1. Introduction

In the context of global industrialization, several environmental issues, including severe weather and ecological environment degradation, not only threaten the ecological balance of nature but also adversely affect the political economy and other aspects of human society, which forces countries worldwide to acknowledge and defend the challenges brought about by environmental problems [

1]. As traditional technologies and methods have been unable to solve these problems effectively [

2], advanced green technologies have increasingly emerged as a crucial method for addressing environmental issues and fostering sustainable development. Their importance has become increasingly prominent. In recent years, China has prioritized green technology innovation (GTI), and the 19th CPC National Congress report explicitly stated the task requirements for building a market-oriented GTI system. The 20th CPC National Congress report outlined plans to enhance the ability of GTI and accelerate the development and spread of innovative, energy-efficient, and carbon-reduction technologies. The Third Plenary Session report of the 20th Party Central Committee emphasized supporting the manufacturing sector’s upscale, wise, and environmentally friendly growth and supporting enterprises to use digital intelligence technology and green technology to transform and upgrade traditional industries. GTI considers economic and environmental benefits and emphasizes technological breakthroughs [

3]; it can drastically cut carbon emissions in the area [

4,

5], reduce resource consumption and environmental pollution, improve energy efficiency [

6], and is the cornerstone of economic growth [

7]. However, promoting GTI more effectively remains a complex problem. Currently, GTI faces many challenges, including an imperfect management system, a shortage of financial resources [

8], imperfect market development [

9], and the linkage bottleneck in the coordination mechanism. These problems not only limit the development speed and technical depth of GTI but also require that the promotion of GTI crosses a higher threshold and has a more substantial research and development capability [

10]. In this complex situation, it is difficult for a single entity to cope with the difficulties and challenges of GTI [

11], and multiple participants must cooperate to solve the problem. Therefore, enterprises expect to solve these challenges through the active policy support of the government and the technical assistance provided by scientific research institutions and universities. Strengthening the integration of IUR has become crucial for encouraging the expansion of businesses’ GTI, and the research on the integration of IUR has a significant impact on GTI.

By establishing an industry–university–research (IUR) integration system, collaborative enterprises, universities, and research institutions can address the challenges in GTI and advance its development. In this process, enterprises are market discerners and practitioners of innovation, able to provide market-relevant information and financial support for GTI [

12]. Colleges and universities, as centers for knowledge dissemination [

13], can conduct research on the theoretical foundations of GTI and develop advanced technical talent pertinent to technological innovation (TI) [

14]. As research and development institutions, scientific research institutions can conduct research and development of key technologies of GTI and breakthroughs in key issues of GTI [

15]. As an innovative model, the integration of IUR combines the cooperation of the three institutions, and its advantages are mainly reflected in the transformation of results, resource integration, and improvement in economic benefits [

16]. Explicitly speaking, first of all, the integration of IUR can solve the application problem of the transformation of innovative achievements. In the process of tripartite cooperation, innovation results can be quickly transferred from the laboratories of universities and scientific research institutions to the market, which ensures that the scientific research results are highly matched with the market demand so that they can be applied more accurately. Secondly, integrating IUR can effectively promote the integration of resources, thereby helping enterprises to innovate. The integration of IUR effectively integrates the resources of IUR and forms innovation synergy through resource integration and complementarity, assisting enterprises to break through innovation difficulties and overcome their capacity limitations [

17] to increase businesses’ abilities to independently innovate. The innovation outcomes produced by the collaboration of IUR can enhance the industrial structure and stimulate the advancement of associated sectors. The integration of IUR enables innovative scientific research results to be continuously transformed into productive forces, thereby forming a virtuous cycle, continuously giving back and promoting innovative development, driving the growth of related industries and modernizing the industrial structure, producing significant financial gains, and constantly enhancing inventive outcomes [

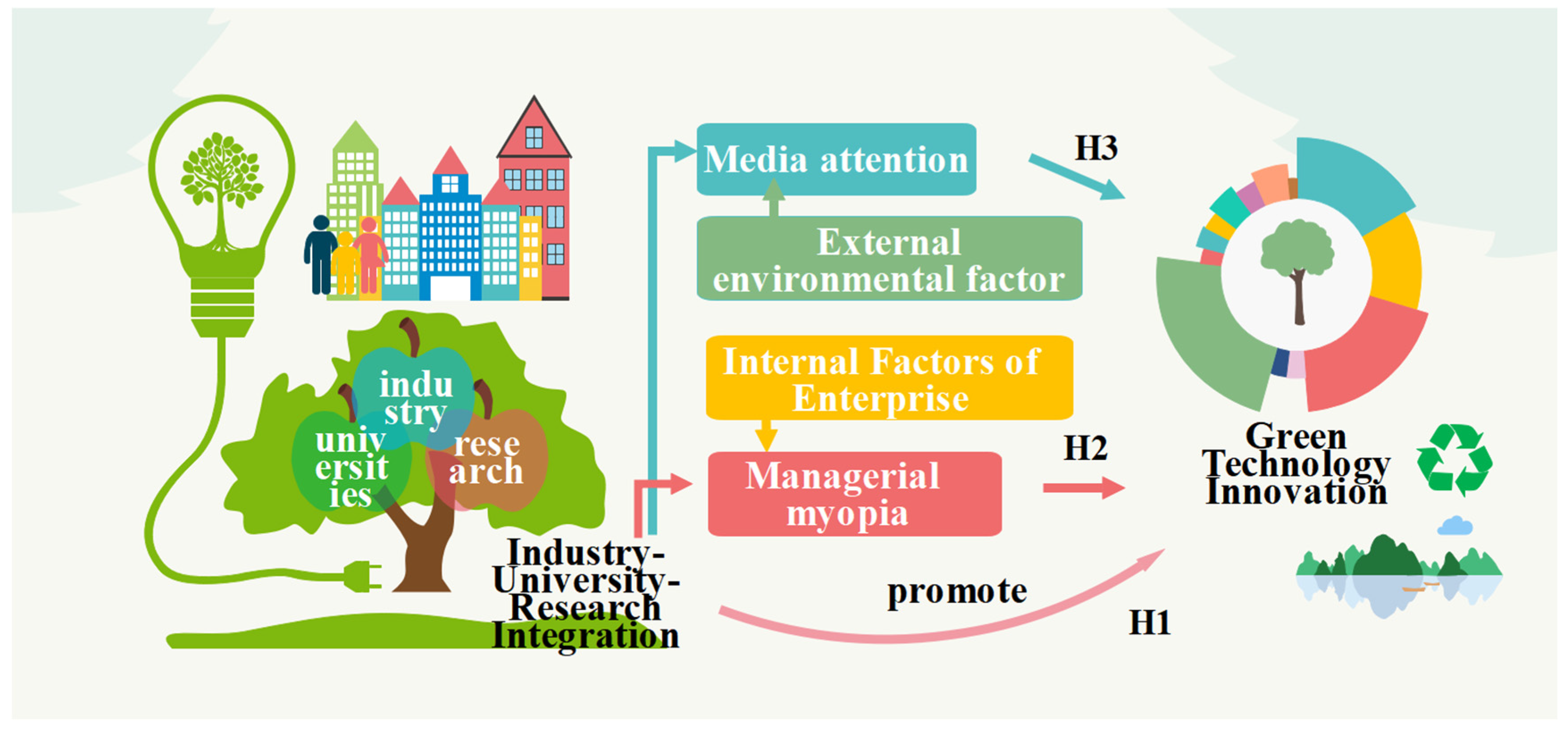

18]. Although the existing research has affirmed the value of the integration of IUR for overall innovation, there is a lack of dedicated discussions on GTI. Moreover, most of the existing studies explain the cooperative effect from the perspective of technological improvement, paying less attention to its action path and the degree of cooperation. Therefore, this research addresses three inquiries: (1) From the overall perspective, can integrating IUR significantly promote GTI? (2) From the perspective of the mechanism of action, does the integration of IUR indirectly promote GTI through mechanisms such as external supervision and internal governance? (3) From the perspective of the cooperation mechanism, what is the relationship between the depth and breadth of the integration of IUR and GTI?

To reveal the internal mechanism by which the integration of IUR influences GTI, this paper constructs a multi-dimensional theoretical framework that encompasses internal capabilities of enterprises, acquisition of external resources, and knowledge interaction among organizations. The analysis is mainly based on the resource-based theory and the knowledge absorption theory. The resource-based theory emphasizes that an enterprise’s competitive advantage stems from its possession of scarce, difficult-to-imitate, and difficult-to-replace resources [

19]. From this perspective, inter-organizational cooperation is regarded as an important way for enterprises to acquire external resources, which can compensate for the limitations of a single organization in resource acquisition [

20]. In the context of GTI facing high uncertainty and high investment, this resource complementarity is particularly important. At the same time, the knowledge absorption theory points out that resource acquisition itself cannot directly translate into innovation performance; enterprises also need to have the ability to effectively identify and absorb external knowledge in order to realize the transformation of resource input into innovation outcomes [

21]. Especially in the field of GTI, where enterprises obtain key resources through the integration of IUR, whether they can truly promote innovation development largely depends on the enterprise’s ability to absorb and transform these resources. From the perspective of combining the resource-based theory and the knowledge absorption theory, both reveal the basic logic of cooperation in the process of achieving innovation from different dimensions. This logic indicates that the promotion effect of the integration of IUR on GTI is not a simple addition of resources but is based on the enterprise’s reasonable integration and efficient utilization of resources [

22]. The resource-based theory explains why industries, universities, and research institutions (IUR) need to cooperate, and the knowledge absorption theory further answers the key question of whether cooperation can effectively drive innovation. The two complement each other and jointly constitute the core support of the theoretical analysis in this paper.

The marginal contribution of this paper is primarily evident in four aspects: Initially, from the standpoint of research, this paper discusses the role of IUR integration in GTI and emphasizes the synergistic effect of the joint action of enterprises, universities, and scientific research institutions, and compared with previous studies on the influence of these three independent roles on GTI, it is more comprehensive. This integrated perspective not only makes up for the deficiency of previous studies in viewing innovation subjects in a fragmented way but also reveals the manifestation of the integration of IUR as a key driving force, enriching the understanding of the driving mechanism of GTI. Secondly, regarding the research subject, most of the current research on GTI focuses on information disclosure, corporate performance, and other influencing factors while paying insufficient attention to the role and influence of stakeholders. By integrating IUR as the starting point, combined with media attention, this paper can more deeply analyze the driving mechanism affecting GTI. This research content fills the gap in the exploration of the driving mechanism of stakeholder interaction and provides a more microscopic and dynamic analytical dimension for understanding the complex driving system of GTI. Thirdly, from the perspective of the research dimensions, in terms of measuring the integration of IUR, the existing literature generally relies on a single quantitative indicator, such as the number of joint patent applications, which makes it difficult to reflect the quality and structural characteristics of cooperation. Based on the reasonable utilization of the number of joint patent applications, this paper measures two key dimensions: the depth and breadth of IUR cooperation, and it empirically examines their nonlinear impacts on GTI. This multi-dimensional and refined research breaks through the limitations of traditional single indicators and deepens the understanding of how the IUR cooperation model differentiates and influences the innovation effect. Finally, in terms of the research methods, this paper employs a nonlinear regression model to examine the inverted U-shaped influence relationship between the depth and breadth of IUR cooperation and GTI. Compared with the standard linear regression models studied in the existing literature, this method can capture more complex nonlinear correlations, thereby making the research more in-depth. This research method fills the gap in the existing literature for the empirical testing of the nonlinear relationship between IUR cooperation and GTI, providing an accurate quantitative analytical tool for understanding the optimal threshold of cooperation depth and breadth and its dynamic influence mechanism.

The frame diagram of the full text is shown in

Figure 1.

2. Literature Review

This article refers to the critical literature review framework of Battistella (2016) [

23] and lists the previous literature reviews as shown in

Table 1. Most of the previous literature separately discuss the relationship between IUR and GTI; therefore, this article conducts a literature review on GTI from the perspectives of I in IUR, U in IUR (including the combined perspectives of I and U), and R in IUR (including the perspectives of I, U, and R).

2.1. GTI from the Perspective of I in IUR

Businesses usually have a significant influence on GTI because they are the leading organization of GTI. Currently, enterprise GTI research focuses on the driving elements, which can be divided into two categories: internal and external driving factors:

(1) Internal factors: The existing literature proposes that digital transformation and financing constraints are internal factors affecting GTI. On the one hand, the digital revolution has an uneven effect on GTI, and it has a more substantial incentive effect on state-owned enterprises (SOEs), large enterprises (LEs), and non-heavy-polluting enterprises. Initially, digital transformation encourages GTI by boosting government green subsidies and company R&D expenditure, which has a more significant effect on SOEs than non-state-owned enterprises (NSOEs) [

30]. Secondly, digital transformation promotes GTI through knowledge sharing, and this impact is influenced by the size of the organization, with larger organizations being more affected [

31]. Finally, the lack of environmental awareness in heavily polluting industries leads to poor project quality control, which makes digital transformation less effective at promoting GTI than enterprises in non-heavily polluting industries [

32]. On the other hand, most studies on the connection between GTI and financing constraints concentrate on how these restrictions moderate the effects of different factors on GTI. For instance, the merging of the digital and real economies is encouraged by digital transformation [

33] and digital technology and traditional financial services [

24], which effectively alleviates financing constraints and further improves the green innovation (GI) capabilities of enterprises. In addition, the CEO’s social capital [

34], cross-shareholding between the legal subsidiary and parent company [

35], and the firm’s occupation of a core position or strategic node in the social network [

36] can also alleviate financing constraints and have a positive effect on enterprise GTI.

(2) External factors: Most studies focus on the environmental regulation level [

37]. Environmental legislation can encourage GTI and is crucial in closing the gap between green and non-green technology [

25]. Key components such as environmental regulation, justice, and legislation can also significantly improve enterprises’ GTI levels. For example, environmental regulation has a compensatory effect on GTI. As the level of environmental regulation changes from low to high, the impact on R&D efficiency presents an inverted U shape [

38]. Environmental justice is a powerful environmental legislation that greatly enhances businesses’ GTI [

39]. Environmental legislation has improved the environmental awareness of senior managers and increased cash holdings, thereby enhancing GI [

40]. Enterprise innovation benefits from these policy connections created by environmental restrictions [

41]; however, depending on these connections is insufficient to boost businesses’ capacities for innovation. To increase the effectiveness and quality of innovation, academia and industry must complement each other. This calls for close cooperation between academic institutions and private businesses and specific support from policymakers to foster productive connections and spur innovation development [

42].

To sum up, as the main body of IUR cooperation, industries (I) mostly approach GTI research from internal and external driving factors, demonstrating their attention to mechanisms such as resource acquisition and attention allocation, and forming specific collaborative relationships with universities (U).

2.2. GTI from the Perspective of U in IUR

Colleges and universities are the key forces in the promotion of technological progress and innovation and play an essential role in GTI. The research on GTI from the perspective of universities mainly comes from the two perspectives of higher education and personnel training. Higher education can help China’s economy shift from being driven by factors to being driven by innovation and lessen the detrimental effects of natural resources on sustainable economic development [

43]. The contribution of higher education to GI is reflected in three dimensions: technological development, economic growth, and knowledge transformation. Specifically, in terms of the first dimension, higher education and research institutions can promote the in-depth exploration of science and technology and stimulate the vitality of innovation, thereby effectively promoting the development of cleaner technologies and processes [

26] and reducing carbon emissions [

32,

44]. Second, higher education is a crucial component of green development since it fosters technical innovation and supports it, both of which favor economic growth [

45]. Third, higher education provides the inexhaustible impetus for innovative activities through the production and transformation of knowledge [

46]. The academics now working on this topic are primarily focused on the human capital component of talent training, which includes health and green education and the general level of human capital. Human capital related to health education indirectly or directly affects GTI through the training of high-quality talents, enhancing green environmental awareness, improving labor efficiency, and other means [

47]. The overall human capital level can affect the ability of GTI to translate into actual environmental benefits. Still, its index needs to reach a certain level to effectively regulate the impact of GTI on the ecological footprint [

48]. Green human capital positively affects GTI [

49] by encouraging entrepreneurs’ green behaviors and enhancing firms’ capabilities [

50].

To sum up, as the main body of IUR cooperation, universities (U) have mostly explored GTI from the perspectives of higher education and talent cultivation in their current research, and this demonstrates their significant role as providers of knowledge and technology as well as sources of resources.

2.3. GTI from the Perspective of R in IUR

As one of the central bodies of IUR cooperation, scientific research institutions are closely related to GTI. The existing literature mainly starts in two parts: one discusses the independent role of scientific research institutions, and the other discusses them as part of the main body of IUR combined with universities and enterprises. From the perspective of the independent role of scientific research institutions, through direct or indirect knowledge cooperation, they can reduce the R&D cycle and generate spillover value [

51], such as increases in knowledge production technology facilities and knowledge bases [

28], which helps to enhance the GTI capabilities of enterprises. At the same time, random errors and environmental circumstances impact scientific research institutions’ creative promotion role [

52]. On the one hand, as for environmental factors, a supportive policy environment, healthy economic environment, and good social and cultural environment can create a better atmosphere for innovation, help stimulate the creativity of researchers, and encourage scientific research institutions to give full play to their research and development capabilities, which will bring benefits to TI. On the other hand, random errors occur in the research of scientific research institutions, and the accumulation of random errors requires R&D personnel to spend more time adjusting the equipment, which leads to more significant costs and efforts for innovation in scientific research institutions, thereby reducing the efficiency of TI. From the perspective of the cooperation impact of scientific research institutions, combining enterprises and universities will first affect the innovation performances and participation of scientific research institutions and then ultimately affect GTI. Specifically, the scientific research and innovation performances of research institutions will be affected by the behavior of enterprises and universities in the collaboration network [

53], and the incentive cost of talent training for enterprises and universities will affect the probability of TI training jointly conducted by the scientific research institutions of enterprises and universities [

29]. Secondly, scientific research organizations can investigate the innovation requirements of different subjects in the innovation system, and they also affect the innovation of businesses and universities. Establishing significant hubs and networks for information feedback can reduce the asymmetry between the supply and demand of university resources in enterprises, allowing for the most efficient allocation of GTI resources [

54].

In conclusion, as the main body of IUR cooperation, research institutions (R) play an independent role; however, their innovative effects are often explored within the framework of collaboration with industries (I) and universities (U), demonstrating their potential functions in behavior guidance and cooperative governance.

2.4. Literature Summary

In conclusion, even though current researchers have studied the integration of IUR and GTI in great detail, the following shortcomings remain: From a research standpoint, the majority of GTI studies solely concentrate on the three distinct IUR views, and this is not comprehensive enough to discuss the impact of GTI only from the perspective of their independent roles. In fact, given the increasing complexity of GTI, it is more influenced by the interaction of these agents. However, there are no studies from the perspective of IUR integration that integrate the roles of these three and explore their comprehensive impact on GTI in depth. Most of the literature on the influence of IUR on the GTI ability at the research object level uses macro-data at the provincial or regional level, which helps understand the overall trend and regional differences in promoting GTI by institutions in different provinces and regions. However, no literature uses data at the individual and industry levels; thus, the differences between various industries and individual institutions are ignored. As a result, the research is not detailed enough, and it is difficult to accurately reflect the specific behaviors and actual impacts of various institutions in the process of GTI.

7. Further Study

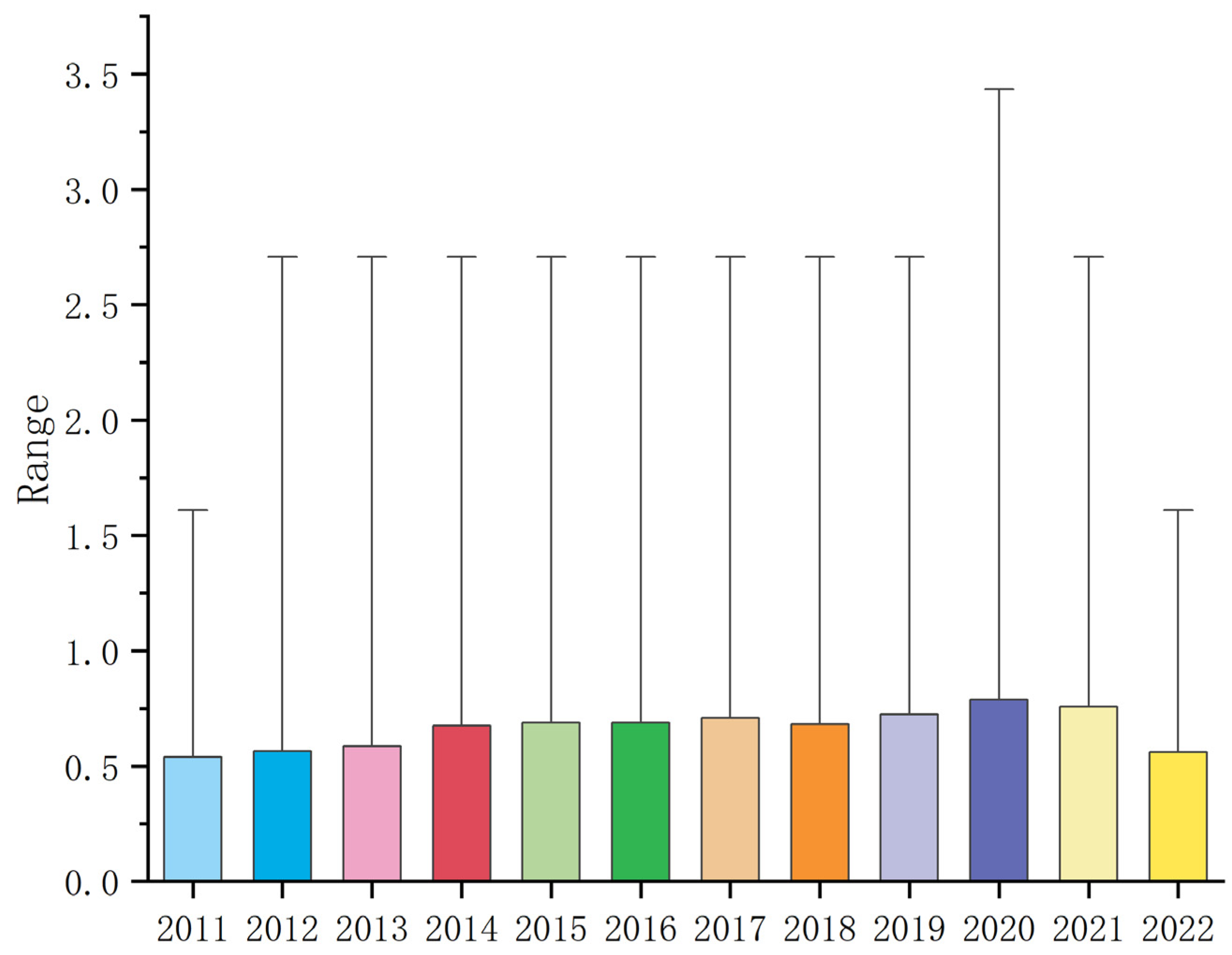

Depending on whether enterprises, universities, and research institutions (IUR) jointly apply for patents, the samples are divided into groups participating in IUR cooperation and groups not participating in IUR cooperation. The number of joint patent applications only represents the presence or absence of cooperation and cannot provide deeper information. To examine the effects of IUR integration on GTI in more detail, this paper refers to Liu Fei-ran’s study [

87]. It measures the breadth of IUR cooperation by the number of different partners with enterprises and the depth of IUR cooperation by the total number of enterprises participating in IUR cooperation/the breadth of cooperation. The impact of IUR cooperation results on GTI is illustrated through the depth and breadth of cooperation. Considering that the effect of the depth and breadth of IUR cooperation on GTI may be nonlinear, this paper verifies the relationship between the variables through both linear and nonlinear models.

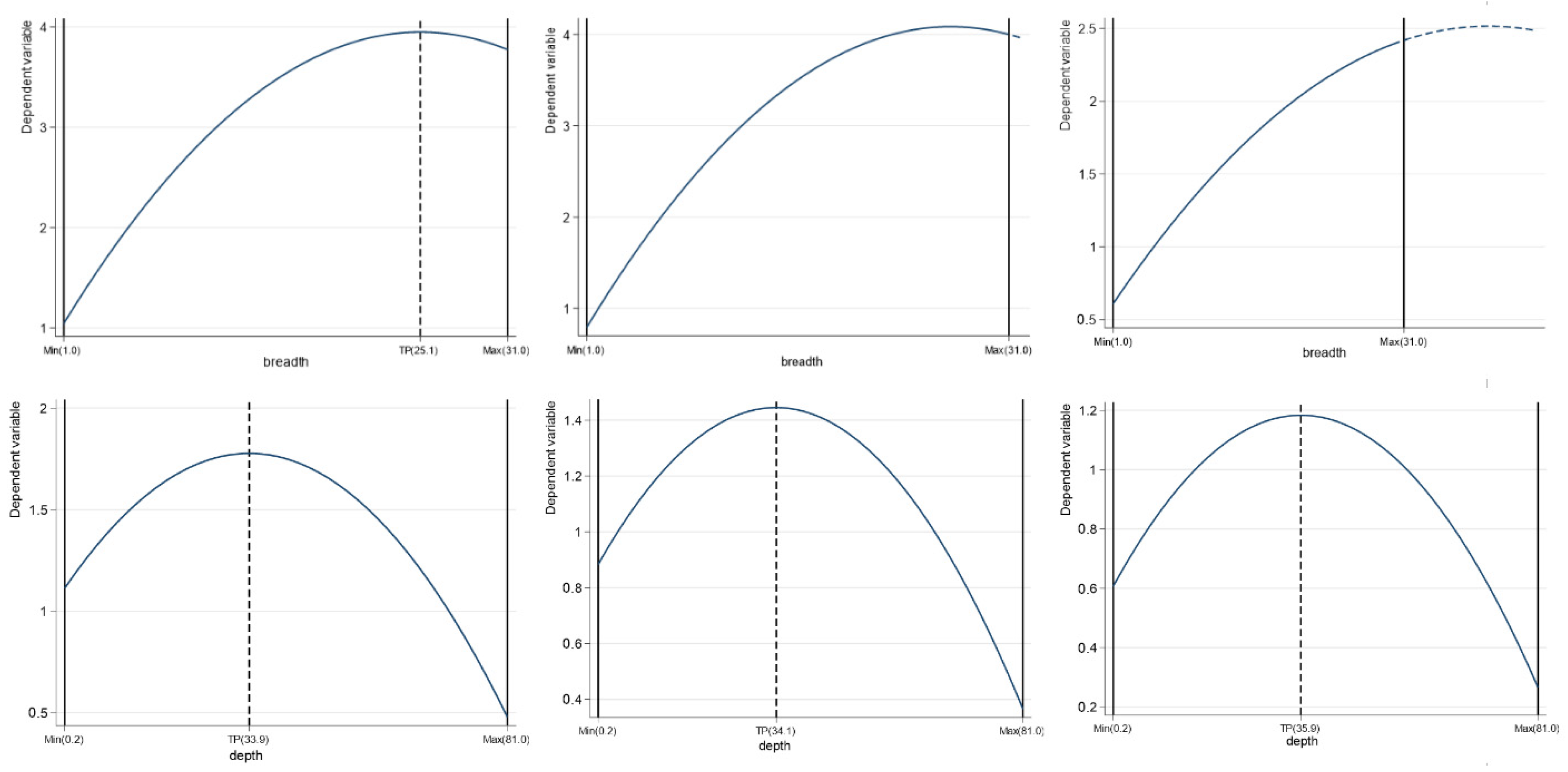

The influence of the depth and breadth of IUR cooperation on GTI is shown in

Table 12. It was discovered that the breadth regression coefficients on GT1, GT2, and GT3 are positive and significant, while the square terms of the breadth and depth on GT1, GT2, and GT3 are negative and significant. To determine the breadthand depth of IUR cooperation, which has a nonlinear inverse U-shaped impact on GTI, a utest was conducted, and

Figure 5 was drawn to show that the increase in the number of IUR partnerships and the deepening of cooperation have the effects of promoting and inhibiting GTI.

This paper believes that the empirical results show a relationship between promotion and inhibition because businesses must invest more money in personnel and material resources as the number of IUR partnerships grows. The depth of these partnerships increases, and such an increase in capital and manpower costs reduces the resources required for enterprise innovation, resulting in a decline in the level of enterprise GTI. At the same time, expanding the cooperation breadth and deepening the cooperation depth means that the participants are more diverse and the cooperation is closer. However, this may make it difficult for the partners’ interests to be reasonably distributed, affecting the enthusiasm of the partners and the stability of cooperation. Consequently, GTI is negatively impacted.