The Synergistic Empowerment of Digital Transformation and ESG on Enterprise Green Innovation

Abstract

1. Introduction

2. Theoretical Basis and Literature Review

2.1. Theoretical Basis

2.2. The Impact of ESG on Enterprise Green Innovation

2.3. The Impact of Digital Transformation on Enterprise Green Innovation

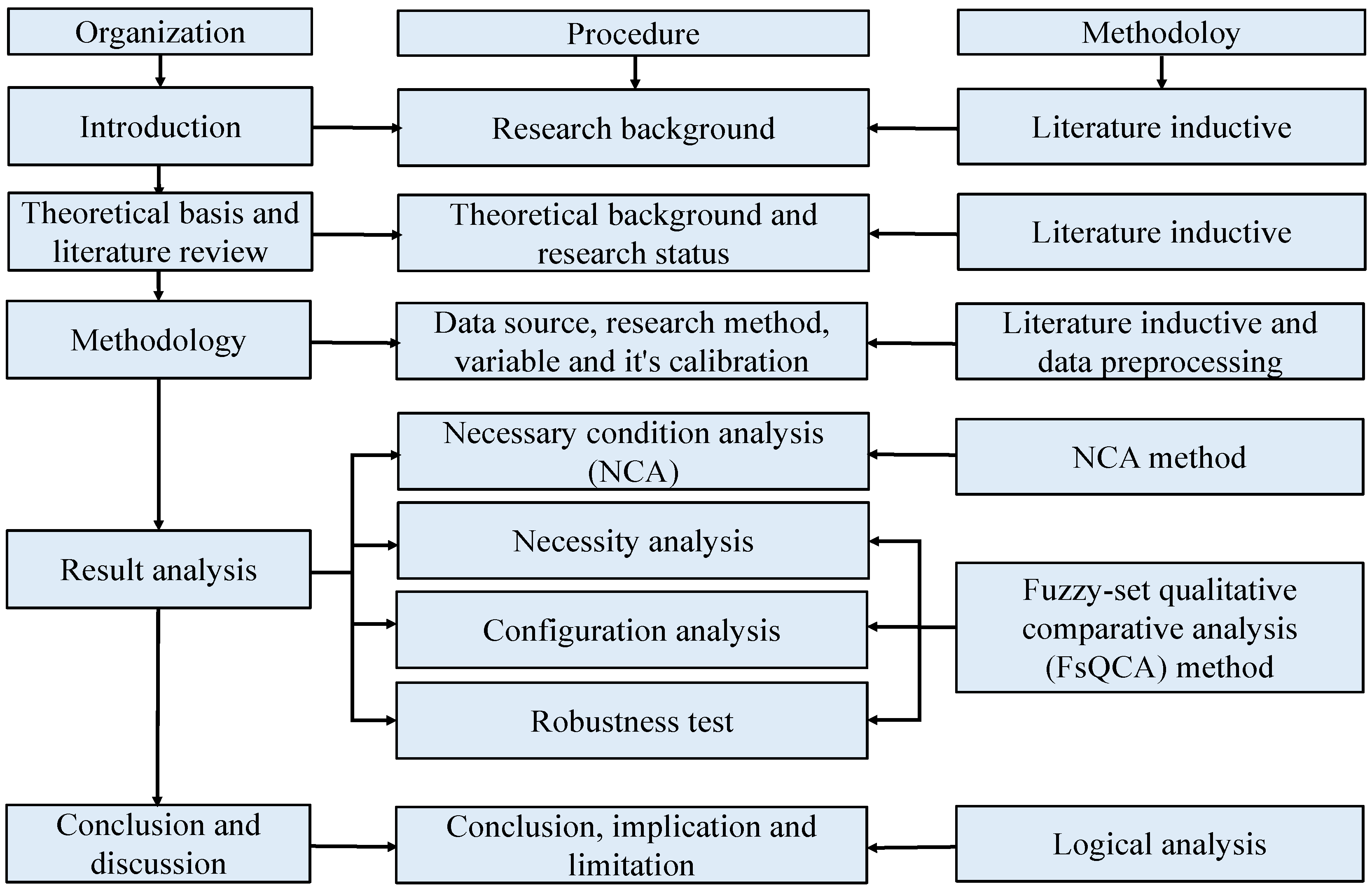

3. Methodology

3.1. Data Source

3.2. Research Method

3.3. Research Variable

3.4. Variable Calibration

4. Result Analysis

4.1. Necessary Condition Analysis

4.2. Necessary Analysis

4.3. Configuration Analysis

4.3.1. The Comprehensive Analysis of High Green Innovation Level

4.3.2. The Grouping Analysis of High Green Innovation Level

- (1)

- The dual-core-driven configuration

- (2)

- The digitally driven configuration

4.3.3. The Analysis of Low Green Innovation Level

4.4. Robustness Test

5. Conclusions and Discussion

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Wen, J.; Zhao, X.X.; Fu, Q.; Chang, C.P. The impact of extreme weather events on green innovation: Which ones bring to the most harm? Technol. Forecast. Soc. Change 2023, 188, 122322. [Google Scholar] [CrossRef]

- Bian, Z.; Liu, J.; Zhang, Y.; Peng, B.; Jiao, J. A green path towards sustainable development: The impact of carbon emissions trading system on urban green transformation development. J. Clean. Prod. 2024, 442, 140943. [Google Scholar] [CrossRef]

- Wen, H.; Zhong, Q.; Lee, C.C. Digitalization, competition strategy and corporate innovation: Evidence from Chinese manufacturing listed companies. Int. Rev. Financ. Anal. 2022, 82, 102166. [Google Scholar] [CrossRef]

- Bai, C.; Sarkis, J. Improving green flexibility through advanced manufacturing technology investment: Modeling the decision process. Int. J. Prod. Econ. 2017, 188, 86–104. [Google Scholar] [CrossRef]

- Yoo, Y.; Boland, R.J.; Lyytinen, K.; Majchrzak, A. Organizing for innovation in the digitized world. Organ. Sci. 2012, 23, 1398–1408. [Google Scholar] [CrossRef]

- Simsek, Z.; Vaara, E.; Paruchuri, S.; Nadkarni, S.; Shaw, J.D. New ways of seeing big data. Acad. Manag. J. 2019, 62, 971–978. [Google Scholar] [CrossRef]

- Bajari, P.; Chernozhukov, V.; Hortaçsu, A.; Suzuki, J. The impact of big data on firm performance: An empirical investigation. AEA Pap. Proc. 2019, 109, 33–37. [Google Scholar] [CrossRef]

- Schwertner, K. Digital transformation of business. Trakia J. Sci. 2017, 15, 388–393. [Google Scholar] [CrossRef]

- Reis, J.; Melao, N.; Matos, P. Digital transformation: A literature review and guidelines for future research. Trends Adv. Inf. Syst. Technol. 2018, 1, 411–421. [Google Scholar]

- Warner, K.S.R.; Wäger, M. Building dynamic capabilities for digital transformation: An ongoing process of strategic renewal. Long Range Plan. 2019, 52, 326–349. [Google Scholar] [CrossRef]

- Munoz-Torres, M.J.; Fernandez-Izquierdo, M.A.; Rivera-Lirio, J.M.; Escrig-Olmedo, E. Can environmental, social, and governance rating agencies favor business models that promote a more sustainable development? Corp. Soc. Responsib. Environ. Manag. 2019, 26, 439–452. [Google Scholar] [CrossRef]

- Jiang, Z.; Wang, Z.; Li, Z. The effect of mandatory environmental regulation on innovation performance: Evidence from China. J. Clean. Prod. 2018, 203, 482–491. [Google Scholar] [CrossRef]

- Siew, R.Y.J.; Balatbat, M.C.A.; Carmichael, D.G. The impact of ESG disclosures and institutional ownership on market information asymmetry. Asia-Pac. J. Account. Econ. 2016, 23, 432–448. [Google Scholar] [CrossRef]

- Dilla, W.; Janvrin, D.; Perkins, J.; Raschke, R. Do environmental responsibility views influence investors’ use of environmental performance and assurance information? Sustain. Account. Manag. Policy J. 2019, 10, 476–497. [Google Scholar] [CrossRef]

- Amore, M.D.; Bennedsen, M.C. Corporate governance and green innovation. J. Environ. Econ. Manag. 2016, 75, 54–72. [Google Scholar] [CrossRef]

- Eliwa, Y.; Aboud, A.; Saleh, A. ESG practices and the cost of debt: Evidence from EU countries. Crit. Perspect. Account. 2021, 79, 102097. [Google Scholar] [CrossRef]

- Xue, R.; Wang, H.; Yang, Y.; Linnenluecke, M.K.; Jin, K.; Cai, C.W. The adverse impact of corporate ESG controversies on sustainable investment. J. Clean. Prod. 2023, 427, 139237. [Google Scholar] [CrossRef]

- Greenwood, R.; Raynard, M.; Kodeih, F.; Micelotta, E.R.; Lounsbury, M. Institutional complexity and organizational responses. Acad. Manag. Ann. 2011, 5, 317–371. [Google Scholar] [CrossRef]

- Du, Y.; Kim, P.H.; Aldrich, H.E. Hybrid strategies, dysfunctional competition and new venture performance in transition economies. Manag. Organ. Rev. 2016, 12, 469–501. [Google Scholar] [CrossRef]

- Meyer, J.W.; Scott, W.R. Organizational Environments: Ritual and Rationality; Sage Publications: Beverly Hills, CA, USA, 1983. [Google Scholar]

- Donovan, G. Environmental disclosures in the annual report: Extending the applicability and predictive power of legitimacy theory. Account. Audit. Account. J. 2002, 15, 344–371. [Google Scholar] [CrossRef]

- Queiroz, M.; Vasconcelos, F.C.; Goldszmidt, R.G.B. Economic rents and legitimacy: Incorporating elements of organizational analysis institutional theory to the field of business strategy. Rev. Adm. Contemp. 2007, 11, 177–198. [Google Scholar] [CrossRef]

- Zhu, J.H.; Feng, T.W.; Lu, Y.; Xue, R. Optimal government policies for carbon-neutral power battery recycling in electric vehicle industry. Comput. Ind. Eng. 2024, 189, 109952. [Google Scholar] [CrossRef]

- Wang, D.; Huang, J. ESG Theory and Practice; Economy & Management Publishing House: Beijing, China, 2021. [Google Scholar]

- Frynas, J.G.; Yamahaki, C. Corporate social responsibility: Review and roadmap of theoretical perspectives. Bus. Ethics Eur. Rev. 2016, 25, 258–285. [Google Scholar] [CrossRef]

- Zhu, J.H.; Baker, J.S.; Song, Z.T.; Yue, X.-G.; Li, W. Government regulatory policies for digital transformation in small and medium-sized manufacturing enterprises: An evolutionary game analysis. Humanit. Soc. Sci. Commun. 2023, 10, 751. [Google Scholar] [CrossRef]

- Bag, S.; Pretorius, J.H.C.; Gupta, S.; Dwivedi, Y.K. Role of institutional pressures and resources in the adoption of big data analytics powered artificial intelligence, sustainable manufacturing practices and circular economy capabilities. Technol. Forecast. Soc. Change 2020, 163, 120420. [Google Scholar] [CrossRef]

- Foltean, F.; Trif, S.M.; Tuleu, D.L. Customer relationship management capabilities and social media technology use: Consequences on firm performance. J. Bus. Res. 2019, 104, 563–575. [Google Scholar] [CrossRef]

- Dubey, R.; Gunasekaran, A.; Childe, S.J.; Blome, C.; Papadopoulos, T. Big data and predictive analytics and manufacturing performance: Integrating institutional theory, resource-based view and big data culture. Br. J. Manag. 2019, 30, 341–361. [Google Scholar] [CrossRef]

- Yang, S.; Song, T.; Wu, X. The institutional motivation and process of digital transformation of enterprises. Sci. Res. Manag. 2023, 44, 39–46. [Google Scholar]

- Wang, J.; Ma, M.; Dong, T.; Zhang, Z. Do ESG ratings promote corporate green innovation? A quasi-natural experiment based on SynTao Green Finance’s ESG ratings. Int. Rev. Financ. Anal. 2023, 87, 102623. [Google Scholar] [CrossRef]

- Long, H.; Feng, G.F.; Gong, Q.; Chang, C.P. ESG performance and green innovation: An investigation based on quantile regression. Bus. Strategy Environ. 2023, 32, 5102–5118. [Google Scholar] [CrossRef]

- Fu, Q.; Zhao, X.X.; Chang, C.P. Does ESG performance bring to enterprises’ green innovation? Yes, evidence from 118 countries. Oeconomia Copernic. 2023, 14, 795–832. [Google Scholar] [CrossRef]

- Li, J.L.; Yang, Z.; Chen, J. Will ESG performance drive green technology innovation? Micro evidence from Chinese listed companies. J. Ind. Eng. Eng. Manag. 2024, 38, 1–17. [Google Scholar]

- Wang, L.; Lian, Y.; Dong, J. Study on the impact mechanism of ESG performance on corporate value. Secur. Mark. Her. 2022, 5, 23–34. [Google Scholar]

- Sun, H.B.; Bai, T.H.; Fan, Y.Q.; Liu, Z.L. Environmental, social, and governance performance and enterprise sustainable green innovation: Evidence from China. Corp. Soc. Responsib. Environ. Manag. 2024, 31, 3633–3650. [Google Scholar] [CrossRef]

- Zhang, H.; Lai, J.; Jie, S.J. Quantity and quality: The impact of environmental, social, and governance (ESG) performance on corporate green innovation. J. Environ. Manag. 2024, 354, 120272. [Google Scholar] [CrossRef]

- Lin, B.H.; Li, B.X.; Zhang, D. ESG implementation, public environmental concern, and corporate green technology innovation: Analysis based on the background of China’s “Dual Carbon” targets. Environ. Dev. Sustain. 2024. [Google Scholar] [CrossRef]

- Zhai, Y.M.; Cai, Z.H.; Lin, H.; Yuan, M.; Mao, Y.; Yu, M.C. Does better environmental, social, and governance induce better corporate green innovation: The mediating role of financing constraints. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 1513–1526. [Google Scholar] [CrossRef]

- Tang, H. The effect of ESG performance on corporate innovation in China: The mediating role of financial constraints and agency cost. Sustainability 2022, 14, 3769. [Google Scholar] [CrossRef]

- Zhang, D.; Lucey, B.M. Sustainable behaviors and firm performance: The role of financial constraints’ alleviation. Econ. Anal. Policy 2022, 74, 220–233. [Google Scholar] [CrossRef]

- Christensen, D.M.; Serafeim, G.; Sikochi, A. Why is corporate virtue in the eye of the beholder? The case of ESG ratings. Account. Rev. 2022, 97, 147–175. [Google Scholar] [CrossRef]

- Lenz, I.; Wetzel, H.A.; Hammerschmidt, M. Can doing good lead to doing poorly? Firm value implications of CSR in the face of CSI. J. Acad. Mark. Sci. 2017, 45, 677–697. [Google Scholar] [CrossRef]

- Ng, A.C.; Rezaee, Z. Business sustainability performance and cost of equity capital. J. Corp. Financ. 2015, 34, 128–149. [Google Scholar] [CrossRef]

- Yang, F.; Chen, T.W.; Zhang, Z.B. Can environmental, social, and governance performance drive two-way foreign direct investment behavior? Evidence from Chinese listed companies. J. Clean. Prod. 2023, 430, 139761. [Google Scholar] [CrossRef]

- Zhang, Y.; Lv, Q.; Han, Y. Institutional investors drive corporate green governance: Monitoring effects and internal mechanisms. J. Manag. World 2024, 40, 197–221. [Google Scholar]

- Dhaliwal, D.S.; Li, O.Z.; Tsang, A.; Yang, Y.G. Voluntary non-financial disclosure and the cost of equity capital: The case of corporate social responsibility reporting. Account. Rev. 2011, 86, 59–100. [Google Scholar] [CrossRef]

- Gao, J.Y.; Chu, D.X.; Lian, Y.H.; Zheng, J. Can ESG performance improve corporate investment efficiency? Secur. Mark. Her. 2021, 11, 24–34+72. [Google Scholar]

- Guo, J.; Jian, X. Analyst’s external supervision effect: An evidence from perks of corporate executives. J. Cent. Univ. Financ. Econ. 2021, 2, 73–88. [Google Scholar]

- Yu, F. Analyst coverage and earnings management. J. Financ. Econ. 2008, 88, 245–271. [Google Scholar] [CrossRef]

- Oduro, S.; Maccario, G.; De Nisco, A. Green innovation: A multidomain systematic review. Eur. J. Innov. Manag. 2021, 25, 567–591. [Google Scholar] [CrossRef]

- Long, Z.W.; Zhang, X.F. The impact of ESG performance on corporate green technology innovation: Based on the empirical evidence of Chinese listed companies. S. China Financ. 2023, 9, 56–70. [Google Scholar]

- Rezaee, Z.; Tuo, L. Are the quantity and quality of sustainability disclosures associated with the innate and discretionary earnings quality? J. Bus. Ethics 2019, 155, 763–786. [Google Scholar] [CrossRef]

- Zheng, Y.; Zhang, Q. Digital transformation, corporate social responsibility and green technology innovation: Based on empirical evidence of listed companies in China. J. Clean. Prod. 2023, 424, 138805. [Google Scholar] [CrossRef]

- Skog, D.; Wimelius, H.; Sandberg, J. Digital disruption. Bus. Inf. Syst. Eng. 2018, 60, 431–437. [Google Scholar] [CrossRef]

- Bharadwaj, A.; El Sawy, O.A.; Pavlou, P.A.; Venkatraman, N. Digital business strategy: Toward a next generation of insights. MIS Q. 2013, 37, 471–482. [Google Scholar] [CrossRef]

- He, J.; Du, X.; Tu, W. Can corporate digital transformation alleviate financing constraints? Appl. Econ. 2023, 56, 2434–2450. [Google Scholar] [CrossRef]

- Skare, M.; Soriano, D.R. How globalization is changing digital technology adoption: An international perspective. J. Innov. Knowl. 2021, 6, 222–233. [Google Scholar] [CrossRef]

- Zhang, H.; Wu, J.; Mei, Y.; Hong, X. Exploring the relationship between digital transformation and green innovation: The mediating role of financing modes. J. Environ. Manag. 2024, 356, 120558. [Google Scholar] [CrossRef]

- Sun, Y. Digital transformation and corporates’ green technology innovation performance: The mediating role of knowledge sharing. Financ. Res. Lett. 2024, 62, 105105. [Google Scholar] [CrossRef]

- De Luca, L.M.; Herhausen, D.; Troilo, G.; Rossi, A. How and when do big data investments pay off? The role of marketing affordances and service innovation. J. Acad. Mark. Sci. 2021, 49, 790–810. [Google Scholar] [CrossRef]

- Song, Y.; Du, C.; Du, P.; Liu, R.; Lu, Z. Digital transformation and corporate environmental performance: Evidence from Chinese listed companies. Technol. Forecast. Soc. Change 2024, 201, 123159. [Google Scholar] [CrossRef]

- Zhu, J.H.; Feng, T.W.; Lu, Y.; Jiang, W. Using blockchain or not? A focal firm’s blockchain strategy in the context of carbon emission reduction technology innovation. Bus. Strategy Environ. 2024, 33, 3505–3531. [Google Scholar] [CrossRef]

- Zhu, J.H.; Dong, R.K.; Feng, T.W. Technological innovations in carbon emission reduction: A comparative analysis of R&D and carbon offsetting strategies. Comput. Ind. Eng. 2025, 206, 111153. [Google Scholar] [CrossRef]

- Keswani, M.; Khedlekar, U.; Gour, H. Optimizing pricing and promotions for sustained profitability in declining markets: A Green-Centric inventory model. Data Sci. Financ. Econ. 2024, 4, 83–131. [Google Scholar] [CrossRef]

- Tang, M.G.; Liu, Y.L.; Hu, F.X.; Wu, B.J. Effect of digital transformation on enterprises’ green innovation: Empirical evidence from listed companies in China. Energy Econ. 2023, 128, 107135. [Google Scholar] [CrossRef]

- Jiang, X.J. Resource reorganization and the growth of the service industry in an interconnected society. Econ. Res. J. 2017, 52, 4–17. [Google Scholar]

- Saarikko, T.; Westergren, U.H.; Blomquist, T. The internet of things: Are you ready for what’s coming? Bus. Horiz. 2017, 60, 667–676. [Google Scholar] [CrossRef]

- Gil-Alana, L.A.; Škare, M.; Claudio-Quiroga, G. Innovation and knowledge as drivers of the ‘great decoupling’ in China: Using long memory methods. J. Innov. Knowl. 2020, 5, 266–278. [Google Scholar] [CrossRef]

- Giusti, J.D.; Alberti, F.G.; Belfanti, F. Makers and clusters: Knowledge leaks in open innovation networks. J. Innov. Knowl. 2020, 5, 20–28. [Google Scholar] [CrossRef]

- Luo, Y.D.; Bu, J. How valuable is information and communication technology? A study of emerging economy enterprises. J. World Bus. 2016, 51, 200–211. [Google Scholar] [CrossRef]

- Arnold, J.M.; Javorcik, M.; Lipscomb, M.; Mattoo, A. Services reform and manufacturing performance: Evidence from India. Econ. J. 2016, 126, 1–39. [Google Scholar] [CrossRef]

- Rihoux, B.; Ragin, C.C. Configurational Comparative Methods: Qualitative Comparative Analysis (QCA) and Related Techniques; Sage: Thousand Oaks, CA, USA, 2009. [Google Scholar]

- Dou, Z.; Sun, Y. System identification of enterprise innovation factor combinations: A fuzzy-set qualitative comparative analysis method. Systems 2024, 12, 53. [Google Scholar] [CrossRef]

- Zhen, H.; Wang, X.; Fang, H. Administrative protection of intellectual property rights and corporate digital transformation. Econ. Res. J. 2023, 58, 62–79. [Google Scholar]

- Jiang, K.; Du, X.; Chen, Z. Firms’ digitalization and stock price crash risk. Int. Rev. Financ. Anal. 2022, 82, 102196. [Google Scholar] [CrossRef]

- Yang, Q.; Gao, D.; Song, D.; Li, Y. Environmental regulation, pollution reduction and green innovation: The case of the Chinese Water Ecological Civilization City Pilot policy. Econ. Syst. 2021, 45, 100911. [Google Scholar] [CrossRef]

- Crilly, D.; Zollo, M.; Hansen, M.T. Faking it or muddling through? Understanding decoupling in response to stakeholder pressures. Acad. Manag. J. 2012, 55, 1429–1448. [Google Scholar] [CrossRef]

- Du, Y.; Liu, Q.; Cheng, J. What kind of ecosystem for doing business will contribute to city-level high entrepreneurial activity? A research based on institutional configurations. J. Manag. World 2020, 36, 141–155. [Google Scholar]

- Ragin, C.; Fiss, P. Net effects analysis versus configurational analysis: An empirical demonstration. Redesigning Soc. Inq. Fuzzy Sets Beyond 2008, 240, 190–212. [Google Scholar]

- Zhang, M.; Chen, W.H.; Lan, H.L. Why do Chinese enterprises completely acquire foreign high-tech enterprises? A fuzzy set qualitative comparative analysis (fsQCA) based on 94 cases. China Ind. Econ. 2019, 4, 117–135. [Google Scholar]

| Variable | Anchor Point | ||

|---|---|---|---|

| Full Membership | Crossover Point | Full Non-Membership | |

| X1 | 4.03 | 0.60 | 0.00 |

| X2 | 4.13 | 1.50 | 0.00 |

| X3 | 3.90 | 2.43 | 0.00 |

| X4 | 46.00 | 6.00 | 0.00 |

| X5 | 15.00 | 1.00 | 0.00 |

| X6 | 38.00 | 7.00 | 0.00 |

| Y | 31.00 | 2.00 | 0.00 |

| Y | X1 | X2 | X3 | X4 | X5 | X6 |

|---|---|---|---|---|---|---|

| 0 | NN | NN | NN | NN | NN | NN |

| 10 | NN | NN | NN | NN | NN | NN |

| 20 | NN | NN | NN | NN | NN | NN |

| 30 | NN | NN | NN | NN | NN | NN |

| 40 | NN | NN | NN | NN | NN | NN |

| 50 | NN | NN | NN | NN | NN | NN |

| 60 | NN | NN | NN | NN | NN | NN |

| 70 | NN | NN | NN | NN | NN | NN |

| 80 | NN | NN | NN | NN | NN | NN |

| 90 | NN | NN | NN | NN | NN | 2.1 |

| 100 | NN | NN | NN | 5.3 | NN | 4.1 |

| Variable | Method | Accuracy% | Interval | Range | d | p Value |

|---|---|---|---|---|---|---|

| X1 | CR | 100.00 | 0.00 | 0.90 | 0.00 | 1.00 |

| CE | 100.00 | 0.00 | 0.90 | 0.00 | 1.00 | |

| X2 | CR | 100.00 | 0.00 | 0.90 | 0.00 | 1.00 |

| CE | 100.00 | 0.00 | 0.90 | 0.00 | 1.00 | |

| X3 | CR | 100.00 | 0.00 | 0.90 | 0.00 | 1.00 |

| CE | 100.00 | 0.00 | 0.90 | 0.00 | 1.00 | |

| X4 | CR | 100.00 | 0.00 | 0.90 | 0.00 | 1.00 |

| CE | 100.00 | 0.00 | 0.90 | 0.00 | 1.00 | |

| X5 | CR | 100.00 | 0.00 | 0.90 | 0.00 | 1.00 |

| CE | 100.00 | 0.00 | 0.90 | 0.00 | 1.00 | |

| X6 | CR | 100.00 | 0.00 | 0.90 | 0.00 | 1.00 |

| CE | 100.00 | 0.00 | 0.90 | 0.00 | 1.00 |

| Y | ~Y | |||

|---|---|---|---|---|

| Consistency | Coverage | Consistency | Coverage | |

| X1 | 0.601979 | 0.6408 | 0.489031 | 0.59629 |

| ~X1 | 0.620748 | 0.514699 | 0.705411 | 0.669977 |

| X2 | 0.624035 | 0.645002 | 0.508031 | 0.60148 |

| ~X2 | 0.614435 | 0.521607 | 0.700156 | 0.680836 |

| X3 | 0.621257 | 0.618251 | 0.541866 | 0.617683 |

| ~X3 | 0.615824 | 0.539914 | 0.665108 | 0.667943 |

| X4 | 0.586991 | 0.611572 | 0.551582 | 0.658272 |

| ~X4 | 0.672007 | 0.566783 | 0.674527 | 0.651661 |

| X5 | 0.595156 | 0.631835 | 0.519525 | 0.63177 |

| ~X5 | 0.653146 | 0.542701 | 0.697246 | 0.663615 |

| X6 | 0.617414 | 0.607392 | 0.586225 | 0.660598 |

| ~X6 | 0.654998 | 0.580179 | 0.651592 | 0.661116 |

| Variable | High Level of Green Innovation | Low Level of Green Innovation | ||||

|---|---|---|---|---|---|---|

| S1 | S2 | S3 | S4 | NS1 | NS2 | |

| X1 | ● | ● | X | X | ||

| X2 | ⬤ | ⬤ | ⬤ | ⬤ | X | X |

| X3 | ● | ● | X | X | X | |

| X4 | X | X | ⬤ | ⬤ | X | |

| X5 | ⬤ | ⬤ | ⬤ | ⬤ | X | X |

| X6 | X | X | ⬤ | X | ⬤ | |

| Consistency | 0.91 | 0.91 | 0.88 | 0.93 | 0.88 | 0.87 |

| Raw coverage | 0.25 | 0.22 | 0.24 | 0.21 | 0.19 | 0.20 |

| Unique coverage | 0.02 | 0.01 | 0.02 | 0.05 | 0.05 | 0.06 |

| Solution consistency | 0.89 | 0.88 | ||||

| Solution coverage | 0.33 | 0.25 | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dou, Z.; Jia, S. The Synergistic Empowerment of Digital Transformation and ESG on Enterprise Green Innovation. Systems 2025, 13, 740. https://doi.org/10.3390/systems13090740

Dou Z, Jia S. The Synergistic Empowerment of Digital Transformation and ESG on Enterprise Green Innovation. Systems. 2025; 13(9):740. https://doi.org/10.3390/systems13090740

Chicago/Turabian StyleDou, Zixin, and Shuaishuai Jia. 2025. "The Synergistic Empowerment of Digital Transformation and ESG on Enterprise Green Innovation" Systems 13, no. 9: 740. https://doi.org/10.3390/systems13090740

APA StyleDou, Z., & Jia, S. (2025). The Synergistic Empowerment of Digital Transformation and ESG on Enterprise Green Innovation. Systems, 13(9), 740. https://doi.org/10.3390/systems13090740