Abstract

With the increasing focus on R&D (research and development) subsidies of various researchers, there is growing interest in how these subsidies affect radical innovation. Based on the limited attention paid to this area in the existing literature, this paper investigates the impact of R&D subsidies on radical innovation. Using a sample of Chinese listed firms, we investigate how innovation orientation and competitive intensity moderate this relationship. By incorporating concepts from Path Dependence Theory, we propose that R&D subsidies alter firms’ assessment of the value and risk associated with investments in radical innovation, influencing their innovation strategies. Subsidies may increase the attractiveness of incremental innovations, which have lower volatility and faster returns, compared to radical innovations, which inherently involve higher risk and uncertainty. Based on the results of our analysis, we find that R&D subsidies negatively affect radical innovation, but firms with a stronger innovation orientation (which reflects their greater tolerance for risk) are less negatively affected. Conversely, an increase in the intensity of competition exacerbates the negative impact of subsidies because it induces firms to make safer incremental investments. The robustness analysis confirms that the main effects remain significant even when using alternative proxies for innovation. Our study sheds light on the mechanisms affecting the effectiveness of subsidies from the perspective of finance theory and highlights the conditions under which subsidies may unintentionally discourage radical innovation.

1. Introduction

In the context of the knowledge economy and global competition, corporate radical innovation has become a key strategic driver of transformative technologies, disruptive products, and new business models [1]. It plays a pivotal role in driving industrial transformation, reshaping the market landscape, and ensuring the long-term competitiveness of national economies. Unlike incremental innovations, radical innovations create entirely new technological trajectories or market paradigms that enable firms to tap into “blue ocean markets” and can rapidly capture market share or even trigger the reorganization of industrial ecosystems [2]. For example, Tesla’s disruptive technologies in electric vehicles and Amazon’s pioneering initiatives in cloud computing services both exemplify the core value of radical innovation in sustaining firm growth. However, this model of innovation has not been easy in practice. First, radical innovation is characterized by high uncertainty, long development cycles, high R&D investment, and a high risk of failure, which often leads firms to adopt conservative resource allocation decisions [3]. Second, it is in contrast to the capital market’s focus on short-term returns and the risk-averse mindset of traditional funding mechanisms, like bank loans and venture capital [4], which create obstacles for firms seeking to obtain appropriate funding. Third, radical innovation typically involves the blending of diverse knowledge domains, as well as the solution of intricate technological problems, imposing heavy demands on a firm’s technological resources, organizational adaptability, and risk management [5]. The challenges combined make up three barriers against radical innovation in firms: resource, capability, institutional.

An innovative mindset plays a crucial role in encouraging firms to engage in radical innovation. Firms with a strong innovation orientation are more likely to take on high-risk, high-reward projects that could lead to breakthroughs. However, it is also important to recognize that not all innovations, even when radical, contribute positively to society. Some innovations, particularly in areas like artificial intelligence and biotechnology, can raise ethical concerns or lead to unintended societal harm. As Neukam and Bollinger (2022) point out, actors within the innovation ecosystem may focus on technological progress and profitability, sometimes overlooking the potential risks their innovations could pose to society [6]. Therefore, it is crucial to integrate sustainable and ethical considerations into the innovative mindset to ensure that innovation benefits society.

Existing research on the drivers of firms’ radical innovation focuses on the interactions between internal capabilities (e.g., R&D investment intensity, executive risk appetite, and organizational learning mechanisms) and external market environments (including competitive intensity, dynamic customer demand, and industry–university–research collaboration networks). For example, open innovation theory emphasizes the role of external knowledge acquisition in promoting radical innovation [7]. However, the impact of government subsidies on firms’ radical innovation, as an important tool of government intervention in the market, remains under-explored. This gap is important for a number of reasons: first, government subsidies can lower the financial constraints on firms by injecting capital, providing tax credits, and bearing part of R&D costs, thereby reducing their trial-and-error costs and their perceived risk of innovation. This, in turn, encourages firms to pour resources into risky, long-cycle disrupter projects, or “moonshots” [8]. Second, subsidy policies have the potential to serve as a signal, enabling external stakeholders (such as investors and suppliers) to have greater confidence in the firm’s innovation strategy, ultimately benefiting its financing environment. Moreover, investment will improve data-based technologies of strategic new industries, directing firms to expand working on their own technologies to surmount crucial technological obstacles within the industry. However, the current studies have not given a detailed analysis of what the effects are of subsidies, and there is little dialogue about the possible moral hazards that can result, like strategic or low-quality innovation claims by firms.

This study reveals the impact of government subsidies on firms’ radical innovation and makes three important theoretical contributions. First, it fills a gap in the explanation of policy incentive effects by revealing the theoretical mechanism by which R&D subsidies induce innovation path dependence. The existing literature generally observes selective and biased incentive effects of R&D subsidies, as firms tend to innovate incrementally rather than radically due to short-term incentives. However, these analyses are usually limited to exploring the static relationship between policy and firm behavior, and do not incorporate a dynamic analysis in practice. This study breaks through this limitation by suggesting that R&D subsidies may lead to path dependence on existing technological paradigms through two mechanisms: increased returns to scale for technology and higher switching costs for technology adoption. That is, subsidy-induced reallocation of resources reinforces the existing technological trajectory, increasing returns to scale and switching costs, thus creating a dynamic “path dependency trap”.

Second, this study develops an integrated analytical paradigm of “policy tools–resource reconfiguration–innovation leapfrogging” that connects theory to empirical research. Based on financial decision-making frameworks, we emphasize that subsidies modify the evaluation and risk assessment mechanisms on which firms base their innovation investments. This research offers subtle theoretical framing for interpreting policy-induced shifts in firm resources, by recursively embedding financial considerations of option valuation, payoff uncertainty, and risk–return tradeoffs within innovation decision-making processes. It highlights how the way firms think about risk, uncertainty, and potential payoffs shapes their strategic choices about innovation in response to policy incentives.

Third, this study has stronger practical implications by revealing the conditional effects of innovation orientation and competitive intensity on the subsidy–innovation relationship. Our empirical analysis of Chinese firms shows that firms with higher innovation orientation can mitigate the negative impact of subsidies on radical innovation due to their lower risk aversion. On the contrary, intense market competition increases the relative attractiveness of less risky incremental innovations, thus exacerbating the negative impact. Not only that, but we also propose new criteria for measuring radical innovation from the perspective of technological similarity, which allows for a more accurate and objective assessment of the quality of innovation and provides policymakers with tools to accurately evaluate policies.

2. Literature Review and Theoretical Analysis

2.1. Reimagining R&D Subsidies: Fostering Radical Innovation Beyond Quantity

Innovation has been identified as one of the key drivers of economic growth and industrial transformation [9]. Governments all over the world have adopted policies to encourage innovation, and one of the most important tools is R&D subsidies. To better understand the impact of these subsidies on radical innovation, we draw on dynamic capabilities theory [10], which helps explain how firms with varying innovation orientations adapt their internal resources and capabilities to respond to external policy incentives, thereby influencing their innovation trajectories. Thus, these subsidies are designed to alleviate firms’ monetary pressures and motivate them to engage in innovation [11]. However, they were also questioned about their ability to better promote high-risk, long-term forms of innovations. Pavitt (1984) proposed a taxonomy for sectoral patterns of technical change, arguing that different industries are driven by distinct innovation patterns [12]. For instance, in some industries, innovation is primarily driven by technological push (e.g., high-tech sectors), while in others, it is demand-driven or influenced by government actions (e.g., public health or infrastructure sectors). Recent studies, such as Antonczak et al. (2025), have further explored the roles of various actors, including government, firms, and research institutions, in shaping innovation systems within industries [13]. These insights emphasize the importance of considering sector-specific factors when analyzing innovation drivers, as they can significantly affect the outcomes of R&D subsidies and other policy interventions.

Over the last few decades, government-led innovation policies have taken on a significant role in shaping what the innovation landscape looks like. As an example, in China, the policy direction has moved from technology followership to local technology [14]. This change is illustrated by the Outline of the National Medium and Long-Term Plan for Scientific and Technological Development (2006–2020), which calls on both public and private firms to expand their R&D activities. In this context, R&D subsidies are becoming an important support mechanism that alleviates financial constraints in the expected pursuit of innovation, particularly in high-tech industries [15]. Radical innovations—defined as epochal breakthroughs leading to new products or technologies—pose even greater hurdles to overcome. These innovations demand more investment, longer development times, and additional financing from the public and private sectors.

It has been reported in various studies that R&D subsidies may drive firms to greater innovation quantity overall, but also prevent them from pursuing more radical types of innovation instead of incremental ones [16,17]. This is, in part, because government evaluation systems often favor counting the number of patents filed as a measurable output of scientific achievement. In China, for example, firms are often judged on their patent output; thus, this can push them to engage in low-risk, incremental innovations with shorter returns [18]. However, such policies could pull firms into a discontinuous cycle of incremental innovation, deterring investment in the more erratic, high-risk projects required for radical breakthroughs [19]. This effect is sometimes called “incremental innovation lock-in”. These developmental practices also depend on the structures of R&D subsidy programs. While patents are among the short-term, quantifiable outcomes characterized in the evolution of knowledge [20], and thus are often prioritized within the parameter of subsidies, they are not the goals of firms dealing with radical innovation [21]. Most existing subsidy structures may not be well suited to providing support for these types of industries, as radical innovations are slower to develop, highly uncertain, and risky. Consequently, new product development in innovation is driven by more radical innovations that can pose high costs on firms [22].

However, it has also been argued that R&D subsidies, if properly designed, can promote radical innovation by reducing financial risk and encouraging firms to take on more projects with high returns [23]. For example, the creation of specialized funds dedicated to supporting high-risk, high-return innovations can provide firms with the resources they need to pursue transformative technological advances [24]. These targeted funds can help balance the risks inherent in radical innovation with the financial support needed to undertake such projects [9]. To improve the effectiveness of R&D subsidies, governments could shift their focus from simply increasing the number of patents to assessing the technological novelty and long-term potential of innovations. By aligning policy incentives with the needs of firms pursuing radical innovations, governments can better support breakthrough developments that have the potential to reshape industries. In addition, by fostering innovation ecosystems and encouraging collaboration between firms, research institutions and universities can help create the networks needed to successfully develop and commercialize radical innovations [25].

2.2. The Unintended Consequences of R&D Subsidies: Hindering Radical Innovation

R&D subsidies are widely recognized as incentives for firms to innovate. However, the proportion, role, and timeliness of subsidies play a key role in encouraging innovation. While they can stimulate incremental innovation, subsidies focused on short-term outcomes may discourage radical innovation, which requires long-term commitment and higher risk. For example, Huawei used government R&D subsidies to develop 5G technology, a high-risk, long-term project. The subsidies helped reduce financial risks, allowing Huawei to push forward with this breakthrough innovation. To better support radical innovation, subsidies should target long-term, high-risk technologies rather than short-term, measurable results, ensuring firms are incentivized to pursue breakthrough innovations [26]. First, many subsidy programs rely on short-term or easily quantifiable outcomes—such as the number of patents—to assess innovation performance [27]. This emphasis on short-term metrics may steer firms away from more transformative, risky projects. Radical innovations typically require longer development cycles and have less predictable returns, making them less attractive when firms feel pressured to meet near-term goals tied to subsidies.

Second, by emphasizing tangible outputs that can be shown in the short term, R&D subsidies may entrench risk-averse behavior among firms. Radical innovation requires a willingness to venture into uncharted territory of technology, embrace fears of failure, and invest significant resources over a long time [28,29]. Subsidies based on short-term results can discourage firms from investing in disruptive technologies that might not produce immediate, easily quantified benefits.

Third, these subsidies can produce path dependence, in which firms are locked into certain technology trajectories [30]. Path Dependence Theory [31,32] further enriches our theoretical framework by explaining how historical decisions and initial conditions constrain current innovation activities, causing firms to become locked into incremental innovation trajectories. This theory posits that initial successes with incremental innovations, compounded by subsidy evaluation systems that prioritize quantifiable, short-term outcomes (such as patent counts), can lead firms to adopt conservative innovation strategies. As a result, deviating from these established paths to pursue more radical innovations becomes increasingly difficult, as firms perceive higher levels of risk and uncertainty. By integrating Institutional Theory with Path Dependence Theory, our study develops hypotheses that clearly demonstrate how both institutional forces and historical paths together shape firms’ responses to R&D subsidies, offering valuable insights into the conditions required to foster radical innovation. As they constantly receive funding for initiatives that meet short-term performance requirements, they become increasingly less likely to explore radically new areas that involve more uncertainty. In the long run, this dynamic tends to lock organizations into a well-rehearsed dogma, constraining their ability—and willingness—to seek real game-changing breakthroughs. Hence, we hypothesize the following:

H1.

R&D subsidies have a negative impact on radical innovation.

2.3. Innovation Orientation as a Moderator: Amplifying or Mitigating the Negative Effects of R&D Subsidies on Radical Innovation

In the current innovation policy environment, governments, including the Chinese government, use R&D subsidies to improve technological competitiveness. When such subsidies emphasize the quantity of innovation, they can have unintended consequences, with the potential to steer firms away from ambitious, high-uncertainty pursuits [30]. This phenomenon can be understood as the ‘innovation paradox’, whereby well-intentioned incentives prioritize short-term outcomes over transformative achievements. As firms respond to these incentives, radical innovations may be marginalized because of their complexity and higher risk [28]. How firms’ innovation orientations influence this process is a crucial but not yet fully explored question.

Firms with high innovation orientation [33] are characterized by a focus on long-term technological progress and industry leadership, rather than near-term gains. Such firms leverage internal motivations to achieve breakthroughs, irrespective of policy frameworks that emphasize short-term outcomes: a proposition informed by Schumpeter’s theory of innovation. By keeping their eye on distant horizons, they do not get boxed into surpassing a clear short-term payoff, and this allays the dampening effects of R&D subsidies on radical innovation.

Second, firms that are less innovation-orientated often place short-term financial returns at the heart of their development. Such external financial support, particularly R&D subsidies connected to easily demonstrable outputs, fortifies the picture of firms gravitating toward more predictable projects rather than radical experimentation [34,35]. Since these projects are designed specifically to aim for quicker returns and more transparent metrics, firms’ interests are more likely to remain focused on short-term targets, thus increasing the chances that subsidies will inhibit risk-taking. This orientation strengthens the case against public funding harming radical innovation.

Third, low-innovation-oriented firms, from a pathway dependence perspective, are at risk of becoming locked in on their current trajectories [36]. Reliance on subsidies that favor concrete, near-term outcomes can reinforce routines, complicating the transition towards radically novel technologies [37]. In contrast, firms with a high innovation orientation deploy subsidies as a launchpad for daring experimentation, investing financial support into great potential directions that develop transformative thinking rather than reinforcing the status quo. Thus, we hypothesize the following:

H2.

Innovation orientation moderates the negative relationship between R&D subsidies and radical innovation, such that firms with a high innovation orientation will weaken the negative impact, while firms with a low innovation orientation will amplify the negative impact.

2.4. The Role of Competition Intensity: How Market Pressure Influences R&D Subsidies’ Impact on Radical Innovation

When it comes to R&D subsidies, promoting innovation and improving the technological competitiveness of firms are the main objectives of governments. While these subsidies can stimulate overall innovation, their impact on radical innovation is insignificant when policy frameworks prioritize easily quantifiable metrics over ambitious explorations [38]. Consequently, firms’ decisions based on these metrics may tend to favor safer, more predictable projects over the pursuit of disruptive technologies. This paradox inadvertently diverts valuable resources away from radical pursuits that truly reshape entire industries. The intensity of market competition further determines how firms navigate these incentives: those in highly competitive environments have a more pressing need to innovate radically to gain a strategic advantage [39].

First, since firms in a competitive environment have stronger pressures for differentiation from competitors, firms focus on radical innovation to obtain first-mover advantages and market leadership [40]. In this scenario, R&D subsidies can be used to offset the contradictory effect of quantitative funding that discourages boldness while also wisely funding high-risk, high-reward endeavors [41]. Such actions follow the principles of competitive dynamics theory that states that high competitiveness forces companies to exhibit radical innovation to ensure they are better positioned for business.

Second, firms experience less external pressure to initiate major technological change in markets with limited competition [42]. With minimal incentives to stand out, these firms favor activities that are more predictable and have clearer short-term returns. Therefore, R&D subsidies linked to tangible deliverables reinforce this tendency, as accomplishing near-term goals appears to be more achievable than venturing into uncertain territory [19]. Thus, the negative impact of subsidies on radical innovation tends to be more pronounced when competitive forces are limited and the incentives to disrupt existing technological paradigms remain weak.

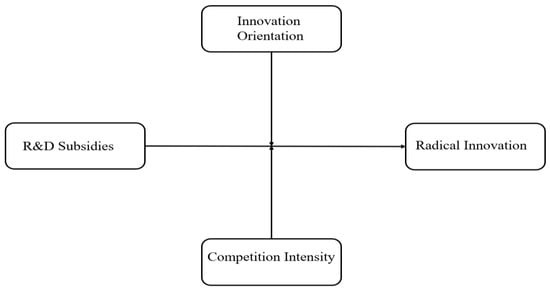

Third, resource allocation differs across competitive contexts. When confronted with intense competitive pressures, companies are more likely to invest in high-risk, radical innovations in the knowledge that the potential rewards can be great compared to the additional costs of development and time to market [43]. R&D subsidies offer critical financial support, which alleviates more of the constraints as well as promotes novel exploration. On the other hand, firms operating under low-competition settings are less compelled by any such pressure to engage in radical initiatives, and might thus prefer to focus resource allocation on less risky ones [44]. This cautious behavior gradually compounds the negative impact of quantity-oriented subsidies on radical innovation as firms’ attitudes towards maintaining existing strategies overtakes motivations to make disruptive advances. The theoretical model diagram of the research is shown in Figure 1.

Figure 1.

Theoretical model diagram.

H3.

Competition intensity moderates the negative relationship between R&D subsidies and radical innovation, such that in high-competition environments, R&D subsidies will weaken the negative impact, while in low-competition environments, R&D subsidies will amplify the negative impact.

3. Financial Modeling of R&D Subsidies and Innovation Trade-Offs

In this section, we build a decision-making model to analyze how R&D subsidies influence firms’ innovation structures, particularly focusing on the trade-off between incremental and radical innovation [45]. We assume an economy in which firms produce multiple intermediate goods and must choose whether to make incremental improvements to existing technologies or engage in radical innovation, developing entirely new technological paths. The firms’ decisions are driven by two key factors: policy incentives (such as R&D subsidies) and the risk–return structures associated with these innovations, which involve balancing risk and reward.

3.1. Firm’s Innovation Choice

We consider a firm that consists of multiple production lines. The innovation choices of the firm are influenced not only by its accumulated technological knowledge but also by government policy incentives [46]. Assume that each production line has a quality level , which represents the technological level of that line and reflects its competitive position in the market. The firm’s goal is to enhance the quality of these production lines through innovation activities, thereby increasing its market share.

According to Kratochvil (2025), there are two types of innovation activity at the firm level; incremental innovative activity and radical innovative activity [47]. While incremental innovation involves improvements in already available production line technologies, generating output from existing technologies, radical innovation means building a new technological trajectory with a new generation of technologies, allowing for more complex innovations and generating higher chances of market disruption. The firm’s production function can be defined as follows:

where represents the quality level of intermediate good ; is the input quantity; and , , and are the production elasticity coefficients, with representing labor elasticity. This function shows how technological improvements in intermediate goods, through innovation activities, can lead to enhanced production efficiency in the final good.

3.2. The Impact of R&D Subsidies on Innovation Decisions

Government R&D subsidies play a crucial role in influencing firms’ innovation decisions [48]. We assume that the government’s subsidy policy is based on observable metrics such as the firm’s R&D investment and innovation output. Specifically, the subsidy for incremental innovation is denoted by , and, for radical innovation, it is . The firm’s objective is to maximize its profit by optimizing its innovation investments, considering both the subsidies and the expected innovation returns. The firm’s subsidy income can be expressed as follows:

where represents the subsidy amount for each unit of innovation success, and is a factor that adjusts the success probability for radical innovation. By receiving subsidies, firms’ innovation decisions are altered. Since the marginal return from incremental innovations is higher, subsidies tend to push firms toward investing more in incremental innovation rather than radical innovations.

We now analyze the adjustment in innovation structure caused by subsidies. The firm’s profit function is set as follows:

where represents the set of all production lines in the firm, is the market profit from production line , and is the expected profit. The terms and represent the returns from incremental and radical innovations, respectively. By differentiating this profit function, we obtain the following optimal innovation decision conditions for the firm:

Starting from these conditions, we can see that after receiving the subsidies, firms are also more likely to invest in incremental innovation, as the subsidies enhance the marginal rewards associated with incremental innovations. The subsidies, however, do not sufficiently reward the risks and costs of radical innovation. Consequently, R&D subsidies constrain firms’ investments in radical innovation, resulting in a “path dependence” mechanism, in which firms become more and more susceptible to existing technological paths.

This analysis reveals that while quantity-based R&D subsidies can effectively stimulate overall innovation activity, they may unintentionally weaken radical innovation. This happens because incremental innovations involve relatively lower investments, have higher success rates, and benefit more from subsidies, thereby increasing their marginal returns [45]. In contrast, radical innovations, due to their high costs and uncertainties, are not sufficiently compensated for by the subsidies, leading to a reliance on existing technological paths. This result suggests that quantity-based subsidies may hinder truly disruptive innovations. Policymakers should consider alternative support mechanisms, such as quality-based subsidies or additional incentives for radical innovations, to foster breakthrough technologies.

4. Methodology

4.1. Data and Sample

We examine Chinese A-share-listed firms listed on the Shanghai and Shenzhen stock exchanges for 2010–2022, focusing on firms’ innovation behaviors and R&D subsidy effect on firms’ innovation outputs. The raw data of innovation output take the original date from the China National Intellectual Property Administration (CNIPA), because it has specific basic data, such as the year, the number of patent applications, the number of patents approved, and other related intellectual property data.

Data regarding corporate financial and R&D expenditures were sourced from the China Securities Market & Accounting Research (CSMAR) database [49], which is recognized for its more extensive and accurate financial data. Data pertaining to R&D subsidies were obtained from public reports and government databases that describe fiscal support for innovation activities through government grants and tax incentives. To guard against potential bias in the government data, we ensured that only publicly accessible, official sources were used, minimizing reliance on selectively published data. To further ensure the accuracy and reliability of these data, we cross-referenced the government data with independent sources, including academic studies and industry reports. Additionally, sensitivity analyses were conducted to detect any potential biases in the data, and we examined the consistency of reported subsidies with actual firm-level R&D expenditures. By incorporating data from multiple government agencies, including the Ministry of Science and Technology and the National Bureau of Statistics, we ensured the robustness of the dataset and reduced the risk of bias from any single source. These measures were taken to ensure the data’s objectivity and enhance the reliability of our findings. Data on firm characteristics, such as size, industry, and leverage, were also obtained from the CSMAR database to control for characteristics that could affect firms’ innovation behavior. Consistent with past work, we applied a variety of filters to maintain data quality. This process involves removing (1) financial, insurance, and real estate companies that do not directly correspond to common innovation actions; (2) ST firms, in order to keep the data stable and continuous; (3) companies with unavailable financial or economic data, and major outliers that may affect the results [40]. To protect the robustness of our results even more, we winsorized all continuous variables at the 1st and 99th percentiles to minimize the impact of extreme outliers on our analyses.

4.2. Variables

4.2.1. Dependent Variables

Radical innovation is measured by the number of patents filed or granted to a firm, focusing on patents that represent significant technological breakthroughs or advancements over existing technologies. For example, X Corp was granted a patent for its innovative artificial intelligence system in 2020, which introduced a novel method for automating manufacturing processes. This patent was categorized under the IPC (International Patent Classification) code for AI technologies and is considered a major leap in the industry, as it represents a shift from conventional techniques [50]. By analyzing the number of such breakthrough patents, we classify firms as engaging in radical innovation. Furthermore, we assess the novelty of each patent based on the number of citations it receives within the first two years post-grant. Patents with a higher citation rate are considered more influential and are deemed to represent more radical innovations [27]. This approach helps distinguish between incremental improvements and radical innovations, ensuring that we capture only those patents that truly reflect significant advancements.

In order to classify and measure radical innovations (RIs), we use a classification based on the first four digits of a patent’s IPC code, which reflects the main technological field of the invention. The basic criterion for determining whether a patent is a radical innovation depends on whether it introduces a new field of technology that has not previously been addressed by the same company. Specifically, we use a five-year look-back period to assess whether the four-digit IPC code of a new patent has already appeared in any patents filed by the same company in the past five years.

Formally, let the set of IPC codes used by firm in year be denoted as , which consists of all unique four-digit IPC codes associated with patents filed by firm in year . For each patent filed in year , we define the set as the four-digit IPC code of that patent. A patent is classified as radical if the following condition holds:

Here, represents the union of the four-digit IPC codes used by firm in the five years preceding year . If the code of patent in year is not found in this union, then the patent is considered radical.

This criterion reflects the idea that radical inventions introduce fundamentally new technological concepts that are distinct from previous technological domains of the firm, thus representing a meaningful departure from prior knowledge. This method has been widely adopted in patent studies, as it allows for the identification of technological breakthroughs that constitute significant leaps in innovation, rather than incremental improvements on existing technologies [28].

Furthermore, to refine the measure of radical innovation, we introduce a time-decay factor that accounts for the relative novelty of a patent over time. As technological progress accumulates, the relevance of older inventions diminishes, and the novelty of newer patents becomes more significant [51]. We adjust for this dynamic by incorporating a weight factor , which decreases over time. The weighted measure of radical innovation can be expressed as follows:

where is a time-decay function that assigns higher weights to patents filed more recently. This weighted measure helps ensure that more recent breakthroughs are given greater significance, aligning the classification of radical inventions with the cumulative nature of technological progress.

4.2.2. Independent Variable

In this study, R&D subsidies are measured by determining whether a firm receives government financial support for research and development activities in a given year [49]. To quantify this, we construct a binary indicator variable , which takes the value of 1 if firm received R&D subsidies in year , and 0 otherwise. This variable reflects whether a firm has received R&D subsidies, which is typically reported in the firm’s annual filings and government subsidy records.

To enhance the accuracy of this measurement, we employ a weighted keyword extraction algorithm that adjusts the importance of subsidy-related keywords over time [48]. We use the Term Frequency-Inverse Document Frequency (TF-IDF) method to compute the adjusted subsidy score :

where represents the -th keyword related to R&D subsidies, and is the weight assigned to this keyword, reflecting its importance in the context of subsidy-related documents.

To refine this measurement, we further calculate the government’s total R&D subsidy amount received by firm in year . Let denote the government subsidy amount for firm in year . To account for the scale of the firm, we divide the subsidy amount by the firm’s total assets in year , denoted as , to eliminate size effects and normalize the subsidy measure:

This approach enables us to accurately measure R&D subsidies, accounting for both the receipt of subsidies and their delayed effects on firm innovation. It provides a robust framework for analyzing the impact of R&D subsidies on a firm’s propensity for both incremental and radical innovations.

4.2.3. Moderating Variables

Innovation orientation and competitive intensity are two effective moderating factors influencing the strength of R&D subsidies on firms [30] that are considered in this study. These two factors arguably strongly affect the degree to which firms engage in incremental versus radical innovations.

Innovation orientation is captured by the ratio of innovation-related keywords in the management discussion and analysis (MD&A) section of a firm’s annual report to the total word count of that section. Firms with a higher proportion of innovation-related terms are considered to have a high innovation orientation. This method provides an insight into how a company prioritizes innovation in its strategic communication. Exploratory R&D refers to research activities aimed at developing new technologies or entering new markets, often involving higher uncertainty and long-term rewards. For example, Company A might emphasize its investment in developing a new AI-powered technology for healthcare in its MD&A, signaling a focus on exploratory innovation aimed at a new technological frontier. In contrast, exploitative R&D focuses on improving existing technologies or products, typically with shorter-term returns and lower risks. For example, Company B might highlight its efforts to enhance the efficiency of its existing solar panels, reflecting an exploitative innovation that builds on established technology. The innovation orientation indicator for firm in year is given by the following ratio:

where represents the firm’s R&D expenditure dedicated to exploratory research in year , and is the firm’s total R&D expenditure in the same year. Firms with a ratio of exploratory R&D expenditure exceeding 50% are classified as having a high innovation orientation, indicating a greater focus on radical innovation. Conversely, firms with a ratio below 50% are considered to have a low innovation orientation, reflecting a focus on incremental innovation. This method provides a precise measure of a firm’s strategic direction toward either incremental or radical innovation. Additionally, we incorporate a measure of innovation orientation based on the frequency of innovation-related terms in the firm’s management analysis and discussion sections, normalized by the total word count in those sections. This measure serves as a complementary indicator of a firm’s strategic focus, where a higher frequency of terms related to radical or disruptive innovation can indicate a stronger orientation toward radical innovation [52]. This method provides a precise measure of a firm’s strategic direction toward either incremental or radical innovation.

The industry is defined as the field in which similar businesses operates when it comes to competition within the firms [53]. In competitive environments, these firms are also likely to pursue radical innovation as a means of firm distinction that leads to a competitive advantage [54]. Conversely, in markets with low levels of competition, firms may be more likely to pursue incremental innovation. To quantify the intensity of competition, we use the Herfindahl–Hirschman Index (HHI) to measure the degree of market concentration for each industry. A higher HHI means less competition, and a lower HHI indicates a more competitive market. The HHI is calculated as follows:

where represents the market share of firm in the industry, and is the total number of firms in that industry. The HHI ranges from 0 to 1, where a value closer to 1 reflects a concentrated, less competitive market, and a value closer to 0 indicates a more fragmented, competitive market. To capture the intensity of competition that a firm faces, we define the competition intensity index for firm in year as the inverse of the HHI for the industry:

where represents the level of competition in the industry where firm operates in year . A higher reflects greater competition, while a lower reflects reduced competition.

4.2.4. Control Variables

Building on previous research examining innovation behaviors of firms [55], we incorporate a set of control variables that may impact the dependent variable. These controls include firm size (Size), firm age (ListAge), board size (Board), proportion of independent directors (Indep1), CEO duality (Dual), the proportion of shares held by the top five shareholders (Top5), leverage ratio (Lev), and the ratio of net fixed assets to total assets (FIXED).

4.3. Model Specifications

This study examines the impact of research and development subsidies (SUB) on firms’ radical innovation (Radical) using a fixed effects model based on firm-level panel data. The choice of the fixed effects model is motivated by the need to account for unobserved heterogeneity across firms that could bias the results if omitted. By controlling for firm-level, industry-level, and year-specific fixed effects, the model helps mitigate potential endogeneity issues, ensuring that the estimated effect of R&D subsidies reflects within-firm variation over time. Furthermore, we use Driscoll–Kraay standard errors [56] to address potential issues of autocorrelation and heteroskedasticity in the panel data, thus ensuring the robustness of the findings. This choice is particularly relevant as the data span multiple years, and Driscoll–Kraay standard errors provide reliable estimates in the presence of serial correlation and heteroskedasticity, which are common in large panel datasets. The empirical model is specified as follows:

where Radical serves as the measure of a firm’s radical innovation, while the primary independent variable is SUB (R&D subsidies). Controls represent a set of control variables, Industry and Year denote industry and year fixed effects, respectively, indicates the firm, represents the year, corresponds to the estimated coefficients for the control variables, and is the random error term. By applying firm-level fixed effects, this model accounts for unobserved heterogeneity across firms, allowing us to isolate the within-firm variation in R&D subsidies over time.

To test the moderating effects of innovation orientation (DIO) and market competition intensity (IH), we extend the baseline model by adding interaction terms. This allows us to investigate how DIO and IH influence the relationship between R&D subsidies and radical innovation. The extended model is specified as follows:

In Equation (2), Moderator represents the moderating variables, which can be either DIO (innovation orientation) or IH (market competition intensity), and their interaction with R&D subsidies (SUB). These interaction terms enable us to evaluate how innovation orientation and market competition intensity moderate the relationship between R&D subsidies and radical innovation.

5. Empirical Results

5.1. Descriptive Statistics and Correlation Analysis

Table 1 provides descriptive statistics for the main regression variables. During the sample period, the mean value of Radical is 1.377 with a standard deviation of 2.341, indicating that the level of radical innovation varies significantly across firms. The mean value of R&D subsidy (SUB) is 0.524 with a standard deviation of 0.485, indicating that the amount of subsidy does not vary significantly. The mean value of innovation orientation (DIO) is 0.078 with a standard deviation of 0.100, reflecting that firms place limited emphasis on innovation orientation. The mean value of intensity of market competition (IH) is 0.956 with a standard deviation of 0.073, indicating intense market competition. The mean value of the firm size (Size) is 22.119 with a standard deviation of 1.259, indicating that the sample firms are relatively large. Descriptive statistics for other variables also show similar patterns of variation among firms.

Table 1.

Descriptive statistics.

Table 2 shows the correlation results for key variables. Radical innovation (Radical) is weakly negatively correlated with innovation orientation (DIO) (−0.116 ***) and weakly positively correlated with market competition (IH) (0.086 **). The firm size (Size) is negatively correlated with the R&D subsidies (SUB) (−0.212 ***). The proportion of independent directors (Indep) is negatively correlated with board size (Board) (−0.556 ***). Overall, the correlations suggest complex relationships between innovation, firm characteristics, and governance structures. The correlation coefficients are all below 0.7, indicating no significant multicollinearity issue, ensuring the reliability of the regression results.

Table 2.

Correlation analysis results.

5.2. Main Results

Table 3 presents the baseline regression results. In Model (1), the coefficient for R&D subsidies (SUB) is −0.119 and statistically significant at the 1% level, indicating a negative relationship between R&D subsidies and radical innovation (Radical). This suggests that increased R&D subsidies are associated with a decrease in radical innovation. The firm size (Size) shows no significant relationship in Model (1) but becomes significantly negative in Model (2) (coef. = −0.124, p < 0.01), indicating that larger firms tend to have lower levels of radical innovation. The average firm age (ListAge) is positively related to radical innovation in Model (1) (coef. = 0.258, p < 0.01), suggesting that older firms engage more in radical innovation, but this relationship weakens and loses significance in Model (2), implying that higher leverage is associated with less radical innovation. The adjusted R2 increases from 0.004 in Model (1) to 0.021 in Model (2), reflecting the added explanatory power from the inclusion of industry and year fixed effects.

Table 3.

Baseline regression results.

5.3. Moderating Effect Results

To test the moderating effects of innovation orientation (DIO) and market competition (WIH), the model incorporates interaction terms SUB × DIO and SUB×IH. The results in Column (1) of Table 4 show that the coefficient for the interaction term SUB × DIO is positive and statistically significant (β = 0.823, p < 0.01), providing strong evidence that innovation orientation positively moderates the relationship between R&D subsidies and radical innovation (Radical). In Column (2), the interaction term SUB×IH remains positive and significant (β = 0.762, p < 0.01), suggesting that higher market competition strengthens the positive impact of R&D subsidies on radical innovation.

Table 4.

Moderating effect results.

This indicates that not only innovation orientation, but also market competition, is pivotal in boosting the effectiveness of R&D subsidies in augmenting radical innovation [55,57]. Firms that focus more on innovation or have a competitive market context are better at translating subsidies into more radical innovation outcomes. Moreover, firm size (Size) is consistently negatively correlated with radical innovation across all models, with a statistically significant coefficient, suggesting that larger firms tend to indulge in less radical innovation.

5.4. Robustness Tests

Following the recommendations of Driscoll and Kraay (1998), we conducted robustness tests using Driscoll–Kraay (D-K) standard errors to address potential autocorrelation and heteroskedasticity issues [57]. The results in Table 5 show that the coefficient on R&D subsidies (SUB) is consistently negative and statistically significant at the 1 per cent level in models (1) and (2). This further confirms that R&D subsidies are negatively associated with radical innovation (Radical), even after accounting for autocorrelation and heteroscedasticity. The adjusted R2 improves from 0.004 in model (1) to 0.023 in model (2), suggesting that the inclusion of industry and year fixed effects increases the explanatory power. These results support the robustness of the findings, confirming that the relationship between R&D subsidies, firm characteristics, and radical innovation holds even when adjusted for Driscoll–Kraay standard errors.

Table 5.

Driscoll–Kraay (D-K) standard errors.

In addition, to reduce the potential impact of the global financial shocks and crises considered in this paper, we exclude 2008 and 2015, two years in which the McKinley scores were significantly affected by the global financial crisis and the Chinese stock market bouncing event. This is because these two years had the most severe financial shocks and the most pronounced impact on financial markets and individual firm performance. Considering the results of the analyses and these dynamics and periods with financial shocks, this steps out of line with our research hypothesis [58]. We tried to exclude these two periods in order to reduce the potential bias introduced by extreme negative periods.

According to the results in Table 6, excluding these years, the core findings of the study do not change. More precisely, the coefficients of SUB remain negative and significant at the 0.127, 0.01 and 0.129, 0.01 levels in both models, which proves that there is a negative correlation between R&D subsidies and the probability of the occurrence of radical innovation. In addition, the negative association between size and radical innovation remains significant in the model: 0.128, 0.05. The explanatory power is almost doubled when industry and year fixed effects are added in Model 2. The adjusted R2 increases from 0.004 in Model 1 to 0.021 in Model 2.

Table 6.

Accounting for global financial shocks and crises.

The robustness check results in Table 7 examine the impact of lagged R&D subsidies (SUB) on radical innovation (FRadical). In Model (1), the coefficient for R&D subsidies is −0.069 *, statistically significant at the 10% level, suggesting a weak negative relationship between subsidies and radical innovation when lagged by one period. In Model (2), the coefficient for R&D subsidies increases to −0.089 **, significant at the 5% level, indicating a stronger negative effect once industry and year fixed effects are included. The adjusted R2 increases from 0.006 in Model (1) to 0.024 in Model (2), showing that the inclusion of fixed effects enhances the model’s explanatory power. Overall, the results confirm that R&D subsidies negatively affect radical innovation, with the impact becoming more pronounced after controlling for industry- and year-specific factors.

Table 7.

Lagged R&D subsidies.

This robust test in Table 8 was conducted to address the potential impact of the total patent counts on the relationship between R&D subsidies and radical innovation. By using the invention patents as a proportion of total patents (Invent), we mitigate the influence of total patent counts on the results, focusing more on the degree of radical innovation represented by invention patents. In both models (1) and (2), the coefficient for R&D subsidies (SUB) is negative and statistically significant at the 5% level (t = −2.319 and −2.336, respectively). This finding indicates that R&D subsidies negatively affect radical innovation, as measured by the proportion of invention patents to total patents. This supports our hypothesis that subsidies, often directed at encouraging incremental innovation, inadvertently hinder firms from pursuing more radical innovations.

Table 8.

Alternative dependent variable measurement results.

6. Conclusions and Implications

6.1. Conclusions

This study examines the impact of R&D subsidies on radical innovation from the perspectives of innovation orientation and competitive intensity. It examines how R&D subsidies affect firms’ adoption of radical innovation strategies, especially when moderated by firms’ innovation orientation and the intensity of competition in the market. The empirical results reveal the following key findings.

First, R&D subsidies have a negative impact on radical innovation: research confirms that R&D subsidies tend to encourage incremental innovation and reduce the likelihood that firms will pursue radical innovation. This result highlights the potential drawbacks of quantitatively-focused R&D subsidy programs, which may inadvertently steer firms towards less disruptive innovations.

Second, this study finds that innovation orientation moderates the relationship between R&D subsidies and radical innovation: Firms that are highly innovation-oriented are less affected by the adverse effect of R&D subsidies on radical innovation. In particular, for those companies which focus on disruptive technologies, R&D subsidies reduce the disincentive effect of radical innovation.

Third, the competition intensity moderates the relationship between R&D subsidies and radical innovation: This study finds that, in highly competitive environments, R&D subsidies weaken the negative impact on radical innovation. This is because competition drives firms to seek technological differentiation and innovation, thereby mitigating the negative effects of subsidies. The results suggest that the effectiveness of R&D subsidies in promoting radical innovation is influenced by a combination of firm-level strategies, such as innovation orientation, and market conditions, such as the intensity of competition. Financial models demonstrate a clearer and extensive quantification of the mechanics at work, which offer important insights for policymakers to implement subsidy programs that drive more transformative innovation outcomes.

6.2. Theoretical Contributions

This study makes several key theoretical contributions to the understanding of the relationship between R&D subsidies and radical innovation, particularly in the context of innovation orientation and competition intensity.

First, this study has deepened the understanding of firms’ innovation behavior by introducing innovation orientation as a moderating factor. From a financial mathematics perspective, analyses of the impact of R&D subsidies on firms’ innovation choices have, in the past, been limited to direct effects. However, this study adopts a more sophisticated approach by considering how firms’ internal capabilities and strategic focus on radical versus incremental innovation change their response to subsidies. By applying financial modeling techniques, we find that a firm’s innovation strategy can be viewed as a dynamic optimization problem, with R&D subsidies altering the cost–benefit analysis of a firm’s choice between different types of innovation. This insight expands the understanding of how firms optimize their R&D investments according to their strategic orientation, highlighting the role of the financial decision-making process in shaping innovation outcomes.

Second, this study contributes to the theory of competitive dynamics in innovation by introducing competitive intensity as a moderating variable. We show how different levels of competition affect firms’ willingness to pursue radical innovations in the presence of R&D subsidies. In highly competitive environments, firms tend to view innovation as a strategic necessity to achieve differentiation and are therefore more likely to innovate radically despite the presence of subsidies. This study applies to the financial risk–return framework to model how subsidies affect the expected returns to radical innovation in different competitive environments. The study shows that in less competitive environments, firms have lower expected returns from radical innovations and therefore prefer to focus on incremental improvements, which are perceived as less risky.

Third, the study extends the dynamic capabilities theory by demonstrating how firms with varying innovation orientations and competitive pressures develop distinct capabilities to exploit R&D subsidies for either incremental or radical innovation. This contribution highlights that firms with different risk appetites, based on their innovation orientation and market position, make distinct financial decisions regarding the allocation of R&D resources. These decisions can be modeled as a dynamic stochastic process where the firm’s risk profile, external competition, and innovation orientation dictate the expected payoff structure of R&D investments. This theoretical extension provides a quantitative lens through which one can view how R&D subsidies affect the strategic direction of innovation, emphasizing the importance of financial optimization in the innovation process. By integrating financial modeling approaches into the analysis of R&D subsidies and innovation outcomes, this study provides a more nuanced understanding of how external financial incentives interact with internal strategic orientations to shape innovation decisions. It contributes to the growing body of literature on innovation policy by providing tools to quantitatively assess the trade-offs firms face when deciding how to allocate resources for innovation in different market environments.

6.3. Practical Contributions

This should prompt policymakers to put their effort with R&D subsidies into more high-risk, long-term R&D projects instead of incremental innovations, to promote radical innovation. (Research subsidies of existing technologies should promote breakthroughs, rather than the number of patents or slight improvements; funding should be tied to hitting major tech milestones.) By doing so, innovation quality is highlighted, which may drive companies to invest more in disruptive innovation rather than focusing on the number of innovation outputs. This approach better reflects that the aim is to foster radical innovation, which is best supported with flexible financial vehicles, rather than subsidies.

First, to create a step-change direction of innovation policy, government policies must incentivize firms to invest in breakthrough rather than incremental innovations. Governments could, for example, implement training programs to direct executives’ attention to exploratory R&D. In addition, providing tax incentives or subsidies for firms that emphasize exploratory R&D activities can help align firms’ strategies with radical innovation. Firms seeking radical technological change ought to encourage collaborations between research and industry, in order to create environments in which firms are incentivized to innovate in radical ways.

Second, market competition should be increased, especially in those areas where firms are likely engaged in just incremental innovation to make competition more effective for innovation. Organizing innovation competitions or challenges that require firms to develop radical innovations in response to market demands can also inspire firms to apply R&D subsidies to game-changing technologies. Greater competition provides firms the incentive to pursue radical innovation in order to stand out in the market.

Third, by aligning R&D subsidy programs with the innovation orientation of firms and by fostering a competitive environment, governments can create an ecosystem that better supports radical innovation. These measures will ensure that R&D subsidies provide not only financial support but also a catalyst for disruptive technological advances.

6.4. Limitations and Future Research

There are some limitations to this study that suggest future research directions. First, although the direct relationship between R&D subsidies and radical innovation is the focus, the crucial roles of political connections are not taken into account. Future works may study how the political connections could change through time or the impact on innovation strategy.

Secondly, while the study considers innovation orientation and competition intensity as moderators, it does not discuss other factors that may be relevant, including corporate governance and management characteristics. Future studies may investigate how leadership styles, management choices, or governance mechanisms could affect the effectiveness of R&D subsidies at spurring radical innovation.

Third, this study is conducted on Chinese firms only, so the generalizability of the findings could be a concern. Future work could include samples from other countries or regions, probing whether the findings replicate under different political and economic settings, as well as how government support, competition, and innovation orientation relate in such contexts.

Author Contributions

Conceptualization, X.H. and X.W.; methodology, X.H. and X.W.; formal analysis, X.H. and S.W.; investigation, S.W. and B.Z.; writing—original draft preparation, X.H. and X.W.; writing—review and editing, X.H., S.W., B.Z. and X.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data presented in this study are available in China National Intellectual Property Administration (CNIPA) and China Stock Market and Accounting Research (CSMAR) database (https://data.csmar.com/).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Wu, F.-S.; Tsai, C.-C.; Wu, C.-H.; Lo, T.-H. An exploratory study of breakthrough innovations in digital businesses: The case of the Perfect Corporation. Technol. Forecast. Soc. Change 2024, 201, 123233. [Google Scholar] [CrossRef]

- Wang, S.; Yan, Y.; Li, H.; Wang, B. Whom you know matters: Network structure, industrial environment and digital orientation. Technol. Forecast. Soc. Change 2024, 206, 123493. [Google Scholar] [CrossRef]

- Strupinski, J.; Witek-Hajduk, M. Relationships between high-tech SME suppliers and foreign buyers: Effects of relational trust, relationship-specific investments and contract specificity on product innovation. Eur. J. Innov. Manag. 2024. [Google Scholar] [CrossRef]

- Stojčić, N.; Dabić, M.; Kraus, S. Customisation and co-creation revisited: Do user types and engagement strategies matter for product innovation success? Technovation 2024, 134, 103045. [Google Scholar] [CrossRef]

- Stettler, T.R.; Moosauer, E.J.; Schweiger, S.A.; Baldauf, A.; Audretsch, D. Absorptive capacity in a more (or less) absorptive environment: A meta-analysis of contextual effects on firm innovation. J. Prod. Innov. Manag. 2025, 42, 18–47. [Google Scholar] [CrossRef]

- Neukam, M.; Bollinger, S. Encouraging creative teams to integrate a sustainable approach to technology. J. Bus. Res. 2022, 150, 354–364. [Google Scholar] [CrossRef]

- Spanjol, J.; Noble, C.H.; Baer, M.; Bogers, M.L.; Bohlmann, J.; Bouncken, R.B.; Bstieler, L.; De Luca, L.M.; Garcia, R.; Gemser, G. Fueling innovation management research: Future directions and five forward-looking paths. J. Prod. Innov. Manag. 2024, 41, 893–948. [Google Scholar] [CrossRef]

- Howell, S.T. Financing innovation: Evidence from R&D grants. Am. Econ. Rev. 2017, 107, 1136–1164. [Google Scholar]

- Pan, X.; Chen, X.; Qiu, S. Pushing boundaries or overstepping? Exploring the paradoxical impact of radical innovation on government subsidies in Chinese SMEs. Technovation 2024, 132, 102988. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Zhang, M.M.; Zhu, J.C.; De Cieri, H.; McNeil, N.; Zhang, K. Innovation-enhancing HRM, employee promotive voice and perceived organizational performance: A multilevel moderated serial mediation analysis. Pers. Rev. 2024, 57, 1861–1884. [Google Scholar] [CrossRef]

- Pavitt, K. Sectoral patterns of technical change: Towards a taxonomy and a theory. Res. Policy 1984, 13, 343–373. [Google Scholar] [CrossRef]

- Antonczak, L.; Bureth, A.; Burger-Helmchen, T. Unveiling Keith Pavitt as a pioneer of innovation-as-practice. J. Manag. Hist. 2025. [Google Scholar] [CrossRef]

- Yuan, K.; Wang, C.; Wu, G. Range Coopetition: NEV Automakers’ Strategies Under Dual Credit Policy Influences. J. Knowl. Econ. 2024, 1–37. [Google Scholar] [CrossRef]

- Yu, J.; Mao, Y.; Guo, P. Firm export, trade war, and R&D investment of family firm. Small Bus. Econ. 2024, 64, 531–547. [Google Scholar]

- Sun, B.; Zhang, Y.; Zhao, Y.; Mao, H.; Kang, M.; Liang, T. Does continuous innovation failure lead firm innovation to hesitate to press forward?: Evidence from Chinese-listed technology-intensive industries firms. J. Bus. Res. 2025, 186, 114986. [Google Scholar] [CrossRef]

- Xu, L.; Li, Z. The impact of “Internet plus” enterprises on municipal solid waste classification and social welfare: An example from China. Technol. Forecast. Soc. Change 2024, 200, 123185. [Google Scholar] [CrossRef]

- Liu, G.; Chen, Y.; Ko, W.W. The influence of marketing exploitation and exploration on business-to-business small and medium-sized enterprises’ pioneering orientation. Ind. Mark. Manag. 2024, 117, 131–147. [Google Scholar] [CrossRef]

- Ren, X.; Li, W.; Li, Y. Climate risk, digital transformation and corporate green innovation efficiency: Evidence from China. Technol. Forecast. Soc. Change 2024, 209, 123777. [Google Scholar] [CrossRef]

- Smojver, V.; Štorga, M.; Zovak, G. Exploring knowledge flow within a technology domain by conducting a dynamic analysis of a patent co-citation network. J. Knowl. Manag. 2021, 25, 433–453. [Google Scholar] [CrossRef]

- Pellens, M.; Peters, B.; Hud, M.; Rammer, C.; Licht, G. Public R&D investment in economic crises. Res. Policy 2024, 53, 105084. [Google Scholar]

- Chen, H.; Yao, Y.; Zan, A.; Carayannis, E.G. How does coopetition affect radical innovation? The roles of internal knowledge structure and external knowledge integration. J. Bus. Ind. Mark. 2021, 36, 1975–1987. [Google Scholar] [CrossRef]

- Salerno, M.S.; Barbosa, A.P.P.L.; Lasmar, T.P.; O’Connor, G.C. Resourcing radical innovation: Leveraging from the mainstream to create the newstream. Technovation 2025, 139, 103126. [Google Scholar] [CrossRef]

- Rouyre, A.; Fernandez, A.-S.; Bruyaka, O. Big problems require large collective actions: Managing multilateral coopetition in strategic innovation networks. Technovation 2024, 132, 102968. [Google Scholar] [CrossRef]

- Tian, Q.; Cao, G.; Weerawardena, J. Strategic use of social media in new product development in B2B firms: The role of absorptive capacity. Ind. Mark. Manag. 2024, 120, 132–145. [Google Scholar] [CrossRef]

- Mora-Contreras, R.; Carrillo-Hermosilla, J.; Hernández-Salazar, G.; Torres-Guevara, L.E.; Mejia-Villa, A.; Ormazabal, M. Eco-innovation for circular economy and sustainability performance: Insights and evidence from manufacturing firms. Bus. Strateg. Environ. 2025, 34, 1231–1256. [Google Scholar] [CrossRef]

- Ma, D.; Wu, W. Experience as a double-edged sword: CEO experience and power on breakthrough innovation. Manag. Decis. 2025, 63, 338–367. [Google Scholar] [CrossRef]

- Li, Q.; Li, J.; Luo, Y. The impact of research and development internationalisation on environmental, social and governance: Evidence from emerging market multinational enterprises. Bus. Strateg. Environ. 2024, 33, 6451–6467. [Google Scholar] [CrossRef]

- Liu, Y.; Ying, Z.; Ying, Y.; Wang, D.; Chen, J. Artificial intelligence orientation and internationalization speed: A knowledge management perspective. Technol. Forecast. Soc. Change 2024, 205, 123517. [Google Scholar] [CrossRef]

- Liu, Z.; Zhou, J.; Li, J.; Ma, X. More is less: The dual role of government subsidy in firms’ new product development. J. Bus. Res. 2024, 185, 114908. [Google Scholar] [CrossRef]

- David, P.A. Clio and the Economics of QWERTY. Am. Econ. Rev. 1985, 75, 332–337. [Google Scholar]

- Arthur, W.B. Competing technologies, increasing returns, and lock-in by historical events. Econ. J. 1989, 99, 116–131. [Google Scholar] [CrossRef]

- Yan, W.Y.; Loang, O.K. Building a research model for the relationship between enterprise innovation values and employees’ innovation behavior: With innovation self-efficacy as a mediator. In Technology-Driven Business Innovation: Unleashing the Digital Advantage, Volume 1; Springer: Berlin/Heidelberg, Germany, 2024; pp. 55–65. [Google Scholar]

- Valero-Gil, J.; Suárez-Perales, I.; Garcés-Ayerbe, C.; Rivera-Torres, P. Navigating toward the promised land of digitalization and sustainability convergence. Technol. Forecast. Soc. Change 2024, 202, 123283. [Google Scholar] [CrossRef]

- Wang, C.; Thai, M.T.T. Entrepreneurial orientation in the social network age: Navigating with dynamic capabilities and cognitive flexibility. Ind. Mark. Manag. 2024, 121, 100–114. [Google Scholar] [CrossRef]

- Tang, K.; Wang, Y.-y.; Wang, H.-j. The impact of innovation capability on green development in China’s urban agglomerations. Technol. Forecast. Soc. Change 2024, 200, 123128. [Google Scholar] [CrossRef]

- Shehzad, M.U.; Jianhua, Z.; Naveed, K.; Zia, U.; Sherani, M. Sustainable transformation: An interaction of green entrepreneurship, green innovation, and green absorptive capacity to redefine green competitive advantage. Bus. Strateg. Environ. 2024, 33, 7041–7059. [Google Scholar] [CrossRef]

- Sarmento, M.; Simões, C.; Lages, L.F. From organizational ambidexterity to organizational performance: The mediating role of value co-creation. Ind. Mark. Manag. 2024, 118, 175–188. [Google Scholar] [CrossRef]

- Zhang, C.; Yuan, L.; Yu, X.; Chen, X. The linkage misalignment of productive services and firms’ domestic value-added ratio——Evidence from Chinese micro-firm data. Technol. Forecast. Soc. Change 2024, 199, 123085. [Google Scholar] [CrossRef]

- Wang, S.; Yan, C.; Zhao, Y. Technological peer pressure and corporate sustainability. Energy Econ. 2024, 130, 107257. [Google Scholar] [CrossRef]

- Tiedemann, S.; Müller-Hansen, F. Auctions to phase out coal power: Lessons learned from Germany. Energy Policy 2023, 174, 113387. [Google Scholar] [CrossRef]

- Song, Y.; Xiu, Y.; Zhao, M.; Tian, Y.; Wang, J. Intellectual property protection and enterprise innovation: Evidence from China. Financ. Res. Lett. 2024, 62, 105253. [Google Scholar] [CrossRef]

- Reischauer, G.; Engelmann, A.; Gawer, A.; Hoffmann, W.H. The slipstream strategy: How high-status OEMs coopete with platforms to maintain their digital extensions’ edge. Res. Policy 2024, 53, 105032. [Google Scholar] [CrossRef]

- Otrachshenko, V.; Hartwell, C.A.; Popova, O. Energy efficiency, market competition, and quality certification: Lessons from Central Asia. Energy Policy 2023, 177, 113539. [Google Scholar] [CrossRef]

- Laachach, A. Comparing Radical and Incremental Innovation in Venture Capital Syndication: Exploring the Influence of R&D Intensity and Sector-Specific Effects. J. Knowl. Econ. 2024, 15, 15550–15576. [Google Scholar] [CrossRef]

- Cao, L.Y.; Jiang, H.L.; Li, G.W.; Zhu, L.J. Haste makes waste? Quantity-based subsidies under heterogeneous innovations. J. Monet. Econ. 2024, 142, 12. [Google Scholar] [CrossRef]

- Kratochvil, R. The process of framing innovation activities: How strategic leaders erode their ideas for radical innovations. Res. Policy 2025, 54, 105107. [Google Scholar] [CrossRef]

- Cheng, L.; Wang, X.H.; Zhang, S.P.; Zhao, M.L. On corporate total factor productivity: Public procurement. Manag. Decis. 2025, 63, 76–100. [Google Scholar] [CrossRef]

- Li, G.W.; Branstetter, L.G. Does “Made in China 2025” work for China? Evidence from Chinese listed firms. Res. Policy 2024, 53, 14. [Google Scholar] [CrossRef]

- Li, S.; Hu, J.; Cui, Y.; Hu, J. DeepPatent: Patent classification with convolutional neural networks and word embedding. Scientometrics 2018, 117, 721–744. [Google Scholar] [CrossRef]

- Calabrese, A.; Costa, R.; Haqbin, A.; Ghiron, N.L.; Tiburzi, L. How do companies adopt open innovation to enable circular economy? Insights from a qualitative meta-analysis of case studies. Bus. Strateg. Environ. 2024, 33, 6852–6868. [Google Scholar] [CrossRef]

- Alkaraan, F.; Elmarzouky, M.; Jabbour, A.; Jabbour, C.J.C.; Gulko, N. Maximising sustainable performance: Integrating servitisation innovation into green sustainable supply chain management under the influence of governance and Industry 4.0. J. Bus. Res. 2025, 186, 15. [Google Scholar] [CrossRef]

- Bimmermann, C.; Greven, A.; Fischer-Kreer, D.; Brettel, M. Exploring the dark side of inter-firm coopetition: The harmful effect on customer satisfaction. Ind. Mark. Manag. 2024, 122, 13–25. [Google Scholar] [CrossRef]

- Che, J.; Chen, J. Empirical study on marketing investment and business innovation—A case analysis based on small and medium enterprises. Financ. Res. Lett. 2024, 69, 106023. [Google Scholar] [CrossRef]

- Li, Z.; Liu, L. The impact of organizational innovation culture on employees' innovation behavior. Soc. Behav. Personal. Int. J. 2022, 50, 12. [Google Scholar] [CrossRef]

- Driscoll, J.C.; Kraay, A.C. Consistent covariance matrix estimation with spatially dependent panel data. Rev. Econ. Stat. 1998, 80, 549–560. [Google Scholar] [CrossRef]

- Arroyabe, M.F.; Arranz, C.F.; de Arroyabe, J.C.F. The integration of circular economy and digital transformation as a catalyst for small and medium enterprise innovation. Bus. Strateg. Environ. 2024, 33, 7162–7181. [Google Scholar] [CrossRef]

- Chor, D.; Manova, K. Off the cliff and back? Credit conditions and international trade during the global financial crisis. J. Int. Econ. 2012, 87, 117–133. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).