Unraveling the Spatial Effects of Fintech on Urban Energy Efficiency in China

Abstract

1. Introduction

2. Theoretical Analysis and Research Hypotheses

2.1. Fintech’s Influnce on Energy Efficiency and Spatial Spillovers Effects

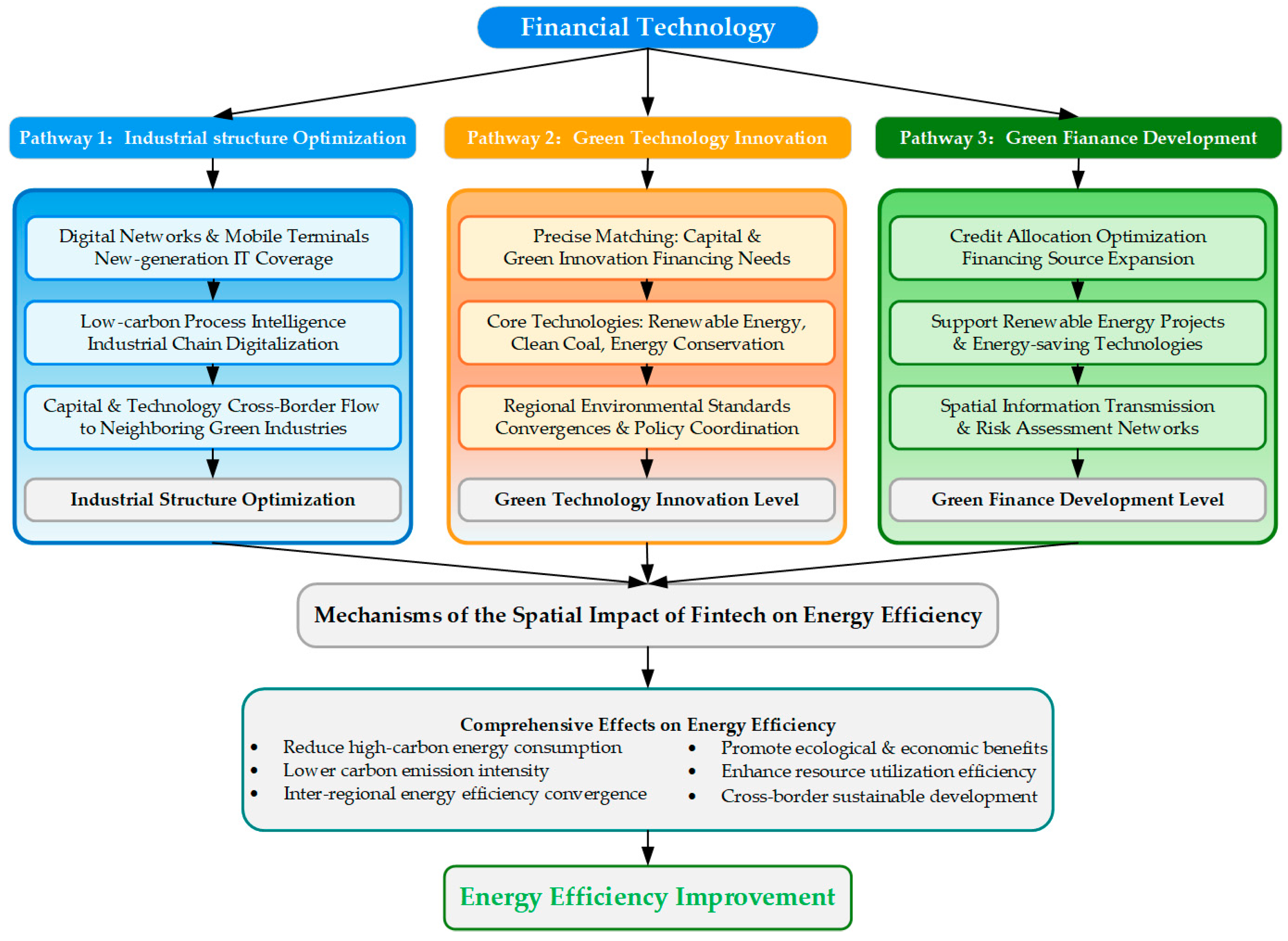

2.2. Mechanisms of Fintech’s Spatial Effect over Energy Efficiency

2.3. The Moderating Mechanism of Fintech Affecting Energy Efficiency

3. Research Design

3.1. Spatial Autocorrelation Test

3.2. Model Establishment and Variable Definition

3.2.1. Spatial Durbin Model

3.2.2. Spatial Mechanism Test Model

3.3. Data and Variables

3.3.1. Independent Variable: Financial Technology (Fintech)

3.3.2. Dependent Variable: Energy Efficiency (EE)

- (1)

- Labor input, measured using the total quantity of employees across all units, utilizing data from the China Urban Statistical Yearbook.

- (2)

- Capital input, assessed by the perpetual inventory technique with a depreciation rate of 10.96% [70].

- (3)

- Energy input, measured by using data on energy usage published in the China Energy Statistical Yearbook to assess regional energy input. Due to the large number of energy components, the unit of energy consumption was uniformly converted to tons of standard coal for convenience of calculation. Since prefectural cities do not publish their energy consumption, night-light data is used to decompose the energy consumption of each province to each prefectural city [71]. This method is founded on the strong empirical correlation between the intensity of artificial nighttime lighting and a variety of socioeconomic variables, including GDP, electricity consumption, and total energy consumption [72,73]. The underlying assumption is that the distribution of energy consumption within a province is proportional to the distribution of nighttime light emissions. Specifically, we calculate the share of each city’s average nighttime light luminosity within the total luminosity of its province. The city-level energy consumption is then estimated by multiplying the provincial total energy consumption by this share. This approach provides a reasonable and widely adopted approximation for sub-provincial energy use where official data is lacking [74].

- (4)

- We used real GDP as the desirable output, using 2011 as the base year and the GDP deflator to adjust nominal GDP for each city.

- (5)

- Regarding undesirable outputs, following the common practice on eco-efficiency measurement in China, all undesirable outputs are assigned equal weights in the SBM-ML model [75]. This assignment is based on two considerations. First, from a policy perspective, China’s environmental protection system addresses these pollutants with comparable urgency and stringency [76], as reflected in the ‘Ten Environmental Protection Measures’ and other key policies that target coordinated control of multiple pollutants. Second, methodologically, in the absence of explicit market prices or social costs to differentiate the severity of different pollutants, the assumption of equal weights is a common and neutral benchmark that avoids subjective arbitrariness [77]. This approach ensures that the model captures the joint production of economic growth and environmental pollutants without prioritizing one pollutant over another.

3.3.3. Control Variables

- (1)

- Population density (POP) was expressed using the ratio of population to administrative area, which can portray agglomeration activities’ impacts.

- (2)

- Economic development (PGDP) was expressed using GDP per capita, which reflects economic expansion’s influence on energy efficiency.

- (3)

- Science expenditure (SCI) was quantified as the ratio of science expenditure to regional GDP.

- (4)

- Government intervention (GOV) was characterized by the ratio of local general budget expenditures to regional GDP. Market mechanisms cannot solve the problem of researching, developing, and promoting energy conversation and emission mitigation technologies, so government intervention is needed. Reasonable government intervention can help solve market failures and enforce various energy saving and emission mitigation measures while enhancing energy governance.

- (5)

- Urbanization rate (UR) was expressed as the ratio of the urban population to the city’s to measure urbanization evolution’s impact.

- (6)

- Infrastructure construction (IC) was defined by the ratio of postal and telecommunications services to the area GDP. Highly developed postal and telecommunication services provide urban residents with convenient channels for information exchange and real-time interaction. However, the construction and operation of this communication infrastructure require a large amount of energy support, which has an effect on energy efficiency.

3.3.4. Mediating Variables

- (1)

- Industrial structure (IND) was defined by the ratio of tertiary industry’s added value to GDP, reflecting the influence of industrial scale characteristics on energy efficiency.

- (2)

- As for green technology innovation (TECH), green invention patents can reflect a superior degree of innovation, and the volume of patent applications can better reflect green innovation’s actual extent than the quantity of patents authorized. Therefore, green invention patent applications per 100 individuals in each city are used as a measurement [8].

- (3)

- Green finance development (GF), calculated using the entropy method, was measured by constructing a system of assessment indicators that included four first-level green indicators, namely bonds, credit, funds, and insurance, as well as fourteen second-level indicators, like green investment, support, rights, and interests [79].

3.3.5. Moderating Variable

3.4. Spatial Weighting Matrixes Setting

4. Empirical Analysis

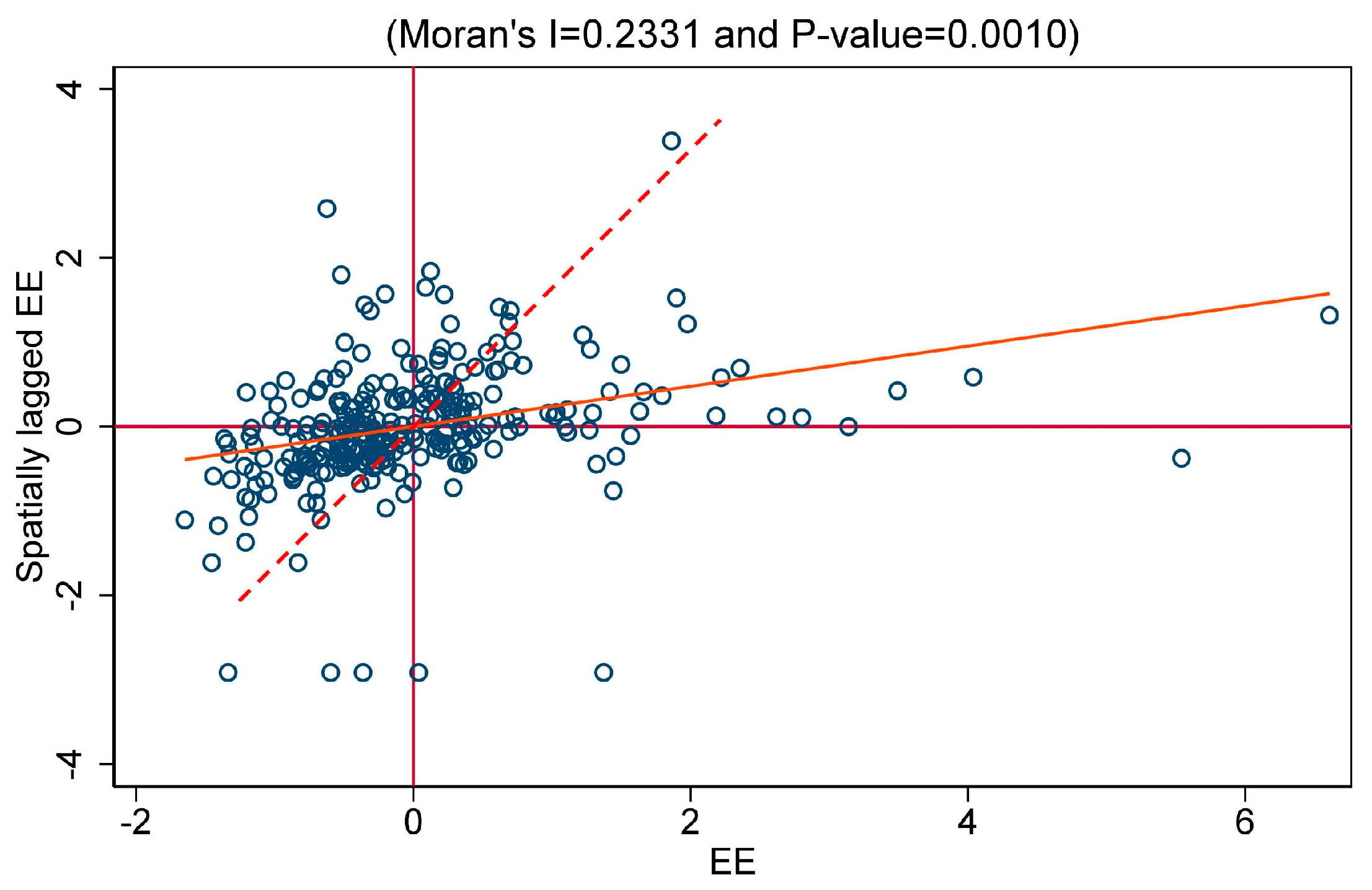

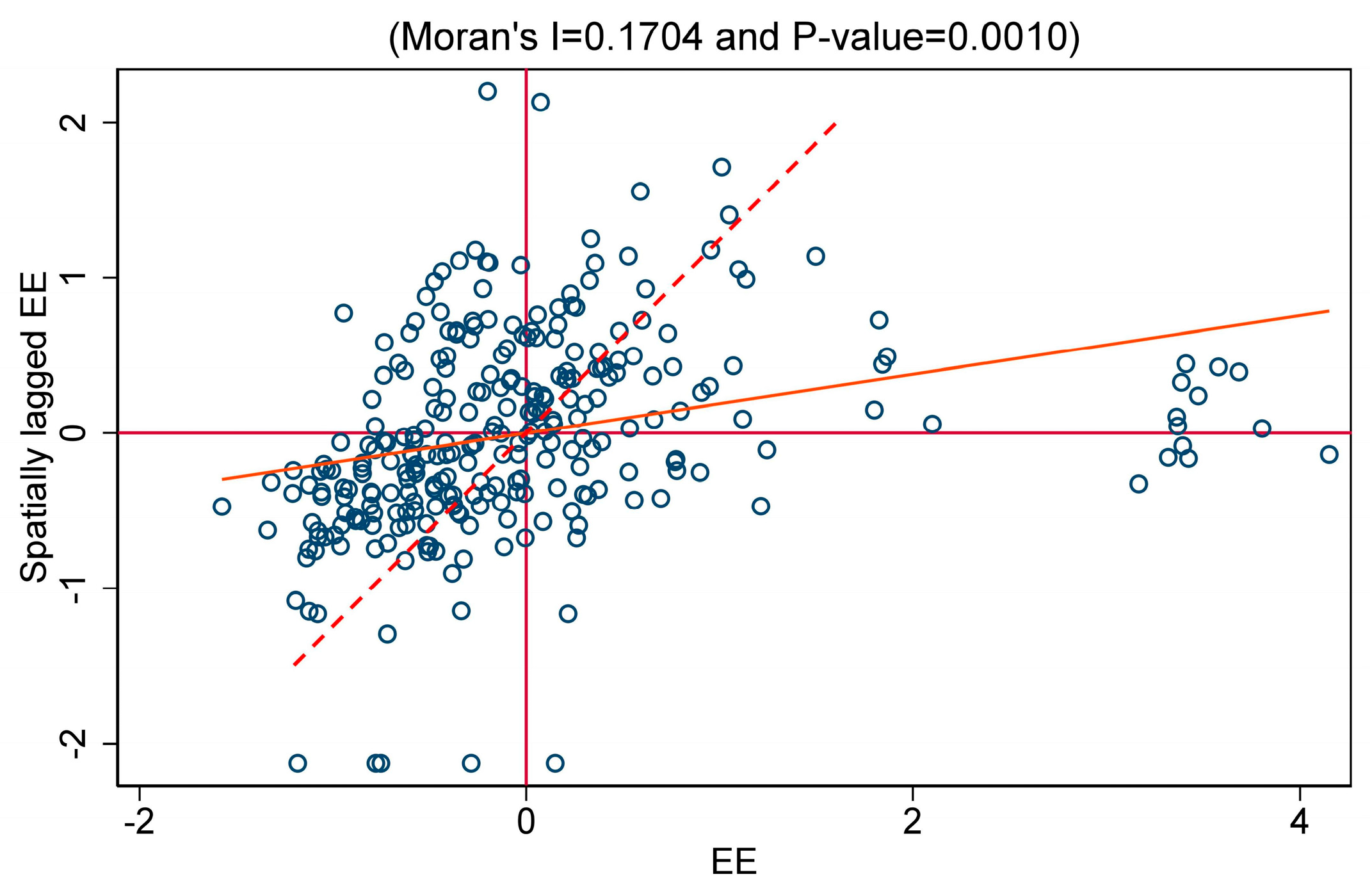

4.1. Spatial Correlation Test

4.1.1. Global Spatial Autocorrelation

4.1.2. Local Spatial Autocorrelation

4.2. Benchmark Regression Results

4.3. Robustness Tests

4.3.1. Transforming the Sample Interval

4.3.2. Shrinking 1% Treatment

4.3.3. Lagging the Fintech by One Period

4.3.4. Alternative Spatial Weight Matrix: Transportation Distance Matrix

4.3.5. Alternative Fintech Measurement Indicator

4.4. Endogeneity Test

4.4.1. Instrumental Variables Method

4.4.2. Exogenous Policy Shock Test: DID

4.4.3. Dynamic Panel Analysis GMM

5. Mechanism Analysis

6. Further Analysis

6.1. The Moderating Effect of Environmental Regulations

6.2. Heterogeneity Analysis

6.2.1. Resource Dependence Heterogeneity

6.2.2. Digital Infrastructure Heterogeneity

6.3. Potential Negative Effects: The Rebound Effect

7. Conclusions

7.1. Main Findings

7.2. Theoretical and Practical Implications

7.2.1. Theoretical Contributions

7.2.2. Practical Significance

7.3. Limitations and Future Research

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Group | N | Mean of EE | Std. Dev. | t-Statistic | p-Value |

|---|---|---|---|---|---|

| High-Fintech | 1668 | 37.51 | 12.07 | −10.93 | 0.000 |

| Low-Fintech | 1668 | 32.14 | 15.99 |

| Variables | Fintech | POP | PGDP | UR | SCI | GOV | IC |

|---|---|---|---|---|---|---|---|

| Direct | 0.084 ** | 0.030 *** | 0.0002 *** | 0.003 | −0.022 ** | −0.026 *** | −1.432 *** |

| Indirect | 1.203 *** | −0.193 *** | −0.001 *** | 0.087 *** | 0.403 *** | 0.340 *** | 5.098 |

| Total | 1.286 *** | −0.163 *** | −0.001 *** | 0.090 *** | 0.381 ** | 0.314 *** | 3.666 |

| Variables | Adj Matrix | Geo-dis Matrix | Eco-geo Matrix | Trans Matrix |

|---|---|---|---|---|

| Direct | 0.011 *** | 0.011 *** | 0.010 *** | 0.008 *** |

| Indirect | 0.010 *** | 0.075 *** | 0.023 *** | 0.120 *** |

| Total | 0.021 *** | 0.086 *** | 0.033 *** | 0.129 *** |

References

- Liu, H.M.; Zhang, Z.X.; Zhang, T.; Wang, L.Y. Revisiting China’s provincial energy efficiency and its influencing factors. Energy 2020, 208, 118361. [Google Scholar] [CrossRef]

- Shah, W.U.; Sarfraz, M.; Yasmeen, R. Unveiling the impact of natural energy resources depletion on energy industry productivity in top 10 economies: Moderating role of FinTech. Energy 2025, 315, 134405. [Google Scholar] [CrossRef]

- Wang, D.; He, B.; Hu, Z.M. Financial technology and firm productivity: Evidence from Chinese listed enterprises. Finance Res. Lett. 2024, 63, 105405. [Google Scholar] [CrossRef]

- Jaksic, M.; Marinc, M. Relationship banking and information technology: The role of artificial intelligence and FinTech. Risk Manag. Int. J. 2019, 21, 1–18. [Google Scholar] [CrossRef]

- Tian, M.W.; Wang, L.K.; Yan, S.R.; Tian, X.X.; Liu, Z.Q.; Rodrigues, J. Research on Financial Technology Innovation and Application Based on 5G Network. IEEE Access 2019, 7, 138614–138623. [Google Scholar] [CrossRef]

- Watanabe, C.; Naveed, K.; Tou, Y.; Neittaanmäki, P. Measuring GDP in the digital economy: Increasing dependence on uncaptured GDP. Technol. Forecast. Soc. Change 2018, 137, 226–240. [Google Scholar] [CrossRef]

- Li, X.Y.; Liu, J.; Ni, P.J. The Impact of the Digital Economy on CO2 Emissions: A Theoretical and Empirical Analysis. Sustainability 2021, 13, 7267. [Google Scholar] [CrossRef]

- Gyau, E.B.; Appiah, M.; Gyamfi, B.A.; Achie, T.; Naeem, M.A. Transforming banking: Examining the role of AI technology innovation in boosting banks financial performance. Int. Rev. Financ. Anal. 2024, 96, 103700. [Google Scholar] [CrossRef]

- Cao, S.; Nie, L.; Sun, H.; Sun, W.; Taghizadeh-Hesary, F. Digital finance, green technological innovation and energy-environmental performance: Evidence from China’s regional economies. J. Clean. Prod. 2021, 327, 129458. [Google Scholar] [CrossRef]

- Singhal, K.; Feng, Q.; Ganeshan, R.; Sanders, N.R.; Shanthikumar, J.G. Introduction to the Special Issue on Perspectives on Big Data. Prod. Oper. Manag. 2018, 27, 1639–1641. [Google Scholar] [CrossRef]

- Peng, H.-R.; Zhang, Y.-J.; Liu, J.-Y. The energy rebound effect of digital development: Evidence from 285 cities in China. Energy 2023, 270, 126837. [Google Scholar] [CrossRef]

- Capello, R. Recent Theoretical Paradigms in Urban Growth. Eur. Plan. Stud. 2013, 21, 316–333. [Google Scholar] [CrossRef]

- Chen, L.; Msigwa, G.; Yang, M.Y.; Osman, A.I.; Fawzy, S.; Rooney, D.W.; Yap, P.S. Strategies to achieve a carbon neutral society: A review. Environ. Chem. Lett. 2022, 20, 2277–2310. [Google Scholar] [CrossRef]

- Arabi, B.; Munisamy, S.; Emrouznejad, A.; Shadman, F. Power industry restructuring and eco-efficiency changes: A new slacks-based model in Malmquist-Luenberger Index measurement. Energy Policy 2014, 68, 132–145. [Google Scholar] [CrossRef]

- Geng, Z.Q.; Song, G.L.; Han, Y.M.; Chu, C. Static and dynamic energy structure analysis in the world for resource optimization using total factor productivity method based on slacks-based measure integrating data envelopment analysis. Energy Convers. Manag. 2021, 228, 113713. [Google Scholar] [CrossRef]

- Chen, Y.F.; Liu, Y.N. How biased technological progress sustainably improve the energy efficiency: An empirical research of manufacturing industry in China. Energy 2021, 230, 120823. [Google Scholar] [CrossRef]

- Liu, Y.J.; Zhang, X.W.; Shen, Y. Technology-driven carbon reduction: Analyzing the impact of digital technology on China’s carbon emission and its mechanism. Technol. Forecast. Soc. Change 2024, 200, 123124. [Google Scholar] [CrossRef]

- Song, M.L.; Zheng, H.Y.; Shen, Z.Y. Whether the carbon emissions trading system improves energy efficiency—Empirical testing based on China’s provincial panel data. Energy 2023, 275. [Google Scholar] [CrossRef]

- Shapiro, J.S.; Walker, R. Why Is Pollution from US Manufacturing Declining? The Roles of Environmental Regulation, Productivity, and Trade. Am. Econ. Rev. 2018, 108, 3814–3854. [Google Scholar] [CrossRef]

- Butu, H.M.; Nsafon, B.E.K.; Park, S.W.; Huh, J.S. Leveraging community based organizations and fintech to improve small-scale renewable energy financing in sub-Saharan Africa. Energy Res. Soc. Sci. 2021, 73, 101949. [Google Scholar] [CrossRef]

- Croutzet, A.; Dabbous, A. Do FinTech trigger renewable energy use? Evidence from OECD countries. Renew. Energy 2021, 179, 1608–1617. [Google Scholar] [CrossRef]

- Tan, Q.; Yasmeen, H.; Ali, S.; Ismail, H.; Zameer, H. Fintech development, renewable energy consumption, government effectiveness and management of natural resources along the belt and road countries. Resour. Policy 2023, 80, 103251. [Google Scholar] [CrossRef]

- Teng, M.; Shen, M. Fintech and energy efficiency: Evidence from OECD countries. Resour. Policy 2023, 82, 103550. [Google Scholar] [CrossRef]

- El Khoury, R.; Nasrallah, N.; Hussainey, K.; Assaf, R. Spillover analysis across FinTech, ESG, and renewable energy indices before and during the Russia–Ukraine war: International evidence. J. Int. Financ. Manag. Account. 2023, 34, 279–317. [Google Scholar] [CrossRef]

- Ullah, A.; Ullah, S.; Pinglu, C.; Khan, S. Impact of FinTech, governance and environmental taxes on energy transition: Pre-post COVID-19 analysis of belt and road initiative countries. Resour. Policy 2023, 85, 103734. [Google Scholar] [CrossRef]

- Xu, S.; Zhang, Y.; Chen, L.; Leong, L.W.; Muda, I.; Ali, A. How Fintech and effective governance derive the greener energy transition: Evidence from panel-corrected standard errors approach. Energy Econ. 2023, 125, 106881. [Google Scholar] [CrossRef]

- Lu, Y.; Tian, T.; Ge, C. Asymmetric effects of renewable energy, fintech development, natural resources, and environmental regulations on the climate change in the post-covid era. Resour. Policy 2023, 85, 103902. [Google Scholar] [CrossRef]

- Gao, D.; Cai, J.J.; Wu, K. The smart green tide: A bibliometric analysis of AI and renewable energy transition. Energy Rep. 2025, 13, 5290–5304. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F. The impact of artificial intelligence adoption and financial accessibility on energy sustainability. Energy Strat. Rev. 2025, 59, 101744. [Google Scholar] [CrossRef]

- Xu, B.C. Inclusive green finance approach to assess energy resilience: Integrating artificial intelligence (AI) utilization in energy strategy perspective. Energy Strat. Rev. 2025, 59, 101696. [Google Scholar] [CrossRef]

- Zhou, C.Y.; Wu, Y.F. Geographic distance, information asymmetry, and ESG ratings. Appl. Econ. Lett. 2025, 1–5. [Google Scholar] [CrossRef]

- Liu, Y.L.; Lian, X. The spatial spillover effect of digital economy on regional tax Revenue: An empirical study based on the decay boundary and spillover path. Int. Rev. Econ. Financ. 2025, 102, 104352. [Google Scholar] [CrossRef]

- Yu, H.Y.; Wei, W.; Li, J.H.; Li, Y. The impact of green digital finance on energy resources and climate change mitigation in carbon neutrality: Case of 60 economies. Resour. Policy 2022, 79, 103116. [Google Scholar] [CrossRef]

- Young, A. The razor’s edge: Distortions and incremental reform in the People’s Republic of China. Q. J. Econ. 2000, 115, 1091–1135. [Google Scholar] [CrossRef]

- Xiao, S.; Sun, B. How Has the Inter-City Corporate Network Spatio-Temporally Evolved in China? Evidence from Chinese Investment in Newly Established Enterprises from 1980–2017. Land 2023, 12, 204. [Google Scholar] [CrossRef]

- Ghasemaghaei, M.; Calic, G. Does big data enhance firm innovation competency? The mediating role of data-driven insights. J. Bus. Res. 2019, 104, 69–84. [Google Scholar] [CrossRef]

- Zhao, X.Q.; Zeng, S.; Ke, X.J.; Jiang, S.Y. The impact of green credit on energy efficiency from a green innovation perspective: Empirical evidence from China based on a spatial Durbin model. Energy Strat. Rev. 2023, 50, 101211. [Google Scholar] [CrossRef]

- Kanga, D.; Oughton, C.; Harris, L.; Murinde, V. The diffusion of fintech, financial inclusion and income per capita. Eur. J. Financ. 2022, 28, 108–136. [Google Scholar] [CrossRef]

- Shi, Y.R.; Yang, B. How digital finance and green finance can synergize to improve urban energy use efficiency? New evidence from China. Energy Strat. Rev. 2024, 55, 101553. [Google Scholar] [CrossRef]

- Jiang, H.; Chen, Z.H.; Liang, Y.W.; Zhao, W.C.; Liu, D.; Chen, Z.Y. The impact of industrial structure upgrading and digital economy integration on China’s urban carbon emissions. Front. Ecol. Evol. 2023, 11, 1231855. [Google Scholar] [CrossRef]

- Ren, X.H.; Zeng, G.D.; Gozgor, G. How does digital finance affect industrial structure upgrading? Evidence from Chinese prefecture-level cities. J. Environ. Manag. 2023, 330, 117125. [Google Scholar] [CrossRef] [PubMed]

- Wang, H.L.; Guo, J.G. Impacts of digital inclusive finance on CO2 emissions from a spatial perspective: Evidence from 272 cities in China. J. Clean. Prod. 2022, 355, 131618. [Google Scholar] [CrossRef]

- Su, Y.Y.; Li, Z.H.; Yang, C.Y. Spatial Interaction Spillover Effects between Digital Financial Technology and Urban Ecological Efficiency in China: An Empirical Study Based on Spatial Simultaneous Equations. Int. J. Environ. Res. Public Health 2021, 18, 8535. [Google Scholar] [CrossRef]

- Zhang, M.L.; Liu, Y. Influence of digital finance and green technology innovation on China’s carbon emission efficiency: Empirical analysis based on spatial metrology. Sci. Total. Environ. 2022, 838, 156463. [Google Scholar] [CrossRef]

- Lin, B.Q.; Ma, R.Y. How does digital finance influence green technology innovation in China? Evidence from the financing constraints perspective. J. Environ. Manag. 2022, 320, 115833. [Google Scholar] [CrossRef]

- Li, G.X.; Zhang, R.; Feng, S.L.; Wang, Y.Q. Digital finance and sustainable development: Evidence from environmental inequality in China. Bus. Strat. Environ. 2022, 31, 3574–3594. [Google Scholar] [CrossRef]

- Liu, X.; Razzaq, A.; Shahzad, M.; Irfan, M. Technological changes, financial development and ecological consequences: A comparative study of developed and developing economies. Technol. Forecast. Soc. Change 2022, 184, 122004. [Google Scholar] [CrossRef]

- Qin, L.; Aziz, G.; Hussan, M.W.; Qadeer, A.; Sarwar, S. Empirical Evidence of Fintech and Green Environment: Using the Green Finance As a Mediating Variable. Int. Rev. Econ. Financ. 2024, 89, 33–49. [Google Scholar] [CrossRef]

- Xu, J.; Chen, F.; Zhang, W.; Liu, Y.; Li, T. Analysis of the Carbon Emission Reduction Effect of Fintech and the Transmission Channel of Green Finance. Financ. Res. Lett. 2023, 56, 104127. [Google Scholar] [CrossRef]

- Zhao, K.; Wu, C.; Liu, J.; Liu, Y. Green Finance, Green Technology Innovation and the Upgrading of China’s Industrial Structure: A Study from the Perspective of Heterogeneous Environmental Regulation. Sustainability 2024, 16, 4330. [Google Scholar] [CrossRef]

- Lee, C.-C.; Wang, C.-S.; He, Z.; Xing, W.-W.; Wang, K. How Does Green Finance Affect Energy Efficiency? The Role of Green Technology Innovation and Energy Structure. Renew. Energy 2023, 219, 119417. [Google Scholar] [CrossRef]

- Li, J. Impact of green finance on industrial structure upgrading: Implications for environmental sustainability in Chinese regions. Environ. Sci. Pollut. Res. 2024, 31, 13063–13074. [Google Scholar] [CrossRef] [PubMed]

- Sampene, A.K.; Li, C.; Wiredu, J. An Outlook at the Switch to Renewable Energy in Emerging Economies: The Beneficial Effect of Technological Innovation and Green Finance. Energy Policy 2024, 187, 114025. [Google Scholar] [CrossRef]

- Han, J.; Zhang, W.; Isik, C.; Zhao, W.; Anas, M.; Zheng, Q.; Xie, D.; Bakhsh, S. Sustainable Development Pathways: Exploring the Impact of Green Finance on Urban Metabolic Efficiency. Sustain. Dev. 2024, 32, 7226–7245. [Google Scholar] [CrossRef]

- Mehboob, M.Y.; Ma, B.; Mehboob, M.B.; Zhang, Y. Does Green Finance Reduce Environmental Degradation? The Role of Green Innovation, Environmental Tax, and Geopolitical Risk in China. J. Clean. Prod. 2024, 435, 140353. [Google Scholar] [CrossRef]

- Kong, X.Y.; Xu, T. How FinTech affects total factor energy efficiency? Evidence from Chinese cities. Front. Energy Res. 2023, 11, 1296820. [Google Scholar] [CrossRef]

- Yu, X.; Wang, P. Economic effects analysis of environmental regulation policy in the process of industrial structure upgrading: Evidence from Chinese provincial panel data. Sci. Total. Environ. 2021, 753, 142004. [Google Scholar] [CrossRef]

- Zhou, Q.; Zhong, S.H.; Shi, T.; Zhang, X.L. Environmental regulation and haze pollution: Neighbor-companion or neighbor-beggar? Energy Policy 2021, 151, 112183. [Google Scholar] [CrossRef]

- Yan, Z.M.; Yu, Y.; Du, K.R.; Zhang, N. How does environmental regulation promote green technology innovation? Evidence from China’s total emission control policy. Ecol. Econ. 2024, 219, 108137. [Google Scholar] [CrossRef]

- Feng, Y.C.; Wang, X.H.; Du, W.C.; Wu, H.Y.; Wang, J.T. Effects of environmental regulation and FDI on urban innovation in China: A spatial Durbin econometric analysis. J. Clean. Prod. 2019, 235, 210–224. [Google Scholar] [CrossRef]

- Zhang, Y.; Chen, M.; Zhong, S.; Liu, M.Y. Fintech’s role in carbon emission efficiency: Dynamic spatial analysis. Sci. Rep. 2024, 14, 23941. [Google Scholar] [CrossRef]

- Chen, W.; Shen, Y.; Wang, Y.A.; Wu, Q. How do industrial land price variations affect industrial diffusion? Evidence from a spatial analysis of China. Land Use Policy 2018, 71, 384–394. [Google Scholar] [CrossRef]

- Zhou, J.; Lan, H.L.; Zhao, C.; Zhou, J.P. Haze Pollution Levels, Spatial Spillover Influence, and Impacts of the Digital Economy: Empirical Evidence from China. Sustainability 2021, 13, 9076. [Google Scholar] [CrossRef]

- Li, Y.Z.; Ye, C.F.; Li, M.X.; Shum, W.Y.; Lai, F.J. Regional FinTech development and total factor productivity among firms: Evidence from China. N. Am. J. Econ. Financ. 2025, 75, 102304. [Google Scholar] [CrossRef]

- Guo, F.; Kong, S.T.; Wang, J. General patterns and regional disparity of internet finance development in China: Evidence from the Peking University Internet Finance Development Index. China Econ. J. 2016, 9, 253–271. [Google Scholar] [CrossRef]

- Ghazinoory, S.; Ameri, F.; Farnoodi, S. An application of the text mining approach to select technology centers of excellence. Technol. Forecast. Soc. Change 2013, 80, 918–931. [Google Scholar] [CrossRef]

- Chen, W.; Wang, J.; Ye, Y. Financial technology as a heterogeneous driver of carbon emission reduction in China: Evidence from a novel sparse quantile regression. J. Innov. Knowl. 2024, 9, 100476. [Google Scholar] [CrossRef]

- Chen, Y.; Zhang, Y.; Wang, M. Green credit, financial regulation and corporate green innovation: Evidence from China. Financ. Res. Lett. 2024, 59, 104768. [Google Scholar] [CrossRef]

- Wang, L.L.; Szirmai, A. Capital inputs in the Chinese economy: Estimates for the total economy, industry and manufacturing. China Econ. Rev. 2012, 23, 81–104. [Google Scholar] [CrossRef]

- Young, A. Gold into base metals: Productivity growth in the People’s Republic of China during the reform period. J. Political Econ. 2003, 111, 1220–1261. [Google Scholar] [CrossRef]

- Wu, J.S.; He, S.B.; Peng, J.; Li, W.F.; Zhong, X.H. Intercalibration of DMSP-OLS night-time light data by the invariant region method. Int. J. Remote Sens. 2013, 34, 7356–7368. [Google Scholar] [CrossRef]

- Chen, Z.Q.; Yu, B.L.; Yang, C.S.; Zhou, Y.Y.; Yao, S.J.; Qian, X.J.; Wang, C.X.; Wu, B.; Wu, J.P. An extended time series (2000–2018) of global NPP-VIIRS-like nighttime light data from a cross-sensor calibration. Earth Syst. Sci. Data 2021, 13, 889–906. [Google Scholar] [CrossRef]

- Shi, K.F.; Yu, B.L.; Huang, Y.X.; Hu, Y.J.; Yin, B.; Chen, Z.Q.; Chen, L.J.; Wu, J.P. Evaluating the Ability of NPP-VIIRS Nighttime Light Data to Estimate the Gross Domestic Product and the Electric Power Consumption of China at Multiple Scales: A Comparison with DMSP-OLS Data. Remote Sens. 2014, 6, 1705–1724. [Google Scholar] [CrossRef]

- Henderson, J.V.; Storeygard, A.; Weil, D.N. Measuring Economic Growth from Outer Space. Am. Econ. Rev. 2012, 102, 994–1028. [Google Scholar] [CrossRef] [PubMed]

- Gao, D.; Mo, X.L.; Xiong, R.C.; Huang, Z.L. Tax Policy and Total Factor Carbon Emission Efficiency: Evidence from China’s VAT Reform. Int. J. Environ. Res. Public Health 2022, 19, 9257. [Google Scholar] [CrossRef]

- Zhang, B.B.; Wang, Y.; Sun, C.W. Urban environmental legislation and corporate environmental performance: End governance or process control? Energy Econ. 2023, 118, 106494. [Google Scholar] [CrossRef]

- Guo, K.; Cao, Y.Q.; He, S.; Li, Z.Y. Evaluating the efficiency of green economic production and environmental pollution control in China. Environ. Impact Assess. Rev. 2024, 104, 107294. [Google Scholar] [CrossRef]

- Schleich, J.; Rogge, K.; Betz, R. Incentives for energy efficiency in the EU Emissions Trading Scheme. Energy Effic. 2009, 2, 37–67. [Google Scholar] [CrossRef]

- Wang, Y.; Zhao, N.; Lei, X.; Long, R. Green Finance Innovation and Regional Green Development. Sustainability 2021, 13, 8230. [Google Scholar] [CrossRef]

- He, W.; Wang, B. Environmental jurisdiction and energy efficiency: Evidence from China’s establishment of environmental courts. Energy Econ. 2024, 131, 107358. [Google Scholar] [CrossRef]

- Gao, D.; Wang, G.M. Does the opening of high-speed rails improve urban carbon efficiency? Evidence from a spatial difference-in-difference method. Environ. Sci. Pollut. Res. 2023, 30, 101873–101887. [Google Scholar] [CrossRef]

- Shao, X.; Fang, T. Performance analysis of government subsidies for photovoltaic industry: Based on spatial econometric model. Energy Strat. Rev. 2021, 34, 100631. [Google Scholar] [CrossRef]

- Lan, Y.J. Does Fintech development affect capital misallocation: A non-linear and spatial spillover perspective. Financ. Res. Lett. 2024, 60, 104847. [Google Scholar] [CrossRef]

- Zhang, T.; Zhang, R. The spatial effect of low-carbon development of regional industries driven by the digital economy: Evidence from Chinese cities. Humanit. Soc. Sci. Commun. 2024, 11, 706. [Google Scholar] [CrossRef]

- Morikawa, M. Population density and efficiency in energy consumption: An empirical analysis of service establishments. Energy Econ. 2012, 34, 1617–1622. [Google Scholar] [CrossRef]

- Li, W.; Elheddad, M.; Doytch, N. The impact of innovation on environmental quality: Evidence for the non-linear relationship of patents and CO2 emissions in China. J. Environ. Manag. 2021, 292, 112781. [Google Scholar] [CrossRef]

- Smulders, S.; Tsur, Y.; Zemel, A. Announcing climate policy: Can a green paradox arise without scarcity? J. Environ. Econ. Manag. 2012, 64, 364–376. [Google Scholar] [CrossRef]

- Teng, M.M.; Shen, M.H. The impact of fintech on carbon efficiency: Evidence from Chinese cities. J. Clean. Prod. 2023, 425, 138984. [Google Scholar] [CrossRef]

- Chong, T.T.L.; Lu, L.P.; Ongena, S. Does banking competition alleviate or worsen credit constraints faced by small- and medium-sized enterprises? Evidence from China. J. Bank. Financ. 2013, 37, 3412–3424. [Google Scholar] [CrossRef]

- Bellégo, C.; Benatia, D.; Dortet-Bernadet, V. The chained difference-in-differences. J. Econ. 2025, 248, 105783. [Google Scholar] [CrossRef]

- Liu, J.T.; Zhang, Y.; Kuang, J. Fintech development and green innovation: Evidence from China. Energy Policy 2023, 183, 113827. [Google Scholar] [CrossRef]

- Gao, D.; Zhou, X.T.; Wan, J. Unlocking sustainability potential: The impact of green finance reform on corporate ESG performance. Corp. Soc. Responsib. Environ. Manag. 2024, 31, 4211–4226. [Google Scholar] [CrossRef]

- Gao, D.; Feng, H.; Cao, Y.J. The Spatial Spillover Effect of Innovative City Policy on Carbon Efficiency: Evidence from China. Singap. Econ. Rev. 2024, 1–23. [Google Scholar] [CrossRef]

- Wang, Q.; Yang, J.B.; Chiu, Y.H.; Lin, T.Y. The impact of digital finance on financial efficiency. Manag. Decis. Econ. 2020, 41, 1225–1236. [Google Scholar] [CrossRef]

- Sutherland, W.; Jarrahi, M.H. The sharing economy and digital platforms: A review and research agenda. Int. J. Inf. Manag. 2018, 43, 328–341. [Google Scholar] [CrossRef]

- Lu, H.Y.; Wu, Z.F. Digital finance and equitable industrial carbon emissions: An empirical analysis of Chinese cities. Humanit. Soc. Sci. Commun. 2025, 12, 175. [Google Scholar] [CrossRef]

- Wang, J.D.; Dong, K.Y.; Ren, X.H. Is the spatial impact of digital financial inclusion on CO2 emissions real? A spatial fluctuation spillover perspective. Geosci. Front. 2024, 15, 101656. [Google Scholar] [CrossRef]

- Banzhaf, H.S.; Walsh, R.P. Do People Vote with Their Feet? An Empirical Test of Tiebout’s Mechanism. Am. Econ. Rev. 2008, 98, 843–863. [Google Scholar] [CrossRef]

- Song, W.F.; Han, X.F. A bilateral decomposition analysis of the impacts of environmental regulation on energy efficiency in China from 2006 to 2018. Energy Strat. Rev. 2022, 43, 100931. [Google Scholar] [CrossRef]

- Gao, D.; Zhou, X.T.; Yan, Z.L.; Mo, X.L. The Impact of the Resource-Exhausted City Program on Manufacturing Enterprises’ Performance: A Policy Measures Perspective. Systems 2023, 11, 415. [Google Scholar] [CrossRef]

- Sorrell, S. Jevons’ Paradox revisited: The evidence for backfire from improved energy efficiency. Energy Policy 2009, 37, 1456–1469. [Google Scholar] [CrossRef]

- Fich, L.E.; Viola, S.; Bentsen, N.S. Jevons Paradox: Sustainable Development Goals and Energy Rebound in Complex Economic Systems. Energies 2022, 15, 5821. [Google Scholar] [CrossRef]

- Ojha, V.P.; Pohit, S.; Ghosh, J. Recycling carbon tax for inclusive green growth: A CGE analysis of India. Energy Policy 2020, 144, 111708. [Google Scholar] [CrossRef]

- Wang, D.; Shao, X. Research on the impact of digital transformation on the production efficiency of manufacturing enterprises: Institution-based analysis of the threshold effect. Int. Rev. Econ. Financ. 2024, 91, 883–897. [Google Scholar] [CrossRef]

- Gao, D.; Tan, L.; Chen, Y. Smarter is greener: Can intelligent manufacturing improve enterprises’ ESG performance? Humanit. Soc. Sci. Commun. 2025, 12, 529. [Google Scholar] [CrossRef]

| Dimension | Keyword |

|---|---|

| Basic technology | Big data, cloud computing, artificial intelligence, blockchain, biometrics, Internet of Things |

| Payment and clearing | Online payment, mobile payment, third party payment, QR code payment, mobile payment, online payment |

| Intermediary service | Internet lending, Internet banking, e-banking, Internet insurance, Internet wealth management, insurance finance, mobile banking, direct banking, intelligent customer service |

| Direct name | Internet finance, financial technology, fintech |

| Variable | Name | Symbol | Indicator Measure | Unit |

|---|---|---|---|---|

| Dependent variable | Energy efficiency | EE | Calculated by SBM–Malmquist–Luenberger | - |

| Independent variable | Financial technology | Fintech | Number of regional fintech companies | home |

| Mediating variables | Industrial structure | IND | Ratio of tertiary value added to GDP | % |

| Green innovation | TECH | Patent applications for green inventions per 100 people | Pieces /100 persons | |

| Green finance | GF | Entropy method | - | |

| Control variables | Population density | POP | Ratio of population to administrative area | Persons /km2 |

| Economic development | PGDP | GDP per capita | Yuan /person | |

| Science expenditure | SCI | Ratio of local science expenditure to GDP | % | |

| Government intervention | GOV | Ratio of local general budget expenditures to GDP | % | |

| Urbanization rate | UR | Ratio of urban population to total city population | % | |

| Infrastructure construction | IC | Ratio of total post and telecommunications business to GDP | % | |

| Moderating variable | Environmental regulations | ER | Government work reports and environmental protection penalties | % |

| Variables | Obs | Mean | S.D. | Min | Max |

|---|---|---|---|---|---|

| EE | 3336 | 34.8240 | 14.4196 | 10.2558 | 138.7942 |

| Fintech | 3336 | 193.9909 | 76.0084 | 19.5300 | 361.0663 |

| IND | 3336 | 4296.1720 | 1009.0150 | 1436.0000 | 8387.0000 |

| TECH | 3336 | 4.2953 | 7.6892 | 0.0000 | 93.8556 |

| GF | 3336 | 7.2843 | 0.9919 | 4.3730 | 9.8854 |

| POP | 3336 | 446.9832 | 346.1415 | 5.0000 | 2712.0000 |

| PGDP | 3336 | 56,050.1100 | 32,514.9600 | 97.2000 | 203,489.0000 |

| SCI | 3336 | 28.5563 | 25.6646 | 1.2826 | 229.1220 |

| GOV | 3336 | 199.0323 | 94.5009 | 35.2607 | 744.2022 |

| UR | 3336 | 569.6020 | 149.3328 | 181.5000 | 1177.9000 |

| IC | 3336 | 3.3369 | 0.8167 | 1.0495 | 6.2810 |

| ER | 3336 | 454.0808 | 29.2367 | 350.5970 | 700.3065 |

| Year | Adj Matrix | Geo-Dis Matrix | Eco-Geo Matrix | |||

|---|---|---|---|---|---|---|

| Moran’s I | p Value | Moran’s I | p Value | Moran’s I | p Value | |

| 2011 | 0.2331 | 0.0000 | 0.0517 | 0.0000 | 0.1165 | 0.0000 |

| 2012 | 0.1918 | 0.0000 | 0.0403 | 0.0000 | 0.0888 | 0.0000 |

| 2013 | 0.1261 | 0.0011 | 0.0287 | 0.0000 | 0.1025 | 0.0000 |

| 2014 | 0.1560 | 0.0001 | 0.0328 | 0.0000 | 0.1193 | 0.0000 |

| 2015 | 0.1657 | 0.0000 | 0.0401 | 0.0000 | 0.1286 | 0.0000 |

| 2016 | 0.1590 | 0.0001 | 0.0287 | 0.0000 | 0.0912 | 0.0000 |

| 2017 | 0.1885 | 0.0000 | 0.0370 | 0.0000 | 0.1028 | 0.0000 |

| 2018 | 0.1707 | 0.0000 | 0.0337 | 0.0000 | 0.0869 | 0.0000 |

| 2019 | 0.2033 | 0.0000 | 0.0356 | 0.0000 | 0.1020 | 0.0000 |

| 2020 | 0.1893 | 0.0000 | 0.0372 | 0.0000 | 0.1186 | 0.0000 |

| 2021 | 0.1708 | 0.0000 | 0.0361 | 0.0000 | 0.1144 | 0.0000 |

| 2022 | 0.1704 | 0.0000 | 0.0360 | 0.0000 | 0.1142 | 0.0000 |

| Test | Adj Matrix | Geo-Dis Matrix | Eco-Geo Matrix |

|---|---|---|---|

| Moran’s I | 16.636 *** | 25.708 *** | 20.957 *** |

| LM-error | 262.005 *** | 549.255 *** | 423.473 *** |

| Robust LM-error | 146.911 *** | 244.890 *** | 205.940 *** |

| LM-lag | 136.173 *** | 328.275 *** | 258.089 *** |

| Robust LM-lag | 21.078 *** | 23.910 *** | 40.555 *** |

| Wald_spatial-error | 237.62 *** | 183.24 *** | 184.66 *** |

| Wald_spatial-lag | 258.07 *** | 273.03 *** | 267.98 *** |

| LR_spatial-error | 229.74 *** | 239.37 *** | 197.19 *** |

| LR_spatial-lag | 248.30 *** | 273.2 *** | 260.42 *** |

| Hausman | 56.69 *** | 1404.52 *** | −105.64 |

| LR_SDM_ind | 95.77 *** | 132.24 *** | 73.61 *** |

| LR_SDM_time | 3340.24 *** | 3338.09 *** | 3418.84 *** |

| Variable | Adj Matrix | Eco-Geo Matrix | ||||

|---|---|---|---|---|---|---|

| City | Year | Both | City | Year | Both | |

| Fintech | −0.0439 *** | 0.0480 ** | 0.1036 *** | 0.0950 *** | 0.0456 * | 0.1001 *** |

| (0.0129) | (0.0236) | (0.0275) | (0.0315) | (0.0261) | (0.0314) | |

| W×Fintech | 0.0513 *** | −0.0079 | 0.0825 *** | −0.1089 *** | 0.0079 | 0.1723 ** |

| (0.0138) | (0.0163) | (0.0143) | (0.0326) | (0.0674) | (0.0720) | |

| Spatial rho | 0.1590 *** | 0.2961 *** | 0.1060 *** | 0.3821 *** | 0.4970 *** | 0.1873 *** |

| (0.0242) | (0.0222) | (0.0250) | (0.0411) | (0.0394) | (0.0487) | |

| sigma2_e | 57.1628 *** | 149.6729 *** | 55.7030 *** | 55.7787 *** | 153.0659 *** | 54.7955 *** |

| (1.4032) | (3.7176) | (1.3650) | (1.3698) | (3.8165) | (1.3401) | |

| Variables | Adj Matrix | Geo-Dis Matrix | Eco-Geo Matrix | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Direct | Indirect | Total | Direct | Indirect | Total | Direct | Indirect | Total | |

| Fintech | 0.107 *** | 0.100 *** | 0.207 *** | 0.106 *** | 0.752 *** | 0.858 *** | 0.103 *** | 0.229 *** | 0.332 *** |

| (0.028) | (0.015) | (0.032) | (0.031) | (0.172) | (0.162) | (0.032) | (0.084) | (0.074) | |

| POP | 0.029 *** | −0.054 *** | −0.024 ** | 0.029 *** | −0.218 *** | −0.189 *** | 0.026 *** | −0.063 *** | −0.037 *** |

| (0.004) | (0.011) | (0.011) | (0.004) | (0.055) | (0.054) | (0.004) | (0.012) | (0.013) | |

| PGDP | 0.000 *** | −0.000 *** | 0.000 | 0.000 *** | −0.001 *** | −0.001 *** | 0.000 *** | −0.000 *** | −0.000 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| UR | 0.005 | 0.012 ** | 0.017 *** | 0.002 | 0.066 ** | 0.068 ** | 0.006 | 0.035 *** | 0.040 *** |

| (0.003) | (0.006) | (0.006) | (0.003) | (0.030) | (0.029) | (0.003) | (0.013) | (0.012) | |

| SCI | −0.026 ** | −0.013 | −0.040 * | −0.023 ** | 0.275 ** | 0.252 * | −0.031 *** | 0.045 | 0.013 |

| (0.011) | (0.022) | (0.022) | (0.011) | (0.133) | (0.131) | (0.011) | (0.043) | (0.042) | |

| GOV | −0.022 *** | 0.059 *** | 0.037 *** | −0.026 *** | 0.299 *** | 0.273 *** | −0.027 *** | 0.158 *** | 0.131 *** |

| (0.005) | (0.007) | (0.007) | (0.005) | (0.048) | (0.047) | (0.005) | (0.016) | (0.015) | |

| IC | −1.702 *** | 1.202 ** | −0.499 | −1.476 *** | 5.882 ** | 4.406 | −1.187 *** | 0.804 | −0.382 |

| (0.424) | (0.581) | (0.460) | (0.381) | (2.880) | (2.698) | (0.401) | (1.122) | (0.951) | |

| Effects | Transforming Sample Interval | Shrinking 1% | One Period Lagged | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Adj Matrix (1) | Geo-Dis Matrix (2) | Eco-Geo Matrix (3) | Adj Matrix (4) | Geo-Dis Matrix (5) | Eco-Geo Matrix (6) | Adj Matrix (7) | Geo-Dis Matrix (8) | Eco-Geo Matrix (9) | |

| Direct | 0.0683 ** | 0.1068 *** | 0.1136 *** | 0.0671 ** | 0.0579 * | 0.0509 * | 0.1079 *** | 0.1262 *** | 0.1197 *** |

| (0.0331) | (0.0370) | (0.0371) | (0.0272) | (0.0297) | (0.0303) | (0.0291) | (0.0321) | (0.0328) | |

| Indirect | 0.1644 *** | 0.9186 *** | 0.2477 ** | 0.0842 *** | 0.7325 *** | 0.2759 *** | 0.1170 *** | 0.7287 *** | 0.2196 *** |

| (0.0207) | (0.2663) | (0.0971) | (0.0143) | (0.1657) | (0.0785) | (0.0160) | (0.1931) | (0.0850) | |

| Total | 0.2327 *** | 1.0254 *** | 0.3613 *** | 0.1513 *** | 0.7903 *** | 0.3268 *** | 0.2249 *** | 0.8549 *** | 0.3393 *** |

| (0.0364) | (0.2550) | (0.0852) | (0.0302) | (0.1566) | (0.0693) | (0.0328) | (0.1839) | (0.0751) | |

| R-squared | 0.1378 | 0.0736 | 0.0893 | 0.1144 | 0.0515 | 0.0678 | 0.0931 | 0.0515 | 0.0747 |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| City FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 2780 | 2780 | 2780 | 3336 | 3336 | 3336 | 3058 | 3058 | 3058 |

| Variables | IV1 | IV2 | DID | GMM | ||

|---|---|---|---|---|---|---|

| Fintech (1) | EE (2) | Fintech (3) | EE (2) | Fintech (1) | EE (6) | |

| Fintech | 0.2598 ** | 0.3460 * | 0.1830 * | |||

| (0.1565) | (0.1904) | (0.1033) | ||||

| IV_1 | −0.0280 *** | |||||

| (0.0028) | ||||||

| IV_2 | 0.2889 *** | |||||

| (0.0616) | ||||||

| KP-LM | 64.688 *** | 32.411 *** | ||||

| CD Wald-F | 595.029 [16.38] | 243.221 [16.38] | ||||

| Treat × Post | 2.4451 *** | |||||

| (1.1516) | ||||||

| L.EE | 0.4147 *** | |||||

| (0.0694) | ||||||

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| City FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 3336 | 3330 | 2780 | 2780 | 3336 | 2780 |

| R-squared | 0.1373 | 0.1252 | 0.1330 | |||

| AR(1) | 0.001 | |||||

| AR(2) | 0.107 | |||||

| Hansen | 0.260 | |||||

| Variables | Ind | Tech | GF | |||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Fintech | −2.4286 ** | 0.1002 *** | 0.0828 *** | 0.0765 ** | 0.0080 *** | 0.1115 *** |

| (1.1588) | (0.0304) | (0.0118) | (0.0305) | (0.0007) | (0.0306) | |

| W × Fintech | 31.4317 *** | 0.8471 *** | −0.0642 | 0.7326 *** | −0.0127 *** | 0.6275 *** |

| (4.6154) | (0.1350) | (0.0469) | (0.1242) | (0.0026) | (0.1242) | |

| Ind | 0.0010 ** | |||||

| (0.0005) | ||||||

| W × Ind | −0.0155 *** | |||||

| (0.0042) | ||||||

| Tech | 0.3221 *** | |||||

| (0.0455) | ||||||

| W × Tech | −0.7613 ** | |||||

| (0.3725) | ||||||

| GF | 0.0084 *** | |||||

| (0.0019) | ||||||

| W × GF | 0.1671 *** | |||||

| (0.0413) | ||||||

| control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| City FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 3336 | 3336 | 3336 | 3336 | 3336 | 3336 |

| R-squared | 0.1816 | 0.0418 | 0.2027 | 0.0445 | 0.2106 | 0.0520 |

| Variables | EE (1) | EE (2) | EE (3) | EE (4) |

|---|---|---|---|---|

| Fintech | 0.0916 *** | 0.0983 *** | 0.0945 *** | 0.0981 *** |

| (0.0307) | (0.0305) | (0.0305) | (0.0305) | |

| W × Fintech | 0.7184 *** | 0.6977 *** | 0.6252 *** | 0.6135 *** |

| (0.1246) | (0.1241) | (0.1259) | (0.1259) | |

| ER | −0.0144 * | −0.0086 * | ||

| (0.0087) | (0.0047) | |||

| W × ER | −0.1512 | −0.1347 * | ||

| (0.1128) | (0.0814) | |||

| ER × Fintech | 0.0048 * | 0.0014 | 0.0520 *** | 0.0494 *** |

| (0.0027) | (0.0018) | (0.0100) | (0.0097) | |

| W × ER × Fintexh | 0.0949 ** | 0.0609 ** | 0.7164 *** | 0.6627 *** |

| (0.0380) | (0.0282) | (0.2229) | (0.2201) | |

| control variables | Yes | Yes | Yes | Yes |

| City FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Observations | 3336 | 3336 | 3336 | 3336 |

| R-squared | 0.0455 | 0.0478 | 0.0436 | 0.0499 |

| Variables | Resource-Based (1) | Non-Resource-Based (2) | Low Infrastructure (3) | High Infrastructure (4) |

|---|---|---|---|---|

| Fintech | −0.0669 | 0.1282 * | −0.0301 | 0.1696 ** |

| (0.0469) | (0.0696) | (0.0404) | (0.0716) | |

| Control variables | Yes | Yes | Yes | Yes |

| City FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Observations | 1668 | 1668 | 1668 | 1668 |

| R-squared | 0.1140 | 0.0346 | 0.1300 | 0.1383 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, D.; Wang, T.; Zhao, R. Unraveling the Spatial Effects of Fintech on Urban Energy Efficiency in China. Systems 2025, 13, 815. https://doi.org/10.3390/systems13090815

Wang D, Wang T, Zhao R. Unraveling the Spatial Effects of Fintech on Urban Energy Efficiency in China. Systems. 2025; 13(9):815. https://doi.org/10.3390/systems13090815

Chicago/Turabian StyleWang, Di, Tianqi Wang, and Rong Zhao. 2025. "Unraveling the Spatial Effects of Fintech on Urban Energy Efficiency in China" Systems 13, no. 9: 815. https://doi.org/10.3390/systems13090815

APA StyleWang, D., Wang, T., & Zhao, R. (2025). Unraveling the Spatial Effects of Fintech on Urban Energy Efficiency in China. Systems, 13(9), 815. https://doi.org/10.3390/systems13090815