Abstract

Amid intensifying global ESG regulations and the expanding influence of green finance, China’s digital economy policies have emerged as key institutional instruments for promoting corporate sustainability. Leveraging the implementation of the National Big Data Comprehensive Pilot Zone as a quasi-natural experiment, this study utilizes panel data of Chinese listed firms from 2009 to 2023 and applies multi-period Difference-in-Differences (DID) and Spatial DID models to rigorously identify the policy’s effects on corporate ESG performance. Empirical results indicate that the impact of digital economy policy is not exerted through a direct linear pathway but operates via three institutional mechanisms, enhanced information transparency, eased financing constraints, and expanded fiscal support, collectively constructing a logic of “institutional embedding–governance restructuring.” Moreover, disruptive technological innovation significantly amplifies the effects of the transparency and fiscal mechanisms, but exhibits no statistically significant moderating effect on the financing constraint pathway, suggesting a misalignment between innovation heterogeneity and financial responsiveness. Further heterogeneity analysis confirms that the policy effect is concentrated among firms characterized by robust governance structures, high levels of property rights marketization, and greater digital maturity. This study contributes to the literature by developing an integrated moderated mediation framework rooted in institutional theory, agency theory, and dynamic capabilities theory. The findings advance the theoretical understanding of ESG policy transmission by unpacking the micro-foundations of institutional response under digital policy regimes, while offering actionable insights into the strategic alignment of digital transformation and sustainability-oriented governance.

1. Introduction

In 2023, Environmental, Social, and Governance (ESG) practices formally entered China’s mainstream capital markets: 96% of A-share listed companies released ESG reports for the first time. This signals a remarkable institutional shift. However, beneath this surge lies a stark reality—only approximately 12% of firms meet internationally comparable disclosure standards, and 40% of small and medium-sized enterprises (SMEs) lack core indicators in the “Social” and “Governance” dimensions [1,2]. Meanwhile, international capital markets are increasingly treating ESG performance as a prerequisite for market access. Firms failing to meet ESG thresholds are experiencing systematic marginalization, facing structural discounts in green financing, export qualifications, and valuation potential.

This paradox—widespread ESG participation but limited substantive compliance—reveals a deep institutional challenge: How can policy interventions translate symbolic ESG adoption into substantive sustainability transformation? In particular, as ESG performance becomes not only a reputational benchmark but also a market entry condition, the capability of firms to respond effectively has become a new competitive frontier. Thus, understanding the institutional forces that shape these capabilities is no longer optional—it is essential for both scholars and policymakers.

Amid this transformation, state-driven digital economy policies have emerged as a strategic response. Since 2015, China’s State Council has successively approved the establishment of multiple National Big Data Comprehensive Pilot Zones (NBDCPZs) in key regions such as Guizhou, Beijing, and Shanghai. These zones serve as institutional testbeds for reconfiguring government–enterprise–data relations, with the strategic aim of enabling data-driven governance, industrial upgrading, and digital transformation. The pilot zone policy is not merely infrastructural, but represents a bundled institutional reform encompassing platform rules, data rights, intelligent supervision, and fiscal support mechanisms [3].

Theoretically, this policy aligns with new institutional economics and ICT4D frameworks, positioning data not only as a production factor but also as a regulatory resource [4]. Empirical studies have shown that the policy contributes to industrial structure upgrading [5], carbon emission reduction [6], and digital innovation spillovers [7]. Importantly, the NBDCPZs have been designed as quasi-natural experiments with a staggered rollout, which justifies their use in causal identification strategies such as DID and SDID models.

Unlike prior studies that treat ESG performance as a static outcome of internal governance or macro norms, this study introduces the national big data pilot zone policy as a dynamic, quasi-natural institutional intervention. It innovatively explores how digital policy instruments transform ESG behavior through specific transmission mechanisms, moderated by firm-level technological heterogeneity.

Yet policy outcomes have diverged significantly: while a small number of technologically advanced firms have achieved ESG breakthroughs, many others remain constrained by low transparency, financing bottlenecks, and institutional misalignment, thereby failing to mount effective responses.

This divergence raises a pressing and underexplored question: Can digital economy policies serve as effective institutional drivers of ESG performance in emerging economies? If so, what are the operative transmission pathways through which such policies exert influence? Specifically, how do institutional mechanisms—such as information transparency, financial accessibility, and fiscal support—contribute to this effect? Moreover, does firm-level heterogeneity in technological innovation amplify or attenuate these policy outcomes?

While prior research has produced rich insights into the role of digital economy policies in promoting innovation [8], efficiency, and high-quality development [9], ESG-focused studies have predominantly emphasized internal firm characteristics [10], governance structures [11], and macro-institutional environments [12]. These two strands of the literature, however, have long evolved in parallel without meaningful integration. On the one hand, scant attention has been paid to the role of digital economy policies as formal institutional drivers of ESG outcomes, and even fewer studies have elucidated their underlying mechanisms. On the other hand, existing ESG mechanism research largely centers on single dimensions (e.g., information disclosure or financial constraints), lacking a systematic modeling approach that is grounded in institutional theory. Additionally, although firm-level heterogeneity in technological capability is well-documented in the strategic management literature, its moderating role in ESG policy efficacy remains underexplored.

Hence, three critical issues demand systematic inquiry: the causal linkage between digital economy policies and ESG performance, the “mechanism chain” mediating this effect, and the moderating role of capability heterogeneity. To address these gaps, this study leverages the national big data pilot zone policy as a quasi-natural experiment. Furthermore, this study departs from conventional approaches by employing a dual identification strategy—Difference-in-Differences (DID) and Spatial DID (SDID)—to capture both direct policy effects and spatial spillovers, enhancing the robustness and generalizability of causal claims. We construct a moderated mediation model framed as “institutional pressure—mechanism variables (information transparency, financing constraints, government subsidies)—capability moderation (disruptive technological innovation),” identifying the mechanisms through which digital economy policies influence firm-level ESG outcomes.

This study makes the following key contributions:

(1) Theoretical Innovation: This paper conceptualizes national digital economy policy—specifically, the big data pilot zone initiative—as a formal institutional driver of ESG transformation, operationalized through multi-stage mechanisms. By developing a moderated mediation framework integrating institutional theory (external pressure), agency theory (intermediary responses), and dynamic capabilities theory (internal heterogeneity), this study offers a comprehensive explanation of how state-led digitalization translates into firm-level sustainability behavior.

(2) Methodological Innovation: We adopt a dual identification approach—multi-period Difference-in-Differences (DID) and Spatial DID—to isolate the causal effects of digital economy policies, while also capturing policy spillover effects across regions. This design significantly enhances the robustness of causal inference in ESG mechanism research.

(3) Practical Implications: The findings identify a replicable transmission chain—information transparency, financing constraints, and fiscal incentives—through which digital economy policies influence ESG outcomes. Moreover, the moderating role of disruptive innovation highlights the importance of firm-level capabilities in institutional adaptation. These insights offer policy recommendations for refining digital ESG and firm strategies in emerging economies.

2. Literature Review and Research Hypotheses

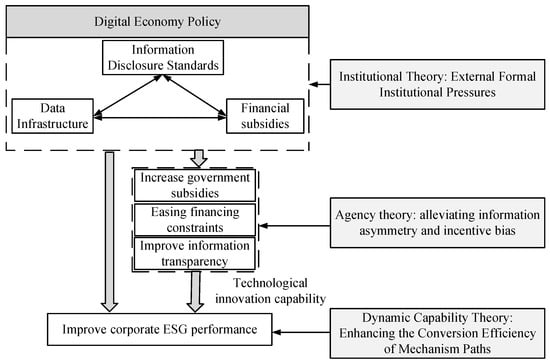

This study is grounded in institutional theory, which posits that digital economy policies exert institutional pressure on firms through normative constraints and resource-based incentives. Such pressure drives firms to incorporate ESG performance into their strategic frameworks in pursuit of legitimacy. As illustrated in Figure 1, agency theory provides a micro-governance perspective, elucidating how these policies operate by enhancing information transparency and alleviating financing constraints—thereby mitigating agency conflicts and reinforcing the implementation of corporate sustainability strategies.

Figure 1.

Theoretical Framework.

Dynamic capabilities theory further introduces the lens of firm-level capability heterogeneity, highlighting the moderating role of technological innovation capacity in shaping firms’ responsiveness to policy. This perspective emphasizes how innovation capabilities influence the processes of policy perception, resource integration, and organizational transformation, ultimately determining the effectiveness and the pathway through which external institutional pressure translates into internal ESG outcomes.

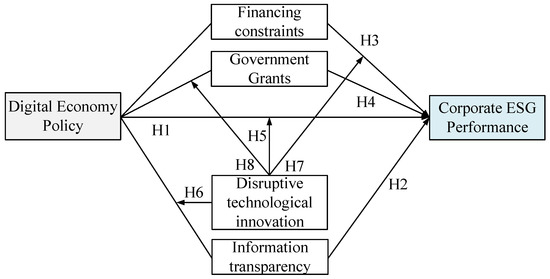

Together, these three theoretical frameworks construct a coherent logic chain of “institutional pressure-mechanism transmission-capability moderation.” This integrated model systematically explains the procedural mechanisms and boundary conditions through which digital economy policies affect corporate ESG performance, as depicted in Figure 2.

Figure 2.

Conceptual Framework.

2.1. Digital Economy Policy and Corporate ESG Performance

Institutional theory emphasizes that firms seek legitimacy by aligning with the regulatory and normative expectations embedded in their institutional environments [13]. As a formal institutional arrangement, China’s digital economy policy—anchored in the national big data pilot zone framework—functions as both a coercive and normative institutional force, leveraging mechanisms such as government–enterprise data platforms, smart infrastructure, and green fiscal incentives to construct a systemic field of compliance pressure. These policies reshape firms’ strategic cognition and behavioral logic, compelling them to embed Environmental (E), Social (S), and Governance (G) considerations into their core planning processes.

In response to these evolving institutional expectations and internal governance demands, firms are increasingly incentivized to enhance clean production, fulfill social responsibilities, and optimize governance structures—thereby reducing agency conflicts and increasing institutional alignment. Theoretically, this process reflects the institutionalization of ESG values through regulative (coercive compliance), normative (peer benchmarking), and cognitive (strategic legitimacy) channels, which together reinforce sustainable transformation.

Empirical studies suggest that digital economy policies significantly reshape corporate ESG strategy formulation [14,15] and reconfigure resource allocation logics [16], thereby improving the strategic fit between organizational objectives and sustainability demands. Moreover, the embedded resource incentives—including green credit access, ESG subsidy preference, and digital rating advantages—have been shown to mediate the relationship between ESG-oriented actions and circular economy goals ([17,18]), enhancing organizational responsiveness to sustainability norms [19]. Environmental regulatory pressure, in particular, is recognized as a critical external driver of green transformation and performance enhancement [20].

Therefore, digital economy policies—via the dual mechanism of institutional regulation and incentive alignment—significantly strengthen firms’ capacity for institutional adaptation, policy responsiveness, and governance effectiveness, thereby enhancing their overall ESG performance. This mechanism is conceptually framed as a pathway of “institutional pressure → ESG cognition reshaping → strategic action adjustment,” forming the first link in the broader moderated mediation model proposed in this study.

H1:

Digital economy policies positively promote corporate ESG performance by strengthening institutional environments and reallocating incentive-based resources.

2.2. The Mediating Role of Information Transparency

Agency theory posits that information asymmetry is a core source of principal–agent conflicts within firms, which undermines the effective implementation of long-term strategies such as ESG initiatives [21]. Under conditions of asymmetry, managers may engage in short-term opportunism, delay sustainability investments, or conceal ESG underperformance. Against this backdrop, information transparency acts not only as a governance tool, but also as a strategic enabler of stakeholder accountability and internal alignment.

Digital economy policies institutionalize improvements in corporate disclosure by leveraging government–enterprise data platforms, blockchain-based registries, and public supervision systems. These mechanisms lower the cost of external information acquisition and compress the space for managerial discretion, thereby enhancing managerial responsiveness to ESG strategies. From a policy design perspective, these technologies convert traditional soft governance signals into hard infrastructure constraints, creating a regulatory environment where transparent ESG disclosures are both expected and rewarded.

Empirical research supports the assertion that digital disclosure systems significantly improve the transparency and consistency of ESG information, bolstering external oversight [22]. Transparency is strongly and positively associated with governance quality, and it contributes to firm value [23]. Moreover, higher transparency helps firms accumulate social capital and strengthen stakeholder trust [24]. Additionally, board structure has been shown to moderate ESG transparency, suggesting that firms can optimize disclosure mechanisms to align financial goals with sustainability strategies, thereby improving overall governance effectiveness and ESG outcomes [25].

In summary, the transparency mechanism illustrates how digital economy policies operate through agency-conflict mitigation, aligning internal governance systems with external institutional demands. This pathway constitutes the first mediating channel through which digital institutional pressure influences ESG strategy formulation and execution.

Based on the theoretical rationale and empirical findings above, we propose the following hypothesis:

H2:

Information transparency positively mediates the relationship between digital economy policy and corporate ESG performance—that is, digital economy policies enhance ESG outcomes indirectly by increasing firms’ transparency, thereby strengthening external oversight and internal accountability mechanisms.

2.3. The Mediating Role of Financial Constraints

In the pursuit of sustainable strategies, financial constraints represent a significant barrier to firms’ ESG-related investments [26]. According to agency theory, information asymmetry complicates credit assessment and impedes access to external financing [27], especially when ESG outcomes are intangible, long-term, and difficult to verify. Under such conditions, capital providers are reluctant to fund sustainability initiatives that lack standardized disclosure, increasing firms’ financing frictions.

In contrast, dynamic capabilities theory posits that firms can adapt to institutional and market uncertainty by reconfiguring internal and external competencies, particularly through resource orchestration, sensing, and their absorptive capacity [28]. Building on this logic, digital economy policies serve as institutional catalysts, helping firms and markets bridge information gaps through systemic financial infrastructure—such as data-sharing platforms, blockchain-based credit interfaces, and ESG scoring systems. These technologies not only reduce ESG information opacity but also operationalize trust signals for financial institutions, lowering risk premiums and improving access to green capital.

Empirical evidence indicates that digital capabilities strengthen the dynamic match between firms and capital markets, particularly alleviating financing bottlenecks for small and medium-sized enterprises [29]. The synergy between digital transformation and organizational capabilities also facilitates optimal resource allocation and reduces agency conflicts [30]. Green finance policies indirectly promote ESG outcomes by lowering transaction costs and improving disclosure efficiency [31], while ESG strategies—when supported by technology and transparent communication—are more likely to be favorably received by capital markets [9]. Furthermore, strong digital capabilities enhance the credibility of ESG signals, improving third-party ESG ratings and thereby generating reputational capital and investor confidence [32].

Thus, the financing constraint mechanism operates through a dual pathway: (1) technological infrastructure reduces the informational cost of sustainability evaluation; (2) dynamic capabilities amplify the firm’s ability to translate ESG intentions into credible financial signals. Together, they constitute the second mediating channel through which digital economy policies enhance ESG execution.

H3:

Financial constraints positively mediate the relationship between digital economy policy and corporate ESG performance—that is, digital economy policies enhance ESG outcomes indirectly by alleviating firms’ financing constraints.

2.4. The Mediating Role of Government Subsidies

Within the framework of institutional theory, government subsidies function not only as tools for resource allocation but also as regulatory instruments that reward institutional conformity and reinforce legitimacy-based behavior patterns [33]. As a formal institutional arrangement, fiscal subsidies mitigate financing pressures while guiding firms to strategically align with national policy priorities through coercive and normative constraints [34].

Under the auspices of digital economy policies, various green funds, smart transformation grants, and carbon neutrality incentives have collectively established a targeted fiscal preference system centered on ESG performance. This system encourages firms to reconfigure their resource allocation and operational models in alignment with the dual policy thrust of digitalization and sustainability. From a signaling perspective, subsidies reflect a “selective legitimacy endorsement” mechanism, where qualifying firms are perceived as institutionally aligned, increasing their attractiveness to investors, creditors, and regulators.

Empirical studies confirm that green subsidies significantly enhance firms’ ESG scores and disclosure quality, highlighting the catalytic role of fiscal incentives in driving institutional responses [35]. The integration of digital finance also improves the precision, traceability, and equity of subsidy targeting, alleviates firms’ concerns about the long payback periods of sustainability investments, and strengthens strategic execution [36]. Moreover, urban digitalization increases firms’ likelihood of securing green subsidies and contributes to improved environmental governance outcomes [37]. Synergies between fiscal mechanisms and ESG investment further enhance resource allocation efficiency and technological innovation capabilities [38].

Some scholars suggest that government subsidies essentially serve as a “screening signal” for institutional fit—firms with higher ESG maturity and innovation potential are more likely to meet subsidy criteria, leading to a recursive reinforcement of policy alignment [39]. From the perspective of dynamic capabilities theory, only firms with a sufficient absorptive capacity, compliance responsiveness, and innovation-readiness can fully leverage fiscal incentives for sustainability transformation.

Taken together, government subsidies serve not only a mitigating function but also act as a critical institutional mechanism for procedural ESG alignment, reputational signaling, and resource-based advantage creation. They form the third mediation pathway—connecting institutional pressure with ESG outcomes through the conduit of fiscal institutional incentives.

H4:

Government subsidies positively mediate the relationship between digital economy policy and corporate ESG performance—that is, digital economy policies enhance ESG outcomes indirectly by increasing the level and precision of government subsidy allocation.

2.5. The Moderating Role of Disruptive Technological Innovation

Within the institutional pressure field established by digital economy policies, a firm’s capacity for strategic response becomes critical to the success of its ESG transformation. According to dynamic capabilities theory, firms with superior sensing, integration, and transformation abilities are better equipped to interpret, absorb, and operationalize policy signals, thereby translating external institutional constraints into internal strategic advantage.

Firms possessing disruptive technological innovation—owing to their first-mover advantages in information systems, data infrastructures, and green technology deployment—are more adept at embedding ESG objectives into their strategic core, thereby constructing a proactive logic of institutional adaptation. These firms are not merely policy recipients; they act as institutional co-shapers, responding rapidly to policy shifts and even influencing the policy feedback loop.

At the operational level, innovation-intensive firms accelerate ESG responsiveness and alignment by building green technology chains, intelligent governance platforms, and real-time disclosure systems. This facilitates a shift from passive compliance to active transformation, increasing the firms’ eligibility for green finance, fiscal incentives, and favorable policy evaluation. Such firms also exhibit stronger routines for cross-functional integration, enabling faster ESG information processing, shorter adaptation cycles, and better stakeholder alignment.

Empirical research supports these claims. Digital transformation has been shown to activate dynamic capabilities and promote the internal integration of ESG strategies [40]. Technological innovation enhances firms’ ability to perceive institutional change and restructure resources, thereby accelerating institutional adaptation [33]. Some studies also reveal reverse causality, wherein ESG strategies stimulate digital innovation, forming a closed strategic loop of “policy signal–technological pathway–performance feedback” [41]. As a core component of dynamic capabilities, knowledge management strengthens the coupling between digital policy and ESG performance [42]. Data from small and medium-sized enterprises further show that technological innovation significantly moderates environmental performance and governance structures, underscoring the crucial role of capability heterogeneity in shaping policy outcomes [43].

Therefore, disruptive technological innovation not only moderates the direct effects of institutional pressure on ESG performance but also amplifies the transmission pathways—information transparency, financing facilitation, and subsidy responsiveness—by enhancing firms’ absorptive and transformative capacities.

H5:

Disruptive technological innovation positively moderates the relationship between digital economy policy and corporate ESG performance—that is, higher levels of innovation enhance the effectiveness of digital policy in promoting ESG outcomes.

2.6. The Moderating Effect of Technological Innovation on Mediation Pathways

According to dynamic capabilities theory, firms operating in rapidly evolving institutional environments must possess the capacity to sense, assimilate, and transform external signals into effective organizational responses. Within the ESG context, information transparency represents not only a compliance obligation but also a governance mechanism that connects firm behavior to stakeholder legitimacy.

Firms endowed with disruptive technological innovation typically exhibit higher maturity in building real-time ESG data systems, automating disclosure processes, and deploying digital compliance platforms that integrate internal reporting with external verification. These capabilities enhance the timeliness, accuracy, and interactivity of ESG disclosures, thus amplifying the effect of institutional policies that promote transparency.

Under digital economy policies, technology-sensitive firms are particularly capable of externalizing ESG practices through blockchain-based registration systems, AI-assisted ESG auditing, and interactive online sustainability dashboards. These mechanisms institutionalize transparency as a dynamic asset, transforming static ESG reports into real-time, verifiable, and stakeholder-responsive disclosures.

Existing research supports these claims, suggesting that digital maturity strengthens policy transmission effects—firms with higher levels of digital capability not only respond more effectively to disclosure mandates but also align more closely with policy incentives, enjoying greater reputational and financial rewards [44]. From a theoretical standpoint, disruptive innovation magnifies the transparency channel by enhancing the absorptive capacity and reducing organizational inertia, thereby improving ESG responsiveness.

H6:

Disruptive technological innovation positively moderates the effect of digital economy policy on information transparency—that is, the stronger a firm’s innovation capability, the more pronounced the policy’s impact on enhancing transparency.

According to dynamic capabilities theory, technological innovation is not merely a production-side enhancer but also a strategic sensing and reconfiguration capability that enables firms to navigate environmental uncertainties—including policy shifts, disclosure demands, and sustainability-linked financing constraints. In the context of ESG transformation, access to green capital often hinges on a firm’s ability to translate sustainability efforts into credible, measurable, and forward-looking information.

Under digital economy policies, innovation-oriented firms can harness financial technologies—such as AI-powered ESG risk rating models, blockchain-based credit registries, and digital loan scoring platforms—to reduce traditional barriers of information asymmetry that hinder financing access. These tools not only signal firms’ ESG commitment to investors and lenders but also increase the granularity, traceability, and auditability of green initiatives, thereby enhancing market confidence and creditworthiness.

Moreover, such firms can proactively synchronize ESG narratives with capital market expectations by integrating sustainability indicators into financial disclosures, investor communications, and capital budgeting decisions. This capability effectively bridges the gap between ESG policy intentions and capital market resource flows, enabling better alignment between policy tools and firm-level financing outcomes.

Empirical evidence suggests that in green finance environments, technological innovation significantly heightens capital markets’ sensitivity to ESG signals, improving access to external financing and optimizing the cost of capital structures [45]. Additionally, firms with a strong innovation capacity are more likely to secure favorable ratings from third-party ESG evaluators, which in turn enhances their credit profile and attractiveness to sustainability-linked investment vehicles.

In summary, disruptive technological innovation strengthens the intermediation pathway between policy and finance by reinforcing the firm’s ability to signal, structure, and secure green finance under institutional pressure.

H7:

Disruptive technological innovation positively moderates the effect of digital economy policy on firms’ financing constraints—that is, the greater the firm’s innovation capability, the stronger the policy’s effect in alleviating financing constraints.

From the perspective of institutional theory, the allocation of policy-driven fiscal resources such as ESG-related subsidies is not determined solely by firms’ past performance or disclosed metrics, but also by their perceived institutional alignment, strategic foresight, and adaptive capacity. As a manifestation of institutional fit, disruptive technological innovation equips firms with the ability to more fully internalize policy objectives, comply with complex eligibility criteria, and signal high policy responsiveness.

Firms possessing high levels of innovation capability are more likely to satisfy ESG subsidy conditions—such as carbon accounting standards, smart manufacturing benchmarks, or digital green transition roadmaps—thus increasing their selection probability, subsidy accuracy, and allocation intensity. More importantly, such firms often develop intelligent ESG reporting interfaces, real-time policy monitoring systems, and automated compliance modules, which streamline policy engagement and accelerate administrative feedback cycles.

Through the lens of dynamic capabilities theory, these innovation-intensive firms exhibit superior sensing and integration capabilities, enabling them to swiftly reconfigure internal processes to match new subsidy logic. This includes rapid response to policy windows, fast-track document assembly, and data-driven performance demonstrations that enhance institutional legitimacy in the eyes of regulators.

Empirical studies confirm that firms with strong green innovation capabilities are more likely to be prioritized in ESG-related subsidy programs and tend to secure higher and more consistent public funding than non-innovative peers [46]. Furthermore, the interaction between innovation capability and digital governance tools enhances the precision, timeliness, and value-maximization of fiscal resource acquisition.

In summary, disruptive technological innovation acts as a capability amplifier that strengthens the institutional signaling and policy absorption functions that are necessary for subsidy effectiveness—thereby reinforcing the transmission mechanism between digital policy pressure and ESG performance outcomes.

H8:

Disruptive technological innovation positively moderates the effect of digital economy policy on government subsidies—that is, the greater the firm’s innovation capability, the more pronounced the policy’s effect on enhancing access to government subsidies.

This study addresses several critical research gaps in the ESG and digital policy literature, as shown in Table 1. First, while prior research has explored ESG determinants, it often lacks mechanism-based models; we respond by constructing a multi-pathway mediation model including transparency, financing constraints, and government subsidies, supported by [14,15,31]. Second, empirical evaluations of digital policy impacts on ESG remain limited—this study innovates by using a quasi-natural experiment based on China’s national big data pilot zones, applying both DID and Spatial DID techniques [12,15,19]. Third, existing studies seldom integrate institutional theory, agency theory, and dynamic capabilities into a unified analytical framework; we address this by proposing an integrated moderated mediation model [17,18,19,33]. Fourth, few studies examine the role of innovation heterogeneity in shaping ESG responses—this work incorporates disruptive technological innovation as a key moderator [38,41,42]. Lastly, we respond to the neglected spatial dimension in ESG policy research by identifying regional policy spillovers using Spatial DID [12,32]. Together, these contributions offer a theoretically grounded and empirically robust explanation of how digital economy policies influence ESG performance through formal institutional channels and firm-level adaptive capacity.

Table 1.

Research gaps and contributions.

3. Research Design

3.1. Model Specification

To evaluate the impact of digital economy policy on corporate ESG performance, this study employs the national big data comprehensive pilot zone policy as a quasi-natural experiment. A multi-period Difference-in-Differences (DID) approach is utilized to identify the causal effects of the policy. Initiated in 2015 in Guizhou Province and subsequently expanded to a second batch of cities in 2016, the policy features a clearly defined temporal shock and spatial heterogeneity—fulfilling the exogeneity conditions required for a quasi-experimental design.

The study period of 2009–2023 is deliberately chosen based on the staged rollout of China’s National Big Data Comprehensive Pilot Zones. As detailed in Table 2, firms are classified by treatment timing: the first batch of pilot zones launched in 2015, followed by a second batch in 2016, while non-pilot firms remain untreated throughout. Therefore, the years of 2011–2014 are uniformly designated as the pre-treatment period, supporting parallel trend validation across treated and control firms. The years from 2015 onward represent varying levels of policy exposure for different treatment cohorts, enabling robust multi-period DID and SDID identification. This temporal design is consistent with the need to observe both immediate and lagged institutional effects, while the 2020–2021 window additionally captures firm responses during systemic shocks (e.g., COVID-19) under differentiated policy conditions.

Table 2.

Firm grouping based on policy exposure and timing.

The choice of the double difference method as the core methodology is rooted in the “quasi-natural experiment” attribute of policy implementation and the unique advantages of the DID method in addressing endogeneity challenges in nonexperimental policy evaluation. The establishment of the National Big Data Comprehensive Pilot Zones was not simultaneously rolled out in all cities across the country, but rather selected in batches and regions for pilot testing in specific areas. This nonrandom policy implementation model with clear temporal and spatial differences has created a valuable “quasi-experimental” scenario for research. The core logic of the DID method is to effectively extract the “net effect” of the policy itself by comparing the average changes in ESG performance between the treatment group and the control group before and after policy implementation. Its advantage lies in its ability to simultaneously control two types of potential confounding factors: one is the time trend factor, the second is the inherent unobservable differences between the treatment group and the control group. This method design can more effectively alleviate endogeneity bias caused by endogenous policy selection or omitted variables compared to simple policy before and after comparisons or horizontal inter-group comparisons, thereby providing evidence that is closer to causal relationships.

In this framework, firms located within the national big data pilot zones are designated as the treatment group, while firms from non-pilot provinces serve as the control group. The DID estimation compares firm-level ESG performance before and after the policy implementation across these two groups. Accordingly, we construct the following multi-period DID model:

In this model, represents the ESG performance of firm i in year t. The variable is a treatment indicator, taking the value of 1 if the firm is located in a city covered by the national big data pilot zone policy, and 0 otherwise. The variable is a time dummy that equals 1 for years after the policy implementation (i.e., ), and 0 for years prior. The interaction term captures the net effect of the policy on corporate ESG performance, serving as the primary coefficient of interest. Control variables, denoted by , include firm-level characteristics such as size, profitability, capital structure, and regional fixed effects. accounts for firm fixed effects and year fixed effects, which control for time-invariant firm heterogeneity and common temporal shocks, respectively. Finally, represents the stochastic error term.

Given the staggered implementation of the policy, this study further introduces year-by-year interaction terms to construct a multi-period DID model, aiming to capture the heterogeneous dynamics before and after policy adoption.

To further clarify the identification strategy of the DID design, firms are classified into four categories based on policy coverage and time dimensions, as illustrated in Table 2 below.

The treatment group consists of firms located in cities designated as national big data pilot zones, which were exposed to institutional incentives under digital economy policies only after policy implementation. The control group includes firms from non-pilot cities, which remained unaffected by institutional interventions throughout the study period. The core identification strategy of the model lies in comparing changes in ESG performance between the treatment group and the control group after the policy rollout, thereby isolating the policy effect from temporal trends and firm-level fixed characteristics. To enhance the validity of the model, this study further incorporates extended mediation and moderation models to explore the underlying transmission channels and heterogeneous response mechanisms.

3.2. Mediation Model Specification

To further explore the mechanisms through which digital economy policies influence corporate ESG performance, this study constructs three mediation pathway models grounded in institutional theory and agency theory. These models aim to systematically test the transmission effects of three key mediating variables: information transparency, the alleviation of financial constraints, and government subsidies. Each mediation path is modeled using a two-stage regression approach, which is well-suited to identify indirect effects within a multi-period DID framework.

(1) Information Transparency Pathway (Institutional Pressure → Disclosure → ESG). According to institutional theory, digital economy policies enhance information transparency by leveraging government–enterprise data interfaces, blockchain-enabled disclosure, and public oversight systems. These mechanisms mitigate agency problems caused by governance opacity and thereby improve firms’ ESG performance. The corresponding mediation model is specified as follows:

where represents the level of corporate information transparency. If the coefficients of and are reduced in magnitude compared to the baseline model, it indicates the presence of a partial mediation effect.

(2) Financing Constraint Pathway (Institutional Facilitation → Financing Improvement → ESG). Based on agency theory and dynamic capabilities theory, digital financial platforms reduce information asymmetry in credit markets and alleviate financing barriers for small and medium-sized enterprises (SMEs) seeking green credit. This, in turn, enhances firms’ capacity to execute ESG strategies. The corresponding mediation model is specified as follows:

where denotes a reverse indicator of financing constraints, where lower values indicate better access to financing. A significant positive coefficient for suggests that improvements in financing conditions positively affect ESG performance.

(3) Government Subsidy Pathway (Institutional Incentives → Fiscal Preference → ESG). From the perspective of institutional responsiveness, firms with higher institutional alignment—such as those adopting ESG strategies—are more likely to receive fiscal support. Digital economy policies reinforce this logic through mechanisms like intelligent approval systems and green fiscal preference frameworks. The corresponding mediation model is specified as follows:

where represents either the total amount of government subsidies received by the firm in a given year or a binary variable indicating whether the firm obtained green-targeted fiscal incentives.

3.3. Moderation Model Specification

To further investigate the influence of firm-level heterogeneity in technological capabilities on the relationship between digital economy policy and ESG performance, this study introduces disruptive technological innovation capability as a moderating variable. A three-way interaction model is constructed to examine how this capability shapes the policy’s transmission mechanism. The model is specified as follows:

where denotes the three-way interaction term used to test the moderating effect of disruptive technological innovation capability on the policy impact; represents the firm’s level of disruptive technological innovation capability.

In terms of variable construction, this study draws on the existing literature and adopts two dimensions to measure a firm’s disruptive innovation capability: (1) the green patent ratio, the proportion of authorized green invention patents to total authorized patents (data source: China National Intellectual Property Administration); and (2) AI investment intensity, the frequency of AI-related keywords in firms’ annual reports, measured through text mining. Through this model specification, the study systematically depicts the complete logical chain of “institutional incentives-mechanism pathways-capability moderation,” providing empirical support for uncovering the mechanisms and boundary conditions through which digital economy policy influences ESG strategic performance.

3.4. Data Sources and Variable Definitions

The sample comprises non-financial A-share listed firms in China from 2009 to 2023. The primary data sources include the CSMAR database, WIND database, Choice database, and the China National Intellectual Property Administration. The year 2009 is selected as the starting point to avoid the distortions caused by the 2008 global financial crisis, while 2023 marks the endpoint, covering the full cycle of the national big data pilot zone policy and enabling dynamic policy impact evaluation.

To ensure data quality and estimation robustness, several data cleaning steps are implemented: excluding firms with an ST and *ST status, omitting financial sector firms, removing observations with missing values for key variables, and winsorizing continuous variables at the 1st and 99th percentiles.

The dependent variable is corporate ESG performance, measured using the WIND ESG rating index. Scores range from AAA to C and are converted into a 1–9 scale for analysis. The core explanatory variable is a digital economy policy dummy, operationalized through the DID interaction term Treat × Post, which captures the effect of the national big data pilot zone policy.

Three mediating variables are constructed: (1) Information transparency, measured through a composite index including annual report disclosure ratings, IFRS adoption status, and the proportion of independent directors; (2) financing constraints, proxied by the absolute value of the SA index; and (3) government subsidies, measured by the natural logarithm of the total fiscal subsidies received.

The moderating variable, disruptive technological innovation, is captured via a composite index that includes the green patent ratio, AI investment intensity, and innovation density. Control variables include the leverage ratio, firm age, profitability, cash flow ratio, board size, executive incentive mechanisms, and ownership concentration—comprehensively accounting for firm-level heterogeneity. For detailed measurement methods and data sources, see Table 3 below.

Table 3.

Variable definitions.

4. Empirical Analysis

4.1. Descriptive Statistics and Correlation Analysis

Table 4 presents the descriptive statistics of the core variables used in the analysis. The mean ESG score is 4.204, with a range from 1.75 to 6.25, indicating substantial variation in sustainability performance across the sample firms. The mean value of the DID variable is 0.229, suggesting that approximately 22.9% of the sample firms are located in regions covered by the national big data pilot zone policy. The average leverage ratio (Lev) is 42.5%, and the average return on assets (ROA) is 4.3%, both within reasonable bounds. Control variables such as board size, firm age, and the shareholding ratio of the largest shareholder are relatively balanced across the sample, providing a solid foundation for subsequent empirical modeling.

Table 4.

Descriptive statistics.

To further examine the relationships among variables, this paper analyzes the correlation matrix of the core variables. The results indicate that most control variables exhibit statistically significant correlations with ESG performance. Variables such as ROA, Top1, and Pay are positively correlated with ESG scores, implying that firms with higher profitability, concentrated ownership, and better executive incentives are more likely to engage in socially responsible behavior. Conversely, the leverage ratio (Lev) is negatively correlated with ESG performance, suggesting that highly leveraged firms may be constrained in their ability to invest in sustainability. All correlation coefficients are below 0.6, mitigating concerns about multicollinearity. The observed structural differences and inter-variable relationships offer strong theoretical support for the upcoming regression and mediation analyses.

4.2. Analysis of Main Effects (Baseline Regression Results)

Table 5 reports the baseline regression results, assessing the impact of digital economy policy on corporate ESG performance, with robustness checks under varying levels of control specifications.

Table 5.

DID regression results.

Model 1 (No Controls): This model includes only the DID specification without any fixed effects or control variables. The coefficient of the DID interaction term is 0.067 and is significantly positive at the 1% level, providing preliminary support for the hypothesis that digital economy policy positively influences firms’ ESG performance.

Model 2 (With Fixed Effects): Building on Model 1, this specification adds firm- and time-fixed effects. The DID coefficient increases to 0.087, remaining significant at the 1% level. This indicates that unobserved heterogeneity does not materially bias the estimated policy effect.

Model 3 (Full Controls + Fixed Effects): In addition to fixed effects, this model incorporates all control variables (e.g., Sive, Lev, ROA, etc.). The DID coefficient further rises to 0.105, significant at the 1% level, thereby confirming H1.

These findings are consistent with institutional theory, suggesting that formal institutional incentives—such as digital economy policies—substantially enhance firms’ responsiveness to sustainability governance. Moreover, the estimated effect is economically meaningful: on a 1-to-9 ESG rating scale, digital policy exposure increases firm scores by an average of 10.5%, representing a substantive improvement rather than a marginal adjustment, indicating that such policies are a critical driver of strategic transformation.

The analysis of control variables further supports agency theory: Sive, ROA, and Top1 all have significantly positive coefficients, implying that companies with a larger scale, and firms with stronger profitability and a higher ownership concentration are more capable and willing to implement ESG practices. Possible channels include expanding company size, enhancing financial capabilities, promoting ESG investment, strengthening shareholder supervision, improving governance transparency, and enhancing strategic coherence.

4.3. Mechanism Analysis

To further investigate how digital economy policies influence corporate ESG performance, this study employs a Difference-in-Differences (DID) mediation framework incorporating three theoretically grounded mechanism pathways: information transparency (institutional legitimacy perspective), financing constraints (agency cost perspective), and government subsidies (resource-based view). The estimation results are presented in Table 6, and a summary of the mediation pathway validations is provided in Table 7.

Table 6.

Mediation effect estimation results.

Table 7.

Summary of mediation pathways.

(1) Information Transparency Mechanism: Enhancing Institutional Legitimacy. Column (1) of Table 5 shows that the DID variable has a significantly positive effect on disclosure quality (DS), with a coefficient of 0.048 (t = 3.39), significant at the 1% level. This suggests that digital economy policies, through institutional norms and technological platforms, improve firms’ external disclosures. In Column (2), the coefficient of DS on ESG is 0.147 (t = 13.63), while the direct effect of DID on ESG remains significantly positive at 0.076 (t = 3.64), indicating a partial mediation effect. These findings support Hypothesis H2, demonstrating that digital policy enhances ESG performance by increasing transparency and strengthening organizational responsiveness to social and regulatory legitimacy.

(2) Financing Constraint Mechanism: Alleviating Agency Costs. Column (3) reports a significant negative relationship between DID and financing constraints (Fc), with a coefficient of −0.020 (t = −11.10), suggesting that the policy mitigates firms’ financing difficulties. Column (4) shows that Fc negatively affects ESG, with a coefficient of −0.723 (t = −10.67), and the direct effect of DID on ESG remains significantly positive (0.091, t = 5.09). This pathway confirms Hypothesis H3, indicating that digital economy policies reduce internal agency costs and financial bottlenecks, thereby enabling firms to invest in long-term ESG initiatives.

(3) Government Subsidy Mechanism: Resource-Based Support Channel. In Column (5), DID has a significantly positive impact on government subsidies (SUB), with a coefficient of 0.185 (t = 4.03), indicating that the policy strengthens fiscal support for firms. Column (6) shows that SUB significantly enhances ESG performance (0.012, t = 4.97), and the direct effect of DID on ESG remains positive (0.105, t = 5.85). This validates Hypothesis H4, suggesting that digital economy policies increase firms’ access to fiscal resources, thereby easing short-term financial pressures and supporting ESG-related investment.

4.4. Moderation Effect Analysis

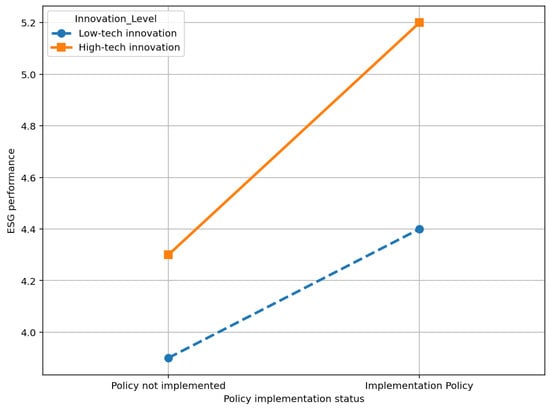

Figure 3 illustrates that following the implementation of digital economy policy, firms with high levels of disruptive technological innovation experience significantly greater improvements in ESG performance compared to their low-innovation counterparts. This finding supports the hypothesis that technological innovation positively moderates the relationship between policy incentives and ESG outcomes. To formally test this moderating effect, the following model is specified:

Figure 3.

The joint effect of policy implementation and innovation level.

Equations (10)–(12) define the moderation effect models, where M represents the three mediating variables: corporate information transparency, financing constraints, and government subsidies. DTI denotes the moderating variable—disruptive technological innovation. The definitions of other variables are consistent with those in regression model (2).

To further investigate how firms with different levels of innovation capacity respond to policy incentives, this study introduces the moderating variable “Disruptive Technological Innovation (DTI)” and constructs an extended model incorporating three-way interaction terms to test its role in the mechanism of digital economy policies. Specifically, models (6)–(8) are formulated, where M represents the mediators: information transparency (DS), financing constraint (Fc), and government subsidies (SUB). The interaction term DID × DTI captures whether the policy effects vary based on a firm’s innovation capacity.

Column (1) of Table 8 presents the interaction between the base DID effect and disruptive innovation in relation to ESG performance. The interaction term coefficient is 0.285, which is significantly positive (p < 0.01), indicating that firms with a stronger innovation capacity benefit more from the policy in terms of ESG improvement. This finding supports Hypothesis H8. To further test whether disruptive innovation moderates the three specific pathways, moderated mediation analysis is performed. This involves checking whether policy effects on mediating variables vary by innovation capacity (Models 6–7), and whether the mediators themselves have heterogeneous effects on ESG depending on innovation levels (Model 8).

Table 8.

Moderating effect test results.

Column (2) shows that the DID × DTI interaction coefficient is –0.028, which is marginally significant (p < 0.01), and Column (3) shows that M is −0.671, which is significantly positive at the 1% level, indicating that in the financing constraint pathway, disruptive innovation significantly enhances the effect of the policy in alleviating financing constraints and subsequently improving ESG performance. This supports Hypothesis H5.

Column (4) shows a DID × DTI coefficient of 0.178 (p < 0.01), and Column (5) shows M as 0.135, which is also significant at 1%, demonstrating that higher transparency and innovation capacity enhance the policy’s effect on ESG performance. This confirms Hypothesis H6, underscoring the role of innovation in strengthening the “institutional pressure → information response → ESG improvement” mechanism.

Column (6) shows that the DID × DTI coefficient is not significant. Although M in Column (7) is 0.009 (significant at 1%), the absence of a significant first-stage interaction implies that the overall moderation mechanism is not supported. Thus, Hypothesis H7 is not validated. This may indicate that policy-driven fiscal resource allocation tends to be based more on regional or industrial criteria rather than firm-level technological attributes.

4.5. Heterogeneity Analysis

(1) Conditional Boundaries of Policy Effectiveness. To further explore how digital economy policies affect firms differently based on their characteristics, this paper conducts sub-sample regressions from four dimensions: corporate governance structure, ownership type, level of digital transformation, and industry competition. This approach investigates the conditional boundaries of policy effects, aiming to identify internal and external contextual variables that influence the realization of policy outcomes, thereby enriching the theoretical understanding of institutional responses at the micro-firm level in digital governance.

(2) Governance Structure Heterogeneity: Internal Power Allocation and Policy Absorption. Corporate governance plays a critical role in how external policy signals are absorbed and translated into organizational actions. Specifically, the separation of roles between the CEO and board chair enhances decision professionalism and compliance. Columns (1)–(2) in Table 9 indicate that for both dual-role and separated-role structures, the DID coefficients are significantly positive at the 1% level. However, the effect is stronger in firms with role separation (0.136) than in dual-role firms (0.106), with a statistically significant difference (p = 0.002). This suggests that greater governance independence boosts the responsiveness to digital economic policies by improving strategic alignment and strengthening board oversight. This may be because the independence and professionalism of corporate governance structures are stronger. In the case of the separation of duties, the chairman is mainly responsible for supervising the operation of the enterprise, while operational managers focus on the day-to-day management, decision planning, and execution of the business, with greater decision-making and discourse power. This clear governance structure and clear division-of-labor system help the management leverage their professional expertise, thereby incorporating the improvement of the enterprise’s ESG performance into the company’s strategic management.

Table 9.

Heterogeneity Analysis by Corporate Governance and Ownership Structure.

(3) Ownership Type Heterogeneity: Institutional Embeddedness and Policy Sensitivity. Ownership type defines a firm’s institutional positioning and embeddedness. Columns (3)–(4) in Table 8 show that digital economy policies significantly improve ESG performance in both state-owned enterprises (SOEs) and non-SOEs, with SOEs showing a stronger response (0.124 vs. 0.078; p = 0.010). SOEs are often subject to performance assessments tied to national strategic goals, which makes them more responsive and better executors of policy incentives. This may be because state-owned enterprises often play a, exemplary and leading role. Due to non-economic goals such as political goals, state-owned enterprises will take on more social responsibility. In recent years, the SASAC of the State Council has promulgated a series of guiding opinions, integrating state-owned enterprises into the national green development strategy, and making clear regulations on the ESG disclosure, performance, and requirements of SOEs.

(4) Digital Transformation Heterogeneity: Technological Foundation and Absorptive Capacity. Digital capability is a key intermediary in receiving and responding to policy stimuli. Columns (1)–(2) in Table 9 show that firms with high levels of digital transformation experience a significantly stronger effect from digital economy policies (0.117) than those with lower digital capability (0.0635). This confirms the enabling role of digital infrastructure and analytics in facilitating ESG system development and amplifying policy impacts. The reason for this may be that enterprises with a high degree of digital transformation have stronger data management and analysis capabilities and can effectively use the data resources in the Big Data Comprehensive Experimental Zone to optimize corporate strategies and improve ESG performance. Digital transformation helps companies allocate resources efficiently and reduce waste, which is consistent with the environmental responsibility and sustainability requirements of the ESG principles.

(5) Industry Competition Heterogeneity: Market Pressure and Strategic Resource Allocation. Industry competition reflects the external institutional pressure on firms. According to the Herfindahl–Hirschman Index (HHI), Columns (3)–(4) in Table 10 indicate that low-competition industries exhibit the most pronounced ESG improvements under policy influence (DID = 0.162), compared to highly competitive industries (DID = 0.0631). Firms in less competitive environments can focus more on long-term sustainable strategies—like low-carbon technology and environmental efficiency—without intense market share battles, translating policy support more effectively into ESG gains. When the industry competition level of the enterprise is low, it means that the enterprise does not need to invest a lot of funds to compete with competitors for market shares, and it is easier to maintain a relatively stable market position. Enterprises facing low levels of industry competition, relying on their flexibility and abundant financial reserves, can promote technological innovation and resource integration through more proactive measures. These measures help companies swiftly mitigate carbon emissions, improve energy efficiency, and optimize production processes, thereby achieving significant results in environmental protection and achieving higher environmental performance, ultimately enhancing the company’s ESG performance.

Table 10.

Heterogeneity Analysis by Digitalization and Market Competition.

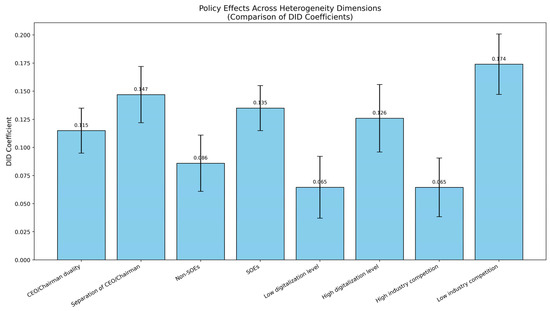

Figure 4 illustrates the comparative DID effects of the digital economy policy on corporate ESG performance across various dimensions of heterogeneity, including governance structure, ownership type, degree of digital transformation, and industry competition intensity. Firms with separated CEO and board chair roles (0.147) responded more strongly to the policy than those with role duality (0.115), confirming that governance independence enhances policy transmission effectiveness. State-owned enterprises (0.135) exhibited a significantly higher responsiveness than non-SOEs (0.086), reflecting their heightened policy sensitivity. Firms with high digitalization levels (0.126) reacted more actively to the policy, while those in low-competition industries (0.174) experienced the most pronounced ESG performance improvements under policy influence, compared to firms in highly competitive industries (0.065).

Figure 4.

Policy effects across heterogeneity.

4.6. Robustness Checks

(1) Parallel Trend Test. Under the quasi-natural experimental framework, the DID method captures the causal impact of policy shocks by comparing the pre- and post-treatment differences between the treatment and control groups. This approach is effective in isolating the causal relationship from potential confounding factors. However, the validity of DID critically depends on the parallel trend assumption, i.e., the ESG performance of firms in the designated big data pilot zones should not differ systematically from that of control firms before the policy was implemented. To test this assumption, an event study model is constructed as follows:

In this model, variable denotes a dummy variable indicating whether firm i is affected by the policy in year t; if t is negative, it represents the t-th year prior to the policy implementation. The definitions of other variables follow those used in regression model (1), with the first year of policy implementation in a firm’s region set as the baseline year. Coefficient captures the difference in ESG performance between the treatment and control groups in year t following policy implementation. Model (2) is employed in this study to conduct the parallel trend test and examine the dynamic characteristics of firms’ ESG performance over time.

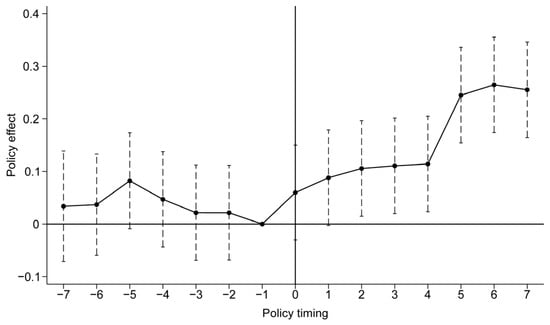

Figure 5 presents the estimation results from the event–time regression. The estimated coefficients for the years prior to policy implementation fluctuate around zero and are statistically insignificant, indicating that the treatment and control groups exhibited parallel trends in ESG performance—thereby validating the parallel trend assumption. From the second year after policy implementation onward, the coefficients become significantly positive and show a sustained upward trend, suggesting that the impact of digital economy policies on corporate ESG performance is both lagged and persistent. This further reinforces the internal validity of the study’s identification strategy.

Figure 5.

Dynamic changes in policy effects before and after policy intervention.

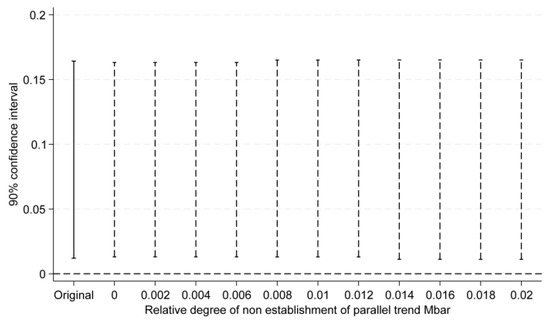

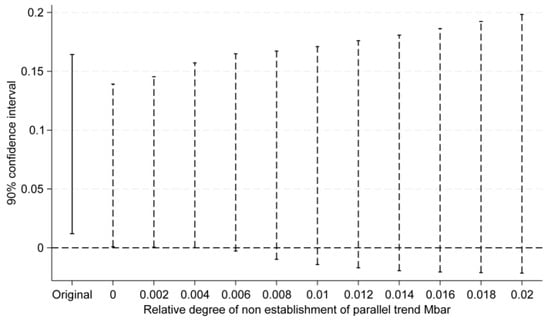

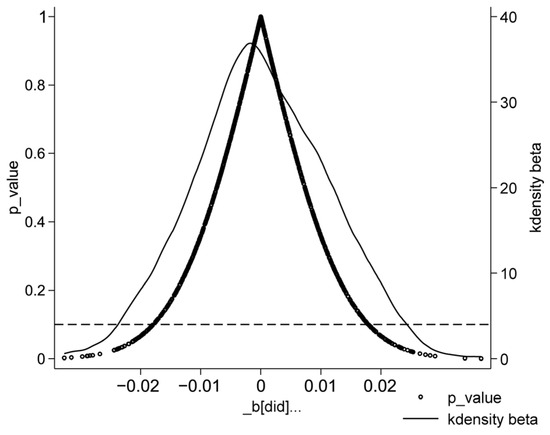

Recent DID studies have shown that pre-treatment trend tests do not fully prove the parallel trend hypothesis [47]. In fact, this traditional test has low statistical efficacy and may lead to bias or distortion in estimation and inference. Therefore, [48] proposed a new method for detecting violations of the parallel trend hypothesis. The key to this method lies in inferring and conducting sensitivity analysis on the confidence intervals of the processed point estimates. The test consists of two parts: the first is to construct the maximum deviation degree (Mbar) from the parallel trend, and the second is to construct a confidence interval for the processed point estimate corresponding to the degree of deviation mentioned above. If the confidence interval of the processed point estimate does not contain a zero value at the maximum deviation level, it indicates that the processing effect has good robustness to the deviation of parallel trends. Referring to existing research, set the maximum deviation degree Mbar = 1 × standard error to test the parallel trend sensitivity of the treatment effect after the implementation of the pilot policy, as shown in Figure 6 and Figure 7.

Figure 6.

Placebo Parallel Trend Test I.

Figure 7.

Placebo Parallel Trend Test II(Further expand the deviation range to 0.02).

The following figures show the parallel trend sensitivity test results of the annual treatment effect of policy implementation under relative deviation and smoothing constraints. It is not difficult to find that the parallel trend is still robust under relative deviation and smoothing constraints, indicating that under certain impact deviations, digital economy policies still significantly improve corporate ESG performance.

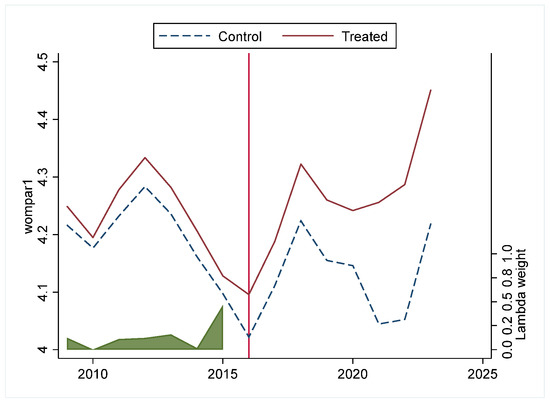

(2) Synthetic Difference-in-Differences (SDID). To enhance the precision and robustness of causal identification, this study adopts the SDID method, which integrates the matching advantage of the synthetic control method with the temporal variation identification strength of traditional DID. By constructing optimally weighted synthetic control units in a high-dimensional covariate space, the SDID approach significantly mitigates estimation bias under regional heterogeneity, making it especially suitable for evaluating regional policy impacts, as shown in Table 11.

Table 11.

Results of the SDID estimation.

Given the limited sample size of the first pilot batch (15 firms in Guizhou Province), this study focuses on the second batch of National Digital Economy Innovation Development Pilot Zones (BDCZs) to systematically assess the policy’s effect on corporate ESG performance. The procedure involves (1) constructing a counterfactual synthetic control for each treated firm using the SDID approach; (2) defining treated firms as those in pilot zones and untreated firms as controls, within a DID estimation framework; and (3) quantifying the net effect of policy intervention.

As shown in Figure 8, the dynamic trend plot indicates strong pre-treatment parallelism in ESG performance between treated firms and their synthetic controls, validating the parallel trend assumption. Table 10 further confirms that the policy interaction term is significantly positive (p < 0.01), affirming that digital economy policies exert a clear and robust positive influence on firms’ ESG performance.

Figure 8.

Dynamic trends based on SDID.

(3) Placebo Test. To further validate the robustness of the baseline regression results, this study conducts a placebo test using Monte Carlo simulation. Specifically, the core explanatory variable is randomly reassigned to generate a set of placebo policy variables. The estimation process that is consistent with the baseline model is then repeated 1000 times to construct a simulated distribution of pseudo-policy effects. As shown in Figure 9, the regression coefficients of the placebo policy variable exhibit a symmetric distribution centered around zero, with over 90% of the simulated p-values exceeding 0.1. This indicates that in the absence of a genuine policy intervention, significant effects are unlikely to emerge by chance. These results effectively eliminate the influence of random noise, further reinforcing the credibility and robustness of the study’s policy effect identification.

Figure 9.

Placebo test.

(4) Endogeneity test. The assessment of the impact of national big data comprehensive experimental zone policies on corporate ESG performance may face potential endogeneity challenges. On the one hand, the policy of the pilot zone may directly empower enterprises to improve their ESG practices by providing policy support, optimizing the data element market, and promoting technological innovation and application. On the other hand, companies with excellent ESG performance or strong sustainability intentions may have more motivation and ability to actively strive for or respond to policies. This potential reverse causal relationship may lead to biased estimation results. To minimize the interference of endogeneity issues on research conclusions, this study uses the instrumental variable method for robustness testing. There was a preliminary selection of the development level of postal and telecommunications services in various cities in 1984 as the instrumental variable for policy implementation in the experimental zone. The selection of experimental zone policies is not completely random, and usually prioritizes areas with good digital infrastructure, data resource endowments, or industrial development foundations. The level of postal and telecommunications development profoundly reflects the status of information and communication infrastructure and the potential for information technology development in the region. To a large extent, it has shaped the development path and social acceptance of the region in the digital economy era, making it more likely to be included in the pilot scope during the sample period and meet the relevance requirements. As a social infrastructure, postal and telecommunications mainly provide communication services for the public, and they do not directly affect the environmental performance, social responsibility fulfillment, or corporate governance structure of specific enterprises during the sample period. To meet the conditions of exogeneity, in view of the fact that the post and telecommunications data of each city in 1984 is cross-sectional data, which is difficult to directly apply to the panel model, this paper constructs the transfer term of the number of Internet users nationwide and the number of fixed telephones per 10,000 people in each prefecture-level city in 1984 as instrumental variables. Table 12 presents the estimation results of the two-stage instrumental variable method. The test results show that the Kleiberen–Paaprk LM statistic is significant at the 1% level, indicating sufficient identification of instrumental variables. The Cragg-Donald Wald F statistic is greater than the critical value of the Stock Logo weak instrumental variable test at the 10% level, ruling out the possibility of weak instrumental variables. Therefore, the selected instrumental variables are effective and reliable. Furthermore, the estimated DID coefficient is significantly positive, confirming that the core conclusion of this paper remains robust.

Table 12.

Instrumental variable regression estimates.

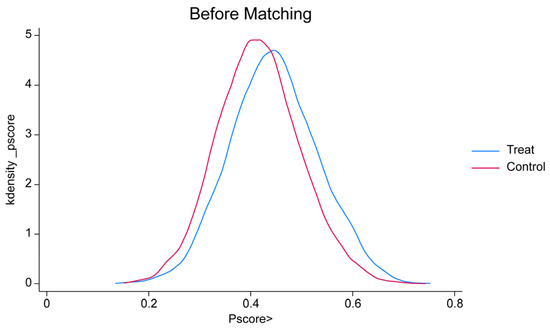

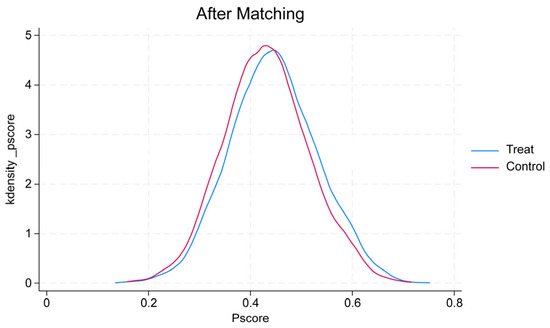

(5) Additional Robustness Checks. ① The Propensity Score Matching Difference-in-Differences (PSM-DID). To control for potential sample selection bias in causal identification, this study applies the PSM-DID method as a robustness check. Using all control variables, a covariate system is constructed, and one-to-one nearest neighbor matching is performed to generate comparable treatment and control group samples, ensuring that the common support assumption is satisfied. Kernel density comparisons in Figure 10 and Figure 11 demonstrate convergence in the distribution of propensity scores between groups after matching, verifying covariate balance. The DID regression results based on the matched samples (Column 1 of Table 13) show that the interaction term remains significantly positive at the 1% level, with the estimated direction consistent with the main regression, further confirming the robustness of the study’s conclusions.

Figure 10.

Propensity score matching before.

Figure 11.

Propensity score matching after.

Table 13.

Robustness checks.

② Replacing the Dependent Variable. To mitigate the influence of outliers on regression estimation, this study replaces the original ESG score with the median ESG score of the firm in the rating year. This substitution strategy effectively alleviates potential bias caused by measurement errors. As shown in Column (2) of Table 13, the coefficient of DID is 0.112, remaining significant at the 1% level, confirming the robustness of the main findings.

③ Lagged Policy Effect. Given the potential implementation lag of policy effects, the core variable DID is lagged by one period. The sample size and control variable structure remain unchanged. Column (3) of Table 13 indicates a policy coefficient of 0.117 after lag adjustment, which is still significant at the 1% level, suggesting that the policy impact is both persistent and structural.

④ Excluding COVID-19 Impact. The COVID-19 pandemic may have exerted exogenous shocks on firms’ ESG performance, potentially confounding policy effect identification. To address this, all observations from 2020 onwards (6344 in total) are excluded, retaining a symmetric pre- and post-policy sample window for re-estimation. Column (4) of Table 11 shows that the DID coefficient is 0.042, significant at the 5% level, indicating that the research conclusions are not artifacts of pandemic-related randomness.

Lastly, we address excluding Special Municipality Samples. Digital economy policy pilots are often concentrated in regions with superior resource endowments, particularly direct-administered municipalities, which may introduce institutional bias. To eliminate regional heterogeneity, this study excludes four municipalities (Beijing, Shanghai, Tianjin, and Chongqing), removing 2710 observations. The re-estimated model in Column (5) of Table 13 still yields a significant DID coefficient (0.047, p < 0.05), further enhancing the robustness and external validity of the main conclusions.

5. Discussion

5.1. Theoretical Contributions

(1) Enriching Institutional Theory: Mechanisms of ESG Alignment. Prior research often frames institutional pressure as a driver of isomorphic compliance. This study extends that understanding by uncovering how digital economy policies construct a field of embedded compliance through regulatory instruments (e.g., transparency mandates) and incentive alignment (e.g., subsidies, credit access). We build a mechanism-based institutional framework that shifts the analytical focus from surface legitimacy to strategic ESG transformation, aligning with insights from [6,8,25]. Furthermore, we identify firm-level heterogeneity in institutional responsiveness, consistent with the contextual adaptation paths emphasized in [9].

(2) Advancing Agency Theory: Information Infrastructure as Governance. Agency theory identifies information asymmetry as a key constraint on long-term strategy implementation. Our findings show that digital economy policies reduce asymmetry by institutionalizing real-time data disclosure and improving credit visibility through fintech platforms—thus enhancing internal governance and stakeholder accountability. This extends the work of [10,12], who link disclosure complexity and transparency to ESG outcomes, and aligns with the moderating role of board structures reported in [15]. Additionally, our analysis of CEO duality effects supports the governance implications explored in [11,40], reinforcing how internal structures condition the translation of institutional intent into ESG outcomes.

(3) Extending Dynamic Capabilities Theory: Technological Moderation of Policy Effects. By introducing disruptive technological innovation as a moderator, we show that dynamic capabilities not only support innovation but also amplify firms’ responsiveness to institutional change. Innovative firms exhibit stronger alignment between ESG strategy and digital policy, validating the theoretical predictions of [1,2,32]. Moreover, our staged model—“institutional pressure → mediation mechanism → capability moderation”—echoes the resource orchestration framework in [30], illustrating how technological assets serve as adaptive levers under institutional evolution.

Together, these contributions demonstrate that digital economy policy is not merely a background condition but a dynamic institutional architecture that reshapes ESG through embedded incentives, moderated by firm-level technological and governance capacities.

5.2. Managerial Implications

First, since information transparency serves as a critical mediating channel through which digital economy policies impact corporate ESG performance, the government should establish a unified ESG information disclosure platform and ensure interoperability with national credit systems and green certification platforms to enhance data accessibility and transparency. Policymakers should also mandate ESG disclosure standards to improve the completeness and comparability of reported data. Enterprises are advised to adopt blockchain and other emerging technologies to develop ESG data management systems and engage third-party auditors to enhance external supervision.

Second, to mitigate financing constraints, regulators should promote the development of digital green financial products and encourage financial institutions to offer ESG-linked credit lines. These tools would align capital allocation more effectively with ESG performance. On their part, firms should strengthen carbon asset management and ESG creditworthiness to improve access to capital markets and unlock ESG-related financial resources.

Third, although often overlooked, government subsidies are found to significantly contribute to ESG improvement. Policymakers should refine subsidy mechanisms by transitioning from broad-based support to a more precise, performance-based model. “Input-first, subsidy-later” frameworks could be adopted to link fiscal support with ESG outcomes. Enterprises should proactively plan ESG project portfolios and align them with government policy priorities to increase the likelihood of receiving targeted subsidies.