Power is an important basic industry and public utility related to the national economy and people’s livelihoods. The main purpose of a power market reform is to break the monopoly, improve the production efficiency of the power industry and realize the optimal allocation of resources by introducing the competition mechanism. Chile [

1] was the first country to marketize the electricity market. In 1982, Chile officially promulgated new electricity laws and regulations, which defined the position that the transmission system is open to all domestic power plants and all individual electricity users in the form of official national laws, thus changing the situation of a regional monopoly and starting a new reform in the operation of contract electricity trading and real-time electricity trading; therefore, various power enterprises’ operation changed from monopoly to competition. The power system in Chile has achieved the expected results, which not only ensures the basic stability of electricity prices, but also ensures that power producers can obtain considerable profits; however, some problems are also exposed, including the lack of investment in grid development caused by the imperfect pricing of electricity sales and the imperfect pricing system of the transmission system. After decades of development, the reform of the electricity market in the UK has achieved many phased results [

2]. After four stages of electricity market reform, Britain has established a fair, transparent and open electricity trading market, and introduced privatization and competition through the four aspects of power generation, electricity sales, distribution and electricity sales. However, with the continuous practice of electricity reform, the British electricity market has also exposed some drawbacks, such as the complexity of system marginal price calculations, and the quotations of power producers can not truly reflect their power generation costs. Since the 1990s, China has successively carried out the practice and exploration of electricity marketization reform [

3,

4,

5,

6], and provinces (regions) have carried out various types of reform practices, including transmission and distribution price verification, electricity sales side reform, direct trading, etc., in combination with policy requirements and their own actual conditions. However, it was not until August 27, 2019, when the State Grid Corporation of China issued the Notice of the Ministry of Industry of the State Grid on the Withdrawal of Electricity Sales by Collective Enterprises of the Company System, requiring the collective enterprises of the company system to withdraw from the electricity sales business, that China’s electricity sales side was fully opened, forming a market structure of multiple buyers and sellers, breaking the monopoly of the power grid on the power industry, and making great progress in the construction of electricity marketization. However, there are still problems, such as untimely information disclosure, inadequate market supervision and imperfect pricing mechanisms. The National Energy Market (NEM) of Australia is one of the well-known free-bidding electricity markets in the world. Its electricity reform was based on the experiences and lessons of other countries and adjustments were made according to local conditions. The reform of electricity marketization in Australia has roughly gone through three stages: the structural restructuring of the electricity industry, building a unified electricity market system and re-establishing the electricity regulatory system [

7]; it has always focused on providing users with lower electricity prices, promoting competition among internal departments of the power industry, optimizing energy investment and providing open access to the power network [

8]. After decades of development, Australia’s power system reform has achieved remarkable results, not only in reducing electricity prices and improving the efficiency of the power industry, but also in increasing investment in the power industry, which improved the competitiveness of Australia’s industry. To sum up, the electric power system reform in various countries aims to achieve the following objectives: 1. provide a stable electricity price and power supply; 2. break monopoly barriers and improve competitiveness; and 3. improve the transparency and satisfaction of power trading, and make the power market truly fair, just and open.

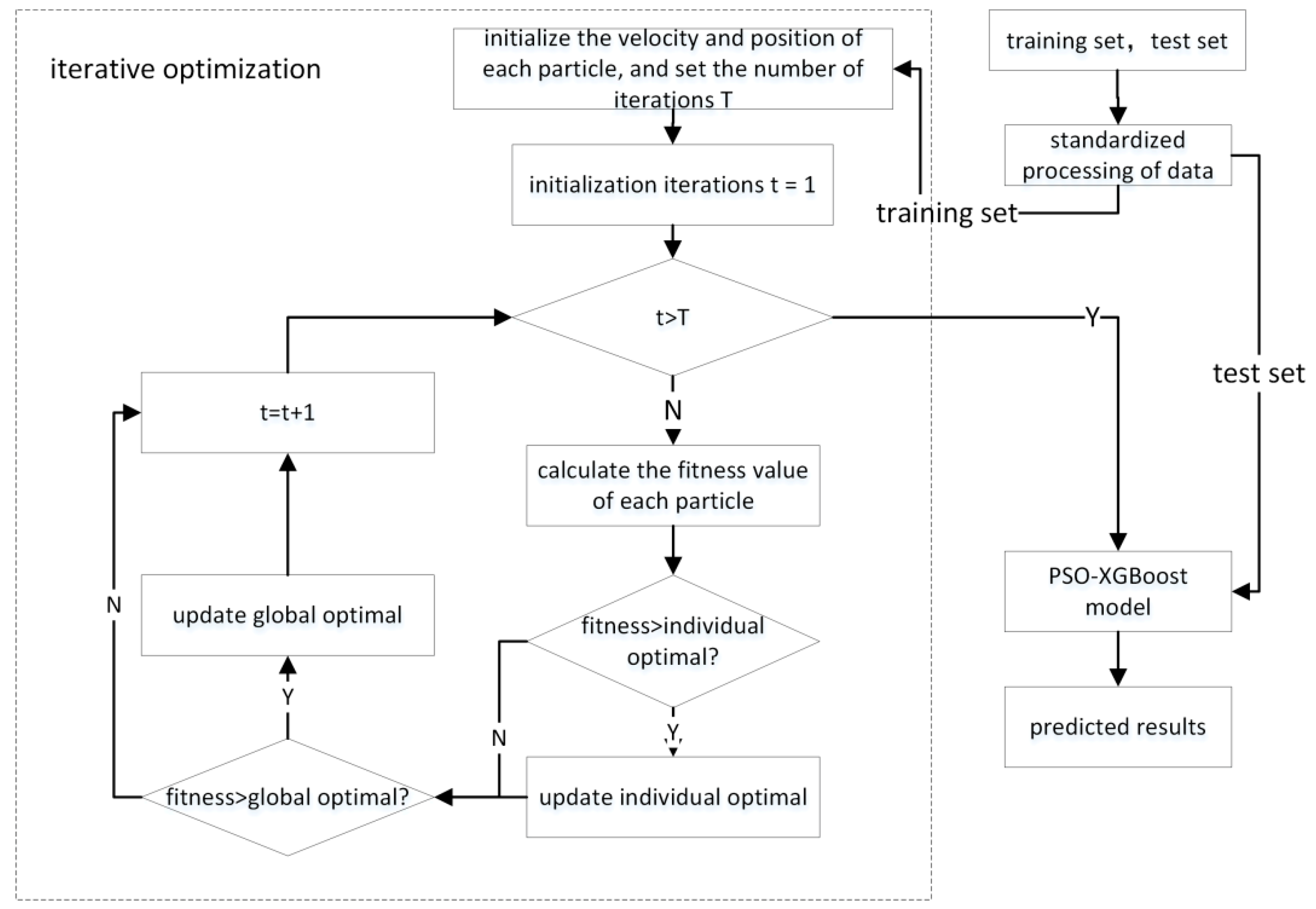

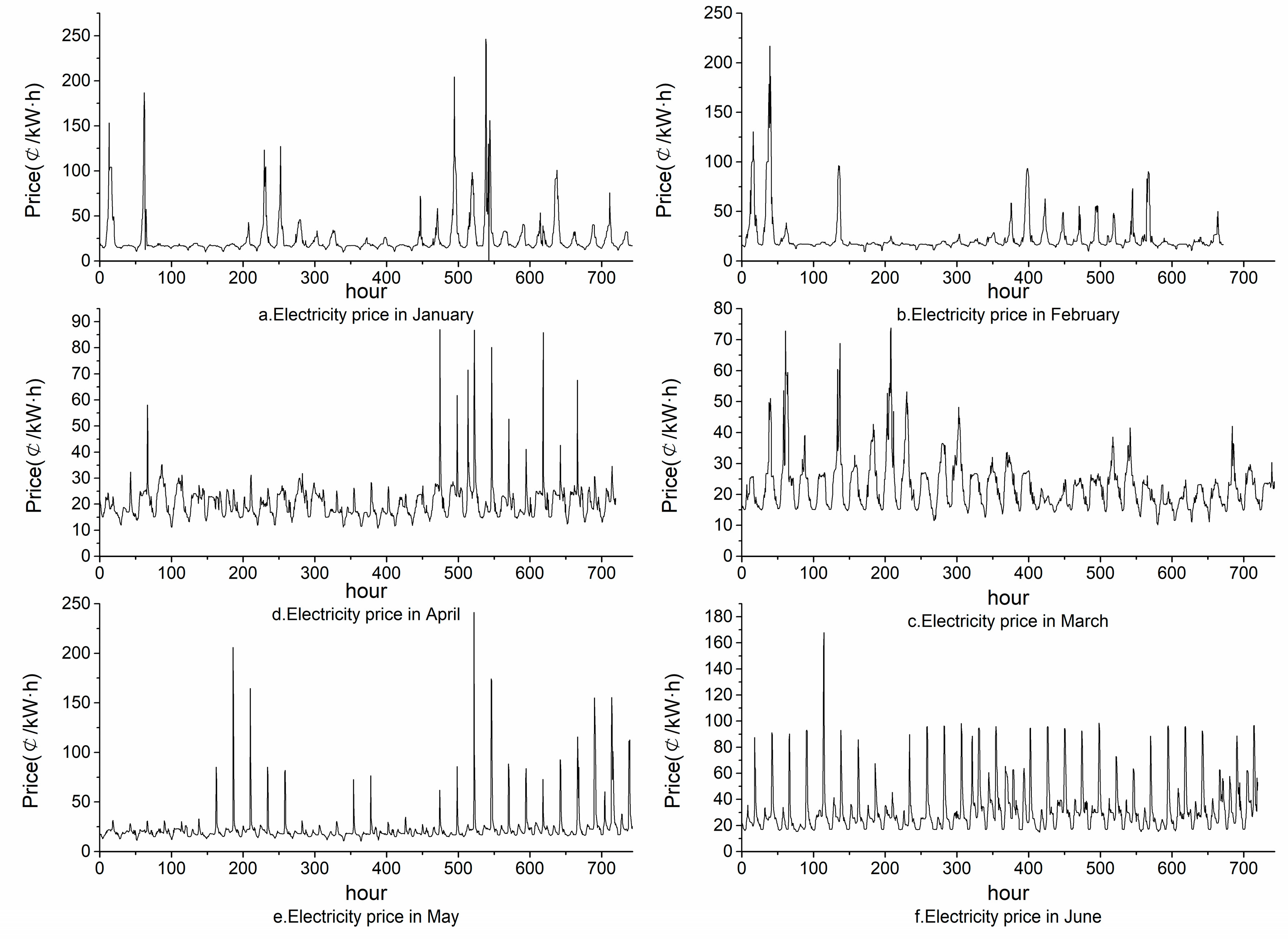

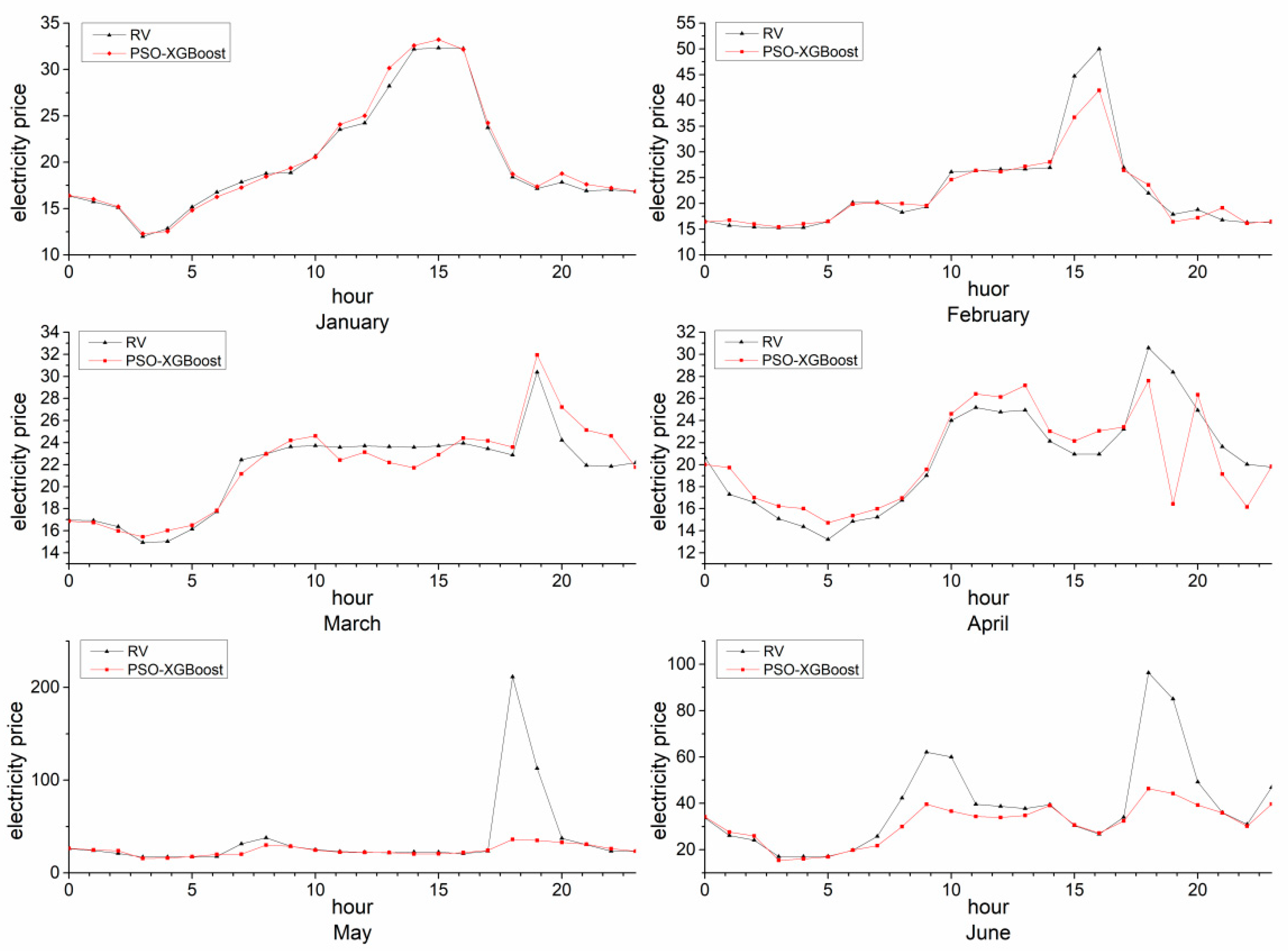

With the continuous advancement of the reforms of the power system and the liberalization of the power sales side in various countries, the power trading market has gradually become the leading development trend in the current power industry, and power resources have become a commodity. The power price is the core content of power market transactions, and power price forecasting is of great significance for the fair trading and supply–demand interaction of all players in the power market. For power producers, they need to make bidding strategies based on an accurate forecast of power prices to meet the principle of maximum income and minimum risk, and accurate forecasting of power prices can enable power producers to accurately grasp the market trends and then formulate the best price strategy. For power purchasers, the accurate prediction of power prices can enable power purchasers to effectively control power consumption and reasonably plan for power consumption according to their own actual conditions, thus reducing the cost of electricity consumption. For market regulation, the accurate prediction of electricity price can provide a scientific basis for formulating various electricity policies, promote the development and progress of the electricity market, and promote the formation of a stable, orderly and healthy market environment [

9]. Therefore, power price forecasting is of great significance. Combined with the historical data on power pricing, this paper uses the PSO-optimized XGBoost to forecast the power price, establishes a power price forecasting model based on the PSO-optimized XGBoost, and compares this model with other models to prove the effectiveness and correctness of PSO-XGBoost.