Enhancing Greenness and Performance of Agricultural Supply Chains with Nash Bargaining Contract Under Consumer Environmental Awareness

Abstract

1. Introduction

- (1)

- What is the optimal Nash bargaining contract that incorporates the process of negotiating on green cost-sharing ratios within agricultural supply chains?

- (2)

- How does the Nash bargaining contract impact the greenness and performance of agricultural supply chains?

- (3)

- How does consumer environmental awareness change the impact of the Nash bargaining contract?

2. Literature Review

2.1. Consumer Environmental Awareness (CEA) in Supply Chains

2.2. Greenness-Improving Supply Chain Contracts with CEA

2.3. Greenness-Improving Contracts for Agricultural Supply Chains

2.4. Research Gap

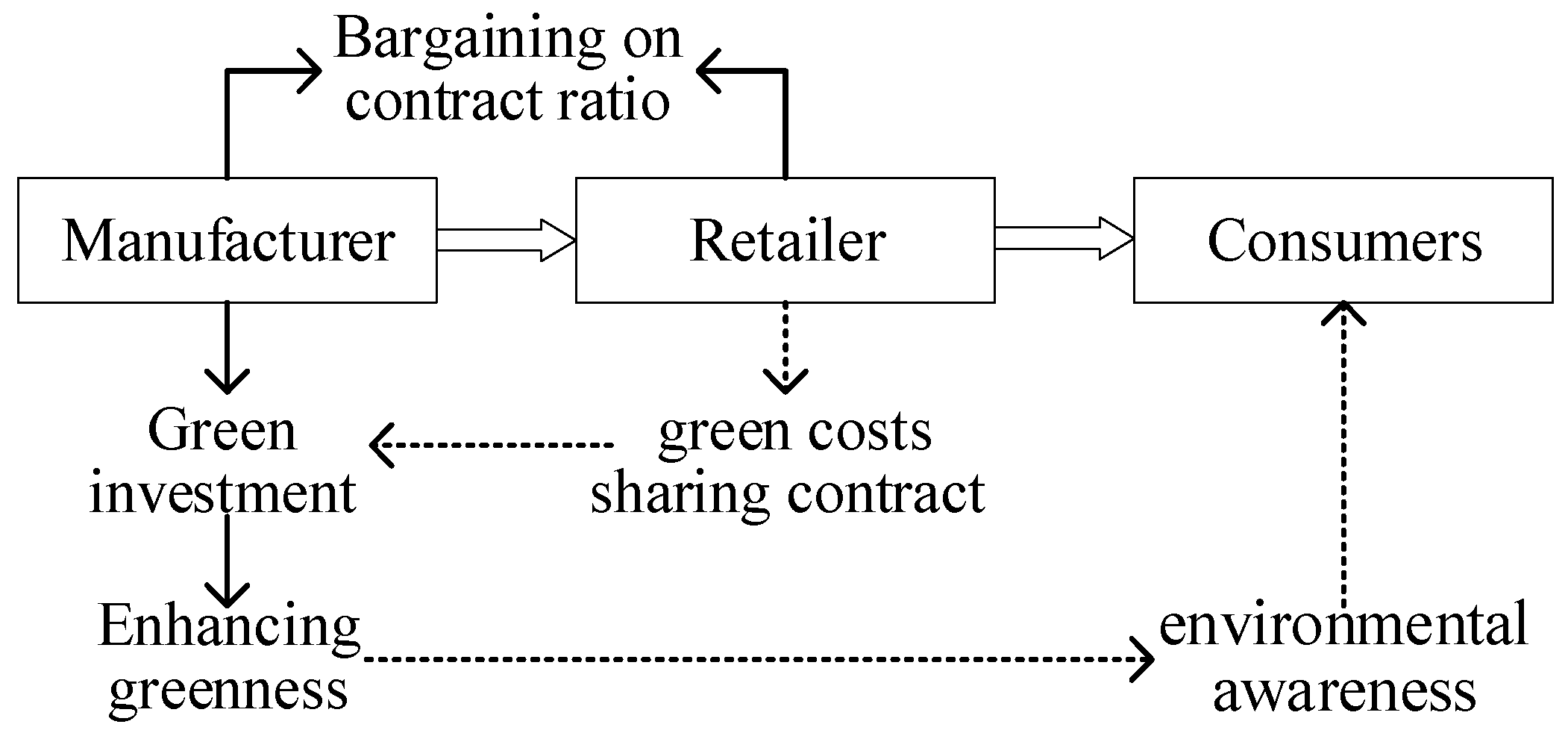

3. Problem Description

3.1. Framework

3.2. Methods

3.3. Assumptions

3.4. Notations

4. Model Construction and Solution

4.1. Competitive Scenario Without Nash Bargaining

4.1.1. Optimization Model

4.1.2. Optimal Solution

4.2. Local Cooperative Scenario with Given Ratio

4.2.1. Optimization Model

4.2.2. Optimal Solution

4.3. Global Cooperative Scenario with Nash Bargaining

4.3.1. Optimization Model

4.3.2. Optimal Solution

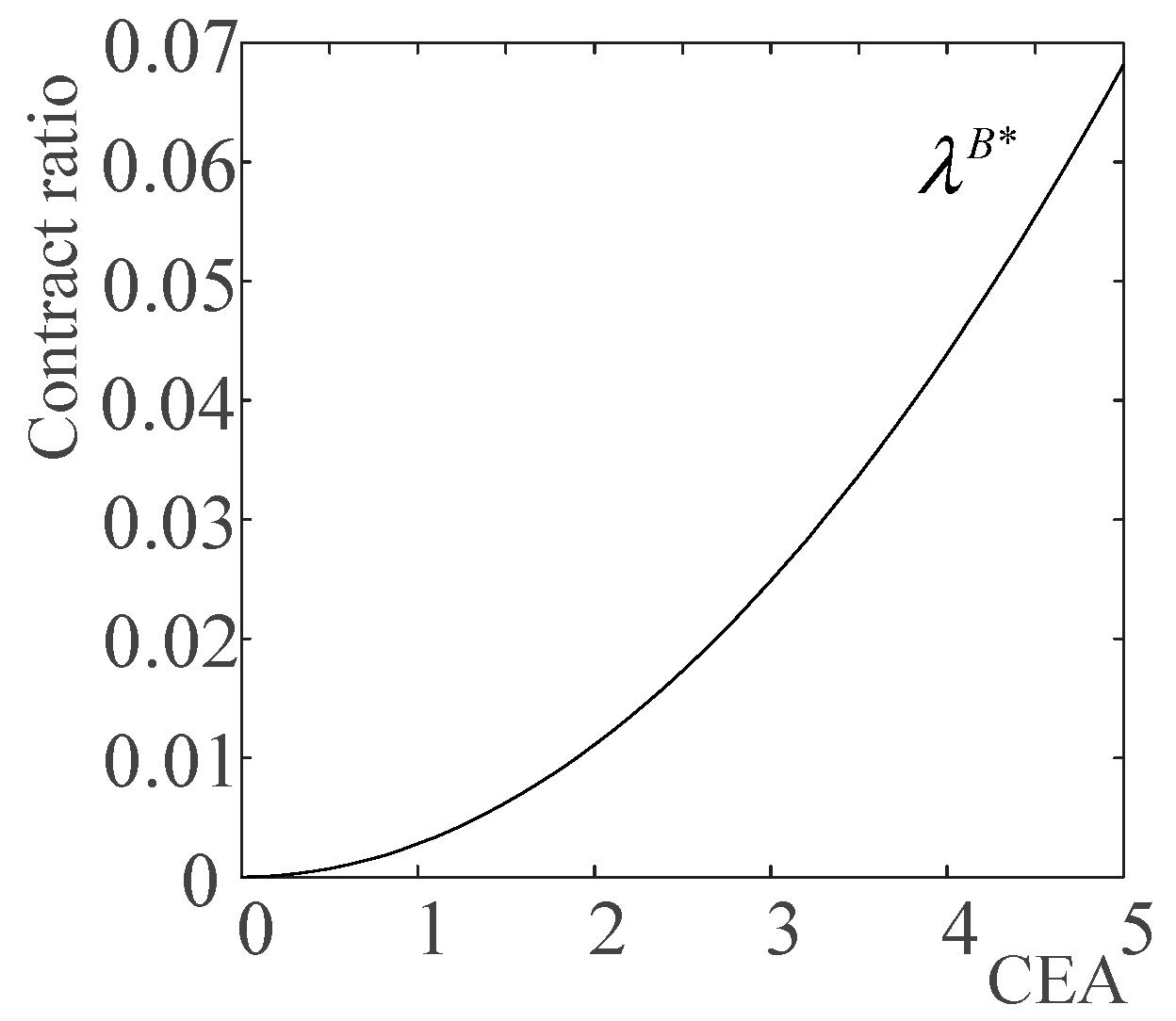

- Optimal Negotiated Contract Ratio

- Optimal Agricultural Product Greenness

- Optimal Supply Chain Profitability

5. Comparisons and Sensitivity Analysis

5.1. Case Study: Data from Green Hot Pepper Supply Chains in Guizhou Province of China

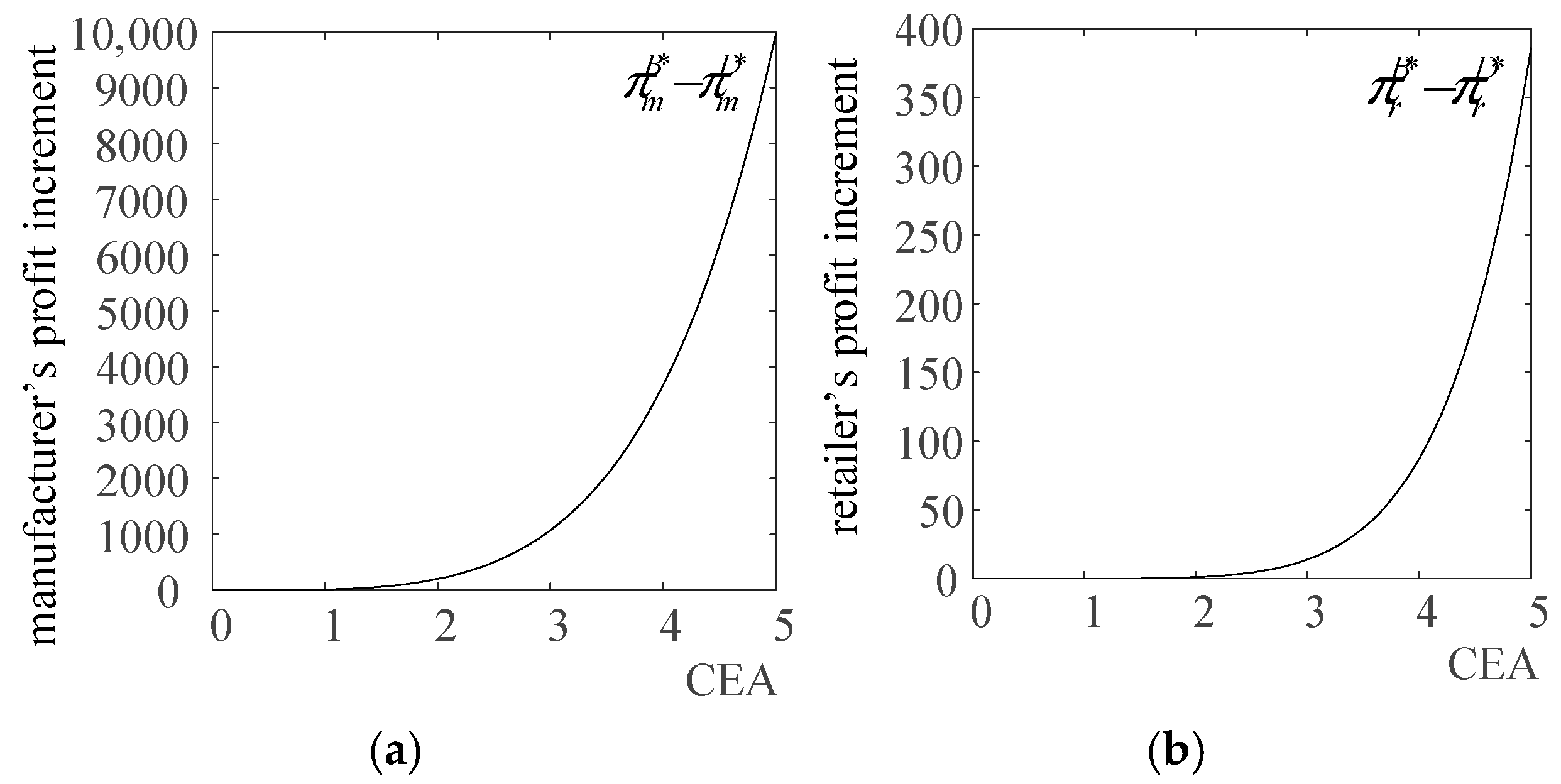

5.2. Comparisons: Enhancements from Nash Bargaining

5.2.1. Enhancement of Product Greenness

5.2.2. Enhancement of Product Price

5.2.3. Enhancement of Supply Chain Profitability

5.3. Sensitivity Analysis: Effect of CEA on the Enhancements

5.3.1. Amplifying the Enhancement of Product Greenness

5.3.2. Amplifying the Enhancement of Product Price

5.3.3. Amplifying the Enhancement of Supply Chain Profitability

6. Conclusions

6.1. Main Findings

6.2. Managerial Implications

6.3. Future Directions

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

Appendix A.1. Proof of Theorem 1

Appendix A.2. Proof of Theorem 2

Appendix A.3. Proof of Corollary 1

Appendix A.4. Proof of Theorem 3

Appendix A.5. Proof of Corollary 2

Appendix A.6. Proof of Corollary 3

Appendix A.7. Proof of Theorem 4

Appendix A.8. Proof of Corollary 4

Appendix A.9. Proof of Corollary 5

Appendix A.10. Proof of Theorem 5

Appendix A.11. Proof of Proposition 1

Appendix A.12. Proof of Proposition 2

Appendix A.13. Proof of Proposition 3

Appendix A.14. Proof of Proposition 4

Appendix A.15. Proof of Proposition 5

Appendix A.16. Proof of Proposition 6

References

- Jiang, J.D.; Jiang, S.H.; Xu, G.Y.; Li, J. Research on pricing strategy and profit-distribution mechanism of green and low-carbon agricultural products’ traceability supply chain. Sustainability 2024, 16, 2087. [Google Scholar] [CrossRef]

- Li, F.C.; Du, Y.D.; Gui, Y.T.; Wen, J. Research on the optimization of supply chain decisions for green agricultural products based on farmers’ risk preferences and disaster year subsidies. Int. J. Ind. Eng. Comput. 2025, 16, 275–294. [Google Scholar] [CrossRef]

- Wang, W.K.; Cao, Q.L.; Liu, Y.; Zhou, C.; Jiao, Q.H.; Mangla, S.K. Risk management of green supply chains for agricultural products based on social network evaluation framework. Bus. Strat. Environ. 2024, 33, 4913–4934. [Google Scholar] [CrossRef]

- Yang, M.X.; Tang, X.; Cheung, M.L.; Zhang, Y. An institutional perspective on consumers’ environmental awareness and pro–environmental behavioral intention: Evidence from 39 countries. Bus. Strat. Environ. 2021, 30, 566–575. [Google Scholar] [CrossRef]

- Xu, X.P.; Wang, S.Y.; Yu, Y.G. Consumer’s intention to purchase green furniture: Do health consciousness and environmental awareness matter? Sci. Total Environ. 2020, 704, 135275. [Google Scholar] [CrossRef] [PubMed]

- He, X.H.; Hu, Y.Y.; Hong, Z.Y. Consumers’ intention to purchase electric vehicles: The moderating role of environmental awareness. J. Environ. Plann. Manag. 2025, 68, 935–956. [Google Scholar] [CrossRef]

- Wang, Y.Z.; Witlox, F. Global trends in electric vehicle adoption and the impact of environmental awareness, user attributes, and barriers. Energy Rep. 2025, 13, 1125–1137. [Google Scholar] [CrossRef]

- Yu, N.; Xiong, M.N.; Zhou, P.; Bai, Q.G. Contract design for a retailer-dominated supply chain under asymmetric green investment cost information. Oper. Res. 2025, 25, 15. [Google Scholar] [CrossRef]

- Liao, C.H.; Lu, Q.H.; Ghamat, S.; Cai, H.H. Blockchain adoption and coordination strategies for green supply chains considering consumer privacy concern. Eur. J. Oper. Res. 2025, 323, 525–539. [Google Scholar] [CrossRef]

- Ghosh, D.; Shah, J. Supply chain analysis under green sensitive consumer demand and cost sharing contract. Int. J. Prod. Econ. 2015, 164, 319–329. [Google Scholar] [CrossRef]

- Shen, J.Y.; Yan, H.Y.; Sheng, L.X.; Zhang, B.; Shi, Y.J.; Shen, S.S. Pricing decision in an uncertain green product supply chain under cost sharing contract. Expert Syst. Appl. 2024, 250, 123899. [Google Scholar] [CrossRef]

- Wang, X.F.; Xiong, M.F.; Yang, F.; Shi, W.Q. Decision-making and coordination of a three-tier fresh agricultural product supply chain considering dynamic freshness-keeping effort. Int. Trans. Oper. Res. 2025; early access. [Google Scholar] [CrossRef]

- Wang, Y.Y.; Fang, L.; Jiang, M.C. Optimal contract design for carbon emission reduction in a green supply chain: Monetary incentive vs. symbolic incentive. Manag. Decis. Econ. 2024, 45, 3152–3162. [Google Scholar] [CrossRef]

- Daraghmi, E.Y.; Jayousi, S.; Daraghmi, Y.A.; Daraghma, R.S.M.; Fouchal, H. Smart contracts for managing the agricultural supply chain: A practical case study. IEEE Access 2024, 12, 125462–125479. [Google Scholar] [CrossRef]

- Wang, Q.Y.; Ni, M.H.; Wen, W.; Qi, R.J.; Zhang, Q.W. Study on sustainable operation mechanism of green agricultural supply chain based on uncertainty of output and demand. Sustainability 2024, 16, 5460. [Google Scholar] [CrossRef]

- Xu, C.Y.; Wang, Y.Q.; Yao, D.L.; Qiu, S.Y.; Li, H. Research on the coordination of a marine green fuel supply chain considering a cost-sharing contract and a revenue-sharing contract. Front. Mar. Sci. 2025, 12, 1552136. [Google Scholar] [CrossRef]

- Das, R.; Barman, A.; Roy, B.; De, P.K. Pricing and greening strategies in a dual-channel supply chain with cost and profit-sharing contracts. Environ. Dev. Sustain. 2023, 25, 5053–5086. [Google Scholar] [CrossRef]

- Chen, X.Q.; Tabata, T. Circular economy in fashion: Consumer awareness and life-style, and environmental impact on second-hand clothes. J. Mater. Cycles Waste Manag. 2024, 26, 3876–3892. [Google Scholar] [CrossRef]

- Li, Z.T.; Zhang, C.H.; Kong, W.; Lyu, R.X. The optimal product-line design and incentive mechanism in a supply chain with customer environmental awareness. J. Ind. Manag. Optim. 2023, 19, 730–759. [Google Scholar] [CrossRef]

- Liu, Z.G.; Anderson, T.D.; Cruz, J.M. Consumer environmental awareness and competition in two-stage supply chains. Eur. J. Oper. Res. 2012, 218, 602–613. [Google Scholar] [CrossRef]

- Han, X.Y.; Zhou, Y.Y. Responding to consumer environmental awareness: A variational inequality approach to green manufacturing optimization. Comput. Ind. Eng. 2024, 191, 110174. [Google Scholar] [CrossRef]

- Yu, Y.G.; Han, X.Y.; Hu, G.P. Optimal production for manufactures considering consumer environmental awareness and green subsidies. Int. J. Prod. Econ. 2016, 182, 397–408. [Google Scholar] [CrossRef]

- Zhou, H.; Duan, Y.R. Online channel structures for green products with reference greenness effect and consumer environmental awareness (CEA). Comput. Ind. Eng. 2022, 170, 108350. [Google Scholar] [CrossRef]

- Ge, G.H.; Wang, D.P.; Epede, M.B. Pricing policies of green dual-channel supply chain with fairness concerns and altruistic preferences based on consumers’ environmental awareness and channel preference. Int. J. Environ. Res. Public Health 2022, 19, 13564. [Google Scholar] [CrossRef] [PubMed]

- Tao, F.; Zhou, Y.; Bian, J.S.; Lai, K.K. Agency selling or reselling? Channel selection of green products with consumer environmental awareness. Int. J. Logist. Res. Appl. 2024, 27, 326–345. [Google Scholar] [CrossRef]

- Cao, X.G.; Hu, M.T.; Wen, H.; Huang, K. Green supply chain decision-making and coordination considering consumer’s environmental mindset and fairness concerns in the context of sustainable development. Environ. Dev. Sustain. 2024, 26, 28485–28517. [Google Scholar] [CrossRef]

- Xu, L.; Wang, C.X.; Miao, Z.; Chen, J.H. Governmental subsidy policies and supply chain decisions with carbon emission limit and consumer’s environmental awareness. RAIRO-Oper. Res. 2019, 53, 1675–1689. [Google Scholar] [CrossRef]

- Tat, R.; Heydari, J.; Mlinar, T. Supply chain coordination: The application of consignment and zero wholesale price contracts under customized cap-and-trade and consumers’ environmental awareness. Int. J. Retail Distrib. Manag. 2023, 51, 1388–1412. [Google Scholar] [CrossRef]

- Zhang, L.H.; Zhou, H.; Liu, Y.Y.; Lu, R. Optimal environmental quality and price with consumer environmental awareness and retailer’s fairness concerns in supply chain. J. Clean. Prod. 2019, 213, 1063–1079. [Google Scholar] [CrossRef]

- Chen, L.; Shen, H.; Liu, Q.R.; Rao, C.J.; Li, J.; Goh, M. Joint optimization on green investment and contract design for sustainable supply chains with fairness concern. Ann. Oper. Res. 2025; early access. [Google Scholar] [CrossRef]

- Ouyang, J.J.; Fu, J. Optimal strategies of improving energy efficiency for an energy-intensive manufacturer considering consumer environmental awareness. Int. J. Prod. Res. 2020, 58, 1017–1033. [Google Scholar] [CrossRef]

- Sun, H.X.; Li, H. Pricing strategies for end-of-life vehicle regarding reward-penalty mechanism and customers’ environmental awareness. RAIRO-Oper. Res. 2024, 58, 397–421. [Google Scholar] [CrossRef]

- Cheng, S.S.; Zhang, F. Regulatory pressure and consumer environmental awareness in a green supply chain with retailer responsibility: A dynamic analysis. Manag. Decis. Econ. 2022, 43, 1133–1151. [Google Scholar] [CrossRef]

- Dai, Y.; Wu, H.L.; Pan, H.L.; Luo, L.J. The manufacturers’ strategy selection of carbon emission reduction and pricing under carbon trading policy and consumer environmental awareness. Front. Environ. Sci. 2023, 11, 1120165. [Google Scholar] [CrossRef]

- Li, J.; Wang, H.Y.; Shi, V.; Sun, Q. Manufacturer’s choice of online selling format in a dual-channel supply chain with green products. Eur. J. Oper. Res. 2024, 318, 131–142. [Google Scholar] [CrossRef]

- Barman, A.; Das, R.; De, K.P.; Sana, S.S. Pricing policies for a competitive dual-channel supply chain with green investment and sales effort under revenue-sharing contract. RAIRO-Oper. Res. 2024, 58, 3985–4012. [Google Scholar] [CrossRef]

- Che, C.; Li, Q.; Yin, Q.; Li, S.H.; Zheng, H.X.; Geng, X. Research on technological innovation and marketing publicity decision of green intelligent home appliance supply chain considering consumer subsidy and cost-sharing contract. Front. Energy Res. 2023, 11, 1259566. [Google Scholar] [CrossRef]

- Ghosh, S.K.; Goswami, P. Green initiative in a two-echelon supply chain with coordination and contract. RAIRO-Oper. Res. 2024, 58, 1147–1161. [Google Scholar] [CrossRef]

- Jiang, W.; Yuan, M. Coordination of prefabricated construction supply chain under cap-and-trade policy considering consumer environmental awareness. Sustainability 2022, 14, 5724. [Google Scholar] [CrossRef]

- Zhang, Y.F.; Qin, Y. Carbon emission reductions, pricing and social welfare of three-echelon supply chain considering consumer environmental awareness under carbon tax policy. Front. Environ. Sci. 2022, 10, 969613. [Google Scholar] [CrossRef]

- Li, B.; Wen, S.N.; Li, X.F.; Cheng, Y.P. Contract adoption of motivating green technological innovation in a supply chain. Int. Trans. Oper. Res. 2025; early access. [Google Scholar] [CrossRef]

- Zhang, G.M.; Jin, H.; Xu, S.S. A study on green innovation behavior of eldercare products supply chain based on the perspective of cost-sharing-revenue-sharing contract. Environ. Eng. Manag. J. 2024, 23, 2607–2615. [Google Scholar] [CrossRef]

- Heydari, J.; Govindan, K.; Basiri, Z. Balancing price and green quality in presence of consumer environmental awareness: A green supply chain coordination approach. Int. J. Prod. Res. 2021, 59, 1957–1975. [Google Scholar] [CrossRef]

- Samanta, B.; Giri, B.C.; Chaudhuri, K. A supply chain model with two competitive buyers under a hybrid greening cost and revenue-sharing contract. J. Manag. Anal. 2023, 10, 270–307. [Google Scholar] [CrossRef]

- Li, M.; He, L.N.; Yang, G.C.; Lian, Z. Profit-sharing contracts for fresh agricultural products supply chain considering spatio-temporal costs. Sustainability 2022, 14, 2315. [Google Scholar] [CrossRef]

- Li, M.; Lian, Z.; Yang, G.C.; Li, L.N. Profit-sharing contract of the fresh agricultural products supply chain under community group purchase mode considering freshness preservation efforts. Sustainability 2023, 15, 7572. [Google Scholar] [CrossRef]

- Xiao, Q.; Zhang, Q.Y.; Gao, Z.Y. A quantum gaming study on the pricing of fresh mixed dual-channel supply chains considering the level of preservation effort. J. Ind. Manag. Optim. 2025, 21, 79–102. [Google Scholar] [CrossRef]

- Tan, M.Y.; Tu, M.L.; Wang, B.; Zou, T.Y.; Cheng, H. A two-echelon agricultural product supply chain with freshness and greenness concerns: A cost-sharing contract perspective. Complexity 2020, 2020, 8560102. [Google Scholar] [CrossRef]

- Yan, B.; Liu, G.D.; Wu, X.H.; Wu, J.W. Decision-making on the supply chain of fresh agricultural products with two-period price and option contract. Asia-Pac. J. Oper. Res. 2021, 38, 2050038. [Google Scholar] [CrossRef]

- Xi, J.; Lai, L.L.; Li, Y.; Yang, D.T. The coordination mechanism of fresh agricultural products supply chain: A game-theoretic approach considering retailer’s fairness concern and price competition. Econ. Comput. Econ. Cybern. Stud. Res. 2025, 59, 120–137. [Google Scholar]

- Wang, L.; Xu, L.Q.; Zheng, Z.Y.; Liu, S.Y.; Li, X.T.; Cao, L.; Li, J.B.; Sun, C.H. Smart contract-based agricultural food supply chain traceability. IEEE Access 2021, 9, 9296–9307. [Google Scholar] [CrossRef]

- Zhao, Z.; Cheng, Y. Two-stage decision model of fresh agricultural products supply chain based on option contract. IEEE Access 2022, 10, 119777–119795. [Google Scholar] [CrossRef]

- Wang, X.J.; He, T.R. The community group buying models and strategic management for fresh food under supply uncertainty. Comput. Ind. Eng. 2025, 204, 111083. [Google Scholar] [CrossRef]

- Mohamadi, N.; Transchel, S.; Fransoo, J.C. Coordinate or collaborate? Reducing food waste in perishable-product supply chains. Eur. J. Oper. Res. 2025, 323, 795–809. [Google Scholar] [CrossRef]

- Li, Y.; Shan, B. Exploring the role of health consciousness and environmental awareness in purchase intentions for green-packaged organic foods: An extended TPB model. Front. Nutr. 2025, 12, 1528016. [Google Scholar] [CrossRef] [PubMed]

- Khan, F.; Abbass, K.; Qun, W.; Grebinevych, O. Moderating role of digital media on environmental awareness and environmental beliefs to shape farmers’ behavioral intentions towards sustainable agricultural land conservation. J. Environ. Manag. 2025, 373, 123745. [Google Scholar] [CrossRef]

- Shi, L.G.; Pang, T.; Peng, H.J.; Feng, X. Green technology outsourcing for agricultural supply chains with government subsidies. J. Clean. Prod. 2024, 436, 140674. [Google Scholar] [CrossRef]

- Xia, L.L.; Li, K.; Xiong, Y. The influence of distributional fairness concern on quality co-creation mobile application supply chain: Exogenous and endogenous revenue-retaining mechanisms. Transp. Res. Part E-Logist. Transp. Rev. 2025, 195, 103966. [Google Scholar] [CrossRef]

- Li, H.M.; Zhang, Z.Y.; Wang, W.; Liao, F.N. Optimal relation-specific investment, financing, and the supply chain capital structure under uncertainty. Int. Rev. Financ. Anal. 2025, 97, 103854. [Google Scholar] [CrossRef]

- Li, Z.P.; Wang, J.J.; Perera, S.; Shi, J. Coordination of a supply chain with Nash bargaining fairness concerns. Transp. Res. Part E-Logist. Transp. Rev. 2022, 159, 102627. [Google Scholar] [CrossRef]

| Literature | CEA | Nash Bargaining | Greenness Improving | Agricultural Product |

|---|---|---|---|---|

| [7,32] | √ | |||

| [8,38] | √ | √ | ||

| [11,30] | √ | √ | √ | |

| [15,54] | √ | √ | √ | |

| This paper | √ | √ | √ | √ |

| Classifications | Notations | Meanings |

|---|---|---|

| Symbols | Manufacturer of the agricultural supply chain, the upstream agricultural company, he. | |

| Retailer of the agricultural supply chain, the downstream sales firm, she. | ||

| Entire agricultural supply chain system. | ||

| Parameters | Demand for agricultural products. | |

| Utmost potential demand. | ||

| Price sensitivity coefficient. | ||

| Consumer environmental awareness. | ||

| Unit production cost. | ||

| Marginal green cost. | ||

| Profit of the manufacturer. | ||

| Profit of the retailer. | ||

| Profit the supply chain system. | ||

| Social welfare defined in Nash bargaining theory. | ||

| Costs of green investment on eco-friendly technologies. | ||

| Variables | Greenness of agricultural products, established by the manufacturer’s green investment. | |

| Wholesale price established by the manufacturer. | ||

| Retail price established by the retailer. | ||

| Ratio of green costs shared by the retailer reached through Nash bargaining between the manufacturer and the retailer. | ||

| Superscripts | * | Optimal results. |

| Scenario without Nash bargaining contract. | ||

| Local scenario with ratio-given contract. | ||

| Global scenario with Nash bargaining contract. |

| Parameters | Meanings | Standardized Values |

|---|---|---|

| Utmost potential demand. | 5000 | |

| Price sensitivity coefficient. | 3 | |

| Unit production cost. | 1 | |

| Marginal green cost. | 20 | |

| Consumer environmental awareness. | [0, 5] |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wei, G.; Zhang, X.; Bary, B. Enhancing Greenness and Performance of Agricultural Supply Chains with Nash Bargaining Contract Under Consumer Environmental Awareness. Systems 2025, 13, 337. https://doi.org/10.3390/systems13050337

Wei G, Zhang X, Bary B. Enhancing Greenness and Performance of Agricultural Supply Chains with Nash Bargaining Contract Under Consumer Environmental Awareness. Systems. 2025; 13(5):337. https://doi.org/10.3390/systems13050337

Chicago/Turabian StyleWei, Guangxing, Xinyue Zhang, and Binta Bary. 2025. "Enhancing Greenness and Performance of Agricultural Supply Chains with Nash Bargaining Contract Under Consumer Environmental Awareness" Systems 13, no. 5: 337. https://doi.org/10.3390/systems13050337

APA StyleWei, G., Zhang, X., & Bary, B. (2025). Enhancing Greenness and Performance of Agricultural Supply Chains with Nash Bargaining Contract Under Consumer Environmental Awareness. Systems, 13(5), 337. https://doi.org/10.3390/systems13050337