Assessing Lead Waste and Secondary Resources in Major Consumer Nations: A Vanishing Resource or a Toxic Legacy?

Abstract

1. Introduction

2. Materials and Methods

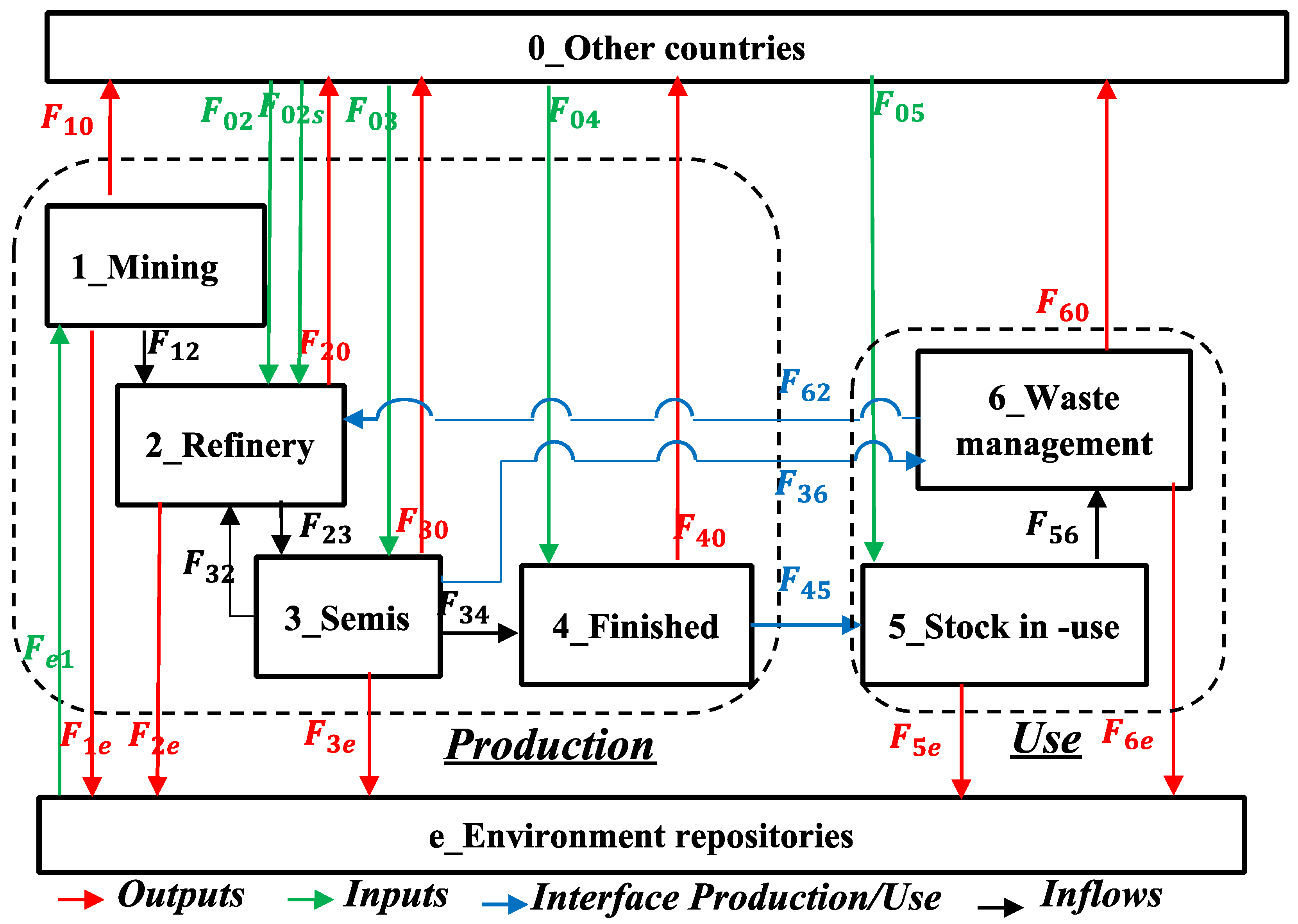

2.1. Lead Life Cycle and Material Flow Analysis (MFA) Indicators

- 1.

- Share of domestically sourced input: Measures the ability of the production system to rely on domestic sources.

- 2.

- Share of production output with economic value: Measures the efficiency of the production system.

- 3.

- Dependence on imports for in-use stock input: Measures how much of the in-use stock depends on imported lead.

- 4.

- Ratio of recycled end-of-life scrap to in-use stock input: Indicates the fraction of final demand that can be met by secondary materials.

- 5.

- Recycling rate (RR): The fraction of end-of-life scrap recovered instead of being landfilled.

2.2. In-Use Stock and Generated Scrap

- is the stock at the beginning of year i + N issued from the final demand of year i for end use category j.

- is the dissipated amount during year i + N

- is the generated waste during year i + N.

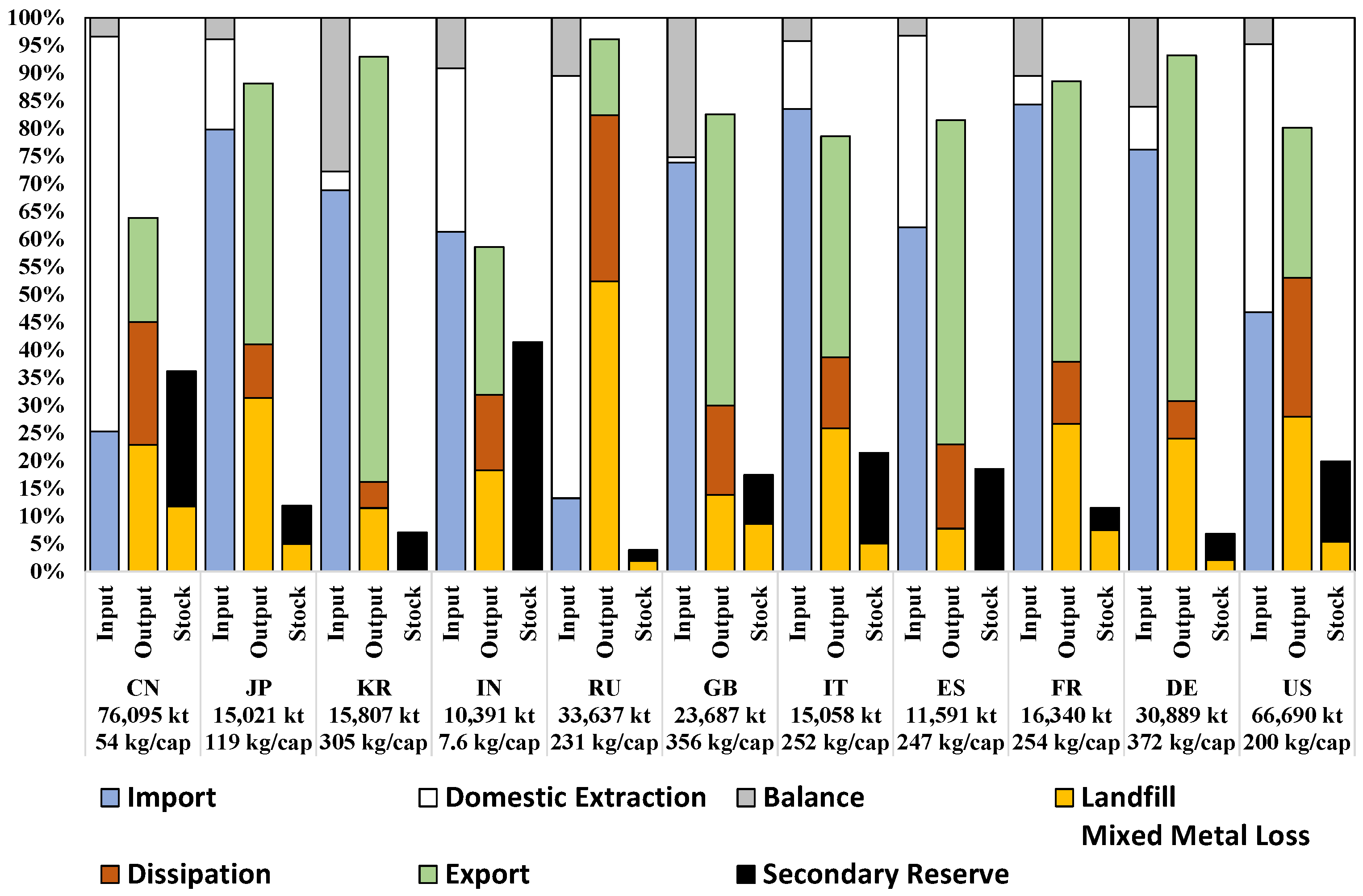

2.3. The Secondary Reserve Classification Framework

- Economic Reserve (Eco): The portion of the stock recoverable under current economic conditions.

- Marginal Economic Reserve (MEco): The portion that may be recoverable under favorable economic conditions.

- Sub-economic Resource includes the following:

- ○

- Landfill (L): Lead waste in landfills.

- ○

- Mixed Metal Loss (ML): Lead that has been incorporated into other metal cycles and is not available for direct recovery.

- ○

- Dissipation (D): Lead lost through emissions, corrosion, or wear.

2.3.1. Cumulated Input

2.3.2. Cumulated Output

2.3.3. Stock

2.4. Data Sources and Collection

2.4.1. Country Selection

2.4.2. Period Selection

2.4.3. Data Collection

3. Results

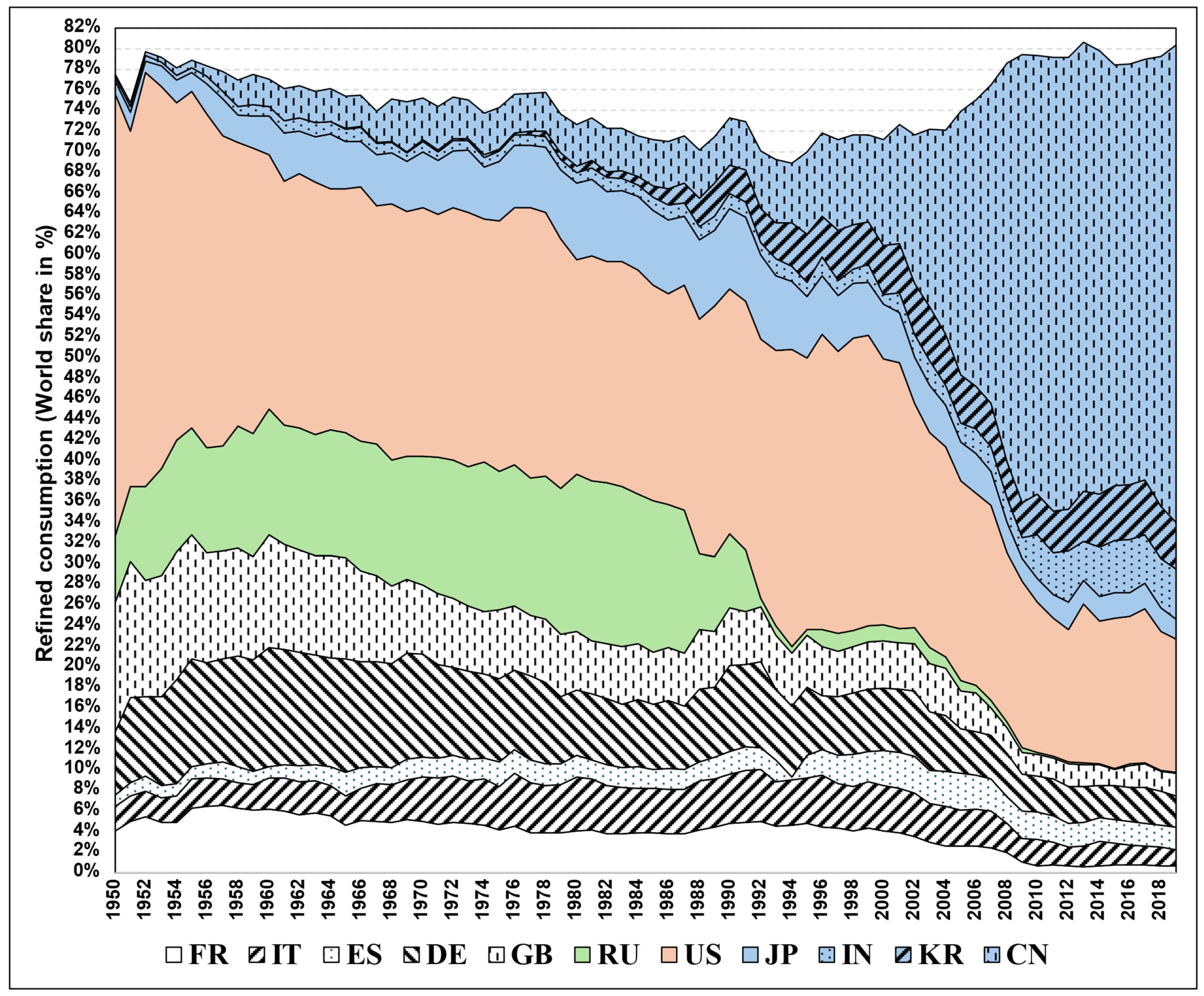

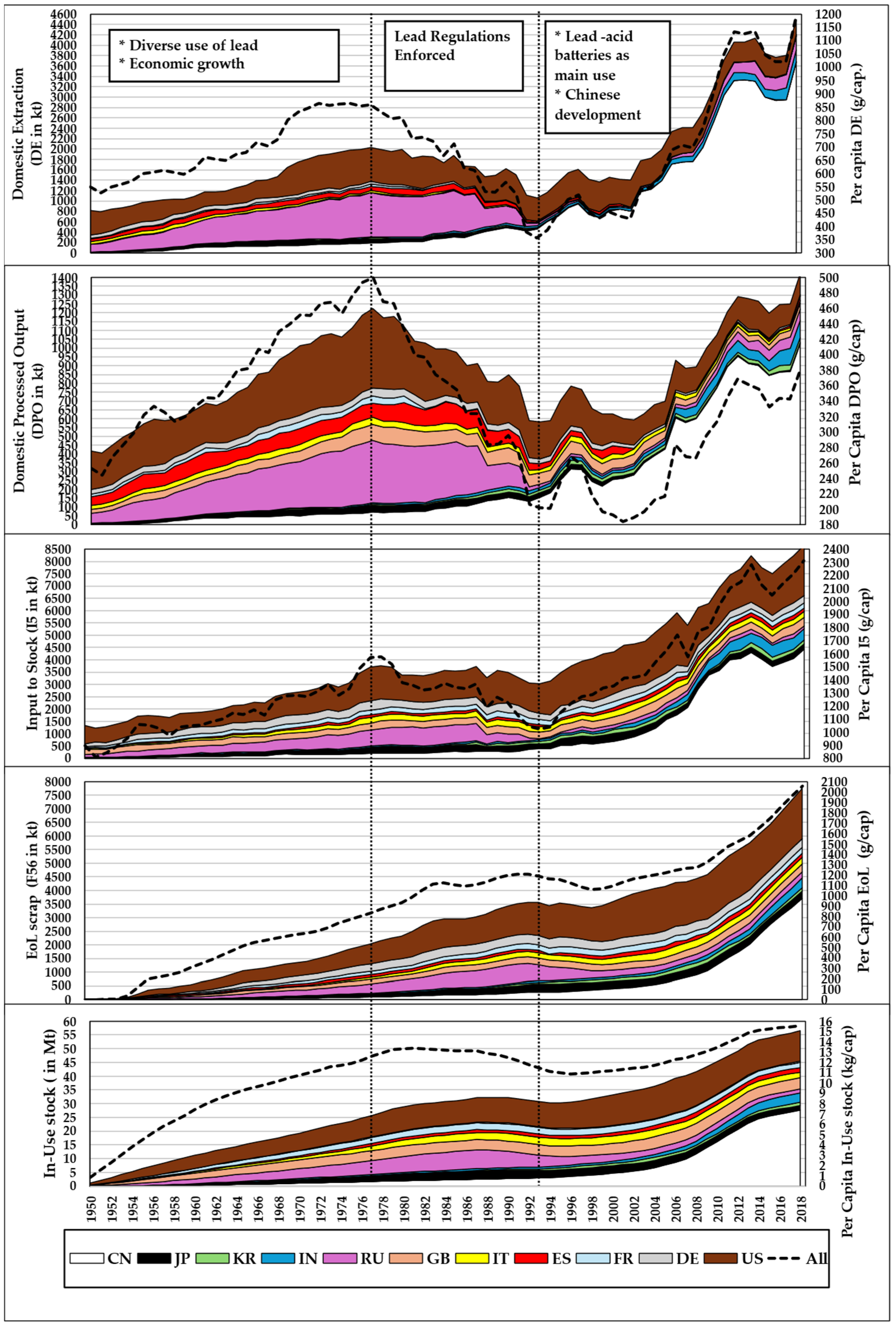

3.1. Evolution of Lead Inputs, Outputs, and Stocks

3.1.1. Economic Expansion and Diverse Lead Applications (1950–1976)

3.1.2. Regulatory Transition and Shifting Industrial Demand (1977–1994)

3.1.3. Transportation and Chinese Domination (1995–2018)

3.2. Material Flow Indicators

3.3. Secondary Reserve

4. Discussion

4.1. A Vanishing Resource or a Toxic Legacy

4.2. Limitations and Validation

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. Material Flow Analysis

| Code | Item_Name | Lc_Stage | Value | Unit | Flow | Ref |

|---|---|---|---|---|---|---|

| HS 262020 | Ash or residues containing mainly lead | Recycle | 0.005 | kg Pb/kg | F02s,F60 | [40] |

| HS 262021 | Slag, ash and residues; (not from the manufacture of iron or steel), containing mainly lead; leaded | Recycle | 0.005 | kg Pb/kg | F02s,F60 | [40] |

| HS 262029 | Slag, ash and residues; (not from the manufacture of iron or steel), containing mainly lead; excludi | Recycle | 0.005 | kg Pb/kg | F02s,F60 | [40] |

| HS 780200 | Lead; waste and scrap | Recycle | 0.9 | kg Pb/kg | F02s,F60 | [18] |

| SITC 28406 | Lead waste and scrap | Recycle | 0.9 | kg Pb/kg | F02s,F60 | [18] |

| HS 260700 | Lead ores and concentrates | Refinery | 0.64 | kg Pb/kg | F10,F02 | [10] |

| HS 780199 | Lead; unwrought, unrefined, not containing by weight antimony as the principal other element | Refinery | 0.98 | kg Pb/kg | F10,F02 | [18] |

| HS 780191 | Lead; unwrought, unrefined, containing by weight antimony as the principal other element | Refinery | 0.98 | kg Pb/kg | F10,F02 | [18] |

| SITC 2834 | Ores and concentrates of lead | Refinery | 0.64 | kg Pb/kg | F10,F02 | [10] |

| SITC 68511 | Unrefined lead | Refinery | 0.98 | kg Pb/kg | F10,F02 | [18] |

| SITC 68513 | Lead alloys, unwrought | Refinery | 0.98 | kg Pb/kg | F10,F02 | [18] |

| HS 780110 | Lead; unwrought, refined | Refinery | 1 | kg Pb/kg | F20,F03 | Assumed |

| SITC 68512 | Refine lead (excluding lead alloys), unwrought | Refinery | 1 | kg Pb/kg | F20,F03 | Assumed |

| HS 282410 | Lead monoxide (litharge, massicot) | Semi-Products | 0.93 | kg Pb/kg | F30,F04 | PbO |

| HS 282420 | Red lead & orange lead | Semi-Products | 0.91 | kg Pb/kg | F30,F04 | Pb3O4 |

| HS 282490 | Lead oxides; n.e.c. in heading no. 2824 | Semi-Products | 0.87 | kg Pb/kg | F30,F04 | PbO2 |

| HS 283670 | Lead carbonates | Semi-Products | 0.78 | kg Pb/kg | F30,F04 | PbCO3 |

| HS 284120 | Chromates of zinc/of lead | Semi-Products | 0.64 | kg Pb/kg | F30,F04 | PbCrO4 |

| HS 293110 | Organo-inorganic compounds; tetramethyl lead and tetraethyl lead | Semi-Products | 0.71 | kg Pb/kg | F30,F04 | C8H20Pb C4H12Pb |

| HS 381111 | Anti-knock preparations; based on lead compounds | Semi-Products | 0.00033 | kg Pb/kg | F30,F04 | [18] |

| HS 390421 | Vinyl chloride, other halogenated olefin polymers; non-plasticised poly(vinyl chloride), in primary | Semi-Products | 0.014 | kg Pb/kg | F30,F04 | [41] |

| HS 391620 | Vinyl chloride polymers; monofilament, of which any cross-sectional dimension exceeds 1 mm, rods, sti | Semi-Products | 0.014 | kg Pb/kg | F30,F04 | [41] |

| HS 392041 | Sheet/film not cellular/reinf rigid vinyl polymer | Semi-Products | 0.014 | kg Pb/kg | F30,F04 | [41] |

| HS 721020 | Iron or non-alloy steel; flat-rolled, width 600mm or more, plated or coated with lead, including ter | Semi-Products | 0.71 | kg Pb/kg | F30,F04 | [42] |

| HS 780300 | Lead bars, rods, profiles & wire | Semi-Products | 0.95 | kg Pb/kg | F30,F04 | [18] |

| HS 780411 | Lead; sheets, strip and foil, of a thickness (excluding any backing) not exceeding 0.2 mm | Semi-Products | 0.95 | kg Pb/kg | F30,F04 | [18] |

| HS 780419 | Lead; plates, sheets, strip and foil, of a thickness (excluding any backing) exceeding 0.2 mm | Semi-Products | 0.95 | kg Pb/kg | F30,F04 | [18] |

| HS 780420 | Lead; powders and flakes | Semi-Products | 0.95 | kg Pb/kg | F30,F04 | [18] |

| HS 780500 | Lead tubes, pipes & tube/pipe fittings (e.g., couplings, elbows, sleeves) | Semi-Products | 0.95 | kg Pb/kg | F30,F04 | [18] |

| HS 780600 | Lead; articles n.e.c. in chapter 78 | Semi-Products | 0.95 | kg Pb/kg | F30,F04 | [18] |

| HS 850710 | Electric accumulators; lead-acid, of a kind used for starting piston engines, including separators, | Semi-Products | 0.58 | kg Pb/kg | F30,F04 | [41] |

| HS 850720 | Electric accumulators; lead-acid, (other than for starting piston engines), including separators, wh | Semi-Products | 0.58 | kg Pb/kg | F30,F04 | [41] |

| HS 854011 | Tubes; cathode-ray television picture tubes, including video monitor cathode-ray tubes, colour | Semi-Products | 0.21 | kg Pb/kg | F30,F04 | [18] |

| HS 854012 | Tubes; cathode-ray television picture tubes, including video monitor cathode-ray tubes, monochrome | Semi-Products | 0.21 | kg Pb/kg | F30,F04 | [18] |

| HS 854030 | Cathode-ray tubes, except for television | Semi-Products | 0.21 | kg Pb/kg | F30,F04 | [18] |

| HS 854060 | Tubes; cathode ray, n.e.c. in heading no. 8540 | Semi-Products | 0.21 | kg Pb/kg | F30,F04 | [18] |

| HS 854091 | Parts of cathode-ray tubes | Semi-Products | 0.21 | kg Pb/kg | F30,F04 | [18] |

| SITC 51356 | Lead oxides | Semi-Products | 0.8 | kg Pb/kg | F30,F04 | [18] |

| SITC 68521 | Bars, rods, angles, shapes, sections/wire of lead | Semi-Products | 0.95 | kg Pb/kg | F30,F04 | [18] |

| SITC 68523 | Lead foil, powders and flakes | Semi-Products | 0.95 | kg Pb/kg | F30,F04 | [18] |

| SITC 68522 | Plates,sheets and strip of lead | Semi-Products | 0.95 | kg Pb/kg | F30,F04 | [18] |

| SITC 68524 | Tubes, pipes, blanks/fittings, hollow bars of lead | Semi-Products | 0.95 | kg Pb/kg | F30,F04 | [18] |

| SITC 69896 | Articles of lead, n.e.s. | Semi-Products | 0.95 | kg Pb/kg | F30,F04 | [18] |

| HS 391723 | Plastics; tubes, pipes and hoses thereof, rigid, of polymers of vinyl chloride | Consumer Products | 0.014 | kg Pb/kg | F40,F05 | [41] |

| HS 701321 | Drinking glasses (excl. of glass-ceramics), of lead crystal | Consumer Products | 0.2785 | kg Pb/kg | F40,F05 | [41] |

| HS 701322 | Stemware drinking glasses, of lead crystal | Consumer Products | 0.2785 | kg Pb/kg | F40,F05 | [41] |

| HS 701331 | Glassware of a kind used for table/kitchen purps. (excl. drinking glasses), ... | Consumer Products | 0.2785 | kg Pb/kg | F40,F05 | [41] |

| HS 701333 | Glassware; drinking glasses (not stemware), of lead crystal | Consumer Products | 0.2785 | kg Pb/kg | F40,F05 | [41] |

| HS 701341 | Glassware of a kind used for table or kitchen purposes (not drinking glasses), of lead crystal | Consumer Products | 0.2785 | kg Pb/kg | F40,F05 | [41] |

| HS 701391 | Glassware; n.e.c. in heading no. 7013, of lead crystal | Consumer Products | 0.2785 | kg Pb/kg | F40,F05 | [41] |

| HS 852810 | Colour television receivers/monitors/projectors | Consumer Products | 0.2291 | kg Pb/kg | F40,F05 | [43] |

| HS 852820 | Monochrome television receivers/monitors/projectors | Consumer Products | 0.2291 | kg Pb/kg | F40,F05 | [43] |

| HS 852812 | Color television receive | Consumer Products | 0.2291 | kg Pb/kg | F40,F05 | [43] |

| HS 852813 | B & W television receive | Consumer Products | 0.2291 | kg Pb/kg | F40,F05 | [43] |

| HS 852821 | Video monitors, colour | Consumer Products | 0.2291 | kg Pb/kg | F40,F05 | [43] |

| HS 852822 | Video monitors, black & white/oth. monochrome | Consumer Products | 0.2291 | kg Pb/kg | F40,F05 | [43] |

| HS 852830 | Video projectors | Consumer Products | 0.2291 | kg Pb/kg | F40,F05 | [43] |

| HS 852841 | Cathode-ray tube monitors; of a kind solely or principally used in an automatic data processing syst | Consumer Products | 0.2291 | kg Pb/kg | F40,F05 | [43] |

| HS 852842 | Monitors; cathode-ray tube, capable of directly connecting to and designed for use with an automatic | Consumer Products | 0.2291 | kg Pb/kg | F40,F05 | [43] |

| HS 852849 | Monitors; cathode-ray tube, n.e.c. in subheading 8528.42, whether or not colour | Consumer Products | 0.2291 | kg Pb/kg | F40,F05 | [43] |

| HS 852851 | Monitors other than cathode-ray tube; of a kind solely or principally used in an automatic data proc | Consumer Products | 0.00067 | kg Pb/kg | F40,F05 | [43] |

| HS 852852 | Monitors; other than cathode-ray tube; capable of directly connecting to and designed for use with a | Consumer Products | 0.00067 | kg Pb/kg | F40,F05 | [43] |

| HS 852859 | Monitors other than cathode-ray tube; n.e.c. in subheading 8528.52, whether or not colour | Consumer Products | 0.00067 | kg Pb/kg | F40,F05 | [43] |

| HS 852872 | Reception apparatus for television, whether or not incorporating radio-broadcast receivers or sound | Consumer Products | 0.00067 | kg Pb/kg | F40,F05 | [43] |

| HS 852873 | Reception apparatus for television, whether or not incorporating radio-broadcast receivers or sound | Consumer Products | 0.00067 | kg Pb/kg | F40,F05 | [43] |

| HS 903020 | Cathode-ray oscilloscopes, oscillographs | Consumer Products | 0.2291 | kg Pb/kg | F40,F05 | [43] |

| HS 8701 | Tractors (other than works, warehouse equipment) | Consumer Products | 16.667 | kg Pb/unit | F40,F05 | [44] |

| HS 8702 | Public-transport type passenger motor vehicles | Consumer Products | 19.444 | kg Pb/unit | F40,F05 | [44] |

| HS 8703 | Motor vehicles for transport of persons (except buses | Consumer Products | 10.833 | kg Pb/unit | F40,F05 | [44] |

| HS 8704 | Motor vehicles for the transport of goods | Consumer Products | 19.444 | kg Pb/unit | F40,F05 | [44] |

| HS 8705 | Special purpose motor vehicles | Consumer Products | 17.111 | kg Pb/unit | F40,F05 | [44] |

| HS 842710 | Fork-lift and other works trucks; fitted with lifting or handling equipment, self-propelled by elect | Consumer Products | 4.556 | kg Pb/unit | F40,F05 | [44] |

| HS 842720 | Fork-lift and other works trucks; fitted with lifting or handling equipment, self-propelled by other | Consumer Products | 4.556 | kg Pb/unit | F40,F05 | [44] |

| HS 8709 | Work truck, self-propelled, except lift trucks etc. | Consumer Products | 4.556 | kg Pb/unit | F40,F05 | [44] |

| HS 8710 | Tanks and other armoured fighting vehicles | Consumer Products | 22.222 | kg Pb/unit | F40,F05 | [44] |

| HS 8711 | Motorcycles, bicycles etc. with auxiliary motor | Consumer Products | 3.178 | kg Pb/unit | F40,F05 | [44] |

| SITC 7241 | Television broadcast receivers | Consumer Products | 0.229 | kg Pb/kg | F40,F05 | [43] |

| SITC 7125 | Tractors, other than road tractors | Consumer Products | 16.667 | kg Pb/unit | F40,F05 | [44] |

| SITC 7325 | Road tractors for tractor trailer combinations | Consumer Products | 16.667 | kg Pb/unit | F40,F05 | [44] |

| SITC 7322 | Buses, including trolleybuses | Consumer Products | 19.444 | kg Pb/unit | F40,F05 | [44] |

| SITC 7321 | Passenger motor cars, other than buses | Consumer Products | 10.833 | kg Pb/unit | F40,F05 | [44] |

| SITC 7323 | Lorries and trucks, including ambulances, etc. | Consumer Products | 19.444 | kg Pb/unit | F40,F05 | [44] |

| SITC 7324 | Special purpose lorries, trucks and vans | Consumer Products | 17.111 | kg Pb/unit | F40,F05 | [44] |

| SITC 71932 | Fork lift trucks for moving goods within plant | Consumer Products | 4.556 | kg Pb/unit | F40,F05 | [44] |

| SITC 95101 | Armoured fighting vehicles | Consumer Products | 22.222 | kg Pb/unit | F40,F05 | [44] |

| SITC 73291 | Motorcycles, auto cycles, etc. side cars | Consumer Products | 3.178 | kg Pb/unit | F40,F05 | [43] |

Appendix B. Selection of Countries

- →

- Italy (IT): 1996, 2007

- →

- Spain (ES): 2009

- →

- Germany (DE): 1950–2018

- →

- Great Britain (GB): 1950–1995; 1998–1999; 2002–2004

- →

- USSR and Russian Federation (RU): 1950–1991

- →

- India (IN): 2010–2018

- →

- South Korea (KR): 1997, 2000–2018

- →

- China (CN): 1992–2018

References

- Rogich, D.G.; Matos, G.R. Global Flows of Metals and Minerals; US Department of the Interior, US Geological Survey: Washington, DC, USA, 2008.

- Vidal, O.; Rostom, F.; François, C.; Giraud, G. Global trends in metal consumption and supply: The raw material–energy nexus. Elements 2017, 13, 319–324. [Google Scholar] [CrossRef]

- Deetman, S.; Pauliuk, S.; Van Vuuren, D.P.; Van Der Voet, E.; Tukker, A. Scenarios for demand growth of metals in electricity generation technologies, cars, and electronic appliances. Environ. Sci. Technol. 2018, 52, 4950–4959. [Google Scholar] [PubMed]

- Watari, T.; Nansai, K.; Nakajima, K. Review of critical metal dynamics to 2050 for 48 elements. Resour. Conserv. Recycl. 2020, 155, 104669. [Google Scholar] [CrossRef]

- Schafer, L.L.; Mountford, P.; Piers, W.E. Earth abundant element compounds in homogeneous catalysis. Dalton Trans. 2015, 44, 12027–12028. [Google Scholar]

- Mudd, G.M.; Jowitt, S.M.; Werner, T.T. The world’s lead-zinc mineral resources: Scarcity, data, issues, and opportunities. Ore Geol. Rev. 2017, 80, 1160–1190. [Google Scholar] [CrossRef]

- Harper, E.; Kavlak, G.; Burmeister, L.; Eckelman, M.J.; Erbis, S.; Espinoza, V.S.; Nuss, P.; Graedel, T.E. Criticality of the geological zinc, tin, and lead family. J. Ind. Ecol. 2015, 19, 628–644. [Google Scholar]

- Graedel, T.E.; Harper, E.M.; Nassar, N.T.; Reck, B.K. Criticality of metals and metalloids. Proc. Natl. Acad. Sci. USA 2015, 112, 4257–4262. [Google Scholar] [CrossRef]

- World Bureau Metal Statistics (WBMS). Lead Statistics and Information. 2022. Available online: https://www.refinitiv.com/en/financial-data/commodities-data/metals-data/world-bureau-of-metal-statistics-wbms (accessed on 10 May 2024).

- United States Geological Survey (USGS). Lead Statistics and Information. 2023. Available online: https://www.usgs.gov/centers/national-minerals-information-center/lead-statistics-and-information (accessed on 10 May 2024).

- Reck, B.K.; Graedel, T.E. Challenges in metal recycling. Science 2012, 337, 690–695. [Google Scholar]

- Rees, N.; Fuller, R. The Toxic Truth: Children’s Exposure to Lead Pollution Undermines a Generation of Future Potential; UNICEF: Geneva, Switzerland, 2020; ISBN 978-92-806-5140-9. [Google Scholar]

- Gupt, Y.; Sahay, S. Managing Used Lead Acid Batteries in India: Evaluation of EPR-DRS Approaches. J. Health Pollut. 2015, 5, 52–63. [Google Scholar] [CrossRef]

- United States Environmental Protection Agency (EPA). Lead Regulations and Laws. Available online: https://www.epa.gov/lead (accessed on 20 September 2024).

- Elshkaki, A.; van der Voet, E.; Van Holderbeke, M.; Timmermans, V. Long-term consequences of non-intentional flows of substances: Modelling non-intentional flows of lead in the Dutch economic system and evaluating their environmental consequences. Waste Manag. 2009, 29, 1916–1928. [Google Scholar] [CrossRef]

- Elshkaki, A.; Van der Voet, E.; Van Holderbeke, M.; Timmermans, V. The environmental and economic consequences of the developments of lead stocks in the Dutch economic system. Resour. Conserv. Recycl. 2004, 42, 133–154. [Google Scholar] [CrossRef]

- Ando, S.; Murakami, S.; Yamatomi, J. Material flow/stock analysis of lead in Japan. J. MMIJ 2010, 126, 482–489. (In Japanese) [Google Scholar] [CrossRef]

- Mao, J.S.; Yang, Z.F.; Lu, Z.W. Industrial flow of lead in China. Trans. Nonferrous Met. Soc. China 2007, 17, 400–411. [Google Scholar] [CrossRef]

- Liu, W.; Sang, J.; Chen, L.; Tian, J.; Zhang, H.; Palma, G.O. Life cycle assessment of lead–acid batteries used in electric bicycles in China. J. Clean. Prod. 2015, 108, 1149–1156. [Google Scholar]

- Liu, W.; Chen, L.; Tian, J. Uncovering the evolution of lead in-use stocks in lead-acid batteries and the impact on future lead metabolism in China. Environ. Sci. Technol. 2016, 50, 5412–5419. [Google Scholar]

- Liu, W.; Cui, Z.; Tian, J.; Chen, L. Dynamic analysis of lead stocks and flows in China from 1990 to 2015. J. Clean. Prod. 2018, 205, 86–94. [Google Scholar]

- Bleiwas, D.I. Stocks and Flows of Lead-Based Wheel Weights in the United States; Open-File Reports; U.S. Geological Survey: Sunrise Valley Drive Reston, VA, USA, 2006; Volume 1111. Available online: https://pubs.usgs.gov/of/2006/1111/2006-1111.pdf (accessed on 10 March 2025).

- Hashimoto, S.; Daigo, I.; Murakami, S.; Matsubae-Yokoyama, K.; Fuse, M.; Nakajima, K.; Oguchi, M.; Tanikawa, H.; Tasaki, T.; Yamasue, E.; et al. Framework of material stock accounts: Toward assessment of material accumulation in the economic sphere. In Proceedings of the 8th International Conference EcoBalance, Tokyo, Japan, 10–12 December 2008. [Google Scholar]

- Maung, K.N.; Hashimoto, S.; Mizukami, M.; Morozumi, M.; Lwin, C.M. Assessment of the secondary copper reserves of nations. Environ. Sci. Technol. 2017, 51, 3824–3832. [Google Scholar] [CrossRef]

- Le, T.V.; Dente, S.M.R.; Hashimoto, S. Contemporary and Future Secondary Copper Reserves of Southeast Asian Countries. Recycling 2024, 9, 116. [Google Scholar] [CrossRef]

- Le, T.V.; Yamamoto, R.; Dente, S.M.R.; Hashimoto, S. Contemporary and Future Secondary Copper Reserves of Vietnam. Resources 2024, 13, 82. [Google Scholar] [CrossRef]

- Maung, K.N.; Yoshida, T.; Liu, G.; Lwin, C.M.; Muller, D.B.; Hashimoto, S. Assessment of secondary aluminum reserves of nations. Resour. Conserv. Recycl. 2017, 126, 34–41. [Google Scholar] [CrossRef]

- Maung, K.N.; Lwin, C.M.; Hashimoto, S. Assessment of secondary zinc reserves of nations. J. Ind. Ecol. 2019, 23, 1109–1120. [Google Scholar]

- United Nations Environment Programme. The Use of Natural Resources in the Economy: A Global Manual on Economy-Wide Material Flow Accounting; United Nations Environment Programme: Washington, DC, USA, 2023; Available online: https://wedocs.unep.org/20.500.11822/36253 (accessed on 10 March 2025).

- Mao, J.S.; Dong, J.; Graedel, T.E. The multilevel cycle of anthropogenic lead: I. Methodology. Resour. Conserv. Recycl. 2008, 52, 1058–1064. [Google Scholar]

- Mao, J.S.; Dong, J.; Graedel, T.E. The multilevel cycle of anthropogenic lead: II. Results and discussion. Resour. Conserv. Recycl. 2008, 52, 1050–1057. [Google Scholar] [CrossRef]

- Ciacci, L.; Reck, B.K.; Nassar, N.T.; Graedel, T.E. Lost by Design. Environ. Sci. Technol. 2015, 49, 9443–9451. [Google Scholar] [CrossRef] [PubMed]

- European Commission. Evaluation of the Directive 2006/66/EC on Batteries and Accumulators and Waste Batteries and Accumulators and Repealing Directive 91/157/EEC. In EU Battery Regulations and Market Impact, 2nd ed.; European Union: Brussels, Belgium, 2019; Volume 3, pp. 154–196. [Google Scholar]

- Batteries International. China Issues New Collection and Recycling Plan for Lead Batteries. Batteries International. 14 February 2019. Available online: https://www.batteriesinternational.com/2019/02/14/china-issues-new-collection-and-recycling-plan-for-lead-batteries/ (accessed on 9 February 2025).

- International Energy Agency (IEA). Global EV Outlook 2020: Entering the Decade of Electric Drive? IEA: Paris, France, 2020; pp. 1–243. [Google Scholar]

- United Nations Comtrade. 2022. Available online: https://comtradeplus.un.org (accessed on 17 April 2024).

- JYC Battery. 2025 Lead-Acid Battery Industry: Current Status and Future Trends. JYC Battery. 17 January 2025. Available online: https://www.jycbattery.com/2025-lead-acid-battery-industry-current-status-and-future-trends/ (accessed on 9 February 2025).

- GME Recycling. Do Lead Acid Batteries Have a Future? Gianni Mori Engineering. 15 December 2023. Available online: https://www.gme-recycling.com/do-lead-acid-batteries-have-a-future/ (accessed on 9 February 2025).

- SAFETY4SEA. Lithium Batteries vs Lead Acid Batteries. SAFETY4SEA. 23 December 2022. Available online: https://safety4sea.com/cm-lithium-batteries-vs-lead-acid-batteries/ (accessed on 9 February 2025).

- Health Protection Programme. Treatment and Disposal of Leaded Petrol Sludges (Waste Management Guide: 03); Department of Health: Wellington, New Zealand, 1988; ISBN 0-477-04543-X.

- Heavy Metals in Waste. European Commission DG ENV. E3. Heavy Metals in Waste: Final Report. COWI A/S. C:\temp\IECache\OLK29\Heavy metals in waste1.doc. 2002.

- QQ-T-201F (Federal Specification for Terneplate). General Services Administration. Federal Specification QQ-T-201F: Terneplate, for Roofing and Roofing Products. U.S. Federal Supply Service. 1986.

- Wang, M.; You, X.; Li, X.; Liu, G. Watch more, waste more? A stock-driven dynamic material flow analysis of metals and plastics in TV sets in China. J. Clean. Prod. 2018, 187, 730–739. [Google Scholar] [CrossRef]

- European Commission. Heavy Metals in Vehicles II: Final Report; European Commission, DG Environment: Hamburg, Germany, 2006. [Google Scholar]

| Production (P) | Use (U) | Society (S) | |

|---|---|---|---|

| Domestic extraction (DE) | |||

| Import (M) | |||

| Export (E) | |||

| Domestic Material Input (DMI) | |||

| Physical Trade Balance (PTB) | |||

| Domestic Processed Output (DPO) | |||

| Domestic material Consumption (DMC) | |||

| Input (I) | |||

| Output (O) | |||

| Net Addition to Stock (NAS) |

| Number of Years by Which | Transport | Construction | Chemical | Alloys | Miscellaneous |

|---|---|---|---|---|---|

| 50% of inputs left the stock (t50) | 5 | 30 | 12 | 12 | 12 |

| 90% of inputs left the stock (t90) | 6 | 45 | 15 | 15 | 15 |

| Reference | [30,31] | ||||

| In-use dissipation ratio (d in %) | 0 | 0 | 0.062 | 0.133 | 0 |

| Reference | [32] | ||||

| Stock Released in | Cumulated Output | Cumulated Input | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Year | Future | Int | L | D | E | Int | M | DE | B | ||||

| Production (P) | Economic | 1 | 2 | 3 | 4 | 5 | 6 | 26 | |||||

| Marginal Economic | |||||||||||||

| Sub-economic | 7 | ||||||||||||

| 8 | |||||||||||||

| 9 | |||||||||||||

| Total | Σc | Σc | Σc | Σc | Σc | Σr | Σc | Σc | Σc | Σc | Σr | ||

| Use (U) | Economic | 10 | 11 | 4 | 12 | 2 | 13 | ||||||

| Marginal Economic | 14 | 15 | |||||||||||

| Sub-economic | 16 | 17 | 18 | 7 | 25 | ||||||||

| 19 | 20 | 21 | 8 | ||||||||||

| 22 | 23 | 24 | |||||||||||

| Total | Σc | Σc | Σc | Σc | Σc | Σc | Σr | Σc | Σc | Σc | Σc | Σr | |

| Society (S) | Economic | 1 + 10 | 11 | 5 | 6 | 26 | |||||||

| Marginal Economic | 14 | 15 | |||||||||||

| Sub-economic | 16 | 17 | 18 | 25 | |||||||||

| 19 | 20 | 21 | |||||||||||

| 22 | 23 | 9 + 24 | |||||||||||

| Total | Σc | Σc | Σc | Σc | Σc | Σc | Σr | Σc | Σc | Σc | Σc | Σr | |

| CN | Stock Released in | Cumulated Output | Cumulated Input | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Year | Future | Int | L | D | E | Int | M | DE | B | ||||

| Produciton (P) | Economic | 0 | 61,962 | 14,291 | 18,088 | 18,959 | 54,237 | 2589 | |||||

| 0.0% | 66% | 15% | 19% | 20% | 58% | 3% | |||||||

| Marginal Economic | |||||||||||||

| SubEconomic | 1290 | ||||||||||||

| 1.4% | |||||||||||||

| 553 | |||||||||||||

| 0.6% | |||||||||||||

| 15,777 | |||||||||||||

| 17% | |||||||||||||

| Total | 0 | 63,805 | 15,777 | 14,291 | 93,873 | 18,088 | 18,959 | 54,237 | 2589 | 93,873 | |||

| 0.0% | 68% | 16.8% | 15% | 100% | 19% | 20% | 58% | 3% | 100% | ||||

| Use (U) | Economic | 1468 | 8909 | 18,088 | 8 | 61,962 | 297 | ||||||

| 2.3% | 14% | 28% | 0.0% | 97% | 0.5% | ||||||||

| Marginal Economic | 1152 | 6988 | |||||||||||

| 1.8% | 11% | ||||||||||||

| SubEconomic | 889 | 5394 | 12,190 | 1290 | 14 | ||||||||

| 1.4% | 8% | 19% | 2.0% | 0.0% | |||||||||

| 381 | 2312 | 5224 | 553 | ||||||||||

| 0.6% | 4% | 8.1% | 0.9% | ||||||||||

| 5 | 28 | 1081 | |||||||||||

| 0.008% | 0.043% | 1.7% | |||||||||||

| Total | 3894 | 23,631 | 18,088 | 17,414 | 1081 | 8 | 64,116 | 63,805 | 297 | 0 | 14 | 64,116 | |

| 6.1% | 37% | 28% | 27% | 1.7% | 0.0% | 100% | 100% | 0% | 0% | 0% | 100% | ||

| Society (S) | Economic | 1468 | 8909 | 14,299 | 19,255 | 54,237 | 2589 | ||||||

| 1.9% | 12% | 19% | 25% | 71% | |||||||||

| Marginal Economic | 1152 | 6988 | |||||||||||

| 2% | 9% | ||||||||||||

| SubEconomic | 889 | 5394 | 12,190 | 14 | |||||||||

| 1.2% | 7% | 16% | 0.0% | ||||||||||

| 381 | 2312 | 5224 | |||||||||||

| 0.5% | 3% | 6.9% | |||||||||||

| 5 | 28 | 16,857 | |||||||||||

| 0.007% | 0.037% | 22% | |||||||||||

| Total | 3894 | 23,631 | 0 | 17,414 | 16,857 | 14,299 | 76,095 | 19,255 | 54,237 | 2603 | 76,095 | ||

| 5.1% | 31% | 0% | 23% | 22% | 19% | 0% | 25% | 71% | 3% | 100% | |||

| Domestic Extraction (DE) | End-of-Life Scrap (F56) | Recycled Scrap (F62) | Finished Product Consumption (I5) | In-Use Stock | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Country | Other | This Study | Other | This Study | Other | This Study | Other | This Study | Other | This Study |

| China (CN) | 825 1, 832 3 | 810 | 153 1, 190 3 | 391 | 39 1, 202 3 | 115 | 327 1, 598 3 | 694 | 1843 2, 1432 3, 910 4 * | 4645, 1864 * |

| Germany (DE) | 0 1 | 0 | 227 1 | 323 | 205 1 | 194 | 270 1 | 321 | 1502 2 | 3172 |

| Spain (ES) | 61 1 | 47 | 132 1 | 69 | 114 1 | 107 | 167 1 | 137 | 594 2 | 1227 |

| France (FR) | 0 1 | 0 | 200 1 | 208 | 128 1 | 109 | 220 1 | 241 | 1079 2 | 2315 |

| Great Britain (GB) | 0 1 | 1.2 | 246 1 | 233 | 172 1 | 152 | 306 1 | 307 | 1543 2 | 3821 |

| India (IN) | 45 1 | 45 | 53 1 | 74 | 21 1 | 12 | 136 1 | 63 | 326 2 | 779 |

| Italy (IT) | 3.6 1 | 3.9 | 206 1 | 212 | 159 1 | 154 | 238 1 | 239 | 1039 2 | 2718 |

| Japan (JP) | 11 1 | 11 | 247 1 | 257 | 178 1 | 174 | 276 1 | 320 | 1487 2 | 2743 |

| South Korea (KR) | 3.8 1 | 3.3 | 112 1 | 116 | 56 1 | 40 | 160 1 | 162 | 443 2 | 909 |

| USSR and Russian Federation (RU) | 18 1 | 16 | 89 1 | 224 | 11 1 | 15 | 116 1 | 132 | 444 2 | 2631 |

| United States (US) | 515 1 | 514 | 1481 1 | 1401 | 1061 1 | 644 | 1727 1 | 1719 | 6878 2 | 11,006 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dente, S.M.R.; Zhang, J.; Hashimoto, S. Assessing Lead Waste and Secondary Resources in Major Consumer Nations: A Vanishing Resource or a Toxic Legacy? Resources 2025, 14, 52. https://doi.org/10.3390/resources14040052

Dente SMR, Zhang J, Hashimoto S. Assessing Lead Waste and Secondary Resources in Major Consumer Nations: A Vanishing Resource or a Toxic Legacy? Resources. 2025; 14(4):52. https://doi.org/10.3390/resources14040052

Chicago/Turabian StyleDente, Sebastien M. R., Jian Zhang, and Seiji Hashimoto. 2025. "Assessing Lead Waste and Secondary Resources in Major Consumer Nations: A Vanishing Resource or a Toxic Legacy?" Resources 14, no. 4: 52. https://doi.org/10.3390/resources14040052

APA StyleDente, S. M. R., Zhang, J., & Hashimoto, S. (2025). Assessing Lead Waste and Secondary Resources in Major Consumer Nations: A Vanishing Resource or a Toxic Legacy? Resources, 14(4), 52. https://doi.org/10.3390/resources14040052