In the process of the digital transformation of companies, employees play an essential role in the use of modern technologies (IS), so the following indicators were analyzed:

- Enterprises that employ ICT specialists expressed as a percentage of enterprises employing specialists—IS1;

- Enterprises that provide training to develop/upgrade the ICT skills of their personnel, expressed as a percentage of total enterprises—IS2.

From among the indicators of sustainable performance, the study approaches one indicator for each economic, social, and environmental variable:

- For the economic performance indicator, the indicator of turnover per person employed, expressed in thousand EUR—EP was considered;

- Annual net earnings (single person without children earning 100% of the average earnings), expressed in thousand EUR—SP, was considered representative of the social component;

- As the principal environmental indicator at the corporate level, information regarding greenhouse gases was collected, expressed in million tons—NP.

3.2. Creating the Structural Model

To achieve sustainable performance along with the financial-accounting indicators, companies place more emphasis on reporting social performance indicators and environmental protection indicators. Thus, sustainability reporting must include a range of information on environmental performance (energy efficiency, climate change, greenhouse gas emissions, air and water quality, deforestation, and waste management), social aspects that examine how a company fosters its people and culture, and how this impacts on the wider community (inclusion, gender, and diversity, employee engagement, customer satisfaction, data protection, privacy, community relations, human rights, labor standards), about governance that considers a company’s internal system of controls, practices, and procedures (compliance, board structure, executive compensation, internal controls, and shareholder rights, political contributions, environmental and social policies, and any other issues related to how a company interacts with the government) [2].

The study is structured in two parts to identify the role of digitization on the sustainable performance reporting of companies at the EU level.

To achieve the research objectives, in the first part, based on the analysis of the specialized literature and our observations, we developed a conceptual model that was the basis for testing the formulated hypotheses (H1–H7). By the reviewed literature and formulated hypotheses, a conceptual model with ten constructs is proposed: (1) Connectivity (CO); (2) Websites and use of social media (WS); (3) Information management tools (IM); (4) Electronic commerce (EC); (5) E-Government (EG); (6) Other uses of ICTs (IT); (7) ICT skills (IS); (8) Economic performance indicator (EP); (9) Social performance indicator (SP); (10) Environmental performance indicator (NP). The model variables were divided into seven exogenous (independent) and three endogenous (dependent) variables, each represented by a certain number of articles. The constructs, the number of items for each construct, and their corresponding coding are presented in Table 1.

Table 1.

Constructs, items, and coding for structural model.

Once the variables in the model were identified, the relationships between them were estimated based on linear regressions and modeling structural equations (SEM).

The second part of the study is devoted to identifying a ranking of digitization indicators according to their impact on sustainability performance indicators using structural equation modeling and neural networks (ANN).

3.3. Estimating Relationships between Variables Using Linear Regressions

The impact of digital transformation indicators on sustainability indicators is investigated using the linear regression model for each endogenous variable with each exogenous variable:

where:

- t = 1, … t,—years;

- Y—the natural logarithms of the endogenous variables (LEP, LSP, and LNP) at time t (variables in natural logarithms are interpreted as growth rate);

- —the exogenous variables (CO1, CO2, CO3, WS1, WS2, IM1, IM2, IM3, IM4, EC1, EC2, EC3, EG1, IT1, IS1, IS2) at time ;

- —the values of the exogenous variables (LEP, LSP, and LNP);

- —the values of the components of the endogenous variables (CO1, CO2, CO3, WS1, WS2, IM1, IM2, IM3, IM4, EC1, EC2, EC3, EG1, IT1, IS1, IS2);

- The terms, , are the unknown parameters to be estimated, and , are the error terms.

After the parameterization, a test of the stationarity of the variables will be carried out, and the degree of their cointegration will be identified. The Augmented Dickey–Fuller (ADF) test will be used to verify and identify the integration order of the time series. If the data series are found to be integrated in the same order, the cointegration relationship is tested using the Johansen cointegration procedure. Then the long-term causality relationships and the direction of causality between variables will be studied using cointegration tests, error correction models, and Granger causality tests between digital transformation indicators (exogenous variables) and sustainable performance indicators (endogenous variables). Next, the model validity (cointegration equation) will be checked by applying the White test to see if the random errors are homoscedastic. The econometric analysis will be performed with the EViews 13 software application.

3.4. SEM-ANN Model

To rank the influence factors of digital transformation on sustainable performance reporting, SEM will be used because it simultaneously processes several related dependent variables, estimating at the same time the structure, the relationship of the factors, and the degree of fit of the model as a whole. SEM is used because sustainability reporting and digital indicators with their influencing factors have multidimensional characteristics and are difficult to measure directly [145]. At the same time, SEM is an intensive tool used for multivariate analysis in the economic field because it allows the examination of a set of relationships between one or more independent variables and one or more dependent variables [133].

The structural model equation is set as follows:

where is the coefficient matrix of the result latent variable , and also the path coefficient matrix between the result latent variables; Γ is the coefficient matrix of the cause latent variable , and also the path coefficient matrix of the cause latent variables to the corresponding endogenous latent variable; is the residual term of the structural equation, which is the part failed to explain within the model.

After determining the ranking of the impact of the variables, the models are validated using ANN since this can produce more accurate predictions than SEM [67,146]. This study used the artificial neural network multilayer perceptron (MLP) model because it is very flexible to be applied to the indicators analyzed and compatible with the regressions used. MLP has an architecture of three main layers: input, output, and a hidden layer. The hidden neurons (nodes) are generated automatically. The hyperbolic tangent activation function is used for the hidden layer and the Sigmoid function for the output one. For each neural network constructed, the activation functions identify the capability and performance of the neural network (hidden layer) and the validity of the regression model (output layer). The magnitude of the connection between nodes and the significance of the relationship (direct or indirect) between nodes is given by the synaptic weight. To check if the architecture of the constructed neural network best matches the analyzed data, the additional parameter bias will be used. The data sets will be divided into training and test data, and the prediction accuracy of the network will be measured using ten-fold cross-validation [147]. The prediction accuracy of the ANN model is evaluated by calculating the root mean square error (RMSE) for both datasets using Equation (3) [148]:

where SSE is the sum of squares error and N is the number of elements.

The collected data will be processed using IBM SPSS Statistics 26.0 software to verify the validity of the conceptual model and IBM SPSS AMOS 26.0 software to validate the structural model.

4. Results and Discussion

4.1. Analysis of the Relationship between Sustainability Performance Reporting Indicators and Those of Digitization—Hypothesis Testing

To test the validity of hypotheses H1–H7, we first used regression models to determine the relationships between variables. Then through SEM, we identified the significance of each indicator on the economic, social, and environmental performance.

To determine the existence of the relationship and its meaning between each of the sustainable reporting indicators (EP, SP, NP) and each of the digitalization indicators (CO, WS, IM, EC, EG, IT, IS), the regression equations were estimated linear, considering as dependent variables (y) the logarithmic values of sustainable reporting indicators (LEP, LSP, and LNP) and as independent variables digital transformation indicators (x). The sustainable performance variables were taken in logarithmic form and interpreted as elasticity coefficients (elasticity expresses how strongly digitalization indicators change relative to changes in digital reporting indicators).

The estimation parameters of the regression equations are presented in Table A1. Based on the analysis, it is found that the estimated coefficients in most of the equations (except IM1 and EC2) are statistically significant at a significance level of 1% because the probability for the estimated coefficients is 0, so the hypothesis that they are equal to 0 is rejected. The test results show that the linear regression coefficients are relevant for determining the impact of digitization indicators on sustainable performance indicators.

The values of the estimated regression coefficients corresponding to the independent variables (CO1, CO2, CO3, WS1, WS2, IM1, IM2, IM3, IM4, EC1, EC2, EC3, EG1, IT1, IS1, IS2) determined for linear regressions having as variables dependent LEP and LSN show a favorable impact on these indicators of sustainable reporting (Table A1).

The results of the regression equations with LNP as the dependent variable (Table A1) show that the coefficients determined for this linear regression are significant least at the 10% level, but have negative values, which means that an increase in digitalization indicators leads to a decrease in the consumption of gas emissions, which is favorable for the transition to an ecological economy.

Consequently, these regression models are relevant for determining the impact of digitalization on sustainable performance reporting indicators.

Testing the stationarity and identifying the degree of integration of the time series by applying the ADF test was conducted for the level series. The results show that EP, SP, and NP time series are non-stationary (being at nominal values). Thus, several statistical tests were used to transform them into stationary series. Time series become stationary and integrated at the first difference for all variables analyzed at least at the 10% level (Table A2).

The analysis of the data series after they have been stationary by differentiation and by removing the trend presents the disadvantage of the loss of the informational content of the data, especially in terms of long-term dynamics. This disadvantage is overcome by analyzing the cointegration relationship by applying the Johansen test. The results for testing the cointegration of the variables indicate the existence of a cointegration relationship between the variables at the 5% significance level (Table A3), which means that there is a long-term equilibrium relationship between the variables, and therefore, there is a Granger causality between them, in at least one direction.

Performing the Granger causality test, the following results are obtained (Table A3):

- There is bidirectional causality between: LEP and WS2; LSP and WS1, WS2, IM2, IM3, EG1; LNP and CO1, CO3, WS1, WS2;

- There is unidirectional causality, between LEP and IS1 and IS2; LSP and IM1, EC2, IS1; LNP and IM2, EC1, EC2, EC3;

- There is unidirectional reverse causality between LEP and CO2, CO3, WS1, IM4, EC1, EC2, EC3, EG1, IT1; LSP and CO1, CO2, CO3, IM4, EC1, EC3, IT1, IS2; LNP and CO2, IM3, IM4, EG1, IT1, IS1, IS2;

- There is no causality between LEP and CO1, IM1, IM2, IM3; LNP and IM1.

It continues by checking the model validity (cointegration equation) by applying the White test to see if the random errors are homoscedastic. It is found that there is homoscedasticity thus, the chosen models are valid, respectively, the variance of the model about the explanatory variables remains constant.

It is observed that there is a long-term equilibrium relationship between the variables, with various types of Granger causality between them (Table A4), depending on the level of influence of the digital transformation indicators on the sustainability reporting indicators, results confirmed by other studies [6,11,16,18].

From these results, it can be concluded that the regression models are validated and the hypotheses H1–H7 are verified in the sense that the digitalization indicators CO, WS, IM, EC, EG, IT, and IS have a positive influence on the indicators that measure economic (EP) and social (SP) performance. At the same time, the digitalization indicators are in an inverse relationship with the environmental indicator (NP), which demonstrates within the proposed model that the influence of digitalization is negative and determines the reduction of carbon emissions.

After identifying the relationships between the variables through the regression equations, we went on to evaluate the significance of the impact of digitization on sustainable reporting through SEM.

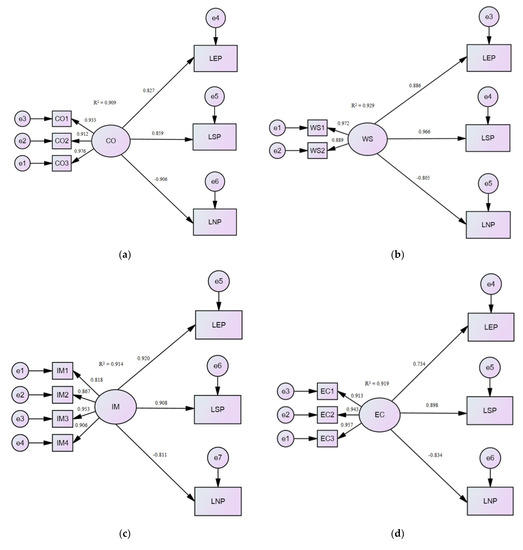

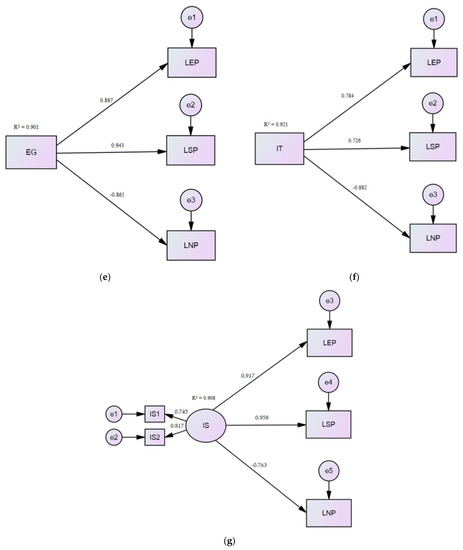

The diagram of the relationships between the variables is shown in Figure A1. Based on the path coefficient values (β), the effect between endogenous and exogenous variables is determined (Table 2).

Table 2.

Significance Impact indicators.

It is observed that the β coefficient values, in absolute value, are greater than 0.5, which proves that the indicators chosen in the construction of the SEM models have a very strong effect on the three endogenous variables. However, their impact is different, positive on LEP and LSP (increasing digitalization indicators leads to increased economic and social performance), and negative on LNP (increasing digitalization indicators leads to a reduction in gas emissions). So, hypotheses H1–H7 are also validated by SEM. Due to all the influencing factors of the exogenous variables having values greater than 0.5, it shows that they are relevant for data analysis.

4.2. Ranking the Impact of Digitization Indicators on Sustainable Performance Indicators through the SEM-ANN Model

To rank the impact of digitalization on sustainable reporting, SEM models were used with endogenous variables (LEP, LSP, and LNP) and exogenous variables (CO, WS, IM, EC, EG, IT, IS) (Figure A1, Table 2), which then they were validated through artificial neural networks (ANN). In establishing the prediction of the relationship between exogenous and endogenous variables, it is observed that the weight of the first six digitization indicators (CO, WS, IM, EC, EG, IT) is significantly different from zero for p-values at the 0.001 level (two-tailed). At the same time, it is found that for IS, the prediction is significantly different from zero for p-value 0.001 (two-tailed), only for LEP and LSP, and for LNP, it is significantly different from zero for p-value 0.01 (two-tailed).

In the structural equation models, the interaction between variables was measured by fit indices: Chi-square has an insignificant result for the test at a 0.05 threshold, and RMSEA (root mean square error of approximation), between 0.06 and 0.08. The values obtained demonstrate a sound significance of SEM.

After the SEM model analyses, building neural networks proceeded to validate the results. MLPs of ANNs are constructed to determine the effects of the seven digital transformation indicators on each of the three sustainable performance reporting indicators. MLP model has only one hidden layer considered, which may be the increase in investment in digitalization.

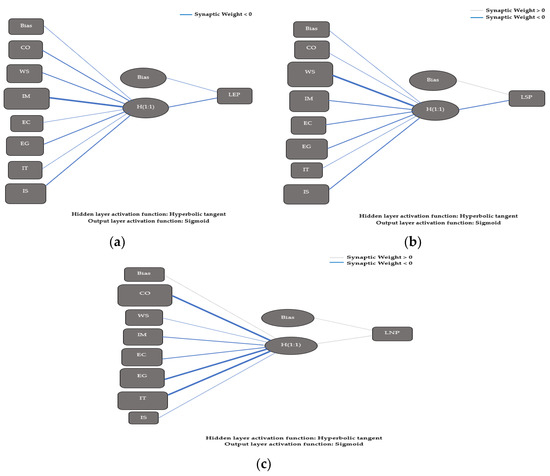

Digitalization indicators are used as inputs to the ANN to highlight the relevant importance of each predictor variable. Estimation of the parameters of the relationships between the variables, resulting from the construction of neural networks with one input layer each defined by the digitization indicators (CO, WS, IM, EC, EG, IT, IS2) and one output layer each defined by LEP, LSP, and LNP is presented in Table 3 and Figure 1. We will have seven input layers (predictors) and one output layer each (LEP, LSP, and LNP).

Table 3.

Estimation of MLP parameters.

Figure 1.

MLP network for identifying the influences of digital transformation indicators on economic performance (a), social performance (b), and environmental performance (c).

The hyperbolic tangent function shows that the hidden layer (H(1:1)) (which may be represented by increases in digitalization investment) has a significant impact on neural network performance. Synaptic weight identifies a direct relationship between digitization indicators and LEP and LSP, and an indirect relationship between digitalization indicators and LNP. These demonstrate the validity of the model.

The additional parameter bias demonstrates that the constructed neural networks are the most suitable for the analyzed data, thus, the regression models are validated.

The effect of digital indicators on sustainability performance may be amplified by the increase in digitalization investments.

According to SEM, there is an interaction between the variables thus, the ANN models are fit until the models with the most suitable effects are identified. For the optimization of the ANN model, the data sets are divided into training and test data, the proportion of which differs in the three ANNs due to the parameter optimization process (Table 4). In determining the prediction accuracy, the root mean square error (RMSE) was analyzed for both data sets. For each model, the neural network was run 10 times, which determined a decrease in the RMSE values (values close to 0), demonstrating a good fit of the data and a high prediction accuracy of the models (Table 4) [146]. The most suitable model for each of the three fitted ANNs is ANN10 (Table 4).

Table 4.

RMSE values for the ANN model.

The relative importance of each input predictor (digitalization indicators) to each sustainable performance reporting indicator was calculated by the normalized ranking of relative importance (expressed as %) using sensitivity analysis (Table 5). The ranking of independent variables by ANN confirms the impact determined using SEM models.

Table 5.

Normalized variable relative importance.

Based on the importance of the normalized variable, it is found that for the increase in economic performance (EP), expressed by the turnover per employee, the greatest importance is the use of modern tools in information management (IM). From the point of view of social performance (expressed by annual net earnings), the greatest importance is presented by the use of websites and social media (WS). Connectivity (CO) has the strongest impact on environmental performance indicators (expressed by greenhouse gases).

ICT skills (IS), which show the importance given to employed staff to know how to work with digital tools, ranks 2nd in terms of impact on increasing economic and social performance. The 2nd place in terms of importance among environmental performance indicators is occupied by companies’ use of cloud computing (IT).

The E-Government (EG) indicator has a significant contribution to the three categories of sustainable reporting indicators, occupying position 3 in terms of importance.

Following the analysis, it is noted that intensive use of digitalization generates an increase in economic performance, a conclusion that also emerged from other specialized works [126,133,136,149]. At the same time, digitalization has a positive impact on social performance, improving working conditions and increasing the work performance of employees, which contributes to increasing their incomes; these findings were also found by other authors [17,127,128,129,130,131]. Given the need to protect the environment, the use of digital technologies contributes to sustainable development, thus an increase in the value of these indicators leads to a decrease in environmental indicators (gas emissions) results also found in other studies [132,133,134,135,136,137,141].

The modeling of structural equations and the construction of artificial neural networks highlight the direct or indirect effect of digitization indicators on sustainability reporting, with different intensities; these results were also found in other specialized research [18,24,30,126]. SEM and ANN confirmed the results obtained by testing the multifactorial linear equations.

5. Conclusions

Europe aims to be a climate-neutral continent by 2050 [150], thus the European Union believes that companies’ sustainability reporting can play a significant role in achieving this goal. Sustainability reporting is fast becoming an essential part of the business landscape. Companies consider the needs of consumers of their products or services to survive and they are becoming more aware of this.

Company reports are geared towards aligning resources and adopting successful business practices by providing relevant performance information against all corporate sustainability achievements and challenges. Companies are constantly adapting their approach to reporting by monitoring and enforcing sustainability practices, as well as reforming policies to ensure that current needs can be met without sacrificing the needs of future generations. An essential aspect of sustainability reporting is the information collection and communication to be evaluated by stakeholders. In this regard, digital technologies are considered to be real drivers in sustainability reporting, as companies must effectively manage the large amount of information related to environmental, social, and governance factors and integrate them into existing reporting systems. Digitalization of business processes was one of the main ways through which companies managed to cope with the pressure of the COVID-19 crisis, putting significant pressure on firms regarding the remodeling of their business processes. The pandemic had more impact on companies’ transition to digital transformation to improve threats and opportunities management, demonstrating the need for EU states to make relevant and real-time decisions.

Based on these considerations, the study of specialized literature was oriented towards identifying the role of digitalization indicators on the economic, social, and environmental performance of companies, with a view to the transition of companies to sustainability reporting. Thus, the study was structured in two directions. In the first part, we created a conceptual model and tested the relationships between its variables. The parameters of the linear regression equations were estimated, and the cointegration and causality of the variables were tested, establishing a long-term equilibrium relationship between them in at least one direction. The second direction identified the impact and intensity of digitalization indicators on sustainability performance reporting indicators using SEM-ANN models.

Based on this research, the study has a series of practical and theoretical implications that may be relevant in the conditions where the digitalization of companies is of significant importance for the European Union to achieve sustainable development that ensures a better future for community members. This study adds value to existing investigations by creating a conceptual model that includes a series of digitalization indicators that compete for sustainable performance. At the same time, it is a novelty to test the relationship between the considered indicators and then to identify their meaning and intensity by approaching modeling through structural equations and building neural networks. The SEM-ANN model made to measure the impact of digitization indicators on sustainability performance provided a possible new research methodology paradigm.

The practical implications of our empirical research carried out at the level of the European Union allow us to state that the increase in the use of information technologies at the level of companies has a significant favorable influence on their economic and social performance. At the same time, implementation of modern technologies at the company level leads to sustained protection of the environment (providing a clean environment for the next generations) by reducing polluting factors. From a practical perspective, the proposed analysis model can become a framework for creating dashboards at the macro or microeconomic levels with key indicators that are the basis of sustainability reporting. Thus, starting from the model developed in this paper, companies can create dashboards to support the analysis and monitoring of sustainable performance in the conditions of the digital era, giving significant importance to digitalization indicators. Thus, the results of this study can be the basis for carrying out other research, potentially having an essential role in establishing economic and environmental strategies at the European level but also at the level of each member country to stimulate the increase in the number of companies that carry out sustainability reports. At the same time, the study can be the basis for governmental and European policies to stimulate sustainable economic growth and adopt appropriate measures.

Following this study, we found that at the level of the European Union, digitalization indicators have a significant direct influence on economic and social performance, and a strong impact, but in the opposite direction on environmental performance (digitalization leads to the reduction of polluting factors). Thus, each member state of the European Union must be aware that, to increase the well-being of its citizens, consistent sustainable policies are needed to protect the environment.

As a limitation of our research, it should be mentioned that this research was carried out at the level of the European Union, and the situation of the member countries has significant differences, both concerning each other and concerning the states of other continents. We propose that in the future investigation, we will perform an analysis of groups of states from each continent to capture the impact of the digital transformation adopted by companies on sustainability reporting.

Author Contributions

Conceptualization, A.M. and G.S.; methodology, A.M. and G.S.; software, A.M. and G.S.; validation, A.M. and G.S.; formal analysis, A.M. and G.S.; investigation, A.M. and G.S.; resources, A.M. and G.S.; writing—original draft preparation, A.M. and G.S.; writing—review and editing, A.M. and G.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Eurostat Database: https://ec.europa.eu/eurostat/databrowser/explore/all/all_themes (accessed on 15 January 2023).

Acknowledgments

The authors acknowledge the anonymous reviewers whose suggestions and comments helped in improving this paper.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Estimating the regression curve and linear regression parameters.

Table A1.

Estimating the regression curve and linear regression parameters.

| Indicator | R2 | S.E.R. | Prob. | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Coef. | Std. Error | Prob. | Coef. | Std. Error | Prob. | ||||

| LEP | |||||||||

| CO1 | 0.800 | 0.018 | 0.000 *** | 4.245 | 0.168 | 0.000 *** | 0.011 | 0.002 | 0.000 *** |

| CO2 | 0.789 | 0.019 | 0.000 *** | 4.907 | 0.060 | 0.000 *** | 0.007 | 0.001 | 0.000 *** |

| CO3 | 0.754 | 0.020 | 0.001 *** | 5.100 | 0.030 | 0.000 *** | 0.007 | 0.001 | 0.001 *** |

| WS1 | 0.720 | 0.022 | 0.001 *** | 4.410 | 0.175 | 0.000 *** | 0.011 | 0.002 | 0.001 *** |

| WS2 | 0.732 | 0.021 | 0.001 *** | 5.095 | 0.032 | 0.000 *** | 0.004 | 0.001 | 0.001 *** |

| IM1 | 0.517 | 0.029 | 0.013 ** | 5.091 | 0.052 | 0.000 *** | 0.005 | 0.002 | 0.013 ** |

| IM2 | 0.615 | 0.025 | 0.004 *** | 4.838 | 0.109 | 0.000 *** | 0.013 | 0.003 | 0.004 *** |

| IM3 | 0.756 | 0.020 | 0.001 *** | 3.485 | 0.335 | 0.000 *** | 0.019 | 0.004 | 0.001 *** |

| IM4 | 0.850 | 0.016 | 0.000 *** | 5.079 | 0.025 | 0.000 *** | 0.003 | 0.000 | 0.000 *** |

| EC1 | 0.646 | 0.024 | 0.003 *** | 5.053 | 0.050 | 0.000 *** | 0.013 | 0.003 | 0.003 *** |

| EC2 | 0.525 | 0.028 | 0.012 ** | 4.997 | 0.081 | 0.000 *** | 0.024 | 0.008 | 0.012 ** |

| EC3 | 0.619 | 0.025 | 0.004 *** | 5.060 | 0.050 | 0.000 *** | 0.016 | 0.004 | 0.004 *** |

| EG1 | 0.805 | 0.018 | 0.000 *** | 1.995 | 0.534 | 0.000 *** | 0.037 | 0.006 | 0.000 *** |

| IT1 | 0.615 | 0.025 | 0.004 *** | 5.165 | 0.024 | 0.000 *** | 0.004 | 0.001 | 0.004 *** |

| IS1 | 0.633 | 0.025 | 0.003 *** | 6.675 | 0.362 | 0.000 *** | 0.073 | 0.019 | 0.003 *** |

| IS2 | 0.625 | 0.025 | 0.004 *** | 4.838 | 0.107 | 0.000 *** | 0.020 | 0.005 | 0.004 *** |

| LSP | |||||||||

| CO1 | 0.890 | 0.038 | 0.000 *** | 0.075 | 0.352 | 0.036 ** | 0.032 | 0.004 | 0.000 *** |

| CO2 | 0.787 | 0.054 | 0.000 *** | 2.108 | 0.169 | 0.000 *** | 0.020 | 0.003 | 0.000 *** |

| CO3 | 0.639 | 0.070 | 0.003 *** | 2.686 | 0.101 | 0.000 *** | 0.017 | 0.004 | 0.003 *** |

| WS1 | 0.895 | 0.038 | 0.000 *** | 0.423 | 0.303 | 0.096 * | 0.036 | 0.004 | 0.000 *** |

| WS2 | 0.656 | 0.068 | 0.002 *** | 2.662 | 0.103 | 0.000 *** | 0.010 | 0.002 | 0.003 *** |

| IM1 | 0.831 | 0.048 | 0.000 *** | 2.506 | 0.088 | 0.000 *** | 0.017 | 0.003 | 0.000 *** |

| IM2 | 0.768 | 0.056 | 0.000 *** | 1.773 | 0.240 | 0.000 *** | 0.040 | 0.007 | 0.000 *** |

| IM3 | 0.684 | 0.065 | 0.002 *** | 1.677 | 1.078 | 0.054 * | 0.052 | 0.012 | 0.002 ** |

| IM4 | 0.847 | 0.045 | 0.000 *** | 2.595 | 0.070 | 0.000 *** | 0.009 | 0.001 | 0.000 *** |

| EC1 | 0.820 | 0.049 | 0.000 *** | 2.448 | 0.100 | 0.000 *** | 0.042 | 0.007 | 0.000 *** |

| EC2 | 0.695 | 0.064 | 0.001 *** | 2.251 | 0.184 | 0.000 *** | 0.079 | 0.017 | 0.001 *** |

| EC3 | 0.664 | 0.067 | 0.002 *** | 2.521 | 0.134 | 0.000 *** | 0.048 | 0.011 | 0.002 *** |

| EG1 | 0.889 | 0.039 | 0.000 *** | 6.606 | 1.141 | 0.000 *** | 0.110 | 0.013 | 0.000 *** |

| IT1 | 0.527 | 0.080 | 0.011 ** | 2.855 | 0.075 | 0.000 *** | 0.009 | 0.003 | 0.012 ** |

| IS1 | 0.454 | 0.086 | 0.023 ** | 6.495 | 1.249 | 0.001 *** | 0.175 | 0.064 | 0.023 ** |

| IS2 | 0.639 | 0.070 | 0.003 *** | 1.898 | 0.297 | 0.000 *** | 0.058 | 0.015 | 0.003 *** |

| LNP | |||||||||

| CO1 | 0.765 | 0.035 | 0.000 *** | 16.697 | 0.320 | 0.000 *** | −0.018 | 0.003 | 0.000 *** |

| CO2 | 0.804 | 0.032 | 0.000 *** | 15.578 | 0.101 | 0.000 *** | −0.012 | 0.002 | 0.000 *** |

| CO3 | 0.706 | 0.706 | 0.001 *** | 15.225 | 0.057 | 0.000 *** | −0.011 | 0.002 | 0.001 *** |

| WS1 | 0.557 | 0.048 | 0.008 *** | 16.269 | 0.388 | 0.000 *** | −0.018 | 0.005 | 0.008 *** |

| WS2 | 0.708 | 0.039 | 0.001 *** | 15.237 | 0.059 | 0.000 *** | −0.006 | 0.001 | 0.001 *** |

| IM1 | 0.431 | 0.054 | 0.028 ** | 15.224 | 0.100 | 0.000 *** | −0.008 | 0.003 | 0.028 ** |

| IM2 | 0.485 | 0.052 | 0.017 ** | 15.613 | 0.222 | 0.000 *** | −0.020 | 0.007 | 0.017 ** |

| IM3 | 0.731 | 0.037 | 0.001 *** | 18.022 | 0.618 | 0.000 *** | −0.033 | 0.007 | 0.001 *** |

| IM4 | 0.677 | 0.041 | 0.002 *** | 15.237 | 0.063 | 0.000 *** | −0.005 | 0.001 | 0.002 *** |

| EC1 | 0.703 | 0.039 | 0.001 *** | 15.331 | 0.080 | 0.000 *** | −0.024 | 0.005 | 0.001 *** |

| EC2 | 0.444 | 0.054 | 0.025 ** | 15.379 | 0.155 | 0.000 *** | −0.039 | 0.015 | 0.025 ** |

| EC3 | 0.704 | 0.039 | 0.001 *** | 15.325 | 0.078 | 0.000 *** | −0.031 | 0.007 | 0.001 *** |

| EG1 | 0.749 | 0.036 | 0.001 *** | 20.490 | 1.066 | 0.000 *** | −0.063 | 0.012 | 0.001 *** |

| IT1 | 0.778 | 0.034 | 0.000 *** | 15.138 | 0.032 | 0.000 *** | −0.007 | 0.001 | 0.000 *** |

| IS1 | 0.277 | 0.061 | 0.096 * | 13.309 | 0.893 | 0.000 *** | −0.005 | 0.046 | 0.096 * |

| IS2 | 0.181 | 0.065 | 0.092 * | 15.359 | 0.278 | 0.000 *** | −0.019 | 0.014 | 0.092 * |

Notes: * Denotes significance at 10% level; ** denotes significance at 5% level; *** denotes significance at 1% level.

Table A2.

Results of the unit roots tests.

Table A2.

Results of the unit roots tests.

| Indicators | ADF | |

|---|---|---|

| t-Statistic | Prob. | |

| CO1 | −4.34166 | 0.0382 ** |

| CO2 | −4.07366 | 0.0522 * |

| CO3 | −3.67037 | 0.0026 *** |

| WS1 | −3.99257 | 0.0578 * |

| WS2 | −4.83192 | 0.0276 ** |

| IM1 | −3.95286 | 0.0686 * |

| IM2 | −4.12982 | 0.0574 * |

| IM3 | −5.04468 | 0.017 ** |

| IM4 | −5.52737 | 0.0099 *** |

| EC1 | −3.58086 | 0.003 *** |

| EC2 | −3.01399 | 0.0752 * |

| EC3 | −3.20618 | 0.0582 * |

| EG1 | −207.857 | 0.0001 *** |

| IT1 | −5.3019 | 0.0129 ** |

| IS1 | −4.5153 | 0.038 ** |

| IS2 | −4.20903 | 0.0523 * |

| LEP | −3.99101 | 0.0657 * |

| LSP | −3.87182 | 0.066 * |

| LNP | −2.38238 | 0.0239 ** |

Notes: * Denotes significance at 10% level; ** denotes significance at 5% level; *** denotes significance at 1% level.

Table A3.

Results of Johansen cointegration test.

Table A3.

Results of Johansen cointegration test.

| Indicators | Probability | Indicators | Probability | Indicators | Probability |

|---|---|---|---|---|---|

| LEP-CO1 | 0.0479 | LSP-CO1 | 0.0003 | LNP-CO1 | 0.0122 |

| LEP-CO2 | 0.0021 | LSP-CO2 | 0.0000 | LNP-CO2 | 0.0043 |

| LEP-CO3 | 0.0290 | LSP-CO3 | 0.0000 | LNP-CO3 | 0.0002 |

| LEP-WS1 | 0.0101 | LSP-WS1 | 0.0001 | LNP-WS1 | 0.0024 |

| LEP-WS2 | 0.0037 | LSP-WS2 | 0.0000 | LNP-WS2 | 0.0000 |

| LEP-IM1 | 0.0418 | LSP-IM1 | 0.0000 | LNP-IM1 | 0.0470 |

| LEP-IM2 | 0.0252 | LSP-IM2 | 0.002 | LNP-IM2 | 0.0072 |

| LEP-IM3 | 0.0172 | LSP-IM3 | 0.0000 | LNP-IM3 | 0.0201 |

| LEP-IM4 | 0.0057 | LSP-IM4 | 0.0000 | LNP-IM4 | 0.0020 |

| LEP-EC1 | 0.0295 | LSP-EC1 | 0.0001 | LNP-EC1 | 0.0274 |

| LEP-EC2 | 0.0424 | LSP-EC2 | 0.0003 | LNP-EC2 | 0.0019 |

| LEP-EC3 | 0.0071 | LSP-EC3 | 0 | LNP-EC3 | 0.0367 |

| LEP-EG1 | 0 | LSP-EG1 | 0.0001 | LNP-EG1 | 0.0132 |

| LEP-IT1 | 0.0133 | LSP-IT1 | 0 | LNP-IT1 | 0.0068 |

| LEP-IS1 | 0.0001 | LSP-IS1 | 0.0002 | LNP-IS1 | 0.0436 |

| LEP-IS2 | 0.0149 | LSP-IS2 | 0.0004 | LNP-IS2 | 0.0013 |

Table A4.

Granger causality.

Table A4.

Granger causality.

| Hypot. | t-St. | Prob. | Conc. | Hypot. | t-St. | Prob. | Conc. | Hypot. | t-St. | Prob. | Conc. |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LEP-CO1 | 1.74 | 0.286 | Accept | LSP-CO1 | 0.87 | 0.486 | Accept | LNP-CO1 | 3.13 | 0.092 * | Reject |

| CO1-LEP | 0.59 | 0.598 | Accept | CO1-LSP | 16.5 | 0.012 ** | Reject | CO1-LNP | 4.24 | 0.093 * | Reject |

| LEP-CO2 | 1.07 | 0.595 | Accept | LSP-CO2 | 0.31 | 0.752 | Accept | LNP-CO2 | 0.88 | 0.378 | Accept |

| CO2-LEP | 15.7 | 0.061 * | Reject | CO2-LSP | 13.7 | 0.000 *** | Reject | CO2-LNP | 4.33 | 0.076 * | Reject |

| LEP-CO3 | 0.28 | 0.614 | Accept | LSP-CO3 | 2.14 | 0.233 | Accept | LNP-CO3 | 43.4 | 0.011 ** | Reject |

| CO3-LEP | 3.39 | 0.100 * | Reject | CO3-LSP | 27.8 | 0.005 *** | Reject | CO3-LNP | 52.5 | 0.091 * | Reject |

| LEP-WS1 | 0.29 | 0.839 | Accept | LSP-WS1 | 3.13 | 0.092 * | Accept | LNP-WS1 | 4.62 | 0.091 * | Reject |

| WS1-LEP | 14.5 | 0.066 * | Reject | WS1-LSP | 2.95 | 0.096 * | Reject | WS1-LNP | 37.3 | 0.091 * | Reject |

| LEP-WS2 | 21.3 | 0.016 ** | Reject | LSP-WS2 | 3.01 | 0.099 * | Reject | LNP-WS2 | 19.5 | 0.000 *** | Reject |

| WS2-LEP | 6.99 | 0.033 ** | Reject | WS2-LSP | 30.7 | 0.004 *** | Reject | WS2-LNP | 6.58 | 0.054 * | Reject |

| LEP-IM1 | 0.15 | 0.706 | Accept | LSP-IM1 | 2.91 | 0.092 * | Reject | LNP-IM1 | 0.18 | 0.842 | Accept |

| IM1-LEP | 0.99 | 0.352 | Accept | IM1-LSP | 0.04 | 0.953 | Accept | IM1-LNP | 1.52 | 0.323 | Accept |

| LEP-IM2 | 0.79 | 0.513 | Accept | LSP-IM2 | 4.06 | 0.084 * | Reject | LNP-IM2 | 2.66 | 0.097 * | Reject |

| IM2-LEP | 1.09 | 0.418 | Accept | IM2-LSP | 12.9 | 0.009 *** | Reject | IM2-LNP | 0.17 | 0.692 | Accept |

| LEP-IM3 | 0.93 | 0.465 | Accept | LSP-IM3 | 4.10 | 0.098 * | Reject | LNP-IM3 | 1.22 | 0.307 | Accept |

| IM3-LEP | 1.71 | 0.290 | Accept | IM3-LSP | 19.1 | 0.009 *** | Reject | IM3-LNP | 3.49 | 0.094 * | Reject |

| LEP-IM4 | 0.62 | 0.706 | Accept | LSP-IM4 | 1.69 | 0.293 | Accept | LNP-IM4 | 2.04 | 0.465 | Accept |

| IM4-LEP | 78.3 | 0.028 ** | Reject | IM4-LSP | 52.8 | 0.001 *** | Reject | IM4-LNP | 25.1 | 0.014 ** | Reject |

| LEP-EC1 | 0.18 | 0.683 | Accept | LSP-EC1 | 3.20 | 0.385 | Accept | LNP-EC1 | 8.18 | 0.024 ** | Reject |

| EC1-LEP | 3.74 | 0.094 * | Reject | EC1-LSP | 28.4 | 0.097 * | Reject | EC1-LNP | 0.18 | 0.677 | Accept |

| LEP-EC2 | 0.23 | 0.649 | Accept | LSP-EC2 | 6.92 | 0.050 * | Reject | LNP-EC2 | 16.0 | 0.012 ** | Reject |

| EC2-LEP | 4.94 | 0.062 * | Reject | EC2-LSP | 0.63 | 0.578 | Accept | EC2-LNP | 1.27 | 0.372 | Accept |

| LEP-EC3 | 2.06 | 0.243 | Accept | LSP-EC3 | 2.35 | 0.212 | Accept | LNP-EC3 | 4.96 | 0.061 * | Accept |

| EC3-LEP | 5.89 | 0.064 * | Reject | EC3-LSP | 5.53 | 0.071 * | Reject | EC3-LNP | 0.51 | 0.495 | Accept |

| LEP-EG1 | 0.56 | 0.479 | Accept | LSP-EG1 | 12.1 | 0.000 *** | Reject | LNP-EG1 | 1.42 | 0.342 | Accept |

| EG1-LEP | 3.25 | 0.095 * | Reject | EG1-LSP | 27.8 | 0.005 *** | Reject | EG1-LNP | 2.70 | 0.091 * | Reject |

| LEP-IT1 | 2.98 | 0.397 | Accept | LSP-IT1 | 0.66 | 0.567 | Accept | LNP-IT1 | 1.03 | 0.433 | Accept |

| IT1-LEP | 49.9 | 0.033 ** | Reject | IT1-LSP | 10.6 | 0.025 ** | Reject | IT1-LNP | 8.49 | 0.036 ** | Reject |

| LEP-IS1 | 9.37 | 0.031 ** | Reject | LSP-IS1 | 3.53 | 0.092 * | Reject | LNP-IS1 | 0.56 | 0.605 | Accept |

| IS1-LEP | 0.97 | 0.453 | Accept | IS1-LSP | 0.19 | 0.673 | Accept | IS1-LNP | 3.15 | 0.090 * | Reject |

| LEP-IS2 | 26.9 | 0.091 * | Reject | LSP-IS2 | 12.6 | 0.207 | Accept | LNP-IS2 | 0.33 | 0.732 | Accept |

| IS2-LEP | 1.98 | 0.472 | Accept | IS2-LSP | 39.6 | 0.038 ** | Reject | IS2-LNP | 6.12 | 0.060 * | Reject |

Note: * Denotes that the null hypothesis is rejected at 0.1 level; ** denotes that the null hypothesis is rejected at 0.05 level; *** denotes that the null hypothesis is rejected at 0.01 level. The null hypothesis is accepted for all other values.

Figure A1.

The diagram of the relationships in structural equation modeling: (a) CO, (b) WS, (c) IM, (d) EC, (e) EG, (f) IT, (g) IS on LEP, LSP, and LNP.

References

- EUR-Lex. Regulation (EU) No 537/2014 of the European Parliament and of the Council of 16 April 2014 on Specific Requirements Regarding Statutory Audit of Public-Interest Entities and Repealing Commission Decision 2005/909/EC. Available online: http://data.europa.eu/eli/reg/2014/537/oj (accessed on 10 December 2022).

- EUR-Lex. Directive (EU) 2022/2464 of the European Parliament and of the Council of 14 December 2022 Amending Regulation (EU) No 537/2014, Directive 2004/109/EC, Directive 2006/43/EC and Directive 2013/34/EU, as Regards Corporate Sustainability Reporting—Corporate Sustainability Reporting Directive (CSRD) COM/2021/189. Available online: http://data.europa.eu/eli/dir/2022/2464/oj (accessed on 10 December 2022).

- European Comission. Europe’s Digital Decade: Commission Sets the Course towards a Digitally Empowered Europe by 2030. Available online: https://ec.europa.eu/commission/presscorner/detail/en/IP_21_983 (accessed on 10 December 2022).

- Bouchetara, M. The Impact of Digitalization on the Quality of Accounting Information. The Case of Algeria. Audit Financ. 2022, 2, 295–303. [Google Scholar] [CrossRef]

- Gușe, G.R.; Mangiuc, M.D. Digital Transformation in Romanian Accounting Practice and Education: Impact and Perspectives. Amfiteatru Econ. 2022, 24, 252–267. [Google Scholar] [CrossRef]

- Vărzaru, A.A.; Bocean, C.G.; Mangra, M.G.; Mangra, G.I. Assessing the Effects of Innovative Management Accounting Tools on Performance and Sustainability. Sustainability 2022, 14, 5585. [Google Scholar] [CrossRef]

- Abdelraheem, A.; Hussaien, A.; Mohammed, M.; Elbokhari, Y. The Effect of Information Technology on the Quality of Accounting Information. Accounting 2021, 7, 191–196. [Google Scholar] [CrossRef]

- Huy, P.Q.; Phuc, V.K. The Impact of Public Sector Scorecard Adoption on the Effectiveness of Accounting Information Systems Towards the Sustainable Performance in Public Sector. Cogent Bus. Manag. 2020, 7, 1717718. [Google Scholar] [CrossRef]

- Farida, I.; Mulyani, S.; Akbar, B.; Setyaningsih, S.D. Quality and efficiency of accounting information systems. Utopía Y Prax. Latinoam. 2021, 26, 323–337. [Google Scholar]

- Edmunds, A.; Morris, A. The problem of information overload in business organisations: A review of the literature. Int. J. Inf. Manag. 2000, 20, 17–28. [Google Scholar] [CrossRef]

- Rowbottom, N.; Locke, J.; Troshani, I. When the tail wags the dog? Digitalisation and corporate reporting. Account. Organ. Soc. 2021, 92, 101226. [Google Scholar] [CrossRef]

- United Nations. Transforming Our World: The 2030 Agenda for Sustainable Development; United Nations Resolution 70/1; United Nations: New York, NY, USA, 2015; Available online: https://sdgs.un.org/2030agenda (accessed on 10 December 2022).