Veterinary Telemedicine: A System Dynamics Case Study

Abstract

:1. Introduction

1.1. Industry Overview

1.2. Opportunity

- Full time specialists who examine and interpret test materials for the company and have no other veterinary practice.

- Scheduled specialists who examine and interpret test materials for the company on a scheduled basis, but who have their own practice.

- Non-scheduled specialists, who examine and interpret test results for the company on an ad hoc basis, but who have their own practice.

2. Materials and Methods

2.1. Overview of the System Dynamics Method

- Defining problems dynamically, in terms of graphs over time; in system dynamics, these are called “reference modes”.

- Striving for an endogenous, behavioral view of the significant dynamics of a system, a focus inward on the characteristics of a system that themselves generate or exacerbate the perceived problem; this is called a “dynamic hypothesis”.

- Thinking of all concepts in the real system as continuous quantities interconnected in loops of information feedback and circular causality.

- Identifying independent stocks or accumulations (levels) in the system and their inflows and outflows (rates).

- Formulating a behavioral model capable of reproducing, by itself, the dynamic problem of concern. The model is usually a computer simulation model expressed in nonlinear equations, with the stocks being integrations of the flows mentioned in the last point.

- Deriving understandings and applicable policy insights from simulations done using the resulting model.

- Implementing changes resulting from model-based understandings and insights [9].

- Reinforcing feedback, which amplifies disturbances in the loop. Some feedback theorists refer to these as positive feedback loops.

- Balancing feedback, which dampens disturbances in the loop. Some feedback theorists refer to these as negative feedback loops.

2.2. Appropriateness of System Dynamics for This Study

A central tenet of system dynamics is that the complex behaviors of organizational and social systems are the result of ongoing accumulations—of people, material or financial assets, information, or even biological or psychological states—and both balancing and reinforcing feedback mechanisms. The concepts of accumulation and feedback have been discussed in various forms for centuries. System dynamics uniquely offers the practical application of these concepts in the form of computerized models in which alternative policies and scenarios can be tested in a systematic way that answers both “what if and why”.[Emphasis supplied]

2.3. System Dynamics Model Used in This Paper

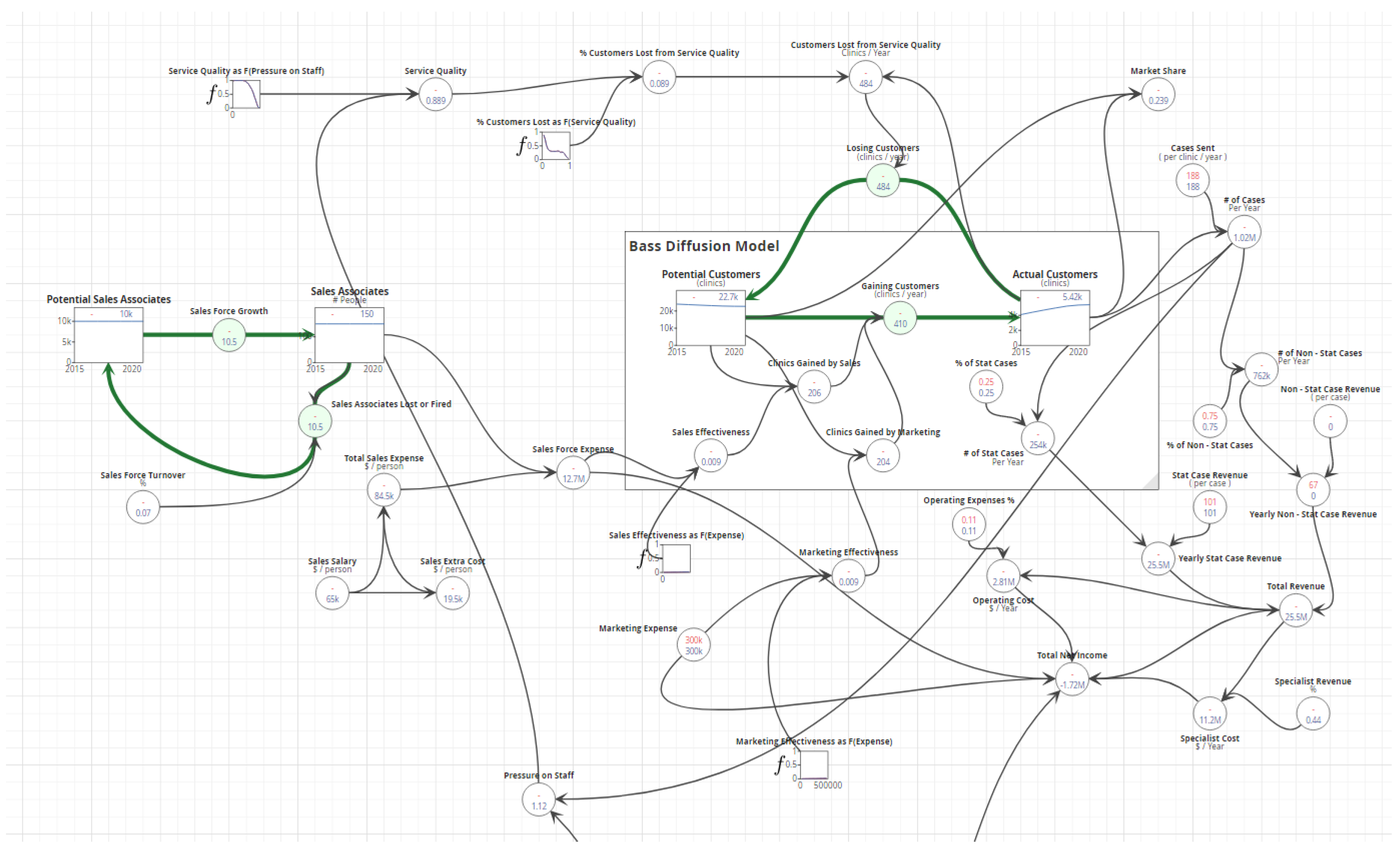

2.3.1. Market Opportunity

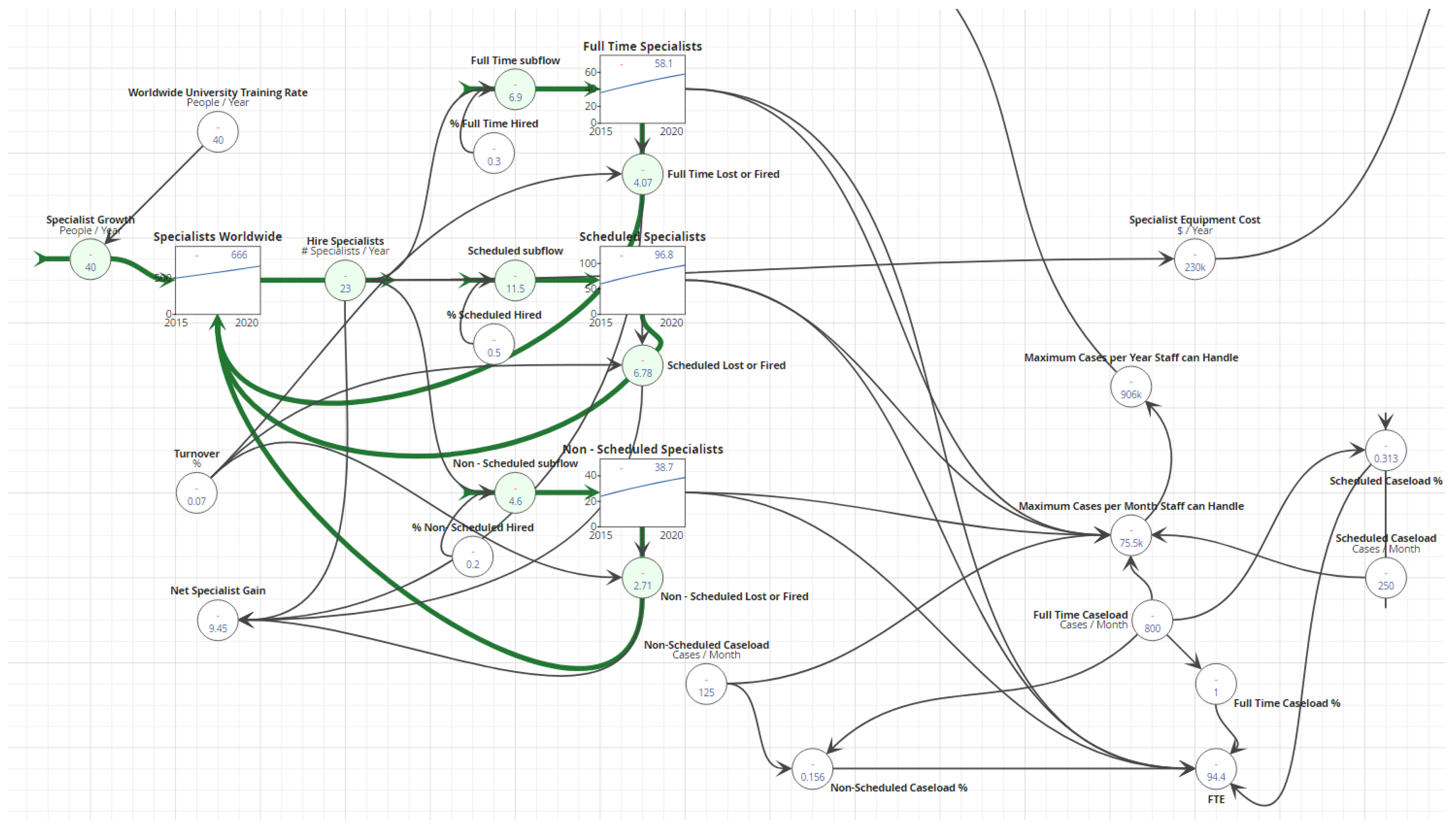

2.3.2. Specialists and Hiring

3. Results and Discussion

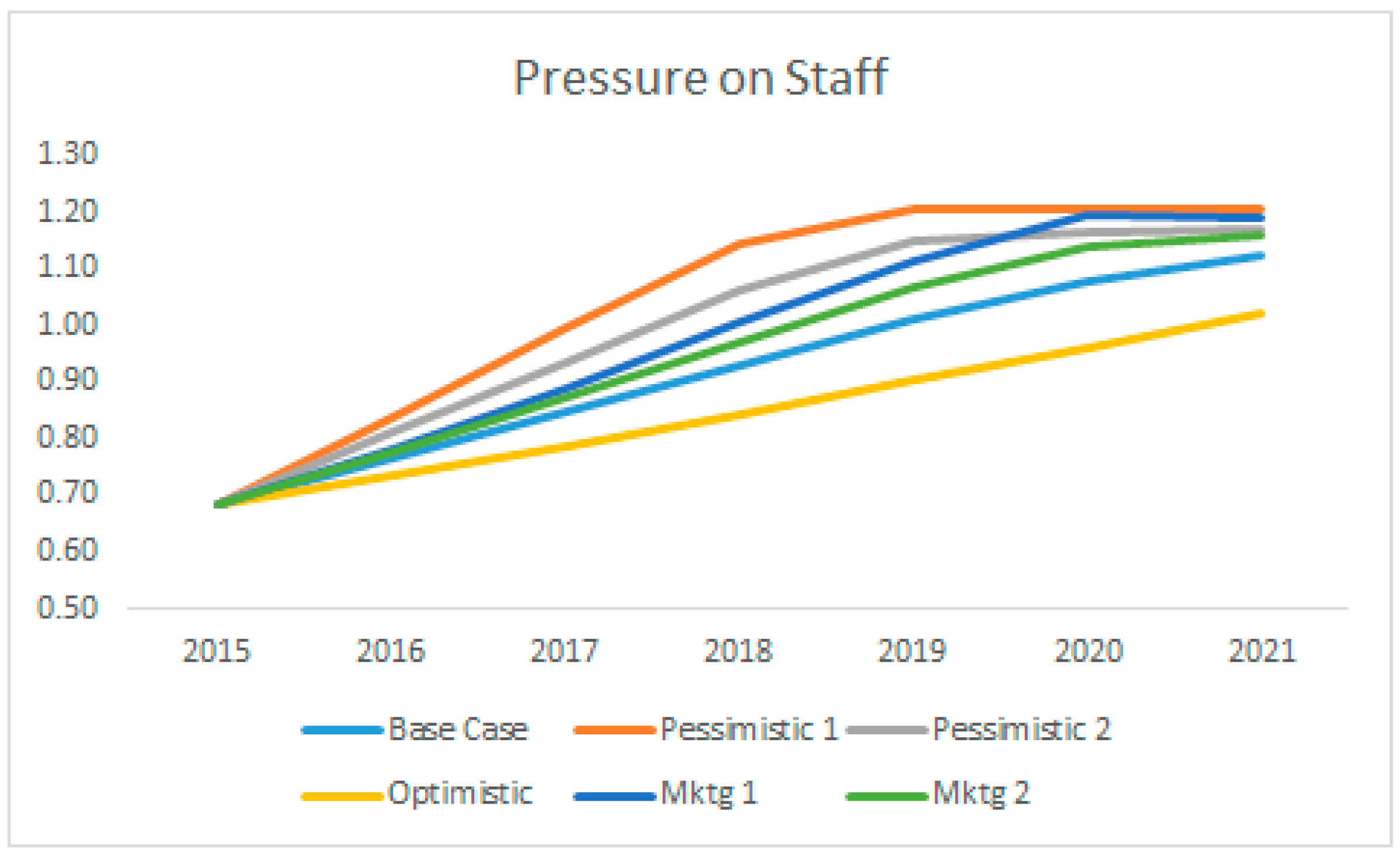

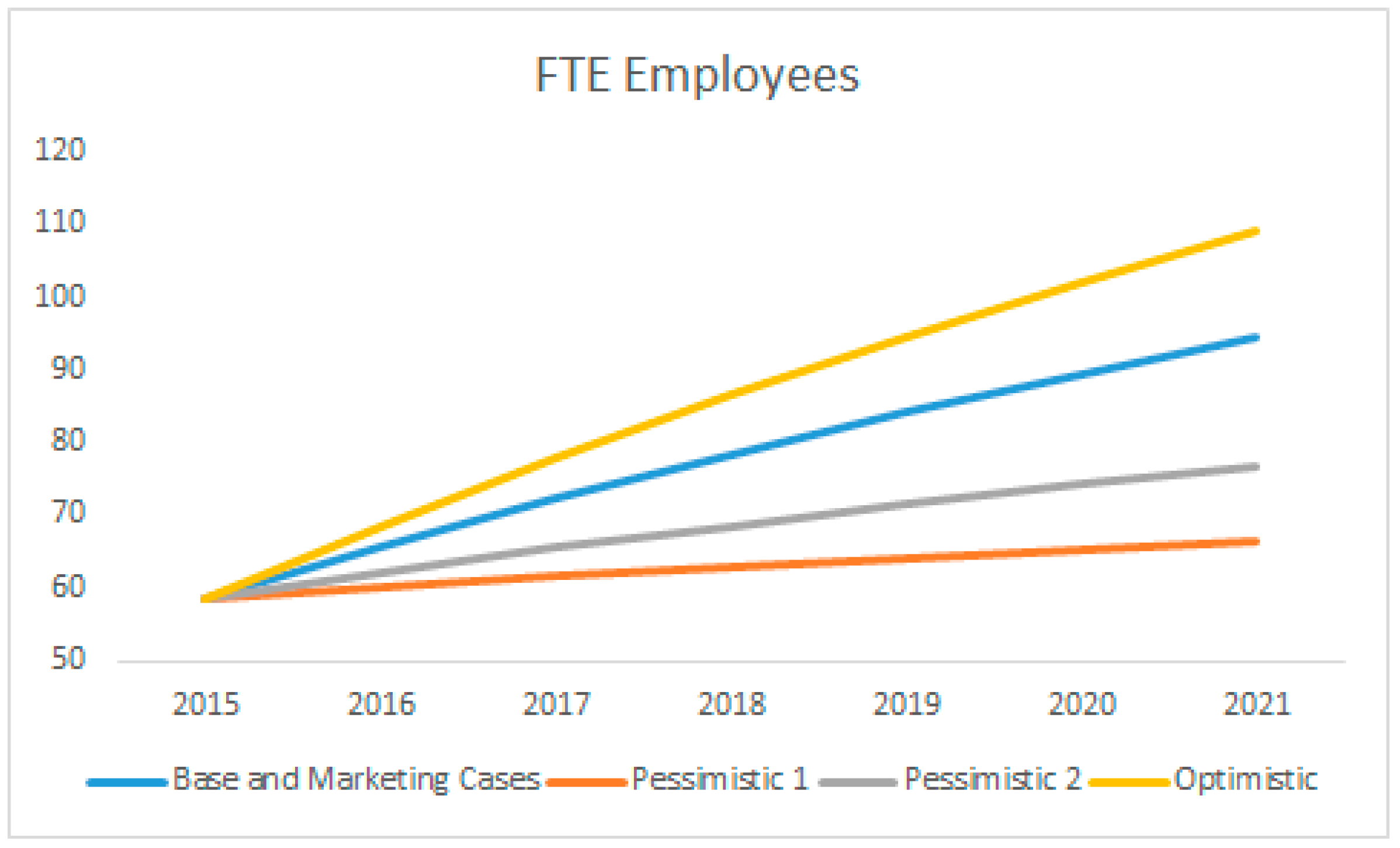

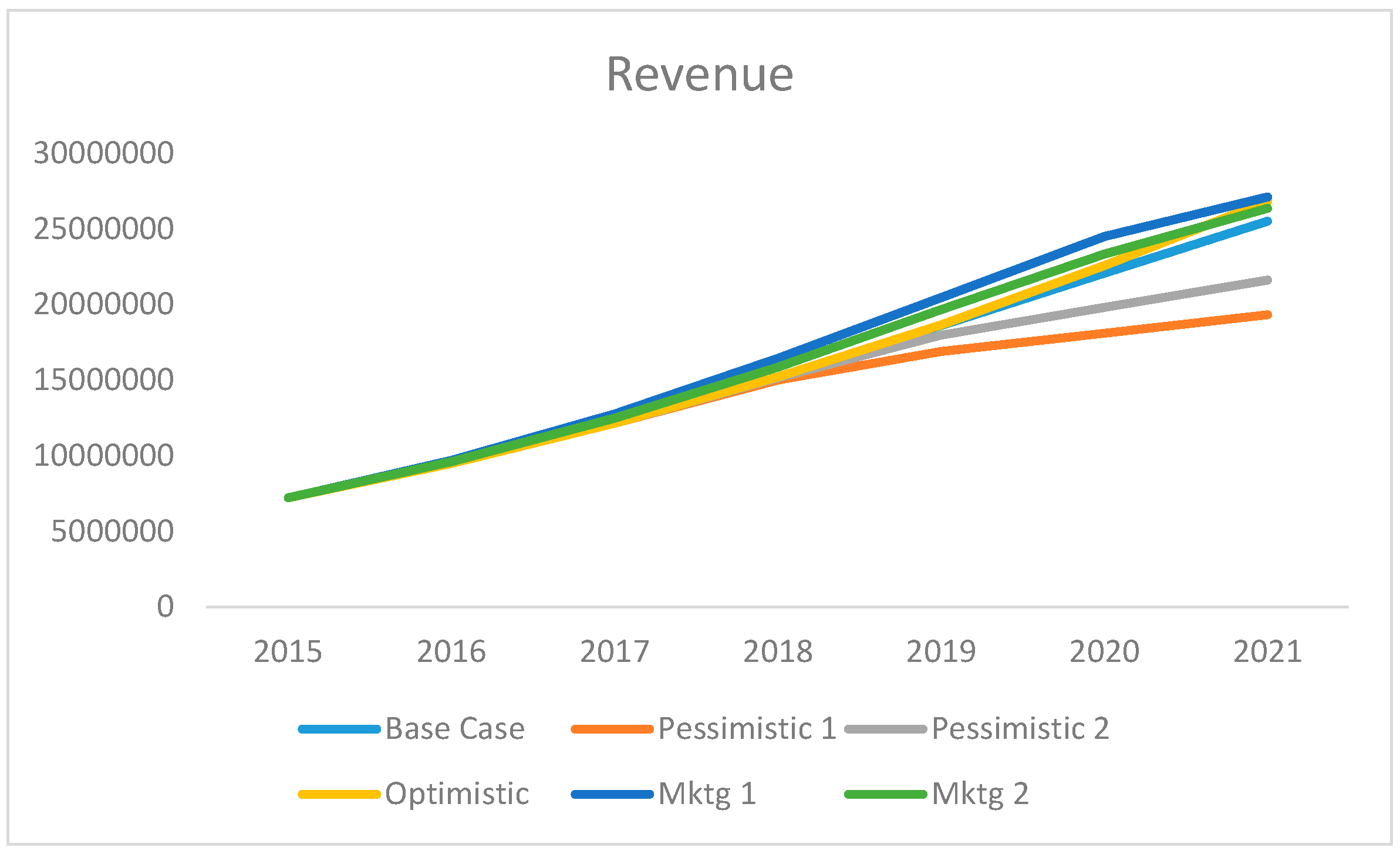

- In the base case (based on projections the company supplied), by year-end 2021 the company receives 1.02 million cases, and surpasses $20 million in net income. It ends the year with 94.4 FTE employees, barely under its target of 95. However, the charts in Figure 4 for customer gains and losses and service quality indicate a problem for the company. Because of the increase in cases, pressure on staff reaches a level after year 3 where it causes service quality to drop significantly.

- These factors cause the percentage of customers lost from service quality to rise above a steady rate of 3% to a rate of 8.9%. By the end of 2021, the company is losing more customers than it is gaining. For these reasons, it is clear that because of the specialists’ numbers, the company is not able to handle the growth in number of cases clients send. Following simulations will explore in detail this relationship between different hiring scenarios and performance.

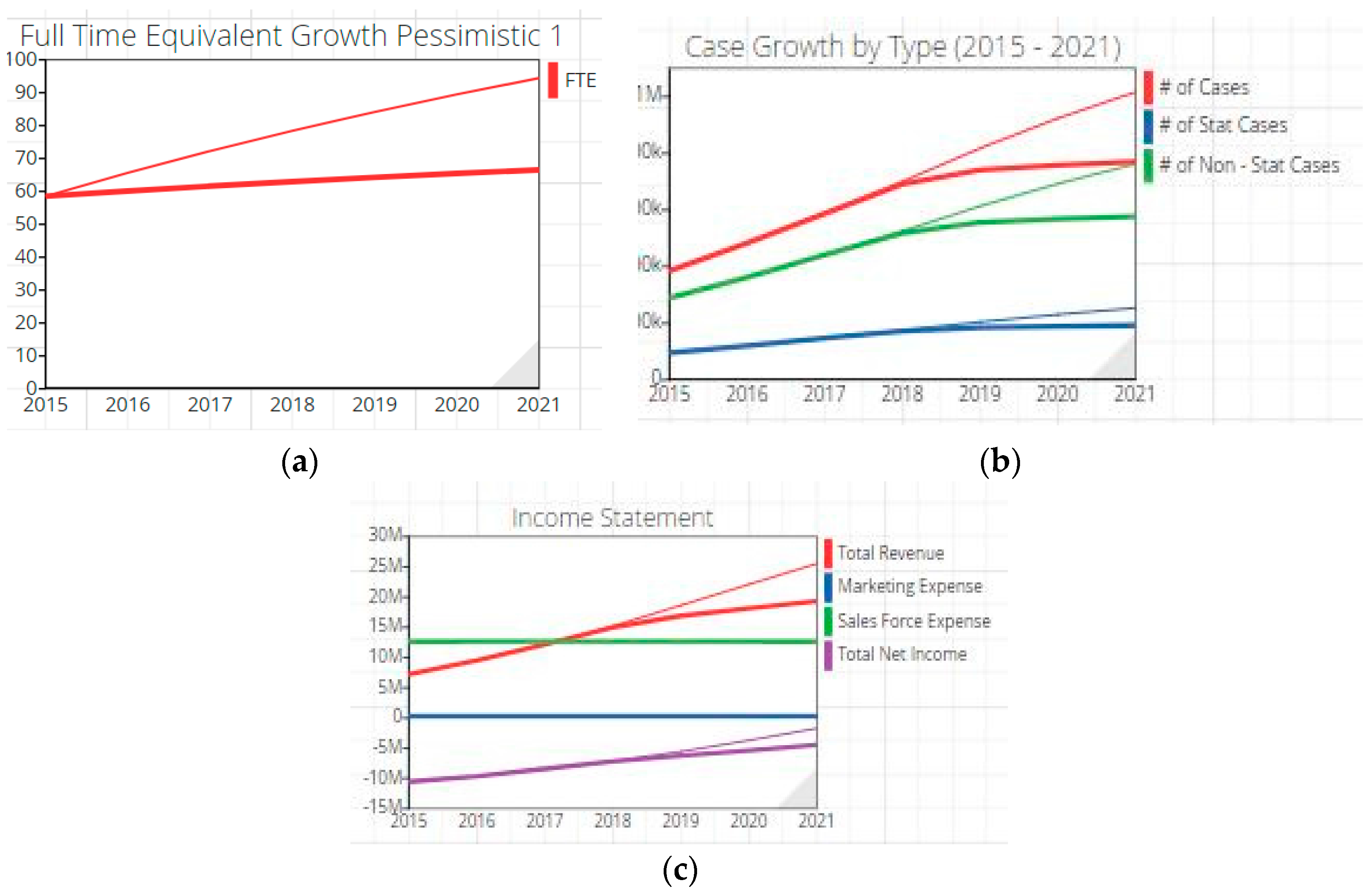

3.1. Pessimistic Hiring Scenario #1

3.2. Pessimistic Hiring Scenario #2

3.3. Optimistic Hiring Scenario

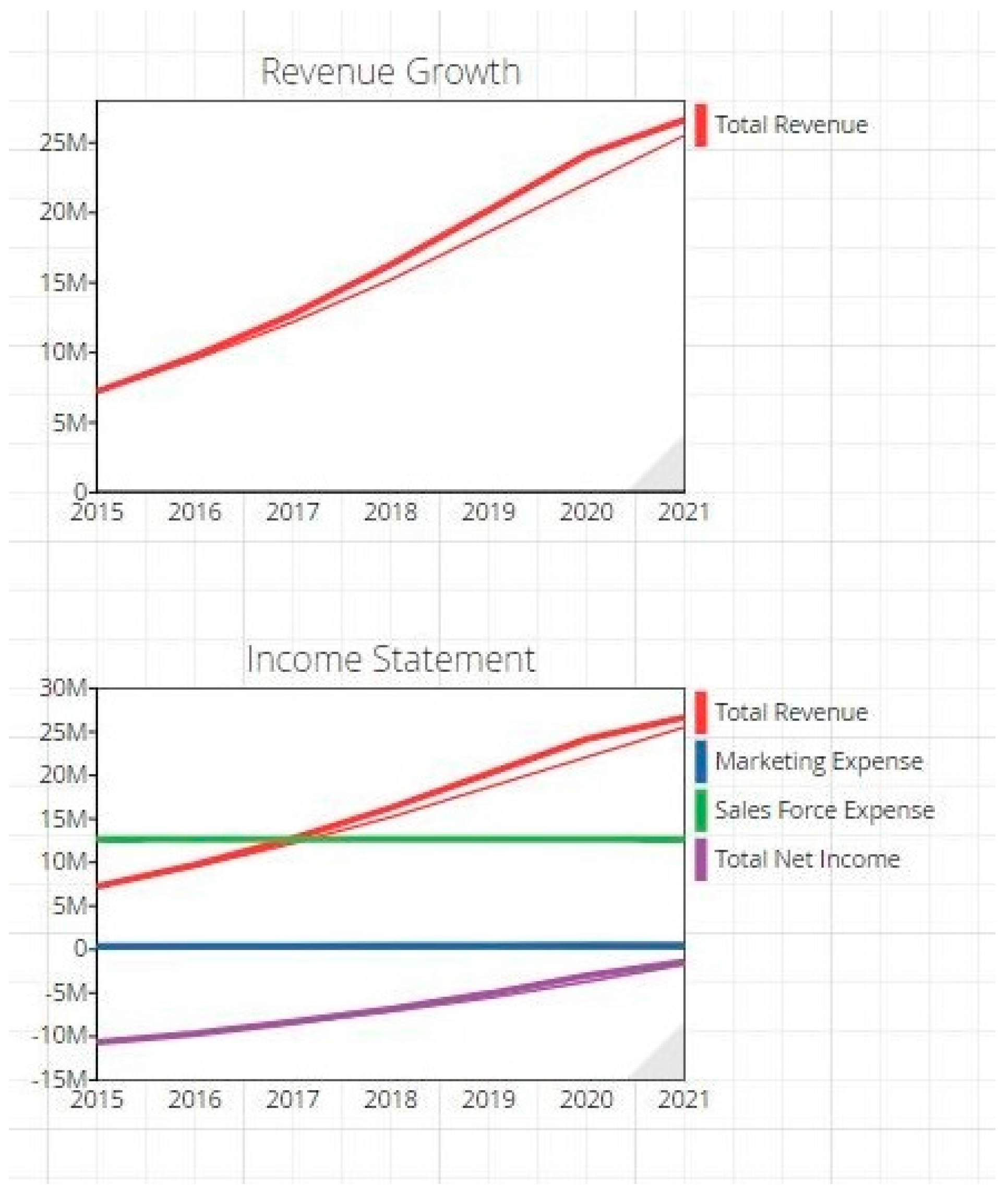

3.4. Marketing Scenarios

3.4.1. Assumptions

3.4.2. Marketing Scenario 1

3.4.3. Marketing Scenario 2

3.5. Comparison of Scenarios

3.5.1. Pressure on Staff

3.5.2. FTE Employees

3.5.3. Revenue

4. Conclusions

- Focus on creating relationships with universities that produce specialists.

- Try to improve the hiring rate of current specialists through incentive programs.

- Develop incentive programs to persuade scheduled and non-scheduled specialists to switch to full time.

- Pursue greater investments in marketing and sales force only if the company can hire specialists to keep up with the growth.

- Scale this telemedicine business model to other specialties in veterinary medicine, to reduce the unique risks created by the lack of specialists in this particular specialty.

Author Contributions

Conflicts of Interest

References

- Meher, S.K.; Rath, B.K.; Kailash, S. Telemedicine: AIIMS experience. Ukr. J. Telemed. 2008, 6, 387–404. [Google Scholar]

- Devi, S.; Singh, R.D.; Ghasura, R.S.; Sharma, M.K.; Sharma, M.C. Telemedicine: A new rise of hope to animal health care sector-A Review. Agric. Rev. 2015, 36, 153–158. [Google Scholar] [CrossRef]

- Papageorges, M.; Hebert, P. Other telemedicine applications. Clin. Tech. Small Anim. Pract. 2001, 16, 125–126. [Google Scholar] [CrossRef] [PubMed]

- Papageorges, M. Foreword. Clin. Tech. Small Anim. Pract. 2001, 16, IV. [Google Scholar] [CrossRef]

- Papageorges, M. Introduction. Clin. Tech. Small Anim. Pract. 2001, 16, 87–89. [Google Scholar] [CrossRef] [PubMed]

- Poteet, B. Veterinary Teleradiology. Vet. Radiol. Ultrasound 2008, 49, S33–S36. [Google Scholar] [CrossRef] [PubMed]

- Warren, S.; Nagl, L.; Schmitz, R.; Yao, J.; Hildreth, T.; Erickson, H.; Poole, D.; Andresen, D. A distributed infrastructure for veterinary telemedicine. In Proceedings of the 25th Annual International Conference of the IEEE Engineering in Medicine and Biology Society, Cancun, Mexico, 17–21 September 2003. [Google Scholar]

- Forrester, J. Industrial Dynamics; MIT Press: Cambridge, MA, USA, 1961. [Google Scholar]

- System Dynamics Society. Introduction to System Dynamics. Available online: https://www.systemdynamics.org/what-is-sd (accessed on 10 January 2018).

- Forrester, J.W.; Senge, P.M. Tests for building confidence in system dynamics models. In System Dynamics: TIMS Studies in the Management Sciences; Legasto, A., Forrester, J., Lyneis, J., Eds.; North-Holland: New York, NY, USA, 1980; pp. 209–228. [Google Scholar]

- Homer. Why we iterate: Scientific modeling in theory and practice. In System Dynamics Review; Homer: Los, Griechenland, 1996. [Google Scholar]

- Morecroft, J.D.W. Rationality in the analysis of behavioral simulation models. Manag. Sci. 1985, 31, 900–916. [Google Scholar] [CrossRef]

- Randers, B.v.J. Elements of the System Dynamics Method; MIT Press: Cambridge, MA, USA, 1980. [Google Scholar]

- Richardson, G.P. Feedback Thought in Social Science and Systems Theory; University of Pennsylvania Press: Philadelphia, PA, USA, 1991. [Google Scholar]

- Sterman, J. Business Dynamics: Systems Thinking and Modeling for a Complex World; Irwin/McGraw-Hill: Boston, MA, USA, 2000. [Google Scholar]

- Sterman, J. System dynamics modeling: Tools for learning in a complex world. Calif. Manag. Rev. 2001, 43, 8–25. [Google Scholar] [CrossRef]

- Homer, J.B.; Hirsch, G.B. System dynamics modeling for public health: Background and opportunities. Am. J. Public Health 2006, 96, 452–458. [Google Scholar] [CrossRef] [PubMed]

- Wernerfelt, B. A resource-based view of the firm. Strateg. Manag. J. 1984, 5, 171–180. [Google Scholar] [CrossRef]

- Dierickx, I.; Cool, K. Asset stock accumulation and sustainability of competitive advantage. Manag. Sci. 1989, 35, 1504–1511. [Google Scholar] [CrossRef]

- Warren, K. The dynamics of strategy. Bus. Strateg. Rev. 1999, 10, 1–16. [Google Scholar] [CrossRef]

- Bayer, S.; Barlow, J.; Curry, R. Assessing the impact of a care innovation: Telecare. Syst. Dyn. Rev. 2007, 23, 61–80. [Google Scholar] [CrossRef]

- Jean, C.; Jankovic, M.; Stal-Le Cardinal, J.; Bocquet, J.-C. Predictive modelling of telehealth system deployment. J. Simul. 2015, 9, 182–194. [Google Scholar] [CrossRef]

- Shared version of the system dynamics model to mirror the strategic architecture of the focal veterinary telemedicine company. Available online: https://app.sysdea.com/shared/4cM1hUf6wKFxRKLoxTpBOA (accessed on 14 February 2018).

- Breierova, L.; Choudhari, M. An Introduction to Sensitivity Analysis. MIT Sloan School D-Memo D-4526–2. 1996. Available online: https://ocw.mit.edu/courses/sloan-school-of-management/15-988-system-dynamics-self-study-fall-1998-spring-1999/readings/sensitivityanalysis.pdf (accessed on 14 February 2018).

- Senge, P. The Fifth Discipline; Currency/Doubleday: New York, NY, USA, 2000. [Google Scholar]

- Porter, M. Competitive Strategy; The Free Press: New York, NY, USA, 1980. [Google Scholar]

- Warren, K. Strategy Dynamics Essentials; Strategy Dynamics Ltd.: Princes Risborough, UK, 2015. [Google Scholar]

| Decisions | Results (Year End 2021) | ||

|---|---|---|---|

| Marketing Expense | $300,000 | # of Cases | 1.02 Million |

| Specialists Hired | 23 | Revenue | $76.6 Million |

| % Full Time Hired | 30 | Total Net Income | $21.3 Million |

| % Scheduled Hired | 50 | FTE Employees | 94.4 |

| % Non-Scheduled Hired | 20 | Pressure on Staff | 1.12 |

| Sales Salary | $65,000 | Service Quality | 0.889 |

| % Sales Force Growth | 10.5 | Customers Lost | 484 (8.9% of actual) |

| Market Share (% of NA Clinics) | 23.9% | ||

| Decisions | #1 Reduced Hires | #2 Hires Same as Base |

|---|---|---|

| Marketing Expense | $300,000 | $300,000 |

| Specialists Hired | 17 | 23 |

| % Full Time Hired | 10 | 10 |

| % Scheduled Hired | 60 | 60 |

| % Non-Scheduled Hired | 30 | 30 |

| Sales Salary | $65,000 | $65,000 |

| % Sales Force Growth | 10.5 | 10.5 |

| 17 Hires with 10% FTE Hiring | 23 Hires with 10% FTE Hiring | Base Case (23 Hires with 30% FTE Hiring) | |

|---|---|---|---|

| Specialists Employed | 163 | 192 | 192 |

| Percentage of Employees Full Time | 66.5% | 76.6% | 94.4% |

| Total Cases Handled by Staff per Year | 639,000 | 736,000 | 906,000 |

| Actual Customers | 4104 | 4590 | 5420 |

| Total Net Income | $13 Million | $16 Million | $21.3 Million |

| Decisions | Results (Year End 2021) | ||

|---|---|---|---|

| Marketing Expenditure | $300,000 | # of Cases | 1.08 Million |

| Hire Specialists | 29 | Revenue | $81.1 Million |

| % Full Time Hired | 50 | Total Net Income | $23.2 Million |

| % Scheduled Hired | 30 | FTE Employees | 129 |

| % Non-Scheduled Hired | 20 | Pressure on Staff | 0.867 |

| Sales Salary | $65,000 | Service Quality | 0.99 |

| % Sales Force Growth | 10.5 | Customers Lost | 184 (3.2% of actual) |

| Market Share (% of NA Clinics) | 25.70% | ||

| Decisions | 2016 | 2021 | Yearly Increase | Results (Year End 2021) | ||

|---|---|---|---|---|---|---|

| Marketing Expenditure | $325,000 | $475,000 | $25,000 | Base Case | Marketing Scenario | |

| Hire Specialists | 23 | 23 | 0 | Total Revenue | $76.6 M | $81.4 M |

| % Full Time Hired | 30 | 30 | 0 | Total Net Income | $21.3 M | $16.2 M |

| % Scheduled Hired | 50 | 50 | 0 | Customers Lost | 484 | 889 |

| % Non-Scheduled Hired | 20 | 20 | 0 | Clinics Gained by Marketing | 204 | 404 |

| Sales Salary | $68,575 | $90,025 | 5.5% or $3575 | Clinics Gained by Sales | 206 | 349 |

| % Sales Force Growth | 11.5 | 17.5 | 1.0 | Pressure on Staff | 1.12 | 1.19 |

| Operating Cost | $8.42 M | $8.95 M |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Voyer, J.; Jordan, T. Veterinary Telemedicine: A System Dynamics Case Study. Systems 2018, 6, 6. https://doi.org/10.3390/systems6010006

Voyer J, Jordan T. Veterinary Telemedicine: A System Dynamics Case Study. Systems. 2018; 6(1):6. https://doi.org/10.3390/systems6010006

Chicago/Turabian StyleVoyer, John, and Tristan Jordan. 2018. "Veterinary Telemedicine: A System Dynamics Case Study" Systems 6, no. 1: 6. https://doi.org/10.3390/systems6010006

APA StyleVoyer, J., & Jordan, T. (2018). Veterinary Telemedicine: A System Dynamics Case Study. Systems, 6(1), 6. https://doi.org/10.3390/systems6010006