Abstract

The paper is devoted to the analysis of the current and the forecast of the prospective state of introducing digital technologies into the oil and gas mining industry of the Russian Arctic. The authors of the paper analyzed the global trends that define the process of digital technologies’ introduction into the oil and gas mining industry. They also reviewed the Russian companies’ experience in this sphere. The main trends and prospects for the development of oil and gas resources extraction in the Russian Arctic in the digitalization sphere were identified. Together with this, the researchers considered prospects for digital technologies’ introduction into the oil and gas industry, observing their competition with RES. As a result, the authors have come to the following conclusions: (1) in Russian companies, digitalization is being more actively introduced into the processes of general enterprise management. (2) The main purpose of Russian oil and gas sector digitalization is to increase the efficiency of business process management, while the key constraining factors of digitalization are the lack of qualified personnel, lack of material and technical base and cyber-security threats aggravation. (3) The prospects of introducing a new package of sanctions can become both an incentive for a qualitative leap in Russian software development/implementation and an obstacle to the development of Arctic projects due to their rise in price. (4) The COVID-19 pandemic factor is one of the incentives for the widespread introduction of production and various business processes automation in the oil and gas industry, as well as the development of digital communications. (5) The leader in the digital technology development industry among Russian oil and gas companies is “Gazprom Neft” PJSC, followed by “NK Rosneft” PJSC. (6) “Gazprom” PJSC continues to lag behind in the sphere of digitalization; however, qualitative changes here should be expected in 2022. (7) The “sensitivity parameters” influencing the industry digitalization process in the Arctic region are the high dependence on foreign technological solutions and software, characteristics of the entire Russian oil and gas industry, and the problem of ensuring cybersecurity in Arctic oil and gas projects and power outages. (8) For the Arctic regions, the use of RES as the main source of electricity is the most optimal and promising solution; however, hydrocarbon energy will still dominate the market in the foreseeable future.

1. Introduction

The exhaustion of readily available hydrocarbons leads to the need to change the principles, strategy and tactics of the development and operation of deposits with hard-to-recover reserves. First, the issue is the optimization of the processes taking place at the enterprise and the introduction of new effective technologies that reduce the cost of production.

Under these conditions, there is a natural increase in the pace at which oil and gas companies introduce intelligent technologies for hydrocarbons production management. These companies ensure the optimal redistribution of resources and effective planning of production in the short and long term. Taking into account the peculiarities of Arctic hydrocarbon deposits (remoteness from existing infrastructure and consumption centers, harsh climatic conditions, etc.), such technologies become essential, since they aim to reduce downtime and drilling costs, reducing production losses, as well as increasing the oil recovery coefficient [1]. Digitalization is designed to reduce the costs associated with hydrocarbons’ exploration and production, as well as with the development and production of special equipment. The received geological, technical, statistical and other data are available in a single cloud, where they are stored, processed and analyzed. This allows track production indicators to be tracked in real time and, among other things, prevents breakdowns and accidents in real time.

The Arctic is a region, which has a strong potential for the global oil and gas industry development. At the same time, there is a number of factors limiting the extractive industry development and other economic activities in the region, especially in the Russian sector: remoteness of territories, difficult climatic conditions, a fragile ecosystem, lack of trained specialists, poorly developed infrastructure, etc. These limitations make the introduction and widespread development of digital technologies a particularly promising concept. In this regard, the purpose of this study is to analyze the current and forecast the prospective state of introducing digital technologies into the oil and gas mining industry in the Russian Arctic. For this, it seems necessary to analyze the global trends of digital technologies’ introduction into the oil and gas mining industry, consider the experience of Russian companies in this area, identify the main trends and prospects of oil and gas resources’ development in the Russian Arctic from a digitalization point of view, and consider the prospect of digital technologies’ introduction into the oil and gas industry under RES competition.

The structure of this paper is as follows: a description of research methods and approaches (including an expert survey of characteristics); analysis of the expert survey results; review of global trends in oil and gas resources production digitalization; analysis of the Russian oil and gas production digitalization experience; analysis of the specifics of hydrocarbon production in the Arctic (including “sensitivity parameters” that affect the process of digitalization in Russian Arctic oil and gas projects); analysis of prospects for the introduction of digital technologies in the Arctic oil and gas industry in competition with RES; research results; and an appendix (description of the expert survey).

2. Research Methodology

This research is based on the analysis of the modern, foreign and Russian scientific literature, as well as open sources (official websites of companies, statistical and cartographic materials).

The analysis of the scientific literature and strategic documents belonging to the largest energy companies (Shell, Chevron, BP, Petoro, Halliburton, Schlumberger, Gazpromneft, Rosneft, Lukoil, etc.), as well as the experience of implementing specific projects on digital solutions introduction (“Captain”, “Cognitive Geologist”, “Digital Core”, etc.) allowed us to identify the main trends in oil and gas resources extraction digitalization, in order to highlight the main developments and formulate the vector of digitalization development in Russian companies, the specifics of hydrocarbon production in the Arctic, and Russia’s experience in the use of digital technologies, in particular, in practical projects.

The analysis of the scientific literature and open statistical and cartographic materials made it possible to conduct a comparative analysis of Industry 4.0 technologies usage, in practice (Smart Field, Smart Wells, Digital Field and other concepts) in the oil and gas sector and renewable energy sources (RES) and to formulate prospects for digital technologies’ introduction in oil and gas sector competing with RES.

As part of the study, the method of system and structural analysis was applied in terms of the study of digital technologies’ use at various stages of the production, operation and maintenance of deposits.

In order to identify the qualitative characteristics of digitalization development in the Russian extractive oil and gas industry, an expert survey was conducted (Appendix A), which interviewed the leading Russian oil and gas companies’ employees and heads of educational and scientific organizations involved in the training of Arctic personnel.

The expert survey was sent to 48 respondents from 17 institutions at the end of December 2021. The survey results were received by the authors in early January 2022. In total, 36 experts actually took part in the survey; unfortunately, 12 respondents refused to participate.

The survey was attended by heads of departments, shift supervisors, geologists and engineers of Russian companies specializing in oil and gas production, as well as heads of departments and researchers of scientific institutes (55.6%) dealing with the problems of resources, who trained the oil and gas industry specialists (30.5%). The authors purposefully gave a prediction (in a numerical ratio) to experts from oil and gas companies due to the need to understand the real picture emerging in this area (Table 1).

Table 1.

The expert group description 1.

3. Results of the Expert Survey

The survey showed that experts identify the following digital technologies as the most effective in the extraction of oil and gas resources: digital twins—seism-geological, hydrodynamic and integrated modeling (44.4%); Big Data (25%); and artificial intelligence (14%). Other technologies were indicated by 16.6% of respondents, among which they noted robotics, automated control systems, integrated development environments for modular cross-platform Eclipse applications, Petrel software platform, and digital communications.

At the same time, experts mainly noted digital twins (38.9%), robotics (30.3%), digital communications (14%), automated control systems (8.4%) and other technologies (8.4%) as among the most effective technologies in oil and gas projects’ implementation in the Arctic. Among other technologies, in addition to Eclipse and Petrel, they emphasized additive technologies. Accordingly, the survey revealed specific features of digitalization in relation to the implementation of oil and gas projects in the Arctic.

The majority of experts noted that the leader in digital technologies’ introduction in Russia is “Gazprom Neft” PJSC (52.8%). The level of digitalization of “NK ‘Rosneft’” PJSC (22.2%) and “Gazprom” PJSC (19.4%) companies was estimated to be approximately equal. The experts also singled out “NOVATEK” PJSC Company (5.6%).

According to the respondents, Russian oil and gas companies most successfully and effectively implemented the following digital projects and technologies: “Digital Core” (33.3%), “Cognitive Geologist” (27.7%), “Cyber Hydraulic Fracturing” (22.2%) and “Digital Field” (22.2%). The respondents also noted the following digital projects and programs: tNavigator, Eclipse and Petrel, “CAPTAIN” system, and “Gazprom Neft” PJSC. Attention is drawn to the fact that the vast majority of projects were developed and implemented by “Gazprom Neft” PJSC, which correlates with the data given above.

In turn, assessing digital technologies and projects that are most effectively implemented by Russia today in the extraction of oil and gas resources in the Arctic, the respondents identified specialized Arctic projects: “CAPTAIN”, a digital logistics management system (27.8%), and block chain technologies on the sea-ice-resistant stationary platform, “Prirazlomnaya” (hereinafter “Prirazlomnaya” SISP) (19.4%). “Cognitive geologist” (19.4%), “Digital core” (16.7%) and “Digital twin of the Vostochno-Messoyakhskoye field” (16.7%) were also noted. All the programs and projects were also developed and implemented by “Gazprom Neft” PJSC (the digital twin of the Vostochno-Messoyakhskoye field was created together with “NK Rosneft” PJSC). These results suggest that today’s experts rate the company as a leader in digital projects’ development and implementation in the Arctic (Table 2).

Table 2.

Qualitative characteristics of the Russian extractive oil and gas industry development 1.

According to the respondents, the main factors that influenced the intensification of digital technologies’ introduction by Russian oil and gas companies are the need to improve the efficiency of business process management and the need to reduce companies’ expenses, which naturally increase companies’ competitiveness in the market. At the same time, Russian state policy in the digitalization field, the problem of import substitution and sanctions, as well as the COVID-19 pandemic are causing companies to revert to their second and even third plans. In turn, the factors hindering digital technologies’ introduction in this area are mainly the lack of qualified personnel (41.7%) and the lack of an appropriate material and technical base (36.1%). Problems with ensuring cybersecurity (22.2%) can be considered a secondary factor (Table 3).

Table 3.

Factors that influenced the intensification of digital technologies’ introduction by Russian oil and gas companies in 2019–2021 1.

In order to identify the prospects for digital technologies’ introduction in the oil and gas industry within its competition with RES, the respondents were asked questions about the prospects for the use of RES. The survey showed that, according to the respondents, renewable energy use is mainly advisable due to its economic benefits (52.7%). At the same time, RES is recognized to be the most optimal solution for providing an energy supply to hard-to-reach Arctic regions (66.6%). It is noteworthy that skepticism towards renewable energy is mainly typical of oil and gas companies’ representatives (Table 4).

Table 4.

The ratio of renewable energy and hydrocarbon sources’ use (RES) 1.

4. Transition to Digital and Smart Deposits: General Analysis of the Current State, the Leading Companies’ Experience

Information technologies in the oil and gas industry were first introduced at the beginning of 1980, and in the early 2000s they were combined into a set of programs for reservoir modeling, the calculation of optimal logistics, analysis of financial and economic indicators, visualization of current processes, and others [2]. Digital fishing technologies evolved “from simple to complex”, that is, from the processes of the primary collection, aggregation and analysis of fishing data to the introduction of complex analytical systems that solved current and future tasks in real time and were integrated into a single network of circulation and the analysis of information [2].

In 2006, Shell oil and gas company presented the concept of “smart field” technology on the Brunei shelf for the first time. Currently, the accelerated processing of heterogeneous data and the use of intelligent technologies are key factors of accelerating the search for optimal solutions in the sphere of oil and gas fields development and operation. Modern analytical systems provide an automation of data collection, storage and processing, physical processes description, forecast of expected hydrocarbon production and visualization of key parameters for the preparation and subsequent implementation of solutions at all levels of management [2].

The offshore oil platform has about 90 thousand sensors that generate up to 15 petabytes of data throughout the entire development period, that is, at least for 15–20 years. Digitalization makes it possible to monitor this array of oilfield information, process it and display it in an accessible form.

To date, almost all major oil and gas companies are implementing concepts for the software and hardware complex’s introduction in production processes (Table 5).

Table 5.

Digital technologies used by large oil and gas companies (prepared by the authors; the information was taken from the companies’ official websites) 1.

The analysis of the scientific literature allows us to identify several approaches to understanding the “digital field” concept essence:

- A system of interrelated technologies and business processes that ensure an increase in the efficiency of all elements of oil and gas assets’ production and management;

- A software package that includes a set of applications that allow for modeling and managing processes in the field;

- A way to generate additional value of an oil and gas asset by improving the cycle of data collection, processing, modeling, decision making and their execution;

- A system of operational management of an oil and gas facility that aims to optimize production and reduce financial losses through a predictive analysis of problems and rapid responses based on data obtained online [2,3,4].

However, a focus on one of the segments or on a separate technology does not allow us to describe the essence of oil and gas facilities’ digitalization. It is worth noting that various digital technologies are used in different segments of oil and gas production (upstream, midstream, downstream), so digitalization is a much more complex process than it may seem [5]. For example, in upstream processes, for the most part, this term rather means a complex of digital technologies introduced into operational processes, and the main directions of upstream digitalization include Big Data, the industrial Internet, robotics and artificial intelligence [6].

In other words, the concept of a “digital field” aims to integrate all of the stages (geology, development, drilling and completion of wells, oil production, construction, economics, ecology, risk analysis) into a single system and improve the efficiency of their implementation by optimizing processes online.

Innovative technical solutions for the digital modernization of oil and gas facilities include:

- Digital twin—cyber-physical oil and gas production system;

- The construction of super-heavy permanently operating systems for monitoring the seismological situation and combined active–passive systems of seismological monitoring;

- Building systems for the integrated control of development processes in various physical fields;

- The integration of borehole probes into self-organizing sensor networks;

- The construction of high-precision positioning systems and identification of deep processes;

- The construction of control and measurement systems for monitoring oil and gas fields and wells and others [6].

The digital twin acts as the basic digital technology of industrial modernization [7,8]. There are three important processes in this technology:

- The transformation of physical data into digital, which includes the following processes of collecting information on a real object: verification and rejection of incorrect data and the formation of an archive of events that significantly affect the physical process.

- The creation of a numerical model of a physical process, creation of specialized calculation modules of the digital twin, optimal solutions base formation;

- The ranking of action options by decision-making levels using intelligent technologies [7,8,9].

Ideally, the digital model in the field has algorithms for obtaining and processing data from remote field development monitoring systems, and allows us to automate control processes and predict and plan the work of each of the field system components with the elimination of labor-intensive manual processes [2]. The purpose of constructing such models is to increase the efficiency of not only each individual system, but also the entire asset as a whole, taking into account the mutual influence of the systems [2].

Digitalization makes it possible to significantly reduce operating costs and increase the share of recoverable hydrocarbons. According to experts, the introduction of digital technologies makes it possible to increase the oil recovery rate by up to 50% compared to the global average of 30% [8,10]. At the same time, digitalization is only the initial stage of the industry digital transformation, which is characterized by qualitative changes in its structure and management models.

At the moment, the number of wells where digital technologies have been partially or fully implemented is about 20 thousand, and this indicator is expected to double in the next 5 years. According to experts, foreign leading oil and gas companies are moving to full digital control coverage of production wells. For comparison, “Shell” corporation is already managing its entire well fund in real time, and “BP” company is increasing the same management by 60% [11].

Thus, there is a rapid pace of the oil and gas sector digitalization, as the intellectualization and introduction of unpopulated technologies allows the profitability of oil production to be maintained at an acceptable level by increasing the efficiency of field operation and optimizing labor costs. This issue is especially relevant for deposits in the Arctic and the Russian Far East. In this regard, a fuel and energy complex acts as the “locomotive” of the country’s economy digitalization, especially in its northern region.

The main digital technologies used in oil and gas enterprises are Big Data, neurotechnology and artificial intelligence, distributed registry systems, the industrial Internet of Things, robotics and sensor components, as well as virtual and augmented reality technologies [12,13].

5. Experience of Russian Oil and Gas Production Digitalization

Digital technologies first came to Russia in 2000. The use of “smart wells” technology in the Salym group of fields can be considered one of the first successful projects in the sphere of digital technologies in oil and gas industry production. “Salym Petroleum Development” company started the implementation of this project in 2006 based on Shell technologies [14,15].

The year of 2017 was an important period for digital technologies’ development. This was the year when, taking into account the priorities outlined in “Digital Economy of the Russian Federation” national program framework, the Ministry of Energy created a departmental project “Digital Energy” (lasting until 2024), which increased the key fuel and energy sector organizations share up to 40%, using digital technologies and various platform solutions. The project provides for the oil and gas complex digitalization [16]. As a result, digital technologies are becoming drivers of oil and gas industry development. Since 2017, the largest Russian oil corporations have implemented several projects on the introduction of digital technologies.

To date, the leaders in digital technologies’ implementation are the “Gazprom Neft” PJSC and “NK ‘Rosneft’” PJSC companies, which is confirmed by the survey conducted by the authors. The digitalization of various technological and business processes (self-learning programs, neural networks, artificial intelligence, digital twins and Big Data) will play a key role in these companies’ innovative development programs until 2025 [17,18].

Experts [19] identify the following areas of the digital transformation strategy of “Gazprom Neft” PJSC: cognitive exploration; cognitive engineering; drilling management corporate center; production management center; and digital twins [19]. The main digital strategies of “Rosneft-2022” are:

- The launch of a corporate data processing center with an industrial Internet platform and an integrated digital twin of fields;

- The testing of technology for monitoring production facilities using drones and machine vision;

- The use of artificial intelligence in field development;

- Tests of the ice rig monitoring system for offshore drilling;

- The implementation of predictive analytics systems and dynamic equipment status indicators [19].

One of the most popular technological trends is the creation of programs for the modeling of oil and gas production processes (for example, mathematical [20,21] and digital [22] modeling in the sphere of drilling, hydrocarbon systems modeling (basin modeling) [23])—the creation of “digital twins”.

To date, it is the developments, digital technologies and projects of “Gazprom Neft” that are recognized by experts as the most successful in the sphere of Russian oil and gas production digitalization (this is also demonstrated by the results of an expert survey conducted by the authors of this paper). Back in 2007, the company established a Scientific and Technical Center (“Gazpromneft STC” LLC), which deals with the following:

- The creation of regional models of oil and gas basins; construction of structural–tectonic and geological models of deposits; and modeling in the sphere of exploration drilling;

- The creation of digital models of fields (for example, in Priobskoye field by “Gazprom Neft”);

- Modeling the properties of reservoir fluids for the selection of optimal oil production technologies (they developed a self-learning program “Digital Core”, which predicts the properties of rocks in new fields);

- Conceptual geological modeling;

- Cognitive programs (“Cognitive geologist” project) [24].

In 2014, the company began developing the “Digital Deposit” program. In 2017, the company established an Oil and Gas Production Management Center, on the basis of which a self-learning “digital twin” of the field was created [25]. The company is successfully implementing the “Digital Core” project (a digital laboratory for core material research, which allows data on the characteristics of the formation to be obtained and the selection of optimal solutions for production) [26]. In 2019, the company presented a hydraulic fracturing simulator “Cyber Hydraulic fracturing” (which simulates the creation of hydraulic fracturing and the search for the best algorithms for geological operations) [27], and in 2020, it presented an improved simulator “Cyber Hydraulic Fracturing 2.0”, which allowed operation options to be developed for extreme conditions.

In the wake of “Gazprom Neft”, “Rosneft Oil Company” PJSC is moving in this direction. Back in 2005, the company began the formation of a corporate scientific and technical complex.

In 2019, the company launched the “Digital Field” project on the basis of the Ilishevsky field, “Bashneft” ANC PJSC (a subsidiary of “NK ‘Rosneft’” PJSC), covering all the main processes of oil production and logistics. In the same year, the company managed to test a drone monitoring system that could automatically detect the presence of people and equipment in protected areas and inform about oil spills. Another daughter company of “Rosneft”, “Rospan International” JSC tested the technology of unmanned aerial vehicles for remote monitoring the liquidated and mothballed “Hermes” wells’ fund state [28]. In 2021, Rosneft began using drones to control greenhouse gas emissions in oil and gas treatment and transportation facilities [29].

In 2019, “Rosneft” created a prototype and put into operation a modern system for repair crews and services management—the “Digital Crews TCRS” platform, which enabled the operational management of crews and services, processing of data from control systems, detecting anomalies, notifying about incidents and risks during well repairs, etc. [28].

Moreover, in the same year, the company developed the concept of a digital gas field. As a result, the technology of the operational integrated optimization of gas production at the Wheatgrass gas condensate field was successfully tested using machine-learning methods. A prototype of the integrated model of the “Odin” deposit was created, an information technology platform implementing a digital twin of the Wheatgrass fishery was tested, and a prototype with a three-dimensional visualization of “Mitra” fishery was created [28].

In 2021, “Rosneft” company demonstrated its new developments: models and algorithms of geomechanics, hydrodynamics, petrophysics, and geology, which formed the basis of the software products “RN-GRID” (a hydraulic fracturing simulator), “RN-SIGMA” (risk management of drilling wells), “RN-KIM” (a hydrodynamic simulator of hydrocarbon deposits), etc. [30].

In addition, “LUKOIL” PJSC also achieved certain results in the sphere of digitalization. In 2018, the “LUKOIL” Board of Directors approved the functional program “Information Strategy of the ‘LUKOIL’ Group”, which became a part of “LUKOIL” Group’s Strategic Development Program for 2018–2027. “LUKOIL-Technologies” LLC created an intelligent platform of the Unified Information Space (UIS), and in 2021, they began to improve their infrastructure (UIS) [31]. The company is working on the creation of integrated operations centers of a single digital platforms for data analysis and management. It is modeling drilling conditions and processes, as well as the automation of various management, planning and control processes (“Integrated Management Systems”). New integrated models of fields under development are also being created (for example, in 2020, they developed the Imilorskoye field and fields named after V. Vinogradov and V. Greifer) [32].

“Tatneft” PJSC has achieved some success by developing a program to create a digital platform for managing large geological, geophysical and field data—a project (jointly with “ChemTech” company) on the depth of oil refining at “TANECO” oil refining complex [25]. In 2019, the company began to create a unified data collection system (USDC). In 2020, “Tatneft”, supported by Huawei, successfully implemented the Huawei OceanStor Dorado V6 data storage system [33].

Experts also highlight the achievements in the digitalization sphere by “NOVATEK” PJSC (according to the conducted survey, the company ranks third in terms of digital technology development after “Gazprom Neft” PJSC and “NK ‘Rosneft’” PJSC). In 2010, the company established “NOVATEK Scientific and Technical Center” LLC (hereinafter, NOVATEK STC), which is engaged in the development and implementation of digital technologies, among its other projects. Back in 2017, the company commissioned the “Digital Field Production Management System” to manage production and ensure a prompt response to technological incidents at “Yamal SPG” OJSC [34]. Starting in 2019, the comprehensive digitalization of drilling and down-hole operations, also with the use of artificial intelligence technologies, was carried out on an ongoing basis. In 2020, the process of seismic exploration digitalization was launched on an ongoing basis. The company also conducted research in the sphere of “unattended/unmanned technologies” introduction—a system for remote monitoring and conducting the technological process of extracting hydrocarbons from wells [35].

In 2021, NOVATEK STC, together with Umbrella IT company, developed a voice assistant, the “Nova” application, which in a few seconds provides company employees with access to data on the processes regarding wells (including offline mode) [36].

According to experts [37], “NK ‘Rosneft’” PJSC and “LUKOIL” PJSC occupied the leading positions in the implementation of digital technologies in the field of gas production in 2020, while “Gazprom” PJSC occupied only the third place. Today, it is obvious that, by the end of 2021, “NOVATEK” PJSC was also among the leaders. At the same time, “Gazprom” definitely ranks first in terms of investments in digitalization. However, in comparison to other countries around the world, the Russian Federation lags far behind foreign competitors in terms of business processes for the digitalization of natural gas production and LNG production in terms of the number of projects and their quality (about 30% of the projects are implemented with significant delays) [37]. In turn, only “Gazprom” PJSC has a product capable of developing according to the laws of Industry 4.0; at the end of 2020, among the platforms of industrial digitalization, the most successful Russian solution was EvOil from “Gazprom” PJSC [37].

In 2020, “Gazprom” put information management systems (IMS) into permanent operation. Since 2020, the company has also been developing a Unified Digital Platform (UDP), the main purpose of which is to increase the efficiency of business processes in “Gazprom”’s investment activities through the use of digital technologies [38], as well as the “Company’s Digital Twin” project.

In December 2021, the “Gazprom” Group’s digital transformation strategy for 2022–2026 was approved. Its main purpose is to create a Unified Data Model of “Gazprom” Group companies that will be integrated with the National Data Management System. As a result, it plans to create digital platforms, which would become the basis for the digital ecosystems of the gas, oil and electric power business. Each platform is a group of specialized IT solutions and services united by a single regulatory reference information. At the same time, the company stated that the implementation of the strategy will be provided mainly by domestic technological solutions [39].

In the process of transition to digital technologies in the oil and gas industry, the most important directions are in the sphere of exploration and production drilling of wells and their subsequent maintenance and support. However, unfortunately, the transition to digital technologies in these areas in Russia is slow. Nevertheless, as shown above, there is certain progress in this development direction demonstrated by Russian companies.

According to experts (including the survey conducted by the authors of this paper), one of the key factors hindering the introduction of digital technologies in the extraction of oil and gas resources in Russia is the lack of qualified personnel. Therefore, leading Russian companies cooperate with leading universities and institutes in their training of specialists in the digital technologies sphere. Thus, in 2019, with the support of “Gazprom Neft” PJSC, the Department of Mathematics and Computer Science was established at St. Petersburg State University. The company employs its best graduates. It also cooperates with Moscow Institute of Physics and Technology and St. Petersburg Polytechnic University in the sphere of digital technologies. “Rosneft” cooperates with Gubkin Russian State University of Oil and Gas (Research Center), Lomonosov Moscow State University, Moscow Institute of Physics and Technology, “Higher School of Economics” Research University, etc. [40]. Therefore, it is not surprising that today these companies are Russian leaders in the sphere of oil and gas resources extraction digitalization. However, it should be noted that all oil and gas companies are trying to maintain contacts and implement scientific and technical projects with leading Russian universities.

In addition, the factors hindering the process of the widespread use of digital technologies are the lack of appropriate material and technical bases, as well as the problem of ensuring cyber security [25]. It can be noted that, with sector digitalization, the issues of neutralizing emerging threats are being actualized. Such threats can be present in the form of both information flows distortion (changes in the real values of critical parameters, false protection triggers, false fault definitions) and inconsistencies of the digital model with the original one, etc. [41].

The main reason for the existing problems in the sphere of information security, as well as in the sphere of digitalization in general, is the lack of highly qualified personnel, which is especially obvious in companies operating in hard-to-reach regions, in particular, in the Arctic. This leads to the fact that companies are forced to outsource the task of ensuring digital services operation and provide third-party organizations with remote access to their digital systems, which, in some cases, can lead to serious problems in the sphere of information security.

Despite the fact that the expert survey (conducted from the end of December 2021 to the beginning of January 2022) showed the secondary role of import substitution and sanctions problems, as well as the role of the COVID-19 pandemic in the process of intensifying the digital technologies’ introduction in Russian oil and gas producing companies (Table 3), it is not possible to reduce the impacts of these factors or to completely exclude them.

It is noteworthy that the COVID-19 pandemic can also be considered a stimulating factor for the accelerated transition to digital solutions in the extractive sector. Restrictions imposed by most countries, including Russia, have led to the search for opportunities to introduce “unattended/unmanned” technologies, including digital communications development. According to EY surveys, more than 70% of multinational companies’ managers plan to increase investments in digital technologies, and more than 35% are already actively investing in business process automation [42]. Moreover, the reports and company development strategies studied by the authors also mention COVID-19 as one of the accelerated digitalization factors [32,40].

Speaking about the problem of import substitution, we note that until recently, companies mainly used foreign practices and software in the sphere of security, which imposed additional difficulties. However, an analysis of the companies’ annual reports and development strategies has shown that the problem of import substitution, including software and technological solutions, comes to the fore under the conditions of a possible tightening of sanctions. The new developments by “Gazprom Neft”, “Rosneft”, “Gazprom” and “LUKOIL”, described above, indicate the beginning of a qualitative shift in this direction.

One of the decisive factors here is the growth in international tension since the end of 2021 and the prospect of a new package of sanctions being introduced against Russian oil and gas companies in connection with the Russian–Ukrainian conflict that broke out at the end of February 2022. Despite the fact that Western countries, in particular the United States, refused to impose sanctions against the Russian oil sector, it is clear that software and equipment could fall under this sanctions regime, which could cause significant damage to the development of the industry, since digital technologies are introduced mainly when implementing joint projects with foreign companies. For example, ‘Gazprom Neft’, the leader in the digitalization of the Russian oil and gas industry, is implementing its flagship projects together with foreign companies (IBM Services, Brasil and PwC).

Of course, in recent years, there has been progress in the production of Russian microprocessors and operating systems. Only recently were Russian operating systems based on the Linux operating system (for example, Astra Linux, Rosa Linux, etc.) actively introduced in Russia [43,44]. Russia also produced and is beginning to widely introduce its own microprocessors, such as Elbrus and Baikal [45].

However, in today’s realities, the prospect of the development of these processors becomes a big question: both microprocessors are manufactured by TSMC (Taiwan Semiconductor Manufacturing Company, Taiwan, China), but the company stopped its deliveries to Russia and its suppliers due to the imposition of sanctions against Russia following the Russian–Ukrainian conflict [46].

6. Specifics of Hydrocarbon Production in the Arctic

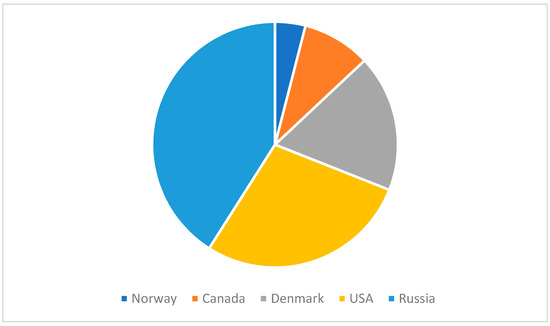

Huge mineral resources are concentrated in the Arctic. Currently, 10% of the world’s oil and one-quarter of natural gas are produced in this region. The Russian Arctic zone now produces about 70% of gas and up to 20% of oil from the total production of the country [47]. At the same time, the Russian part of the Arctic has the largest projected oil reserves (Figure 1) (according to experts, there are 7.3 billion tons of oil reserves in the Arctic zone of the Russian Federation [48]). In other words, the Arctic region will be of key importance for the Russian fuel and energy complex in the medium term.

Figure 1.

Projected oil reserves in the Arctic by country [49].

The peculiarities of hydrocarbon production in the Arctic include:

- Extreme natural and climatic conditions (polar nights, strong winds combined with low air temperatures, frequent magnetic anomalies in the atmosphere, etc.);

- Ice formations of various natures (icebergs, ice cover of various cohesion);

- The significant (up to 600 km) remoteness of supply bases and the practical lack of infrastructure to ensure the development of offshore fields;

- High sensitivity of the Arctic ecosystem to man-made impacts [50].

The above-mentioned natural and climatic features of the Arctic entail adaptation and optimization of technologies and production processes. In fact, the Arctic region provides companies with unique opportunities to develop not only new technologies but also innovative strategies for the development of economic activities—the formation of clusters, which increases the efficiency of capital-intensive and technically complex projects, accelerates the development of high-tech technologies (“Messoyakha”, “Yamal LNG”, “New Port” Arctic projects) [51].

As mentioned earlier, the integrated application of digital technologies and effective management algorithms serve as the basis for optimizing operating costs and provides the possibility of remote management of production facilities, which is extremely important for facilities in the Arctic.

As the first experience of the development of offshore fields located in the waters of freezing seas has shown, the direct transfer of technologies and equipment for the development and operations of offshore oil and gas fields in other areas of the world’s oceans to the Arctic and subarctic regions is not always the best solution. An example of such a transfer is the Shtokman Gas Condensate field (GCF) development project, which was eventually frozen and has been postponed until 2028 [52].

One of the factors that influenced the freezing of the Shtokman Gas Processing Plant was the high dependence on foreign technologies, which negatively affected the prospects of the project after the 2014 Ukrainian crisis. According to experts [53], the technological dependence of the Russian oil and gas sector on the Arctic ranges from 80 to 95%. This “technological gap” leads to an additional increase in the cost of Arctic offshore projects. In this regard, nowadays, the problem of import substitution in the sphere of technical and software solutions for Arctic projects is quite acute.

It is important to note that the deposits digitalization in the Arctic is associated with a comprehensive solution of tasks: not only oil production, but also the development of all related infrastructure.

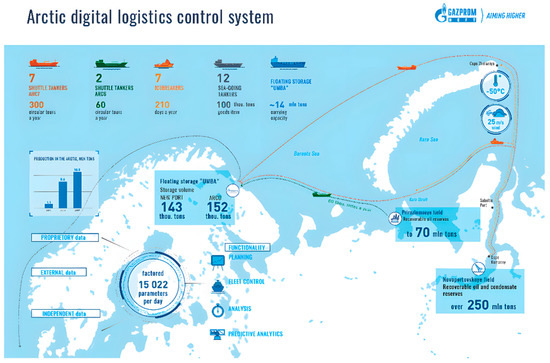

In this regard, special attention is paid to the development of a digital logistics management system. It is the digital projects in this area that are recognized by experts (in correlation with the results of the survey conducted by the authors) as the most effective in the extraction of oil and gas resources by Russian companies in the Arctic.

“Gazpromneft-Snabzheniye” LLC (a subsidiary of “Gazprom Neft” PJSC) has successfully implemented a project on block-chain use at the “Prirazlomnaya” sea-ice-resistant stationary platform [19]. So, in order to work with data on the movement of goods, radio frequency (RFID) tags and GPS sensors were installed on them at the plant in Veliky Novgorod city. This made it possible to process data on all the routes, the transportation speed and the location of goods. Due to the use of block-chain technology, all data on the cargo movement were collected in a single information space, but not on a centralized server, while each user connected to the block-chain network had a copy of the records and could confirm the addition of new blocks. All participants in the system had access to the data while the possibility of errors, substitution or correction of records was eliminated using block-chain; the logistics became as transparent as possible for all participants in the process [54].

At the moment, the most successful example of the digital logistics management system development in the Russian Arctic is the “CAPTAIN” system (a complex for automatic planning of interactive Arctic oil transportation), developed and implemented by “Gazprom Neft”. As the company officially reported, the economic efficiency from the introduction of “CAPTAIN”, the digital management system of the Arctic logistics, amounted to RUB 0.9 billion in 2019–2020 [53]. This is a result of optimizing the tanker operations costs by choosing the best routes, saving fuel, reducing the cost of icebreaking wiring, as well as of reducing downtime and maximizing oil exports.

The “CAPTAIN” system consolidates data from all the objects of the Arctic logistics chain and analyzes about 15 thousand input parameters online, including telemetry from support vessels and tanker fleets, cargo tanks of floating oil storage facilities and terminals, information about weather conditions, etc. Every 15 min, the system recalculates the movement schedule of tankers and oil shipments from terminals, choosing the best solution (Figure 2) [55].

Figure 2.

“CAPTAIN”, a digital logistics management system [54].

The conditions for the implementation of large-scale Arctic oil and gas projects are associated with solving non-trivial tasks and finding ways to reduce costs while maintaining environmental friendliness and safety at a high level. As noted earlier, the transition to digital deposits aims to increase production, minimizing expenses, labor costs, and the likelihood of human error [56].

The introduction of digital technologies reduces costs, but requires significant investments in technology and changes in the approach to managing production processes. The Arctic is a unique innovative “testing ground” for the Russian oil and gas industry.

In the sphere of hard-to-recover oil reserves extraction in the Arctic, according to experts, the use of the “Cognitive Geologist” platform, the flagship project by “Gazprom Neft” (developed jointly with IBM Services Brasil), is extremely promising. The IT platform is a self-learning program that allowed the company to obtain additional oil at Vyngapurovskoye field (Yamalo-Nenets Autonomous Okrug). In June 2021, at the 24th St. Petersburg Economic Forum, “Gazprom Neft” and PwC consulting company representation in Russia signed a memorandum of cooperation in the development of intelligent digital solutions for geology and oil production. The key place is given to the “Cognitive Geologist” [57].

Experts also highlight the “Digital Core” program (a self-learning program presented in the form of a single database of core samples and grinds that predicts the properties of rocks in new fields). It has been successfully implemented in the study of Achimov deposits of hard-to-recover oil at Yamburskoye oil and gas field (creating a digital model of Achimov core) [58].

In 2021, “Messoyakhaneftegaz” JSC (a joint venture of “Gazprom Neft” and “NK ‘Rosneft’”) created a digital twin of the Vostochno-Messoyakhskoye field and, in partnership with “Schlumberger”, simulated a full drilling cycle using the DrillPlan platform, which allowed for automated calculations and optimized well planning. As a result, the terms of well design for the hard-to-recover Arctic continental reserves development were halved [59,60].

Nevertheless, despite the implementation of a number of successful digital oil and gas projects in the Arctic, we need to note the critical parameters that influenced the industry digitalization process in the region.

“Sensitivity parameters” influencing the digitalization process in Arctic oil and gas projects.

High dependence on foreign technological solutions and software, characteristic of the entire Russian oil and gas industry (discussed above).

6.1. The Problem of Ensuring Cybersecurity in Arctic Oil and Gas Projects

Ensuring information security in the Arctic, in comparison with the central territories of Russia, encounters a number of problems, primarily caused by the inaccessibility of the Arctic territory. For example, there is a problem with ensuring security during data transmission. The fact is that laying secure wired communication lines is often impossible, and wireless data transmission is obviously the most vulnerable to attacks, in particular, to a man-in-the-middle attack. The introduction of the full encryption of all transmitted data along the entire transmission path, and reliable and non-compromised algorithms such as GOST 28147-89 [61] are the only solution to this problem.

Another problem is related to the provision of information security specialists. The fact is that IT specialists, unlike other specialists in the extractive industry, receive a decent salary in the central regions of Russia and do not seek to move to work in the Arctic at all. Accordingly, companies are forced to employ these specialists remotely and outsource this work, which leads to additional security problems, since the work towards setting up equipment protection is carried out by unverified people, often in insufficient numbers.

6.2. Power Outages

In Arctic conditions, power outages can occur [62] as a result of extremely low temperatures. This, in turn, will lead to the failure of all digital systems.

The solution to this problem may be the use of smart power distribution systems, which will allow a reconfiguring of network topology depending on the possible occurrence of a failure on the line and the even distribution of the load on power lines. To date, there is a project [63] of a smart grid system designed for the Arctic region, which, in addition to the above-mentioned requirements, makes it possible to increase the reliability of the power supply system by connecting a backup battery in the event of a failure. However, the use of this technology is possible only if there are prediction systems based on digital twins that would allow the battery to be connected shortly before the upcoming failure.

Special attention should be paid to secondary power supply sources intended to supply end users, which include actuators responsible for the operation of individual system nodes. The main requirements for the design of secondary power supply sources are the use of a modular architecture with parallel channels to implement a redundancy system in case of failure, as well as the development of unified mechanisms for the interaction of all segments with a common centralized management system [64].

7. Prospects for the Digital Technologies’ Introduction in the Oil and Gas Industry within Its Competition with RES

In the energy sector, despite the rapid growth of RES shares, the oil/gas sector remains the dominant supplier of electricity [65] and will remain such for at least the next 20–30 years [66]. At the same time, in 2020, the share of renewable energy in global energy consumption increased by 9.7% (which is its largest ever increase), while gas and oil consumption fell by 9.3% and 2.3%, respectively [65]. The reason for this is the high environmental friendliness of obtaining energy from renewable sources. It is a good alternative to extracting energy from hydrocarbons, producing up to three quarters of all carbon dioxide emissions into the atmosphere [67]. RES is also most appropriate technology for use in conditions where centralized management is difficult, for example, in the Arctic zone [68].

Thus, one of the main aspects of Industry 4.0 is the direction towards the rational use of natural resources, which implies an energy-efficient production process with the achievement of its maximum environmental friendliness [69].

The main technologies of Industry 4.0 are robotics, modeling (digital twins), system integration, industrial Internet of Things, cyber security, cloud computing, 3D printing, and augmented reality [70,71].

Considering the introduction of Industry 4.0 technologies in the oil and gas sector, which competes with RES, a comparative analysis of the above-mentioned use of technologies at each stage of production was carried out.

7.1. Application of Industry 4.0 Technologies in the Oil and Gas Sector

The oil/gas industry is a complex system that includes a large number of interconnected processes that must control the extraction of raw materials, its processing, productivity and equipment wear, the efficiency of personnel, and be clearly coordinated with each other. The optimization and strict control of each of the above-mentioned items helps to reduce the cost of equipment operation, increase overall productivity, as well as reducing the risks of accidents [72].

Thus, the following problems stand in the way of creating a centralized automatic control system [73]:

- A variety of protocols, as well as a variety of data types. As the number of devices and sensors grows, the number of protocols for data collection increases, which urges the need to create new interfaces for organizing device networks and integrating them with existing data ecosystems. In addition, there is a need for a centralized data management system, which should be able to integrate disparate data types to create their single representations.

- Increasing the number of devices and sensors. Hubs, aggregators, gateways and other network equipment are needed to manage the lifecycle of new devices and sensors. At the same time, the amount of data created in the course of work and their dynamic nature may exceed the capabilities of systems used for operational decision support. Sensors, and the data produced by them, must be ordered, combined, matched and transformed.

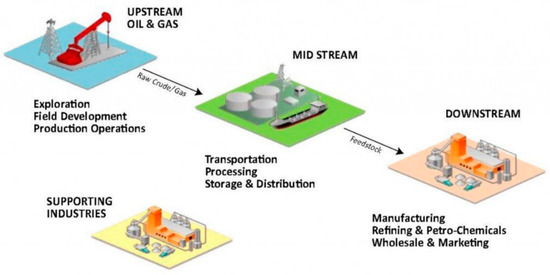

At the same time, traditional control systems such as PLC, DCS and SCADA can be inherently complex and expensive to upgrade or expand. The solution to this is to use Internet of Things technologies, Big Data, as well as cloud computing, through the use of which it is possible to create a unified system of control, management, as well as support in making operational decisions. For a more detailed analysis of digital technologies’ introduction in oil and gas production automation, we shall consider the process of raw materials extraction in the oil and gas industry. The whole process can be divided into three main parts (Figure 3):

Figure 3.

The production process in the oil and gas industry system [74].

- Search, exploration and development (upstream).

- Storage and transportation (midstream).

- Processing, marketing and sales (downstream).

Currently, the process of introducing new technologies for each of the sectors is not regulated due to the complexity of technological processes, as well as their close correlations with each other.

The conceptual model of transition to the concept of Industry 4.0 should focus on the following areas:

- The increase in the oil recovery coefficient;

- The reduction in operating and capital costs;

- The reduction in pollutant emissions;

- The increase in high-tech jobs;

- Improving the energy efficiency of production [75].

Based on the data given in Table 6, it can be concluded that the main focus of the research on Industry 4.0 introduction in the oil and gas sector is on the following technologies: industrial Internet of Things; digital twins; Big Data; and augmented reality.

Table 6.

The use of Industry 4.0 technologies in the oil and gas sector 1.

7.2. Application of Industry 4.0 Technologies for Renewable Energy

According to experts [91], in the context of Industry 4.0 technologies’ use in renewable energy, the main emphasis should be placed on:

- Improving the stability of the energy system state;

- Providing additional flexibility for renewable energy systems;

- Improving energy efficiency;

- Reducing energy consumption.

Similar to the oil and gas sector, the process of obtaining energy from renewable sources can be divided into:

- Generation;

- Buffering;

- Transmission;

- Consumption.

Industry 4.0 technologies, presented in Table 7, contribute to the achievement of impressive indicators for each of the designated points.

Table 7.

Use of Industry 4.0 technologies for RES 1.

Thus, the main focus in the renewable energy sector is on the following technologies: industrial Internet of Things, Big Data, digital twins.

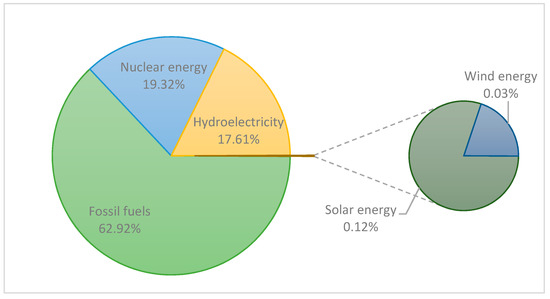

7.3. Competitiveness of Renewable Energy in Russia

Despite the fact that the bulk of Russian energy consumption is accounted for by hydrocarbon energy sources (the total share of energy consumption from renewable sources does not exceed 0.15%, according to Rosstat data for 2019 [107]), the share of renewable energy is growing rapidly every year (Figure 4). By 2030, the share of renewable energy consumption in Russia will increase by 5% [108]. This is facilitated by the problem of climate change associated with the extraction of energy from fossil energy sources, and, as a result, increased public interest in the use of “green” energy sources [109].

Figure 4.

Electricity consumption in Russia [107].

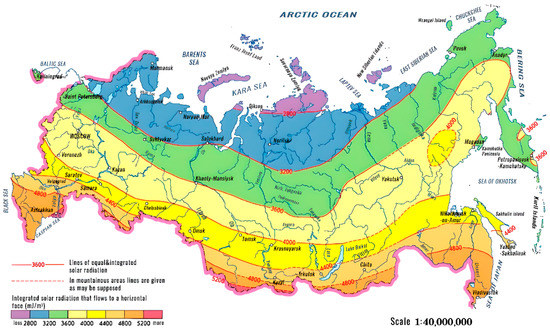

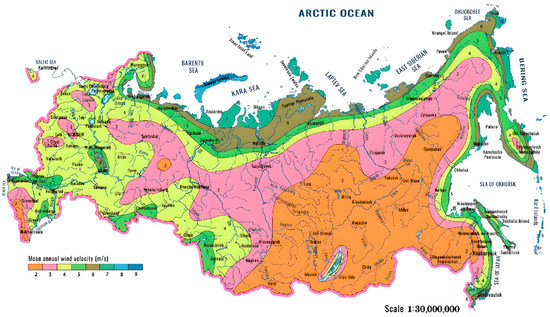

According to the maps of wind and solar energy presented in [110], the greatest intensity of solar and wind energy falls on regions remote from the central part of Russia (Figure 5 and Figure 6). It is also worth noting that, nowadays, the cost of energy extracted from petroleum products is significantly lower than analogues from renewable energy sources. However, the estimated cost of hydrocarbon fuel, in the case of its delivery to remote parts of the Russian Federation, may significantly exceed the cost of energy supplied by RES [111].

Figure 5.

Average annual solar radiation intensity map in Russia [110].

Figure 6.

Average annual wind intensity map in Russia [110].

Therefore, for the regions located on the periphery of the Russian Federation, especially for the Far North region of Russia, which is the most promising region for the development of rich mineral deposits [112,113,114], the use of renewable energy as the main source of electricity is the most optimal and promising solution.

Based on the above, it can be concluded that the issue of introducing digital technologies into the oil and gas sector is now most difficult, since, despite the increasing demand for renewable energy, the use of which is limited to regions that are remote from the central region of Russia, hydrocarbon energy remains dominant in the market. At the same time, the digitalization of the oil and gas sector is a more time-consuming task due to the presence of more complex technological processes, as well as the large working personnel’s involvement in the production processes. In accordance with this, the use of technologies such as virtual and augmented reality are most relevant for the oil and gas sector, as these technologies contribute to reducing the influence of human factors, as well as increasing the final speed and efficiency of performing the required operations. At the same time, virtual reality, the Internet of Things and artificial intelligence are currently the least-used technologies, compared with Big Data and robotics, due to the complexity of developing and implementing the final product for an introduction into the production process [25]. Therefore, research that focuses on the above-mentioned introduction of technologies into the oil and gas industry is the most relevant.

8. Conclusions

The paper is a review and analysis of the main approaches to the introduction of digital technologies in the modern Russian oil and gas industry under Arctic conditions as well as the problems that arise in this case. The study is based on information obtained from open sources, as well as opinions and assessments provided by experts working in the Arctic and those who are becoming training specialists in this region.

The paper brings together information about the digital technologies currently used in Russian oil and gas production in the Arctic, as well as a survey of experts who are directly involved in their implementation. Based on the information provided, the significance of these technologies for improving oil exploration and production is demonstrated, as well as the main problems that prevent their large-scale application in the Arctic region.

The need to reduce the costs of operating deposits in the Far North region, due to natural, climatic and other factors, stimulates the development of the remote management capabilities of production facilities and the use of unmanned technologies. The technologies that are most actively implemented in oil and gas enterprises include working with Big Data, neurotechnologies, distributed registry systems, industrial Internet of Things, robotics and sensor components, and, in the future, with the use of virtual and augmented reality technologies, which are currently used mainly for training events.

The main purpose of the digitalization of the Russian oil and gas sector is to increase the efficiency of business process management. The key constraining factors of digitalization are the lack of qualified personnel, lack of material and technical bases and increase in cyber security threats. The latter factor often requires a transformation of the entire enterprise security system. The main reason for these existing problems in the sphere of information security is, once again, the shortage of highly qualified personnel, which is especially clear in companies that operate in hard-to-reach regions, particularly in oil and gas facilities in the Arctic region.

Russian experts (especially representatives of oil and gas companies) underestimate the sanctions regimes against their country. Nevertheless, the prospects of a new package of sanctions being introduced against Russia (due to the Russia–Ukraine conflict), could, on the one hand, become an incentive for a qualitative leap in the development and implementation of Russian software, including in Arctic projects. On the other hand, what is more likely in the short and medium term is that these sanctions will become obstacles to the development of Arctic projects’ due to rising costs and could even become a reason to freeze a number of them.

Another underestimated factor of the COVID-19 pandemic is one of the incentives for the widespread introduction of production automation and various business processes in the oil and gas industry, as well as the development of digital communications, which is most relevant to remote Arctic territories.

To date, the leader in the digital technology development industry among Russian oil and gas companies is “Gazprom Neft” PJSC (the company has held the leading positions for the past 4 years), with “NK “Rosneft” PJSC in second place. These companies invest in the development and implementation of domestic software solutions and platforms.

According to the results of an expert survey, the most successful Russian digital projects in the Arctic are the projects by the “Gazprom Neft” PJSC: “CAPTAIN” logistics management system, the use of block-chain technologies in “Prirazlomnaya” SISP, “Cognitive Geologist” IT platform, “Digital Core” self-learning program and the digital twin of the Vostochno-Messoyakhskoye field (together with “NK ‘Rosneft’” PJSC).

“Gazprom” PJSC continues to lag behind in the sphere of digitalization; however, given the “Gazprom” group’s digital transformation strategy adopted at the end of 2021, we should expect a “breakthrough” in this direction in 2022.

The “sensitivity parameters” influencing the industry digitalization process in the Arctic region are:

- A high dependence on foreign technological software solutions, characteristic of the entire Russian oil and gas industry;

- The problem of ensuring cybersecurity in Arctic oil and gas projects (ensuring security during data transmission and providing companies with information security specialists);

- Power outages.

For the Arctic regions, the use of renewable energy as the main source of electricity is the most optimal and promising solution. However, despite the increasing demand for renewable energy, hydrocarbon energy will dominate the market in the near future. At the same time, it is in the oil and gas sector that the economic effect of digitalization is expected to be higher, and some technologies, such as virtual reality, the Internet of Things and artificial intelligence, are more applicable to oil and gas enterprises.

The authors of this study plan to focus on identifying and studying in more depth the specifics of the digitalization of Russian oil and gas projects in the Arctic in the context of international sanctions in the near future.

The expert survey presented in the paper is an integral part (the first stage) of a larger study to identify the qualitative characteristics of digitalization development in the Russian extractive oil and gas industry in the Arctic and the prospects for its development. As the next stage of the study, the authors plan to conduct a large-scale survey (at least 500 respondents and an expanded list of questions) among employees of Russian oil and gas companies and representatives of scientific and educational institutions, as well as foreign specialists, which will significantly expand our understanding of the development of digitalization in the Russian oil and gas industry as a whole, particularly in Arctic oil and gas projects, as well as deepening our understanding of the ongoing digitalization processes under the current sanctions regime.

Author Contributions

Conceptualization, E.S. and D.M.; methodology, E.S.; validation, A.M.; formal analysis, E.S. and A.L.; resources, R.-E.K.; writing—original draft preparation, E.S., D.M. and A.L.; writing—review and editing, A.M.; visualization, R.-E.K.; project administration, E.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The study did not require ethical approval.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Expert Survey

- Specify your company/work place/institution

- Specify your position

- Specify the digital technologies that, in your opinion, are most effective in the extraction of oil and gas resources in the entire industry.

- Big Data

- Digital twins

- Artificial intelligence

- Robotization

- Automated control systems

- Digital communication

- Specify your own option

- Specify the digital technologies that, in your opinion, are most effective when implementing oil and gas projects in the Arctics.

- Big Data

- Digital twins

- Artificial intelligence

- Robotization

- Automated control systems

- Digital communication

- Specify your own option

- Specify the Russian oil and gas company that, in your opinion, is the leader in digital technologies’ introduction

- Gazprom Neft

- Gazprom

- Rosneft

- NOVATEK

- LUKOIL

- TATNEFT

- Specify your own option

- Specify three digital technologies/projects/programs that, in your opinion, are successfully and effectively implemented by Russian oil and gas companies.

Open question (without provided options)

- 7.

- Specify three digital technologies/projects that, in your opinion, are most effectively implemented today in the extraction of oil and gas resources in the Arctic.

Open question (without provided options)

- 8.

- Specify 3 factors that, in your opinion, influenced the intensification of the introduction of digital technologies in 2019–2021.

- The need to reduce the costs for companies

- Improving the efficiency of business process management

- Adoption of the national program “Digital Economy of the Russian Federation” 2017

- Import substitution and sanctions

- COVID-19 pandemic

- Specify your own option

- 9.

- Specify the main factor for the digital technologies’ introduction intensification in 2019–2021.

- The need to reduce the costs of companies

- Improving the efficiency of business process management

- The adoption of “Digital Economy of the Russian Federation” 2017 national program

- Import substitution and sanctions

- The COVID-19 pandemic

- 10.

- In what cases, in your opinion, is the use of renewable electricity sources more appropriate in comparison with the use of hydrocarbons?

- If it is economically unprofitable to extract hydrocarbons

- In the absence of hydrocarbon resources (remote stations)

- If it is necessary to ensure a favorable environmental situation (Ecological issues)

- No way

- 11.

- Is renewable energy, in your opinion, the most optimal solution for providing energy supply to hard-to-reach Arctic regions?

- Yes

- No

- I find it difficult to answer

- 12.

- Will RES, in your opinion, be able to completely replace hydrocarbon energy in the future?

- Yes

- No

- I find it difficult to answer

References

- Eryomin, N.A.; Stolyarov, V.E.; Sardanashvili, O.N.; Chernikov, A.D. Intelligent drilling in digital field development. Autom. Telemech. Commun. Oil Ind. 2020, 5, 26–36. [Google Scholar] [CrossRef]

- Vlasov, A.I.; Mozhchil, A.F. Technology overview: From digital to intelligent oilfield PRONEFT. Prof. Oil 2018, 3, 68–74. [Google Scholar]

- Tcharo, H.; Vorobyev, A.E.; Vorobyev, K.A. Digitalization of the oil industry: Basic approaches and rationale for “intelligent” technologies. Eurasian Sci. J. 2018, 2, 1–17. Available online: https://esj.today/PDF/88NZVN218.pdf (accessed on 30 January 2022).

- Mazakov, E.B. Knowledge representation and processing in information automated systems of intellectual deposits. J. Min. Inst. 2014, 208, 256–262. [Google Scholar]

- Makhovikov, A.B.; Katuntsov, E.V.; Kosarev, O.V.; Tsvetkov, P.S. Digital Transformation in Oil and Gas Extraction. In Innovation-Based Development of the Mineral Resources Sector: Challenges and Prospects—11th Conference of the Russian-German Raw Materials, Potsdam, Germany, 7–8 November 2018; CRC Press: Boca Raton, FL, USA, 2018; pp. 531–538. [Google Scholar]

- Eryomin, N.A.; Dmitrievsky, A.N. Digital development of Russian Arctic zone: Status and best practices. Reg. Energy Energy Conserv. 2018, 3, 60–61. [Google Scholar]

- Pashali, A.A.; Kolonskikh, A.V.; Khalfin, R.S.; Silnov, D.V.; Topolnikov, A.S.; Latypov, B.M.; Urazakov, K.R.; Katermin, A.V.; Palaguta, A.A.; Enikeev, R.M. A digital twin of well as a tool of digitalization of bringing the well on to stable production in bashneft pjsoc. Neftyanoe Khozyaystvo Oil Ind. 2021, 3, 80–84. [Google Scholar] [CrossRef]

- Clemens, T.; Viechtbauer-Gruber, M. Impact of digitalization on the way of working and skills development in hydrocarbon production forecasting and project decision analysis. SPE Reserv. Eval. Eng. 2020, 23, 1358–1372. [Google Scholar] [CrossRef]

- Shishkin, A.N.; Timashev, E.O.; Solovykh, V.I.; Volkov, M.G.; Kolonskikh, A.V. Bashneft digital transformation: From concept design to implementation. Oil Ind. 2019, 3, 7–12. [Google Scholar] [CrossRef]

- Litvinenko, V.S.; Tsvetkov, P.S.; Dvoynikov, M.V.; Buslaev, G.V. Barriers to implementation of hydrogen initiatives in the context of global energy sustainable development. J. Min. Inst. 2020, 244, 428–438. [Google Scholar] [CrossRef]

- Linnik, Y.N.; Kiryukhin, M.A. Digital technologies in the oil and gas complex. State Manag. Univ. Bull. 2019, 7, 37–40. [Google Scholar]

- Eryomin, N.A.; Dmitrievsky, A.N.; Tikhomirov, L.I. Present and future of intellectual deposits. Oil Gas Innov. 2015, 12, 44–49. [Google Scholar]

- Dmitrievskiy, A.N.; Eryomin, N.A.; Stolyarov, V.E. Digital transformation of gas production. IOP Conf. Ser. Mater. Sci. Eng. 2019, 700, 012052. [Google Scholar] [CrossRef]

- Timchuk, D.D. “Smart wells” technology application at Salym group of deposits illustrated with the example of Western Salym. Sci. Forum. Sib. 2017, 3, 11. [Google Scholar]

- Kondeikina, K.V.; Tsoi, I.V. “Smart wells” technology application illustrated with the example of Western Salym. Acad. J. Sib. 2017, 13, 9. [Google Scholar]

- The Results of Russian Ministry of Energy Work and the Main Results of the Fuel and Energy Complex Functioning in 2020. Tasks for 2021 and the Medium Term. Available online: https://minenergo.gov.ru/node/20515 (accessed on 30 January 2022).

- Passport of the Innovative Development Program by “Gazprom Neft” PJSC until 2025. Saint Petersburg: “Gazprom Neft” PJSC. 2020. Available online: https://www.gazprom.ru/f/posts/97/653302/prir-passport-2018-2025.pdf (accessed on 30 January 2022).

- Passport of the Innovative Development Program by “NK ‘Rosneft’” PJSC. Moscow: “NK ‘Rosneft’” PJSC. 2016. Available online: https://www.rosneft.ru/upload/site1/document_file/FU6HdSZ3da.pdf (accessed on 30 January 2022).

- Zaichenko, I.M.; Fadeev, A.M.; Kostyuchenko, A.I. Building trends in the development of the fuel and energy complex enterprises in the Russian Federation in the context of digital business transformation. South Russ. State Polytech. Univ. (NPI) Bull. 2021, 3, 162–181. [Google Scholar]

- Dvoynikov, M.V.; Kunshin, A.A.; Blinov, P.A.; Morozov, V.A. Development of Mathematical Model for Controlling Drilling Parameters with Screw Downhole Motor. Int. J. Eng. IJE Trans. A Basics 2020, 7, 1423–1430. [Google Scholar]

- Litvinenko, V.S.; Dvoynikov, M.V. Methodology for determining the parameters of drilling mode for directional straight sections of well using screw downhole motors. J. Min. Inst. 2020, 241, 105–112. [Google Scholar] [CrossRef]

- Belozerov, I.P.; Gubaidullin, V. On the concept of technology for determining filtration-capacitance properties of terrigenous reservoirs on a digital core model. J. Min. Inst. 2020, 244, 402–407. [Google Scholar] [CrossRef]

- Prishchepa, O.M.; Borovikov, I.S.; Grokhotov, E.I. Oil and gas potential of the little-studied part of the north-west of the Timan-Pechora oil and gas province according to the results of basin modeling. J. Min. Inst. 2021, 247, 66–81. [Google Scholar] [CrossRef]

- Official Website of “Gazprom Neft” Scientific and Technical Center. Available online: https://ntc.gazprom-neft.ru/ (accessed on 30 January 2022).

- Razmanova, S.V.; Andrukhova, O.V. Oilfield service companies in the framework of economy digitalization: Assessment of innovative development prospects. J. Min. Inst. 2020, 244, 482–492. [Google Scholar] [CrossRef]

- Idrisova, S.A.; Tugarova, M.A.; Stremichev, E.V.; Belozerov, B.V. Digital core. integration of carbonate rocks thin section studies with results of routine core tests. PRONEFT’. Professional’no o Nefti 2018, 2, 36–41. [Google Scholar] [CrossRef][Green Version]

- Erofeev, A.A.; Nikitin, R.N.; Mitrushkin, D.A.; Golovin, S.V.; Baykin, A.N.; Osiptsov, A.A.; Paderin, G.V.; Shel, E.V. BCYBER FRAC—Software platform for modeling, optimization and monitoring of hydraulic fracturing operations. Neftyanoye Khozyastvo 2019, 12, 64–68. Available online: https://www.oil-industry.net/Journal/archive_detail.php?art=235137 (accessed on 30 January 2022). [CrossRef]

- “NK ‘Rosneft’s’” Annual Report for Year 2019. Available online: https://www.rosneft.ru/upload/site1/document_file/a_report_2019.pdf (accessed on 30 January 2022).

- Rosneft Expands the Geography of the Use of Unmanned Aerial Vehicles to Control the Level of Greenhouse Gases. Available online: https://www.rosneft.ru/press/news/item/207499 (accessed on 30 January 2022).

- RN Digital. Software by “NK ‘ROSNEFT’” PJSC in the Sphere of Field Development. Available online: https://rn.digital/ (accessed on 30 January 2022).

- Lukoil-Technologies Expand the Possibilities of a Unified Information Space. LUKOIL-Technologies. Available online: https://technologies.lukoil.ru/ru/News/News?rid=539160 (accessed on 30 January 2022).

- “LUKOIL” PJSC’s Annual Report. Available online: https://lukoil.ru/FileSystem/9/551394.pdf (accessed on 30 January 2022).

- “Tatneft’s” Official Website. Available online: https://tatneft.ru/press-tsentr/press-relizi/more/8020/?lang=ru (accessed on 30 January 2022).

- “NOVATEK’s” Annual Report 2017. Transformation into a Global Gas Company. Available online: https://docplayer.com/80367186-Transformaciya-v-globalnuyu-gazovuyu-kompaniyu-godovoy-otchet.html (accessed on 30 January 2022).

- “NOVATEK’s” Sustainability Report for Year 2020. Available online: https://www.novatek.ru/common/upload/doc/NOVATEK_SR_2020_RUS.pdf (accessed on 30 January 2022).

- Digitalization of the Industry: Why Oil and Gas Companies Are Introducing Voice Assistants? Available online: https://neftegaz.ru/science/tsifrovizatsiya/711911-tsifrovizatsiya-otrasli-zachem-neftegazovye-kompanii-vnedryayut-golosovykh-pomoshchnikov/ (accessed on 30 January 2022).

- Titkov, I.A. Digital gap in the sphere of technologies on extraction and production of liquefied natural gas: A strategic factor in weakening the economic security of the country. Econ. Soc. Mod. Models Dev. 2020, 10, 309–329. [Google Scholar]

- Gazprom Digital Project Services. A Single Digital Platform. Available online: https://gazpromcps.ru/?page_id=29#section-briefcase (accessed on 30 January 2022).

- The Management Board Approved Gazprom Group’s Digital Transformation Strategy for 2022–2026. Available online: https://www.gazprom.ru/press/news/2021/december/article545124/ (accessed on 30 January 2022).

- “NK ‘Rosneft’s” Annual Report for Year 2020. Available online: https://www.rosneft.ru/upload/site1/document_file/a_report_2020.pdf (accessed on 30 January 2022).

- Pravikov, D.I. Actual approaches to ensuring the safety of industrial automation systems. Methods Tech. Means Ensuring Inf. Secur. 2020, 29, 15–17. [Google Scholar]

- Steve Krouskos Our Capital Confidence Barometer Survey Forms Part of a Wider Range of Insights on the COVID-19 Crisis. Available online: https://www.ey.com/en_ru/ccb/how-do-you-find-clarity-in-the-midst-of-covid-19-crisis (accessed on 30 January 2022).

- Made in Russia: Overview of 20 Russian Operating Systems. Available online: https://3dnews.ru/958857/made-in-russia-obzor20-rossiyskih-operatsionnih-sistem (accessed on 26 February 2022).

- Is There Life on the Russian OS Market? Overview of Popular Russian OS. Available online: https://habr.com/ru/company/digdes/blog/442906/ (accessed on 26 February 2022).

- Comparison of Baikal-M and Elbrus-8SV Processors. Available online: https://habr.com/ru/company/icl_services/blog/558564/ (accessed on 26 February 2022).

- CNA: Semiconductor Manufacturer TSMC Has Stopped Deliveries to Russia. Available online: https://ria.ru/20220227/tayvan-1775376385.html (accessed on 30 January 2022).