Abstract

Based on the relevant framework of evolutionary geography, this article explores the direct effect of industrial diversification on urban economic resilience and its indirect effect on urban economic resilience through entrepreneurial spirit. The research finds that during the period from 2018 to 2023, cities with a stronger degree of industrial diversification demonstrated stronger economic resilience in the face of external shocks. Industrial diversification can not only disperse the risks from external shocks, but more importantly, it can stimulate entrepreneurial spirit, thereby promoting innovation and transformation in industries and enhancing the economic resilience of cities.

1. Introduction

Entrepreneurial spirit mainly refers to the spirit in which entrepreneurs lead their enterprises to overcome various difficulties. By enhancing entrepreneurs’ patriotic spirit, innovative spirit, spirit of honesty and credit, sense of social responsibility and international vision, etc., enterprises can become a vanguard in the process of economic construction and development and achieve brilliance. Since the reform and opening up more than 40 years ago, China’s economic development has made rapid and remarkable progress. Under the current circumstances, China’s economic development is confronted with the dual predicament of a low value chain for products and a backward economic structure. In this broad social context, it is required that China promote the innovative spirit of industries, namely the entrepreneurial spirit. This requirement clearly states that China should vigorously develop the industrial agglomeration of manufacturing and service industries, and enhance the technological added value and international competitiveness of products. Accelerating the agglomeration and development of manufacturing and service industries can, to a certain extent, alleviate external shocks and thereby enhance the economic resilience of cities. Therefore, an in-depth exploration of industrial agglomeration, entrepreneurial spirit, and urban economic resilience has very important theoretical and practical significance for the upgrading of industries and the improvement of product value chains. The entrepreneurial spirit studied in this article mainly emphasizes the innovative spirit of entrepreneurs.

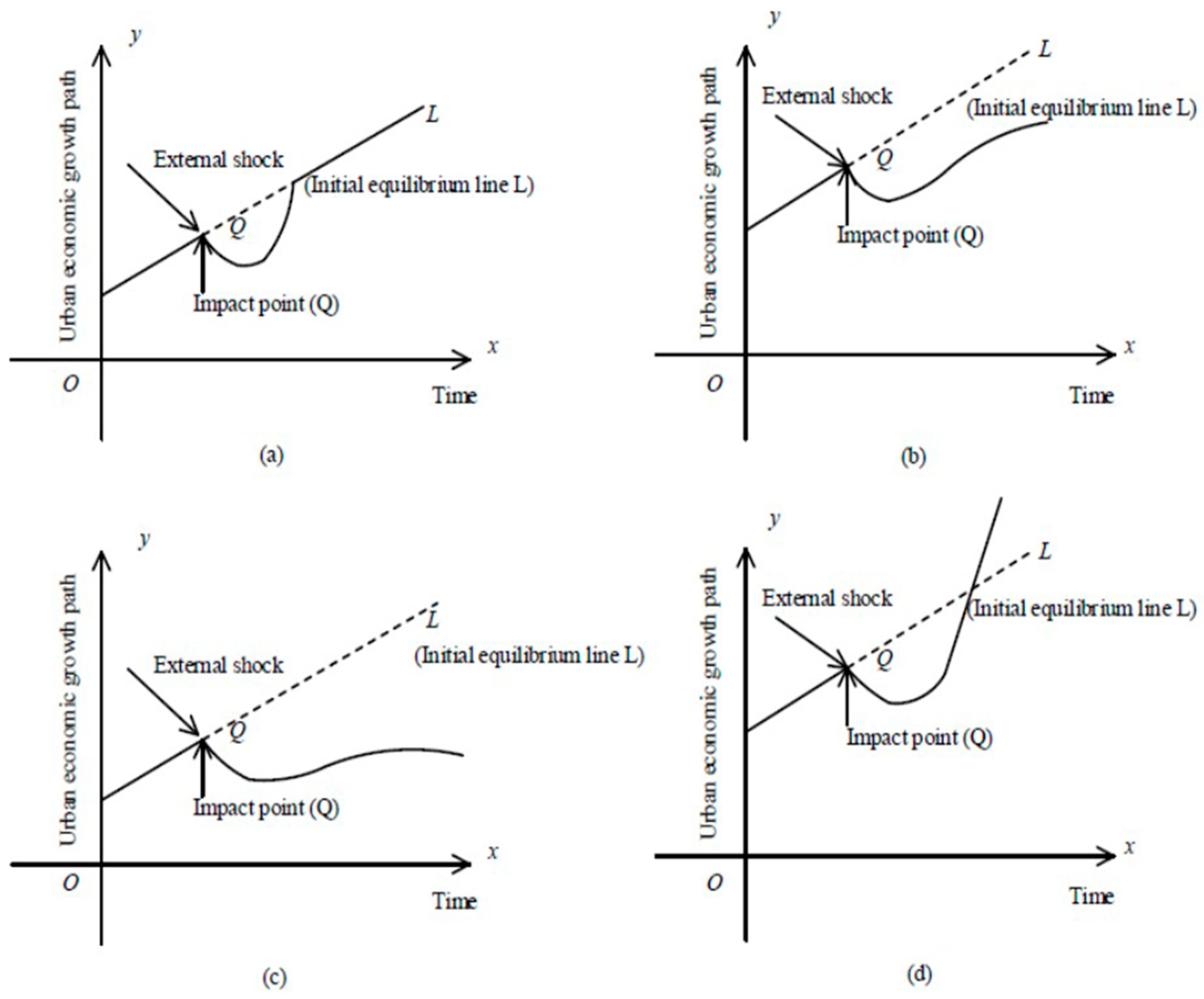

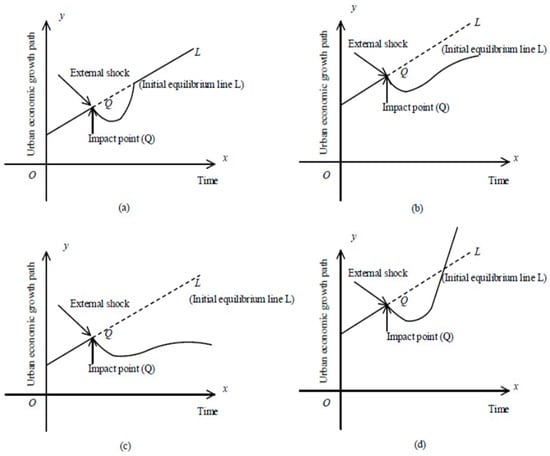

The economic resilience of a city is reflected in the continuous adjustment of its economic operation mode under the impact of the economic system. When faced with external shocks, some cities can quickly recover, while others are trapped in economic difficulties that are difficult to get rid of, which reflects the economic resilience of different cities. If a city has good urban economic resilience, it can quickly adapt to new environments and adjust new ways of urban economic operation, thereby repairing the losses caused by the impact on the city and achieving healthy growth in urban economic development. Simmie and Martin (2010) believe that there are roughly four situations when a city is affected by external shocks: The first situation, as shown in Figure 1a, is when the city’s economic system is affected by external shocks, and after a period of adjustment, it returns to its original development path. The second scenario, as shown in Figure 1b, is when a city is subjected to external shocks; although it continues to maintain economic growth after a period of adjustment, it is difficult to restore its original development path. The third scenario is shown in Figure 1c: When a city is hit by external shocks, its economic development falls into a sustained downturn. The fourth scenario is shown in Figure 1d: When a city is subjected to external shocks, it has strong adaptability, quickly breaking the original development equilibrium point and optimizing the city’s economic growth path [1].

Figure 1.

(a–d) Different responses of the urban economic system after external shocks.

Industrial agglomeration is a spatial distribution state, usually referring to the agglomeration behavior of the same industry within a range of 5 km. The concept similar to industrial agglomeration is industrial agglomeration, which usually targets the proximity of different industries and has similar measurement methods. The theoretical research on industrial agglomeration in domestic and foreign literature mainly focuses on the long-term trends and industry divisions of industrial agglomeration. The consensus is that the agglomeration of a certain industry is more composed of inter-industry agglomeration, but the agglomeration of the sub industry itself is the key to improving the efficiency of industrial agglomeration. The agglomeration of various industries under the same industry is not conducive to efficiency improvement, and efficient industrial agglomeration tends to be diversified across industries. (Kim, 1995; Ellison, 1997; Durant, 2005; Overman, 2008; Glazer, 2010; Liu Xiuyan, 2021; Hu Xuhua, 2021; Xiao Qianwen, 2021; Su Chenchen, 2022; Qiao Bin, 2023; He Canfei, 2023; Li Zhixu, 2025; Gu Jiang, 2025) [2,3,4,5,6,7,8,9,10,11,12,13,14,15]. Diversified industrial agglomeration is a common spatial distribution pattern in industrial agglomeration. In the relevant literature of economics, it is often used to analyze its relationship with the local economic development situation and employment situation. Later, it was introduced into the research of urban economic resilience by scholars. The general industrial diversification agglomeration can be divided into related diversification agglomeration and unrelated diversification agglomeration. (1) Industry-related diversified agglomeration refers to the economic behavior where enterprises with certain related industries gather together in a specific geographical location. These industries have economic correlations in production or technology. Although they may differ in content and characteristics, they are closely related in terms of input and output. Because the development of an industry inevitably requires the assistance of products and services from other industries, on the other hand, the products produced by an industry will drive the production and consumption of other sectors. If a certain industry undergoes changes, it will also cause a series of changes in other industries. This effect is called the industrial correlation effect. These correlation methods include product correlation, service correlation, technology correlation, supply and demand correlation, etc.

(2) Industrial-independent diversified agglomeration refers to an economic behavior where multiple industries with relatively low substitutability or complementarity in technical services come together within a certain geographical space range. The impact of industry-independent diversification on industrial innovation has both advantages and disadvantages. Firstly, in terms of the breadth of knowledge, due to the low degree of correlation between industries, cross-industry background cooperation may greatly change the original development model of the region and achieve disruptive development. However, on the other hand, due to the large industry gap between unrelated industries and the considerable distance between technologies and business concepts, it is impossible to achieve technological exchange and experience absorption at the current level in the short term, which affects the play of Jacobs externalities and hinders the development of scientific and technological innovation.

The agglomeration of a single industry is highly vulnerable to external risks. The agglomeration of diversified industries, due to the diversification of the industrial structure, can effectively disperse external risks and thus has stronger urban economic resilience. The impact of industrial diversification and agglomeration on the economic resilience of cities also stems from the types of pillar industries that guide the economic development of cities. Anhusen (2009) [16] holds that once a city selects a certain industry as its leading sector, it will follow a specific development model in the long term. It will be very difficult to change this path unless there is a stronger external shock to change the economic layout; then, it is possible to update the development trajectory. Martin (2012) [17] holds that for different types of industries, the demand elasticity of cities for products and jobs, the structure of human capital, the orientation of import and export trade, and the sensitivity of industries to external risks all vary. Generally speaking, heavy industrial enterprises have a longer payback period and higher costs for technological upgrading, so their economic resilience is relatively poor. However, as they involve more industrial chains and have a larger scale, they can generate local tax revenue and solve local employment problems. Therefore, the government usually supports the development of heavy industrial enterprises.

Judging from the existing literature, the research on urban economic resilience has only just started in recent years, and there are very few articles studying the correlation among industrial diversification and agglomeration, entrepreneurship, and urban economic resilience. On this basis, based on the urban panel data of 264 prefecture-level cities in China from 2018 to 2023, we explore how the diversification and agglomeration of industries affect the economic resilience of cities through entrepreneurial spirit. The purpose of exploring the above content is to identify the deficiencies in the economic resilience of Chinese cities during the development process, with the expectation of contributing to the revitalization and development of the Chinese economy.

2. Selection of Data and Setting of Models

2.1. Data Sources and Sample Selection

The data in this article are sourced from the China Urban Statistical Yearbook. After excluding samples of county-level cities and all outlier indicators, we selected 264 prefecture-level cities in China. After processing the urban yearbook data of each prefecture-level city from 2018 to 2023, we ultimately obtained 1584 sample data. All regression analyses of the data were conducted using Stata 15. This article processes the data outliers as follows: (1) Eliminate the samples from 2017 and before. Since the administrative and industrial divisions of some cities have been adjusted after 2018, in order to ensure the consistency of the data statistical standards and the accuracy of the calculation, this article adopts the administrative regional divisions and industrial category divisions in 2018 and later as the standards, and the time dimension of the sample is calculated from 2018. (2) Some sample cities were excluded. The exclusion of these samples will not affect the accuracy of the data results. Firstly, cities with a short establishment time and a relatively small data statistics time range were excluded, such as Xigaze City, Chamdo City, Turpan City, Hami City, Nyingchi City, Shannan City, Bijie City, Tongren City, etc. Secondly, cities with a relatively small time range for data statistics due to city revocation were excluded, such as Chaohu City, etc. Finally, cities with severe data deficiencies were excluded, such as Lhasa City, etc. (3) For the situation where a small portion of the year data are missing in the panel data of individual cities, this article uses the mean values of the two years before and after to perform linear interpolation processing on it.

2.2. Description of Main Variables

① Urban economic resilience. Through literature review, we find that scholars at home and abroad prefer to use the AHP (Analytic Hierarchy Process) for the analysis of indicators. However, during the application of the AHP, it is inevitable that there will be influences from subjective factors. Therefore, this article also refers to the indicator weight method of Qi Xin, Zhang Jingshuai, and Xu Weixiang (2019) [15] to measure the economic resilience of cities, as shown in Table 1. The entropy weight method was selected to evaluate the resilience level of the urban economy.

Table 1.

Comprehensive evaluation index system for urban economic resilience level.

Firstly, the degree of industrial agglomeration we mainly adopt is the urbanization rate, which is a positive indicator. Secondly, the growth rate of a city’s GDP mainly reflects the macroeconomic development level of the city and is the optimal indicator for measuring the economic situation of a region. It is a positive indicator. Thirdly, disposable income in urban and rural areas is a key indicator for measuring the economic stability of a city. The smaller the disposable income between urban and rural areas, the more stable the economic situation of the city. The larger the ratio of disposable income between urban and rural areas, the poorer the economic resilience of the city. Therefore, our prediction for this indicator is negative. Fourth, the proportion of income from the tertiary industry in GDP is an important indicator for measuring the optimization of a city’s industrial structure. The greater the proportion of this indicator, the more reasonable the economic development structure of the region tends to be, which is a positive indicator. Fifth, the sensitivity of urban economy mainly selected the proportion of FDI in GDP, the proportion of income from the primary industry in GDP, the rate of college students per 10,000 people, and the unemployment rate of the city. Except for the rate of college students per 10,000 students being a positive indicator, the other three indicators are all negative. The constructed matrix is as follows:

To evaluate the economic resilience level of a city in the past 5 years, we selected 5 criteria layers, with the horizontal axis a representing criteria and the vertical axis b representing years. This study selected data from 264 prefecture-level cities from 2012 to 2018 as samples. The steps for calculating the level of economic resilience of prefecture-level cities in China based on Xu Bo’s (2018) [18] calculation are as follows.

1. At the indicator level, there are both positive and negative indicators. For positive indicators, we can choose Formulas (1)–(4):

2. For the standardization of negative indicators, we can choose Formula (2):

3. To calculate the proportion of sample b under indicator a, we can choose Formula (3):

4. We can choose a formula to calculate the entropy value under the b-th index (4):

5. Calculate the coefficient of difference for indicator b. For indicator b, the greater the difference in indicator value Xab, the higher the evaluation coefficient for the entire scheme and the lower the entropy value. A formula can be selected (5):

6. To calculate the corresponding indicator weights, Formula (6) can be selected:

7. The score of resilience level for each prefecture-level city can be calculated using Formula (7) [18]:

The index weight method of Qi Xin, Zhang Jingshuai, and Xu Weixiang (2019) [15] was also referred to measure the urban economic resilience, thereby testing the measurement results of urban economic resilience, as shown in Table 2.

Table 2.

The weights of each index finally determined by the Delphi method (unit: %).

The influence of different indicators on urban economic resilience varies. Through Table 2, we find that the ratio of college students has a relatively significant impact on urban economic resilience. The reason is that the ratio of college students can reflect a city’s investment in scientific research and innovation. Cities with a higher proportion of college students have stronger scientific research and innovation capabilities, have greater advantages when facing external shocks, and have stronger economic resilience. Secondly, there are the urban unemployment rate and the Gini coefficient. Here, we use the ratio of disposable income between urban and rural areas and rural areas to represent the Gini coefficient. In this article, the geodetector method can also be adopted to measure the weights of each index, and its calculation formula is shown in the following Formula (8):

Among them, q represents the explanatory power of each influencing factor for the spatial differentiation of economic resilience, and its value range is between 0 and 1. The larger the q value is, the stronger the explanatory power of the independent variable for the dependent variable will be. N represents 264 prefecture-level cities across the country; represents the indicator variance.

Based on this, we can calculate the economic resilience scores of 264 prefecture-level cities across the country from 2018 to 2023. The higher the score, the higher the economic resilience of the city; conversely, the lower the score, the lower the economic resilience [19].

② Core explanatory variable I: Industry-related diversification. Industry-related diversification mainly refers to the distribution of industries with a high degree of economic and technological correlation within or around a certain area. To further measure the urban industry-related diversification index, we assume that the small industry i belongs to the large industry Sk, where k = 1, 2, 3, 4, …, k. The proportion of major departments in a city to the total is Pk, the proportion of small sectors in a city to all industries is Pi, resulting in the following equation:

Then the industry-related diversification index (RV) can represent the entropy index of the sub-sectors under all major sectors. Hk represents the entropy index of each subcategory department within the major category department.

We refer to Boschma’s (2015) [19] measurement method to measure industry-related diversification. Firstly, calculate the explicit comparative advantage of a certain industry j, and then set a threshold value. Industries higher than this standard value are included in the set, and then calculate the diversification index between all industries in the set. Firstly, we calculate the comparative advantage of a certain industry j, as shown in model (12):

Among them, represents the product production quantity of industry j in C city in year t, and represents the output quantity of all industrial products in C city in year t. is the number of products produced by all industries in the country in year t, representing the production quantity of all industries in the country during year t. Referring to He Canfei (2019) [20], we set an R value greater than 0.5 to represent that a certain industry j has a comparative advantage in the market share and is included in the set:

In this article, the correlation between industries i and j in a certain prefecture-level city C is calculated using Formula (13), and based on this, the correlation between all industries and industry j is theoretically calculated. The median is used as the threshold to form the set of all industries related to industry j in city C in year t. Then, the correlation diversification index of all industries related to industry j in city C in year t is calculated using Formulas (14) and (15):

③ Key explanatory variable II: Industries have nothing to do with the level of diversification. Let us assume that the small industry i belongs to the large industry k, where k = 1, 2, 3, 4, …, k. The proportion of major departments in a city to the total is Pk, The proportion of small sectors in a city to all industries is Pi; The non-correlated diversification (UV) of industries can be expressed as the entropy index of major sectors [21]:

④ Core independent variable III: Entrepreneurial spirit (bossmanship). The most important aspect of entrepreneurial spirit is the innovative spirit of entrepreneurs. This article selects the number of patent authorizations from the China Urban Statistical Yearbook from 2018 to 2023 as the indicator of entrepreneurial spirit for measurement. Meanwhile, referring to Xu Yuan (2020) [21], this article also used the number of invention patent applications per unit of GDP as a measure of entrepreneurial spirit level for robustness testing.

⑤ Other control variables. In order to increase the goodness of fit of the model, it is necessary to select other control variable indicators of the model. Referring to the literatures such as Mao Jinxiang (2018) [22], as well as Chen Jianjun (2017) [23], Liu Yue (2017) [24], we draw the following conclusion: Since the proportion of the primary industry in GDP, the proportion of the tertiary industry in GDP, the proportion of Fdi in GDP, and the proportion of fixed asset investment in GDP may all have an impact on the economic resilience of a city, we select the above four indicators as other control variables and incorporate them into the model.

2.3. Research Model Setting

The issue studied in this article is the correlation among industrial diversification and agglomeration, entrepreneurship, and urban economic resilience. Drawing on the MRW model (1992) [25], the econometric model constructed in this paper is as follows:

resiliencei,t = Bnonoagr + C bossmanshipi,t + rXi,t + UI + бi,t

In this article, urban economic resilience is expressed by “resilience”, and “nonagr” represents the degree of industrial diversification and agglomeration. “Bossmanship” represents entrepreneurship. The most important aspect of entrepreneurship is the innovative spirit of entrepreneurs. “X” represents other control variables. In Model (17), the subscripts “I” and “t” of each variable respectively represent city I of a certain city and time t. The industrial diversification agglomeration item in this article adopts a lagging three-period treatment [26].

2.4. Descriptive Statistics

Based on the externality effect brought about by entrepreneurial spirit. Cities with higher levels of entrepreneurial spirit tend to attract high-quality resources into the city, which are all key to enhancing the economic resilience of the city. In this part, we mainly identify whether entrepreneurial spirit is conducive to industrial innovation and thereby enhances the economic resilience level of the city. The explained variable is urban economic resilience. The core explanatory variables are industrial diversification, industrial-related diversification, industrial-unrelated diversification, and entrepreneurial spirit. To alleviate the possible bias of missing variables in the estimation, we incorporate as many other control variables at the prefectural city level as possible. The sum of the total number of top scorers and the jinshi in the imperial examinations during the Ming and Qing dynasties, and the number of higher education institutions in each prefecture-level city after the two major adjustments of departments and colleges in China were taken as instrumental variables of entrepreneurial spirit. A logical chain was established through the two-stage least square method: highly skilled human capital is the main driving force for the distribution of talents, which in turn affects the level of entrepreneurial spirit.

To study the long-term development mechanism of urban entrepreneurship, there must be sufficient and reasonable instrumental variables as the basis (Morreti, 2004 [27], Morreti, 2010 [28], Berry and Glaser, 2005 [29], Tabelini, 2010 [30]; Becker and Woessmann, 2009 [31]; Akcomak et al., 2016 [32]). In the existing literature, apart from Glaeser, 1999 [33], Glaeser 2001 [34], Glaeser 2014 [35], Glaeser and Lu (2018) [36] and the relocation policies of Chinese universities used in this paper, no measurable policy impact on urban-level highly skilled human capital has been found in other countries. Based on the research deficiencies at the theoretical and empirical levels mentioned above, this article attempts to utilize the information of the jinshi in the imperial examinations since the Ming and Qing dynasties in China to construct a unique instrumental variable of high-skilled entrepreneurship across the century, taking the “university relocation” movement in the era of planned economy in China as the policy shock. The long-term development footprint of urban economic development is studied from three aspects: the area of the city walls during the Ming and Qing Dynasties, policy impact, and talent mobility. The path dependence of the diversified agglomeration of urban industries and economic resilience is examined from the perspective of entrepreneurship, with the expectation of making breakthroughs and advancing the existing research. Table 3 is the assignment of the variables included in the regression, and Table 4 is the description of each statistical variable.

Table 3.

Assignment descriptions of each variable (2018–2023).

Table 4.

Statistical description in Variables (2018–2023).

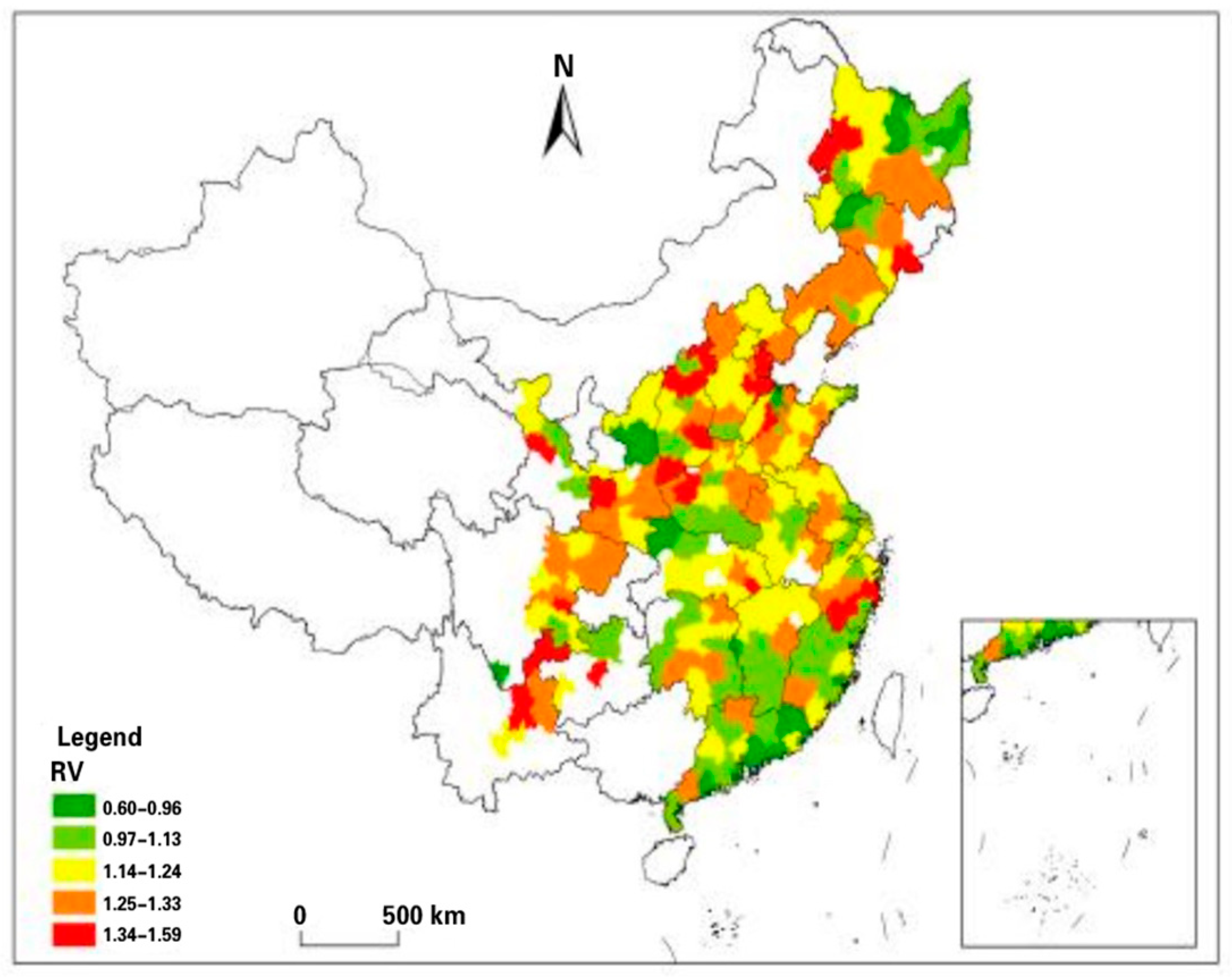

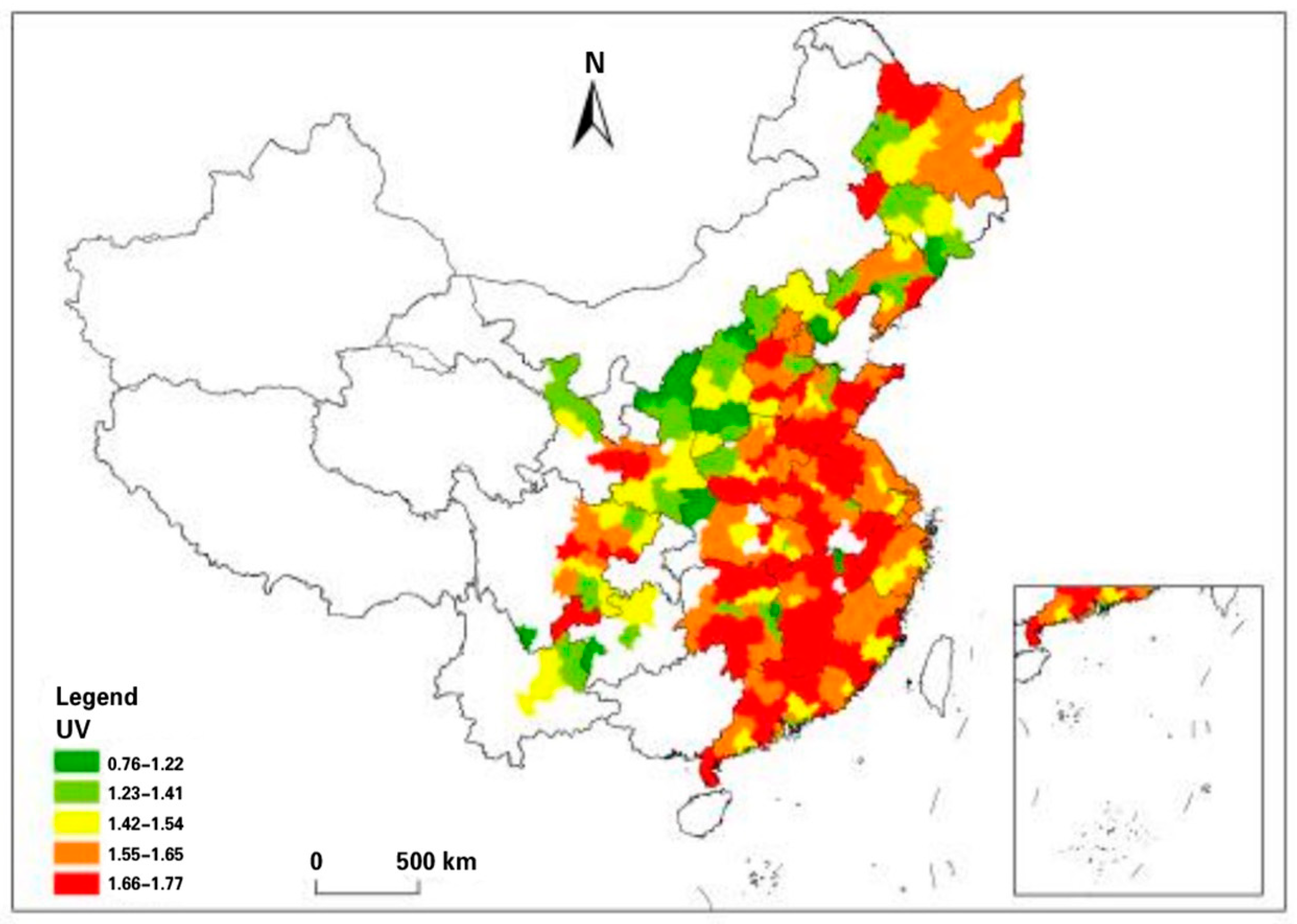

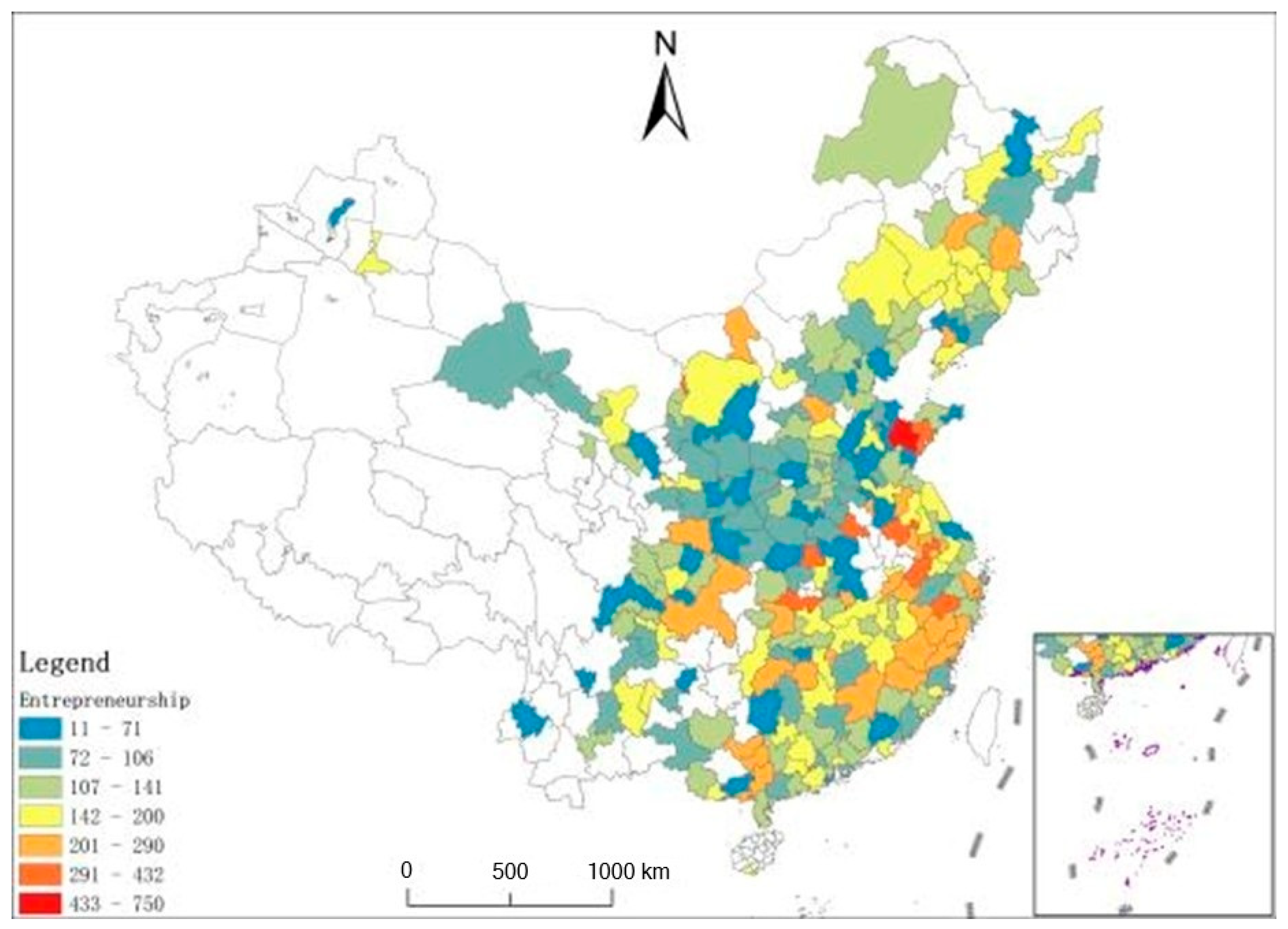

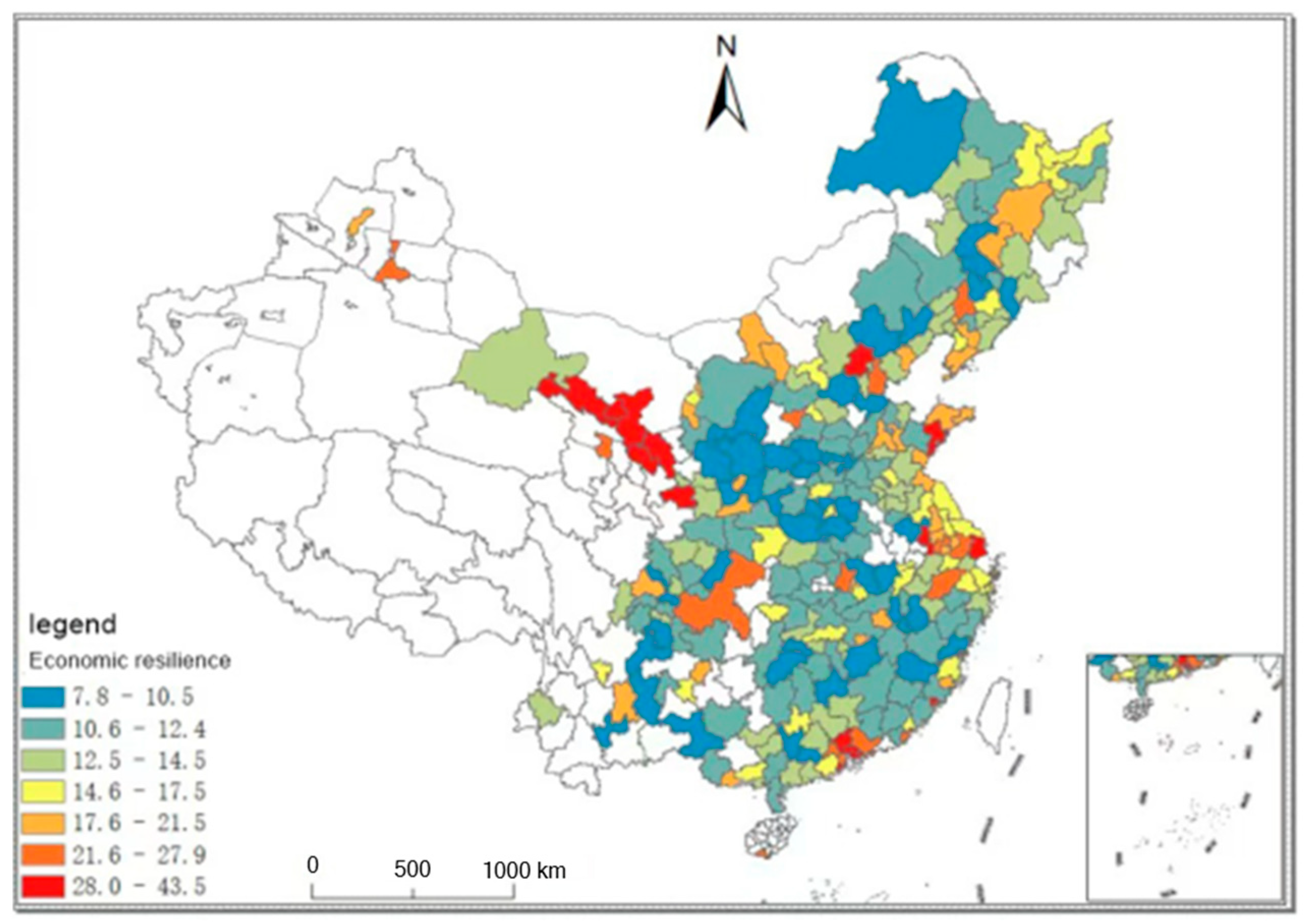

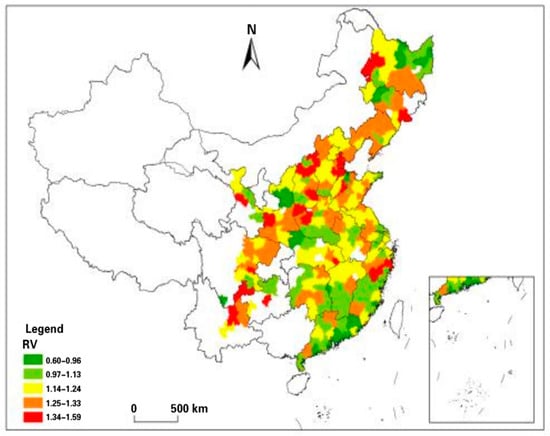

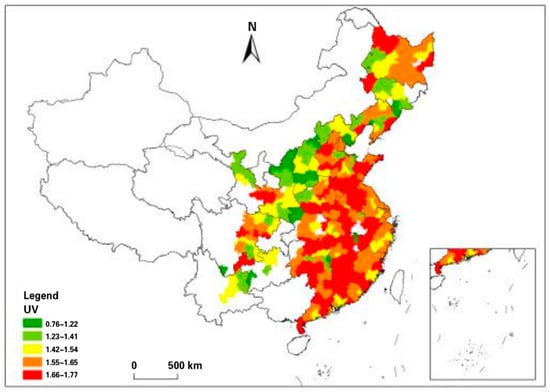

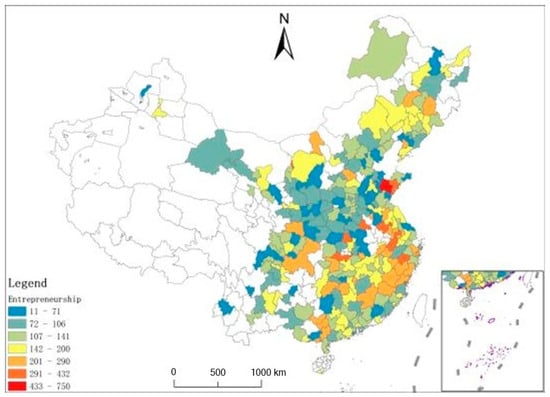

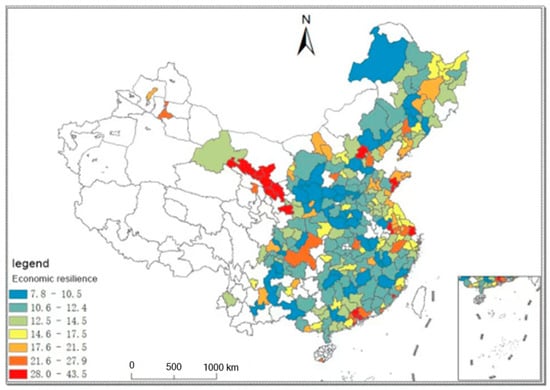

Note that in Table 4, the mean value of urban economic resilience is 21.59150 and the standard deviation is 18.39868. This indicates that compared with other variables, the distribution of urban economic resilience across the country is generally more moderate. The mean value of industrial diversification is −17.90511, and the standard deviation is 15.43315. The distribution differences among various cities are also significant. The logarithmic mean of entrepreneurial spirit is 7.80381 and the standard deviation is 1.50095, which indicates that the differences in industry innovation capabilities among various cities are also significant. The selection of other control variables drew on Zhao Chunyan and Wang Shiping (2020) [37], and their basic characteristic descriptions were basically consistent with those of Zhao Chunyan and Wang Shiping (2020) [37]. This article uses ARCGIS to draw and present the geographical distribution maps of related diversity, unrelated diversity, entrepreneurship, and urban economic resilience on the map of China, as shown in Figure 2, Figure 3, Figure 4 and Figure 5.

Figure 2.

Distribution map of urban diversification in China.

Figure 3.

Distribution map of unrelated diversification in Chinese cities.

Figure 4.

Distribution of entrepreneurial spirit in Chinese cities.

Figure 5.

Distribution of economic resilience in Chinese cities.

3. Empirical Results and Analysis

3.1. Benchmark Regression

Firstly, to explore the impact of industrial diversification on urban economic resilience, this paper conducted model estimation on Formula (17), and the results are shown in Table 5. Whether it is industrial diversification, industry-related diversification, or industry-unrelated diversification, they all show a significant correlation with urban economic resilience. It can be seen that industrial diversification has the function of automatic stabilizers, which can ensure that cities can quickly self-repair when facing external shocks. Industrial diversification, as it facilitates technology spillover and knowledge exchange between industries, is more helpful in helping the system resist external risk shocks. From another perspective, it can also be said that if the economic structure of a region is too single, it will not only lead to a country’s economic source being too single, but also cause significant economic fluctuations in specific sectors after external shocks, making it difficult for enterprises to exit. Therefore, diversification of industrial structure can not only share external risks but also promote regional structural innovation and industrial upgrading. Regions with diversified industrial structures have gathered a large number of related and unrelated diversified enterprises. When a certain industry receives external shocks, labor can flow across industries according to market and personal needs, thereby retaining high-quality human capital for the local area and providing a talent reservoir for the upgrading of urban economic structure. Regions with diverse industrial structures can drive local innovation through technology spillovers.

Table 5.

Diversification and urban economic resilience.

In order to overcome the endogeneity problem caused by the existence of omitted variables, based on the benchmark model, this paper supplements the use of the Spatial Durbin Model (SDM) economic distance matrix for regression estimation. The SDM model is helpful to solve the potential unobused heterogeneity and can effectively alleviate the estimation bias caused by the absence of variables. The results in Table 6 are basically consistent with those in Table 5. Both industrial-related diversification and industrial-unrelated diversification can have a positive promoting effect on urban economic resilience. From a long-term perspective, industrial-related diversification is more helpful for urban economic resilience. In addition, during the process of upgrading a city’s industries, it is necessary to attach importance to the integration between the industry itself and non-related industries. A city can transfer the problem of industrial unemployment through the combination of non-related industries. Meanwhile, factors such as the industrial structure of industries, human capital, and cultural services are also important for forming the economic resilience of a city. So far, Hypothesis 1 of this paper has been confirmed.

Table 6.

Diversification and urban economic resilience (spatial regression results).

3.2. The Intermediate Mechanism of Entrepreneurship

Entrepreneurship is an important factor for a city to influence environmental changes and adapt to structural adjustments after receiving external shocks. Entrepreneurship mainly refers to the spirit of innovation, adventure, integrity, and cooperation of entrepreneurs, but the spirit of innovation is the essence of entrepreneurship. There are mainly three ways to influence entrepreneurship: (1) Income inequality will affect the system and environment of the entire society, thereby affecting the promotion of entrepreneurship. The existence of social income inequality has increased the crime rate of the entire society, and this conclusion has also been confirmed by the American scholar inrohoroglu (1999) [38]. Wu Yiping and Rui Meng (2010) also proved this view through the inter-provincial panel data of China [39]. (2) From the perspective of the promotion or decline of entrepreneurship, income inequality can be further subdivided into opportunity inequality and effort inequality. Inequality of opportunity has a negative impact on the stimulation of entrepreneurship. For example, when both parents are university professors, the probability of their children having a low educational attainment will be greatly reduced. In addition, inequality of opportunities can also reduce the accumulation of human capital in the form of unfair educational opportunities, thereby greatly reducing the stimulation of entrepreneurial talents. And effort inequality has a positive effect on the stimulation of entrepreneurship. The higher the degree of inequality in efforts, the more it will stimulate the improvement and accumulation of human capital, thereby stimulating the development of entrepreneurial talents. (3) The income level and per capita consumption capacity of the location of this city will also affect the entrepreneurial ability of this city. The widening gap between the rich and the poor makes high-income people wealthier and more willing to pay higher prices for high-end products, thereby stimulating entrepreneurial talents. However, low-income people, due to the lack of effective demand, will restrain entrepreneurial innovation. Therefore, whether the gap between the rich and the poor promotes or inhibits entrepreneurial talent depends on the relative magnitudes of the two consumption effects brought about by high-income groups and low-income individuals. Combined with Jacobs’ externality theory, we construct Formula (18) to examine whether industrial diversification (including related diversification and unrelated diversification) has an impact on entrepreneurship, and further to test whether industrial diversification can indirectly affect urban economic resilience through entrepreneurship.

Bossmanshipi,t = Bnonoagr + rXi,t + UI + бi,t

In Formula (18), bossmanship represents entrepreneurship. In this paper, the number of patent authorizations is selected to represent it. X represents other control variables. In this paper, four indicators—namely the proportion of the primary industry in GDP, the proportion of the tertiary industry in GDP, the proportion of fdi in GDP, and the proportion of fixed asset input in GDP—are selected to reflect. u represents the fixed effect of the city, and б represents the error term. In Formula (18), the subscripts i and t of each variable represent city i and time t, respectively. The industrial diversification in this article adopts a lagging three-period treatment.

Regression was conducted on Formula (18), and the results are shown in models (1) to (3) in Table 7. Whether it is industrial diversification, industrial-related diversification, or industrial-unrelated diversification, they all show a significant positive correlation with entrepreneurship. The essence of entrepreneurship lies in stimulating the innovative spirit of entrepreneurs throughout society. Through industrial innovation-driven development, the economic resilience of cities can be more full and balanced, thereby demonstrating strong economic resilience in the face of domestic and international shocks. Cities with a higher degree of industrial diversification are more innovative due to the diversification of their industrial structure. The industrial agglomeration of all walks of life indirectly affects the economic resilience of the city through the bridge of entrepreneurship. To enhance the robustness of the research conclusion, we adopted the number of patent applications as the proxy variable of entrepreneurship. The regression results are listed in models (4)–(6) of Table 7 and Table 8. There was no substantial change in the regression results. It can also be seen from the regression results that industry-related diversity has a greater positive impact on entrepreneurship. This indicates that from a long-term perspective, the diversification related to industries promotes communication and learning among industries, contributes to the structural optimization and innovation among related industries, and plays a promoting role in entrepreneurship.

Table 7.

Diversification and entrepreneurial spirit.

Table 8.

Industrial diversification agglomeration and entrepreneurship (2SLS regression results) (2018–2023).

Logically speaking, there may be certain endogeneity problems in the empirical analysis of industrial diversification and entrepreneurship mentioned above. The reasons for these endogeneity problems mainly fall into two aspects. First of all, there is the two-way causal relationship. Industrial diversification can promote the development of entrepreneurship through factors such as external effects of human capital, information spillover, and technology spillover. Meanwhile, entrepreneurship can also have an impact on industrial diversification through the growth pole effect, industrial structure optimization, and knowledge spillover effect. The second is the problem of missing variables. Therefore, this paper incorporates as many other control variables at the prefecture-level city level as possible. The sum of the total number of top scorers and jinshi in the imperial examinations during the Ming and Qing dynasties and the number of higher education institutions in each prefecture-level city after the two major adjustments of departments and colleges in China were taken as instrumental variables of entrepreneurship. A logical chain was established through the two-stage least square method: highly skilled human capital is the main driving force for the distribution of talents, which in turn affects the level of entrepreneurship. All the data in the model of this paper are derived from the statistical yearbooks of various prefecture-level cities in China from 2018 to 2023. Table 6 shows the regression results of the instrumental variables. The regression results indicate that industrial diversification, industrial-related diversification, and industrial-unrelated diversification all show highly positive significance for entrepreneurship, which is basically the same as the regression results in Table 7 and Table 8. This indicates that on the basis of controlling the endogeneity problem, The conclusion obtained previously in this article remains robust.

According to the usual regression method of the mediating effect, the economic resilience, industrial diversification, and entrepreneurship of the city need to be simultaneously incorporated into the model, as shown in Formula (19):

resiliencei,t = Bnonoagr + C bossmanshipi,t + rXi,t + UI + бi,t

In this article, the urban economic resilience is represented by resilience, and nonagr represents the degree of industrial diversification and agglomeration (including industrial-related diversification and industrial-unrelated diversification). Bossmanship represents entrepreneurship. The most important aspect of entrepreneurship is the innovative spirit of entrepreneurs. Therefore, this article uses patent innovation to represent entrepreneurship. X represents other control variables. In this paper, four indicators, namely the proportion of the primary industry in GDP, the proportion of the tertiary industry in GDP, the proportion of FDI in GDP, and the proportion of fixed asset input in GDP, are selected to reflect. u represents the urban fixed effect, бi,t represents the error terms. In Model (19), the subscripts I and t of each variable represent city I and time t respectively. The industrial diversification agglomeration item in this article adopts a lagging three-period treatment. Given that the Bootstrap test cannot solve the endogeneity problem, this mediating effect is only used as a supplementary explanation for the robustness test in this paper. The test results of the mediating effect are shown in Table 9. Both variables representing entrepreneurship have a significant positive correlation with urban economic resilience. This indicates that the diversified development model and the innovativeness of the economic growth mode are of great significance to the development of the urban economy. Entrepreneurship, as the internal driving force for industrial economic innovation in China, is the driving force for enhancing the resilient development of urban economies. Therefore, it is extremely urgent to improve the entrepreneurship of cities. If a region has a relatively high level of entrepreneurship, it will contribute to the sustainable growth of the urban economy. Local entrepreneurship contributes to the development of the resilience of the local regional economy.

Table 9.

Diversification, entrepreneurial spirit, and urban economic resilience (mediating effect).

4. Robustness Test

This section selects the spatial panel data from 2004 to 2018; further constructs the correlation among industrial diversification and agglomeration, entrepreneurship, and urban economic resilience; and conducts the estimation results and tests of the non-spatial panel fixed-effect model as the robustness test, as shown in Table 10. Table 10 reports the OLS benchmark regression results. From a national perspective, the industrial agglomeration item is significantly positive. For every one percentage point increase in the industrial agglomeration item, the economic resilience of the city will increase by 1489.213 percentage points, and this is significant at the 1% level. The entrepreneurship item is significantly positive. For every one-percentage-point increase in the entrepreneurship item, the economic resilience of the city will increase by 0.0665 percentage points at a 10% level. In columns (2), (3), and (4), the 264 prefecture-level cities we selected in China were divided into cities in the eastern, central, and western regions. It was found that the coefficient symbol of the entrepreneurial spirit term remained unchanged in the eastern and western cities, and was significantly positive at the 10% and 5% levels, respectively, while it was significantly negative at the 5% level in the central region. This is closely related to the large-scale transfer of industrial bases to the central region promoted by the country during the 13th Five-Year Plan period. The state has implemented a strategy of restricting the development of large cities and focusing on supporting second- and third-tier cities, especially those in the central and western regions, which has promoted the development of central cities. This has led to an increase in housing prices in cities. The shortage of land resources is an important reason for this regression result. The industrial agglomeration items are significantly positive in cities in the east, central, and western regions. In Table 10, the coefficients of the mixed model of the common panel passed the significance test. Both the fitting coefficients R2 and Adj-R2 were very high, and the likelihood function value LogL was relatively low. The joint test of the individual fixed effect and the time fixed effect showed that both the individual fixed effect and the time fixed effect passed the significance test (p = 0.000). Obviously, neither of the two inspection methods can be rejected. This indicates that there is no spatial correlation between the individual fixed effect of the non-spatial panel and the temporal fixed effect of the non-spatial panel in the eastern, central, and western cities of the 264 prefecture-level cities selected in this chapter.

Table 10.

Estimation results and tests of industrial diversification, entrepreneurship, and urban economic resilience (2004–2018).

In Table 11 and Table 12, we specifically subdivide the industrial agglomeration items into industrial-related diversified agglomeration and industrial-unrelated diversified agglomeration. Through the regression results in Table 11 and Table 12, we find that the effect of industrial-related diversified agglomeration on urban economic resilience is significantly positive in national, eastern, and western cities, and significantly negative in central cities. However, the regression results of industry-independent diversification were not significant. This shows that the stronger the tendency of industrial diversification in a city is, the higher the levels of technology spillover and information spillover among industries will be. The reason why it is negative in central cities is related to the increase in the cost of production factors caused by the migration of the country’s industries and enterprises to central cities.

Table 11.

Estimation results and tests of industrial-related diversification Agglomeration, entrepreneurship, and urban economic resilience (2004–2018).

Table 12.

Estimation results and tests of industry-independent diversified agglomeration, entrepreneurship and urban economic resilience (2004–2018).

Due to the relatively close technological correlation among industries, when a certain industry is subjected to external shocks, the labor force and industrial structure among related external industries will transfer to each other, alleviating the occurrence of employee unemployment waves and enterprise closures. However, the communication and information spillover effect among industries brought about by industry-unrelated diversification is not strong, unless there is a major structural transformation of the industry. So it is not significant for economic resilience. Therefore, industrial-related diversification has a promoting effect on urban economic resilience, while industrial-unrelated diversification has no significant effect on urban economic resilience. The regression results in Table 11 and Table 12 are approximately the same as those in Table 10. Overall, the level of entrepreneurship in China is not very high. The relatively higher areas are mainly concentrated in the southeastern region. This requires China to further develop the positive externality advantages of industrial agglomeration in the east and southeast, lowering the entry threshold of large cities, so as to attract more talents to gather in eastern cities and create a favorable development environment for the formation of world-class industrial agglomeration. Further, through the positive external effects of industrial clusters, China will increase the national wealth; drive the development of cities in the central and western regions; achieve a balanced development of cities in the east, central, and western regions; and thereby comprehensively enhance the economic resilience of Chinese cities.

5. Conclusions and Recommendations

5.1. Conclusions

This paper utilizes the large sample data of 264 prefecture-level cities in China from 2018 to 2023. Based on the relevant framework of evolutionary geography, it explores the direct effect of industrial diversification on urban economic resilience and its indirect effect on urban economic resilience through entrepreneurship. The research results show that during the period from 2018 to 2023, cities with a stronger degree of industrial diversification will demonstrate stronger economic resilience in the face of external shocks. Both industrial-related diversification and unrelated diversification are significantly positive for urban economic resilience. Industrial diversification can not only disperse the risks from external shocks, but more importantly, it can stimulate entrepreneurship, thereby promoting innovation and transformation in industries and enhancing the economic resilience of cities.

5.2. Implications and Countermeasures and Suggestions

- (1)

- Promote cross-industry technology cooperation platforms, facilitate the sharing and collaboration of data assets, and enhance exchanges and cooperation among industries. We strive to build a data platform to achieve the interconnection and interoperability of data among different industries and systems, and encourage experts and scholars from various industries to exchange ideas. We also promote cross-industry technological innovation and cooperation by holding forums and seminars.

- (2)

- Establish a regional industrial innovation fund. Drawing on the development model of Xi ’an, an innovative mechanism of “regional sub-fund + urban renewal + industrial introduction” is carried out. The government’s guiding fund model is fully leveraged to innovate a sustainable implementation model, establish a diversified fund-raising mechanism, actively guide social capital to participate in urban renewal projects, and fully support the improvement of urban economic resilience and industrial transformation and upgrading.

Author Contributions

The first author of this article Y.C. is responsible for the writing of the article, while the second author C.G. is responsible for providing theoretical guidance and paying for the layout fee of the article. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by General Project of Philosophy and Social Sciences Planning in Zhejiang Province for the Year 2025 (25NDJC094YBMS).

Data Availability Statement

All data analysis in this article is true and effective.

Acknowledgments

Thank you to the teachers and classmates who provided all the help and revision suggestions for this paper.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Simmie, J.; Martin, R. The economic resilience of regions: Towards an evolutionary approach. Camb. J. Reg. Econ. Soc. 2010, 3, 27–43. [Google Scholar] [CrossRef]

- Kim, J. Endogenous Vehicle-Type Choices in a Monocentric City. Reg. Sci. Urban Econ. 2012, 42, 749–760. [Google Scholar] [CrossRef]

- Ellison, G.; Glaeser, E.L. Geographic Concentration in US Manufacturing Industries: A Dartboard Approach. J. Political Econ. 1997, 105, 889–927. [Google Scholar] [CrossRef]

- Duranton, G.; Overman, H.G. Testing for Localization Using Micro-Geographic Data. Rev. Econ. Stud. 2005, 72, 1077–1106. [Google Scholar] [CrossRef]

- Criscuolo, C.; Martin, R.; Overman, H.G.; Van Reenen, J. Some Causal Effects of an Industrial Policy. Am. Econ. Rev. 2019, 109, 48–85. [Google Scholar] [CrossRef]

- Glaeser, E.L.; Kim, H.; Luca, M. Nowcasting the Local Economy: Using Yelp Data to Measure Economic Activity at Scale; National Bureau of Economic Research: Cambridge, MA, USA, 2017. [Google Scholar]

- Chen, L.; Liu, X. Industrial Space Convergence and Enterprise Total Factor Productivity. Mod. Econ. Explor. 2021, 88–97. [Google Scholar] [CrossRef]

- Hu, X.; Chen, M.; Luo, Y.; Chen, Y. Research on Coupling and Coordination between Manufacturing and Productive Service Industries, Spatial Convergence, and Green Innovation Effects. Forum Stat. Inf. 2021, 36, 97–112. [Google Scholar]

- Zhao, R.; Xiao, Q. Evolution of industrial spatial system in the process of Chinese path to modernization. J. Northwest Univ. Natl. (Philos. Soc. Sci. Ed.) 2025, 136–147. [Google Scholar]

- Su, C. The Impact of Industrial Agglomeration in the Yangtze River Economic Belt on the Quality of Economic Development; Central South University for Nationalities: Wuhan, China, 2024. [Google Scholar]

- Qiao, B.; Dai, P. The impact effect of digital economy empowering industrial agglomeration. J. Jishou Univ. (Soc. Sci. Ed.) 2023, 44, 65–77. [Google Scholar]

- He, C.; Ren, Z.; Wu, W. Product dynamic technology correlation and geographical convergence of China’s export industry. Geogr. Res. 2023, 42, 2283–2301. [Google Scholar]

- Li, Z.; Peng, S. Global Value Chain Risk Exposure and Demand Shock Transmission: A Unified Analysis Framework. Econ. Res. 2025, 60, 39–55. [Google Scholar]

- Gu, J.; Shi, Z.; Shu, H. The dynamic mechanism and strategic layout of Chinese path to modernization from the perspective of humanistic economics. Soc. Sci. Front. 2025, 71–82+281. [Google Scholar]

- Qi, X.; Zhang, J.; Xu, W. Research on the Evaluation of Resilient Development of County Economy in Zhejiang Province. Zhejiang Soc. Sci. 2019, 40–46+156. [Google Scholar]

- An, H.; Chen, F. Obstacles to Human Capital Flow in the Development and Opening up of Binhai New Area: A Comparison between Pudong Development and Binhai New Area Development and Opening Up, Science and Technology Management; Economic Science Press: Beijing, China, 2009. [Google Scholar]

- Martin, R. Regional economic resilience, hysteresis and recessionary shocks. J. Econ. Geogr. 2012, 12, 1–32. [Google Scholar] [CrossRef]

- Xu, B. Measurement of Urban Resilience Level and Path Selection for Improvement in Anhui Province; Anhui University of Finance and Economics: Bengbu, China, 2018. [Google Scholar]

- Boschma, R. Towards an evolutionary perspective on regional resilience. Reg. Stud. 2015, 49, 733–751. [Google Scholar] [CrossRef]

- He, C.; Chen, T. External demand shocks, related diversification, and export resilience. China Ind. Econ. 2019, 61–85. [Google Scholar]

- Xu, Y.; Deng, H. Diversification, Innovation Capability, and Urban Economic Resilience. Econ. Dyn. 2020, 88–104. [Google Scholar]

- Mao, J.; Zhang, K. Research on the Spatial Correlation between Economic Agglomeration and Regional Innovation: A Case Study of the Yangtze River Delta Region. Mod. Urban Res. 2018, 47–52+78. [Google Scholar]

- Chen, J.; Chen, H. Review of Measurement Methods for Agglomeration: Research Based on Frontier Literature. J. Southwest Univ. Natl. (Humanit. Soc. Sci. Ed.) 2017, 134–147. [Google Scholar]

- Liu, Y.; Zou, M.; Chen, J. Industrial Collaborative Agglomeration from the Perspective of Spatial Economics: A Literature Review. Jianghuai Forum 2017, 47–53. [Google Scholar]

- Mankiw, N.G.; Romer, D.; Weil, D.N. A contribution to the empirics of economic growth. Q. J. Econ. 1992, 107, 407–437. [Google Scholar] [CrossRef]

- Moretti, E. Human Capital Externalities in Cities. In Handbook of Regional and Urban Economics; Henderson, J.V., Thisse, J.F., Eds.; Elsevier: Amsterdam, The Netherlands, 2004; Volume 4, pp. 2243–2291. [Google Scholar]

- Moretti, E. Estimating the Social Return to Higher Education: Evidence from Longitudinal and Repeated Cross-sectional Data. J. Econom. 2004, 121, 175–212. [Google Scholar] [CrossRef]

- Moretti, E. Local Multipliers. Am. Econ. Rev. 2010, 100, 373–377. [Google Scholar] [CrossRef]

- Berry, C.R.; Glaeser, E.L. The Divergence of Human Capital Levels across Cities. Reg. Sci. 2005, 84, 407–444. [Google Scholar] [CrossRef]

- Tabellini, G. Culture and Institutions: Economic Development in the Regions of Europe. J. Eur. Econ. Assoc. 2010, 8, 677–716. [Google Scholar] [CrossRef]

- Becker, S.O.; Woessmann, L. Was Weber Wrong? A Human Capital Theory of Protestant Economic History. Q. J. Econ. 2009, 124, 531–596. [Google Scholar] [CrossRef]

- Akcomak, S.; Webbink, D.; Weel, B. Why did the Netherlands Develop so Early? The Legacy of the Brethren of the Common Life. Econ. J. 2016, 126, 821–860. [Google Scholar] [CrossRef]

- Glaeser, E.L. Learning in Cities. J. Urban Econ. 1999, 46, 254–277. [Google Scholar] [CrossRef]

- Glaeser, E.L.; Maré, D.C. Cities and Skills. J. Labor Econ. 2001, 19, 316–342. [Google Scholar] [CrossRef]

- Glaeser, E.L.; Ponzetto, G.; Tobio, K. Cities, Skills and Regional Change. Reg. Stud. 2014, 48, 7–43. [Google Scholar] [CrossRef]

- Glaeser, E.L.; Lu, M. Human Capital Externalities in China; No. w24925; National Bureau of Economic Research: Cambridge, MA, USA, 2018. [Google Scholar]

- Zhao, C.; Wang, S. The impact of economic agglomeration on urban economic resilience. J. Cent. South Univ. Econ. Law 2021, 102–114. [Google Scholar]

- Acemoglu, D.; Shimer, R. Efficient Unemployment insurance. J. Political Econ. 1999, 107, 893–928. [Google Scholar] [CrossRef]

- Wu, Y.; Rui, M. Regional Corruption, Marketization, and China’s Economic Growth. Manag. World 2010, 10–17+27. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).