1. Introduction

Negotiation is an effective approach for social interaction and diverse parties use it as a resolving dispute mechanism [

1,

2]. Through an exchange of opinions, the parties aim to reach an agreement that satisfies all. This paper asserts that negotiation is an effective mechanism for finding a solution between opponents in various domains [

3]. For example, negotiation is used in politics to find an agreement point between opponents [

4]. Business partners negotiate deals and agreements etc. [

3]. This paper focuses on the buying and selling process between software agents for the purpose of automating the negotiation process.

Negotiation can be seen as a negotiation process in which two or more parties articulate requests and then move towards an agreement [

1]. For the last two decades, multi-agent negotiations were an important research subject [

5,

6,

7,

8,

9,

10]. Most work in the literature investigates the offer generation problem. Offer formulation is not an easy task during the interaction between negotiators especially if the offer consists of multiple issues of different kinds. A proper mechanism for offer generation may improve the chance of reaching an agreement with acceptable outcomes for the negotiating parties [

2,

11,

12].

Negotiations are an important field of research in numerous areas, including economics, game theory, IT, and artificial intelligence. It has used in several sectors, including electronic trade, service structure and grid computation [

13,

14].

There are a numerous benefits to automating the negotiating process. In terms of both time required to reach agreement and negotiation results, it is more efficient than manual negotiation. A larger search space for an agreement can be explored by automating the negotiations process and indeed better results in multi-issue negotiations [

6] can be achieved. Moreover, manual negotiations are generally regarded as too uncomfortable or stressful. Automation also eliminates human sensitivities and could lead to more successful outcomes [

15].

This paper further explores on our previous work [

16] to include more experimental work and discussions of the proposed offer generation mechanisms. The strategy presented in [

16] is a meta negotiation strategy for multi-issue negotiation. It can be applied in different domains and addresses both quantitative and qualitative issues. In the case of quantitative offers, the preference-based negotiation strategy uses the fundamental assumption is that agent preferences differ over negotiation issues [

17,

18]. In contrast, the fuzzy similarity mechanism formulates the next offer for the qualitative issues [

19]. The agent using the fuzzy similarity mechanism offers the most similar offers to the offer obtained in the previous round of negotiations.

The main objective of this research is to promote automating the negotiation process in different domains especially in the business domain. What makes this work different from other related works is that it presents a negotiation scenario that considers both quantitative and qualitative negotiation issues at once for an object (car in our scenario). Most related works in the literature consider either a single or multiple quantitative issue(s) [

20,

21] and rarely consider qualitative issues. Negotiation strategies for such a scenario are discussed and applied in a realistic business negotiation scenario (buying and selling cars). This scenario illustrates the practicality of using automated negotiation and it can be generalized to other various domains. This work improves the outcomes of negotiation deals between business entities by reaching agreements quickly with the best possible outcome for each negotiation party which is a win-win game.

The novelty of this paper is demonstrated by considering a complex and realistic negotiation scenario in which two software agents may negotiate on the behalf of their owners for buying/selling a car under a number of constraints. Different offer generation mechanisms are presented and used to generate offers/counteroffers for both quantitative and qualitative issues during negotiation in real time.

The contributions of this paper are summarized as follows:

Presenting a hybrid negotiation strategy in multi-issue negotiation that handles both quantitative and qualitative negotiation issues

Validating the proposed strategy against the basic negotiation strategy experimentally.

Comparing four negotiation strategies empirically: basic, fuzzy similarity, preference-based and hybrid.

The rest of the paper is organized as follow:

Section 2 reviews the related work.

Section 3 presents the negotiation model, where

Section 4 presents a motivational scenario.

Section 5 explains the proposed meta-strategy.

Section 6 discusses the experimental settings while

Section 7 shows the experimental results part I and

Section 8 presents the experimental results part II. The last section concludes the paper and suggests directions for future work.

2. Related Works

This section presents the related works in automated multi-issue negotiations. Most studies consider either a single quantitative [

22] issue or multiple quantitative issues [

23]. A fewer studies consider negotiations over quantitative and qualitative issues at once [

23,

24]. In [

24,

25], a non-biased mediator is proposed to manage the negotiation process. The mediator was assumed to collect private preferences of each agent. Another multi-issue mediator negotiation [

26] presents an agent-based sealed offer process where agents are submitting their separate offers to a mediator at the same time. However, a non-biased mediator may lack trust and hence a trusted mediator can be difficult to find.

The study presented in [

27] considers two agents negotiating over four issues which are price, response time, reliability, and availability. However, the reliability and availability (as qualitative issues) are dealt with as a probability while we consider the fuzzy similarity when generating offers for qualitative issues.

The trade-off approach is widely used in multi-issue negotiation to improve the outcome of negotiations [

19,

24,

28]. The work in [

19] used the trade-off negotiation mechanism to formulate offers for qualitative issues. A negotiation agent uses fuzzy similarity technique to generate qualitative offers. The agent produces a series of offers that resemble the last offer the opponent receives. All the offers generated positioned on the same indifference curve of the agent generating the offers. Once an impediment has reached, the agent reduces its aspiration level by issuing the following counteroffers and repeats the same procedure.

Preference understanding is important for improving the outcome of automated multi-issue negotiation. A preference-learning framework is presented in [

29], which formalizes automated procedures with insufficient knowledge. The approach maps the preferences inferred from the user into utility values. The proposed strategy is more effective compared to the baseline negotiation strategy. The work shown in [

17,

18] presents a preferential negotiating mechanism. During negotiations, the opponents’ preferences concerning different matters are learned. The mechanism assumes that negotiating agents have divergent preferences over most negotiation issues. During negotiation, the proposing agent concedes more on matters or issues that are more significant for the counterpart agent. In line with their concession behavior, this strategy brings the opponent’s issues into two groups: the favorable group and the unfavorable group. The proposing agent provides more concessions on the favorable issues and less concessions unfavorable issues to improve reaching an agreement with high utility to both negotiating agents. This strategy is applicable to quantitative issues.

The work given in [

16] combines the fuzzy similarity with a the preference-based mechanisms to generate offers where the experimental findings reveal that the proposed hybrid method outperforms the basic negotiation strategy in terms of utility rate, agreement rate and Nash product rate under various negotiating environment.

This paper fills the gap of addressing the problem of negotiating both quantitative and qualitative issues at once as it was mentioned in the first part of this section that most related work discuses the negotiation problem over a single or multiple quantitative issues negotiation issues [

20,

21].

This work extends the work presented in [

16] by analyzing how performance of each individual negotiation strategy is compared with other negotiation strategies and with the hybrid strategy under different negotiation environments.

Making decisions in multi-agent systems are discussed in [

30] using a knowledge base based on predicate logic. The work presented in this paper does not assume a knowledge-base about the opponent.

3. Negotiation Model

Since we consider a one-to-one negotiation form and to characterize our work by being self-contained, we present a simplified negotiation model of the one that introduced in [

6]. It is a simplified negotiation model because we are considering a bilateral negotiation (a buyer agent and a seller agent) while the model presented in [

6] considers multiple seller agents and multiple buyer agents.

The negotiation model in this paper is presented as a tuple: :

O: set of negotiation objects. The negotiation objects are any negotiable item such as book, flight, service etc., let , where is a negotiation object.

s: seller agent.

b: buyer agent.

J: negotiation issues set, where and each issue should be negotiated by at least one pair of negotiators.

Negotiation starts by an agent who proposes an offer to its opponent then the opponent accepts the offer or sends a counteroffer. The process repeats until one of agent accepts an offer/counteroffer, negotiation time ends or one of the agents withdraw from negotiation. Every agent has a reservation value for each issue . The provides the agent with the minimum acceptable utility. A negotiating agent does not reveal its negotiation deadlines, reservation values and utility structures to its opponent.

For a quantitative issue such as price, the reservation interval is denoted by = . For a decreasing utility value of an agent for an issue such as price, the value represents the for an agent (such as a buyer agent) where the value represents the of its opponent (such as a seller agent). For a decreasing utility value of an issue, the buyer agent usually starts offering the value of that issue while the seller agent starts offering the value of the issue. In this case, each agent starts hoping to gain a maximum utility which is an ideal situation that is rarely exists. In our experiments, reservation values are private information for each agent. When negotiation goes on, each agent may concede in every negotiation round until reaching an agreement of negotiation ends with a failure.

For quantitative issues, Equation (

1) is used to calculate the utility of an offer/counteroffer/ agreement for a decreasing utility and Equation (

2) is used to calculate the utility of an offer/counteroffer/agreement for an increasing utility.

A similarity function between two offers is used as the utility of an offer/counteroffer/agreement for a qualitative issue, see Equation (

3)

5. Meta-Negotiation Strategy

The proposed meta-negotiation strategy includes two mechanisms for generating offers; the preference-based mechanism is used for generating the quantitative issue offers and considers the opponent’s preferences when formulating offers [

17,

18], while the the fuzzy similarity mechanism is used for generating the qualitative issues’ offers [

19].

Merging these two strategies in formulating offers allows an agent to negotiate more efficiently on objects having both qualitative and quantitative issues. This can help improve the social well-being in terms of Nash product rate, agreement rate, and utility rate. As proof of the concept, the detailed negotiations mechanism in terms of producing offers from a buyer agent and counteroffers from a seller are illustrated by a real motivating scenario, as shown in

Section 4.

In our scenario, the preference-based negotiation strategy deals with the quantitative issues: price, delivery time, warranty, fuel consumption, and inspection. This technique takes into account opponents’ preferences for various issues, in which an agent concedes more on issues that are thought to be more important for the opponent than others.

This strategy divides the issues of opponent into two primary categories: a favorable group and an unfavorable group based on opponent concessions. At the start of negotiation, an agent watches for the amount of concession provided on each issue, when large concession is offered on a certain issue, this issue is considered in the favorable group and vice versa. Alternatively, domain knowledge can be used to collect preferences over various issues. For example, it is known that young people usually prefer racing cars.

Given the fact that a negotiating agent considers the preferences of its opponent, it is expected that the chances of reaching an agreement will improve. The negotiation mechanism of the preference-based approach is called the iterative offer generation concession (

IOG-concession) which is a concession offer generation method where an agent needs to assign its current acceptable utility before starting generating a composite offer [

17,

18] (i.e., an offer contains values for more than one issue) for the next negotiation round where the weighted average utility of the generated composite offer should equal the pre-assigned utility. For the current offer, the minimum acceptable utility value should be smaller than the utility value of the previous composite offer. That means, in each round of negotiation, the agent should select a lower iso-curve (see

Figure 1) than the one in the previous round.

Figure 1 shows different iso-curves, where

x and

y are the issues of negotiations (e.g., x = price, y = quality). The iso-curve consists of an unlimited number of equal utility points. Each quality point depends on the values of different issues. For example, a person may consider a price and quality of a service as the issues of negotiation, then the utility of an offer depends on the price and level of quality provided. If we reduce the price and reduce the quality of the service, the utility can be equal to another offer with a higher price and a better quality, so these two offers lie on the same iso-curve, e.g.,

in

Figure 1. An agent may remain on a specific iso-curve during negotiations, while modifying the curve points by adjusting the value of each issue throughout any round of negotiations. However, a deadlock might arise sometimes when the agents do not improve and do not come to an agreement during negotiations.

An offer may be described as a composite offer in multi-issue negotiations, since it combines values for several issues. From the point of view of the opponents, the

IOG-concession mechanism begins to agree with one of the strategies of negotiation. The last agents offer all of the values of other issues. The process shown in

Figure 2. The problems in

Figure 2 are arranged by the opponent’s preferences.

When the current least important issue (CLII) calculated value of the agent surpasses their CLII reservation, then the agent must update a second lowest-level issue, which becomes a CLII. This approach repeated until the agent finds a composite offer with the usefulness of its current iso curve or every issue reaches the value of its reservation.

On the other side, it employs qualitative issues to propose offers based on the fuzzy similarity. The purpose of this strategy is to identify the counter-offer most similar to the last offer received, as the opposite can accept this counter-offer. It is easy to find similarities across ongoing issues, such as pricing, because if there is a little variation between two different prices, the similarity is quite high. The challenge arises when the similarity between discreet negotiating issues, such as colors, is attempted.

The following example shows the process of proposing a counteroffer for the qualitative issues mentioned in

Section 4.

The quality of a car is represented as

, and the first number in each vector element refers to a certain car brand such as Mercedes, Ford etc. and the second number is the preference weight for this brand car, while the third value is the preference weight for car safety. Consider that the buyer agent works on the behalf of an old man who weighs safety the most. On the other hand, let the weight vector

, where

is the weight of the brand and the

is the safety weight. The similarity between two cars can be calculated using Equation (

3).

with

. Using Equation (

1), the similarity between car 1 and car 2 in the

Q vector above is calculated as follows:

To generalize the similarity formula, we replace car1 and car2 with object_1 (

) and object_2 (

), see Equation (

4), where

and

represent any two objects, e.g., two books, two houses, two countries, etc.

The similarity between two different colors can be calculated in a similar way. For example, consider the color vector , where the first number in each vector element refers to the criteria corresponding to temperature of a color (warm is 1, cold is 0). The second value is the luminosity of a color (maximum is 1 and minimum is 0) and the third one is the visibility of a color (the maximum is 1 and the minimum is 0) and assume the weights (w) for the colors is , then the similarity between and is .

If a selling agent receives an offer for a certain car from a buyer agent, it searches for its available cars. The seller seeks the car in the most comparable color to that specified by the buyer when the requested car is available, but with a different color. If the buyer does not purchase the preferred car, the seller finds the quality and color most similar to the requested vehicle. Algorithm 1 provides the method for selecting the most similar counteroffer for the quantitative issues to the last offer received.

| Algorithm 1: |

Require:

- 1:

Find the most similar quality to the received offer - 2:

for do - 3:

- 4:

- 5:

end for - 6:

- 7:

Find the most similar color to the received offer - 8:

for do - 9:

- 10:

- 11:

end for - 12:

- 13:

- 14:

|

Algorithm 1 demonstrates two independent operations, one for quality searching, see lines 1–5 and the other, lines 6–10, for the search for a comparable color car.

6. Experimental Settings

This section includes two parts. The first one presents the issues, strategies and negotiation environment parameters while the other discusses the negotiation process.

6.1. Negotiation Environment

This section describes the conditions and evaluation criteria utilized in our experiments. The experiments include a buyer and seller agent. Two types of agents assumed: agents with a basic strategy for negotiating and agents with a hybrid strategy. A random deadline chosen from the interval for each round of negotiations is allocated to each agent. The basic negotiating agent selects a random concession behavior in every round of negotiations: Boulware (tough), linear, or conceder. There are three experiments, based on the overlap percentage of agents’ reservation intervals: small (), medium () and high (). When the overlap between the agent’s reservation intervals is small, that would reduce the chances of reaching an agreement and vice versa.

The following assessment criteria will calculate at the end of each experiment: utility rate for each agent, agreement rate, and Nash product rate. The utility of an agreement is calculated using Equations (1) and (2), while the utility rate is the sum of utilities per number of agreements. The agreement rate is the number of agreements per number of negotiation rounds. The Nash product is the product of the utilities of the two agents for an agreement. The Nash product rate is the sum of the Nash products per number of agreements.

The seller is assumed to have 20 different car brands and 20 different car colors. The negotiation starts by a buyer agent asking for a certain car with a certain price, brand and safety requirements then the seller responds with a counteroffer. The negotiation ends with an agreement or ends with a failure if reaching the deadline of the buyer agent without agreement. The negotiations terminate with failure when the buyer employs the basic tactic and requests a car or color that does not exist with the seller. If the buying agent utilizes the hybrid technique, the most similar car requested if the seller agent does not have the exact required car. The issues related to a car object is illustrated in

Table 1At the start of negotiation, each agent starts with an offer that provides it with the highest utility. For example, a buyer agent would start asking a car that has high quality, most preferable car color, lowest price, highest fuel consumption rate, longer warranty and lowest delivery time. During negotiation, the buyer agent would concede on these issues aiming to reach an agreement of buying a car with the best possible outcome.

The negotiation parameters are the deadlines and overlap percentages between issues (quantitative) reservation values. In our experiments, negotiation rounds should end at a certain time. Therefore, each agent has a deadline that affects its concession behaviour. For example, at the agent’s deadline, that agent may concede largely on different issues in order to reach an agreement before the end of negotiation. The overlap between the reservation intervals of quantitative negotiation issues is another important negotiation parameter which can be used to test different negotiation strategies and it is widely used in the negotiation literature [

32,

33]. If the two agents have the same reservation intervals, that would improve the probability of reaching an agreement regarding that issue. For example, if the buyer agent has a reservation interval of [

$10,000,

$20,000] for a car and the seller agent has a reservation value of [

$21,000,

$30,000] for the same car, then the negotiation process will end without reaching an agreement, because the highest price that buyer agent would pay is

$20,000 and the minimum selling price for the same car by the seller agent is

$21,000.

6.2. Negotiation Method

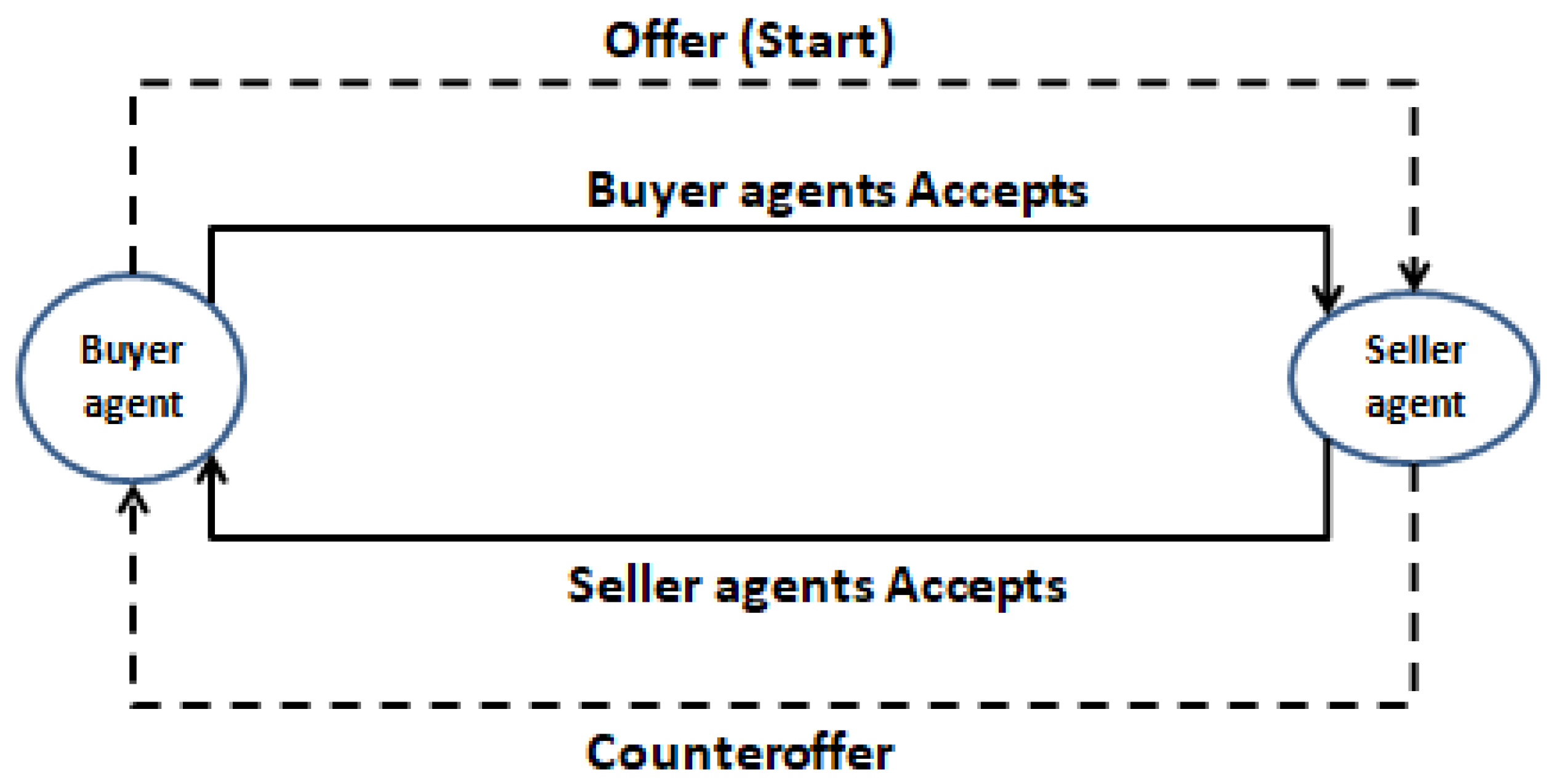

The negotiation process is assumed to start by the buyer agent—it could start by the seller agent too—by sending an offer to the the seller agent, see

Figure 3.

Figure 3 shows that the buyer agent sends an offer to the seller agent. The seller agent either accepts the offer or sends a counteroffer. This process continues until the seller agent accepts the offer, the buyer agent accepts the counter offer, or one of the two agents reaches its deadline and the negotiation process ends with a conflict.

The decision of accepting an offer/counteroffer depends of the utility of the received offer/counteroffer. If is equal or better than the last sent offer/counteroffer, the agent accepts the proposal and the negotiation process ends with success, otherwise the negotiation process continues.

The different negotiation strategies are played against each other, where the negotiation strategies used in this paper are shown in

Table 2.

We used python to simulate the negotiation process and each agent is represented by a set of functions such as functions to generate offers/counteroffers, functions to calculate the utility of offers/counteroffers, etc.

8. Experimental Results and Discussion: Part II

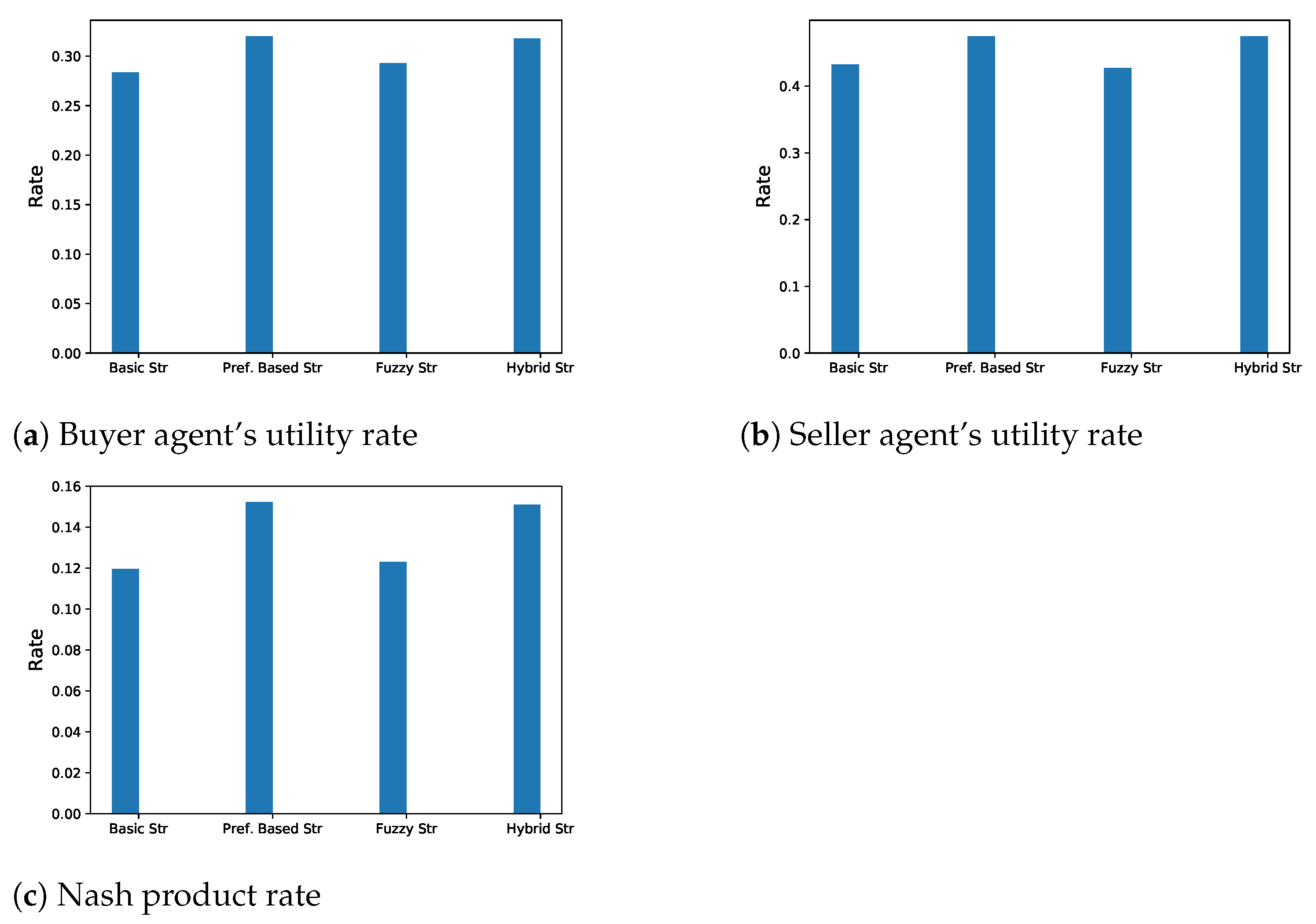

This part of the experimental results compares four negotiation strategies in terms of utility rate, agreement rate, and Nash product rate.

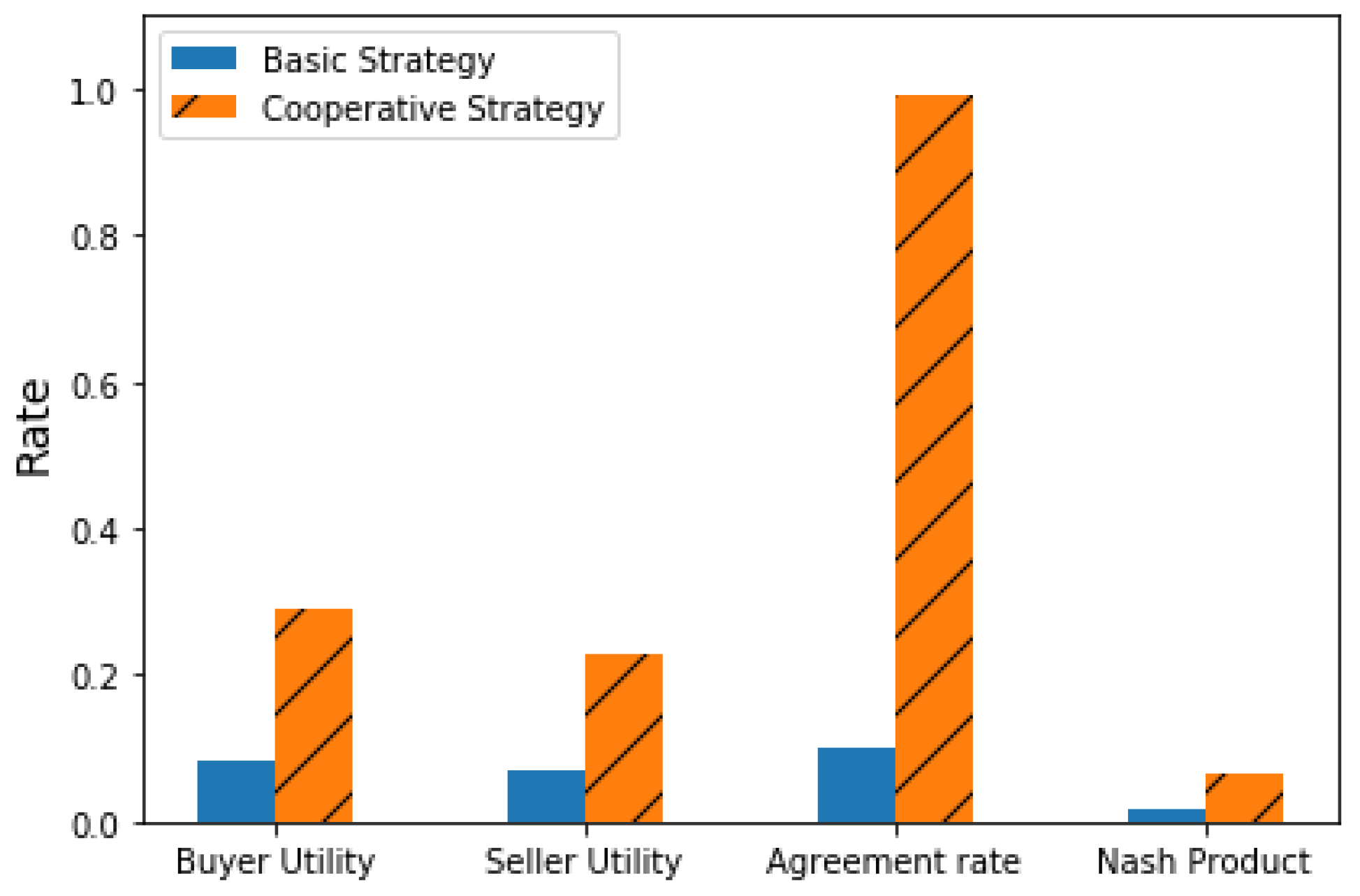

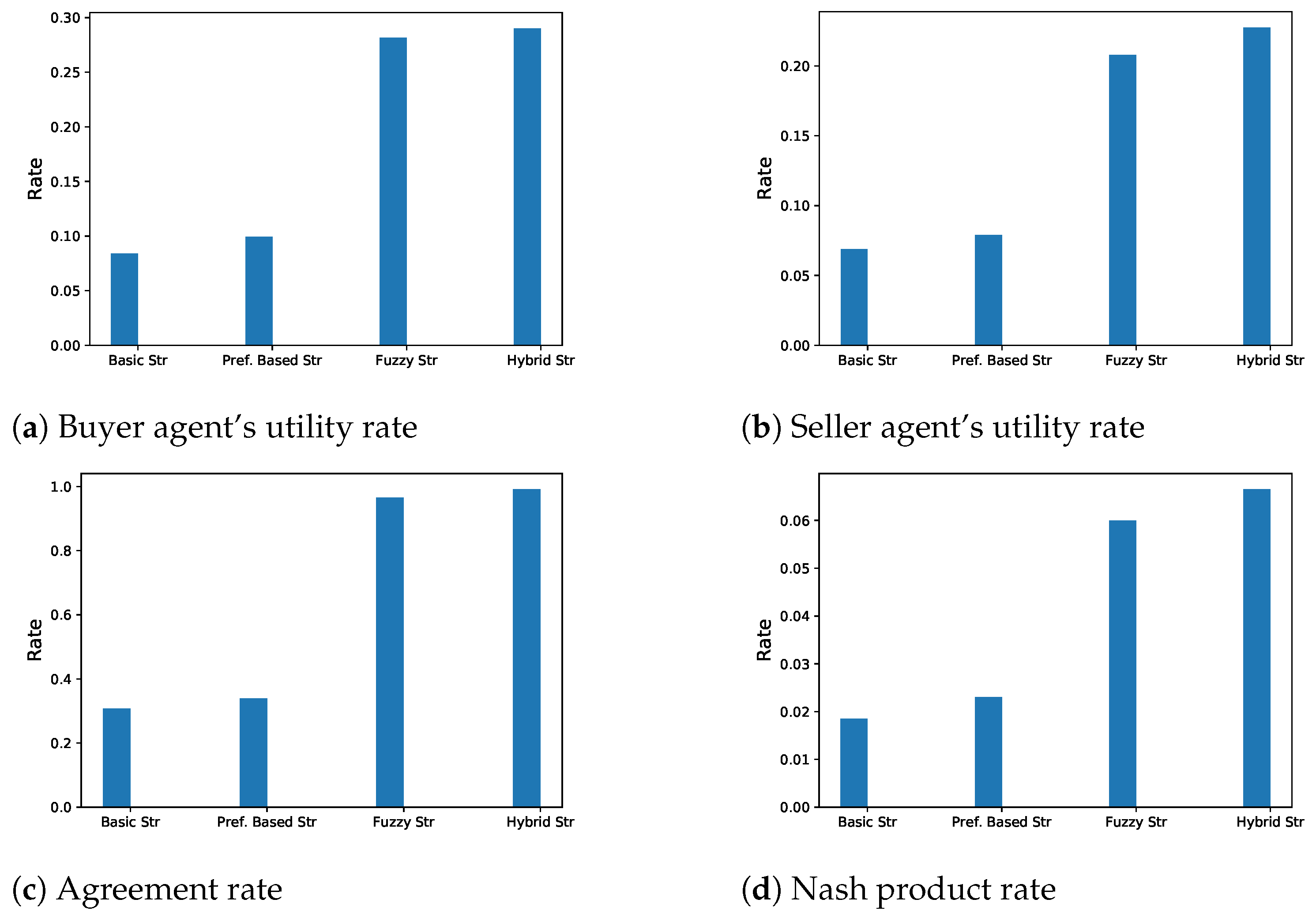

Figure 7 shows the results of negotiation when the negotiation environment is characterized by small overlap and random deadlines.

Figure 7a shows the buyer agent utility for each of the four negotiation strategies. It is noticed that the hybrid strategy performs the best in terms of utility gain. The second best performer is the fuzzy-based strategy. The basic strategy provided the lowest utility rate. The seller agent gains better utility rates when the buyer agent uses either the hybrid or fuzzy similarity strategies, see

Figure 7b. Even though the seller agent gets better utility rates when the buyer agent uses any of the non-basic negotiation strategies, these strategies provide the buyer agent with better utility rates than the ones for the seller agent, see

Figure 7a,b. What makes the utility rates higher for the fuzzy strategy is that it results in more agreements. See

Figure 7.

The agreement rate results are shown if

Figure 7c. The hybrid strategy performs the best while the fuzzy-based comes next and the preference based outperforms the basic strategy. The Nash product results are shown in

Figure 7d. Again, the hybrid strategy performs the best and the fuzzy-based strategy comes next. It is noticed that the results are consistent for the three evaluation criteria and support that effectiveness of the hybrid strategy over other strategies.

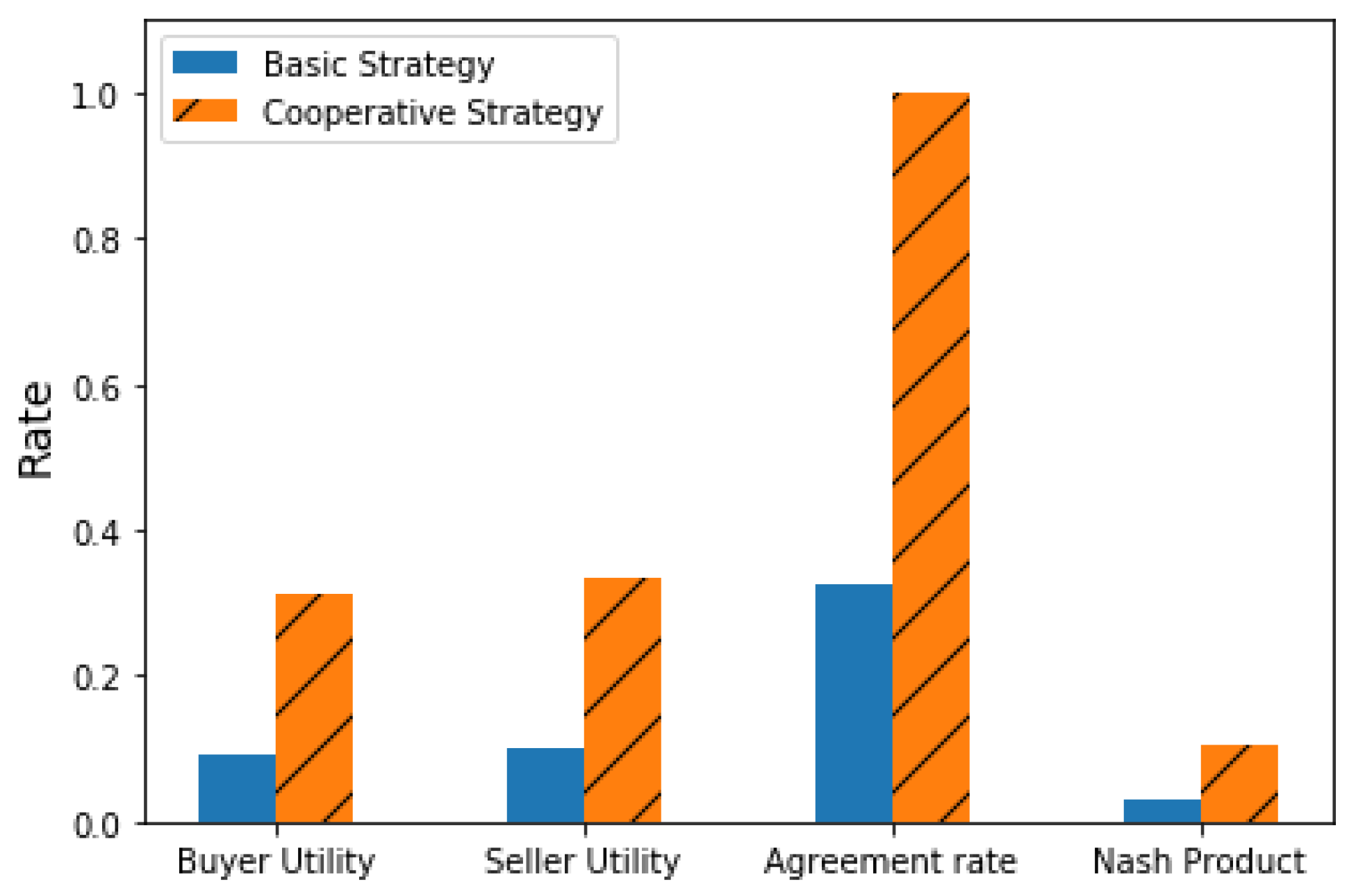

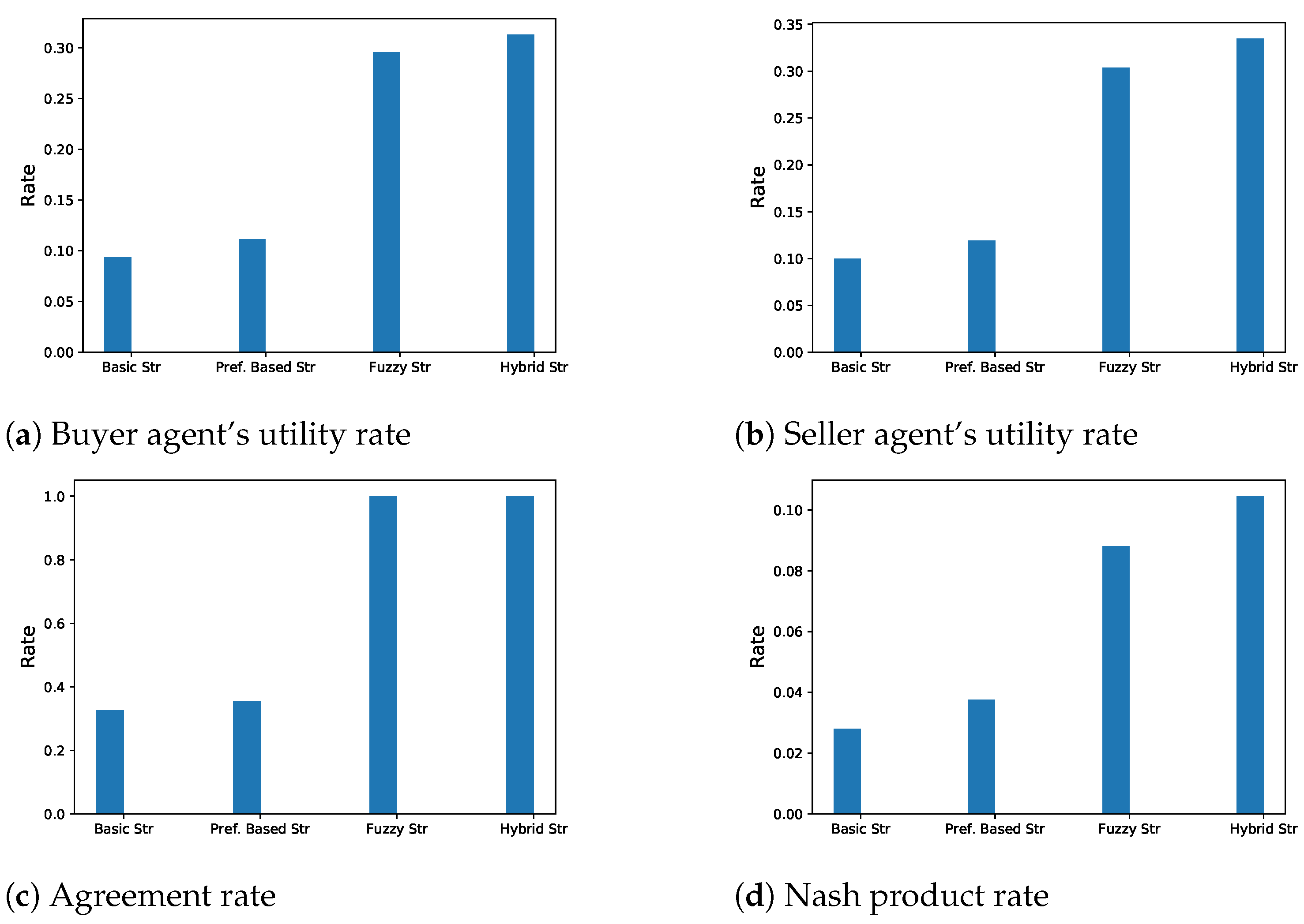

Figure 8 shows the results of negotiation when the environment is characterized by medium overlap and random deadlines. The utility rates results for the buyer agent and the seller agent are shown in

Figure 8a,b respectively. The Figures show that both the buyer agent and the seller agent gain better utility rates when the buyer agent uses the hybrid strategy. The second best for both agents is the fuzzy-based strategy. The utility rate results are consistent with the utility rates shown in

Figure 7.

The agreement rates are shown in

Figure 8c. The agreement rates show that the hybrid and fuzzy-based strategies performs better than the other two strategies. Since the overlap percentage here is higher than the one used to produce the results in

Figure 7c, the agreement rate here is higher than the agreement rates shown in

Figure 7c.

The Nash product rates (see

Figure 8d) show that the hybrid strategy performs better that other strategies which is consistent with the results shown in

Figure 7d. However, due to the higher overlap percentages used in this experiment, the Nash products rates shown in

Figure 8d are higher than the Nash product rates in

Figure 7d.

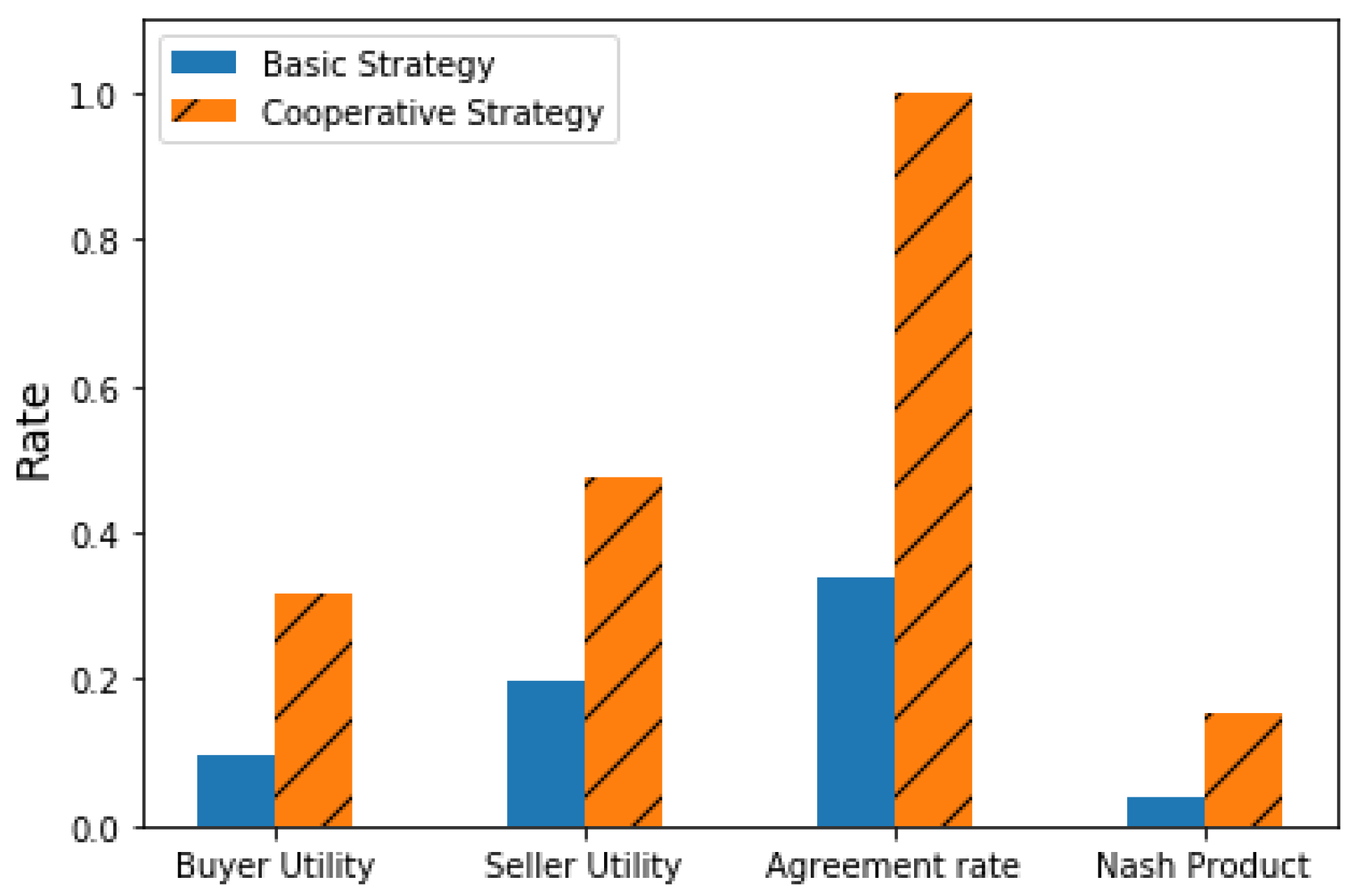

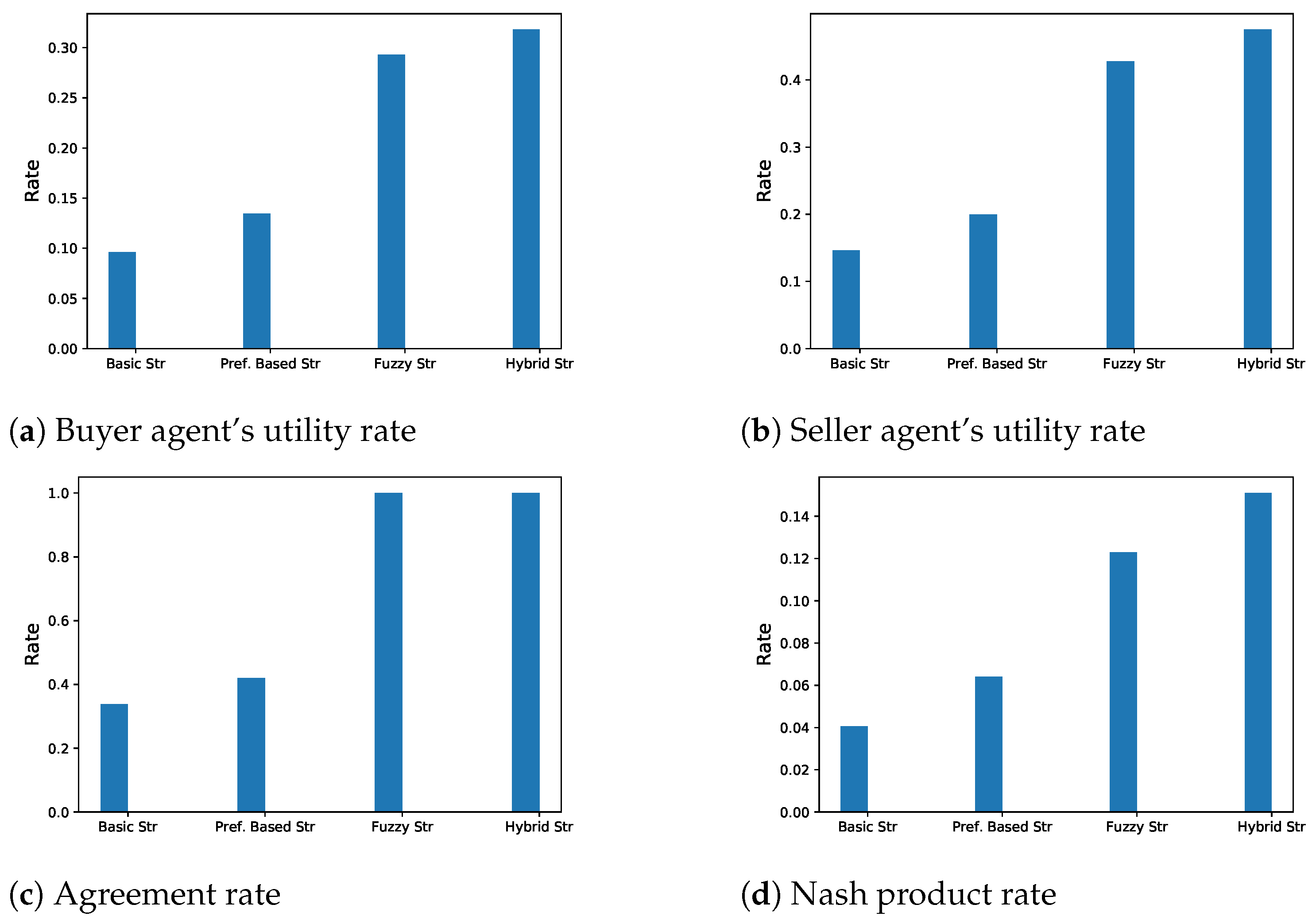

Figure 9 shows the results of negotiation when using large overlap and random deadlines.

For large overlap and medium deadlines,

Figure 9a shows that the hybrid strategy performs higher utility rate that the other negotiation strategies. The fuzzy negotiation strategies provide a better utility rate to the buyer agent than the preference-based strategy. The basic strategy provides the least utility rate. The four negotiation strategies perform similarly for the seller agent in terms of utility rate, see

Figure 9b.

The agreement rate results are shown in

Figure 9c. Both the hybrid and the fuzzy negotiation strategies performs similarly in terms of the agreement rate. The Nash product rate results are shown in

Figure 9d. The hybrid strategy provides the best rate, the fuzzy strategy comes next, and the preference-based strategy comes in the third position.

The performance of different negotiation strategies in terms of utility and Nash product per agreement rates for different negotiation strategies are shown in

Figure 10,

Figure 11 and

Figure 12.

The utility rate per agreement for the buyer agent with small overlap and random deadlines are shown in

Figure 10a. It is noticed that the hybrid, fuzzy and preference-based strategies perform better than the basic negotiation strategy, while the preference-based strategy shows the best utility rate per agreement. The results for the seller agent’s utility rates are shown in

Figure 10b. The figure shows that the fuzzy strategy has similar results to the basic strategy in terms of utility per agreement rate. The reason for this is that the seller utility formula does include the utility gained from the qualitative issues since the seller agent is assumed to care only about selling a car and its utility comes from the quantitative issues. On the other hand, the utility formula for the buyer agent includes both the quantitative and qualitative issues.

Figure 10c shows the Nash product rate per agreement. The Figure shows that the hybrid strategy performs similar to the preference-based strategy.

The experimental results for the utility and Nash product per agreement rates in a negotiation environment characterized by medium overlap and random deadlines are shown in

Figure 11. In terms of utility per agreement rates for the buyer and the seller agents, the hybrid and preference-based negotiation performs better than the fuzzy and basic strategies. The same applies for the Nash product per agreement rate, see

Figure 11c.

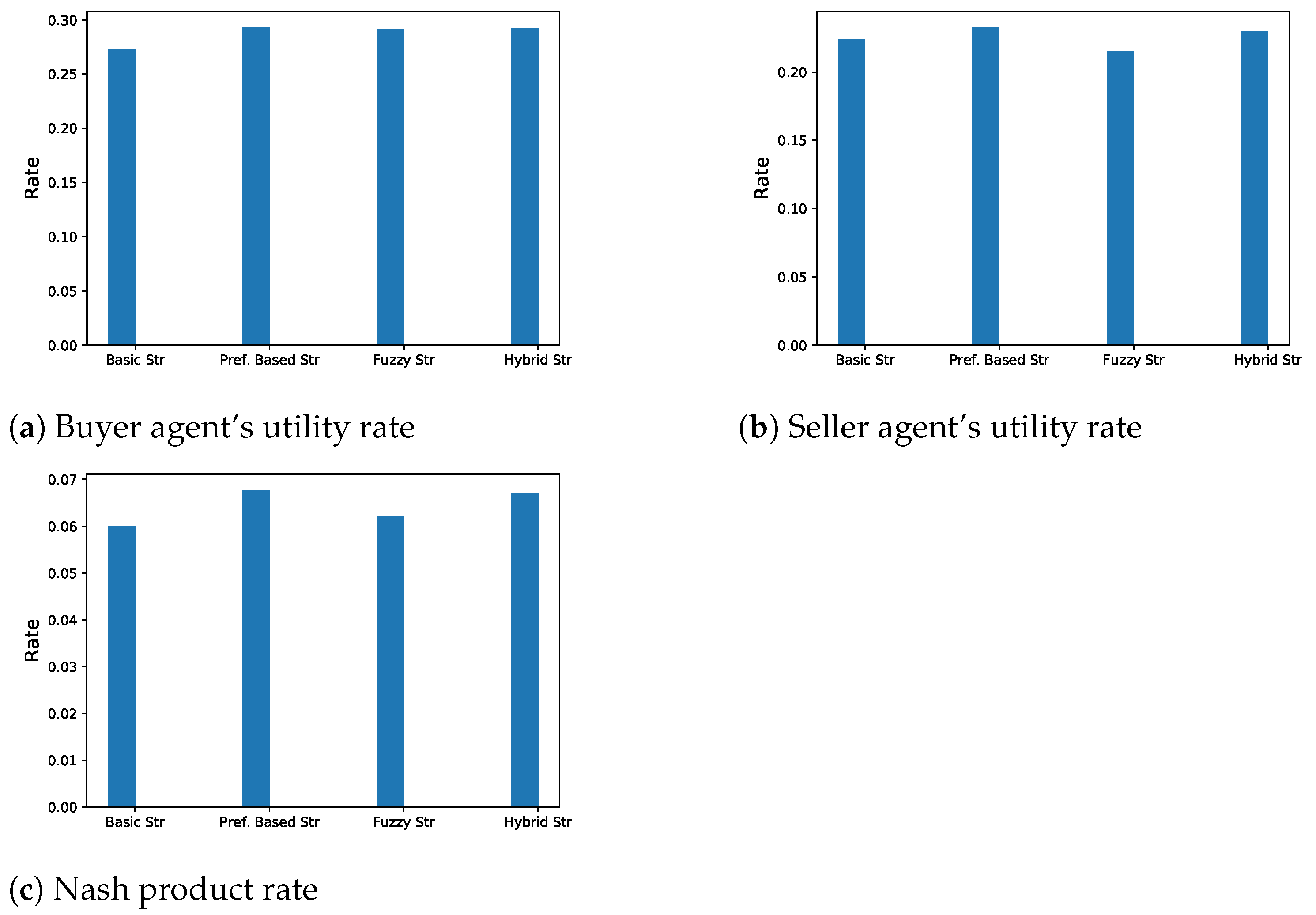

Figure 12 shows the results in terms of utility and Nash product per agreement rates with large overlap and random deadlines under different negotiation strategies.

The preference-based and the hybrid negotiation strategies performs better than the fuzzy and basic strategies, see

Figure 12a,b. The preference-based and the hybrid strategies performs similarly and better than than the fuzzy and basic negotiation strategies, see

Figure 12c.