1. Introduction

Small suppliers have made remarkable contributions to the development of the world economy. They significantly contribute to tax revenue, gross domestic product, technological innovation, urban employment, and the creation of new jobs [

1]. Most well-known brands source their raw materials from these small suppliers. Unfortunately, many of these suppliers face capital constraints and lack the creditworthiness needed to access low-interest capital markets [

2]. High-interest private lending remains the primary financing option for small suppliers. The International Finance Corporation (IFC) estimates that 65 million firms, or 40% of formal micro, small, and medium enterprises in developing countries, face an unmet financing need of USD 5.2 trillion annually [

3]. The lack of financial resources in one firm can jeopardize the performance of the entire supply chain [

4].

Accounts receivable financing is an effective method to alleviate the financing problems faced by small suppliers [

5]. Under this financing model, small suppliers can use the receivables issued by the core enterprise (i.e., the downstream buyer) as collateral to secure working capital [

6]. Traditional accounts receivable financing (TF), however, has a significant drawback: buyers typically have direct relationships only with tier-1 suppliers and have limited visibility into deeper tiers of their supply chains. This means that only tier-1 suppliers can leverage accounts receivable notes issued by the core enterprise. Consequently, downstream buyer-initiated accounts receivable financing schemes are limited to assisting immediate upstream suppliers [

2]. Tier-2 suppliers cannot obtain mortgage financing using the receivables notes issued by tier-1 suppliers due to insufficient creditworthiness to gain the trust of banks [

7]. As a result, most deep-tier suppliers, despite being the entities most in need of liquidity, do not have access to accounts receivable financing. Statistics show that such deep-tier suppliers constitute 80% of the total [

8].

Advances in blockchain technology enable core enterprises to extend their credit benefits to deep-tier suppliers, driving the development of blockchain-enabled accounts receivable financing (BF) [

9]. This innovation is mainly reflected in three key dimensions. Firstly, the traceability function of blockchain (relying on hash value chain storage and timestamp technology) [

10] not only verifies the indirect transaction relationship between suppliers and core enterprises, but, more importantly, ensures the rigid constraints of transaction rules through the automatic execution mechanism of smart contracts, enhancing the credibility of deeper suppliers engaging in financing activities [

7]. This is a trust guarantee that traditional database technology cannot achieve. Secondly, blockchain demonstrates unique advantages in establishing multi-party trust. Its distributed ledger feature makes the digital notes of accounts receivable issued by core enterprises verifiable and immutable, significantly enhancing the financing credibility of secondary and above suppliers. Thirdly, the divisibility and transferability of these digital bills have created a new circulation mechanism: first-level suppliers can split and allocate part of the bills to second-level suppliers, and suppliers at all levels can pledge these bills confirmed by blockchain to obtain financing. However, traditional electronic bill systems are difficult to support such multi-level credit circulation. At the end of the period, the smart contract automatically executes the process of the core enterprise redeeming all digital sub-notes from the bank [

11]. This automated and irreversible settlement mechanism is precisely the core value of blockchain compared to other digital technologies, fully demonstrating the irreplaceability of blockchain technology in the supply chain finance scenario. In summary, blockchain technology ultimately empowers lenders with enhanced capabilities and renewed confidence to extend credit to borrowers who are currently deemed non-creditworthy. However, blockchain technology also has some problems and limitations. First of all, enterprises need to invest funds to build and operate blockchain platforms. Second, the issues of data security and privacy protection cannot be ignored. Furthermore, blockchain technology requires the establishment of a professional team, which may increase the operational risks for enterprises.

Given the advantages of blockchain technology, industry leaders have been exploring its applications in deep-tier supply chain financing (SCF) [

12]. By 2018, approximately 90% of U.S. and European banks had begun exploring the potential of blockchain [

13]. In September 2018, the People’s Bank of China launched a trade finance blockchain platform in Shenzhen, primarily focusing on multi-tier accounts receivable financing. As of December 2019, 38 banks had participated in the platform, generating a combined business volume of 87 billion CNY (approximately 12.4 billion USD) [

14]. Since then, major enterprises such as Samsung, JD.com, Foxconn, and Linklogis have either established or joined blockchain-based multi-tier accounts receivable financing platforms to provide financing for small suppliers at various levels [

2].

The time value of capital must be considered in accounts receivable financing for the following reasons. Trade credit, also known as deferred payment, is a globally recognized trading tool [

15]. Industries worldwide have accumulated numerous accounts receivable [

16]. The following examples illustrate this point clearly. According to the National Bureau of Statistics of China, in the first two months of 2020, industrial enterprises above the designated size reported profits totaling 410.7 billion CNY. The average number of days for accounts receivable was 71.3 days, an increase of 19.1 days year-on-year [

17]. In 2020, the proportion of average payment periods exceeding 120 days reached 23% [

16]. According to statistics by The Hackett Group, the average payment period for 1000 U.S. listed companies increased from 40.1 days in 2008 to 56.7 days in 2017 [

18]. Given the significance of the time factor in accounts receivable financing, the time value of capital—or the opportunity cost of cash—must be considered as a key concept in investment and financing activities [

19,

20]. Specifically, traditional financing (TF) and blockchain financing (BF) differ not only in capital availability but also in terms of capital acquisition costs, acquisition times, and holding periods. Therefore, this research considers the time value of capital as a critical influencing factor in the study of blockchain accounts receivable financing.

In practice, both traditional financing (TF) and blockchain financing (BF) can be utilized to fund small suppliers. TF has problems such as blocked credit transmission, poor liquidity of bills, and information asymmetry. The credit of core enterprises only covers first-level suppliers. Paper bills are difficult to be split and transferred, and banks are cautious in granting credit because they cannot verify the authenticity of transactions with deep suppliers. BF achieves credit penetration through a distributed ledger, making deep supplier transactions traceable. It enhances the flexibility of capital flow with separable digital bills and guarantees payment through smart contracts, systematically compensating for the shortcomings of TF and providing a new solution for improving the financing efficiency of the entire supply chain. Despite some financial institutions offering BF with lower financing interest rates, many small and medium suppliers still opt for TF to alleviate their financing challenges. Participants in the supply chain often lack clarity on when and which financing model to choose, particularly concerning the conditions under which the emerging blockchain financing model should be applied. Motivated by these observations, we aim to investigate the following research questions:

- (i)

How does the supply chain make integrated operational and financial decisions under blockchain accounts receivable financing (BF)?

- (ii)

Analyzed from the perspective of technical economy, which financing strategy (TF or BF) is more efficient and should be adopted by the supply chain?

- (iii)

Combined with the credit penetration effect of blockchain, how do key factors such as the time value of capital and credit level influence financing choices and supply chain performance?

To address these questions, we first develop respective financing models for TF and BF within a three-level supply chain that includes a capital-constrained tier-2 supplier, a capital-constrained tier-1 supplier, and an established retailer. Furthermore, we derive the optimal financing selection strategy between TF and BF, particularly highlighting the conditions under which BF is applicable. Interestingly, our findings suggest that although BF provides suppliers with cheaper capital (lower interest rates) than TF, when the time value of capital (credit level) of the tier-1 supplier is sufficiently high (low), the profits of all supply chain participants under BF are lower than those under TF. We provide a reasonable explanation for this phenomenon.

The primary contributions of this work are summarized as follows: First, blockchain-enabled accounts receivable financing has emerged as a critical driving force in addressing the financing challenges faced by micro-, small-, and medium-sized enterprises (MSMEs). This study is among the first to consider the split and flow characteristics of digital accounts receivable, establish a blockchain accounts receivable supply chain optimization model, and conduct joint decision-making for operations and financing. Second, we are among the first to compare the two financing models, BF and TF, and comprehensively summarize the applicable conditions for the BF model. This provides valuable references for the industry to select reasonable blockchain application scenarios. Third, while the time value of capital is a crucial factor affecting accounts receivable financing, it has been overlooked in existing studies. This research is one of the few to integrate the time value of capital and credit level into the analysis, discussing their impacts on the operational and financing decisions of supply chain participants, including pricing and financing scheme choices. Furthermore, research on capital constraints and financing for deep-tier suppliers is still in its early stages. Deep-tier suppliers financing should fully leverage the advantages of blockchain technology, enhance the ability of credit penetration, break the hierarchical barriers under the traditional financing model, focus on key factors such as the time value of capital and credit level, optimize financing strategies, and effectively alleviate the capital predicament of deep suppliers. This paper contributes to the development of the intersection between operations and supply chain finance.

The remainder of the paper is organized as follows:

Section 2 reviews the related literature.

Section 3 describes the notations and assumptions.

Section 4 and

Section 5 analytically derive the equilibria under traditional accounts receivable financing and blockchain accounts receivable financing, respectively.

Section 6 compares the supply chain performance of the two financing models.

Section 7 conducts numerical studies.

Section 8 summarizes the research conclusions and managerial insights.

2. Literature Review

2.1. Supplier Financing

This study primarily relates to three main streams of research: supplier financing, the intersection of blockchain and supply chain operations, and the time value of capital.

The first stream of related research focuses on supplier financing. In supply chains comprising financially constrained suppliers and well-capitalized retailers, numerous scholars have explored methods to provide financing to suppliers and jointly optimize supply chain operations and financial strategies. Reindorp et al. examined the strategic interaction between informational transparency and purchase quantity in purchase order financing between suppliers and retailers [

21]. Devalkar and Krishnan demonstrated that trade credit combined with a well-designed reverse factoring program can effectively improve supply chain performance [

15]. Yan et al. focused on e-retailer finance in a dual-channel supply chain, providing a value-added service for both the e-retailer and the supplier [

5]. Yi et al. evaluated the optimal financing scheme for agricultural supply chains by comparing bank financing, direct financing, and guarantor financing [

4]. Yan et al. discussed the value of factoring finance for loss-averse decision-makers, analyzing and comparing factor-led and retailer-led factoring approaches [

6]. Lee et al. explored the value of dynamic trade finance, discussing the impacts of associated information frictions and process uncertainties [

22]. Li et al. investigated the optimal credit guarantee policy in supplier finance, analyzing the effects of bankruptcy costs on credit guarantee schemes [

23].

The comparison between different financing models has also been a focus of scholarly research. Tang et al. compared purchase order financing with buyer-direct financing and found that the latter is superior if the supplier is severely financially constrained [

24]. Deng et al. compared buyer finance with bank finance in a system with multiple suppliers, identifying the appropriate conditions for each financing mode [

25]. Kouvelis and Zhao investigated the impacts of credit ratings on operational and financial decisions in a supply chain where both the supplier and retailer are financially constrained [

26]. Chen et al. demonstrated that introducing third-party logistics providers can enhance supply chain efficiency by providing both transportation and financial services [

27]. Zhao and Huchzermeier provided the retailer’s financing choice strategy between advance payment discounts and buyer-backed purchase order financing to mitigate the supplier’s financial distress [

28]. Gupta and Chen identified the conditions under which a supplier prefers retailer-direct financing over bank financing under a consignment platform, also obtaining the equilibrium decisions regarding the retailer’s debt seniority choice and the supplier’s production quantity [

29]. Kouvelis and Xu explored when factoring and reverse factoring should be adopted and who benefits from these schemes when the supplier requires immediate working capital [

30]. Yoo et al. integrated and optimized sourcing and financing strategies to improve the overall performance of a multilevel supply chain [

31]. Hu studied how a supplier should choose between debt financing and equity financing to expand capacity and mitigate a capacity under-investment problem in supply chains [

32]. Jena et al. concluded that reverse factoring yields higher profits for manufacturers and retailers compared to non-reverse factoring in a multi-echelon supply chain [

33].

Although the aforementioned studies have conducted extensive research on supplier financing, most focus on tier-1 suppliers who have a direct transactional relationship with buyers. In contrast, our study examines blockchain-driven financing solutions for deep-tier suppliers within a three-tier supply chain.

2.2. Blockchain and Supply Chain Operation Interface

In recent years, scholars have paid increasing attention to the impact of the blockchain adoption on supply chain operations. They have conducted research on the application of blockchain technology in anti-counterfeiting, data sharing, risk identification, and supply chain finance, etc. Pun et al. assumed that the manufacturer can signal product authenticity either with blockchain technology or through pricing [

34]. They explored how the government could encourage blockchain adoption by offering a subsidy. Wang et al. pointed out that the high cost is a major obstacle to the adoption of blockchain in the container cargo supply chains [

35]. They proposed a compensation mechanism to address this obstacle. Wang et al. designed a blockchain-enabled data-sharing marketplace for a stylized supply chain to overcome the impediments in supply-chain data sharing [

36]. Shen et al. found that permissioned blockchain technology plays a critical role in combating copycats [

37]. However, the brand name company may reduce the quality of its products when using blockchain. Tan shown that the introduction of a blockchain-based preowned virtual item transaction is better for both developer and consumer than a new transaction [

38]. Dong et al. explored whether blockchain traceability can reduce contamination risks and food waste. Interestingly, the results demonstrate that blockchain traceability could lead to lower supply chain profits and higher pollution risks [

9]. Iyengar et al. found that blockchain adoption is socially beneficial [

39]. They also designed a profit transfer mechanism to realize the Pareto improvement of supply chain members. Luo and Choi explored whether governments should impose cyber-security penalty schemes when facing risks from cyber-attacks [

40]. They also examined how adopting blockchain will affect the government’s choice of imposing a penalty. Zhang et al. hypothesized that the use of blockchain technology would increase consumer purchasing preferences [

41]. They explored who should introduce blockchain technology in a dual-channel supply chain.

Many studies have highlighted the increasingly significant role of blockchain technology in supply chain finance, particularly in the financing of small and medium-sized enterprises. Chod et al. found that blockchain technology enables firms to secure favorable financing terms at lower signaling costs by providing transparency into the supply chain [

42]. Liu et al. compared blockchain platform finance with retailer-independent finance and clearly summarized the applicable conditions for blockchain platform finance [

7]. Chod et al. showed that raising capital by issuing tokens rather than equity can mitigate the under-provision of effort [

42]. They also investigated the impact of decentralized governance on token financing. Wang and Xu examined how the adoption of smart contracts could create value for supply chain firms, analyzing and comparing different trade finance structures [

43].

The study closest to ours is by Dong et al. [

2], who also examined how blockchain adoption influences the optimal joint operational and financial strategy in a deep-tier supply chain. However, their focus was on the risk-mitigation value of blockchain technology. Specifically, they considered a scenario where the manufacturer adopts blockchain to gain visibility into the financial status of a tier-2 supplier, using this information to provide financial support to the tier-1 supplier and thereby mitigating the risk of supply disruptions. In contrast, our research explores a different application of blockchain technology, aiming to alleviate suppliers’ financial constraints through the splitting and flow of blockchain-enabled digital accounts receivable notes.

2.3. Time Value of Capital

The third stream of related research concerns the time value of capital (or the opportunity cost of cash). As payment cycles gradually lengthen, both industry and academia have become increasingly aware of the importance of the time value of money in operational decision-making. Chen et al. studied the effects of inflation and the time value of money on fuzzy multicycle manufacturing and remanufacturing production decisions [

44]. Johari et al. proposed a bi-level credit period coordination scheme to integrate the supply chain under periodic review replenishment policies and time value of money considerations [

45]. Tong et al. designed a wholesale price contract with partial consignment timing to coordinate multi-echelon inventory supply chain systems [

46]. Bakos and Halaburda found that higher capital costs enhance the effectiveness of tokens in solving financing issues for new marketplaces [

47].

In recognition of the importance of the time value of capital, the timing of payment has become a critical decision factor for optimizing the operations of supply chain participants. Previous studies have conducted detailed analyses and comparisons of pre-payment, cash payment, and deferred payment schemes. Zhang et al. examined the buyer’s inventory policy under advance payment, analyzing both all payment in advance and partial advanced–partial delayed payment schemes [

48]. Zhan et al. compared the impact of advanced payment and reverse factoring models on the sustainability efforts of suppliers in a supply chain [

19]. Deng et al. compared buyer finance and bank finance in assembly systems, analyzing the impact of capital opportunity costs on financing selection strategies [

25]. Wu et al. examined and compared early payment, delayed payment, and reverse factoring schemes, finding that delayed payment outperforms the others when the cost of capital is low [

20]. Chen et al. incorporated the time value of money into a deferred payment supply chain, exploring the key role of third-party logistics providers in supply chain financing [

27]. Li et al. compared advance, cash, credit, advance–cash, advance–credit, and cash–credit payments, concluding that the retailer achieves the highest profit from credit payment over other payment types [

49]. Huang designed different contractual terms, including advance payment, payment timelines, and discount rates, to provide financing to disruptive suppliers [

50]. Wu et al. compared advance payment discounts and buyer-supported purchase order financing modes, examining the effects of the clearance times of unsold items on the supplier’s discount rate [

51]. Wu et al. provided the applicable conditions for a buyback support advance payment discount model and explored how to formulate the optimal discount rate under this model [

52]. Sun et al. (2022) explored the conditions under which early payment financing is superior to bank financing and portfolio financing, and the influence of the early payment discount factor [

53].

This paper differs from previous studies in the following aspect. Most existing accounts receivable financing models ignore the effect of the time value of capital. We incorporate this crucial factor into the accounts receivable financing models, particularly the blockchain accounts receivable model, and examine its impacts on joint operational and financial decisions, as well as financing mode choices in a multi-tier supply chain. This focus is not addressed in prior studies.

3. Model Framework

This section considers a three-level supply chain [

54] consisting of a retailer

(the core enterprise), a tier-1 supplier

(a small business), and a tier-2 supplier

(also a small business). The retailer has sufficient capital to support its retailing activities, whereas the suppliers must rely on external financing to cover their operations. The tier-2 supplier produces semi-finished products at a unit cost

and sells them to the tier-1 supplier at a supply price

. The tier-1 supplier then manufactures finished products at a unit cost

and sells them to the retailer at a wholesale price

. The retailer incurs a retail cost

and sells the products at a retail price

. Market demand is a linearly decreasing function of the retail price, given by

, where

represents the market base and

denotes the price sensitivity [

33]. We assume that the market demand is deterministic and that the supply chain operates on a demand-driven basis, i.e.,

, where

denotes the order quantity.

Based on industry observations, we describe the payment and financing mechanisms within the supply chain as follows. Delayed payment, as a short-term credit tool, is widely used in commercial activities. The interval between product delivery and payment is referred to as the account period. We assume that the seller and the buyer within the supply chain engage in transactions using this delayed payment tool. The account periods for different links in the supply chain are denoted as , indicating that the tier-1 supplier (retailer) shall pay the tier-2 supplier (tier-1 supplier) within days after receiving the semi-finished (finished) products. During the account period, the tier-2 supplier and the tier-1 supplier must seek external financing to maintain production for the next phase. This research considers two financing models: the traditional accounts receivable financing model (Model T) and the blockchain accounts receivable financing model (Model B).

We first describe the working process of Model T. In the downstream of the supply chain, the retailer purchases finished products from the tier-1 supplier and issues a paper accounts receivable note () to the tier-1 supplier. The amount of is . The retailer will cash on days after receipt of the products. As the core enterprise of the supply chain, the retailer is considered to have high credit, allowing the tier-1 supplier to pledge to the bank for liquidity. However, since is a paper note, it cannot be split or circulated. The tier-1 supplier can only discount in full and pay (the interest on ) to the bank. Upon the expiration of , the retailer pays (the principal of ) to the bank. In the upstream of the supply chain, the tier-1 supplier purchases semi-finished products from the tier-2 supplier and issues a paper accounts receivable note () to the tier-2 supplier. However, as a small business, the tier-1 supplier is considered to have a low credit rating, making non-cashable at the bank. To maintain production and operations, the tier-2 supplier must seek private loans. We assume that the interest rate on private lending is .

In Model B, the retailer establishes a blockchain accounts receivable financing platform. To focus on comparing the operational differences between Models B and T, we do not consider the construction and operation costs of the platform [

7]. When a transaction occurs, the retailer issues a digital receivables note (

) and delivers it to the tier-1 supplier via the platform. The main differences between the blockchain digital note (

) and the traditional paper note (

) are as follows: Firstly, the digital note

can be split into sub-notes (

and

), whereas the paper note

cannot be split or circulated [

11]. Secondly, the blockchain platform offers information traceability, meaning that the sub-notes

and

indicate that their ultimate acceptor (payer) is the retailer. Consequently, each sub-note receives credit enhancement from the retailer, allowing the sub-note holder to obtain financing from the bank through sub-note discounting [

42]. This is because the blockchain platform has information traceability. It fully records the circulation process of sub-note and clearly indicates that the final recipient (payer) of the sub-note is the retailer. This information means for financial institutions such as banks that even if the holders of sub-note are suppliers at a deeper level in the supply chain, their credit risks have been greatly reduced due to the presence of retailers as the ultimate payers. Based on this, sub-note holders (including suppliers at all levels) can obtain financing from banks through the discounting of the sub-note by virtue of such a credit-enhanced sub-note. In summary, under Model B, the retailer’s credit benefits all tiers of the supply chain, particularly enabling deep-tier suppliers to access low-interest bank financing. We assume that the total amount of the note

is

. The amounts of the sub-notes

and

are

and

, respectively. The discount rate for all e-notes and sub-notes is

. To maintain production and operations, the tier-1 supplier discounts note

with a discount amount of

and an interest of

. Similarly, the discount amount of the tier-2 supplier’s note

is

, and the interest is

. After discounting, the amounts of the electronic notes

and

become

and

, respectively. The two suppliers discount the remaining amount at the end of the sales period without paying additional interest. The illustrations of the financing models are provided in

Figure 1.

Similar to [

27], we assume that cash has a time value. We use the parameter

to denote the time value of capital from the beginning to the end of the period [

33]. Due to the differing values of funds across enterprises, we denote the time values of the tier-2 supplier, tier-1 supplier, and the retailer as

,

, and

, respectively. Consistent with reality, the credit borrower (the tier-2 supplier under Model T) pays the loan interest rate at the end of the period. The note holders (the tier-1 suppliers under Model T and Model B, and the tier-2 supplier under Model B) pay the discount rate when they discount the notes at the beginning of the period [

19,

20]. We assume that the financing rate of private lending is significantly higher than that of bank lending, i.e.,

.

The timeline for Model T is as follows: The retailer orders finished products from the tier-1 supplier and, at the beginning of the period (time 0), pays the tier-1 supplier a non-divisible paper accounts receivable note (). The tier-1 supplier pledges the note () to the bank to obtain low-interest working capital. Subsequently, the tier-1 supplier orders raw materials from the tier-2 supplier and promises to pay at the end of the period. The tier-2 supplier borrows high-interest working capital from a private financial institution and organizes the production of semi-finished products. The tier-2 and tier-1 suppliers, in turn, deliver the semi-finished and finished products to downstream buyers. The retailer sells the products to the market and generates a profit.

At the end of the sales period (time 1), the retailer redeems the paper accounts receivable note (

) from the bank. The tier-1 supplier pays the tier-2 supplier for the semi-finished products, and the tier-2 supplier repays the principal and interest of the loan to the bank. The profit functions of the tier-2 supplier, tier-1 supplier, and the retailer under Model T are depicted as follows:

Formula (3) indicates that at time 0, the retailer orders finished products from the tier-1 supplier and pays a non-divisible paper accounts receivable note with an amount of

, sells the product to obtain

, and pledges them to the bank as production funds for organizing activities. At time 1, the accounts receivable notes mature and the retailer pays

to the tier-1 supplier and obtains the time value of the funds

. Formula (2) indicates at time 0, since the paper accounts receivable notes can only be fully discounted, the tier-1 supplier takes out

from bank and pays the bank interest of

. The tier-1 supplier pays a paper accounts receivable note with an amount of

to the tier-2 supplier. At time 1, the tier-1 supplier receives a payment of

from the retailer and the time value of the funds of

, and pays

to the tier-2 supplier. Formula (1) indicates that at time 0, the tier-2 supplier is unable to exchange the note at the bank and can only borrow funds from private individuals for production. Considering the credit level

of the tier-2 supplier, the principal and interest are

. At time 1, the tier-2 supplier receives a payment of

from the tier-1 supplier. The illustration of the financing Model T is provided in

Figure 2.

The timeline for Model B is as follows: The retailer orders products from the tier-1 supplier and, at the beginning of the period (time 0), pays the tier-1 supplier a detachable electronic accounts receivable note (). The tier-1 supplier divides into three parts. The first part () is transferred to the upstream supplier (in this study, we assume that the tier-1 supplier must transfer the digital bill to the tier-2 supplier to alleviate the tier-2 supplier’s financing difficulties). The second part () is pledged to the bank for working capital to organize production and operations, and the third part () is retained until time 1. The tier-2 supplier divides the e-note () obtained from the tier-1 supplier into two parts. The first part () is discounted to the bank to obtain working capital for production and operations, and the second part () is retained until time 1. The tier-2 and tier-1 suppliers, in turn, deliver semi-finished and finished products to downstream buyers. The retailer sells the products to the market and generates a profit. At time 1, the retailer and tier-1 supplier pay the tier-1 supplier and tier-2 supplier for their orders, respectively, and the suppliers repay the principal and interest of their loans to the financial institutions. According to the above description, we characterize the profit functions of the tier-2 supplier, tier-1 supplier, and the retailer under Model B as follows:

According to the above description, we characterize the profit functions of the tier-2 supplier, tier-1 supplier, and the retailer under the model B as follows:

Formula (6) indicates that at time 0, the retailer orders finished products from the first-level supplier and sells

, pays the tier-1 supplier a detachable electronic accounts receivable note with the amount of

, and pledges

to the bank as working capital for organizing production. At time 1, the accounts receivable notes mature, and the retailer pays

to the tier-1 supplier and obtains the time value of the funds

. Formula (5) indicates that at time 0, the tier-1 supplier, based on the detachable electronic accounts receivable note, does not need to fully discount and borrows

from the bank as production funds and first pays the bank interest

. At time 1, the tier-1 supplier receives

paid by the retailer, pays

to the tier-2 supplier, pays the loan

to the bank, and the time value of the loan funds is

. Formula (4) indicates that at time 0, the tier-2 supplier, due to the the detachable electronic accounts receivable note, can take out a loan of

from the bank and first pay an interest of

for production. At time 1, the tier-2 supplier receives

from the tier-1 supplier and pays the bank loan

, and the time value of the loan funds is

. The illustration of the financing Model B is provided in

Figure 3.

4. Equilibrium Analysis

We use a Stackelberg game to characterize the interactions between the tier-2 supplier and the tier-1 supplier, as well as between the tier-1 supplier and the retailer. Backward induction is employed to obtain the game equilibrium solution. Specifically, the tier-2 supplier first decides the supply price, followed by the tier-1 supplier deciding the wholesale price, and finally, the retailer determines the retail price. The equilibrium results in Model T are derived as shown below.

Lemma 1. The optimal procurement price , wholesale price , and retail price under Model T are derived as follows:

There exists that the retail cost has an upper limit .

Similarly, we acquire the following result in model B.

Lemma 2. The optimal procurement price , wholesale price , and retail price under Model B are derived as follows:

There exists that the retail cost has an upper limit , satisfying .

Lemmas 1 to 2 illustrate the optimal decisions and profits of the supply chain members under the two financing models. Following this, a sensitivity analysis is conducted to understand the impacts of the main parameters, as summarized in Propositions 1 to 2.

Proposition 1. The impact of the time value of capital on operational decisions is shown in Table 1. The influence of the time value of capital () on optimal decisions and overall efficiency of the supply chain is manifested as follows: the tier-1 supplier converts the entire paper receivables note into cash at time 0. Only a portion of this cash is used to manufacture products, while the remainder generates time value for the tier-1 supplier. Therefore, the wholesale and retail prices decline with the time value of capital (). This result indicates that under Model T, the increase in the time value of the capital of the tier-1 supplier is conducive to alleviating the dual marginal costs between the tier-1 supplier and retailers to improve the overall operational efficiency of the supply chain. In Model B, the tier-1 supplier converts only a part of the digital receivable into cash and is unable to fully benefit from the time value of capital during the sales cycle. Consequently, the wholesale and retail prices increase with the time value of capital (). Therefore, in Model B, from the perspective of the overall efficiency of the supply chain, as the () of the first-level suppliers increases, the dual marginal benefits of the downstream supply chain intensify, thereby reducing the overall efficiency of the supply chain.

The influence of the time value of capital () on the optimal decisions and overall efficiency of the supply chain is manifested as follows: In Model B, the tier-2 supplier pays a portion of the financing interest in cash at the beginning of the period, which results in a loss of the time value of capital. This causes tier-2 suppliers to increase their wholesale prices, leading to an increase in the retail prices and wholesale prices of the entire supply chain, thereby intensifying the dual marginal benefits of the supply chain, and reducing the overall efficiency of the supply chain. The difference is that in Model T, the tier-2 supplier’s profit and costs are settled at the end of the period; so, has no influence on the tier-2 supplier.

The influence of the time value of capital () on the optimal decisions and overall efficiency of the supply chain is manifested as follows: The retailer holds cash throughout the sales cycle and pays costs at the end of the period, leading to a decrease in the retail price with an increase in , while the supply and wholesale prices increase accordingly. This indicates that an increase in () will cause the two suppliers to raise prices for each other, thereby intensifying the dual marginal benefits between upstream suppliers. However, it is worth noting that although the increase in () raises the cost of purchasing goods, the sales volume of the product has actually increased due to the reduction in retail prices. This result may increase the profit of the entire supply chain.

Proposition 2. The impact of the credit level on operational decisions is shown in Table 2. We can analyze Proposition 2 from the following perspectives. Firstly, an enterprise’s expenditure rises along with its credit level. Therefore, creditworthy companies increase operating prices to balance costs. Secondly, the price-increasing behavior of downstream enterprises has a negative impact on terminal sales, while upstream enterprises tend to reduce supply/wholesale prices to boost ordering. Thus, high credit for each supply chain member decreases its own and downstream operating prices and increases the upstream operating price. The following theorem illustrates the relationship of supply price decisions under three financing models. The comparison results of supply prices under different models are presented below.

Theorem 1. The comparison between and is as follows: (i) There exists a threshold such that if , then ; otherwise, . (ii) There exists a threshold such that if , then ; otherwise, .

Theorem 1 implies managerial insights. (i) Impact of the Credit Level on the Supply Price: When the credit level () is high, the tier-2 supplier should set a higher supply price under Model T than under Model B. Only in Model T does the tier-2 supplier borrow money from a financial institution. The higher the credit level of the tier-2 supplier, the higher the probability that it will need to repay the financial institution. In this case, the tier-2 supplier sets a higher supply price under Model T compared to Model B. Therefore, from the perspective of the overall operation of the supply chain, when the credit rating of secondary suppliers improves, it may lead to the double marginal benefit in Model T being higher than that in Model B, thereby making the supply chain efficiency in Model T lower than that in Model B. (ii) Impact of the Time Value of Money on Wholesale and Supply Prices: When the time value of money () is high, the tier-2 supplier should set a higher supply price under Model T than under Model B. The tier-1 supplier earns a higher time value of money under Model T compared to Model B. The higher is, the lower the wholesale price the tier-1 supplier sets under Model T. Consequently, the tier-2 supplier raises the supply price to compensate for the lower wholesale price. Correspondingly, the changes in wholesale prices brought about by are also reflected in the overall operation of the supply chain. The increase in intensifies the dual marginal benefits among suppliers under Model T, thereby resulting in the operational efficiency of the upstream chain in Model T being lower than that in Model B.

Theorem 2. The comparison between and is as follows: (i) There exists a threshold such that if , then ; otherwise, . (ii) There exists a threshold such that if , then ; otherwise, .

Theorem 2 indicates that under Model T, the higher the time value of money () is, the greater the time value of money for the tier-1 supplier, and consequently, it sets a lower wholesale price compared to Model B. The principle is the same as that in Proposition 1. Since in Model T, the tier-1 supplier fully convert the paper accounts receivable notes into cash in advance, the increase in the time value of funds will cause the tier-1 suppliers to lower their wholesale prices in Model Tl, thereby increasing the overall sales volume of the supply chain and reducing the dual marginal benefits of the downstream supply chain to improve the operational efficiency of the supply chain.

Theorem 3. The comparison between and is as follows: (i) There exists a threshold such that if , then ; otherwise, . (ii) There exists a threshold such that if , then ; otherwise, .

Theorem 3 indicates that the impacts of the time value of money () and the credit level () on the retail price and the overall efficiency of supply chain operations are the same as their impacts on the wholesale price. We will not elaborate further on the pricing strategies under Model B and Model T, but instead proceed to compare the supply chain profits in both modes.

5. Performance Analysis

By analyzing the impact of the time value of capital on the profits of supply chain members, we obtain the following proposition:

Proposition 3. The impact of the time value of capital on optimal profits is shown in Table 3. Under Model T, the tier-1 supplier cashes out all receivables at the beginning of the period. This idle capital creates time value for the tier-1 supplier and the entire supply chain. Thus, the profits of all supply chain participants increase with the time value of capital (). In Model B, the tier-1 supplier is required to pay interest to the bank at the beginning of the period. Hence, the return of the entire supply chain decreases with . Additionally, the bank charges the financing rate to the tier-2 supplier at the beginning in Model B. Therefore, the profits of the supply chain participants decrease with . The retailer benefits from a higher by being able to receive cash transfers in real time. The following analysis further explores the influence of the credit level on the supply chain.

Therefore, the conclusion of this proposition has the following important guiding values for the practice of supply chain finance. Under Model T, the tier-1 supplier can generate three benefits through early capital realization: first, activate book assets and convert receivables into operational funds; second, create the time value of capital and enhance the overall rate of return through capital operation; third, generate a synergistic effect and enhance the overall efficiency of the entire supply chain. In contrast, although blockchain technology endows Model B with theoretical advantages such as immutability and decentralization, it can alleviate the problems of information asymmetry and fraud, but it faces dual cost pressures due to the fact that tier-1 supplier cannot redeem accounts receivable in advance: the front-end interest expenses directly erode the enterprise’s profits, and the back-end financing rate transmission increases the financial burden on the supply chain. Therefore, the benefits of the time value of capital cannot be reflected. Meanwhile, in practical applications, blockchain technology still faces challenges such as non-uniform technical standards, difficulties in cross-chain collaboration, and high access costs for small and medium-sized enterprises, which limit the advantages of Model B. It is particularly worth noting the efficiency improvement effect of real-time cash flow at the retail end, which provides an important direction for the innovation of supply chain finance—by optimizing the payment and settlement system, the commercial vitality at the end can be significantly enhanced. These findings provide a basis for enterprises in aspects such as the selection of different financing strategies, the improvement of capital operation efficiency, and the collaborative management of the supply chain. The following text will conduct an in-depth analysis of the mechanism of the influence of credit ratings on supply chain performance.

Proposition 4. The impact of credit level on optimal profits is shown in Table 4. As illustrated in Proposition 4, under conditions of limited repayment liability, higher credit levels are generally adverse to the supply chain and its participants. Borrowers may prefer to default to avoid repayment obligations, which should raise the attention of financial institutions. We then focus on the profit comparison under different financing models and reach the following theorems. The results of the comparison of the tier-2 supplier’s profit under different financing models are shown below.

Theorem 4. The comparison between and is as follows: (i) There exists a threshold such that if , then ; otherwise, . (ii) There exists a threshold such that if , then ; otherwise, .

We set aside the analysis of Theorem 4 and further compare the profit of the tier-1 supplier under different financing models. Through simple algebraic operations, we find that and hold certain relationships. Based on this, we summarize the comparative characteristics of the tier-1 supplier’s profits under different models.

Theorem 5. The comparison between and is as follows: (i) There exists a threshold such that if , then ; otherwise, . (ii) There exists a threshold such that if , then ; otherwise, .

Theorem 5 implies that the results of the comparison of the tier-1 supplier’s profits under Models T, B, and I, along with the corresponding establishment conditions, are the same as those of the tier-2 supplier. Through further derivation, we find that and . Based on the above assumptions and preliminary analysis results, we obtain the following properties regarding the comparison of the retailer’s profits.

Theorem 6. The comparison between and is as follows: (i) There exists a threshold such that if , then ; otherwise, . (ii) There exists a threshold such that if , then ; otherwise, .

Theorems 4–6 imply managerial insights. (i) The lower the time value of capital of the tier-1 supplier (), the more inclined supply chain members should be to choose Model B over other financing models. In other words, only when is low is the supply chain with capital-constrained suppliers suitable for adopting the blockchain receivable financing model; otherwise, it should adopt the traditional receivable financing model. We can understand this result from the following perspective: Intuitively, the use of blockchain reduces the financing cost of the tier-2 supplier (financing cost reduction effect). This effect is beneficial for the tier-2 supplier and prompts it to lower the supply price, leading to a low procurement cost for the tier-1 supplier (low procurement price effect). However, the tier-1 supplier obtains a lower cash value in Model B than in Model T due to splitting and transferring the digital note to the tier-2 supplier (cash value loss effect). For the tier-1 supplier, only when is below a critical point does the positive effect of the low procurement price surpass the negative effect of the cash value loss. The influences of these two effects on the tier-1 supplier are then transmitted to the entire supply chain and lead to the profit comparison result demonstrated by Theorems 4 to 6.

From the perspective of the practical application of blockchain technology in supply chain finance, this theorem reveals from the perspective of the triple effect that there exists a transmission chain of “financing cost savings → purchase price reduction → cash value depreciation” in the supply chain, explaining the internal reasons for the differences in the application effects of blockchain in reality. On the one hand, the smart contract feature of blockchain can indeed reduce the cost of financing verification. But, on the other hand, the rigid settlement mechanism caused by its immutability may accelerate the depreciation of the time value of capital. This conclusion also provides a theoretical basis for supplier enterprises with long accounts payable cycles, such as those in the automotive manufacturing and electronic equipment industries, to adjust their financing models in a timely manner by measuring the time value of their own funds.

(ii) The credit level of the tier-2 supplier being higher means that the supply chain should increasingly opt for Model T instead of Model B to finance the upstream suppliers. This once again validates that blockchain technology can be a “double-edged sword” when it comes to financing upstream suppliers. The possible reasons are that under model T, an increase in leads to higher costs for the tier-2 supplier and even the entire supply chain. We term this the high-credit effect, which is disadvantageous to the supply chain. When is sufficiently high, the negative impact of high credit surpasses the positive effect of the financing cost reduction effect, and Model T becomes the predominant financing strategy compared to Model B. The conclusion reveals the potential contradiction of blockchain technology in the application of supply chain finance: high-credit enterprises may be troubled by the “credit paradox”. The transparency of blockchain and the automatic execution feature of smart contracts, while enhancing the efficiency of financing, may also limit the flexibility of capital operation for high-credit enterprises. Financial institutions need to establish a dynamic credit rating mechanism and set reasonable threshold trigger rules to balance the efficiency advantages of blockchain technology with the flexibility requirements of traditional finance.

(iii) Theorem 6 reveals that under the same conditions, the retailer prefers the traditional financing model (Model T) over the blockchain financing model (Model B) compared to the suppliers. This is because, in Model B, the retailer bears more of the financing guarantee risk than in other models. Thus, the retailer requires more incentives to support blockchain financing for suppliers. Reasonable incentives or profit distribution mechanisms should be appropriately designed to encourage the retailer to initiate blockchain supply chain finance. This conclusion also corresponds to real cases in reality, such as the “government–enterprise joint incentive mechanism” introduced in Zhejiang Province, China, which further supports retailers in using supply chain finance through measures such as government guarantees. However, the distributed nature of blockchain has an inherent tension with the centralized guarantee mechanism. On the one hand, the automatic execution of smart contracts can reduce guarantee costs. On the other hand, government guarantees may weaken the decentralized advantage of blockchain and create new “centralized risk points”. This reminds us that when promoting blockchain supply chain finance, careful design of an incentive compatibility mechanism is necessary, giving full play to technological advantages while avoiding the institutional predicament of “new wine in old bottles”.

The above analysis provides a decision reference for the supply chain to optimally choose a financing strategy and reasonably use blockchain technology based on the time value of capital and the credit level of financing participants. The following numerical analysis provides a more intuitive understanding of the theoretical conclusions.

6. Numerical Analysis

The establishment of the numerical analysis model is based on the Stackelberg game, combined with the actual scenarios of supply chain operations. By abstracting and simplifying the operation mechanism of the model, the model assumptions and boundary conditions can be clarified. Under this framework, the model structure is repeatedly corrected, and finally a numerical analysis model that conforms to the research goals is formed. We present a set of numerical examples to illustrate, verify, and extend the aforementioned analytical results. First, we compare the profits of Models B and T throughout the numerical analysis to understand the impacts of the financing model choice on the upstream capital-constrained supply chain. Second, we investigate the influence of the main parameters—the time value of capital of the tier-1 supplier (

), the credit level of the tier-2 supplier (

), the account period (

), and the interest rate of the bank loan (

)—on the optimal decisions and payoffs of supply chain members. After sufficient market research, the exogenous parameters are simulated and set as follows:

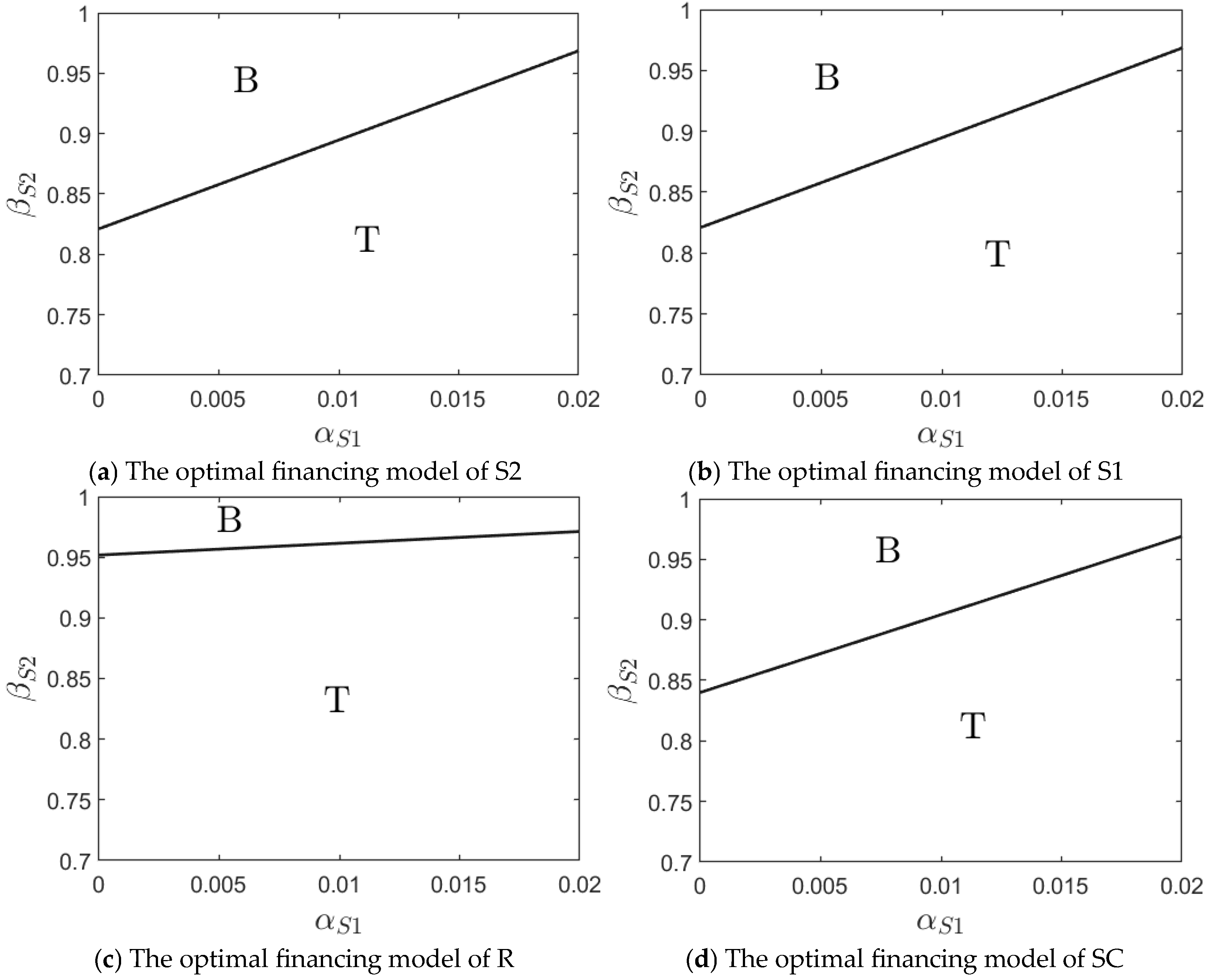

The analysis results are presented in

Figure 4,

Figure 5 and

Figure 6. “B” indicates that the optimal financing model is BF. “T” indicates that the optimal financing model is TF. As illustrated in

Figure 4, the optimal financing choice strategy of supply chain participants changes with the time value of capital (

) and the credit level (

). Specifically, when

is high enough, Model B is the optimal financing model for all supply chain members. Conversely, Model B and Model T are dominant models for the supply chain if

is low and high, respectively. The above numerical results are consistent with the findings of Theorems 4 to 6; so, we will not reiterate them here.

Figure 5 illustrates the effects of the account period (

). An interesting finding is that the profits of supply chain members increase with the extension of the account period (

). The change in supply chain members’ profits with respect to

is more sensitive in Model T than in other models. When the parameter

is below and above a certain threshold, the profits of supply chain participants are highest in Model B and Model T, respectively. The potential reasons are that the extension of payment terms increases the cost of capital for suppliers (i.e., cost of capital increase effect), but it also reduces the operating cost of the retailer, prompting the retailer to sell products at a lower retail price, thereby increasing supply chain product sales (i.e., sales increase effect). For the supply chain and its participants, the positive effect of increasing sales volume outweighs the negative effect of increasing capital cost. In Model T, the tier-1 supplier additionally benefits from the time value generated by idle capital. Therefore, Model T benefits more from an extended accounting period. These results suggest that supply chain participants should use blockchain accounts receivable financing for short supply chain accounts receivable periods and traditional accounts receivable financing for long supply chain accounts receivable periods. This is consistent with the actual situation. When the account period (

) is short, in Model B, tier-1 and tier-2 suppliers can quickly recover funds by using separable blockchain accounts receivable notes, effectively improve the efficiency of capital turnover, reduce capital costs, and obtain more profits through the increase effect of retailer sales. When the accounts receivable cycle is extended, such as in the infrastructure industry, the account period (

) is generally long, and supply chain participants pay more attention to the time value of funds, confirming the applicability of Model T under a long period.

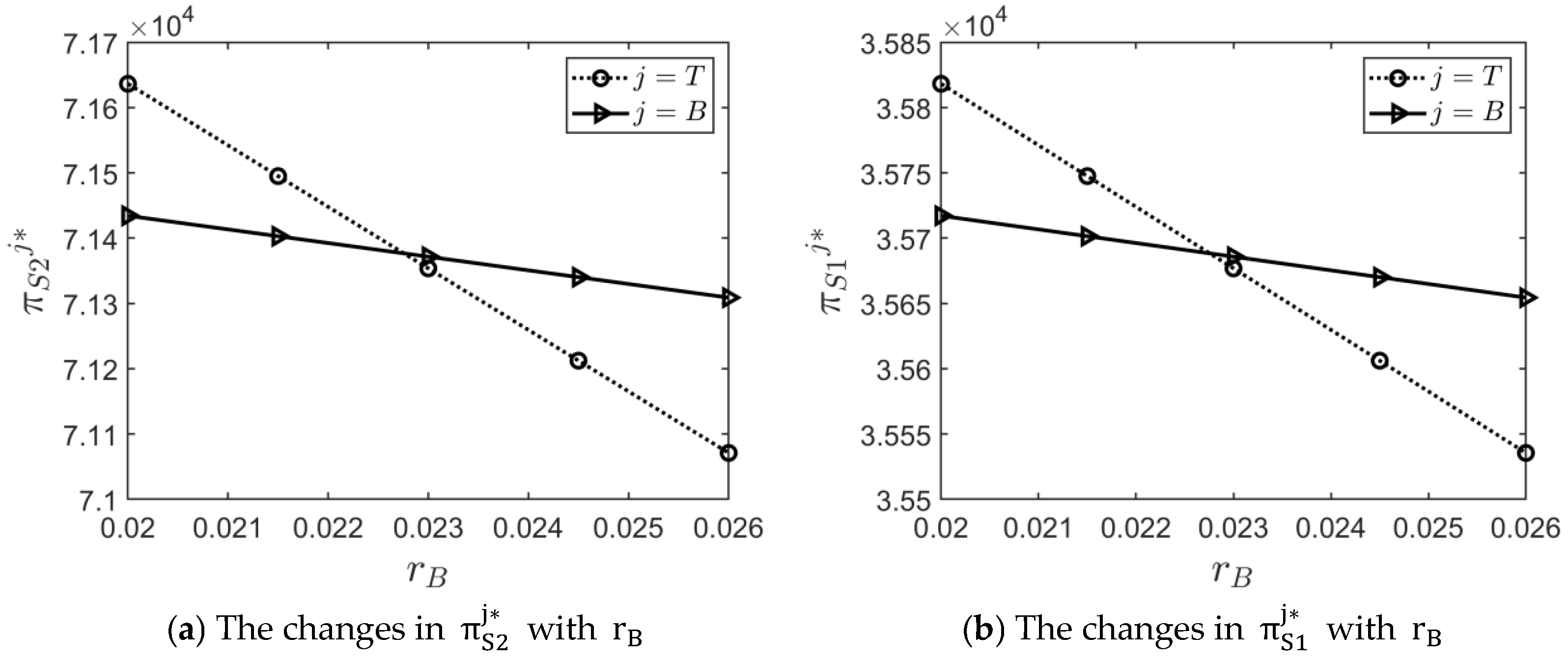

Figure 6 shows how the profits of supply chain participants change with the bank financing rate (

). We can observe that the profits of supply chain participants in Model T and Model B decrease with the parameter

, and Model T is more affected by the parameter

. More importantly, when

is at a low and high level, the dominant financing models for the supply chain are Model T and Model B, respectively. This is consistent with the reality. When the financing rate is low, the financing cost for supply chain participants is low, and they have no incentive to choose Model B. As the rate rises and the financing cost keeps increasing, supply chain participants actively choose Model B as the financing model to reduce the financing cost. The above analysis results provide decision-making suggestions for supply chain managers to determine financing models according to financing interest rate changes.

7. Academic Contributions and Practical Significance

This chapter mainly explains the influence of the proposed model and research findings on academic theories and practical applications.

This study has made three significant contributions to academic theory by constructing a three-level supply chain financing model and providing research findings: (i) Firstly, the theoretical mechanism of the “credit penetration effect” was innovatively proposed, systematically revealing how blockchain technology can achieve the transmission of the credit of core enterprises to secondary suppliers through the divisibility of digital bills. This discovery compensates for the limitation of the traditional supply chain finance theory that only focuses on two-level credit transmission. Secondly, an analytical framework covering both the time value of funds and credit ratings was established, providing a new theoretical perspective for understanding the differences in supplier decisions under different financing models. Thirdly, through a comparative static analysis, the marginal effects of blockchain technology on shortening the settlement cycle and reducing financing costs were quantitatively proved for the first time. These findings provide important reference benchmarks for subsequent modeling research in the field of supply chain finance.

(ii) This study has made three important breakthroughs at the theoretical level of supply chain finance. Firstly, the “triple effect” transmission mechanism (financing cost savings → reduction in purchase price → depreciation of cash value) was innovatively proposed, systematically revealing the interaction mechanism between the time value of capital (

) and credit rate

under different financing models, making up for the theoretical limitation of existing studies that only focus on a single effect [

27]. Secondly, the “credit paradox” phenomenon of high-credit enterprises was discovered. That is, when the credit rating exceeds the threshold, it instead leads to an increase in the overall cost of the supply chain. This discovery challenges the linear assumption of the traditional credit rating theory. Thirdly, a dynamic decision-making model incorporating the technical characteristics of blockchain (separability and immutability) has been constructed, providing a new theoretical framework for understanding the technical adoption threshold. These theoretical innovations have provided important modeling ideas and analytical dimensions for subsequent research on supply chain finance.

At the practical level, the proposed model and research findings provide specific guidance for different stakeholders. (i) For supplier enterprises, the research results show that secondary suppliers can obtain lower bank financing interest rates under the blockchain model, which provides a quantitative basis for the selection of financing channels for small and medium-sized enterprises. For core enterprises, this research reveals that through blockchain platforms, the utilization rate of their credit resources can be enhanced, which strengthens the economic impetus for enterprises to build supply chain finance platforms. For financial institutions, the model confirms that the traceability of blockchain can reduce the credit risk premium of deep suppliers, which provides theoretical support for banks to design tiered interest rate products. In particular, the matching principle between the accounting period (l) and the time value of capital proposed in this research has been applied and verified in a certain supply chain platform, helping it optimize the bill discounting strategy.

(ii) For deep-tier suppliers, these findings have confirmed that when the time value of capital of first-tier suppliers is relatively low, adopting Model B can increase profits, which provides a quantitative standard for the selection of financing strategies. For financial institutions, the discovery of the “credit paradox” prompted the introduction of nonlinear adjustment factors in risk control models. After applying this discovery, a certain commercial bank reduced the non-performing loan ratio. For policymakers, Zhejiang Province has effectively alleviated the guarantee concerns of retailers participating in Model B through the “government–enterprise joint incentive mechanism”, verifying the actual value of the profit-sharing plan. This empirical evidence highlights the practical value of the research conclusions in optimizing the supply chain finance ecosystem.

8. Conclusions

Many deep-tier suppliers, due to their small sizes and lack of direct transactions with core enterprises, cannot obtain low-interest credit financing or core enterprise guarantee financing from commercial banks. Recent advancements in blockchain technology (e.g., digital acceptance split and transfer technology) make it possible to share core enterprises’ credit throughout the supply chain and propel the development of blockchain-enabled accounts receivable financing.

This paper examines the impacts of blockchain technology on joint financing and operational decisions in a three-tier supply chain with upstream capital constraints, and analyzes the optimal selection strategy between blockchain accounts receivable financing (Model B) and traditional accounts receivable financing (Model T). The paper obtains the following research conclusions and managerial insights:

- (i)

Blockchain Accounts Receivable Financing Modeling and Decision Analysis—A suitable three-level supply chain decision model with upstream capital constraints considering the time value of capital is designed to characterize the blockchain-enabled accounts receivable financing. The impact of the time value of capital on operational decisions and optimal profits is analyzed with emphasis. We find that under Model B (versus Model T), the higher the time value of capital owned by suppliers, the higher (lower) the profits of supply chain participants. Therefore, when the time value of the supplier’s funds is relatively high, the supplier should actively utilize the blockchain accounts receivable financing Model B to accelerate the recovery of funds and expand production. Regardless of the model, the higher the value of capital owned by the retailer, the more advantageous it is for the supply chain. The retailer can appropriately increase the purchase volume to enhance the overall efficiency of the supply chain. We also investigate the influence of credit levels on supply chain operations and performance. Financing interest rates and amounts are differentiated based on credit ratings to encourage enterprises to enhance the supplier’s credit. The above analysis results provide a framework for supply chain members to reasonably make joint financing and operational decisions when participating in blockchain accounts receivable financing.

- (ii)

Comparative Analysis of Financing Models—We systematically compare the financing Models B and T, and derive numerous managerial insights. When the time value of capital of the tier-1 supplier is low and high enough, Models B and T become the dominant financing models for supply chain participants, respectively. The tier-1 supplier, when the time value of funds is low enough, actively adopts Model B financing and plans in advance for key links such as raw material procurement and equipment upgrading to improve production efficiency. When the time value of funds is high enough, Model T financing is chosen, and the payment cycle of funds is reasonably arranged to reduce the financing costs. The lower (higher) the credit level of the supplier (retailer), the more advantageous private lending is compared to other financing models. In terms of credit management, suppliers should strive to enhance their own credit levels, such as standardizing financial statements, making timely repayments, and reducing the reliance on private lending. Retailers can strive for more favorable financing conditions, such as lower interest rates and higher credit limits, by virtue of their higher credit. When the financing interest rate of the commercial bank is at low and high levels, financing Models T and B should be adopted for financing upstream suppliers in the deep-tier supply chain, respectively. When the rate is relatively low, upstream suppliers adopting the financing Model T can use the funds for upgrading production equipment, technological research and development, and optimizing supply chain collaboration by establishing an information sharing platform. When the rate is relatively high, upstream suppliers adopting the financing Model B can use blockchain technology to jointly build a trusted data pool with financial institutions to secure preferential financing. Meanwhile, supply chain members can reduce costs through joint procurement and other means. We provide reasonable explanations for the above conclusions. The above research results offer strategic guidance for multi-level supply chains with upstream capital constraints to reasonably choose financing methods to address their financial dilemmas.

- (iii)

Blockchain Accounts Receivable Financing Value and Applicability Analysis—Blockchain digital acceptance split and flow technology conditionally creates value for a multi-stage supply chain with upstream capital constraints. For instance, when the time value of capital of the tier-1 supplier is high enough, the profits of supply chain members and the overall performance under the blockchain financing model are lower than those under the traditional financing model. Many such conditions are identified in this study. New technologies like blockchain may act as a “double-edged sword” and should be conditionally introduced into the supply chain. This study summarizes the advantages and applicable conditions of the blockchain accounts receivable financing model compared to traditional financing models, taking into account the time value of capital. It provides managerial insights and policy suggestions for supply chain managers to introduce blockchain technology judiciously.

There are several limitations in the model construction of this study that need to be deeply explored. These limitations have important implications for the practical application of the research conclusions. Firstly, in the dimension of supply chain structure, the existing models only contain two-level of suppliers (tier-1 and tier-2), failing to fully reflect the complexity of the actual supply chain network. Take the automotive industry as an example. A typical supply chain usually involves suppliers at levels four to six, and there are significant differences in the capital transmission effect and risk accumulation mechanism among suppliers at all levels. Although this simplified processing ensures the feasibility of the model, it may underestimate the financing constraints and risk amplification effects faced by deep-level suppliers (such as tier-3 and above). Secondly, in terms of the assumption of technical costs, this study sets the implementation and usage costs of blockchain technology to zero. This idealized treatment ignores several key cost factors existing in reality: technical deployment costs, continuous operation costs, compliance transformation costs, etc. These actual cost factors may significantly affect enterprises’ technology adoption decisions. Thirdly, in terms of research methods, this study has only conducted a theoretical model analysis so far, lacking empirical data support. This makes the model validation face challenges and limits the universality of the research conclusions.

In practical applications, JD Supply Chain’s “Jingbaobei” financing platform, through blockchain technology, unites core enterprises with small and medium-sized suppliers along the industrial chain. The credit of core enterprises can be transmitted multiple levels upstream along the supply chain. Small and medium-sized suppliers can alleviate the problems of difficult and expensive financing with the immutable trade records on the chain, verifying the technical feasibility of blockchain in multi-level credit transmission [

55]. Our research can be extended in several directions for future studies to address other open questions regarding blockchain-enabled deep-tier supply chain finance. First, it will be interesting to explore other application potentials of blockchain technology, such as risk identification, in addition to our current focus on credit transmission. Moreover, the impacts of factors other than the time value of capital on blockchain-driven supply chain finance are also an interesting direction for future research. Second, in this study, the supply chain is assumed to be in a risk-free and information-complete sharing environment. It will be valuable to explore how blockchain tools can be used to mitigate risks and information asymmetry in supply chain finance. For markets such as Africa and Latin America, where access to external financing is very limited, this study has significant theoretical reference value and practical guiding significance for improving the financing situation of deep-tier suppliers in the market. Finally, in addition to the accounts receivable financing model studied in this paper, there are many other forms of blockchain-enabled supply chain finance, such as inventory financing and account prepaid financing, which could be incorporated as possible future research avenues.