Credible Peer-to-Peer Trading with Double-Layer Energy Blockchain Network in Distributed Electricity Markets

Abstract

:1. Introduction

- (1)

- It is difficult to authenticate participants in plug-and-play energy blockchain networks. Some nodes could re-register their IDs (Identity Documents) and rejoin the system after performing malicious behaviors [23]. The distributed data structure also exposes the privacy of users to the risk of leakage and reduces enthusiasm to participate [24].

- (2)

- The credibility of the distributed electricity market is not guaranteed. In two-way auctions and matching transactions, participants with good credit behavior are not encouraged. Then, participants with malicious behavior also have no clear punishment measures. Ignoring rewards and penalties for credible behavior is not conducive to the large-scale implementation of blockchain-based P2P energy trading.

- (3)

- Ineffective supervision is also an urgent problem in the current P2P energy trading market. Some energy trading based on consortium blockchain isolates trading information from the outside, and leads to value islands [25]. Then, in the absence of supervision, energy sellers may underreport electricity to evade taxes, and industrial users may underreport electricity to falsify energy consumption targets.

- (1)

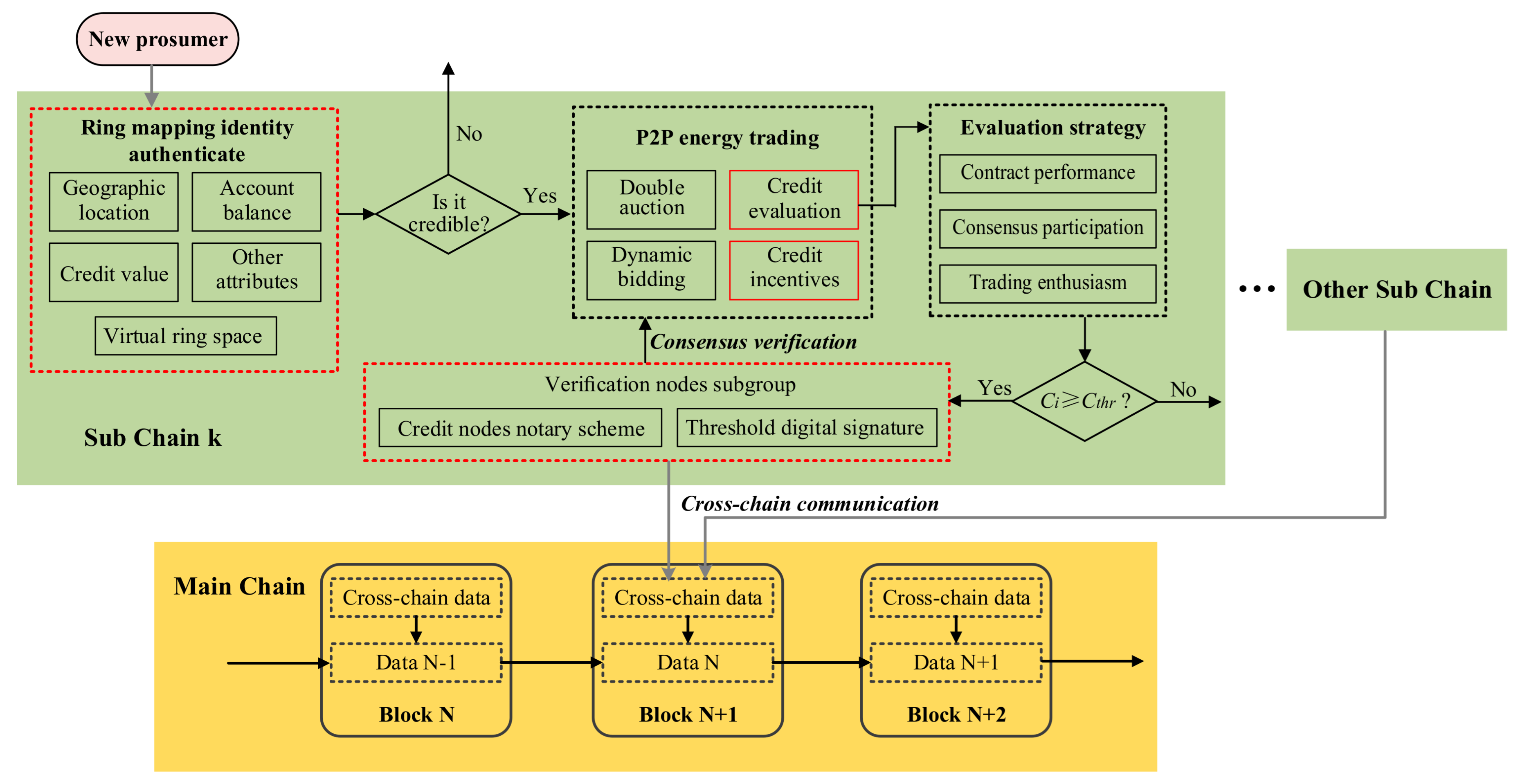

- A double-layer energy blockchain network is proposed based on the cross-chain interoperability and notary scheme. This blockchain network that includes several Sub Chains and a Main Chain can ensure the effective separation and combination of different trading functions.

- (2)

- The ring mapping identity authentication and credit-threshold notary schemes are designed for P2P energy trading. The ring mapping gives each participant an accurate, traceable identity. In addition, the nodes with higher credit evaluation results are more credible as notaries to verify the system information.

- (3)

- A dynamic credit incentive trading model is embedded into the double-layer blockchain network. Different from previous studies, this two-way auction rewards or punishes participants according to their behaviors. This incentive model guarantees the rights and economic profits of credible prosumers.

- (4)

- A real case of Erenhot, China is simulated and analyzed to prove that the presented mode provides a reference for the effective implementation of credible P2P energy trading. The real case scenario is more convincing to demonstrate the credibility and value of this work.

2. Literature Review

2.1. Peer-to-Peer Energy Trading

2.2. Blockchain-Based Energy Management

2.3. Conclusions from the Literature Review and Objectives

3. Double-Layer Energy Blockchain Network

3.1. System Structure

3.2. Ring Mapping Identity Authentication

3.3. Credit-Threshold Notary Scheme

4. Energy Trading Model

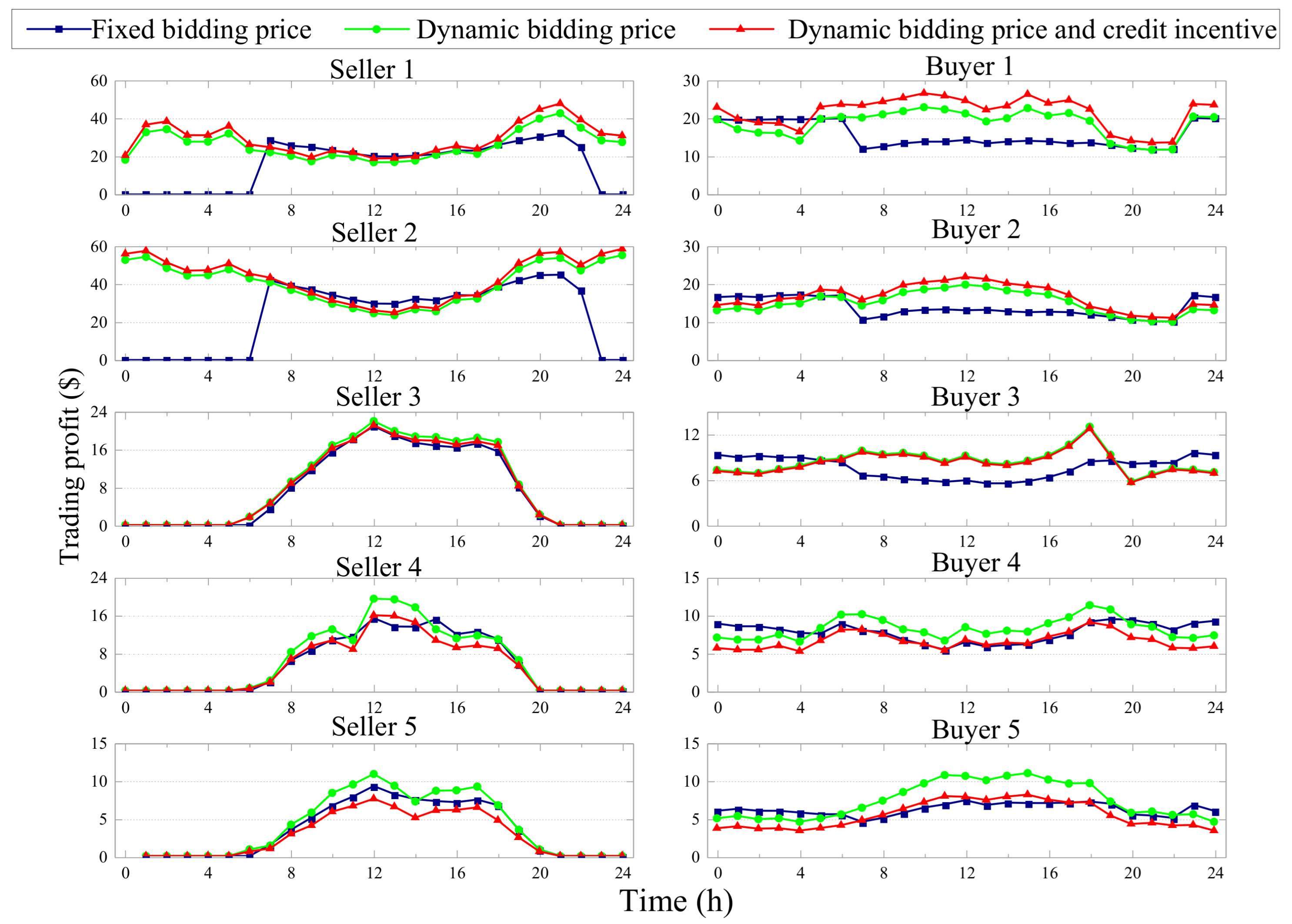

4.1. Dynamic Bidding Strategy

4.2. Credit Incentives

5. Case Study

5.1. Scenario Set

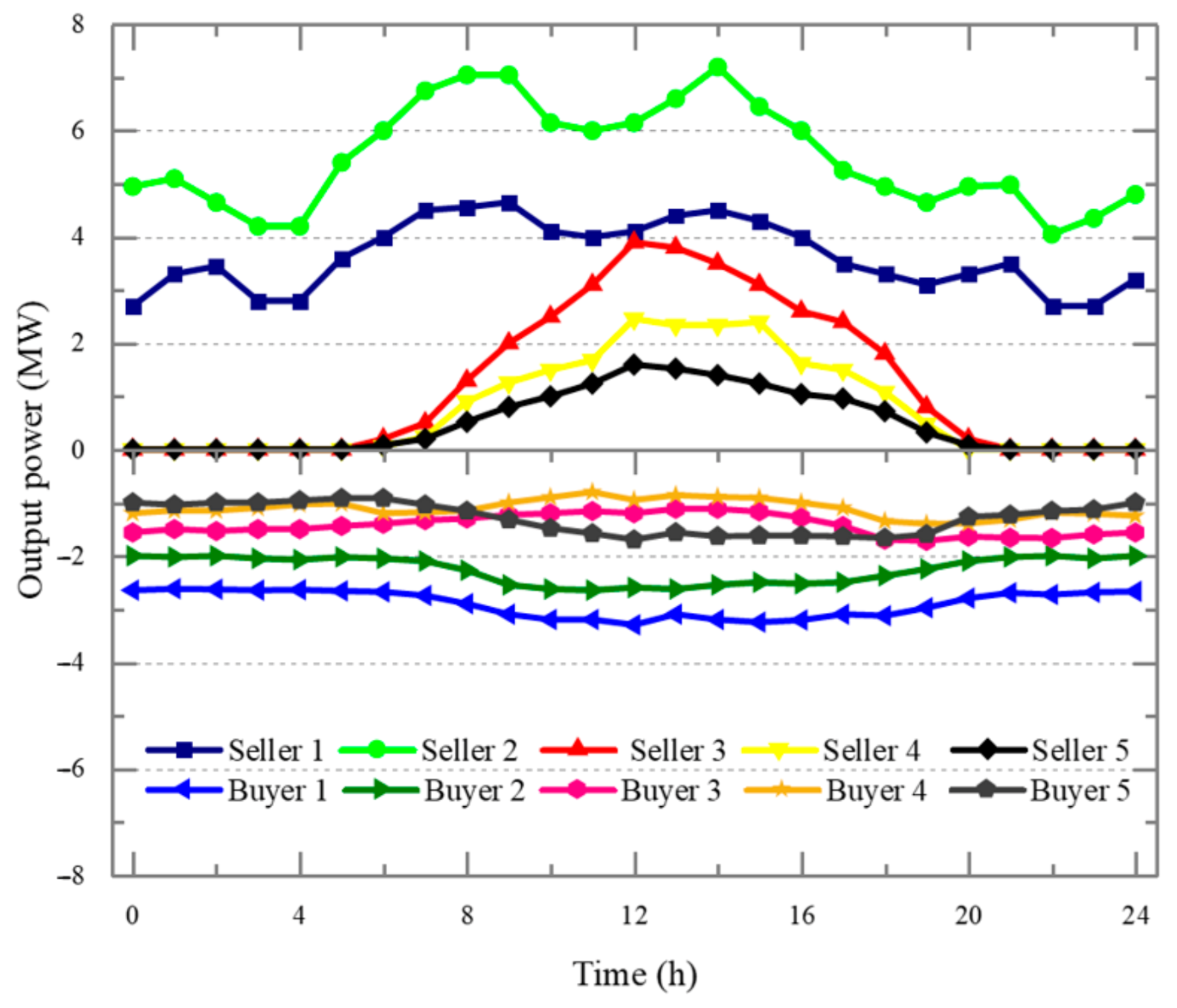

5.2. Basic Data

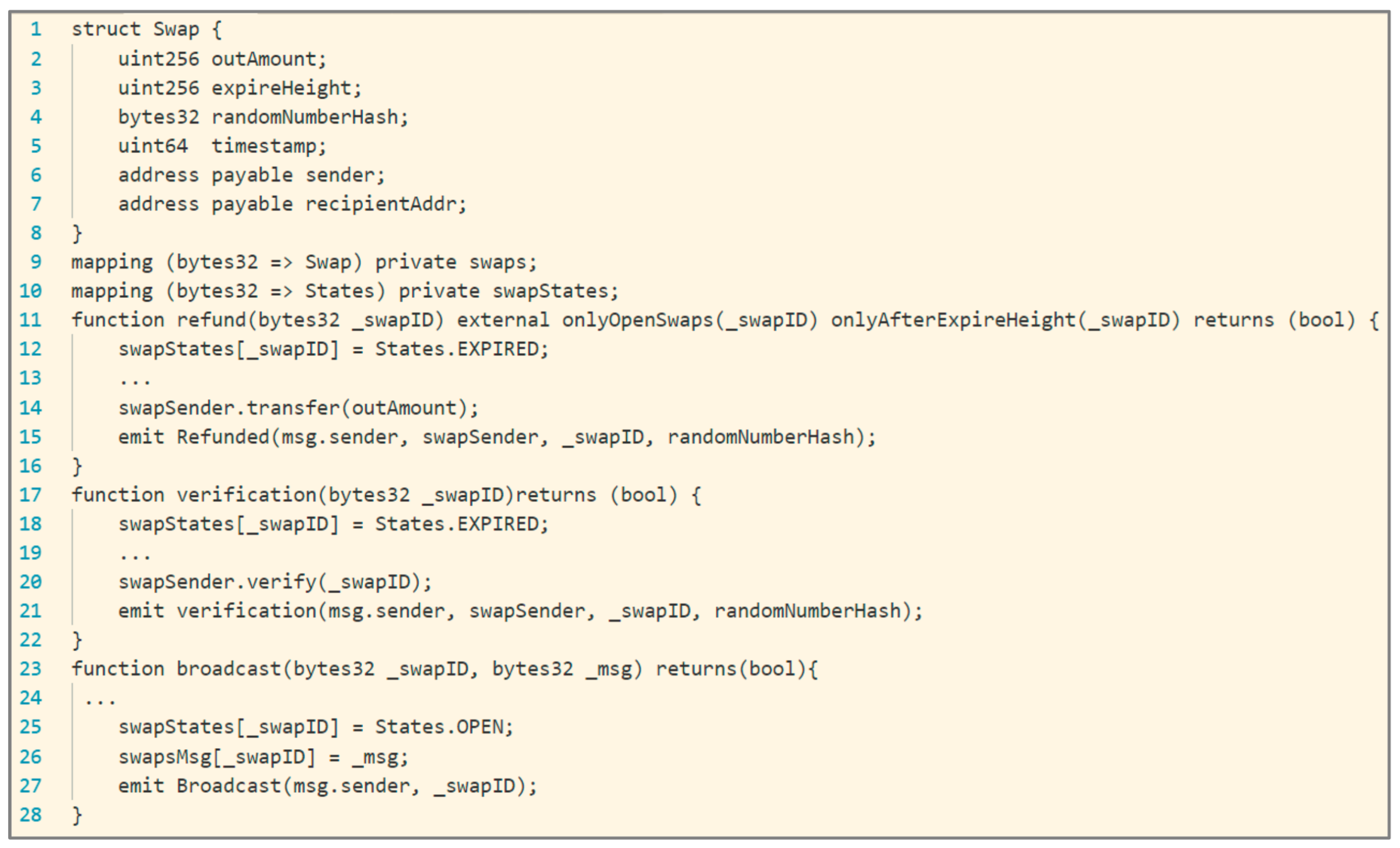

5.3. System Design and Implementation

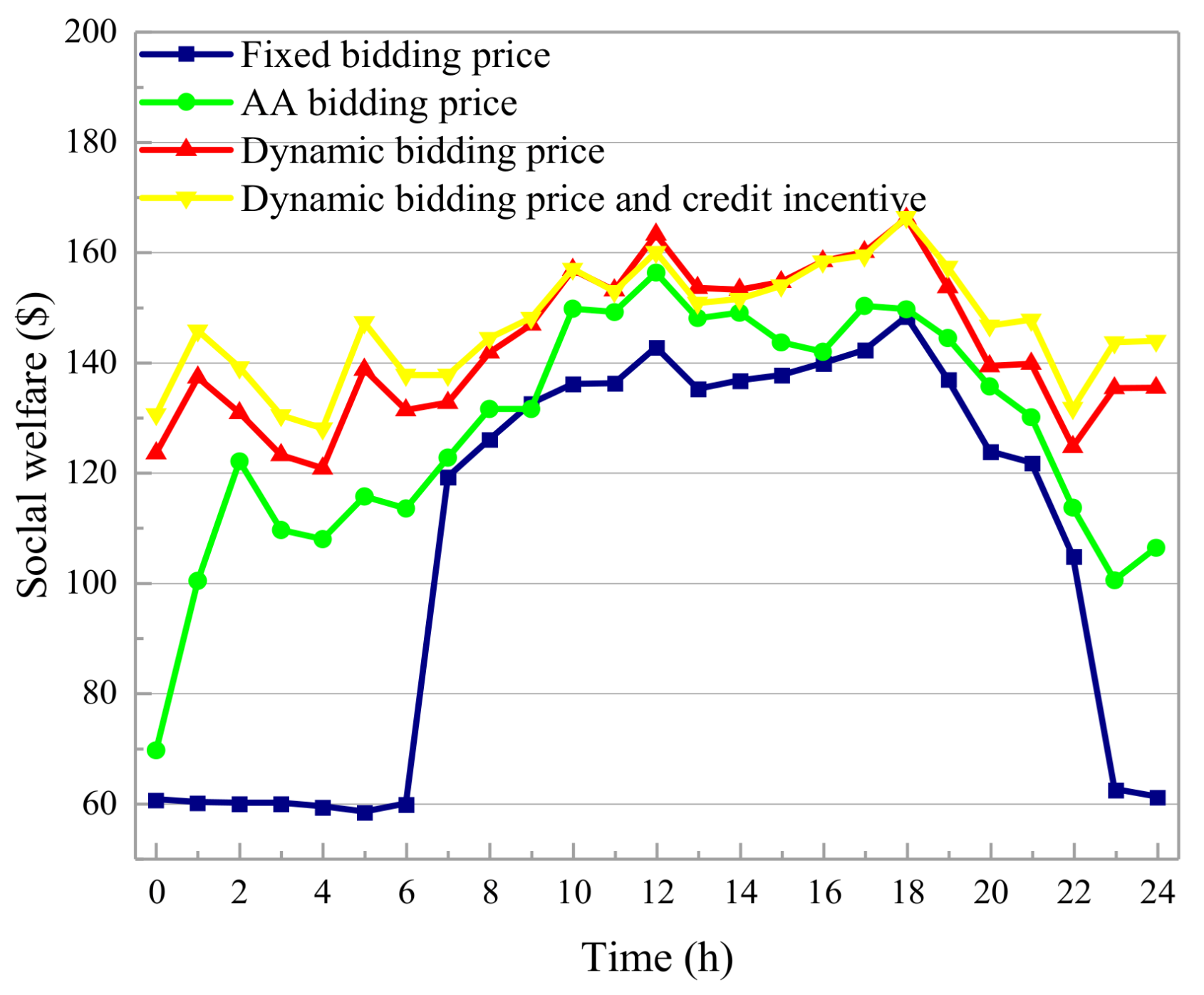

5.4. Operation Results

5.5. Discussion

6. Conclusions

- (1)

- Blockchain structure: This paper designs a double-layer energy blockchain network for distributed electricity markets to ensure privacy protection and effective supervision. The blockchain structure is constructed by cross-chain interoperability technology, and the credit-threshold notary scheme and blockchain digital signature separates P2P trading data from the information to be made public.

- (2)

- Identity authentication: The ring mapping algorithm is innovatively introduced into distributed electricity markets, allowing each energy prosumer to have a proprietary identity in the energy blockchain network. This mapping identity authentication makes entity identity traceable so that uncredible nodes are excluded from the trading platform.

- (3)

- Information verification: Credit evaluation and sorting are according to contract performance, consensus participation, and trading enthusiasm of energy prosumers. The VNS is formed by high-credit nodes, which verifies the energy trading data on each Sub Chain and the Main Chain. This mode makes the formation of new blocks with high credibility.

- (4)

- Trading model: The proposed bidding strategy can adjust quotation dynamically according to real-time market information so that the P2P trading has higher social welfare and renewable energy consumption. Moreover, the credit incentives can incite the credit behavior of energy prosumers.

- (5)

- Research value: This study is expected to solve the technical problems of insufficient credit and unregulated P2P energy trading, which can promote the application of P2P trading and blockchain technology.

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Nomenclature

| address information of node i | |

| account balance of node i | |

| credit value of node i | |

| other attributes of node i | |

| public key of CA | |

| private key of CA | |

| public key of the ring node | |

| private key of the ring node | |

| and | random large prime number |

| private key to generate digital signature | |

| ring mapping space | |

| selecting random number of CA | |

| result of decryption verification | |

| filled message from new node | |

| hash value | |

| original signature | |

| target signature | |

| number of all nodes in VNS | |

| minimum number required to pass a verification | |

| actual number pass a verification | |

| public key of the verification nodes | |

| credit evaluation of contract performance by supplier i in time t | |

| credit evaluation of contract performance by supplier i in time t-1 | |

| credit evaluation of contract performance by user j in time t | |

| credit evaluation of contract performance by user j in time t-1 | |

| power quantity of smart contract in time t | |

| actual power quantity in time t | |

| credit evaluation of consensus participation in time t | |

| vicious vote in time t | |

| virtuous vote in time t | |

| penalty factor | |

| basics credit evaluation of supplier i in time t | |

| basics credit evaluation of user j in time t | |

| penalty factor of supplier for not actively participating in market operating | |

| penalty factor of user for not actively participating in market operating | |

| number of time slots in continuous non-participation in the system operation | |

| credit evaluation of supplier i in time t | |

| credit evaluation of user j in time t | |

| propensity factor for users’ purchasing | |

| propensity factor for electricity output | |

| propensity factor for supply and demand relationship | |

| comprehensive propensity factor of supplier i in time t | |

| maximum power quantity of users at time t | |

| total power of all users at time t | |

| total power of all prosumers at time t | |

| power quantity of prosumer i at time t | |

| highest selling prices of prosumer i | |

| lowest selling prices of prosumer i | |

| rational choice function | |

| degree of urgent need for electricity in time t | |

| bidding price of power user | |

| basics bidding price of power user | |

| minimum of user’s bidding price sequence up to round t | |

| maximum of user’s bidding price sequence up to round t | |

| transaction price of round t | |

| reserve price of power supplier i | |

| reserve price of power user j | |

| trading volume of supplier i in time t | |

| trading volume of user j in time t | |

| total expense of electricity market operation |

References

- Sorknæs, P.; Lund, H.; Skov, I.R.; Djørup, S.; Skytte, K.; Morthorst, P.E.; Fausto, F. Smart Energy Markets—Future electricity, gas and heating markets. Renew. Sustain. Energy Rev. 2020, 119, 109655. [Google Scholar] [CrossRef]

- Leaders Spar at UN General Assembly Amid Global Crisis. Available online: https://edition.cnn.com/2020/09/22/world/un-general-assembly-trump-bolsonaro-intl/index.html (accessed on 20 December 2020).

- China to Bring Total Installed Capacity of Wind, Solar Power to over 1.2 bln kW by 2030: Xi. Available online: http://www.xinhuanet.com/english/2020-12/12/c_139584740.html (accessed on 20 December 2020).

- Mararakanye, N.; Bekker, B. Renewable energy integration impacts within the context of generator type, penetration level and grid characteristics. Renew. Sustain. Energy Rev. 2019, 108, 441–451. [Google Scholar] [CrossRef]

- Tabar, V.S.; Abbasi, V. Energy management in microgrid with considering high penetration of renewable resources and surplus power generation problem. Energy 2019, 189, 116264. [Google Scholar] [CrossRef]

- Andrea, P.; Ridoy, D.; Yue, W.; Zunaib, A.; Richard, K.; Ghanim, P.; Roberto, T. Micro market based optimisation framework for decentralised management of distributed flexibility assets. Renew. Energy 2021, 163, 1595–1611. [Google Scholar]

- Ahmadi, M.; Adewuyi, O.B.; Danish, M.S.S.; Mandal, P.; Yona, A.; Senjyu, T. Optimum coordination of centralized and distributed renewable power generation incorporating battery storage system into the electric distribution network. Int. J. Electr. Power Energy Syst. 2021, 125, 106458. [Google Scholar] [CrossRef]

- Kumar, G.V.B.; Sarojini, R.K.; Palanisamy, K.; Padmanaban, S.; Holm-Nielsen, J.B. Large Scale Renewable Energy Integration: Issues and Solutions. Energies 2019, 12, 1996. [Google Scholar] [CrossRef] [Green Version]

- Kyoungsoo, B.; Sunyong, P.; Jongtae, L.; Jaesoo, Y. Mobile P2P-Based Skyline Query Processing over Delay-Tolerant Networks. Electronics 2019, 8, 1276. [Google Scholar]

- Gijs, V.L.; Tarek, A.; Madeleine, G.; Wilfried, V.S. An integrated blockchain-based energy management platform with bilateral trading for microgrid communities. Appl. Energy 2020, 263, 114613. [Google Scholar]

- Guerrero, J.; Chapman, A.C.; Verbič, G. Decentralized P2P Energy Trading Under Network Constraints in a Low-Voltage Network. IEEE Trans. Smart Grid 2019, 10, 5163–5173. [Google Scholar] [CrossRef] [Green Version]

- Noor, S.; Yang, W.; Guo, M.; van Dam, K.H.; Wang, X. Energy Demand Side Management within micro-grid networks enhanced by blockchain. Appl. Energy 2018, 228, 1385–1398. [Google Scholar] [CrossRef]

- Mahmud, K.; Nizami, M.S.H.; Ravishankar, J.; Hossain, M.J.; Siano, P. Multiple Home-to-Home Energy Transactions for Peak Load Shaving. IEEE Trans. Ind. Appl. 2020, 56, 1074–1085. [Google Scholar] [CrossRef]

- Das, S.; Ray, A.; De, S. Optimum combination of renewable resources to meet local power demand in distributed generation: A case study for a remote place of India. Energy 2020, 209, 118473. [Google Scholar] [CrossRef]

- Hasan, M. Peer-to-peer home energy management incorporating hydrogen storage system and solar generating units. Renew. Energy 2020, 156, 183–192. [Google Scholar]

- Foti, M.; Vavalis, M. Blockchain based uniform price double auctions for energy markets. Appl. Energy 2019, 254, 113604. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Gärttner, J.; Rock, K.; Kessler, S.; Orsini, L.; Weinhardt, C. Designing microgrid energy markets: A case study: The Brooklyn Microgrid. Appl. Energy 2018, 210, 870–880. [Google Scholar] [CrossRef]

- Tushar, W.; Yuen, C.; Saha, T.K.; Morstyn, T.; Chapman, A.C.; Alam, M.J.E. Peer-to-peer energy systems for connected communities: A review of recent advances and emerging challenges. Appl. Energy 2021, 282, 116131. [Google Scholar] [CrossRef]

- Japanese Blockchain Consortium Researches Electricity Trading. Available online: https://www.ledgerinsights.com/japanese-blockchain-consortium-researches-electricity-trading/ (accessed on 25 December 2020).

- $20 Million Research Programme to Boost Singapore’s Power Engineering Capabilities. Available online: https://www.ema.gov.sg/media_release.aspx?news_sid=20181029wBCLGRF7Apau (accessed on 25 December 2020).

- Power Ledger P2P Platform Goes across the Meter with BCPG at T77 Precinct, Bangkok. 2020. Available online: https://medium.com/power-ledger/powerledger-p2p-platform-goes-across-the-meter-with-bcpg-at-t77-precinct-bangkok-62df5aba3d0a (accessed on 20 December 2020).

- Lin, J.; Pipattanasomporn, M.; Rahman, S. Comparative analysis of auction mechanisms and bidding strategies for P2P solar transactive energy markets. Appl. Energy 2019, 255, 113687. [Google Scholar] [CrossRef]

- Lwin, M.T.; Yim, J.; Ko, Y.-B. Blockchain-Based Lightweight Trust Management in Mobile Ad-Hoc Networks. Sensors 2020, 20, 698. [Google Scholar] [CrossRef] [Green Version]

- Sheikh, M.I.; Mariusz, N.; Roshan, J.; Ashish, K.M. Security Aspects of Blockchain Technology Intended for Industrial Applications. Electronics 2021, 10, 951. [Google Scholar]

- Trabucchi, D.; Moretto, A.; Buganza, T.; Alan, M. Disrupting the Disruptors or Enhancing Them? How Blockchain Re-Shapes Two-Sided Platforms. In Proceedings of the 26th Innovation and Product Development Management Conference, Leicester, UK, 6–9 June 2019; pp. 1–17. [Google Scholar]

- Koirala, B.P.; Koliou, E.; Friege, J.; Hakvoort, R.A.; Herder, P.M. Energetic communities for community energy: A review of key issues and trends shaping integrated community energy systems. Renew. Sustain. Energy Rev. 2016, 56, 722–744. [Google Scholar] [CrossRef] [Green Version]

- Luthander, R.; Widén, J.; Nilsson, D.; Palm, J. Photovoltaic self-consumption in buildings: A review. Appl. Energy 2016, 142, 80–94. [Google Scholar] [CrossRef] [Green Version]

- Lehlogonolo, P.I.L.; Gerhard, P.H.; Sherrin, J.I.; Hein, S.V. Smart Microgrid Energy Market: Evaluating Distributed Ledger Technologies for Remote and Constrained Microgrid Deployments. Electronics 2021, 10, 714. [Google Scholar]

- Lu, Z.; Wang, J.; Yong, W.; Tang, Z.; Yang, M.; Zhang, B. Coordinated P2P electricity trading model with aggregated alliance and reserve purchasing for hedging the risk of deviation penalty. Energy Reports 2021, 7 (Suppl. 1), 426–435. [Google Scholar] [CrossRef]

- Cintuglu, M.H.; Martin, H.; Mohammed, O.A. Real-time implementation of multiagent-based game theory reverse auction model for microgrid market operation. IEEE Trans. Smart Grid 2015, 6, 1064–1072. [Google Scholar] [CrossRef]

- Shamsi, P.; Xie, H.; Longe, A.; Joo, J.-Y. Economic dispatch for an agent-based community microgrid. IEEE Trans. Smart Grid 2016, 7, 2317–2324. [Google Scholar] [CrossRef]

- De Paola, A.; Angeli, D.; Strbac, G. Price-based schemes for distributed coordination of flexible demand in the electricity market. IEEE Trans. Smart Grid 2017, 8, 3104–3116. [Google Scholar] [CrossRef]

- Zhou, Y.; Wu, J.; Long, C. Evaluation of peer-to-peer energy sharing mechanisms based on a multiagent simulation framework. Appl. Energy 2018, 222, 993–1022. [Google Scholar] [CrossRef]

- Long, C.; Wu, J.; Zhou, Y.; Jenkins, N. Peer-to-peer energy sharing through a two-stage aggregated battery control in a community Microgrid. Appl. Energy 2018, 226, 261–276. [Google Scholar] [CrossRef]

- Nguyen, S.; Peng, W.; Sokolowski, P.; Alahakoon, D.; Yu, X. Optimizing rooftop photovoltaic distributed generation with battery storage for peer-to-peer energy trading. Appl. Energy 2018, 228, 2567–2580. [Google Scholar] [CrossRef]

- El-Baz, W.; Tzscheutschler, P.; Wagner, U. Integration of energy markets in microgrids: A double-sided auction with device-oriented bidding strategies. Appl. Energy 2019, 241, 625–639. [Google Scholar] [CrossRef]

- Lucchi, E.; Lopez, C.S.P.; Franco, G. A conceptual framework on the integration of solar energy systems in heritage sites and buildings. IOP Conf. Ser. Mater. Sci. Eng. 2020, 949, 012113. [Google Scholar] [CrossRef]

- Mohan, V.; Bu, S.; Jisma, M.; Rijinlal, V.; Thirumala, K.; Thomas, M.S.; Xu, Z. Realistic energy commitments in peer-to-peer transactive market with risk adjusted prosumer welfare maximization. Int. J. Electr. Power Energy Syst. 2020, 124, 106377. [Google Scholar] [CrossRef]

- Ghatikar, G.; Mashayekh, S.; Stadler, M.; Yin, R.; Liu, Z. Distributed energy systems integration and demand optimization for autonomous operations and electric grid transactions. Appl. Energy 2016, 167, 432–448. [Google Scholar] [CrossRef] [Green Version]

- Dongjun, N.; Sejin, P. Fusion Chain: A Decentralized Lightweight Blockchain for IoT Security and Privacy. Electronics 2021, 10, 391. [Google Scholar]

- Zhang, Y.; Wang, L.; Wu, J.; Yuan, R.; Li, M. Blockchain and integrated energy system: Application and prospect. Natl. Nat. Sci. Found. China 2020, 34, 35–41. [Google Scholar]

- Wu, X.; Duan, B.; Yan, Y.; Zhong, Y. M2M blockchain: The case of demand side management of smart grid. In Proceedings of the 2017 IEEE 23rd International Conference on Parallel and Distributed Systems (ICPADS), Shenzhen, China, 15–17 December 2017. [Google Scholar]

- Tsao, Y.C.; Thanh, V.V. Toward blockchain-based renewable energy microgrid design considering default risk and demand uncertainty. Renew. Energy 2021, 163, 870–881. [Google Scholar] [CrossRef]

- Sikorski, J.J.; Haughton, J.; Kraft, M. Blockchain technology in the chemical industry: Machine-to-machine electricity market. Appl. Energy 2017, 195, 234–246. [Google Scholar] [CrossRef]

- Li, Y.; Yang, W.; He, P.; Chen, C.; Wang, X. Design and management of a distributed hybrid energy system through smart contract and blockchain. Appl. Energy 2019, 248, 390–405. [Google Scholar] [CrossRef]

- Wang, L.; Liu, J.; Yuan, R.; Wu, J.; Zhang, D.; Zhang, Y.; Li, M. Adaptive bidding strategy for real-time energy management in multi-energy market enhanced by blockchain. Appl. Energy 2020, 279, 115866. [Google Scholar] [CrossRef]

- Hua, W.; Jiang, J.; Sun, H.; Wu, J. A blockchain based peer-to-peer trading framework integrating energy and carbon markets. Appl. Energy 2020, 279, 115539. [Google Scholar] [CrossRef]

- Zhang, H.; Wang, J.; Ding, Y. Blockchain-based decentralized and secure keyless signature scheme for smart grid. Energy 2019, 180, 955–967. [Google Scholar] [CrossRef]

- Han, D.; Zhang, C.; Ping, J.; Yan, Z. Smart contract architecture for decentralized energy trading and management based on blockchains. Energy 2020, 199, 117417. [Google Scholar] [CrossRef]

- Schulte, S.; Sigwart, M.; Frauenthaler, P.; Borkowski, M. Towards blockchain interoperability. In Proceedings of the International Conference on Business Process Management, Vienna, Austria, 1–6 September 2019. [Google Scholar]

- Pop, C.; Antal, M.; Cioara, T.; Anghel, I.; Sera, D.; Salomie, I. Blockchain-based scalable and tamper-evident solution for registering energy data. Sensors 2019, 19, 3033. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Daghmehchi, F.M.; Ghorbani, A.; Kim, H.; Song, J. Hy-Bridge: A hybrid blockchain for privacy-preserving and trustful energy transactions in Internet-of-Things platforms. Sensors 2020, 20, 928. [Google Scholar] [CrossRef] [Green Version]

- He, H.; Luo, Z.; Wang, Q.; Chen, M.; He, H.; Gao, L.; Zhang, H. Joint Operation Mechanism of Distributed Photovoltaic Power Generation Market and Carbon Market Based on Cross-Chain Trading Technology. IEEE Access 2020, 8, 66116–66130. [Google Scholar] [CrossRef]

- Wang, L.; Wu, J.; Yuan, R.; Zhang, D.; Liu, J.; Jiang, S.; Zhang, Y.; Li, M. Dynamic Adaptive Cross-Chain Trading Mode for Multi-Microgrid Joint Operation. Sensors 2020, 20, 6096. [Google Scholar] [CrossRef] [PubMed]

- Ma, C. Research on Improved Consensus Mechanism of Delegated Proof of Stake in Blockchain. Ph.D. Thesis, Liaoning University, Shenyang, China, 2020. [Google Scholar]

- Qiao, R.; Luo, X.; Zhu, S.; Liu, A.; Yan, X.; Wang, Q. Dynamic Autonomous Cross Consortium Chain Mechanism in e-Healthcare. IEEE J. Biomed. Health Inform. 2020, 24, 2157–2168. [Google Scholar] [CrossRef] [PubMed]

- Qin, J.; Sun, W.; Li, Z.; Zhu, Y. Credit Consensus Mechanism for Microgrid Blockchain. Autom. Electr. Power Syst. 2020, 44, 15. [Google Scholar]

- He, Y.X.; Liu, P.L.; Li, Z.; Yan, Z.; Yang, L. Competitive model of pumped storage power plants participating in electricity spot Market—In case of China. Renew. Energy 2021, 173, 164–176. [Google Scholar] [CrossRef]

- Wang, J.; Wang, Q.; Zhou, N.; Chi, Y. A Novel Electricity Transaction Mode of Microgrids Based on Blockchain and Continuous Double Auction. Energies 2017, 10, 1971. [Google Scholar] [CrossRef] [Green Version]

| Prosumer | Initial Bidding Price (USD/MWh) | Reserve Price (USD/MWh) | Credit Value |

|---|---|---|---|

| Seller 1 | 67.45 | 47.22 | 90 |

| Seller 2 | 66.50 | 46.45 | 70 |

| Seller 3 | 70.63 | 49.50 | 50 |

| Seller 4 | 70.50 | 48.45 | 30 |

| Seller 5 | 70.35 | 48.30 | 10 |

| Buyer 1 | 51.85 | 66.70 | 100 |

| Buyer 2 | 52.00 | 67.60 | 80 |

| Buyer 3 | 50.00 | 65.00 | 60 |

| Buyer 4 | 51.00 | 66.50 | 40 |

| Buyer 5 | 51.50 | 65.00 | 20 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, L.; Xie, Y.; Zhang, D.; Liu, J.; Jiang, S.; Zhang, Y.; Li, M. Credible Peer-to-Peer Trading with Double-Layer Energy Blockchain Network in Distributed Electricity Markets. Electronics 2021, 10, 1815. https://doi.org/10.3390/electronics10151815

Wang L, Xie Y, Zhang D, Liu J, Jiang S, Zhang Y, Li M. Credible Peer-to-Peer Trading with Double-Layer Energy Blockchain Network in Distributed Electricity Markets. Electronics. 2021; 10(15):1815. https://doi.org/10.3390/electronics10151815

Chicago/Turabian StyleWang, Longze, Yu Xie, Delong Zhang, Jinxin Liu, Siyu Jiang, Yan Zhang, and Meicheng Li. 2021. "Credible Peer-to-Peer Trading with Double-Layer Energy Blockchain Network in Distributed Electricity Markets" Electronics 10, no. 15: 1815. https://doi.org/10.3390/electronics10151815

APA StyleWang, L., Xie, Y., Zhang, D., Liu, J., Jiang, S., Zhang, Y., & Li, M. (2021). Credible Peer-to-Peer Trading with Double-Layer Energy Blockchain Network in Distributed Electricity Markets. Electronics, 10(15), 1815. https://doi.org/10.3390/electronics10151815