1. Introduction

Competition for CLSCs is intensifying as global companies continue to focus on sustainability and environmental protection. Many companies are developing circular economy models that maximize the life of products through remanufacturing, as well as recycling and reusing materials at the end of their life cycle. Remanufacturing is an important means for the country to achieve the “carbon peak and carbon neutrality” goal and to promote the development of a green economy [

1]. China first proposed the “Dual carbon” goal at the 75th session of the General Assembly of the United Nations. Considering the greenness and economy of remanufacturing, many enterprises and some Original Equipment Manufacturer (OEM) companies, such as Caterpillar, Xerox, EPSON, HP, IBM, and Michelin, have been actively involved in remanufacturing activities [

2,

3]. Remanufactured products not only extend the life cycle of products and reduce resource wastage, but also reduce production costs and environmental impacts. By reusing and reprocessing waste materials, remanufactured products provide an effective way for companies to achieve resource recycling, which helps to reduce carbon emissions and over-exploitation of natural resources. For instance, Nike has developed Nike Grind, a recycled material made from used sports shoes and production waste, which is used in the manufacture of new sports shoes and sports surfaces [

4]. It has recycled 140 million pounds of waste materials since 1992. IKEA reduces resource consumption and environmental impact by recycling and reusing waste furniture materials to produce new furniture products [

5].

Currently, remanufacturing models mainly include independent remanufacturing, outsourced remanufacturing and authorised remanufacturing. Independent remanufacturing refers to the production and sale of new and remanufactured products by OEM and Third-Party Remanufacturer (TPR) respectively, which are independent and compete with each other. Outsourced remanufacturing means that the OEM and the TPR are in a partnership, where the OEM outsources the remanufacturing activities to the TPR, thus focusing on the production of new products, but with pricing power for remanufactured products. For example, Land Rover outsources its remanufacturing activities to Caterpillar [

6]. Authorized remanufacturing is another partnership model where the OEM authorises remanufacturing activities to TPR while the pricing of the remanufactured product is transferred to TPR. However, it is a major challenge for CLSCs to choose the optimal remanufacturing mode in the face of competition. Specifically, we address the following questions:

1. What is the optimal remanufacturing model decision for a CLSC in a competitive market?

2. Which factor, the intensity of market competition or the discount on remanufactured products, has a strong influence on the decision of a CLSC remanufacturing model?

3. When in a competitive market, should a CLSC choose a conservative strategy (aligned with the other party’s strategy) or a risky strategy (not aligned with the other party’s strategy)?

In competitive markets, the choice of remanufacturing model can have a significant impact on the profitability, market positioning, and sustainability of OEMs. The optimal decision depends on a number of key factors, such as unit savings from remanufacturing, competitive intensity, and discount of remanufactured products. In less competitive situations, OEMs may prefer an outsourced remanufacturing model to maximize control over pricing and quality. However, in highly competitive markets, authorized remanufacturing activities to TPRs tend to be more attractive because it allows OEMs to profit from licensing fees while avoiding a direct price war.

The intensity of market competition and the discount of remanufactured products both influence decision-making, but their relative importance varies. In markets with fierce competition, OEMs are more likely to adopt an authorized remanufacturing mode to stabilize prices and reduce rivalry. Conversely, when consumers highly value remanufactured products (i.e., the discount is small), OEMs may prioritize capturing the secondary market through outsourced remanufacturing. The balance between these factors determines whether an OEM should compete, cooperate, or abstain from remanufacturing altogether.

The choice between conservative and risky strategies depends on market stability and risk tolerance. A conservative approach—aligning with competitors’ strategies—reduces uncertainty and is preferable in volatile markets. However, if an OEM has a strong cost advantage or superior brand reputation, a risky strategy can lead to higher profits.

The rest of this paper is organized as follows:

Section 2 reviews the relevant literatures.

Section 3 introduces the notations and models used later on.

Section 4 builds six Stackelberg models, respectively, and solves for the decision variables and the profit equilibrium solution for each subject.

Section 5 introduces numerical experiments, which include the CLSC’s remanufacturing mode selection, impact of each parameter on decision-making, and profits of CLSCs.

Section 6 includes some discussion and conclusions. The proofs of all corollaries are given in

Appendix A.

3. Model

To examine competitive decision-making in CLSCs, we developed a Prisoner’s dilemma framework involving two parallel CLSCs, each consisting of an OEM and a Third-Party Remanufacturer (TPR) producing substitute products. The model distinctly segregates production responsibilities: OEMs exclusively manufacture new products while TPRs specialize in remanufactured products, with both distributing directly to consumers. This segregation ensures clarity and efficiency in the production processes within each CLSC. Each CLSC offers three distinct remanufacturing models: independent remanufacturing, outsourced remanufacturing, and authorised remanufacturing, so there are nine strategies in total. Because the two CLSC costs are homogeneous, the profit matrix is symmetric along the diagonal, and this paper unfolds the six strategies: Model II, Model IO, Model IA, Model OO, Model OA and Model AA, which are structured as shown below

Figure 1. Our study specifically explored how remanufactured product unit saving costs affect remanufacturing model decisions across varying levels of market competition intensity and remanufactured product discounts, providing comprehensive insights into competitive CLSC dynamics.

The main assumptions about costs, product life, consumers, authorised remanufacturing mode and outsourced remanufacturing mode in this paper are as follows.

Table 2 shows the notations used in this paper.

Let

s and

c denote the unit saving costs of new and remanufactured products and unit production costs of the new products, respectively. According to the related literature [

38], the cost of manufacturing remanufactured products is lower than the cost of manufacturing new products, that is,

s exists and satisfies:

. The inequality ensures the economic viability of remanufacturing, while it reflects the fundamental cost advantage that makes remanufacturing an attractive alternative to conventional production.

All events take place within a single period. We presume the product was already present in the market. The quantity of remanufactured products should not exceed that of used products that can be gathered from consumers within a single period [

39]. Therefore, the new and remanufactured product quantities satisfy:

.

Consumers’ willingness to pay

v for new products is assumed to obey a uniform distribution on

. Specifically, the net utility gained by consumers from purchasing the new product is

. Consistent with the related literatures [

40,

41], consumers generally have a lower willingness-to-pay for remanufactured products. The consumer’s valuation discount on remanufactured products is denoted by

. The consumer’s net utility from purchasing remanufactured products is

. Furthermore,

indicates the intensity of competition in the market, and as the value increases, the competition becomes more intense [

42]. A consumer possesses a maximum of one item, either new or remanufactured, with the market size standardized to 1. Therefore, the inverse demand function of the new and remanufactured products of two products can be formulated as follows:

In order to acquire authorization for selling remanufactured products, the TPR must pay the unit authorizing fee

or

() to the OEM [

43]. This fee is an exogenous variable set by the OEM and remains unaffected by the demand for remanufactured products; OEM outsourcing the production of remanufactured products to TPR is required to pay the unit outsourcing fee

or

(

) to TPR [

19]. This fee is an exogenous variable set by the TPR and remains unaffected by the demand for remanufactured products.

5. Numerical Analysis

In this Section we used numerical experiments to analyze the equilibrium solutions from

Section 4. The intensity of market competition

takes values between (0, 1). When

is close to 0, there is almost no substitutability of products. Taking

allows for the most intensely competitive markets; taking

reflects a partially homogeneous market, which is consistent with the classical duopoly model of competition, such as the automobile industry (e.g., Toyota vs. Honda) [

44]; and the interval of 0.3 clearly distinguishes the degree of competition, so we take

[

45,

46,

47]. When

, products are highly differentiated and competition is weak—e.g., Rolex vs. Patek Philippe—with brand reputation and unique features limiting direct price competition [

48]. The discounts of remanufactured products

reflect consumers’ willingness to pay for a remanufactured product relative to a new product. The higher

indicates a lower level of discounting. When

, remanufactured products face steep discounts. For instance, recycled automotive components like alternators that cost even more to recycle than new products [

49]. At

, we observed moderate discounts common for certified refurbished consumer electronics such as smartphones or laptops, where professional refurbishment and limited warranties help maintain about half the value of new devices [

50]. The highest

value (0.8) applies to premium remanufactured goods that retain most of their functionality and brand value, exemplified by networking equipment like Cisco routers [

51]. These differential discount rates are well-documented in the literature [

40,

41], our choice of

can cover most market situations. In order to satisfy the two conditions that both decision variables are greater than 0 and the number of new products is greater than the number of remanufactured products,

s needs to be satisfied:

, fixing

[

14,

41].

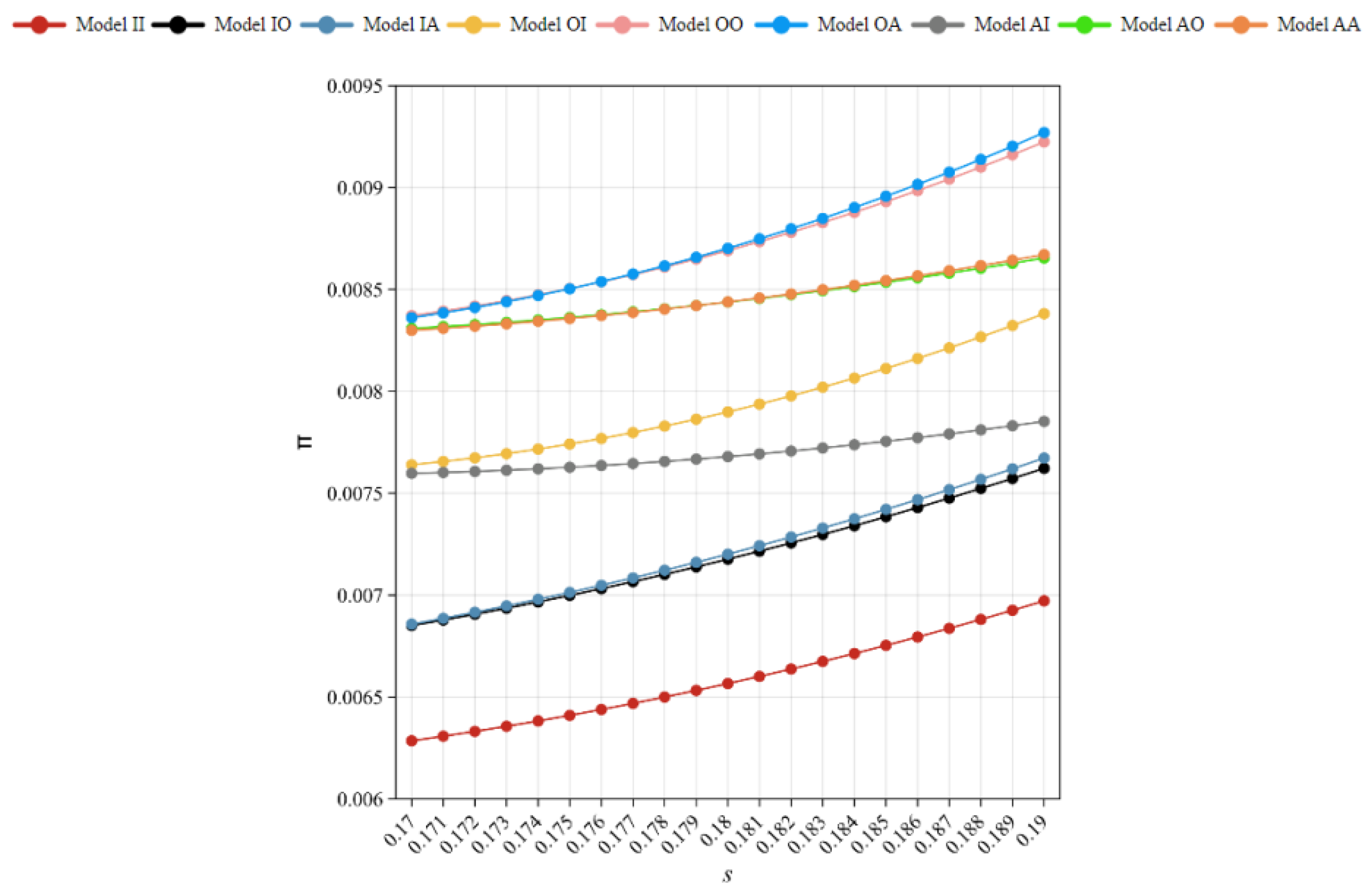

We first explore the low-competition and high-discount scenario, where the competition intensity is low

and the discount factor is high

. This situation represents an industry environment with limited competitive pressure but substantial production cost savings in remanufacturing, which may reduce manufacturers’ incentives for proactive remanufacturing investments. In this setting,

s takes the range

(See

Appendix A for details), testing how unit savings affect behavior.

Corollary 1. In a low-competition, high-discount market environment, CLSC can maximize own profits by choosing outsourced remanufacturing mode.

(1)

, take

, the profits of the CLSC remanufacturing model are as follows

Table 3:

(2) Take

, the profits of the CLSC remanufacturing model are as follows

Table 4:

(3)

, take

, the profits of the CLSC remanufacturing model are as follows

Table 5:

Combined with the analysis of the Nash equilibrium scribing method in

Figure 2, it can be concluded that the optimal strategy is the outsourcing remanufacturing mode under the condition of low competition and high discount. This is because in the case of high discounts, the profit obtained by remanufacturing is very small, and there is no need to invest too much effort in the remanufacturing market. By outsourcing remanufacturing activities, OEMs can not only seize the remanufactured market, but also concentrate on producing new products, thereby gaining a greater advantage in a low-competition market.

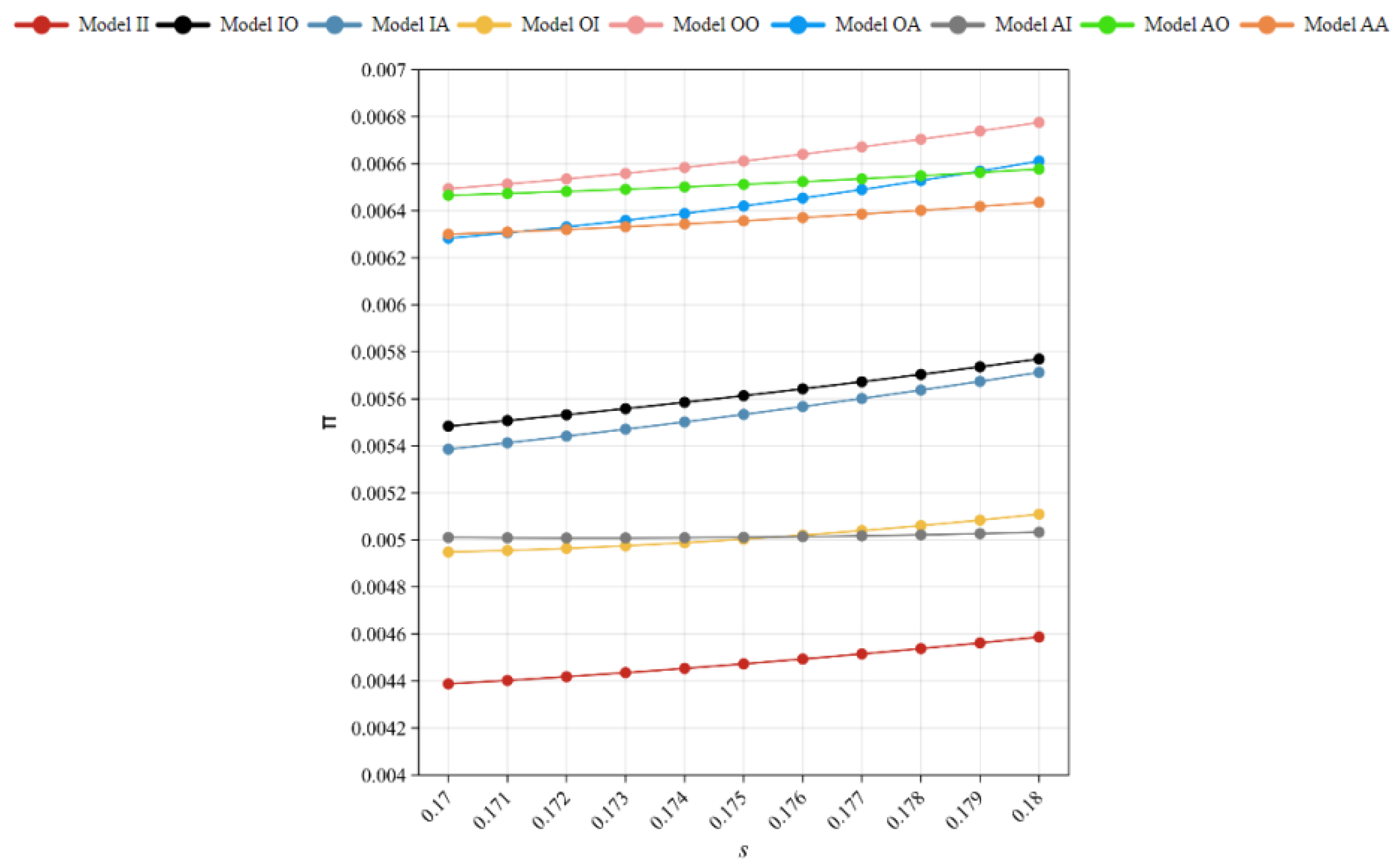

We next examine the low-competition and mid-discount scenario, where competition intensity remains low while the remanufacturing discount factor is moderate . This reflects a market with limited rivalry but a balanced cost advantage for remanufactured products, resulting in intermediate incentives for strategic investments in remanufacturing. In this situation, . The following corollary can be made:

Corollary 2. The optimal strategy for CLSC in a low-competition, mid-discount market is outsourced remanufacturing mode.

(1)

, take

, the profits of the CLSC remanufacturing model are as follows

Table 6:

(2) Take

, the profits of the CLSC remanufacturing model are as follows

Table 7:

(3)

, take

, the profits of the CLSC remanufacturing model are as follows

Table 8:

(4) Take

, the profits of the CLSC remanufacturing model are as follows

Table 9:

(5)

, take

, the profits of the CLSC remanufacturing model are as follows

Table 10:

As

Figure 3, OEMs are still willing to focus on new products to improve market competitiveness when there is low-competition and mid-discount. Due to higher consumer preference for remanufactured products, OEMs prefer to retain pricing power over remanufactured products when handing over remanufacturing activities to Third-Party Remanufacturers (TPRs), i.e., they prefer the outsourced remanufacturing model.

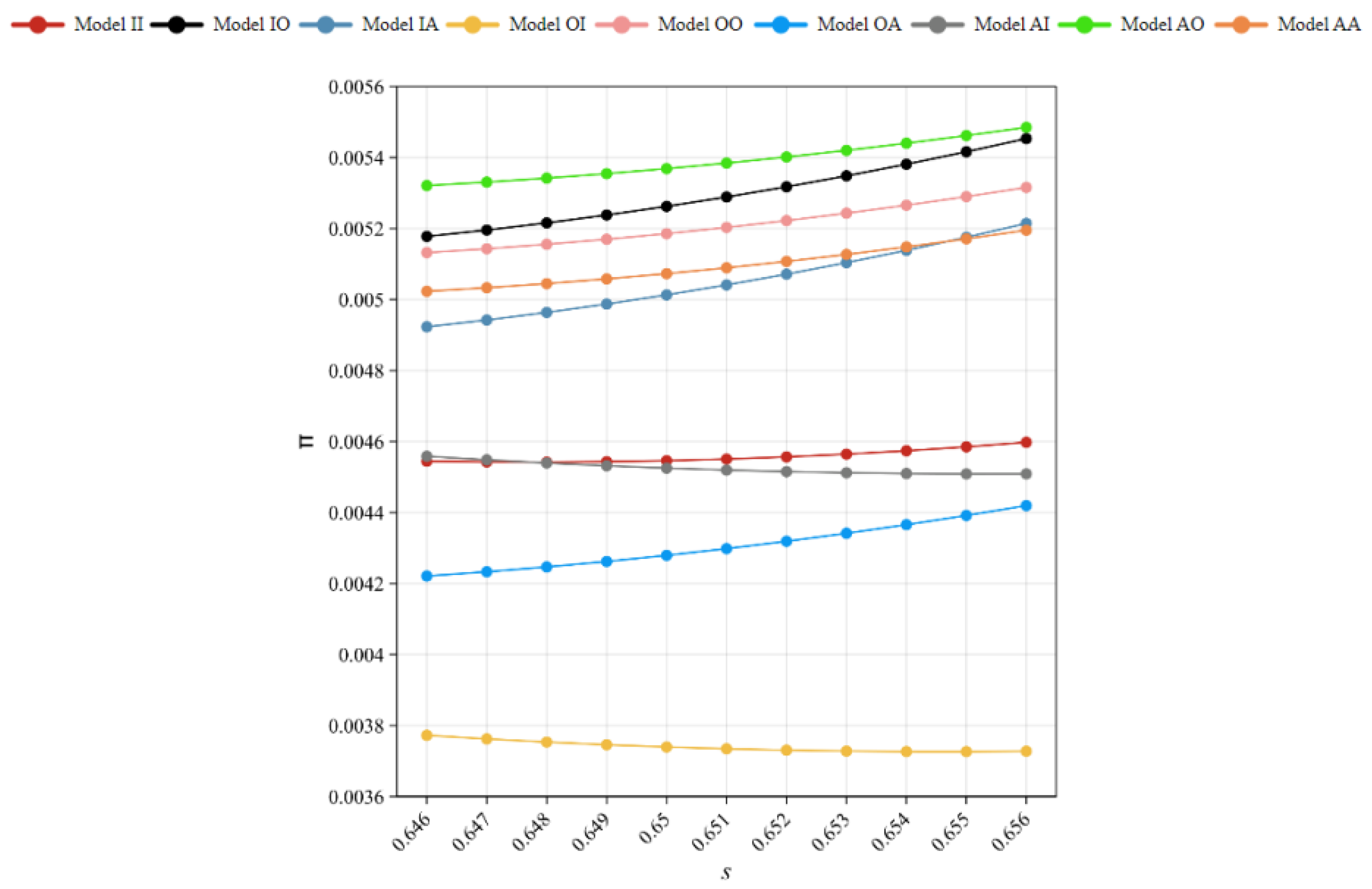

We then investigate the low-competition and low-discount scenario, featuring weak market competition and a modest cost differential between new and remanufactured products . This configuration reflects a market with limited competitive pressure where remanufacturing offers relatively small unit cost savings . Our study focuses on how these specific cost savings affect the CLSCs’ overall profitability.

Corollary 3. The optimal strategy for the CLSC in the low-competition, low-discount scenario is still outsourced remanufacturing mode.

(1)

, take

, the profits of the CLSC remanufacturing model are as follows

Table 11:

(2) Take

, the profits of the CLSC remanufacturing model are as follows

Table 12:

(3)

, take

, the profits of the CLSC remanufacturing model are as follows

Table 13:

When competition is low, OEMs prefer third-party remanufacturing (as

Figure 4). Mid-discount and low-discount have little effect on the OEM’s remanufacturing model decision, and the OEM still prefers the outsourced remanufacturing model.

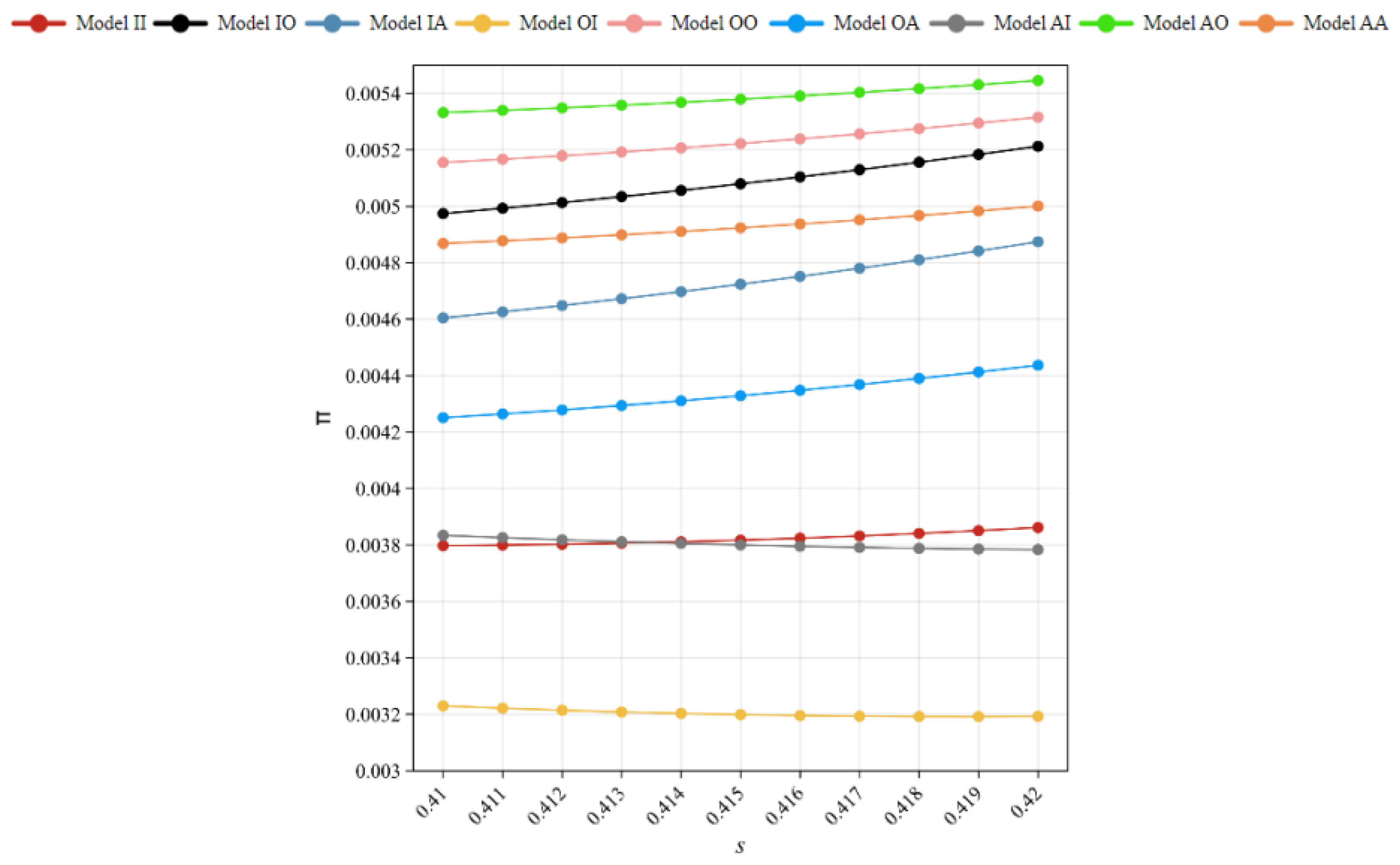

We next analyze the mid-competition and high-discount scenario, characterized by moderate market competition coupled with significant cost advantages for remanufactured products . This parameter configuration depicts an industry environment with balanced competitive pressure where remanufacturing offers substantial unit cost savings. In this scenario, .

Corollary 4. The optimal strategy for CLSC when in a mid-competition, high-discount market is authorised remanufacturing mode.

(1)

, take

, the profits of the CLSC remanufacturing model are as follows

Table 14:

(2) Take

, the profits of the CLSC remanufacturing model are as follows

Table 15:

(3)

, take

, the profits of the CLSC remanufacturing model are as follows in

Table 16:

As shown in the above

Figure 5, when in the mid-competition, OEMs will focus more on new product manufacturing to improve competitiveness. Due to the high discount of remanufactured products, OEMs do not tend to take the pricing power of remanufactured products into their own hands, and prefer to authorize thethe remanufacturing model at this time.

We then examine the mid-competition and mid-discount scenario, characterized by balanced market competition and intermediate cost advantages for remanufactured products . This situation represents an industry environment with moderate competitive pressure where remanufacturing provides measurable but not substantial unit cost savings . We can draw the following Corollary:

Corollary 5. In a market with mid-competition and mid-discount, the optimal strategy authorizedzed remanufacturing mode when the unit savings are small; when the savings are large, the optimal strategy is outsourced remanufacturing mode.

(1)

, take

, the profits of the CLSC remanufacturing model are as follows

Table 17:

(2) Take

, the profits of the CLSC remanufacturing model are as follows

Table 18:

(3)

, take

, the profits of the CLSC remanufacturing model are as follows

Table 19:

According to the

Figure 6, when the cost savings are small, the profit margins on remanufactured products are small and OEMs do not tend to retain pricing rights on remanufactured products, thus choosing the authorised remanufacturing model, however, when the cost savings are high, the increase in profit margins makes the OEMs more willing to retain pricing rights, and at this point, they prefer to choose outsourced remanufacturing model.

Our analysis now turns to the mid-competition, low-discount scenario, where market competition maintains a medium intensity level while the cost benefits derived from remanufacturing remain comparatively modest . This particular configuration models an industrial setting that strikes a balance between competitive forces and production economics—sufficient competition exists to influence market dynamics, yet the economic incentives for remanufacturing are constrained by the relatively narrow cost differential between new and remanufactured products, creating distinct operational challenges for CLSC management. In this situation, . The corollary is as follows:

Corollary 6. When the CLSC is in a mid-competition, low-discount market, the optimal strategy is outsourced remanufacturing mode.

(1)

, take

, the profits of the CLSC remanufacturing model are as follows

Table 20:

(2) Take

, the profits of the CLSC remanufacturing model are as follows

Table 21:

(3)

, take

, the profits of the CLSC remanufacturing model are as follows

Table 22:

(4) Take

, the profits of the CLSC remanufacturing model are as follows

Table 23:

(5)

, take

, the profits of the CLSC remanufacturing model are as follows

Table 24:

(6) Take

, the profits of the CLSC remanufacturing model are as follows

Table 25:

(7)

, take

, the profits of the CLSC remanufacturing model are as follows

Table 26:

In this market environment, the huge profits brought by low discounts make OEMs reluctant to give up the remanufacturing market and prefer to control the profit margins by taking the pricing power of remanufactured products into their own hands (as

Figure 7), so they are more inclined to choose the outsourcing remanufacturing model.

We now analyze the high-competition, high-discount scenario, where market competition reaches an elevated intensity level while remanufacturing offers substantial cost advantages . This configuration represents an industrial environment marked by intense competitive pressures coupled with significant economic incentives for remanufacturing—the considerable cost differential between new and remanufactured products creates both opportunities and challenges for CLSC optimization.

Corollary 7. When the CLSC is in a high-competition, high-discount market, the optimal strategy is authorised remanufacturing mode.

(1)

, take

, the profits of the CLSC remanufacturing model are as follows

Table 27:

(2) Take

, the profits of the CLSC remanufacturing model are as follows

Table 28:

(3)

, take

, the profits of the CLSC remanufacturing model are as follows

Table 29:

(4) Take

, the profits of the CLSC remanufacturing model are as follows

Table 30:

(5)

, take

, the profits of the CLSC remanufacturing model are as follows

Table 31:

When in a highly competitive market, the optimal strategy is the authorized remanufacturing model (as

Figure 8), because OEMs can consolidate their position by occupying the market share of new products and remanufactured products, and should not give up the remanufacturing market at this time. However, only by focusing on new product innovation and research and development can they further improve their competitiveness, so OEMs are more inclined to choose the authorized remanufacturing model.

We now examine the high-competition, mid-discount scenario, where market competition reaches an elevated intensity level while remanufacturing maintains intermediate cost advantages . This situation represents an industrial environment characterized by strong competitive pressures alongside measurable but not overwhelming economic incentives for remanufacturing—the moderate cost differential between new and remanufactured products . Firms must navigate intense market rivalry while capitalizing on the available but limited cost benefits of remanufacturing operations.

Corollary 8. When the CLSC is in a high-competition, mid-discount market, the optimal strategy is still authorised remanufacturing mode.

(1)

, take

, the profits of the CLSC remanufacturing model are as follows

Table 32:

(2) Take

, the profits of the CLSC remanufacturing model are as follows

Table 33:

(3)

, take

, the profits of the CLSC remanufacturing model are as follows

Table 34:

According

Figure 9, When in a highly competitive market, high and medium discounts have little impact on the optimal strategy of the CLSC, and OEMs can improve their competitiveness by choosing the authorized remanufacturing model to obtain greater profits.

Finally, we examine the high-competition, low-discount scenario, characterized by intense market competition coupled with minimal cost advantages for remanufactured products . This challenging configuration represents an industrial environment where strong competitive pressures coincide with limited economic incentives for remanufacturing—the narrow cost differential between new and remanufactured products creates particularly complex strategic dilemmas for CLSC management, as firms must contend with fierce market rivalry while operating within constrained opportunities for cost savings through remanufacturing activities.

Corollary 9. When in a market with high-competition and low-discounts, with the increase of unit costs, the optimal decision shifts from the authorized remanufacturing model to the outsourcing remanufacturing model.

(1)

, take

, the profits of the CLSC remanufacturing model are as follows

Table 35:

(2) Take

, the profits of the CLSC remanufacturing model are as follows

Table 36:

(3)

, take

, the profits of the CLSC remanufacturing model are as follows

Table 37:

(4) Take

, the profits of the CLSC remanufacturing model are as follows

Table 38:

(5)

, take

, the profits of the CLSC remanufacturing model are as follows

Table 39:

On the basis of

Figure 10, the low-discount boosts the profit margins on remanufactured products, and as savings increase, this is offset by the OEM’s resistance to remanufactured products in a high-competition scenario, making all three strategies potentially optimal decisions possible.