Abstract

This study is devoted to a comprehensive technical and economic assessment of the prospects for the development of the oil and gas sector in the Republic of Mozambique in the context of the global energy transition. The analysis of key gas projects, including Coral South FLNG and Mozambique LNG, focused on their technological features, economic parameters and environmental impact. It is shown that the introduction of floating liquefaction technology reduces capital expenditures, increases operational flexibility, and minimizes infrastructure risks, especially in conditions of geopolitical instability. Based on a comparative analysis of the projects, it was found that the use of modular solutions and the integration of carbon capture and storage (CCS) systems contribute to improving sustainability and investment attractiveness. A patent analysis of technological innovations was carried out, which made it possible to substantiate the prospects for using nanotechnologies and advanced CO2 capture systems for further development of the sector. The results of the study indicate the need to strengthen content localization, develop human capital, and create effective revenue management mechanisms to ensure sustainable growth. The developed strategic development concept is based on the principles of the sixth technological paradigm, which implies an emphasis on environmental standards and technological modernization, including on the basis of nanotechnology. Thus, it is established that the successful implementation of gas projects in Mozambique can become the basis for long-term socio-economic development of the country, provided that technological and institutional innovations are integrated.

1. Introduction

1.1. Current State of Mozambique’s Oil and Gas Sector

Mozambique’s oil and gas sector has played a key role in the national economic strategy in recent years. The discovery of large natural gas deposits in the Ruvuma basin in the 2010s, with total proven reserves exceeding 100 trillion cubic feet, provided the country with the opportunity to take a significant position in the world market of liquefied natural gas [1,2,3]. In the context of the global energy transition to a low-carbon economy, natural gas is considered as an important intermediate energy source that can provide a balance between energy availability and reducing greenhouse gas emissions [4,5].

Key projects that determine the development of Mozambique’s gas industry are Mozambique LNG (TotalEnergies), Rovuma LNG (ExxonMobil and Eni), and Coral South LNG (Eni), the first floating gas liquefaction plant in Africa [1,2]. The implementation of these projects is accompanied by significant investments exceeding 50 billion US dollars, and is aimed at increasing gas production, export revenues and gross domestic product [3]. At the same time, the development of the sector is associated with the need to address the challenges of ensuring security in regions of political instability, compliance with environmental standards and effective income management to prevent undesirable consequences [4].

Given the high capital intensity of projects, technological risks and requirements for compliance with the principles of sustainable development, it is particularly important to assess the effectiveness of applied solutions. Floating LNG platforms, carbon capture and storage (CCS) systems, and the use of nanotechnologies in production and processing processes are important elements for improving the competitiveness of projects [5,6].

Mozambique’s gas industry is undergoing intensive development, centered around four large-scale liquefied natural gas (LNG) projects that are at various stages of implementation. Based on the collected data, it is established that these projects form the basis of the national LNG strategy. Table 1 provides an overview of these initiatives, including their key characteristics and stages of implementation.

Table 1.

Major gas projects in Mozambique’s portfolio (Mtpa—millions of tons of LNG per year). FID—Final investment decision.

1.2. Areas of Technical and Economic Development

Natural gas is viewed globally as a transition fuel that can help balance energy needs and climate goals [2]. In Mozambique’s case, LNG projects could supply fast-growing Asian and European markets, reducing reliance on higher-emitting fuels. Advances in floating LNG (FLNG) technology enable development of remote deep-water fields without extensive onshore infrastructure [1]. For example, the Coral South FLNG was built offshore and integrated on site, reportedly cutting capital costs by roughly 40% compared to conventional multi-product FLNG facilities [1]. In addition, innovations like nanotechnology and carbon capture and storage (CCS) are being explored to boost efficiency and lower greenhouse gas emissions [7,8].

The development of Mozambique’s oil and gas industry is carried out through targeted technical innovations and strategic economic policies aimed at the efficient development of natural resources. The main technical focus is on expanding the exploration capabilities of offshore and coastal deposits in the Ruvuma basin using advanced seismic exploration and deep-sea drilling technologies [7,8]. The introduction of floating liquefied natural gas (FLNG) technologies, in particular Coral Sul, allows Mozambique to overcome the infrastructure limitations of remote areas, reducing project implementation times and minimizing capital costs [9,10].

In parallel, the pipeline network and port infrastructure are being developed to integrate gas production with domestic electricity production and export logistics [11,12]. Examples include the Temane gas power plant and LNG terminals in the Palme area.

The economic policy is aimed at ensuring sustainable growth through economic diversification and rational management of revenues from hydrocarbons. Revenues are invested in agriculture, industry, and renewable energy. The creation of a Sovereign Wealth Fund based on the Norwegian model involves financing healthcare, education and infrastructure, ensuring intergenerational equality [13,14].

Content localization policies require the involvement of local businesses and labor, facilitating technology transfer and developing national competencies.

The introduction of natural gas liquefaction technologies helps strengthen Mozambique’s position in global energy markets, given the growing demand for LNG in Asia and Europe [15]. The use of nanotechnologies in the production and processing of hydrocarbons increases the durability of equipment, reduces production costs, and develops carbon capture and storage (CCS) technologies [16,17].

The development of regional cooperation with South African states and integration associations (for example, SADC) enhances economic integration. Mozambique is seeking to leverage its strategic location on the Indian Ocean coast to serve Asian and European markets, which has been strengthened by changes in global demand.

The Mozambique LNG and Rovuma LNG projects include the introduction of CO2 capture and methane emission reduction technologies that meet international environmental requirements [18,19]. The development of digital monitoring systems based on artificial intelligence increases the safety of production processes, especially in regions with unstable conditions.

Financing of energy projects is carried out with the involvement of multilateral institutions and is focused on supporting hybrid projects in the field of renewable energy. Financial instruments are being developed, including green bonds and climate loans, which meet the requirements of environmental, social and managerial responsibility (ESG) [20].

The development of human capital is realized through the expansion of educational programs in the field of petroleum engineering and maintenance. Joint initiatives of universities and industrial companies are aimed at training highly qualified local specialists, reducing dependence on foreign labor and improving the sustainability of the sector.

The analysis shows that the sustainable development of the oil and gas sector requires the formation of effective governance mechanisms aimed at preventing corruption, ensuring transparency in the distribution of income and resolving regional conflicts.

The purpose of this study is to conduct a technical and economic assessment of the prospects for the development of the oil and gas sector in Mozambique, focusing on a comparative analysis of the Coral South FLNG and Prelude FLNG projects (Shell, Australia). Based on the analysis of capital and operating expenses, income structure, socio-economic and environmental impact, an integrated concept of sustainable development of the sector is proposed, focusing on the balance between technological innovation, localization of economic benefits and compliance with ESG standards. Based on patent analysis, a review of policy and legal documents, and financial modeling, the concept of sustainable development of the oil and gas industry in Mozambique is proposed, focusing on technological innovation, localization of economic effects, and compliance with environmental standards.

Despite these technological promises, critical gaps remain. In particular, the research gap lies in integrating the techno-economic analysis of Mozambique’s LNG projects with environmental, social, and governance (ESG) considerations in the Sub-Saharan African context. Few studies have simultaneously evaluated the financial viability, technical options, and socio-environmental risks of these projects from a local perspective. This paper addresses that gap by combining case studies (Mozambique Coral South FLNG vs. Australia’s Prelude FLNG), patent analysis of emerging technologies, and regulatory review to assess project prospects. The motivation is to inform decision-makers on how to harness Mozambique’s gas resources while ensuring sustainable development.

Research Gap: Previous analyses have often treated Mozambique’s gas projects in isolation from their regional and global context. This study explicitly examines LNG development trends in Sub-Saharan Africa, technological innovations (e.g., FLNG, nanotech, CCUS), and ESG implications together. We identify a lack of integrated assessments that combine economic indicators (NPV, IRR, MROR) with environmental and social impacts specific to Mozambique. This work fills that gap by providing a systemic techno-economic evaluation and outlining policy recommendations tailored to Mozambique’s context.

2. Literature Review

2.1. Application of FLNG Technology in the Development of Mozambique’s Oil and Gas Sector

Introduction of innovative technologies aimed at improving the efficiency of natural gas production, processing and liquefaction remains one of the key unresolved challenges for the oil and gas sector in Mozambique [1]. Based on the analysis, it was found that despite the availability of separate solutions, such as carbon dioxide injection for enhanced oil recovery (EOR) [21,22] and floating natural gas liquefaction (FLNG) technology, their large-scale implementation in the country is limited [23,24]. The main barriers are insufficient adaptation of technologies to local conditions and high capital expenditures, which slows down the effective development of natural resources [25,26].

Mozambique’s gas sector development strategy relies on the use of FLNG technology, which ensures the rapid development of remote offshore fields, such as the Ruvuma basin [1,25]. FLNG technology eliminates the need to build onshore infrastructure, reducing capital costs and increasing resilience to external threats. An example is the Coral South FLNG project implemented by Eni, where gas liquefaction is carried out directly on the shelf, which minimizes land use and simplifies logistics [9,27].

Coral South FLNG was built abroad and delivered to Mozambique, which significantly reduced the project implementation time. The modular design, focused exclusively on LNG production (3.4 million tons per year) [28,29], provided a 40% reduction in capital expenditures compared to multi-functional installations, such as Shell’s Prelude FLNG, whose cost reached US $ 12–17 billion [30].

Coral Sul’s deep-water placement (~2000 m) required innovative engineering solutions, including polyester mooring ropes and suction anchors. The use of modern technologies, such as fully electric control systems and fiber-optic monitoring, has ensured high reliability of the facility and reduced operating costs by 30% compared to earlier FLNG projects [9,27].

The Coral South project has demonstrated high stability: in the first year of operation, 100 LNG shipments were shipped [31,32]. As a result, the efficiency of applying the concept of compact, modular FLNG installations for the development of deep-water gas fields was confirmed.

The approval of the Coral North FLNG indicates a strategic decision to continue using FLNG technology in Mozambique. It is predicted that the development of additional floating production facilities will allow Mozambique to quickly adapt to market demand and optimize the development of small deposits. The current evolution of FLNG technologies, including more compact designs and improved liquefaction processes, further reduces costs and increases project efficiency [33,34].

Thus, the experience of Coral South FLNG implementation confirms that floating natural gas liquefaction technology is an effective tool for commercialization of remote gas resources, reducing the need for capital onshore infrastructure and ensuring resilience to external risks [26,27]. The diversification strategy—a combination of floating and onshore solutions—provides a solid foundation for the long-term development of Mozambique’s gas sector.

2.2. Application of Nanotechnologies and CO2 Capture Systems in the Oil and Gas Sector of the Republics of Mozambique

Mozambique is integrating cutting-edge technological solutions to maximize economic efficiency and ensure the sustainable development of gas projects. The key areas are the application of nanotechnologies in the oil and gas chain and the introduction of CO2 capture systems2 to reduce greenhouse gas emissions [21,22]. These innovations reflect the formation of a new technical and economic paradigm of the energy sector, focused on increasing productivity while meeting environmental requirements [35].

Nanotechnologies in the Oil and Gas Industry

Nanotechnology involves designing materials at the nanoscale to take advantage of their unique physical and chemical properties. In the oil and gas sector, nanomaterials contribute to improving the efficiency partially of equipment and processes [22]. For Mozambique’s gas projects, which are characterized by difficult conditions for offshore drilling and gas liquefaction, the use of nanotechnology provides a number of advantages:

Improvement of materials and equipment: the use of nanocoats and nano-additives increases the resistance of drilling tools and equipment to corrosion, high temperatures and pressure, which is especially important for deep-sea developments in the Ruvuma basin [6];

Increasing the efficiency of gas processing: nanoscale catalysts increase the rate of chemical reactions, contributing to more efficient gas purification and reducing energy costs for LNG production [36];

Increasing the hydrocarbon recovery rate: the introduction of nanoparticles in enhanced oil recovery (EOR) methods promotes the release of hydrocarbons from reservoirs, increasing production volumes [21];

Lower operating costs: faster filtration processes and increased equipment durability reduce recycling, transportation, and maintenance costs [37].

Special attention is paid to the development of carbon capture and storage (CCS) technologies using carbon nanotubes and nanoporous materials. The integration of nanostructured CO2 scrubbers in LNG plants can significantly reduce carbon dioxide emissions, contributing to the achievement of sustainable development goals [22,38]. Thus, the application of nanotechnology in the gas sector of Mozambique is a promising area for improving technological efficiency and minimizing environmental risks.

2.3. CO2 Capture, Use and Storage Technologies (CCUS) and Their Integration into Oil and Gas Projects in the Republic of Mozambique

In the context of high carbon emissions typical of large gas projects, Mozambique is actively exploring carbon capture and storage (CCS) technologies as a tool for achieving climate goals and attracting funding. Carbon capture and storage (CCS) is considered at two key points: at the stage of removing CO2 from raw gas prior to the liquefaction process, and at the stage of processing emissions from gas turbine units at LNG plants [39,40]. Captured CO2 can be pumped into shelf geological formations for long-term storage [41].

ExxonMobil has announced plans to recycle the Rovuma LNG project with the integration of CO2 capture technologies aimed at reducing emissions and optimizing costs [18]. In particular, the possibility of synergy with the TotalEnergies project for the joint use of CO2 capture and injection infrastructure is being considered. It is planned to incorporate amine scrubber technologies and build pipelines for pumping CO2 into depleted wells, which will significantly reduce greenhouse emissions throughout the entire project life cycle [38].

The combination of nanotechnology and carbon capture and storage (CCS) is a promising area of development. Studies show that the use of organometallic framework structures and nanoporous materials can significantly increase the efficiency of CO2 separation [42]. Pilot projects on the use of membrane CO2 capture technologies can be implemented at installations such as Coral FLNG, where it is possible to install experimental systems for removing CO2 from flare gas or exhaust gases [38,42].

It is expected that by the time larger projects such as Rovuma LNG are launched, carbon capture and storage (CCS) technologies will be ready for full industrial integration. The use of these solutions contributes not only to reducing the carbon footprint, but also to increasing the economic efficiency of projects [39]. Thus, technological innovations in the field of carbon capture and storage (CCS) not only meet environmental requirements, but also significantly increase the investment attractiveness of gas projects in Mozambique in the context of stricter global carbon regulation.

2.4. Investment Environment: Capital, Operational Efficiency and Risk Factors

Mozambique’s oil and gas industry is being developed in a challenging investment environment characterized by high capital expenditures, long development timelines, and significant operational requirements. Successful implementation of projects requires a balance between potential profitability and geopolitical, market and regulatory risks [43].

Capital Expenditures and Financing

The Mozambique LNG and Rovuma LNG projects, which require investments of US $ 20 billion and US $ 30 billion, respectively, are the largest energy initiatives in the region [7,18]. Financing is provided by consortia of international oil and gas companies, export credit agencies (ECA), and development financial institutions such as EXIM Bank, JBIC, and the African Development Bank [4,44]. The high share of the contracted LNG volume with financially stable buyers (about 86% for Mozambique LNG) confirms the investment attractiveness of the projects.

The approval by EXIM Bank of a loan worth about $ 5 billion in 2025 was an important signal for the market [3]. Despite the positive dynamics, the cost of capital remains increased due to risk premiums, requiring projects to maintain high profitability.

Operational Efficiency and Revenue Optimization

The profitability of projects depends on efficient operation and favorable market conditions. The use of modern technologies, digital monitoring systems and predictive maintenance reduces operating costs and minimizes downtime [35].

Mozambique’s geographical location provides access to both Atlantic and Asian markets. Long-term contracts with consumers in Europe and Asia help to stabilize revenues, although some volumes may be subject to spot market volatility. To ensure competitiveness, it is necessary to maintain a low production cost [43].

Risk Factors

Geopolitical risks. The restoration of control in the Cape Delgado region with the support of international partners has allowed the resumption of projects, but maintaining security remains critical. Human rights violations identified by a number of organizations may pose additional reputational risks [43].

Risks of resource nationalism. With an increase in income, there may be attempts to revise the contract terms or increase the tax burden. The adoption of a Sovereign Fund is aimed at increasing transparency and reducing political risks [45,46].

Climate and market risks. The projects are criticized for their possible high carbon footprint. In response, carbon capture and storage (CCS) technologies are being integrated and green finance opportunities are being considered [43,47]. Fluctuations in global LNG prices also pose long-term threats, which are offset by the diversification of contract strategies and the development of domestic gas consumption.

Mozambique’s oil and gas sector combines high investment potential with significant risks. Successful capital mobilization and effective risk management have created a solid foundation for development [4,48]. If the conditions of operational efficiency and sustainable management are met, it is expected that the country will be able to generate revenues of about 100 billion US dollars over 25 years [49,50], contributing to economic growth and energy security.

2.5. Content Localization, Skill Development, and Revenue Management

Based on the oil and gas legislation, mandatory requirements for attracting local labor and companies are established. Operators are required to give preference to goods, services and personnel from Mozambique, while meeting quality standards and deadlines [51,52]. These measures encourage the development of small and medium-sized businesses and facilitate technology transfer. As part of the TotalEnergies and Eni projects, several thousand Mozambican citizens were trained and employed, which lays the foundation for the transition of local specialists to qualified technical positions.

Additionally, there are obligations to supply part of the gas to the domestic market, in particular for the Temane power plant with a capacity of 450 MW, which contributes to expanding access to electricity.

2.5.1. Developing Skills

LNG projects are accompanied by educational programs, scholarships and internships aimed at training highly qualified personnel in the field of engineering, geosciences and maintenance. Eni and ExxonMobil finance the education of Mozambican citizens both at home and abroad. These initiatives are aimed at reducing dependence on foreign labor and increasing domestic value added.

2.5.2. Sovereign Wealth Fund (SWF)

In March 2024, a decree was approved on the creation of a Sovereign Wealth Fund to accumulate and invest gas revenues [3,11]. According to the structure, 40% of LNG revenues will be allocated to the fund during the first 15 years of operation, which will ensure long-term sustainability and intergenerational equity. The fund is managed in accordance with the principles of transparency and independent oversight, with the support of the IMF and the World Bank.

2.5.3. Preventing a Resource Curse

Aware of the risks associated with the resource curse, Mozambique is taking steps to strengthen institutions, fight corruption and diversify its economy. Funds from gas projects are planned to be invested in agriculture, industry and renewable energy sources, reducing dependence on hydrocarbon revenues. Funding from international organizations is accompanied by requirements for compliance with management standards and fiscal discipline.

Mozambique’s integrated approach to content localization, skills development and revenue management creates the conditions for making the gas sector a source of sustainable and inclusive growth. If these strategies are effectively implemented, the country has the potential to become a model for responsible management of natural resources in Africa.

2.6. Environmental Challenges and Mitigation Measures

The development of Mozambique’s oil and gas resources is accompanied by serious environmental challenges, such as greenhouse gas emissions and impacts on local ecosystems [41]. Balancing economic growth and effective environmental management is considered a priority task for both national authorities and the international community.

The literature notes serious environmental challenges from LNG projects in Mozambique. Besides CO2 and methane emissions, impacts include marine ecosystem disturbance and possible coastal erosion. For instance, dredging and onshore construction associated with pipelines and terminals can damage mangroves and reefs [53]. The Quirimbas area is especially sensitive, hosting endangered sea turtles and whales [6]. Any accidental LNG spill or flare discharge could have catastrophic local consequences (extreme heat or vapor clouds harming wildlife). Thus, environmental impact assessments (EIAs) and regulatory oversight are critical.

Mitigation measures suggested in the literature include strict leak detection and flaring controls (infrared monitoring, maintenance upgrades) and the use of renewable power for LNG plants to cut emissions. Plans to restore coastal ecosystems (e.g., mangrove reforestation) are underway to offset some impacts. We also note broader considerations of social justice: Mozambique is highly vulnerable to climate change, so its role as an LNG exporter raises questions of global responsibility and the rights of local communities.

- (Further analysis of biodiversity impacts, marine ecology, and social outcomes is underway.)

Carbon Footprint of LNG Projects

The production of liquefied natural gas (LNG) is an energy-intensive process involving gas extraction, removal of impurities (including CO2 emissions), and supercooling of gas to a liquid state, which requires significant energy costs. Based on the existing data, it has been established that the operation of LNG plants is accompanied by a significant carbon footprint [5,40]. When you take into account the emissions that occur at the end-use stage of gas (when it is burned), the total carbon footprint increases significantly.

It is predicted that the implementation of all announced LNG projects in Mozambique (with a production capacity of over 30 million tons per year by 2030) will lead to emissions equivalent to 100–120 million tons of CO2 per year [5,42]. These figures have drawn criticism from environmental organizations that label the projects as potential “carbon bombs” that run counter to global climate goals.

It should be noted that Mozambique is also one of the country’s most vulnerable to the effects of climate change, including cyclones and floods, and has a significant potential for developing fossil resources [5,53]. The Government’s position is to position natural gas as a transition fuel that, while being less carbon-intensive than coal and oil, can contribute to reducing global emissions in the medium term. According to current estimates, natural gas emits about 50% less CO2 during combustion than coal [5].

However, the problem of methane (Ch4) leakage, which is the main component of natural gas and has a greenhouse effect 80 times more pronounced than CO2 in the 20-year horizon, is of particular importance [54,55]. It has been established that gas drilling, processing, and transportation processes can be accompanied by unauthorized methane emissions [56,57], which significantly increases the total climate impact of projects [53,54]. Thus, effective management of methane emissions is a prerequisite for ensuring the environmental sustainability of gas projects in Mozambique, along with controlling carbon dioxide emissions.

3. Materials and Methods

Based on a systematic approach, a multi-layered methodological framework has been developed that combines qualitative and quantitative methods for conducting a comparative analysis of floating liquefied natural gas (FLNG) projects in Mozambique and Australia. The methodological framework is formed on the basis of three complementary components: structural and functional analysis, assessment of technological and economic parameters, and expert assessment of regulatory conditions [35].

- Structural and Functional Analysis

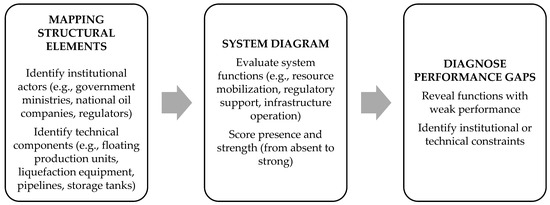

The initial step involved mapping the structural and functional components of each country’s FLNG system, utilizing an innovation-systems approach. Relevant institutional actors (such as government ministries, national oil companies, regulators, service firms, etc.) and technical components (including floating production units, liquefaction equipment, pipelines, storage tanks, etc.) were identified through document analysis and expert interviews, and subsequently organized into a system diagram. This structural map was analyzed in conjunction with a functional analysis of system processes (e.g., resource mobilization, regulatory support, infrastructure operation) in order to identify performance gaps within the system. According to Gust-Bardon (2015) [58], structural–functional analysis “enables the identification of issues within a system” by uncovering the roles of actors, networks, and infrastructure.

The well-established list of innovation-system functions was employed to evaluate the presence and strength of each function, ranging from absent to strong. By comparing these functions within the contexts of Mozambique and Australia—specifically the strength of investment mobilization and technology adaptation functions—systemic bottlenecks were identified. Functions exhibiting weak performance or the absence of structural elements indicated institutional or technical constraints on FLNG development.

Thus, the integrated structural–functional mapping provided a comprehensive framework for contrasting the institutional arrangements and technical capacities between the two case studies (Figure 1).

Figure 1.

Scheme of a structural–functional analysis. Source: compiled by the authors.

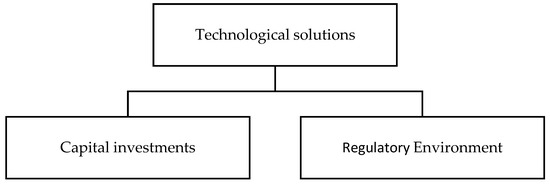

The study uses structural and functional analysis to identify systemic relationships between the organizational and operational models of floating natural gas liquefaction (FLNG) projects and their integration into national socio-economic systems [47]. The methodological basis was an adapted version of the system theory, which allowed us to decompose projects into the main components: technological solutions, capital investments, and regulatory conditions (Figure 2).

Figure 2.

Scheme of a technological solution with a focus on the investment and regulatory contexts. Source: compiled by the authors.

Based on the analysis, the functional synergy between the selected elements and their combined impact on macroeconomic indicators, including the contribution to gross domestic product (GDP), job creation and improving the level of energy security, was evaluated.

Projects in Mozambique (Coral South FLNG, Ruvuma basin) and Australia (Prelude FLNG) are considered as objects of the case study. Mozambique’s early-stage projects were analyzed from the perspective of infrastructure development, the involvement of multinational corporations (such as Eni and ExxonMobil), and the evolution of interaction with local communities.

In contrast, Australian projects demonstrate mature operational models characterized by streamlined supply chains, standardized logistics processes, and integration of sustainability principles, including environmental, social, and governance (ESG) considerations [58,59].

Thus, the structural and functional analysis revealed key differences in organizational strategies, the degree of technological maturity, and the levels of local integration of FLNG projects in various socio-economic contexts.

- Innovation and Patent Review

To monitor technological advancements, a patent landscape analysis of FLNG technologies was conducted. Patent databases (e.g., WIPO PATENTSCOPE, Espacenet, national patent offices) were queried using keywords related to FLNG systems (e.g., “Floating LNG”, “FLNG processing”, “LNG heat exchanger”) to retrieve relevant filings. The retrieved set of patent documents was subsequently processed using text-mining and clustering techniques. For example, Lin et al. (2025) [30] retrieved all FLNG patents from China’s patent platform and employed clustering methods to “systematically identify and categorize the constituent elements of FLNG systems”.

Similarly, patent titles and abstracts were clustered to group innovations by technology area (e.g., liquefaction equipment, storage designs, offloading systems). From the clustered data, key technology domains (e.g., advanced heat exchangers, cryogenic storage tanks, loading systems) were identified, and patent families were counted by year and assignee. Patent-based indicators, such as annual patent counts, citation metrics, and technological sub-classification trends, were used to assess innovation intensity and diffusion.

This bibliometric approach, based on patent informatics, enabled the quantification and comparison of technological progress in FLNG between the two contexts.

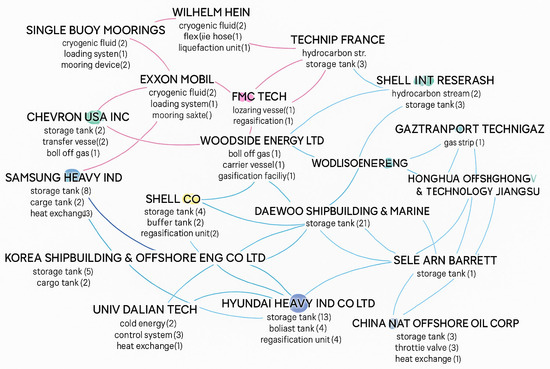

To identify the most advanced technological solutions for FLNG platforms, a cluster analysis of 20 patent documents was conducted (Figure 3) [25,60,61]. It took into account such criteria as economic impact, effectiveness in mitigating environmental risks, as well as proven applicability of technologies in various regional contexts.

Figure 3.

Correlation of 20 patent holders by terminology extracted from patents. Source: compiled by the authors [25].

Thus, the applied methodological tools provided a comprehensive and reproducible assessment of the technological and institutional aspects of FLNG project development.

- Assessment of Technological and Economic Parameters

A financial model was developed for representative FLNG projects in each country to assess their economic viability. This process involved the detailed estimation of capital expenditure (CAPEX) and operating expenditure (OPEX) based on project design parameters and engineering specifications. CAPEX inputs included costs for the FLNG vessel or platform, processing modules, and supporting infrastructure, while OPEX comprised crew, maintenance, fuel, and docking costs. These cash flows were then used to compute standard project metrics presented on results.

Following established methodologies, net present value (NPV) was calculated by discounting annual net cash flows (revenues minus OPEX and taxes) to the present at a chosen discount rate. The internal rate of return (IRR) was derived as the discount rate that equates NPV to zero. A project was considered financially viable if NPV > 0 and if the IRR exceeded the investor’s required rate of return (MROR). For instance, Budiyanto et al. (2023) [26] performed a similar LNG ship analysis by calculating NPV, IRR, and payback period from CAPEX/OPEX projections.

Additionally, sensitivity analyses were conducted by varying key assumptions (such as LNG sales price, OPEX escalation, and construction lead time) to observe how NPV and IRR responded. Thus, CAPEX/OPEX modeling, alongside discounted-cash-flow criteria (NPV, IRR, payback period), provided a quantitative benchmark for assessing the financial feasibility of FLNG projects in Mozambique and Australia.

- Technological Criteria

Technological efficiency assessment was carried out in the following areas:

- Innovative potential determined by comparative analysis of gas liquefaction systems, including modular installations (for example, Coral South FLNG, Mozambique) and large-capacity platforms (for example, Prelude FLNG, Australia) [27];

- Logistics optimization, which was evaluated based on the characteristics of sea routes, the level of port infrastructure development, and the degree of integration of projects into global supply chains.

- Environmental factor expressed by calculating the carbon footprint (in terms of CO2 equivalent) and analyzing the share of renewable energy sources in the energy balance of facilities.

- Economic Indicators

The economic sustainability of the projects was assessed by the following parameters:

- Capital (CAPEX) and operating (OPEX) costs adjusted for regional risks;

- Financial profitability, determined by calculating net present value (NPV), minimum required rate of return (MROR) and internal rate of return (IRR), taking into account the volatility of global natural gas prices (using Henry Hub indices and spot quotes in Asian markets).

Thus, the proposed methodological approach makes it possible to objectively compare the technological maturity and economic efficiency of FLNG projects in various regional contexts, ensuring the validity of conclusions regarding their competitiveness and sustainability.

- Minimum Required Rate of Return (MROR)

The Minimum Required Rate of return (MROR), also referred to as the “barrier rate”, is a value that reflects the level of risk associated with the implementation of an investment project. In accordance with modern concepts of financial analysis, it is established that risk has a direct impact on the amount of required profitability: projects with a higher level of risk should provide investors with a higher expected return compared to investments with a low level of risk.

Based on the theoretical principles of financial management, the expected return on an investment project is defined as the sum of the risk-free interest rate and the corresponding risk premium, which compensates for the specific risks of the project.

To calculate the minimum required rate of return for Coral South FLNG projects, the methodology presented in Equation (1) was used. The calculations took into account the political, economic, environmental, social and technological risks characteristic of the investment climate in Mozambique, as well as the geological features of the developed gas fields.

Based on the analysis, key risk groups were quantified using MROR determination methods. The results obtained are presented in Section 4 and allow us to objectively characterize the risk profile of the projects under consideration.

Mathematically, an arbitrary pricing theory (APT) can be used to calculate the hurdle rate or otherwise known as minimum rate of return (MROR) or expected or required rate of return and is given as:

where

RFE—risk-free bid.

E(R)—expected rate of return.

bi—sensitivity of each risk factor.

(Rfactor—RFE)—risk premium.

The risk premium usually ranges from 3% to 9%, where the lower limit (about 3%) is typical for investments in government ministries and similar structures that are characterized by a relatively low level of risk compared to the private sector.

Based on this premise, the concept of quantitative assessment of the cost of risk through the discount rate when calculating the minimum required rate of return (MROR) is considered as a more accurate and realistic tool for the economic assessment of investment projects. Unlike standard methods, the use of MROR allows you to take into account the totality of acceptable risks that can affect the financial performance of the project and jeopardize the achievement of a positive net present value (NPV).

Thus, the application of the minimum required rate of return provides a more comprehensive assessment of the investment attractiveness of projects, taking into account the specifics of political, economic, technological and environmental risks.

- Net Present Value (NPV)

The Net Present Value (NPV) method is widely used in the economic analysis of investment projects due to its ability to objectively assess the project’s current value. Using this method, you can discount the expected future revenues of the project to their current value, and then subtract the initial capital costs from it, which makes it possible to determine whether the investment will be profitable (with a positive NPV) or unprofitable (with a negative NPV).

Based on the above methodology, the net present value of the project is calculated using Equation (2) below:

where

CFn—discounted cash flow for the given period (i.e., present value).

n—the accrual period (in years).

K—total accrual period (in years).

i—the interest rate for each accrual period (in this case, MROR is used).

PVbenefits—the discounted present value of future income for the period.

PVcosts—discounted present expenses for future capital expenditures.

NPV—profitability indicator (if positive, the project is accepted, if negative, it is rejected).

- Data Processing Methods

The empirical analysis was based on the use of regression modeling of corporate financial indicators and stress testing of multivariate scenarios, including fluctuations in market prices, changes in regulatory requirements and environmental risks.

To minimize systematic errors, data normalization methods were used, taking into account regional characteristics of capital expenditures (CAPEX) and operating expenses (OPEX). The normalization made it possible to ensure comparability of results in different economic and institutional contexts.

Verification of the results obtained was carried out by comparing them with industry standards, as well as with forecast models of the International Monetary Fund (IMF) and the International Energy Agency (IEA).

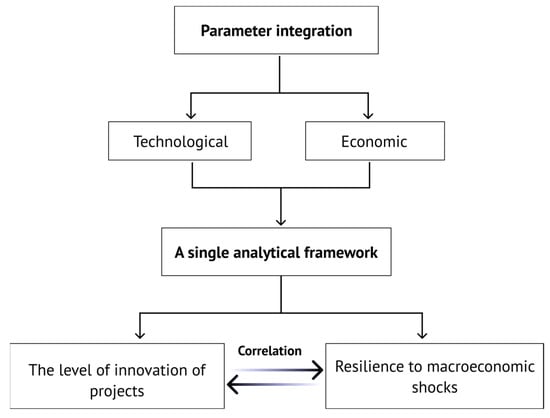

Integration of technological and economic parameters into a single analytical framework allowed us to identify a positive correlation between the level of innovation projects and their resilience to macroeconomic shocks (Figure 4). Thus, the applied data processing methods provided a comprehensive and objective analysis of the sustainability of FLNG projects in a changing external environment.

Figure 4.

Combined diagram of technological and economic parameters in one branch of analysis. Source: compiled by the authors.

- Expert analysis of regulatory conditions

A cross-country regulatory review was conducted to compare the legal frameworks and governance structures for LNG development. In Mozambique, the analysis focused on the 2014 Petroleum Law (Law 21/2014) and associated decrees (e.g., D. 34/2015), which define licensing terms and fiscal regimes. Key agencies in Mozambique were identified, including the Ministry of Mineral Resources and Energy, the National Petroleum Institute (INP), the hydrocarbon licensing authority, and the sovereign wealth fund for LNG revenues. The mandates and coordination of these institutions were documented, with the INP specifically responsible for managing technical data and concession registers.

In Australia, the Commonwealth Offshore Petroleum and Greenhouse Gas Storage Act 2006 (OPGGS Act) and relevant state and federal statutes governing LNG projects were examined. Australia’s institutional framework includes the offshore regulator NOPSEMA (responsible for safety and environmental regulations) and state petroleum authorities (which oversee onshore permits) [46,61]. A comparison was also made between policy instruments (e.g., content requirements, local content laws) and taxation/tariff structures in the two countries.

This regulatory analysis, based on statutes, policy documents, and expert interviews, highlighted key differences in how Mozambique and Australia approach resource ownership, concession terms, and environmental obligations.

- Environmental analysis

The environmental methodology involved benchmarking the greenhouse gas (GHG) emissions and local impacts of FLNG operations. Emission factors for CO2 and methane were compiled for each segment of the value chain. Specifically, the potential for carbon capture and storage (CCS) on FLNG units was assessed. Industry reviews (e.g., IEAGHG 2019) [61] indicate that post-combustion CO2 capture on FLNG is highly challenging due to space, weight, and power constraints, with only pre-treatment capture (removing CO2 from feed gas) potentially being feasible. Accordingly, the analysis assumed limited CCS on-board.

Methane emissions, including leaks and slip, were also considered, using values from the literature. For instance, recent measurements indicate that low-pressure LNG engines emit approximately 3–6% of fuel as unburned methane. These emissions were converted into CO2-equivalent impacts for comparison.

Marine environmental impacts, such as thermal discharges, water quality, and noise, were evaluated qualitatively by reviewing FLNG environmental impact statements and offshore installation standards. Where feasible, ambient parameters (e.g., permitted water temperature rise and acoustic levels) were benchmarked against regulatory guidelines.

In summary, the environmental analysis incorporated the best-available GHG emissions data (including methane slip and partial CCS scenarios) and marine impact benchmarks to assess the ecological footprint of proposed FLNG projects.

- Empirical basis and evaluation criteria

The empirical base of the study was formed on the basis of data obtained during 15 semi-structured interviews with representatives of non-governmental organizations, government agencies and the corporate sector, which provided triangulation of information sources and increased the reliability of conclusions.

The content analysis of documents published under the Extractive Industries Transparency Initiative (EITI), as well as texts of bilateral investment agreements, was supplemented by an assessment of three key criteria:

- Legislative stability, which determines the predictability of business conditions in the long term;

- Efficiency of licensing procedures, which characterizes the speed and transparency of obtaining permits for operations;

- Mechanisms for resolving social conflicts, illustrated through an analysis of land use cases in Mozambique.

Applying a comparative approach revealed a positive correlation between the flexibility of regulatory regimes and the ability of FLNG projects to minimize operational delays. As the results presented in the previous sections have shown, this factor has a direct impact on the economic viability of projects in an unstable external environment.

- Comparative approach: Justification of the choice of case stages

The case study methodology used in this study is based on the principle of contrasting case selection, which allowed us to identify the impact of institutional and operational contexts on the implementation of floating natural gas liquefaction (FLNG) projects.

Mozambique, as a representative of emerging markets, demonstrates the contradiction between the high resource potential of the Ruvuma basin and systemic risks, including political instability in the province of Cabo Delgado. In contrast, the Australian model, seen as a benchmark for a mature market ecosystem, is characterized by a well-developed infrastructure, diversified export corridors and stable regulatory practices, which contributes to a predictable environment for long-term investment.

To increase the reliability of the study, data triangulation was applied, including:

- analysis of regulatory legal acts;

- conducting semi-structured expert interviews;

- statistical modeling of economic indicators.

The use of an integrated approach allowed minimizing errors associated with the limited representativeness of individual cases, as well as establishing causal relationships between regional characteristics and the effectiveness of FLNG projects. The results obtained confirm the conclusions of the previous sections of the study regarding the crucial role of regulatory conditions and the degree of technological adaptability in ensuring the sustainability of projects in the energy markets.

- Methodological limitations

This study has a number of methodological limitations that must be taken into account when interpreting the results obtained.

One of the key limitations is the data availability asymmetry, which creates an imbalance in the comparative analysis. While the Australian case studies (Prelude FLNG, Ichthys) are based on an extensive database of open statistical resources and standardized reporting, data on projects in Mozambique (for example, Coral South FLNG) are limited due to the early stage of implementation and existing institutional barriers to access to information.

An additional uncertainty factor is the high volatility of the global liquefied natural gas (LNG) market, which is exacerbated by geopolitical crises and energy transition processes. This limits the possibility of long-term extrapolation of the conclusions reached and requires regular updating of estimates based on changes in price indices such as Henry Hub and JKM [49].

The potential subjectivity of expert assessments, despite the measures taken to ensure the reliability of data, also represents a methodological limitation. The risks of cognitive biases were minimized through a quota sample of respondents that included representatives of non-governmental organizations, government regulators and the corporate sector, which ensured pluralism of points of view. However, residual errors related to regional communication patterns (for example, the limited openness of some stakeholders in Mozambique) require caution in summarizing the results.

These limitations were partially offset by the use of the data triangulation method described in Section “Data processing methods”, which increased the reliability of the conclusions, but at the same time emphasizes the need for further research as the empirical base expands.

4. Results

4.1. Case Study: Synergy Between Platforms

Mozambique’s natural gas sector, which is focused on developing the resources of the Ruvuma basin, has the world’s largest undeveloped natural gas reserves (more than 100 trillion cubic feet). At the same time, systemic constraints have been identified, including infrastructure deficits, logistical barriers, and geopolitical instability in Cabo Delgado province [3].

As an adaptive strategy, the Coral South FLNG project, implemented by a consortium led by Eni and ExxonMobil, uses modular FLNG platforms, which made it possible to start production without the need for large-scale investments in onshore terminals [3]. The analysis showed that this approach reduced the time to market by 20–30%, reduced the impact of local risks and increased operational flexibility. At the same time, the high dependence on foreign technologies and capital raises questions about the long-term sustainability of the model.

The Coral South project, located in the Ruvuma basin, minimized the impact of security risks due to its offshore configuration, ensuring stable production at 3.4 million tons of LNG per year [43,62]. The project uses advanced underwater technologies designed for depths up to 2000 m, and a pipeline system through a 13-kilometer underwater canyon [28].

The platform’s modular design, combined with aeroderivative turbines and heat recovery systems, resulted in energy efficiency optimization and a 33% reduction in CO2 emissions compared to similar onshore facilities. Approximately 70% of capital expenditures ($7.7 billion) were allocated to international contractors [28].

By the end of 2024, the total production of Coral South exceeded 5 million tons of LNG [7], which confirmed its technical and economic viability. However, the flaring incidents recorded in January 2024 revealed a significant environmental footprint: the emissions reached the equivalent of 8.5 years of energy consumption of the average Italian family.

Initial estimates of the environmental impact (150 thousand tons of CO2-e per year) were revised: actual emissions in 2022 reached 1.098 million tons of co2-e, accounting for 11.2% of Mozambique’s total emissions for the year [11]. The projected combined emissions of Coral South and the planned Coral North are estimated at 1 billion tons of CO2-e over 25 years of operation, which is three times the annual emissions of Italy [11].

Environmental sustainability of projects requires the integration of emission reduction technologies and strict regulation, similar to Norway’s approach, which combines oil production with carbon capture and storage (CCS) and renewable energy development.

In comparison, Prelude Shell’s Prelude FLNG project in the Timor Sea is characterized by the use of advanced engineering solutions: a depth of up to 250 m, a hull length of 488 m, and a displacement of about 600,000 tons [30]. However, extreme climatic conditions required additional security measures.

Compliance with Australia’s strict environmental and safety requirements led to an increase in capital expenditures to $ 17–19 billion [30]. Frequent technical failures and forced downtime reduced Prelude’s operational efficiency to 11–14 MMBtu, which negatively affected its competitiveness in the global LNG segment.

- Mitigation Measures (CO2 Capture and Methane Control)

The strategy to reduce the climate impact of LNG projects in Mozambique includes the integration of carbon capture and storage (CCS) technologies. According to official statements, the Mozambique LNG project implemented by TotalEnergies will include CO2 capture systems with subsequent injection into geological formations [42,63]. Carbon capture and storage (CCS) capture at the gas processing stage can significantly reduce direct emissions.

An additional reduction in carbon intensity is achieved through the use of highly efficient refrigeration compressors, including aeroderivative turbines, as in the Coral South FLNG project [15,41]. With the successful implementation of major CCS initiatives, including ExxonMobil’s plans to modernize the Rovuma LNG project, Mozambique can become one of the LNG suppliers with a minimal carbon footprint on the global market.

Reducing methane emissions remains an important area of focus. Eni, for example, has reported a 95% reduction in methane emissions since 2014 and has stated a goal of achieving near-complete elimination of leaks by 2030 [64,65]. The main activities include the use of infrared cameras for monitoring, upgrading equipment to leak-resistant components, and the introduction of all-electric control systems, as implemented in Coral FLNG.

The project also provides for the capture of gas that would otherwise be subjected to flaring. Although large flare emissions were recorded during pre-commissioning operations in early 2024, the project operator took measures to minimize such incidents [15,31].

A promising area is the use of renewable energy sources for partial power supply of LNG installations. Given the high solar activity and hydropower potential of Mozambique, it is possible to introduce solar and hydro power to reduce the carbon intensity of the production cycle.

Emission compensation measures are also being explored, including the restoration of mangroves that have a high carbon sequestration capacity. As part of the environmental commitments of the Coral South project, programs have been initiated to restore mangrove ecosystems along the coast, which also contributes to strengthening storm protection and climate change adaptation.

Thus, the integration of technological and natural solutions is aimed at reducing the overall environmental footprint of LNG projects in Mozambique and improving their compliance with international climate requirements.

- Regional integration and cross-border partnerships

The development of Mozambique’s oil and gas sector is important not only for the national economy, but also for the regional energy security of the countries of South Africa. Working with neighboring countries and participating in integration initiatives of the South African Development Community (SADC) enhances the potential of the industry.

South Africa, Zimbabwe and Botswana are facing energy shortages, while Mozambique has significant natural gas reserves. Since the early 2000s, gas has been exported from the Pando/Temane fields to South Africa via an 865 km pipeline, which has become an example of successful regional integration. Plans to build new pipelines from the Ruvuma basin are being discussed, but high costs (~2500 km) make it more realistic to expand LNG supplies with subsequent regasification in South Africa [11,49].

Zimbabwe is also interested in importing gas for power plants and fertilizer plants. The South African Gas Roadmap initiative, supported by the African Development Bank, aims to integrate gas supply for Malawi, Zambia and other countries in the region [11].

An alternative strategy is to convert gas into electricity in Mozambique and then export it through the Southern African Power Pool. The new 450 MW Temane power plant is already connected to cross-border networks. New gas-fired power plants are being developed in the Maputo area to further increase the supply of electricity.

The security sector also demonstrates regional integration: SADC States (South Africa, Botswana, Angola) sent SAMIM forces to stabilize Cabo Delgado province, which provided protection for LNG investments [11,66]. SADC’s involvement in restoring peace is critical to the smooth development of projects.

Economic integration is strengthened through the harmonization of regulatory standards within the SADC, including the development of unified requirements for tariffs and pipeline safety [11]. This facilitates the implementation of cross-border energy projects and encourages the flow of investment.

There is potential for joint development with Tanzania, which has its own gas fields in the Ruvuma region. Opportunities include exchange of experience in security and infrastructure development.

The successful implementation of gas projects in Mozambique can significantly change the energy balance of the region, reducing the dependence of South African countries on coal, supporting decarbonization goals and promoting industrial growth.

In parallel, the development of transport infrastructure related to LNG logistics can improve the accessibility of Mozambique ports to Zimbabwe, Zambia, and Malawi.

At the same time, challenges remain: the construction of cross-border pipelines requires significant investment and intergovernmental coordination; there is competition in the global LNG market, as well as the need to balance national interests and regional cooperation [3,11].

Nevertheless, the gradual implementation of energy projects, SADC support and Mozambique’s participation in regional structures create prerequisites for the country’s transformation into a key gas hub in South Africa. Regional integration makes it possible not only to expand sales markets, but also to increase the sustainability of the energy sector through diversification and deepening of partnerships [11,66].

- Technical and economic comparative analysis

- Capital Expenditure Analysis (CAPEX)

The capital expenditure analysis (CAPEX) for floating natural gas liquefaction (FLNG) projects shows a significant dependence on the project scale, technological complexity, and environmental conditions.

Пpoeкт The Coral South FLNG project in Mozambique is characterized by a relatively low level of capital expenditures—about 7 billion US dollars. The reduction in costs is due to the limited scale of production (3.4 million tons of LNG per year) and the specialization of infrastructure per product, which excluded the cost of processing condensate and liquefied petroleum gases (LPG) [9,59]. However, placing the facility in ultra-deep-water conditions (more than 2000 m) required the use of advanced mooring systems, including polyester ropes and suction anchors, which increased the initial investment [15]. Thus, a compromise was found between specialization, simplification of operations, and the need for technological adaptation to extreme conditions.

In contrast, the Prelude FLNG project in Australia, with capital expenditures ranging from US $ 12 billion to US $ 17 billion, is one of the most capital-intensive FLNG projects in the world. The high cost is due to the scale (production capacity of 3.6 million tons of LNG per year), multi-product orientation (simultaneous processing of LNG, LPG and condensate), as well as the complexity of engineering deployment in the shallow waters of the Brose Basin [67]. The integration of the turret mooring system and steel rope lifts (SCR), which is necessary to stabilize the platform in dynamic conditions, has led to an additional increase in the cost of materials and construction work.

Thus, the comparative analysis highlights that the choice between multi-product flexibility and specialized infrastructure simplification critically affects the capital cost structure and operational efficiency of FLNG projects.

- 2.

- Operating Expenses (OPEX) and reliability

A comparative analysis of operational efficiency reveals significant differences between projects.

Prelude FLNG has experienced numerous operational disruptions, including power outages and labor disputes, resulting in unplanned shutdowns and a 15–20% drop in annual revenue. High maintenance costs are attributed to the use of outdated underwater infrastructure exposed to the corrosive effects of shallow waters, which requires regular inspections and repairs [68,69].

In contrast, Coral South FLNG has integrated state-of-the-art technology solutions aimed at improving reliability. The use of fully electric umbilical systems and fiber-optic monitoring makes it possible to perform diagnostics in real time, preventing the development of mechanical defects [70]. The use of an optimized mooring system adapted to the stable deep-water conditions of the Ruvuma basin further reduces the likelihood of unplanned downtime. Calculations show that Coral South FLNG’s annual operating expenses are 30% lower compared to Prelude, which highlights the advantages of using innovative technological solutions in deep-sea operations [70,71].

- 3.

- Revenue streams and market integration

Analysis of market strategies shows differences in revenue generation models between projects. Coral South FLNG is focused on a single-product model, exporting LNG under long-term contracts for 20 years, in particular with European companies such as BP [62,70]. This strategy simplifies operational processes and reduces technological risks, but limits the diversification of revenue sources [71]. Coral South’s launch coincided with Europe’s growing need to diversify its energy supply following the Ukraine crisis, which significantly strengthened its market position. At the same time, the link to the European market increases the project’s vulnerability to fluctuations in regional demand for natural gas [49,72].

As can be seen from the data presented in Table 2, the economic performance of the Coral South FLNG project confirms its investment feasibility. The net present value (NPV) is US $ 2,171,213 million, which exceeds the zero mark, which is the main criterion for project approval. The Minimum Required Rate of Return (MROR), which reflects the total risk (political, economic, environmental and technological) of the northern Mozambique region, was lower than the internal rate of return (IRR), which further indicates the attractiveness of the project.

Table 2.

Economic indicators of the analyzed case study (Coral South).

The Prelude FLNG project implements a different revenue generation strategy, focusing on premium long-term LNG supply contracts with Asian buyers (Japan and South Korea), indexed to oil benchmarks. A significant role in the revenue structure (20–25%) is also played by the sale of related products—condensate and liquefied petroleum gases (LPG), which partially compensates for the risks associated with the volatility of LNG prices. Thus, differences in financial models reflect the specifics of market strategies and technological solutions of each project.

- Regional socio-economic and environmental impact

The Coral South FLNG project serves as a catalyst for the formation of Mozambique’s gas economy. Content localization programs ensure the participation of about 10% of the Mozambican workforce, accompanied by professional development initiatives. Infrastructure improvements, including modernization of ports and transport corridors, contribute to creating a multiplicative economic effect [70,73].

However, the project’s high dependence on foreign investment (ExxonMobil, Eni) increases its vulnerability to the risks of resource nationalism, which is reflected in the 2021 tax disputes. In contrast, the Prelude FLNG project faced criticism for the limited involvement of the local population: more than 80% of technical positions were occupied by foreign specialists, mainly due to the high level of automation [67]. Despite contributing to the strengthening of Australia’s position as one of the world’s leading LNG exporters, the project raises environmental concerns, including methane leaks (estimated at 0.28% of production) and high carbon intensity of liquefaction processes, which contradicts Australia’s national goals to reduce greenhouse gas emissions [41,68]. Thus, differences in the socio-economic and environmental impact of projects emphasize the importance of adapting localization strategies and environmental management to the conditions of a particular region.

- Risks and long-term viability

For the successful economic and technological development of the oil and gas complex in the Republic of Mozambique, a comprehensive approach is required to reduce the risks associated with the possible strategic technological backwardness of the country’s oil and gas complex [74,75]. Developing a strategy aimed at the future economic and technological development of the oil and gas complex helps to mitigate these risks. In general, the recommended methods for risk mitigation can be grouped into the following four main categories:

- risk compensation—this group includes the use of strategic planning and forecasting methods. The most important direction in reducing the risks of the development of the oil and gas complex is very important to substantiate the directions of strategic development, which is presented on the basis of the concept of technological structures that objectively change based on the patterns of technical and economic development;

- risk avoidance—ongoing projects should not be characterized by excessively high risks;

- risk dissipation—it is necessary to implement not one project, but various projects. The article proposes to implement not only a modernization project (5th technological stage), but also projects related to nanotechnology (6th technological stage). The latter direction is not obvious, and it needs to be justified, including at the conceptual level, which is presented in the article (the concept of a new technological paradigm);

- risk localization—creating venture capital and other structures to reduce the impact of risks on the entire enterprise.

The sustainability of the Coral South FLNG project is determined by the impact of geopolitical and regulatory factors (Table 3 and Table 4). Despite its high technological readiness, the project is subject to political instability in Mozambique, including threats from armed groups in Cabo Delgado province and possible renegotiations of contract terms [4,43].

Table 3.

Calculation of MROR risk factors for Coral South (before using carbon capture and storage (CCS) technologies).

Table 4.

Calculation of MROR risk factors for Coral South (after applying carbon capture and storage (CCS) technologies).

However, Coral South FLNG’s focus on achieving carbon reduction goals and integrating low-carbon production technologies provide a strategic advantage [42]. Compliance with environmental standards increases the likelihood of attracting “green” financing, since international lenders and financial institutions show a preference for projects with a minimal carbon footprint [42]. Thus, technological modernization and environmental adaptability increase the long-term investment attractiveness of the project, despite the presence of political risks.

A comparative analysis of the Coral South FLNG and Prelude FLNG projects allowed us to identify the strengths of both platforms, which creates the basis for forming a new approach to technological innovations in the LNG sector for the Republic of Mozambique.

Based on the results of cluster analysis of twenty advanced patents in the field of natural gas liquefaction technologies, the concept of a technological solution adapted to the conditions of the target region, taking into account environmental and economic criteria for sustainable development, was developed.

In the context of the preparation of the Coral North FLNG project (the next stage of development in the Ruvuma basin) [33], these improvements are expected to be integrated, which will allow for a subsequent assessment of their economic viability, taking into account the specific operational and institutional conditions of Mozambique.

Table 5 provides a structured comparative analysis summarizing the key technological, economic, and environmental differences between the Coral South and Prelude FLNG projects.

Table 5.

Technological innovations.

- Economic results of case feasibility analysis

Based on the analysis carried out, it is established that the integration of carbon capture and storage (CCS) technologies using nanomaterials is a necessary direction for the modernization of FLNG projects.

Table 6 illustrates the projected economic impact following a US $ 1.15 billion investment in carbon nanotube CO2 capture technologies. The implementation of this technology reduces environmental risks, which, in turn, helps to reduce the minimum required rate of return (MROR) and optimize the financial performance of the project, increasing its overall investment attractiveness.

Table 6.

Economic indicators of the analyzed case (Coral South 1 and Coral South 2).

Originally developed for the Coral South FLNG project, this technology approach can be adapted and expanded as part of the Coral North FLNG project to further reduce carbon emissions and meet more stringent environmental standards.

Based on the obtained data, it is established that the introduction of carbon capture and storage (CCS) capture technology using nanomaterials improves the economic viability of the project by significantly reducing environmental risks and increasing profits, which, in turn, increases its investment attractiveness.

(In-depth techno-economic scenario analyses are underway in our ongoing research)

4.2. Justification of Strategic Development Based on Nanotechnologies

To substantiate the directions of strategic development of the oil and gas sector in Mozambique, a concept of technical and economic development based on technological paradigms is proposed (according to S. Y. Glazyev, Schumpeter and N. D. Kondratyev) [76]. The technological paradigm is defined as a relatively stable, integrated system that covers the extraction of natural resources (including oil and gas), the stages of primary processing of resources, and the production of final goods that meet the needs of society at a certain stage of development.

At every stage of the field’s life cycle, there are challenges, the successful solution of which depends on the progress and adaptability of the applied technologies. When developing and evaluating investment projects in the oil and gas sector, it is necessary to give priority to the novelty and competitiveness of technologies. Novelty should be evaluated by categorizing technologies according to their respective technological paradigm and equipment generation.

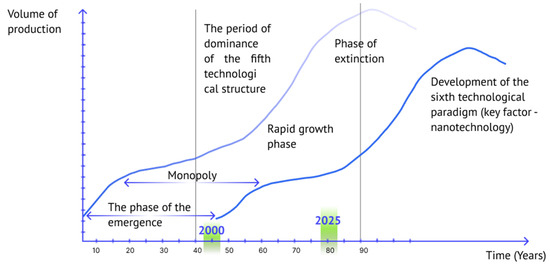

Currently, project evaluations and strategic planning for the oil and gas sector should take into account that the global economy continues to dominate the fifth technological paradigm based on microelectronic components. However, the sixth technological paradigm, based on nanotechnology, is actively developing. In addition to core innovations, this paradigm includes related advances such as information technology, cognitive science, and biotechnology. The conceptual framework for modern technical and economic development (illustrated in the attached figure) should be the basis for strategic planning of Mozambique’s oil and gas industry.

Each technological paradigm passes through a life cycle consisting of three main phases (as shown in Figure 5), the total duration of which is about 100 years. Paradigm dominance usually lasts for 40–60 years. The first phase involves the emergence and formation of a paradigm during the period of dominance of its predecessor. The second phase covers structural transformations of the technical and economic basis, corresponding to the dominance of the new paradigm and the peak of its development.

Figure 5.

Conceptual framework of strategic technical and economic development, corresponding to the period of dominance and the most active phase of development of the new technological paradigm. Source: compiled by the authors.

It should be noted that the output growth curve shows two sharp rises. Between these segments is a plateau phase, in which some companies may take a monopoly position in technological progress. Over time, competition from other enterprises increases, which contributes to the accelerated diffusion of new technologies based on the main factors of the prevailing technological paradigm. Subsequently, the economy and socio-ecological development experience a renewal of technological chains of production and service provision.

Analysis of technical and economic trends shows that the fifth technological order is approaching the limits of its growth, as evidenced by fluctuations in energy prices and repeated financial crises. Studies confirm that structural economic restructuring based on technologies of the sixth paradigm has already begun [77]. These trends should take into account the strategic planning of Mozambique’s oil and gas sector, whose priority is to support the development of nanotechnology.

5. Discussion

A comparative feasibility study of the Coral South FLNG project in Mozambique and Shell’s Prelude FLNG project has identified a key interaction between technological innovation, economic viability, and environmental sustainability in both emerging and mature energy markets.

The results of the analysis showed that the modular deep-sea architecture of the Coral South project provides a reduction in capital (CAPEX) and operational (OPEX) costs by 40% and 30%, respectively, compared to the multifunctional Prelude platform. These savings are due to the optimization of the infrastructure for the production of exclusively LNG, the use of fully electric underwater control systems and the use of widespread mooring in ultra-deep-water fields.

However, having lower costs does not eliminate the long-term risks associated with geopolitical instability, security threats, and limited technology transfer. Despite the implementation of content localization policies (~10% of the workforce), the development of internal infrastructure and supply chains remains insufficient. The effectiveness of the proposed Sovereign Wealth Fund will depend on transparent governance and institutional consistency.

From a technological point of view, the integration of AP-DMR™ liquefaction processes and nanotechnology for CO2 capture opens up prospects for improving efficiency. Simulations have shown that using nanotube-reinforced membranes can reduce MROR by more than 2 percentage points, increase IRR from 28% to 37%, and increase NPV by $ 1.1 billion over a 25-year operational cycle.

In contrast, the Prelude FLNG project faced high maintenance costs due to the complexity of the design and the impact of extreme weather conditions. Regular power outages, technological improvements for hurricane resilience, and methanol injection increased OPEX, while methane leaks (~0.28% of production capacity) weakened the project’s compliance with ESG standards.

The analysis showed that strict regulatory requirements alone are not sufficient to ensure sustainability: technological choice and optimization of design decisions remain the determining factors.

The socio-economic impact of Coral South goes beyond financial indicators: infrastructure development (ports, roads) has created the prerequisites for the implementation of energy initiatives, including the gasification of power plants in Temane and the electrification of more than 150,000 households. However, long-term sustainability requires channeling income into diversified sectors, which will avoid the “resource curse” effect and ensure balanced economic development.

- Long-term and phased development strategy

The development of Mozambique’s oil and gas sector is at a critical stage. Sustainable and inclusive capacity-building requires systematic planning and phased implementation of strategic initiatives.

- Short-term perspective (1–3 years): Consolidation and elimination of risks.

In the short term, Mozambique needs to focus on the following priorities:

- Secure facilities and engage local communities through employment programs, social infrastructure, and educational initiatives, which will strengthen the social license to operate.

- Piloting environmental technologies, including the installation of experimental CCS systems on the Coral South FLNG platform and testing nanomaterial-based membranes.

- Optimization of regulatory procedures through the creation of “single windows” for licensing and customs clearance, as well as the development of a regulatory framework for new technologies.

- Completion of financing and Investment Decision Making (FID) for the Mozambique LNG and Rovuma LNG projects to resume construction activities.

- Medium-term perspective (4–7 years): Expansion and technological integration

In the period up to 2032, the strategic objectives are:

- Launch of Coral North FLNG and Mozambique LNG onshore installations, while minimizing delays and budget overruns.