Abstract

As environmental, social, and governance (ESG) concerns increasingly shape corporate behavior, understanding their financial implications remains critical. This study investigates the impact of ESG performance on shareholder value, focusing on the mediating role of dividend policy. A multi-period difference-in-differences (DID) approach is applied to panel data from Chinese A-share listed firms between 2011 and 2022 to address endogeneity and establish causal inference. The empirical findings indicate that strong ESG performance significantly enhances shareholder value and that dividend policy is a credible transmission mechanism by signaling financial stability and governance quality. Heterogeneity analysis reveals that the magnitude of the ESG effect is further shaped by firm size, profitability, and ownership concentration, with larger, more profitable, and less concentrated firms benefiting more. Industry-level analysis reveals stronger ESG effects in capital- and technology-intensive sectors, with comparatively minor effects in labor-intensive industries. These results extend the literature by clarifying how ESG translates into financial value and by identifying contextual conditions that amplify or attenuate its impact. The findings also offer practical insights for aligning ESG strategies with financial policies and tailoring sustainability regulation to organizational and industry-specific dynamics.

1. Introduction

Incorporating environmental, social, and governance (ESG) factors into corporate strategies is increasingly essential for long-term financial performance and sustainability. As stakeholders demand greater transparency and ethical conduct, ESG principles now influence corporate decision-making across various industries [1]. This trend reflects a growing belief that sustainable business models can strengthen competitive advantage and mitigate financial risk [2]. While academic research has expanded in parallel, many studies focus on ESG’s influence on general firm performance indicators, such as profitability or market capitalization [3,4]. However, the direct link between ESG performance and shareholder value remains underexplored. Shareholder value, typically measured by dividends and stock price appreciation, offers a more investor-centric and precise measure of financial returns [5]. Understanding how ESG performance affects shareholder value is particularly relevant in modern finance, where reconciling sustainability objectives with shareholder interests is an ongoing challenge [6].

Building on this gap, a vital follow-up question emerges: through which internal pathways might ESG performance affect shareholder value? While shareholder value is central to investors, the mechanisms through which ESG initiatives translate into such outcomes are still poorly understood. One potential transmission channel is dividend policy, a key element of financial strategy governing the distribution of profits. Dividends are often interpreted as signals of financial strength, governance quality, and long-term orientation [7]. ESG-oriented firms may follow divergent payout strategies—some increase dividends to signal resilience and attract long-term capital [8]. In contrast, others retain earnings to fund ESG-related investments with delayed financial payoffs [9]. These contrasting patterns raise whether dividend policy mediates the relationship between ESG performance and shareholder value.

In addition to underexplored mechanisms, existing studies rely on static models, overlooking how ESG’s financial impact may evolve over time. ESG investments often take time to be absorbed by markets or embedded in operational performance. These dynamics are shaped by internal firm capacities and broader institutional environments [10,11]. Static cross-sectional models may thus miss key aspects of how ESG affects long-term firm value. Moreover, limited research has addressed how this relationship varies across firms. Organizational factors—such as size, profitability, ownership concentration, and industry-specific characteristics—may influence the ESG–value nexus, but such heterogeneity has not been systematically examined [12].

To address these gaps, this study draws on panel data from Chinese A-share listed firms spanning 2011 to 2022. It applies a multi-period difference-in-differences (DID) approach to assess the causal effect of ESG performance on shareholder value. This framework allows for identifying dynamic effects while controlling for unobserved firm and time heterogeneity. To ensure robustness, the analysis incorporates Propensity Score Matching combined with DID (PSM-DID) and Instrumental Variables (IV) methods [13,14,15]. Dividend policy is integrated into the empirical framework to test for mediation, and subgroup regressions are conducted to examine firm-level and industry-level heterogeneity.

This study contributes to the literature in three key ways. First, it identifies dividend policy as a mediating mechanism linking ESG performance to shareholder value—an outcome has received limited empirical attention in ESG-finance research. Second, it employs a dynamic DID approach that advances beyond static models by capturing temporal variation. Third, it provides evidence of heterogeneous ESG effects based on firm characteristics and industry types, offering a more contextualized understanding of ESG’s financial implications. The remainder of this paper is structured as follows: Section 2 reviews the literature and develops the hypotheses. Section 3 presents the methodology, data, and model specifications. Section 4 provides empirical results, followed by robustness checks and mechanism tests. Section 5 conducts heterogeneity analysis, and Section 6 concludes with implications and future research directions.

2. Literature Review

2.1. ESG and Shareholder Value

Shareholder value refers to the wealth generated for shareholders through dividends and capital gains, typically measured by indicators such as Economic Value Added (EVA) and Tobin’s Q [16,17]. Maximizing shareholder value is central to corporate finance as it reflects the goal of increasing wealth for equity holders. ESG performance indicates how a company addresses its environmental impact, social obligations, and governance standards [18]. These factors indicate a company’s capability to navigate long-term risks and take advantage of new opportunities, thereby boosting investor trust and minimizing perceived risks. Strong ESG performance indicates reduced operational risks, effective management, and sound governance, which can lead to increased firm valuations [3].

From the signaling theory perspective, first introduced by Spence (1973), firms facing information asymmetry can convey their underlying quality to external stakeholders through observable and credible actions [19]. In corporate finance, such signals often take the form of dividend payouts, capital structure choices, or sustainability commitments [19]. Extending this logic, ESG engagement functions as a non-financial yet highly visible signal of corporate resilience, operational transparency, and long-term strategic vision. Firms with superior ESG performance are perceived as better equipped to navigate regulatory transitions, reputational risks, and environmental shocks [6,8]. This perceived stability often translates into lower financing costs and higher firm valuations, especially in markets sensitive to sustainability risks [20]. However, agency theory introduces a counterpoint, suggesting that ESG investments may divert resources from short-term profit maximization, particularly when their financial returns are uncertain or long-term [21]. Such misalignments may reduce distributions to shareholders in the near term.

Despite these theoretical tensions, empirical studies largely support a positive relationship between ESG performance and shareholder value. For instance, Yadav et al. (2024) show that ESG-compliant firms exhibit stronger profitability and lower stock volatility [22]. Kräussl et al. (2024) demonstrate that ESG performance enhances firm valuation by building investor confidence and reducing capital costs [23]. ESG-led initiatives such as resource efficiency, inclusive employment, and robust governance further enhance cost savings, productivity, and reputational capital [24,25,26]. Taken together, ESG performance reflects a firm’s ability to mitigate risk and sustain long-term performance, which investors increasingly value. Yet, existing research has not fully accounted for how such benefits translate directly into shareholder value as an outcome variable. This study aims to fill that gap by empirically testing the link between ESG and shareholders’ value. Thus, this study put forward the subsequent hypothesis.

H1:

Higher ESG performance is associated with higher shareholder value.

2.2. ESG and Dividend Policy

Dividend policy is critical to corporate financial strategy, determining how firms allocate profits between reinvestment and shareholder distribution. A consistent or increasing dividend payout signals financial stability and the firm’s ability to generate sustainable cash flow, making it attractive to investors. In the context of ESG performance, dividend policy is a key mechanism through which firms translate their ESG efforts into shareholder value.

From a signaling theory perspective, companies that exhibit robust ESG performance might utilize dividends to signal financial health and long-term sustainability. By maintaining or increasing dividends, firms reassure investors that their cash flows are stable and that risk management practices are effective, thereby enhancing investor confidence [8]. High ESG performance, particularly in governance and environmental practices, positions firms as low-risk investments, making stable or increasing dividends more likely. This alignment reinforces the firm’s reputation for financial resilience and responsible business practices. In contrast, stakeholder theory argues that ESG-oriented firms may prioritize long-term stakeholder value over immediate shareholder returns [27]. Resources may be redirected toward sustainability initiatives, such as environmental technology or employee welfare, rather than distributed as dividends, which could lead to lower payout ratios in the short term.

Empirical evidence on the link between ESG and dividend policies remains mixed. While some studies suggest that high ESG performers maintain generous dividend policies to signal credibility and reduce information asymmetry [28], others argue that these firms retain more earnings to fund long-term ESG initiatives, particularly when they face innovation or compliance costs [29,30]. These contradictory findings highlight the theoretical and empirical ambiguity in existing research, with limited studies treating dividend policy as a systematic channel through which ESG affects financial performance. Accordingly, this research formulates the following hypothesis:

H2:

Firms with better ESG performance tend to boost dividend payouts, indicating financial stability and long-term shareholder value.

2.3. Dividend Policy and Shareholder Value

Dividend policy is essential in influencing shareholder value as it dictates how companies distribute their earnings between reinvestment and payouts to shareholders. A consistent or increasing dividend payout signals financial stability, operational efficiency, and long-term growth potential, all enhancing shareholder value [7].

Based on signaling theory, companies that uphold or raise dividends convey their financial robustness and the dependability of future cash flows, thereby lowering the information gap between managers and investors. This openness boosts investor confidence, reduces the cost of equity, and increases market value, ultimately benefiting shareholder wealth [31]. Consistent dividend payouts are generally perceived as indicators of low financial risk, attracting long-term investors seeking stable returns and lower volatility. Agency theory, however, suggests that dividend decisions may reflect trade-offs. Managers may prefer to retain earnings to pursue private interests or expansionary strategies, especially when external monitoring is weak [21]. Jensen and Meckling (1979) argue that firms facing high agency costs may reduce dividends to maintain discretionary resource control [21]. In such cases, dividend policy results from governance dynamics and growth opportunities.

Despite these tensions, empirical studies largely validate the positive role of dividend policy in enhancing shareholder value. Firms with sustainable dividend practices attract investor loyalty, signal lower risk, and enjoy greater market credibility [32]. However, in high-growth or capital-intensive contexts, the preference for reinvestment may override dividend signaling motives. Given these trade-offs, this study hypothesizes:

H3:

Dividend policy positively impacts shareholder value as consistent or increasing dividend payouts signal financial stability and long-term growth potential.

2.4. The Role of Dividend Policy in the ESG-Shareholder Value Relationship

Dividend policy is key in linking ESG performance to shareholder value. Companies with strong ESG practices enhance long-term sustainability and convey this commitment through dividend policies. Specifically, dividend payouts may amplify the positive effects of ESG performance on shareholder value by signaling financial health, responsible governance, and stability, thereby attracting long-term investors.

From a signaling theory perspective, companies that exhibit robust ESG performance may use dividends to signal financial resilience and long-term sustainability. By maintaining or increasing dividend payouts, these firms reassure investors that they can generate stable cash flows while pursuing responsible environmental, social, and governance initiatives. As a result, dividend policy acts as an additional layer of credibility, reinforcing the positive signals sent by strong ESG performance and enhancing shareholder value through greater investor confidence [33]. Stakeholder theory presents an alternative view. It suggests that firms with strong ESG performance, particularly those focused on long-term sustainability, may prioritize reinvesting profits into ESG initiatives rather than paying dividends. In this context, firms may reduce dividends to retain earnings for green technologies, social programs, or other strategic initiatives that enhance long-term stakeholder value, including shareholder wealth. In this context, reducing dividends in favor of reinvestment may improve long-term shareholder value despite the short-term decrease in payout ratios.

Studies examining how dividend policy affects the relationship between ESG performance and shareholder value show varied outcomes. Yilmaz et al. (2024) indicate that consistent dividend policies amplify the positive effect of ESG on shareholder value by signaling the firm’s ability to deliver both financial returns and sustainability [34]. These results reinforce the perspective that dividend strategy enhances the beneficial impacts of ESG on shareholder worth [34]. In contrast, Khan et al. (2024) argue that firms with long-term ESG objectives may reduce dividends to fund ESG initiatives, particularly when reinvestment is prioritized over immediate shareholder returns [30]. To empirically examine this mediating mechanism, this research proposes the following hypothesis:

H4:

Dividend policy mediates the relationship between ESG performance and shareholder value.

3. Methodology

This section outlines the methodology used to evaluate how ESG performance affects shareholder value, focusing on the dividend policy. A quantitative approach with robust econometric techniques is employed to ensure reliable results.

3.1. Model Specification

Regulatory authorities in China lack formal ESG rating standards, leading to third-party agencies like SynTao Green Finance providing ratings. These ratings are respected by investors and corporate stakeholders, influencing corporate behavior significantly. This study assesses how ESG ratings affect shareholder value by utilizing the exogenous shock from the initial ESG rating disclosures by SynTao Green Finance, employing a multi-period difference-in-differences (DID) approach [1].

- (1)

- Baseline DID Model

To identify the average treatment effect of ESG disclosure on shareholder value, the following baseline DID model is specified:

The explained variable is the firm’s shareholder value in the year . is the explanatory variable, binary treatment indicator, equal to 1 if SynTao Green Finance released the ESG rating for firm in the year ; it is 0 otherwise. are control variables, including financial, governance, and firm-level characteristics. denotes firm fixed effects. denotes year fixed effects. is error term.

- (2)

- Dynamic DID Model

To capture the temporal dynamics of ESG effects and to test the parallel trends assumption, this research extends the model to a dynamic specification using event-time indicators relative to the treatment year [15]:

where is an indicator for treated firms (firms rated by SynTao ESG from 2015 onward). is event-time dummies, where is the first-year firm was treated. are coefficients for pre-treatment leads (used to test the parallel trends assumption). are coefficients for post-treatment lags (measuring the cumulative treatment effect over time). The primary coefficients of interest are , which reflect how shareholder value responds to ESG disclosure over time. Insignificant values of support the DID identification assumption of parallel trends, while positive and significant indicate treatment effects.

- (3)

- Mediation Model: Dividend Policy

To examine whether dividend policy mediates the effect of ESG performance on shareholder value, we estimate the following equations as suggested by Baron and Kenny (1986) [35]. This approach allows us to evaluate the indirect effect of ESG on shareholder value through changes in dividend behavior, as hypothesized in Section 2.2:

where denotes dividend policy, proxied by the dividend ratio (DR), and is shareholder value (measured by EVA). The remaining variables follow Model (1). The mediation effect is supported if and are statistically significant.

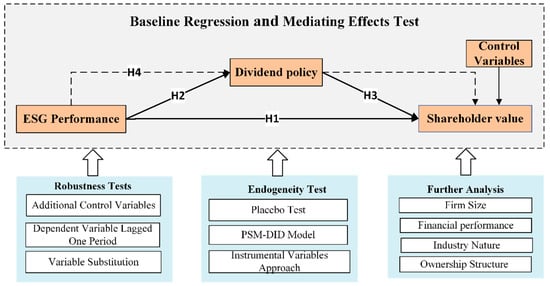

Figure 1 illustrates the research framework, highlighting the causal pathways through which ESG performance affects shareholder value via dividend policy. This visual model aids in understanding the dynamic effects and mediation processes explored in the study.

Figure 1.

Research methodology framework.

3.2. Variable Definitions

Dependent Variable: Economic Value Added (EVA). EVA is characterized as the net operating profit after tax minus the total cost of capital, with the latter referring to the weighted average cost of capital [36]. EVA is widely recognized for capturing a firm’s actual economic profit and aligning management incentives with shareholder interests, making it an effective indicator of value creation. This measure is ideal for this study as it directly reflects the financial benefits of sustainable practices central to ESG performance.

Independent Variable: ESG performance. The Huazheng ESG Rating database evaluates companies’ ESG in China, using a scale from AAA (highest) to C (lowest) across nine tiers. These ratings are assigned numerical values from 9 to 1 for a quantitative assessment of ESG performance.

The study uses SynTao Green Finance as the source of the shock event, leveraging its initial ESG rating disclosure in 2015. SynTao Green Finance is a highly credible institution, the first in China to release ESG ratings and a signatory of the United Nations Principles for Responsible Investment (UNPRI). Its publications, such as the “China Responsible Investment Annual Report” and the “A-Share Listed Companies ESG Rating Analysis Report”, are well regarded in capital markets [37]. By 2022, its ESG ratings covered over 4843 listed companies, providing broad and representative data and using 2015 as the event year to analyze the impacts of ESG disclosures on financial outcomes. Employing a multi-period DID method, the study controls unobserved heterogeneity and examines dynamic effects over time, strengthening the findings.

Mediating Variable: Dividend policy, implemented as the dividend payout ratio (DR). The DR is determined by dividing dividends per share before tax by the ratio of net profit for the current period to paid-in capital for that same period. This measure reflects the firm’s dividend distribution practices and provides insight into how ESG performance influences dividend decisions and shareholder value.

Control Variables: To control confounding factors, several control variables are included: leverage (Lev), board size (Board), the proportion of independent directors (Indep), the operating revenue growth rate (Growth), firm age (FirmAge), and asset market value (TobinQ). Moreover, firm and year fixed effects are included to control for time-invariant firm-specific characteristics and standard macroeconomic shocks, respectively. These control variables are vital in distinguishing the effects of ESG performance and dividend policy on shareholder value, helping isolate the independent effect of ESG and ensures more robust estimation of the mediation and treatment effects [38,39].

Table 1 summarizes the definitions, symbols, and measurements of all variables used in the empirical analysis.

Table 1.

Variable definitions.

3.3. Sample Selection and Data Sources

The research examines A-share listed firms from 2010 to 2022, noting that SynTao Green Finance first disclosed ESG ratings in 2015. To evaluate the influence of ESG ratings on shareholder value in corporations, the study utilizes a multi-period difference-in-differences (DID) approach. The sample selection process excludes financial companies and firms designated as ST, ST*, or PT in the same year to mitigate industry-specific effects and anomalies. Firms with significant data omissions are also excluded to ensure data integrity and reliability. Following the application of these exclusion criteria, the final dataset is composed of 23,467 firm-year observations. To reduce the effects of outliers, tail processing should be conducted on continuous variables at the 1% and 99% quantiles. The ESG rating data are retrieved from the Huazheng ESG Rating database, while additional financial and firm-specific information is sourced from the China Stock Market & Accounting Research (CSMAR) database.

3.4. Descriptive Statistics

Table 2 displays the descriptive statistics for the 23,467 observations. The mean ESG score is 3.831 (SD = 1.272), with scores varying from 0 to 6.250, signifying considerable variability in ESG performance. The mean Economic Value Added (EVA) is −0.00100 (SD = 0.440), with values spanning from −2.461 to 3.283, reflecting diverse economic outcomes. Board size has a mean of 2.079 (SD = 0.188), and leverage (Lev) averages 0.366 (SD = 0.195), suggesting differences in financial structures. The proportion of independent directors (Indep) averages 0.378 (SD = 0.0520). The operating revenue growth rate (Growth) shows substantial variability, with a mean of 0.187 (SD = 0.402). Firm age (FirmAge) averages 2.843 years (SD = 0.363), and Tobin’s Q has a mean of 2.138 (SD = 1.397). The statistics present a comprehensive dataset overview that is important for analyzing the relationship between ESG practices and shareholder value.

Table 2.

Descriptive statistics.

4. Empirical Results

4.1. Baseline Regression Results

Table 3 shows the results analyzing the impact of ESG performance on shareholder value, measured by Economic Value Added (EVA), using a double fixed effects model with firm and year controls. Columns (1) and (2) indicate that ESG performance positively and significantly impacts EVA, with coefficients of 0.045 *** without controls and 0.023 *** with controls. Incorporating control variables enhances the model’s ability to explain the data, increasing R-squared values from 0.017 to 0.455. Additionally, the variables growth (0.217 ***) and firm age (0.192 ***) positively influence EVA, suggesting the importance of these firm-specific factors in enhancing shareholder value. These findings support H1, indicating that better ESG performance correlates positively with increased shareholder value. The robustness of these findings is further supported by the use of double fixed effects models and clustered standard errors. The economic significance of these results is also noteworthy. A one-point increase in the ESG score results in an average rise in EVA of about 0.023, highlighting the significant influence of ESG performance on a company’s value. This association is statistically significant and economically relevant, reinforcing that ESG performance contributes to generating long-term wealth for shareholders, thereby confirming H1.

Table 3.

Regression results.

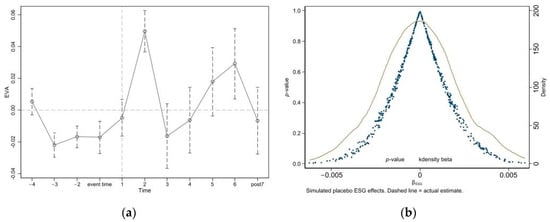

4.2. Parallel Trends Test

This study utilizes a multi-period difference-in-differences (DID) method to evaluate the evolving effects of ESG performance on shareholder value after the 2015 ESG rating announcement. The parallel trends assumption is vital for the reliability of the DID method as it guarantees that without the ESG rating disclosures, both the treatment and control groups exhibited comparable trends in EVA. Model (2) further investigates the effect of ESG ratings on EVA (Figure 2). Before the ESG rating event occurred, the regression coefficients from the pre-treatment period (βs, s < 0) were not statistically significant, which validates the parallel trends assumption [40]. Figure 2a reveals a substantial increase in EVA immediately following the ESG rating event (post-event βs = 0.05), followed by a sustained positive trend in subsequent periods. This indicates that firms with strong ESG performance experience a long-term enhancement in shareholder value, consistent with the theoretical expectations outlined in Hypothesis 1. The delayed and sustained impact can be attributed to gradual information dissemination, internal corporate adjustments, and cumulative positive market responses.

Figure 2.

ESG Effects on EVA and robustness. The left panel (a): Parallel trend test. The right panel (b): Placebo test.

4.3. Robustness Test

Robustness checks are critical to validate the reliability of the empirical findings. Table 3 presents several robustness tests to ensure that model specifications or measurement choices do not drive the results. First, alternative measurements of the dependent variable are employed. Column (3) uses net profit after tax (eva) as a proxy for Economic Value Added (EVA), confirming the positive effect of ESG with a coefficient of 0.038 ***. Column (4) utilizes Bloomberg ESG scores for validation, with the results supporting ESG’s positive impact on EVA (0.027 ***), reaffirming the findings using alternative ESG metrics. Second, including lagged dependent variables addresses potential short-term fluctuations and autocorrelations. Column (5) incorporates lagged EVA, confirming the positive impact of ESG with a coefficient of 0.103 ***.

Third, additional control variables are introduced to address potential omitted variable bias and improve model specification. Column (6) includes: Book-to-Market ratio (BM) and Shareholding Ratio of the Top 5 shareholders (Mshare). Book-to-Market ratio reflects the firm’s valuation relative to its book value and serves as a proxy for firm-level growth opportunities and market mispricing. Firms with high BM are often undervalued or face limited investment opportunities, which may influence the sensitivity of shareholder value to ESG performance [41]. Shareholding Ratio of the Top 5 shareholders captures ownership concentration and is a standard proxy for internal governance intensity. High ownership concentration may amplify or mitigate ESG’s effect on firm value by altering managerial incentives and dividend policy preferences [42].

The results remain consistent, showing that ESG positively impacts EVA (0.025 ***), further reinforcing the robustness of the findings. These results confirm the robustness of H1, providing consistent evidence that strong ESG practices are positively associated with enhanced shareholder value. These findings indirectly support H2, suggesting that the stability of ESG’s relationship with firm performance may encourage firms to increase dividend payouts.

4.4. Endogeneity Test

- (1)

- Placebo Test

The placebo test confirms that ESG ratings’ effect on firm outcomes is not due to random or hidden factors, thus supporting causality [43]. This method generates “fake” ESG variables by randomly assigning ESG ratings and conducting regression analysis to assess any significant effects. If the placebo variables show no significant results, it supports the idea that observed effects are due to actual ESG ratings [44]. Figure 2b illustrates the distribution of placebo coefficients and their associated p-values for EVA. The average placebo coefficient hovers around zero; the distribution resembles a standard curve. Most p-values surpass the 0.10 significance threshold, suggesting that the placebo variables do not have a meaningful effect on EVA. This indicates that the impact of ESG ratings on EVA is not due to chance, supporting H1.

- (2)

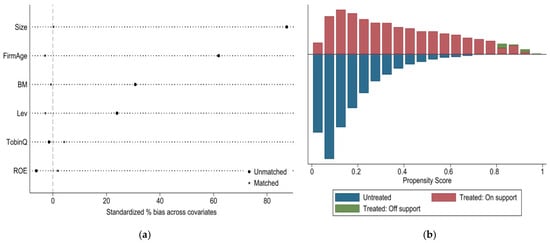

- Propensity Score Matching Difference-in-Differences (PSM-DID) Analysis

The PSM-DID analysis addresses potential biases and enhances causal inference between ESG performance and shareholder value. It combines Propensity Score Matching and difference-in-differences to provide more accurate estimates by controlling for observable and unobservable confounders [45]. Figure 3a shows a substantial reduction in bias across covariates after matching, indicating a well-balanced sample and improving comparability between the treated and control groups. This reduction is critical for ensuring the subsequent analysis is based on comparable samples. Figure 3b shows a significant overlap in propensity scores between treated and untreated groups, confirming successful matching—an essential assumption for PSM-DID validity. Table 4, Column (1) presents the findings from the PSM-DID regression analysis. The DID coefficient for EVA in Column (1) is positive and significant (0.158 ***), indicating that ESG performance enhances shareholder value. The ESG coefficient in Column (2) is also positive and significant (0.022 ***), confirming the reliability of these findings across different models. These results support H1 and further bolster H2 as ESG’s positive effect on shareholder value is confirmed through multiple methodologies.

Figure 3.

Propensity scores matching diagnostics. The left panel (a): Standardized percent bias. The right panel (b): Distribution of estimated propensity scores.

Table 4.

Endogeneity test.

- (3)

- Instrumental Variables (IV) Method

Table 4 displays findings derived from the Instrumental Variables (IV) approach, which addresses potential endogeneity issues between ESG performance and Economic Value Added (EVA). The IV approach yields dependable estimates by utilizing instruments associated with ESG but independent of the error term [46]. This research selects two variables related to institutional ESG investment activities to construct valid instruments: IV1 (Quantity of ESG Fund Holdings). It represents the number of domestic mutual funds explicitly incorporating ESG criteria that hold shares in a given firm in a specific year. It reflects investor recognition of the firm’s ESG standing and public exposure to ESG standards. IV2 (Market Value of ESG Fund Holdings) measures the total market value (in millions of RMB) of shares held by ESG-oriented funds in each firm, providing a scale-based measure of ESG fund influence. Both variables strongly correlate with ESG performance as ESG-rated firms are more likely to attract ESG-focused institutional investors. At the same time, these instruments are plausibly exogenous to firm-specific unobservable factors that directly affect EVA, thus satisfying relevance and exclusion assumptions.

In the first regression stage (Column (2)), IV1 (0.124 ***) is positive and statistically significant, confirming its relevance as an instrument. In the second-stage for EVA (Column (3)), the ESG coefficient is positive and significant (1.031 ***), suggesting that better ESG performance significantly increases shareholder value. The Kleibergen–Paap rk LM statistic (413.898) and the Cragg–Donald Wald F statistic (210.783) suggests robust instruments during diagnostic tests, and the Stock–Yogo weak instrument test (19.93) confirms instrument strength. The IV method results indicate that strong ESG performance positively affects the shareholder value (EVA), with significant first-stage coefficients and consistent second-stage results confirming the study’s reliability.

4.5. Mechanism Test of Dividend Policy

Based on the Baron and Kenny (1986) two-step mediation model specified in Section 3.1 [35], Table 5 presents findings on how dividend policy affects the relationship between ESG performance and shareholder value (EVA). This test is essential for understanding how ESG practices influence financial outcomes through internal corporate mechanisms.

Table 5.

Mechanism test of dividend policy.

In Column (1), ESG performance positively influences dividend policy (DR) with a significant coefficient of 0.0219 ***, indicating that companies with stronger ESG practices tend to distribute more profits to shareholders, supporting H2. This finding suggests that ESG engagement serves as a positive signal of operational stability and governance discipline, encouraging firms to adopt more generous dividend policies to enhance market credibility and attract long-term investors.

In Column (3), when dividend policy (DR) is included as a mediator, both the ESG coefficient (0.0229 ***) and the DR coefficient (0.0290 ***) remain positive and significant. This suggests that dividend policy significantly contributes to enhancing shareholder value, supporting H3. Economically, dividends act as a credible commitment to reduce agency costs, limiting managerial discretion over retained earnings and reinforcing investors’ trust, especially in emerging markets where information asymmetry may be high.

The positive and significant coefficients for both ESG and DR support the hypothesized mediating mechanism. The Sobel test (0.0034 ***) and bootstrapping confidence interval (0.0028993–0.0039704) confirm the robustness of this effect. Taken together, the results validate Hypothesis H4 and suggest that dividend policy is a key internal channel through which ESG practices are capitalized into firm value.

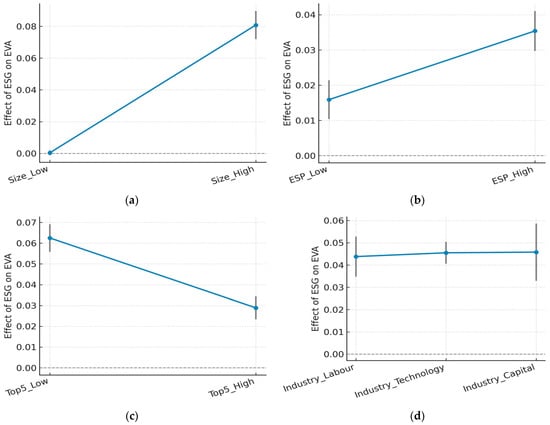

5. Heterogeneous Analysis

To further examine the boundary conditions under which ESG performance affects shareholder value, this research conducts a heterogeneity analysis along four theoretically grounded dimensions: organizational size, profitability, ownership concentration, and industry type. These dimensions are widely recognized in the corporate finance and sustainability literature as critical moderators of firm strategic behavior and value creation mechanisms.

Specifically, larger firms are more likely to possess the resources, organizational slack, and visibility necessary for effective ESG implementation and external signaling [47]. Profitability provides financial flexibility that facilitates long-term investments in ESG activities [48]. Ownership concentration influences agency costs and monitoring intensity, potentially substituting or complementing ESG governance mechanisms [49]. Industry characteristics, such as capital intensity, technological complexity, and labor dependency, determine the salience and financial materiality of ESG practices [50]. These dimensions allow us to uncover nuanced variations in how ESG strategies translate into firm value across different institutional and operational contexts.

All regressions include firm and year fixed effects and control for key firm-level characteristics—board independence, leverage, growth opportunities, firm age, and valuation metrics (Board, Lev, Indep, Growth, FirmAge, and TobinQ). The results are summarized in Figure 4.

Figure 4.

Heterogeneity analysis. Top-left panel (a): Firm Size, Top-right panel (b): Financial Performance, Bottom-left panel (c): Ownership Concentration, Bottom-right panel (d): Industry Type.

Panel (a) shows that ESG performance significantly improves EVA in large firms (β = 0.081, ***), whereas the effect is statistically insignificant in small firms. This supports the view that scale enables firms better to integrate ESG into core strategy and stakeholder communication. Panel (b) reveals that high-profitability firms exhibit a stronger ESG–EVA relationship (β = 0.035, ***) than their low-profitability counterparts (β = 0.016, ***), suggesting that financial capacity reinforces the value capture of ESG efforts.

Panel (c) compares firms with high versus low ownership concentration. The ESG coefficient is more significant in the low-concentration group (β = 0.063 vs. 0.029), consistent with the hypothesis that ESG acts as a complementary governance mechanism in settings with dispersed ownership. Panel (d) reports industry-specific effects. ESG performance is positively associated with EVA across labor-intensive (β = 0.044, ***), capital-intensive (β = 0.046, ***), and technology-intensive (β = 0.046, ***) sectors. The slightly higher coefficients in capital- and tech-intensive firms may reflect the operational risk mitigation and innovation signaling roles of ESG in these contexts. In contrast, the benefits in labor-intensive industries are likely tied to social compliance and workforce management.

Overall, the results reveal that the impact of ESG on shareholder value is not uniform but depends on firm-specific and industry-level characteristics. ESG initiatives generate more substantial financial benefits in firms with greater scale and profitability and in capital- or technology-intensive sectors, indicating that ESG functions as a strategic enhancer rather than a generic signal. Conversely, in firms with limited internal governance or resources, ESG may serve a compensatory role. These findings suggest that ESG value realization is conditional on a firm’s ability to align sustainability efforts with operational complexity and stakeholder expectations.

6. Discussion and Conclusions

6.1. Findings

The empirical results show that ESG performance significantly increases shareholder value, as measured by Economic Value Added (EVA). Dividend policy is a key mediating mechanism through which ESG engagement indirectly contributes to financial returns by signaling cash flow stability and governance credibility. The relationship is not uniform across firms: the positive effect of ESG is stronger in firms with greater asset scale, higher profitability, and lower ownership concentration. Sectoral heterogeneity also emerges, with capital- and technology-intensive industries exhibiting more pronounced ESG effects than labor-intensive ones. To address endogeneity, we employ a multi-period difference-in-differences (DID) framework based on exogenous ESG rating shocks, supplemented by PSM-DID and Instrumental Variables (IV) estimation. All robustness checks confirm the direction and significance of the main findings. Placebo tests validate the parallel trend assumption and coefficient stability across alternative model specifications reinforces the reliability of the estimated effects. These findings provide a comprehensive understanding of ESG’s financial relevance under varying organizational and industry conditions.

6.2. Discussions and Contributions

This study contributes to the evolving discourse on ESG and corporate financial performance by unpacking the mechanisms and contextual boundaries through which ESG engagement influences shareholder value. While existing research has broadly confirmed a positive link between ESG practices and firm-level outcomes, such as profitability, market valuation, and risk management [48,49,50], questions remain about how ESG performance is internalized by capital markets and under what conditions it delivers tangible value. It bridges this gap by introducing dividend policy as a mediating pathway between ESG and shareholder value. This mechanism is theoretically grounded in signaling theory and financially justified through the lens of payout stability and agency mitigation. Empirical results confirm that firms with higher ESG performance are more likely to maintain or raise dividend payouts, strengthening investor confidence and firm valuation. These findings align with prior studies suggesting that ESG engagement improves cash flow discipline [51], enhances reporting credibility [33], and complements financial transparency [52].

Methodologically, our multi-period difference-in-differences (DID) approach provides stronger causal identification than conventional cross-sectional designs. By exploiting the staggered introduction of ESG ratings in China as an exogenous shock, this research captures the temporal dynamics of ESG effects, addressing long-standing concerns over reverse causality and omitted variables.

It further reveals that the effect of ESG on shareholder value is not uniform. Larger firms, more profitable firms, and those with lower ownership concentration benefit more from ESG engagement, supporting the view that resource endowment and governance configurations condition ESG effectiveness [53]. In these firms, ESG serves as a symbolic act and an operational strategy that translates into concrete investor returns. Moreover, our industry-level analysis shows that ESG positively affects EVA across labor-, capital-, and technology-intensive sectors. Although the magnitude of effects is relatively close, firms in capital- and technology-intensive sectors slightly outperform, likely due to more substantial regulatory exposure, innovation signaling, and risk management incentives [54]. These findings extend ESG research by establishing dividend policy as a viable transmission mechanism and empirically demonstrating heterogeneity across firm-level and sectoral contexts. Together, they offer a more nuanced understanding of how ESG delivers economic value and under what conditions it is most effective.

This study provides actionable insights for improving ESG integration across regulatory, corporate, investor, and rating domains in China and other emerging markets. For regulators, ESG disclosure frameworks should prioritize financially material information to support efficient capital allocation while also incorporating broader social and environmental impacts that may not have immediate financial consequences. This balance is essential to maintain ESG’s long-term value orientation. Regulatory design should reflect firm-level heterogeneity: the impact of ESG is more pronounced in larger, more profitable, and less concentrated firms. Accordingly, stricter oversight and third-party verification may be warranted for state-owned enterprises, while smaller or resource-constrained firms could benefit from phased reporting, technical assistance, or incentive-based adoption. Sector-specific guidelines can further align ESG standards with industry-specific risks.

For corporate decision-makers, ESG should be integrated into both strategic and financial decision-making. Aligning sustainability initiatives with credible financial signals, such as dividend policy, can enhance investor confidence and reinforce ESG’s market relevance, especially when tailored to firm size, profitability, and governance characteristics. For institutional investors, dividend policy can complement ESG ratings to signal long-term financial and governance quality. Integrating both dimensions enables more informed capital allocation. Active investor engagement can also promote stronger links between sustainability performance and financial outcomes. For ESG rating agencies, emphasis should be placed on performance metrics that reflect both financial relevance and broader sustainability impact, enhancing the interpretability and decision-usefulness of ESG scores across diverse institutional contexts. Although this study is based in China, its insights—particularly regarding dividend signaling and firm-level heterogeneity—are applicable across emerging economies with similar governance contexts.

6.3. Limitations

While the DID design improves causal identification, it does not fully capture short-term investor reactions or external shocks. Additionally, other mechanisms—such as financing cost, innovation input, or human capital—may also mediate the ESG–value link, future research could examine these pathways. Furthermore, disaggregating ESG into E, S, and G dimensions or comparing results across institutional settings would further enrich the understanding of ESG’s financial relevance.

Author Contributions

Conceptualization, Y.Z.; Methodology, Y.Z.; Software, Y.Z.; Validation, Y.Z.; Formal analysis, Y.Z.; Investigation, Y.Z.; Resources, Y.Z.; Data curation, Y.Z.; Writing—original draft, Y.Z.; Writing—review & editing, W.B.; Supervision, W.B.; Project administration, W.B.; Funding acquisition, W.B. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Data sharing is not applicable to this article as no new data were created or analyzed in this study. The empirical analysis is based on proprietary datasets obtained under license, which cannot be shared due to confidentiality agreements and institutional data use policies.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Yu, T.; Mao, S. Does the establishment of China’s national innovation demonstration zone for sustainable development enhance urban sustainable competitiveness?—Policy effects assessment based on multi-period difference-in-differences models. J. Environ. Manag. 2024, 372, 123439. [Google Scholar] [CrossRef] [PubMed]

- Ni, K.; Zhang, R.; Tan, L.; Lai, X. How ESG enhances corporate competitiveness: Mechanisms and Evidence. Financ. Res. Lett. 2024, 69, 106249. [Google Scholar] [CrossRef]

- Rahat, B.; Nguyen, P. The impact of ESG profile on Firm’s valuation in emerging markets. Int. Rev. Financ. Anal. 2024, 95, 103361. [Google Scholar] [CrossRef]

- Tsang, A.; Frost, T.; Cao, H. Environmental, Social, and Governance (ESG) disclosure: A literature review. Br. Account. Rev. 2023, 55, 101149. [Google Scholar] [CrossRef]

- Chen, Y.; Li, T.; Zeng, Q.; Zhu, B. Effect of ESG performance on the cost of equity capital: Evidence from China. Int. Rev. Econ. Financ. 2023, 83, 348–364. [Google Scholar] [CrossRef]

- Alduais, F. Unravelling the intertwined nexus of firm performance, ESG practices, and capital cost in the Chinese business landscape. Cogent Econ. Financ. 2023, 11, 2254589. [Google Scholar] [CrossRef]

- Bhattacharya, S. Imperfect Information, Dividend Policy, and “The Bird in the Hand” Fallacy. Bell J. Econ. 1979, 10, 259–270. [Google Scholar] [CrossRef]

- Friske, W.; Hoelscher, S.A.; Nikolov, A.N. The impact of voluntary sustainability reporting on firm value: Insights from signaling theory. J. Acad. Mark. Sci. 2023, 51, 372–392. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic management: A stakeholder theory. J. Manag. Stud. 1984, 39, 1–21. [Google Scholar]

- Leoni, L. Integrating ESG and organisational resilience through system theory: The ESGOR matrix. Manag. Decis. 2024; ahead-of-print. [Google Scholar] [CrossRef]

- Song, J. Corporate ESG performance and human capital investment efficiency. Financ. Res. Lett. 2024, 62, 105239. [Google Scholar] [CrossRef]

- Barros, V.; Verga Matos, P.; Miranda Sarmento, J.; Rino Vieira, P. ESG performance and firms’ business and geographical diversification: An empirical approach. J. Bus. Res. 2024, 172, 114392. [Google Scholar] [CrossRef]

- Fredriksson, A.; Oliveira, G.M. Impact evaluation using Difference-in-Differences. RAUSP Manag. J. 2019, 54, 519–532. [Google Scholar] [CrossRef]

- Strumpf, E.C.; Harper, S.; Kaufman, J.S. Fixed effects and difference in differences. Methods Soc. Epidemiol. 2017, 1, 342. [Google Scholar]

- Roth, J.; Sant’Anna, P.H.C.; Bilinski, A.; Poe, J. What’s trending in difference-in-differences? A synthesis of the recent econometrics literature. J. Econom. 2023, 235, 2218–2244. [Google Scholar] [CrossRef]

- Hillman, A.J.; Keim, G.D. Shareholder value, stakeholder management, and social issues: What’s the bottom line? Strateg. Manag. J. 2001, 22, 125–139. [Google Scholar] [CrossRef]

- Hall, J.H. Corporate shareholder value creation as contributor to economic growth. Stud. Econ. Financ. 2024, 41, 148–176. [Google Scholar] [CrossRef]

- Martiny, A.; Taglialatela, J.; Testa, F.; Iraldo, F. Determinants of environmental social and governance (ESG) performance: A systematic literature review. J. Clean. Prod. 2024, 456, 142213. [Google Scholar] [CrossRef]

- Spence, M. Job Market Signaling. Q. J. Econ. 1973, 87, 355–374. [Google Scholar] [CrossRef]

- Aevoae, G.M.; Andrieș, A.M.; Ongena, S.; Sprincean, N. ESG and systemic risk. Appl. Econ. 2023, 55, 3085–3109. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the Firm: Managerial Behavior, Agency Costs, and Ownership Structure. In Economics Social Institutions: Insights from the Conferences on Analysis & Ideology; Brunner, K., Ed.; Springer: Dordrecht, The Netherlands, 1979; pp. 163–231. [Google Scholar]

- Yadav, M.; Dhingra, B.; Batra, S.; Saini, M.; Aggarwal, V. ESG scores and stock returns during COVID-19: An empirical analysis of an emerging market. Int. J. Soc. Econ. 2024; ahead-of-print. [Google Scholar] [CrossRef]

- Kräussl, R.; Oladiran, T.; Stefanova, D. A review on ESG investing: Investors’ expectations, beliefs and perceptions. J. Econ. Surv. 2024, 38, 476–502. [Google Scholar] [CrossRef]

- Niyommaneerat, W.; Suwanteep, K.; Chavalparit, O. Sustainability indicators to achieve a circular economy: A case study of renewable energy and plastic waste recycling corporate social responsibility (CSR) projects in Thailand. J. Clean. Prod. 2023, 391, 136203. [Google Scholar] [CrossRef]

- Tziner, A.; Persoff, M. The interplay between ethics, justice, corporate social responsibility, and performance management sustainability. Front. Psychol. 2024, 15, 1323910. [Google Scholar] [CrossRef]

- Girau, E.A.; Bujang, I.; Paulus Jidwin, A.; Said, J. Corporate governance challenges and opportunities in mitigating corporate fraud in Malaysia. J. Financ. Crime 2022, 29, 620–638. [Google Scholar] [CrossRef]

- Donaldson, T.; Preston, L.E. The Stakeholder Theory of the Corporation: Concepts, Evidence, and Implications. Acad. Manag. Rev. 1995, 20, 65–91. [Google Scholar] [CrossRef]

- Bilyay-Erdogan, S.; Danisman, G.O.; Demir, E. ESG performance and dividend payout: A channel analysis. Financ. Res. Lett. 2023, 55, 103827. [Google Scholar] [CrossRef]

- Luo, D. ESG, liquidity, and stock returns. J. Int. Financ. Mark. Inst. Money 2022, 78, 101526. [Google Scholar] [CrossRef]

- Khan, M.A.; Hassan, M.K.; Maraghini, M.P.; Paolo, B.; Valentinuz, G. Valuation effect of ESG and its impact on capital structure: Evidence from Europe. Int. Rev. Econ. Financ. 2024, 91, 19–35. [Google Scholar] [CrossRef]

- Chouaibi, Y.; Zouari, G. The mediating role of real earnings management in the relationship between CSR practices and cost of equity: Evidence from European ESG data. EuroMed J. Bus. 2024, 19, 314–337. [Google Scholar] [CrossRef]

- Liu, D.; Gu, K.; Hu, W. ESG performance and stock idiosyncratic volatility. Financ. Res. Lett. 2023, 58, 104393. [Google Scholar] [CrossRef]

- Sun, Y.; Zhao, D.; Cao, Y. The impact of ESG performance, reporting framework, and reporting assurance on the tone of ESG disclosures: Evidence from Chinese listed firms. J. Clean. Prod. 2024, 466, 142698. [Google Scholar] [CrossRef]

- Yilmaz, M.K.; Aksoy, M.; Khan, A. Moderating role of corporate governance and ownership structure on the relationship of corporate sustainability performance and dividend policy. J. Sustain. Financ. Invest. 2024, 14, 988–1017. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef] [PubMed]

- Brück, C.; Knauer, T.; Schwering, A. Disclosure of value-based performance measures: Evidence from German listed firms. Account. Bus. Res. 2023, 53, 671–698. [Google Scholar] [CrossRef]

- Zhang, H.; Lai, J. Greening through ESG: Do ESG ratings improve corporate environmental performance in China? Int. Rev. Econ. Financ. 2024, 96, 103726. [Google Scholar] [CrossRef]

- Ellili, N.O. Impact of environmental, social and governance disclosure on dividend policy: What is the role of corporate governance? Evidence from an emerging market. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 1396–1413. [Google Scholar] [CrossRef]

- Liu, Y.-Y.; Lee, P.-S. The impact of environmental, social and governance (ESG) performance on the duration of dividend sustainability: A survival analysis. Manag. Financ. 2025, 51, 337–352. [Google Scholar] [CrossRef]

- Marcus, M.; Sant’Anna, P.H.C. The Role of Parallel Trends in Event Study Settings: An Application to Environmental Economics. J. Assoc. Environ. Resour. Econ. 2020, 8, 235–275. [Google Scholar] [CrossRef]

- Sun, X.; Ci, F.; Cifuentes-Faura, J.; Liu, X. Firm-level climate risk and corporate violations: Perspective of corporate managers’ pressure perception. Manag. Decis. Econ. 2024, 45, 5430–5448. [Google Scholar] [CrossRef]

- Liu, W.; Suzuki, Y. Corporate governance, institutional ownership, and stock liquidity of SMEs: Evidence from China. Asia-Pac. J. Account. Econ. 2025, 32, 299–328. [Google Scholar] [CrossRef]

- La Ferrara, E.; Chong, A.; Duryea, S. Soap Operas and Fertility: Evidence from Brazil. Am. Econ. J. Appl. Econ. 2012, 4, 1–31. [Google Scholar] [CrossRef]

- Eggers, A.C.; Tuñón, G.; Dafoe, A. Placebo Tests for Causal Inference. Am. J. Political Sci. 2023, 68, 1106–1121. [Google Scholar] [CrossRef]

- Ghimire, A.; Ali, S.; Long, X.; Chen, L.; Sun, J. Effect of Digital Silk Road and innovation heterogeneity on digital economy growth across 29 countries: New evidence from PSM-DID. Technol. Forecast. Soc. Change 2024, 198, 122987. [Google Scholar] [CrossRef]

- Mogstad, M.; Torgovitsky, A.; Walters, C.R. Policy evaluation with multiple instrumental variables. J. Econom. 2024, 243, 105718. [Google Scholar] [CrossRef]

- Abdul Rahman, R.; Alsayegh, M.F. Determinants of Corporate Environment, Social and Governance (ESG) Reporting among Asian Firms. J. Risk Financ. Manag. 2021, 14, 167. [Google Scholar] [CrossRef]

- Mahmood, Y.; Rashid, A.; Rizwan, M.F. Do corporate financial flexibility, financial sector development and regulatory environment affect corporate investment decisions? J. Econ. Adm. Sci. 2022, 38, 485–508. [Google Scholar] [CrossRef]

- Hashmi, M.A.; Istaqlal, U.; Brahmana, R.K. Corporate governance and cost of equity: The moderating role of ownership concentration levels. South Asian J. Bus. Stud. 2024, 13, 282–302. [Google Scholar] [CrossRef]

- Matakanye, R.M.; van der Poll, H.M.; Muchara, B. Do Companies in Different Industries Respond Differently to Stakeholders’ Pressures When Prioritising Environmental, Social and Governance Sustainability Performance? Sustainability 2021, 13, 12022. [Google Scholar] [CrossRef]

- Wang, Z.; Zhang, C.; Wu, R.; Sha, L. From ethics to efficiency: Understanding the interconnected dynamics of ESG performance, financial efficiency, and cash holdings in China. Financ. Res. Lett. 2024, 64, 105419. [Google Scholar] [CrossRef]

- Luo, C.; Wei, D.; He, F. Corporate ESG performance and trade credit financing—Evidence from China. Int. Rev. Econ. Financ. 2023, 85, 337–351. [Google Scholar] [CrossRef]

- Lewellyn, K.; Muller-Kahle, M. ESG Leaders or Laggards? A Configurational Analysis of ESG Performance. Bus. Soc. 2023, 63, 1149–1202. [Google Scholar] [CrossRef]

- Cheng, Q.; Yang, J. High-speed rail, resource allocation and haze pollution in China. Transp. Policy 2024, 157, 124–139. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).