Mobile Broadband Performance Evaluation: Analysis of National Reports

Abstract

:1. Introduction

- Consumers to comprehend and compare the quality of the communication service they are receiving as well as the government’s/regulator’s relentless efforts in ensuring a high level of service quality and guaranteeing investments to improve said quality for its citizens;

- Countries to continue as leading nations in communication service and meet the targets set out by the broadband commission;

- Mobile broadband companies to understand their status within and outside the country, which aids their R & D efforts to stay ahead of competitors such that the country meets its “5G+ Strategy”;

- Regulators to find out new and suitable metrics and synchronize them.

2. Methodology

- Regulator: The body responsible for mobile broadband service quality evaluation, the year the regulator started the assessment, the year regulators published the most recent report, and which year that report is about. For instance, Germany’s last report was published in 2019 about the year 2018.

- Evaluated service: The mobile broadband service among 2G, 3G, or 4G is evaluated in the report. For instance, Singapore does not report on services such as 2G because it is no longer provided, whereas countries such as Japan discuss mobile broadband service in general rather than separately.

- Operators: The most prominent operators are mentioned in this part.

- Method: The method used to obtain the data and if statistical correction was used to account for errors is discussed here. Multiple means of obtaining data can be used.

- Metrics: As mentioned earlier, each country used different sets of metrics to evaluate the quality of their mobile broadband service. However, most of them provided some means of measuring coverage.

- Results: This topic is used to discuss the results obtained from each report and the policies outlined to improve the quality of the mobile broadband service.

- Policies: Policies outlined to improve the quality of mobile broadband service are presented.

3. Case Studies

3.1. Broadband Deployment Report: USA

- With the 5 Mbps/1 Mbps speed test, compared to 2014, rural and tribal lands have shown a 3% increase in geographical mobile service coverage in 2018, whereas there is an insignificant increase in urban coverage as almost all the area was covered in 2014.

- There is 97% of urban and 83% of rural areas coverage of 4G service with 10 Mbps/3 Mbps in 2018. However, this result is significant compared to 2014, which was just 70% and 80% coverage for rural and urban, respectively.

- The rule for an over-the-air reception device (OTARD) is expected to be updated such that 5G deployment can start.

- A Universal Service Fund (USF) to improve the rural area coverage is proposed.

- A new “Digital Opportunity Data Collection Order” data collection mechanism is adapted to determine the availability of broadband service.

3.2. Evaluation Report: Korea

- Data/Internet

- –

- Connection success rate (SR) → The proportion of calls that attempted to access the measurement server and succeeded.

- –

- Transmission success rate (SR) → The proportion of calls that successfully connect to the measurement server and sent the data faster than the minimum speed.

- –

- Delay time → The time between signal transmission to the measurement server and receipt of an acknowledgement signal.

- –

- Packet loss rate →The proportion of the data that cannot be sent when sending and receiving the data between the device and measurement server of the service provider.

- –

- Transmission rate → Data sending and receiving speed between the device and measurement server of the service provider.

- –

- Web surfing time → The time required to display the entire web page on the device screen after the user inputs the website address.

- Voice

- –

- Successful connection → Success if connected within 20 s of pressing the call button.

- –

- Call drop → Dropped during a call (65 s).

- –

- Poor sound quality → If the sound quality value (1–5 points) is below 2.2 or 1.9 more than two times in a row (2.2: difficult to understand, 1.9: impossible to understand).

- Coverage

- –

- Over-claim Rate → A proportion of the area where coverage opened by the communications service provider is overstated compared to the actual coverage information.

- The average download to upload speed stands at 150 Mbps by 44 Mbps, which showed 13 and 44 percent increases, respectively, compared to the year before. While the delay is below 40 ms on average, the loss rate is below 1%. All MNOs have considerably great services in terms of data via 4G/LTE services. This trend is similar for 3G services

- The crowd-sourced evaluation confirms the result obtained by the professional evaluator. The data collected via the app are categorized into five groups (A–E) based on maximum speed. The devices under group A have the same specification as that of the professional evaluator.

- The quality of voices is measured while using the same or a different company. The same company refers to the caller and receiver being on the same MNO as well as using the same device types whereas a different company refers to the caller and receiver being on the different MNO as well as using the different device types. Call success rate means the ability to make a successful connection under 20 s, no call drop for >65, and have a sound quality above 2.2. While the 4G-LTE service provides the highest quality, 2G provides the lowest, which is expected.

- While examining the MNOs coverage claim, the report indicated that the average overstatement is 12.9%. LG U+ has the highest overstatement at 34%, whereas SK and KT have 3% and 1% over claim rates, respectively.

3.3. Connected Nations: UK

- As of 2019, 4G is mainly used for carrying about 90% of all data traffic, while the rest is shared by 2G and 3G. On the other hand, 2G and 3G carried 6% and 73% of the voice traffic, respectively, while the remaining is served by 4G.

- Outside premise indicates locations where people usually live, work, or travel. It is assumed, by this regulator/OfCom, to be a good indicator of the availability of coverage.

- –

- The voice from all MNOs is at 99%, and from at least one MNO is 100%.

- –

- 4G data from all MNOs is about 97% available, whereas from at least one is about 100%.

- However, there is a significant difference between urban and rural areas.

- –

- The voice from all urban areas is at 100%, while that number is about 94% in the rural areas. Nevertheless, a voice from at least one MNO in rural areas remains at 100%.

- –

- With regard to 4G availability, in rural areas, at least one MNO it is as high as 99% and another is as high as 100%, whereas for urban areas, one is as low as 85% and one MNO is at least 99%.

- –

- Among MNOs, while EE has the best coverage in both urban and rural areas, Three has the least.

- Indoor/inside premise evaluation is presented in the report. Here, we present a summary of the indoor results as of 2019.

- –

- The voice from all is 93%, and from at least one is 100%. Here, O2 and Vodafone provide 99% of voice service, whereas EE and Three provide 96%

- –

- 4G from all is 80%, and 99% from at least one. In terms of 4G coverage, there is no significant difference from MNOs, but it is not specifically stated in the report.

- The indoor coverage results of the urban and rural gap in terms of both voice call and 4G coverage is very large.

- –

- Voice service from all urban areas is at 97%, whereas only 68% of indoor premises in rural areas benefit from this service.

- –

- This inconsistency becomes worse when considering 4G services. EE has better service in rural areas, whereas O2 and Vodafone provide a superior service in urban areas.

- Specific parts of the country that people often go to/use, such as roads, have also been checked for coverage. Motorways and A roads receive 81% of voice service coverage from all MNOs, whereas B roads only have 67% coverage. In terms of 4G service, the former receives 95% coverage, while the latter only receives 90%. This result is not broken down into rural and urban areas. Additionally, railroad coverage data are still under analysis.

- Thus far, the discussion focused on what percentage of the areas where people are present is receiving voice and 4G coverage. Actual physical land coverage is also presented in the report.

- –

- There is a 79% from all MNOs and 95% from at least one MNO of voice service in all of the UK’s geographic areas. Vodafone and O2 have a 91% geographical coverage, whereas EE and Three are at only 86% for voice service.

- –

- As for 4G data service, the is 66% from all MOs and 91% from at least one operator. EE has the highest 4G geographical presence with 84%, whereas O2 has the lowest with 76%.

3.4. The State of the Internet in France

- Availability of voice → making a phone call for >2 min;

- Availability of Short Message Service (SMS) → receiving a message in <10 s;

- 4G data.

- –

- Web success rate → loading the 30 most visited websites in <10 s;

- –

- Download speed → receiving 10 Mbit data in <1 min;

- –

- Upload speed → sending 2 Mbit data in <1 min;

- –

- Streaming success rate→ watching a high definition (HD) video for >2 min with perfect quality.

- In all the metrics, the geography and population coverage of France, for both voice and 4G data, from at least one operator is >99%.

- The voice and SMS success rate of all four MNOs in France in all areas are 91% and 94%, respectively. These numbers, however, vary in rural and urban areas. For instance, the success rate of making a call that is >2 min with perfect quality in all indoor areas is 90%, whereas it is at 84% in rural areas and 94%.

- For 4G mobile broadband services, the average download and upload speeds in indoors are 39 Mbps and 7 Mbps, respectively. The average download and upload speeds indoors are 50 Mbps and 13 Mbps, respectively. As expected, there is a difference between urban, suburban, and rural areas. Furthermore, Orange provides the best 4G service; Free is the least effective.

3.5. Annual Survey on InfoComm Usage: Singapore

- Voice

- –

- Outdoor/Tunnel coverage → SNR >−100 dBm;

- –

- Call success rate (SR) → connecting to calling or getting a busy tone;

- –

- Call drop rate (DR) → unintended disconnection during >100 s call;

- –

- Indoor coverage → > 85% coverage per building.

- Data

- –

- Outdoor/Tunnel coverage → SNR>−109 dBm;

- –

- Indoor coverage → < 85% coverage per building.

- According to the IMDA’s 3G Public Cellular Mobile Telephone Service (PCMTS) QoS framework, MNOs’ outdoor coverage should be >99%. That is, the SNR received from an MNO by stations in any outdoor area in Singapore should be >−100 dBm. As of 2019, all three MNOs provide >99% voice service coverage. For tunnels, only a pass or fail is given based on the services provided and all three MNOs passed in all tunnels.

- Similarly, a 99% call success rate is expected using the PCMTS framework, which all three MNOs fulfilled.

- The call drop rate should be <1% under the PCMTS framework, which none of the MNOs are above.

- Sixty buildings were selected to test the indoor services. Even though the data from the fourth quarter of 2019 are not completed yet, all three MNOs have an average score of 59/60. This means there is 99% indoor voice service coverage.

- As for 4G service, all three prominent MNOs and one new operator (TPG) are evaluated. The 4G service QoS framework was lowered for TPG since it is new. However, all four MNOs provide >99% outdoor service, have a pass mark in all tunnels, and have an average score of 58/60 in indoor coverage.

3.6. Communication Report: Australia

- Customer satisfaction → rating out of 5;

- Pre- vs. postpaid service;

- Market share.

- Coverage of population from at least one MNO for 3G and 4G services reached 99.4%. In addition, there are now >400 5G-capable base stations in Australia.

- Among the total population, 96% have mobile phones and 83% have smartphones. There are around 35.9 million mobile subscribers from all MNOs, where 54%, 29%, and 15% of the total subscribers belong to Telstra, Optus, and Vodafone, respectively.

- Among the subscribers, 69% are postpaid while the rest are prepaid. This number is only slightly different from previous years.

- There are arrays of quality of services evaluated through customer satisfaction. Although coverage satisfaction has improved, it is still under 4. The same is true for data speed and voice quality.

3.7. White Paper on Information and Communications: Japan

- Number of subscribers;

- Average revenue per user (ARPU);

- Fixed vs. mobile communication services;

- Data vs. voice services;

- Market share.

- The number of BWA users is estimated to be >136 million and 4G subscribers are more than 66 million.

- While the percentage of fixed-line communication sales has been shrinking over the years, those of mobile broadband have been growing.

- Although yearly ARPU is increasing, KDDI and SoftBank registered the highest and lowest ARPU, respectively.

- Voice service shrunk over the years while the usage of data services increased significantly over the years.

- As of 2019, NTT DOCOMO has the highest mobile subscribers market share with 39% total market. KDDI and SoftBank have 27% and 23% shares of the market, while the rest is shared among the subsidies of the three companies.

3.8. Annual Report, 20 Years of Responsibility for Networks: Germany

- Coverage → from at least one MNO and each MNO;

- Speed → download;

- Applications → Messages sent, call minutes, and data volumes;

- Revenue per sim card;

- Number of subscribers.

- In 2018, the 4G data service is available for 97.5% and 95.5% of the population with 2 Mbps and 6 Mbps download speed from at least one MNO. When considering individual MNOs, DTAG, Vodafone and Telefonika Germany provide 98%, 93%, and 88% coverage, respectively, which means the service from all MNOs is 95%.

- More than 1993 m GB of data were sent through mobile broadband communication using 6.78 million UMTS- and LTE-enabled devices.

- On the other hand, while the calls made via mobile broadband services are on the rise and surpassing fixed network calls, the number of SMS is on the decline. In the year 2018, around 119 billion minutes and >8.9 billion messages were sent.

- While the revenue from data service is on the rise, the revenue generated from voice and SMS remains constant when compared to the past data.

4. 5G Communication Status

- Support service diversity in terms of QoS, traffic patterns, mobility and/or data types;

- Some of these services are incompatible and require 5G adaptable via programmability;

- Needs to serve new radio technologies and work with the old CN;

- Allow distributed network architecture unlike its centralized predecessors;

- Have separation of control and user plane functions;

- Process and store data to reduce congestion and response time;

- Possess intelligence such that automation and interoperability can be implemented;

- Serve a user demand with optimal capacity;

- Guarantee reliability with sufficient performance;

- Provide security and privacy to devices as well as data;

- Be energy efficient.

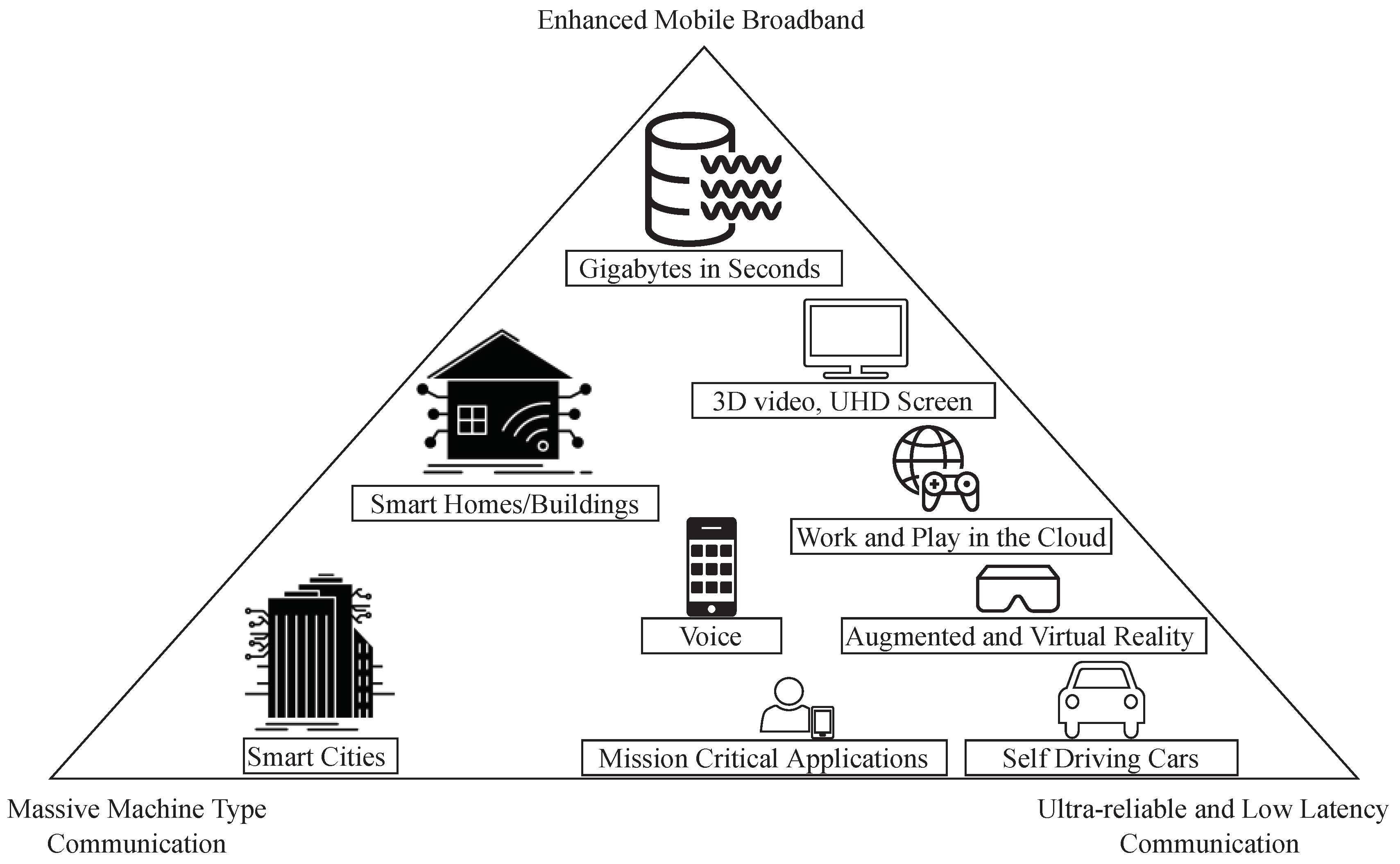

4.1. Applications and Services

- Ultra-reliable and low-latency communication (URLLC) → Extremely delay-sensitive applications such as e-health, autonomous vehicles, and industrial automation are associated with this class [18].

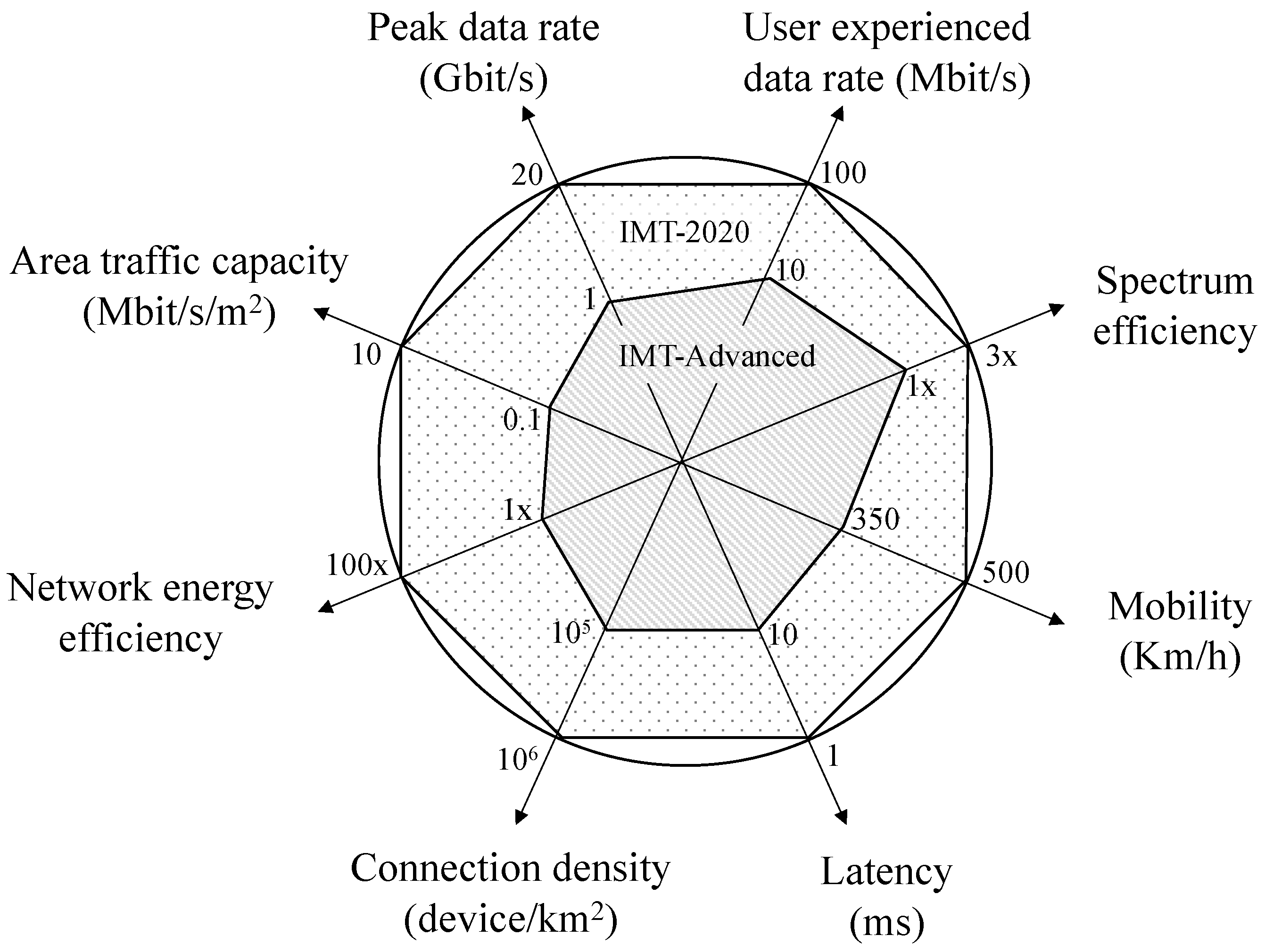

4.2. Evaluating 5G Performance

4.3. Metrics for 5G

- eMMB metrics → The traditional metrics that are discussed above, which were used to evaluate the performance of mobile broadband communication, can be harmonized, and new methodologies such as the usage of UAVs can be incorporated to evaluate eMBB

- mMTC metrics → Research on metrics used to assess the quality of IoT is presented in later sections, which mostly can also be applied for mMTC.

- URLLC metrics → As discussed, the unique behavior of applications requires new and innovative metrics to evaluate applications and services under this class.

4.4. Status by Country

- USA → Three out of four major operators, AT&T, Sprint, and Verizon, had plans to deploy 5G networks in multiple cities starting in late 2018.

- –

- States have announced a public–private partnership to improve the deployment of 5G and other broadband communication infrastructures.

- –

- Recent press releases by FCC indicated the availability of a new spectrum for 5G, which means more deployments to follow [29].

- UK → Ofcom claimed the UK was the leader of 5G in Europe as all four prominent MNOs started providing the service in more than 40 cities and towns [30]. Ofcom is also exploring new schemes to promote 5G.

- France → There is very little in the report from ARCEP, which could be because France is planning to launch 5G in the year 2020.

- –

- One unique requirement for 5G spectrum holders is that MNOs should deploy IPv6 compatible to ensure future-proof infrastructure.

- Singapore → There are several efforts currently underway IMDA to begin the deployment of 5G by 2020 [32].

- –

- 4G TDD networks are ordered to have stringent synchronization to minimize interference such that there is minimal use of inter-operator guard bands.

- –

- Spectrum sharing as most of the spectrum occupied by 4G continues to be so for the coming few years.

- Australia → Two major MNOs, Telstra and Optus, have rolled out 5G, starting in 2019. Currently, there are more than 400 5G enabled sites in Australia. Compared to the rest of the nations, there are more developments in the 5G arena in Australia [15].

- –

- A communication standard to support connected and autonomous vehicles is introduced.

- –

- A five-year, 2018–2022, spectrum management plan that promotes 5G was released.

- –

- All major operators issued plans to start rolling out 5G by the year 2020.

- Japan → MIC considers 5G as an ICT infrastructure that should not only cover residential areas but also be available nationwide. 5G was expected to be available in Sep. 2019 [16].

- –

- Contests to promote and generate ideas on the usage of 5G were held in 2019.

- Germany → As Bundesnetzagentur expects the rollout of 5G in 2020 and 2021, only spectrum regulations are in place so far, [17].

- –

- Following old regulations, MNOs are expected to provide >97% coverage of rural and urban areas as well as transport routes.

- Korea → All three major MNOs in Korea have rolled out 5G in 2019. Although there is no resounding public reception as its predecessor 4G.

- –

- The regulatory body is also working on how to evaluate the different services that come with 5G.

5. Discussion and Conclusions

- Universal fund to improve coverage in rural areas;

- Push MNOs to share infrastructure in rural areas to improve coverage;

- Include and validate third party evaluation to improve quality assessment;

- Create penalties for MNOs that does not deliver on promised quality;

- Create consumer protection code/document;

- Demand MNOs to build future proof infrastructure;

- Installing more base stations in and around transportation facilities.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Roberts, L.G. The evolution of packet switching. Proc. IEEE 1978, 66, 1307–1313. [Google Scholar] [CrossRef]

- Murara, B. IMT-2020 Network High Level Requirements. Available online: https://www.itu.int/en/ITU-T/Workshops-and-Seminars/standardization/20170402/Documents/S2_4.%20Presentation_IMT (accessed on 10 March 2020).

- del Portillo, I.; Eiskowitz, S.; Crawley, E.F.; Cameron, B.G. Connecting the other half: Exploring options for the 50% of the population unconnected to the internet. Telecommun. Policy 2021, 45, 102092. [Google Scholar] [CrossRef]

- Falch, M.; Henten, A. Dimensions of broadband policies and developments. Telecommun. Policy 2018, 42, 715–725. [Google Scholar] [CrossRef]

- Gerli, P.; Van der Wee, M.; Verbrugge, S.; Whalley, J. The involvement of utilities in the development of broadband infrastructure: A comparison of EU case studies. Telecommun. Policy 2018, 42, 726–743. [Google Scholar] [CrossRef] [Green Version]

- Ford, G.S. Is faster better? Quantifying the relationship between broadband speed and economic growth. Telecommun. Policy 2018, 42, 766–777. [Google Scholar] [CrossRef]

- Oughton, E.J.; Frias, Z. The cost, coverage and rollout implications of 5G infrastructure in Britain. Telecommun. Policy 2018, 42, 636–652. [Google Scholar] [CrossRef]

- Yu-Han, C.; James, E. 5G Technology, Market and Forecasts 2022–2032; IDTechEx: Cambridge, UK, 2021. [Google Scholar]

- Paolo, L.; Therese, H. BEREC OECD Webinar BEREC End Users QoS Guidelines. Webinar 2020. Available online: https://berec.europa.eu/eng/events/berec_events_2020/244-berec-oecd-webinar-on-quality-of-services-and-quality-of-experience (accessed on 25 June 2020).

- FCC. 2020 Broadband Deployment Report, June 8, 2020. Available online: https://docs.fcc.gov/public/attachments/FCC-20-50A1.pdf. (accessed on 12 July 2020).

- NIA. National Informatization White Paper 2018. Available online: https://www.nia.or.kr/common/board/Download.do?bcIdx=20861&cbIdx=44086&fileNo=2 (accessed on 30 April 2020).

- Ofcom. Connected Nations 2019-UK Report; Ofcom: London, UK, 2019; p. 49. Available online: https://www.ofcom.org.uk/__data/assets/pdf_file/0023/186413/Connected-Nations-2019-UK-final.pdf (accessed on 10 May 2020).

- ARCEP. The State of the Internet in France Report. 8 June 2020. Available online: https://en.arcep.fr/uploads/tx_gspublication/report-state-internet_2020-edition_250620-ENG.pdf. (accessed on 13 December 2020).

- IMDA. Annual Survey on Infocomm Usage in Households and by Individuals; IMDA: Singapore, 2019; p. 26. Available online: https://www.imda.gov.sg/-/media/Imda/Files/Infocomm-Media-Landscape/Research-and-Statistics/Survey-Report/2019-HH-Public-Report_09032020.pdf (accessed on 1 December 2021).

- ACMA. Communications Report 2018–2019. Available online: https://www.acma.gov.au/sites/default/files/2020-04/Communications%20report%202018-19.pdf (accessed on 25 May 2020).

- MIC. Information and Communications in Japan 2019. Available online: https://www.soumu.go.jp/main_sosiki/joho_tsusin/eng/whitepaper/2019/index.html (accessed on 15 September 2020).

- Bundesnetzagentur. Bundesnetzagentur–Publications–Annual Report 2019; Bundesnetzagentur: Bonn, Germany, 2019. Available online: https://www.bundesnetzagentur.de/SharedDocs/Downloads/EN/BNetzA/PressSection/ReportsPublications/2020/AnnualReport19.pdf;jsessionid=9BF8F5C81D17C8B7779A6DF18C7DAAB7?__blob=publicationFile&v=1 (accessed on 22 November 2020).

- Husenovic, K.; Bedi, I.; Maddens, S.; Bozsoki, I.; Daryabwite, D.; Sundberg, N.; Maniewicz, M. Setting the scene for 5g: Opportunities & Challenges; International Telecommunication Union: Geneva, Switzerland, 2018. [Google Scholar]

- Lehr, W.; Queder, F.; Haucap, J. 5G: A new future for Mobile Network Operators, or not? Telecommun. Policy 2021, 45, 102086. [Google Scholar] [CrossRef]

- Oughton, E.J.; Lehr, W.; Katsaros, K.; Selinis, I.; Bubley, D.; Kusuma, J. Revisiting Wireless Internet Connectivity: 5G vs Wi-Fi 6. Telecommun. Policy 2021, 45, 102127. [Google Scholar] [CrossRef]

- Qualcomm. VR and AR Pushing Connectivity Limits; Qualcomm: San Diego, CA, USA, 2018; Available online: https://www.qualcomm.com/media/documents/files/vr-and-ar-pushing-connectivity-limits.pdf (accessed on 1 December 2021).

- Muluk, T. Enabling Policies for 5G and IoT; ITU Annual Forum on “IoT, Big Data and Smart Cities & Societies” Intel: Dubai, UAE, 2019. [Google Scholar]

- Foukas, X.; Patounas, G.; Elmokashfi, A.; Marina, M.K. Network Slicing in 5G: Survey and Challenges. IEEE Commun. Mag. 2017, 55, 94–100. [Google Scholar] [CrossRef] [Green Version]

- Americas, G. Global 5G: Implications of a Transformational Technology; Rysavy Research: Hood River, OR, USA, 2019; Available online: https://www.5gamericas.org/wp-content/uploads/2019/09/2019-5G-Americas-Rysavy-Implications-of-a-Transformational-Technology-White-Paper.pdf (accessed on 10 July 2020).

- Norp, T. 5G Requirements and Key Performance Indicators. J. Ict Stand. 2018, 15–30. [Google Scholar] [CrossRef] [Green Version]

- Signals Research Group. A Global Perspective of 5G Network Performance, 2019. Available online: https://signalsresearch.com/issue/a-global-perspective-of-5g-network-performance/ (accessed on 7 August 2020).

- Platzgummer, V.; Raida, V.; Krainz, G.; Svoboda, P.; Lerch, M.; Rupp, M. UAV-Based Coverage Measurement Method for 5G. In Proceedings of the 2019 IEEE 90th Vehicular Technology Conference (VTC2019-Fall), Honolulu, HI, USA, 22–25 September 2019; pp. 1–6. [Google Scholar] [CrossRef]

- Pai, A. Chairman Pai on Administration Freeing Up 3.45–3.55 GHz Band for 5G, FCC, 2020. Available online: https://www.fcc.gov/document/chairman-pai-administration-freeing-345-355-ghz-band-5g (accessed on 10 October 2020).

- Ofcom. Connected Nations 2019: Annex A–Methodology; Ofcom: London, UK, 2019. Available online: https://www.ofcom.org.uk/__data/assets/pdf_file/0019/209440/connected-nations-2020-methodology.pdf (accessed on 10 December 2020).

- Ofcom. Supporting the Expanding Role of Wireless Innovation in UK Industry: A Discussion Paper; Ofcom: London, UK, 2019. Available online: https://www.ofcom.org.uk/__data/assets/pdf_file/0020/135362/supporting-role-wireless-innovation-uk-industry.pdf (accessed on 10 December 2020).

- Ofcom. Statement: Enabling Wireless Innovation through Local Licensing; Ofcom: London, UK, 2019. Available online: https://www.ofcom.org.uk/__data/assets/pdf_file/0033/157884/enabling-wireless-innovation-through-local-licensing.pdf (accessed on 10 December 2020).

- IMDA. Consultation Paper Issued by the Info-Communications Media Development Authority; IMDA: Singapore, 2019; p. 26.

- Dasgupta, K.; Gibson, T.; Williams, M. Technological and geographic heterogeneity in broadband markets: The challenge for regulation. Telecommun. Policy 2021, 45, 102042. [Google Scholar] [CrossRef]

- Balmer, R.E.; Levin, S.L.; Schmidt, S. Artificial Intelligence Applications in Telecommunications and other network industries. Telecommun. Policy 2020, 44, 101977. [Google Scholar] [CrossRef]

| Indicator | 2018 Data | Penetration | Source |

|---|---|---|---|

| World Population | 7.6 billion | - | UN |

| Mobile Broadband Subscription | 5.3 billion | 69% | ITU |

| Unique Mobile Subscribers | 5.1 billion | 67% | GSMAi |

| Unique Mobile Internet Subscribers | 3.5 billion | 47% | GSMAi |

| Internet Users | 3.9 billion | 51 % | ITU |

| Active Social media Users | 3.5 billion | 45% | Datareportal (Hootsuite) |

| Fixed Broadband Subscription | 1.1 billion | 14% | ITU |

| Regulator | Evaluated Service | Starting Year | Last Year | Recent Report | |

|---|---|---|---|---|---|

| Australia | ACMA | Comb. | 2005 | 2019 | 2020 |

| France | Arcep | 3G, 4G, Comb. | 1997 | 2019 | 2018 |

| Germany | Bundesnetzagentur | Comb., 4G | 2000 | 2018 | 2020 |

| Korea | NIA | 2G, 3G, 4G, Comb. | 1999 | 2018 | 2018 |

| Japan | MIC | 3G, 4G, Comb. | 1993 | 2018 | 2019 |

| Singapore | IMDA | 3G, 4G | 1990 | 2020 | 2019 |

| UK | OffCom | 2G, 3G, 4G, Comb. | 2004 | 2019 | 2019 |

| US | FCC | 4G | 2000 | 2018 | 2020 |

| Total | Major MNOs | |

|---|---|---|

| Australia | 3 | Telstra, Vodafone, and Optus |

| France | 4 | Bouygues, Free, Orange, and SFR |

| Germany | 3 | Deutsche Telekom AG (DTAG), Vodafone, and Telefonica Germany |

| Korea | 3 | SK, KT, LG U+ |

| Japan | 3 | NTT DOCOMO, KDDI, and SoftBank |

| Singapore | 3 | Singtel, M1, and StarHub |

| UK | 4 | EE, O2, Three, and Vodafone |

| US | 4 | Verizon, T-Mobile, AT&T, and Sprint |

| On Field | MNO | Survey | 3rd Party | Prediction | Stat. | |

|---|---|---|---|---|---|---|

| Australia | X | X | ||||

| France | X | X | X | |||

| Germany | X | X | ||||

| Korea | X | X | X | X | X | |

| Japan | X | X | ||||

| Singapore | X | X | ||||

| UK | X | X | ||||

| US | X | X | X |

| One | All | Indoor | Outdoor | Urban | Rural | V/S | Data | Pop. | Geo. | Roads | Each MNO | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Australia | X | |||||||||||

| France | X | X | X | X | X | X | X | X | X | X | X | X |

| Germany | X | X | X | |||||||||

| Korea | X | X | X | X | X | |||||||

| Japan | X | |||||||||||

| Singapore | X | X | X | X | X | X | X | X | X | |||

| UK | X | X | X | X | X | X | X | X | X | X | X | X |

| US | X | X | X | X | X | X | X | X |

| Metrics | Australia | France | Germany | Korea | Japan | Singapore | UK | US | |

|---|---|---|---|---|---|---|---|---|---|

| Churn | X | ||||||||

| Subscribers | X | X | X | X | X | X | X | X | |

| Speed | Down. | X | X | X | X | ||||

| Up. | X | X | X | X | |||||

| Video SR | X | X | |||||||

| Voice SR | X | X | X | X | |||||

| Web SR | X | ||||||||

| Voice DR | X | ||||||||

| Voice/Year | X | X | |||||||

| Data/year | X | X | |||||||

| Satisfaction | X | ||||||||

| Post. vs. Pre. | X | ||||||||

| Revenue | X | X | X | ||||||

| Others | X | X | X | X | X | X | X | X | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zelalem Jembre, Y.; Jung, W.-y.; Attique, M.; Paul, R.; Kim, B. Mobile Broadband Performance Evaluation: Analysis of National Reports. Electronics 2022, 11, 485. https://doi.org/10.3390/electronics11030485

Zelalem Jembre Y, Jung W-y, Attique M, Paul R, Kim B. Mobile Broadband Performance Evaluation: Analysis of National Reports. Electronics. 2022; 11(3):485. https://doi.org/10.3390/electronics11030485

Chicago/Turabian StyleZelalem Jembre, Yalew, Woon-young Jung, Muhammad Attique, Rajib Paul, and Beomjoon Kim. 2022. "Mobile Broadband Performance Evaluation: Analysis of National Reports" Electronics 11, no. 3: 485. https://doi.org/10.3390/electronics11030485

APA StyleZelalem Jembre, Y., Jung, W.-y., Attique, M., Paul, R., & Kim, B. (2022). Mobile Broadband Performance Evaluation: Analysis of National Reports. Electronics, 11(3), 485. https://doi.org/10.3390/electronics11030485