Abstract

As digital platforms reshape the commercial landscape, brands increasingly collaborate with these platforms to enhance product sales. Many adopt livestream as a strategic tool to attract more traffic, typically choosing between Artificial Intelligence (AI) or Key Opinion Leader (KOL) approaches. Meanwhile, platforms operate under either an agency or a resale mode. However, the relative effectiveness of these strategies remains unclear. This study investigates an e-commerce supply chain comprising a single brand and platform, examining how AI and KOL livestream influence supply chain decisions across different sales modes and identifying optimal strategies for the brand and platform. Results show that when the platform’s revenue sharing rate is low, the agency mode consistently yields a Pareto improvement over resale, regardless of the livestream scheme. Moreover, when the KOL promotion fee rate is low, KOL livestream outperforms AI livestream under both sales modes. When the revenue sharing rate is high, the brand’s optimal strategy is “resale mode and KOL livestream”, while the platform prefers “agency mode and KOL livestream”. Conversely, when the revenue sharing rate is low, the platform’s best strategy is “resale mode and KOL livestream”, while the brand favors the agency mode, with livestream preferences shaped by KOL promotion fee rate.

1. Introduction

In the post-pandemic era, livestream e-commerce has rapidly gained traction, reshaping the digital marketplace [1]. As an emerging information technology, livestream has become a pivotal tool for brands aiming to drive traffic and boost sales. Consequently, an increasing number of e-commerce platforms have started venturing into livestream services. For example, Tmall’s livestream platform has become the largest livestream platform in China [2]. In a 2020 survey, two-thirds of Chinese consumers said they had bought products via livestream in the past year [3]. Furthermore, livestream e-commerce has witnessed explosive growth amid the COVID-19 pandemic, when many people have been stuck at home, such as Alibaba’s Taobao, ByteDance and TikTok. The size of China’s livestream e-commerce market hit RMB 1.2 trillion in 2021, with an annual growth rate of 197.0%. It is estimated to increase at a compound annual growth rate of 58.3% in the next three years and to exceed RMB 4.9 trillion in 2024. Unlike traditional e-commerce, livestream e-commerce involves introducing, demonstrating, and trying products in real-time within a livestream room while answering questions from online viewers. Livestream allows for better product presentation and interaction with consumers, enriching the shopping experience and gaining consumer trust. If consumers are satisfied with the products introduced by the host, they can click on the product link in the live stream, which will redirect them to the official flagship store for purchase.

In livestream marketing, many brand owners choose to collaborate with Key Opinion Leaders (KOLs) who have significant market influence and reach. KOL livestream has emerged as a favored strategy among e-retailers due to its immediate and considerable impact on sales [4]. For example, many brands consider hiring Key Opinion Leaders (KOLs) for traffic generation and marketing [5]. Some influencers on the Kuaishou platform conduct live streams, embedding product links from brand owners in the live stream. This facilitates collaborative promotional campaigns between the brand owners and the KOLs [6]. KOLs provide comprehensive evaluations of products based on their own experiences and professional expertise, earning the trust of online viewers. KOLs can significantly boost the brand’s sales because they often have a large fan base and can attract even more general consumers. This phenomenon is known as the KOL effect [7]. In addition, product descriptions shift from traditional e-commerce images to real-time interaction between consumers and KOLs, offering consumers a novel experience. This leads to herd behavior among consumers, creating strong network externalities. The KOL describes the product to the audience in the livestream room, where viewers also interact with one another, further amplifying network externalities. The main purpose of teaming up with KOLs in livestream commerce is for marketing rather than sales. However high sales may be, the company has to pay the livestreamer a promotion fee of 20–40% [5]. The high KOL promotion fee has made many brands start to pay attention to AI livestream.

Notably, digital technologies like AI and virtual reality have driven the further development of livestream e-commerce. Companies such as Alibaba, iFlytek, and Sogou have recently developed AI livestream, introducing services like AI chatbot interactions and AR try-ons in livestream rooms. Many brands have also created their own AI virtual personas, successfully establishing closer connections with their target consumers and enhancing the brand’s market influence. For example, Hua Xizi creates its virtual character as a spokesperson for product promotion. In addition to Hua Xizi, many other brands have launched their virtual idols: Watsons introduces “Qu Chenxi”, ASUS creates “Tianxuan Ji”, McDonald’s launches “Cool Uncle”, and Yili’s Yo! yogurt has “Xiao You” [8]. These services not only enhance the consumer shopping experience but also reduce uncertainty about the product, thereby increasing consumer trust. Brands pay once for the technology and use it forever. There are no extra costs like sick days or overtime work [9]. Therefore, more and more brands are opening AI livestream to promote product sales. In practice, the performance of AI hosts is almost on a par with human hosts, suggesting that AI hosts can effectively replace KOL hosts in traffic generation and driving product sales.

The differences between AI livestream and KOL livestream can be summarized in three main points. First, in the KOL livestream, consumer trust in the product is built through the personal influence or livestream abilities of the KOL. In AI livestream, however, consumer trust depends on the brand owner’s investment in the AI’s intelligence level. The higher the AI’s intelligence, the more dynamic the product presentation, and the better the AI can respond to consumer inquiries in real time, thus enhancing the shopping experience. Second, when brand owners use KOL livestream, they must sign a revenue-sharing contract with the KOL, meaning the KOL will take a certain percentage of the livestream revenue as a promotion cost. In contrast, for AI livestream, the brand owner incurs a one-time investment cost for AI development. Finally, the decision-makers in AI and KOL livestream differ. When a brand owner launches KOL livestream, the influential KOL will negotiate for discount prices to attract and maintain their fan base [10]. Therefore, in the KOL livestream, the price is determined by the KOL. In AI livestream, since the AI host is a virtual promotion tool and makes no decisions, the brand owner and platform are the ones who decide which livestream scheme to adopt.

The previous section outlines two livestream schemes. With the rapid growth of online e-commerce, two popular sales modes have emerged between brand owners and platforms: the agency mode and the resale mode. Under the agency mode, the brand owner acts as the seller, selling products through the platform, with the brand owner setting the prices. The platform serves as a marketplace, charging a commission on sales revenue. In reality, the marketplaces of JD.com, Amazon.com, and Tmall.com use agency modes [11]. Under the resale mode, the platform acts as the seller. The brand owner sells the products to the e-commerce platform at a wholesale price, and the platform, as the retailer, then determines the retail price. For example, the self-operated brands of many e-retailers (BestBuy.com) utilize resale modes [12]. More recently, e-commerce platforms such as Amazon, Sears, and JD.com have broken away from the traditional resale format and embraced agency sales. For example, Amazon’s agency sales accounted for 64% of its total sales and revenue in 2021 [13]. The primary difference between the two modes lies in who determines the online retail price: under the agency mode, the decision-making power is held by the brand owner, while under the resale mode, it rests with the livestream platform [14,15,16,17]. This paper considers both types of sales modes within the supply chain and compares them. In practice, the collaboration between brands and platforms is crucial. The brand’s choice of livestream scheme and the platform’s sales mode are interdependent and inseparable. We explore how these two factors influence each other and further reveal which decision combinations are more optimal for the brand. This study sheds light on the complex relationships between platforms, brands, and consumers, aiming to optimize the overall positive effects within the supply chain.

In light of the above background, this paper aims to address the following questions:

- (a)

- How do different sales modes impact pricing decisions and performance under various livestream schemes, and which sales mode should the brand select?

- (b)

- How do different livestream schemes influence pricing decisions and performance under various sales modes, and which livestream scheme should the brand select?

- (c)

- How should a brand or platform choose the optimal strategy for selecting livestream schemes and sales modes?

Based on these questions, this paper considers both the agency and resale modes employed by platforms and introduces AI livestream and KOL livestream as marketing tools into the e-commerce supply chain. It explores how the activation of AI livestream and KOL livestream by the brand affects supply chain pricing and performance under both the agency and resale modes. We have studied the impact of different livestream schemes on sales mode selection, as well as the effect of different sales modes on pricing decisions and performance. Our findings indicate that when the platform’s revenue sharing rate is relatively low, in both the no livestream and AI or KOL livestream scenarios, the agency mode consistently allows the brand to achieve higher profits than the resale mode. We also examine how different sales modes influence the choice of livestream schemes and the impact of various livestream schemes on pricing decisions and performance. We find that regardless of whether the sales mode is resale or agency, both AI livestream and KOL livestream can lead to a Pareto improvement for both the brand and the platform. Additionally, we find that livestream helps expand market demand by gaining consumer trust. Moreover, we also explore the optimal decision-making for brands and find that when the platform’s revenue sharing rate is high, brands should lean towards a strategy combining the resale mode and KOL livestream. When the platform’s revenue sharing rate is low, the brand tends to prefer the agency mode, with the choice of a livestream scheme also influenced by the KOL promotion fee rate.

The remainder of this paper is organized as follows. We review the literature in Section 2 and introduce the model in Section 3. The equilibrium analysis for AI and KOL livestream is discussed in Section 4, followed by a discussion of the extension model in Section 5. We conclude in Section 6. All proofs are relegated to Appendix A.

2. Literature Review

This paper examines the impact of the brand’s livestream scheme on pricing decisions and performance under different sales modes in the e-commerce supply chain and the impact of the platform’s sales mode on pricing and performance under different livestream schemes. We analyze the interactive effects of livestream schemes and sales modes and explore which combinations are optimal for the brand or platform. Thus, the literature related to this paper is mainly reflected in the following two research streams: livestream and the selection or introduction of platform modes.

Our model is related to research on livestream, which has been extensively studied in recent years. For instance, Cai et al. [18] incorporated factors including livestream room attractiveness and consumer types to determine the optimal pricing and sequencing for three distinct livestreaming strategies. Fletcher and Gbadamosi [19] assessed the nature of social media’s live content on consumer decision-making. Pun and Fung [20] showed the impact of interactive marketing on sales within the live-streaming platform Douyin. Sun et al. [21] examined how live streaming influences social commerce customers’ purchase intentions in China. Livestream schemes primarily include AI livestream and KOL livestream. The existing literature mainly focuses on exploring the impact of a specific type of livestream on promoting sales. For example, Shen et al. [22] studied the effect of different contracts on the sales of new experience products that the KOLs promote in livestream e-commerce. Zhang et al. [23] explored the effects of virtual influencers powered by AI. Lyu et al. [24] analyzed how retailers in live commerce should select suitable KOLs to promote sales. He and Jin [25] examined the impact of KOLs on consumers’ purchase intentions in live commerce. Hu [26] pointed out that streamers with a large fan base (i.e., top KOLs) can attract more live streaming resources to achieve better live stream sales. Hou et al. [27] explained that high-ranking KOLs in marketplaces are more effective in traffic generation, often attracting a larger audience to the live-streaming sessions. However, few studies have compared AI livestream and KOL livestream to explore the impact of different livestream schemes on sales. Unlike the literature above, Yu et al. [28] analyzed the impact of artificial intelligence (AI) and key opinion leader (KOL) livestream on the profitability of brands and the platform, incorporating the effects of horizontal interactions to identify the optimal livestream mode. Niu et al. [29] explored the trade-offs global brands face when choosing between AI livestreams and KOL livestreams in cross-border operations. The common features of the literature above that differ from ours are that they only consider the scenarios based on the agency mode, while our research considers two operational modes for the platform: the agency mode and the resale mode.

The literature on the selection of platform modes is vast. However, it overlooks how different livestream schemes may impact firms’ sales mode selection. For instance, Hao and Yang [14] examined whether a platform should adopt the agency mode or the resale mode when considering the supplier’s pricing strategy. Liu et al. [30] explored the impact of data-driven marketing and market scale on platform profitability and sales mode selection. It found that as the efficiency of data-driven marketing improves, platforms are more inclined to adopt the resale mode. Chen et al. [31] studied the strategy of offering return shipping insurance by e-sellers under resale and agency modes. They found that the conditions for providing return shipping insurance are more stringent under the agency mode than under the resale mode. Ji et al. [32] explored how social communications affect an upstream firm’s product line design in the platform economy when an online platform makes strategic contract choices. They showed that an agency mode can be preferred in the presence of social communications over a wholesale mode if, and only if, the commission rate is sufficiently high or both the commission rate and the product line extension fee are moderate. Yu et al. [33] constructed decision-making models of trade-in programs under different sales modes and comparatively analyzed the operation decisions.

The above literature considers the impact of various strategic factors on the selection of platform sales modes. To assess what makes a difference, the following scholars have focused on the choice between the agency mode and the resale mode in the context of livestream commerce. For example, Wang et al. [34] studied the impact of the “short video + livestream” marketing strategy on the selection of agency or resale modes in livestream e-commerce. Wang et al. [35] considered the selection of the selling mode in the context of live-streaming commerce and identified the conditions under which agency selling and reselling are chosen when there is a live-streaming sales channel. Yang et al. [36] assessed three common sales modes with live-streaming commerce, including the e-commerce platform mode, transferring mode, and live-streaming platform mode, and explored the selection among the three operational modes. Bicheng et al. [37] examined the impact of livestream on the choice of sales modes and found that when the commission ratio is high, the platform’s optimal decision is first to sign an agency agreement and then apply live selling; conversely, when the commission ratio is low, the platform’s optimal strategy is first to enable the live channel and then to select the reselling format. However, the literature above focuses on livestream sales, while our study focuses on livestream for traffic generation. Additionally, they overlook how different sales modes may impact a brand’s choice of livestream strategy. In contrast, we investigate the issue of brand choice in livestream schemes under different sales modes.

In contrast to the literature above, the primary contributions of our work are severalfold, including (i) most prior studies focus on examining the impact of either AI livestream or KOL livestream on the supply chain independently, with limited research comparing the promotional effects of AI and KOL livestream. This paper addresses this gap by investigating their impacts on supply chain pricing decisions and performance under both the agency mode and the resale mode. (ii) While the existing literatures primarily explore the selection of sales modes in the supply chain, this study introduces livestream marketing into the e-commerce supply chain, providing a novel perspective. To highlight the main differences between this paper and the previous literature, a comparative review table is presented in Table 1.

Table 1.

Comparison of previous literature with our work.

3. Model Formulation and Notations

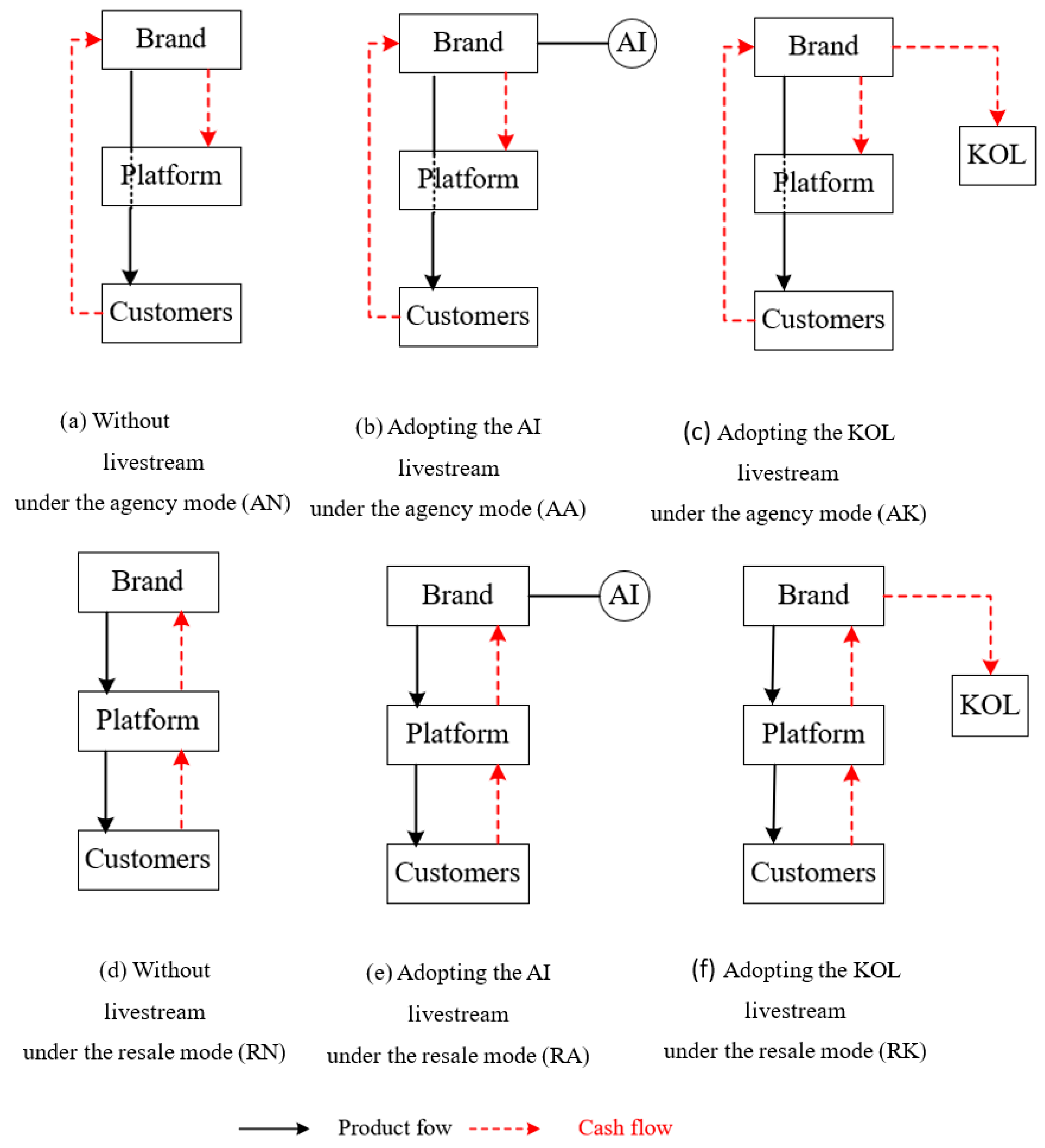

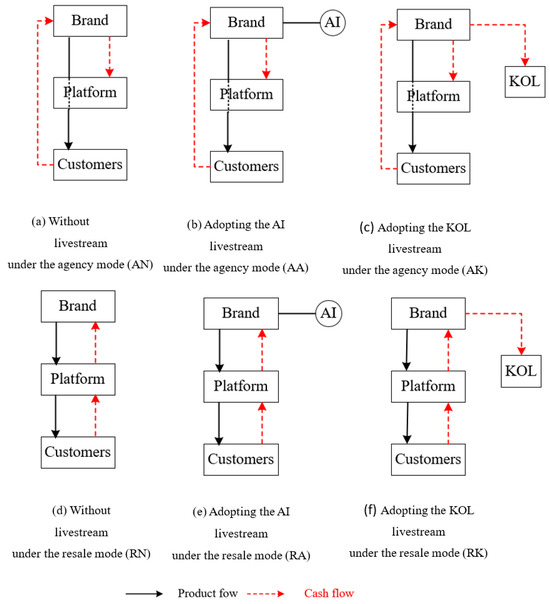

We consider an e-commerce supply chain consisting of a brand (subscripted as ) and a platform (subscripted as ). We use the superscript to denote the strategies adopted by the brand or platform, where represents the livestream scheme, the brand sells products through the platform and can choose from three methods of traffic generation: without livestream (superscripted as ), adopting AI livestream (superscripted as ), or adopting KOL livestream (superscripted as ). And indicates the sales mode. Two platform modes exist: the agency mode (superscripted as ) and the resale mode (superscripted as ). Under the agency mode, the brand sells its products at the retail price on the platform, with the platform merely serving as a marketplace that facilitates transactions, with the platform’s revenue sharing rate being . To reflect real-world scenarios and focus on valuable insights, it is assumed that the platform’s revenue sharing rate does not exceed 25% [14,38,39]. For instance, the revenue sharing rate on Taobao’s livestream platform generally ranges from 10% to 20%, while Amazon’s platform charges between 6% and 25%. Under the resale mode, the brand sells the product to the platform at a wholesale price of , and the platform resells it to consumers at a retail price of . Based on this background, the research covers six game modes: without livestream under the agency mode (AN), adopting the AI livestream under the agency mode (AA), adopting the KOL livestream under the agency mode (AK), without livestream under the resale mode (RN), adopting the AI livestream under the resale mode (RA), and adopting the KOL livestream under the resale mode (RK). The study systematically explores how the livestream scheme and sales mode impact pricing decisions and performance. The structure of the e-commerce supply chain is shown in Figure 1.

Figure 1.

Structure of the e-commerce supply chain.

For simplicity, Table 2 summarizes the notations used in this paper.

Table 2.

Notations and definitions.

As e-commerce and the livestream economy experience rapid growth, more and more consumers are choosing to purchase products online instead of visiting physical stores. This shift in consumer behavior has led many brand owners to focus exclusively on online channels for their sales. For instance, cosmetics brands like Florasis and Maybelline, as well as clothing brands such as ZARA and Duffy Fashion, have adopted online-only strategies to cater to this growing trend [40,41]. To align with this reality, we assume that the brand sells its products exclusively through online channels [28].

We also consider the platform’s revenue sharing rate as an exogenous variable, reflecting its fixed nature in many real-world scenarios [42]. Moreover, following the work of [29,43,44,45,46], we assume that both the brand’s production cost and the platform’s operating cost are negligible. This simplification allows us to focus on the dynamics of pricing and performance without introducing additional cost complexities.

In the context of livestream, AI hosts play a pivotal role in promoting products through online channels by showcasing and explaining their features, thereby enhancing consumer trust. However, the effectiveness of AI hosts varies significantly depending on the brand’s investment in their intelligence level. To capture this, we denote the brand’s investment effort as , with the associated cost given by . Consistent with prior studies, we set .

Compared to traditional offline channels, we recognize that e-commerce inherently has certain market disadvantages. However, livestreaming can offset these disadvantages by leveraging the network externalities of livestreamers, which enhances customers’ emotional value and stimulates purchasing behavior. To reflect this, we assume that several key factors influence market demand: it is negatively correlated with the retail price, negatively correlated with the degree of market disadvantage, and positively correlated with the intensity of the livestreamer’s network externalities. To explore the impact of the brand’s decision to adopt different livestreaming methods on pricing and performance, we define the market demand functions for three scenarios: without livestream, adopting AI livestream, and adopting KOL livestream. Referring to prior studies [29,47], the demand functions are specified as follows: , , , .

3.1. Scenario 1: Different Livestream Schemes Under the Agency Mode (Aj)

Under the agency mode, the brand can choose between not adopting livestream, adopting AI livestream, or adopting KOL livestream. These options are represented by the superscripts AN, AA, and AK, respectively. The parameter combinations are used to illustrate how the brand executes livestream and are summarized in Table 3. Following the work of [29,44,47,48], the profit functions of the brand, platform, and KOL are as follows:

Table 3.

Parameters specifying how the brand executes the livestream.

Using the backward induction method, Theorem 1 can be easily derived, as detailed in Appendix A.

Theorem 1.

Under the agency mode, the optimal effort level, retail price, market demand, and maximum profits for the brand, platform, and KOL of AN, AA, and AK scenarios are given as follows: (i) , ,

;

(ii) when ,

,

,

, , ;

(iii)

,

,

,

,

.

3.2. Scenario 2: Different Livestream Schemes Under the Resale Mode (Rj)

Under the resale mode, the brand can choose between not adopting livestream, adopting AI livestream, or adopting KOL livestream. These options are represented by the superscripts RN, RA, and RK, respectively. Following the work of [29,44,47,48], the profit functions of the brand, platform, and KOL are as follows:

Similarly to Theorem 1, we can easily obtain Theorem 2.

Theorem 2.

Under the resale mode, the optimal effort level, wholesale price, retail price, market demand, and maximum profits for the brand, platform, and KOL of RN, RA, and RK scenarios are given as follows: (i) , , , ; (ii) when , ,,

,

,

; (iii) , , ,

,

,

.

4. Equilibrium Analysis

4.1. The Impact of Sales Modes on Pricing Decisions and Performance

In Section 4.1, we explore the impact of sales modes on pricing decisions and performance under different livestream schemes, as well as the selection of sales modes.

Proposition 1.

The optimal equilibrium solutions for the AN and RN scenarios have the following relationship: ; ; when , , otherwise, ;

when , , otherwise,

.

Proof.

See Appendix A. □

Proposition 1 shows that in the RN scenario, the retail price is higher than in the AN scenario, while market demand is lower in the RN scenario. This is because, in the AN scenario, the retail price is set by the brand, which prioritizes maximizing demand and profit. Consequently, the brand sets a lower retail price to encourage more consumers to buy, leading to higher market demand. In contrast, in the RN scenario, the platform determines the retail price after purchasing products at a wholesale price from the brand. To maximize its margin, the platform typically sets a higher retail price, reducing market demand as a result. This discrepancy in price-setting behavior between the brand and the platform explains why the retail price is higher in the RN scenario compared to the AN scenario, while market demand is higher in the AN scenario than in the RN scenario. When the revenue sharing rate that the brand gives to the platform is relatively low, the brand’s profit in the AN scenario is superior to that in the RN scenario. In contrast, the platform’s profit is higher in the RN scenario. The brand benefits more from the agency mode because it retains a larger share of each sale’s revenue while benefiting from the increased demand driven by the lower retail price. The brand’s profit is thus higher under the agency mode since it both influences pricing to boost demand and minimizes the commission paid to the platform. The platform’s profit is higher in the RN scenario than in the AN scenario because in this RN scenario, the platform fully captures the margin between wholesale and retail prices, leading to higher profits than in agency mode.

Proposition 1 reveals that when the brand does not adopt livestream, the agency mode favors the brand by allowing it to set lower prices, which boosts demand and enables higher profitability with a lower commission paid to the platform. Meanwhile, the resale mode enables the platform to maximize its profit margin by setting higher retail prices, although this approach reduces market demand and the brand’s profit.

Proposition 2.

The optimal equilibrium solutions for the AA and RA scenarios have the following relationship: ; when ,

,

, otherwise, ,

; when and

,

, otherwise,

; when ,

, otherwise,

,

,

.

Proof.

See Appendix A. □

Proposition 2 indicates that when the platform’s revenue sharing rate is low, compared to the RA scenario, the brand’s efforts to enhance consumer trust, the retail price, market demand, and the profits of the brand are all higher in the AA scenario. And the platform’s profit is higher in the RA scenario than in the AA scenario. This is because, in the AA scenario, the brand retains a portion of each sale’s revenue after sharing profits with the platform. This arrangement incentivizes the brand to invest a higher effort level in enhancing AI’s capability to increase consumer trust and drive demand. A more intelligent AI can present products more vividly during live streaming, stimulating consumer purchasing behavior and expanding market demand. In the AA scenario, increased consumer trust leads consumers to accept a higher retail price. Additionally, the brand has an incentive to raise the retail price to offset the costs of investing in AI. The combination of higher retail prices and market demand results in the brand achieving higher profits in the AA scenario compared to the RA scenario. When the platform’s revenue sharing rate is low, it becomes challenging for the platform to achieve higher profits under the agency mode, leading it to prefer the resale mode.

Proposition 2 reveals that the AA scenario often benefits the brand with higher profits under moderate to low values of due to the commission-based profit structure. A lower platform revenue sharing rate results in the platform’s profit being lower in the AA scenario compared to the RA scenario. Additionally, we observe that the higher the intelligence level of AI livestream, the greater the consumer trust. In this scenario, even if the retail price is relatively high, it does not lead to a reduction in market demand, as consumers are willing to spend more to purchase the product.

Combining Propositions 1 and 2, when the platform’s revenue sharing rate is relatively low, the brand achieves a Pareto improvement under the agency mode compared to the resale mode, regardless of whether livestream is not adopted or AI livestream is utilized. Meanwhile, the platform attains higher profits under the resale mode.

Proposition 3.

The optimal equilibrium solutions for the AK and RK scenarios have the following relationship: ;

;

; when

,

, otherwise, ; when

and

or

,

, otherwise, .

Proof.

See Appendix A. □

Proposition 3 indicates that the retail price is higher in the RK scenario than in the AK scenario, while market demand is higher in the AK scenario than in the RK scenario. Consistent with Proposition 1, under the resale mode, the platform controls the retail price and aims to maximize its margin above the wholesale price, leading to a higher retail price. However, the higher price deters some consumers, leading to a reduction in market demand in the RK scenario. When the platform’s revenue sharing rate is relatively low, the brand’s profit is higher in the AK scenario than in the RK scenario. This is because, under the agency mode, the lower retail price encourages higher demand, increasing total sales. And the lower revenue sharing rate means the brand retains a larger share of the profits. When the KOL’s promotion fee rate is high, compared to the AK scenario, the platform’s profit is higher in the RK scenario. This is because, in the AK scenario, the KOL promotion fee rate directly reduces the platform’s revenue, as the platform’s profit is based on a share of the brand’s sales revenue after the KOL commission is deducted. In the RK scenario, the platform avoids the direct impact of the KOL’s promotion fee rate on its margin by setting a higher retail price and capturing the difference between the retail and wholesale prices. When both the KOL’s promotion fee rate and the platform’s revenue sharing rate are relatively low, in the AK scenario, although the lower KOL promotion fee rate does not significantly reduce the platform’s revenue, the lower revenue sharing rate leads to a decrease in the platform’s income. Thus, the platform’s profit is maximized in the RK scenario under high KOL promotion fee rates. The KOL’s profit is higher in the AK scenario than in the RK scenario. This is because, in the AK scenario, the KOL’s commission is based on the higher retail price , while in the RK scenario, the KOL’s commission is based on the wholesale price , which is lower than the retail price. As a result, the KOL earns less in the RK scenario.

Proposition 3 reveals that, when the platform’s revenue sharing rate is relatively low, after adopting KOL livestream, brands tend to collaborate with platforms adopting the agency mode, as it can provide higher profits for the brand. Additionally, compared to the resale mode, the agency mode is also a better choice for KOLs.

Combining the conclusions of Propositions 1–3, it can be observed that, regardless of the livestream scheme, when the platform’s revenue sharing rate is low, the brand’s profit is always higher under the agency mode than under the resale mode, while the platform’s profit is higher under the resale mode. Therefore, when the platform revenue sharing rate is low, brands should actively collaborate with platforms operating under the agency mode.

4.2. The Impact of Livestream Schemes on Pricing Decisions and Performance

The above discussion explores the impact of different sales modes on pricing decisions and performance under various livestream modes, as well as the choice of sales mode. The study finds that when the platform’s revenue sharing rate is relatively low, the brand achieves a Pareto improvement under the agency mode compared to the resale mode, regardless of which livestream scheme is adopted. So, how do different livestream modes under various sales modes affect pricing decisions and performance, as well as the choice of livestream scheme? The following analysis addresses these questions.

First, let’s explore how the brand should select a livestream mode under the agency mode.

Proposition 4.

The optimal equilibrium solutions for the AN and AA scenarios have the following relationship: ,

,

,

.

Proof.

See Appendix A. □

Proposition 4 shows that the retail price, market demand, and profits of both the brand and the platform are higher in the AA scenario compared to the AN scenario. The main reason is that after the brand introduces AI livestream, it provides consumers with comprehensive product information and an opportunity to experience the product’s actual effects. As a result, more consumers choose to purchase from livestream with AI, expanding market demand. The brand incurs high costs to adopt AI livestream, and to compensate for these costs, the brand raises the product price. Interestingly, this price increase does not reduce consumer purchases because AI livestream enhances consumer trust, making them willing to pay a higher price for the product. With both the retail price and market demand rising, the profits of the brand increase. The brand’s investment in AI live streaming yields a positive return by expanding demand and enabling higher pricing. Under the agency mode, the platform also benefits from the brand’s AI livestream efforts. With increased demand and a higher retail price, the platform’s commission (based on a percentage of sales) grows, resulting in higher profit. Therefore, compared to the AN scenario, the brand and the platform achieve the optimal profit outcome in the AA scenario.

Proposition 4 reveals that, under the agency mode, adopting AI livestream enables both the brand and the platform to achieve a Pareto improvement. When the platform operates under the agency mode, the brand should actively adopt AI livestream to enhance profitability.

Proposition 5.

The optimal equilibrium solutions for the AN and AK scenarios have the following relationship: ;

; when

or

< 1 and

, ,

, otherwise,

,

.

Proof.

See Appendix A. □

Proposition 5 shows that both the retail price and market demand in the AK scenario are higher than in the AN scenario. When the KOL promotion fee rate is low or when both the KOL’s promotion fee rate and network externality are high, the brand and platform profits in the AK scenario are superior to those in the AN scenario. This is because, in the AK scenario, the brand uses KOL livestream to promote its product, which increases consumer trust and engagement. This influence allows the brand to set a higher retail price because consumers perceive additional value in the product as introduced by the KOL. Additionally, due to the KOL’s vigorous network externality intensity, more consumers are attracted, resulting in higher market demand in the AK scenario compared to the AN scenario. When both the KOL’s promotion fee rate and network externality are high, in the AK scenario, even though the brand needs to pay a higher promotion fee to the KOL, the increased network externality enhances consumer trust in the product, driving purchase behavior and boosting sales revenue for both the brand and the platform. When the KOL’s promotion fee rate is low, the brand retains a larger share of sales revenue in the AK scenario. The profit increase is attributed to higher demand and a higher retail price. Therefore, when both the KOL’s promotion fee rate and network externality are high, or when the KOL’s promotion fee rate is low, the brand and the platform maximize their profits in the AK scenario compared to the AN scenario.

Proposition 5 reveals that the KOL’s endorsement enhances consumer trust and engagement, allowing the brand to set a higher price and attract more consumers. As a result, the AK scenario outperforms the AN scenario for both the brand and the platform when both the KOL’s promotion fee rate and network externality are high or when the KOL’s promotion fee rate is low. Combining Propositions 4 and 5, we can conclude that under the agency mode, adopting AI or KOL livestream is more beneficial for both the brand and the platform compared to the traditional e-commerce mode. Therefore, to maximize the profits of all channel members, the brand should actively take measures, such as adopting AI or KOL livestream.

The above compares the benefits of the traditional e-commerce mode and livestream (such as AI or KOL livestream) for the brand and platform under the agency mode. It shows that when both the KOL’s promotion fee rate and network externality are high or when the KOL’s promotion fee rate is low, both AI and KOL livestream can lead to a Pareto improvement in the performance of the brand and the platform. So, which option—AI or KOL livestream—yields better results for the brand and platform? Proposition 6 provides the answer.

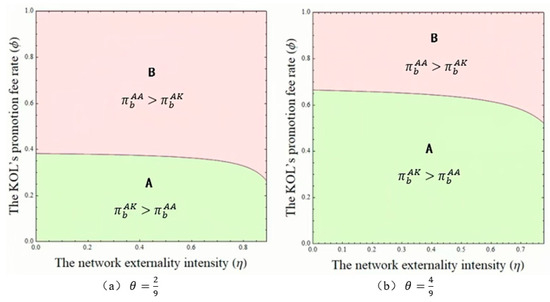

Proposition 6.

The optimal equilibrium solutions for the AA and AK scenarios have the following relationship: ;

; when

, , otherwise,

; when

, , otherwise,

.

Proof.

See Appendix A. □

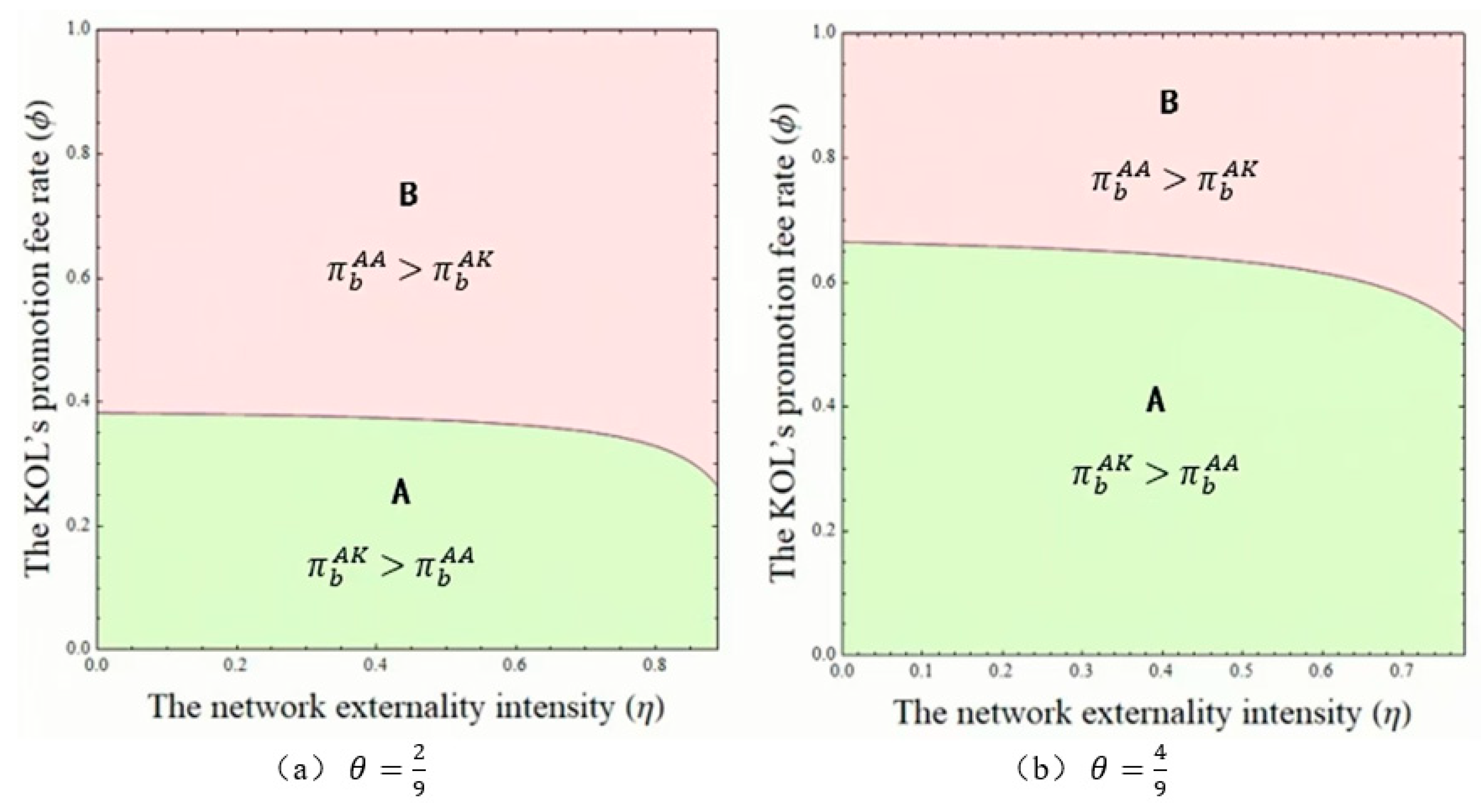

Proposition 6 reveals that both the retail price and market demand are higher in the AK scenario than in the AA scenario. When the KOL promotion fee rate is relatively low, both the brand and platform attain higher profits under the AK scenario. This advantage arises because KOLs are more effective at engaging consumers and stimulating demand, even though the AA scenario offers a lower retail price due to reduced upfront investment in AI livestream. Notably, a higher retail price in the AK scenario does not necessarily reduce demand, as demand is driven by multiple factors beyond price. However, the profitability of AK over AA is not guaranteed. As the KOL promotion fee rises, a greater portion of the brand’s profit shifts to the KOL, making AA a more attractive option. Figure 2a,b show that as network externalities intensify, brands may shift from AK to AA, since AI livestream becomes more intelligent but also more costly, prompting brands to raise retail prices to recover investment. In such cases, the enhanced consumer experience can lead to higher profits in AA. Conversely, as market disadvantage grows, Region A expands, and brands favor the AK scenario because KOLs’ credibility and fan base help overcome consumer trust barriers that AI may struggle to address.

Figure 2.

The impact of network externality intensity and KOL’s promotion fee rate on the brand’s decision-making ().

Proposition 6 reveals that, under the agency mode, when the KOL’s promotion fee rate is low, the brand should opt for KOL livestream. Otherwise, AI livestream is the better choice. Additionally, the brand’s profits are also influenced by factors such as market disadvantage and network externality intensity. Therefore, in practice, brands should consider multiple factors comprehensively before making a decision.

Combining the conclusions of Propositions 4–6, it is clear that both AI and KOL livestreaming can lead to a Pareto improvement in the performance of the brand and the platform compared to traditional e-commerce. However, whether the AA scenario or AK results in higher profits for the brand and platform depends on factors such as the KOL promotion fee rate, market disadvantage, and the strength of network externalities. Under the agency mode, when the KOL’s promotion fee rate is low, the brand should collaborate with KOLs to maximize its benefits. Otherwise, the brand should actively implement AI livestream. Therefore, the brand and platform must still decide which livestream scheme to adopt based on specific market conditions.

The above discussion explores the impact of different livestream modes on pricing decisions and performance under the agency mode, as well as the choice of livestream scheme. The following will address these factors under the resale mode.

Proposition 7.

The optimal equilibrium solutions for the RN and RA scenarios have the following relationship: ,

,

, ,

.

Proof.

See Appendix A. □

Proposition 7 shows that the wholesale price, retail price, market demand, and profits of both the brand and the platform are higher in the RA scenario compared to the RN scenario. The main reason is that, in the RA scenario, the brand invests in AI livestream, which enhances consumer trust and increases demand through network externality intensity. As a result, the brand can set a higher wholesale price, knowing that the added value from AI livestream will stimulate demand. The platform sets a higher retail price due to the increased demand and added consumer trust generated by AI livestream. The higher wholesale price also leads the platform to set a higher retail price to maintain its profit margin. In the RA scenario, the brand and platform enjoy higher profits due to the increased wholesale price, retail price, and higher demand stimulated by AI live streaming.

Proposition 7 reveals that, as with the agency mode, under the resale mode, adopting AI livestream benefits both the brand and the platform. The brand should actively implement AI livestream to enhance the profitability of all channel members.

Proposition 8.

The optimal equilibrium solutions for the RN and RK scenarios have the following relationship: ;

;

;

; when

or

and

, , otherwise,

.

Proof.

See Appendix A. □

Proposition 8 shows that compared to the RN scenario, the wholesale price, retail price, market demand, and platform profit are all higher in the RK scenario. When the KOL promotion fee rate is relatively low, or both the KOL’s promotion fee rate and network externality are high, the brand’s profit in the RK scenario is also higher than in the RN scenario. This is because, in the RK scenario, the brand adopts KOL livestream. Due to KOL’s fan base and vigorous network externality intensity, consumer trust and market demand increased, motivating the brand to set a higher wholesale price. The platform, aiming for higher marginal profit, sets a higher retail price. The increased market demand in the RK scenario leads to higher platform profits compared to the RN scenario, while the brand’s profit depends on the KOL promotion fee rate. When both the KOL’s promotion fee rate and network externality are high, the strong network externality in the RK scenario enhances consumer trust in the product, driving purchase behavior and increasing the brand’s sales revenue. When the KOL promotion fee rate is low, the brand retains a larger portion of the revenue in the RK scenario. The KOL’s influence drives demand, allowing the brand to set a higher wholesale price and achieve better profitability.

Proposition 8 reveals that, under the resale mode, adopting KOL livestream can significantly expand market demand and increase the retail price compared to the RN scenario. Therefore, when the KOL promotion fee rate is relatively low, or both the KOL’s promotion fee rate and network externality are high, adopting KOL livestream benefits both the brand and the platform’s profitability.

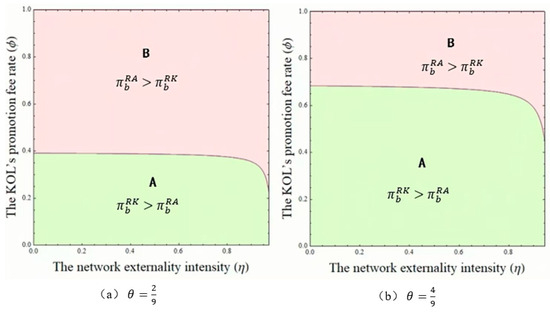

Proposition 9.

The optimal equilibrium solutions for the RA and RK scenarios have the following relationship: ;

;

;

; when

, , otherwise,

.

Proof.

See Appendix A. □

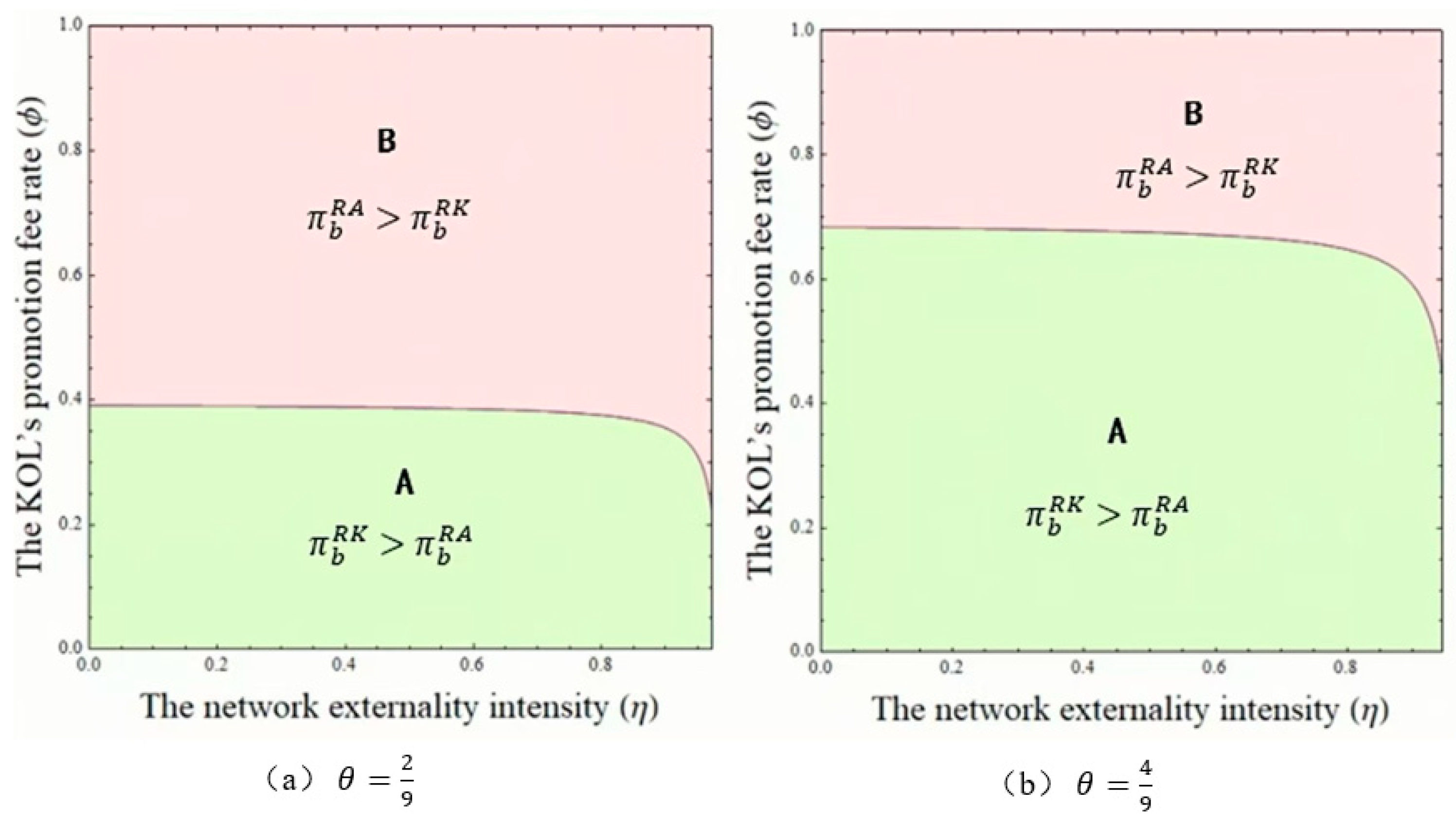

Proposition 9 shows that the wholesale price, retail price, market demand, and platform’s profit are all higher in the RK scenario than in the RA scenario. The brand’s profit, however, depends on the KOL promotion fee rate, the market disadvantage, and the strength of network externality intensity. Similarly to the analysis in Proposition 6, the brand can gain consumer trust by adopting AI livestream without needing to invest heavily in one-time costs. As a result, the wholesale and retail prices in the RA scenario are set lower. In contrast, KOLs are more effective at increasing consumer trust when introducing products, leading to higher market demand in the RK scenario. Consumers are also willing to pay a higher retail price in the RK scenario due to the increased trust and engagement provided by the KOL. As shown in Figure 3, we can clearly observe that, under the resale mode, when the KOL’s promotion fee rate is low, the brand should opt for KOL livestream. Otherwise, the AI livestream is the better choice. Moreover, as the market disadvantage increases, the brand shifts from the RA scenario to the RK scenario, indicating that KOLs are better than AI hosts in gaining consumer trust.

Figure 3.

The impact of network externality intensity and KOL’s promotion fee rate on the brand’s decision-making.

Combining Propositions 7–9, we can reach the same conclusions as under the agency mode. Therefore, under the resale mode, both AI and KOL livestream can enable a Pareto improvement in the performance of the brand and the platform. We encourage brands to actively implement livestream to boost sales and maximize the benefits for all channel members. When the KOL’s promotion fee rate is low, the brand should prefer the RK scenario. Otherwise, the brand should choose the RA scenario. However, in practice, a comprehensive assessment is necessary to make well-informed and strategic decisions.

4.3. Optimal Strategy for Brand

The above analysis explores the impact of different sales modes (livestream schemes) on supply chain decisions under various livestream schemes (sales modes) and identifies which sales mode (livestream scheme) should be chosen. We find that livestream schemes and sales modes significantly affect one another. However, the key question remains: which strategy is optimal for the brand? Below, we address this issue.

Proposition 10.

For brand, (i) AK is the dominant strategy if and

; (ii) AA is the dominant strategy if and

, and (iii) RK is the dominant strategy if and

. ,

.

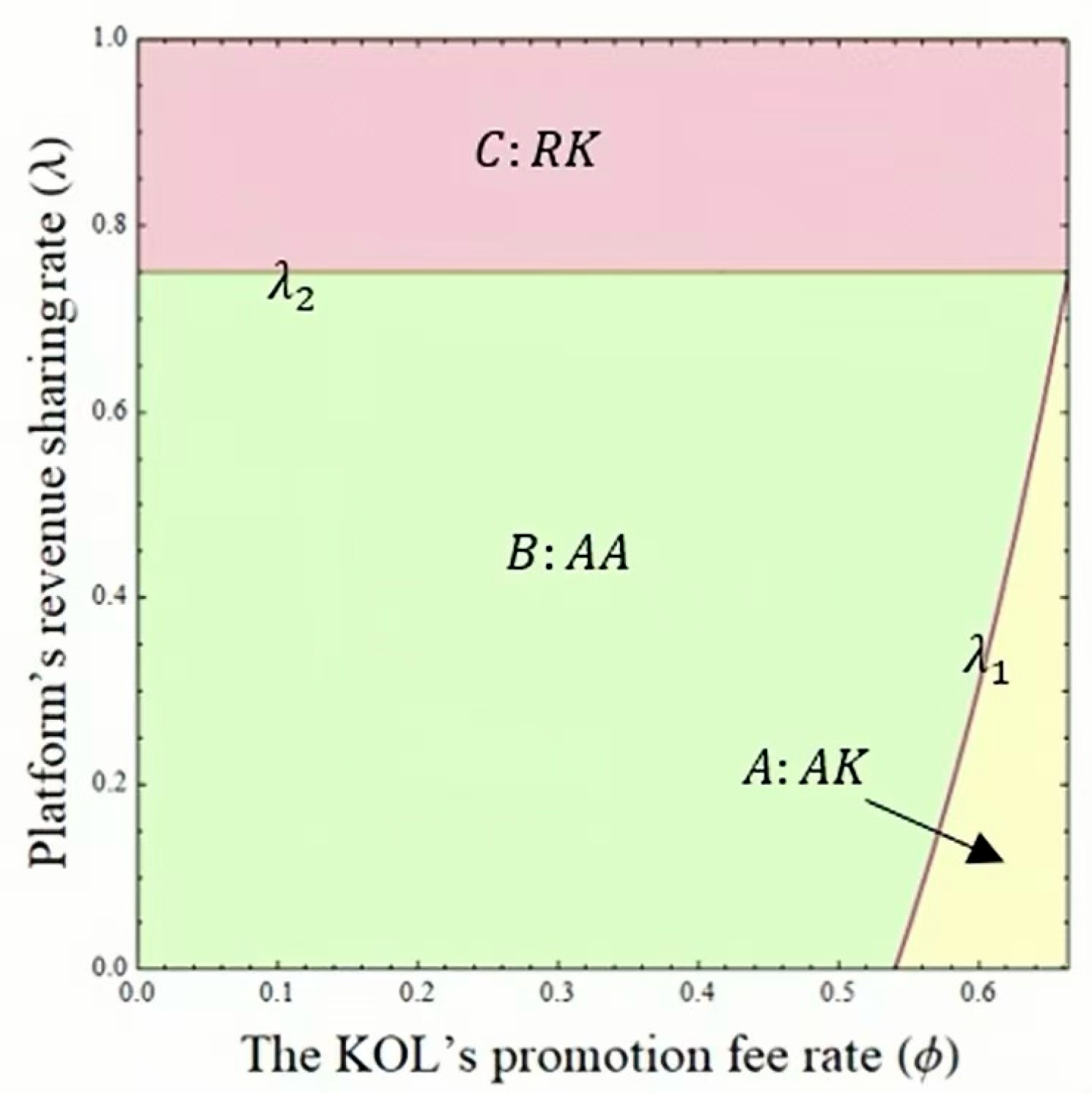

Proposition 10 further compares the six scenarios based on the previous propositions and derives the optimal strategy for the brand. Proposition 10 shows that when the platform’s revenue sharing rate is low but the KOL promotion rate is high (e.g., and ), the dominant strategy for the brand is . This indicates that, under a low platform revenue sharing rate, the platform claims a smaller share of the revenue, making the agency mode more profitable for the brand. A high KOL promotion rate implies that KOL livestream is highly effective, enhancing demand significantly. KOL’s personal interaction and influence resonate well with consumers, maximizing the brand’s profit in combination with the flexibility of the agency mode. When the platform’s revenue sharing rate and the KOL promotion rate are both relatively low (e.g., and ), the dominant strategy for brand shifts to . A moderate platform’s revenue sharing rate makes the agency mode still viable but introduces tighter profit margins. A lower KOL promotion fee implies reduced effectiveness of KOL promotion, making KOL livestream less advantageous compared to AI livestream in this scenario. Conversely, when the platform’s revenue sharing rate is relatively high (e.g., ), the dominant strategy for the brand becomes . In this case, the brand shifts from the agency mode to the resale mode. A high platform revenue sharing rate makes the brand less inclined to adopt the agency mode, as the resale mode allows the brand to achieve higher profits in this scenario.

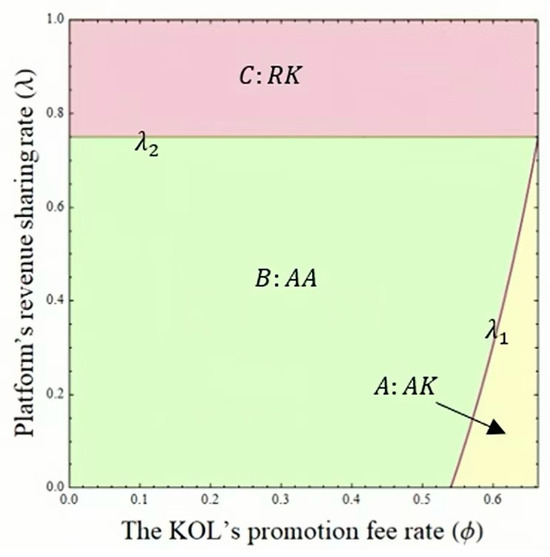

Figure 4 graphically illustrates the results of Proposition 10. Specifically, the brand’s dominant strategy is in region A, in region B, and in region C. This finding further suggests that no single livestream scheme or sales mode can consistently guarantee better profits for the brand. Profitability is closely related to factors such as the platform’s revenue sharing rate and the KOL promotion fee rate. This insight indicates that brands must center their strategies around the platform’s revenue sharing rate and KOL’s promotion fee rate, establishing a “parameter monitoring → strategy alignment → dynamic adaptation” closed-loop management system to achieve profit maximization in complex market environments.

Figure 4.

The dominant strategy for brand ().

4.4. Optimal Strategy for Platform

In the previous section, we explored the optimal strategy for brand. Next, we will examine the optimal strategy for platform and derive the following key insights.

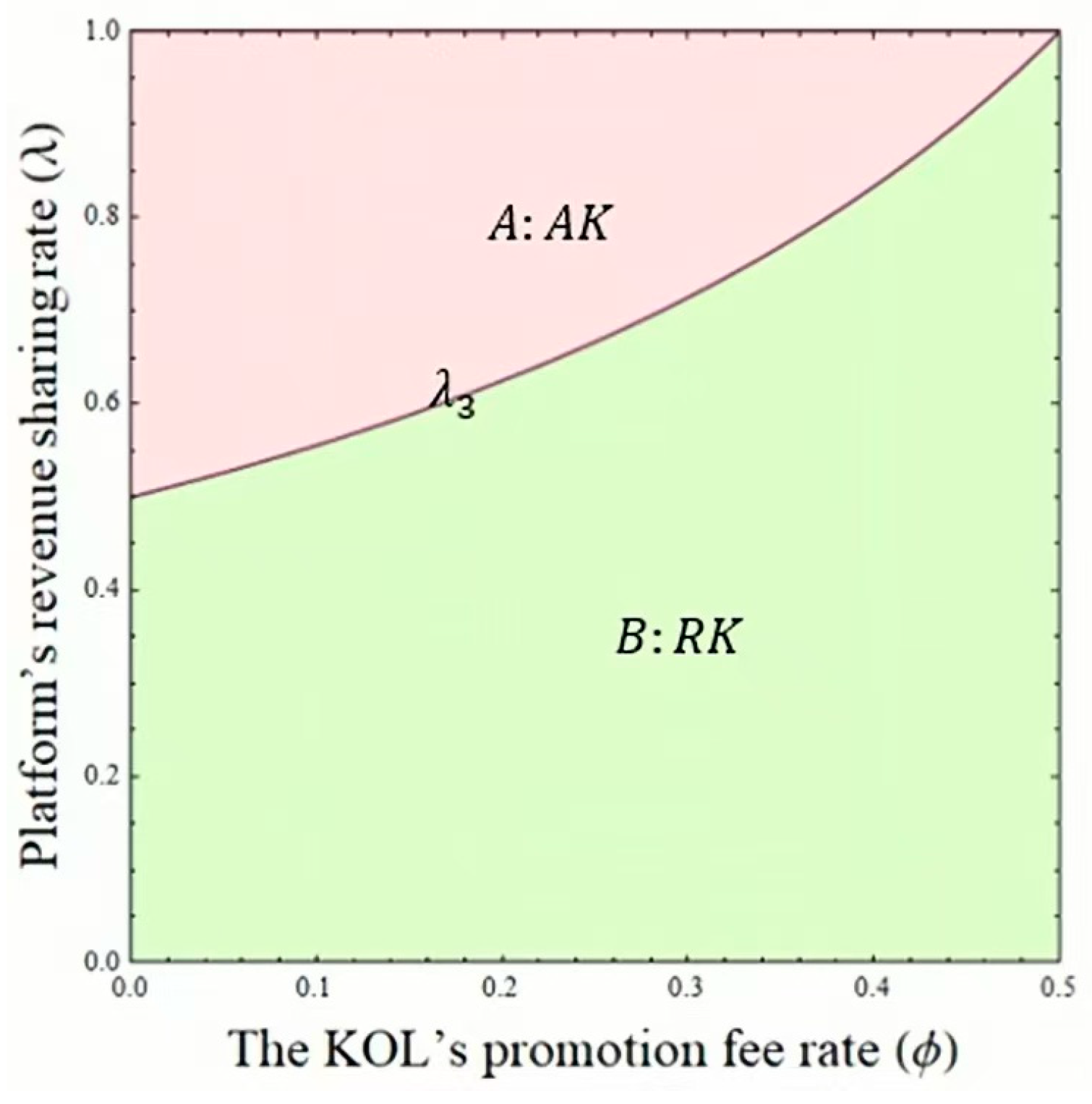

Proposition 11.

For platform, (i) RK is the dominant strategy if and

; (ii) AK is the dominant strategy if and

. .

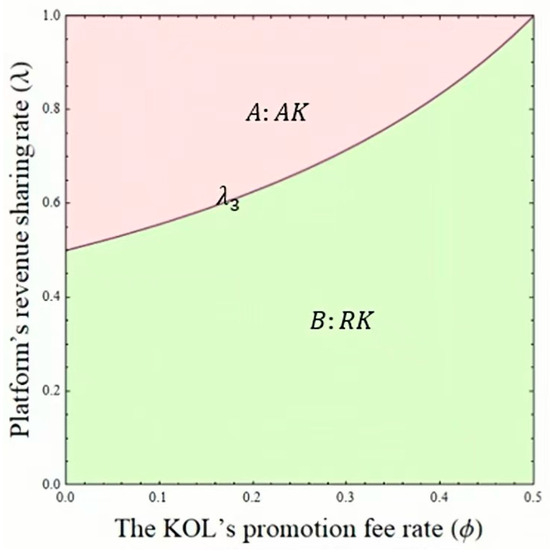

Similarly to Proposition 10, in Proposition 11, we compare the six scenarios and derive the platform’s optimal strategy. Proposition 11 indicates that when the platform’s revenue sharing rate is low (e.g., ), the dominant strategy for the platform is RK. This is primarily because, under the agency mode, the platform’s revenue only constitutes a small portion of the sales income, limiting its ability to capture more revenue. Therefore, the platform prefers the resale mode. When network externalities are low, compared to AI livestream, KOL livestream can increase the retail price of products and expand market demand, enabling the platform to achieve higher benefits. On the other hand, when the platform’s revenue sharing rate is high (e.g., ), the agency mode allows the platform to obtain a greater share of the sales revenue, making it more inclined to operate under the agency mode.

Figure 5 visually demonstrates the conclusions of Proposition 11. In Region A, the platform’s dominant strategy is AK, while in Region B, the dominant strategy is RK. Moreover, as the KOL promotion fee rate increases, the scope of Region B expands. This suggests that when collaborating with major KOLs, the platform should adopt the resale mode to maximize its benefits. Platforms must leverage the revenue sharing rate and KOL promotion fee rate as core strategic levers, establishing a “parameter-driven → strategy alignment → profit optimization” decision-making framework to achieve tripartite win-win outcomes for the platform, brands, and KOLs in a complex ecosystem.

Figure 5.

The dominant strategy for platform ().

5. Model Extension

We relax several assumptions made in the main model to validate the robustness of the main findings in Section 4. In Section 5.1, we allow the platform to decide which livestream scheme to adopt, with the investment cost for AI livestream and the commission for KOLs being borne by the platform. In Section 4.2, we allow AI livestream and KOL livestream to have different network externality intensity, denoted by and respectively, and .

5.1. Extension 1: Platform Decision on Livestream Scheme

In the main model, we consider scenarios where the brand decides which livestream scheme to adopt, with the one-time investment cost for AI live streaming and the KOL promotion fee rate for KOL livestream both borne by the brand. However, in practice, platforms sometimes have the authority to decide the livestream scheme and bear the associated expenses for adopting livestream. We use the superscripts AAA, AKK, RAA, and RKK to represent the following scenarios: AAA refers to the case where the platform adopts AI livestream under the agency mode, AKK refers to the case where the platform adopts KOL livestream under the agency mode, RAA refers to the case where the platform adopts AI livestream under the resale mode, and RKK refers to the case where the platform adopts KOL livestream under the resale mode, and . The profit functions of the brand owner and the platform, along with the related proof process, are provided in Appendix A.

Following a similar approach to the main model, we first examine in Proposition 12 how different livestream schemes influence the selection of sales mode when the platform bears the livestream costs. Subsequently, in Proposition 13, we explore how different sales modes affect the selection of livestream schemes when the platform assumes the associated costs.

Proposition 12.

(i) When the platform adopts AI livestream, the optimal profits of the brand and the platform for the AAA and RAA scenarios have the following relationship: when

, , otherwise, ; when

and

, , otherwise,

; (ii) When the platform adopts KOL livestream, the optimal profits of the brand and the platform for the AKK and RKK scenarios have the following relationship: when

, , otherwise,

; when

,

, otherwise,

.

Proposition 13.

(i) Under agency mode, the optimal profits of the brand and the platform for the AN, AAA, and AKK scenarios have the following relationship: ; when

, ; (ii) Under resale mode, the optimal profits of the brand and the platform for the RN, RAA, and RKK scenarios have the following relationship: ; when

, .

Propositions 12 and 13 reveal that when the platform adopts AI livestream if the market disadvantage and the platform’s revenue sharing rate are low, the agency mode is more advantageous for the brand, while the platform should opt for the resale mode. When the platform adopts KOL livestream, and the platform’s revenue sharing rate is low, the brand tends to prefer the agency mode, while the platform favors the resale mode. We also find that under both agency and resale modes, when KOL’s promotion rates are relatively low, both AI livestream and KOL livestream can lead to a Pareto improvement in the performance of the brand and the platform, with KOL livestream being the more beneficial choice. Notably, compared to the resale mode, adopting AI or KOL livestream under the agency mode can more effectively enhance brand and platform performance. This is because, under the agency mode, the livestream effect can be realized even when network externalities are low, thereby increasing the profits of channel members.

Combining Propositions 1–9 and 12, 13, we conclude that our model’s robustness is validated. Even if the decision thresholds change, the fundamental conclusions of the main model remain applicable. So, the question arises: who should bear the costs? And which livestream scheme is better? Proposition 14 addresses this issue.

Proposition 14.

(i) Under agency mode, the optimal profits of the brand and the platform for the AA and AAA scenarios have the following relationship: when

,

, otherwise,

; when

,

, otherwise,

; (ii) Under agency mode, the optimal profits of the brand and the platform for the AK and AKK scenarios have the following relationship: ; ; (iii) Under resale mode, the optimal profits of the brand and the platform for the RA and RAA scenarios have the following relationship: ; ; (iv) Under resale mode, the optimal profits of the brand and the platform for the RK and RKK scenarios have the following relationship: ;

.

Proposition 14 reveals that, under the agency mode, when the platform’s revenue sharing rate is low, the brand should bear the one-time investment cost of AI livestream, benefiting both the brand and the platform. However, under the resale mode, it is more advantageous for the platform to bear the one-time investment cost of AI livestream for both the brand and the platform. Based on Proposition 13 (ii) and (iv), when adopting KOL livestream, regardless of the mode (agency or resale), for the brand, it is a better choice for the platform to bear the promotion cost of KOL.

Building on the main model, we further find that the implementing entity of the livestream scheme strategy, whether the brand or the platform, does not have a significant impact on the choice of livestream scheme or sales mode. This also validates the robustness of our conclusion. Furthermore, by comparing the scenario where the brand bears the livestream costs and the scenario where the platform bears the costs, we can conclude that, under the resale mode, for the brand, it is better for the platform to bear the related costs, regardless of the livestream marketing channel used. This study provides managerial insights and practical implications for relevant enterprises by considering two models that may arise in real-world practices.

5.2. Extension 2: Different Intensities of Network Externalities

In reality, AI livestream exhibits smaller network externality intensity compared to KOL livestream. This is because the brand controls AI hosts, and consumers will doubt that the brand may blow their own trumpet. On the other hand, KOL hosts possess personal reputations and individual influence, making them more effective at creating engagement, fostering a vibrant atmosphere, and providing greater emotional value to consumers. In this section, we assume that the network externality intensity of AI livestream is lower than that of KOL livestream, i.e., .

In Propositions 15 and 16, we respectively compare the optimal equilibrium solutions for the scenarios where the brand adopts AI livestream and KOL livestream under the agency mode and the resale mode.

Proposition 15.

The optimal equilibrium solutions for the AA and AK scenarios have the following relationship: ;

; when

, , otherwise,

; when

, otherwise

. ,

,

.

Proposition 16.

The optimal equilibrium solutions for the RA and RK scenarios have the following relationship: ;

;

;

; when

, , otherwise,

.

Combining Propositions 15 and 16, it can be observed that under both the agency mode and the resale mode, the optimal retail price and market demand in the KOL livestream scenario are superior to those in the AI livestream scenario. When KOL’s promotion fee rate is relatively low, it is more advantageous for the brand to choose the KOL livestream scheme. This trend aligns with Propositions 6 and 9. We can conclude that whether the network externality strengths of AI and KOL livestream are consistent or not does not fundamentally affect the decision-making of supply chain members in terms of overall trends, but it alters the constraint boundaries. The implication of Propositions 14 and 15 is that brands should consider the cost-effectiveness of KOL promotion when planning their marketing strategies, especially when the network externality of AI livestream is not strong. Furthermore, while the relative strengths of network externalities in AI and KOL livestreams may not drastically alter the overall decision-making of supply chain members, it does shift the boundaries of strategic choices. Brand managers and platform operators must account for these external factors and adapt their strategies to ensure maximum profitability.

6. Conclusions and Managerial Implications

This paper investigates the impact of different livestream schemes on the selection of sales modes, as well as the influence of different sales modes on the choice of livestream schemes. Specifically, the paper defines six game-theoretic models: not adopting the livestream under the agency mode (AN), adopting the AI livestream under the agency mode (AA), adopting the KOL livestream under the agency mode (AK), not adopting the livestream under the resale mode (RN), adopting the AI livestream under the resale mode (RA), and adopting the KOL livestream under the resale mode (RK).

6.1. Conclusions

First, how do different livestream schemes affect a firm’s profits? Regardless of the agency or resale mode, both AI livestream and KOL livestream contribute to an increase in retail prices. With the adoption of livestream marketing, the brand’s products gain consumer trust, and thus, higher retail prices do not lead to a reduction in market demand. As a result, this increases the profits of channel members.

Secondly, how do different livestream schemes affect a firm’s choice of sales mode? When the platform’s revenue sharing rate is relatively low, regardless of the type of livestream scheme used, the agency mode consistently leads to a Pareto improvement for the brand compared to the resale mode.

Thirdly, how do different sales modes affect a firm’s livestream adoption? Under both resale and agency sales modes, both AI and KOL livestream can lead to a Pareto improvement in the performance of the brand and the platform. Furthermore, we find that under both the agency and resale modes, when KOL’s promotion rate is low, KOL livestream is more beneficial for the brand’s performance compared to AI livestream.

Fourthly, how do brands and platforms choose the optimal strategy? When the platform’s revenue sharing rate is high, brands are more likely to select the resale mode because it helps them avoid the profit compression caused by high revenue sharing. A higher revenue sharing rate enables the platform to achieve greater profits under the agency mode. Additionally, the effective traffic generation and market expansion capabilities of KOL livestream enable brands under the resale mode to benefit better from the increased market demand, thereby boosting overall profits. When the platform’s revenue sharing rate is low, brands should prefer the agency mode, where the choice of livestream mode depends on the KOL promotion rate. In this case, the platform prefers KOL livestream under the resale mode, regardless of the KOL promotion fee rate.

Finally, how does the platform bearing the costs related to livestream marketing, as well as unequal network externalities, affect supply chain performance? The results indicate that the party responsible for livestream costs, whether it is the brand or the platform, does not significantly affect the choice of livestream scheme or sales mode. Additionally, we also examine the case where AI livestream and KOL livestream have different strengths of network externalities. The conclusion drawn is that whether the network externalities of AI and KOL livestream are consistent or not does not have a significant impact on the overall decision-making of the supply chain, thus confirming the robustness of our findings.

6.2. Managerial Implications

Our study provides several managerial insights for decision making regarding the integration of livestream schemes in sales mode selection. Firstly, from the brand’s perspective, brands should actively utilize both AI and KOL livestream to establish consumer trust, as both can increase retail prices without negatively impacting market demand. This offers brands an opportunity to boost profits while maintaining or even enhancing customer loyalty. Additionally, brands should remain flexible in collaborating with platforms operating under different sales modes, as the choice of a livestream channel (AI or KOL) does not significantly affect the overall sales strategy. When the platform revenue sharing rate is low, brands should prefer to cooperate with platforms that adopt the agency mode to maximize profits. Furthermore, brands should work closely with platforms to create a mutually beneficial environment. This includes leveraging the platform’s tools and features to enhance the effectiveness of livestream marketing, ensuring that both parties can benefit from increased consumer engagement and trust. Brands need to stay informed about emerging trends in livestream marketing and be ready to adjust their strategies accordingly. This includes evaluating the effectiveness of AI and KOL livestream campaigns, adapting to changes in consumer preferences, and continuously optimizing the pricing and promotional strategies.

Secondly, from the platform’s perspective, platforms should carefully assess the network externalities associated with livestream marketing. When the platform revenue sharing rate is low, platforms may prefer the resale mode, as this allows them to retain better control over pricing and marketing. However, when choosing between the agency and resale modes, platforms should remain flexible and consider the unique needs of each brand. Since livestream marketing significantly boosts consumer trust in products, platforms should provide tools, features, and policies that encourage transparency, authenticity, and reliability in livestream content. This, in turn, can help platforms build long-term relationships with both brands and consumers.

Finally, from the KOL’s perspective, the agency mode yields higher profits compared to the resale mode, suggesting that KOLs should prefer the agency mode. KOLs play a pivotal role in enhancing consumer trust and increasing product demand. Therefore, KOLs should focus on promoting livestream events that align with the brand’s goals to improve trust and engagement. By doing so, they can contribute to both the brand’s success and their profit maximization.

6.3. Limitations and Future Research

This paper has its limitations. First, it assumes that brands only sell products through online channels, neglecting the role of offline retail channels, which limits its applicability to brands that use dual channels. Future research could consider scenarios where brands sell products through both online and offline channels simultaneously. Second, the paper treats the platform commission rate as an exogenous variable. However, in practice, platforms or livestream hosts may adjust the commission rate in real-time based on actual conditions. Therefore, future studies could explore situations where the commission rate is an endogenous variable.

Author Contributions

Conceptualization, T.L. and W.T.; Methodology, S.X. and Q.T.; Writing—original draft preparation, T.L. and S.X.; Writing—review and editing, W.T. and Q.T. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Natural Science Foundation of China (No. 72301163); Humanities and Social Sciences Foundation of Ministry of Education of China (No. 22YJC630067); China Postdoctoral Science Foundation (No. 2023M740960); Shandong Provincial Youth Entrepre-neurship Technology Support Program for Higher Education Institutions (No. 2023RW033); Shandong Provincial Social Science Foundation of China (No. 22DGLJ28); The Education Department Foundation of Liaoning Province (No. LJ112410173009); Natural Science Foundation of Shandong Province (No. ZR2020QG001). And the APC was funded by the Natural Science Foundation of Shandong Province (No. ZR2020QG001).

Data Availability Statement

All data supporting this study are included in Appendix A of the manuscript.

Acknowledgments

We are grateful to the Editor in Chief, Associate Editor, and anonymous referee for their very valuable comments and suggestions.

Conflicts of Interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Appendix A

Appendix A contains the derivation of the equilibrium solutions of different scenarios and the proof of Propositions. The proof of the equilibrium solutions for the AN, AA, AK, RN, RA, and RK scenarios is as follows:

AN scenario: In the AN scenario, based on the backward induction method, it is evident that is a concave function with respect to ,

Then, brand determines to maximize its profit, we obtain,

According to Equation (A1), other optimal solutions in the AN scenario can be derived.

AA scenario: In the AA scenario, according to the backward induction method, where the second-stage game is analyzed first, it is evident that is a concave function with respect to ,

The optimal reaction function is:

The brand maximizes its profit based on the reaction function, yielding the optimal effort level,

Combining Equations (A2) and (A3), the other optimal solutions in the AA scenario can be derived.

AK scenario: In the AK scenario, based on the backward induction method, it is evident that is a concave function with respect to ,

Then, brand determines to maximize its profit, and we obtain,

According to Equation (A4), other optimal solutions in the AK scenario can be derived.

RN scenario: In the RN scenario, based on the backward induction method, it is evident that is a concave function with respect to ,

Then, brand determines to maximize its profit, and we obtain,

Based on the backward induction method, it is evident that is a concave function with respect to ,

Then, platform determines to maximize its profit, and we obtain,

Combining Equations (A5) and (A6), the other optimal solutions in the RN scenario can be derived.

RA scenario: In the RA scenario, according to the backward induction method, where the second-stage game is analyzed first, it is evident that is a concave function with respect to ,

Then, brand determines to maximize its profit, and we obtain,

Based on the backward induction method, it is evident that is a concave function with respect to ,

Then, platform determines to maximize its profit, and we obtain,

Combining Equations (A7) and (A8), the optimal retail price in the RN scenario can be derived,

The brand maximizes its profit based on the reaction function, yielding the optimal effort level,

Combining Equations (A9) and (A10), the other optimal solutions in the AA scenario can be derived.

RK scenario: In the RK scenario, based on the backward induction method, it is evident that is a concave function with respect to ,

Then, KOL determines to maximize its profit, and we obtain,

Based on the backward induction method, it is evident that is a concave function with respect to ,

Then, platform determines to maximize its profit, and we obtain,

Combining Equations (A11) and (A12), the optimal retail price in the RK scenario can be derived,

According to Equation (A13), other optimal solutions in the AK scenario can be derived.

Proof of Proposition 1.

We obtain, , , for , and for .

Thus, , , if , and if . □

A similar approach for Propositions 2–9. Here, we omit it for brevity.

Proof of Proposition 10.

(i): For brand, we obtain, for , for , for .

Thus, AK is the dominant strategy if . □

Similarly, it is easy to obtain Proposition 10 (ii), (iii) and Proposition 11.

Proof of Proposition 12.

When the platform bears the livestream costs, consistent with Table 3 in the main model, the parameter combinations illustrate how the brand implements livestreaming. The profit functions of the brand and the platform in each scenario are as follows:

The equilibrium results are derived using the same process as in the main model and will not be elaborated further here.

When the platform adopts AI livestream, we obtain, for , for , and .

Thus, if , if and .

When the platform adopts KOL livestream, we obtain, for , for .

Thus, if , if . □

A similar approach for Propositions 14–16. Here, we omit it for brevity.

Proof of Proposition 13 (i).

We obtain, , and .

Thus, . □

A similar approach for Proposition 13 (ii). Here, we omit it for brevity.

Sensitivity Analysis:

Lemma A1.

(i) ,

,

,

,

; (ii)

,

,

,

,

; (iii)

,

,

,

,

,

; (iv) ,

,

,

,

,

.

Lemma A1 indicates that under the agency mode, regardless of the livestreaming type adopted by the platform, an increase in network externalities leads to higher product demand. This is because a stronger network effect implies greater utility gained by consumers from the “network”, which, in turn, boosts their willingness to purchase, thereby increasing product demand across the e-commerce supply chain and enhancing the profits of all channel members. The rise in network externalities does not lead to a decrease in the retail price. This is because stronger network effects prompt the brand to invest more in AI livestreaming; to compensate for the additional costs, the brand raises the retail price. Under the reselling mode, when the brand adopts AI livestreaming, the increase in network externalities justifies a higher wholesale price to offset the rising AI investment cost. Consequently, the platform also raises the retail price. Unlike in the agency mode, however, the increase in wholesale prices under the reselling mode reduces the platform’s profit.

Combined with Proposition 6 or 9, it can be seen that under both the agency and resale modes, although brand profits rise with stronger network externalities, the brand shifts from KOL livestream to AI livestream due to the larger one-time investment cost required for AI livestream as the network externality intensity increases. To recoup this cost, the brand adopts a higher retail price in AI livestream. The enhanced intelligence level of AI stimulates market demand, ultimately resulting in greater brand profits under AI livestream than under KOL livestream.

References

- Zeng, S.; Yang, C. Risk evaluation of livestream e-commerce platforms based on expert trust networks and CODAS. Expert Syst. Appl. 2025, 260, 125408. [Google Scholar] [CrossRef]

- Wang, J.; Zhang, X. The value of influencer channel in an emerging livestreaming e-commerce model. J. Oper. Res. Soc. 2023, 74, 112–124. [Google Scholar] [CrossRef]

- Alixpartners. Available online: https://www.alixpartners.com/newsroom/chinese-consumers-rally-for-singles-day-2020/ (accessed on 8 October 2024).

- Chen, Y.; Wang, Y.; Zheng, J.; Song, Y.; Wen, Y. Self-reliance vs. Dependence: Optimal live streaming strategies selection for E-retailers at different developmental stages. J. Retail. Consum. Serv. 2025, 84, 104225. [Google Scholar] [CrossRef]

- CEIBS. Available online: https://www.ceibs.edu/new-papers-columns/ready-join-livestreaming-commerce-think-you-leap (accessed on 20 October 2024).

- CHOZAN. Available online: https://chozan.co/blog/is-kuaishou-the-future-of-live-streaming-in-china-2/ (accessed on 20 October 2024).

- Influencer Marketing Hub. Available online: https://influencermarketinghub.com/kol-marketing/ (accessed on 20 October 2024).

- 36Kr. Available online: https://www.36kr.com/p/1263588113602436 (accessed on 20 October 2024).

- Marketing to China. Available online: https://marketingtochina.com/ai-powered-virtual-hosts-are-taking-over-e-commerce-live-streaming/ (accessed on 23 October 2024).

- SCMP. Available online: https://www.scmp.com/tech/apps-social/article/3093440/steep-discounts-and-kol-endorsements-have-supercharged-live (accessed on 23 October 2024).

- Lin, Z.; Heng, C.S. The paradoxes of word of mouth in electronic commerce. J. Manag. Inf. Syst. 2015, 32, 246–284. [Google Scholar] [CrossRef]

- Xu, M.; Tang, W.; Zhou, C. Procurement strategies of E-retailers under different logistics distributions with quality-and service-dependent demand. Electron. Commer. Res. Appl. 2019, 35, 100853. [Google Scholar] [CrossRef]

- Sohu. Available online: https://www.sohu.com/a/523096976_121057985 (accessed on 24 October 2024).

- Hao, C.; Yang, L. Resale or agency sale? Equilibrium analysis on the role of live streaming selling. Eur. J. Oper. Res. 2023, 307, 1117–1134. [Google Scholar] [CrossRef]

- Ji, G.; Fu, T.; Li, S. Optimal selling format considering price discount strategy in live-streaming commerce. Eur. J. Oper. Res. 2023, 309, 529–544. [Google Scholar] [CrossRef]

- Liu, J.; Ke, H. Firms’ preferences for retailing formats considering one manufacturer’s emission reduction investment. Int. J. Prod. Res. 2021, 59, 3062–3083. [Google Scholar] [CrossRef]

- Zhang, S.; Zhang, J. Agency selling or reselling: E-tailer information sharing with supplier offline entry. Eur. J. Oper. Res. 2020, 280, 134–151. [Google Scholar] [CrossRef]

- Cai, S.; Li, S.; Liu, Y.; Han, X. Who should livestream first? Sequence of dual self-livestreaming rooms for manufacturers. Electron. Commer. Res. Appl. 2025, 71, 101498. [Google Scholar] [CrossRef]

- Fletcher, K.A.; Gbadamosi, A. Examining social media live stream’s influence on the consumer decision-making: A thematic analysis. Electron. Commer. Res. 2024, 24, 2175–2205. [Google Scholar] [CrossRef]

- Pun, B.L.; Fung, A.Y. Live streaming as an interactive marketing media: Examining Douyin and its constructed value and cultural preference of consumption in e-commerce. In The Palgrave Handbook of Interactive Marketing; Springer International Publishing: Cham, Switzerland, 2023; pp. 499–517. [Google Scholar]

- Sun, Y.; Shao, X.; Li, X.; Guo, Y.; Nie, K. How live streaming influences purchase intentions in social commerce: An IT affordance perspective. Electron. Commer. Res. Appl. 2019, 37, 100886. [Google Scholar] [CrossRef]

- Shen, B.; Cheng, M.; He, R.; Yang, M. Selling through social media influencers in influencer marketing: Participation-based contract versus sales-based contract. Electron. Commer. Res. 2024, 24, 1095–1118. [Google Scholar] [CrossRef]

- Zhang, X.; Shi, Y.; Li, T.; Guan, Y.; Cui, X. How do virtual AI streamers influence viewers’ livestream shopping behavior? The effects of persuasive factors and the mediating role of arousal. Inf. Syst. Front. 2024, 26, 1803–1834. [Google Scholar] [CrossRef]

- Lyu, W.; Qi, Y.; Liu, J. Proliferation in live streaming commerce, and key opinion leader selection. Electron. Commer. Res. 2024, 24, 1153–1186. [Google Scholar] [CrossRef]

- He, W.; Jin, C. A study on the influence of the characteristics of key opinion leaders on consumers’ purchase intention in live streaming commerce: Based on dual-systems theory. Electron. Commer. Res. 2024, 24, 1235–1265. [Google Scholar] [CrossRef]