Sustainable Operations: Risk Evolution and Diversification Strategies Throughout the Lifecycle of Wind Energy Public–Private Partnership Projects

Abstract

1. Introduction

2. Research Process and Methods

2.1. Research Process

2.2. Research Methods

3. Construction of a Risk Index System

3.1. Induction and Analysis of Risk Factors Based on the Literature

3.1.1. Preliminary Identification of Risk Factors

3.1.2. Identification and Definition of Risk Factors

3.2. Analysis Model Based on System Dynamics

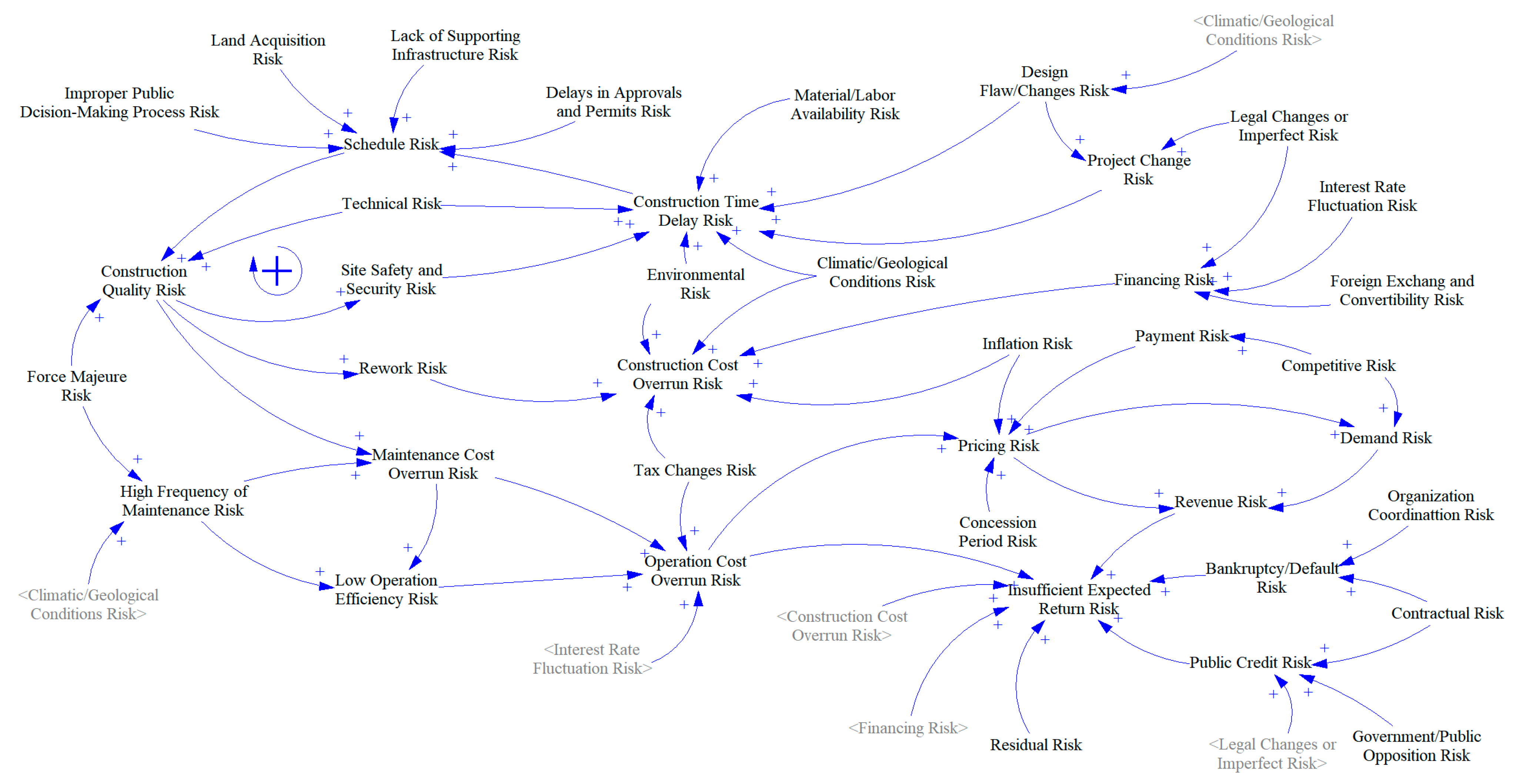

3.2.1. Causal Feedback Diagram of Wind Energy PPP Project Risks

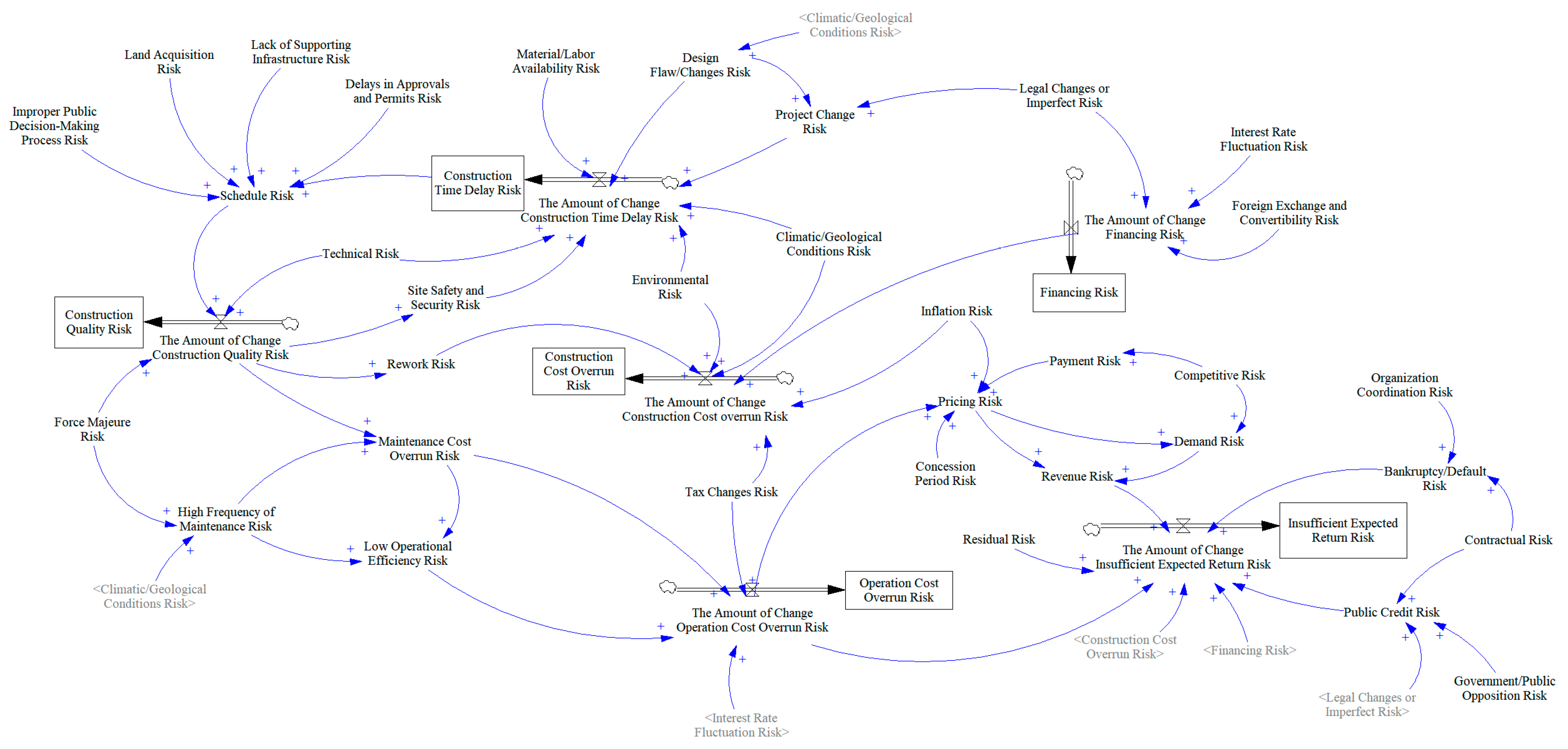

3.2.2. Stock–Flow Diagram of Wind Energy PPP Project Risks

3.3. Boundary and Subsystem Risk Analysis

3.3.1. Identification of Boundary Risks

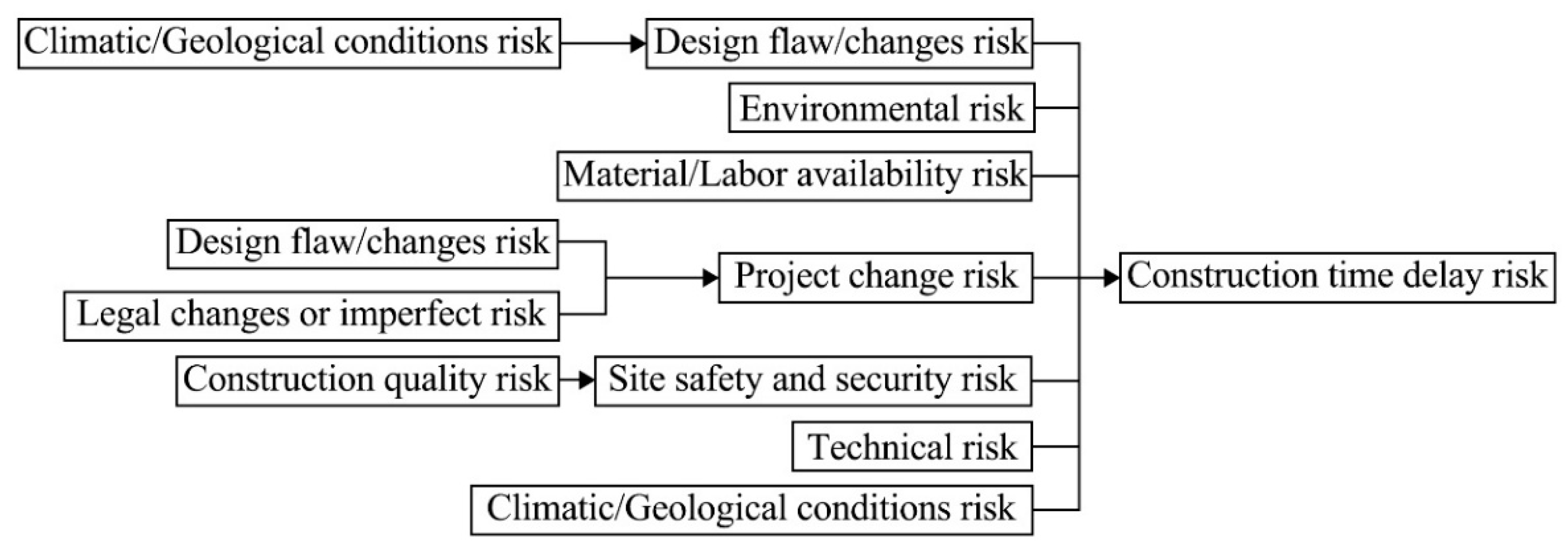

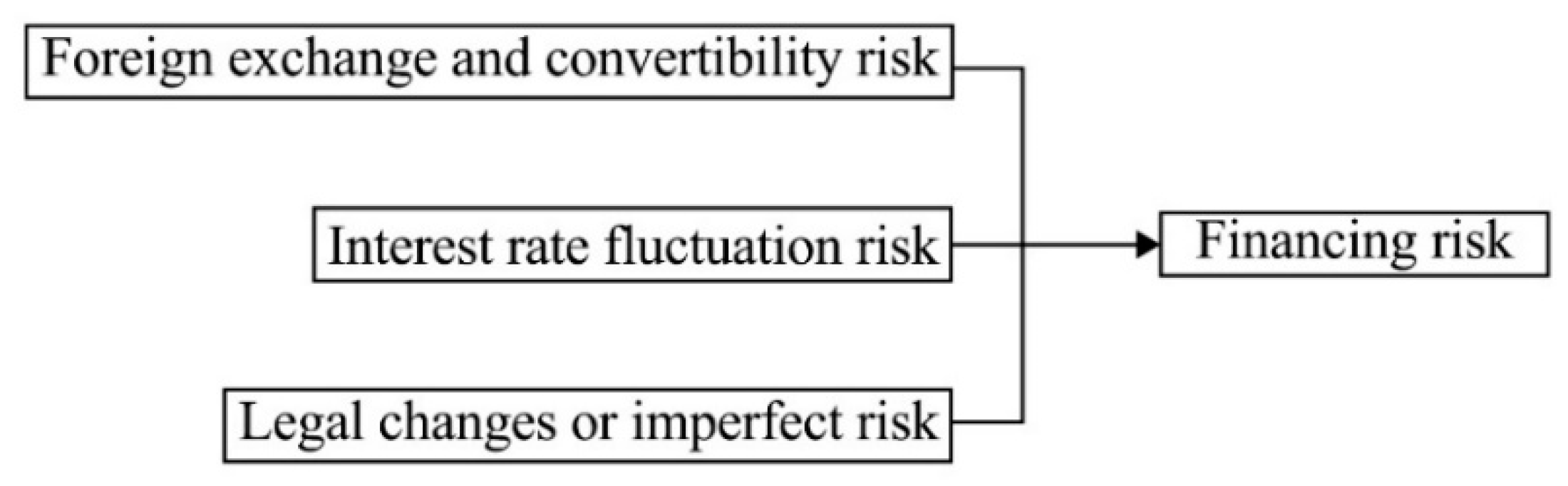

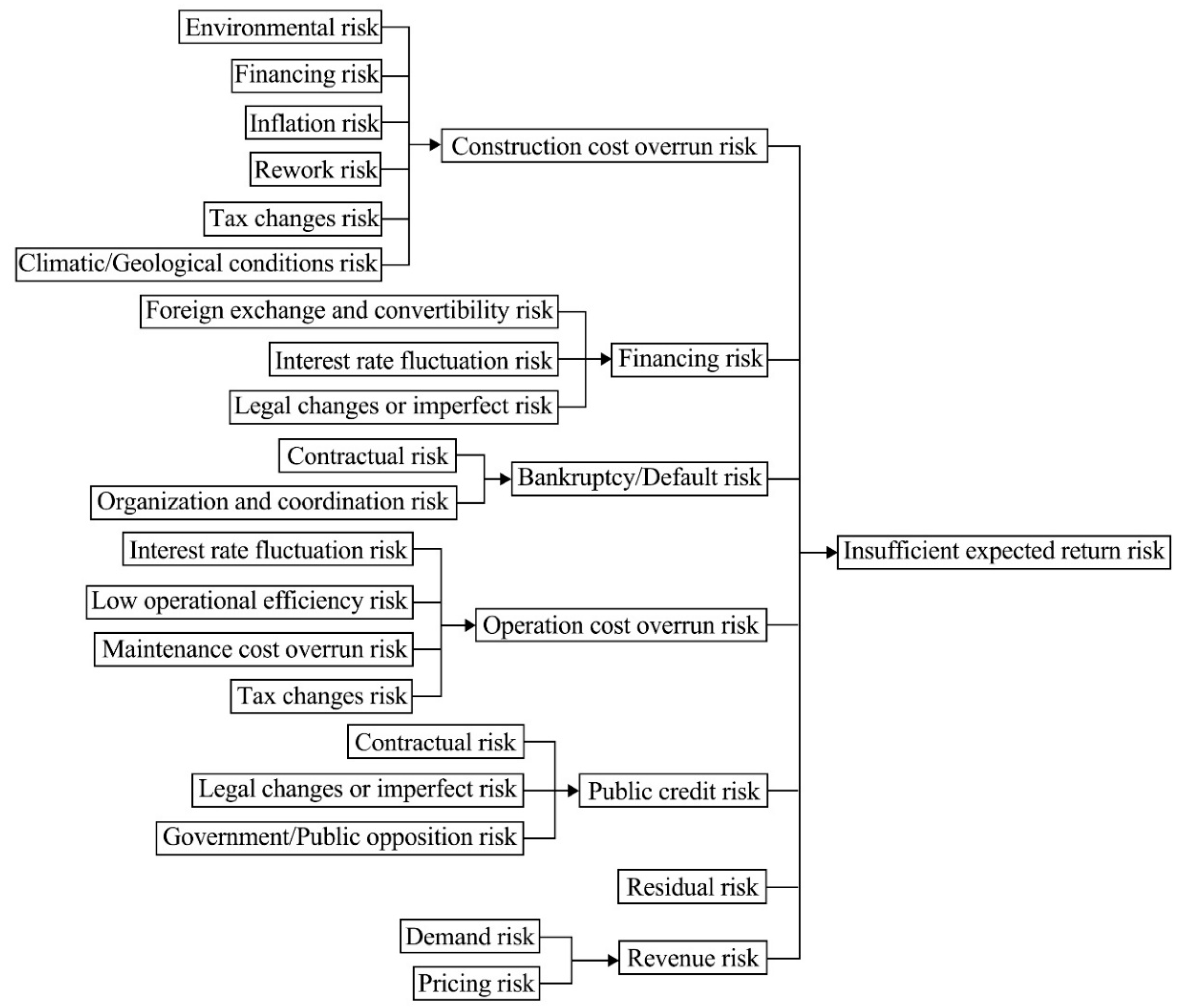

3.3.2. Subsystem Risk Cause Tree Analysis

4. Calculation of Risk Weights and Construction of a Dynamic Risk Model

4.1. Questionnaire Survey and Data Collection

4.2. Calculation of Risk Factor Weight Coefficients

- (1)

- Subjective Weighting Method

- (2)

- Objective Weighting Method

4.2.1. Calculation Using the Improved G1 Method

- ①

- Expert scoring. Scores for the importance of adjacent indicators are collected through survey questionnaires from experts. Please refer to Table A4 in Appendix B for the scoring standards; higher values indicate greater importance of the indicators.

- ②

- Ranking the importance of evaluation indicators. According to the score of the -th expert on the importance of the indicator, according to the size of the score to rank, such as the indicator , the importance score, , is greater than the importance of the indicator score, , and then it is recorded as , and the ranking of importance is as follows:

- ③

- Ratio of importance for adjacent indicators. Based on the score of the -th expert on the importance of the evaluation indicator, the ratio of the importance scores of the adjacent indicators is taken as the ratio of the weights, and the ratio of the weights of the evaluation indicator, , to the indicator is described as follows:where is the weight of the indicator, , based on the score of the -th expert.

- ④

- Calculation of indicator weights. The indicator, , is given a weight as follows:The weights of the other indicators can be derived from the recursive formula as follows:where .The weights of each target risk were calculated using the improved G1 weighting method, with the results detailed in Table A5 in Appendix B.

4.2.2. Calculation Using Entropy Method

- ①

- Constructing the matrix. Expert ratings are collected and a scoring matrix, , is constructed as follows:

- ②

- Quantification of risk indicators. Quantify the risk indicators in the matrix as follows:

- ③

- Calculate the risk factor entropy value, . Calculate the entropy value of each risk factor using the following entropy value formula:where , is the number of samples, .

- ④

- Calculation of the coefficient of variation of risk factors. The coefficient of variation of the indicators is calculated based on entropy as follows:The greater the difference in the indicator value, , and the lower the entropy value, the greater the and the more important the indicator.

- ⑤

- Find the weights. Find the weight of each risk factor based on the coefficient of variation as follows:The entropy method was used to determine the proportion, entropy value, coefficient of variation, and final weight coefficients for each risk factor. The detailed results can be found in Table A6 in Appendix B.

4.2.3. Determining the Combined Weight of the Risk Factors

4.3. System Dynamics Equations for Risk Factors

5. Dynamic Simulation of Risks

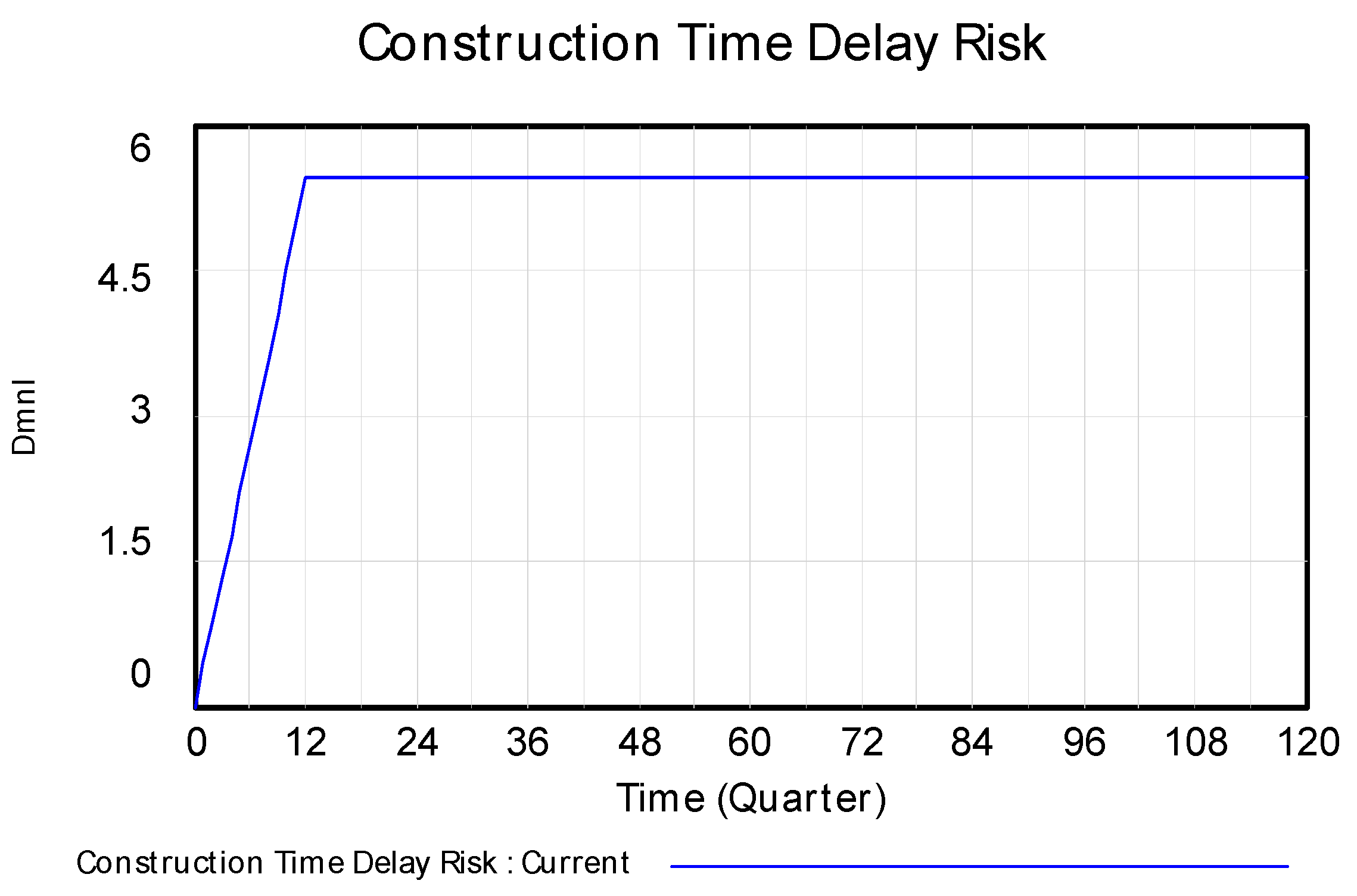

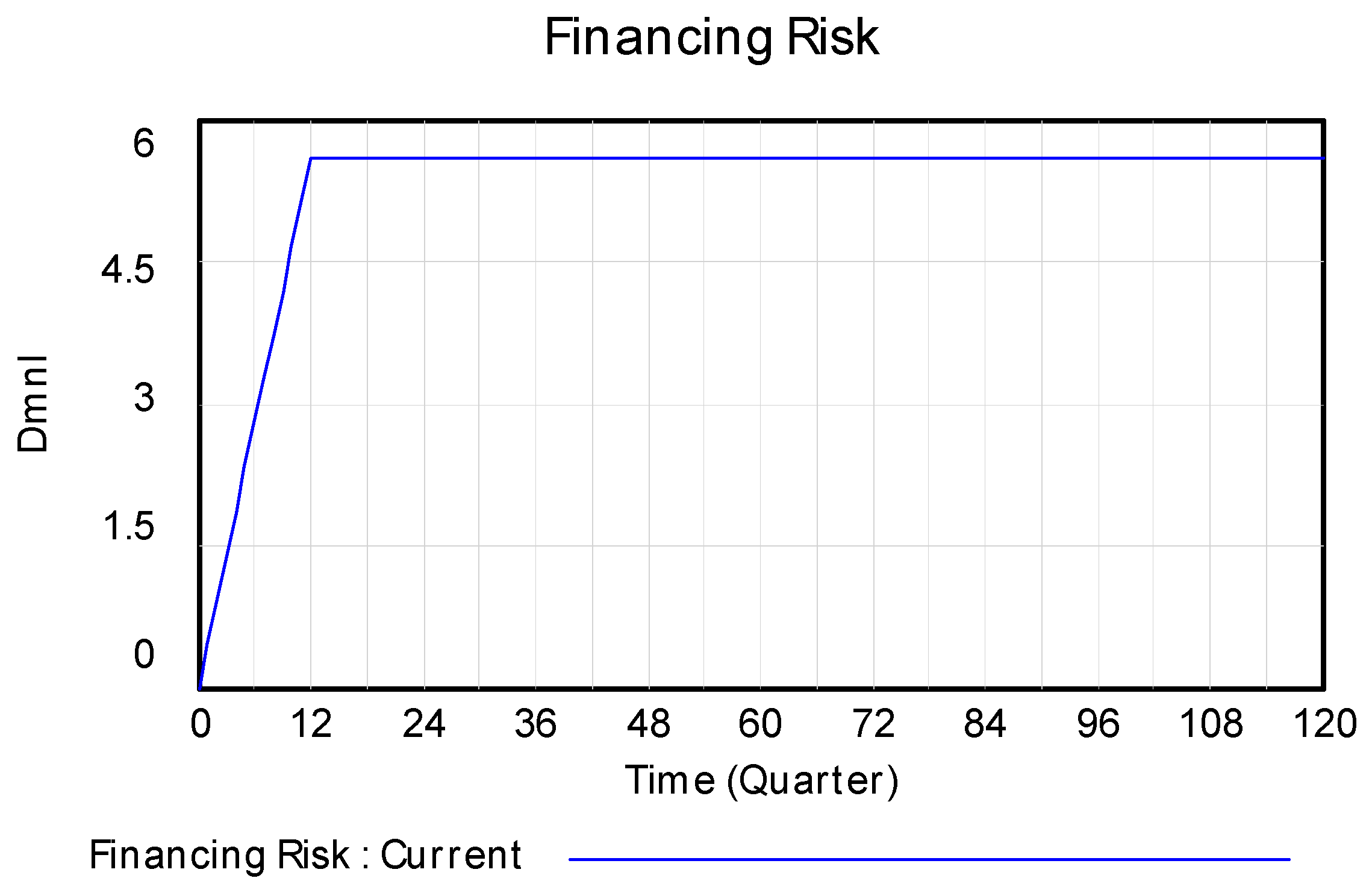

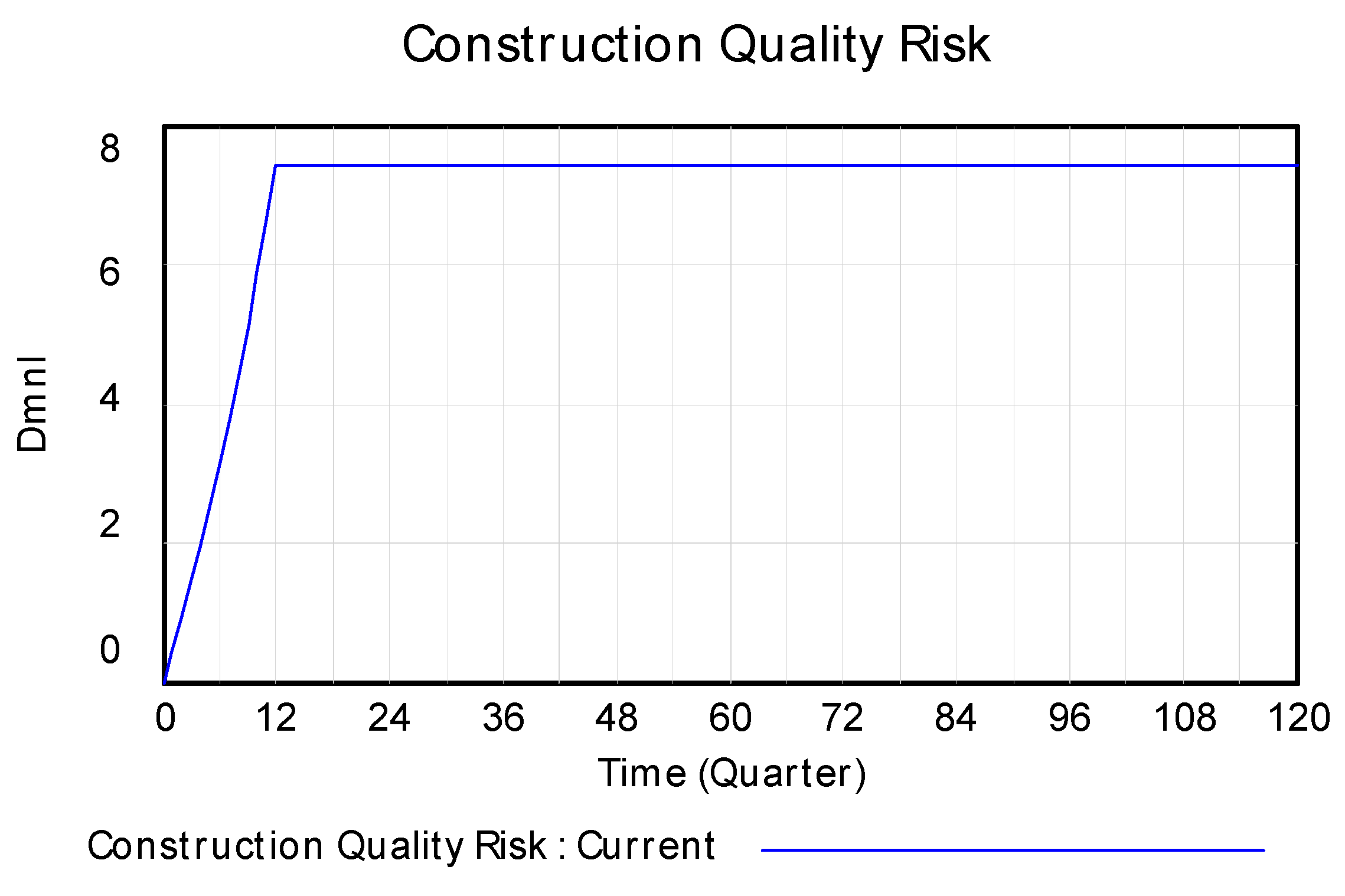

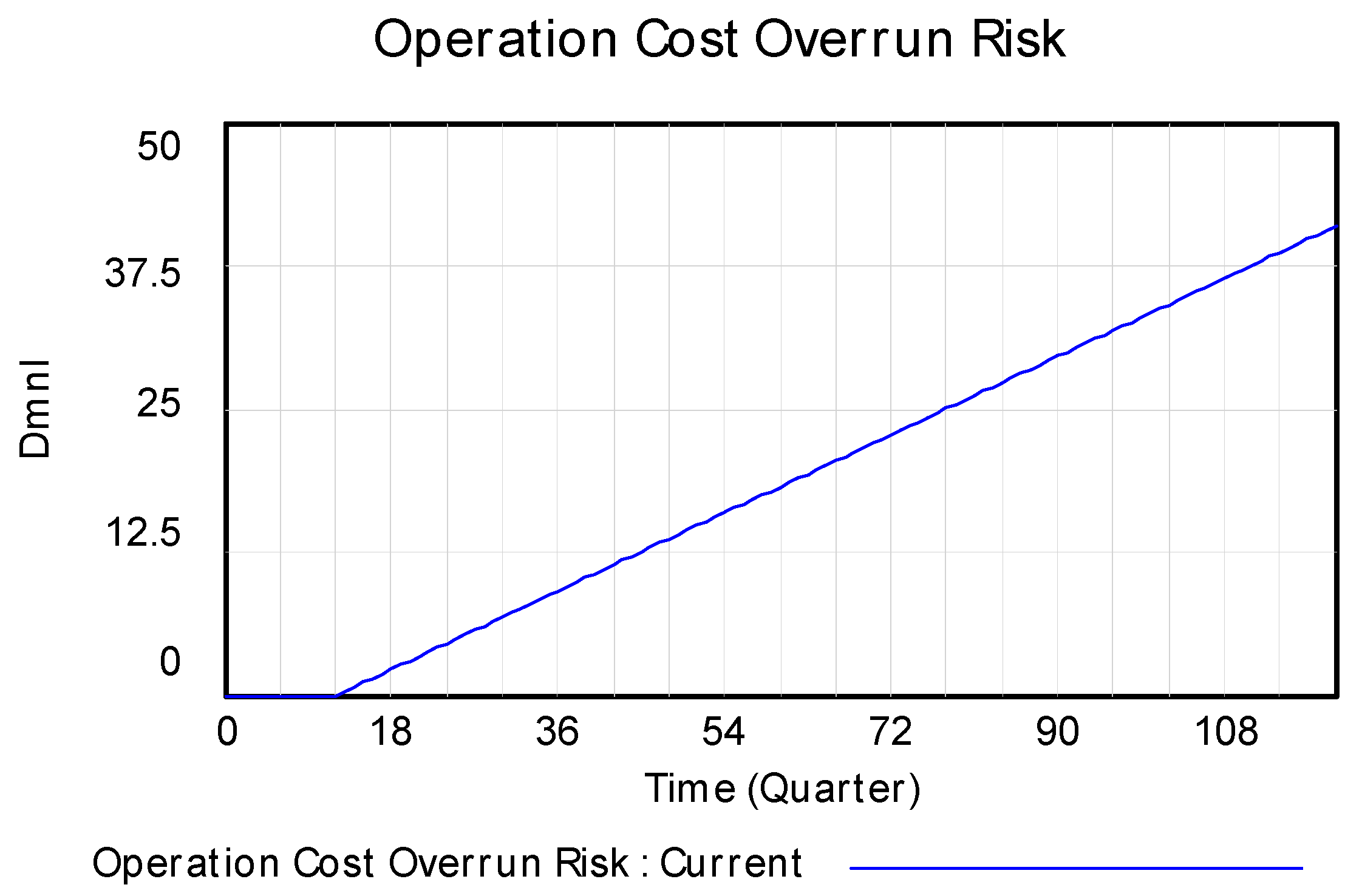

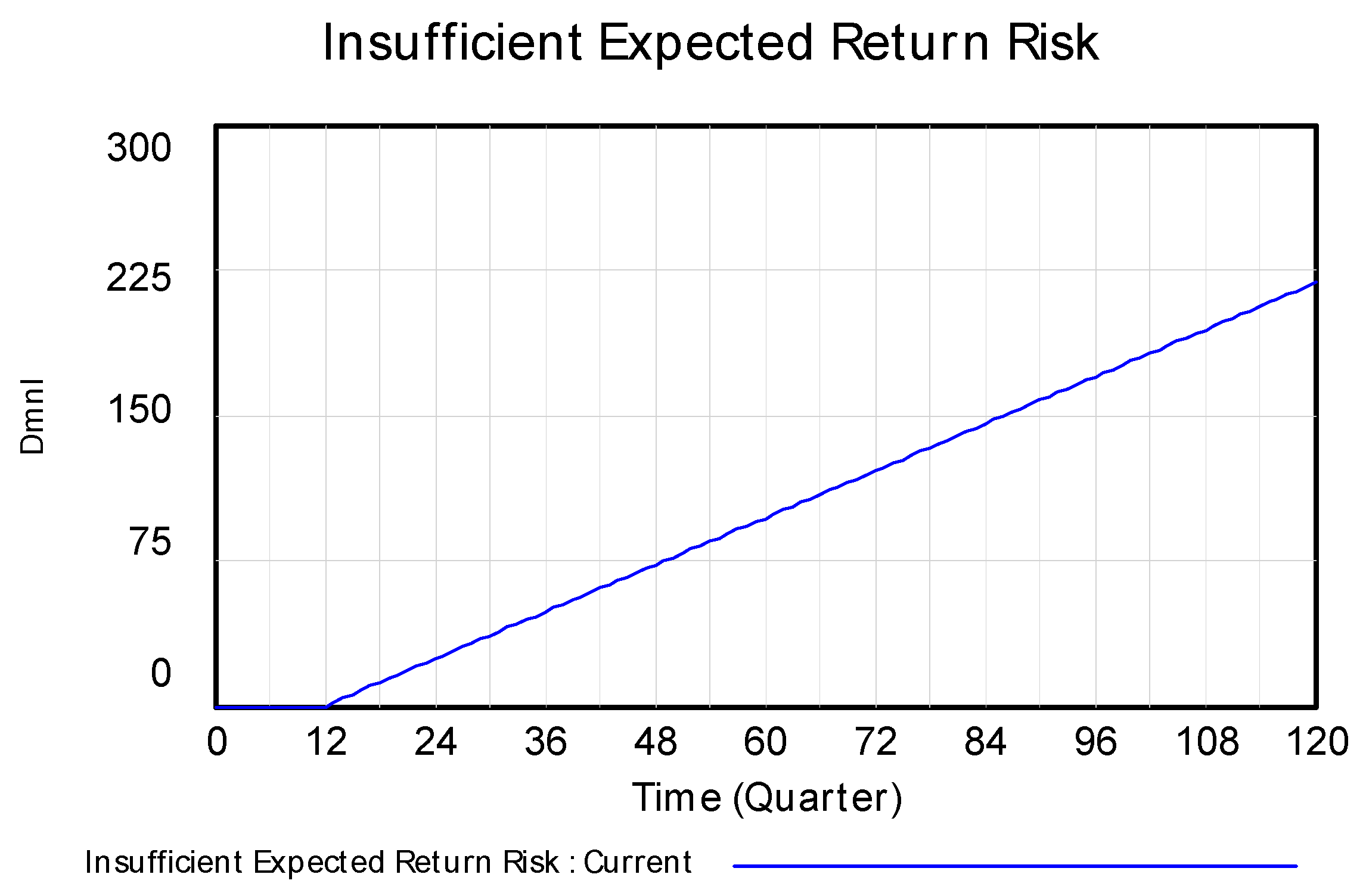

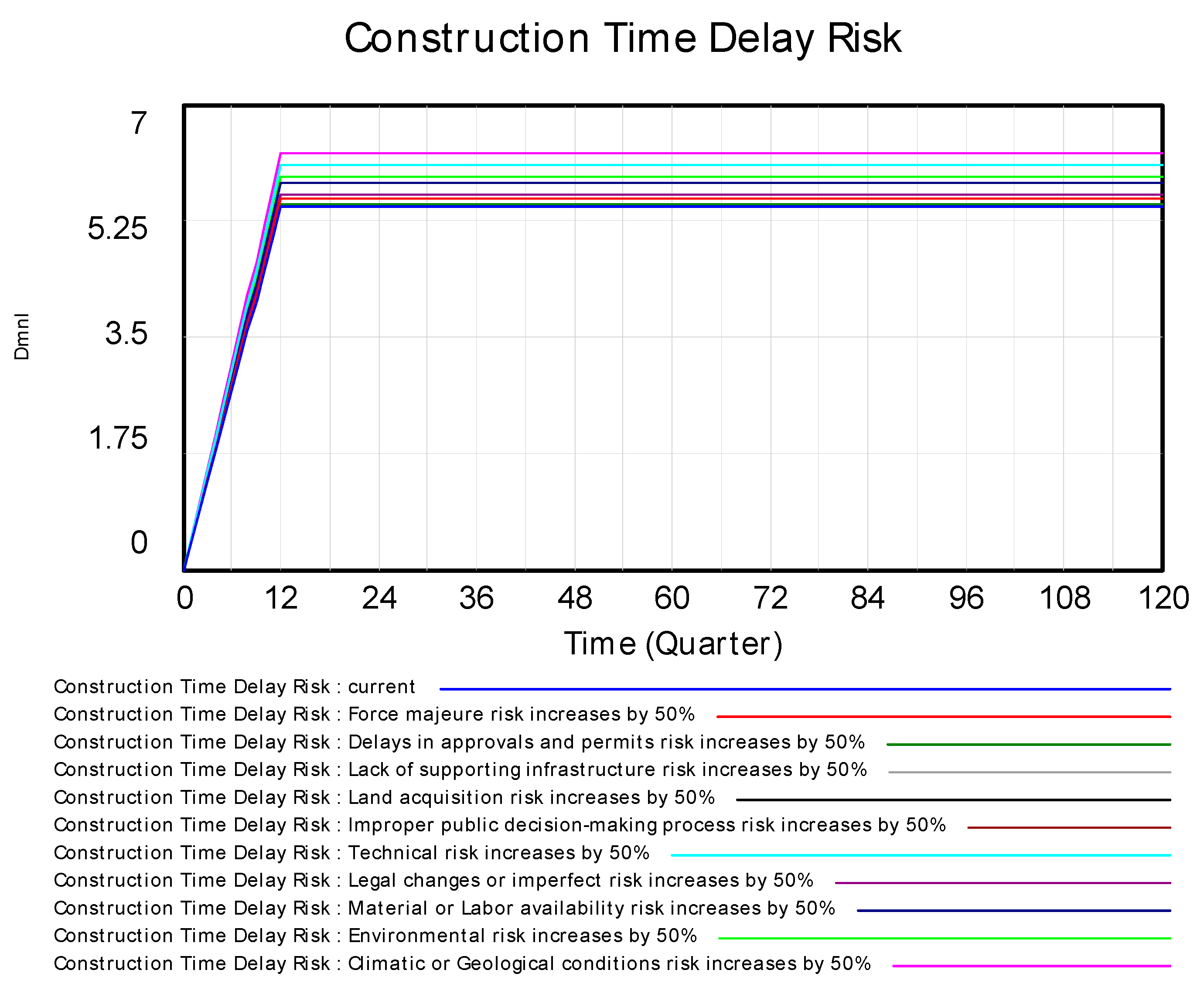

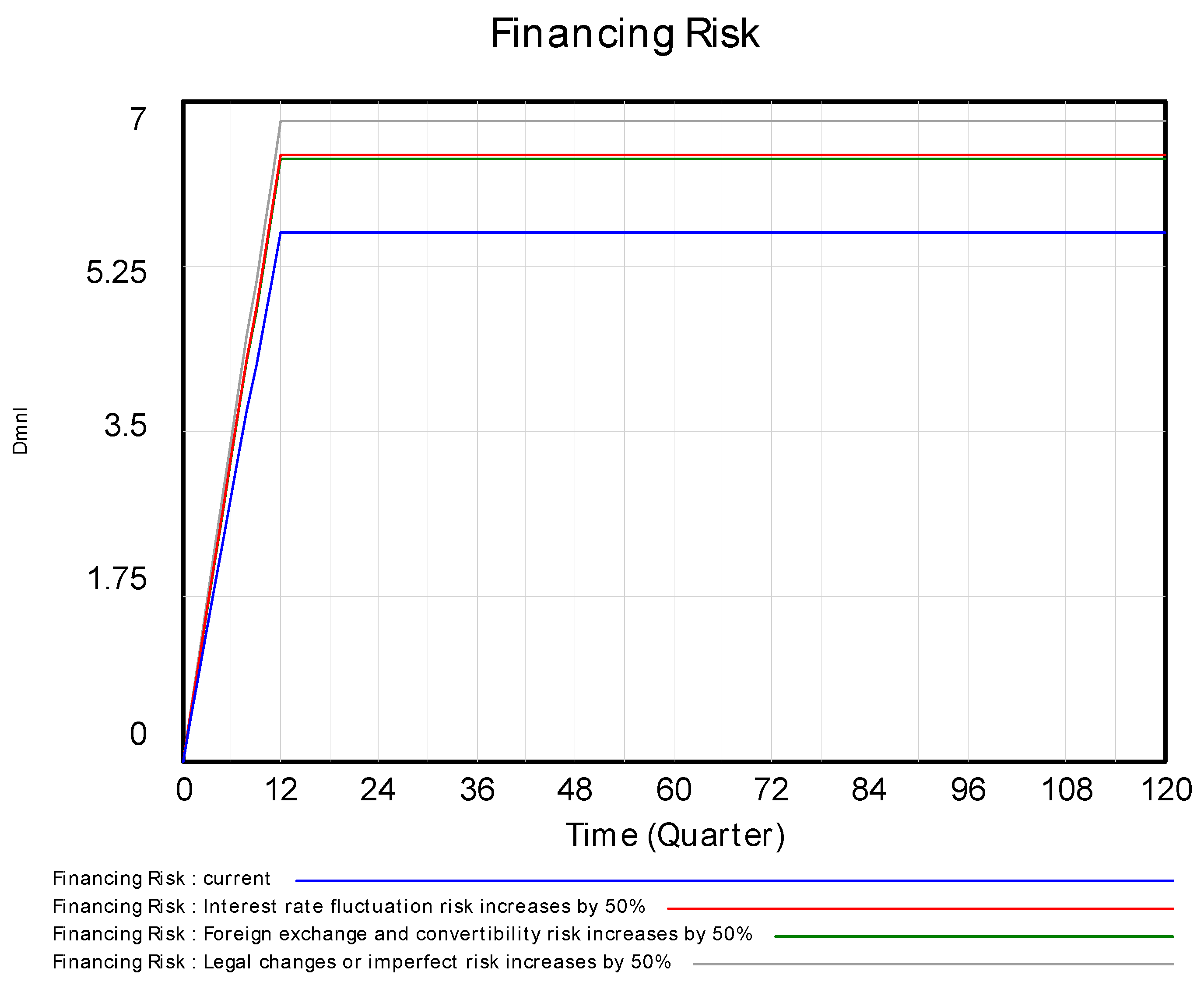

5.1. Numerical Simulation of Subsystems

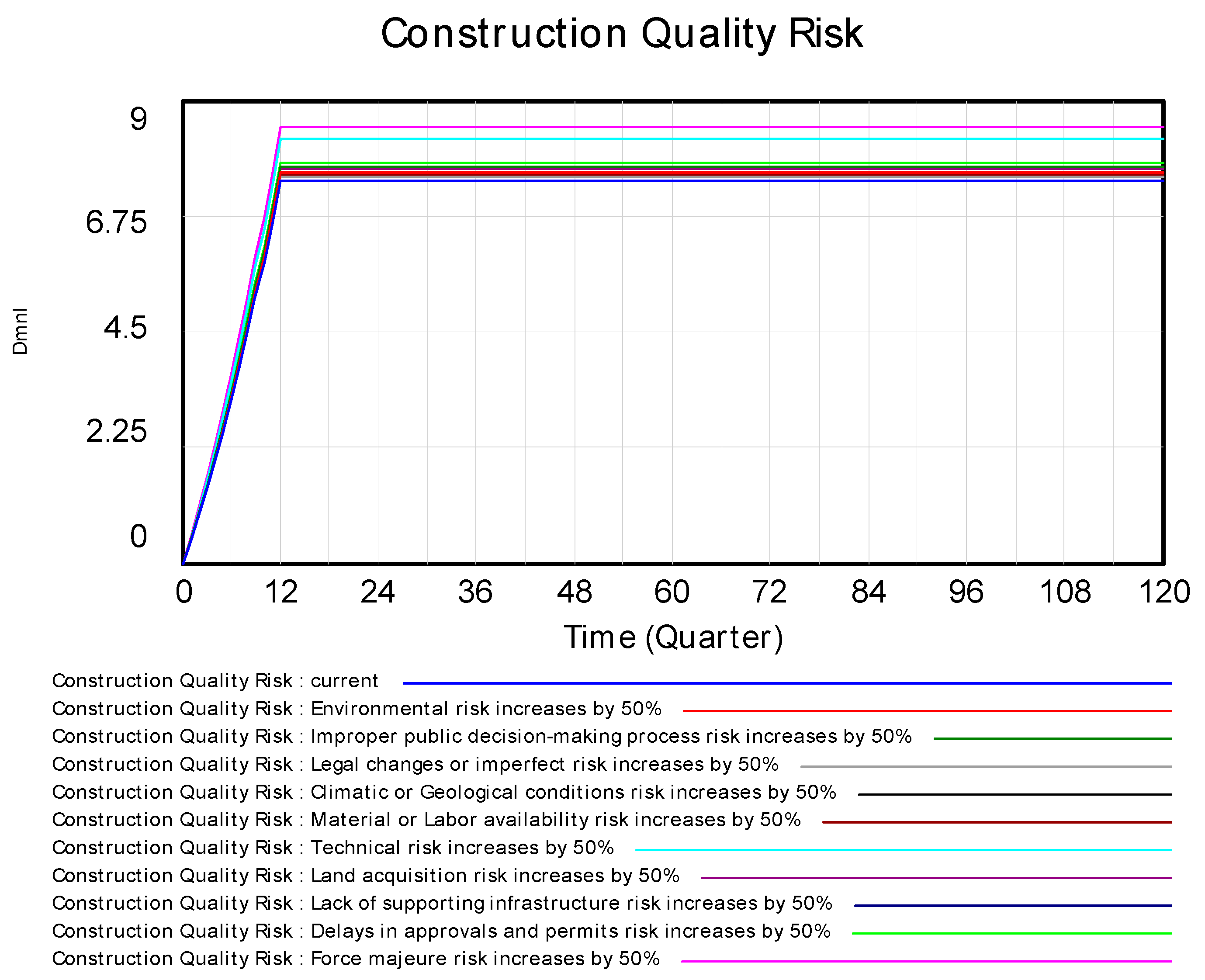

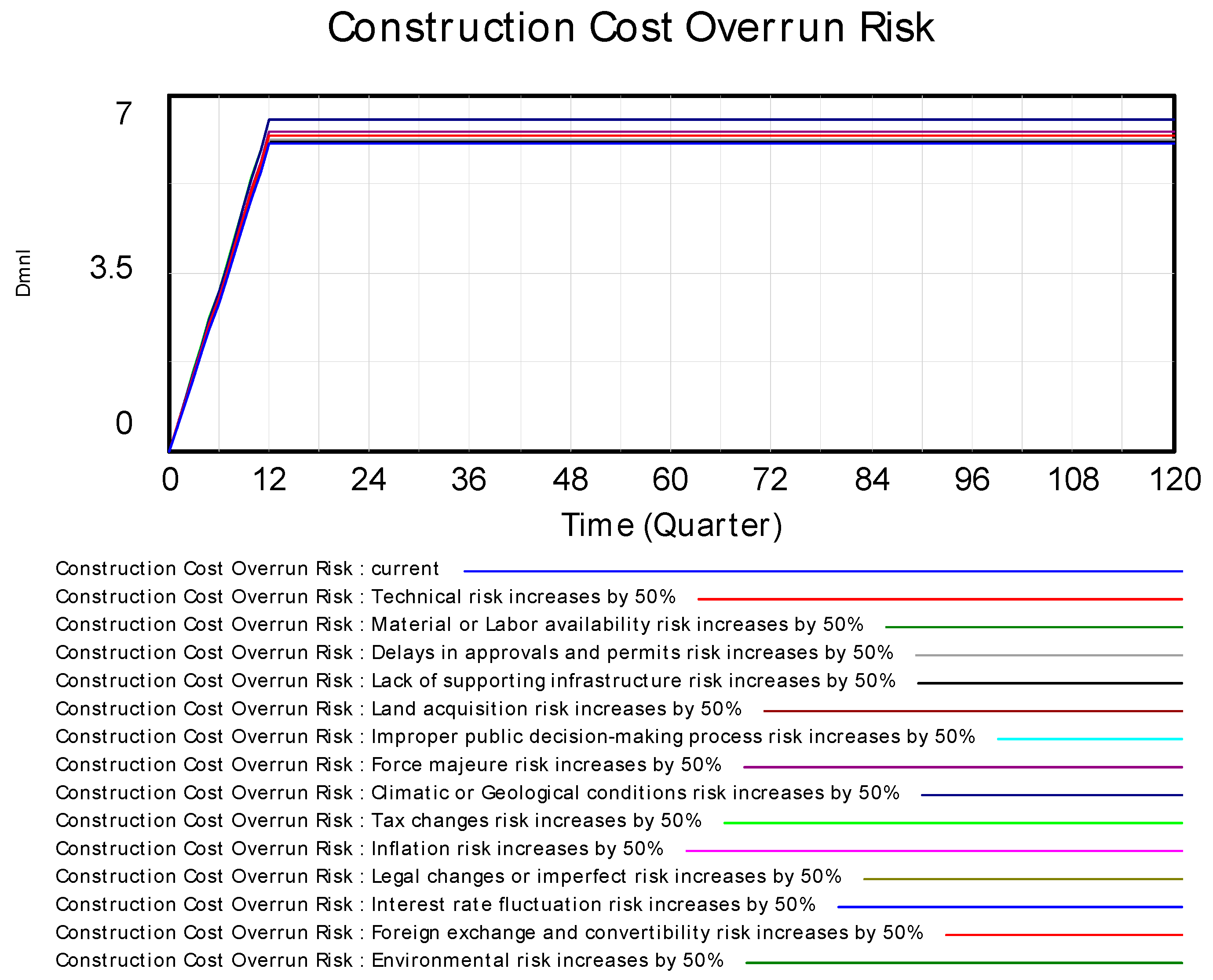

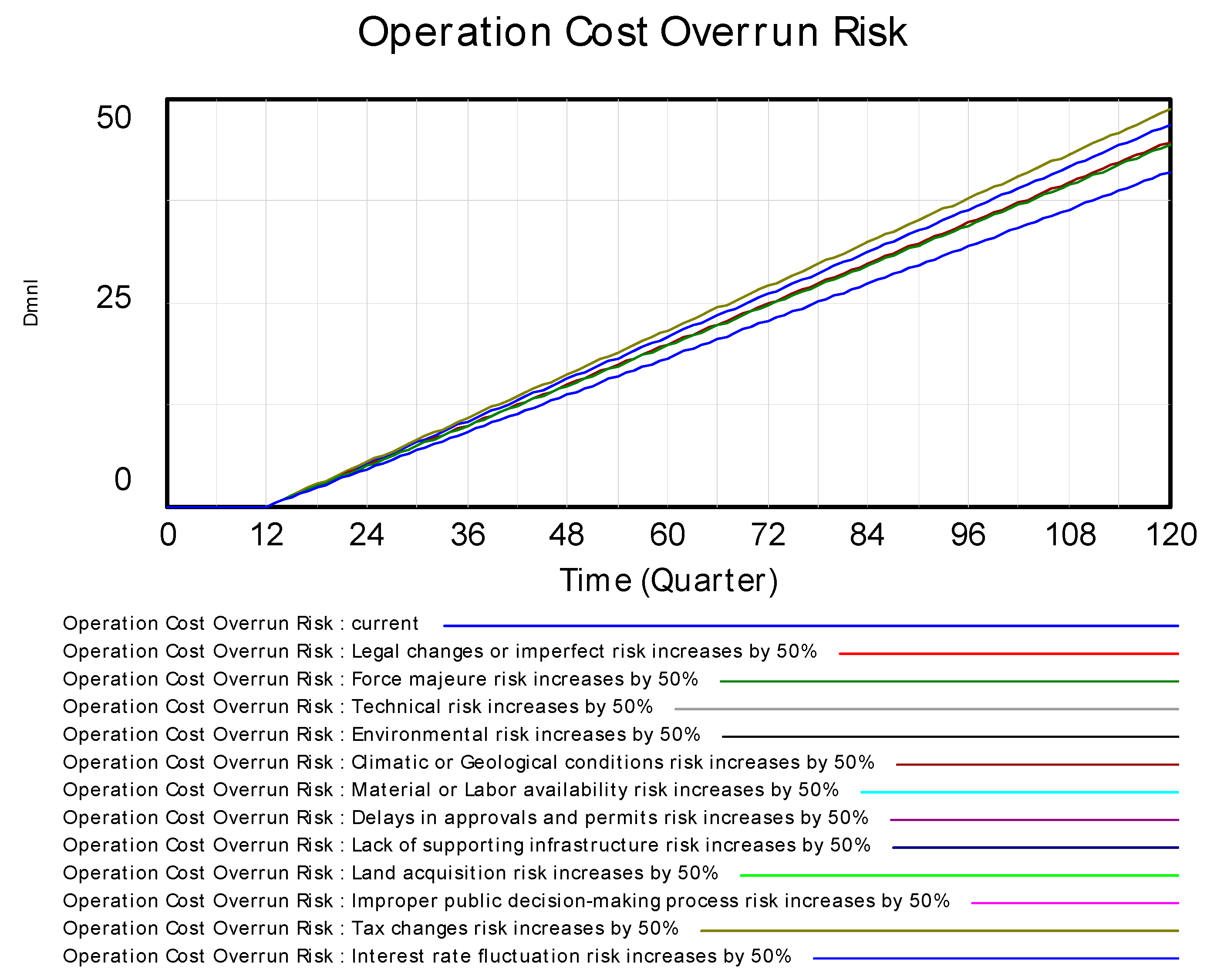

5.2. Sensitivity Analysis of Boundary Risks

6. Results and Discussion

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Risk Factors | References | Total | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z | ||

| Lack of support from government | * | * | * | * | * | * | * | * | * | * | * | 11 | |||||||||||||||

| Unstable government | * | * | * | * | * | * | * | * | * | * | * | * | 12 | ||||||||||||||

| political interference | * | * | * | * | * | * | * | * | * | * | * | * | * | * | * | * | 16 | ||||||||||

| Corruption and bribery | * | * | * | * | * | * | * | * | 8 | ||||||||||||||||||

| Nationalization/expropriation | * | * | * | * | * | * | * | * | * | * | 10 | ||||||||||||||||

| Inflation risk | * | * | * | * | * | * | * | * | * | * | * | * | * | 13 | |||||||||||||

| Interest rate fluctuation risk | * | * | * | * | * | * | * | * | * | * | * | * | * | 13 | |||||||||||||

| Legal changes or imperfect risk | * | * | * | * | * | * | * | * | * | * | * | * | * | * | * | * | * | * | * | 19 | |||||||

| Tax changes risk | * | * | * | * | * | * | * | * | 8 | ||||||||||||||||||

| Government/Public opposition risk | * | * | * | * | * | * | * | * | * | * | * | * | 12 | ||||||||||||||

| Environmental risk | * | * | * | * | * | * | * | * | * | * | * | * | * | * | * | * | 16 | ||||||||||

| Force majeure risk | * | * | * | * | * | * | * | * | * | * | * | * | * | * | * | * | 16 | ||||||||||

| Climatic/Geological conditions risk | * | * | * | * | * | * | * | * | 8 | ||||||||||||||||||

| Construction time delay risk | * | * | * | * | * | * | * | * | * | * | * | * | 12 | ||||||||||||||

| Site safety and security risk | * | * | * | * | * | 5 | |||||||||||||||||||||

| Construction quality risk | * | * | * | * | * | * | * | * | * | * | * | 11 | |||||||||||||||

| Construction cost overrun risk | * | * | * | * | * | * | * | * | * | * | * | * | * | * | 14 | ||||||||||||

| Contractual risk | * | * | * | * | * | * | * | * | * | * | * | * | * | 13 | |||||||||||||

| Material/Labor availability risk | * | * | * | * | * | * | * | * | * | * | 10 | ||||||||||||||||

| Delays in approvals and permits risk | * | * | * | * | * | * | * | * | 8 | ||||||||||||||||||

| Design flaw/changes risk | * | * | * | * | * | * | * | * | * | * | * | * | * | 13 | |||||||||||||

| Demand risk | * | * | * | * | * | * | * | * | * | * | * | * | * | 13 | |||||||||||||

| Maintenance cost overrun risk | * | * | * | * | * | * | * | * | * | 9 | |||||||||||||||||

| Operation cost overrun risk | * | * | * | * | * | * | * | * | * | * | * | * | * | 13 | |||||||||||||

| High frequency of maintenance risk | * | * | * | * | * | * | * | 7 | |||||||||||||||||||

| Low operational efficiency risk | * | * | * | * | * | * | 6 | ||||||||||||||||||||

| Residual risk | * | * | * | * | * | 5 | |||||||||||||||||||||

| Organization coordination risk | * | * | * | * | * | * | * | * | 8 | ||||||||||||||||||

| Political risk | * | * | * | * | * | * | * | * | * | * | * | * | * | * | * | * | 16 | ||||||||||

| Land acquisition risk | * | * | * | * | * | * | * | * | 8 | ||||||||||||||||||

| Revenue risk | * | * | * | * | * | * | * | * | * | * | * | * | 12 | ||||||||||||||

| Technical risk | * | * | * | * | * | * | * | * | * | * | * | * | * | * | * | * | * | 17 | |||||||||

| Financing risk | * | * | * | * | * | * | * | * | * | * | * | * | * | * | * | 15 | |||||||||||

| Concession period risk | * | * | * | * | 4 | ||||||||||||||||||||||

| Payment risk | * | * | * | * | * | * | 6 | ||||||||||||||||||||

| Bankruptcy/Default risk | * | * | * | * | * | 5 | |||||||||||||||||||||

| Competitive risk | * | * | * | * | * | * | * | * | * | 9 | |||||||||||||||||

| Improper public decision-making process risk | * | * | * | * | * | * | * | * | * | * | * | 11 | |||||||||||||||

| Foreign exchange and convertibility risk | * | * | * | * | * | * | * | 6 | |||||||||||||||||||

| Lack of supporting infrastructure risk | * | * | * | * | * | * | 6 | ||||||||||||||||||||

| Public credit risk | * | * | * | * | * | * | * | 7 | |||||||||||||||||||

| Pricing risk | * | * | * | * | * | * | * | 7 | |||||||||||||||||||

| Project change risk | * | * | * | * | * | * | 6 | ||||||||||||||||||||

| Project Phase | Risk Factor | Risk Description |

|---|---|---|

| Decision-making phase | Land acquisition | Wind energy projects often face challenges related to environmental protection requirements and land use rights negotiations, which can lead to increased costs and project delays. |

| Delays in approvals and permits risk | The complex environmental impact assessments and energy planning approval processes add to the costs and time, limiting the flexibility for project adjustments. | |

| Improper public decision-making process risk | Irregular decision-making procedures and a lack of expertise may lead to errors in risk assessment and project delays. | |

| Government/Public opposition risk | Environmental impacts may trigger opposition from the public and government, thereby increasing the political and social risks of the project. | |

| Financing phase | Financing risk | The financing risk of wind energy projects primarily arises from fluctuations in the financial markets and an inadequate financing structure, which may lead to increased funding costs and hinder the financing process. |

| Construction phase | Construction time delay risk | Delays in construction result in increased costs and project schedule slippage, affecting the timely commissioning of wind energy projects. |

| Site safety and security risk | Safety incidents that may occur during construction, including risks associated with high-altitude work and equipment operation. | |

| Construction quality risk | Failure to meet standards in materials or construction may lead to quality issues in wind turbines and their supporting structures. | |

| Construction cost overrun risk | Budget overruns due to fluctuations in raw material prices or construction delays. | |

| Material/Labor availability risk | Shortages of critical materials, such as steel or specialized technical labor, can lead to project delays. | |

| Technical risk | Challenges in implementing wind power technology, including system integration and energy efficiency that do not meet expectations. | |

| Design flaw/changes risk | Insufficient initial design leading to subsequent changes, increasing costs and complexity. | |

| Lack of supporting infrastructure risk | Insufficient connections to the electrical grid or inadequate road infrastructure can impact the construction and operation of wind farms. | |

| Project change risk | Necessary engineering adjustments due to changes in policies, environmental requirements, or technological updates. | |

| Operational phase | Demand risk | Instability in wind power market demand caused by market dynamics, economic fluctuations, or policy changes. |

| Maintenance cost overrun risk | Frequent repairs and increased costs due to quality issues with wind power equipment. | |

| High frequency of maintenance risk | Extreme weather conditions and other force majeure factors frequently impact the stability and maintenance requirements of wind power equipment. | |

| Operation cost overrun risk | Increased operational costs due to changes in interest rates, tax policies, or poor management. | |

| Low operational efficiency risk | Operational inefficiencies or outdated technology affecting the efficiency and energy output of wind farms. | |

| Operational phase | Revenue risk | Revenue falling below expectations due to market price fluctuations in wind power or substandard energy output. |

| Pricing risk | Fluctuations in electricity market prices or policy adjustments affecting wind power sales prices, leading to revenue falling below expectations. | |

| Competitive risk | Market share loss due to new competitors entering the market or improvements in alternative energy technologies. | |

| Payment risk | Delays or inability of the power purchaser to pay electricity fees due to economic pressures or policy changes. | |

| Full life cycle phase | Legal changes or imperfect risk | New environmental regulations or changes that affect the cost and operation of wind power projects. |

| Contractual risk | Ambiguous risk allocation or unclear responsibilities in wind power contracts leading to legal disputes. | |

| Force majeure risk | Damage to wind power facilities caused by natural disasters such as storms or earthquakes. | |

| Environmental risk | Cost increases or project delays due to stricter environmental protection regulations affecting wind power projects. | |

| Climatic/Geological conditions risk | Extreme weather or unstable geological conditions increasing the construction and operational risks of wind power projects. | |

| Bankruptcy/Default risk | Financial difficulties or defaults by partners affecting the continuity of the wind power project. | |

| Inflation risk | Inflation potentially leading to increased operational costs for wind power projects. | |

| Interest rate fluctuation risk | Fluctuations in financing costs due to changes in interest rates, affecting the financial stability of wind power projects. | |

| Tax changes risk | Changes in tax laws that may impact the economic benefits of wind power projects. | |

| Public credit risk | Failure of the government to fulfill support policies or financial commitments, affecting the investment return of the project. | |

| Residual risk | The residual value of facilities after the project ends may be lower than expected. | |

| Concession period risk | An early end to the concession period could result in insufficient investment recovery. | |

| Foreign exchange and convertibility risk | Exchange rate fluctuations or conversion restrictions affecting the cost of procuring equipment from international markets. | |

| Organization coordination risk | Inefficiency and cost overruns caused by poor project management. |

Appendix B

| Respondent Profile | Category and Percentage |

|---|---|

| Type of Organization | Government (1.96%) |

| State-owned Enterprise (29.41%) | |

| Private Enterprise (9.8%) | |

| Research Institution (11.76%) | |

| Universities (47.06%) | |

| Years of Experience in the Construction Industry | Less than 6 years (39.22%) |

| 6–10 years (21.57%) | |

| 11–15 years (13.73%) | |

| More than 15 years (25.49%) | |

| Years of Experience in PPP Projects | None (5.88%) |

| Less than 3 years (41.18%) | |

| 3–5 years (23.53%) | |

| More than 5 years (29.41%) | |

| Number of PPP Projects Participated In | None (3.92%) |

| Less than 3 projects (54.9%) | |

| 3–5 projects (13.73%) | |

| More than 5 projects (27.45%) |

| Importance Level | Score |

|---|---|

| Extremely important | 7 |

| Strongly important | 6 |

| Significantly important | 5 |

| Comparatively important | 4 |

| Fairly important | 3 |

| Slightly important | 2 |

| Not important | 1 |

| Progress risk | Delays in approvals and permits risk | Construction time delay risk | Improper public decision-making process risk | Land acquisition risk | Lack of supporting infrastructure risk | ||||||||||||||||||||

| 0.207 | 0.203 | 0.215 | 0.196 | 0.176 | |||||||||||||||||||||

| Change in construction quality risk | Progress risk | Technical risk | Force majeure risk | ||||||||||||||||||||||

| 0.345 | 0.299 | 0.359 | |||||||||||||||||||||||

| Project change risk | Design flaw/changes risk | Legal changes or imperfect risk | |||||||||||||||||||||||

| 0.520 | 0.480 | ||||||||||||||||||||||||

| Construction time delay risk | Project change risk | Climatic/Geological conditions risk | Design flaw/changes risk | Environmental risk | Site security risk | Technical risk | Material/Labor availability risk | ||||||||||||||||||

| 0.159 | 0.130 | 0.152 | 0.132 | 0.149 | 0.134 | 0.134 | |||||||||||||||||||

| Construction cost overrun risk | Rework risk | Climatic/Geological conditions risk | Environmental risk | Tax changes risk | Financing risk | Inflation risk | |||||||||||||||||||

| 0.178 | 0.154 | 0.158 | 0.198 | 0.158 | 0.156 | ||||||||||||||||||||

| Financing risk | Legal changes or imperfect risk | Interest rate fluctuation risk | Foreign exchange and convertibility risk | ||||||||||||||||||||||

| 0.405 | 0.323 | 0.272 | |||||||||||||||||||||||

| High frequency of maintenance risk | Force majeure risk | Climatic/Geological conditions risk | |||||||||||||||||||||||

| 0.506 | 0.494 | ||||||||||||||||||||||||

| Maintenance cost overrun risk | Change in construction quality risk | High frequency of maintenance risk | |||||||||||||||||||||||

| 0.522 | 0.478 | ||||||||||||||||||||||||

| Low operational efficiency risk | Maintenance cost overrun risk | High frequency of maintenance risk | |||||||||||||||||||||||

| 0.503 | 0.497 | ||||||||||||||||||||||||

| Operation cost overrun risk | Tax changes risk | Maintenance cost overrun risk | Low operational efficiency risk | Interest rate fluctuation risk | |||||||||||||||||||||

| 0.280 | 0.267 | 0.237 | 0.215 | ||||||||||||||||||||||

| Demand risk | Competitive risk | Pricing risk | |||||||||||||||||||||||

| 0.488 | 0.512 | ||||||||||||||||||||||||

| Pricing risk | Payment risk | Inflation risk | Concession period risk | Operating cost risk | |||||||||||||||||||||

| 0.270 | 0.251 | 0.255 | 0.224 | ||||||||||||||||||||||

| Revenue risk | Demand risk | Pricing risk | |||||||||||||||||||||||

| 0.511 | 0.489 | ||||||||||||||||||||||||

| Insolvency default risk | Organization coordination risk | Contractual risk | |||||||||||||||||||||||

| 0.463 | 0.537 | ||||||||||||||||||||||||

| Public credit risk | Contractual risk | Legal changes or imperfect risk | Government/Public opposition risk | ||||||||||||||||||||||

| 0.329 | 0.342 | 0.329 | |||||||||||||||||||||||

| Insufficiency expected return risk | Revenue risk | Construction cost overrun risk | Financing risk | Salvage value risk | Operation cost overrun risk | Bankruptcy/ Default risk | Public credit risk | ||||||||||||||||||

| 0.162 | 0.149 | 0.149 | 0.134 | 0.146 | 0.144 | 0.116 | |||||||||||||||||||

| Key Risks | Risks j | |||

|---|---|---|---|---|

| Progress risk | Delays in approvals and permits risk | 0.963 | 0.037 | 0.313 |

| Construction time delay risk | 0.982 | 0.018 | 0.155 | |

| Improper public decision-making process risk | 0.985 | 0.015 | 0.131 | |

| Land acquisition risk | 0.975 | 0.025 | 0.215 | |

| Lack of supporting infrastructure risk | 0.978 | 0.022 | 0.186 | |

| Change in construction quality risk | Progress risk | 0.950 | 0.050 | 0.427 |

| Technical risk | 0.976 | 0.024 | 0.207 | |

| Force majeure risk | 0.957 | 0.043 | 0.365 | |

| Project change risk | Design flaw/changes risk | 0.977 | 0.023 | 0.421 |

| Legal changes or imperfect risk | 0.968 | 0.032 | 0.579 | |

| Construction time delay risk | Project change risk | 0.982 | 0.018 | 0.066 |

| Climatic/Geological conditions risk | 0.958 | 0.042 | 0.155 | |

| Design flaw/changes risk | 0.982 | 0.018 | 0.067 | |

| Environmental risk | 0.958 | 0.042 | 0.156 | |

| Site security risk | 0.974 | 0.026 | 0.096 | |

| Technical risk | 0.919 | 0.081 | 0.300 | |

| Material/Labor availability risk | 0.957 | 0.043 | 0.159 | |

| Construction cost overrun risk | Rework risk | 0.946 | 0.054 | 0.260 |

| Climatic/Geological conditions risk | 0.966 | 0.035 | 0.167 | |

| Environmental risk | 0.971 | 0.029 | 0.141 | |

| Tax changes risk | 0.966 | 0.034 | 0.163 | |

| Financing risk | 0.98 | 0.020 | 0.095 | |

| Inflation risk | 0.964 | 0.036 | 0.175 | |

| Financing risk | Legal changes or imperfect risk | 0.968 | 0.032 | 0.263 |

| Interest rate fluctuation risk | 0.967 | 0.033 | 0.271 | |

| Foreign exchange and convertibility risk | 0.944 | 0.057 | 0.466 | |

| High frequency of maintenance risk | Force majeure risk | 0.971 | 0.029 | 0.401 |

| Climatic/Geological conditions risk | 0.957 | 0.043 | 0.599 | |

| Maintenance cost overrun risk | Change in construction quality risk | 0.964 | 0.036 | 0.454 |

| High frequency of maintenance risk | 0.956 | 0.044 | 0.547 | |

| Low operational efficiency risk | Maintenance cost overrun risk | 0.965 | 0.035 | 0.468 |

| High frequency of maintenance risk | 0.960 | 0.04 | 0.532 | |

| Operation cost overrun risk | Tax changes risk | 0.938 | 0.062 | 0.336 |

| Maintenance cost overrun risk | 0.967 | 0.033 | 0.179 | |

| Low operational efficiency risk | 0.957 | 0.043 | 0.234 | |

| Interest rate fluctuation risk | 0.954 | 0.047 | 0.251 | |

| Demand risk | Competitive risk | 0.980 | 0.020 | 0.463 |

| Pricing risk | 0.977 | 0.023 | 0.537 | |

| Pricing risk | Payment risk | 0.969 | 0.032 | 0.242 |

| Inflation risk | 0.971 | 0.029 | 0.222 | |

| Concession period risk | 0.954 | 0.046 | 0.351 | |

| Operating cost risk | 0.976 | 0.024 | 0.185 | |

| Revenue risk | Demand risk | 0.980 | 0.020 | 0.538 |

| Pricing risk | 0.983 | 0.017 | 0.462 | |

| Insolvency default risk | Organization coordination risk | 0.968 | 0.032 | 0.650 |

| Contractual risk | 0.983 | 0.017 | 0.350 | |

| Public credit risk | Contractual risk | 0.978 | 0.022 | 0.318 |

| Legal changes or imperfect risk | 0.976 | 0.025 | 0.360 | |

| Government/Public opposition risk | 0.978 | 0.022 | 0.322 | |

| Insufficiency expected return risk | Revenue risk | 0.974 | 0.026 | 0.134 |

| Construction cost overrun risk | 0.967 | 0.033 | 0.171 | |

| Financing risk | 0.980 | 0.020 | 0.103 | |

| Salvage value risk | 0.962 | 0.038 | 0.198 | |

| Operation cost overrun risk | 0.968 | 0.032 | 0.168 | |

| Bankruptcy/Default risk | 0.978 | 0.022 | 0.116 | |

| Public credit risk | 0.979 | 0.021 | 0.111 |

| Progress risk | Delays in approvals and permits risk | Construction time delay risk | Improper public decision-making process risk | Land acquisition risk | Lack of supporting infrastructure risk | ||||||||||||||||

| 0.260 | 0.179 | 0.173 | 0.206 | 0.181 | |||||||||||||||||

| Change in construction quality risk | Progress risk | Technical risk | Force majeure risk | ||||||||||||||||||

| 0.386 | 0.253 | 0.362 | |||||||||||||||||||

| Project change risk | Design flaw/changes risk | Legal changes or imperfect risk | |||||||||||||||||||

| 0.471 | 0.480 | ||||||||||||||||||||

| Construction time delay risk | Project change risk | Climatic/Geological conditions risk | Design flaw/changes risk | Environmental risk | Site security risk | Technical risk | Material/Labor availability risk | ||||||||||||||

| 0.113 | 0.143 | 0.110 | 0.144 | 0.123 | 0.217 | 0.147 | |||||||||||||||

| Construction cost overrun risk | Rework risk | Climatic/Geological conditions risk | Environmental risk | Tax changes risk | Financing risk | Inflation risk | |||||||||||||||

| 0.219 | 0.161 | 0.150 | 0.181 | 0.127 | 0.166 | ||||||||||||||||

| Financing risk | Legal changes or imperfect risk | Interest rate fluctuation risk | Foreign exchange and convertibility risk | ||||||||||||||||||

| 0.334 | 0.297 | 0.369 | |||||||||||||||||||

| High frequency of maintenance risk | Force majeure risk | Climatic/Geological conditions risk | |||||||||||||||||||

| 0.454 | 0.547 | ||||||||||||||||||||

| Maintenance cost overrun risk | Change in construction quality risk | High frequency of maintenance risk | |||||||||||||||||||

| 0.488 | 0.513 | ||||||||||||||||||||

| Low operational efficiency risk | Maintenance cost overrun risk | High frequency of maintenance risk | |||||||||||||||||||

| 0.486 | 0.515 | ||||||||||||||||||||

| Operation cost overrun risk | Tax changes risk | Maintenance cost overrun risk | Low operational efficiency risk | Interest rate fluctuation risk | |||||||||||||||||

| 0.308 | 0.223 | 0.236 | 0.233 | ||||||||||||||||||

| Demand risk | Competitive risk | Pricing risk | |||||||||||||||||||

| 0.476 | 0.525 | ||||||||||||||||||||

| Pricing risk | Payment risk | Inflation risk | Concession period risk | Operating cost risk | |||||||||||||||||

| 0.256 | 0.237 | 0.303 | 0.205 | ||||||||||||||||||

| Revenue risk | Demand risk | Pricing risk | |||||||||||||||||||

| 0.525 | 0.476 | ||||||||||||||||||||

| Bankruptcy default risk | Organization coordination risk | Contractual risk | |||||||||||||||||||

| 0.557 | 0.444 | ||||||||||||||||||||

| Public credit risk | Contractual risk | Legal changes or imperfect risk | Government/Public opposition risk | ||||||||||||||||||

| 0.324 | 0.351 | 0.326 | |||||||||||||||||||

| Insufficiency expected return risk | Revenue risk | Construction cost overrun risk | Financing risk | Salvage value risk | Operation cost overrun risk | Bankruptcy/ Default risk | Public credit risk | ||||||||||||||

| 0.148 | 0.160 | 0.126 | 0.166 | 0.157 | 0.130 | 0.114 | |||||||||||||||

References

- Liu, Y.; Song, P. Digital Transformation and Green Innovation of Energy Enterprises. Sustainability 2023, 15, 7703. [Google Scholar] [CrossRef]

- Li, Y.; Tang, D.; Yuan, C.; Diaz-Londono, C.; Agundis-Tinajero, G.D.; Guerrero, J.M. The Roles of Hydrogen Energy in Ports: Comparative Life-Cycle Analysis Based on Hydrogen Utilization Strategies. Int. J. Hydrogen Energy 2025, 106, 1356–1372. [Google Scholar] [CrossRef]

- Yang, Q.-C.; Zheng, M.; Chang, C.-P. Energy Policy and Green Innovation: A Quantile Investigation into Renewable Energy. Renew. Energy 2022, 189, 1166–1175. [Google Scholar] [CrossRef]

- Berg, V.I.; Zakirzakov, A.G.; Gordievskaya, E.F. Dynamics Analysis of Wind Energy Production Development. IOP Conf. Ser. Earth Environ. Sci. 2017, 50, 012033. [Google Scholar] [CrossRef]

- Li, M.; Carroll, J.; Ahmad, A.S.; Hasan, N.S.; Zolkiffly, M.Z.B.; Falope, G.B.; Sabil, K.M. Potential of Offshore Wind Energy in Malaysia: An Investigation into Wind and Bathymetry Conditions and Site Selection. Energies 2023, 17, 65. [Google Scholar] [CrossRef]

- Acosta-Silva, Y.D.J.; Torres-Pacheco, I.; Matsumoto, Y.; Toledano-Ayala, M.; Soto-Zarazúa, G.M.; Zelaya-Ángel, O.; Méndez-López, A. Applications of Solar and Wind Renewable Energy in Agriculture: A Review. Sci. Prog. 2019, 102, 127–140. [Google Scholar] [CrossRef] [PubMed]

- Mengi-Dinçer, H.; Ediger, V.Ş.; Yesevi, Ç.G. Evaluating the International Renewable Energy Agency through the Lens of Social Constructivism. Renew. Sustain. Energy Rev. 2021, 152, 111705. [Google Scholar] [CrossRef]

- Hopuare, M.; Manni, T.; Laurent, V.; Maamaatuaiahutapu, K. Investigating Wind Energy Potential in Tahiti, French Polynesia. Energies 2022, 15, 2090. [Google Scholar] [CrossRef]

- Kamali Saraji, M.; Streimikiene, D. A Novel Multicriteria Assessment Framework for Evaluating the Performance of the EU in Dealing with Challenges of the Low-Carbon Energy Transition: An Integrated Fermatean Fuzzy Approach. Sustain. Environ. Res. 2024, 34, 6. [Google Scholar] [CrossRef]

- Costoya, X.; deCastro, M.; Carvalho, D.; Gómez-Gesteira, M. On the Suitability of Offshore Wind Energy Resource in the United States of America for the 21st Century. Appl. Energy 2020, 262, 114537. [Google Scholar] [CrossRef]

- Dorrell, J.; Lee, K. The Politics of Wind: A State Level Analysis of Political Party Impact on Wind Energy Development in the United States. Energy Res. Soc. Sci. 2020, 69, 101602. [Google Scholar] [CrossRef]

- Mourão, R.R.; Mayer, A.; Cavallini Johansen, I.; Bortoleto, A.P.; Ninni Ramos, K.; Brown, E.; McCright, A.; Lopez, M.C.; Moran, E. News Consumption, Partisanship, and Energy Preferences in Brazil and the United States. Environ. Commun. 2024, 1–20. [Google Scholar] [CrossRef]

- Borunda, M.; Ramírez, A.; Garduno, R.; García-Beltrán, C.; Mijarez, R. Enhancing Long-Term Wind Power Forecasting by Using an Intelligent Statistical Treatment for Wind Resource Data. Energies 2023, 16, 7915. [Google Scholar] [CrossRef]

- Mastoi, M.S.; Zhuang, S.; Haris, M.; Hassan, M.; Ali, A. Large-Scale Wind Power Grid Integration Challenges and Their Solution: A Detailed Review. Environ. Sci. Pollut. Res. 2023, 30, 103424–103462. [Google Scholar] [CrossRef] [PubMed]

- Tan, J.D.; Chang, C.C.W.; Bhuiyan, M.A.S.; Minhad, K.N.; Ali, K. Advancements of Wind Energy Conversion Systems for Low-Wind Urban Environments: A Review. Energy Rep. 2022, 8, 3406–3414. [Google Scholar] [CrossRef]

- Spyridonidou, S.; Vagiona, D.G. Systematic Review of Site-Selection Processes in Onshore and Offshore Wind Energy Research. Energies 2020, 13, 5906. [Google Scholar] [CrossRef]

- Onar, S.Ç.; Kılavuz, T.N. Risk Analysis of Wind Energy Investments in Turkey. Hum. Ecol. Risk Assess. Int. J. 2015, 21, 1230–1245. [Google Scholar] [CrossRef]

- Martins, A.C.; Marques, R.C.; Cruz, C.O. Public–Private Partnerships for Wind Power Generation: The Portuguese Case. Energy Policy 2011, 39, 94–104. [Google Scholar] [CrossRef]

- Awuku, S.A.; Bennadji, A.; Muhammad-Sukki, F.; Sellami, N. Promoting the Solar Industry in Ghana through Effective Public-Private Partnership (PPP): Some Lessons from South Africa and Morocco. Energies 2022, 15, 17. [Google Scholar] [CrossRef]

- Sastoque, L.M.; Arboleda, C.A.; Ponz, J.L. A Proposal for Risk Allocation in Social Infrastructure Projects Applying PPP in Colombia. Procedia Eng. 2016, 145, 1354–1361. [Google Scholar] [CrossRef]

- Tallaki, M.; Bracci, E. Risk Allocation, Transfer and Management in Public–Private Partnership and Private Finance Initiatives: A Systematic Literature Review. Int. J. Public Sect. Manag. 2021, 34, 709–731. [Google Scholar] [CrossRef]

- Li, F.; Phoon, K.K.; Du, X.; Zhang, M. Improved AHP Method and Its Application in Risk Identification. J. Constr. Eng. Manag. 2013, 139, 312–320. [Google Scholar] [CrossRef]

- Cesarone, F.; Colucci, S. Minimum Risk versus Capital and Risk Diversification Strategies for Portfolio Construction. J. Oper. Res. Soc. 2018, 69, 183–200. [Google Scholar] [CrossRef]

- Akomea-Frimpong, I.; Jin, X.; Osei-Kyei, R. A Holistic Review of Research Studies on Financial Risk Management in Public–Private Partnership Projects. Eng. Constr. Arch. Manag. 2021, 28, 2549–2569. [Google Scholar] [CrossRef]

- Gao, Y.; Lau, C.K. Risk Assessment of Urban Rail Transit Project Using Interpretative Structural Modelling: Evidence from China. Math. Probl. Eng. 2021, 2021, 5581686. [Google Scholar] [CrossRef]

- Zhang, K.; Zhou, H.; Li, H.; Tang, A.; Li, C. Composite Power System Risk Evaluation Considering the Accurate Model of Renewable Power Output. Energy Rep. 2023, 9, 1861–1874. [Google Scholar] [CrossRef]

- Liu, J.; Liu, J.; Hu, J. Forecasting the Investors’ Escalation of Commitment in PPP Project at Different Project Stages: A Regression Model Based on the Influence of Social Factors. Eng. Manag. J. 2024, 36, 30–41. [Google Scholar] [CrossRef]

- Martiniello, L.; Morea, D.; Paolone, F.; Tiscini, R. Energy Performance Contracting and Public-Private Partnership: How to Share Risks and Balance Benefits. Energies 2020, 13, 3625. [Google Scholar] [CrossRef]

- Mao, Y.; Zhang, Y. Risk Identification and Allocation of the Utility Tunnel PPP Project. AIP Publishing LLC 2017, 1839, 020132. [Google Scholar] [CrossRef]

- Karim, N.A.A. Risk Allocation in Public Private Partnership (PPP) Project: A Review on Risk Factors. Int. J. Sustain. Constr. Eng. Technol. 2011, 2, 8–16. [Google Scholar]

- Liu, J.; Liu, J.; Bu, Z.; Zhou, Y.; He, P. Path Analysis of Influencing Government’s Excessive Behavior in PPP Project: Based on Field Dynamic Theory. Transp. Res. Part A Policy Pract. 2022, 166, 522–540. [Google Scholar] [CrossRef]

- Wang, D.; Qiao, Z. The Influence of Capital Deepening on Regional Economic Development Gap: The Intermediary Effect of the Labor Income Share. Sustainability 2022, 14, 16853. [Google Scholar] [CrossRef]

- Liu, Y.; Ling, H.; Ou, P.; Xu, K.; Kong, L. Pollution Emission Right Trading Policy and Green Total Factor Productivity. Technol. Anal. Strateg. Manag. 2024, 1–18. [Google Scholar] [CrossRef]

- Choo, W.; De Jong, P. Insights to Systematic Risk and Diversification across a Joint Probability Distribution. Insur. Math. Econ. 2016, 67, 142–150. [Google Scholar] [CrossRef]

- Li, Q.; Zhang, W. Sparse and Risk Diversification Portfolio Selection. Optim. Lett. 2023, 17, 1181–1200. [Google Scholar] [CrossRef]

- Ciullo, A.; Strobl, E.; Meiler, S.; Martius, O.; Bresch, D.N. Increasing Countries’ Financial Resilience through Global Catastrophe Risk Pooling. Nat. Commun. 2023, 14, 922. [Google Scholar] [CrossRef]

- Frey, R.; Hledik, J. Diversification and Systemic Risk: A Financial Network Perspective. Risks 2018, 6, 54. [Google Scholar] [CrossRef]

- Deng, G.; Kang, S.; Guo, K. Analysis on the Present Situation of Agricultural Catastrophe Risk Diversification in China. In Proceedings of the 7th Annual Meeting of Risk Analysis Council of China Association for Disaster Prevention, Changsha, China, 4–6 November 2016. [Google Scholar]

- Uchiyama, Y.; Kadoya, T.; Nakagawa, K. Complex Valued Risk Diversification. Entropy 2019, 21, 119. [Google Scholar] [CrossRef]

- Sugitomo, S.; Maeta, K. Quaternion Valued Risk Diversification. Entropy 2020, 22, 390. [Google Scholar] [CrossRef]

- Amiri, O.; Ayazi, A.; Rahimi, M.; Khazaeni, G. Risks of Water and Wastewater PPP Projects: An Investors’ Perspective. Constr. Innov. 2022, 22, 1104–1121. [Google Scholar] [CrossRef]

- Adu Gyamfi, T.; Aigbavboa, C.O.; Thwala, W.D. Risk Resources Management Influence on Public–Private Partnership Risk Management in Construction Industry. Confirmatory Factor Analysis Approach. J. Eng. Des. Technol. 2022, 22, 1544–1569. [Google Scholar] [CrossRef]

- Zhang, J.; Wang, T.; Zhang, L. Legal Risk Assessment Framework for International PPP Projects Based on Metanetwork. J. Constr. Eng. Manag. 2021, 147, 04021090. [Google Scholar] [CrossRef]

- Chen, H.; Wan, A.; Wei, G.; Peng, B. Multi-Dimensional Identification of Investment Risks in Renewable Energy Projects along the Belt and Road: An Integrated Framework Based on HHM and WRT. Technol. Anal. Strateg. Manag. 2024, 1–14. [Google Scholar] [CrossRef]

- Attarzadeh, M.; Chua, D.K.H.; Beer, M.; Abbott, E.L.S. Options-Based Negotiation Management of PPP–BOT Infrastructure Projects. Constr. Manag. Econ. 2017, 35, 676–692. [Google Scholar] [CrossRef]

- Cvetković, P.N. Typology and Control of the Risks by the Public Private Partnership. Zb. Rad. Pravnog Fak. Nišu 2012, 63, 121–145. [Google Scholar]

- Mineo, S. Comparing Rockfall Hazard and Risk Assessment Procedures along Roads for Different Planning Purposes. J. Mt. Sci. 2020, 17, 653–669. [Google Scholar] [CrossRef]

- Guo, J.; Ma, K. Risk Analysis for Hazardous Chemical Vehicle-Bridge Transportation System: A Dynamic Bayesian Network Model Incorporating Vehicle Dynamics. Reliab. Eng. Syst. Saf. 2024, 242, 109732. [Google Scholar] [CrossRef]

- Li, X.; Yan, X.; Ma, L.; Li, H.; Wang, H.; Cai, L.; Lu, S.; Tang, C.; Wei, X. Probabilistic Risk Analysis for Catenary System of Heavy-Haul Railway Based on Casual Inference. Concurr. Comput. 2025, 37, e8368. [Google Scholar] [CrossRef]

- Xu, Z.; He, Z.; Wang, X. Efficient Risk Estimation via Nested Multilevel Quasi-Monte Carlo Simulation. J. Comput. Appl. Math. 2024, 443, 115745. [Google Scholar] [CrossRef]

- Guo, B.; Li, J. Research on the Evolution of Participants Collaboration Mechanism in PPP Model Based on Computer Simulation: Based on the Old Community Renovation Project. J. Supercomput. 2020, 76, 2417–2434. [Google Scholar] [CrossRef]

- Li, R.; Zhang, G.; Li, S.; Wang, A. Driving Mechanism of High-Tech Enterprises Sustainable Development from Collaborative Dual Innovation Perspective in Eastern China Based on System Dynamics Model. Technol. Anal. Strateg. Manag. 2023, 36, 4531–4548. [Google Scholar] [CrossRef]

- Bajomo, M.; Ogbeyemi, A.; Zhang, W. A Systems Dynamics Approach to the Management of Material Procurement for Engineering, Procurement and Construction Industry. Int. J. Prod. Econ. 2022, 244, 108390. [Google Scholar] [CrossRef]

- Zhao, Y.; Zhou, Y.; Zhang, Y.; Chen, H. Exploring Intellectual Property Risk Inducement and Formation Mechanism of Innovation-Oriented Enterprises: A Grounded Theory Approach and System Dynamics Model Analysis. Technol. Anal. Strateg. Manag. 2023, 36, 4686–4700. [Google Scholar] [CrossRef]

- Liu, A.; Chen, K.; Huang, X.; Li, D.; Zhang, X. Dynamic risk assessment model of buried gas pipelines based on system dynamics. Reliab. Eng. Syst. Saf. 2021, 208, 107326. [Google Scholar] [CrossRef]

- Huang, L.; Wang, C.; Cui, B.; Zhou, H.; Wu, M.; Li, C. Employing an Interpretive Structural Modeling–System Dynamics Approach for Deep Foundation Pit Risk Assessment Model. ASCE-ASME J. Risk Uncertain. Eng. Syst. Part A Civ. Eng. 2024, 10, 04024004. [Google Scholar] [CrossRef]

- Hu, B.; Leopold, A.; Pickl, S. Concept and Prototype of a Web Tool for Public–Private Project Contracting Based on a System Dynamics Model. Cent. Eur. J. Oper. Res. 2015, 23, 407–419. [Google Scholar] [CrossRef]

- Morcillo, J.D.; Angulo, F.; Franco, C.J. Analyzing the Hydroelectricity Variability on Power Markets from a System Dynamics and Dynamic Systems Perspective: Seasonality and ENSO Phenomenon. Energies 2020, 13, 2381. [Google Scholar] [CrossRef]

- Calvo-Amodio, J.; Tercero-Gómez, V.G.; Ramirez-Galindo, J.G.; Martínez-Salazar, I. A Systemic Analysis of Professional Certification Rates: The Case of a Six Sigma Training Certificate Program. Eng. Manag. J. 2014, 26, 13–22. [Google Scholar] [CrossRef]

- Reiner, G.; Natter, M.; Drechsler, W. Life Cycle Profit–Reducing Supply Risks by Integrated Demand Management. Technol. Anal. Strateg. Manag. 2009, 21, 653–664. [Google Scholar] [CrossRef]

- Li, B.; Akintoye, A.; Edwards, P.J.; Hardcastle, C. Perceptions of Positive and Negative Factors Influencing the Attractiveness of PPP/PFI Procurement for Construction Projects in the UK: Findings from a Questionnaire Survey. Eng. Constr. Archit. Manag. 2005, 12, 125–148. [Google Scholar] [CrossRef]

- Salman, A.F.M.; Skibniewski, M.J.; Basha, I. BOT Viability Model for Large-Scale Infrastructure Projects. J. Constr. Eng. Manag. 2007, 133, 50–63. [Google Scholar] [CrossRef]

- Ying, L.; Qianying, D.; Zhihui, C.; Junwen, C.; Zhengjiang, L. Generation Model of Optimal EmergencyTreatment Technology for Sudden Heavy MetalPollution Based on Group-G1 Method. Pol. J. Environ. Stud. 2021, 30, 5899–5908. [Google Scholar] [CrossRef]

- de Rada, V.D. Handbook of Survey Research. Rev. Int. Sociol. 2013, 71, 229–233. [Google Scholar]

- Shannon, C.E. The Mathematical Theory of Communication. Bell Labs Tech. J. 1950, 3, 31–32. [Google Scholar] [CrossRef]

- Nikunj Agarwal, H.G. Entropy Based Multi-Criteria Decision Making Method under Fuzzy Environment and Unknown Attribute Weights. Glob. J. Technol. Optim. 2015, 06, 13–20. [Google Scholar] [CrossRef]

- Bayer, S. Business Dynamics: Systems Thinking and Modeling for a Complex World. Interfaces 2004, 34, 324–326. [Google Scholar]

- Wang, Y.; Gong, L.; Zheng, S.; Han, X.; Zhang, J.; Huang, Y. Temporal and Spatial Evolution of Public–Private Partnership (PPP) Project Risks in China: 2003–2019. Adv. Civ. Eng. 2024, 2024, 2689594. [Google Scholar] [CrossRef]

- John, A.; Yang, Z.; Riahi, R.; Wang, J. A Risk Assessment Approach to Improve the Resilience of a Seaport System Using Bayesian Networks. Ocean Eng. 2016, 111, 136–147. [Google Scholar] [CrossRef]

- Saltelli, A.; Puy, A.; Lo Piano, S. Sensitivity Analysis. SSRN J. 2021. [Google Scholar] [CrossRef]

- Hwang, B.-G.; Zhao, X.; Gay, M.J.S. Public Private Partnership Projects in Singapore: Factors, Critical Risks and Preferred Risk Allocation from the Perspective of Contractors. Int. J. Proj. Manag. 2013, 31, 424–433. [Google Scholar] [CrossRef]

- Chou, J.-S.; Pramudawardhani, D. Cross-Country Comparisons of Key Drivers, Critical Success Factors and Risk Allocation for Public-Private Partnership Projects. Int. J. Proj. Manag. 2015, 33, 1136–1150. [Google Scholar] [CrossRef]

- Loosemore, M.; Cheung, E. Implementing Systems Thinking to Manage Risk in Public Private Partnership Projects. Int. J. Proj. Manag. 2015, 33, 1325–1334. [Google Scholar] [CrossRef]

- Zhang, S.; Chan, A.P.C.; Feng, Y.; Duan, H.; Ke, Y. Critical Review on PPP Research—A Search from the Chinese and International Journals. Int. J. Proj. Manag. 2016, 34, 597–612. [Google Scholar] [CrossRef]

- Shrestha, A.; Chan, T.-K.; Aibinu, A.A.; Chen, C.; Martek, I. Risks in PPP Water Projects in China: Perspective of Local Governments. J. Constr. Eng. Manag. 2017, 143, 05017006. [Google Scholar] [CrossRef]

- Shrestha, A.; Chan, T.-K.; Aibinu, A.A.; Chen, C.; Martek, I. Risk Allocation Inefficiencies in Chinese PPP Water Projects. J. Constr. Eng. Manag. 2018, 144, 04018013. [Google Scholar] [CrossRef]

- Nguyen, A.; Mollik, A.; Chih, Y.-Y. Managing Critical Risks Affecting the Financial Viability of Public–Private Partnership Projects: Case Study of Toll Road Projects in Vietnam. J. Constr. Eng. Manag. 2018, 144, 05018014. [Google Scholar] [CrossRef]

- Keers, B.B.M.; Van Fenema, P.C. Managing Risks in Public-Private Partnership Formation Projects. Int. J. Proj. Manag. 2018, 36, 861–875. [Google Scholar] [CrossRef]

- Wang, H.; Liu, Y.; Xiong, W.; Song, J. The Moderating Role of Governance Environment on the Relationship between Risk Allocation and Private Investment in PPP Markets: Evidence from Developing Countries. Int. J. Proj. Manag. 2019, 37, 117–130. [Google Scholar] [CrossRef]

- Le, P.T.; Chileshe, N.; Kirytopoulos, K.; Rameezdeen, R. Investigating the Significance of Risks in BOT Transportation Projects in Vietnam. Eng. Constr. Arch. Manag. 2020, 27, 1401–1425. [Google Scholar] [CrossRef]

- Owolabi, H.A.; Oyedele, L.O.; Alaka, H.A.; Ajayi, S.O.; Akinade, O.O.; Bilal, M. Critical Success Factors for Ensuring Bankable Completion Risk in PFI/PPP Megaprojects. J. Manag. Eng. 2020, 36, 04019032. [Google Scholar] [CrossRef]

- Feng, Y.; Guo, X.; Wei, B.; Chen, B. A Fuzzy Analytic Hierarchy Process for Risk Evaluation of Urban Rail Transit PPP Projects. J. Intell. Fuzzy Syst. 2021, 41, 5117–5128. [Google Scholar] [CrossRef]

- Luo, C.; Ju, Y.; Dong, P.; Gonzalez, E.D.R.S.; Wang, A. Risk Assessment for PPP Waste-to-Energy Incineration Plant Projects in China Based on Hybrid Weight Methods and Weighted Multigranulation Fuzzy Rough Sets. Sustain. Cities Soc. 2021, 74, 103120. [Google Scholar] [CrossRef]

- Othman, K.; Khallaf, R. Identification of the Barriers and Key Success Factors for Renewable Energy Public-Private Partnership Projects: A Continental Analysis. Buildings 2022, 12, 1511. [Google Scholar] [CrossRef]

- Kaminsky, J.A. Improving Public–Private Partnerships for Renewable Electricity Infrastructure in Lower- and Middle-Income Countries. J. Constr. Eng. Manag. 2022, 148, 04022012. [Google Scholar] [CrossRef]

- Bao, F.; Martek, I.; Chen, C.; Wu, Q.; Chan, A.P.C. Critical Risks Inherent to the Transfer Phase of Public–Private Partnership Water Projects in China. J. Manag. Eng. 2022, 38, 04022006. [Google Scholar] [CrossRef]

- Sun, G.; Sun, J.; Li, F. Influencing Factors of Early Termination for PPP Projects Based on Multicase Grounded Theory. J. Constr. Eng. Manag. 2022, 148, 04022120. [Google Scholar] [CrossRef]

- Wang, Y.; Li, Q.; Zuo, J.; Bartsch, K. How Did Balance Loss Occur? A Cross-Stakeholder Analysis of Risk Misallocation in a Sponge City PPP Project. Water Resour. Manag. 2022, 36, 5225–5240. [Google Scholar] [CrossRef]

- Othman, K. Renewable Energy Public-Private Partnership Projects in Egypt: Perception of the Barriers and Key Success Factors by Sector. Alex. Eng. J. 2023, 75, 513–530. [Google Scholar] [CrossRef]

- Chen, H.; Wang, J.; Feng, Z.; Liu, Y.; Xu, W.; Qin, Y. Research on the Risk Evaluation of Urban Wastewater Treatment Projects Based on an Improved Fuzzy Cognitive Map. Sustain. Cities Soc. 2023, 98, 104796. [Google Scholar] [CrossRef]

- Guo, Y.; Wang, X.; Liu, L.; Chen, C.; Martek, I.; Luo, X. Dynamic Assessment of the Transfer Risks in China’s Public–Private Partnership Water Projects: A System Dynamics Approach. J. Infrastruct. Syst. 2023, 29, 04023033. [Google Scholar] [CrossRef]

- Jiang, F.; Lyu, Y.; Zhang, Y.; Guo, Y. Research on the Differences between Risk-Factor Attention and Risk Losses in PPP Projects. J. Constr. Eng. Manag. 2023, 149, 04023090. [Google Scholar] [CrossRef]

- Liu, Y.; Wang, X.; Zhang, J.; Guo, S. How Risk Factors Lead to the Early Termination of Public–Private Partnership Projects in China: A Multi-Case Study Based on Social Network Analysis and Interpretive-Structure Modeling. Eng. Constr. Arch. Manag. 2023, 32, 824–846. [Google Scholar] [CrossRef]

- Wang, Z.; Zhou, Y.; Jin, X.; Zhao, N.; Sun, J. Risk Allocation and Benefit Distribution of PPP Projects for Construction Waste Recycling: A Case Study of China. Eng. Constr. Archit. Manag. 2023, 30, 3927–3956. [Google Scholar] [CrossRef]

- Chang, Z.; Zheng, Y.; Qu, M.; Gao, X.; Tian, X.; Liu, G. Motion Analysis of International Energy Agency Wind 15 MW Floating Offshore Wind Turbine under Extreme Conditions. J. Mar. Sci. Eng. 2024, 12, 1166. [Google Scholar] [CrossRef]

- Fleta-Asín, J.; Muñoz, F. Risk Allocation Schemes between Public and Private Sectors in Green Energy Projects. J. Environ. Manag. 2024, 357, 120650. [Google Scholar] [CrossRef] [PubMed]

| Name of Risk Subsystem | Equation |

|---|---|

| Construction time delay risk subsystem | |

| Financing risk subsystem | |

| Construction quality risk subsystem | |

| Construction cost overrun risk subsystem | |

| Operation cost overrun risk subsystem | |

| Insufficiency expected return risk subsystem | |

| Boundary Risk | Risk Value | Boundary Risk | Risk Value | Boundary Risk | Risk Value |

|---|---|---|---|---|---|

| Improper public decision-making process risk | Foreign exchange and convertibility risk | Concession period risk | |||

| Land acquisition risk | Technical risk | Competitive risk | |||

| Lack of supporting infrastructure risk | Environmental risk | Organization coordination risk | |||

| Delays in approvals and permits risk | Climatic/Geological conditions risk | Contractual risk | |||

| Material/Labor availability risk | Inflation risk | Residual risk | |||

| Legal changes or imperfect risk | Force majeure risk | Government/Public opposition risk | |||

| Interest rate fluctuation risk | Tax changes risk |

| Risk Level | Value-at-Risk Range | Construction Phase | Operational Phase |

|---|---|---|---|

| Low risk | [0,1.484] | [0,43.632] | |

| Average risk | [1.484,2.967] | [43.632,87.264] | |

| Medium risk | [2.967,4.451] | [87.264,130.897] | |

| High risk | [4.451,5.934] | [130.897,174.529] | |

| Significant risk | [5.934,7.418] | [174.529,218.161] |

| Period | Risk Subsystem | Risk Ranking (Top Five) |

|---|---|---|

| Construction period | Construction time delay risk subsystem | Climatic/Geological conditions risk > Technical risk > Environmental risk > Material/Labor availability risk > Legal changes or imperfect risk |

| Financing risk subsystem | Legal changes or imperfect risk > Interest rate fluctuation risk > Foreign exchange and convertibility risk | |

| Construction quality risk subsystem | Force majeure risk > Technical risk > Delays in approvals and permits risk > Climatic/Geological conditions risk > Environmental risk | |

| Construction cost overrun risk subsystem | Tax changes risk> Interest rate fluctuation risk >Climatic/Geological conditions risk > Environmental risk > Force majeure risk | |

| Operation period | Operation cost overrun risk subsystem | Tax changes risk > Interest rate fluctuation risk > Climatic/Geological conditions risk > Force majeure risk |

| Insufficiency expected return risk subsystem | Legal changes or imperfect risk > Interest rate fluctuation risk > Foreign exchange and convertibility risk > Tax changes risk > Inflation risk |

| Boundary Risk | Government and Regulatory Agencies | Project Implementers | Market and Societal Stakeholders |

|---|---|---|---|

| Force Majeure Risk | Develop disaster response plans and emergency protocols to ensure a quick and effective response mechanism in the event of natural disasters or other force majeure events. | Ensure the use of construction methods that meet disaster resistance standards and develop comprehensive disaster management plans to ensure business continuity and rapid recovery. | Strengthen project understanding and cooperation, jointly develop risk mitigation measures for force majeure events, and enhance overall response capabilities. |

| Technical Risk | Support and promote technological research and innovation and provide technology validation and certification services to ensure that the adopted technologies are suitable for local application and reliable. | Adopt mature technological solutions and collaborate with technology providers for preliminary trials and technology validation to ensure technology adaptability and reliability. | Actively participate in the technology evaluation process to ensure that the technology choices meet environmental and societal needs. |

| Delays in Approvals and Permits Risk | Optimize the approval process to ensure transparency and efficiency and set clear approval timelines and requirements to reduce project delays caused by administrative inefficiencies. | Proactively communicate with government agencies, submit accurate application materials on time, anticipate potential approval delays, and make corresponding adjustments to the project plan. | Strengthen public participation in the approval process, improve process transparency, and help mitigate the potential impact of approval delays on the project. |

| Climatic/Geological Conditions Risk | Establish strict construction standards and regulations to ensure that wind energy projects can operate stably in complex environments, and regularly monitor the project to ensure compliance with safety standards. | Project design and technology solutions should be based on detailed geological and climatic data, enhancing the durability and disaster resistance of buildings and infrastructure while developing emergency response plans. | Actively participate in the project’s environmental impact assessment to ensure that concerns and perspectives are considered, and promote project planning that is sensitive to climatic and geological conditions. |

| Environmental Risk | Establish strict environmental protection policies and regulatory mechanisms, continuously monitor the project’s environmental impact, and implement necessary environmental protection measures. | Implement rigorous environmental management and monitoring plans, ensuring that environmentally friendly materials and technologies are used during construction and operation to minimize impact on ecosystems. | Actively participate in environmental monitoring and management, promote sustainable environmental strategies, and improve community involvement and project transparency through environmental education, thereby enhancing public trust. |

| Tax Changes Risk | Ensure the stability and predictability of tax policies, provide timely updates on tax law changes, and offer project implementers sufficient time for preparation and adaptation measures. | Enhance financial planning flexibility by collaborating with financial advisors to forecast tax changes and develop response strategies, including the use of potential tax incentives and benefits. | Focus on tax policy changes and actively participate in tax law reform discussions to influence policy formation, ensuring the fairness and transparency of tax policies. |

| Legal Changes/Imperfect Risk | Ensure continuity and stability in laws and policies, provide a clear and reliable legal environment for the project, promptly communicate any major legal changes, and offer clear guidance and training. | Collaborate closely with legal advisors to continuously monitor changes in the legal environment, assess the potential impact of these changes on wind energy projects, and design flexible contract terms to address potential legal risks. | Participate in policy-making and legal discussions, ensuring that new laws or policy changes support the development of sustainable energy projects. |

| Interest Rate Fluctuation Risk | The government should consider providing fixed-rate loans or interest rate subsidies to reduce the risk of interest rate fluctuations in project financing. Additionally, adjusting monetary policies to stabilize market interest rates can help mitigate the impact of economic volatility. | Use financial derivatives, such as interest rate swaps and futures contracts, to lock in loan interest rates or hedge against interest rate fluctuations, and design flexible financing structures that combine fixed and floating-rate loans to adapt to market changes. | Monitor and evaluate the potential impact of interest rate trends on the financial stability of the project. Adjust investment decisions or credit strategies in a timely manner to minimize negative effects on project financing. |

| Foreign Exchange and Convertibility Risk | Implement foreign exchange control policies and exchange rate stabilization measures, offering exchange rate hedging tools or fiscal subsidies to help projects mitigate the impact of exchange rate fluctuations caused by international capital. | Use foreign exchange hedging strategies, such as forward contracts and options, to stabilize exchange rate costs, and, whenever possible, settle transactions in local currency to reduce dependency on foreign currency. | Strengthen education and communication regarding foreign exchange risk, ensuring that investors and power purchasers use appropriate financial tools to protect their investments. |

| Inflation Risk | Monitor economic indicators and adjust fiscal and monetary policies in a timely manner to mitigate the impact of inflation on the project’s economic feasibility. | Incorporate inflation-adjustment mechanisms into financial planning by adjusting project costs and fee structures, and by using fixed-rate loans or other financial instruments to lock in costs, ensuring that project revenue can withstand the impact of inflation. | Focus on assessing the impact of inflation on the long-term sustainability of the project, adjusting investment strategies and business models to mitigate inflation risks throughout the project lifecycle. |

| Materials/Labor Availability Risk | Promote the development of local materials and labor markets through policy support, thereby increasing the project’s reliance on local resources. | Establish a diversified supply chain and labor sources, conduct market research to assess and forecast material costs and supply conditions, and ensure a stable supply of materials and labor through contracts and strategic procurement. | Collaborate with the project management team to promote the use of local materials and labor, thereby reducing reliance on external resources. Additionally, participate in environmental and resource conservation awareness campaigns to raise public understanding of sustainable resource usage. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lai, R.; Liu, S.; Wang, Y. Sustainable Operations: Risk Evolution and Diversification Strategies Throughout the Lifecycle of Wind Energy Public–Private Partnership Projects. Systems 2025, 13, 237. https://doi.org/10.3390/systems13040237

Lai R, Liu S, Wang Y. Sustainable Operations: Risk Evolution and Diversification Strategies Throughout the Lifecycle of Wind Energy Public–Private Partnership Projects. Systems. 2025; 13(4):237. https://doi.org/10.3390/systems13040237

Chicago/Turabian StyleLai, Rongji, Shiying Liu, and Yinglin Wang. 2025. "Sustainable Operations: Risk Evolution and Diversification Strategies Throughout the Lifecycle of Wind Energy Public–Private Partnership Projects" Systems 13, no. 4: 237. https://doi.org/10.3390/systems13040237

APA StyleLai, R., Liu, S., & Wang, Y. (2025). Sustainable Operations: Risk Evolution and Diversification Strategies Throughout the Lifecycle of Wind Energy Public–Private Partnership Projects. Systems, 13(4), 237. https://doi.org/10.3390/systems13040237