Integrated Framework to Assess the Extent of the Pandemic Impact on the Size and Structure of the E-Commerce Retail Sales Sector and Forecast Retail Trade E-Commerce

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

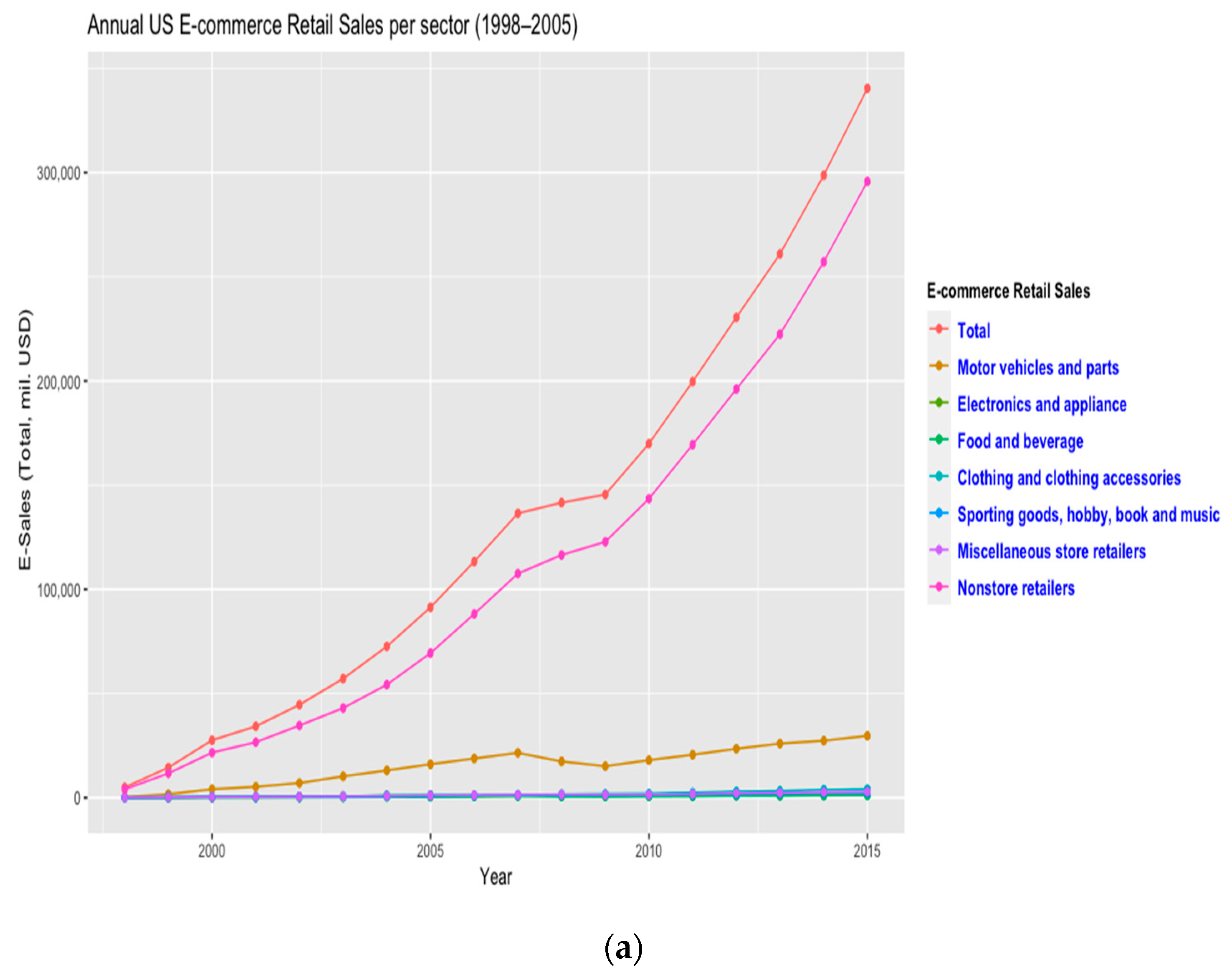

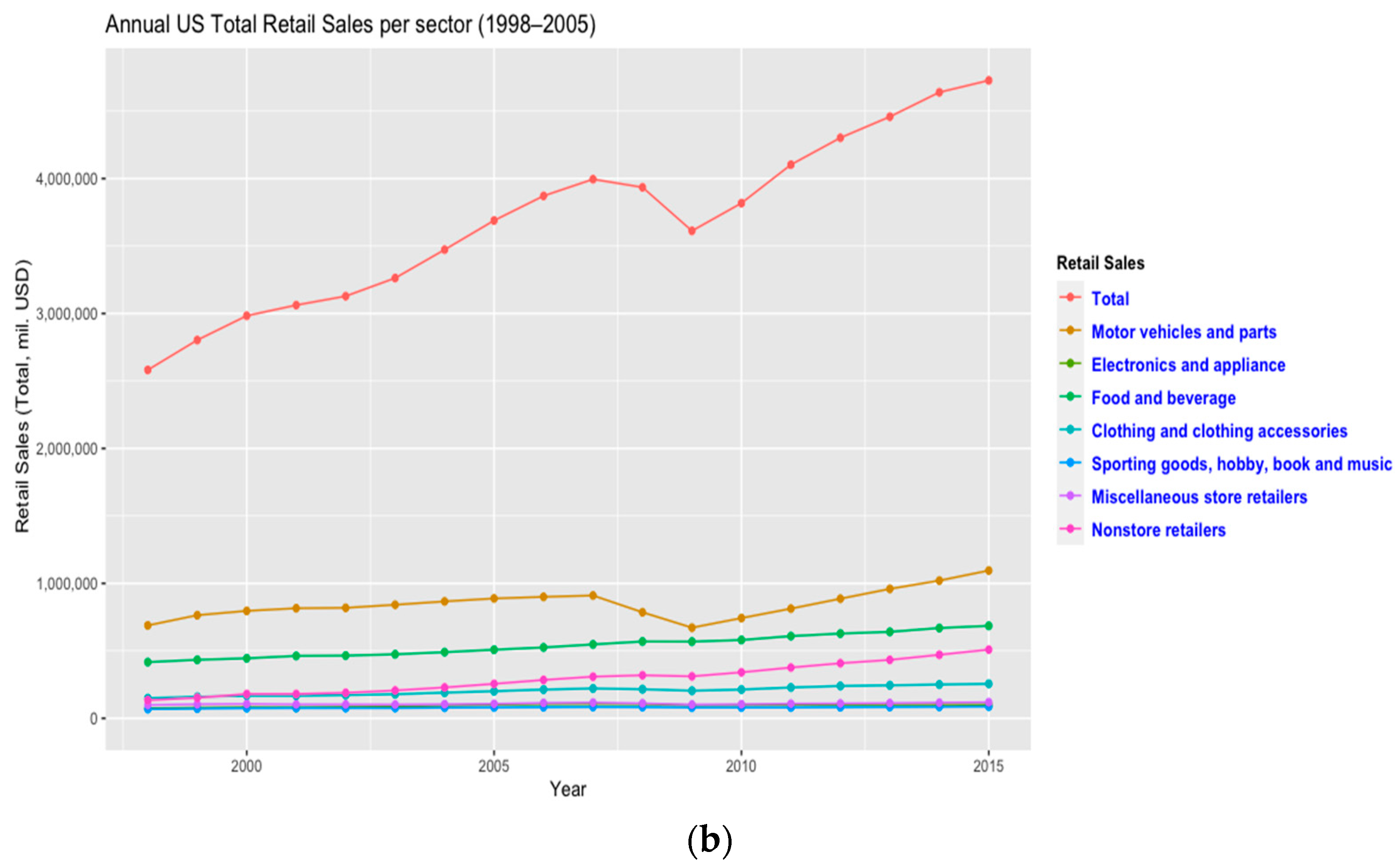

3.1. Data

3.2. Method

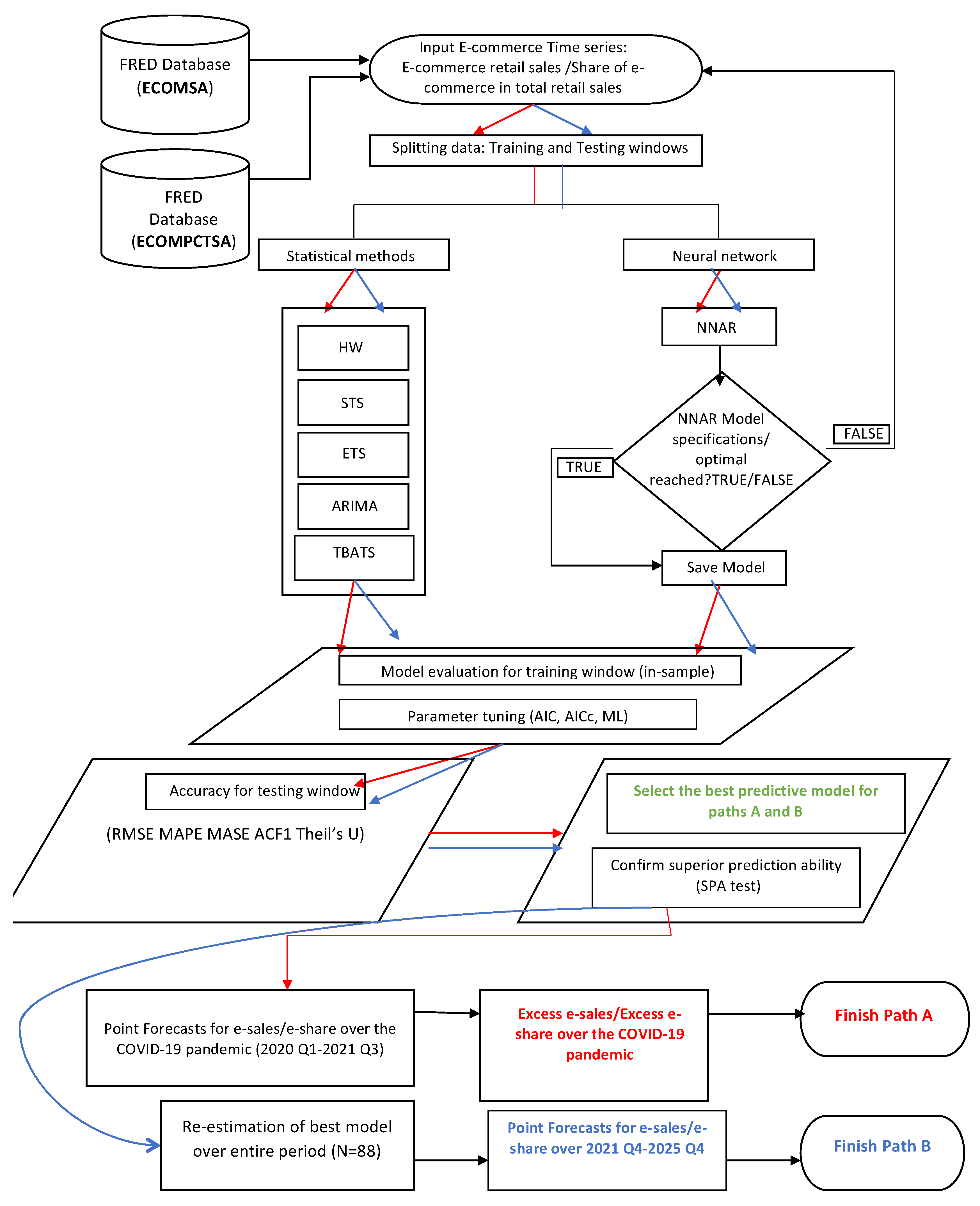

3.2.1. Integrated Framework

3.2.2. Data Splitting Rules and the Forecasting Technique

| Algorithm 1. Sequential steps for excess e-sales/e-share estimation |

| INPUT: Call Quandl() to source FRED data (ECOMSA, ECOMPCTSA series) Step 1. Split each series: 74-7-7 rule (Train/Test/Forecast windows) Step 2. Model fiting on ECOMSA and ECOMPCTSA training windows 2a.call functions HoltWInters(),StructTS(), auto.arima(), ets(),tbats(),nnetar() 2b.establish corresponding fitness function 2c. determine best-fit model specifications for ECOMSA and ECOMPCTSA (2 x 6 best-fit models, in-sample setting) 2d. check the residuals of the 2 x 6 best-fit models from step 2c (ACF plots, PACF Plots, the Box-Ljung test); IF (white noise), go to Step 3. use step 2c models to produce out-of-sample forecasts over the test window for ECOMSA and ECOMPCTSA ELSE, repeat steps 2 a–d Step 4. Compute performance metrics (MAE, MAPE, MASE, RMSE, Theil’s U, ACF1) for the 2 x 6 best-fit models Step 5. Identify best out-of-sample predictive model for ECOMSA and ECOMPCTSA (2 x 1 best forecasting model) Step 6. Confirm superior forecasting ability for Step 5 models (call “DM.test”) Step 7. Re-estimate the Step 5 models on extended Train + Test window (i.e., pre-COVID-19 data, or 81 quarterly observations); retune model parameters; check residuals Step 8. Use updated model specifications from Step 7 to produce forecasts for ECOMSA and ECOMPCTSA up to Q3 2021 Step 8. Estimate and print excess e-sales/e-share FINISH |

3.3. Excess (or Abnormal) E-Commerce Retail Sales (Excess E-Sales) and Excess Share of E-Commerce in Total Retail Sales (Excess E-Share)

3.4. Time Series Forecasting Models

3.5. Forecast Error Measures

3.6. Further Robustness Checks: Tests for Superior Forecasting Performance

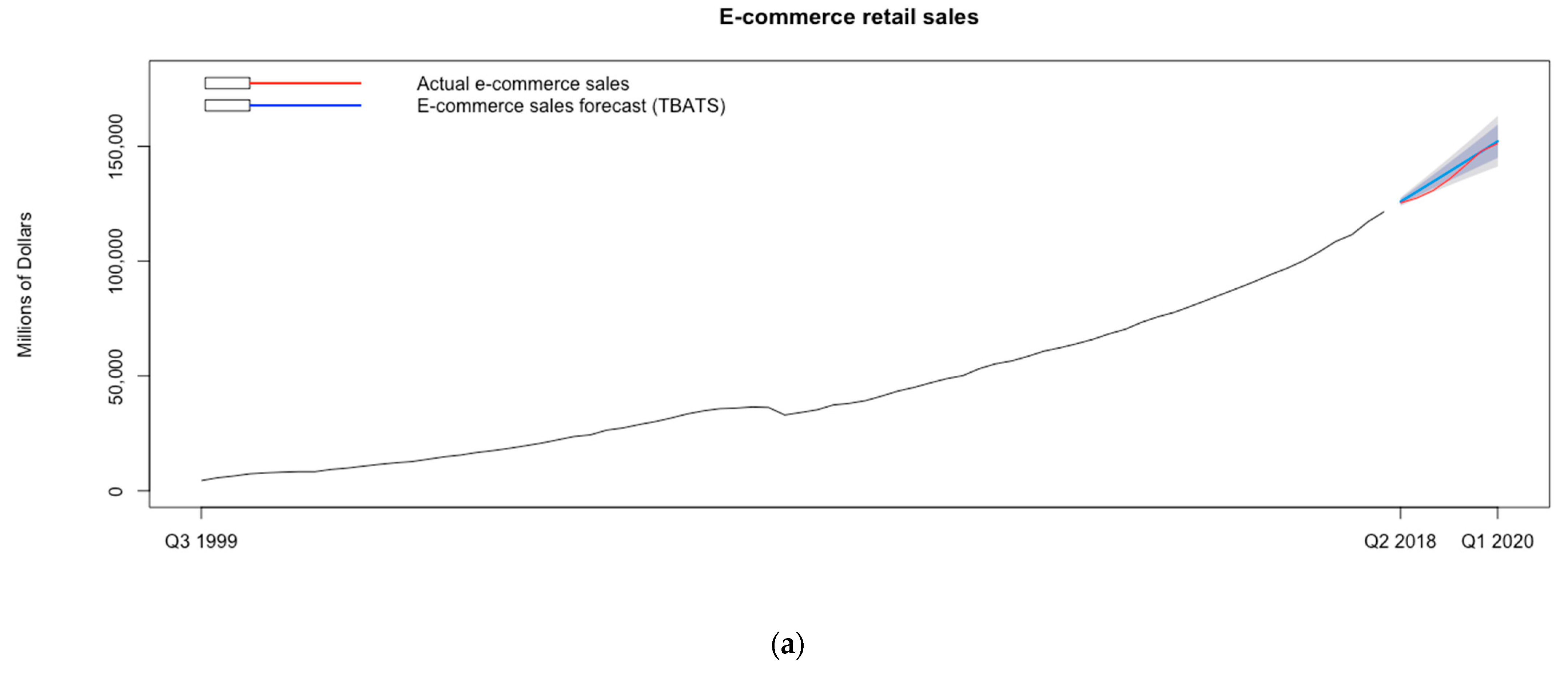

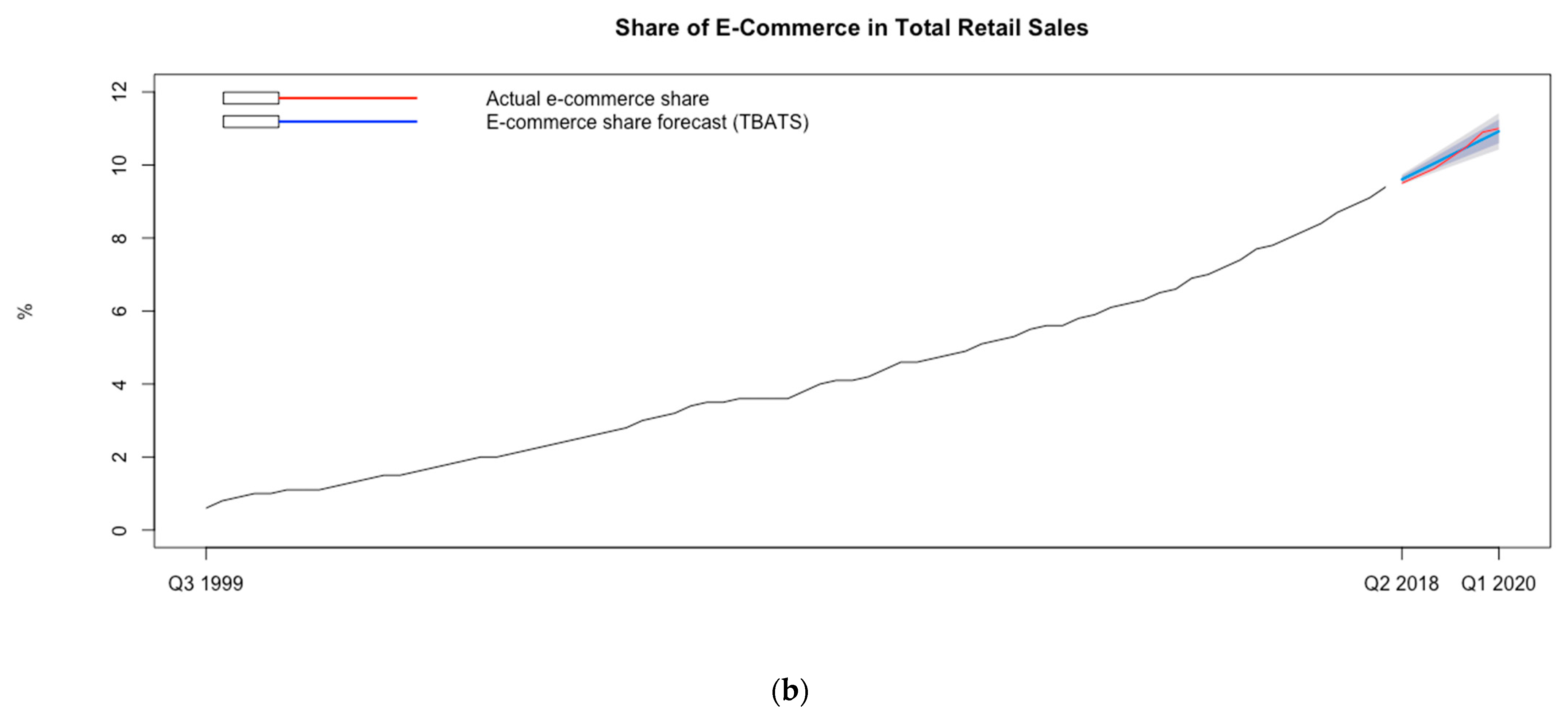

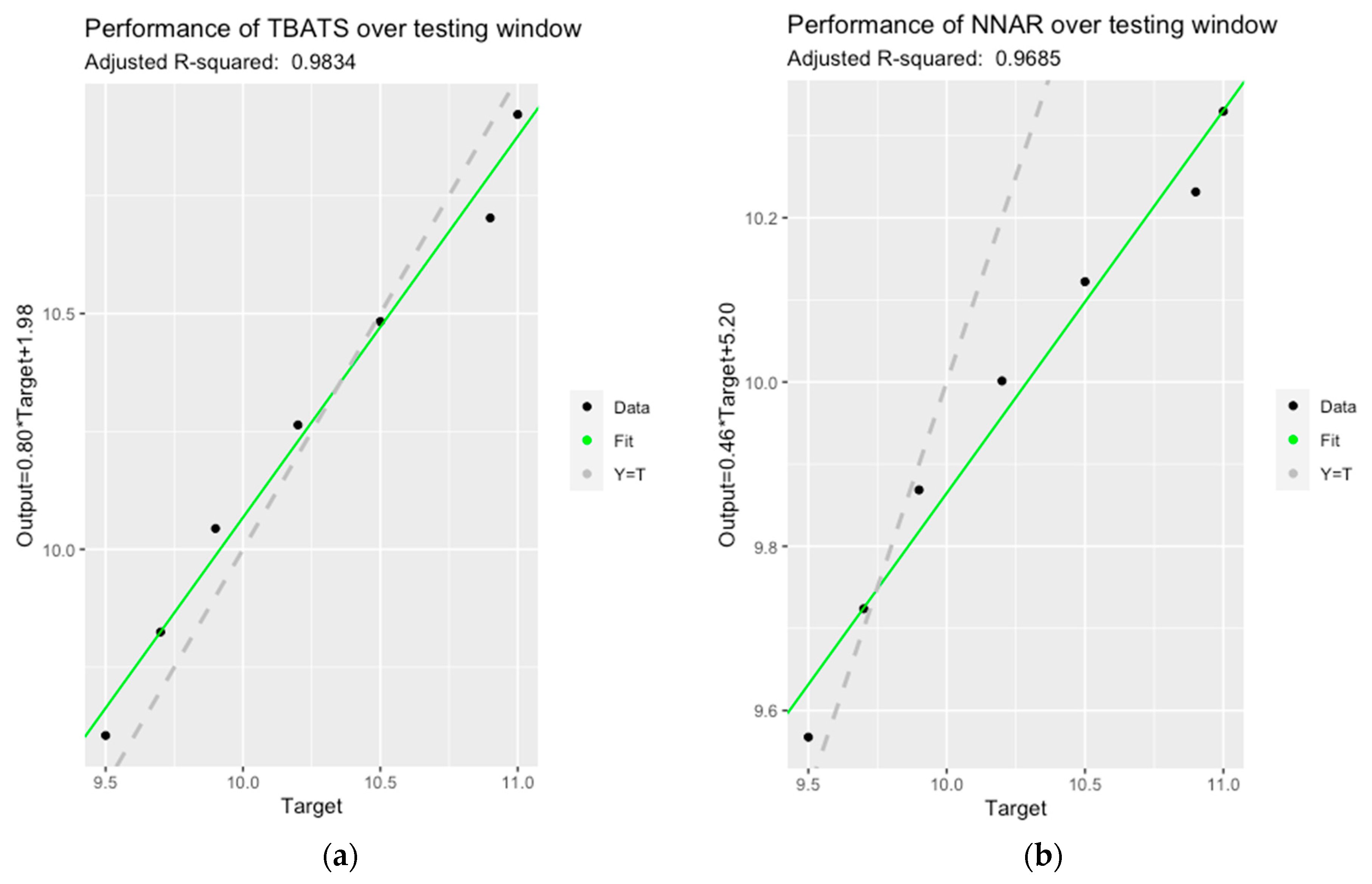

4. Results

5. Discussion

5.1. E-Commerce Trends and the COVID-19 Impact

5.2. Characteristics of E-Commerce Time Series

5.3. Policy Implications

6. Conclusions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix A.1

Appendix A.2. Accuracy Measures

References

- Deloitte. Resilient Leadership Responding to COVID-19, Insights. 2020. Available online: https://www2.deloitte.com/global/en/insights/economy/covid-19/heart-of-resilient-leadership-responding-to-covid-19.html (accessed on 26 January 2022).

- Maria, N.; Zaid, A.; Catrin, S.; Ahmed, K.; Ahmed, A.J.; Christos, I.; Maliha, A.; Riaz, A. The socio-economic implications of the coronavirus pandemic (COVID-19): A review. Int. J. Surg. 2020, 78, 185–193. [Google Scholar]

- Erokhin, V.; Gao, T. Impacts of COVID-19 on trade and economic aspects of food security: Evidence from 45 developing countries. Int. J. Environ. Res. Public Health 2020, 17, 5775. [Google Scholar] [CrossRef] [PubMed]

- Tudor, C.; Sova, R. Infodemiological study on the impact of the COVID-19 pandemic on increased headache incidences at the world level. Sci. Rep. 2022, 12, 10253. [Google Scholar] [CrossRef] [PubMed]

- Raza, S.; Schwartz, B.; Rosella, L.C. CoQUAD: A COVID-19 question answering dataset system, facilitating research, benchmarking, and practice. BMC Bioinform. 2022, 23, 1–28. [Google Scholar] [CrossRef] [PubMed]

- Fletcher, G.; Griffiths, M. Digital transformation during a lockdown. Int. J. Inf. Manag. 2020, 55, 102185. [Google Scholar] [CrossRef] [PubMed]

- Nagel, L. The influence of the COVID-19 pandemic on the digital transformation of work. Int. J. Soc. Soc. Pol. 2020, 40, 861–875. [Google Scholar] [CrossRef]

- Priyono, A.; Moin, A.; Oktaviani Putri VNA. Identifying digital transformation paths in the business model of SMEs during the COVID-19 pandemic. J. Open Innov. Technol. Mark. Complex. 2020, 6, 104. [Google Scholar] [CrossRef]

- Döhring, B.; Hristov, A.; Maier, C.; Roeger, W.; Thum-Thysen, A. COVID-19 acceleration in digitalisation, aggregate productivity growth and the functional income distribution. Int. Econ. Econ. Policy 2021, 18, 571–604. [Google Scholar] [CrossRef]

- Ecommerce Europe, 2021, 2021 European E-Commerce Report. Available online: https://ecommerce-europe.eu/wp-content/uploads/2021/09/2021-European-E-commerce-Report-LIGHT-VERSION.pdf (accessed on 26 February 2022).

- UNCTAD. How COVID-19 Triggered the Digital and E-Commerce Turning Point. 2021. Available online: https://unctad.org/news/how-covid-19-triggered-digital-and-e-commerce-turning-point (accessed on 26 January 2022).

- Insider Intelligence. 2022. Available online: https://www.insiderintelligence.com/insights/ecommerce-industry-statistics/ (accessed on 7 February 2022).

- OECD. E-Commerce in the Time of COVID-19. 2020. Available online: https://www.oecd.org/coronavirus/policy-responses/e-commerce-in-the-time-of-covid-19-3a2b78e8/ (accessed on 7 September 2022).

- Tudor, C. The Impact of the COVID-19 Pandemic on the Global Web and Video Conferencing SaaS Market. Electronics 2022, 11, 2633. [Google Scholar] [CrossRef]

- Rapaccini M, Saccani N, Kowalkowski C, Paiola M, Adrodegari F Navigating disruptive crises through service-led growth: The impact of COVID-19 on Italian manufacturing firms. Ind. Mark. Manag. 2020, 88, 225–237. [CrossRef]

- McKinsey. The Next Normal, The Recovery Will Be Digital. 2020. Available online: https://www.mckinsey.com/~/media/mckinsey/business%20functions/mckinsey%20digital/our%20insights/how%20six%20companies%20are%20using%20technology%20and%20data%20to%20transform%20themselves/the-next-normal-the-recovery-will-be-digital.pdf (accessed on 6 September 2022).

- Vieira, M.; Malaquias, T.; Ketsmur, V.; Ketsmur, V.; Au-Yong-Oliveira, M. Towards a More Sustainable E-commerce in the Post-COVID-19 Recovery of Portuguese Companies. In International Conference on Advanced Research in Technologies, Information, Innovation and Sustainability; Springer: Cham, Switzerland, 2021; pp. 600–613. [Google Scholar]

- Piccinini, D.; Giunchi, C.; Olivieri, M.; Frattini, F.; Di Giovanni, M.; Prodi, G.; Chiarabba, C. COVID-19 lockdown and its latency in Northern Italy: Seismic evidence and socio-economic interpretation. Sci. Rep. 2020, 10, 16487. [Google Scholar] [CrossRef]

- European Commission. Online Sales Continue to Grow Among EU Enterprises. 2021. Available online: https://ec.europa.eu/eurostat/web/products-eurostat-news/-/ddn-20211228-1 (accessed on 26 January 2022).

- UNCTAD. Global E-Commerce Jumps to $26.7 Trillion, COVID-19 Boosts Online Sales. 2021. Available online: https://unctad.org/news/global-e-commerce-jumps-267-trillion-covid-19-boosts-online-sales (accessed on 26 January 2022).

- Forbes. Global E-Commerce Sales To Hit $4.2 Trillion As Online Surge Continues, Adobe Reports. 2021. Available online: https://www.forbes.com/sites/joanverdon/2021/04/27/global-ecommerce-sales-to-hit-42-trillion-as-online-surge-continues-adobe-reports/?sh=268030f350fd (accessed on 26 January 2022).

- Statista. Retail E-Commerce Sales Worldwide from 2014 to 2024. 2022. Available online: https://www.statista.com/statistics/379046/worldwide-retail-e-commerce-sales/ (accessed on 26 January 2022).

- British International Freight Association (BIFA). Global E-Commerce Jumps to $26.7 Trillion. 2021. Available online: https://www.bifa.org/news/articles/2021/may/global-e-commerce-jumps-to-267-trillion (accessed on 26 January 2022).

- Huber, J.; Stuckenschmidt, H. Daily retail demand forecasting using machine learning with emphasis on calendric special days. Int. J. Forecast. 2020, 36, 1420–1438. [Google Scholar] [CrossRef]

- Ramos, P.; Santos, N.; Rebelo, R. Performance of state space and ARIMA models for consumer retail sales forecasting. Robot. Comput.-Integr. Manuf. 2015, 34, 151–163. [Google Scholar] [CrossRef]

- Beheshti-Kashi, S.; Karimi, H.R.; Thoben, K.D.; Lütjen, M.; Teucke, M. A survey on retail sales forecasting and prediction in fashion markets. Syst. Sci. Control. Eng. 2015, 3, 154–161. [Google Scholar] [CrossRef]

- Diron, M. Short-term forecasts of euro area real GDP growth: An assessment of real-time performance based on vintage data. J. Forecast. 2008, 27, 371–390. [Google Scholar] [CrossRef]

- Turner, L.W.; Witt, S.F. Factors influencing demand for international tourism: Tourism demand analysis using structural equation modelling, revisited. Tour. Econ. 2001, 7, 21–38. [Google Scholar] [CrossRef]

- Joseph, A.; Larrain, M. Housing Starts Forecast of Retail Sales through the 2007-2009 Recession. Procedia Comput. Sci. 2012, 12, 271–275. [Google Scholar] [CrossRef][Green Version]

- Deloitte. Retail Sales: Trends in Revenue and Employment. 2018. Available online: https://www2.deloitte.com/us/en/insights/economy/behind-the-numbers/changes-in-retail-sales-economic-impact.html (accessed on 27 January 2022).

- Markhaichuk, M. Impact of online retail on economic development in Russian regions. In Innovation Management, Entrepreneurship and Sustainability (IMES 2018); Vysoká škola ekonomická v Praze: Prague, Czech Republic, 2018; pp. 635–644. [Google Scholar]

- Wyman, O. Is E-Commerce Good For Europe? 2021. Available online: https://www.oliverwyman.com/content/dam/oliver-wyman/v2/publications/2021/apr/is-ecommerce-good-for-europe.pdf (accessed on 7 February 2022).

- Yang, Y.; Fan, C.; Xiong, H. A novel general-purpose hybrid model for time series forecasting. Appl. Intell. 2021, 52, 2212–2223. [Google Scholar] [CrossRef] [PubMed]

- Mukhopadhyay, S.; Samaddar, S.; Nargundkar, S. Predicting Electronic Commerce Growth: An Integration Of Diffusion and Neural Network Models. J. Electron. Commer. Res. 2008, 9. [Google Scholar]

- Gujarati, D.N. Basic Econometrics, 4th ed.; McGraw-Hill: Singapore, 2003. [Google Scholar]

- Gujarati, D.N.; Porter, D.C.; Gunasekar, S. Basic Econometrics; Tata McGraw-Hill Education: Noida, India, 2012. [Google Scholar]

- Silva, E.G.; Neto, P.S.D.M.; Cavalcanti, G.D. A dynamic predictor selection method based on recent temporal windows for time series forecasting. IEEE Access 2021, 9, 108466–108479. [Google Scholar] [CrossRef]

- Breiman, L. Statistical modeling: The two cultures (with comments and a rejoinder by the author). Stat. Sci. 2001, 16, 199–231. [Google Scholar] [CrossRef]

- Miller, A.C.; Foti, N.J.; Fox, E.B. Breiman’s Two Cultures: You Don’t Have to Choose Sides. Obs. Stud. 2021, 7, 161–169. [Google Scholar] [CrossRef]

- Charpentier, A.; Flachaire, E.; Ly, A. Econometrics and machine learning. Econ. Et Stat. 2018, 505, 147–169. [Google Scholar] [CrossRef]

- Koehrsen, W. Thoughts on the Two Cultures of Statistical Modeling. 2019. Available online: https://towardsdatascience.com/thoughts-on-the-two-cultures-of-statistical-modeling-72d75a9e06c2 (accessed on 1 February 2022).

- Zhang, G.; Patuwo, B.E.; Hu, M.Y. Forecasting with artificial neural networks: The state of the art. Int. J. Forecast. 1998, 14, 35–62. [Google Scholar] [CrossRef]

- Kamruzzaman, J.; Sarker, R.A. Artificial neural networks: Applications in finance and manufacturing. In Artificial Neural Networks in Finance and Manufacturing; IGI Global: Hershey, PA, USA, 2006; pp. 1–27. [Google Scholar]

- IJ, H. Statistics versus machine learning. Nat. Methods 2018, 15, 233. [Google Scholar]

- Zao, Q. Statistical Modeling: Returning to Its Roots. 2022. Available online: http://www.statslab.cam.ac.uk/~qz280/post/breiman-reprint-2021/ (accessed on 1 February 2022).

- Adhikari, R.; Agrawal, R.K. An introductory study on time series modeling and forecasting. arXiv 2013, arXiv:1302.6613. [Google Scholar]

- Salinas, D.; Flunkert, V.; Gasthaus, J.; Januschowski, T. DeepAR: Probabilistic forecasting with autoregressive recurrent networks. Int. J. Forecast. 2020, 36, 1181–1191. [Google Scholar] [CrossRef]

- Kuvulmaz, J.; Usanmaz, S.; Engin, S.N. Time-series forecasting by means of linear and nonlinear models. In Mexican International Conference on Artificial Intelligence; Springer: Berlin/Heidelberg, German, 2005; pp. 504–513. [Google Scholar]

- Frank, C.; Garg, A.; Sztandera, L.; Raheja, A. Forecasting women’s apparel sales using mathematical modeling. Int. J. Cloth. Sci. Technol. 2013, 15, 107–125. [Google Scholar] [CrossRef]

- Alon, I.; Qi, M.; Sadowski, R.J. Forecasting aggregate retail sales: A comparison of artificial neural networks and traditional methods. J. Retail. Consum. Serv. 2001, 8, 147–156. [Google Scholar]

- Chu, C.W.; Zhang, G.P. A comparative study of linear and nonlinear models for aggregate retail sales forecasting. Int. J. Prod. Econ. 2003, 86, 217–231. [Google Scholar] [CrossRef]

- Au, K.F.; Choi, T.M.; Yu, Y. Fashion retail forecasting by evolutionary neural networks. Int. J. Prod. Econ. 2008, 114, 615–630. [Google Scholar] [CrossRef]

- Sun, Z.-L.; Choi, T.M.; Au, K.-F.; Yu, Y. Sales forecasting using extreme learning machine with applications in fashion retailing. Decis. Support Syst. 2008, 46, 411–419. [Google Scholar] [CrossRef]

- Thomassey, S. Sales forecasts in clothing industry: The key success factor of the supply chain management. Int. J. Prod. Econ. 2010, 128, 470–483. [Google Scholar] [CrossRef]

- Wong, W.K.; Guo, Z.X. A hybrid intelligent model for medium-term sales forecasting in fashion retail supply chains using extreme learning machine and harmony search algorithm. Int. J. Prod. Econ. 2010, 128, 614–624. [Google Scholar] [CrossRef]

- Office for National Statistics. Impact of the Coronavirus (COVID-19) Pandemic on Retail Sales in 2020. 2021. Available online: https://www.ons.gov.uk/economy/grossdomesticproductgdp/articles/impactofthecoronaviruscovid19pandemiconretailsalesin2020/2021-01-28 (accessed on 27 January 2022).

- Sardar, T.; Nadim, S.S.; Rana, S.; Chattopadhyay, J. Assessment of lockdown effect in some states and overall India: A predictive mathematical study on COVID-19 outbreak. Chaos Solitons Fractals 2020, 139, 110078. [Google Scholar] [CrossRef] [PubMed]

- Corporate Finance Institute (CFI), Abnormal Return. Available online: https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/abnormal-return/ (accessed on 10 January 2022).

- European Commission. Excess Mortality—Statistics. 2022. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Excess_mortality_-_statistics&oldid=550516 (accessed on 4 February 2022).

- Holt, C.C. Forecasting seasonals and trends by exponentially weighted moving averages. ONR Res. Memo. 1959, 52, 5–10. [Google Scholar]

- Winters, P.R. Forecasting sales by exponentially weighted moving averages. Manag. Sci. 1960, 6, 324–342. [Google Scholar] [CrossRef]

- Gelper, S.; Fried, R.; Croux, C. Robust forecasting with exponential and Holt–Winters smoothing. J. Forecast. 2010, 29, 285–300. [Google Scholar]

- Chatfield, C.; Yar, M. Holt-Winters forecasting: Some practical issues. J. R. Stat. Soc. Ser. D 1988, 37, 129–140. [Google Scholar] [CrossRef]

- R Core Team. R: A Language and Environment for Statistical Computing; R Foundation for Statistical Computing: Vienna, Austria, 2012; ISBN 3-900051-07-0. Available online: http://www.R.-project.org/ (accessed on 20 August 2022).

- Hyndman, R.J.; Koehler, A.B.; Snyder, R.D.; Grose, S. A state space framework for automatic forecasting using exponential smoothing methods. Int. J. Forecast. 2002, 18, 439–454. [Google Scholar] [CrossRef]

- Yang, D.; Sharma, V.; Ye, Z.; Lim, L.I.; Zhao, L.; Aryaputera, A.W. Forecasting of global horizontal irradiance by exponential smoothing, using decompositions. Energy 2015, 81, 111–119. [Google Scholar] [CrossRef]

- Perone, G. Comparison of ARIMA, ETS, NNAR, TBATS and hybrid models to forecast the second wave of COVID-19 hospitalizations in Italy. Eur. J. Health Econ. 2021, 23, 917–940. [Google Scholar] [CrossRef] [PubMed]

- Hyndman, R.J.; Khandakar, Y. Automatic time series forecasting: The forecast package for R. J. Stat. Softw. 2008, 26, 1–22. [Google Scholar] [CrossRef]

- Hyndman, R.; Athanasopoulos, G.; Bergmeir, C.; Caceres, G.; Chhay, L.; O’Hara-Wild, M.; Petropoulos, F.; Razbash, S.; Wang, E.; Yasmeen, F. Forecast: Forecasting Functions for Time Series and Linear Models. R package version 8.16. 2022. Available online: https://pkg.robjhyndman.com/forecast/ (accessed on 10 August 2022).

- Box, G.; Jenkins, G. Time Series Analysis: Forecasting and Control; Holden-Day: San Francisco, CA, USA, 1970. [Google Scholar]

- Box, G.E.P.; Jenkins, G.M.; Reinsel, G.C.; Ljung, G.M. Time Series Analysis: Forecasting and Control, 5th ed.; John Wiley & Sons: New York, NY, USA, 2015. [Google Scholar]

- Zhang, G.P. Time series forecasting using a hybrid ARIMA and neural network model. Neurocomputing 2003, 50, 159–175. [Google Scholar] [CrossRef]

- Wang, L.; Zou, H.; Su, J.; Li, L.; Chaudhry, S. An ARIMA-ANN hybrid model for time series forecasting. Syst. Res. Behav. Sci. 2013, 30, 244–259. [Google Scholar] [CrossRef]

- Hyndman, R.J.; Athanasopoulos, G. Forecasting: Principles and Practice, OTexts, Melbourne. 2018. Available online: OTexts.com/fpp2 (accessed on 10 August 2022).

- Silva, E.S.; Hassani, H.; Heravi, S.; Huang, X. Forecasting tourism demand with denoised neural networks. Ann. Tour. Res. 2019, 74, 134–154. [Google Scholar] [CrossRef]

- De Livera, A.M.; Hyndman, R.J.; Snyder, R.D. Forecasting time series with complex seasonal patterns using exponential smoothing. J. Am. Stat. Assoc. 2011, 106, 1513–1527. [Google Scholar] [CrossRef]

- Yu, C.; Xu, C.; Li, Y.; Yao, S.; Bai, Y.; Li, J.; Wang, L.; Wu, W.; Wang, Y. Time series analysis and forecasting of the hand-foot-mouth disease morbidity in China using an advanced exponential smoothing state space TBATS model. Infect. Drug Resist. 2021, 14, 2809. [Google Scholar] [CrossRef]

- Harvey, A.C. Forecasting Analysis of Time Series Models and the Kalman Filter; Cambridge University Press: Cambridge, UK, 1989. [Google Scholar]

- Lawson, A.R.; Ghosh, B.; Broderick, B. Prediction of traffic-related nitrogen oxides concentrations using Structural Time-Series models. Atmos. Environ. 2011, 45, 4719–4727. [Google Scholar] [CrossRef]

- Kapombe, C.M.; Colyer, D. A structural time series analysis of US broiler exports. Agric. Econ. 1999, 21, 295–307. [Google Scholar] [CrossRef]

- Pasini, A. Artificial neural networks for small dataset analysis. J. Thorac. Dis. 2015, 7, 953. [Google Scholar]

- Allende, H.; Moraga, C.; Salas, R. Artificial neural networks in time series forecasting: A comparative analysis. Kybernetika 2002, 38, 685–707. [Google Scholar]

- Gupta, T. Deep Learning: Feedforward Neural Network. 2017. Available online: https://towardsdatascience.com/deep-learning-feedforward-neural-network-26a6705dbdc7 (accessed on 1 February 2022).

- Hill, T.; Marquez, L.; O’Connor, M.; Remus, W. Artificial neural network models for forecasting and decision making. Int. J. Forecast. 1994, 10, 5–15. [Google Scholar] [CrossRef]

- Munim, Z.H.; Shakil, M.H.; Alon, I. Next-day bitcoin price forecast. J. Risk Financ. Manag. 2019, 12, 103. [Google Scholar] [CrossRef]

- Tudor, C.; Sova, R. Benchmarking GHG Emissions Forecasting Models for Global Climate Policy. Electronics 2021, 10, 3149. [Google Scholar] [CrossRef]

- Adya, M.; Collopy, F. How effective are neural networks at forecasting and prediction? A review and evaluation. J. Forecast. 1998, 17, 481–495. [Google Scholar] [CrossRef]

- Munim, Z.H. State-space TBATS model for container freight rate forecasting with improved accuracy. Marit. Transp. Res. 2022, 3, 100057. [Google Scholar] [CrossRef]

- Hyndman, R.J.; Koehler, A.B. Another look at measures of forecast accuracy. Int. J. Forecast. 2006, 22, 679–688. [Google Scholar] [CrossRef]

- Diebold, F.X.; Mariano, R.S. Comparing Predictive Accuracy. J. Bus. Econ. Stat. 1995, 13, 253–263. [Google Scholar]

- Harvey, D.; Leybourne, S.; Newbold, P. Testing the equality of prediction mean squared errors. Int. J. Forecast. 1997, 13, 281–291. [Google Scholar] [CrossRef]

- Hering, A.S.; Genton, M.G. Comparing spatial predictions. Technometrics 2011, 53, 414–425. [Google Scholar] [CrossRef]

- Gilleland, E.; Roux, G. A new approach to testing forecast predictive accuracy. Meteorol. Appl. 2015, 22, 534–543. [Google Scholar] [CrossRef]

- Coroneo, L.; Iacone, F. Comparing predictive accuracy in small samples using fixed-smoothing asymptotics. J. Appl. Econom. 2020, 35, 391–409. [Google Scholar] [CrossRef]

- Diebold, F.X. Comparing predictive accuracy, twenty years later: A personal perspective on the use and abuse of Diebold–Mariano tests. J. Bus. Econ. Stat. 2015, 33, 1. [Google Scholar] [CrossRef]

- Huang, Y.; Chai, Y.; Liu, Y.; Shen, J. Architecture of next-generation e-commerce platform. Tsinghua Sci. Technol. 2018, 24, 18–29. [Google Scholar] [CrossRef]

- COFACE. Has the Global Retail Sector Returned to Normal? 2021. Available online: https://www.coface.com/News-Publications/News/Has-the-global-retail-sector-returned-to-normal (accessed on 27 January 2022).

- Statista. E-Commerce in the United States—Statistics & Facts. 2022. Available online: https://www.statista.com/topics/2443/us-ecommerce/ (accessed on 4 February 2022).

- World Economic Forum. These Are the World’s Biggest E-Commerce Markets. 2021. Available online: https://www.weforum.org/agenda/2021/09/e-commerce-fast-growth-online-sales-china-europe-america/ (accessed on 4 February 2022).

- Aye, G.C.; Balcilar, M.; Gupta, R.; Majumdar, A. Forecasting aggregate retail sales: The case of South Africa. Int. J. Prod. Econ. 2015, 160, 66–79. [Google Scholar] [CrossRef]

- Di, G.; Latorre, V.; Lucidi, S.; Procacci, E. An application of support vector machines to sales forecasting under promotions. 4OR 2016, 14, 309–325. [Google Scholar]

- Zhang, G.P.; Qi, M. Neural network forecasting for seasonal and trend time series. Eur. J. Oper. Res. 2005, 160, 501–514. [Google Scholar] [CrossRef]

- Saarikko, T.; Westergren, U.H.; Blomquist, T. Digital transformation: Five recommendations for the digitally conscious firm. Bus. Horiz. 2020, 63, 825–839. [Google Scholar] [CrossRef]

- Aras, S.; Deveci Kocakoç, İ.; Polat, C. Comparative study on retail sales forecasting between single and combination methods. J. Bus. Econ. Manag. 2017, 18, 803–832. [Google Scholar] [CrossRef]

- Loureiro, A.L.; Miguéis, V.L.; da Silva, L.F. Exploring the use of deep neural networks for sales forecasting in fashion retail. Decis. Support Syst. 2018, 114, 81–93. [Google Scholar] [CrossRef]

- Quaedvlieg, R. Multi-horizon forecast comparison. J. Bus. Econ. Stat. 2021, 39, 40–53. [Google Scholar] [CrossRef]

- Leuthold, R.M. On the use of Theil’s inequality coefficients. Am. J. Agric. Econ. 1975, 57, 344–346. [Google Scholar] [CrossRef]

| Path A: Training Set (October 1999 to March 2017) and Test Set (April 2017 to December 2019) | ||||||

| Predictive Model | MAE | MAPE | MASE | RMSE | Theil’s U | ACF1 |

| NNAR | 4662.79 | 3.19 | 2.74 | 6592.65 | 1.48 | 0.64 |

| ETS | 2131.34 | 1.59 | 1.25 | 2548.14 | 0.63 | 0.36 |

| ARIMA | 1923.24 | 1.44 | 1.13 | 2353.49 | 0.58 | 0.41 |

| STS | 1978.93 | 1.48 | 1.16 | 2421.46 | 0.60 | 0.39 |

| HW | 2102.57 | 1.57 | 1.24 | 2526.42 | 0.63 | 0.37 |

| TBATS | 1885.01 | 1.41 | 1.11 | 2301.64 | 0.57 | 0.40 |

| DM (TBATS/ARIMA) (p-value) | 0.0357 ** | |||||

| Path B: Training Set (October 1999 to June 2017) and Test Set (July 2017 to September 2021) | ||||||

| Predictive Model | MAE | MAPE | MASE | RMSE | Theil’s U | ACF1 |

| NNAR | 32,950.70 | 26.69 | 24.68 | 33,666.45 | 1.74 | 0.50 |

| ETS | 15,516.73 | 12.60 | 11.99 | 15,846.25 | 1.47 | 0.41 |

| ARIMA | 15,530.94 | 12.11 | 11.56 | 15,860.50 | 1.52 | 0.41 |

| STS | 15,540.40 | 12.59 | 11.58 | 15,870.03 | 1.47 | 0.41 |

| HW | 15,530.95 | 13.67 | 11.67 | 15,860.51 | 1.48 | 0.41 |

| TBATS | 14,702.29 | 11.59 | 11.01 | 15,000.50 | 1.47 | 0.39 |

| DM (TBATS/STS) (p-value) | 0.0729 ** | |||||

| Path A: Training Set (October 1999 to March 2017) and Test Set (April 2017 to December 2019) | ||||||

| Predictive Model | MAE | MAPE | MASE | RMSE | Theil’s U | ACF1 |

| NNAR | 0.28 | 2.60 | 2.31 | 0.38 | 1.45 | 0.61 |

| ETS | 0.11 | 1.05 | 0.89 | 0.12 | 0.46 | 0.29 |

| ARIMA | 0.11 | 1.08 | 0.91 | 0.12 | 0.47 | 0.31 |

| STS | 0.10 | 1.01 | 0.85 | 0.12 | 0.45 | 0.28 |

| HW | 0.12 | 1.15 | 0.96 | 0.13 | 0.49 | 0.34 |

| TBATS | 0.10 | 1.02 | 0.86 | 0.12 | 0.45 | 0.26 |

| DM (STS/TBATS) (p-value) | 0.653 | |||||

| Path B: Training Set (October 1999 to December 2019) and Test Set (January 2020 to October 2021) | ||||||

| Predictive Model | MAE | MAPE | MASE | RMSE | Theil’s U | ACF1 |

| NNAR | 1.72 | 13.65 | 14.81 | 2.26 | 1.21 | 0.72 |

| ETS | 0.91 | 6.73 | 7.80 | 1.53 | 1.08 | 0.56 |

| ARIMA | 0.91 | 6.61 | 7.08 | 1.52 | 1.09 | 0.55 |

| STS | 0.87 | 6.34 | 7.61 | 1.52 | 0.87 | 0.55 |

| HW | 0.90 | 6.56 | 7.68 | 1.50 | 1.08 | 0.55 |

| TBATS | 0.76 | 5.51 | 6.60 | 1.38 | 0.87 | 0.52 |

| DM (STS/TBATS) (p-value) | 0.0217 ** | |||||

| Real Value (mil. USD) | Estimated Value (mil. USD) | Excess E-Sales (mil. USD) | |

|---|---|---|---|

| 2020 Q1 | 154,575 | 155,453.7 | −878.7 |

| 2020 Q2 | 203,847 | 159,944.5 | 43,902.5 |

| 2020 Q3 | 201,385 | 164,464.1 | 36,920.9 |

| 2020 Q4 | 199,665 | 169,012.3 | 30,652.7 |

| 2021 Q1 | 215,290 | 173,588.4 | 41,701.6 |

| 2021 Q2 | 221,951 | 178,192.2 | 43,758.8 |

| 2021 Q3 | 214,586 | 182,823.2 | 31,762.8 |

| Sum | 227,820.6 |

| Real Value(%) | Estimated Value (%) | Excess E-Share (%) | |

|---|---|---|---|

| 2020 Q1 | 11.4 | 11.25 | 0.15 |

| 2020 Q2 | 15.7 | 11.49 | 4.21 |

| 2020 Q3 | 13.8 | 11.73 | 2.07 |

| 2020 Q4 | 13.6 | 11.97 | 1.63 |

| 2021 Q1 | 13.6 | 12.21 | 1.39 |

| 2021 Q2 | 13.3 | 12.45 | 0.85 |

| 2021 Q3 | 13.0 | 12.69 | 0.31 |

| Sum | 10.61 |

| Point Forecast E-Sales (mil. USD) | Point Forecast E-Share (%) | |

|---|---|---|

| 2021 Q4 | 225,330.1 | 13.47 |

| 2022 Q1 | 233,242.8 | 13.67 |

| 2022 Q2 | 241,361.6 | 13.87 |

| 2022 Q3 | 249,690.0 | 14.08 |

| 2022 Q4 | 258,231.6 | 14.28 |

| 2023 Q1 | 266,989.9 | 14.49 |

| 2023 Q2 | 275,968.5 | 14.65 |

| 2023 Q3 | 285,171.2 | 14.89 |

| 2023 Q4 | 294,601.5 | 15.09 |

| 2024 Q1 | 304,263.2 | 15.30 |

| 2024 Q2 | 314,160.0 | 15.56 |

| 2024 Q3 | 324,295.7 | 15.71 |

| 2024 Q4 | 334,674.1 | 15.93 |

| 2025 Q1 | 345,298.9 | 16.11 |

| 2025 Q2 | 356,174.2 | 16.32 |

| 2025 Q3 | 367,303.6 | 16.54 |

| 2025 Q4 | 378,691.2 | 16.72 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tudor, C. Integrated Framework to Assess the Extent of the Pandemic Impact on the Size and Structure of the E-Commerce Retail Sales Sector and Forecast Retail Trade E-Commerce. Electronics 2022, 11, 3194. https://doi.org/10.3390/electronics11193194

Tudor C. Integrated Framework to Assess the Extent of the Pandemic Impact on the Size and Structure of the E-Commerce Retail Sales Sector and Forecast Retail Trade E-Commerce. Electronics. 2022; 11(19):3194. https://doi.org/10.3390/electronics11193194

Chicago/Turabian StyleTudor, Cristiana. 2022. "Integrated Framework to Assess the Extent of the Pandemic Impact on the Size and Structure of the E-Commerce Retail Sales Sector and Forecast Retail Trade E-Commerce" Electronics 11, no. 19: 3194. https://doi.org/10.3390/electronics11193194

APA StyleTudor, C. (2022). Integrated Framework to Assess the Extent of the Pandemic Impact on the Size and Structure of the E-Commerce Retail Sales Sector and Forecast Retail Trade E-Commerce. Electronics, 11(19), 3194. https://doi.org/10.3390/electronics11193194