Multi-Entity Collaboration Mechanism of Key Core Technology Innovation Based on Differential Game

Abstract

1. Introduction

2. Issue Description and Hypotheses

3. Model Construction

3.1. Nash Non-Collaborative Mechanism

3.2. Cost-Sharing Mechanism

3.3. Collaborative Mechanism

4. Comparative Analysis

- Proof: see Supplementary Materials.

- Ifthen ; ; ; .

- Otherwise, ; ; ; .

- Proof: see Supplementary Materials.

- Ifthen .

- Proof: see Supplementary Materials.

- Ifthen , .

- Proof: see Supplementary Materials.

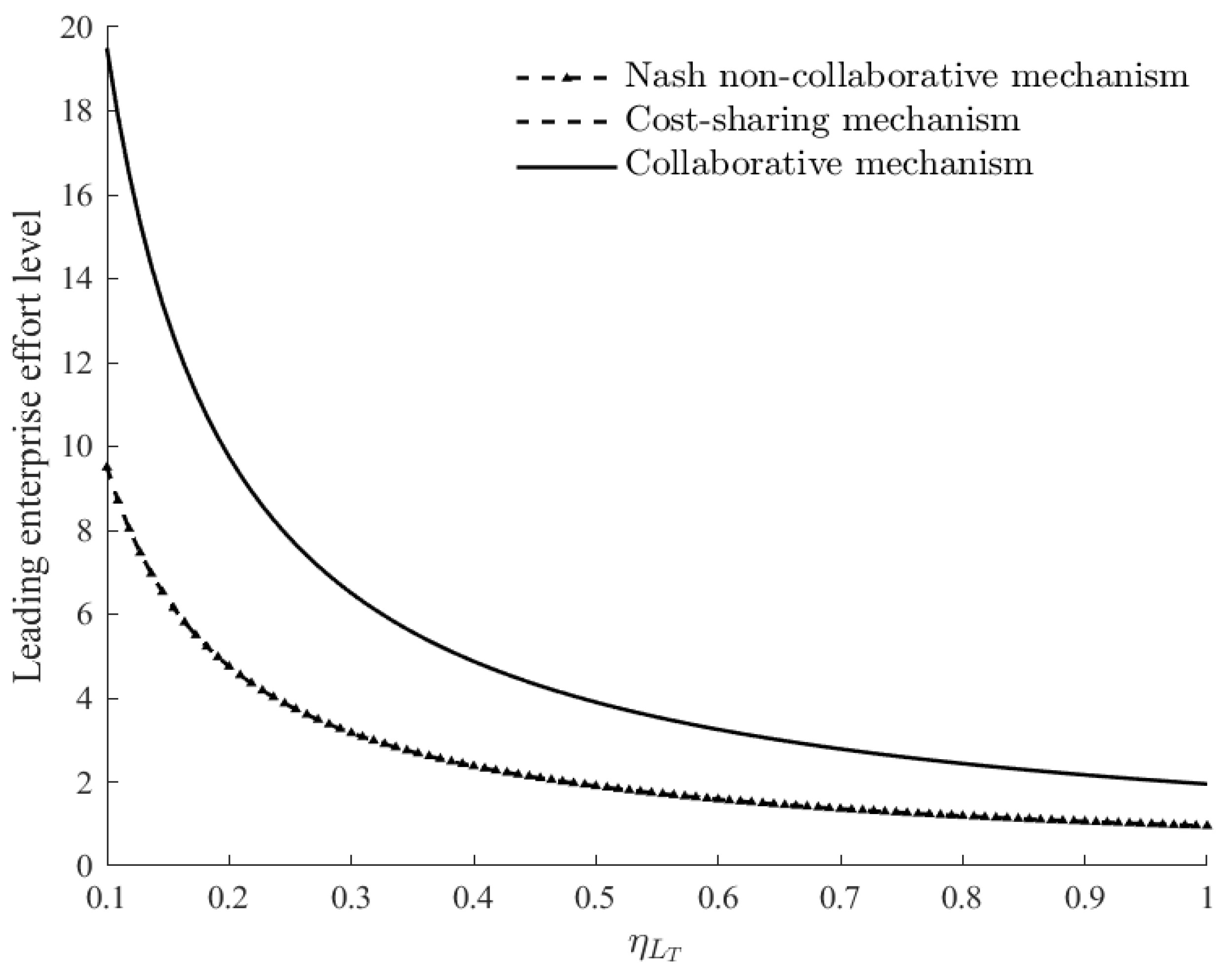

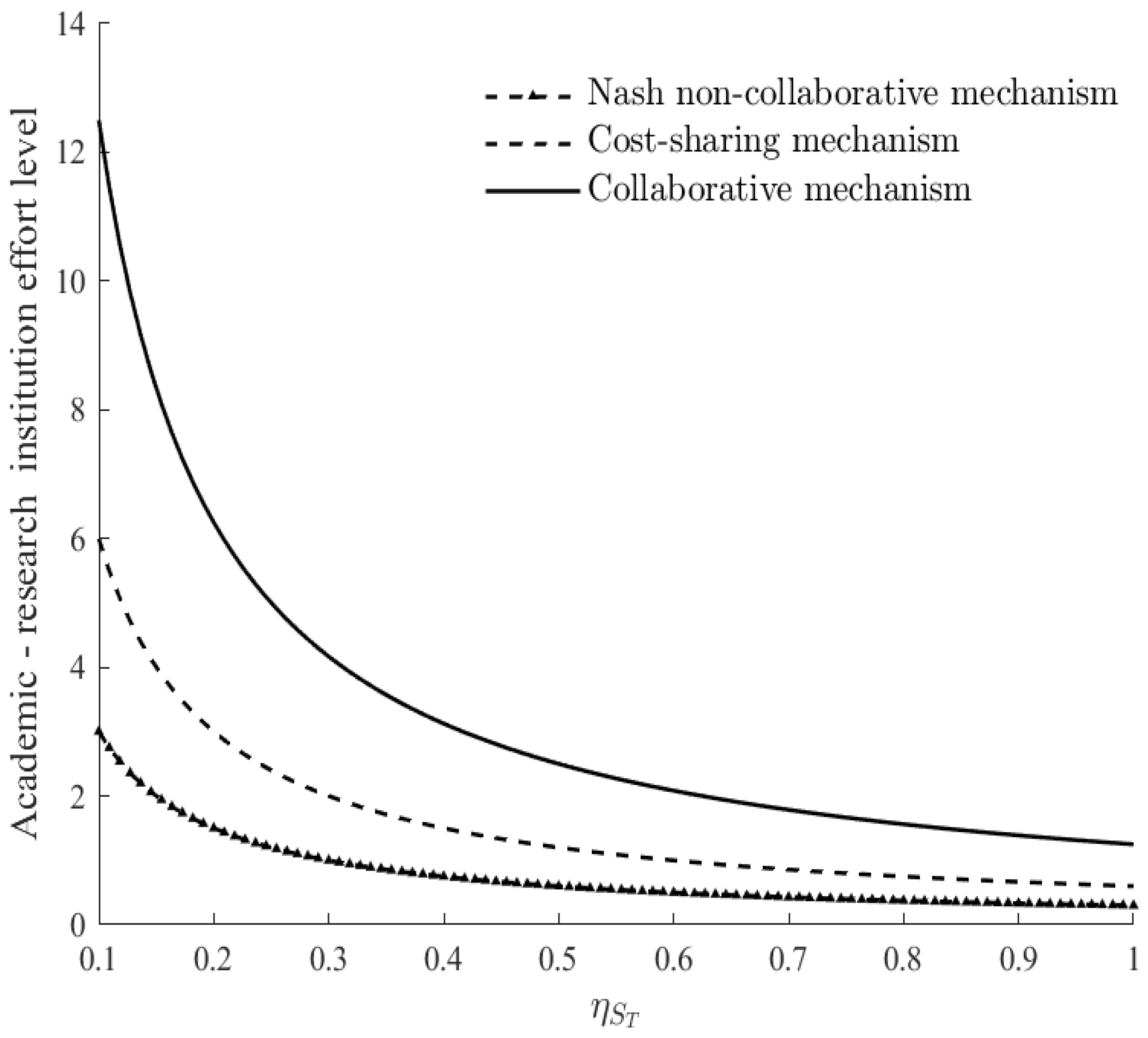

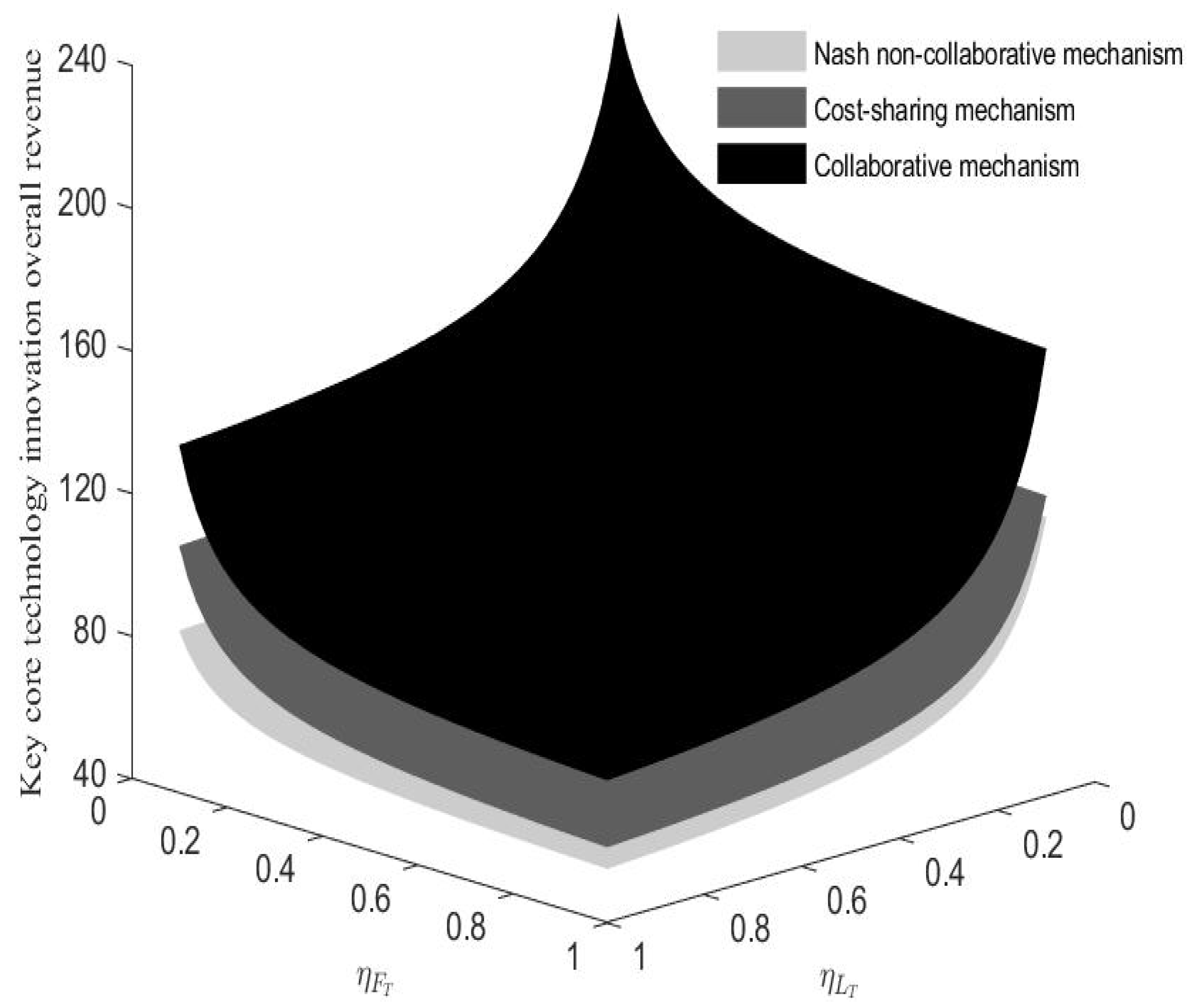

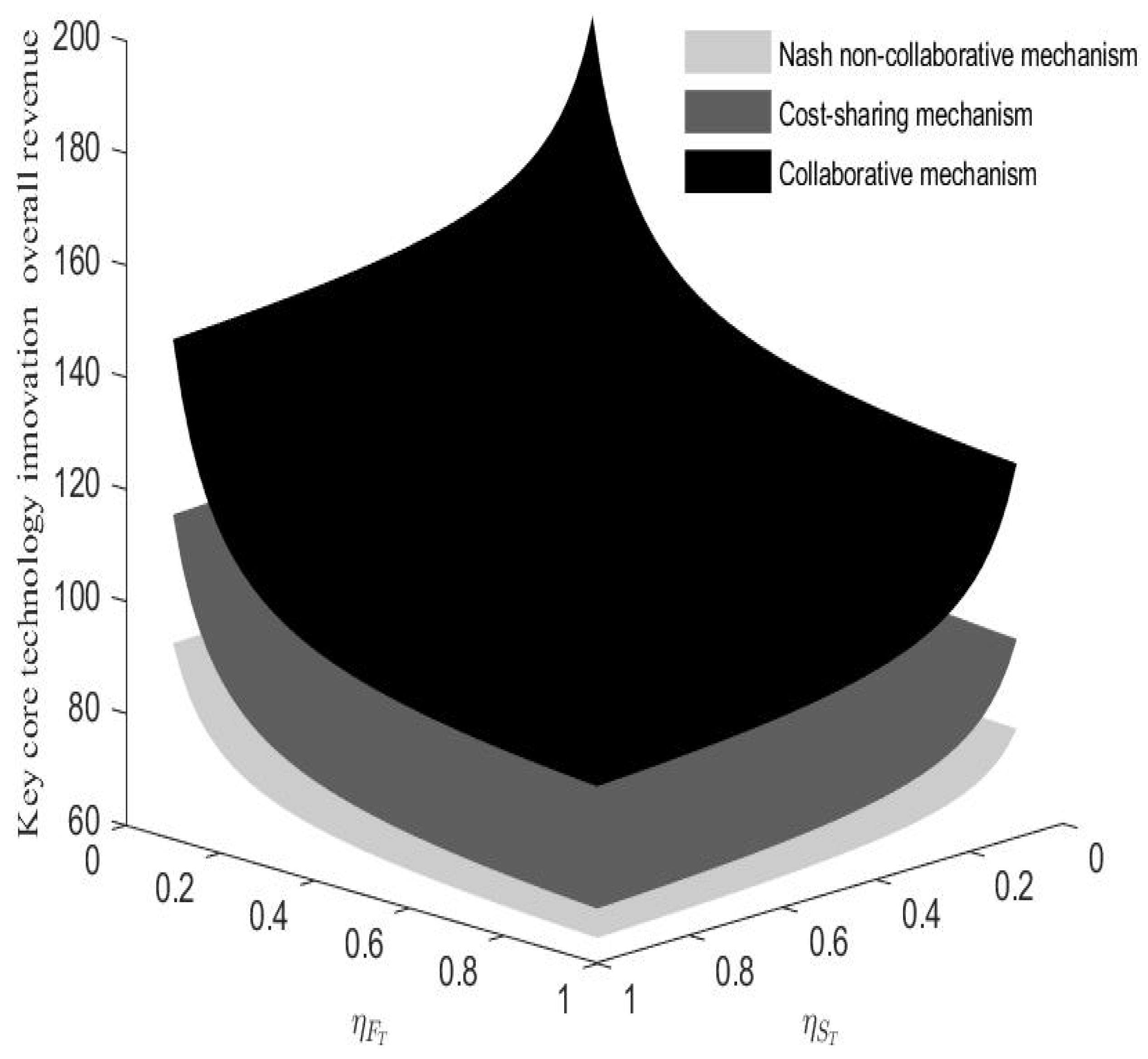

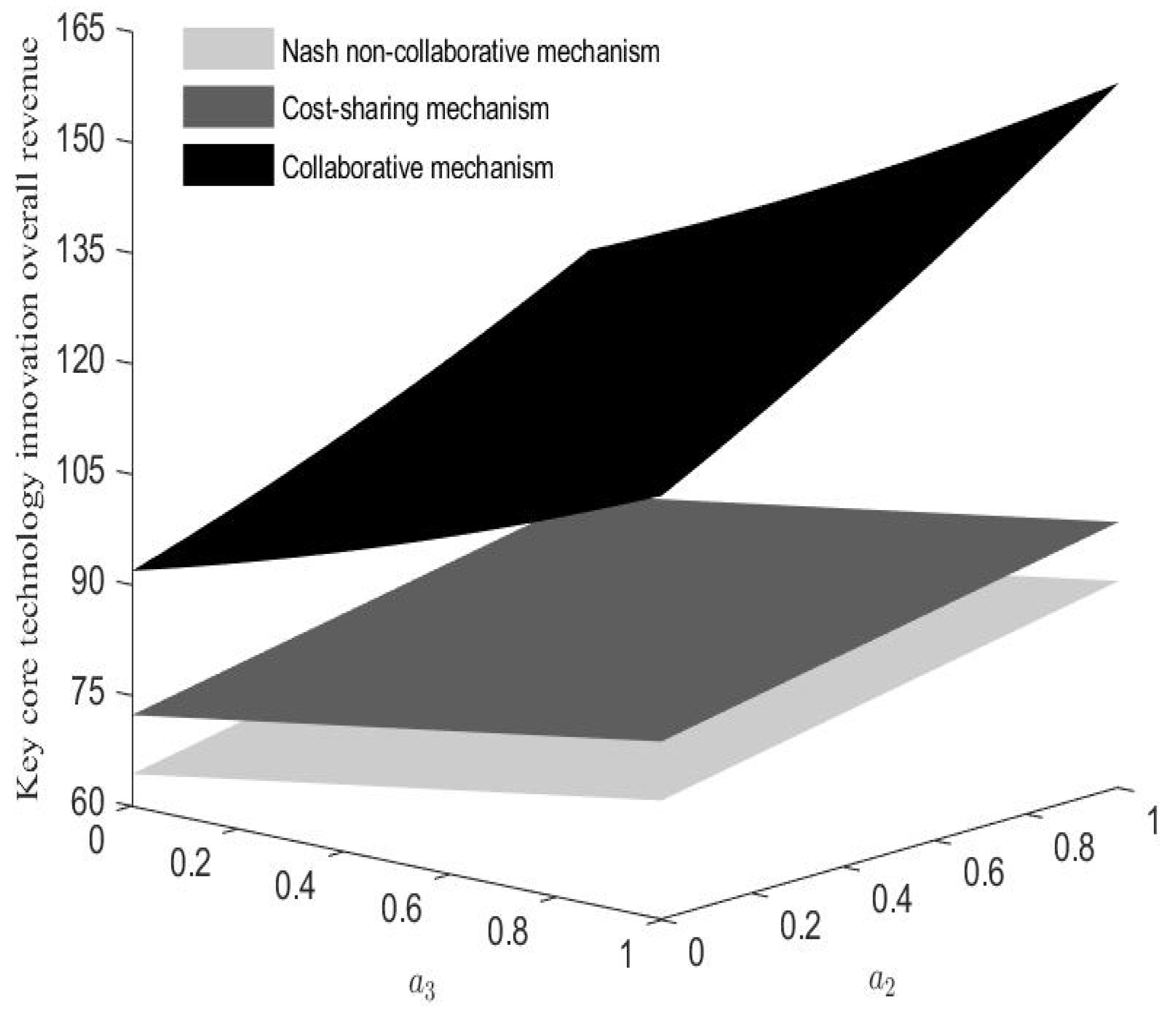

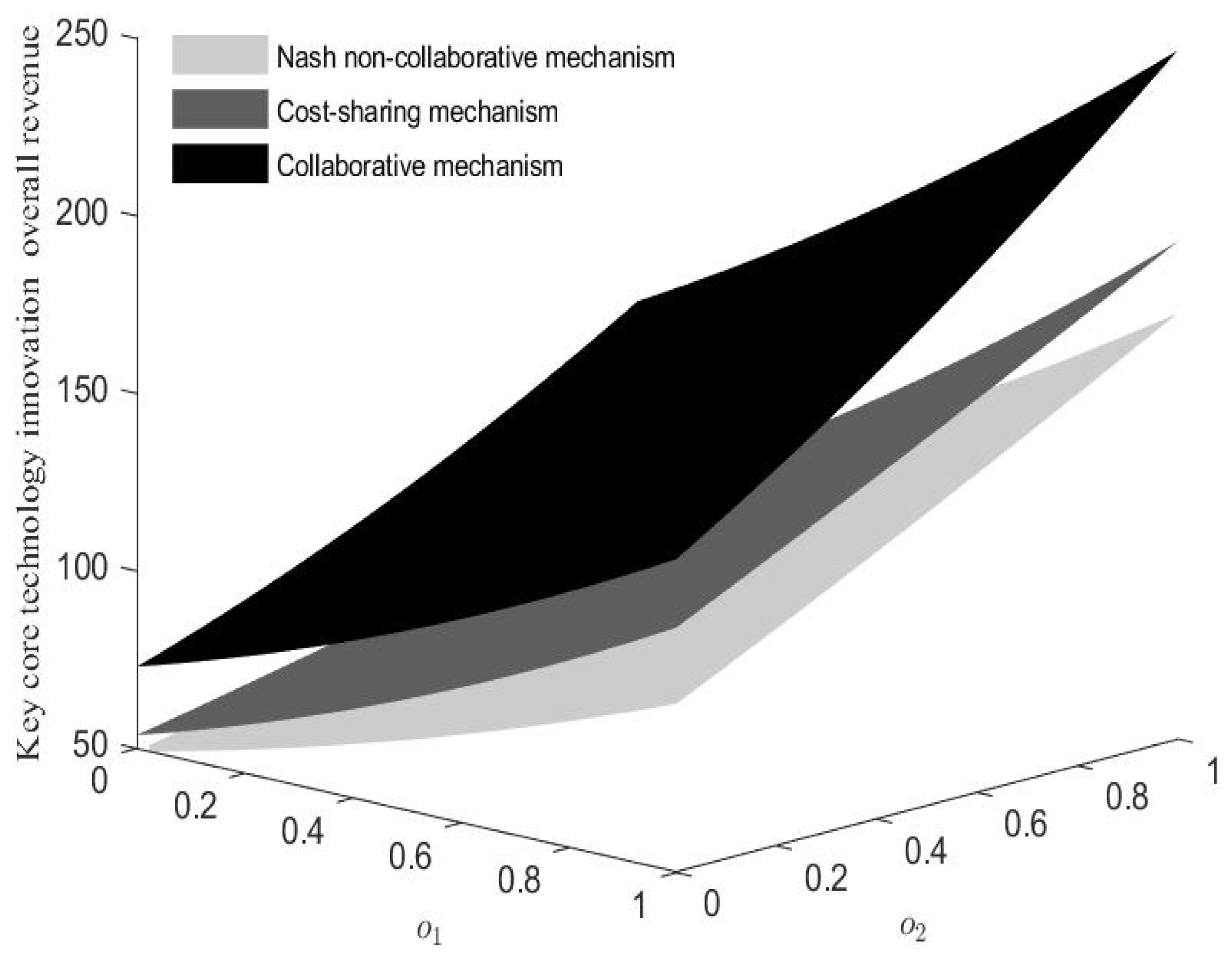

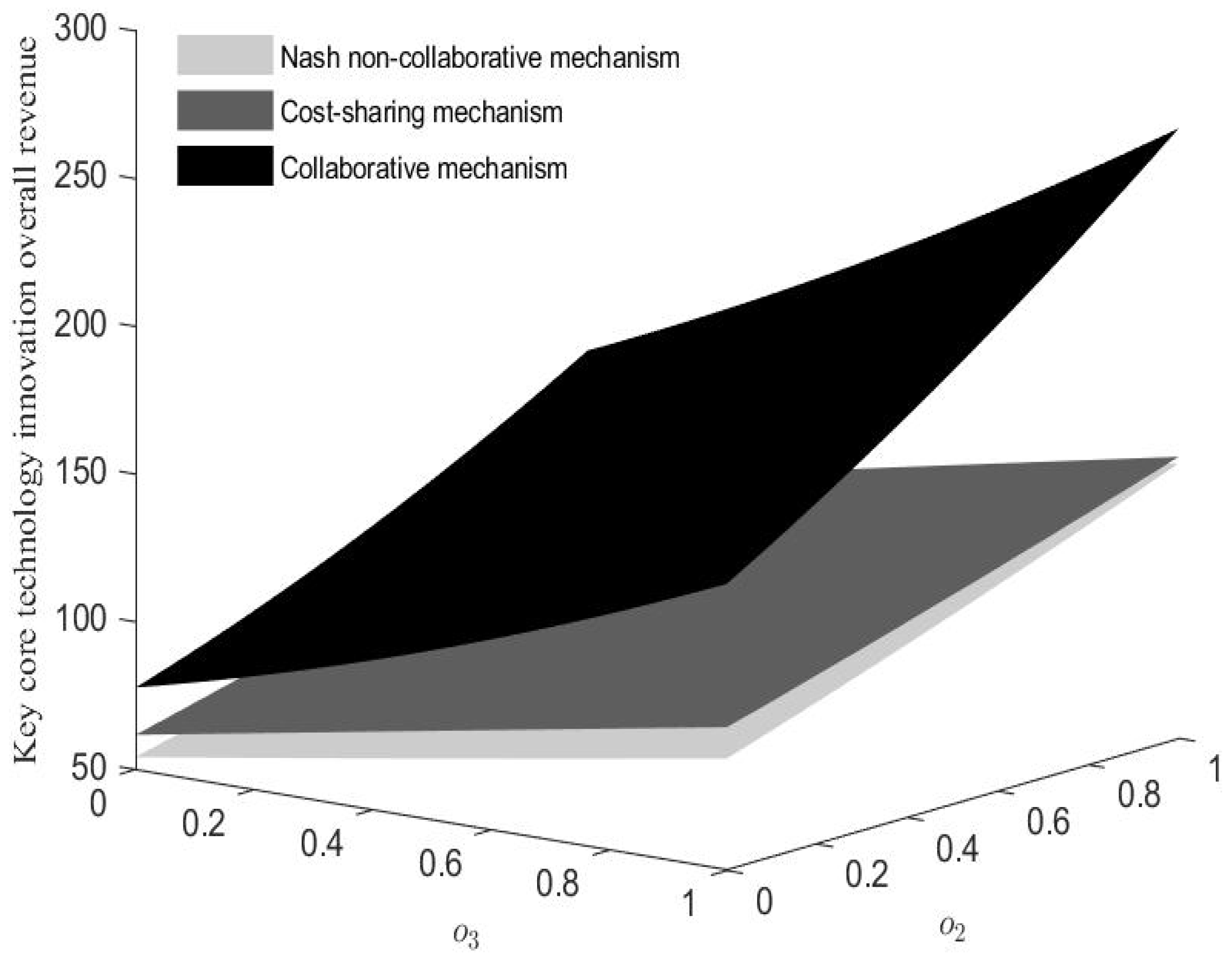

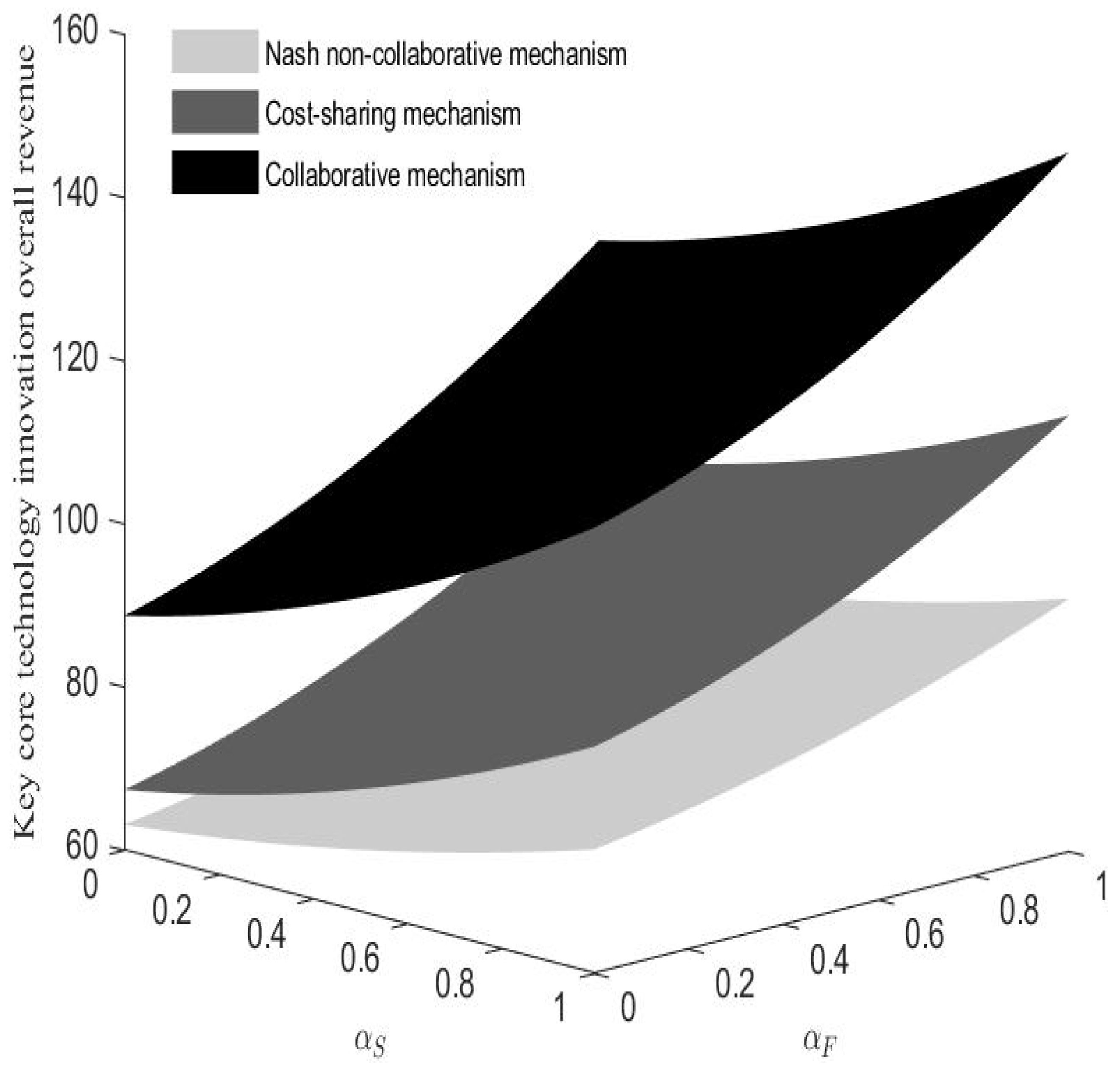

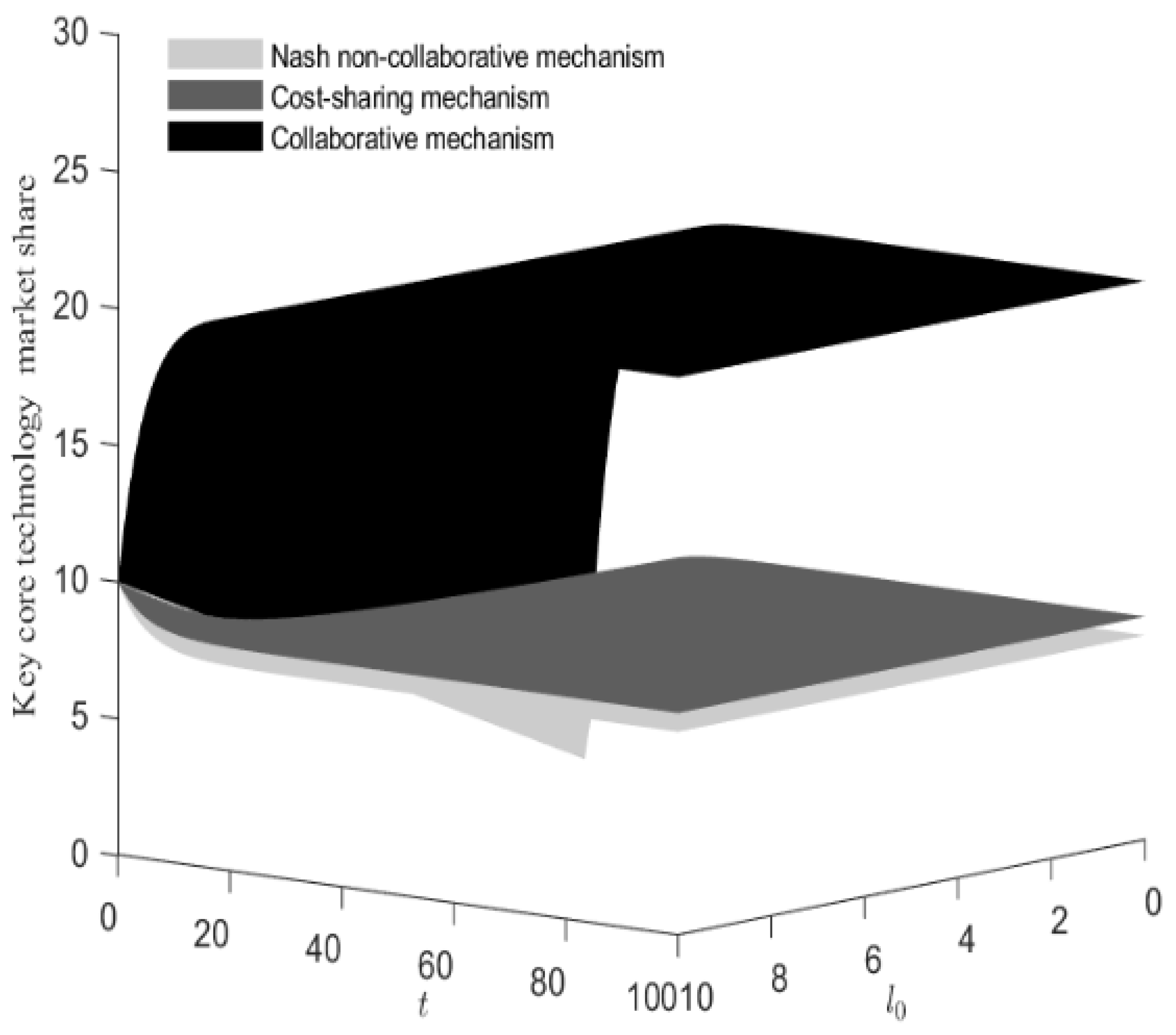

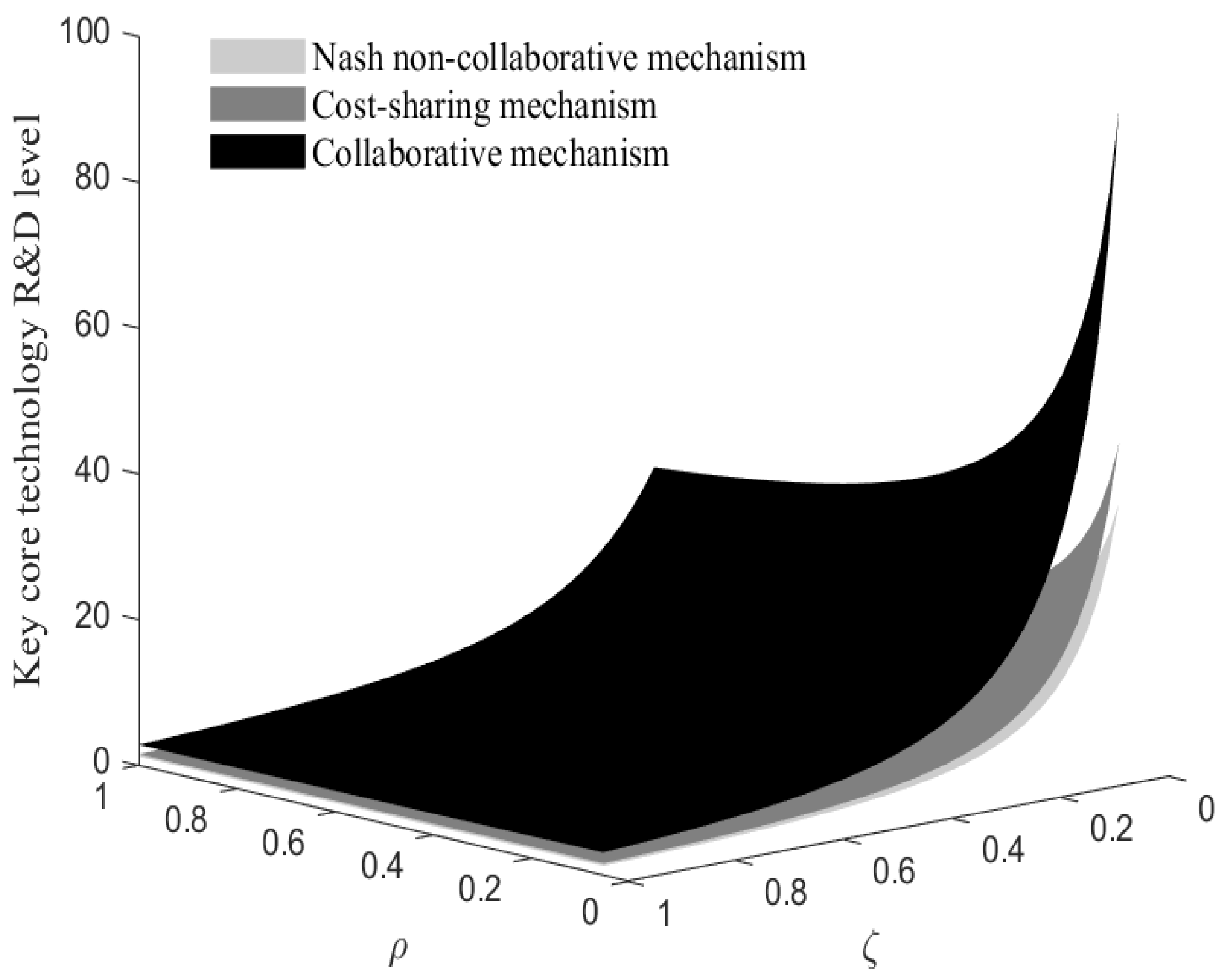

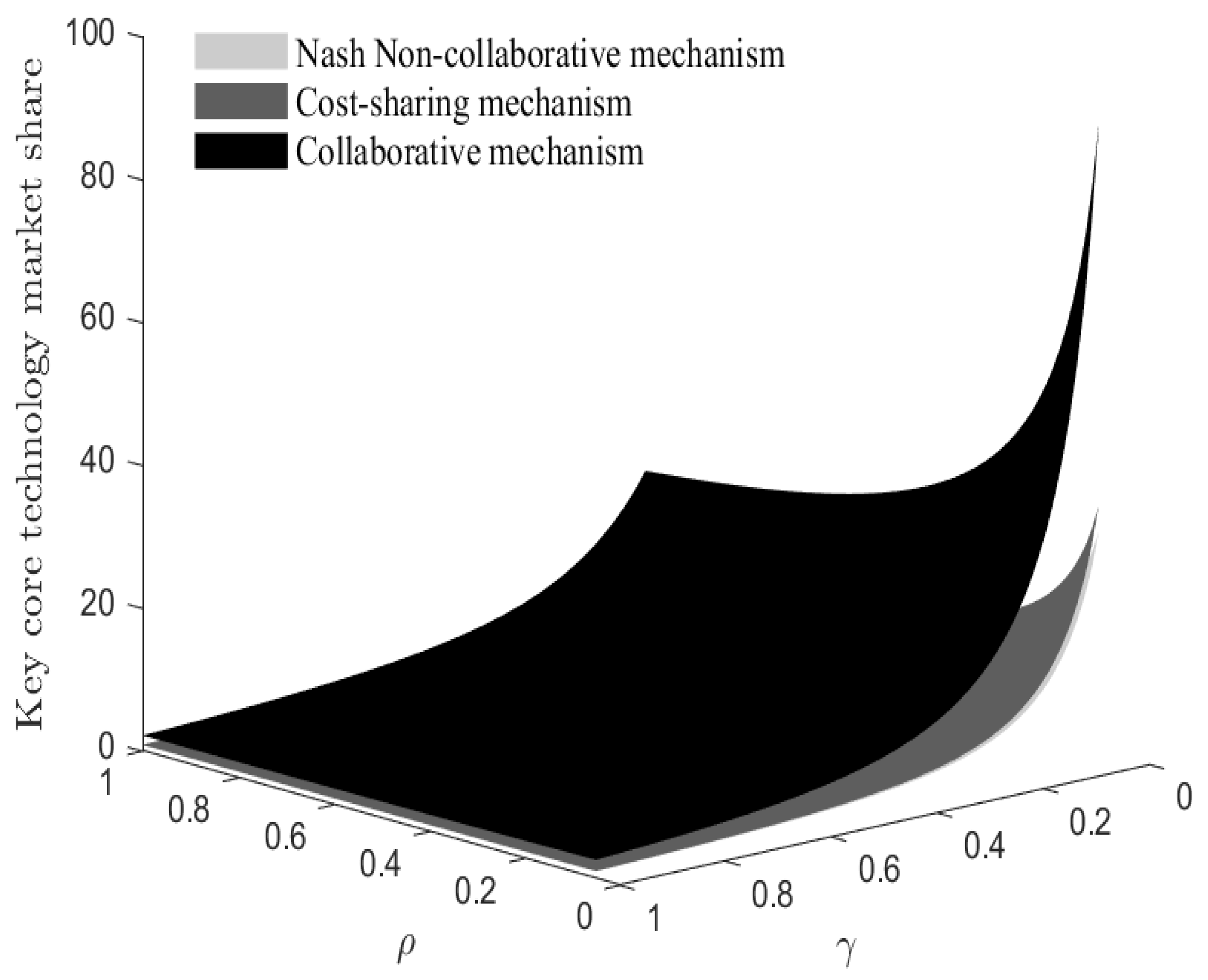

5. Simulation and Analysis

5.1. Parameter Assignment

5.2. Simulation Analysis

6. Conclusions

Main Conclusions

7. Discussion

7.1. Theoretical Contributions

7.2. Practical Implications

7.3. Limitations and Model Extensions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Lai, X.; Nie, L. Maturity of knowledge inputs and the breakthrough of key core technology. Scientometrics 2024, 129, 6551–6570. [Google Scholar] [CrossRef]

- Liu, Y.; Liu, Z.; Xu, K. Imitative innovation or independent innovation strategic choice of emerging economies in non-cooperative innovation competition. J. Ind. Manag. Optim. 2023, 19, 1893–1910. [Google Scholar] [CrossRef]

- Yu, M.; Xu, Z.; Ma, C. The role of venture capital in promoting innovation in key & core technology companies: A pre-registered study. Pac.-Basin Financ. J. 2024, 83, 102222. [Google Scholar] [CrossRef]

- Wang, F.; Huang, Z. Analysis of international competitive situation of key core technology in strategic emerging industries: New generation of information technology industry as an example. PLoS ONE 2023, 18, e0287034. [Google Scholar] [CrossRef]

- An, X.; Tong, L. Research on the stable strategies for collaborative R&D in innovation consortiums formed by leading enterprises with multi-agent participation. Technol. Anal. Strat. Manag. 2025, 1–19. [Google Scholar] [CrossRef]

- Ma, B.; Li, K.; Xu, H.; An, J.; Wang, Y.; Zhang, Y. Research on heterogeneous financial support mechanisms for innovation in different types of technology enterprises. Financ. Res. Lett. 2024, 68, 105992. [Google Scholar] [CrossRef]

- Masucci, M.; Brusoni, S.; Cennamo, C. Removing bottlenecks in business ecosystems: The strategic role of outbound open innovation. Res. Policy 2020, 49, 103823. [Google Scholar] [CrossRef]

- Schøtt, T.; Jensen, K.W. Firms’ innovation benefiting from networking and institutional support: A global analysis of national and firm effects. Res. Policy 2016, 45, 1233–1246. [Google Scholar] [CrossRef]

- Yuan, N.; Li, M. Research on collaborative innovation behavior of enterprise innovation ecosystem under evolutionary game. Technol. Forecast. Soc. Change 2024, 206, 123508. [Google Scholar] [CrossRef]

- Qi, N.; Zhang, A. Technological cooperation relationships among supply chain enterprises under the perspective of technological blockade: A tripartite evolutionary game model. J. Clean. Prod. 2024, 447, 141240. [Google Scholar] [CrossRef]

- Shi, J. Adaptive change: Emerging economy enterprises respond to the international business environment challenge. Technovation 2024, 133, 102998. [Google Scholar] [CrossRef]

- Aubry, M.; Wang, Y. Vertical cooperation stability in R&D programs: A game theory analysis of the semiconductor industry. Technol. Forecast. Soc. Change 2024, 209, 123738. [Google Scholar] [CrossRef]

- Wang, Y.C.; Phillips, F.; Yang, C. Bridging innovation and commercialization to create value: An open innovation study. J. Bus. Res. 2021, 123, 255–266. [Google Scholar] [CrossRef]

- Haakonsson, S.J.; Kirkegaard, J.K. Configuration of technology networks in the wind turbine industry. A comparative study of technology management models in European and Chinese lead firms. Int. J. Technol. Manag. 2016, 70, 281–299. [Google Scholar] [CrossRef]

- Li, X.; Zheng, F.; Qi, Y.; Zhang, H. Study on the identification of key core technology “strangled” problem of the new generation information technology industry. Kybernetes 2024. [Google Scholar] [CrossRef]

- Eghbali, M.A.; Rasti-Barzoki, M.; Altmann, J. An evolutionary game-theoretic approach to analysis the green innovation chain dynamics under government policies. Technol. Soc. 2024, 77, 102568. [Google Scholar] [CrossRef]

- Xie, C.; Yang, N.; Wang, Y.; Zhang, M. Firm’s openness and innovation radicalness within R&D networks: Reconciling the openness paradox through the network pluralism view. Technovation 2025, 141, 103163. [Google Scholar] [CrossRef]

- Zhang, R.J.; Tai, H.W.; Cao, Z.X.; Cheng, K.T.; Wei, C.C. Innovation ecosystem based on low-carbon technology: Value co-creation mechanism and differential game analysis. Technol. Forecast. Soc. Change 2025, 210, 123852. [Google Scholar] [CrossRef]

- Elhelaly, N.; Ray, S. Collaborating to innovate: Balancing strategy dividend and transactional efficiencies. J. Mark. 2024, 88, 153–179. [Google Scholar] [CrossRef]

- Marcon, A.; Ribeiro, J.L.D.; Olteanu, Y.; Fichter, K. How the interplay between innovation ecosystems and market contingency factors impacts startup innovation. Technol. Soc. 2024, 76, 102424. [Google Scholar] [CrossRef]

- Aarikka-Stenroos, L.; Sandberg, B.; Lehtimäki, T. Networks for the commercialization of innovations: A review of how divergent network actors contribute. Ind. Mark. Manag. 2014, 43, 365–381. [Google Scholar] [CrossRef]

- Arora, A.; Fosfuri, A.; Rønde, T. The missing middle: Value capture in the market for startups. Res. Policy 2024, 53, 104958. [Google Scholar] [CrossRef]

- Haki, K.; Tanriverdi, H.; Safaei, D.; Schmid, M.; Aier, S.; Winter, R. Generativity and profitability on B2B innovation platforms: A simulation-based theory development. MIS Q. 2024, 48, 583–612. [Google Scholar] [CrossRef]

- Zilberman, D.; Reardon, T.; Silver, J.; Lu, L.; Heiman, A. From the laboratory to the consumer: Innovation, supply chain, and adoption with applications to natural resources. Proc. Natl. Acad. Sci. USA 2022, 119, e2115880119. [Google Scholar] [CrossRef]

- Kenzhaliyev, O.; Ilmaliyev, Z.B.; Tsekhovoy, A.; Triyono, M.B.; Kassymova, G.; Alibekova, G.Z.; Tayauova, G.Z. Conditions to facilitate commercialization of R & D in case of Kazakhstan. Technol. Soc. 2021, 67, 101792. [Google Scholar] [CrossRef]

- Lambrecht, D.; Block, J.; Neuenkirch, M.; Steinmetz, H.; Willeke, T. The interdependence of intellectual property rights and sales in the manufacturing industry: Evidence from the triangle of patents, trademarks, and sales. Econ. Innov. New Technol. 2025, 1–25. [Google Scholar] [CrossRef]

- Aarikka-Stenroos, L.; Sandberg, B. From new-product development to commercialization through networks. J. Bus. Res. 2012, 65, 198–206. [Google Scholar] [CrossRef]

- Stojčić, N. Collaborative innovation in emerging innovation systems: Evidence from Central and Eastern Europe. J. Technol. Transf. 2021, 46, 531–562. [Google Scholar] [CrossRef]

- Moradlou, H.; Roscoe, S.; Reefke, H.; Handfield, R. Using not-for-profit innovation networks to transition new technologies across the valley of death. Int. J. Oper. Prod. Manag. 2024, 44, 591–616. [Google Scholar] [CrossRef]

- Mukherjee, A.; Carvalho, M. Dynamic decision making in a mixed market under cooperation: Towards sustainability. Int. J. Prod. Econ. 2021, 241, 108270. [Google Scholar] [CrossRef]

- Jond, H.B.; Platoš, J. Differential game-based optimal control of autonomous vehicle convoy. IEEE Trans. Intell. Transp. Syst. 2022, 24, 2903–2919. [Google Scholar] [CrossRef]

- Sadana, U.; Reddy, P.V.; Zaccour, G. Nash equilibria in nonzero-sum differential games with impulse control. Eur. J. Oper. Res. 2021, 295, 792–805. [Google Scholar] [CrossRef]

- Zhao, C.; Zhu, W. Strategic IPO timing of technology innovation-driven enterprises: A differential game analysis of market returns, disclosure costs, and industry dynamics. Financ. Res. Lett. 2025, 72, 106588. [Google Scholar] [CrossRef]

- Ferrer-Serrano, M.; Latorre-Martinez, M.P.; Fuentelsaz, L. Regional knowledge asymmetries and innovation performance from collaborations across European regions. J. Technol. Transf. 2025. [Google Scholar] [CrossRef]

- Li, C.; Shafait, M. Assessing the impact of network embeddedness on SMEs innovation performance through resource bricolage: A mediated-moderated model. Oper. Manag. Res. 2025, 18, 72–88. [Google Scholar] [CrossRef]

- Leng, X.; Zhang, Y. The frontiers in manufacturing technologies initiative and university innovation. China World Econ. 2024, 32, 197–225. [Google Scholar] [CrossRef]

- Robertson, J.; McCarthy, I.P.; Pitt, L. Leveraging social capital in university-industry knowledge transfer strategies: A comparative positioning framework. Knowl. Manag. Res. Pract. 2019, 17, 461–472. [Google Scholar] [CrossRef]

- Xu, A.; Qiu, K.; Zhu, Y. The measurements and decomposition of innovation inequality: Based on Industry-University-Research perspective. J. Bus. Res. 2023, 157, 113556. [Google Scholar] [CrossRef]

- Deng, M.; Chen, J.; Ding, J. Improving success probability of innovation through multi-agent collaboration: A differential game model. Technol. Anal. Strat. Manag. 2025, 37, 109–124. [Google Scholar] [CrossRef]

- Wang, J.; Liu, W.; Wang, Z.; Shi, S. A four-party evolutionary game analysis of collaborative construction strategies for zero-carbon tourism cities. Manag. Decis. Econ. 2024, 45, 5125–5145. [Google Scholar] [CrossRef]

- Yi, H.; Zhang, Q. How does product innovation affect the performance of university-industry collaboration? A dynamic knowledge transfer perspective. Int. J. Technol. Manag. 2024, 95, 55–89. [Google Scholar] [CrossRef]

- Manikas, A.S.; Patel, P.C. The value of operational response in varied industries during the great recession. IEEE Trans. Eng. Manag. 2018, 67, 54–69. [Google Scholar] [CrossRef]

- Haefner, N.; Wincent, J.; Parida, V.; Gassmann, O. Artificial intelligence and innovation management: A review, framework, and research agenda. Technol. Forecast. Soc. Change 2021, 162, 120392. [Google Scholar] [CrossRef]

- Yu, A.; Shi, Y.; You, J.; Zhu, J. Innovation performance evaluation for high-tech companies using a dynamic network data envelopment analysis approach. Eur. J. Oper. Res. 2021, 292, 199–212. [Google Scholar] [CrossRef]

- Bzhalava, L.; Cantner, U. The journey towards open innovation: Why do firms choose different routes? Eurasian Bus. Rev. 2018, 8, 245–265. [Google Scholar] [CrossRef]

- Kshetri, N. The evolution of the internet of things industry and market in China: An interplay of institutions, demands and supply. Telecommun. Policy 2017, 41, 49–67. [Google Scholar] [CrossRef]

- Wei, J.; Wang, C. Improving interaction mechanism of carbon reduction technology innovation between supply chain enterprises and government by means of differential game. J. Clean. Prod. 2021, 296, 126578. [Google Scholar] [CrossRef]

- Sun, R.; He, D.Y.; Yan, J.J. Dynamic analysis of green technology innovation in products and processes under supply chain competition scenarios—A study based on stochastic differential game model. J. Environ. Manag. 2025, 373, 123545. [Google Scholar] [CrossRef]

- Su, N.; Shi, Z.; Zhu, X.; Xin, Y. An evolutionary game model of collaborative innovation between enterprises and colleges under government participation of China. SAGE Open 2021, 11, 21582440219. [Google Scholar] [CrossRef]

- Gkypali, A.; Filiou, D.; Tsekouras, K. R&D collaborations: Is diversity enhancing innovation performance? Technol. Forecast. Soc. Change 2017, 118, 143–152. [Google Scholar] [CrossRef]

- Munoz-Penas, J.; Clarke, A.H.; Evald, M.R. Building a commercialization capability: A dynamic capability view. Ind. Mark. Manag. 2024, 117, 344–355. [Google Scholar] [CrossRef]

- He, B.; Tian, S.; Zhang, X. Does the pilot free trade zone policy increase regional innovation ability? Evidence from China. Appl. Econ. Lett. 2025, 32, 576–581. [Google Scholar] [CrossRef]

- Boakye, D.; Sarpong, D.; Mordi, C. Regulatory review of new product innovation: Conceptual clarity and future research directions. Technol. Forecast. Soc. Change 2022, 175, 121419. [Google Scholar] [CrossRef]

| Notations | Descriptions | Specific Implications |

|---|---|---|

| Parameters | ||

| Cost coefficients for all three parties | The degree of costs or resource consumption required to achieve technological R&D and market promotion | |

| The sensitivity coefficients of technology R&D for all three parties | The impact of R&D effort of the innovation entities on the R&D level of key core technology | |

| The sensitivity coefficients of market promotion for innovation entities | The impact of market effort of the innovation entities on the market promotion of key core technology | |

| () | The influence coefficient of the R&D effort of key core technology of all three parties on their respective revenues | The impact of R&D efforts on the revenues of innovation entities |

| () | The influence coefficient of market promotion effort on respective revenues of the three parties | The impact of market promotion efforts on the revenues of innovation entities |

| () | The influence coefficient of technology R&D and market share on the revenues of the three parties. | The impact of the R&D level and market share on the revenues of innovation entities |

| Technology recession rate | The degree of slowdown or regression in the development of key core technology | |

| Market recession coefficient | The degree of slowdown or regression in the market demand of key core technology | |

| Discount rate | The present value of future cash flows | |

| Decision Variables | ||

| The R&D level of key core technology at time t | / | |

| The market share of key core technology at time t | / | |

| Revenues of leading enterprises, supporting enterprises, and academic research institutions, respectively | / | |

| Variables | ||

| The R&D efforts of key core technology of all three parties at time t | The R&D efforts of the innovation entities | |

| The market promotion efforts of key core technology of all three parties at time t | The marketing efforts of the innovation entities | |

| The proportion of technology R&D costs borne by leading enterprises for supporting enterprises and academic research institutions | / | |

| The proportion of market promotion costs borne by leading enterprises for supporting enterprises and academic research institutions | / |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fan, X.; Xiao, D.; Hui, P.; Cui, L.; Zhu, G. Multi-Entity Collaboration Mechanism of Key Core Technology Innovation Based on Differential Game. Systems 2025, 13, 436. https://doi.org/10.3390/systems13060436

Fan X, Xiao D, Hui P, Cui L, Zhu G. Multi-Entity Collaboration Mechanism of Key Core Technology Innovation Based on Differential Game. Systems. 2025; 13(6):436. https://doi.org/10.3390/systems13060436

Chicago/Turabian StyleFan, Xinxin, Dingding Xiao, Peng Hui, Lizhuang Cui, and Guilong Zhu. 2025. "Multi-Entity Collaboration Mechanism of Key Core Technology Innovation Based on Differential Game" Systems 13, no. 6: 436. https://doi.org/10.3390/systems13060436

APA StyleFan, X., Xiao, D., Hui, P., Cui, L., & Zhu, G. (2025). Multi-Entity Collaboration Mechanism of Key Core Technology Innovation Based on Differential Game. Systems, 13(6), 436. https://doi.org/10.3390/systems13060436