A Game Theoretic Approach to Electric Vehicle Promotion Policy Selection from the Consumer Side

Abstract

1. Introduction

- What are the optimal decisions for the consumers, the manufacturers, and the government under different levels of EV carbon emissions?

- In the context of promoting EVs, restraining FVs, reducing environmental pollution, and enhancing social welfare, which policy is more advantageous?

- How does the basic utility valuation heterogeneity affect the implementation effect of different policies for promoting EVs?

2. Literature Review

2.1. The Impact of Basic Utility Heterogeneity Difference on Automotive Supply Chain Decisions

2.2. The Effect of the Government’s Incentive Policies on EVs

2.3. Research Summary

3. Model

3.1. Model Description

3.2. Basic Assumption

4. PS Policy

4.1. PS ()

- (i)

- When , then and would increase as the difference in basic utility valuation increased.

- (ii)

- Whenif , then would increase as the difference in basic utility valuation increased,if , then would decrease as the difference in basic utility valuation increased,if , then would increase as the difference in basic utility valuation increased,if , then would decrease as the difference in basic utility valuation increased.

- (i)

- When , the overall social welfare increases with the increase in purchase subsidy.

- (ii)

- Whenif , then the overall social welfare increases with the increase in purchase subsidy.If , then the overall social welfare decreases with the increase in purchase subsidy.

- (iii)

- When , the overall social welfare decreases with the increase in purchase subsidy.

4.2. PS ()

- (i)

- When , the overall social welfare increases with the increase in purchase subsidy.

- (ii)

- When ,if , then the overall social welfare increases with the increase in purchase subsidy;if , then the overall social welfare decreases with the increase in purchase subsidy.

- (iii)

- When , the overall social welfare decreases with the increase in purchase subsidy.

5. PCT Policy

5.1. PCT ()

- (i)

- When , the and would increase as the difference in basic utility valuation increased.

- (ii)

- Whenif , then an increase in produces an increase in the ,if , then an increase in produces a decrease in the ,if , then an increase in produces an increase in the ,if , then an increase in produces a decrease in the .

- (i)

- When , the overall social welfare increases with the increase in personal carbon tax.

- (ii)

- When ,if , the overall social welfare increases with the increase in personal carbon tax;if , the overall social welfare decreases with the increase in personal carbon tax.

- (iii)

- When , the overall social welfare decreases with the increase in personal carbon tax.

5.2. PCT ()

- (i)

- When , the overall social welfare increases with the increase in .

- (ii)

- When ,if , then the overall social welfare increases with the increase in ;if , then the overall social welfare decreases with the increase in

- (iii)

- When , the overall social welfare decreases with the increase in .

6. Numerical Simulations

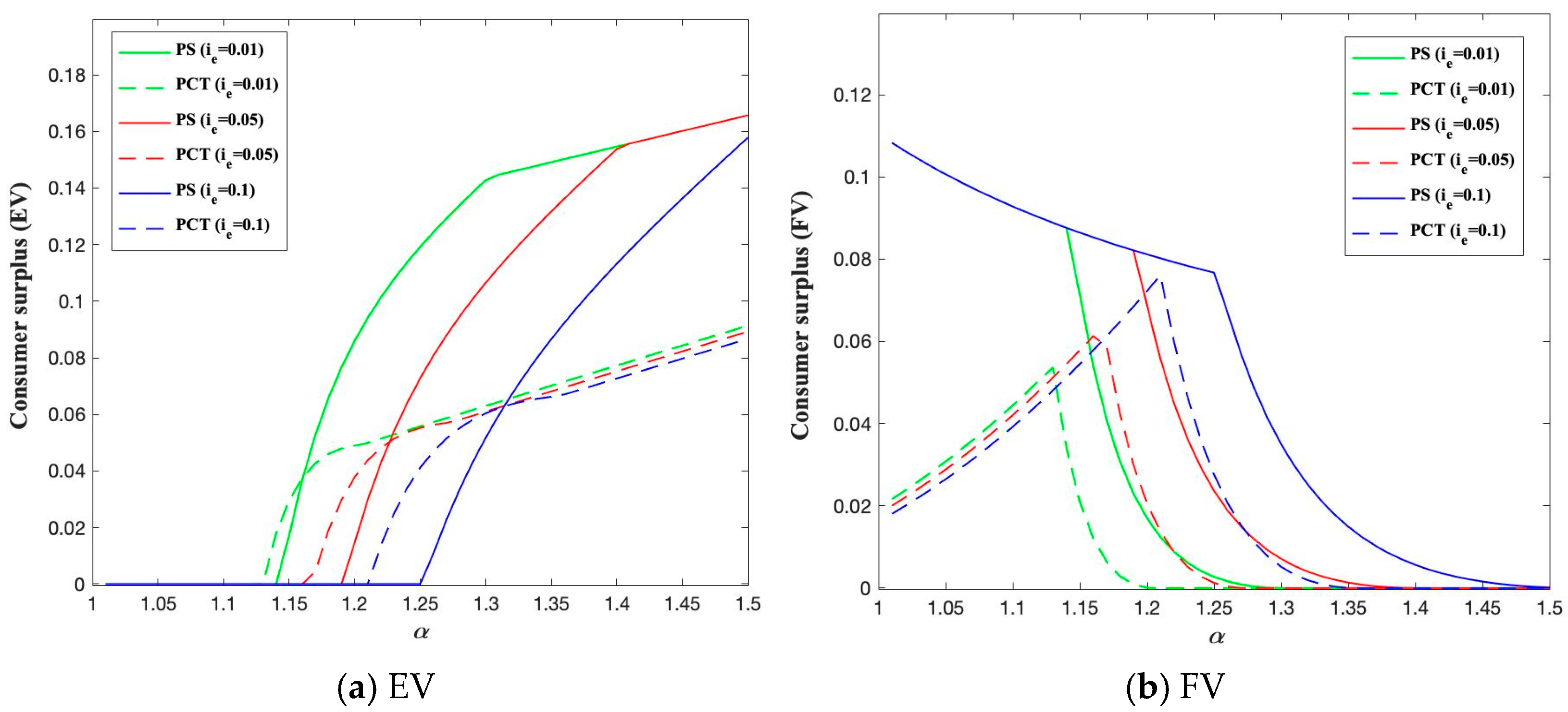

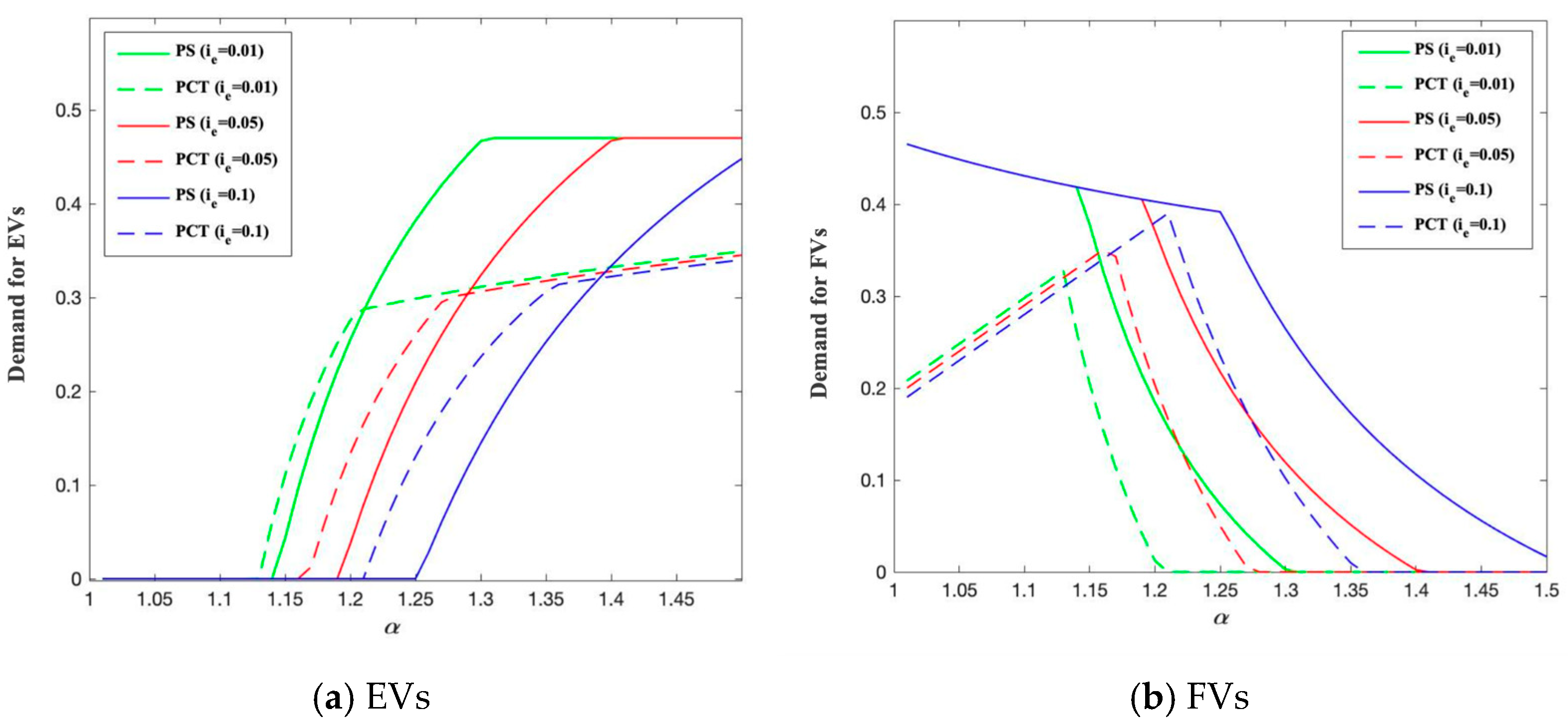

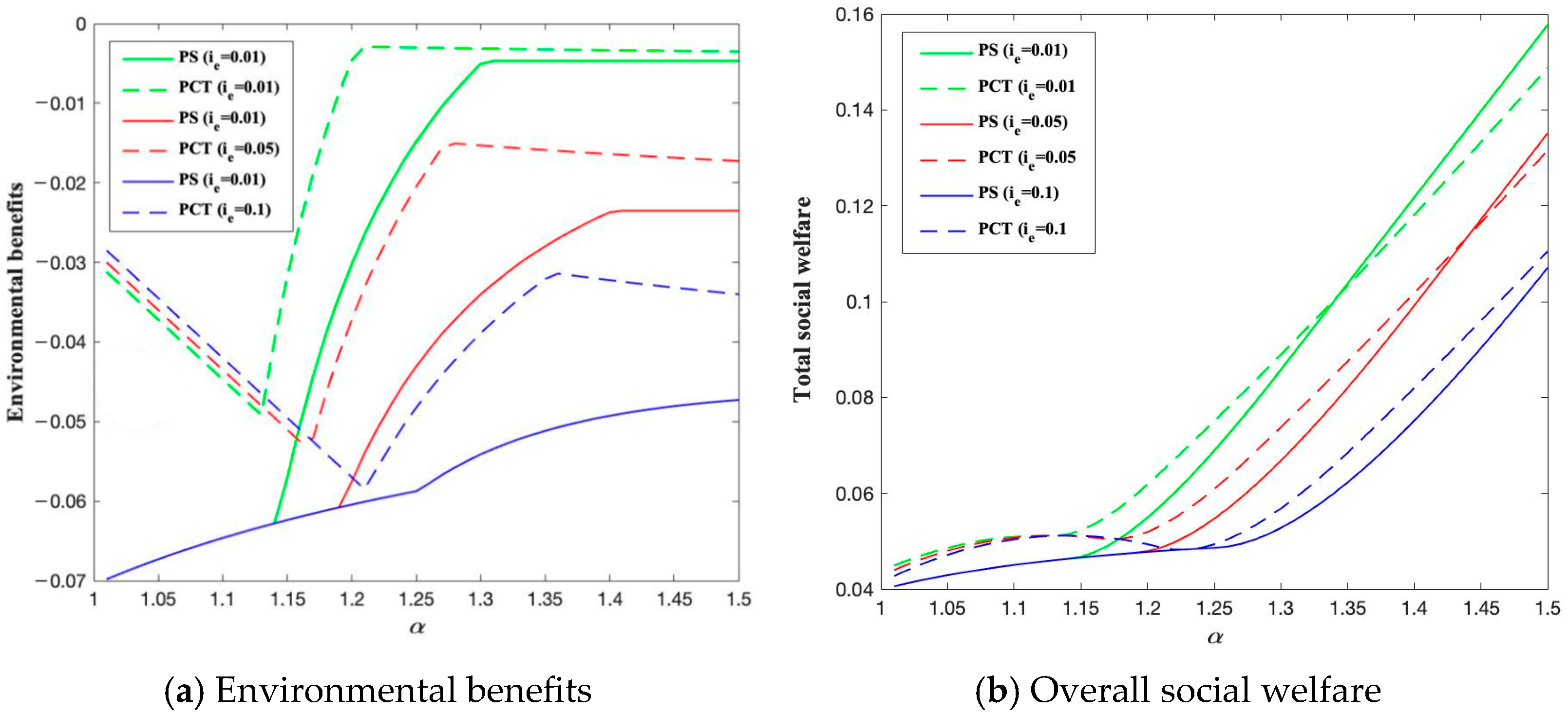

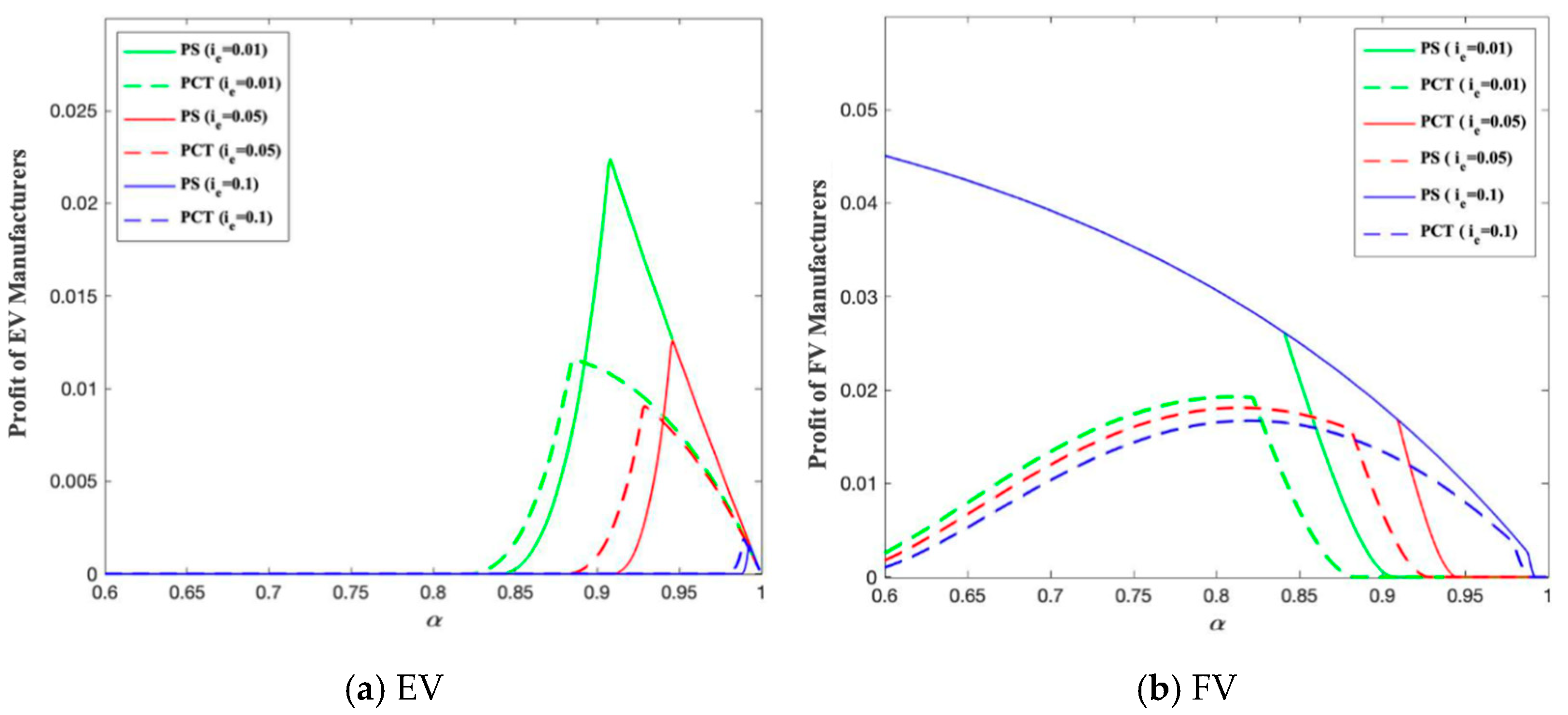

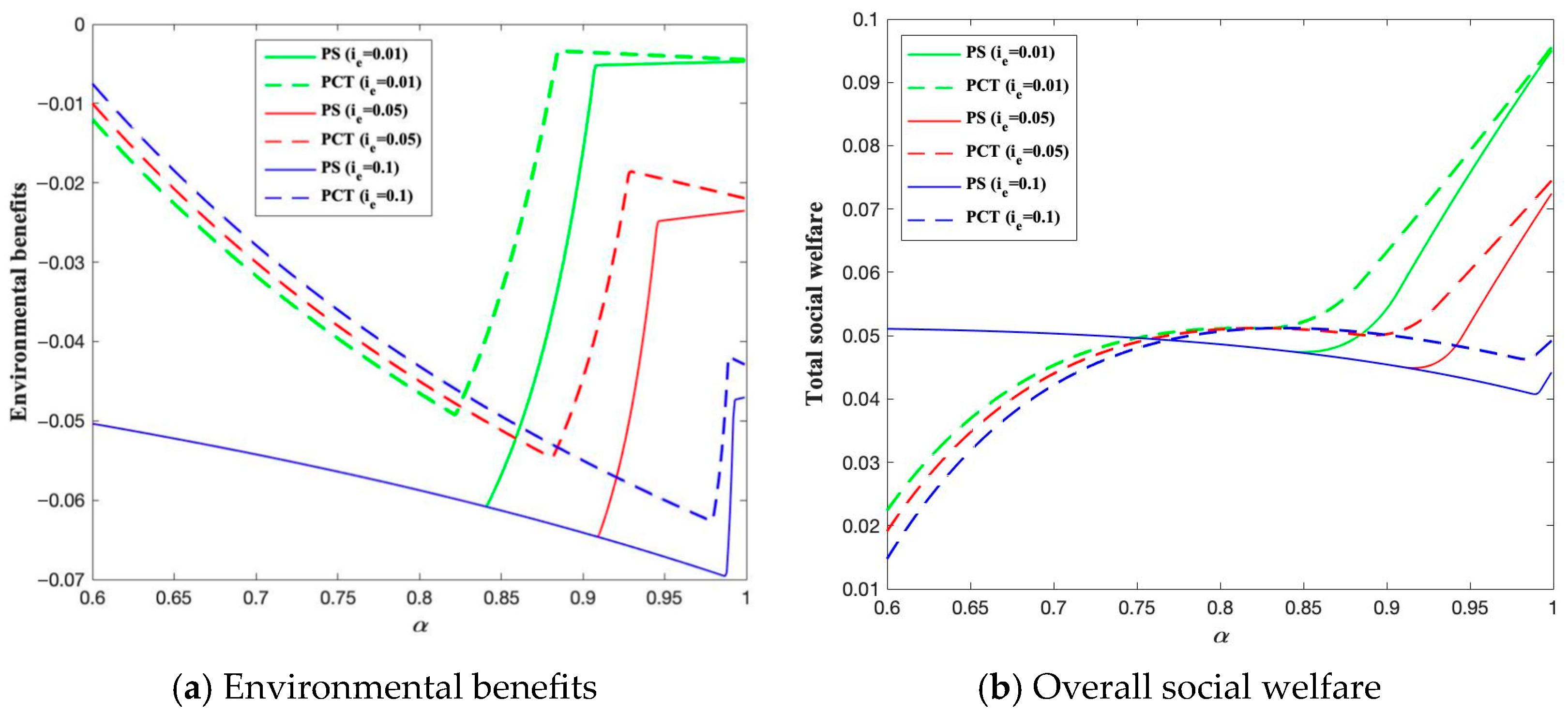

6.1. Comparison of PCT and PS When

- (1)

- We first standardize the model parameters. Assuming that the market size is standardized to 1, we proportionally map key parameters such as unit production costs, unit environmental impact, and market retail prices for both FV and EV to the range [0, 1]. According to the latest data from the Chinese Ministry of Public Security and the China Association of Automobile Manufacturers, the total number of vehicles in China reached 353 million in 2024, with over 260 million passenger cars. The regional distribution shows significant differences: developed coastal areas have a higher penetration rate of private cars, with, for example, 72 private cars per 100 households in urban Zhejiang, while Sichuan has only 32 per 100 households. Based on these data patterns, we set the consumer value acceptance threshold range to [0.32, 0.72]. Since is lower than , and does not exceed the average consumer valuation, we select as the baseline production cost parameter, which is the median of the preset range and well represents the industry’s average cost level.

- (2)

- Regarding the setting of the production cost coefficient, based on the research of Nie et al. [30] and Deng et al. [47], the unit production costs of EVs and FVs are approximately USD 29,000 and USD 25,000, respectively. According to the 2025 industry report by Eletra Consulting (https://www.go-electra.com/es/, (accessed on 22 June 2025)), as the scale production effect of EVs becomes more apparent, the current production cost of EVs is about 1.1 to 1.7 times that of FVs. Based on this, we set the production cost coefficient under the PS policy to 1.6 and under the PCT policy to 1.1, considering the cost differences in extreme cases.

- (3)

- Environmental pollution is calculated using a life cycle analysis method. Based on the research by Cen et al. [55] and Shao et al. [34], the exhaust pollution control cost of traditional fuel vehicles is approximately USD 0.01 per mile. Assuming the vehicle scrap mileage is 600,000 miles, the pollution control cost during the usage phase reaches USD 6000. Adding the disposal cost of USD 1430, as estimated by Crane and Mao [56], the total environmental management cost for a fuel vehicle over its entire life cycle is USD 7430. After standardization, is set to 0.15, which accurately reflects the relative environmental impact of the vehicle usage phase.

- (4)

- The United Nations “Global Sustainable Development Report” points out that 60% of Chinese consumers prefer to buy low-carbon emission vehicles and are willing to pay an additional 5–10% for environmentally friendly products and services (https://sdgs.un.org/zh/gsdr, (accessed on 22 June 2025)). It can be reasonably inferred that, in the car-buying decision process, the weight of the low-carbon factor is lower than the price factor but still has a significant influence. Based on the research of Shao et al. [34] and Nie et al. [30], we set to 0.2.

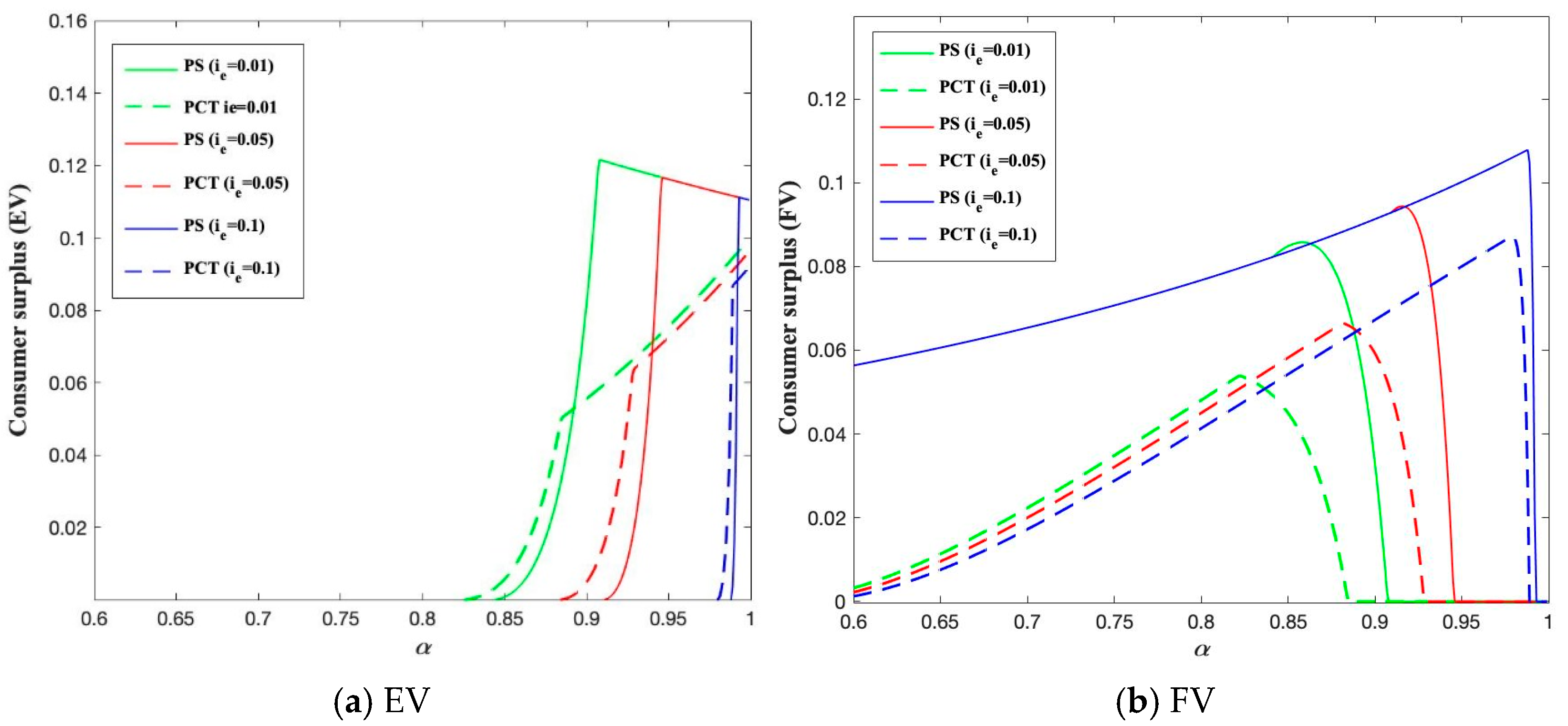

6.2. Comparison of PCT and PS When

7. Conclusions

7.1. Findings

7.2. Practical Contributions

7.3. Future Research Directions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

Proof for Solving the Optimal Decision

- (1)

- PS ()

- (2)

- PS ()

- (3)

- PCT ()

- (4)

- PCT ()

References

- Anufriev, I.E.; Khusainov, B.; Tick, A.; Devezas, T.; Sarygulov, A.; Kaimoldina, S. Mathematical model for assessing new, non-fossil fuel technological products (li-Ion batteries and electric vehicle). Mathematics 2025, 13, 143. [Google Scholar] [CrossRef]

- Chen, L.; Dong, T.; Li, X.; Xu, X. Logistics engineering management in the platform supply chain: An overview from logistics service strategy selection perspective. Engineering 2025, 47, 236–249. [Google Scholar] [CrossRef]

- Fang, L.; Li, Y.; Govindan, K. Entry mode selection for a new entrant of the electric vehicle automaker. Eur. J. Oper. Res. 2024, 313, 270–280. [Google Scholar] [CrossRef]

- Ma, H.; Yang, R.; Li, X. Delivery routing for a mixed fleet of conventional and electric vehicles with road restrictions. Int. J. Prod. Res. 2024, 1–24. [Google Scholar] [CrossRef]

- Zhang, W.; Dou, Y. Coping with spatial mismatch: Subsidy design for electric vehicle and charging markets. Manuf. Serv. Oper. Manag. 2022, 24, 1595–1610. [Google Scholar] [CrossRef]

- Abouee-Mehrizi, H.; Baron, O.; Berman, O.; Chen, D. Adoption of electric vehicles in car sharing market. Prod. Oper. Manag. 2021, 30, 190–209. [Google Scholar] [CrossRef]

- Qiu, Y.; Ding, S.; Pardalos, P.M. Routing a mixed fleet of electric and conventional vehicles under regulations of carbon emissions. Int. J. Prod. Res. 2024, 62, 5720–5736. [Google Scholar] [CrossRef]

- Liu, J.; Li, L.; He, L.; Ma, X.; Yuan, H. Consumers or infrastructure firms? Who should the government subsidize to promote electric vehicle adoption when considering the indirect network and herd effects. Transp. Policy 2024, 149, 163–176. [Google Scholar] [CrossRef]

- Song, Y.; Li, G.; Wang, Q.; Meng, X.; Wang, H. Scenario analysis on subsidy policies for the uptake of electric vehicles industry in China. Resour. Conserv. Recycl. 2020, 161, 104927. [Google Scholar] [CrossRef]

- He, C.; Ozturk, O.C.; Gu, C.; Chintagunta, P.K. Consumer tax credits for EVs: Some quasi-experimental evidence on consumer demand, product substitution, and carbon emissions. Manag. Sci. 2023, 69, 7759–7783. [Google Scholar] [CrossRef]

- Chung, H.; Ahn, H.S.; Lee, M.; Kim, S.W. Optimal subsidy policy for innovation: Technology push and demand pull. Prod. Oper. Manag. 2024, 33, 817–831. [Google Scholar] [CrossRef]

- Wang, C.; Sun, H.; Wang, Y. Synergy and effectiveness evaluation of carbon policy and government subsidies: Variational inequality model based on supply chain network. Mathematics 2025, 13, 1099. [Google Scholar] [CrossRef]

- Yang, S.; Cheng, P.; Li, J.; Wang, S. Which group should policies target? Effects of incentive policies and product cognitions for electric vehicle adoption among Chinese consumers. Energy Policy 2019, 135, 111009. [Google Scholar] [CrossRef]

- Xia, L.; Gao, S.; Wei, J.; Ding, Q. Government subsidy and corporate green innovation-Does board governance play a role? Energy Policy 2022, 161, 112720. [Google Scholar] [CrossRef]

- Harvey, L.D. Rethinking electric vehicle subsidies, rediscovering energy efficiency. Energy Policy 2020, 146, 111760. [Google Scholar] [CrossRef]

- Mohammadzadeh, N.; Zegordi, S.H.; Kashan, A.H.; Nikbakhsh, E. Optimal government policy-making for the electric vehicle adoption using the total cost of ownership under the budget constraint. Sustain. Prod. Consum. 2022, 33, 477–507. [Google Scholar] [CrossRef]

- Li, K.; Wang, L. Optimal electric vehicle subsidy and pricing decisions with consideration of EV anxiety and EV preference in green and non-green consumers. Transp. Res. Part E Logist. Transp. Rev. 2023, 170, 103010. [Google Scholar] [CrossRef]

- Huang, C.Y.; Chen, Z.; Fan, Z.P.; Zhang, Q. Sharing mode selection and optimal pricing for an electric vehicle manufacturer. Int. J. Gen. Syst. 2024, 53, 403–425. [Google Scholar] [CrossRef]

- Shi, L.; Sethi, S.P.; Çakanyıldırım, M. Promoting electric vehicles: Reducing charging inconvenience and price via station and consumer subsidies. Prod. Oper. Manag. 2022, 31, 4333–4350. [Google Scholar] [CrossRef]

- Li, W.; Long, R.; Chen, H.; Yang, M.; Chen, F.; Zheng, X.; Li, C. Would personal carbon trading enhance individual adopting intention of battery electric vehicles more effectively than a carbon tax? Resour. Conserv. Recycl. 2019, 149, 638–645. [Google Scholar] [CrossRef]

- Mohammadzadeh, N.; Zegordi, S.H.; Nikbakhsh, E. Pricing and free periodic maintenance service decisions for an electric-and-fuel automotive supply chain using the total cost of ownership. Appl. Energy 2021, 288, 116471. [Google Scholar] [CrossRef]

- Srivastava, A.; Kumar, R.R.; Chakraborty, A.; Mateen, A.; Narayanamurthy, G. Design and selection of government policies for electric vehicles adoption: A global perspective. Transp. Res. Part E Logist. Transp. Rev. 2022, 161, 102726. [Google Scholar] [CrossRef]

- Fawcett, T. Personal carbon trading: A policy ahead of its time? Energy Policy 2010, 38, 6868–6876. [Google Scholar] [CrossRef]

- Xie, F.; Liu, N.; Jin, M.; Lin, Z. Impacts of the consumer heterogeneity in fuel economy valuation on compliance with fuel economy standards. Energy 2019, 177, 167–174. [Google Scholar] [CrossRef]

- He, H.; Wang, C.; Wang, S.; Ma, F.; Sun, Q.; Zhao, X. Does environmental concern promote EV sales? Duopoly pricing analysis considering consumer heterogeneity. Transp. Res. Part D Transp. Environ. 2021, 91, 102695. [Google Scholar] [CrossRef]

- Behnood, A.; Haghani, M.; Golafshani, E.M. Determinants of purchase likelihood for partially and fully automated vehicles: Insights from mixed logit model with heterogeneity in means and variances. Transp. Res. Part A Policy Pract. 2022, 159, 119–139. [Google Scholar] [CrossRef]

- Jia, W.; Chen, T.D. Investigating heterogeneous preferences for plug-in electric vehicles: Policy implications from different choice models. Transp. Res. Part A Policy Pract. 2023, 173, 103693. [Google Scholar] [CrossRef]

- Cheng, Y.; Fan, T. Production coopetition strategies for an FV automaker and a competitive NEV automaker under the dual-credit Policy. Omega 2021, 103, 102391. [Google Scholar] [CrossRef]

- Yi, Y.; Zhang, M.; Zhang, A.; Li, Y. Can “dual credit” replace “subsidies” successfully?-based on analysis of vehicle supply chain decisions under the digital transformation of technology. Energy Econ. 2024, 130, 107303. [Google Scholar] [CrossRef]

- Nie, Q.; Zhang, L.; Li, S. How can personal carbon trading be applied in electric vehicle subsidies? A Stackelberg game method in private vehicles. Appl. Energy 2022, 313, 118855. [Google Scholar] [CrossRef]

- Wang, N.; Shang, K.; Liu, H.; Duan, Y.; Qin, D. How carbon trading policy should be integrated with existing industrial policies: A case study of Chinese automotive industry. Appl. Energy 2025, 384, 125442. [Google Scholar] [CrossRef]

- Yu, Y.; Zha, D.; Zhou, D.; Wang, Q. Promoting the adoption of electric vehicles through private charging infrastructure: Should subsidies be for the builder or non-builder? Transp. Res. Part A Policy Pract. 2025, 192, 104368. [Google Scholar] [CrossRef]

- Chen, T.; Zheng, X.X.; Jia, F.; Koh, L. Toward mass adoption of electric vehicles: Policy optimisation under different infrastructure investment scenarios. Int. J. Prod. Res. 2025, 1–26. [Google Scholar] [CrossRef]

- Shao, L.; Yang, J.; Zhang, M. Subsidy scheme or price discount scheme? Mass adoption of electric vehicles under different market structures. Eur. J. Oper. Res. 2017, 262, 1181–1195. [Google Scholar] [CrossRef]

- Kumar, R.R.; Chakraborty, A.; Mandal, P. Promoting electric vehicle adoption: Who should invest in charging infrastructure? Transp. Res. Part E Logist. Transp. Rev. 2021, 149, 102295. [Google Scholar] [CrossRef]

- Liao, H.; Peng, S.; Li, L.; Zhu, Y. The role of governmental policy in game between traditional fuel and new energy vehicles. Comput. Ind. Eng. 2022, 169, 108292. [Google Scholar] [CrossRef]

- Fan, Z.P.; Cao, Y.; Huang, C.Y.; Li, Y. Pricing strategies of domestic and imported electric vehicle manufacturers and the design of government subsidy and tariff policies. Transp. Res. Part E Logist. Transp. Rev. 2020, 143, 102093. [Google Scholar] [CrossRef]

- Zhang, J.; Huang, J. Vehicle product-line strategy under government subsidy programs for electric/hybrid vehicles. Transp. Res. Part E Logist. Transp. Rev. 2021, 146, 102221. [Google Scholar] [CrossRef]

- Xu, Y.; Tian, Y.; Pang, C.; Tang, H. Manufacturer vs. Retailer: A comparative analysis of different government subsidy strategies in a dual-channel supply chain considering green quality and channel preferences. Mathematics 2024, 12, 1433. [Google Scholar] [CrossRef]

- Ashraf, F.; Equbal, A.; Khan, O.; Yahya, Z.; Alhodaib, A.; Parvez, M.; Ahmad, S. Assessment and ranking of different vehicles carbon footprint: A comparative study utilizing entropy and TOPSIS methodologies. Green Technol. Sustain. 2025, 3, 100128. [Google Scholar] [CrossRef]

- Yu, Y.; Zhou, D.; Zha, D.; Wang, Q.; Zhu, Q. Optimal production and pricing strategies in auto supply chain when dual credit policy is substituted for subsidy policy. Energy 2021, 226, 120369. [Google Scholar] [CrossRef]

- Liu, J.; Zhao, H.; Li, J.; Yue, X. Operational strategy of customized bus considering customers’ variety seeking behavior and service level. Int. J. Prod. Econ. 2021, 231, 107856. [Google Scholar] [CrossRef]

- Zhang, Q.; Liu, Y. Promoting electric vehicle adoption in ride-hailing platforms: To control or subsidize? Comput. Ind. Eng. 2024, 191, 110146. [Google Scholar] [CrossRef]

- Wang, Z.; Li, X. Demand subsidy versus production regulation: Development of new energy vehicles in a competitive environment. Mathematics 2021, 9, 1280. [Google Scholar] [CrossRef]

- Yang, A.; Liu, C.; Yang, D.; Lu, C. Electric vehicle adoption in a mature market: A case study of Norway. J. Transp. Geogr. 2023, 106, 103489. [Google Scholar] [CrossRef]

- Li, C.; Lu, X.; Liu, Y.; Xia, Z.; Wang, X.; Zhao, H. A study of tripartite strategies for closed-loop charging infrastructure construction of new energy vehicles in China under the expectation of government withdrawal subsidies. J. Clean. Prod. 2025, 493, 144943. [Google Scholar] [CrossRef]

- Deng, R.; Shen, N.; Zhao, Y. Diffusion model to analyse the performance of electric vehicle policies: An evolutionary game simulation. Transp. Res. Part D Transp. Environ. 2024, 127, 104037. [Google Scholar] [CrossRef]

- Bao, B.; Ma, J.; Goh, M. Short-and long-term repeated game behaviours of two parallel supply chains based on government subsidy in the vehicle market. Int. J. Prod. Res. 2020, 58, 7507–7530. [Google Scholar] [CrossRef]

- Han, Z.; Si, Y.; Wang, X.; Yang, S. Battery mode selection and carbon emission decisions of competitive electric vehicle manufacturers. Mathematics 2024, 12, 2472. [Google Scholar] [CrossRef]

- Varian, H.R. Microeconomic Analysis; W. W. Norton & Company: New York, NY, USA, 1992. [Google Scholar]

- Bian, J.; Zhang, G.; Zhou, G. Manufacturer vs. consumer subsidy with green technology investment and environmental concern. Eur. J. Oper. Res. 2020, 287, 832–843. [Google Scholar] [CrossRef]

- Liu, C.; Huang, W.; Yang, C. The evolutionary dynamics of China’s electric vehicle industry–Taxes vs. subsidies. Comput. Ind. Eng. 2017, 113, 103–122. [Google Scholar] [CrossRef]

- Okada, T.; Tamaki, T.; Managi, S. Effect of environmental awareness on purchase intention and satisfaction pertaining to electric vehicles in Japan. Transp. Res. Part D Transp. Environ. 2019, 67, 503–513. [Google Scholar] [CrossRef]

- Bunsen, T.; Cazzola, P.; Gorner, M.; Paoli, L.; Scheffer, S.; Schuitmaker, R.; Teter, J. Global EV Outlook 2018: Towards Cross-Modal Electrification; International Energy Agency: Paris, France, 2018. [Google Scholar]

- Cen, X.; Lo, H.K.; Li, L. A framework for estimating traffic emissions: The development of passenger car emission unit. Transp. Res. Part D Transp. Environ. 2016, 44, 78–92. [Google Scholar] [CrossRef]

- Crane, K.; Mao, Z. Costs of Selected Policies to Address Air Pollution in China; RAND Corporation: Santa Monica, CA, USA, 2015. [Google Scholar]

| Articles | Basic Utility Valuation Heterogeneity Difference | Personal Carbon Tax | Purchase Subsidy | Policy Comparison | EV | FV | Social Welfare |

|---|---|---|---|---|---|---|---|

| Li and Wang [17] | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| Srivastava et al. [22] | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

| He et al. [25] | ✓ | ✓ | ✓ | ||||

| Nie et al. [30] | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| Shao et al. [34] | ✓ | ✓ | ✓ | ✓ | |||

| Kumar et al. [35] | ✓ | ✓ | ✓ | ✓ | |||

| Fan et al. [37] | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| Zhang and Huang [38] | ✓ | ✓ | ✓ | ||||

| This paper | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Notations | Descriptions |

|---|---|

| Decision variables | |

| Retail price of an EV | |

| Retail price of an FV | |

| Personal carbon tax charged to FV buyers | |

| Purchase subsidy given to EV buyers | |

| Parameters | |

| Basic driving utility for consumer, | |

| Consumers’ basic utility valuation difference, and | |

| Unit cost of an FV, | |

| Cost coefficient of an EV relative to an FV, | |

| Per-unit carbon emission of EVs, | |

| Per-unit carbon emission of FVs, | |

| Consumers’ low-carbon preference, | |

| Market demand for EVs | |

| Market demand for FVs | |

| Superscript | |

| Under the PS policy, | |

| Under the PS policy, | |

| Under the PCT policy, | |

| Under the PCT policy, |

| Parameters | Optimal Solution | Range |

|---|---|---|

| Parameters | Optimal Solution | Range |

|---|---|---|

| Parameters | Optimal Solution | Range |

|---|---|---|

| Parameters | Optimal Solution | Range |

|---|---|---|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shao, L.; Zhou, J.; Li, P.; Zhang, Z.; Chen, L. A Game Theoretic Approach to Electric Vehicle Promotion Policy Selection from the Consumer Side. Systems 2025, 13, 506. https://doi.org/10.3390/systems13070506

Shao L, Zhou J, Li P, Zhang Z, Chen L. A Game Theoretic Approach to Electric Vehicle Promotion Policy Selection from the Consumer Side. Systems. 2025; 13(7):506. https://doi.org/10.3390/systems13070506

Chicago/Turabian StyleShao, Lulu, Jingxi Zhou, Peng Li, Zongxiang Zhang, and Lin Chen. 2025. "A Game Theoretic Approach to Electric Vehicle Promotion Policy Selection from the Consumer Side" Systems 13, no. 7: 506. https://doi.org/10.3390/systems13070506

APA StyleShao, L., Zhou, J., Li, P., Zhang, Z., & Chen, L. (2025). A Game Theoretic Approach to Electric Vehicle Promotion Policy Selection from the Consumer Side. Systems, 13(7), 506. https://doi.org/10.3390/systems13070506