Abstract

The rapid development and adoption of artificial intelligence (AI) technology has sparked debates about its implications for labor markets, yet the micro-level relationship between AI and labor share remains underexplored. Based on the theory of skill-biased technological change, this study aims to examine whether AI technology increases labor share by labor structure upgrading at the enterprise level. Using panel data for China’s listed companies from 2012 to 2022, this study tests this relationship using a two-way fixed effects model. The empirical results reveal that AI technology significantly increases labor share, with labor structure upgrading playing a mediating role in this relationship. Heterogeneity analysis reveals that the influence of AI technology on labor share is stronger for enterprises characterized by low labor market rigidity, high labor market supply, and talent policy support in external environments, as well as among labor-intensive, high-tech, and non-state-owned enterprises. Notably, this study finds that advancements in AI technology have achieved mutually beneficial outcomes of improving labor share and enhancing total factor productivity. Our research findings provide detailed empirical evidence for enterprises to formulate and implement AI strategies.

1. Introduction

Artificial intelligence (AI) technology has emerged as a pivotal force in restructuring economic paradigms and production structure [1]. At the 2023 G20 Summit, policymakers emphasized the need to balance AI-driven productivity gains with inclusive governance frameworks (G20 New Delhi Leaders’ Declaration, 2023), indicating the vital role of AI technology in fostering regional inclusive economic growth. The rapid adoption of AI technology is evident, with recent surveys indicating that 50% of organizations have implemented the technology in at least one business function [2]. This widespread integration significantly impacts labor markets, influencing the income distribution and employment of different labor groups [3,4]. For instance, by leveraging AI technology, translation applications have been shown to increase trade volume on online platforms by 17.5%, enhancing the activity of downstream transactions while also replacing basic translation positions within enterprises [5]. Conversely, AI technology adoption helps pharmaceutical researchers to predict which drug molecules are most likely to aid in treatment, thereby enhancing their individual value and drug research efficiency [6]. These phenomena reveal the complexity of labor value reconfiguration driven by AI technology. Consequently, investigating the influence of AI technology on labor relations holds significant theoretical and practical importance.

AI technology refers to technologies that simulate human cognitive functions through computer systems, with the goal of enabling capabilities such as learning, reasoning, perception, and decision making [7]. Existing studies have primarily examined AI technology’s economic consequences, including its effects on innovation output [8,9], productivity and employment [10], firm performance [11], and employee responsibility [12], yet largely overlooked its impact on firms’ labor share. In contrast to labor investment efficiency and labor productivity, labor share refers to the proportion of income that laborers receive in the enterprise [13]. A higher labor share can help enterprises to improve employees’ well-being and work efficiency [14]. Existing research has predominantly identified structural constraints, such as product market regulation, government investment, industry concentration, and the relative price of investment [15,16,17], as well as strategic enablers like digital transformation [13,18], as key determinants of labor share. However, the relationship between AI technology and labor share remains underexplored. Consequently, understanding how AI technology influences labor share and identifying the pathways through which this effect occurs have emerged as critically important research questions.

The theory of skill-biased technical change indicates that technological advances drive changes in income distribution by shifting labor demands, reducing wages and opportunities for routine labor, and increasing demand for both high-skill and physical labor [19,20]. As a technological advancement, AI technology exerts substitution and complementarity effects within enterprises [21]. On the one hand, unlike earlier automation technologies that only replaced routine physical labor with industrial robots, AI technology could displace routine intellectual labor through intelligent prediction and decision making [22,23]. For instance, in the financial sector, AI technology can efficiently perform transactional tasks, such as transaction clearing and tax document processing, while maintaining a lower error rate than human employees. On the other hand, the innovation and adoption of AI technology can complement high-skill talent and drive demand for high-skill talent [24,25,26]. For example, in healthcare settings, AI prediction technology has enhanced emergency care efficiency through reducing diagnostic redundancies and increasing the demand for emergency physicians [6]. Therefore, AI technology has facilitated the upgrading of labor structure by reducing the proportion of routine labor and increasing the demand for high-skill talent. This shift encourages enterprises to raise average wage levels [19,22]. Further, enterprises will optimize compensation and resource allocation to attract and retain high-skill talent, thereby significantly boosting labor share [21]. Based on this, as well as the theory of skill-biased technical change, this study aims to analyze how AI technology increases labor share through labor structure upgrading.

To investigate this, the study employs a two-way fixed effects model to investigate the impact of AI technology on labor share by taking listed companies in China from 2012 to 2022 as a sample. The empirical results reveal that AI technology significantly increases labor share, which remains valid after conducting a series of endogeneity tests and robustness tests. Labor structure upgrading serves as an important mechanism through which AI technology positively influences labor share. In addition, the study finds that enterprises with low labor market rigidity, high labor market supply, and talent policy support in external environments experience a more significant positive impact of AI technology on labor share. AI technology also plays a more significant role in promoting labor share in labor-intensive, high-tech, and non-state-owned enterprises. Furthermore, this study explores how AI technology influences firms’ total factor productivity (TFP) while improving labor share.

This study makes the following theoretical contributions. First, it extends the research on the organizational outcomes of AI technology by revealing the relationship between AI technology and labor share. It also advances the understanding of boundary conditions by demonstrating that the effect of AI technology on labor share is significantly stronger for enterprises with low labor market rigidity, high labor market supply, and talent policy support in external environments, as well as among labor-intensive, high-tech, and non-state-owned enterprises. Second, it introduces labor structure upgrading as a mediating variable to uncover the underlying mechanisms through which AI technology influences labor share based on the theory of skill-biased technical change. Third, it reveals that AI technology enhances both TFP and labor share, enriching the microeconomic consequences of AI via synergistic improvements in efficiency and equity that jointly advance enterprise performance and employee welfare.

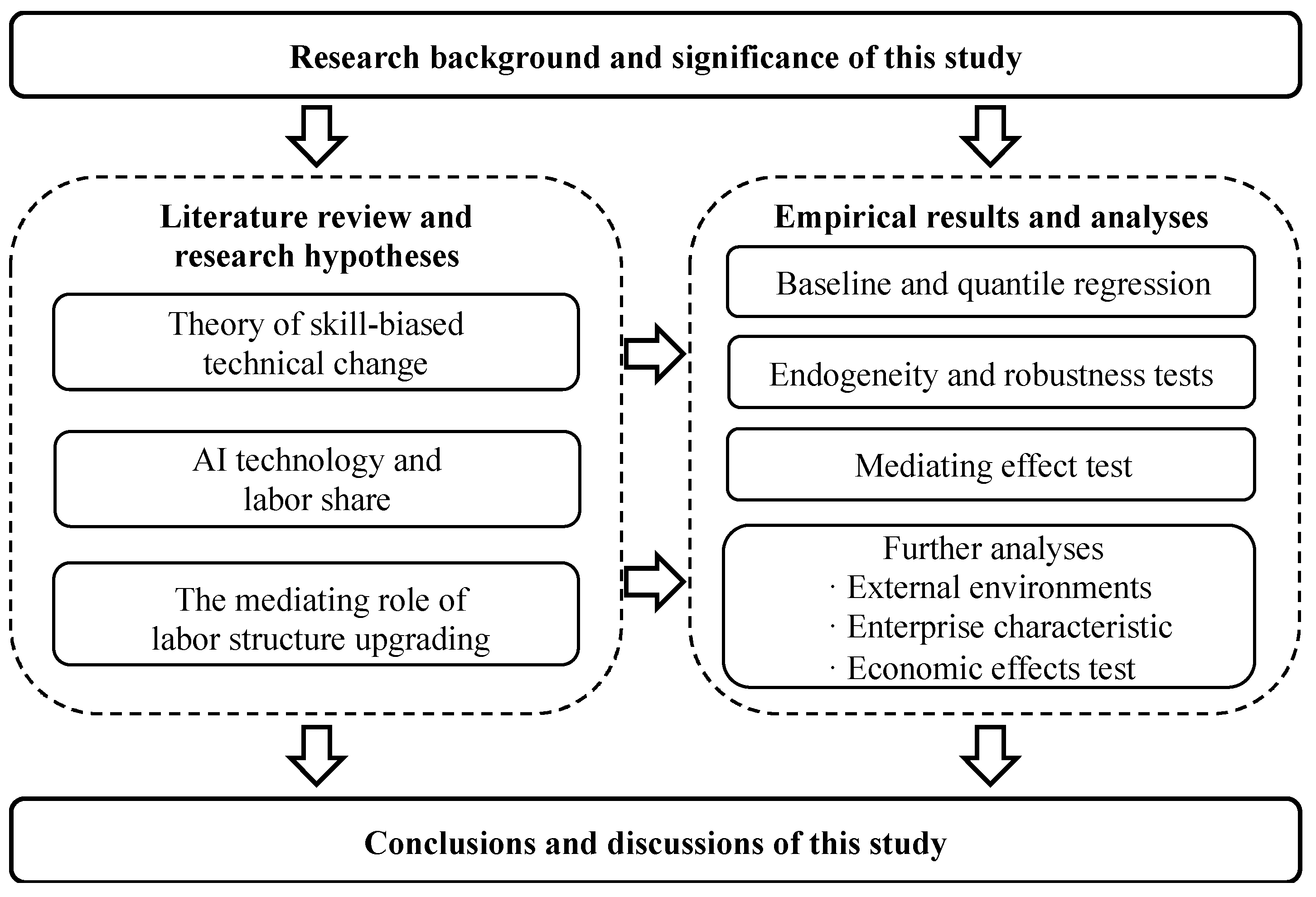

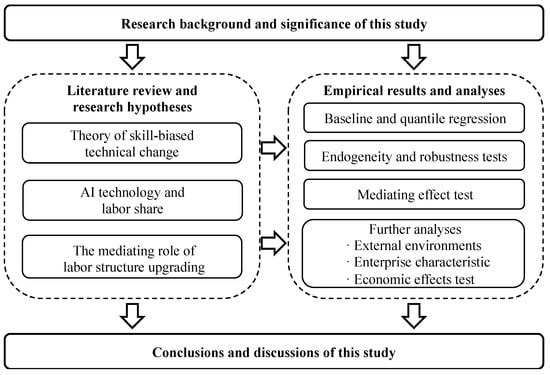

Following this introduction, Section 2 reviews the related literature and presents the development of hypotheses. Section 3 illustrates the research design. Section 4 discusses the empirical results and analyses. Section 5 presents further analysis. Section 6 provides the conclusions and discussion. Figure 1 presents the diagram of the research framework.

Figure 1.

Framework diagram.

2. Literature Review and Research Hypotheses

2.1. Literature Review

The outcomes of AI technology have emerged as a focal point of scholarly inquiry. A portion of the research examining the impact of AI technology on the labor aspect has primarily focused on the macro level. For instance, Frey & Osborne [27] found that the development of AI technology may have a substitution effect on many future occupations. Aghion et al. [21] pioneered the exploration of how AI technology can foster balanced socioeconomic growth, alter factor distribution, and potentially lead to labor income inequality. In a comparable vein, Xie et al. [25] demonstrated that AI technology significantly influences the labor structure across various regions in China. These findings indicate that AI technology reduces the relative demand for routine labor nationwide while simultaneously increasing the demand for high-skill labor.

Recent scholarship has advanced this inquiry by investigating the pathways linking AI technology to labor share. For instance, Qian et al. [4] argued that AI technology influences factor income distribution through a dual mechanism of task substitution and task addition within China’s enterprises. The task substitution effect reduces the set of labor tasks, causing wage growth to lag behind productivity growth, thereby decreasing labor share. By contrast, the task addition effect expands the scope of labor tasks, producing a positive moderating effect that partially counteracts the negative impact of the substitution effect. Furthermore, Autor et al. [23] analyzed the impact of AI technological innovation on occupational skill demand, finding that automated and procedural AI technology may reduce routine employment opportunities, while generative AI technology boosts opportunities and income share for high-skill labor, creates new employment positions, and increases the demand for professional skills.

In recent years, research investigating the impact of AI technology on the labor aspect has increasingly shifted focus from the macro level to the micro level. For instance, Rammer et al. [8] argued that enterprises with extensive experience in applying AI technology are more likely to achieve higher innovation output and derive greater economic returns from these innovations. Yang [10] emphasized that a 10% increase in the number of AI-related patents held by an enterprise is associated with an approximately 5% increase in TFP. Additionally, this author also found that enterprises are likely to continuously hire more high-skill labor to maintain and utilize AI-related patents. Wamba [11] concluded that AI technology has a significant positive impact on firms’ performance, and this relationship is achieved through enhancing organizational and customer agility. Wang et al. [12] proposed that the adoption of AI technology within enterprises has significantly increased employees’ job insecurity and career stress, thereby leading to a notable increase in their turnover intentions. While these studies have mainly explored the organizational outcomes of AI technology, few have examined its impact on labor share at the enterprise level.

Regarding the antecedents of labor share, existing research has predominantly identified structural constraints that suppress labor share, including product market regulation, government investment, industry concentration, and the relative price of investment [15,16,17]. Recently, scholars have started to uncover the strategic enablers of labor share. For instance, Li et al. [13] found that enterprises can accelerate digital transformation to increase labor share by easing financing constraints. Similarly, Miao et al. [18] indicated that the digital transformation of manufacturing enterprises has significantly promoted an increase in labor share, with technological innovation and industry–university–research collaboration playing mediating and moderating roles, respectively. However, there has not yet been an in-depth exploration of the relationship between AI technology and labor share within enterprises from a technological perspective. In fact, increased innovation and adoption of AI technology lead to higher demand for relevant skilled personnel [10,26], suggesting that AI advancements are closely linked to shifts in workforce composition and income distribution within enterprises [28,29,30]. Therefore, there is a critical need for empirical studies examining the effects of AI technology on labor share at the enterprise level.

2.2. Theoretical Background and Research Hypotheses

2.2.1. Skill-Biased Technical Change

The theory of skill-biased technical change suggests that technological advance is a key driver of changes in income distribution [19]. Recent studies have examined changes in the labor market from this perspective, particularly regarding how technological change shapes skill demand and wage structure. For example, Wang et al. [20] concluded that technological change in China exhibits skill-biased characteristics, driving labor shifts and significantly intensifying polarization in the labor market. Specifically, they found that technological advances have caused a decline in wages and job opportunities for routine intelligent labor while increasing demand for both high-skill and routine physical labor. This shift results in increased job competition for routine physical labor and a reduction in labor share, while high-skill labors are required to acquire more advanced skills to remain competitive, thus driving an increase in their wages.

In the digital economy, much of the existing research on skill-biased technical change primarily focuses on the impact of digital transformation at the enterprise level. For example, Feng et al. [31] proposed that digital transformation drives skill-biased technical change, as the digitization of production processes leads to the replacement of routine physical labor by high-skill labor. The marginal productivity of high-skill labor is significantly higher than that of routine physical labor, thereby enhancing the position of Chinese manufacturing enterprises in the global value chain. Li et al. [32] explored how a shortage of high-skill labor during digital transformation hinders the ability to meet the demand for digital technologies in production processes, resulting in higher skill premiums for high-skill labor. They also found that while digital transformation increases the proportion of high-skill labor within enterprises, it helps to reduce internal wage inequality through labor structure optimization. Several studies have also focused on the role of industrial robotics technology in accumulating and allocating human capital within enterprises. For example, Luo & Qiao [33] pointed out that industrial robotics, as a skill-biased technological tool, encourages the use of more high-skill labor for operating and maintaining machines, while it reduces the need for routine labor in production processes. This shift has positive implications for enterprise development and innovation. Collectively, existing research mainly focuses on how digital transformation and industrial robotics drive skill-biased technical change, shaping value chain positioning, wage structure, and productivity. However, it overlooks how AI technology affects firms’ labor share through labor structure upgrading.

AI technology, as a disruptive digital technology, has the potential to transform organizational structures [34]. It not only enhances the productivity of high-skill workers who possess expertise in utilizing digital technologies but also displaces routine tasks through automation [22]. AI technology exhibits typical characteristics of skill-biased technical change, significantly influencing intra-firm labor allocation dynamics [6,35]. Therefore, this study explores the impact of AI technology on enterprise-level labor share through labor structure upgrading. Crucially, whereas conventional digital tools primarily substitute routine physical labor statically [31], AI-driven cognitive systems dynamically replace both routine physical and intellectual labor (e.g., financial and sales personnel) via intelligent decision-making assistance, while simultaneously enhancing the productivity of high-skill workers (e.g., research and development [R&D] personnel, and technical personnel) [36,37]. However, existing studies fail to recognize that labor structure upgrading serves as the critical transmission channel that reconciles AI’s displacement effects with its potential to enhance aggregate labor share. Based on the theory of skill-biased technical change, our framework advances the literature by demonstrating how AI technology reshapes labor share through active structural upgrading rather than passive skill-biased automation.

2.2.2. AI Technology and Labor Share

AI technology is positively related to labor share. First, the development of AI technology has led to the emergence of numerous new industries, giving rise to new production sectors and job opportunities [23]. The increase in related positions will enhance firms’ labor share. In addition, the development of AI technology has intensified competition for skilled talent [38,39]. Due to their scarcity, skilled workers often hold a more advantageous position in salary negotiations. Therefore, AI’s development indirectly strengthens the bargaining power and income share of skilled workers [40,41]. In the labor market, the intensifying competition for skilled workers is compelling enterprises to adopt strategic measures to attract and retain them [42]. These measures include offering competitive compensation packages and investing in employee development programs, all of which enhance firms’ labor share.

Second, the innovation and adoption of AI technology can promote information flow within enterprises, significantly improving the quality and transparency of information disclosure [43]. This allows external stakeholders to more efficiently identify enterprises with growth potential, thereby enhancing investor confidence and effectively increasing investment. Additionally, enterprises that focus on AI technology research are more likely to receive government grants for technological innovation [44,45]. With increased financial support, these enterprises often expand their workforce, ultimately increasing the share of labor compensation in income distribution [46].

Third, AI technology, as a representative of advanced productive forces, possesses the capabilities of machine learning and logical reasoning. AI technology enables the analysis of a firm’s historical operational data and future market trends, which facilitates the planning of production and business activities [47,48]. This, in turn, reduces inventory levels and enhances production efficiency. Notably, the improvement in productivity is a key factor influencing labor share [13]. As performance increases, it typically leads to a corresponding rise in the proportion of labor compensation in the distribution of a firm’s value.

To sum up, this study proposes the following hypotheses:

Hypothesis 1.

AI technology can significantly increase labor share.

2.2.3. The Mediating Role of Labor Structure Upgrading

Based on the theory of skill-biased technical change, this study considers that AI technology can increase labor share by labor structure upgrading. The theory of skill-biased technical change implies that technological advances require more skilled labor instead of relying on basic manual labor [49,50]. The innovation and adoption of AI technology require support from R&D and technical personnel. To enable this, enterprises implement talent recruitment and training programs to upgrade labor structures, ultimately increasing their investment in the labor force [24,51]. This shift gradually prompts routine labor to enhance their competitiveness through knowledge acquisition and skill training to retain employment and increase income levels [36]. As a result, this leads to the upgrading of the labor force and an increase in labor share.

Additionally, advancements in AI technology have optimized production processes, displacing many repetitive and routine jobs, thereby reducing the demand for routine physical and less educated personnel in production tasks [37,52]. Meanwhile, as AI technology becomes increasingly embedded in corporate strategic management, the scenarios of human–machine collaboration in business management will continue to grow [10]. More technical and highly educated personnel will participate in human–machine collaboration, which will further increase the added value of firms’ output per unit of labor [3,53]. This productivity premium raises the wages of technical and highly educated personnel, thereby contributing to an increase in firms’ labor share. Therefore, this study proposes the following hypothesis:

Hypothesis 2.

AI technology can increase labor share by labor structure upgrading.

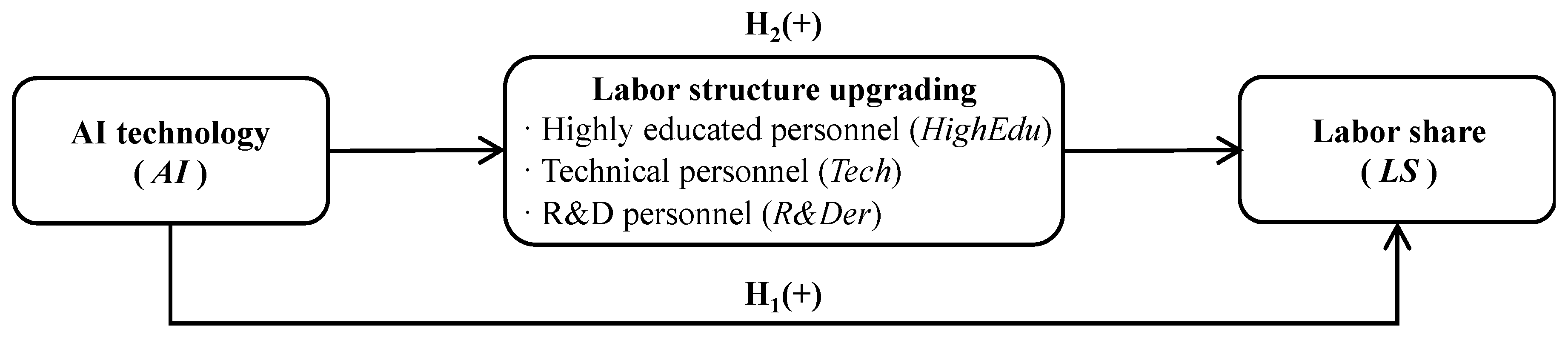

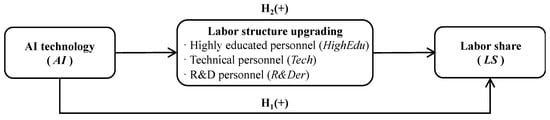

To sum up, the conceptual framework of this study is presented in Figure 2.

Figure 2.

Conceptual framework.

3. Research Design

3.1. Data Sources

This study uses panel data of China’s listed companies from 2012 to 2022. Sample screening was carried out according to the following principles: (1) Samples with missing variables were excluded; and (2) samples belonging to *ST and ST listed companies were excluded to minimize the influence of associated risks. All continuous variables were winsorized at the 1% level, resulting in 31,467 observation samples. The AI patent data used in this study were derived from the “China Digital Economy Innovation Database” (CDEI), which was independently developed by our research group. The remaining data were obtained from the “China Stock Market & Accounting Research Database” (CSMAR).

3.2. Variable Selection

3.2.1. Dependent Variable

The dependent variable is labor share (LS). Labor share reflects the distribution relationship of a firm’s income between capital owners and laborers, which is an important indicator for analyzing the internal income distribution structure of the enterprise [54]. As in this paper, labor share is an economic indicator whose rise implies that employee compensation is outpacing returns to capital and it bears no direct relationship to employment share [55]. Labor share is measured as the ratio of the cash paid to and for employees in the current period to the total operating income of the enterprise [13,56], as presented in Equation (1):

3.2.2. Independent Variable

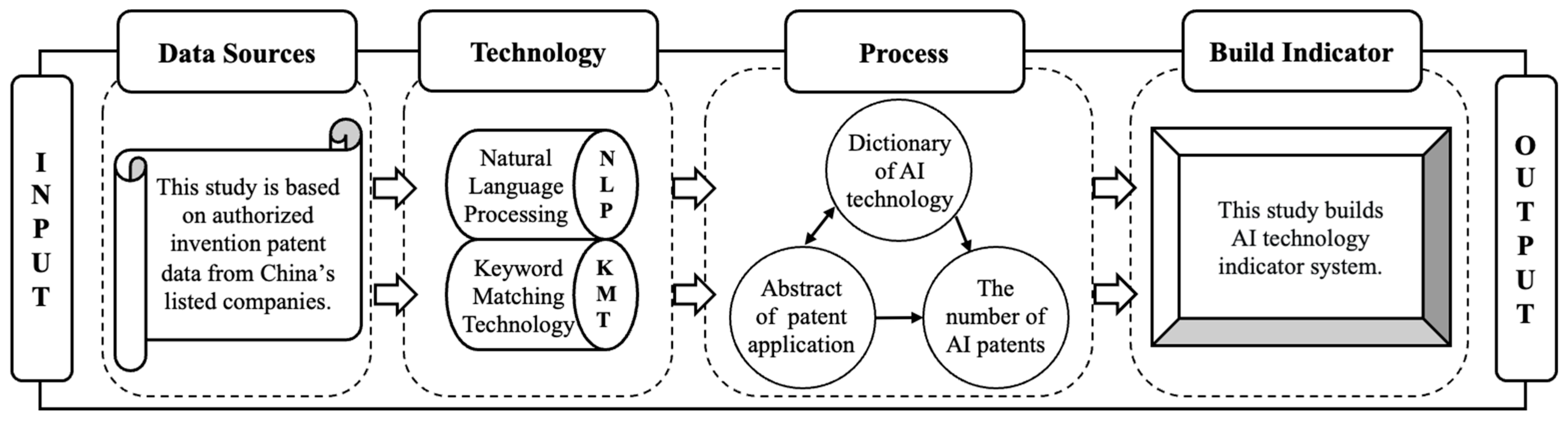

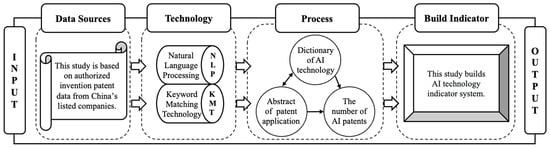

Our independent variable is artificial intelligence technology (AI). While prior literature predominantly employs questionnaires to evaluate the innovation and adoption of AI technology in enterprises [32,57], such self-reported data exhibit inherent limitations in sample coverage and scalability, particularly for constructing large-scale panel datasets. To address this methodological gap, this study generates a “Dictionary of AI technology” (see Figure A1) adapted from Xi & Shao [9]. Based on natural language processing (NLP) and keyword-matching technologies, this study searches for AI technology terms in patent abstracts to determine whether a patent is AI related [58]. Specifically, if terms such as Machine Learning, Intelligent Computing, Big Data Analytics, and Neural Network from the “Dictionary of AI technology” are identified in the abstract of the granted patent, this study classifies the patent as an AI patent. Finally, the natural logarithm of the number of AI patents is used as a metric for measuring the level of AI technology. The screening flowchart for indicator of AI technology is presented in Figure 3.

Figure 3.

Screening flowchart for indicator of AI technology.

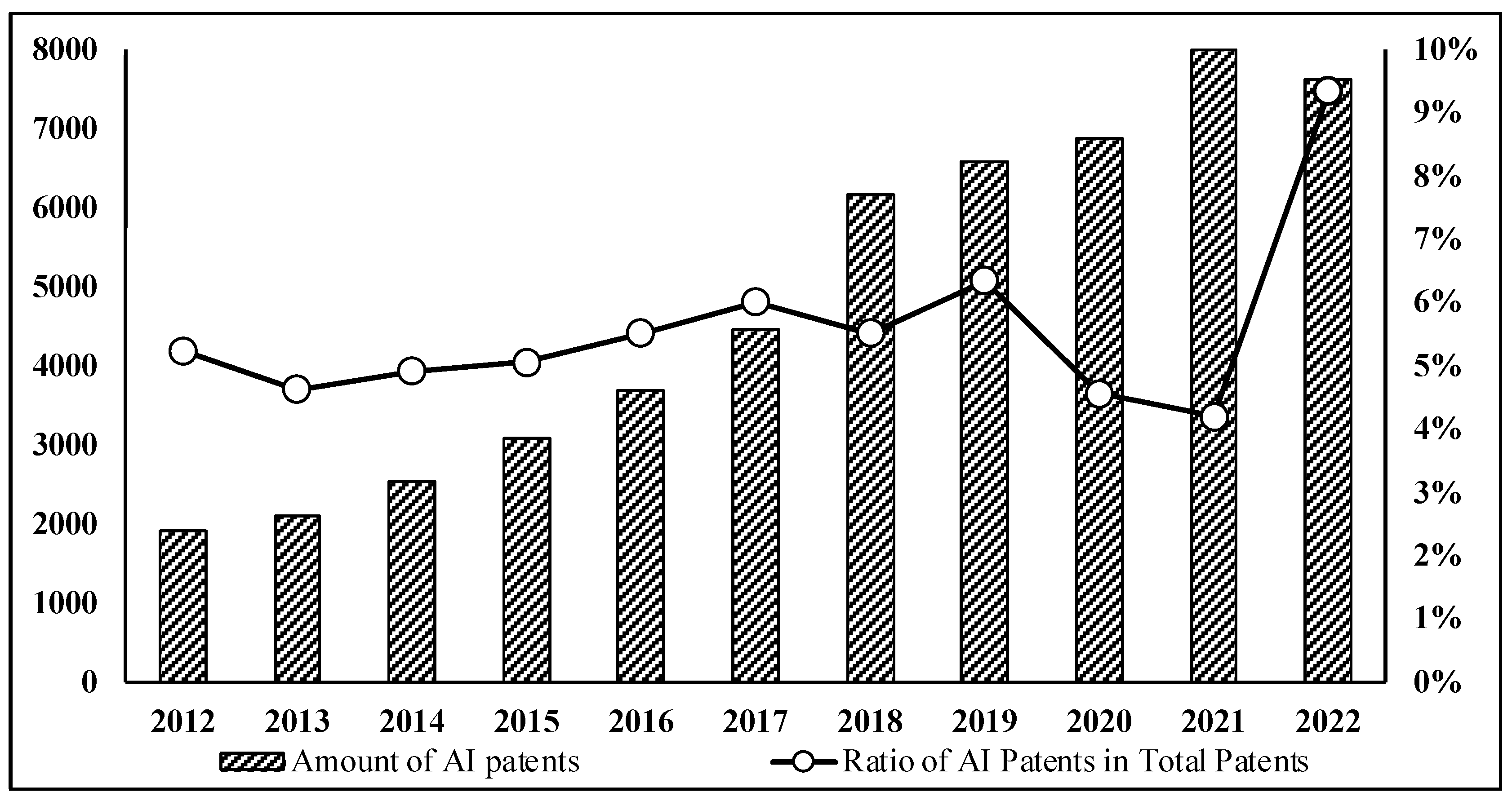

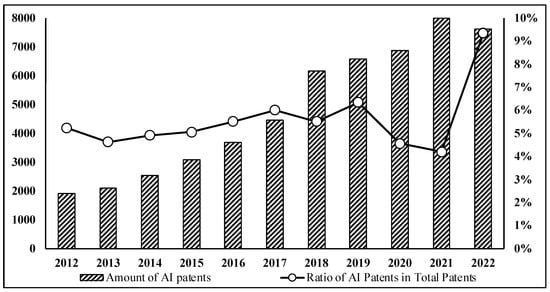

Empirical validation of this measurement framework reveals critical insights. As illustrated in Figure 4, the number of AI patents among China’s listed companies exhibited sustained growth from 2012 to 2021. Although the number of AI patents decreased in 2022, the proportion of AI patents to total patents peaked at 9% in that year. This divergence illustrates that AI patent development demonstrates stronger resilience compared to non-AI patents amid macroeconomic turbulence, suggesting that our methodology successfully captures strategic prioritization of AI technology, a dimension obscured by traditional survey-based measures.

Figure 4.

Trend in the AI patents by China’s listed companies.

3.2.3. Mediating Variables

Labor structure upgrading involves adjusting and refining the allocation of labor resources. This process aims to more appropriately align with the demands of firms’ development and technological advancement [37]. This study follows Dou’s method [36], using three specific indicators: the proportion of personnel with a bachelor’s degree or higher (HighEdu), the proportion of technical personnel (Tech), and the proportion of R&D personnel (R&Der). These indicators jointly measure the labor structure of enterprises.

3.2.4. Control Variables

To avoid the potential impact of other factors on firms’ labor share, the interference of missing variables needs to be minimized. According to previous research [13], this study selects eight control variables as follows: First, with regard to firms’ basic characteristics, this study controls indicators such as firm size (Size), labor intensity (Intensity), and the manager’s shareholding ratio (Mshare), as these operational characteristics can indirectly influence a firm’s labor relations [59]. Second, this study controls financial indicators, including the growth rate of operating income (Growth), management fee rate (Mfee), net profit margin on sales (Net Profit), and total asset turnover ratio (Turnover), as a firm’s financial performance can influence its labor investment decisions [60]. Furthermore, the study controls indicators related to non-AI technology patents (Other Patents), as non-AI technologies can also influence employment and income in the labor market [61]. Table 1 provides the definitions for all variables in the regression.

Table 1.

Variable definitions.

3.3. Regression Model Construction

This study primarily investigates the impact of AI technology on firms’ labor share. To avoid the impact of missing variable bias, Year, Industry, and Province are controlled, and the following fixed effect model is constructed:

In Equation (2), LS represents the dependent variable, which is labor share. AI stands for the independent variable, which is AI technology. Control refers to control variables. Year represents year controls. Industry represents industry controls. Province represents province controls. β is the coefficient. ε is the random perturbation term. The symbols i and t denote individual enterprises and years, respectively.

According to the above theoretical analysis, this study argues that AI technology can increase labor share by labor structure upgrading. Based on the above logic, this study conducts a two-stage test. First, this study tests whether AI technology facilitates labor structure upgrading; second, this study examines whether labor structure upgrading affects labor share. To empirically explore this mechanism, we adopt a two-stage analysis following Di Giuli and Laux’s research method [62].

Me is the mediating variable, representing labor structure upgrading (HighEdu, Tech and R&Der). The other variables are the same as in Equation (2). Equation (3) is the first-stage test, which indicates the impact of AI technology on labor structure upgrading. Equation (4) is the second-stage test, which indicates the influence of the affected labor structure upgrading on labor share.

4. Empirical Results and Analyses

4.1. Descriptive Statistics

Table 2 presents the descriptive statistical results of the main variables used in this study. The average value of LS is 0.144. More than 14% of the operating income of sample enterprises in China is used to pay salaries. The mean value of AI is 0.356, and the standard deviation is 0.777. The standard deviation is greater than the mean, indicating that the AI technology possessed by different enterprises varies widely. The mean value of HighEdu is 0.281, that of Tech is 0.215, and that of R&Der is 0.117, indicating that employees of Chinese listed companies are mainly less educated personnel, and the proportions of R&D and technical personnel are relatively small.

Table 2.

Descriptive statistics.

4.2. Baseline Regression

Table 3 presents the baseline regression results of the relationship between AI technology and firms’ labor share. The regression coefficient of AI in column (1) of Table 3 is significant at the 1% level. After adding the control variables and using the fixed effect model in column (2) of Table 3, the regression coefficient of AI decreases, and the significance level of the AI regression coefficient remains unchanged, revealing that AI technology can significantly promote firms’ labor share. Furthermore, we conducted quantile regressions at the 10%, 50%, and 90% levels, as shown in columns (3) to (5) of Table 3. The regression results reveal that the positive impact of AI technology on labor share intensifies. Therefore, Hypothesis 1 is supported.

Table 3.

Baseline regression.

4.3. Endogeneity Tests

4.3.1. Instrumental Variable Method

A potential reverse causal relationship may exist between AI technology and firms’ labor share. Specifically, an increase in labor share may lead to rising labor costs and a heightened demand for automation and intelligent technologies, prompting enterprises to expand their investment in AI research, development, and adoption. In this scenario, changes in labor share serve as a driving force behind AI technology development rather than its outcome [51]. Therefore, this study adopts the two-stage least squares method. The results are presented in Table 4.

Table 4.

Endogeneity tests.

First, the mean value of AI technology in Year–Industry–Region (M-AI) is selected as an instrumental variable [63], as in the same year, the industry and region where the enterprise is located are closely related to the individual AI technology of the enterprise, while being irrelevant to labor share.

Second, the level of internet development in the region where an enterprise is located supports the firm’s development and adoption of AI technology. Therefore, this study uses the number of local internet access points (10,000 per unit) to measure the level of internet development (Access) and selects it as an instrumental variable [64]. The level of internet development has no direct relationship with labor share.

The regression results in columns (1) and (2) of Table 4 show that both the average Year–Industry–Region AI technology (M-AI) and the level of internet development (Access) are positively correlated with AI technology, and the F-value is greater than 10. In the second stage, as shown in columns (3) and (4) of Table 4, the regression coefficients of AI technology on labor share are significantly positive at the 1% level. The instrumental variable method further supports Hypothesis 1 of this study.

4.3.2. Propensity Score Matching (PSM)

In the baseline regression analysis, a portion of the AI technology data contains zero values, and the control variables are correlated with labor share, potentially leading to sample selection bias. For instance, some enterprises that do not engage in AI technology innovation and adoption may exhibit characteristics such as smaller size and lower operating revenue, which could simultaneously influence labor share. Failing to consider this self-selection bias may result in misleading conclusions. Therefore, we use propensity score matching (PSM) to weaken the error caused by sample self-selection [65]. We set the samples with AI patents as the experimental group and those with zero AI patents as the control group. In the PSM analysis, we use the selected control variables as covariates to balance the two AI technology groups based on enterprise characteristics, so that the difference between the two groups of samples is only affected by AI technology, and they are matched using 1:1 nearest neighbor matching based on the covariates. After the matching process, the treatment and control group enterprises exhibit more similar characteristics in the propensity score-matched sample. This similarity enhances the comparability of their AI technology innovation and adoption behaviors, aligning them more closely with the conditions of a quasi-natural experiment. The regression results in column (5) of Table 4 show that the coefficient of AI is significantly positive at the 1% level. The results reveal that the conclusions of this study are still robust after alleviating the problem of self-selection bias.

4.4. Robustness Tests

4.4.1. Replacing the Labor Share Metrics

To eliminate potential bias in the regression results arising from different measurement methods, the ratio of the credit amount payable in employee compensation to total operating income is used as a proxy for measuring labor share (LS2). As presented in column (1) of Table 5, the regression results are consistent with the previous analysis.

Table 5.

Robustness tests.

4.4.2. Replacing the AI Technology Indicators

To ensure the robustness of the results, this study calculates authorized invention patents related to AI technology as the apportion of the total invention authorized patents of China’s listed companies to remeasure the AI technology indicator [AI (Authorized)] and tests the relationship between AI technology and labor share. Additionally, following the measurement approach developed by Xia & Shao [6], we extract text information related to “AI” from listed companies’ annual reports and employ the natural logarithm of total word frequency as a proxy indicator for firms’ AI technology [AI (Keyword)]. The results are presented in columns (2) and (3) of Table 5, and the significance of the regression coefficient of AI is consistent with the previous analysis, indicating the reliability of the conclusions in this study.

4.4.3. Considering the Lagging Effect of AI Technology

To improve the reliability of the conclusions and take into account the lagged effect of AI technology, this study uses lagged AI technology as the independent variable to verify its influence. The regression results are presented in column (3) of Table 5; the regression coefficients of AI are significantly and positively correlated at the 1% level, and the regression results are consistent with the previous analysis, which further validates the reliability of the conclusions in this study.

4.4.4. Excluding Samples from Special Years

The global COVID-19 pandemic, which peaked from 2020 to 2021, had a detrimental impact on corporate innovation and operations, potentially causing significant volatility in the data from these years. As a result, this study excludes the 2020 and 2021 samples in its robustness test. The findings presented in column (4) of Table 5 demonstrate that the regression coefficient for AI is significantly positive at the 1% level. These results suggest that, even after excluding the data from these exceptional years, the empirical findings remain robust, further reinforcing the conclusions of this study.

4.5. Mediating Effect Test

As AI technology advances and penetrates enterprise operations, it generates an escalating demand for R&D, technical, and highly educated personnel [22]. This trend aligns with the hypothesis that AI technology exerts a “complementary effect” on R&D, technical, and highly educated labor [66]. While our baseline analysis establishes a statistically significant positive association between AI technology and labor share, the transmission channel warrants rigorous investigation. Based on this, the study examines the impact of AI technology on labor share by promoting labor structure upgrading, and the corresponding results are presented in Table 6. In the first-stage test, columns (1) to (3) of Table 6 show that the regression coefficients of AI are significantly positive at the 1% level, indicating that AI technology increases labor structure upgrading. In the second-stage test, columns (4) to (6) of Table 6 show that the regression coefficients of HighEdu, Tech, and R&Der are significantly positive at the 1% level, suggesting that labor structure upgrading can increase labor share. The regression results reveal that AI technology can upgrade labor structure, thereby increasing labor share. Therefore, Hypothesis 2 is supported.

Table 6.

Mediating tests.

5. Further Analysis

5.1. Heterogeneity Analysis

In the above analysis, this paper examines the relationship between AI technology and the labor share of enterprises from an overall perspective. To deepen the investigation, we further analyze how AI technology exerts differentiated effects under varying external environments and enterprise characteristics. Therefore, this study further explores the heterogeneous impact of AI technology on labor share across external environments and enterprise-specific factors.

5.1.1. Heterogeneity Analysis of External Environments

First, the density of labor unions and strict employment protection regulations are significant factors contributing to labor market rigidity. This rigidity imposes greater constraints on enterprises when dismissing routine labor, thereby hindering the optimization of firms’ labor structures [67]. To evaluate the labor market rigidity in different regions, this study uses the number of local grassroots trade union organizations from the China Labor Statistical Yearbook. As grassroots unions often advocate stronger labor protection measures, they result in reduced flexibility in personnel adjustments for enterprises. Based on the median of the number of local grassroots trade union organizations, the sample was divided into two groups. The results of the heterogeneity test are shown in columns (1) and (2) of Table 7. In the sample group with low labor market rigidity, the effect of AI technology on increasing firms’ labor share is statistically more significant. This finding indicates that a low level of labor market rigidity helps enhance the benefits of AI technology in raising the labor share of enterprises.

Table 7.

Heterogeneity analysis of external environments.

Second, a mature factor market featuring a diverse labor force and high mobility provides labor support for enterprises to optimize their labor structure. Therefore, this study adopts the Fan Gang Index to measure the degree of labor market supply [68]. Based on the median value of the Fan Gang Index, the sample is divided into two groups. The heterogeneity test results are shown in columns (3) and (4) of Table 7. In the sample group with high labor market supply, the effect of AI technology on increasing the labor share of enterprises is more significant. The empirical results indicate that the higher labor market supply in the regions where enterprises are located, the more pronounced the impact of AI technology on enhancing the labor share of enterprises.

In addition, talent policy support can effectively reduce the costs for enterprises to attract and retain scientific and technological talent while enhancing the salary competitiveness of R&D and technical positions [69]. This study divides the sample into two groups based on the “government subsidy details” disclosed in the financial statements of the listed companies: enterprises receiving talent policy subsidies and those without. The heterogeneity test results are shown in columns (5) and (6) of Table 7. In the sample group of enterprises receiving talent policy support, the effect of AI technology on increasing the labor share of enterprises is more significant. This result indicates that the more subsidies enterprises receive, the more pronounced the role of AI technology in promoting their labor share will be.

5.1.2. Heterogeneity Analysis of Enterprise Characteristics

First, labor-intensive enterprises have a large workforce and relatively lower employee qualifications. Therefore, labor-intensive enterprises might be more sensitive to AI technology [13]. This study divides the samples into two groups based on the mean value of labor intensity and categorizes enterprises into labor-intensive and capital-intensive groups. Columns (1) and (2) of Table 8 present the regression results of labor-intensive enterprises and capital-intensive enterprises. The results reveal that AI technology has a significantly positive effect on labor share in labor-intensive enterprises compared to the capital-intensive subsample.

Table 8.

Heterogeneity analysis of enterprise characteristics.

Besides, work in high-tech enterprises requires employees with sufficient skills and knowledge, and their abilities are more valued [70]. Consequently, high-tech enterprises are more willing to increase the salaries of high-skill personnel, whose roles are more critical in such enterprises. This study separates the sample into high-tech and non-high-tech enterprises according to “Administrative measures for the determination of high and new technology enterprises” by the Ministry of Science and Technology in 2016. Columns (3) and (4) of Table 8 show the regression results of high-tech and non-high-tech enterprises. The regression coefficient is more obvious in the high-tech enterprises, illustrating that AI technology is more effective in enhancing labor share for high-tech enterprises.

Finally, non-state-owned enterprises face greater competitive pressure in the market, tending to adopt more flexible and responsive business models when implementing AI technology [71]. In other words, the labor share in non-state-owned enterprises is likely to be more significantly influenced by AI technology. This study divides the sample into state-owned enterprises and non-state-owned enterprises. Columns (5) and (6) of Table 8 present the regression results for these subgroups. The regression coefficient is more significant in the non-state-owned enterprise subgroup, indicating that the positive effect of AI technology on labor share is more significant in non-state-owned enterprises.

5.2. Economic Effects Test

Extensive research demonstrates that advancements in AI technology enhance the automation of business processes and provide robust decision support systems [6,50]. These advancements are further associated with enterprise growth and increased TFP [10,72]. Building on this foundation, our study further explores how AI technology influences TFP through its impact on labor share. From an enterprise perspective, labor share essentially reflects labor costs [73]. The innovation and adoption of AI technology generally increase labor share, implying heightened labor cost burdens and greater cash flow pressure for enterprises, which may reduce a firm’s TFP. For employees, an increase in labor share signifies improved wages and benefits [14], which may enhance employee motivation and productivity, thereby positively influencing TFP [10].

To examine how AI technology affects TFP by influencing labor share, this study calculates TFP using the methods proposed by Levinson & Petrin [74] and Olley & Pakes [75]. In Equations (5) and (6), TFP is treated as the dependent variable, while AI technology (AI), labor share (LS), and their interaction term (AI × LS) are included as key variables. Other variables remain the same as in Equation (2). Equations (5) and (6) are specifically designed to test the impact of AI technology on firms’ TFP by affecting labor share.

As shown in columns (1) and (2) of Table 9, the coefficients of AI are significantly positive at the 1% level, indicating that AI technology contributes to the enhancement of firms’ TFP. Furthermore, this study examines the impact of the increase in labor share induced by AI technology on firms’ TFP. The results, reported in columns (3) and (4) of Table 9, show that the coefficients of AI remain significantly positive, while those of LS are significantly negative at the 1% level. This suggests that a higher labor share has an adverse effect on firms’ TFP, aligning with the theoretical expectation of a negative relationship between labor share and firms’ TFP. Notably, the interaction term AI × LS is significantly positive at the 1% level. These results indicate that AI technology mitigates the negative impact of labor share on firms’ TFP. While AI technology increases labor share, it also achieves a mutually beneficial outcome of improved employee welfare and enhanced TFP for enterprises.

Table 9.

Economic effects test.

6. Theoretical and Practical Implications

6.1. Theoretical Implications

This study makes three theoretical implications. First, this study enhances our understanding of AI technology outcomes by exploring the relationship between AI technology and labor share within enterprises. Unlike earlier research on AI technology outcomes at the macro level [4,23,25], recent studies have shifted focus to the micro level, particularly organizational analyses. Although these studies have investigated the influence of AI technology on firms’ innovation output, productivity, employee behavior, and performance [8,9,10,11,12], its impact on labor share from a micro-level organizational perspective remains underexplored. Our study thus contributes to the micro-level analysis of AI technology outcomes by revealing its positive influence on labor share while clarifying the boundary conditions under which this effect is stronger—specifically, in regions with low labor market rigidity, high labor market supply, and talent policy support, as well as among labor-intensive, high-tech, and non-state-owned enterprises.

Second, this study extends the literature on the theory of skill-biased technical change by uncovering the transmission channel of labor structure upgrading between AI technology and labor share. While prior literature predominantly examines how digital transformation and industrial robotics reshape enterprise-level labor relations under this theoretical framework [31,32,33], it overlooks the technological attributes of cognitive augmentation for AI. Building on previous theoretical analysis, we empirically demonstrate that AI technology innovation and adoption increase labor share by driving skill-biased structural transformation through its heightened demand for high-skill labor (e.g., highly educated, technical, and R&D personnel). This stands in contrast with the “technology dividend substitution” hypothesis [21], offering fresh evidence that AI-driven labor upgrading can indirectly increase income share. Therefore, our study uncovers the relationship between AI technology and labor share from the mediating mechanism of labor structure upgrading, thereby advancing the understanding of the theory of skill-biased technical change.

In addition, this study investigates the impact of AI technology on the firms’ TFP while increasing labor share, thereby enriching the microeconomic consequences of AI technology. Although the existing literature elucidates AI’s productivity-enhancing effects via automation and intelligent decision [6,10], this study contributes novel evidence suggesting that AI technology elevates both TFP and labor share – a critical finding that challenges conventional assumptions about the efficiency–equity tradeoff. Our enterprise-level analysis reveals that AI-driven operational optimization and human capital augmentation foster synergistic development between enterprises and employees, reconciling productivity growth with equitable income distribution. These results enrich emerging debates on the distributional consequences of AI technology by demonstrating its potential to generate Pareto improvements in enterprise-level economic systems [3,10]. Ultimately, this facilitates a mutually beneficial outcome for both employee welfare and enterprise development.

6.2. Practical Implications

The conclusions of this study provide the following practical implications for enterprise managers in formulating and implementing strategies. First, as AI technology continues to reshape industries, enterprises are encouraged to prioritize the integration of these technologies into their core operations to ensure seamless adaptation to technological changes. Our findings indicate that AI technology can increase the labor share of enterprises while mitigating the negative impact of rising labor costs by enhancing the marginal productivity of employees. Consequently, driving the innovation and adoption of AI technology is strategically important for enterprises, as it enables the synergistic optimization of both employee welfare and productivity.

Second, to fully harness the potential of AI technology, enterprises should proactively restructure their workforce according to technological demands. This study considers that labor structure upgrading is a key condition for AI technology to enhance firms’ labor share. Enterprises can optimize their labor structure through strategic mergers such as technological acquisitions and the integration of R&D teams, thereby aligning advanced technological capabilities with high-skill talent. Additionally, enterprises could prioritize recruiting, training, and retaining technical, R&D, and highly educated professionals, all of who are essential for implementing AI technologies. Competitive incentives, including career development programs, performance-based rewards, and a supportive work environment, will further strengthen employee engagement and productivity.

Finally, it would be beneficial for enterprises to fully leverage external environment factors and their specific characteristics, adopting a multidimensional strategy to advance the innovation and adoption of AI technology. This study suggests that the impact of AI technology on labor share varies across external environments and enterprise characteristics. Enterprises should dynamically assess the potential impact of external environment factors, including low labor market rigidity, high labor supply, and talent policy support, as well as firms’ specific characteristics on labor relations, such as labor intensity, technological nature, and property rights structure. By doing so, they can enhance AI’s role in upgrading labor structures and improving employee welfare.

7. Conclusions

Based on the theory of skill-biased technological change, this study explores the impact of AI technology on labor share at the enterprise level. Our findings reveal that AI technology can significantly increase firm’s labor share, with labor structure upgrading playing a mediating role in this relationship. Moreover, the influence of AI technology on labor share is stronger for enterprises with low labor market rigidity, high labor market supply, and talent policy support in external environments, as well as in labor-intensive, high-tech, and non-state-owned enterprises. Notably, this study finds that advancements in AI technology have achieved mutually beneficial outcomes of improving labor share and enhancing TFP. These insights will help advance research on AI technology, labor share, labor structure upgrading, and the theory of skill-biased technological change.

While this study has several insights, it is not without limitations. First, the research conclusions are developed based on a sample of China’s listed companies. Due to significant differences in governance structures and operation processes between listed and non-listed companies, the findings should be applied to non-listed companies with caution. To enhance the generalizability of the findings, future research could combine questionnaire survey methods to expand the sample size and validate the generalizability of the theoretical framework, which may yield richer insights.

Second, this study mainly employs natural language processing (NLP) and keyword-matching technologies to identify AI patents by extracting relevant keywords from the “Dictionary of AI Technology” in the abstracts of granted patents. Future research could incorporate firm-level R&D activity in AI projects, or use AI-related keyword frequency data extracted from annual reports, to measure AI technology intensity more accurately.

Third, the labor share discussed in this study is an income distribution indicator that captures how a firm’s value added is divided between labor and capital, which does not directly reflect changes in workforce size. In addition, because of data availability constraints, our labor share measure mainly relies on employees’ direct wages and excludes implicit compensation such as stock-based incentives and fringe benefits. Future research could extend this work by adding quantity indicators (such as employment size) as supplementary analyses and broadening the labor share definition to include a more comprehensive set of remuneration components.

Author Contributions

Conceptualization, X.X., J.C., W.X. and C.W.; methodology, X.X., J.C., W.X. and C.W.; software, J.C.; formal analysis, J.C.; validation, W.X.; investigation, W.X.; data curation, J.C.; writing—original draft, J.C.; writing—review and editing, J.C., W.X. and C.W.; supervision, X.X.; project administration, C.W.; resources, X.X.; funding acquisition, X.X. and C.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Guangzhou Industrial Science and Technology Innovation Big Data and Intelligent Computing Technology Key Laboratory [grant number 2025A03J3140], the Guangdong Provincial Department of Education Innovation Team Project [grant number 2022WCXTD020], the Guangdong Philosophy and Social Science Foundation [grant number GD25YSG02], and the National Natural Science Foundation of China [grant number 72302012].

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Informed consent was obtained from all subjects involved in this study.

Data Availability Statement

These data are not publicly available for privacy protection reasons. If needed, one can request access to the data used in this study from the corresponding author.

Acknowledgments

The authors thank the Systems editors-in-chief and the anonymous reviewers for their guidance and advice throughout the review process.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

Based on the research by Xi and Shao [9], we extracted 73 terms from the “Dictionary of AI Technology” (see Figure A1). Following Xue’s [58] method and leveraging natural language processing (NLP) and keyword-matching technologies, we identified AI technology terms in patent abstracts to determine whether a patent is AI related.

Figure A1.

Dictionary of AI technology.

Figure A1.

Dictionary of AI technology.

References

- Xia, L.; Han, Q.; Yu, S. Industrial intelligence and industrial structure change: Effect and mechanism. Int. Rev. Econ. Financ. 2024, 93, 1494–1506. [Google Scholar] [CrossRef]

- The State of AI in 2022 and a Half Decade in Review. Available online: http://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai-in-2022-and-a-half-decade-in-review (accessed on 20 June 2025).

- Damioli, G.; Van Roy, V.; Vertesy, D. The impact of artificial intelligence on labor productivity. Eurasian Bus. Rev. 2021, 11, 1–25. [Google Scholar] [CrossRef]

- Qian, C.; Zhu, C.; Huang, D.H.; Zhang, S. Examining the influence mechanism of artificial intelligence development on labor income share through numerical simulations. Technol. Forecast. Soc. Change 2023, 188, 122315. [Google Scholar] [CrossRef]

- Brynjolfsson, E.; Hui, X.; Liu, M. Does machine translation affect international trade? Evidence from a large digital platform. Manag. Sci. 2019, 65, 5449–5460. [Google Scholar] [CrossRef]

- Agrawal, A.; Gans, J.S.; Goldfarb, A. Artificial intelligence: The ambiguous labor market impact of automating prediction. J. Econ. Perspect. 2019, 33, 31–49. [Google Scholar] [CrossRef]

- Kaplan, A.; Haenlein, M. Siri, Siri, in my hand: Who’s the fairest in the land? On the interpretations, illustrations, and implications of artificial intelligence. Bus. Horiz. 2019, 62, 15–25. [Google Scholar] [CrossRef]

- Rammer, C.; Fernández, G.P.; Czarnitzki, D. Artificial intelligence and industrial innovation: Evidence from German firm-level data. Res. Policy 2022, 51, 104555. [Google Scholar] [CrossRef]

- Xi, K.; Shao, X. Impact of AI applications on corporate green innovation. Int. Rev. Econ. Financ. 2025, 99, 104007. [Google Scholar] [CrossRef]

- Yang, C.H. How artificial intelligence technology affects productivity and employment: Firm-level evidence from Taiwan. Res. Policy 2022, 51, 104536. [Google Scholar] [CrossRef]

- Wamba, S.F. Impact of artificial intelligence assimilation on firm performance: The mediating effects of organizational agility and customer agility. Int. J. Inf. Manag. 2022, 67, 102544. [Google Scholar] [CrossRef]

- Wang, J.; Xing, Z.; Zhang, R. AI technology application and employee responsibility. Humanit. Soc. Sci. Commun. 2023, 10, 356. [Google Scholar] [CrossRef]

- Li, C.; Huo, P.; Wang, Z.; Zhang, W.; Liang, F.; Mardani, A. Digitalization generates equality? Enterprises’ digital transformation, financing constraints, and labor share in China. J. Bus. Res. 2023, 163, 113924. [Google Scholar] [CrossRef]

- Bryson, A.; Clark, A.E.; Freeman, R.B.; Green, C.P. Share capitalism and worker wellbeing. Labour Econ. 2016, 42, 151–158. [Google Scholar] [CrossRef] [PubMed]

- Karabarbounis, L.; Neiman, B. The global decline of the labor share. Q. J. Econ. 2013, 129, 61–103. [Google Scholar] [CrossRef]

- Barkai, S. Declining labor and capital shares. J. Financ. 2020, 75, 2421–2463. [Google Scholar] [CrossRef]

- Bom, P.R.; Erauskin, I. Productive government investment and the labor share. Int. Rev. Econ. Financ. 2022, 82, 347–363. [Google Scholar] [CrossRef]

- Miao, Y.; Shi, Y.; Jing, H. Effect of digital transformation on labor income share in manufacturing enterprises: Insights from technological innovation and industry–university–research collaborations. Kybernetes 2024, 53, 24–46. [Google Scholar] [CrossRef]

- Acemoglu, D. Why do new technologies complement skills? Directed technical change and wage inequality. Q. J. Econ. 1998, 113, 1055–1089. [Google Scholar] [CrossRef]

- Wang, J.; Hu, Y.; Zhang, Z. Skill-biased technological change and labor market polarization in China. Econ. Model. 2021, 100, 105507. [Google Scholar] [CrossRef]

- Aghion, P.; Jones, B.F.; Jones, C.I. Artificial Intelligence and Economic Growth; National Bureau of Economic Research: Cambridge, MA, USA, 2017. [Google Scholar]

- Acemoglu, D.; Restrepo, P. Automation and new tasks: How technology displaces and reinstates labor. J. Econ. Perspect. 2019, 33, 3–30. [Google Scholar] [CrossRef]

- Autor, D.; Chin, C.; Salomons, A.; Seegmiller, B. New frontiers: The origins and content of new work, 1940–2018. Q. J. Econ. 2024, 139, 1399–1465. [Google Scholar] [CrossRef]

- Lokuge, S.; Sedera, D.; Grover, V.; Dongming, X. Organizational readiness for digital innovation: Development and empirical calibration of a construct. Inf. Manag. 2019, 56, 445–461. [Google Scholar] [CrossRef]

- Xie, M.; Ding, L.; Xia, Y.; Guo, J.; Pan, J.; Wang, H. Does artificial intelligence affect the pattern of skill demand? Evidence from Chinese manufacturing firms. Econ. Model. 2021, 96, 295–309. [Google Scholar] [CrossRef]

- Ma, H.; Gao, Q.; Li, X.; Zhang, Y. AI development and employment skill structure: A case study of China. Econ. Anal. Policy 2022, 73, 242–254. [Google Scholar] [CrossRef]

- Frey, C.B.; Osborne, M.A. The future of employment: How susceptible are jobs to computerisation? Technol. Forecast. Soc. Change 2017, 114, 254–280. [Google Scholar] [CrossRef]

- Wu, Y.; Lin, Z.; Zhang, Q.; Wang, W. Artificial intelligence, wage dynamics, and inequality: Empirical evidence from Chinese listed firms. Int. Rev. Econ. Financ. 2024, 96, 103739. [Google Scholar] [CrossRef]

- Jiang, H.; Wang, X.; Liu, C. Automated machines and the labor wage gap. Technol. Forecast. Soc. Change 2024, 206, 123505. [Google Scholar] [CrossRef]

- Fossen, F.M.; Sorgner, A. New digital technologies and heterogeneous wage and employment dynamics in the United States: Evidence from individual-level data. Technol. Forecast. Soc. Change 2022, 175, 121381. [Google Scholar] [CrossRef]

- Feng, S.; Zhang, R.; Di, D.; Li, G. Does digital transformation promote global value chain upgrading? Evidence from Chinese manufacturing firms. Econ. Model. 2024, 139, 106810. [Google Scholar] [CrossRef]

- Li, R.; Xu, S.; Zhang, Y. Can digital transformation reduce within-firm pay inequality? Evidence from China. Econ. Model. 2023, 129, 106530. [Google Scholar] [CrossRef]

- Luo, H.; Qiao, H. Exploring the impact of industrial robots on firm innovation under circular economy umbrella: A human capital perspective. Manag. Decis. 2024, 62, 2763–2790. [Google Scholar] [CrossRef]

- Holmström, J. From AI to digital transformation: The AI readiness framework. Bus. Horiz. 2022, 65, 329–339. [Google Scholar] [CrossRef]

- Buera, F.J.; Kaboski, J.P. The rise of the service economy. Am. Econ. Rev. 2012, 102, 2540–2569. [Google Scholar] [CrossRef]

- Dou, B.; Guo, S.; Chang, X.; Wang, Y. Corporate digital transformation and labor structure upgrading. Int. Rev. Financ. Anal. 2023, 90, 102904. [Google Scholar] [CrossRef]

- Li, W.; Yang, X.; Yin, X. Digital transformation and labor upgrading. Pac. Basin Financ. J. 2024, 83, 102280. [Google Scholar] [CrossRef]

- Zhu, Y.; Yu, D. Digital transformation and firms’ bargaining power: Evidence from China. J. Bus. Res. 2024, 183, 114851. [Google Scholar] [CrossRef]

- Yuan, Y.; Sun, Y.; Chen, H. Does artificial intelligence affect firms’ inner wage gap? Appl. Econ. 2025, 57, 2365–2371. [Google Scholar] [CrossRef]

- Goldfarb, A.; Taska, B.; Teodoridis, F. Could machine learning be a general purpose technology? A comparison of emerging technologies using data from online job postings. Res. Policy 2023, 52, 104653. [Google Scholar] [CrossRef]

- Acemoglu, D.; Johnson, S. Learning from Ricardo and Thompson: Machinery and labor in the early industrial revolution and in the age of artificial intelligence. Annu. Rev. Econ. 2024, 16, 597–621. [Google Scholar] [CrossRef]

- Xu, X.; Wang, W.; Zeng, Y.; Dong, Y.; Hao, H. Innovations in attracting regional talent. Manag. Decis. 2025, 63, 1763–1786. [Google Scholar] [CrossRef]

- Monteiro, A.; Cepêda, C.; Da Silva, A.C.F.; Vale, J. The relationship between AI adoption intensity and internal control system and accounting information quality. Systems 2023, 11, 536. [Google Scholar] [CrossRef]

- Liu, J.; Chang, H.; Forrest, J.Y.L.; Yang, B. Influence of artificial intelligence on technological innovation: Evidence from the panel data of China’s manufacturing sectors. Technol. Forecast. Soc. Change 2020, 158, 120142. [Google Scholar] [CrossRef]

- Giuggioli, G.; Pellegrini, M.M. Artificial intelligence as an enabler for entrepreneurs: A systematic literature review and an agenda for future research. Int. J. Entrep. Behav. Res. 2023, 29, 816–837. [Google Scholar] [CrossRef]

- Caggese, A.; Cuñat, V.; Metzger, D. Firing the wrong workers: Financing constraints and labor misallocation. J. Financ. Econ. 2019, 133, 589–607. [Google Scholar] [CrossRef]

- Ying, Y.; Cui, X.; Jin, S. Artificial intelligence and green total factor productivity: The moderating effect of slack resources. Systems 2023, 11, 356. [Google Scholar] [CrossRef]

- Liu, L.; Wang, X.; Tang, L.; Sun, Z.; Wang, X. Exploring the conditional ESG payoff of AI adoption: The roles of learning capability, digital TMT, and operational slack. Systems 2025, 13, 399. [Google Scholar] [CrossRef]

- Buera, F.J.; Kaboski, J.P.; Rogerson, R.; Vizcaino, J.I. Skill-biased structural change. Rev. Econ. Stud. 2022, 89, 592–625. [Google Scholar] [CrossRef]

- Acemoglu, D.; Restrepo, P. The race between man and machine: Implications of technology for growth, factor shares, and employment. Am. Econ. Rev. 2018, 108, 1488–1542. [Google Scholar] [CrossRef]

- Acemoglu, D.; Autor, D.; Hazell, J.; Restrepo, P. Artificial intelligence and jobs: Evidence from online vacancies. J. Labor. Econ. 2022, 40, S293–S340. [Google Scholar] [CrossRef]

- Brynjolfsson, E.; Mitchell, T.; Rock, D. What can machines learn, and what does it mean for occupations and the economy. AEA Pap. Proc. 2018, 108, 43–47. [Google Scholar] [CrossRef]

- Brynjolfsson, E.; McElheran, K. The rapid adoption of data-driven decision-making. Am. Econ. Rev. 2016, 106, 133–139. [Google Scholar] [CrossRef]

- Du, J.; He, J.; Yang, J.; Chen, X. How industrial robots affect labor income share in task model: Evidence from Chinese A-share listed companies. Technol. Forecast. Soc. Change 2024, 208, 123655. [Google Scholar] [CrossRef]

- Autor, D.; Salomons, A. Is Automation Labor-Displacing? Productivity Growth, Employment, and the Labor Share. NBER Work. Pap. 2018, 1–74. [Google Scholar] [CrossRef]

- Chen, N.; Sun, D.; Chen, J. Digital transformation, labour share, and industrial heterogeneity. J. Innov. Knowl. 2022, 7, 100173. [Google Scholar] [CrossRef]

- Lennartz, S.; Dratsch, T.; Zopfs, D.; Persigehl, T.; Maintz, D.; Große Hokamp, N.; Pinto dos Santos, D. Use and control of artificial intelligence in patients across the medical workflow: Single-center questionnaire study of patient perspectives. J. Med. Internet Res. 2021, 23, e24221. [Google Scholar] [CrossRef]

- Xue, X.; Tan, X.; Ji, A.; Xue, W. Measuring the global digital technology innovation network in the construction industry. IEEE Trans. Eng. Manag. 2024, 71, 11138–11165. [Google Scholar] [CrossRef]

- Atanassov, J.; Kim, E.H. Labor and corporate governance: International evidence from restructuring decisions. J. Financ. 2009, 64, 341–374. [Google Scholar] [CrossRef]

- Cao, J.; Tang, J. Party organization embedding and enterprise labor income share. Int. Rev. Econ. Financ. 2024, 96, 103638. [Google Scholar] [CrossRef]

- Su, C.W.; Yuan, X.; Umar, M.; Lobonţ, O.R. Does technological innovation bring destruction or creation to the labor market? Technol. Soc. 2022, 68, 101905. [Google Scholar] [CrossRef]

- Di Giuli, A.; Laux, P.A. The effect of media-linked directors on financing and external governance. J. Financ. Econ. 2022, 145, 103–131. [Google Scholar] [CrossRef]

- Huang, Q.; Fang, J.; Xue, X.; Gao, H. Does Digital Innovation Cause Better ESG Performance? An Empirical Test of A-Listed Firms in China. Res. Int. Bus. Financ. 2023, 66, 102049. [Google Scholar] [CrossRef]

- Huang, Q.Y.; Xu, C.H.; Xue, X.L.; Zhu, H. Can digital innovation improve firm performance: Evidence from digital patents of Chinese listed firms. Int. Rev. Financ. Anal. 2023, 89, 102810. [Google Scholar] [CrossRef]

- King, G.; Nielsen, R. Why propensity scores should not be used for matching. Polit. Anal. 2019, 27, 435–454. [Google Scholar] [CrossRef]

- Herrendorf, B.; Rogerson, R.; Valentinyi, K. Growth and structural transformation. Handb. Econ. Growth 2014, 2, 855–941. [Google Scholar]

- Nickell, S. Unemployment and labor market rigidities: Europe versus North America. J. Econ. Perspect. 1997, 11, 55–74. [Google Scholar] [CrossRef]

- Hu, X.; Liu, L.; Wang, D. How does regional carbon transition affect loan pricing? Evidence from China. Financ. Res. Lett. 2024, 70, 106356. [Google Scholar] [CrossRef]

- Shao, Y.; Chen, Z. Can government subsidies promote the green technology innovation transformation? Evidence from Chinese listed companies. Econ. Anal. Policy 2022, 74, 716–727. [Google Scholar] [CrossRef]

- Nunes, P.M.; Serrasqueiro, Z.; Leitao, J. Is there a linear relationship between R&D intensity and growth? Empirical evidence of non-high-tech vs. high-tech SMEs. Res. Policy 2012, 41, 36–53. [Google Scholar]

- Liu, Y.; Guo, M.; Han, Z.; Gavurova, B.; Bresciani, S.; Wang, T. Effects of digital orientation on organizational resilience: A dynamic capabilities perspective. J. Manuf. Technol. Manag. 2024, 35, 268–290. [Google Scholar] [CrossRef]

- Furman, J.; Seamans, R. AI and the economy. Innov. Policy Econ. 2019, 19, 161–191. [Google Scholar] [CrossRef]

- Grossman, G.M.; Oberfield, E. The elusive explanation for the declining labor share. Annu. Rev. Econ. 2022, 14, 93–124. [Google Scholar] [CrossRef]

- Levinson, J.; Petrin, A. Estimating production functions using inputs to control for unobservables. Rev. Econ. Stud. 2003, 70, 317–341. [Google Scholar] [CrossRef]

- Olley, S.; Pakes, A. The dynamics of productivity in the telecommunications equipment industry. Econometrica 1996, 64, 1263–1297. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).