1. Introduction

In oil and gas producing companies, a preliminary study, including an analysis of the available geological and geophysical information about the region under investigation, precedes the adoption of a management decision on investing in exploration, and subsequent development. It is also required to conduct technical and economic calculations that confirm the investment attractiveness of potential hydrocarbon feedstock objects.

Management decisions at the pre-investment stage that ensure sustainable reproduction of the resource base of the oil company should be scientifically grounded and based on the methodology of geological and economic assessment of the predicted oil resources. It is very important to choose the most attractive resource objects, and to determine the order of their geological study, to optimize investment costs.

As noted in the paper of Carayannis et al. [

1], poorly-researched hydrocarbon resources, including unconventional reserves and arctic fields, are the closest reserves for replenishment of oil and gas resource bases in Russia. Resources on poorly-researched hydrocarbon objects ensure the sustainable development of the oil and gas complex of Russia in the medium and long-term [

1].

Poorly-researched oil objects include those in the early stages of exploration. These objects can include identified perspective structures with geological resources of the Dl category (D1—prospective resources that reflect the possibility of discovering oil and gas fields in the assessed region, and that are used to design regional oil and gas geological exploration, to select areas, and to determine the order of the prospecting works) and prepared for exploratory drilling structures or non-drilled productive reservoirs of discovered fields with geological D0 category resources (D0—prepared resources that reflect the possibility of discovering oil and gas deposits in a trap prepared for exploratory drilling and are used to design prospecting works). The present study examined poorly-researched hydrocarbon objects located on the Arctic territory of the north-east of the Timan-Pechora province.

The methodology of the geological and economic assessment is designed to determine the industrial significance and investment attractiveness for identified and prospected fields. The indicators of geological reserves of such objects have sufficiently definite verification intervals, and therefore, the investment risks associated with their development should be more fully taken into account on the basis of the effects of factors, that are not of a natural, but of an economic nature (prices, taxation system, etc.).

Problems, related to methodological approaches aimed at developing algorithms for making managerial decisions in the geological study and industrial development of poorly-researched oil objects were considered in a number of research papers by Russian and foreign economic geologists. The rationale for making managerial decisions is based on the results of the economic evaluation. The algorithm for carrying out technical and economic calculations, taking into account investment risks, currently does not have an unambiguous methodological solution.

In the work presented by the team of scientists-economists: Gert et al. [

2,

3], focused on methodological approaches to the valuation of predictive resources, and proposed the use of probabilistic methods after carrying out an economic valuation of hydrocarbon raw materials. As input data for modelling, it is proposed to use three coefficients that reflect the transfer of resources from the lower categories to the higher ones, the success of evaluation and exploration works, and the confirmation of the quantitative estimate of resources. When assessing poorly-researched hydrocarbon resources, these indicators do not adequately reflect the complexity of the assessment.

In the article Ampilov et al. [

4] the authors provide a justification for the application of probabilistic methods for estimating the forecasted gas resources, using the Monte Carlo mathematical simulation method just before the economic evaluation process.

Some scientists clearly determine the place of application of probabilistic methods of forecasted resources quantitative estimation in the system of economic research. Oil and gas companies, along with financial and credit organizations, apply in practice the probabilistic quantitative assessment methodology set out in the Securities and Exchange Commission (SEC), the Petroleum Resources Management System (PRMS), the Society of Petroleum Engineers (SPE) classifications [

5,

6,

7,

8].

In a scientific article Carolina et al. consider the possibility of applying flexible strategies in making managerial decisions in the implementation of projects for the development of oil fields in conditions of low awareness [

9]. In the opinion of scientists, the application of the proposed approach facilitates quick management decisions related to the extraction process, which will subsequently have a positive effect on the efficiency of development. It is supposed in the article that this approach is used in developing of oil fields using intelligent wells. However, during the development of management decisions at the research stage, this approach is not practical. In this case, the flexible strategy methodology can be applied only on the basis of constructing either a set of probabilistic empirical models of reserve selection that are modelled subject to changes in geological and technical conditions, or a probabilistic quantitative assessment of the raw material potential, determination of the quantitative value of the extractable reserves P10, P50, and P90, and reasonable projection of the most probable technological extraction streams [

9].

(P90)—minimum resources, the amount of oil that can be extracted from the subsoil with a probability of 90%;

(P50)—probable resources, the amount of oil, which can be extracted with a probability of 50%;

(P10)—maximum resources, the amount of oil with the probability of extraction equal to 10%.

The scientific article of Tugan et al. [

10] is focused on probabilistic estimation, economic-mathematical modelling issues, and software tools that allow the multivariant geological and economic calculations to be performed. The authors propose the use of the probabilistic estimation in determining the main efficiency indicators, net present value (NPV) and internal rate of return (IRR), of the shale gas field’s development, applicable to the three stages: research and assessment, exploration, and extraction. The software package offered as a toolkit has wide graphical capabilities for interpreting the results obtained for the best perception. However, the methodical approach proposed by the authors is aimed at geological and economic studies of shale gas objects. The results of the study do not cover the issues of probabilistic modelling methods that can be used to generate cash flows from the economic evaluation of the exploration and development of traditional oil and gas objects.

Kaiser [

11] presents the results of analytical research focused on the study of the impact of the shale gas extraction process from wells P10, P50, and P90 on the company’s economy. The tax preferences applied depend on the intensity of extraction, and, accordingly, on the size of the company’s tax-free profits. Just as in previous studies, the authors did not consider the processes associated with the geological study of poorly-researched forecasted objects of both shale and traditional hydrocarbon raw materials.

In the Clews [

12], in Chapter 6, the authors note that the process of geological exploration and industrial development of oil and gas resources is subject to one of the most complex risks in the industry, and as a result, the development of management decisions on financing such projects poses significant challenges for management. The geological factor is one of the key factors in making such decisions; therefore, the need to account for it with the use of various economic instruments provides an opportunity for investors to make the most informed decision about the appropriateness of investing money in the project. This account is especially relevant for poorly-researched oil and gas objects.

In the paper [

13] the authors Tang et al. emphasize that oil companies, as a justification for investing in mining projects, require the mandatory use of estimation methods related to geological and economic uncertainties. According to the authors, it is much more important to answer the question of optimal investment, i.e., selecting the best available potential assets for investment. The article suggests the analysis of investment opportunities of the oil field project at the development stage, taking into account the uncertainty, the risks present, and the management flexibility. Among the methods of risk assessment, it is proposed to use a three-dimensional real options pricing model, a method for determining cumulative probability, and decision trees. An effective application of a real options method in the oil and gas industry was examined in the papers of Armstrong et al., 2001 [

14], Davis et al., 2006 [

15], Boer, 2000 and others [

16].

However, under the conditions of the Russian industry, such assessments must be carried out at the stage preceding the development: research and evaluation, i.e., even before investing in the construction of exploration wells. This opinion is also supported by Gandhi et al. in the monograph [

17]. In the seventh chapter of the work, a detailed description of the schemes and approaches for the geological exploration process is presented. The authors note that the most important components of a successful investment of funds at the pre-investment stage are: the geological justification of the choice of the territory for research, the optimal level of financing, and the use of the most effective technologies for minerals prospecting.

Despite a number of advantages of the real options method, different authors, for example, Trifonov et al. [

18] and Damodaran [

19] noted a number of shortcomings, which include, in particular: the complexity of the Black-Scholes formula application for real options, the direct dependence of the underlying asset growth on the asset dispersion growth rate that has not been methodologically proven, and in projects with geological risks it often has no justification, there is a risk of reduction in the motivation for the result, since the project implementation can possibly be abandoned at any given stage.

Researchers Zhu et al. in their work [

20] emphasize the importance of using the Monte Carlo method in investment analysis to evaluate the investment in foreign oil assets. In the opinion of scientists, it is important to conduct economic and mathematical modelling of the processes that are associated with the uncertainty of oil prices and domestic currency exchange rate. At the same time, researchers do not pay attention to the modelling of geological risks.

In [

21] Cheng et al. also accentuate the need to use economic and mathematical modelling methods to make managerial decisions at the pre-investment stage. The main emphasis in the article is on-the-shelf deposits. At the same time, as in the works of the previous authors [

9,

11,

12,

13,

20], traditional poorly-researched objects of hydrocarbon raw materials are not considered with sufficient attention.

Considering the differences in approaches to the economic evaluation of poorly-researched objects, the present study justifies the chosen algorithm for carrying out technical and economic calculations.

While in the process of geological and economic research and the choices of subsequent managerial decisions on the development of poorly-researched objects, it is primarily necessary to take into account the geological risks associated with the non-confirmation of the hydrocarbons resource base. In the framework of this study, a probabilistic approach based on a mathematical method, the Monte Carlo simulation, was implemented. The results obtained in the simulation are further subjected to economic evaluation, the final indicators of which are the basis for making further management decisions about the feasibility of investing in poorly-researched objects of hydrocarbon resources.

The purpose of the study is to develop an algorithm for making management decisions on investing in geological exploration and development of poorly-researched objects of hydrocarbon resources based on the probabilistic approach, and adjusted for geological and investment risks.

2. Materials and Methods

The study is conducted using a software system based on the platform “EVA”, which makes it possible to quickly carry out geological and economic evaluation of the projected hydrocarbon objects in poorly-researched areas at the pre-investment stage, and to make informed management decisions on the appropriateness and effectiveness of geological exploration and the subsequent commercial development of projected objects in the prospective land and water areas.

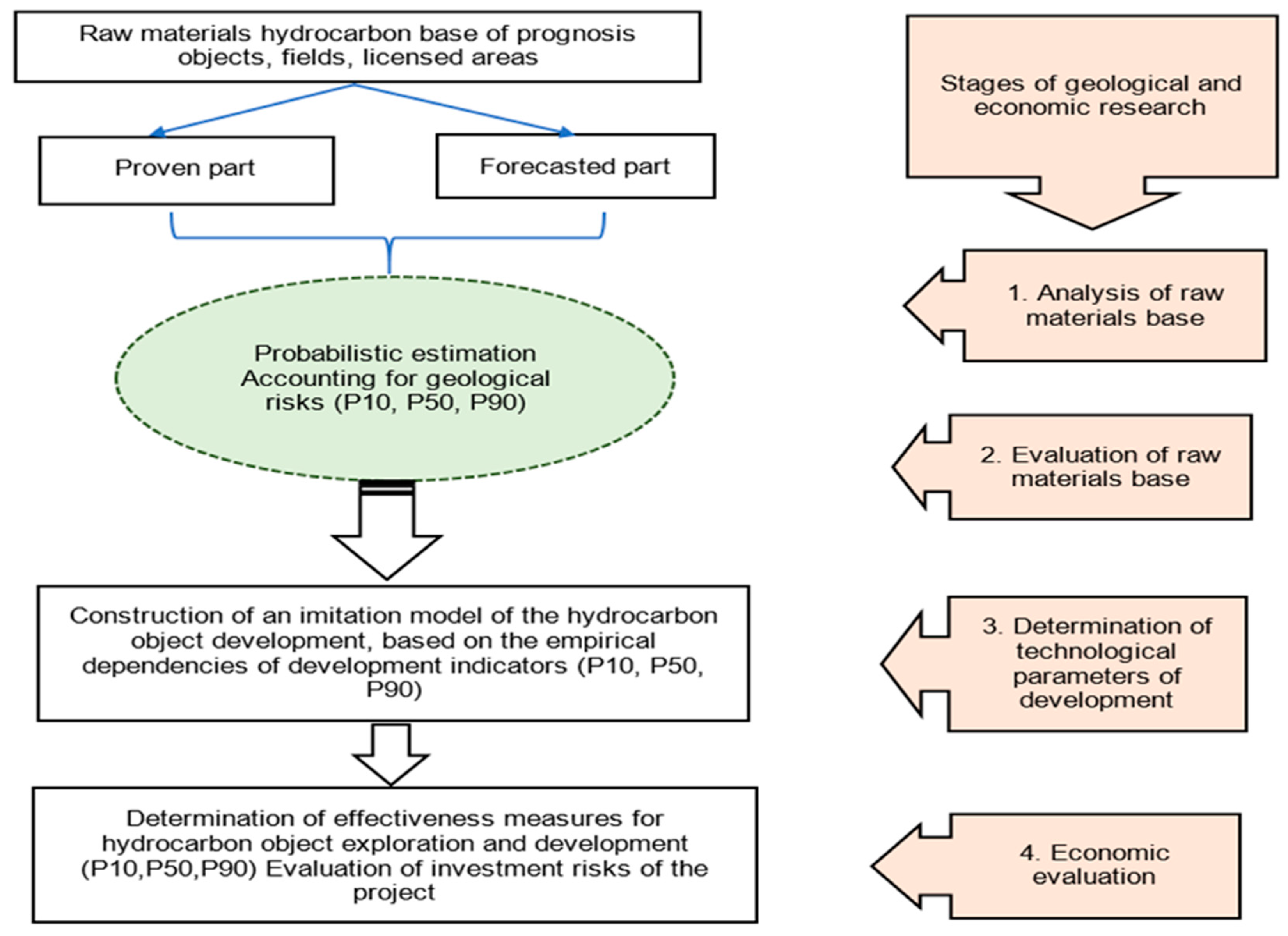

The methodology of this study was based on a clear sequence of geological and economic studies on poorly-researched oil and gas objects, including four stages (

Figure 1).

At the first stage of the research, the raw material base of the territory and prospective for licensing, were analyzed, and its proved and forecasted parts were identified. Then, a quantitative assessment of hydrocarbon objects was performed, based on the available factual information, and in the case of its lack or absence, the estimation parameters were determined on the basis of information about the analogue objects.

At the second stage, quantitative estimation of poorly-researched oil and gas objects was performed with adjustment to the geological risk, which was associated with the probability of hydrocarbon potential confirmation. Probabilistic assessment of resources takes advantage of the mathematical Monte Carlo simulations method [

22,

23]. The instrument for performing estimations is the EVA—Risk Assessment program.

The software is based on a volumetric method for estimating the extractable hydrocarbon resources [

24,

25,

26,

27] (Formula (1)), using main calculation parameters (area, power, porosity coefficient, oil saturation coefficient, scaled coefficient, oil extraction factor). In addition to this formula, you can enter the trap occupancy factor by area and by power to refine the amount of extractable resources.

where

—recoverable oil resources, mln tons;

—area of deposit, km

2;

—net thickness, m;

—porosity effectiveness;

—oil-saturation factor;

—oil density, tons/m

3;

—scaled coefficient;

—oil recovery factor.

Each of the listed parameters is a variable. To carry out a probabilistic assessment of the extractable resources, it is necessary, on the basis of the available geophysical and geological information, to determine the basic, minimum and maximum values of the geological parameters used in the calculations, and type of their distribution.

As a result of probabilistic calculations, P10, P50, and P90 values are determined. The reliability of the probabilistic estimate depends on the validity of the design parameters used in determining their magnitude. The number of iterations of the calculation parameters by the Monte Carlo method can reach 3000 [

2,

3,

4].

At the third stage, the technological development parameters are determined for each estimated object with different confirmability of the resources P10, P50, and P90: development options are defined, and their values were calculated in dynamics for each of the options (extraction of the main and complementary products, input and movement of a fund of wells, production rate of wells, volumes of production drilling).

Evaluation of technological indicators for the development of projected objects can be carried out using the software package “EVA—economic evaluation of oil and gas development projects”.

The particularity of technological indicators estimation depends on the degree of reliability of the available geological information. The composition of the initial parameters for estimating technology options of hydrocarbon fields development depends on the applied algorithm and includes data on oil reserves, extraction depth, reservoir properties, and so forth.

The definition of technological indicators for the development of poorly-researched objects can be carried out on the basis of aggregated imitation models that take into account the lack of necessary initial information and its high uncertainty.

To calculate the technological parameters of the development of oil object in “EVA—economic evaluation of oil and gas development projects”, one can use an imitation model, which is based on the use of empirical dependency of development indicators on defined geological parameters of the object, as well as a number of other parameters characterizing the change in production during operation process. The algorithm is compiled on the basis of the methodology for determining the technological parameters of oil production under limited information conditions [

28,

29]. The methodology is adjusted in accordance with the features of applied software complex. The compilation of the algorithm involves reference and statistical information related to the development of oil fields.

As a result of the calculations, the following output indicators were determined for each year of development: the volume of oil, associated gas and liquid production, accumulated oil production, general selection of the initial recoverable reserves of oil, the rate of oil and liquid production from wells, the funds needed for producing and injection wells, the volume of water injection, the water cut, and the volume of production drilling.

At the fourth stage of geological and economic research, the economic evaluation of all projected objects with different confirmability of the resources P10, P50, and P90 was carried out directly using the economic block of the program complex, which was based on the generalization of the methodological approaches of Russian scientific economists [

30,

31,

32]. The procedure for calculating the indicators of economic evaluation is shown in

Figure 2.

Calculations of the development costs were based on a specialized information and regulatory framework that was prepared by collection and statistical processing of the initial information, including the existing project data from oil and gas companies, materials of statistical collections, and publications. The information and regulatory database consisted of blocks containing indicators of the costs for geological exploration, development of fields, costs for the transportation of oil and gas, and economic indicators (prices, taxes, payments). The amount of geological exploration required to prepare the reserves, and the costs of its organization are calculated for each valuated object separately.

Capital investments and the current costs for the extraction and transportation of hydrocarbons were determined on the basis of enlarged items of expenditure in accordance with the selected technological options for the development of oil and gas objects.

Calculation of economic evaluation indicators incorporates the taxation conditions: the composition of taxes, the rates of taxes and payments, and the approaches for calculating them, as established by the legislation of the Russian Federation, and tax exemptions provided by the Tax Code of the Russian Federation.

Economic evaluation is carried out for the whole and for a profitable production period, which includes the time interval from the beginning of work to the moment when the current net income for the object becomes negative.

Under the basis of technical and economic calculations, in addition to the costs of exploration, capital and operational development costs, and raw material transport to the consumer costs, the main indicators of economic efficiency of development are estimated: net income (NI), NPV, and IRR, the payback period of capital investments, the profitability index, and the index of profitableness of expenses.

Taking into account the received economic evaluation indicators, the geological and economic efficiency of geological exploration is calculated to determine the order of the introduction into the geological study, and the subsequent development of poorly-researched objects of the hydrocarbon raw materials. Generally, geological efficiency is determined on the basis of the increment of reserves per meter of exploratory drilling, and on economic factors—the value of the NPV per unit of profitable reserves. Geological exploration should primarily take place on objects that can contribute the greatest increase in reserves per meter of exploratory drilling. Entry into industrial development makes sense for the objects with the highest value of NPV indicator. In addition, it is necessary to take into account objects related by the development system and transport capabilities.

At the final stage of the economic evaluation, investment risks are taken into account in order to make objective managerial decisions, the initial parameters for the evaluation of which are presented in

Table 1. In the construction of

Table 1, the results of the investigations of Nazarov [

31] and Filimonova [

32] were used.

The introduction of a risk premium to the basic discount rate depends on the degree of study of the object and its geographical location—the higher the degree of study and the more developed the industrial infrastructure, the lower the risk premium, and vice versa [

31,

32]. In the case of obtaining a positive value of NPV under the increased discount rate, the object development was considered to be effective even after risk adjustment.

The sensitivity analysis was carried out by a traditional change in the main influencing factors on the NPV.

The scenario approach involved making calculations by forecasting the various values of oil prices in the domestic and world markets, the share of exports, the dollar exchange rate, and so on.

The presented methods of study were tested by specialists of JSC “VNIGRI” while performing work for the Russian and foreign oil and gas companies (PJSC “Rosneft”, LLC “DIA UA”, JSC “NOC”, EVROTEK—Repsol and others).

3. Results and Discussion

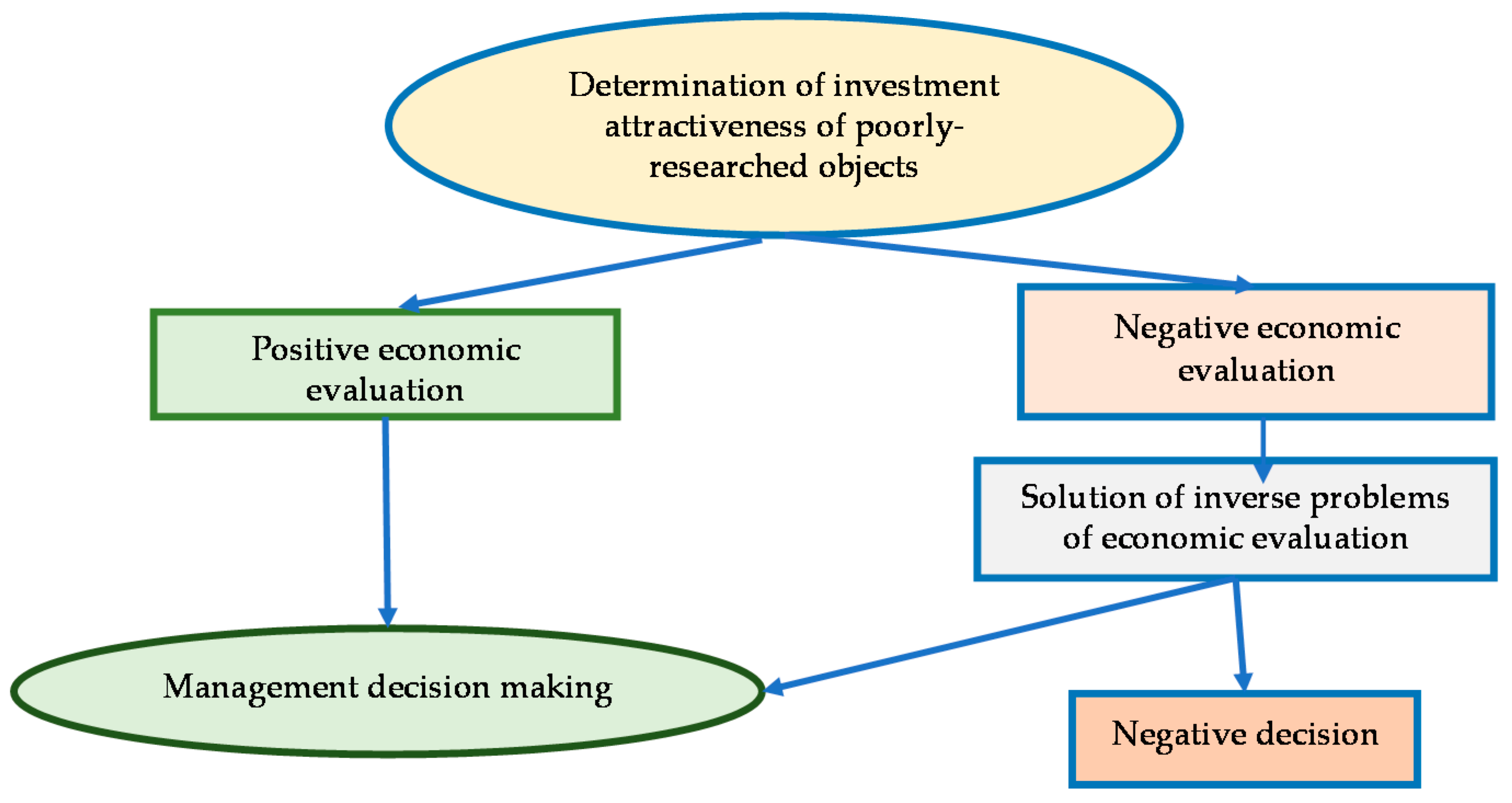

The algorithm of a management decision-making on the basis of an economic evaluation was developed by the authors (

Figure 3). The results of economic calculations can be either positive or negative. If negative results are obtained, the solution of inverse problems is required to determine the limiting geological and economic characteristics (the minimum volume of profitable oil reserves, the minimum acceptable level of oil prices, etc.), at which the economic evaluation of the object becomes positive. If, for example, the development of a hydrocarbon raw materials object becomes effective at an oil price that does not significantly exceed the level accepted in the calculations, then the investor can make a positive decision about initiating exploration and subsequent development based on the projected expectations of a higher world oil price.

In this study, the authors present an assessment of poorly-researched hydrocarbon resources objects in order to develop recommendations for making managerial decisions regarding feasibility of investment at further geological exploration of the northeast territory of the Timan-Pechora province, which forms a part of the Arctic zone of Russian Federation.

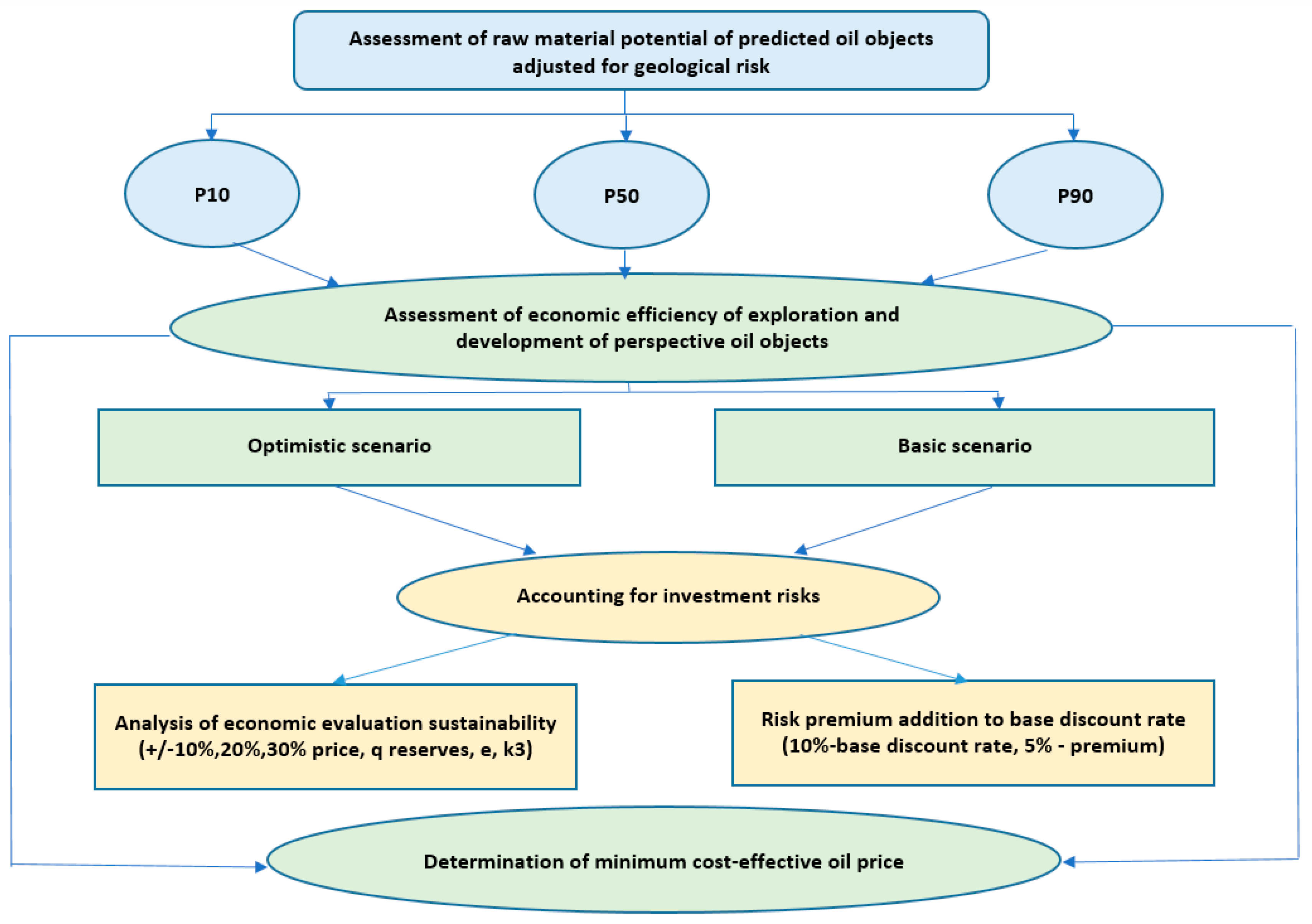

The authors propose the following sequence of geological and economic oil potential assessment of poorly-researched objects in (

Figure 4).

The investment attractiveness evaluation was carried out on nine poorly-researched oil objects located within the boundaries of the four forecasted structures. All objects of assessment, adjusted for the geological structure and spatial location, were combined into development objects (Nos. 1–9) and were ranked within the forecasted structures by the size of the extractable resources, from the largest to the smallest.

The results of the probabilistic estimation of oil resources of the predicted objects adjusted for geological risk are presented in

Table 2. For all assessed objects, the technical parameters of the development were determined, taking into account the size of extractable resources P10, P50, and P90.

Economic calculations performed under two price scenarios—basic (world oil price of $40/bar., dollar exchange rate of 68 rubles/US$) and optimistic ($60/bar., 53 rubles/US$).

Based on the calculations performed, in addition to the resulting indicators (NPV, IRR, PI, Payback Period), the geological and economic efficiency of geological exploration was assessed to determine the sequence of initiating further geological study of the objects under consideration, located within the territories of prospective licensing. Thereafter, objects were ranked using these indicators. An example of the calculation results of geological and economic efficiency is presented for both price scenarios with the highest confirmation probability of the raw potential of the projected P50 objects (

Table 3 and

Table 4).

Table data suggests the expedient order of initiating the exploration and development of predicted objects in the region of study, on the basis of their geological and economic efficiency indicators.

Under the optimistic price scenario and the confirmability of the raw potential P (50), the recommended order of objects’ initiating into further geological exploration in terms of the increment of reserves per meter of exploratory drilling is as follows: Object 7, Object 5, Object 9, Object 8, Object 2, Object 6, and Object 1.

For industrial development, a different order is recommended: Objects No. 5–No. 7 (structure No. 2), Objects No. 1–No. 2 (structure No. 1), Object 9 (structure No. 4), and Object 8 (structure No. 3), which is associated with the fact that the capital expenditures for the creation of transport infrastructure and commercial arrangement are assigned to the objects that have the highest volumes of extractable reserves (Objects No. 1–No.2 and No. 5–6).

Considering the basic scenario and confirmability of P50, only the geological exploration of objects could be recommended, whereas industrial development under the accepted economic conditions seemed inefficient.

It should be noted that with less resource confirmability for the P10 objects, even in an optimistic scenario, they became unattractive investments.

Sustainability analysis was carried out for each reserves option (P10, P50, P90) under both price scenarios for each evaluated object. As a result, the main factors influencing the sustainability of economic evaluation results were identified (

Table 5). Red color indicates the most sensitive objects to changes in the main influencing factors, green—the most stable. Among the main influencing factors were the price of oil on the external market, the volume of capital expenditures, the volume of reserves and the discount rate.

Thus, any change in the price of oil had a very strong effect on the results of the economic valuation of almost all the objects—only objects 5, 7, and 9 remained stable. The increase in capital expenditures, the volume of reserves, and the discount rate by 10% mainly affected objects with a decrease in their raw material potential up to P50, as well as at a lower oil price.

Changing all of these factors by 20% had a more significant impact on the studied objects—only the same objects, 5, 7, and 9 were efficient, given a high confirmability of their resources. When the proposed factors are changed by 30%, almost all objects were beyond the profitability limit.

The estimations of the effect of the discount rate on the value of the NPV for the objects of the region under consideration are presented in

Table 6. The risk premium was accepted at 5%.

According to the data demonstrated, at a discount rate of 15%, only objects with the largest volume of resources, P10 and P50, remained profitable, whereas for objects with no evidence of the raw material potential (P90), none of the projects paid off, even under an optimistic price scenario.

At the final stage of the study, the solution of the inverse problem of economic evaluation was presented—the determination of the minimum price of oil on the external market, which ensured the cost-effective development of the resources of each of the evaluated objects. Notice that calculations were made at two exchange rate levels—53 rubles/dollar and 68 rubles/dollar (see

Table 7).

The data in the table indicated that in order to ensure cost-effective development of prospective objects in the region under investigation, it is necessary that the price of oil in the world market remains at the range of 50–60 dollars per barrel, and in the case of minimum confirmability of reserves it should exceed $60–70 per barrel, which is very problematic and difficult to predict.

Given the strong volatility and uncertainty of the world oil price forecasts, according to which it is most likely that in the near future price will fluctuate in the range of $45 to $75 per barrel, geological exploration in the territories of prospective licensing seems very risky.

The novelty of this paper was characterized by the application of an integrated approach to risk management when making managerial decisions to involve poorly-researched objects in development. The integrated approach involved the use of a scenario approach and a probabilistic assessment of the raw material potential, as well as the risk premium adjustment to the base discount rate and sensitivity analysis. Sensitivity analysis allows for inverse problems in determining the minimum price of oil on the external market to be solved, which ensures cost-effective resource development of each of the evaluated objects.

The closest in meaning and content from the cited papers are [

2,

3,

4]. These works are deeply studied from a methodological and practical perspective. Based on these papers, the authors of this article constructed and described the concept of involving poorly-researched oil objects in industrial circulation, which is an important scientific result of the study. Practical implementation of the proposed concept will give a powerful impetus to the development of the junior oil business in Russia.

The approach proposed in the study for the evaluation of poorly-researched objects as a whole does not contradict the international practice of estimating probable resources. Most of the research [

10,

11] is currently related to the assessment of the non-traditional oil reserves, while Russia still does not have a large number of small objects of traditional oil involved in industrial development. The application of the proposed methodological approach in Russian practice will allow small and medium-sized oil companies that need foreign borrowing capital to construct and submit for financial organization’s review business plans, for which investment attractiveness is based on the classifications of reserves and forecast resources used in international practice. In case of the junior business development in Russia, the demand for foreign loans will increase. Simultaneously, the placement of shares of the junior company on the stock exchange in order to raise funds, given the transparency of geological and economic information about the forecast resources, will facilitate the use of the proposed methodology and will increase the confidence of foreign investors in the Russian junior exploration business.

The papers of Russian authors Prischepa O.M., Nazarov V.I., Krasnov O.S., et al. [

30,

31,

32] do not address the mechanisms for raising investment capital, although this is one of the key issues in the implementation of geological exploration projects and the industrial development of poorly-researched hydrocarbon objects. The methodology of economic evaluation proposed in this article, unlike the one presented in existing studies [

30,

31,

32], involves calculating the key indicators of geological and economic efficiency under the conditions of uncertainty and risk that are understandable for foreign investors. In addition, the cybernetic tools used to conduct technical and economic calculations are the most flexible for its application in terms of input parameters usage in comparison with the tools proposed in the works of Gert et al. [

2,

3].

The proposed practical example of the methodology approbation, in contrast to the majority stated in [

2,

3,

4], is a real project. Its geological basis includes the actual data obtained during additional seismic operations by the Russian branch of Repsoil. While carrying out scientific works for this company in the field of geological and economic research, one of the main requirements was the modelling of geological risks in calculating the estimated reserves, with the mandatory assessment of P10, P50, and P90.

4. Conclusions

The tasks of involving poorly-researched hydrocarbon resources in the industrial development ensure sustainable development of the oil and gas complex and rational subsoil use, and therefore are focused on developing the circular economy as a new economic model.

The methodological approach developed in the study will allow Russian companies of small and medium-sized oil business, which have the need to attract investment for geological studies of poorly-researched objects, to raise capital from foreign investors. The assessment of investment attractiveness according to the proposed approach is based on the classifications of reserves and forecast resources used in international practice.

Management decisions on the feasibility of an investment in the exploration, and subsequent development of the poorly-researched oil objects should be based on a probabilistic assessment of resource potential, taking into account the geological risk.

As a result of the probabilistic modelling for each projected object, three resource potential estimates are determined with probability of reserves confirmation—P10, P50, and P90. Further economic calculations are carried out for each object. Under the scenario approach, different oil price levels and U.S. dollar exchange rates are applied—basic (the world price of oil is $40/bar with an exchange rate of 68 rubles/dollar) and optimistic ($60/bar with a rate of 53 rubles/dollar).

Nine prospective hydrocarbon objects are considered in the poorly-researched Arctic territory of the northeast of the Timan-Pechora province. Based on the results of economic calculations for each object, the geological and economic efficiency of geological exploration are calculated: geological—based on the increment of reserves per meter of exploratory drilling, and economic—based on the net discounted income indicator. At the same time, the order of commissioning of objects in development should take into account the related objects, according to spatial location, and investment burden associated with the creation of transport infrastructure. Thereafter, the recommended order of geological study and industrial development is determined for all considered objects.

Risk accounting should be performed with a set of methods—in addition to applying the scenario approach and probabilistic estimation of the raw material potential, the risk premium should be added to the basic discount rate, and the sensitivity analysis should be conducted. The latter method allows one to assess the main influencing factors on the results of economic evaluation and the degree of their impact. The study identifies major factors affecting the sustainability of the economic objects valuation results.

Furthermore, the inverse problems of determining the minimum price level under which objects become attractive investment opportunities, is solved for all nine cases. It allows investors to assess the degree of objects development efficiency. The approach proposed in the study to solve inverse problems will make it possible to make managerial decisions on investing in the development of poorly-researched objects under the conditions of a changing economic situation and world oil prices.

5. Patents

Authors of this article (D.M. Metkin and A.A. Gladilin) participated in the development of software systems “EVA—risk assessment” and “EVA—economic evaluation of oil and gas development projects” and possess the copyright certificates.