Abstract

This article considers regulatory strategies that promote more efficient use of material inputs within the Australian economy, with particular focus on recycling and recovery of metals, drawing upon the concept of a “circular economy”. It briefly reviews the nature of regulation and trends in regulatory strategies within changing policy contexts, and then examines the regulatory framework applicable to the various phases in the life cycle of metals, ranging from extraction of minerals to processing and assimilation of metals into finished products, through to eventual disposal of products as waste. Discussion focuses upon the regulatory strategies applied in each phase and the changing roles of government and business operators within global distribution networks. It is concluded that the prevailing political agenda favoring deregulation and reduced taxation may be a major barrier to development of new styles of regulation and more effective use of taxation powers that is needed to support a more circular economy in metals. The implication for future research is the need to substantiate the outcomes of reflexive regulatory strategies with well-designed empirical studies.

1. Introduction

The availability of the widely used base metals appears assured for the immediate future, but the same cannot be said for by-product metals (known as daughter or companion metals), which are increasingly used for important renewable energy technologies such as solar panels and wind turbines [1]. When projections of global population growth and future production and consumption patterns are taken into account it is also clear that, in the longer term, security of supply for all metals may be problematic [2]. Recycling and recovery of metals from waste streams are logical responses to this problem. However, a recent United Nations Environment Program (UNEP) report has noted that metal recycling has become increasingly difficult due to the growing complexity of products and complex interactions within recycling systems [3]. The UNEP report warns that far more sophisticated approaches to recycling than those adopted at present are required.

This paper firstly considers the general purpose and nature of regulation and changing policy contexts. It then more specifically reviews the current regulatory framework applicable to the various phases in the life cycle of metals in Australia, ranging from extraction of minerals to processing and assimilation of metals into finished products, through to eventual disposal of products as waste. Discussion focuses upon the regulatory strategies applied in each phase and the changing roles of government and business operators within global distribution networks. One limitation of this paper is that the range of relevant laws is potentially vast, including international agreements, Australian Commonwealth legislation, State and Territory legislation, local government by-laws and regulations, and various industry agreements. Accordingly the scope of this paper will be limited to selected aspects of the relevant laws. The paper does not purport to cover all Australian jurisdictions; it uses the laws of the State of Victoria to illustrate the general nature of laws in other States and Territories.

2. Changing Policy Contexts

In 2009, the Commonwealth Government released a National Waste Policy which recognized that continued growth in waste streams and the more complex nature of the current waste load (such as increasing e-waste) demonstrated the need for “holistic approaches which address market, regulatory and governance failures, duplications and inconsistencies” whereby “waste streams are managed as a resource” [4]. This policy includes a guiding principle that “participants in the product supply and consumption chain, rather than the general community, bear responsibility for the costs of resource recovery and waste management” and an objective that by 2020 “Governments, industry and the community have embraced product stewardship and extended producer responsibility approaches … leading to improvements in the design, longevity and disassembly of products, a reduction in hazardous content, less waste, and more thoughtful consumer choices.” This policy represents a significant re-commitment to several fundamental principles of sustainable development, including the internalization of environmental costs and polluter pays principles [5]. It also envisages the adoption of new regulatory measures to promote product stewardship and a more circular economy. The Ellen MacArthur Foundation (EMF) has described the “circular economy” as one:

“That is restorative or regenerative by intention and design. It replaces the “end-of-life” concept with restoration, shifts towards the use of renewable energy, eliminates the use of toxic chemicals, which impair reuse, and aims for the elimination of waste through the superior design of materials, products, systems, and, within this, business models.”[6]

Whilst the EMF firmly believes that the longer term economic benefits of a circular economy will make business the primary driver of change, it also endorses government action to accelerate this process by supporting markets for collection and recovery of materials, shifting the tax burden away from (renewable) labor inputs to non-renewable resources, strengthening education, improving product labeling and toxic chemical phase-out, and using its own procurement activities to support circular outcomes [7]. However UNEP has recognized a systemic problem that many existing metal recycling strategies have grown largely out of environmental policies, whereas successful recycling programs are primarily driven by economic factors. Accordingly, UNEP recommends that government recycling policy for metals should focus on creating a robust best available technology (BAT) and “helping industry to do this” ([3], pp. 165–169). In particular, UNEP suggests that government policy should focus upon measures that will:

- (1)

- Influence the economics of any part of the recycling chain; with particular consideration of policies affecting the cost of recycling activities and security of supply, including the relative cost of alternatives, taxation, subsidies, trade restrictions, labour regulation and energy costs;

- (2)

- Provide the incentives and means for stakeholders to exchange information and co-operate; with particular focus upon Extended Producer Responsibility (EPR);

- (3)

- Enhance the role of government as a stakeholder in the chain; with particular emphasis on waste collection and processing infrastructure provided by local government;

- (4)

- Coordinate interactions between relevant policy makers; with particular focus upon better cooperation between relevant government agencies to create a more holistic approach ([3], Chapter 7).

The nature and form of government action in this field will also be strongly influenced by the competition policy principles, which have been applied by Australian State governments since the 1980s and formally adopted by the Council of Australian Governments (COAG) in 1995 [7]. Competition policy has prompted the privatization of many former government owned enterprises including energy, transport, water and telecommunications infrastructure, and the outsourcing of many regulatory activities. It has also prompted comprehensive reviews of legislation in all Australian jurisdictions to remove “red tape” that is perceived to add unnecessary costs to business and barriers to competition [8]. COAG has issued a Guide to “Best Practice Regulation” which sets out principles to be applied in formulating new regulatory measures, including a requirement that whenever regulatory options are being considered, a Regulatory Impact Statement (RIS) must be prepared [9]. The RIS must consider the use of self-regulatory, co-regulatory and non-regulatory approaches as alternatives to direct regulation. Further, any new regulation should not restrict competition unless the overall community benefit outweighs the costs, and there are no other alternatives to achieve the regulatory objectives [9]. Thus, competition policy is broadly compatible with the self-regulatory market-based approach recommended by EMF and UNEP. However the question for further consideration is whether the ambitious Commonwealth Government objective that all sectors will have embraced product stewardship and extended producer responsibility by 2020 can be met by these approaches alone. This question is addressed by first considering the general purpose and common approaches to regulation in Australia.

3. The Purpose and Approaches of Regulation

3.1. What Is Regulation

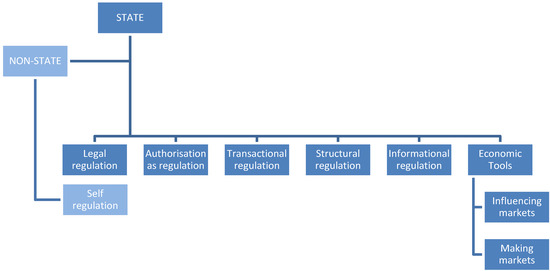

Regulation can be defined as any “intentional measure or intervention that seeks to change the behavior of individuals or groups” [10]. This generally involves establishment of some form of on-going rules or standards to influence future behavior, ranging from “top down” rule-making by a governing body, through to more facilitative roles that can be played by the governing body as a licensing authority, market participant or information provider. The range of regulatory tools is categorised by Freiberg as follows (Figure 1).

Figure 1.

The tools of government (Adapted from Freiberg ([10], p. 85)).

The most direct tool is legal regulation, whereby a governing authority prescribes what may or may not be done, along with penalties for non-compliance. This approach, often referred to as “command and control” has been quite successful at controlling acute localized problems, like industrial pollution discharges [11]. Authorisation as regulation is often integrated with command and control approaches, whereby of permits or licenses are issued to allow a limited range of activities that would otherwise be prohibited. Common examples include discharge licenses for industrial pollution and extraction rights for publicly owned resources such as minerals, water and forests. Licensing arrangements usually include a liability to pay fees or royalties in exchange for the rights conferred. Structural regulation arises through provision by government (or private actors) of essential infrastructure such as power stations, dams, ports, railways and roads, which are a powerful enabling factor for many new enterprises. Transactional regulation can be implemented as part of supply chain management or procurement policies of government agencies or other large-scale purchasers of goods or services. In such cases suppliers may be regulated through additional contractual obligations to achieve desirable public policy objectives. Informational regulation may be adopted where other strategies have proved less effective, particularly for widespread social problems like littering or dumping of waste. Public education programs are often directed at the whole community, whilst disclosure and reporting rules can compel business enterprises to inform stakeholders about the risk profile of particular activities. Economic tools include a wide range of market based strategies which create a “price signal”, to influence consumption choices rather than by government directives. They are widely regarded as a “least cost” form of regulation, which give the business sector more autonomy in deciding how to meet specified objectives. On the other hand, the price signal is often distorted by earlier interventions promoting a problematic activity, such as pre-existing subsidies or tax concessions [12]. This categorisation also recognizes that it is not just governments that regulate behavior, but also a wide range of other “non-State” actors such as industry associations, corporations and community groups, exercising various forms of “self-regulation” based on internal values and/or self-interest. Most of the regulatory tools mentioned above can be readily applied by non-State actors.

UNEP has pointed out that recycling has traditionally been considered an environmental problem. This paper will now examine more specifically how regulatory tools have been applied in environmental law.

3.2. Trends in Environmental Regulation

3.2.1. Command and Control Approaches

The history of environmental regulation shows a significant shift in regulatory approaches. The early schemes favored prescriptive command and control mechanisms. For instance, the first major air pollution schemes in the 1960s and 1970s focused upon mandating “best available technology” at major industrial sites to minimize specific forms of hazardous pollution such as sulphur and nitrous oxides [13]. This approach was very effective for dealing with discrete sources of toxic pollution that were previously unregulated. However, over recent decades the range and nature of environmental problems has expanded significantly, as rapid population growth, globalization of industry and a more resource intensive lifestyles have contributed to a complex new set of environmental issues. In addition to localized industrial pollution, regulators must now deal with more widespread and incremental problems across all sectors like waste management, depletion of non-renewable resources, deforestation, biodiversity loss, water scarcity and climate change. Most of these are systemic problems deeply rooted in linear business models and consumer lifestyles that are difficult to address by command and control approaches.

3.2.2. Responsive Regulation

One of the problems with command and control approaches based upon criminal offences with harsh penalties is the need for close monitoring by a well-resourced enforcement agency. In the early 1990s, Ayres and Braithwaite [14] developed a highly influential theory of “responsive regulation” to alleviate this situation. They proposed a more dynamic approach which shifts the emphasis away from enforcement and deterrence towards an on-going relationship between the regulator and regulatee. Responsive regulation uses an enforcement action hierarchy, based on co-operation and voluntary compliance in the majority of cases, whilst reserving the right to use more coercive responses if regulatory objectives were not met.

3.2.3. Outcome Based Regulation

Command and control approaches are often criticized for failing to provide incentive for a firm to reduce pollution and waste “beyond compliance” levels. This reflects a common view that environmental compliance is non-productive and merely imposes a cost burden upon the business. Professor Michael Porter at Harvard Business School rejected this view, arguing that pollution and waste was often a sign of inefficient use of material inputs and poor management practices [15]. In his view, resource productivity is a key contributor to competitive advantage. Porter therefore argued that the effectiveness of environmental regulation should be measured by how well it promotes innovation, and this requires a focus on outcomes rather than technology. Under this approach regulators specify a desired environmental objective and leave industry managers free to choose for themselves how to achieve that result. This reduces administration costs for the regulator, and provides incentive for a firm to go “beyond compliance” by thinking about innovation across the whole production process. Professor Porter’s outcome-based approach has become a blueprint for many modern environmental laws (including many economic tools, or “market based instruments”) [16].

3.2.4. Management Based Regulation

A number of environmental law scholars have argued that outcome based approaches have limitations in certain cases. For instance, Coglianese and Lazer [17] contended that outcome-based are only appropriate where regulators can easily monitor and measure the relevant environmental outcomes in connection with a particular business activity. This is increasingly difficult in a global economy, where businesses are commonly part of large conglomerates, with high levels of vertical integration, extensive international networks and increasing influence over government policies. In this context, business managers themselves are far better placed than local regulators to monitor environmental impacts (including extra-jurisdictional impacts) and identify opportunities for innovations in resource efficiency. Colognaise and Lazer [17] argue that “management-based regulation”, may offer a better approach in these situations. This style of regulation places the onus upon firms “to engage in their own planning and internal rule-making efforts that are supposed to aim toward the achievement of specific public goals”.

3.2.5. Reflexive Regulation

More recently, Hirsch extended this analysis by considering how management based approaches can encourage “green business” models of the type that would contribute to a more circular economy. This envisages win-win scenarios in which firms take voluntary actions to achieve better environmental outcomes whilst simultaneously making the firm more competitive [16]. Hirsch drew upon the work of German social theorist Gunther Teubner, who argued that legal systems have evolved from “formal” common law systems governing market transactions (e.g., contract, property and tort) to “substantive laws” which provide for government interventions to correct for market failures arising from growing complexities in society (e.g., technology and outcome based environmental standards). However, as society has become more complex, governments have become less important than many self-regulating subsystems, such as large firms, industry groups, political parties, religions and even sporting bodies. Thus, Teubner recognised a third phase of regulation that he called “reflexive regulation”, which pushes firms to take on part of the traditional role of government, by internalizing social norms and “reflecting” upon their own performance with respect to those norms [18]. Applying this approach to green business models, Hirsch suggests that the first step of internalizing environmental norms, requires information based strategies and communication based strategies. The second step of reflecting upon and managing environmental performance can be achieved by procedure-based strategies; such as environmental management systems (EMS), sustainability reporting, and disclosure-based strategies; such as stakeholder engagement, life cycle assessment (LCA) and EPR. These strategies are all well recognized in sustainability management literature as key steps towards achieving a “business case” for sustainability and they have featured in some of the more innovative regulatory strategies to be mentioned later in this article [19].

The theoretical approaches to regulation described above can be used to analyse the specific strategies that have been applied to promote re-use and recycling of minerals and metals in Australia. This analysis will consider these regulatory strategies throughout three broad phases of the commercial life-cycle of minerals:

- (1)

- exploration and extraction;

- (2)

- processing and manufacturing; and

- (3)

- disposal and re-use.

4. The Regulatory Framework for the Life-Cycle of Minerals and Metals in Australia

4.1. Regulation during Exploration and Extraction

In Australia, the common law rule that ownership of minerals vests in the land owner has been displaced by State mining laws which vest ownership in the Crown [20,21]. Thus State governments are the primary regulators of exploration and extraction activities for minerals located within their boundaries. State mining laws typically provide an authorization process for grant of exploration and mining licences over a particular site, including privately owned land. A range of conditions are generally imposed upon licensees including obligations to provide work plans, environmental protection measures, compensation to landholders and site remediation [22]. A mining license also creates liability to pay an ad valorem royalty based on the quantity or value of the material extracted [23]. Mining royalties are a particularly important contribution to revenue collections in the resource rich States of Western Australia, Queensland and New South Wales [24]. A Commonwealth resource rent tax applies to offshore oil and gas projects [25]. In 2012, this tax was extended to on-shore oil and gas extractions in conjunction with the new mining tax [26].

Due to the significant environmental degradation caused by mining activities, new projects usually require some form of environmental impact assessment (EIA). All Australian States have statutory EIA processes for projects within their borders, however the application of these processes is often discretionary [27,28]. A Commonwealth impact assessment process may also be required if a project is likely to have a significant impact upon certain “matters of national environmental significance” (which are primarily matters concerned with Commonwealth places and international treaty obligations like World Heritage protection) [29]. Whilst EIA is generally viewed as an authorization process, it may be better described as an informational measure, as its central object is to “inform decision making and result in appropriate levels of environmental protection and community well-being” [30]. In practice, EIA usually focuses upon local impacts, and numerous conditions may be imposed upon a project for that purpose. There is scope to use EIA processes to require mine managers to promote a wider range of outcomes, such as the future recovery of minerals from discarded tailings.

Improved management of disused tailings may be inhibited by weaknesses in State laws regarding ownership of the tailings. The Western Australian legislation provides that when a mining tenement expires any tailings or other mining product “left upon the land” becomes the property of the Crown, and thus available for subsequent use by other parties under new mining licences [31]. Tarrant has argued that disputes may arise about precisely what materials may or may not been (re)-vested in the Crown in Western Australia, and this position will vary from State to State [32]. This is an area where clarification of the law and greater uniformity between State laws is needed to enable more effective recovery of valuable minerals from discarded tailings.

The National Pollutant Inventory (NPI) is a significant example of informational regulation applicable to the mining sector [33]. The NPI was introduced by the Commonwealth Government to create a national information database on the use and storage of hazardous materials throughout Australia, modeled upon the US Toxic Release Inventory [34]. Under the Australian NPI it is mandatory for facilities handling quantities of listed substances above reporting thresholds to provide prescribed data on emissions and transfer of those substances, including substances stored or transferred to a destination for containment, including transfers to landfill, tailings storage facility, underground injection, or other long term purpose-built waste storage structure. The data is reported initially to States and Territories and then supplied to the Commonwealth for collation and dissemination through an on-line database. The most recent review of the NPI raised some concern that the database systems were “at risk of failure and require significant expenditure to provide confidence that they are sufficiently robust to support the present level of data traffic” [35]. The Review also highlighted a fundamental question about the purpose of such a database, in particular, whether:

“The NPI should operate principally as an instrument of environmental management and performance assessment, or to consider it principally as a more general tool for raising public and industry awareness of emissions to our environment and the need for cleaner production and waste minimisation. The former requires a higher level of funding to generate high quality data and more extensive data sets than the latter, but its effectiveness increases. It appears to be the direction in which international systems are headed.”

Rapid advances in information technology make this type of open access database increasingly important as a regulatory (and self-regulatory) tool in the metal sector. Another Commonwealth sponsored on-line database with a focus on mineral resources is the Australian Mines Atlas, produced by a partnership of Geoscience Australia, the Department of Resources, Energy and Tourism and the Minerals Council of Australia [36].

Given the vast amounts of energy and raw materials normally involved in mining operations, resource efficiency should be a strong driver of competitive advantage in this sector. Porter and others have argued that management based strategies are the most appropriate regulatory style in this context. Many mining companies have adopted voluntary disclosure strategies through the publication of comprehensive sustainability reports, and increasing numbers are using best practice guidelines such as the Global Reporting Initiative [37]. The ability to raise capital is another important component of competitive advantage in the mining sector. Banks and other and lending institutions are increasingly using sustainability criteria as an indicator of creditworthiness, with many leading lenders have committed to the use of social responsibility criteria like the Equator Principles for determining, assessing and managing environmental and social risk in projects [38]. Many institutional investors also use corporate sustainability criteria in portfolio investment decisions, based upon indices like the Dow Jones Sustainability Index [39].

Leading industry associations in the minerals sector also promote resource efficiency and corporate responsibility to members. The International Council on Mining and Metals (ICMM), has established ten Sustainable Development Principles that member companies are expected to implement and measure their performance against, including Principle 8 below, which provides a strong commitment to a life cycle approach in metals management and recycling [40]:

“Principle 8. Facilitate and encourage responsible product design, use, re-use, recycling and disposal of our products.

- advance understanding of the properties of metals and minerals and their life-cycle effects on human health and the environment;

- conduct or support research and innovation that promotes the use of products and technologies that are safe and efficient in their use of energy, natural resources and other materials;

- develop and promote the concept of integrated materials management throughout the metals and minerals value chain;

- provide regulators and other stakeholders with scientifically sound data and analysis regarding our products and operations as a basis for regulatory decisions;

- support the development of scientifically sound policies, regulations, product standards and material choice decisions that encourage the safe use of mineral and metal products.”

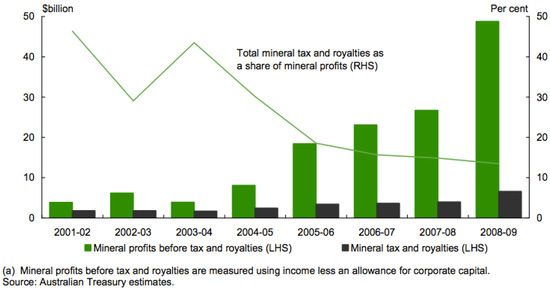

In this context it is interesting to consider how concepts normally associated with manufacturing, like “responsible product design”, “recycling” and “life cycle effects” could be effectively applied to the mining sector? Minerals produced by Australian mining activities are generally used as raw materials for many different industries and a multitude of possible end-products worldwide. One practical approach is for mining companies to take greater financial responsibility for the consequences of the downstream use of metals in general, rather their own specific outputs. The Commonwealth Government’s Mineral Resources Rent Tax (MRRT) [26], in essence a surtax on Australian mining profits, was prompted by findings from the 2009 Henry Review of Australia’s Future Tax System, that throughout the recent minerals boom, State mining royalty collections have fallen dramatically as a share of total mineral profits [41], as shown in Figure 2.

According to the 2013 Commonwealth Budget, the original revenue estimate for the MRRT was in excess of $8 billion dollars per annum [42]. A massive public relations campaign by the mining industry persuaded the former Gillard Government to greatly reduce its fiscal impact, and the MRRT is now due to be repealed entirely by the current Federal Government. Whilst original revenue estimates may have been optimistic, they show that a major untapped revenue opportunity exists in this sector. There is clearly scope for a more levy upon mining activities, or increases to State royalties, to help fund the new infrastructure needed for expansion of recovery and re-processing of metals in Australia.

Figure 2.

Mineral tax and royalties as a share of mineral profits. (Henry Review Panel, Chart C1-1 ([41], p. 226)).

Given the obvious political sensitivity surrounding possible new taxes upon mining activity, a more subtle option to achieve a similar effect is the review and removal of various “tax expenditures” available in that sector. For instance, in the 2012–2013 financial year, it is estimated that the mining companies will receive $550 million in tax deductions for exploration activities alone, which is in essence a subsidy to the industry [43]. Other significant tax expenditures in this sector include capital expenditure write-offs and exemptions from the Commonwealth fuel excise. Whilst these tax breaks have some justification due to the need for large capital expenditures, hazardous extraction processes in remote locations, high transport and labour costs etc., many of them were introduced for historical reasons that no longer apply, and the current direction of industry policy in Australia is firmly towards removal of unjustified industry assistance. The Henry Review also recommended that tax expenditures needed much greater scrutiny and transparency [44]. In these circumstances, it may be very difficult to call for new tax expenditures to help stimulate innovation and growth in the metals recycling industry. Nevertheless, many of the justifications for tax breaks in the extraction phase also apply when considering assistance to new industries in recovery and re-processing of metals.

4.2. Regulation during Processing and Manufacture Phase

The processing and manufacturing phase of metals encompasses a very diverse range of industries including steel and aluminum smelting through to manufacturing of numerous products containing metal components such as cars, buildings, household appliances and electronic goods. In Australia these industries are primarily regulated by the State and Territory governments under planning laws which restrict the location of industrial facilities, using authorisational mechanisms such as planning permits and land use zoning prescribed by planning schemes [45]. State industrial pollution and waste management laws are based upon classic command and control approaches which strictly prohibit discharges of pollution to the atmosphere, water and land, by imposing criminal offences and substantial financial penalties for breach, including possible personal liability for company executives [46]. However the strictness of these laws is softened by licensing arrangements administered by the Environment Protection Authority (EPA). These authorisational arrangements permit pollution at a particular site within prescribed limits subject to a range of license conditions being met. Economic tools are also applied by the EPA in the form of license fees and the risk of substantial penalties for breaches of the license and other pollution offences. Informal economic incentives are also provided by the potential for common law liability if pollutants or waste cause harm to the property or economic interests of third parties.

The Victorian pollution control laws have been progressively amended to establish a range of incentives for firms to take voluntary management based actions to reduce environmental impacts [46]. A scheme to promote environmental improvement plans was introduced in 1989, whereby licensees were encouraged to establish on-going consultations with local community stakeholders ([46], Section 31C). An accredited licensee scheme was introduced in 1994 to encourage firms to adopt environmental management plans and internal audits in exchange for relaxation of licence fees and certain other conditions ([46], Section 26A). In 2001, a broader community wide partnership approach was promoted by provisions promoting neighborhood environment improvement plans ([46], Section 26A). In 2002, voluntary sustainability covenants were introduced, which encouraged firms to adopt more holistic approaches to resource efficiency and ecological impacts in liaison with the EPA ([46], Section 49AA) and [47]. These reforms have collectively facilitated (but not mandated) the internalization of environmental norms through information based and procedure based strategies envisaged by Hirsch. They also reflect a broader EPA role extending beyond that of a traditional environmental regulator prescribing specific actions, to a wider role as a coordinator of negotiations between industry and the community.

Victoria has also pioneered several regulatory mechanisms to promote resource efficiency. Under the Industry Greenhouse Program introduced in 2002, firms using over 500GJ of energy and those emitting over 100 tonnes of CO2eq greenhouse emissions were required to carry out an audit to identify investments in energy efficiency that would have a payback period of three years or less. This program proved to be extremely successful with many firms finding energy efficiency investments that would pay for themselves in less than one year, with the added bonus of significant greenhouse emission reductions [48]. A similar model was introduced by the Commonwealth Government in 2006, requiring all large energy-using businesses across Australia (with energy use exceeding 500 TJ) to increase their energy efficiency through cost-effective energy saving opportunities [49,50]. In 2006, the Victorian Government introduced the Energy and Resource Efficiency Plan (EREP) scheme which extended the Industry Greenhouse Program to water consumption and waste generation [51]. The extended scheme required all commercial and industrial sites consuming over 100 TJ of energy and/or 120 mL of water per annum at 1 January 2008, to identify and implement actions reducing energy, water and waste that would a payback period of three years or less. By 2013, over 250 companies had participated in the EREP program and collectively saved over 7000 TJ of energy; over 7500 mL of water; over 100,000 tonnes of solid waste; and collectively reduced business costs by over $120 million per year [52]. Despite these impressive results, which far outweighed initial expectations, the Victorian government recently terminated the EREP program as part of its “Red Tape Reduction Program” [53], on the basis that it duplicated various Commonwealth emission reduction schemes [54].

For petroleum based oils and synthetic equivalents, the Commonwealth Government introduced a levy of 5.449 cent per litre in 2000, which is used to provide financial support to used-oil recyclers [55]. However, the current National Waste Policy adopted self-regulatory, co-regulatory and informational arrangements as its priority strategies, rather than levies and charges.

One of the first co-regulatory schemes launched under this policy was the Australian Packaging Covenant, which encourages major industry players to design more sustainable packaging, increase recycling rates and reduce packaging litter [56,57]. In 2011, the Product Stewardship Act 2011 (Cth) was introduced to provide a statutory framework for a wider range of measures to more effectively manage the environmental, health and safety impacts of products, particularly impacts associated with disposal of products [58]. This legislation operates by setting a range of general obligations for “liable parties”. The first co-regulatory scheme established covers importers and manufacturers of televisions, computers, printers and peripherals, with liable parties specified by regulation as importers or manufacturers of over 5000 units (or 15,000 for peripherals) [59]. In such cases the general obligation is for liable parties to join an “approved co-regulatory arrangement”, which specifies certain outcomes within a range of general objectives ([57], Section 21). The televisions and computers regulation further elaborates the required outcomes as:

- (1)

- reasonable access to collection services in metropolitan, inner regional, outer regional and remote areas must be provided (free of charge to households);

- (2)

- certain recycling targets for each product in the class must be met in each year; and

- (3)

- a material recovery target must be met in each year (from 1 July 2014) ([58], Regulations 3.01–3.03).

In 2012, guidelines were released for a new product stewardship scheme covering “end-of-life tyres”. These guidelines envisage a voluntary, industry-led program that will impose a levy upon participating tyre importers to fund the operation of the scheme. Other products currently being considered for similar arrangements include architectural and decorative waste paint, end-of-life handheld batteries, packaging, end-of-life air conditioners with small gas charges, and end-of-life refrigerators with small gas charges [60].

Guidance on the future of product stewardship schemes may be revealed by the progress of similar schemes that have been operating for longer periods overseas. The EU Directive on Waste Electrical and Electronic Equipment [61] requires Member States to establish systems for users and distributors to return household EEE waste to collection facilities free of charge, and requires producers to finance the collection and processing of EEE waste at these facilities. [62]. For non-household EEE, producers are obliged to provide for the collection of such waste by joining a collection scheme. However the specific schemes introduced pursuant to this Directive can vary significantly from country to country.

4.3. Regulation of Disposal and Re-Use of Metals

Laws on waste disposal and recycling are generally administered by State or Territory EPAs as part of their role in regulating industrial pollution. However responsibility for landfills and waste recycling facilities is often shared with local government and private enterprise. In Victoria, the Environment Protection Act was amended in 2002 to foster environmentally sustainable uses of resources and best practice in waste management (under Part IX—Resource Efficiency). This reform established a new statutory corporation, Sustainability Victoria, to oversee industrial waste management plans, a Metropolitan Waste Management Group, to facilitate local government waste management and resource recovery services, and Regional Waste Management Groups, to plan for municipal waste within a certain declared regions. Landfill operators must pay to the EPA a landfill levy for each tonne of waste deposited at their premises [63]. The current rates vary from $22 to $58.50 per tonne depending upon the source (municipal vs. industrial) and nature of the waste. Waste is categorized as Category A (most hazardous), Category B or Category C (least hazardous). Category A waste cannot be disposed of in landfills at all unless processed to a less hazardous state. There are some 35 landfill sites across Victoria and only one (Lyndhurst) is licensed to receive Category B waste [64]. In effect, the landfill levy is paid by households and businesses that deposit waste at those sites, providing a price signal to discourage the quantity of waste sent to landfills. The revenue raised by the levy contributes a major portion of the funding of EPA operations in Victoria.

Numerous defects in the management of landfills by the EPA and local councils in Victoria were highlighted in a recent Ombudsman’s inquiry into a serious methane leak from a landfill site adjacent to a new housing development at Cranbourne on the outskirts of Melbourne [65]. A separate report by the Victorian Auditor General’s Office into EPA management of hazardous waste also found many deficiencies in record keeping and procedures within the EPA [66]. The EPA responded to these criticisms by instituting its own Compliance and Enforcement Review [67] and recently announced that it had implemented 117 of the 119 recommendations from that review [68].

Sustainability Victoria has established a range of programs delivered in partnership with local governments that are directed to recovery and recycling of certain problematic products including “Detox Your Home” (for household chemicals) “Battery Back” (for used household batteries), “Byteback” (computers and peripherals) and “Paintback” (paint). In 2013, the Victorian Government issued a new vision for waste and resource recovery called Getting Full Value: the Victorian Waste and Resource Recovery Policy [69], which seeks to engage industry all levels of government to adopt a shared approach to the management of products at end-of-life, moving (like the national policy) away from government driven waste collection to industry based product stewardship schemes [70].

The existence of markets for export of waste and used goods brings international law into consideration. The most notable treaty in this field is the 1989 Basel Convention on the Control of Transboundary Movements of Hazardous Wastes and their Disposal [71], which commits participating nations to reduce the production of hazardous waste and to restrict its trans-boundary movements. The Basel Convention has 180 participating nations, including Australia. However the USA, one of the world’s greatest waste producers, has not implemented the Convention, due in part to potential conflicts with US laws, including the Resource Conservation and Waste Recovery Act (1994), and comprehensive EPA waste management requirements [72]. The Commonwealth Government has introduced legislation to implement its obligations under the Basel Convention [73], as well as guidelines for transfer of hazardous waste between States and Territories [74]. It has been suggested that national legislation applying the Basel Convention may be in conflict with free trade rules [75]. However, the World Trade Organisation has stated that the principles of non-discrimination and transparency do not conflict with trade-related measures needed to protect the environment [76]. The OECD also has a number of Directives relating to the movement of waste between member nations which establish a two-tier system for “green” and “amber” (hazardous) wastes which inter alia, requires the exporting country to re-admit any amber waste if it cannot be recycled as intended by the original consent procedures [77].

5. Observations and Analysis

This paper has reviewed the general framework of regulation applicable the various phases of the metal life cycle in Australia. A summary of the regulatory schemes considered and the particular form of strategies applied in each phase is set out in Table 1.

Table 1.

Summary of regulatory schemes considered and main regulatory strategies applied.

| (1) Exploration and Extraction Phase | |

|---|---|

| Regulatory Scheme (legislative instruments) | Regulatory Strategy Applied |

| State Government (Victoria) | |

|

|

| Commonwealth Government | |

|

|

| Industry self-regulation | |

|

|

| (2) Processing and Manufacturing Phase | |

| State Government (Victoria) | |

|

|

| Commonwealth Government | |

|

|

| (3) Disposal and Re-Use Phase | |

| State Government (Victoria) | |

|

|

| Commonwealth Government | |

|

|

| International agreements | |

|

|

For the exploration and extraction phase it has been found that regulation consists primarily of State mining laws, which are prescriptive and authorisational in character, and primarily aimed at promoting resource development. Some environmental protection objectives are met by site rehabilitation obligations and other conditions imposed under mining licences. Relatively low royalty rates are applied, which form an important part of State revenue, but have no apparent role in internalization of environmental costs. Environmental protection in this phase is primarily governed by licence conditions and environmental impact assessment rules that apply both authorisational and informational strategies. There is scope for additional conditions to be imposed in mining licences and/or EIA conditions to facilitate re-processing of tailings. Some uncertainty concerning ownership of minerals in discarded tailings was also noted. Industry self-regulation principles promoting resource efficiency are becoming more common, but these strategies are still largely voluntary and not widely adopted. Thus more empirical research is needed to establish whether voluntary measures alone would be effective in promoting better recovery and recycling of metals. The Commonwealth has encouraged some management focused approaches through informational strategies like the NPI and greenhouse reporting but some weaknesses are apparent in these schemes. A strong case for increased taxation was provided by the Henry Review but the recent attempt to introduce a new mining profits tax has been largely ineffectual. Nevertheless, whilst government revenue shortfalls continue, scope for further tax reform in the mining sector remains. This would be of particular importance to raise revenue to support investment in new infrastructure for the metal recycling industry.

In the processing and manufacturing phase, prescriptive State environment protection schemes administered by State EPAs are the dominant approach. Site based licensing schemes have evolved beyond command and control to promote management based strategies for resource efficiency, using outcome-based regulation and voluntary management-based approaches, whereby a greater onus is placed upon industry players to recognize the business case for resource efficiency and waste minimization. More recently, Commonwealth product stewardship legislation has encouraged some manufacturers and importers to support collection schemes for certain products that contain a range of recyclable metals, such as TVs and computers, with proposals for future schemes covering batteries, air conditioners and refrigerators. There is also one example of a product levy (on oil) to provide funding to support recycling. Deeper stewardship measures like design-for-sustainability remain a voluntary matter.

In the disposal and re-use phase, State government, local government and private business entities share regulatory responsibility for waste collection and landfills. Landfill levies are an important economic tool, creating a significant price signal to promote recycling and re-use, whilst also providing revenue to support relevant government agency costs. The Commonwealth product stewardship legislation has also contributed to several new product-based waste recovery schemes. The export of products and metals for disposal or re-use overseas is subject to some restrictions under international agreements.

The UNEP proposal for a metal recycling sector driven by economics is getting some support from a shift in regulatory style that encourages management based strategies and resource efficiency. On the other hand, the recycling sector faces a complex array of regulatory schemes that present a significant barrier to market based reforms. This is not surprising for a sector advancing a new business model that cuts across many industries and many levels of government, involving inherently hazardous activities, within extensive global production and distribution networks. Recent competition policy initiatives have promoted new business opportunities through “red tape” reduction and removal of barriers to competition. However there are two caveats that regulators should bear in mind. Firstly, the hazardous consequences of careless waste management and recycling will always justify some form of government intervention, on both economic and social policy grounds. The inquiry into the Cranbourne gas leak revealed that the Victorian EPA had failed to enforce its own landfill design rules under pressure from the local government authority over cost, and later delayed enforcement activity that could have averted a public health emergency, partly due to a lack of resources. This reveals the high danger of weakening the role of prescriptive legislation where community welfare may be at risk. Secondly, Hirsch has pointed out that voluntary management based strategies are unlikely to arise without some government intervention. Göran Roos has portrayed this dilemma as a failure of the current business model, under which private firms are unwilling to pay for solutions to social problems unless they can capture a reasonable share of the value added to social welfare [78]. For most businesses, objectives like resource efficiency and better waste management are not central to their business model, and often represent only a relatively small line item in the business accounts. Thus, even where cost efficient investments can be identified, managers may still prefer to apply their scarce financial resources to higher profile matters within their traditional comfort zone, like new products and marketing. Similar arguments can be made to justify government interventions to promote “industrial ecology” type synergies whereby waste from one facility could conveniently be used as raw materials for another [79].

Another more general observation is that the trans-boundary nature of the metal extraction and processing, product manufacture and distribution networks tends to fragment regulatory authority both within Australia, and across national borders. Overlapping regulation creates many variations in key definitions such as “waste” and “hazardous waste” which can complicate legal compliance for all parties concerned [80]. This need not be a barrier to the application of concepts like EPR and product stewardship to the life cycle of metals, it simply means that traditional regulatory assumptions about top-down control of the supply chain need to be reconsidered. This strengthens the case for more reliance upon industry self-regulation and enterprise based management strategies, particularly to promote the engagement of multi-national enterprises.

6. Conclusions

Traditional prescriptive regulatory schemes in Australia have failed to provide an effective economic framework to support a circular economy in metal recycling. Regulatory theory suggests that in the context of rapidly changing global production and distribution networks, there is a preference for management-based model of reflexive regulation to promote this type of “green” business. The theoretical model envisages the firm as a global citizen that would internalize appropriate social norms through information and communication-based strategies, and reflect upon its own performance using procedure based strategies to enhance resource efficiency and productivity gains that could contribute to a more circular economy. At present, many institutional barriers limit this approach including complex and overlapping regulation of the metal life cycle across relevant industry sectors, a limited range of support for a more management based reflexive business model and industry policies that still favor a linear life cycle for metals. Economic barriers include the high cost of collection and technology for re-processing of metals, inappropriate taxation and royalty regimes, and a lack of reward for firms incurring costs to contribute to public welfare outcomes. There has also been a strong push for deregulation to cut red tape and reduce business costs. However, this narrow approach may be detrimental if it also suppresses regulatory reforms that would remove some of the market failures that currently obstruct a circular economy in metals and other valuable waste streams. Instead of deregulation and reduced taxation, there is a need for better regulation and more effective use of taxation powers, to overcome the current economic and institutional disadvantages suffered by business models based upon product stewardship and resource efficiency. The implication for future research is the need to substantiate the theoretical advantages and potential limitations of reflexive regulatory strategies with well-designed empirical studies.

References

- Graedel, T.E. On the future availability of energy metals. Annu. Rev. Mater. Res. 2011, 41, 323–335. [Google Scholar] [CrossRef]

- Michaux, S. Peak Mining & Implications for Natural Resource Management; Sustainable Population Institute of Australia: Canberra, Australia, 2013. [Google Scholar]

- Reuter, M.A.; Hudson, C.; van Schaik, A.; Heiskanen, K.; Meskers, C.; Hageliken, C. Metal Recycling: Opportunities, Limits, Infrastructure, a Report of the Working Group on Global Metals Flows to the International Resource Panel; United Nations Environment Program, International Resources Panel: Paris, France, 2013. [Google Scholar]

- Commonwealth of Australia. National Waste Policy: Less Waste More Resources; Department of the Environment, Water, Heritage and the Arts: Canberra, Australia, 2009.

- United Nations Conference on the Environment and Development (UNCED). Declaration of the Conference Held at Rio De Janiero from 3 to 14 June 1992 (“The Rio Declaration”); United Nations General Assembly: New York, NY, USA, 1992. [Google Scholar]

- Towards the Circular Economy; Economic and Business Rationale for an Accelerated Transition; Ellen MacArthur Foundation (EMF): Cowes, UK, 2012; Volume 1.

- Council of Australian Governments. Competition Principles Agreement—11 April 1995 (As Amended to 13 April 2007); Commonwealth of Australia: Canberra, Australia, 1995.

- Regulation Taskforce. In Rethinking Regulation: Report of the Taskforce on Reducing Regulatory Burdens on Business; Commonwealth of Australia: Canberra, Australia, 2006.

- Council of Australian Governments. Best Practice Regulation; A Guide for Ministerial Councils and National Standard Setting Bodies; Commonwealth of Australia: Canberra, Australia, 2007.

- Freiberg, A. The Tools of Regulation; The Federation Press: Sydney, Australia, 2010; p. 319. [Google Scholar]

- Gunningham, N.; Sinclair, D.; Grabosky, P. Instruments for Environmental Protection. In Smart Regulation: Designing Environmental Policy; Clarendon Press: Oxford, UK, 1998; pp. 37–91. [Google Scholar]

- Gumley, W.; Stoianoff, N. Carbon pricing options for a post-Kyoto response to climate change in Australia. Fed. Law Rev. 2011, 39, 131–160. [Google Scholar]

- Clean Air Act of 1970. 42 USC 7401-7626, 1970.

- Ayres, I.; Brathwaite, J. Responsive Regulation: Transcending the Deregulation Debate; Oxford University Press: New York, NY, USA, 1992. [Google Scholar]

- Porter, M.; van der Linde, C. Green and competitive: Ending the stalemate. Harv. Bus. Rev. 1995, 73, 120–134. [Google Scholar]

- Hirsch, D.D. Green business and the importance of reflexive law: What Michael Porter didn’t say. Adm. Law Rev. 2010, 62, 1063–1126. [Google Scholar]

- Coglianese, C.; Lazer, D. Management-based regulation: Prescribing private management to achieve public goals. Law Soc. Rev. 2003, 37, 691–730. [Google Scholar] [CrossRef]

- Teubner, G. Substantive and reflexive elements in modern law. Law Soc. Rev. 1983, 17, 239–285. [Google Scholar] [CrossRef]

- Dunphy, D.C.; Griffiths, A.; Benn, S. Organizational Change for Corporate Sustainability: A Guide for Leaders and Change Agents of the Future; Routledge: London, UK, 2003. [Google Scholar]

- Mineral Resources (Sustainable Development) Act (Vic). No. 92, 1990.

- Bates, G. Environmental Law in Australia, 8th ed.; LexisNexis: Chatswood, Australia, 2013. [Google Scholar]

- Victorian Government, Energy and Earth Resources. Get a Licence. Available online: http://www.energyandresources.vic.gov.au/earth-resources/licensing-and-approvals/minerals/get-a-licence (accessed on 17 February 2014).

- Mineral Resources (Sustainable Development) (Minerals Industries) Regulations 2013 (Vic). S.R No. 216, 2013.

- Australian Government. GST Distribution Review, Final Report; Commonwealth of Australia: Canberra, Australia, 2012.

- Petroleum Resource Rent Tax Assessment Act 1987 (Cth). No. 142, 1987.

- Mineral Resources Rent Tax Act 2012 (Cth). No. 13, 2012.

- Environment Effects Act 1978 (Vic). No. 9135, 1978.

- Victorian Government. Ministerial Guidelines for Assessment of Environmental Effects under the Environment Effects Act 1978; Department of Sustainability and Environment: Melbourne, Australia, 2006.

- Environmental Protection and Biodiversity Conservation Act 1999 (Cth). No. 91, 1999.

- International Association for Impact Assessment and the Institute of Environmental Assessments. Principles of Environmental Impact Assessment Best Practice; International Association for Impact Assessment: Fargo, ND, USA, 1999. [Google Scholar]

- Mining Act 1978 (WA). No. 107, 1978.

- Tarrant, J. Ownership of mining product, tailings and minerals. Aust. Resour. Energy Law J. 2005, 24, 321–330. [Google Scholar]

- Australian Government. National Environment Protection (National Pollutant Inventory) Measure 1998; Commonwealth of Australia: Canberra, Australia, 1998.

- Emergency Planning and Community Right-to-Know Act of 1984. 42 USC 11004-11049, 1984.

- Environment Link. Review of the National Pollutant Inventory; Department of Environment and Heritage: Canberra, Australia, 2005.

- Commonwealth of Australia. The Australian Atlas of Mineral Resources, Mines, and Processing Centres. Available online: http://www.australianminesatlas.gov.au/index.html (accessed on 17 February 2014).

- KPMG International. The KPMG Survey of Corporate Responsibility Reporting 2013; KPMG International Cooperative: Amstelveen, The Netherlands, 2013. [Google Scholar]

- Equator Principles Association. The Equator Principles III 2013. Available online: http://www.equator-principles.com/index.php/ep3 (accessed on 4 April 2014).

- Dow Jones and RobecoSAM. Dow Jones Sustainability Indeces. Available online: http://www.sustainability-indices.com/index.jsp (accessed on 4 April 2014).

- International Council on Mining and Metals (ICMM). Sustainable Development Framework; A Sustained Commitment to Improved Industry Performance; ICMM: London, UK, 2008. [Google Scholar]

- Henry Review Panel. Australia’s Future Tax System, Report to the Treasurer; Commonwealth of Australia: Canberra, Australia, 2010.

- Australian Government. Statement 5 Revenue, Budget Paper No. 1: Budget Strategy and Outlook 2012–2013; Department of Treasury: Canberra, Australia, 2013.

- Commonwealth of Australia. Tax Expenditures Statement 2012; Department of Treasury: Canberra, Australia, 2013.

- Kohler, A. Henry Tax Review: It’s Politics, Not Reform. Business Spectator, Southbank VIC: Austrilia, 2 May 2010. [Google Scholar]

- Planning and Environment Act 1987 (Vic). No. 45, 1987.

- Environment Protection Act 1970 (Vic). No. 8056, 1970.

- Environment Protection Authority Victoria (EPA Victoria). Past Sustainability Covenants. Available online: http://www.epa.vic.gov.au/our-work/programs/sustainability-covenants/past-sustainability-covenants (accessed on 17 February 2014).

- Delivering Business Benefits from Energy Efficiency: Achievements of EPA Victoria’s Industry Greenhouse Program (Publication 1165); EPA Victoria: Melbourne, Australia, 2007.

- Commonwealth of Australia. Energy Efficiency Opportunities. Available online: http://energyefficiencyopportunities.gov.au (accessed on 17 February 2014).

- Energy Efficiency Opportunities Act 2006 (Cth). No. 31, 2006.

- EREP Toolkit Module 1 of 5: Overview; EPA Victoria: Melbourne, Australia, 2008.

- EPA Annual Report 2012–2013; EPA Victoria: Melbourne, Australia, 2013.

- Victorian Competition and Efficiency Commission. An Inquiry into Victoria’s Regulatory Framework: Strengthening Foundations for the Next Decade, Final Report; State of Victoria: Melbourne, Australia, 2011.

- Regulatory Impact Solutions. In Cessation of Environment and Resource Efficiency Plan (EREP) Program; Regulatory Change Measurement Prepared for Department of Environment and Primary Industries; Department of Environment and Primary Industries, State of Victoria: Melbourne, Australia, 2013.

- Product Stewardship (Oil) Act 2000 (Cth). No 102, 2000.

- Australian Packaging Covenant Council. Australian Packaging Covenant; Commonwealth of Australia: Canberra, Australia, 2010.

- National Environment Protection Council. National Environment Protection (Used Packaging Materials) Measure 2011; Commonwealth of Australia: Canberra, Australia, 2011.

- Product Stewardship Act 2011 (Cth). No. 76, 2011.

- Product Stewardship (Televisions and Computers) Regulations 2011. Select Legislative Instrument No. 200, 2011.

- Australian Government. 2013–14 Product List. Available online: http://www.environment.gov.au/topics/environment-protection/national-waste-policy/product-stewardship/legislation (accessed on 17 February 2014).

- European Parliament. Directive 2012/19/EU of the European Parliament and of the Council of 4 July 2012 on waste electrical and electronic equipment (WEEE). Off. J. Eur. Union 2012, L197, 38–71. [Google Scholar]

- Directive 2000/53/EC of the European Parliament and of the Council on End-of Life Vehicles; European Parliament: Brussels, Belgium, 2000.

- Environment Protection (Industrial Waste Resource) Regulations 2009 (Vic). S.R. No. 77/2009, 2009.

- EPA Victoria. Landfill and Prescribed Waste Levies. Available online: http://www.epa.vic.gov.au/your-environment/waste/landfills/landfill-and-prescribed-waste-levies (accessed on 16 December 2013).

- Brouwer, G.E. Brookland Greens Estate—Investigation into Methane Gas Leaks; Ombudsman Victoria: Melbourne, Australia, 2009.

- Frost, P. Hazardous Waste Management; Victorian Auditor General’s Office: Melbourne, Australia, 2010.

- Krpan, S. Compliance and Enforcement Review: A Review of EPA Victoria’s Approach (Publication 1368); EPA Victoria: Melbourne, Australia, 2011.

- Batagol, C. EPA Delivers on Compliance and Enforcement Review (Publication 1557); EPA Victoria: Melbourne, Australia, 2013.

- State of Victoria. Getting Full Value: The Victorian Waste and Resource Recovery Policy; Department of Environment and Primary Industry: Melbourne, Australia, 2013.

- Barnaby, J.; Polhill, J. Take-Back to the Future: Progressing Waste Paint and Handheld Battery Stewardship Schemes in Australia. In Proceedings of WasteMINZ Conference 2013, Rotorua, New Zealand, 22 October 2013.

- United Nations Environment Program. 1989 Basel Convention on the Control of Transboundary Movements of Hazardous Wastes and Their Disposal; United Nations Environment Program: Basel, Switzerland, 1989. [Google Scholar]

- Gaba, J.M. Exporting waste: Regulation of the export of hazardous waste from the United States. William Mary Environ. Law Policy Rev. 2012, 36, 405–490. [Google Scholar]

- Hazardous Waste (Regulation of Exports and Imports) Act 1989 (Cth). No. 6, 1990.

- National Environment Protection Council. National Environment Protection (Movement of Controlled Waste Between States and Territories) Measure 2010; Commonwealth of Australia: Canberra, Australia, 2010.

- Kogan, L. ‘Enlightened’ Environmentalism or Disguised Protectionism? Assessing the Impact of EU Precaution-Based Standards on Developing Countries; National Foreign Trade Council: Washington, DC, USA, 2004. [Google Scholar]

- Widawsky, L. In my backyard: How enabling hazardous waste trade to developing nations can improve the basel convention’s ability to achieve environmental justice. Environ. Law 2008, 38, 577–625. [Google Scholar]

- Organisation for Economic Co-operation and Development (OECD). Decision of the Council Concerning the Control of Transboundary Movements of Wastes Destined for Recovery Operations Development—C(2001)107/FINAL; OECD: Paris, France, 2001. [Google Scholar]

- Roos, G. Business model innovation to creatye and capture resource value in future circular material chains. Resources 2014, 3, 248–274. [Google Scholar] [CrossRef]

- Corder, G.D.; Golev, A.; Fyfe, J.; King, S. The status of industrial ecology in Australia: Barriers and enablers. Resources 2013, 3, 340–361. [Google Scholar] [CrossRef]

- O’Reilly, J.T.; Cuzze, L.B. Trash or treasure? Industrial recycling and international barriers to the movement of hazardous wastes. J. Corp. Law 1997, 508–534. [Google Scholar]

© 2014 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/3.0/).