Pricing Analysis of Risk-Averse Supply Chains with Supply Disruption Considering Reference Price Effect

Abstract

1. Introduction

- This paper focuses on the impact of single-sourcing supply disruption on suppliers’ and retailers’ pricing decisions in dual sourcing. Differently from the existing works only considering the influence of single or partial factors on pricing decisions, we comprehensively analyze the influence of the reference price effect, risk aversion, and single-sourcing supply disruption on pricing decisions.

- In terms of model construction, unlike the existing studies on supply chain risk management, this paper is based on the mean semivariance method to measure the risk-averse behavior of supply chain members. Compared to the traditional mean variance method, this method does not limit excess profits above expected returns so as to control losses below expected returns more reasonably and hence can measure the risk-averse behavior of supply chain members more effectively.

2. Literature Review

2.1. Pricing Decision

2.2. Supply Chain Disruption

2.3. Risk Aversion

2.4. Reference Price Effect

2.5. Risk Measurement Methodology

2.5.1. Mean Variance/Mean Standard Variance

2.5.2. Mean Semivariance

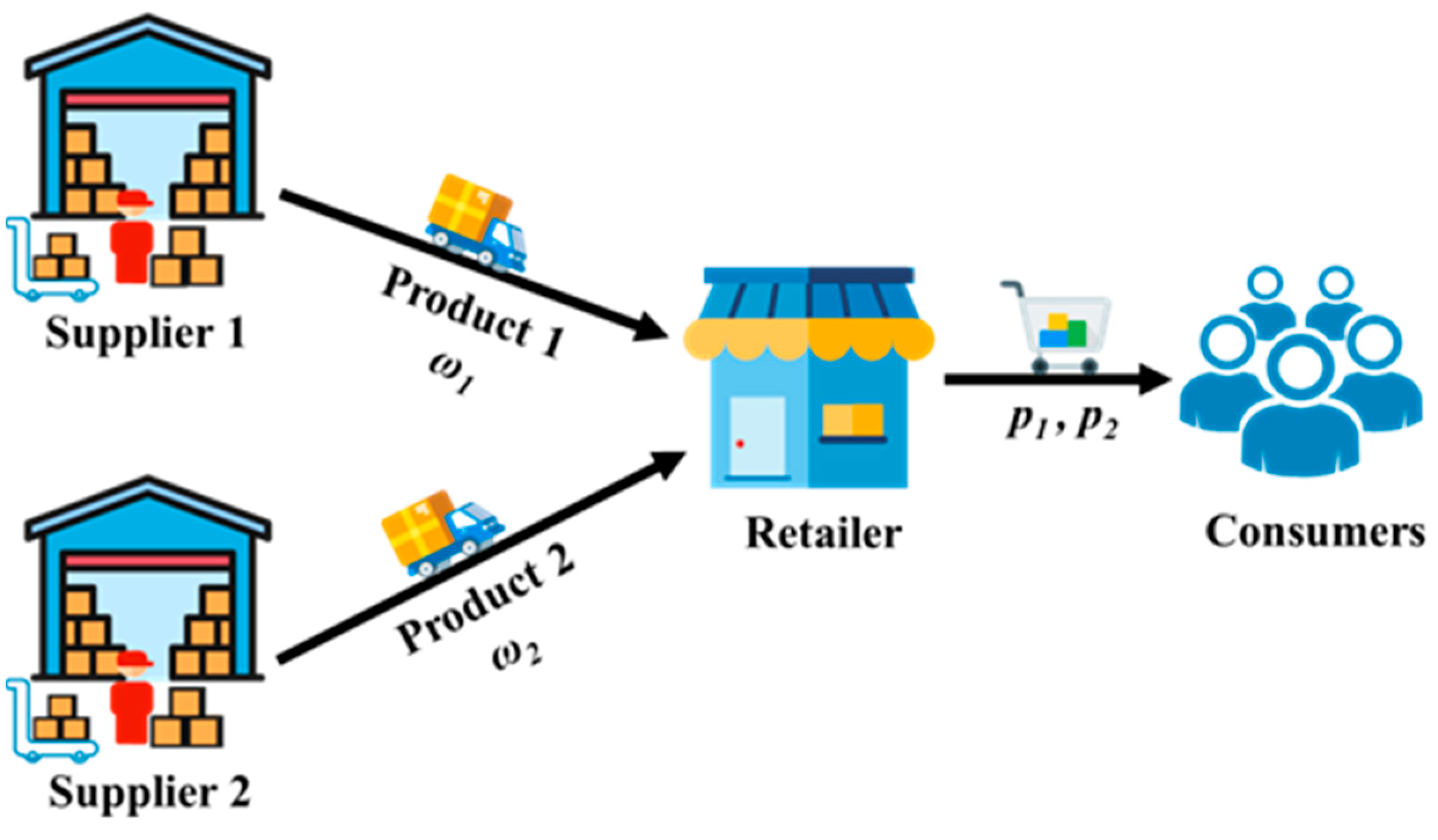

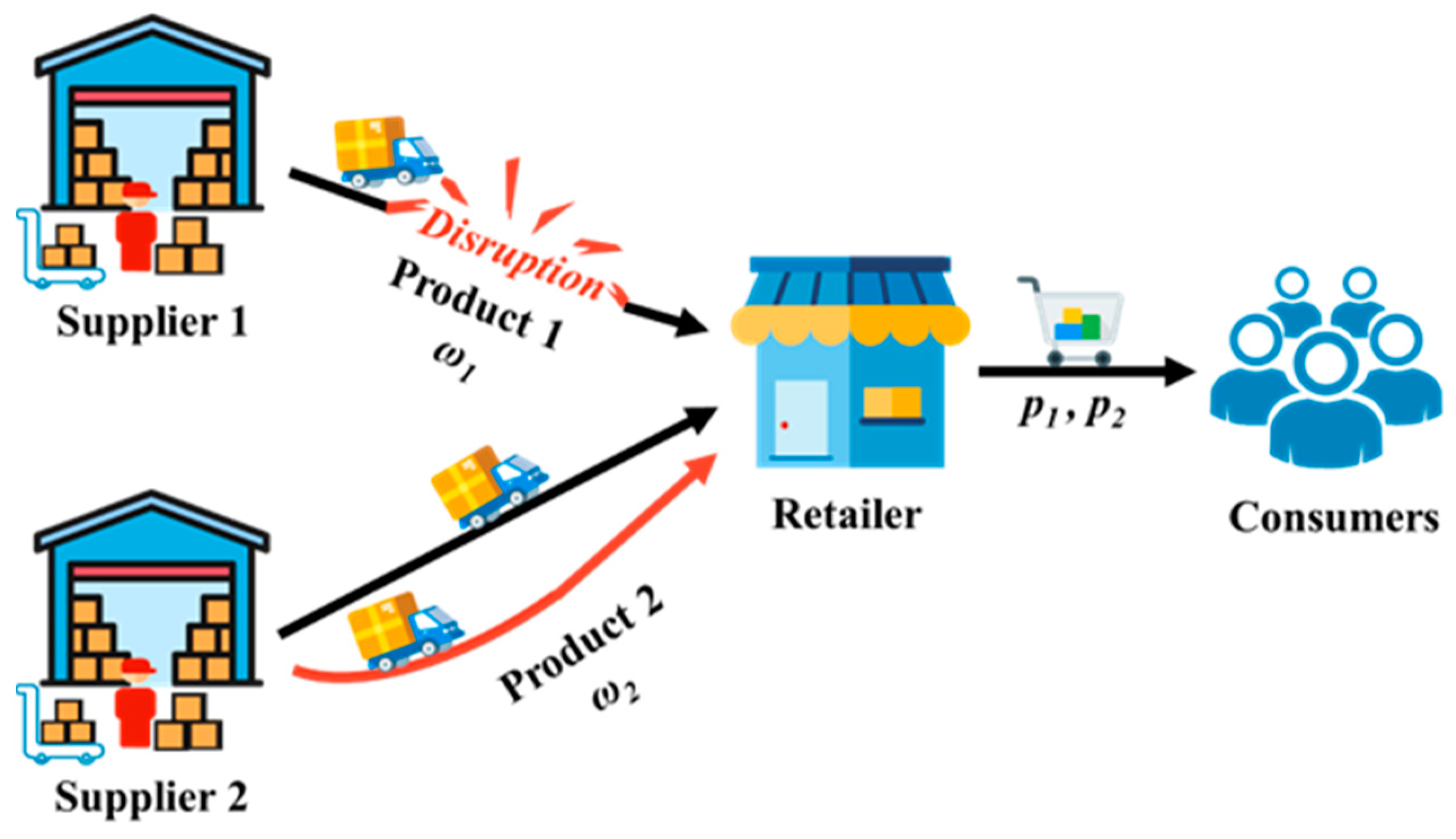

3. Problem Formulation

Model Assumption

4. Game-Theoretic Models

4.1. Non-Disrupted Situation

4.2. Disrupted Situation

5. Model Analysis

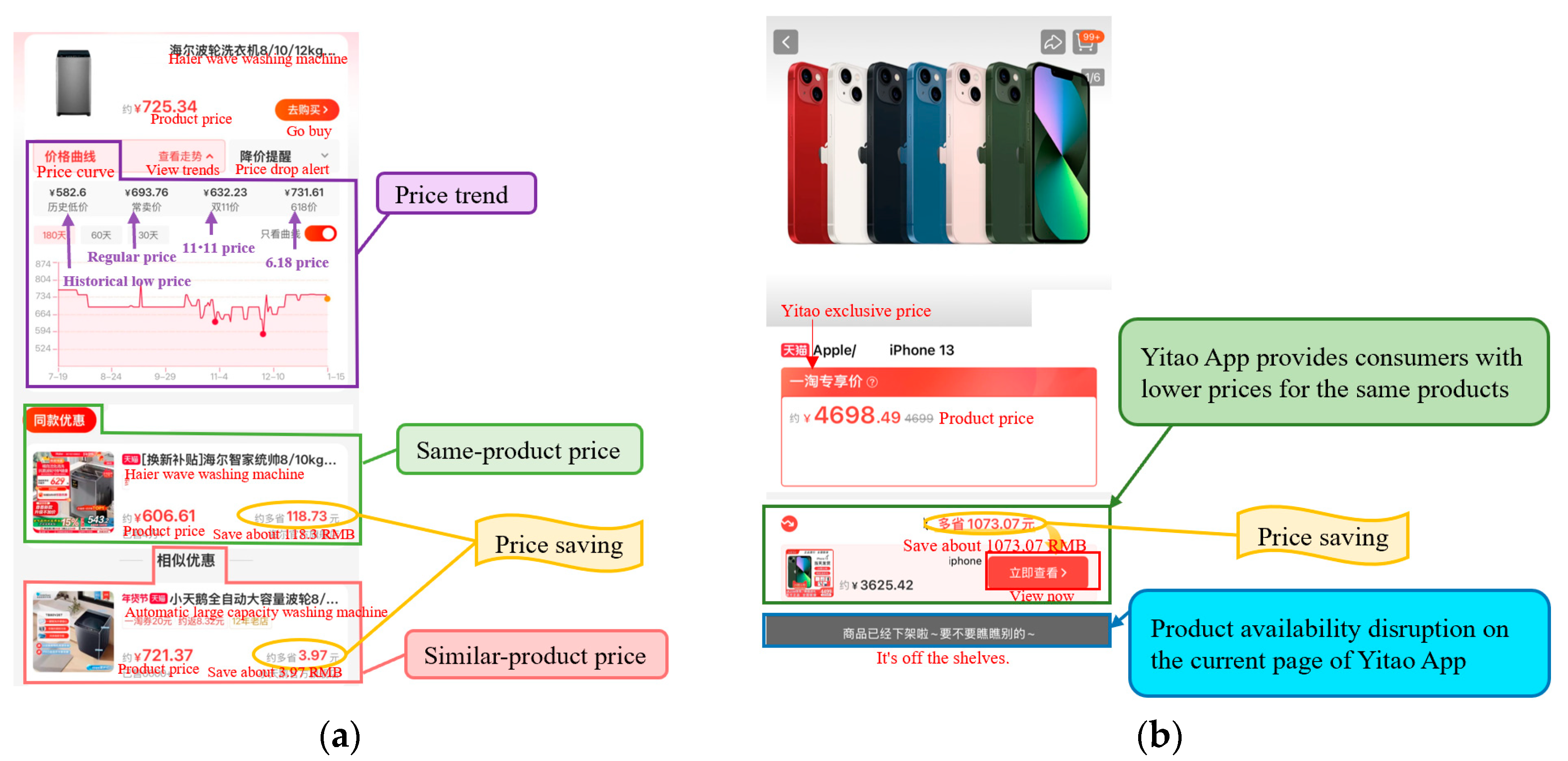

5.1. Case Study

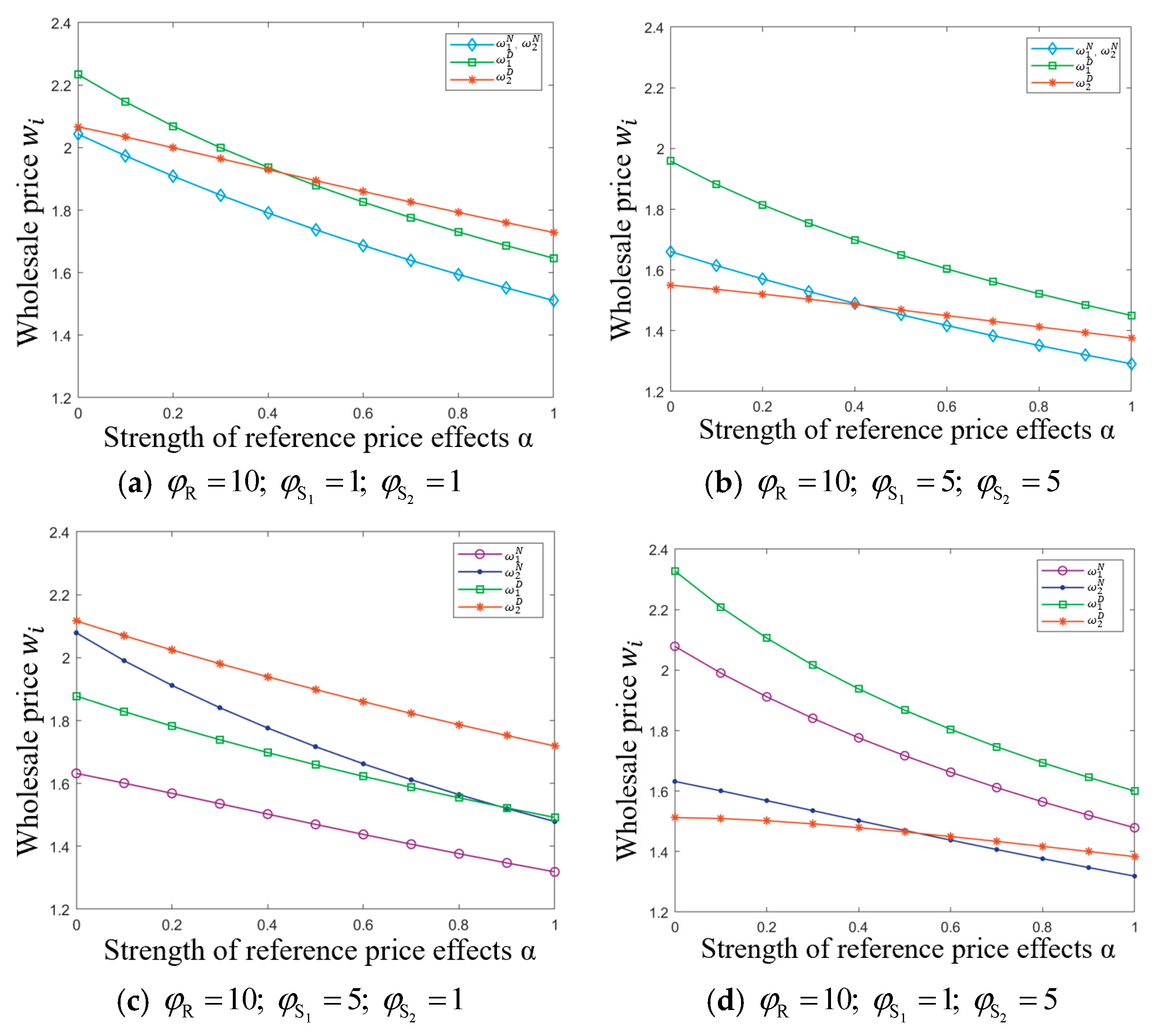

5.2. Numerical Analysis

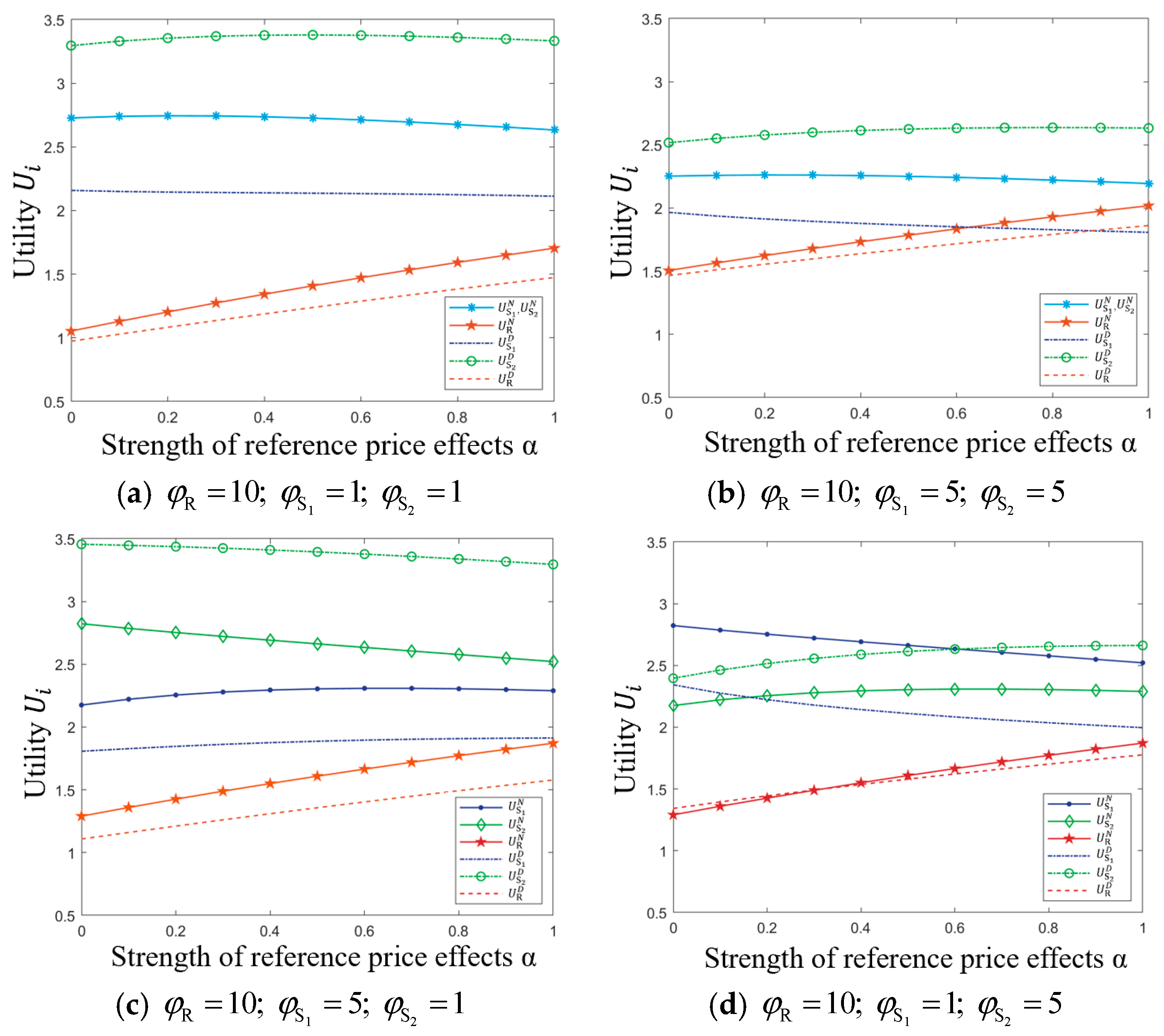

5.2.1. Impact of Reference Price Effects and Risk Aversion

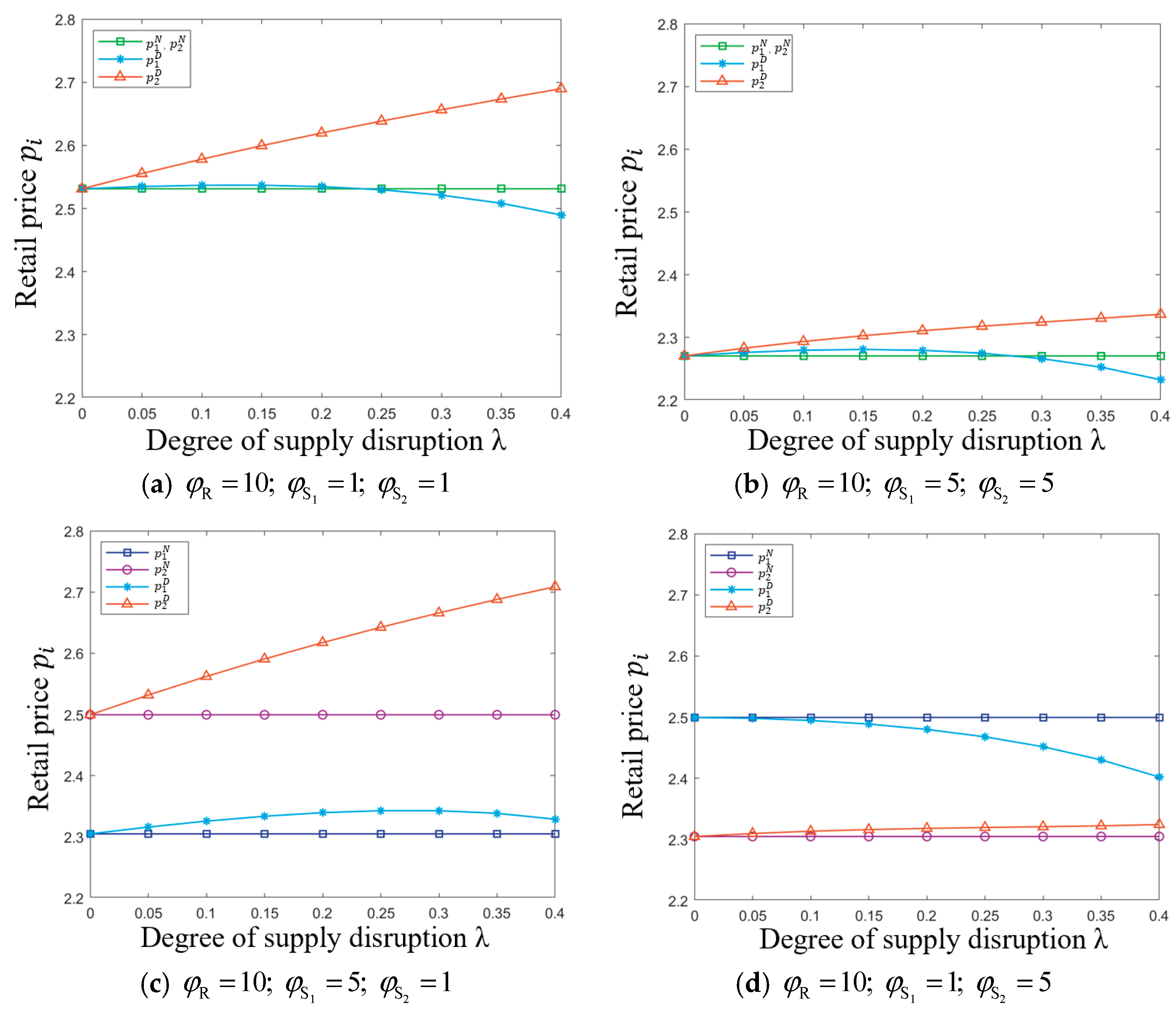

5.2.2. Impact of Single-Sourcing Supply Disruption and Risk Aversion

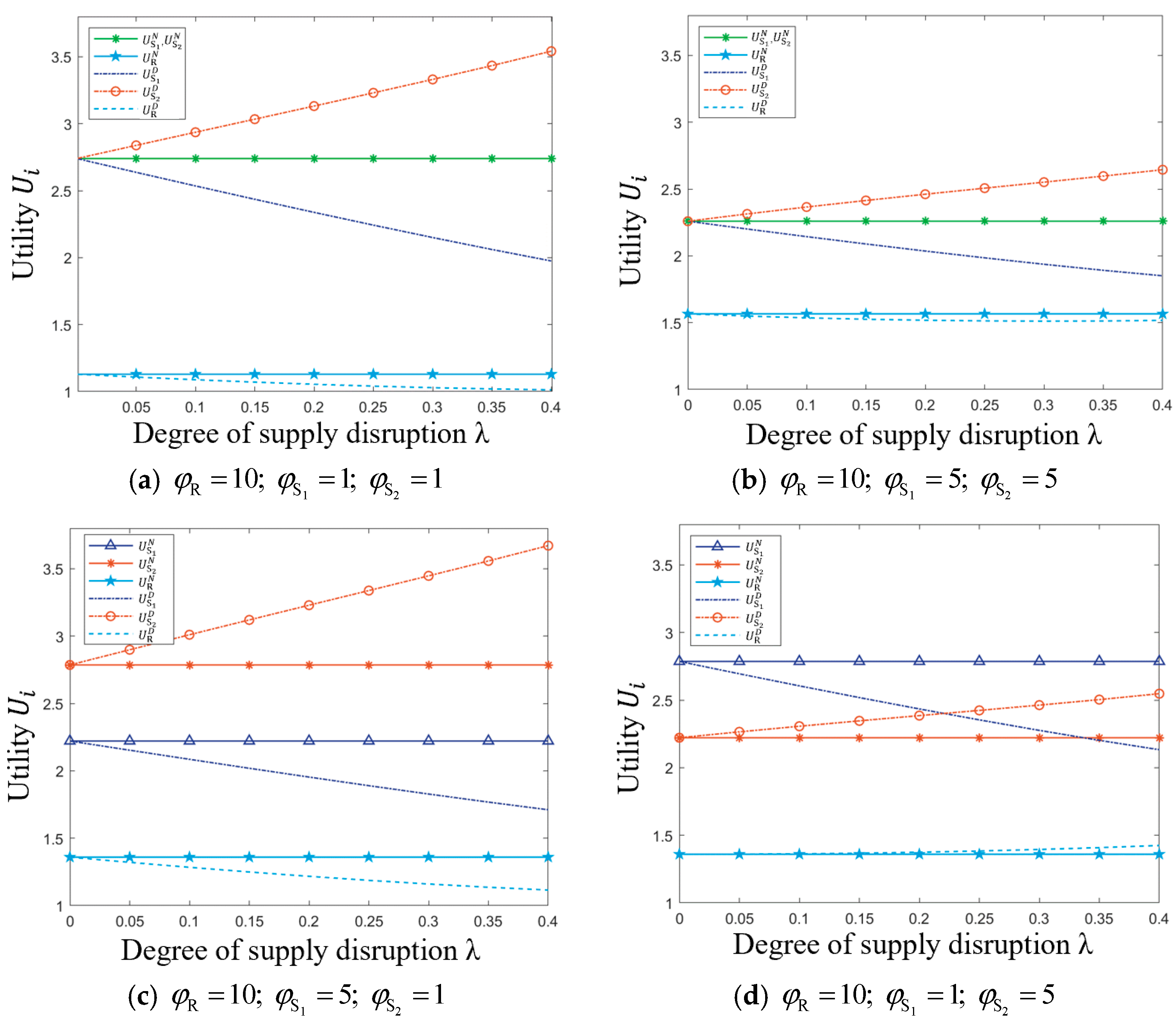

5.2.3. Impact of Multiple Factors on Supply Chain Members’ Utility

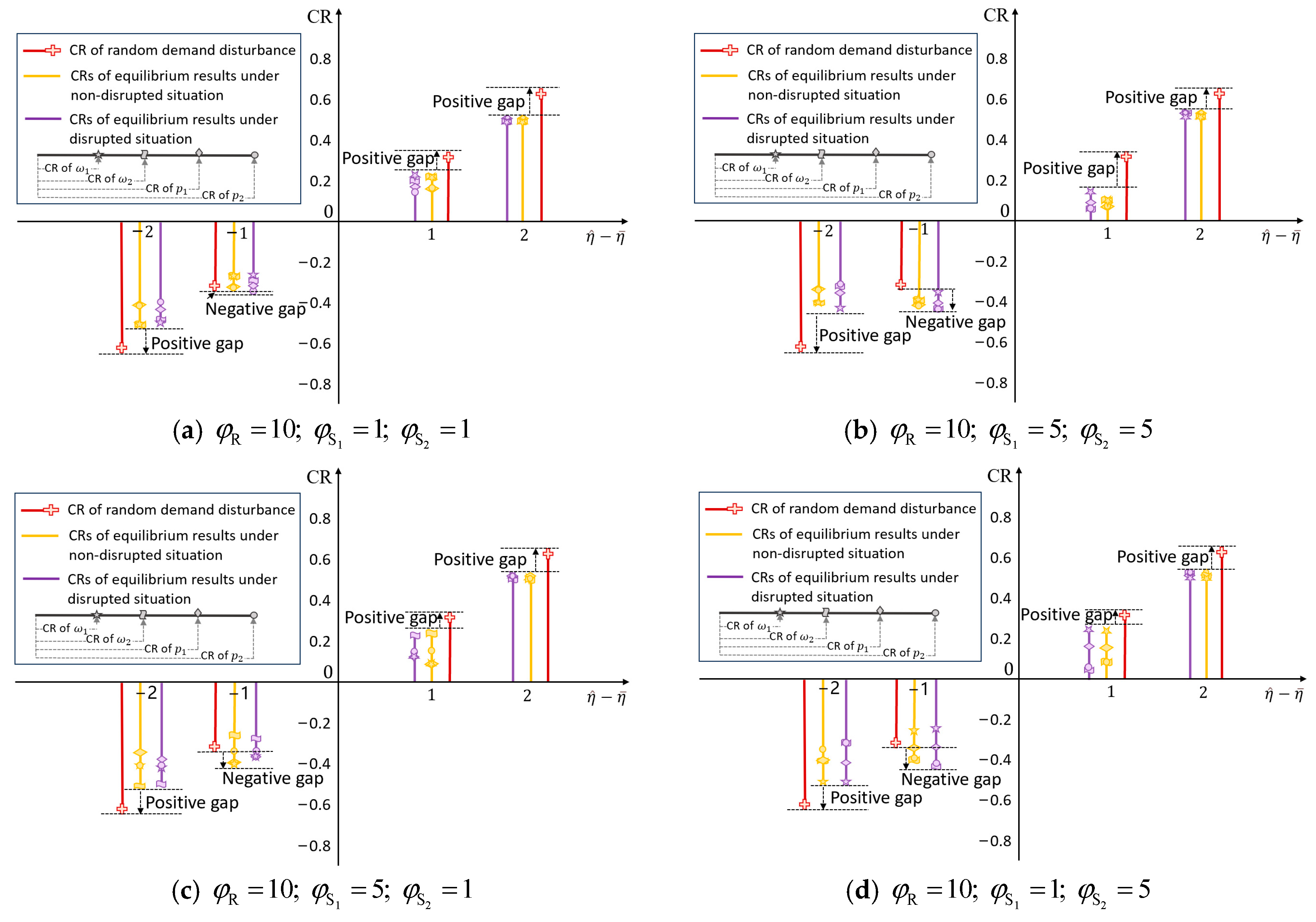

5.3. Robustness Analysis

6. Conclusions

- In the context of dual sourcing, when one supplier is subject to supply disruption, the retailer employs a pricing escalation strategy for regularly supplied products. The retail prices incrementally increase in accordance with the degree of single-sourcing supply disruption. Simultaneously, the non-disrupted supplier may benefit from the disruption of the competitor, with its utility increasing with the degree of single-sourcing supply disruption. During single-sourcing supply disruption, the non-disrupted supplier should seize the opportunity to strategize and implement targeted marketing campaigns to enhance its brand reputation and foster customer loyalty. This proactive approach may yield enduring advantages for the organization in the long term.

- Under various combinations of risk aversion degree and single-sourcing supply disruption degree, the strength of the reference price effect inversely affects wholesale prices and retail prices. Specifically, product pricing decreases as the strength of the reference price effect increases. It can be observed that the reference price effect exerts a significant influence on product pricing and so enterprises should regularly monitor the pricing strategy of competing products and flexibly adjust product prices to adapt to market changes and maintain product competitiveness.

- All members’ pricing decisions and utility are influenced by their risk-aversion degrees. Typically, supply chain members with great risk-aversion degrees tend to adopt more conservative pricing decisions, which may result in low utility. Hence, it is suggested to vigilantly monitor market dynamics and promptly address potential issues to mitigate the adverse impact of supply chain uncertainty. Simultaneously, maintaining an objective and rational stance toward supply disruption is essential for averting undue risk aversion that may result in avoidable losses.

- The models generally exhibit robustness regarding equilibrium decisions among supply chain members across different degrees of risk aversion. However, there is minor negative fluctuation observed under random demand conditions.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix B

| Notation | Explanation |

|---|---|

Appendix C

| utility | ||||

| 15.19/10.65 | 15.19/11.18 | 15.19/11.73 | 15.19/12.31 | |

| 28.16/29.22 | 28.16/29.27 | 28.16/29.26 | 28.16/29.22 | |

| 26.09/25.36 | 26.09/25.77 | 26.09/26.20 | 26.09/26.65 | |

| utility | ||||

| 21.34/15.23 | 21.34/15.81 | 21.34/16.42 | 21.34/17.05 | |

| 21.14/22.15 | 21.14/22.33 | 21.14/22.47 | 21.14/22.57 | |

| 25.13/22.91 | 25.13/23.30 | 25.13/23.71 | 25.13/24.13 | |

| utility | ||||

| 28.54/20.64 | 28.54/21.24 | 28.54/21.88 | 28.54/22.56 | |

| 15.13/16.07 | 15.13/16.35 | 15.13/16.60 | 15.13/16.83 | |

| 26.58/22.31 | 26.58/22.66 | 26.58/23.02 | 26.58/23.41 | |

References

- Hamdi, F.; Ghorbel, A.; Masmoudi, F.; Dupont, L. Optimization of a Supply Portfolio in the Context of Supply Chain Risk Management: Literature Review. J. Intell. Manuf. 2018, 29, 763–788. [Google Scholar] [CrossRef]

- Wang, Y.; Yu, Y. Flexible Strategies under Supply Disruption: The Interplay between Contingent Sourcing and Responsive Pricing. Int. J. Prod. Res. 2020, 58, 4829–4850. [Google Scholar] [CrossRef]

- Rajabzadeh, H.; Khamseh, A.A.; Ameli, M. A Game-Theoretic Approach for Pricing in a Two Competitive Closed-Loop Supply Chains Considering a Dual-Sourcing Strategy in The Presence of a Disruption Risk. Process Integr. Optim. Sustain. 2023, 7, 293–314. [Google Scholar] [CrossRef]

- Li, J.; Li, Y.; Li, B.; Ji, X. Contingent or Stable Dual Sourcing? The Preferences of Manufacturers and Suppliers under Supply Disruption and Competition. Int. J. Logist. Res. Appl. 2023, 26, 279–319. [Google Scholar] [CrossRef]

- Durach, C.F.; Wiengarten, F.; Choi, T.Y. Supplier–Supplier Coopetition and Supply Chain Disruption: First-Tier Supplier Resilience in the Tetradic Context. Int. J. Oper. Prod. Manag. 2020, 40, 1041–1065. [Google Scholar] [CrossRef]

- Gupta, V.; Ivanov, D.; Choi, T.-M. Competitive Pricing of Substitute Products under Supply Disruption. Omega 2021, 101, 102279. [Google Scholar] [CrossRef]

- Qin, C.-X.; Liu, Z. Reference Price Effect of Partially Similar Online Products in the Consideration Stage. J. Bus. Res. 2022, 152, 70–81. [Google Scholar] [CrossRef]

- Johnson, J.W.; Cui, A.P. To Influence or Not to Influence: External Reference Price Strategies in Pay-What-You-Want Pricing. J. Bus. Res. 2013, 66, 275–281. [Google Scholar] [CrossRef]

- Ding, Y.; Liu, J. Joint Pricing Strategies of Multi-Product Retailer with Reference-Price and Substitution-Price Effect. J. Data Inf. Manag. 2021, 3, 49–63. [Google Scholar]

- Zhao, N.; Liu, X.; Wang, Q.; Zhou, Z. Information Technology-Driven Operational Decisions in a Supply Chain with Random Demand Disruption and Reference Effect. Comput. Ind. Eng. 2022, 171, 108377. [Google Scholar] [CrossRef]

- Shu, L.; Wu, F.; Ni, J.; Chu, L.K. On the Risk-Averse Procurement Strategy under Unreliable Supply. Comput. Ind. Eng. 2015, 84, 113–121. [Google Scholar] [CrossRef]

- Wang, Z. Technical Note—Intertemporal Price Discrimination via Reference Price Effects. Oper. Res. 2016, 64, 290–296. [Google Scholar] [CrossRef]

- Li, Q.; Li, B.; Chen, P.; Hou, P. Dual-Channel Supply Chain Decisions under Asymmetric Information with a Risk-Averse Retailer. Ann. Oper. Res. 2017, 257, 423–447. [Google Scholar] [CrossRef]

- Choi, T.-M.; Ma, C.; Shen, B.; Sun, Q. Optimal Pricing in Mass Customization Supply Chains with Risk-Averse Agents and Retail Competition. Omega 2019, 88, 150–161. [Google Scholar] [CrossRef]

- Basu, P.; Liu, Q.; Stallaert, J. Supply Chain Management Using Put Option Contracts with Information Asymmetry. Int. J. Prod. Res. 2019, 57, 1772–1796. [Google Scholar] [CrossRef]

- Zhang, J.; Chiang, W.K. Durable Goods Pricing with Reference Price Effects. Omega 2020, 91, 102018. [Google Scholar] [CrossRef]

- Gupta, V.; Ivanov, D. Dual Sourcing under Supply Disruption with Risk-Averse Suppliers in the Sharing Economy. Int. J. Prod. Res. 2020, 58, 291–307. [Google Scholar] [CrossRef]

- Han, B.; Zhang, Y.; Wang, S.; Park, Y. The Efficient and Stable Planning for Interrupted Supply Chain with Dual-sourcing Strategy: A Robust Optimization Approach Considering Decision Maker’s Risk Attitude. Omega 2023, 115, 102775. [Google Scholar] [CrossRef]

- Li, W.; Huang, S.; Huang, K.; Qi, Y.; An, H. The Pricing and Sourcing Strategies of Competitive Retailers under Supply Disruption in the Presence of Liquidated Damages. Comput. Ind. Eng. 2024, 187, 109782. [Google Scholar] [CrossRef]

- Alptekinoğlu, A.; Bhandari, A.S.; Sapra, A. Demand Management Using Responsive Pricing and Product Variety to Counter Supply Chain Disruptions. Eur. J. Oper. Res. 2024, 314, 867–881. [Google Scholar] [CrossRef]

- Chen, X.; Liu, X. Mitigating Supply Disruption: The Interplay between Responsive Pricing and Information Sharing under Dual Sourcing. Sustainability 2024, 16, 5691. [Google Scholar] [CrossRef]

- Shan, X.; Li, T.; Sethi, S.P. A Responsive-Pricing Retailer Sourcing from Competing Suppliers Facing Disruptions. M&SOM 2021, 24, 196–213. [Google Scholar]

- Mohsenzadeh, A.; Arshadi Khamseh, A.; Naderi, B. Pricing Models for a Two-Echelon Supply Chain with Substitute and Complementary Products Considering Disruption Risk. Int. J. Supply Oper. Manag. 2023, 10, 187–208. [Google Scholar]

- Gheibi, S.; Fay, S. The Impact of Supply Disruption Risk on a Retailer’s Pricing and Procurement Strategies in the Presence of a Substitute Product. J. Retail. 2021, 97, 359–376. [Google Scholar] [CrossRef]

- Parast, M.M.; Subramanian, N. An Examination of the Effect of Supply Chain Disruption Risk Drivers on Organizational Performance: Evidence from Chinese Supply Chains. Supply Chain Manag. Int. J. 2021, 26, 548–562. [Google Scholar] [CrossRef]

- Wu, S.; Shen, Y.; Geng, Y.; Chen, T.; Xi, L. Consumer Panic Buying Behavior and Supply Distribution Strategy in a Multiregional Network after a Sudden Disaster. Systems 2023, 11, 110. [Google Scholar] [CrossRef]

- Chakraborty, T.; Chauhan, S.S.; Ouhimmou, M. Mitigating Supply Disruption with a Backup Supplier under Uncertain Demand: Competition vs. Cooperation. Int. J. Prod. Res. 2020, 58, 3618–3649. [Google Scholar] [CrossRef]

- Liu, Z.; Li, M.; Zhai, X. Managing Supply Chain Disruption Threat via a Strategy Combining Pricing and Self-Protection. Int. J. Prod. Econ. 2022, 247, 108452. [Google Scholar] [CrossRef]

- Xue, C.; Wu, Y.; Zhu, W.; Zhao, X.; Chen, J. Mitigating Behavioral Supply Risk under Dual Sourcing: Evidence from an Order Allocation Game. Prod. Oper. Manag. 2022, 31, 1788–1801. [Google Scholar] [CrossRef]

- Chernonog, T.; Kogan, K. The Effect of Risk Aversion on a Supply Chain with Postponed Pricing. J. Oper. Res. Soc. 2014, 65, 1396–1411. [Google Scholar] [CrossRef]

- Xie, G.; Yue, W.; Wang, S.; Lai, K.K. Quality Investment and Price Decision in a Risk-Averse Supply Chain. Eur. J. Oper. Res. 2011, 214, 403–410. [Google Scholar] [CrossRef]

- Zhu, B.; Wen, B.; Ji, S.; Qiu, R. Coordinating a Dual-Channel Supply Chain with Conditional Value-at-Risk under Uncertainties of Yield and Demand. Comput. Ind. Eng. 2020, 139, 106181. [Google Scholar] [CrossRef]

- Liu, Z.; Hua, S.; Zhai, X. Supply Chain Coordination with Risk-Averse Retailer and Option Contract: Supplier-Led vs. Retailer-Led. Int. J. Prod. Econ. 2020, 223, 107518. [Google Scholar] [CrossRef]

- Zhang, J.; Chiang, W.K.; Liang, L. Strategic Pricing with Reference Effects in a Competitive Supply Chain. Omega 2014, 44, 126–135. [Google Scholar] [CrossRef]

- Cao, Y.; Duan, Y. Joint Production and Pricing Inventory System under Stochastic Reference Price Effect. Comput. Ind. Eng. 2020, 143, 106411. [Google Scholar] [CrossRef]

- Zhao, N.; Wang, Q.; Cao, P.; Wu, J. Dynamic Pricing with Reference Price Effect and Price-Matching Policy in the Presence of Strategic Consumers. J. Oper. Res. Soc. 2019, 70, 2069–2083. [Google Scholar] [CrossRef]

- Chen, K.; Zha, Y.; Alwan, L.C.; Zhang, L. Dynamic Pricing in the Presence of Reference Price Effect and Consumer Strategic Behaviour. Int. J. Prod. Res. 2020, 58, 546–561. [Google Scholar] [CrossRef]

- Colombo, L.; Labrecciosa, P. Dynamic Oligopoly Pricing with Reference-Price Effects. Eur. J. Oper. Res. 2021, 288, 1006–1016. [Google Scholar] [CrossRef]

- Duan, Y.; Feng, Y. Optimal Pricing in Social Networks Considering Reference Price Effect. J. Retail. Consum. Serv. 2021, 61, 102527. [Google Scholar] [CrossRef]

- Liu, X.; Popkowski Leszczyc, P.T.L. The Reference Price Effect of Historical Price Lists in Online Auctions. J. Retail. Consum. Serv. 2023, 71, 103183. [Google Scholar] [CrossRef]

- Shi, S.; Liu, G. Pricing and Coordination Decisions in a Low-Carbon Supply Chain with Risk Aversion under a Carbon Tax. Math. Probl. Eng. 2022, 2022, 7690136. [Google Scholar] [CrossRef]

- Wang, R.; Zhou, X.; Li, B. Pricing Strategy of Dual-Channel Supply Chain with a Risk-Averse Retailer Considering Consumers’ Channel Preferences. Ann. Oper. Res. 2022, 309, 305–324. [Google Scholar] [CrossRef]

- Markowitz, H.M. Portfolio Selection: Efficient Diversification of Investments; Yale University Press: New Haven, CT, USA, 1959. [Google Scholar]

- Chiu, C.-H.; Choi, T.-M. Supply Chain Risk Analysis with Mean-Variance Models: A Technical Review. Ann. Oper. Res. 2016, 240, 489–507. [Google Scholar] [CrossRef]

- Hung, Y.-H.; Li, L.Y.O.; Cheng, T.C.E. Transfer of Newsvendor Inventory and Supply Risks to Sub-Industry and the Public by Financial Instruments. Int. J. Prod. Econ. 2013, 143, 567–573. [Google Scholar] [CrossRef]

- Wang, R.; Chang, Z.; Yan, S. The Pricing Strategy of Dual-Channel Supply Chain with Risk-Averse Agents and Heterogeneous Preference Consumers. Kybernetes 2021, 51, 1413–1428. [Google Scholar] [CrossRef]

- Zhao, H.; Wang, H.; Liu, W.; Song, S.; Liao, Y. Supply Chain Coordination with a Risk-Averse Retailer and the Call Option Contract in the Presence of a Service Requirement. Mathematics 2021, 9, 787. [Google Scholar] [CrossRef]

- Fishburn, P.C. Mean-Risk Analysis with Risk Associated with Below-Target Returns. Am. Econ. Rev. 1977, 67, 116–126. [Google Scholar]

- Esmaeili-Najafabadi, E.; Azad, N.; Saber Fallah Nezhad, M. Risk-Averse Supplier Selection and Order Allocation in the Centralized Supply Chains under Disruption Risks. Expert Syst. Appl. 2021, 175, 114691. [Google Scholar] [CrossRef]

- Shen, Y.; Yang, X.; Dai, Y. Manufacturer-Retail Platform Interactions in the Presence of a Weak Retailer. Int. J. Prod. Res. 2019, 57, 2732–2754. [Google Scholar] [CrossRef]

- Rigamonti, A.; Lučivjanská, K. Mean-Semivariance Portfolio Optimization Using Minimum Average Partial. Ann. Oper. Res. 2024, 334, 185–203. [Google Scholar] [CrossRef]

| Reference | Pricing Decision | Supply Chain Disruption | Risk Aversion | Reference Price Effect | Mean– Semivarance |

|---|---|---|---|---|---|

| Shu et al. (2015) [11] | √ | √ | |||

| Wang (2016) [12] | √ | √ | |||

| Li et al. (2017) [13] | √ | √ | |||

| Choi et al. (2019) [14] | √ | √ | |||

| Basu et al. (2019) [15] | √ | √ | |||

| Zhang and Chiang (2020) [16] | √ | √ | |||

| Gupta and Ivanov (2020) [17] | √ | √ | √ | ||

| Gupta et al. (2021) [6] | √ | √ | |||

| Ding and Liu (2021) [9] | √ | √ | |||

| Zhao et al. (2022) [10] | √ | √ | √ | ||

| Han et al. (2023) [18] | √ | √ | |||

| Rajabzadeh et al. (2023) [3] | √ | √ | |||

| Li et al. (2024) [19] | √ | √ | |||

| This paper | √ | √ | √ | √ | √ |

| Notation | Explanation |

|---|---|

| Wholesale price of product | |

| Retail price of product | |

| Degree of single-sourcing | |

| Degree of supplier | |

| Market demand for product | |

| Profit of supplier ; | |

| Profit of retailer | |

| Utility of supplier | |

| Utility of retailer |

| (1, 5, 5) | 3.02 | 1.53 | 1.59 | 2.96 | 1.53 | 1.65 | 3.00 | 1.68 | 1.76 |

| (1, 10, 10) | 3.80 | 1.23 | 1.22 | 3.78 | 1.31 | 1.22 | 3.83 | 1.55 | 1.26 |

| (1, 10, 5) | 3.36 | 1.23 | 1.59 | 3.23 | 1.28 | 1.67 | 3.19 | 1.46 | 1.80 |

| (1, 5, 10) | 3.46 | 1.53 | 1.22 | 3.50 | 1.57 | 1.20 | 3.62 | 1.77 | 1.23 |

| (1, 5, 5) | 3.40 | 1.49 | 1.59 | 3.28 | 1.44 | 1.68 | 3.24 | 1.46 | 1.79 |

| (1, 10, 10) | 4.07 | 1.20 | 1.23 | 4.01 | 1.21 | 1.25 | 4.02 | 1.31 | 1.29 |

| (1, 10, 5) | 3.69 | 1.25 | 1.54 | 3.50 | 1.24 | 1.66 | 3.39 | 1.31 | 1.79 |

| (1, 5, 10) | 3.79 | 1.43 | 1.27 | 3.80 | 1.40 | 1.27 | 3.88 | 1.46 | 1.28 |

| (1, 5, 5) | 3.72 | 1.44 | 1.55 | 3.56 | 1.38 | 1.68 | 3.46 | 1.35 | 1.79 |

| (1, 10, 10) | 4.30 | 1.16 | 1.21 | 4.21 | 1.15 | 1.26 | 4.19 | 1.19 | 1.30 |

| (1, 10, 5) | 3.97 | 1.24 | 1.48 | 3.74 | 1.22 | 1.64 | 3.58 | 1.23 | 1.78 |

| (1, 5, 10) | 4.07 | 1.36 | 1.27 | 4.04 | 1.30 | 1.29 | 4.07 | 1.30 | 1.31 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lin, G.-H.; Dai, R.; Li, Y.-W.; Zhang, Q. Pricing Analysis of Risk-Averse Supply Chains with Supply Disruption Considering Reference Price Effect. Systems 2025, 13, 188. https://doi.org/10.3390/systems13030188

Lin G-H, Dai R, Li Y-W, Zhang Q. Pricing Analysis of Risk-Averse Supply Chains with Supply Disruption Considering Reference Price Effect. Systems. 2025; 13(3):188. https://doi.org/10.3390/systems13030188

Chicago/Turabian StyleLin, Gui-Hua, Ruimin Dai, Yu-Wei Li, and Qi Zhang. 2025. "Pricing Analysis of Risk-Averse Supply Chains with Supply Disruption Considering Reference Price Effect" Systems 13, no. 3: 188. https://doi.org/10.3390/systems13030188

APA StyleLin, G.-H., Dai, R., Li, Y.-W., & Zhang, Q. (2025). Pricing Analysis of Risk-Averse Supply Chains with Supply Disruption Considering Reference Price Effect. Systems, 13(3), 188. https://doi.org/10.3390/systems13030188