4.1. No Parallel Export of New Energy Vehicles (CN)

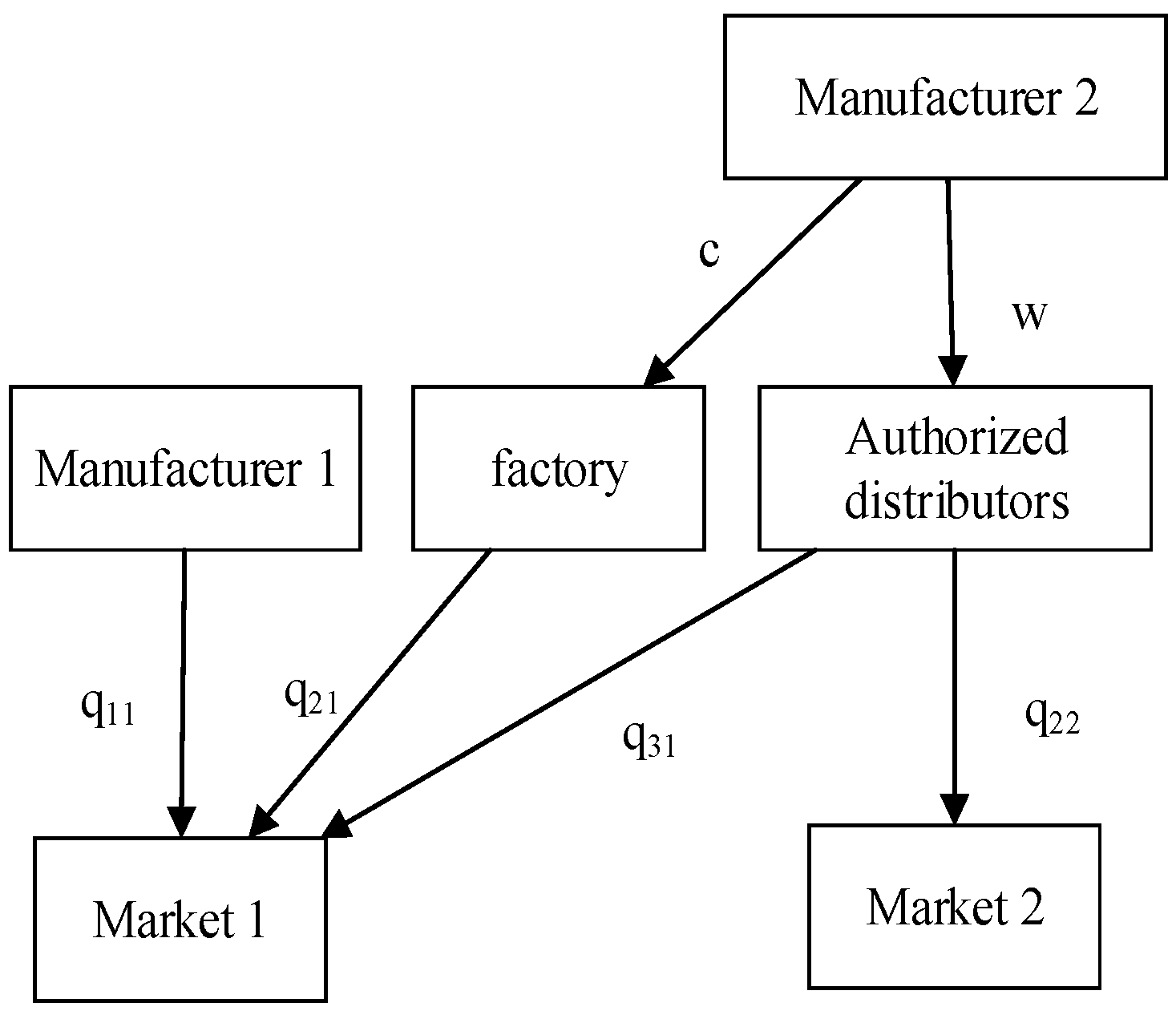

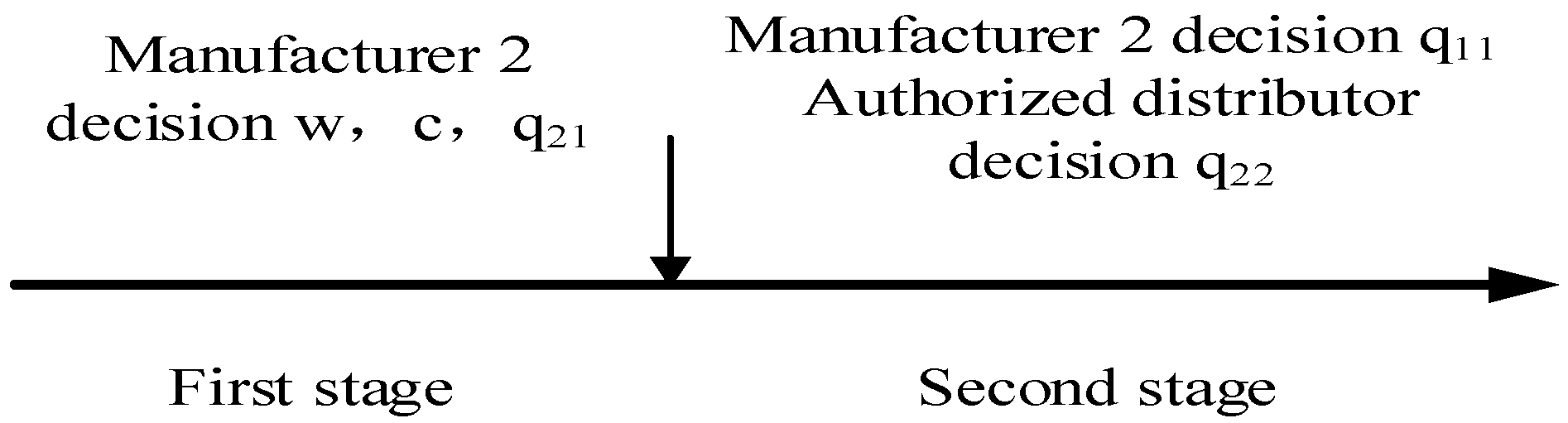

In the base case of no parallel export of new energy vehicles, with the goals of maximizing their own profits, the supply chain members make decisions in the sequence shown in

Figure 3: Firstly, Manufacturer 2 decides the wholesale price

in Market 2, the sales volume

in Market 1, and the level of differentiation

; secondly, Manufacturer 1 decides the sales volume

in Market 1, while the authorized distributor decides the sales volume

in Market 2.

Then, according to the prices of new energy vehicles from supply chain members, consumers in both markets make purchasing decisions based on maximizing their own utility. Firstly, in Market 1, consumers’ utility from product 1 and product 2 is

and

, respectively, and the utility of consumers in Market 2 from product 2 is

. Then, the market share of each product in both markets can be obtained as

solving the conditions

,

. The reverse demand functions are

Next, solving the model in backward induction, the following Theorem 1 can be obtained.

Theorem 1. In the base case of no parallel export, whenthe optimal decisions of Manufacturer 2 arethe optimal local sales volume for Manufacturer 1 isthe optimal sales volume for authorized distributors isthe equilibrium prices and profit are Proof. In the second stage, with the optimal decision of Manufacturer 2 in the first phase, the optimization objectives of Manufacturer 1 and the authorized distributor are

Substituting the reverse demand functions into Equations (1) and (2), the first derivative with respect to

,

can be obtained as

and the second derivatives satisfy the following conditions:

Therefore, there exists a unique optimal decision (the optimal response function) for members in this stage. By making the first-order partial derivative equal to zero, the following can be got:

In the first stage, the optimization objective of Manufacturer 2 is

Substituting the reverse demand function and the optimal response functions of members into Equation (3), we can get the first derivative with respect to

,

,

as

By finding the Hessian matrix with respect to

,

,

, Equation (4) can be got:

Here, , , , and , ,

So, the Hessian matrix is negative definite, and there exists a unique optimal solution when .

Letting the first derivatives be zero and linking, we can get

and both the optimal decision and the equilibrium solution are positive when

. □

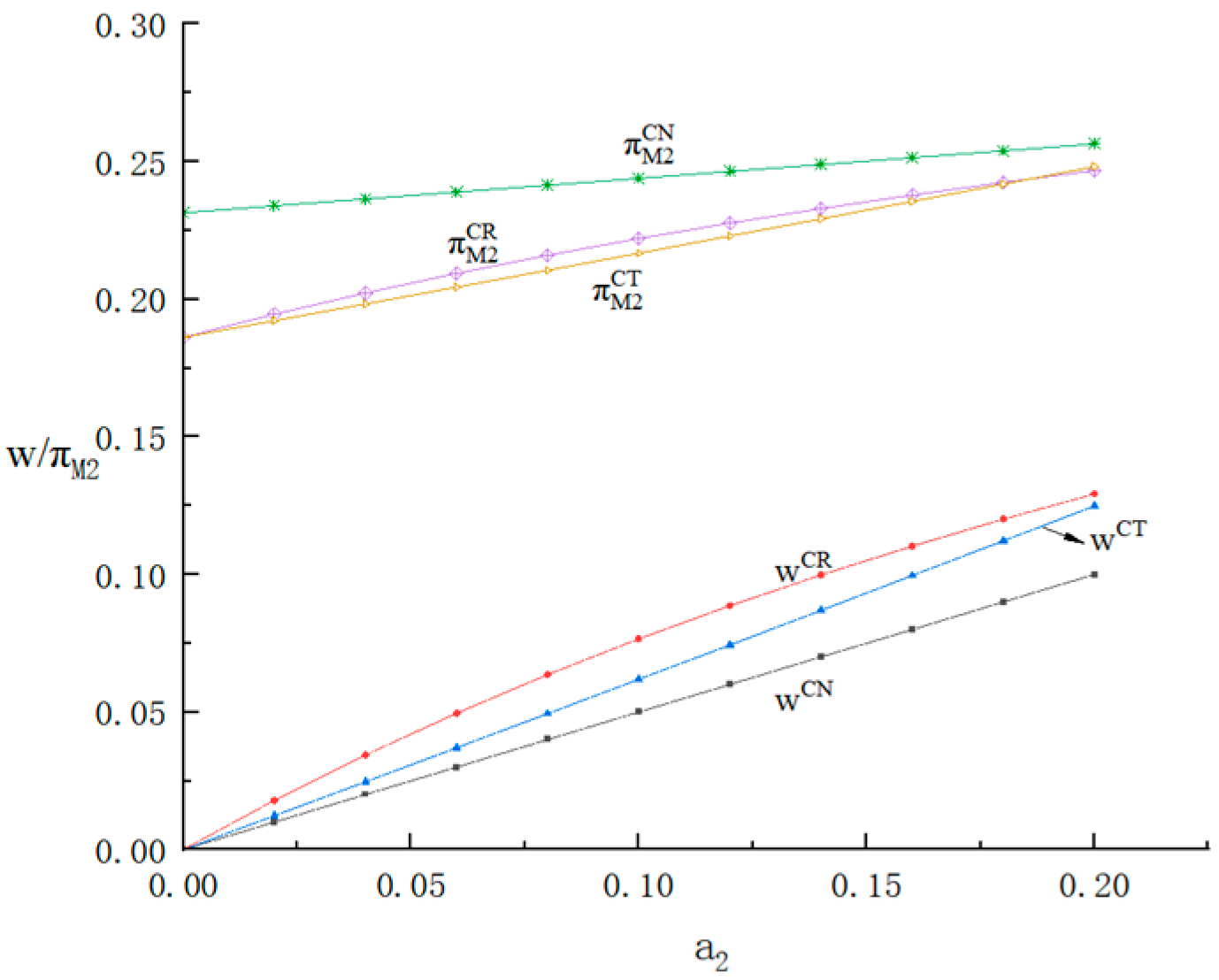

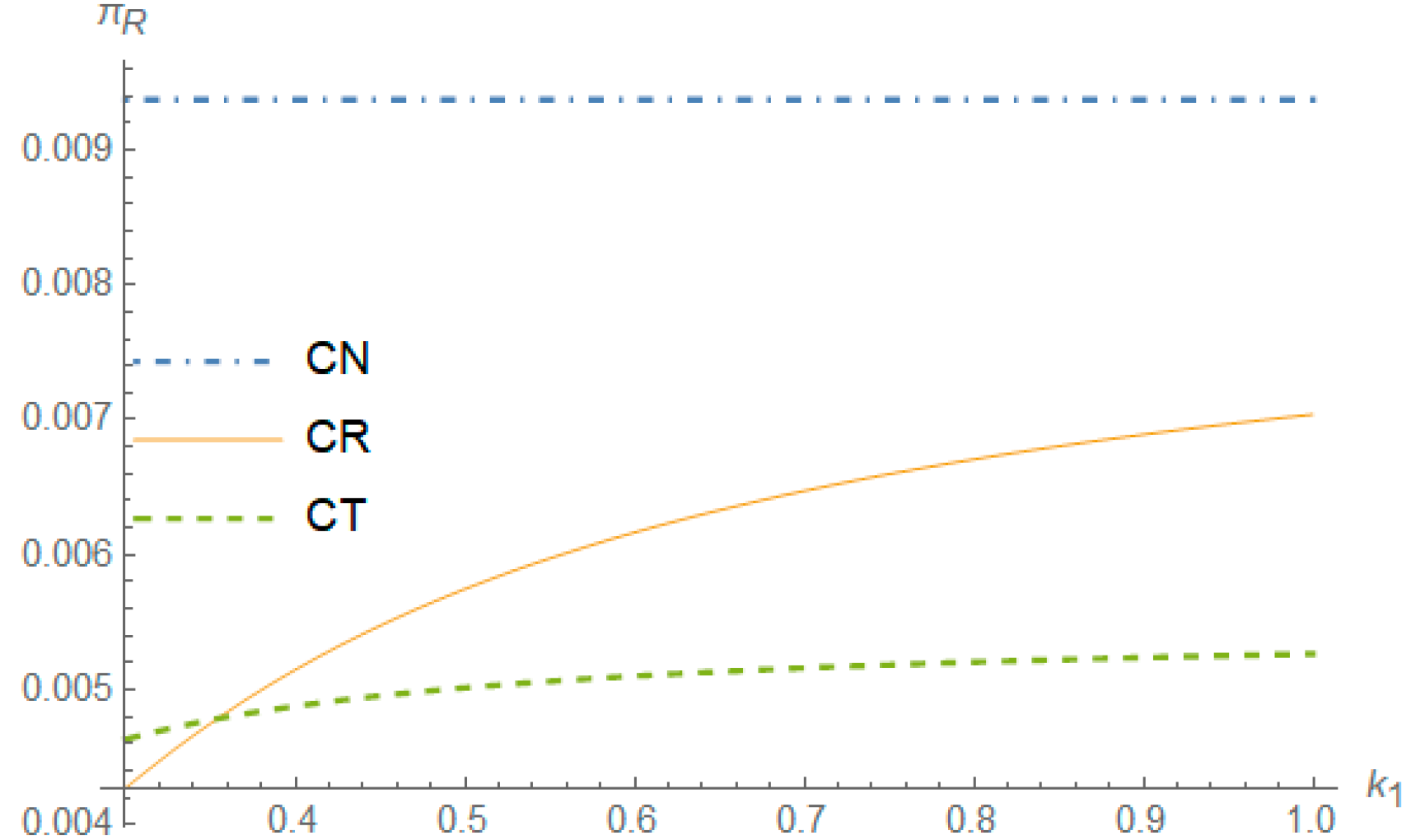

By comparing the sale volume of two products in the market and Manufacturer 2’s profits, Theorem 2 can be obtained as follows:

Theorem 2. - (1)

.

- (2)

.

Proof. (1) Based on the optimal decision of solving above, we can get ; because , , so ; because , .

(2) Based on the optimal decision and equilibrium profit solved above, we can get because and we can get , and then , . □

The above theorem shows that Manufacturer 2 has the highest sales of new energy vehicles with differentiated production in Market 1; Manufacturer 2’s profit in Market 1 is greater than that in Market 2. These benefits stem from the higher willingness of consumers to pay in Market 1, as well as the competitiveness and high prices resulting from differentiated production. It can be seen that when there is no parallel export, differentiated production by Manufacturer 2 in Market 1 based on consumer preferences can increase its sales volume and profit.

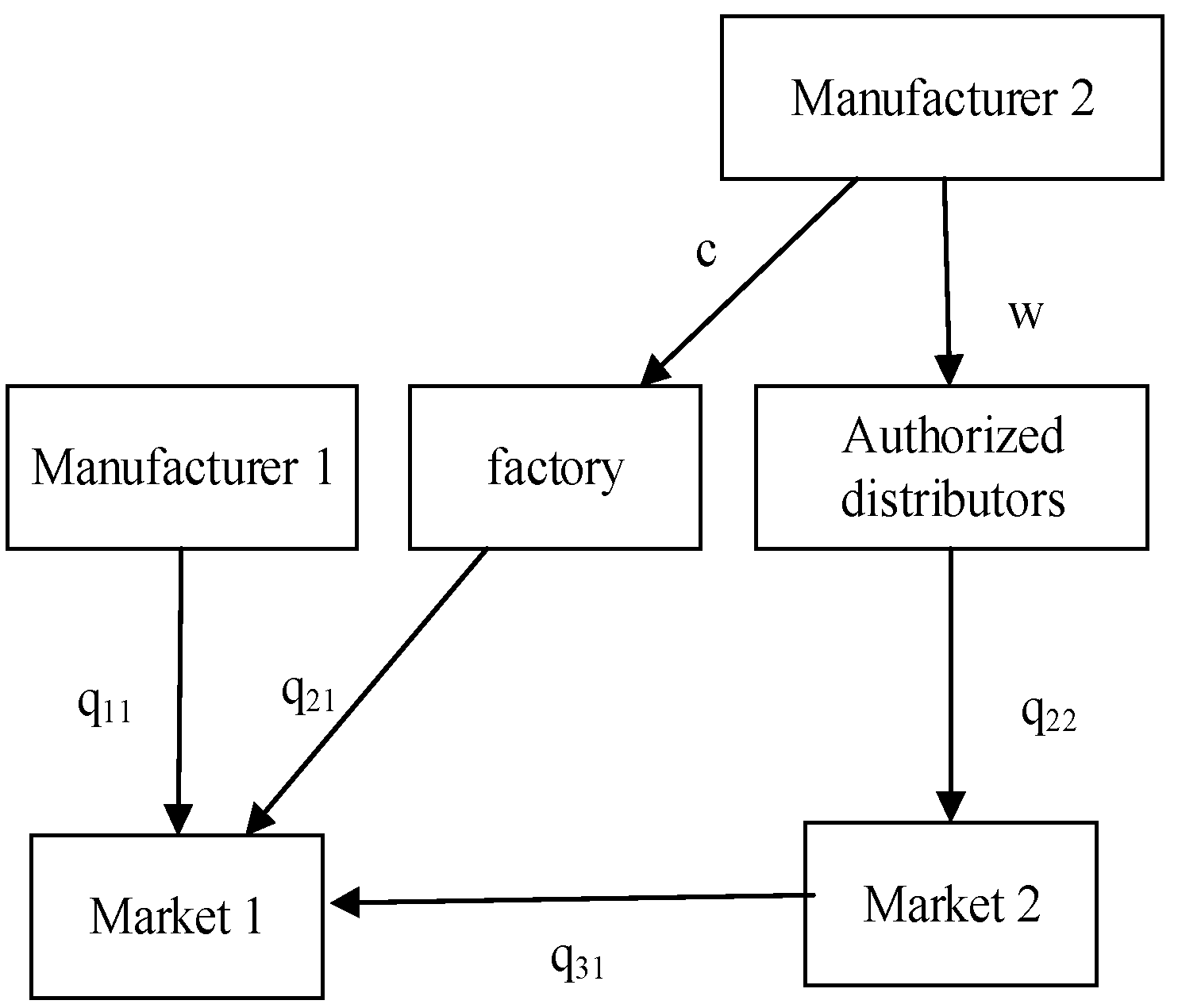

4.2. Authorized Distributors’ Parallel Export (CR)

In the CR model, considering that the authorized distributor exports new energy vehicles in parallel to Market 1, the decision-making sequence of the members can be shown as

Figure 4: the order of decision-making in the first two stages is the same as that in the base model; differently, in the third stage, the authorized distributor need to decide the sales scale of new energy vehicles exported in parallel to Market 1 (

).

In this situation, the consumers in Market 1 obtain utility by purchasing and consuming parallel-exported cars as

Therefore, the demand functions are

The reverse demand functions are

Then, a three-stage game model can be constructed as follows:

Based on Manufacturer 2’s optimal decisions on wholesale price, differentiated production level, and production scale in the first stage, the third and second stages in backward induction are solved, and the optimal responses of the authorized distributor and Manufacturer 1 can be obtained as

By sorting out the above solution results, we can obtain the following Theorem 3 about the scale of parallel export and local sales and Theorem 4 about the authorized distributor’s profit:

Theorem 3. (1), ;

(2) when , ; when , , where

Proof. (1) Because , ; ;

(2) . Because , < 0; for , analysis shows the value is not strictly greater than zero or strictly less than zero, but rather has a critical point. Therefore, we find this critical point by setting . The critical point is . Based on the critical value, it is easy to obtain the following: when , , and then when , . Theorem 3(2) is proven. □

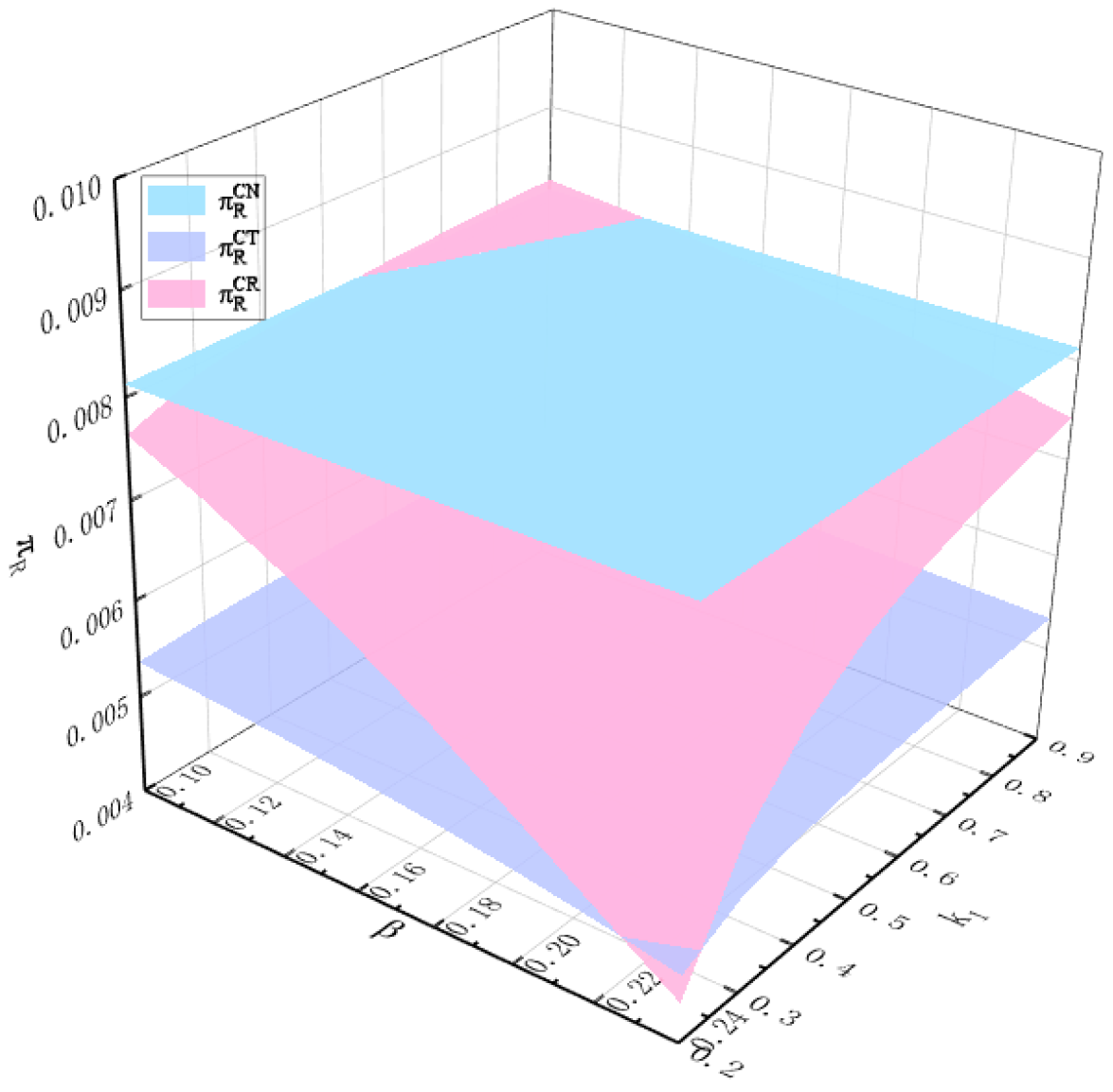

With parallel export of new energy vehicles by authorized distributors, Manufacturer 2 can curb the parallel export volume by regulating the Market 2 wholesale price and sales volume , as shown in the following:

According to Theorem 3(1), the authorized distributor’s parallel export volume in Market 1 will decrease with the increase in Manufacturer 2’s wholesale price in Market 2 and Manufacturer 2’s sales volume in Market 1. Understandably, the margin of profit for authorized distributors conducting parallel export of new energy vehicles will become narrower with the increase in Manufacturer 2’s wholesale price, and there will be less market space in Market 1 for authorized distributors to conduct parallel export when Manufacturer 2 increases the sales volume in Market 1. Then, the authorized distributors would choose to reduce the volume of parallel export of new energy vehicles to Market 1 in both cases. This phenomenon reflects the fact that manufacturers can curb the volume of parallel export of new energy vehicles through wholesale price regulation and market share expansion.

For the sales volume allocation of authorized distributors, as shown in Theorem 3(2), when the range of consumers’ willingness in Market 2 is small and the maximum critical value is smaller than the threshold, their parallel exports will be larger than domestic sales; when the range of consumers’ willingness is wider and the maximum critical value is larger than the threshold, the aggregate demand in the domestic market increases and the authorized distributors’ sales volume is larger in Market 2, where there is no competitors. In addition, this critical threshold is affected by the manufacturer’s decisions, e.g., Manufacturer 2’s wholesale price in Market 2 and sales volume in Market 1. Therefore, manufacturers can effectively curb the extent of parallel exports of new energy vehicles by authorized distributors’ parallel exports by enhancing the willingness to pay of consumers in Market 2 (e.g., by strengthening publicity and promotions, launching marketing campaigns, and increasing advertisements).

Theorem 4. When ,

,

where and are placed in Appendix B.

Proof. Similar to that of Theorem 3(2). □

By comparing the authorized distributor’s profits in the cases of no parallel export and the parallel export scenario, it can be seen that when the wholesale price of Manufacturer 2 is higher, the authorized distributor will gain less profit with parallel exports than in the no parallel export scenario because, with the increase in wholesale price, the authorized distributors will increase the sales price to avoid damage to their profits. As a result, the sales volume decreases, and the profits gained from the parallel export of new energy vehicles will not be enough to make up for the loss caused by the decrease in sales volume. So, in other words, Manufacturer 2 can influence the parallel export behavior of authorized distributors by controlling the wholesale price, or even inhibit the parallel export of authorized distributors for some reasons (maintaining brand image, etc.) (which may not be its optimal choice, of course).

Finally, returning to the first stage, the optimization objective for Manufacturer 2 is

By substituting the reverse demand functions , , into Equation (5), the first derivative with respect to , , can be solved as , ,.

The Hessian matrix with respect to , , for Equation (5) is constructed as , where , , . The Hessian matrix will be negative definite, and there exists a unique optimal solution when , ensuring , , .

By letting the first derivative be zero and joining, we can obtain the optimal decisions of Manufacturer 2 as , , , when .

Then, Manufacturer 1’s optimal decision is

The optimal decisions of the other members in the supply chain are then obtained as

By analyzing the above optimal decisions and profits (other decisions and profits are placed in

Appendix A), the following Theorems 5–7 can be drawn.

Theorem 5. - (1)

For the sales scales of Manufacturer 2,

- (2)

For the market composition of new energy vehicles in Market 1, when

,

; when

,

- (3)

For the volume structure of authorized distributors, when

,

; when

,

Proof. (1). Based on the optimal decision, it can be obtained that: When solving for the Hessian matrix, we get From this equation, we can deduce that Because , ; , and then

(2) Since , it follows that Based on the optimal decision, it can be obtained that It is clear to see that and Then

and .

For

and ,

the proof procedure is the same as in Theorem 3(2).

Thus the conclusion in Theorem 5(2) is confirmed.

(3) Similar to that of Theorem 3(2). □

Under the differentiated production strategy, Theorem 5(1) shows that the sales volume of new energy vehicles undergoing differentiated production by Manufacturer 2 is greater than the total sales volume of standard products in local Market 2. This is because, in an analysis from the market perspective, the consumers’ willingness to pay in Market 1 is greater than that in Market 2, and therefore, the total demand for new energy vehicles in Market 1 is greater than the total demand for new energy vehicles in Market 2. From the product perspective, in Market 1, Manufacturer 2’s differentiated production of new energy vehicles will better meet the needs of consumers in Market 1. Therefore, when developing markets, manufacturers need to fully assess consumers’ willingness to pay and prioritize markets with higher willingness to pay. Also, they should strive to enhance the irreplaceability of their products and increase their competitiveness.

From Theorem 5(2), firstly, Manufacturer 2’s differentiated products are the most competitive in Market 1 and have the highest sales scale. Secondly, the competitiveness of Manufacturer 1’s products and standard products exported from authorized distributors in parallel is related to consumers’ willingness to pay in Market 2. Specifically, when the range of consumers’ willingness in Market 2 is smaller and the maximum critical value is smaller than the threshold, the sales of product 1 are smaller than those of new energy parallel export vehicles; when the range of consumers’ willingness to pay is wider and the maximum critical value is larger than the threshold, the sales of product 1 are larger than those of new energy parallel export vehicles.

From Theorem 5(3), it can be seen that the sales decisions of authorized distributors are also related to the willingness of consumers in Market 2. For example, when consumers’ willingness is low, the sales volume of new energy vehicles exported by distributors in parallel will be higher than that of local sales. Then, Theorem 5(3) and Theorem 3(2) also show that authorized distributors have a larger sales volume in Market 2, where there are no competitors, when the range of consumers’ willingness to pay in Market 2 is wider and the highest critical threshold is larger than the threshold which can be obtained by substituting Manufacturer 2’s wholesale price in Market 2 and the sales volume in Market 1. From Theorems 5(2) and 5(3), it is equally clear that by increasing consumer willingness in Market 2, authorized distributors’ parallel exports will be suppressed, and therefore, Manufacturer 2 should take active measures to increase consumer willingness to pay in Market 2, such as strengthening promotions, marketing campaigns, and increased advertising.

Theorem 6. ; .

Proof. Similar to that of Theorem 5(1). □

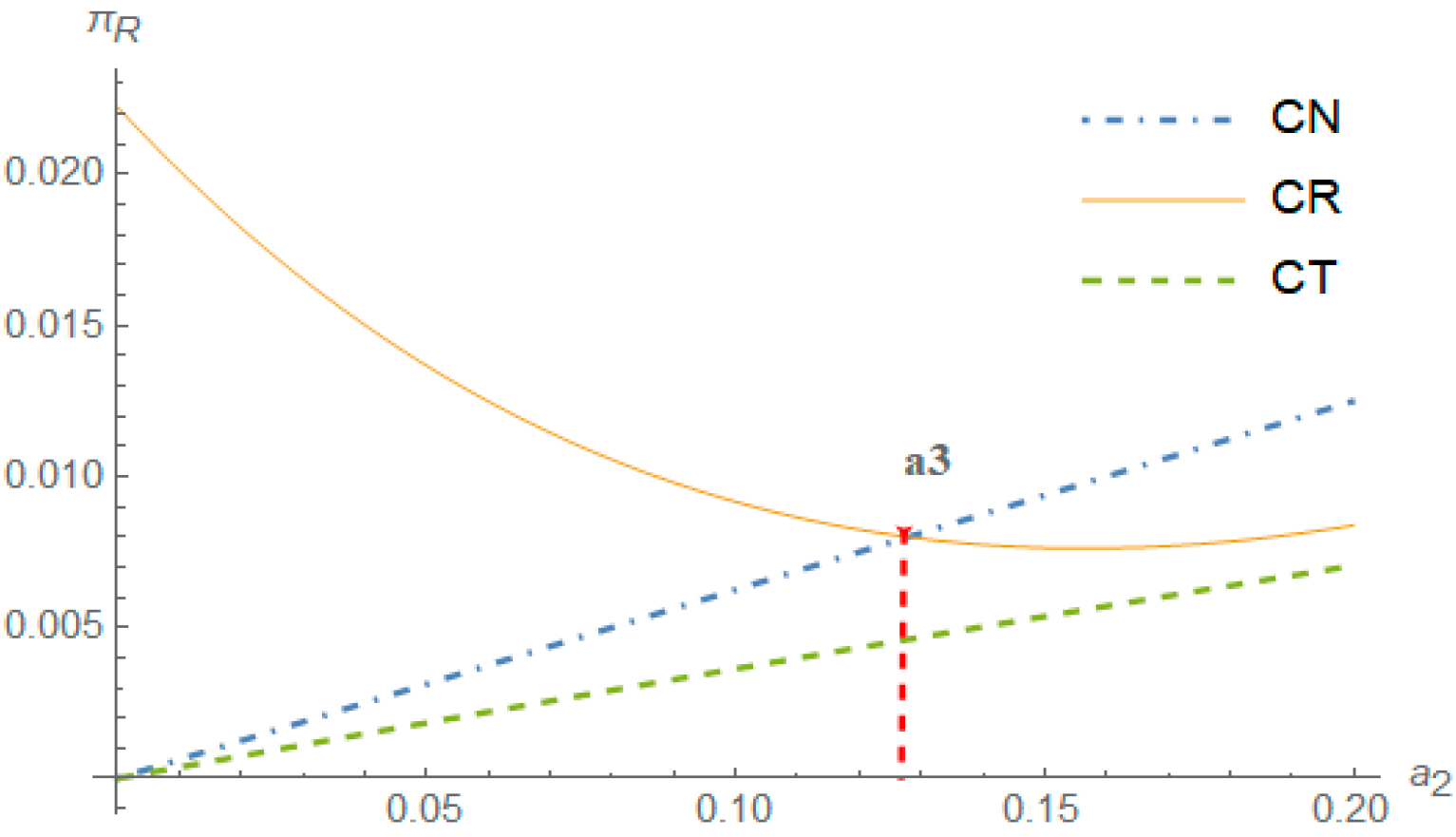

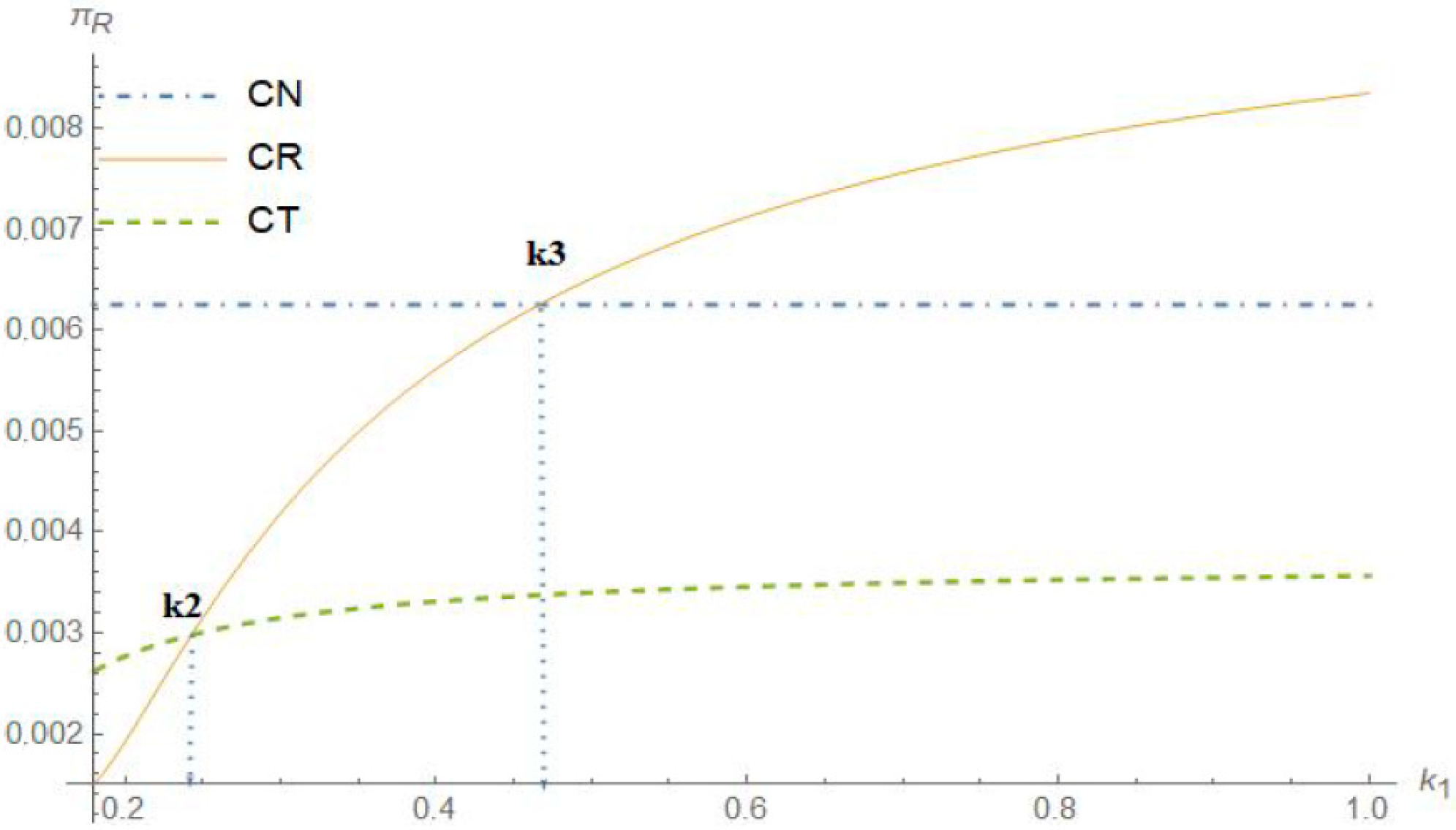

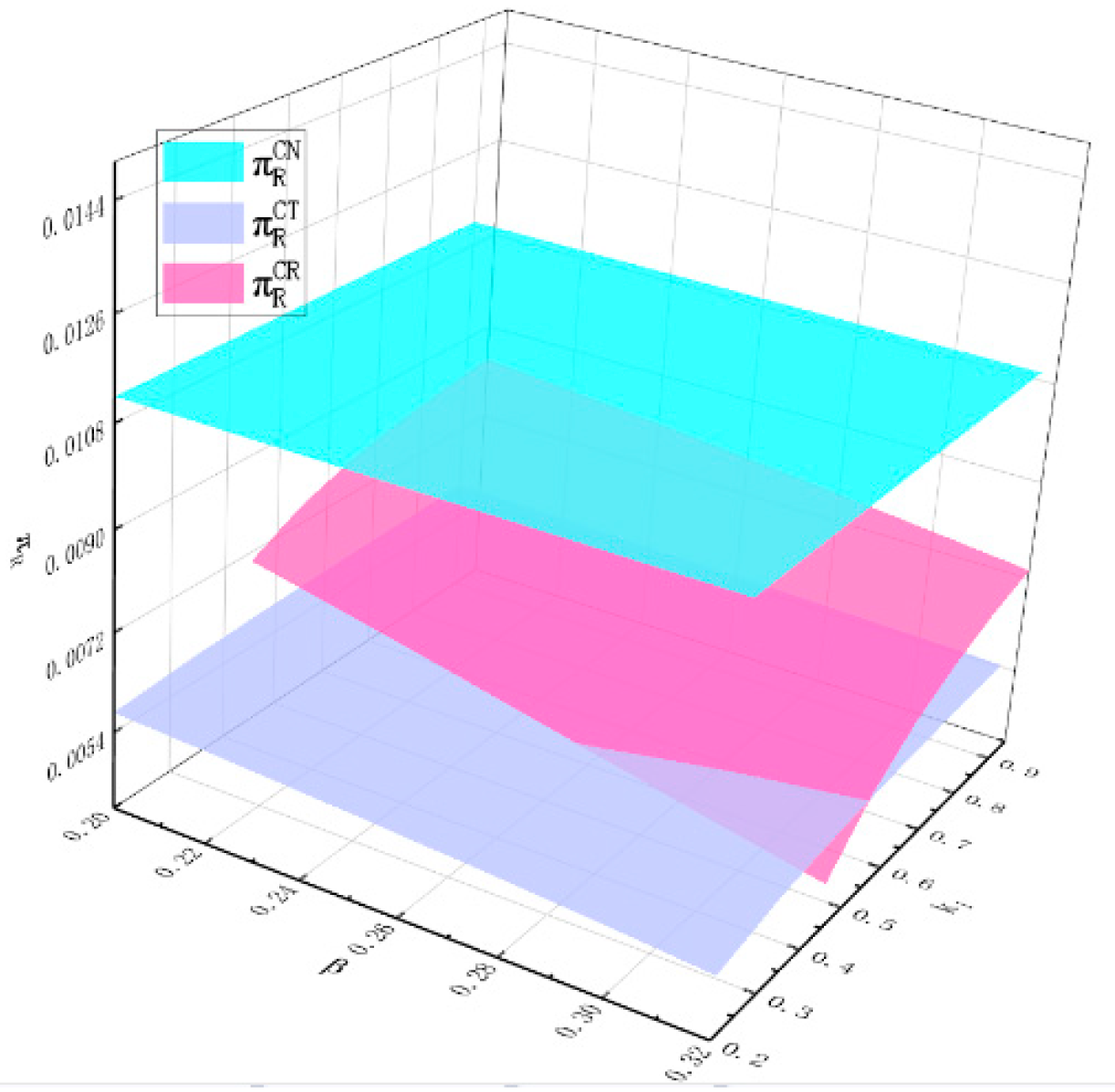

As shown in Theorem 6, it is different from Theorem 2(2) that Manufacturer 2 will obtain less profit from the differentiated production of new energy vehicles in Market 1 than from wholesaling the product in Market 2 when there is parallel export of new energy vehicles by the authorized distributor. And, to make matters worse, the total profit of Manufacturer 2 will also be reduced. This is because when consumer recognition of the brand of parallel export of new energy vehicles increases and the authorized distributor carries out parallel export, Manufacturer 2 will increase the level of differentiated production to improve competitiveness, and at the same time, it will increase the wholesale price to inhibit the authorized distributor to carry out the parallel export of new energy vehicles, so that it pays more cost in Market 1 and obtains a higher unit profit in Market 2 (increasing the wholesale price). Therefore, this theorem reveals that Manufacturer 2’s profits will be harmed by the parallel export of new energy vehicles from the authorized distributor.

This paradoxical situation reveals the potential threat of parallel exports to the profitability of manufacturers: if manufacturers rely only on increasing the degree of production differentiation and wholesale prices to cope with the parallel export of new energy vehicles, they may instead fall into the predicament of “increased investment, profits fell”, so manufacturers can take other measures, such as with the construction of a service system for differentiated production, rather than relying solely on price. Therefore, manufacturers can take other measures, such as differentiated production and services, to weaken the incentives for parallel exports, rather than relying solely on price.

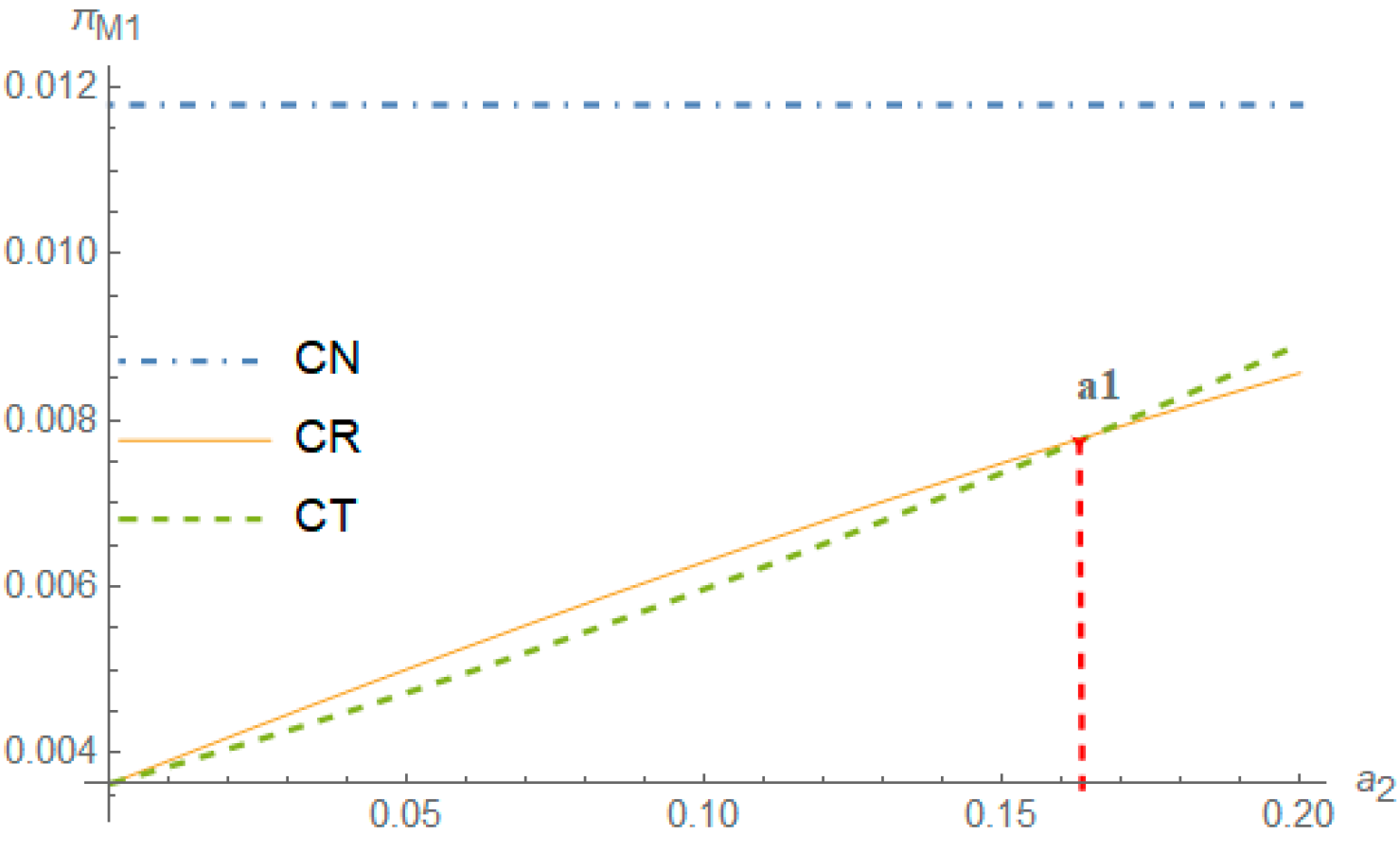

Theorem 7. When , ; when , if , then , and if , then .

Proof. Similar to that of Theorem 3(2). □

As shown in Theorem 7, the authorized distributors will obtain less profit in the case of carrying out parallel export of new energy vehicles, when the maximum critical value of consumers’ willingness to pay is greater than the threshold. This is because, with the increase in consumers’ willingness in Market 2, more potential consumers are willing to purchase new energy vehicles. In the case of the authorized distributor’s parallel export of new energy vehicles, Manufacturer 2 will choose to increase the wholesale price, and the authorized distributor will have to increase the sales price. Then, due to the increase in the price, some consumers in Market 2 will choose not to purchase new energy vehicles, and at the same time, the difference between the prices of the two markets decreases. Thus, the profit difference gained by the authorized distributor from conducting parallel export of new energy vehicles decreases, and the profit gained from conducting parallel export of new energy vehicles is not enough to make up for the profit lost in Market 2.

When the range of consumers’ willingness to pay in Market 2 is small and the maximum critical value is smaller than the threshold value, if Manufacturer 2’s differentiated production cost parameters are large (larger than a certain threshold value), the authorized distributor obtains a higher profit from parallel exporting and will choose to carry out parallel exporting, and if the Manufacturer 2 differentiated production cost parameters are smaller than the threshold value, the authorized distributor damages its own profit by carrying out parallel exporting. This is because when the differentiated production cost parameters are smaller for Manufacturer 2, the incentive for Manufacturer 2 to differentiate production is stronger, more consumers will choose to buy the differentiated production of new energy vehicles, and the authorized distributors will make less profit from parallel export. When the differentiated production cost parameters are large for Manufacturer 2, the incentive for Manufacturer 2 to differentiate production is weaker, the difference between differentiated production of new energy vehicles and parallel export of new energy vehicles will be narrower, the price of parallel export of new energy vehicles is lower, more consumers will buy parallel-exported new energy vehicles, and the authorized distributors will be able to gain higher profits from parallel export of new energy vehicles. Therefore, it is possible to reduce the willingness of authorized distributors to carry out parallel export of new energy vehicles by increasing the willingness to pay of the consumers in Market 2 or by reducing Manufacturer 2’s differentiated production cost parameters.

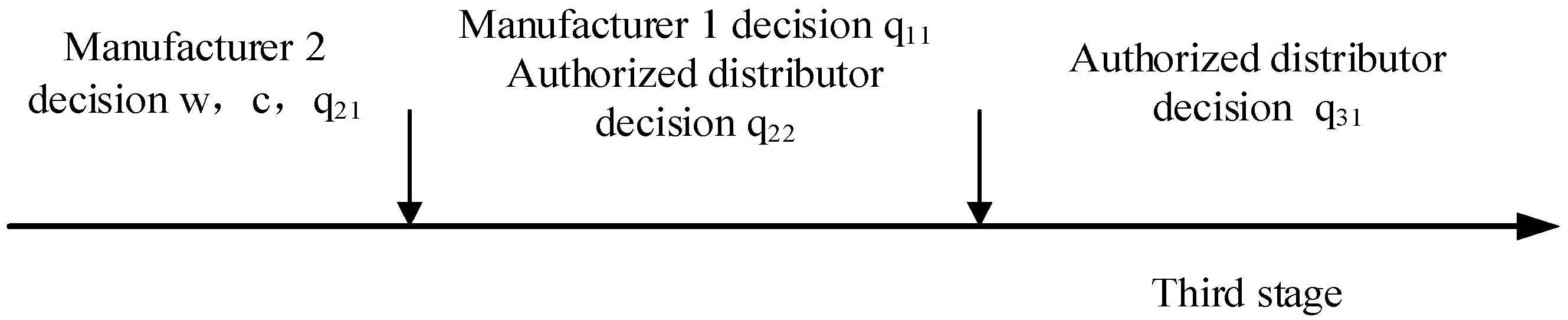

4.3. The Parallel Export of New Energy Vehicles from the Third Party (CT)

For the CT model, the decision-making sequence of the two market members is shown in

Figure 5. The order of decision-making in the first two stages is the same as in the base model; in the third stage, the third party decides the sales of parallel export of new energy vehicles to Market 1 will be

.

In this situation, the consumers in Market 1 obtain utility by purchasing and consuming parallel-exported cars as .

Similarly, the reverse demand functions for new energy vehicles in each market are

Then, the three-stage game model can be constructed as

By solving the model with backward induction, under the rational expectations of Manufacturer 2’s optimal wholesale price, differentiated production level, and production scale, the optimal responses of the third party, the authorized distributor, and Manufacturer 1 can be obtained as , , .

Theorem 8. - (1)

,

.

- (2)

When

,

; when

,

.

Proof. (1) Because , ; ;

(2) , because , ; for , analysis shows the value is not strictly greater than zero or strictly less than zero, but rather has a critical point. Therefore, we find this critical point by setting Then we can derive the critical value Based on the critical value, it is easy to conclude that Theorem 8(2) holds. □

From Theorem 8(1), as in the case of CR, the paralleled export volume to Market 1 of the third party decreases with Manufacturer 2’s wholesale price in Market 2 and the sales volume in Market 1. From Theorem 8(2), when the consumers’ willingness to pay is small in Market 2 and the maximum critical value is smaller than the threshold, most new energy vehicles in Market 2 are purchased by third parties for parallel export. This is because when consumer willingness is low, the total demand in the market is low, and fewer consumers actually buy new energy vehicles and use them domestically, so most of the new energy vehicles are new energy vehicles exported by third parties. And when the range of consumers’ willingness to pay is wider and the highest critical value is greater than the threshold value, the total demand in the domestic market increases, and the number of consumers who buy new energy vehicles and use them in the country increases. At this time, the proportion of new energy parallel export vehicle sales decreases. In addition, this critical threshold is affected by the manufacturer’s decisions, e.g., Manufacturer 2’s wholesale price in Market 2 and sales volume in Market 1.

From Theorem 3 and Theorem 8, it can be seen that, from the viewpoint of management practice, manufacturers can effectively deal with the parallel export problem by dynamically managing two key factors: firstly, the flexible setting of wholesale prices according to different market conditions, and secondly, the scientific arrangement of the sales volume in each market. In addition, when adopting a differentiated product strategy, manufacturers can set up a market monitoring mechanism to keep abreast of changes in consumer demand and accurately adjust pricing in Market 2 and sales volume in Market 1 accordingly. This management method of combining pricing strategy and sales allocation can give full play to the competitive advantages of differentiated products and effectively reduce parallel exports, providing a practical solution for new energy vehicle enterprises to expand their global markets.

Finally, returning to the first stage, the optimization objective for Manufacturer 2 is

Substituting the reverse demand functions into Equation (6), the first derivative with respect to , , can be found as , , .

The Hessian matrix with respect to , , is found, where

, , , . And the Hessian matrix is negative definite, and there exists a unique optimal solution when .

Letting the first derivative be zero and jointed, we can obtain the optimal decisions for Manufacturer 2 as

where

;

.

Manufacturer 1’s optimal decision is

The optimal decision of the other members of the supply chain is then obtained as

By analyzing and calculating the sales volume of each market and the profit of market members, we can get Theorem 9, similar to the previous case CR, without the corresponding explanations, and Theorem 10.

Theorem 9. - (1)

For the sales structure of Manufacturer 2’s new energy vehicles,

- (2)

For the market composition in Market 1, when

,

; when

,

.

Theorem 10. - (1)

,

- (2)

Proof. The proof process of Theorem 9 and Theorem 10 is similar to that of Theorem 8. □

Different from the case of the authorized distributor, when the third party carries out the parallel export of new energy vehicles, Manufacturer 2 earns more profit in Market 1 than in Market 2. This is because the authorized distributors export new energy vehicles at the wholesale level and the third parties carry out parallel export of new energy vehicles at the selling price level. When the price difference between the two markets and the gap between consumers’ willingness to pay is small, the profit margin for authorized distributors to carry out parallel export of new energy vehicles will be larger, and authorized distributors will still choose to carry out parallel export, while some third parties will give up carrying out parallel export of new energy vehicles. In Market 1, when the sales of new energy parallel export vehicles decrease, Manufacturer 2 gains a higher market share, sales increase, and profits increase. Meanwhile, the wholesale price when the third party carries out the parallel export of new energy vehicles is lower than the wholesale price when the authorized distributor carries out the parallel export of new energy vehicles. Therefore, when the third party carries out parallel export of new energy vehicles, Manufacturer 2 obtains higher profits in Market 1.

From Theorem 10, we can similarly see that the parallel export of new energy vehicles by a third party will still harm the profit of Manufacturer 2 and also the profit of the authorized distributor. Authorized distributors are unable to make profits from the parallel export of new energy vehicles by the third party; on the contrary, as a result of the parallel export of new energy vehicles by the third party, Manufacturer 2 will increase the wholesale price of new energy vehicles, and the authorized distributors will have to increase the sales price. Higher sales prices result in the loss of some consumers and damage to the profits of authorized distributors.