Evaluating the Downstream Development Strategy of Oil Companies: The Case of Rosneft

Abstract

:1. Introduction

- to create predictive models of refinery development strategy based on data from a large Russian company;

- to evaluate modernisation strategies for balancing a product line with different margins;

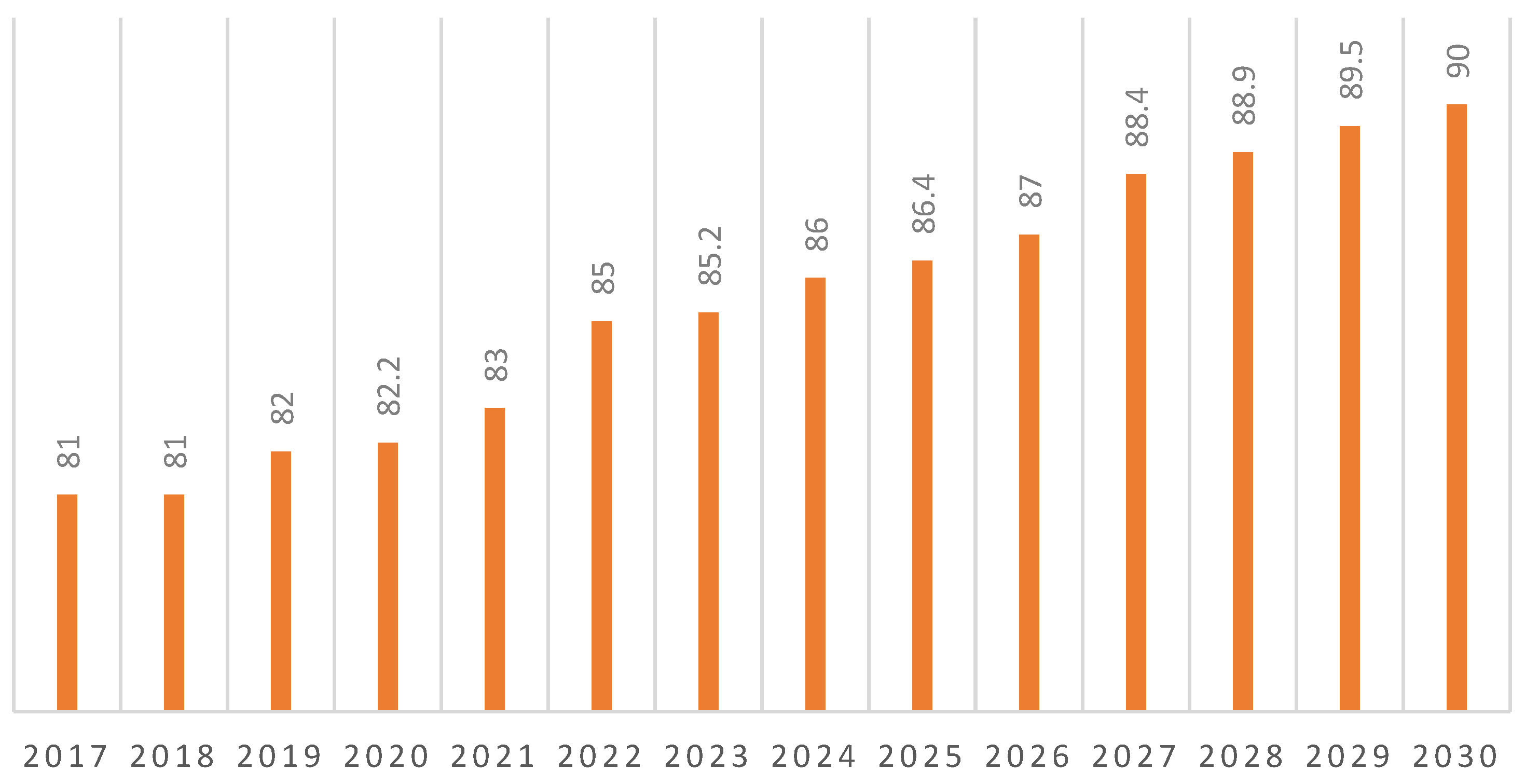

- to analyse the level of attainment of world average product quality and industry forecasts.

2. Literature Review

2.1. Theoretical Basis for the Formation of the Strategy

2.2. Analysis of Modern Problems in the Downstream Sector in the Russian Federation

2.3. An Overview of the Strategies and Priorities of Russian Refining Companies

3. Materials and Methods

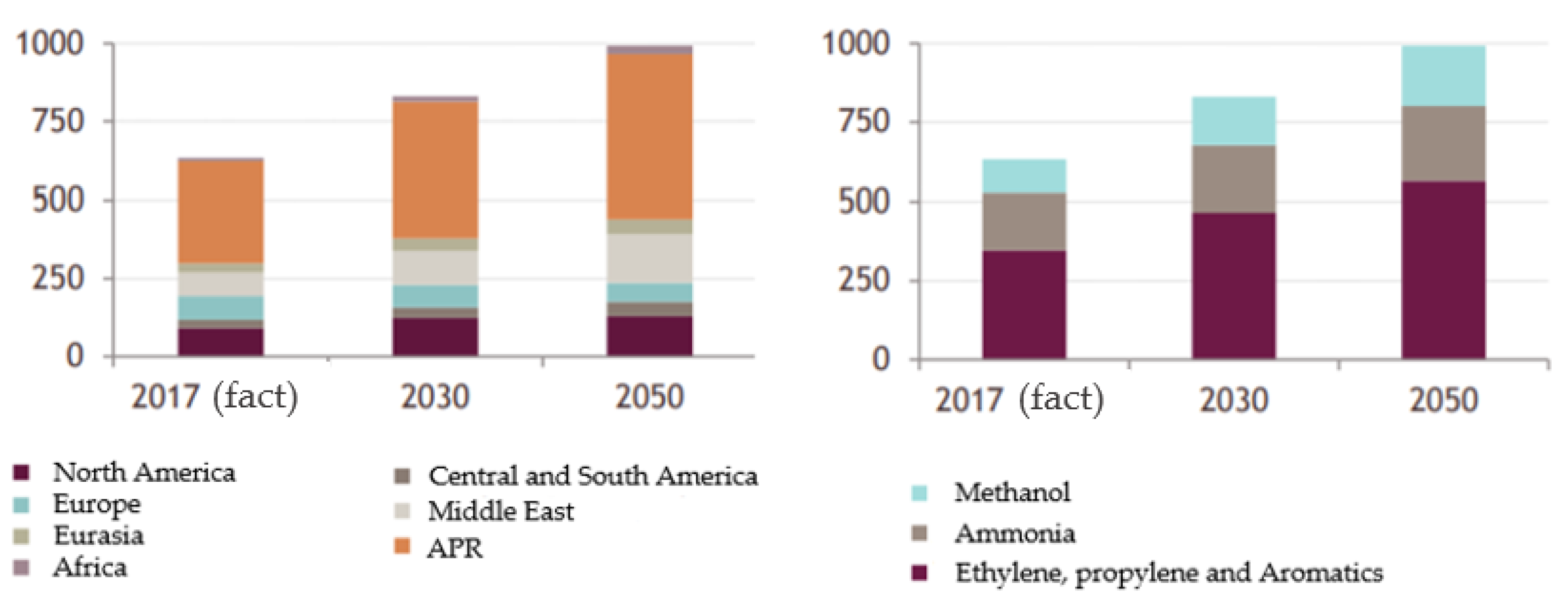

- the increased consumption of chemicals and petrochemicals to the level of industrialised countries;

- the creation of highly productive jobs;

- the transition to an innovative and investment-driven development model by increasing the depth of processing.

4. Results

4.1. Economic Evaluation of the Strategy No. 1

- increasing production efficiency and strengthening the position of the Kuibyshev Refinery (Rosneft);

- a reduction in the production of fuel oil and an increase in the production of light products (including Euro-5 motor fuels).

- increasing the refining depth to 75% by processing heavy residues;

- increased production of high-margin products.

- design and survey work—RUB 1.5 billion;

- licence—about 30 million roubles;

- equipment—RUB 15 billion;

- construction and installation work—RUB 12 billion;

- railway tracks—RUB 50 million;

- other costs.

4.2. Economic Evaluation of Strategy No. 2

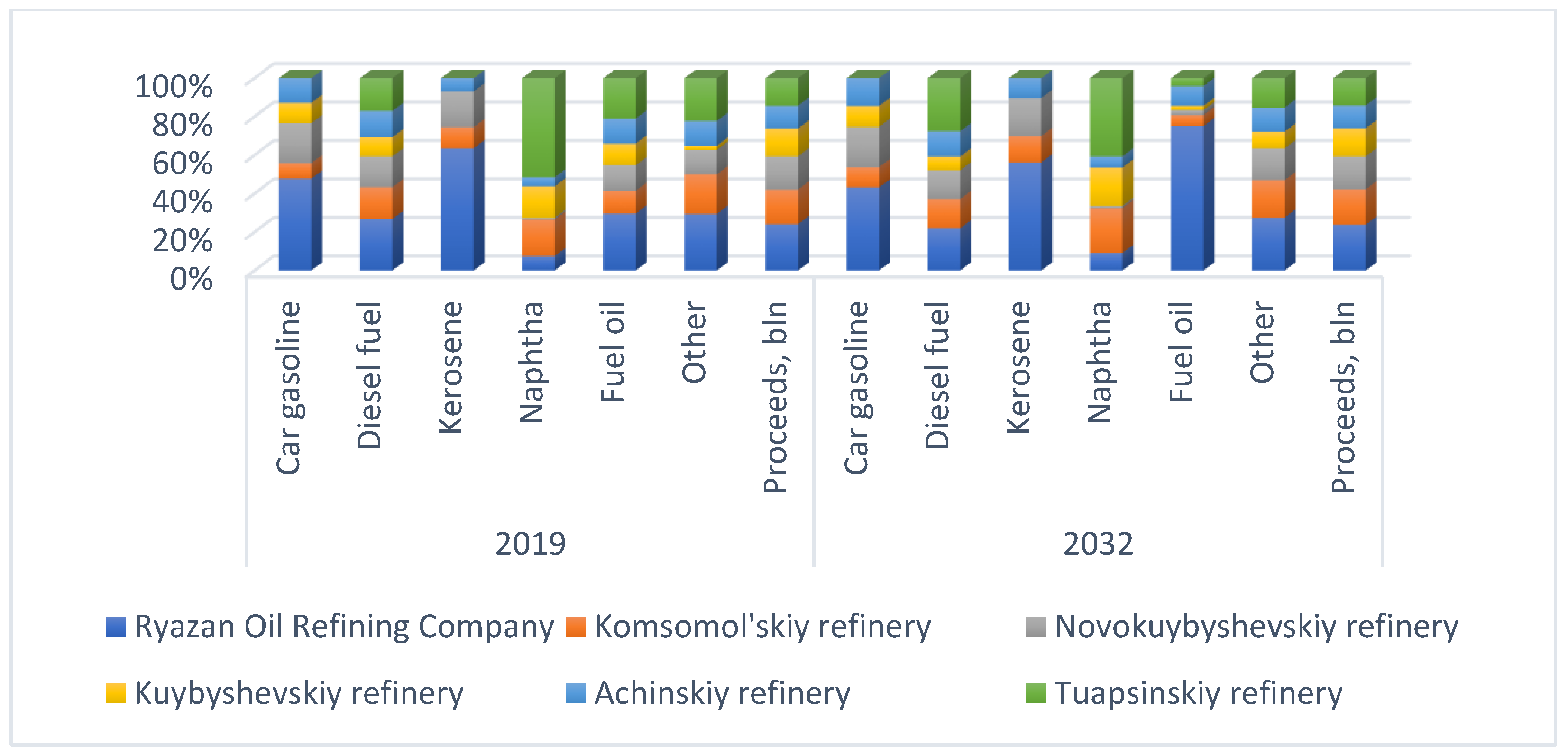

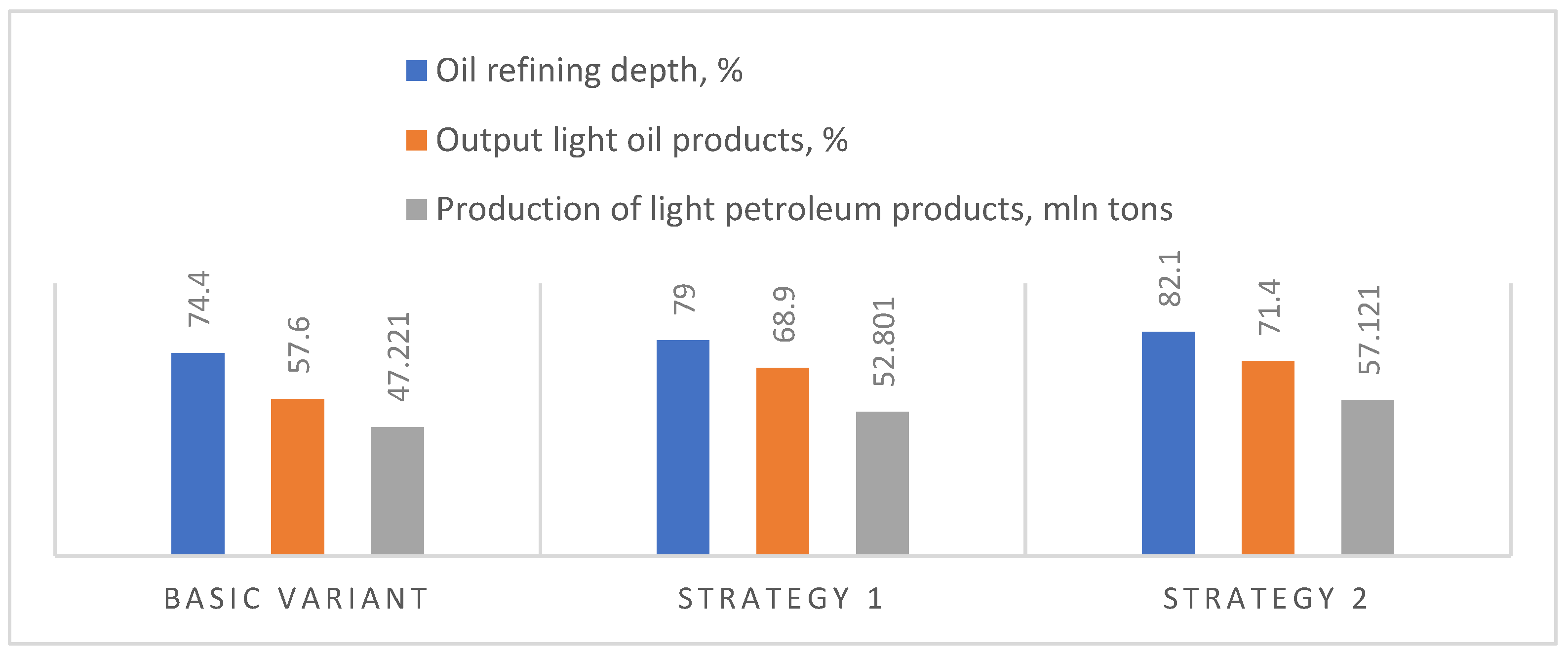

4.3. Comparison of Strategy No. 1 and Strategy No. 2

- Strategy No. 1 will increase the company’s revenue in the refining sector to 66.604 billion roubles, which is 22.687 billion roubles more than in the base case (or 152%). Also, on the technical side, the average refining depth at Rosneft’s refinery group will increase to 79% (from 74%), which will improve marginal yield and reduce fuel oil output by 90.6%. The investment of Strategy No. 1 will be approximately RUB 138.8 billion, with a payback period of 6 years;

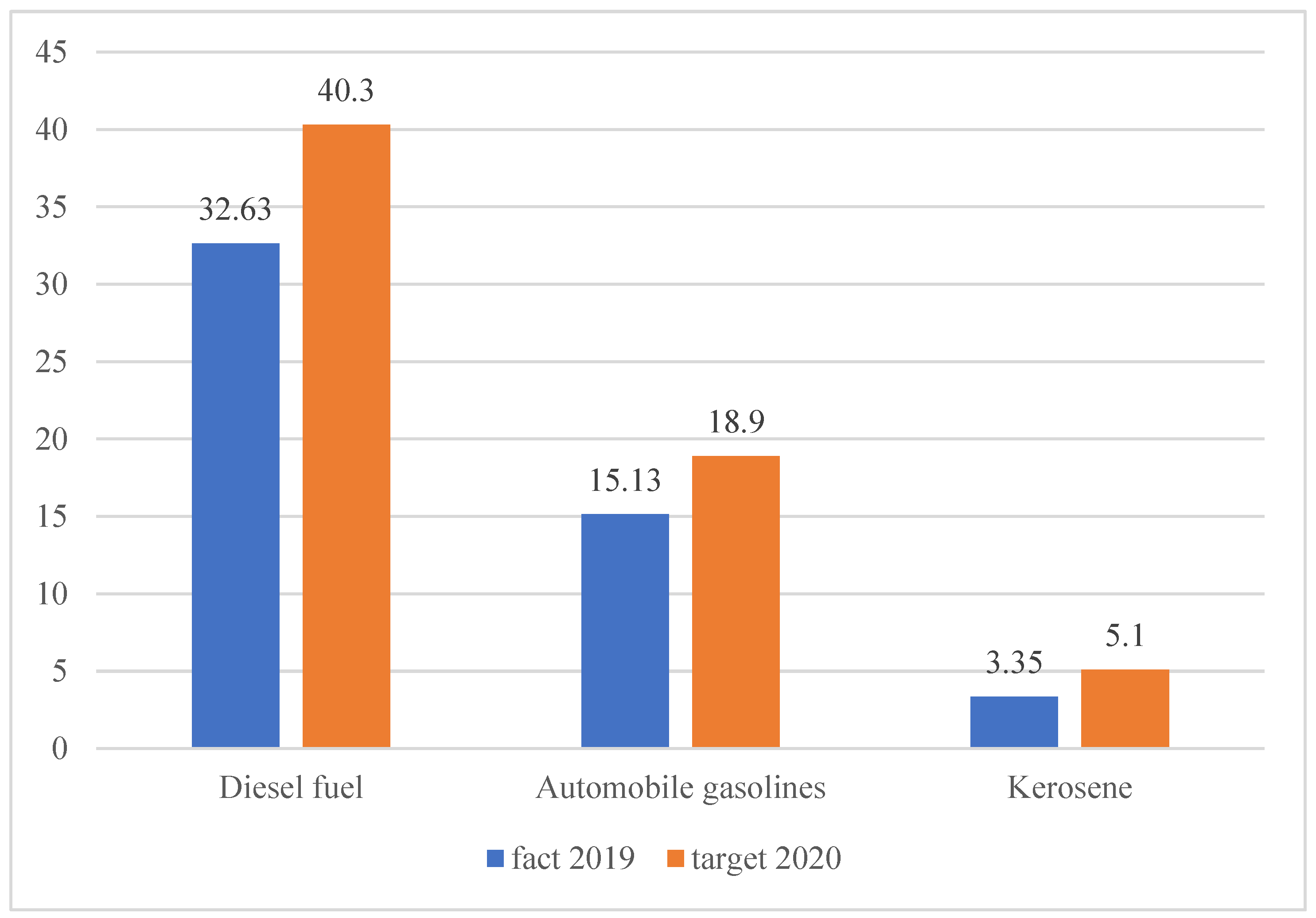

- Strategy No. 2 will increase revenues to RUB 163.694 billion across the six refineries, which is RUB 55.6 billion more than in the base case (or 152%). The depth of refining at the Ryazan refinery will increase from 72.4% to 95%, at the Komsomolsk refinery from 75.9% to 88%, and at the Novokuibyshevsk refinery from 74.2% to 87%. Thus, the average depth of refining at Rosneft will increase from 74.4% to 82.1%, which will increase marginal yield and reduce fuel oil output by 84.5%. The investment of Strategy No. 2 will be approximately RUB 439.7 billion, with a payback period of 6 years. Strategy No. 2 will exceed the company’s 2022 target by increasing diesel output to 41.319 million tonnes (against a target of 40.3 million tonnes), diesel being a product that meets quality standards and can be exported abroad.

5. Discussion

- the depth of processing—by reducing primary processing residues, reducing the share of products used for process purposes, reducing emissions into the atmosphere and lowering energy consumption;

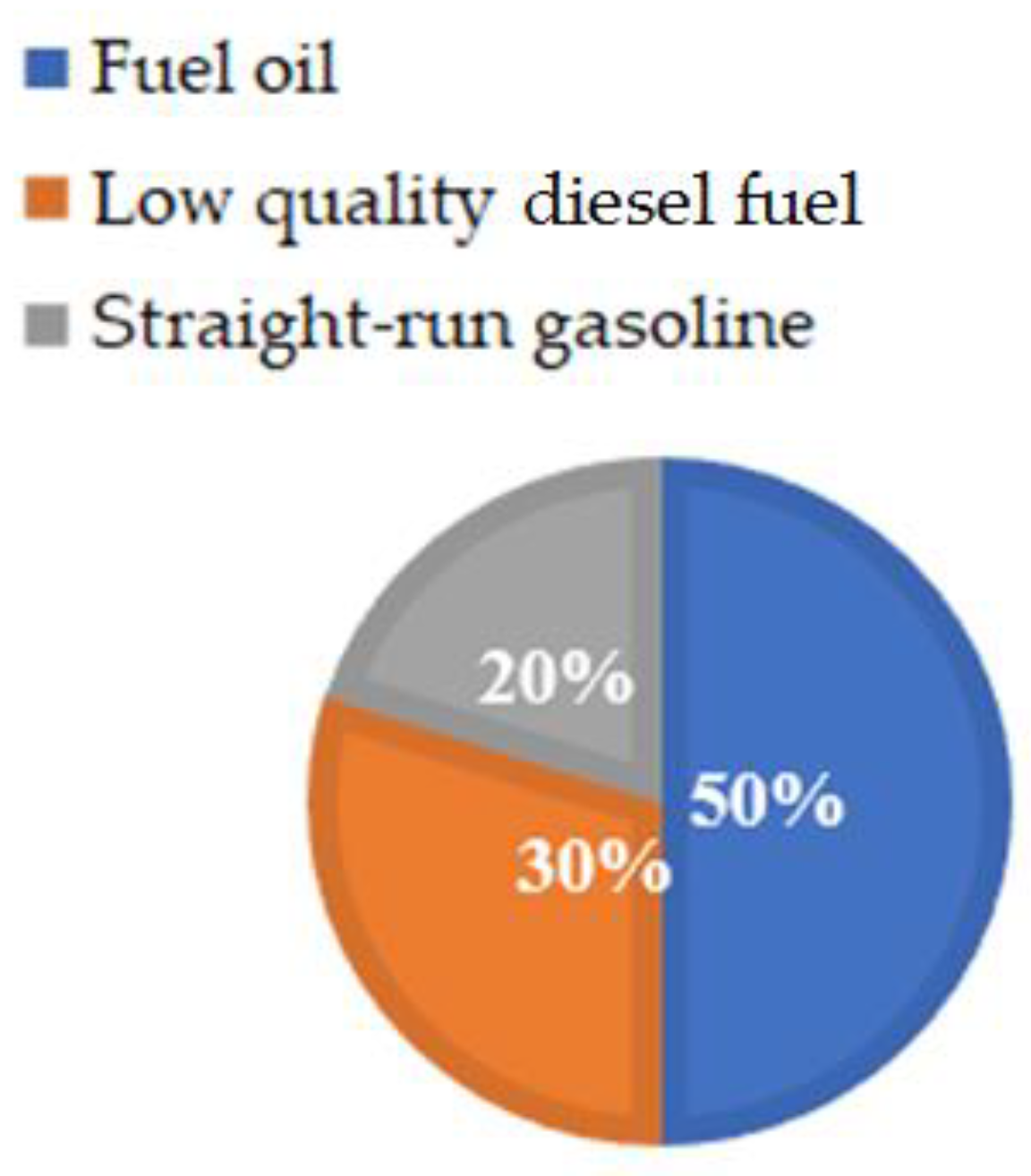

- the percentage of light products output—due to a reduction in the production of fuel oil and other dark products;

- the percentage of renovation of the refinery’s fixed assets.

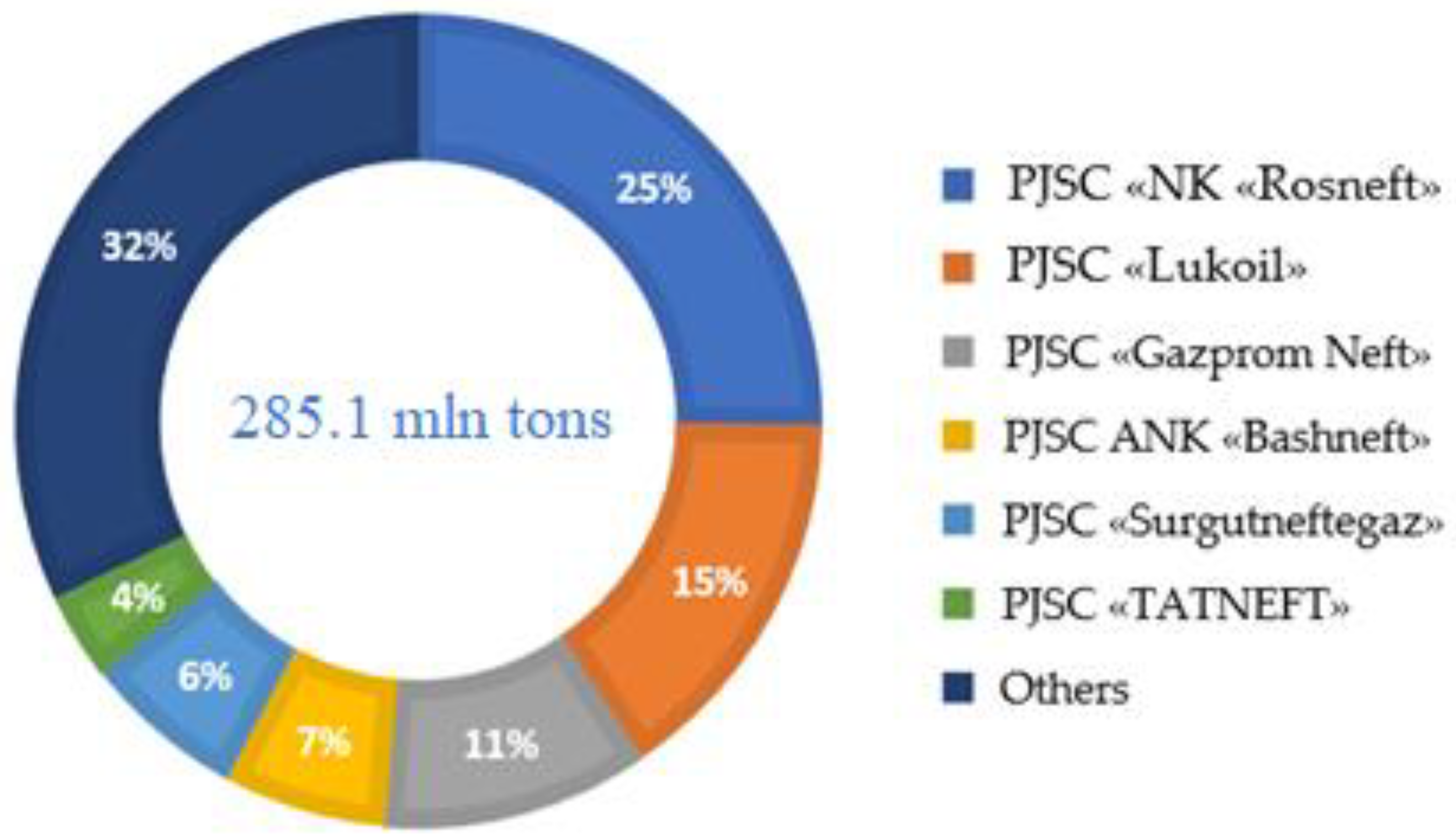

- the study considers the example of one Russian company, the PJSC Rosneft Oil Company, which has 30% of the Russian oil products market;

- the study is limited to an analysis of two possible strategies for upgrading Rosneft’s refining capacity;

- the assessment of project efficiency is presented by indicators of NPV, profitability index and payback period, without taking into account the analysis of project sensitivity to the impact of various risk and uncertainty factors or changes in the main project control parameters, which can significantly change the results in cases of sharp volatility in product prices, growth (reduction) of demand for products and changes in macroeconomic parameters such as credit rates, export duties, introduction of sanctions on hydrocarbon emissions, etc.

6. Conclusions

- An analysis of the existing problems of the downstream sector in the Russian Federation that influence the development of strategic decisions by Russian vertically integrated oil companies has been carried out. The authors show that the main problems in the development of the Russian downstream sector are of a technological nature and that in order to solve them, oil producers must include in their strategies large investments for the purpose of expanding existing facilities in the downstream sector. In order to increase the pace of development of the Russian downstream sector, Russian oil producers should correlate their strategic goals with the strategic objectives set out in the Strategy for the Development of the Chemical and Petrochemical Complex for the period up to 2030;

- The authors conducted an analysis of Rosneft’s operations, which revealed a discrepancy between those operation and the strategic objectives of the downstream sector; the company derives more than half of its profits from the sale of crude oil. As a result of this analysis, the need to develop strategies to improve the efficiency of Rosneft’s operations has been identified;

- To achieve the objectives, the authors formulated two strategies for the development of Rosneft’s downstream sector and assessed their cost-effectiveness. The assessment showed that the implementation of measures under Strategy No. 2 may result in higher rates of growth in the depth of oil refining, production and yield of light petroleum products;

- The authors conclude that the investments made by oil producing companies in upgrading the existing refining facilities can provide solutions to the problem of improving product quality: namely, increasing the depth of oil refining and raising the Nelson Index to European levels. However, as proved by the authors, these strategic decisions cannot ensure the achievement of indicators of industrial development, such as a reduction in the share of imports and an increase in the share of exports of chemical products. In order to achieve these indicators, the strategic objectives of oil producing companies should be to expand existing oil refining capacities and to build new refineries.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Shestakova, I.G. To the question of the limits of progress: Is singularity possible? Vestn. Saint Petersbg. Univ. Philos. Confl. Stud. 2018, 34, 391–401. [Google Scholar] [CrossRef]

- Pashkevich, N.V.; Tarabarinova, T.A.; Golovina, E.I. Problems of reflecting information on subsoil assets in International Financial Reporting Standards. Acad. Strateg. Manag. J. 2018, 17, 1–9. [Google Scholar]

- Dmitrieva, D.M.; Romasheva, N.V. Sustainable development of oil and gas potential of the Arctic and its shelf zone: The role of innovations. J. Mar. Sci. Eng. 2020, 8, 1003. [Google Scholar] [CrossRef]

- Information and Analytical Agency Central Dispatch Office of the Fuel and Energy Complex “Petrochemical Projects”. 20 March 2019. Available online: http://www.cdu.ru/tek_russia/Articles/2/558/ (accessed on 2 August 2021). (In Russian).

- Litvinenko, V.S.; Tsvetkov, P.S.; Molodtsov, K.V. The social and market mechanism of sustainable development of public companies in the mineral resource sector. Eurasian Min. 2020, 2020, 36–41. [Google Scholar] [CrossRef]

- Nedosekin, A.O.; Rejshahrit, E.I.; Kozlovskiy, A.N. Strategic approach to assessing economic sustainability objects of mineral resources sector of Russia. J. Min. Inst. 2019, 237, 354–360. (In Russian) [Google Scholar] [CrossRef]

- Rejshahrit, E.I. Features of energy efficiency management in refineries. J. Min. Inst. 2016, 219, 490–497. (In Russian) [Google Scholar]

- Electronic National Industry Journal “Oil and Gas Vertical”. Available online: http://www.ngv.ru/magazines/article/rossiyskaya-neftepererabotka-na-sovremennom-etape-razvitiya/?sphrase_id=3128172 (accessed on 2 August 2021). (In Russian).

- Electronic Magazine Neftegaz.ru “Refinery (Refinery)”. 10 September 2018. Available online: https://neftegaz.ru/tech-library/pererabotka-nefti-i-gaza/142499-neftepererabatyvayushchiy-zavod-npz/ (accessed on 2 August 2021). (In Russian).

- Jenster, P.; Hussey, D. Analysis of a Company’s Strengths and Weaknesses: Identifying Strategic Opportunities; Translated from English; Publishing House Williams: Moscow, Russia, 2003; 368p. (In Russian) [Google Scholar]

- Evans, V. Key Strategic Tools. 88 Tools Every Manager Should Know; Publishing House Binom. Knowledge Lab: Moscow, Russia, 2021; 456p. (In Russian) [Google Scholar]

- Feigelman, N.V. Analytical substantiation of the company’s strategic development. Bull. Educ. Consort. Cent. Russ. Univ. Ser. Econ. Manag. 2017, 9, 69–71. [Google Scholar]

- Thompson, A.A., Jr.; Strickland, A.J., II. Strategic Management. Concepts and Situations for Analysis; Publishing House Williams: Moscow, Russia, 2007; 928p. (In Russian) [Google Scholar]

- Khanilo, D.A. Analysis of the current state and problems of functioning of enterprises of oil refining and petrochemical complex at the present stage. Young Sci. 2019, 35, 49–53. (In Russian) [Google Scholar]

- Energy Strategy of the Russian Federation to 2035. Available online: https://minenergo.gov.ru/node/1026 (accessed on 2 August 2021). (In Russian)

- Order No. 651/172 of 8 April 2014 “On Approval of the Strategy for the Development of the Chemical and Petrochemical Complex for the Period Up to 2030”. Available online: http://docs.cntd.ru/document/420245722 (accessed on 2 August 2021). (In Russian).

- Information and Analysis Agency of the Central Dispatch Office of the Fuel and Energy Complex “The US Oil and Refining Industry”. 15 April 2020. Available online: https://www.cdu.ru/tek_russia/articles/1/736/ (accessed on 2 August 2021). (In Russian).

- Information and Analytical Agency of the Central Dispatch Directorate of the Fuel and Energy Complex “Russian-Japanese Cooperation in the Fuel and Energy Sector”. 20 May 2020. Available online: https://www.cdu.ru/tek_russia/articles/1/750/?PAGEN_1=8 (accessed on 2 August 2021). (In Russian).

- Information and Analysis Agency Central Dispatch Office of the Fuel and Energy Complex “Oil and Refining Industry in Germany”. 17 July 2020. Available online: https://www.cdu.ru/tek_russia/articles/1/773/?PAGEN_1=2 (accessed on 2 August 2021). (In Russian).

- Information and Analysis Agency Central Dispatch Administration of the Fuel and Energy Complex “Oil and Refining Industry of China”. 30 March 2020. Available online: https://www.cdu.ru/tek_russia/articles/1/725/?PAGEN_1=2 (accessed on 2 August 2021). (In Russian).

- RiaRating Analytical Bulletin. “Chemical Production: Trends and Forecasts”. Issue No. 23, Results of January–June 2016. Available online: http://vid1.rian.ru/ig/ratings/chemistry_sample.pdf (accessed on 2 August 2021). (In Russian).

- Analytical Centre under the Government of the Russian Federation. Available online: https://ac.gov.ru/files/publication/a/19119.pdf (accessed on 2 August 2021). (In Russian)

- PJSC Gazprom Neft Annual Report 2019. Available online: https://ir.gazprom-neft.ru/reports-and-results/annual-reports/ (accessed on 2 August 2021). (In Russian).

- Annual Report PJSC “Surgutneftegas” for 2019. Available online: https://www.surgutneftegas.ru/investors/reporting/godovye-otchety/ (accessed on 2 August 2021). (In Russian).

- Annual Report of PJSC TATNEFT for 2019. Available online: https://www.tatneft.ru/storage/block_editor/files/ff073d3c825320e4709391e336c0ec350e599b49.pdf (accessed on 2 August 2021). (In Russian).

- Ponomarenko, T.; Nevskaya, M.; Marinina, O. An assessment of the applicability of sustainability measurement tools to resource-based economies of the commonwealth of independent states. Sustainability 2020, 12, 5582. [Google Scholar] [CrossRef]

- Vasilenko, N.; Khaykin, M.; Kirsanova, N.; Lapinskas, A.; Makhova, L. Issues for development of economic system for subsurface resource management in Russia through lens of economic process servitization. Int. J. Energy Econ. Policy 2020, 10, 44–48. [Google Scholar] [CrossRef]

- Kirsanova, N.Y.; Lenkovets, O.M. Influence of railroad industry on social and economic development of Russia. In Proceedings of the 19th International Multidisciplinary Scientific Geoconference, Sofia, Bulgaria, 28 June–7 July 2019; pp. 421–428. [Google Scholar] [CrossRef]

- Annual Reports of Rosneft for 2014–2019. Available online: https://www.rosneft.ru/Investors/statements_and_presentations/annual_reports/ (accessed on 2 August 2021). (In Russian).

- Guide to Cost-Benefit Analysis of Investment Projects. 1997. Available online: https://ec.europa.eu/regional_policy/sources/docgener/guides/cost/guide02_en.pdf (accessed on 19 September 2021).

- Annual Report of PJSC Rosneft for 2019. Available online: https://www.rosneft.ru/upload/site1/document_file/a_report_2019.pdf (accessed on 2 August 2021). (In Russian).

- Author’s Team of the Gubkin Russian State University of Oil and Gas under the Supervision of Ph.D.; Bagdasarov, L.N. Popular Oil Refining; Publisher LLC TsSP Platform: Moscow, Russia, 2017; 111p. (In Russian) [Google Scholar]

- LUKOIL Completes Refinery Upgrade with Launch of VGO Hydrocracking Complex. Available online: https://arsenalgroup.ru/news/1795 (accessed on 19 September 2021). (In Russian).

- Neftegaz.ru Electronic Magazine “Heavy Oil Residues”. 17 May 2017. Available online: https://neftegaz.ru/tech-library/pererabotka-nefti-i-gaza/142379-tyazhelye-neftyanye-ostatki/ (accessed on 2 August 2021). (In Russian).

- Tokareva, N.A. Analysis of the cost of firm’s capital (on the example of JSC “GAZPROM CENTREENERGOGAZ”). Soc. State Pers. Youth Entrep. Behav. Econ. 2020, 248–258. (In Russian) [Google Scholar]

- Shigaev, A.I. Ensuring long-term profitability of enterprises on the basis of development strategy. Econ. Anal. Theory Pract. 2008, 9, 42–53. (In Russian) [Google Scholar]

- Report on the Long-Term Forecast of Deflator Indices and Inflation up to 2030 by the Ministry of Economic Development of the Russian Federation. Available online: http://economy.gov.ru/minec/resources/6abc9b804897c56b89d4fb74abf22fc8/pokaz.xls (accessed on 2 August 2021). (In Russian)

- Kuzhaeva, A.; Dzhevaga, N. Particulars of oil structural organization. ARPN J. Eng. Appl. Sci. 2017, 12, 4157–4166. [Google Scholar]

- Kondrasheva, N.; Eremeeva, A.; Nelkenbaum, K.; Baulin, O.A.; Dubovikov, O.A. Development of environmentally friendly diesel fuel. Pet. Sci. Technol. 2019, 37, 1478–1484. [Google Scholar] [CrossRef]

- Eremeeva, A.; Kondrasheva, N.; Nelkenbaum, K. Studying the possibility of improving the properties of environmentally friendly diesel fuels. In Scientific and Practical Studies of Raw Material Issues; CRC Press: Boca Raton, FL, USA, 2020; Volume 2019, pp. 108–113. [Google Scholar]

- Krivtsova, K.B.; Krivtsov, E.B.; Golovko, A.K. Removal of sulfur compounds from diesel fractions by combination of oxidation and extraction. Proc. Tomsk Polytech. Univ. 2011, 3, 116–120. (In Russian) [Google Scholar]

- Zhang, M.; Qin, B.; Zhang, W.; Zheng, J.; Ma, J.; Du, Y.; Li, R. Hydrocracking of Light Diesel Oil over Catalysts with Industrially Modified Y Zeolites. Catalysts 2020, 10, 815. [Google Scholar] [CrossRef]

- Zhang, X.; Wang, Q.; Qin, W.; Guo, L. Sustainable Policy Evaluation of Vehicle Exhaust Control—Empirical Data from China’s Air Pollution Control. Sustainability 2020, 12, 125. [Google Scholar] [CrossRef] [Green Version]

- Taburchinov, R.I.; Belonogov, M.V.; Egorov, R.I. Effect of the Addition of Petrochemicals onto the Atomization and Ignition of the Coal-Water Slurry Prepared from the Wastes. Appl. Sci. 2020, 10, 8574. [Google Scholar] [CrossRef]

- Kuskov, V.B.; Lvov, V.V.; Yushina, T.I. Increasing the recovery ratio of iron ores in the course of preparation and processing. CIS Iron Steel Rev. 2021, 21, 4–8. [Google Scholar] [CrossRef]

- Rosneft Has Planned the Construction of Four VGO Hydrocrackers at Its Refineries in Russia. Available online: https://oilandgasrefining.ru/news/rosneft-zaplanirovala-stroitelstvo-chetyreh-gidrokrekingov-vgo-na-npz-v-rossii/ (accessed on 2 August 2021). (In Russian).

- Handbook of OOO NPP Neftechim/Hydrocracking of Heavy Residues. Available online: https://nefthim.ru/spravochnik/gidrokreking-tjazhelyh-ostatkov (accessed on 2 August 2021). (In Russian).

- Vasilev, Y.; Cherepovitsyn, A.; Tsvetkova, A.; Komendantova, N. Promoting Public Awareness of Carbon Capture and Storage Technologies in the Russian Federation: A System of Educational Activities. Energies 2021, 14, 1408. [Google Scholar] [CrossRef]

- Kutuzova, M. Sea Fever. Sulphur is Squeezed out of Marine Fuel. Kommersant Newspaper “Oil and Gas”. 24 December 2019, Volume 37, p. 2. Available online: https://www.kommersant.ru/doc/4205188 (accessed on 2 August 2021). (In Russian).

| Company | Number of Refineries Belonging to the Company |

|---|---|

| Rosneft (including Bashneft refineries) | 12 |

| PJSC Lukoil | 4 |

| PJSC Gazprom | 3 |

| New Stream Group | 3 |

| PJSC Gazprom Neft | 2 |

| PJSC NGK Slavneft | 2 |

| OJSC Surgutneftegas | 1 |

| Other refineries | 5 |

| Problem | Characteristic | Possible Solutions |

|---|---|---|

| Ageing capacity | A large number of Russia’s refineries were built in the 1940s and 1960s; buildings, facilities, technology and equipment are obsolete. | Construction of new refineries/total replacement of equipment and refining technology/construction of new facilities |

| Low processing depth | At present, refining depth in the Russian Federation is on average 10% less than at US refineries. A large number of remnants after primary processing is used for technological needs. | Allocate investments to modernise equipment to reduce atmospheric emissions and energy consumption |

| Low percentage of light products output | The ratio of light to dark petroleum products in the Russian Federation is 69%, which indicates the production of a large amount of cheap and unpreventable product. Consequently, the country is missing out on the profits that could have been made by selling quality gasoline at new standards. | Reduction in production of fuel oil and other dark oil products/continuation of equipment modernisation |

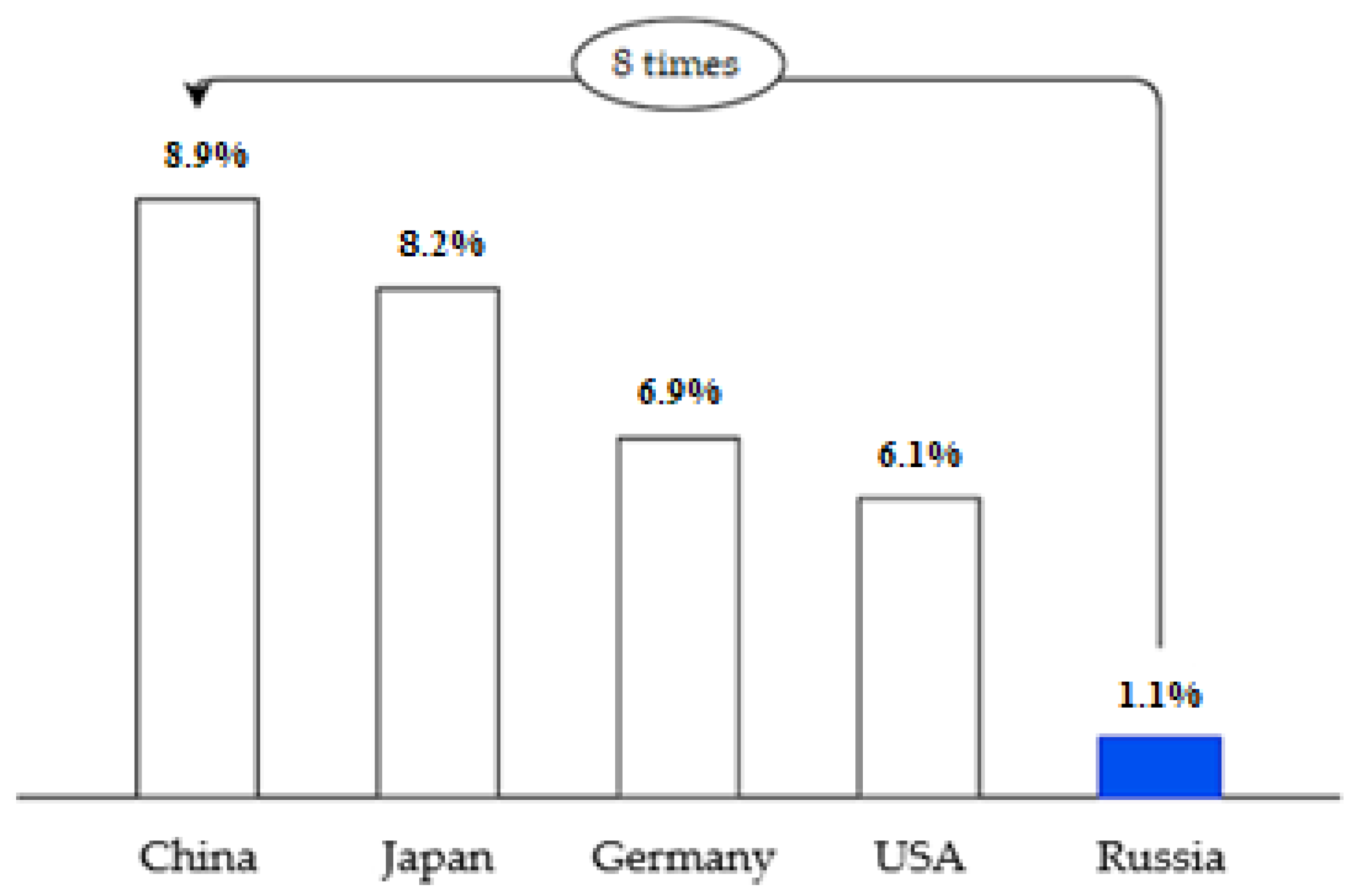

| Low level of the Nelson Index | The current average Nelson index in the RF is 4–5 points, while in European countries it is 8–10 points and in the USA it is 10–12 points. This value of the index indicates the technical “simplicity” of refineries in the Russian Federation. Many Russian refineries have a low number of high-tech recycling units. | Expansion of the technical scheme of refineries, modernisation of production, introduction of newer and more technologically advanced units/allocation of research and development investments to reduce Russia’s dependence on foreign technology |

| Lack of catalysators | Due to the sanctions, some suppliers have stopped supplying catalysts for the production of petroleum products, which has had an impact on the quality of the products produced. | The construction of a modern high-tech catalyst production complex is underway at Gazprom Neft-Omsk Refinery, and a heavy oil hydro-conversion unit using nanoscale catalyst systems is being designed at TANECO. These projects will reduce Russia’s dependence on catalyst supplies from abroad. |

| Low-quality petroleum products | Taken together, the above-mentioned problems result in a drop in the quality of petroleum products, which does not meet the quality standards of many countries, making Russian products uncompetitive abroad. | As a result of addressing the above issues, there will be an increase in the level of product quality. |

| Organisation | Characteristics of the Strategy |

|---|---|

| Gazprom oil [23] | Plans for 2025:

|

| Surgutneftegas [24] | Priority areas:

|

| Tatneft [25] | Strategic objectives 2030:

|

| Target | Indicator |

|---|---|

| The growing importance of the chemical and petrochemical industry in the Russian economy and the development of related industries | 1. Increase the volume of own-produced goods, works and services rendered by own efforts by 2.8 times in 2030 as compared to 2012, which will amount to 6552 billion roubles in this year’s prices. 2. Increase the share of the chemical complex in Russia’s GDP by 2030 to 2.1% (instead of 1.1% in 2012). 3. Maintain annual investments in the development of the chemical complex in the order of 271 bln roubles (2020–2030). |

| Increased consumption of chemicals and petrochemicals to the level of industrialised countries | 4. Increase the consumption of the most important products by 2030:

|

| Creating high-capacity jobs | 5. Increase labour productivity in the chemical complex of the Russian Federation from 4.0 to 21.1 million roubles/person. 6. Ensure an annual increase in high-productive jobs of 90% over the previous year |

| Transition to an innovative and investment-driven development model by increasing the depth of processing | 7. Increase the production of essential products and quality socially oriented products and meet the growing needs of the domestic market for chemicals and new materials, and also expand the range of products. 8. Increase exports during Phase I of the Strategy (2014–2016) by 18% and by 2030 by 3.0 times compared to 2012. 9. Implement effective import substitution and reduce the dependence of the domestic market on the influence of foreign companies, thereby ensuring economic security. 10. Promote the development of technological transport infrastructure to increase the volume and safety of chemical and petrochemical cargo transportation. 11. Promote regional development, formation of interconnected regional production complexes (petrochemical clusters and chemical industrial parks). |

| Product, Thousand Tonnes | Refinery | ||

|---|---|---|---|

| Kuibyshev Refinery | Achinsk Refinery | Tuapse Refinery | |

| 2019 | |||

| Motor gasoline | 746 | 905 | - |

| Diesel fuel | 1584 | 2161 | 2702 |

| Paraffin | - | 118 | - |

| Nafta | 537 | 156 | 1695 |

| Fuel oil | 1628 | 1876 | 3030 |

| Other | 145 | 867 | 1501 |

| Revenue, RUB bln | 15.681 | 12.753 | 15.483 |

| 2032 | |||

| Motor gasoline | 930.6 | 1245 | - |

| Diesel fuel | 1700 | 3161 | 6542 |

| Paraffin | - | 218 | - |

| Nafta | 537 | 156 | 1095 |

| Fuel oil | 81.4 | 379 | 151.5 |

| Other | 645 | 924 | 1139.5 |

| Revenue, RUB billion | 23.986 | 19.393 | 23.225 |

| Product, Thousand Tonnes | Refinery | |||||

|---|---|---|---|---|---|---|

| Ryazan NPK | Komsomolsk Refinery | Novokuibyshevsk Refinery | Kuibyshev Refinery | Achinsk Refinery | Tuapse Refinery | |

| 2022 | ||||||

| Motor gasoline | 3374 | 566 | 1465 | 746 | 905 | - |

| Diesel fuel | 4247 | 2609 | 2534 | 1584 | 2161 | 2702 |

| Paraffin | 1085 | 189 | 317 | - | 118 | - |

| Nafta | 247 | 626 | 30 | 537 | 156 | 1695 |

| Fuel oil | 4268 | 1709 | 1911 | 1628 | 1876 | 3030 |

| Other | 1986 | 1389 | 854 | 145 | 867 | 1501 |

| Revenue, RUB billion | 26.04 | 19.393 | 18.627 | 15.681 | 12.753 | 15.483 |

| 2032 | ||||||

| Motor gasoline | 3714 | 906 | 1805 | 930.6 | 1245 | - |

| Diesel fuel | 5247 | 3609 | 3534 | 1700 | 3161 | 6542 |

| Paraffin | 1185 | 289 | 417 | - | 218 | - |

| Nafta | 247 | 626 | 30 | 537 | 156 | 1095 |

| Fuel oil | 2771 | 212 | 95.55 | 81.4 | 379 | 151.5 |

| Other | 2043 | 1446 | 1229,45 | 645 | 924 | 1139.5 |

| Revenue, RUB billion | 39.06 | 30.0895 | 27.9405 | 23.986 | 19.393 | 23.225 |

| Indicators | Base Case (BV) | Strategy No. 1 | Deviation (+-) from BV, % | Strategy No. 2 | Deviation (+-) from BV, % |

|---|---|---|---|---|---|

| Depth of refining, % | 74.4 | 79.0 | +6.2 | 82.1 | +10.4 |

| Light petroleum product yield, % | 57.6 | 68.9 | +19.6 | 71.4 | +24.0 |

| Production of light petroleum products, million tonnes | 47.221 | 52.801 | +11.8 | 57.121 | +21.0 |

| Costs, RUB billion | - | 138.8 | - | 439.7 | - |

| Product | Base Case | Strategy No. 1 | Strategy No. 2 |

|---|---|---|---|

| Motor gasoline | 13,955 | +525 | +1204 |

| Diesel fuel | 30,754 | +14,956 | +7956 |

| Paraffin | 2512 | +100 | +400 |

| Nafta | 5222 | −600 | −600 |

| Fuel oil | 21,407 | −5922 | −10,922 |

| Other | 12,792 | +196 | +685 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Marinina, O.; Tsvetkova, A.; Vasilev, Y.; Komendantova, N.; Parfenova, A. Evaluating the Downstream Development Strategy of Oil Companies: The Case of Rosneft. Resources 2022, 11, 4. https://doi.org/10.3390/resources11010004

Marinina O, Tsvetkova A, Vasilev Y, Komendantova N, Parfenova A. Evaluating the Downstream Development Strategy of Oil Companies: The Case of Rosneft. Resources. 2022; 11(1):4. https://doi.org/10.3390/resources11010004

Chicago/Turabian StyleMarinina, Oksana, Anna Tsvetkova, Yurii Vasilev, Nadejda Komendantova, and Anna Parfenova. 2022. "Evaluating the Downstream Development Strategy of Oil Companies: The Case of Rosneft" Resources 11, no. 1: 4. https://doi.org/10.3390/resources11010004

APA StyleMarinina, O., Tsvetkova, A., Vasilev, Y., Komendantova, N., & Parfenova, A. (2022). Evaluating the Downstream Development Strategy of Oil Companies: The Case of Rosneft. Resources, 11(1), 4. https://doi.org/10.3390/resources11010004