1. Introduction

Knowledge payment has redefined the way knowledge is created and traded, encouraging individuals to transform their accumulated knowledge and cognitive surplus into high-quality, monetizable knowledge products through digital means and realize value via trading platforms [

1]. With the rise in artificial intelligence and language models, the barriers to creating knowledge products have been further lowered, driving continuous expansion of the global knowledge payment market, particularly in China. Data show that in 2023, the user base of China’s knowledge payment industry exceeded 570 million, with a market size reaching CNY 180 billion, making it the largest single national market in the world [

2].

Compared with traditional digital products, knowledge payment products exhibit distinctive characteristics of potential benefits [

1], meaning that consumers can only obtain actual economic gains after applying what they have learned. Under conditions of insufficient understanding, blind purchases may entail a risk of loss. Consequently, consumers are inclined to filter products that meet their needs from personalized user-generated content (UGC), leading to the emergence of knowledge trading platforms centered on UGC output, such as

Quora,

Skillshare,

Zhihu, and

Bilibili. UGC-based knowledge trading platforms (hereafter referred to as platforms) feature low barriers to entry and rapid content updates, meeting consumers’ demand for personalization [

3]. However, the professional competence of knowledge producers varies significantly, resulting in uneven quality of UGC-based knowledge payment products (UGC products). Knowledge producers often exaggerate product value and pass off inferior products as high-quality ones, thereby undermining user trust and the platform’s sustainable development [

4]. To maintain the content ecosystem’s balance, mainstream platforms in the market generally adopt economic incentive measures to encourage knowledge producers to improve content quality, in addition to offering self-operated products (such as

Zhihu Salted Selection and

Bilibili Classroom). Among these measures, embedded advertising has been widely applied as an effective market regulation mechanism across various platforms [

5].

Embedded advertising alters the revenue structure of knowledge producers, as potential economic returns encourage them to place greater emphasis on content quality and user experience [

3]. For example, in

Zhihu Salted Selection, advertisers only need to pay advertising fees, while the Zhihu platform is responsible for allocating advertising resources and managing content placement, promoting the principle that better content generates higher earnings for knowledge producers. Under the platform-managed model, however, advertising management increases the platform’s operating costs, prompting the platform to consider shifting to an advertiser-managed model, in which advertisers take responsibility for embedded advertising. For instance, on

Bilibili, advertisers can directly sign contracts with knowledge producers (UP owners) and develop detailed advertising placement plans, while

Bilibili only reviews videos for compliance with regulations. However, direct contact between advertisers and knowledge producers leads to changes in the power structure due to resource disparities. This may result in advertisers increasing the intensity of advertising (e.g., frequency, duration) to maximize effectiveness, thereby undermining consumer experience. At the same time, knowledge producers might adopt low-pricing strategies to attract more advertising opportunities, intensifying price competition [

3]. The complex and dynamic market environment (e.g., market competition, power structures) creates uncertainty in the platform’s cooperation strategy with advertisers while balancing revenue, costs, and supply–demand relationships. Furthermore, the uncertainty associated with embedded advertising increases the difficulty of pricing decisions for knowledge payment products.

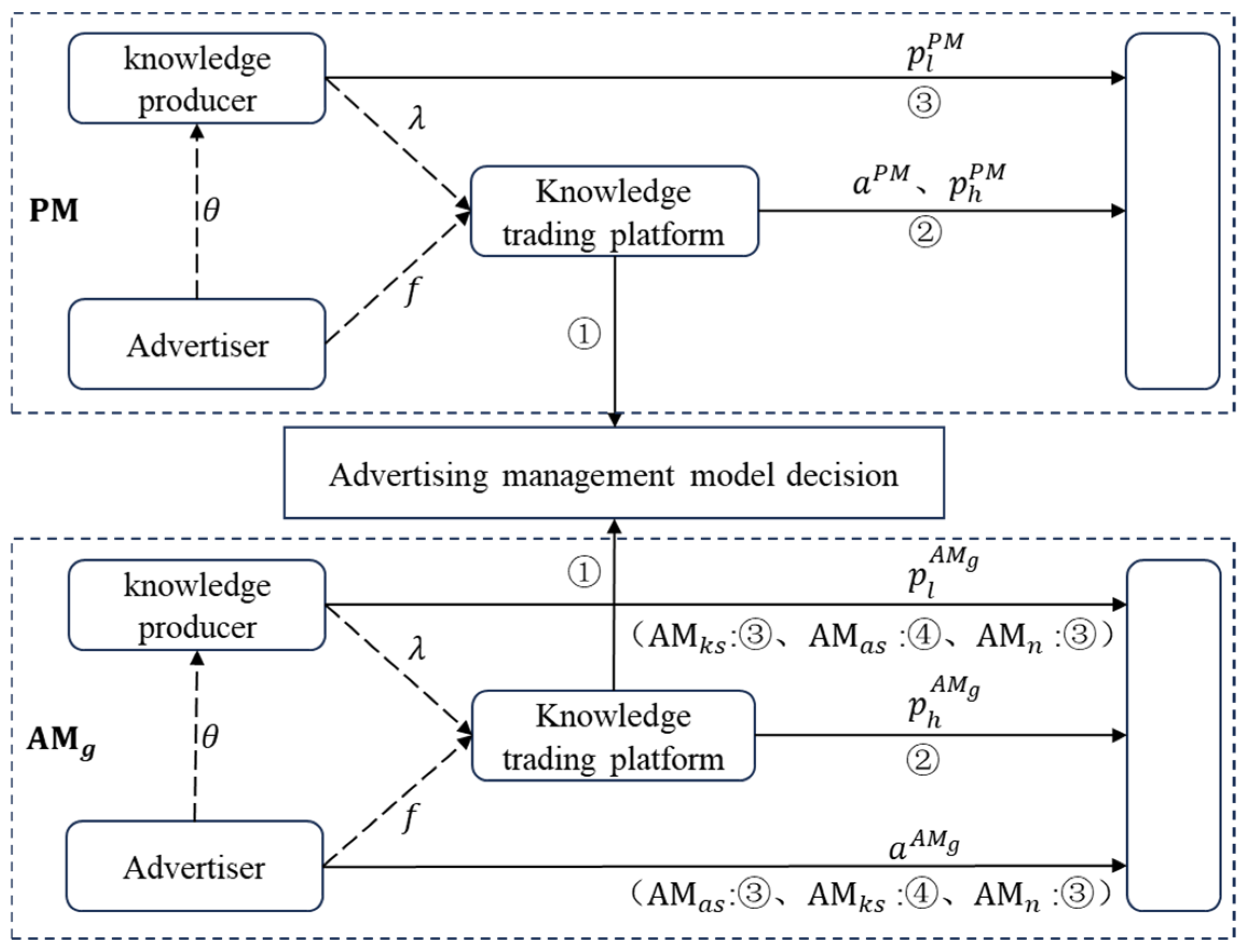

Based on the above background, this paper focuses on the dynamic game and changes in power structure among the platform, knowledge producer, and advertiser under the impact of embedded advertising, addressing the following key questions:

- (1)

How should the platform choose the advertising management mode?

- (2)

How do different advertising management modes affect the pricing strategies and revenues of content providers (platform and knowledge producer)?

- (3)

What is the impact of different power structures on the pricing of knowledge payment products?

In view of these questions, this study takes the knowledge payment product supply chain composed of the “platform–knowledge producer–consumer” as the research object. Considering different embedded advertising management modes and possible changes in power structures, it models market demand through consumer utility functions and develops pricing models for knowledge payment products under four scenarios based on Stackelberg game theory: the platform-managed mode, and three advertiser-managed modes (advertiser partially dominant, knowledge producer partially dominant, and advertiser–knowledge producer partial equilibrium). Subsequently, the study applies backward induction to derive the model equilibria and analyze the pricing decisions of both the platform and knowledge producers. Finally, numerical examples are used to further verify the influence mechanism of embedded advertising and power structure on knowledge product pricing. This paper aims to reveal the intrinsic mechanisms through which differences in embedded advertising management modes and power structures affect the pricing of knowledge payment products, under the context where the platform incentivizes knowledge producers to improve UGC product quality via advertising revenue. The findings provide theoretical support for platforms and knowledge producers to formulate reasonable pricing strategies and optimize their profits.

The rest of the paper is organized as follows:

Section 2 reviews the literature relevant to this study and provides an overview of the technical approach, research content, and contributions;

Section 3 presents the theoretical description of the research problem, defines the assumptions, and outlines the game sequence;

Section 4 introduces the model construction and equilibrium analysis;

Section 5 validates and intuitively illustrates the propositions through numerical analysis;

Section 6 concludes with the main findings, managerial implications, limitations, and future research directions. Additionally,

Appendix A contains the proof of the related propositions.

4. Model Construction and Analysis

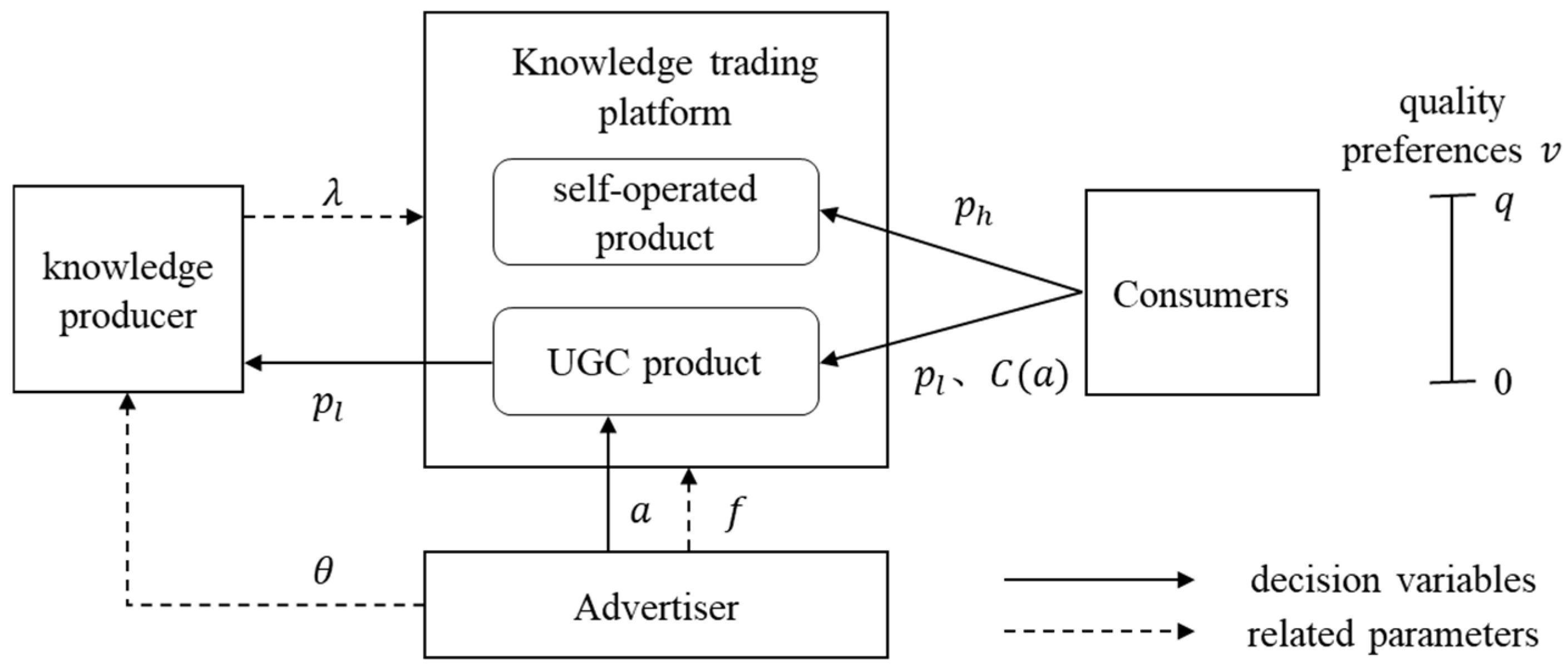

In this section, based on the transaction scenario of knowledge payment products, we construct a pricing game model for knowledge payment products that considers implanted advertisements and power structures. The model includes the following components: consumer utility function, demand function for knowledge payment products, and the profit objective functions for the platform, knowledge producer, and advertiser under two advertising management models.

4.1. Consumer Utility Function

Consumer choice behavior directly determines market demand. This study uses utility theory to describe consumer surplus, which is then used to derive market demand [

16]. As described in the problem, the utility consumers derive from purchasing a unit of product

or

is defined by the extent of their quality preference for the knowledge payment product. The higher the preference, the lower the cost and the greater the utility, and vice versa. The impact of implanted advertisements on consumers is represented as

[

40], meaning that, under the same advertising intensity, the more sensitive the consumer is to the advertisement, the greater the impact of the advertisement. Thus, the utility functions of consumers when purchasing platform’s self-operated product and UGC products can be expressed as follows, respectively:

4.2. Knowledge Payment Product Demand Function

To determine the demand size for different knowledge payment products, we first need to identify the quality preference thresholds at which consumers are willing to purchase self-operated product, UGC product, or opt out of purchasing.

Let , the necessary but not sufficient condition for consumers to be willing to purchase self-operated product is , where .

Similarly, let , the necessary but not sufficient condition for consumers to be willing to purchase UGC product is , where .

In addition, for consumers who gain positive utility from purchasing either the self-operated product or the UGC product, the condition for preferring the self-operated product is , which is equivalent to , where .

In summary, the sufficient and necessary condition for consumers to choose the self-operated product is

and

, which is equivalent to

; the sufficient and necessary condition for consumers to choose the UGC product is

and

, which is equivalent to

. By comparing the sizes of

,

, and

, we can derive:

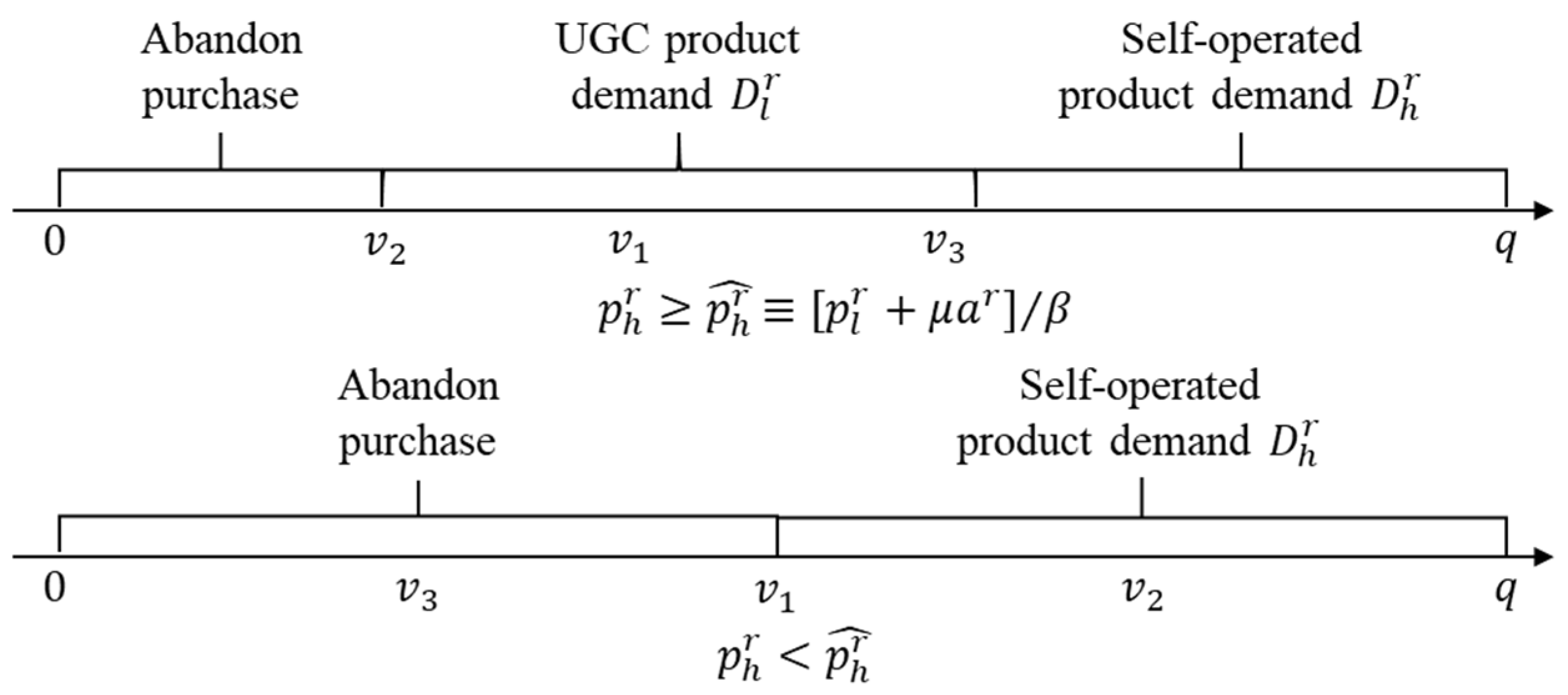

Therefore, the consumer demand in the market can be divided into two scenarios, as shown in

Figure 3: When

, the demand for both knowledge-based paid products (self-operated and UGC products) exists in the market. When

, only the self-operated product has demand in the market.

This article focuses on the scenario where

for the following reasons: (1) From a practical perspective, UGC knowledge transaction platform typically generate content primarily through UGC products, while offering self-operated products to stabilize the platform’s content ecosystem and enhance consumer loyalty. In most cases, both self-operated products and UGC products have demand on the platform, which aligns with the scenario

. (2) From a theoretical perspective, this article aims to explore the pricing strategy of knowledge-based paid products under the influence of implanted advertisements. This issue is meaningful only when both self-operated products and UGC products are in demand. Therefore, this article assumes that

always holds true [

35], and as a result, the demand for self-operated product

and UGC product

can be expressed as follows:

From Formulas (3) and (4), it can be seen that the demand for self-operated products is negatively correlated with and positively correlated with , while the demand for UGC product is positively correlated with and negatively correlated with , which conforms to the market supply and demand relationship. However, when the quality of UGC products is sufficiently high, consumers are more willing to accept the negative utility of implanted ads to avoid the potential effects of knowledge payment products. As a result, they tend to choose personalized UGC product to meet their knowledge needs, leading to a decrease in and an increase in . Conversely, when the consumer’s sensitivity to advertisements is sufficiently high, even if the UGC product quality is high, consumers’ aversion to implanted ads will make them more likely to choose self-operated product, leading to an increase in and a decrease in . Therefore, when formulating pricing strategies, knowledge producers and platforms should consider the price environment, quality environment, and implanted advertising environment of knowledge payment products to maintain their overall revenue levels.

4.3. Objective Function

Based on the consumer demand function, the revenue maximization objectives for different decision-making entities are as follows: the platform’s revenue includes the revenue from self-operated products

, the revenue share from UGC products

, and the revenue from implanted ads

; the knowledge producer’s revenue includes the revenue share from UGC products

and the revenue share from implanted ads

; the advertiser’s revenue is

. Given that the

term already effectively captures the impact of variable operating costs for implanted ads, adding a quadratic cost function for ad intensity

would not provide significant new insights [

35]. To simplify the model and highlight the research focus, only the fixed operating costs for implanted ads for both the platform and the advertiser are considered, assumed to be

[

35]. Therefore, the objective functions for each party are as follows:

(1) When the embedded advertising management adopts the PM model

The revenue objective functions for the platform and knowledge producer can be expressed as

(2) When the embedded advertising management adopts the AM model

The revenue objective functions for the platform, knowledge producer, and advertiser can be expressed as

Since the model involves a multi-stage game, this paper uses backward induction to solve the relevant game equilibrium results under different advertising management models and then analyzes the impact of embedded advertising and power structure on the pricing strategy of knowledge payment products. To simplify the notation in the paper, we define , . To ensure that the model is meaningful and to avoid trivial discussions, we assume .

4.4. Optimal Pricing Decision Analysis Under PM Mode

Under the PM mode, the advertiser does not participate in the decision of embedded advertising intensity, and a platform-dominated Stackelberg game is formed between the platform and the knowledge producer. By substituting Equation (4) into Equation (6), and according to the knowledge payment transaction timing relationship in

Figure 2, the knowledge producer, aiming for profit maximization, will make the optimal response when the platform’s self-operated product pricing and embedded advertising intensity are

and

, respectively. The optimal response function of the knowledge producer is described as Lemma 1:

Lemma 1. Under the PM mode, given the self-operated product pricing and embedded advertising intensity , the optimal reaction function of the knowledge producer is as follows (the proof is shown in Appendix A): Lemma 1 shows that under the PM mode, the optimal pricing of UGC products, , is positively related to the self-operated product price and negatively related to the advertising intensity . By observing the first-order conditions and , it is further clear that embedded advertising has a greater impact on the pricing than the self-operated product price. This implies that when the price of self-operated product and advertising intensity are fixed, if consumers are highly sensitive to advertising (i.e., is large), even if the quality of the UGC product is relatively high, the knowledge producer can only adopt a price reduction strategy to increase demand and maintain the overall revenue level.

Theorem 1. Under the PM mode, when , the platform’s optimal decisions regarding the self-operated product price and the advertising intensity , aimed at maximizing revenue, are as follows (proof provided in Appendix A): where .

Theorem 1 indicates that under the PM model, at equilibrium, knowledge producers still focus on the personalized expression of UGC product, resulting in a significant quality gap compared to self-operated products (), leading to limited revenue. Therefore, the platform always has room for ad placement to guide knowledge producers in improving content quality and optimizing revenue through embedded ads. This also provides a theoretical explanation for why most UGC products in reality include advertisements. By substituting Equations (11) and (12) into Equations (3)–(6) and (10), we obtain the other equilibrium decisions under the PM model, where , .

Based on Theorem 1, by analyzing the impact of UGC product quality on the pricing of knowledge payment products, we derive Corollary 1.

Corollary 1. For UGC product pricing, ; for self-operated product pricing, (proof provided in Appendix A). Corollary 1 indicates that under the PM model, the prices of both knowledge payment products are positively correlated with the quality of UGC products . This is because as the quality gap between products narrows, the knowledge producer increases the price of UGC product to boost revenue. However, raising the UGC product price increases the demand for a self-operated product while reducing the demand for a UGC product, leading to a gradual decline in the platform’s advertising revenue. To maintain overall profitability, the platform is incentivized to raise the price of self-operated product to offset the advertising revenue loss caused by the decline in UGC product demand.

4.5. Optimal Pricing Decision Analysis Under the AM Model

In the AM model, the advertiser determines the intensity of embedded advertising, while the knowledge producer and advertiser act as followers in a Stackelberg game led by the platform. Substituting Equation (4) into Equations (8) and (9), and following the sequence of knowledge payment transactions shown in

Figure 2, both the advertiser and the knowledge producer aim to maximize their respective revenues under different local power structures. Given the platform’s self-operated product pricing as

, the optimal response functions of the knowledge producer and advertiser are stated in Lemma 2.

Lemma 2. Under the AM model, given the self-operated product price , the optimal response functions of the advertiser and the knowledge producer are presented in Table 2 (proof provided in Appendix A). By comparing the advertising intensity and UGC product pricing under different power structures in Lemma 2, we derive Corollary 2:

Corollary 2. Under the AM model, if the self-operated product price remains constant, then: (proof provided in Appendix A). Corollary 2 indicates that in the AM model, differences in the power structure between advertiser and knowledge producer directly influence their decisions. When the platform’s self-operated product price remains unchanged, UGC product pricing is positively correlated with the knowledge producer’s power status, while advertising intensity is negatively correlated with the knowledge producer’s power status. This implies that when the knowledge producer holds a higher power status, he has a first-mover advantage and can adopt a price-increasing strategy to maximize revenue. However, when the power status of the knowledge producer declines, the first-mover advantage shifts to advertiser. In this scenario, increased advertising intensity reduces the utility of UGC products for consumers. To balance overall revenue, the knowledge producer must either improve product quality () or lower the price to boost demand for UGC product.

By substituting the optimal response functions of knowledge producers and advertisers, and , into Equation (7), the platform, aiming to maximize revenue, determines the optimal self-operated product price . The equilibrium decision is presented in Theorem 2 as follows:

Theorem 2. Under the AM model, the platform’s optimal self-operated product price that maximizes its revenue is (proof provided in Appendix A): where

;

;

.

Theorem 2 indicates that under the AM model, there is still room for embedded advertising. However, different power structures grant the advertiser varying degrees of decision-making space (), which may alter the revenue structure of the knowledge producer. This shift may incentivize the knowledge producer to adopt low-pricing strategies in pursuit of advertising revenue. As a result, even though the platform holds an absolute dominant position in the market, it must consider lowering prices to remain competitive. In reality, UGC platforms frequently offer limited-time discounts and promotional activities for self-operated products, indirectly validating this observation.

By substituting Equation (13) into the response functions of knowledge producer and advertiser from

Table 2, the equilibrium decisions under different power structures in the AM model can be obtained. These include

,

where

.

Based on Theorem 2, through analyzing the impact of UGC product quality β\betaβ on the pricing of knowledge payment products, we can derive Proposition 3.

Corollary 3. For UGC product price, When , , otherwise ; When , , otherwise ; When , , otherwise ; For self-operated product price, ; ; (Proof as shown in Appendix A, with expressions for each threshold value in Appendix A Table A1, similarly for the following cases). Corollary 3 shows that in the AM model, when the quality of the UGC product is low, the UGC product price is positively correlated with UGC product quality, and vice versa; while the self-operated product price is negatively correlated with UGC product quality. The reason for this is that when the UGC product quality is low, the market demand is lower, and the revenue structure of the advertiser is more simplistic, relying on the growth of UGC product demand. Therefore, advertisers set a lower advertising intensity, which provides the knowledge producer with the opportunity to raise price. When the UGC product quality is high, the market demand is greater, and the advertiser can increase the revenue by raising advertising intensity, prompting the knowledge producer to lower the UGC product price to maintain overall revenue. In this process, whether the UGC product price increases or the advertising intensity increases, it will increase the demand for a self-operated product. For a platform without advertising cost pressure, there is an incentive to adopt a price reduction strategy, increasing market share and improving revenue through a low-margin, high-volume approach.

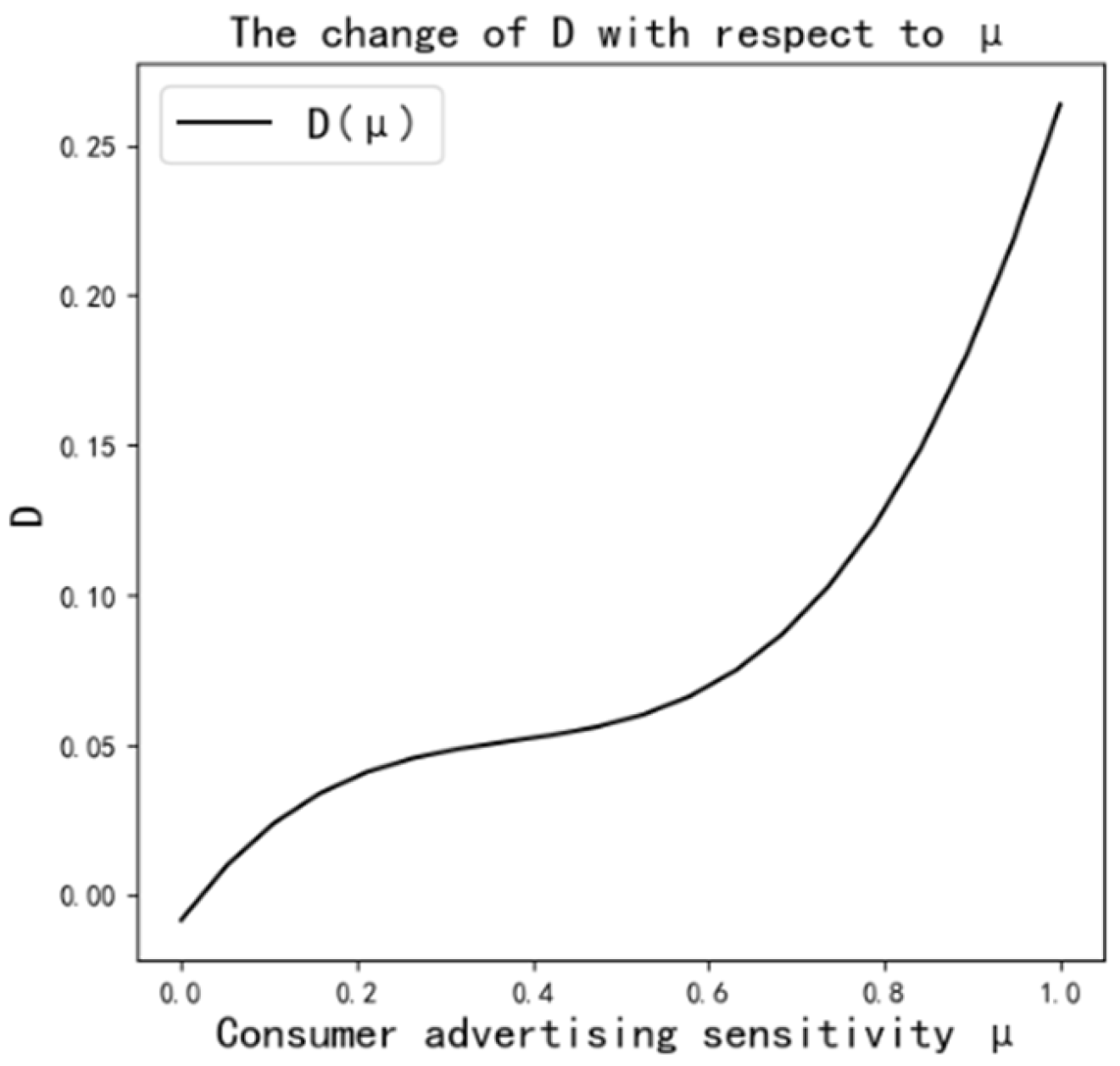

4.6. Impact of Embedded Advertising

This section will compare the equilibrium results and analyze the impact of embedded advertising on the pricing of knowledge-paying products, platform revenue, and knowledge producer revenue. To make the study meaningful, we further assume that , meaning that the platform can always guide knowledge producers to improve the UGC product quality through embedded advertising. Subsequent equilibrium analysis and case analysis will be conducted based on this assumption.

When the local power structure between the knowledge producer and advertiser is fixed, we can derive Proposition 1 by comparing the self-operated product price and UGC product price under the two advertising models.

Proposition 1. For the UGC product price, when , , otherwise ; When , , otherwise ; When and , , otherwise ; For the self-operated product price, ; ; (Proof is provided in Appendix A). Proposition 1 shows that when the UGC product quality is low and the consumer advertising sensitivity is high, the UGC product price is lower under the PM model, while the self-operated product price remains higher under the PM model. This is because in the PM model, the platform not only has price leadership but also directly controls the embedded advertising intensity. The platform will increase the advertising intensity to cope with the cost pressure brought by the lower quality of the UGC product. As a follower, the knowledge producer can only reduce the UGC product price to ensure sales and advertisement viewership to maintain overall revenue level. However, when the consumer advertising sensitivity is low, if the advertising provider has a higher power position, the platform’s diversified revenue structure in the PM model allows the knowledge producer to set a higher UGC product price under lower advertising intensity.

Further, by comparing platform revenue and knowledge producer revenue under different advertising management models, Proposition 2 can be derived.

Proposition 2. For knowledge producer revenue, when , , otherwise ; when , , otherwise ; when and , , otherwise ; for platform revenue, when , , otherwise ; when , , otherwise ; when , , otherwise ; (Proof as shown in Appendix A). From Proposition 2, it can be concluded that when the consumer’s advertisement sensitivity coefficient is relatively high, in general, the platform and the knowledge producer can both achieve higher revenues, realizing a win-win situation, such as when and . This is because, when UGC product quality is low, the demand is smaller, and if the platform implements pricing under the AM model, the shift in advertising costs indirectly increases platform revenue. At the same time, when UGC product demand is low, the advertiser will not consider increasing advertising intensity, which leads to an increase in the knowledge producer’s revenue. On the other hand, when UGC product quality is high, the platform implements pricing under the PM model. The higher demand for UGC product and the platform’s diversified revenue structure allows it to set a lower advertising intensity, which also benefits the knowledge producer’s revenue. However, when the consumer’s advertisement sensitivity coefficient is relatively low, and if the knowledge producer has a lower power position, the advertiser will set a higher advertising intensity, which compresses the demand space for UGC product and leads to lower knowledge producer revenue under the AM model.

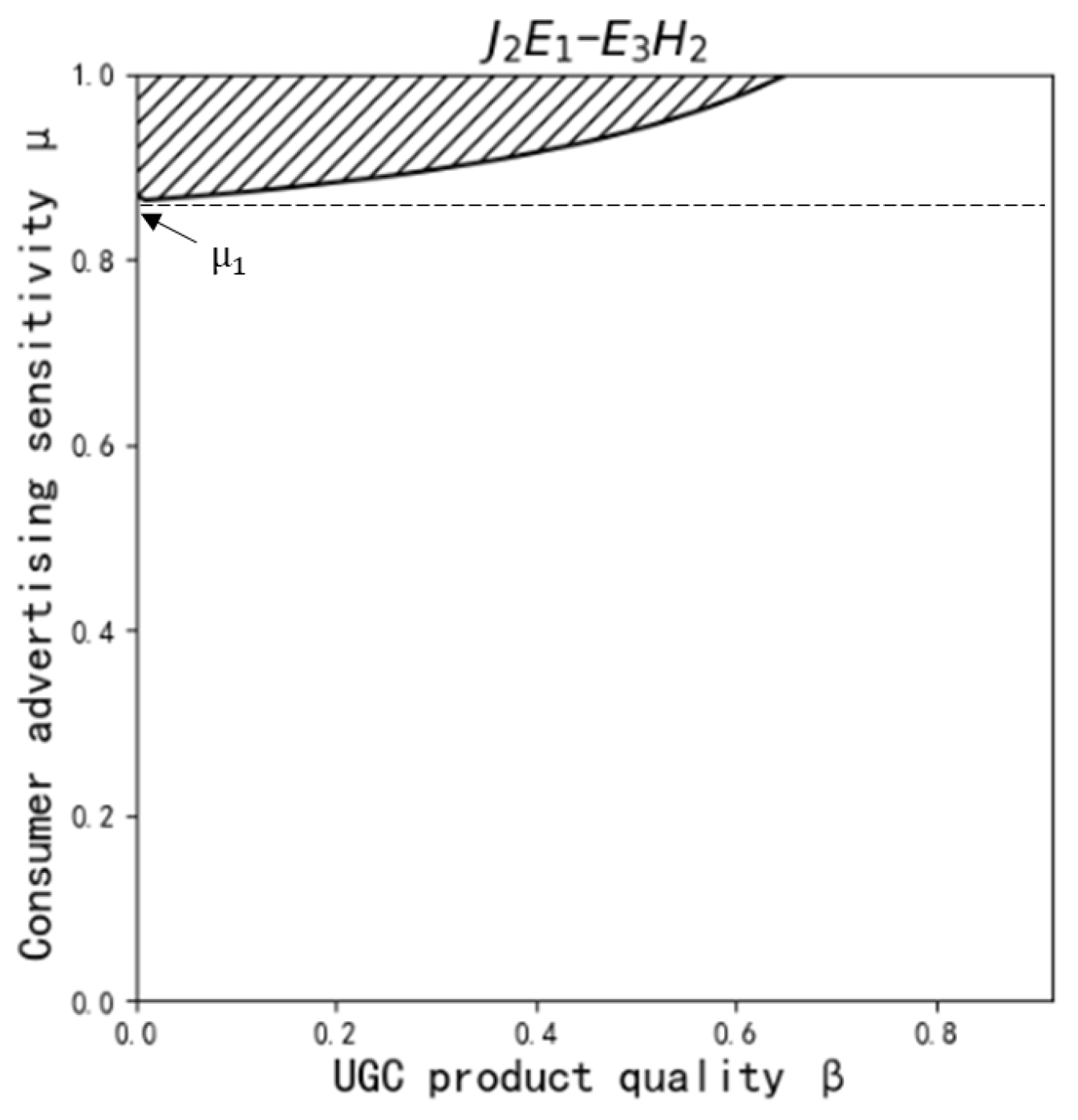

4.7. Influence of Power Structure

Since, in the PM model, the advertiser does not participate in decision-making, the analysis of the influence of the power structure mainly focuses on the AM model. By comparing the self-operated product price and UGC product price under different power structures, Proposition 3 can be derived.

Proposition 3. For the UGC product price, ; when , , otherwise ; For the self-operated product price, (proof as shown in Appendix A). Proposition 3 indicates that in the AM model, the first-mover advantage brought by power position generally allows the knowledge producer to gain profits by setting a higher product price. However, when the quality of UGC product is higher, the knowledge producer with lower power position can also adopt high-price strategies because higher product quality compensates for the negative utility that embedded ads bring to consumers. The platform can always adopt a high-price strategy to gain profits when the power positions of knowledge producer and advertiser are unequal. This is because an increase in UGC product price or advertising intensity will increase the demand for self-operated product.

Furthermore, by comparing the platform’s revenue and knowledge producers’ revenue under different power structures, Proposition 4 can be derived.

Proposition 4. For knowledge producer revenue, , ; when , , otherwise ; For platform revenue, (proof in Appendix A). According to Proposition 4, in the AM model, when UGC product quality is low, the knowledge producer’s best strategy is to implement pricing when their power position is higher. When UGC product quality is high, the knowledge producer does not need to excessively pursue pricing power. This is because the gap in knowledge payment product quality narrows, and consumer demand shifts towards more personalized UGC products. The knowledge producer can balance overall revenue through advertising revenue sharing. When either the knowledge producer or the advertiser has a higher power position, it reduces the demand for UGC product, allowing the platform to achieve higher revenue through increased demand for self-operated product.

5. Case Study Analysis

This section will use numerical experiments to verify and more intuitively present the conclusions derived above and analyze their practical significance. The parameter values for references [

17,

25,

37] are as follows: (1) UGC product revenue share ratio

, embedded advertisement revenue share ratio

: Based on the revenue sharing situation of UGC knowledge trading platforms such as Zhihu and Knowledge Planet, set

,

; (2) consumer advertising sensitivity coefficient: Recent data from the 2024 Global Consumer Trends Index published by Marigold reveals that 63% of global consumers lack trust in advertisements presented on social media platforms [

53]. Combining the limitations of

in

Section 4.6 and

Section 4.7, set

(indicating lower consumer advertising sensitivity) and

(indicating higher consumer advertising sensitivity); (3) revenue per advertisement display, charge per advertisement display: Based on the actual CPM charging situation, the charge per advertisement display is normalized, set

,

; (4) potential market demand

, consumer quality preference upper limit

, and fixed cost

for embedded advertisement management: To ensure the model is meaningful, set

,

,

; (5) UGC product quality

: The value of

is taken within the range defined by relevant conditions.

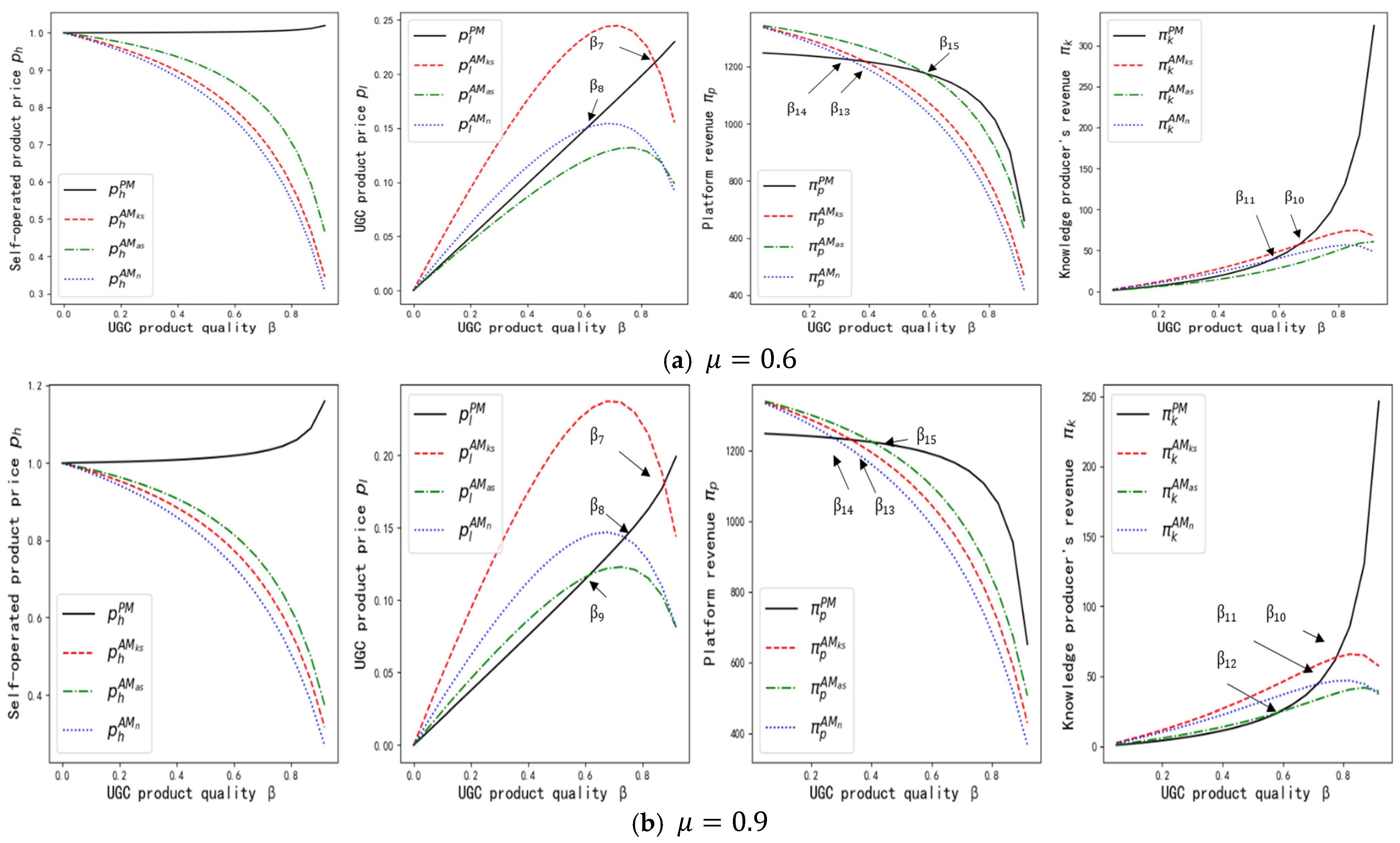

5.1. Impact of Embedded Advertising

First, analyze the impact of different embedded advertising management models on platform and knowledge producer pricing and revenue when the power structure is fixed. By comparing

Figure 4a,b, it can be seen that in the PM model, the prices of both knowledge payment products are positively correlated with the quality of UGC product (Corollary 1). In the AM model, when the quality of UGC product is below a certain threshold, the price of UGC product is positively correlated with UGC product quality; when the quality of UGC product exceeds a certain threshold, the price of UGC product is negatively correlated with UGC product quality, while the price of self-operated products is always negatively correlated with UGC product quality (Corollary 3). When the quality of UGC product

and consumer advertising sensitivity coefficient

are high, the price of UGC product is lower in the AM model, and the price of self-operated product is always lower in the AM model. This is because the revenue structure of advertisers is simple, and under these conditions, they set a higher advertising intensity to achieve revenue, resulting in reduced demand for UGC product. In order to increase demand, the knowledge producer can only resort to price reductions aside from improving product quality and pricing power, while the platform in the AM model, due to reduced decision-making power and the shift in advertising costs, consistently sets lower price. However, when the consumer advertising sensitivity coefficient

is lower, if the knowledge producer’s power position is low, they will adopt a low-price strategy.

For the platform and knowledge producer’s revenue, when the consumer advertising sensitivity coefficient is high, if the UGC product quality is low, the platform can achieve higher revenue in the AM model while the knowledge producer also gains higher revenue, as long as . This is because, on one hand, the shift in advertising costs indirectly increases the platform’s revenue. On the other hand, the advertiser’s revenue depends on UGC product demand. When the consumer advertising sensitivity coefficient is high and UGC product quality is low, the advertiser will reduce advertising intensity to alleviate advertising cost pressure, leading to an increase in the knowledge producer’s market share and higher revenue. If the UGC product quality is high, the platform can also achieve higher revenue along with the knowledge producer in the PM model, as long as . This is because, when UGC product quality is high, the platform can balance advertising costs through UGC product revenue sharing, thus allowing for lower advertising intensity and achieving a win-win situation with the knowledge producer. However, when the consumer advertising sensitivity coefficient is low, if the platform faces high advertising cost pressure, it will inevitably implement pricing in the AM model. At this point, if the pricing power cannot be increased, lower revenue will prompt knowledge producer to consider profiting from advertisements. This also indirectly explains why some content-rich “knowledge influencers” adopt low-price strategies to pursue advertising revenue.

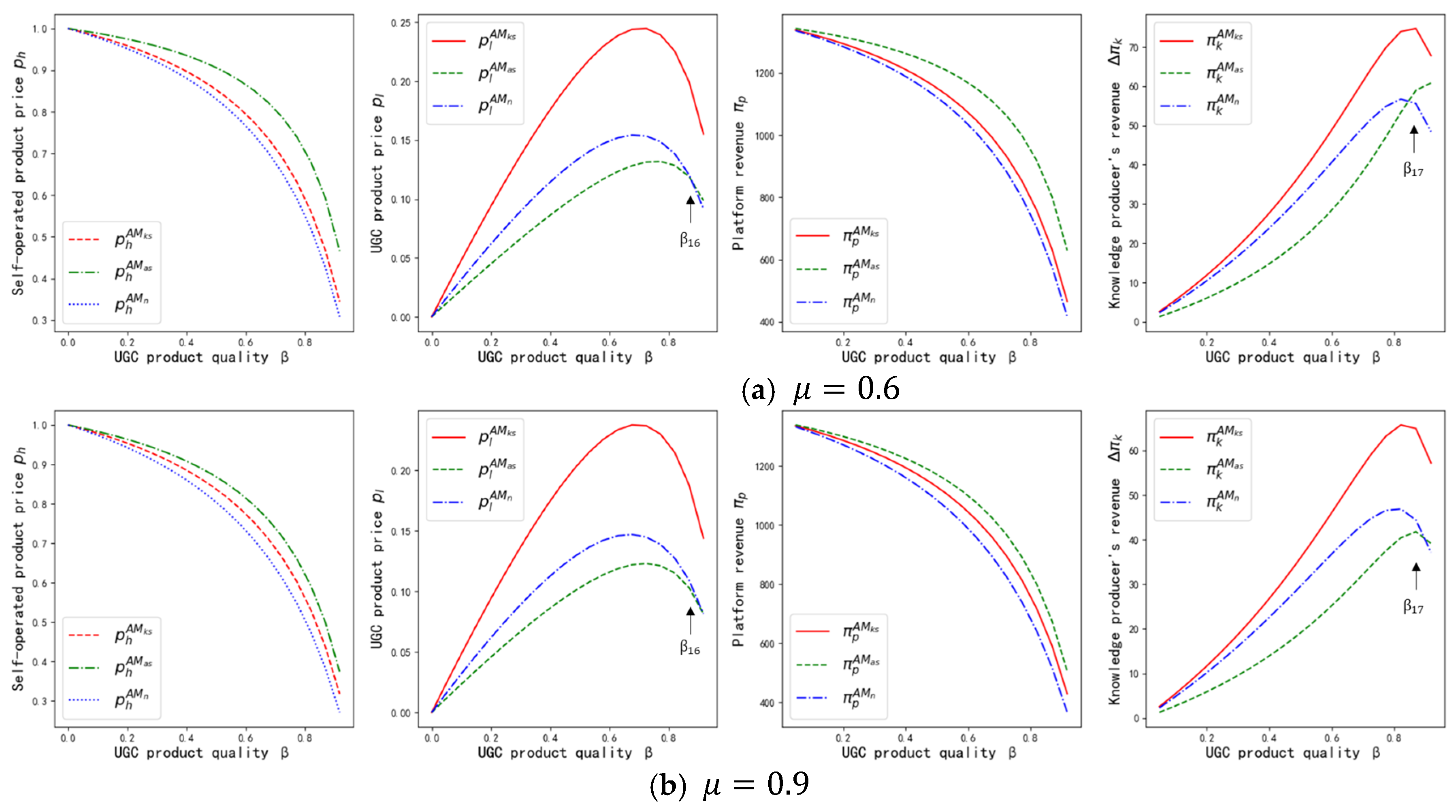

5.2. The Impact of Power Structure

Next, we analyze the impact of the power structure on platform and knowledge producer pricing and revenue. By comparing

Figure 5a,b, we can see that in the AM model, the consumer advertisement sensitivity coefficient

has a minimal impact on the relevant indicators. It only affects the magnitude of the indicators but does not change the relationships between the indicators. When the UGC product quality is below the threshold

, the UGC product price and knowledge producer revenue is positively correlated with the knowledge producer’s power status. However, when the UGC product quality exceeds the threshold

, the knowledge producer does not need to overly pursue market power. This is because the higher product quality compensates for the negative effects of embedded ads on consumers, and consumer demand shifts toward more personalized UGC product. The knowledge producer can set higher UGC product price and improve overall revenue by adjusting the revenue structure. The platform can always achieve higher revenue when the power status between knowledge producer and advertiser is unequal. This is because when the knowledge producer’s and advertiser’s power status is unequal, the increase in UGC product price or advertising intensity will reduce UGC product demand and increase self-operated product demand, allowing the platform to set higher self-operated product price to increase revenue.

6. Discussion

This section outlines a comparison between the current study and the existing literature, discusses its potential applicability in practice, and further highlights the limitations of the research as well as directions for future studies.

6.1. Comparison with Existing Research

This study takes into account the complex interactions among the platform, knowledge producer, and consumers, with a particular focus on the changes in power structure induced by non-price decisions (i.e., embedded advertising). This perspective extends the application boundary of Stackelberg game theory within the field of knowledge payment. The specific extensions and innovations are reflected in the following two aspects:

(1) Incorporation of a Multi-Dimensional Utility Function: Unlike traditional studies that adopt fixed demand function assumptions (e.g., [

1,

46]), this paper incorporates consumers’ sensitivity to embedded advertising (μ) and UGC product quality (β) into the utility function. This allows for capturing consumers’ joint responses to variations in knowledge product quality, advertising intensity, and price. By comparing equilibrium outcomes across different scenarios, the study derives optimal pricing strategies under varying conditions. This extension more accurately reflects the content ecosystem and revenue structure of UGC platforms and knowledge producers under multi-party incentive mechanisms, offering theoretical insights for platforms such as

Skillshare and

Bilibili.

(2) Construction of Multi-Party Game Pricing Models under Differentiated Advertising Management Modes: Existing studies predominantly focus on advertising strategies controlled by either the platform or the advertiser alone (e.g., [

28,

30,

32]), without thoroughly exploring how the allocation of advertising management rights influences the tripartite game relationship among the platform, knowledge producers, and advertisers. This paper advances the literature by further differentiating power structure configurations within the platform-managed mode (PM) and advertiser-managed mode (AM), including advertiser partially dominant, knowledge producer partially dominant, and advertiser–knowledge producer partial equilibrium scenarios. Based on Stackelberg game theory, it constructs multi-scenario pricing models to uncover the nonlinear dynamic mechanisms among advertising intensity, product quality, and consumer sensitivity to advertising. This approach fills a research gap concerning the impact of partial shifts in power structure on knowledge product pricing.

6.2. Practical Applicability

This study can provide decision-making support for UGC platforms and knowledge producers in formulating strategies and selecting cooperation models under embedded advertising scenarios in the following three aspects:

(1) Optimization of Platform Revenue Structure and Strategic Coordination: The findings offer a theoretical foundation for UGC platforms in designing commercialization strategies. They support platforms in flexibly setting product pricing and advertising placement rules under different advertising management modes, thereby achieving dynamic optimization of the revenue structure and improving overall operational efficiency.

(2) Advertising Management Mode Selection and Content Ecosystem Regulation: By constructing an analytical framework that incorporates consumer sensitivity to advertising and the heterogeneity of UGC product quality, this study helps platforms evaluate governance effectiveness under various advertising management models. The results are applicable to real-world scenarios such as user experience management, optimization of content recommendation mechanisms, and the design of advertising revenue allocation systems, ultimately enhancing the platform’s ability to regulate its content ecosystem.

(3) Strategic Adjustment and Behavioral Guidance for Knowledge Producers: Given the frequent changes in platform policies and the ongoing evolution of advertising mechanisms, this study provides actionable guidance for knowledge producers in formulating content creation and advertising strategies aligned with different revenue goals. It supports producers in balancing advertising income with content quality, ensuring effective alignment between their creative behavior and platform rules, and enhancing their long-term monetization potential within the platform ecosystem.

6.3. Limitations and Directions for Future Research

This study has certain limitations, which provide opportunities for future research in the following aspects:

(1) Data Applicability Limitations: This study’s case analysis is based on operational data from Chinese UGC platforms, which may limit the regional applicability of the findings. Future research should incorporate data from international platforms for comparative validation to enhance the model’s generalizability.

(2) Limited Model Scope: To focus on the impact of embedded advertising management and power structure on knowledge product pricing, the current model does not include more complex cross-platform coefficient present in two-sided markets (e.g., the effect of user base changes on product pricing). Future studies could integrate such cross-platform coefficient to extend the model.

(3) Single Advertising Billing Mechanism: The model currently considers only the CPM (cost per mile) billing method and excludes other operational advertising billing mechanisms such as CPC (cost per click) and CPA (cost per action). Since advertisers often adopt behavior-based billing under demand uncertainty, future research should systematically compare the game structures and optimal strategy choices among platforms, knowledge producers, and advertisers under different billing models.

7. Conclusions

The incentive to improve personalized content quality on UGC knowledge trading platforms poses challenges for embedded advertising management. The uncertainty inherent in embedded advertising complicates the pricing of knowledge payment products. This paper abstracts the impact of embedded advertising on the transaction process of knowledge payment products under the UGC model, employing Stackelberg game theory to characterize the dynamic interactions among the platform, knowledge producers, advertisers, and consumers, as well as the power structure shifts between knowledge producers and advertisers under platform leadership. It identifies the effects of embedded advertising on pricing knowledge payment products, analyzes the feasibility conditions for different platform advertising management modes, and uses case analysis to explore the interactive influence of embedded advertising and power structure on product pricing and the revenues of both the platform and knowledge producers.

The main research findings are as follows:

(1) Relationship between Product Price and Content Quality: In the PM mode, prices of both types of knowledge products increase with the improvement of UGC product quality. Conversely, under the AM mode, the price of self-operated products consistently decreases as UGC product quality rises, while the price of UGC products exhibits a rise-then-fall trend.

(2) Impact of Consumer Advertising Sensitivity: When consumers have high sensitivity to advertising, both the platform and knowledge producers are more likely to achieve win-win outcomes, especially when UGC product quality is at relatively low or high levels. However, if consumer advertising sensitivity is low and knowledge producers have weaker power positions, their profits under the AM mode remain consistently constrained.

(3) Pricing Advantages from Power Structure: Power status grants knowledge producers stronger pricing capabilities. Nevertheless, when UGC product quality is sufficiently high, even knowledge producers with lower power can maintain high-price strategies supported by product quality, reducing the need to aggressively seek pricing dominance.

(4) Platform Role Adaptability and Revenue Transfer Mechanism: Depending on UGC product quality levels and power configurations, the platform can maximize revenues by appropriately delegating or reclaiming authority. For example, under the AM mode, the platform can leverage power asymmetries between advertisers and producers to indirectly promote self-operated products.

Based on the above research conclusions, this paper proposes the following management implications:

(1) Regarding the platform: When the quality of UGC products is relatively low, the platform should appropriately relinquish decision-making authority and choose the AM mode, allowing advertisers to bear the advertising management costs. The platform can leverage the power differences between knowledge producers and advertisers to set higher prices and continuously optimize revenue. When UGC product quality is relatively high, the platform is advised to reclaim decision-making power and adopt the PM mode. By controlling advertising intensity and synergizing with high-quality content, the platform and knowledge producers can simultaneously implement price increases to boost revenue, achieving dual revenue growth.

(2) Regarding knowledge producers: Under the PM mode, knowledge producers should continuously improve content quality to gain stronger pricing power and higher advertising revenue shares. Under the AM mode, if UGC product quality is low, knowledge producers should strive for greater pricing leadership to counteract the demand suppression caused by advertisers’ high-intensity advertising strategies. When UGC product quality is high, producers can maintain their content advantage while flexibly adjusting pricing and power demands, balancing overall revenue through advertising revenue sharing. Additionally, there exists a “non-exclusive usage agreement” between the platform and knowledge producers, allowing content to be distributed across multiple platforms. Therefore, knowledge producers should dynamically adjust their platform choices based on the platform’s advertising mechanisms, pricing strategies, and their own content characteristics to maximize revenue and minimize risks.