1. Introduction

Artificial intelligence (AI) has evolved rapidly from a specialized domain of computer science to a pioneering force in digital technology across various sectors [

1]. For electronic commerce, AI technology is being increasingly used to automate processes, enhance customer segmentation, accelerate logistics, and boost overall competitiveness [

2,

3]. While the integration of AI in e-commerce is widespread, its strategic implementation and the extent of functional deployment vary significantly among companies. This variability presents an opportunity to investigate not only how AI is used but also how its adoption aligns with different business models, operational needs, and levels of digital maturity [

4].

Barney (1991) formulated the Resource-Based View (RBV) as a useful framework for describing how firms attain and sustain long-term competitive advantage by strategic leveraging of internal resources [

5]. The resources must be valuable, rare, difficult to imitate, and supported by the firm’s structure and processes—a set of conditions termed the VRIO criteria [

6]. In the context of e-commerce, AI technologies fulfill these conditions when their application is not limited to piecemeal technical solutions but is well-embedded in organizational routines, such as personalization, logistics optimization, or intelligent customer segmentation. Bharadwaj (2000) argues that it is not technology ownership as such that generates value, but the ability of the firm to absorb it into its strategic procedures and competencies [

7]. In this study, therefore, RBV is used not merely as a conceptual backdrop but as an interpretive framework to account for how AI adoption reflects more basic organizational choices that shape performance and differentiation in e-commerce settings.

This conceptual framework is particularly relevant in cases where AI deployment extends across multiple operational layers—as seen in Amazon’s use of integrated personalization, logistics, and security systems—thereby illustrating how RBV can be operationalized in real-world digital commerce contexts.

1.1. AI for Recommendation Systems and Personalization

Much of the work is also concerned with how AI enhances customer experience, particularly through recommendation systems and personalization. Lee and Kim, for example, write about the impact of AI-based personalization strategies to enhance customer loyalty, while Yin et al. (2025) show that personalized recommendation significantly increases purchase intent by highlighting perceived product relevance [

8]. Such evidence sets the strategic significance of AI for consumer interfaces. However, a lot of this effort is still narrowly focused on individual functionalities or one-case platform studies, with minimal data on broader organizational trends of deployment.

1.2. AI in Logistics and Back-End Operations

In addition to customer-facing functionality, AI has also been implemented to streamline back-end operations for e-commerce. Rana et al. (2022) cite the use of AI in supply chain forecasting and warehouse automation as a facilitator of operational effectiveness [

9]. Similarly, News 2024 and Almomani (2024) describe how AI facilitates real-time inventory management and delivery scheduling. Such functional applications aside, however, the current literature is prone to not situating these technologies against the backdrop of firms’ wider business strategies [

10]. There is little comparative work on how these types of systems are applied in different ways across firms or sectors.

1.3. AI as a Strategic Enabler

Beyond operational enhancements, newer threads of work treat AI more as a strategic enabler. Zhou and Zhang (2023) hypothesize, for instance, that AI can lead to high-level decision-making as well as long-term competitiveness, especially when linked to firm-level strategy [

11]. Such an argument finds resonance with the Resource-Based View (RBV) theory, where organizational superiority is linked to the mobilization of rare and unique resources. However, the majority of empirical studies continue to favor technical efficacy over strategic integration, thus not addressing the conceptual space related to AI’s organizational role.

Sharma and Dutta further highlight that successful omnichannel retail strategies increasingly depend on how effectively AI tools are aligned with core business processes [

12]. Their study identifies a gap in AI implementation that bridges front-end personalization and back-end operations, calling for integrated strategic frameworks across e-commerce systems.

1.4. Identified Research Gap

Although much research has concentrated on AI in e-commerce, there are few systematic comparative studies. Current studies are centered around specific companies, technologies, or customer information, with patchy perspectives on the adoption of AI. A Scopus search (2019–2024) using the keywords “AI”, “e-commerce”, “platform comparison”, etc., resulted in 74 hits, of which fewer than 10 took a structured, multi-platform perspective. This lack of cross-company comparison compromises our understanding of the variations in AI maturity as related to business models, operational priorities, and market positions. The current research aims to address this gap through a comparative analysis of five leading e-commerce platforms based on publicly observable AI capabilities and company performance alignment.

Moreover, Aljarboa (2024) emphasizes that AI adoption is not merely a technological decision, but one that is deeply influenced by organizational capabilities, perceived risks, and firm size—factors especially relevant in differentiating strategies between small and large e-commerce firms [

13]. However, most comparative studies fail to address these nuances, leaving an interpretive gap regarding the maturity and scale of AI integration.

Despite the growing interest in AI among scholars and practitioners, few studies have adopted a comparative, cross-company lens to evaluate how AI technologies are deployed across key areas of digital commerce. Most existing research investigates isolated systems or specific firms without offering a comprehensive picture of AI’s strategic role across diverse operational models. To address this void, the current work suggests a qualitative comparison of five leading e-commerce platforms with an emphasis on publicly visible AI features and how they correlate with business performance. This should present practical insights as well as a basis for further research on AI adoption in competitive online markets.

This study addresses this gap by conducting a qualitative comparative analysis of five prominent e-commerce platforms in Europe: Amazon, Apple, Shein, Temu, and IKEA. The companies were selected based on their 2023 revenue rankings, as reported by eCommerce News (2024), providing a relevant basis for evaluating the intersection between AI adoption and market performance [

14].

Methodologically, the study adopts a two-stage approach. First, a bibliographic review was conducted to identify existing research on AI implementation in the selected companies. Second, the walkthrough method [

15,

16] was employed to systematically explore each platform’s digital interface and identify AI-driven features in real- time. This dual method enables both a strategic and user-centered understanding of AI usage in e-commerce.

Accordingly, this research is guided by the following research question:

RQ1. How do leading e-commerce platforms differ in their adoption of AI technologies across core operational areas, and how does this variation relate to their digital maturity and market performance?

Based on this research question, the following hypothesis is proposed:

H1. E-commerce platforms with a higher degree of AI integration across core operational domains exhibit greater technological maturity and stronger market positioning.

This paper begins by describing the theory and background literature on AI adoption in digital business. Then follows a detailed discussion of the methodology, comprising qualitative walkthrough analysis and a comparative score model. The empirical findings are then debated with an emphasis on AI adoption trends among the five leading e-commerce websites. The discussion elaborates on these findings in light of the research hypothesis, and the conclusion offers theoretical implications and practical recommendations for business and future research. However, few studies have explored how such strategic integration of AI varies across firms or how it correlates with competitive outcomes in real-world e-commerce ecosystems.

2. Materials and Methods

2.1. Research Design

This study employs a two-stage qualitative research design to explore how leading e-commerce companies utilize artificial intelligence (AI) in their digital operations. The primary objective is to identify and analyze best practices in AI adoption across different business models and application domains. This exploratory approach is particularly suited to generate insights in areas where quantitative benchmarking is limited, and real-world implementations remain under-documented.

2.2. Sample Selection

The selection of companies for this study was based on the 2024 ranking published by eCommerce News, titled “Top 10 Online Stores in Europe” [

14]. From this list, the five top-ranked companies in terms of estimated revenue for the year 2023 were selected: Amazon, Apple, Shein, Temu, and IKEA. These companies represent diverse product categories and business models, yet they share a common trait: a strong and consistent integration of AI technologies within their digital ecosystems.

The selection criterion was the total e-commerce revenue generated in the European market, ensuring a focus on companies with significant operational scale and consumer impact. This criterion ensures relevance not only in market terms but also in reflecting digital transformation leadership within the sector. The decision to analyze these specific organizations stems not only from their dominant market presence but also from the growing academic and practical interest in their AI strategies.

Data were collected between 15 September 2024 and 15 January 2025 to explore AI-related features implemented in their digital stores, using the Opera and Brave web browsers during the data collection process. These browsers were chosen for their enhanced privacy controls and lower resource consumption, which ensured consistent performance across multiple platform evaluations. Additionally, both browsers provide robust developer tools, ad/script control, and isolation features that allow for accurate inspection of dynamic content, making them particularly suitable for walkthrough-based interface analysis [

14,

17]. The walkthrough was limited to the desktop versions of each site to ensure comparability across platforms.

This selection and data collection framework ensures that the companies studied are not only revenue leaders but also represent influential case studies in the practical application of AI in e-commerce.

2.3. Data Collection

Data for this study were primarily obtained from peer-reviewed academic publications indexed in the Scopus database, as well as from the official websites of the selected e-commerce companies [

18].

- (a)

Scopus Literature Search

The first phase involved a structured bibliographic search conducted via the Scopus database. Keywords were combined using Boolean logic to capture targeted research on each company’s use of artificial intelligence (AI). Specifically, search terms such as “Amazon AND AI”, “AI AND Amazon e-commerce”, “Amazon AND artificial intelligence”, “Amazon AND AI strategy”, “Apple AND AI”, “AI AND Apple e-commerce”, “Apple AND artificial intelligence”, “Apple AND AI strategy”, “Shein AND AI”, “AI AND Shein e-commerce”, “Shein AND artificial intelligence”, “Shein AND AI strategy”, “Temu AND AI”, “AI AND Temu e-commerce”, “Temu AND artificial intelligence”, “Temu AND AI strategy”, “IKEA AND AI”, “AI AND IKEA e-commerce”, “IKEA AND artificial intelligence” and “IKEA AND AI strategy”. The goal was to identify existing studies, conference proceedings, and reviews that provided insight into how these companies integrate AI into their e-commerce operations. The inclusion criteria focused on documents published from 2023 to early 2025 to ensure timeliness. A total of 74 documents were initially retrieved, and 28 were deemed relevant after manual screening. The review focused on identifying AI applications in customer experience, logistics, personalization, and digital infrastructure.

- (b)

Walkthrough Analysis of Corporate Websites

The second phase employed the walkthrough method to systematically explore the digital environments of the selected companies [

15,

16]. This method is particularly suited for analyzing real-time user-facing AI features, as it captures placement, visibility, and contextual relevance within digital interfaces [

16]. Two main sub-steps were followed:

Webpage Examination: Key sections of each website were reviewed manually, including “About”, “Corporate Information”, “Technology”, “Press Room”, and “Sustainability” pages, to identify explicit mentions of artificial intelligence in operational areas such as customer service, logistics, product recommendations, or personalization.

Internal Keyword Search and Content Analysis: Each website’s internal search function was used to locate pages mentioning “artificial intelligence” and “AI”. Searches were performed using both keywords in lowercase format to standardize results. The walkthrough process was aided by a pre-established checklist of AI capabilities based on the literature. For instance, a recommendation system was considered AI-based if it reacted to user interaction dynamically rather than with static filters. A chatbot should indicate contextual awareness or learning features. Following data extraction, content analysis was conducted to evaluate the role, visibility, and narrative framing of AI in each digital storefront [

19].

This study expands the systematic walkthrough method as designed in existing AI adoption studies in cultural organizations [

20]. Specifically, it applies keyword content analysis on firm interfaces using AI-related queries (e.g., “recommendation engine”, “chatbot”, “personalization”) to test the incidence of intelligent features in real retail environments.

2.4. Categorization of AI Use in E-Commerce Companies

To enable structured comparison, the data collected from the literature and website walkthroughs were categorized based on the nature and extent of artificial intelligence (AI) integration across the selected e-commerce companies. Rather than adopting a binary classification (use vs. non-use), this study utilized a thematic categorization grounded in the specific domains where AI is implemented.

The AI applications were grouped into five main categories: (1) Recommendation Systems, (2) Personalized Content and Marketing, (3) Virtual Assistants and Chatbots, (4) Supply Chain and Warehouse Automation, and (5) Security and Fraud Detection [

1,

3,

8,

9,

10]. Each company’s implementation of AI was assessed in these categories, based on publicly available descriptions, internal search findings, and the academic literature.

Where a functionality was not explicitly visible but suggested through CSR reports or press releases, it was recorded but tagged “non-confirmed”. This added yet another note of interpretive prudence.

This categorization approach provides a comprehensive framework to understand the diverse roles AI plays in the e-commerce sector and supports the subsequent synthesis and discussion in the findings section.

2.5. Comparative Analysis Method

To make the comparison across platforms more structured, we decided to create a simple scoring system. The system is not sophisticated or highly technical, but it helps capture what each company is doing with AI, at least based on what is visible to users. The score is based on whether a company uses six specific AI functions that are commonly mentioned in the recent literature on e-commerce. These functions are (1) virtual assistants and chatbots, (2) warehouse automation, (3) content personalization, (4) automated content creation, (5) recommendation systems, and (6) fraud detection or security AI tools.

They were selected not merely due to the number of times they appear in contemporary academic papers, but also because they are operational capabilities that fit the VRIO criteria (valuable, rare, inimitable, and organizationally embedded) according to the Resource-Based View definition [

5]. Their presence is, perhaps, a strategic differentiation in digital commerce.

We chose these six functions because they appear repeatedly in the sources reviewed. Most studies seem to focus on how companies use AI either to improve customer experience or streamline back-end operations. From a strategic point of view, these features could also be seen as resources that align with the ideas of the Resource-Based View [

5], especially if they give a firm a lasting edge over competitors.

For example, recommendation systems were identified when personalized product suggestions shifted depending on browsing history. Virtual assistants were confirmed when chatbots or AI support agents appeared on the homepage or help pages.

For each function, we gave companies a score of 1 if it was present and 0 if not. This resulted in a total score out of 6 for each firm. Of course, this is an approximate measure that does no t reflect how advanced or customized the feature is. For example, one company might use a basic chatbot, while another has a fully integrated AI assistant—but in this model, both are scored the same. Still, the method provides a starting point to look at the breadth of AI use and how it differs from one company to another.

In addition to the binary metrics, the table below sets out percentage calculations by firm and by AI function in order to give a clearer sense of adoption rates and comparison across platforms and categories.

To increase the relative transparency of

Table 1, percentage values have been included horizontally (across firms) and vertically (across AI functions). For example, Amazon and IKEA both have 83% coverage for AI functions, and the most prevalent AI capabilities are recommendation systems and content personalization, each of which is adopted by 80% of the firms included. These quantitative indicators give better measures of the breadth and depth of AI adoption [

4,

21].

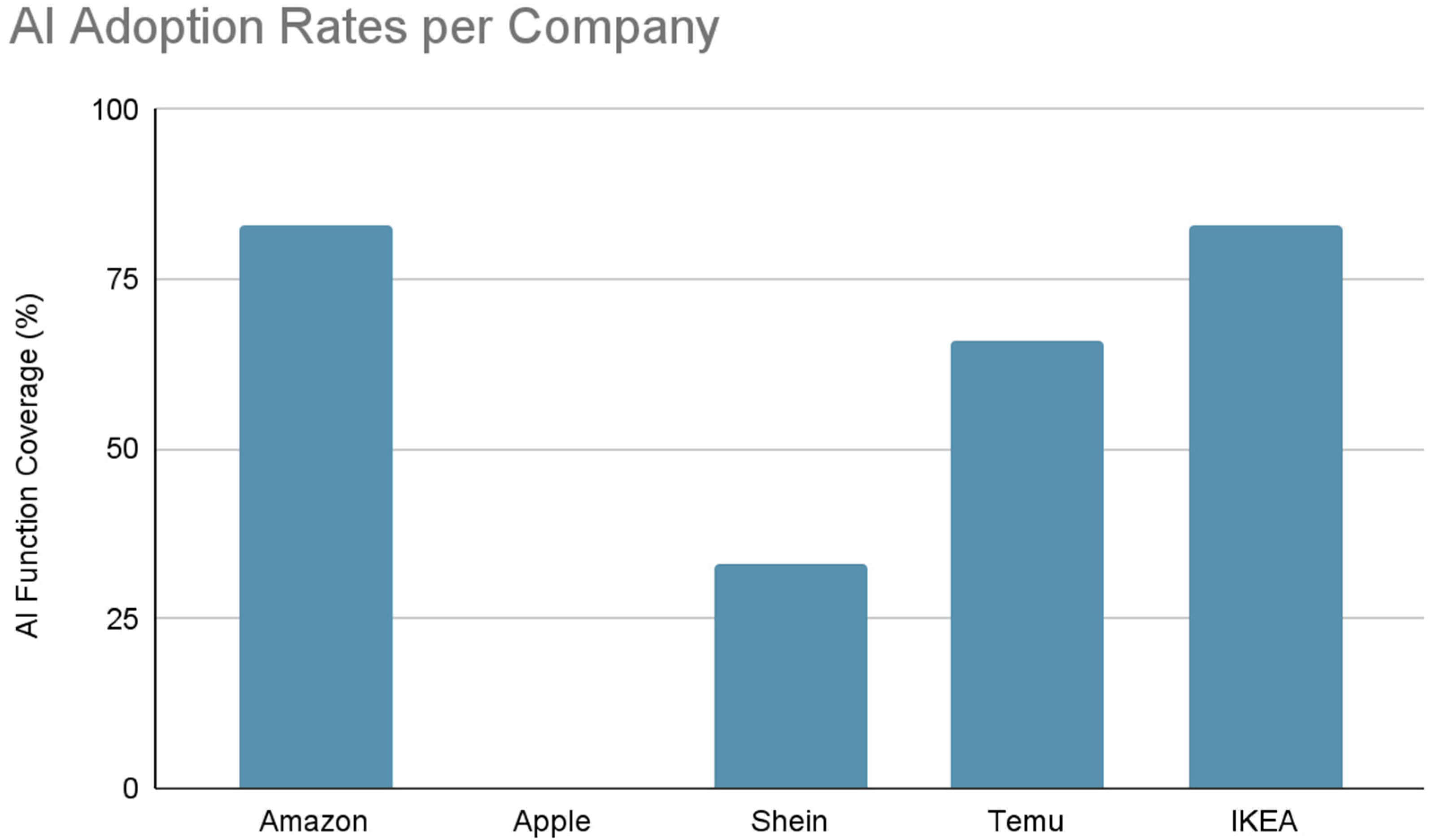

Figure 1 shows the share of adopted AI functions by each e-commerce site, providing a rapid comparison of functional coverage among the six evaluated AI areas.

Figure 2 shows the percentage of companies that have adopted each AI function for the most widely adopted technologies across European e-commerce sites.

One clear observation was that none of the five companies had any visible AI features related to fraud detection or online security. That does not necessarily mean the companies do not use them—it is more likely that these tools operate in the background and are not meant to be seen by end users. However, it does show a limitation of the method used here, which relies heavily on what is visible through walkthroughs.

Moreover, the scoring does not consider depth, degree of customization, or strategic integration of each feature. A basic chatbot and an advanced conversational agent have the same score despite clear functional differences. Weighted scoring or technical auditing may be integrated in future efforts to better assess these differences.

In the next section, we compare these AI scores with how each company performed in terms of revenue in 2023. This can give an approximate indication of whether heavier use of AI across different functions is somehow connected to better commercial outcomes, though, of course, no firm conclusions can be drawn this alone [

22].

Also, one should remember that the absence of a feature from this test does not establish non-existence, but a lack of publicly available evidence or interface-level observability within the walkthrough interval. However, the use of this framework provides a real-world gauge of AI maturity and strategic focus, especially if used within the context of RBV principles and against a market performance benchmark, such as revenue.

3. Results

This research explored the implementation of artificial intelligence (AI) technologies across five leading e-commerce platforms: Amazon, Apple, Shein, Temu, and IKEA. The results are based on thematic categorization of AI applications derived from the literature and interface-level walkthroughs. Each company demonstrated a distinct strategy of AI integration, ranging from advanced recommendation engines and personalization tools to back-end applications in logistics and security.

In line with the Resource-Based View (RBV), the prevalence of AI across strategic domains—e.g., logistics, personalization, and customer service—was not only perceived as a technological advancement but as a potential source of competitive advantage when embedded within firm-specific routines [

5]. The comparative AI adoption scores thus measure indirect capabilities in resource orchestration. This is particularly the case for Amazon, whose AI is deeply embedded in both customer-facing and back-end functions, representing a strong RBV fit through integration and inimitability of digital capabilities [

5,

21].

The analysis identified five primary domains where AI technologies are applied: (1) recommendation systems, (2) personalized content and marketing, (3) virtual assistants and chatbots, (4) supply chain and warehouse automation, and (5) security and fraud detection. Amazon and IKEA exhibited the most comprehensive AI integration across these domains, whereas TEMU presented a more moderate level of adoption, primarily in logistics and content personalization.

The reported percentages of estimated coverage indicate Amazon and IKEA both making use of 83% of the selected AI functions, followed by Temu at 66%, Shein at 33%, and Apple at 0%. Although not a metric for depth or quality, these indicators serve as proxies for functional diversity and may represent a measure of digital operational maturity. This allocation is evidence suggesting that companies with broader AI coverage tend to show greater digital infrastructure preparedness. The omission of specific features may be either a sign of exclusion by choice or a lack of integration in retail platforms.

While this approach provides a comparative view of AI deployment, several limitations must be acknowledged. One key limitation is the absence of publicly available historical data specifying the exact timeline of AI adoption in each company. As a result, it was not possible to conduct longitudinal comparisons to assess the operational or strategic impact of AI over time. Additionally, companies vary significantly in the transparency of their digital strategies; some provide extensive public documentation, while others disclose minimal technical detail.

Also, the absence of AI components in areas such as fraud detection does not mean a lack of use. Most of these kinds of technologies have their foundation in back-end systems and are explicitly concealed from public interfaces. This creates an interpretive blind spot inherent in walkthrough-based research, but it is indicative of industry practices surrounding security opacity.

Unlike studies that apply heavy quantitative analysis or large-scale statistical models, this approach takes a more exploratory route. The walkthrough method, paired with a basic scoring system, does no t aim for precision but offers a practical way to identify patterns in how AI is being used. While the findings do no t claim causality, they still highlight some interesting connections between the breadth of AI adoption and the strategic focus of each company. These observations may be useful as a starting point for future research into digital maturity and technology-driven performance in e-commerce.

To obtain a perspective on the observed trends in AI adoption,

Table 1 shows the revenue-based rankings in 2019 and 2023 of the studied companies. This comparison highlights changes in the market over time, and

Table 2 provides an overview of the condition of AI implementation on each platform. It can be observed that the ranking in

Table 2 aligns with the companies’ 2023 ranking based on their top-line revenues annually, thereby also providing insight into an interpretation of the extent and depth of AI deployment. Although causal linkages cannot be conclusively determined, co-occurrence with business expansion implies a probable strategic advantage from first-mover status.

A review of revenue-based rankings for the European e-commerce market reveals notable transitions between 2019 and 2023. Amazon maintained its dominant position, achieving a substantial increase in revenue while demonstrating extensive AI integration across all operational levels. These include personalized product recommendations, dynamic pricing models, and warehouse automation—features that reinforce both its market share and technological maturity.

Apple, although ranked second in 2023, presents a less transparent case regarding AI deployment in its online retail operations. While its broader ecosystem incorporates AI through services such as Siri, image processing, and device-level personalization, there is no publicly confirmed use of AI within its e-commerce interface, rendering its strategy in this domain relatively opaque.

Shein and Temu, both absent from the top five in 2019, emerged as top players in 2023. Shein’s rapid ascension to the market may be traced, to a certain degree, to the strategic, aggressive implementation of AI technologies. Shein heavily relies on real-time demand forecasting, automated marketing messages, and recommendation engines as the pillars of its rapid-fashion business. Temu, a new startup that began operations in 2022, has gained momentum quickly by embracing AI-powered features such as product recommendations, visual search, and intelligent categorization.

IKEA also joined the top five in 2023, leveraging AI primarily in back-end functions. Its use of technologies focused on stock prediction, customer behavior analytics, and supply chain optimization reflects a more moderate, yet targeted, approach to AI adoption. Although it does not reach the integration depth seen in Amazon, its digital evolution suggests that AI contributes meaningfully to its improved competitive position.

Conversely, former leading companies (2019) such as Otto Group, Zalando, and Tesco are no longer in the top five, hinting at possible changes in consumer tastes and realignment of technological rivalry. Due to the lack of internal data and adoption schedules, market changes that have been observed cannot be confirmed to have been caused by AI; however, they add weight to the postulate that AI can be a game-changing driver of business growth and competitive success in nascent retailing environments [

22].

The overall trend is towards an enhanced strategic relationship between AI adoption and business performance, particularly for companies that have already embraced AI as a core operational factor. Regardless of the failure empirically verify causality with the available data, the universality of this technology on a number of emerging platforms makes it possible that AI may increasingly be a differentiator in the evolving European e-commerce landscape.

The categorization of AI applications across the selected e-commerce platforms is presented in

Table 3, based on the specific type of technology and its primary function. The most prevalent AI functions are related to customer interaction and personalization, including chatbots, recommendation systems, and adaptive content delivery.

Beyond the summarized comparison presented in

Table 3, a more detailed analysis of AI usage is provided in

Table 4, which reveals differentiated strategic orientations among the five selected e-commerce platforms. The distribution of AI applications ranges from direct customer-facing technologies to back-end operational tools, with notable variation in the intensity and scope of adoption.

Customer interaction and support are key areas where AI plays a central role. Chatbots and virtual assistants are widely implemented in Amazon, Temu, and IKEA, offering automated responses, purchase guidance, and after-sales support [

23]. These tools help streamline customer service operations while maintaining high interaction quality [

24,

25,

26]. Although Apple integrates conversational AI within its ecosystem through Siri, such features are not embedded in its online retail interface [

27]. Shein, despite its strong AI presence in other domains, has not yet incorporated chatbot systems on the same scale.

Personalization and product recommendation systems are among the most pervasive AI-driven features across all platforms. Amazon leads this domain with highly advanced recommendation algorithms based on collaborative filtering and deep learning [

17]. Shein and Temu also deploy sophisticated personalization engines to align product suggestions and content with user preferences in real-time, tailored to fast fashion dynamics and mobile-first user behavior. IKEA uses more basic recommendation logic rooted in previous purchases and browsing data, while Apple’s personalization is limited to its wider digital ecosystem and is not explicitly reflected in its web store [

23].

Warehouse automation and logistics optimization are areas where Amazon continues to set industry standards. With AI-driven robotics, predictive logistics, and real-time inventory tracking, it achieves unmatched efficiency in fulfillment processes [

21]. Temu, though newer to the market, also shows significant investment in AI-based demand forecasting and supply chain management [

28]. IKEA has started incorporating AI for internal storage and stock processes, though not yet at Amazon’s scale. In contrast, Apple and Shein primarily focus their resources on digital interaction and marketing rather than physical logistics [

29].

Content generation and merchandising automation represent a growing domain of AI applications. Amazon leverages internal tools for dynamic product listings and targeted advertising. Shein and Temu are believed to employ automated solutions—either in-house or third-party—to streamline the creation of large-scale product descriptions, marketing texts, and SEO-oriented content, though specific tools are not publicly disclosed [

29,

30]. IKEA applies similar approaches to personalize catalog descriptions and newsletters. Apple, in contrast, adopts a more curated content strategy, prioritizing brand consistency over algorithmically generated material.

Interestingly, security and fraud detection, while crucial in e-commerce, do not appear to be openly documented as a focus area for AI implementation across these platforms [

31,

32,

33]. Such systems may be in place but remain undisclosed for strategic or operational reasons [

4]. Apple, for example, is known for its emphasis on data privacy and device-level security, which may rely on AI, yet no direct application within its online retail channel is confirmed.

This functional mapping highlights the differing levels of technological maturity and business priorities that influence AI adoption [

34,

35,

36,

37,

38,

39]. Amazon stands out as the most comprehensive user of AI, integrating intelligent systems across the entire value chain. Shein and Temu focus primarily on customer engagement, dynamic marketing, and agile logistics [

40]. IKEA’s approach reflects a balance between back-end optimization and basic personalization, while Apple maintains a more indirect and ecosystem-oriented use of AI [

41]. These variations reinforce the strategic role of AI as a modular and scalable toolset, tailored to the business models and market positioning of each company [

42,

43].

4. Discussion

The present study highlights the pivotal role of artificial intelligence (AI) in transforming the landscape of electronic commerce [

44]. Through the comparative analysis of five leading companies—Amazon, Apple, Shein, Temu, and IKEA—across six key AI dimensions, it becomes evident that AI adoption is a catalyst for operational efficiency, customer experience enhancement, and strategic digital innovation.

The findings show that AI implementation is not uniform across companies but tailored to specific business models and digital priorities [

1,

2,

16]. This result aligns with earlier research published in Systems, which identified the variability of AI adoption strategies according to organizational objectives and digital maturity levels [

26]. However, unlike most earlier research that either examines individual firms or focuses predominantly on algorithmic performance, the research reported here is cross-company, systematic in nature, and based directly on interface analysis and feature mapping. By doing so, it provides a more holistic view of AI embedding in real e-commerce environments.

Amazon emerges as the most advanced in overall AI integration, leveraging cutting-edge technologies across virtual assistants, warehouse automation, personalization, content generation, and security [

45]. Apple demonstrates strong AI usage in virtual assistance and personalization within its ecosystem. Shein and Temu are rapidly evolving players, utilizing AI intensively in content generation, personalization, and recommendation systems to remain competitive in the fast fashion and discount-driven markets. IKEA, while more conservative in approach, has made significant strides in AI-supported customer service and security measures [

4].

The strategic deployment of AI in such a context is reflective of differentiated resource mobilization strategies in consonance with the Resource-Based View (RBV) of the company [

5,

6,

46,

47,

48]. For example, Amazon’s highly integrated frameworks can be thought of as valuable, rare, and difficult to copy—meeting all VRIO requirements—specifically due to its internal synergies between logistics and customer interfaces. IKEA’s more discerning but more aligned use of AI in back- end processes also indicates an effort to utilize AI as an organizationally embedded capacity, enabling long-term performance in physical and hybrid store models.

Notably, such strategic uses of AI in these firms are consistent with the Resource-Based View (RBV), particularly when such intelligent tools are embedded in routines that are valuable, rare, inimitable, and organizationally supported—thus representing a sustainable advantage [

5,

6].

Temu and Shein, being highly digital in their approach, appear to prioritize agility and front-end dynamism over structural depth, potentially suggesting a different model of resource orchestration—less dependence on long-term capability development and more rapid iteration. This is different from Apple’s minimal AI presence in the e-commerce UI, while strong AI utilization takes place at the device level, suggesting either deliberate de-prioritization or leveraging of ecosystem effects beyond the web retailing space. This raises interesting questions about whether advanced AI capability outside the e-shop translates to retail advantage—something that this research finds modest backing for.

Each company’s AI strategy reflects a different dimension of digital maturity. The presence of advanced virtual assistants and chatbots demonstrates a shift toward human–machine collaboration in customer service. Automated warehouse operations signal a transition to intelligent logistics, enhancing delivery speed and cost-efficiency. Personalization and content automation mark a move toward hyper-relevant digital experiences, while recommendation systems remain at the core of consumer engagement strategies. Moreover, AI in security and fraud detection has become indispensable for building trust and ensuring data protection in digital transactions.

From a strategic management perspective, the variation in AI adoption levels reflects the degree to which firms can transform digital assets into long-term competitive advantages. This implies not just technological adoption but also underlying firm capabilities such as IT alignment, innovation culture, and data governance—all core to RBV and increasingly critical in digital transformation [

49,

50,

51].

The structured evaluation matrix and the consolidated comparative table (

Table 1) are practical tools for benchmarking AI adoption in e-commerce. These tools can be replicated by researchers and business practitioners to assess digital readiness and AI impact across diverse sectors. However, while the analysis reveals a high level of AI implementation in some domains, it does not establish a direct correlation between AI use and business performance indicators such as customer acquisition, loyalty, or revenue growth. These findings are s imilar to those of prior research in the cultural sector.

These results mirror the findings of Kiourexidou & Stamou (2025) [

20], who analyzed AI integration in European museums and concluded that, while AI enhances user experience, it does not necessarily drive attendance or engagement metrics on its own. This cross-sectoral convergence strengthens the argument that AI’s contribution lies more in operational optimization and user-level interaction than in direct performance metrics.

This limitation suggests the need for follow-up research to combine interface-based findings with performance measures, customer feedback, and internal system audits to reveal deeper causal mechanisms. Methods such as user experience (UX) analysis, A/B testing, and business case studies can offer increased detail regarding the effectiveness and perception of AI tools across e-commerce environments.

Moreover, the absence of fraud detection systems in interface analysis—presumably due to being back-end-based—is an indication of a broader methodological problem in AI evaluation: the difficulty of seeing invisible or proprietary implementations. Further triangulation with technical documentation and stakeholder interviews can potentially complete these observation gaps.

5. Conclusions

In this study, the application of artificial intelligence (AI) within the e-commerce sector was examined based on six primary functions across five leading firms. The firms under consideration were Amazon, Apple, Shein, Temu, and IKEA. Through a comparative qualitative study, this study revealed that AI technologies are increasingly being integrated into digital commerce architecture, driving efficiency, customization, and consumer engagement.

Though implementation levels vary, the overall trend is that AI capabilities such as virtual assistance, warehouse automation, content generation, and recommendation systems are becoming industry standards for top players. The formal framework developed here offers a practical approach for measuring AI readiness in various business environments.

This research contributes to the literature by presenting a systematic, cross-firm evaluation grounded in the Resource-Based View (RBV), thus connecting AI implementation with more universal strategic competencies. By integrating the use of both a literature review and walkthrough interface analysis, the research operationalizes a replicable approach that focuses on perceptible AI features without excluding hidden infrastructures.

However, this study also points out the need for additional studies examining the long-term implications of AI deployment in companies. Subsequent studies can employ user-centered approaches, such as customer satisfaction surveys or A/B testing, to find out how AI influences consumer trust, perceived fairness, and experience quality. As emphasized in isomorphic methodological practices applied in the cultural industry [

20], future research will have to make an effort towards aligning walkthroughs with user-centric approaches such as perception studies or longitudinal follow-ups, to improve the explanation of AI’s actual impact on engagement, loyalty, and trust across different digital industries. Broadening the scope of studies to include SMEs and regional differences in AI deployment would provide additional information.

Moreover, empirical measures—such as conversion rates, retention rates, and logistics KPIs—would have the potential to make more accurate correlations between AI integration and firm performance. Longitudinal analysis would also allow researchers to study how AI maturity evolves over a period of time and whether early adopters are able to sustain their competitive edge.

Moreover, issues of ethics and regulation—privacy of data, algorithmic bias, and replacement of jobs—remain high-priority areas of concern. Investigating how AI systems could be designed to enable inclusivity, accessibility, and transparency in decision-making would be of very significant positive bearing on their social acceptability and enduring impact.

As artificial intelligence keeps reshaping the digital retail environment, regulatory frameworks need to evolve in tandem. Follow-up research may explore the mechanisms through which policy actions, standardization approaches, and business models of corporate governance influence the strategic and ethical adoption of AI by companies and geographies.

In short, artificial intelligence is not merely a technological plus but a groundbreaking force behind e-commerce strategy. Its successful and ethical adoption will determine the future health and variety of digital markets in a more automated economy.

Lastly, this study underscores the fact that AI in e-commerce should not just be considered as a foundation for optimization but as a strategic force whose potential depends on the extent to which it is embedded within business models, operations, and values.

Practical applications for e-shoppers: Better AI interfaces facilitate product findability and responsiveness, leading to more user-friendly online shopping experiences. For instance, voice search functionality and AI-driven auto-suggests allow customers to locate products faster on mobile. Visual recommendation engines can also aid discovery by displaying similar or trending products based on the history of searching.

Operational implications for companies and their e-platforms: The adoption of AI in core tasks, such as logistics and personalization, delivers measurable gains in efficiency and market differentiation. Merchants can install AI-powered dynamic pricing applications that learn and adapt in real-time based on competitor actions, reducing overstocking and optimizing conversion rates. Predictive analytics also optimizes supply chain operations through demand forecasting and automated inventory replenishment.

Practical applications of digital transformation leaders: Strategic guidance for prioritizing investments and building digital capabilities is provided by benchmarking AI maturity across organizations. Companies can utilize AI capability audits to identify under-leveraged data streams and invest first where ROI is highest. Competitor benchmarking-based systematic roadmaps help scale the deployment of AI incrementally without bringing the workflow to a standstill.

Study Limitations and Future Research Directions: Our analysis is based on secondary evidence and platform walkthroughs at the platform level, omitting primary data such as user interviews, behavior analysis, or back-end implementation data. Therefore, while it offers rich insights into how AI is made accessible and applied on leading platforms, it does not facilitate direct causal inferences between AI policies and specific performance metrics.

Future research can amend this approach by including user-centered qualitative data or firm-level analysis to obtain a more accurate picture of the true impact of AI. Furthermore, longitudinal analyses of differences in the adoption of AI over time will establish the long-term performance of various applications.