1. Introduction

China’s per capita water resources is only 28% of the global average, and the total area affected by excessive groundwater exploitation has reached 287,000 square kilometers. At the same time, the country’s water supply system faces various potential risks, such as climate change, declining freshwater resources, and over-exploitation of groundwater. In order to improve the resilience and sustainability of water supply systems, not only technological innovations but also economic instruments to regulate water usage practices are urgently needed. On 1 July 2016, China implemented the pilot reform of the water resources tax in Hebei Province [

1]. On 1 December 2017, nine provinces and regions, including Beijing, Tianjin, and Shanxi, were incorporated into the scope of the pilot reform of the water resources tax. Starting from 1 December 2024, the pilot reform of replacing water resources fees with taxes was fully implemented, extending the water resources tax to all 31 provinces across the country [

2]. The water resources tax reform has become an important measure for abolishing fees and establishing taxes. Its policy effects serve as the foundation and key for further perfecting the water resources tax system, as well as for ensuring the sustainable use of water resources.

For the pilot reform of the water resources tax, the focus is based on the following two aspects. Firstly, promoting the economic development and utilization of water resources, such as avoiding the over-exploitation of groundwater so as to enhance the structural resilience of water supply systems in the transition from groundwater dependency to surface water. Secondly, promoting water conservation [

3] and improving water use efficiency to maintain the sustainability of water supply systems. Compared to surface water, over-exploitation of groundwater tends to cause more severe environmental crises. Therefore, the pilot reform of the water resources tax in China could strengthen the structural adjustment between groundwater and surface water supply. This is because the minimum average tax rate for groundwater is twice or more than that for surface water in the pilot regions. Hence, this study proposes the first hypothesis: After the implementation of the pilot reform of the water resources tax, the proportion of groundwater use in total water use will significantly decrease, while the proportion of surface water use in total water use will significantly increase. In other words, the water resources tax reform has a positive impact on the water use structure.

Drawing from existing studies [

4,

5], water use efficiency is commonly defined as the volume of water consumed per ten thousand yuan of gross domestic product (GDP). From the perspective of tax system design, on the one hand, the pilot reform of the water resources tax in China follows the principle of tax and fee transfer at the same amount, maintaining the overall standards of the original water resources fees. After the reform, the burden on urban public water supply enterprises, residents’ normal domestic water use, and the water use for industrial and agricultural production remained unchanged. On the other hand, high tax rates are set for the extraction and use of groundwater, water resources in areas with severe shortages and excessive exploitation, and special water uses such as car washing, bathing, and golf courses. This will significantly increase the water resource tax for industries that have developed in a wasteful manner and consumed large amounts of water. Therefore, water resource tax reform may improve the overall water use efficiency by regulating specific water use behaviors [

6,

7]. Therefore, this paper proposes the second research hypothesis: After implementing the water resources tax reform pilot program, overall water use efficiency will improve.

To test the potential policy effects mentioned above, this study utilizes panel data from prefecture-level and above cities in China from 2012 to 2023, employing a multi-period difference-in-differences approach. Specifically, it identifies the impact of the pilot reform of the water resources tax on water use structure and water use efficiency. Compared to previous studies, this research makes three contributions. First, the study utilizes water resources data and macroeconomic data from 222 prefecture-level and above cities as research samples, enhancing the reliability of the estimation results. Second, it further analyzes the tax difference moderation effects. There are differences in the minimum average tax on surface water and groundwater across provinces, autonomous regions, and municipalities in China. This study constructs a model to test whether these differences amplify or weaken the effects of policy implementation. Third, the research examines the policy effects of the water resources tax in terms of water use structure and water use efficiency. This offers a more comprehensive exploration of the role of the water resources tax.

2. Literature Review

Existing studies suggest that a water resources tax (fee) can protect the environment and save water. It improves water use efficiency, promotes green investment, and affects total factor productivity and income distribution.

2.1. Environmental Protection Effects

Kyei and Hassan [

8] conducted a policy simulation study on water pollution taxation in South Africa and found that the tax system can internalize water pollution costs and achieve environmental goals of protecting aquatic systems. Martínez-Granados and Calatrava [

9] assessed the impact of water taxes on non-point source pollution in the Ebro Basin in Spain. They found that water taxes can reduce water pollution and encourage farmers to adopt emission reduction measures, such as better irrigation systems. Ndahangwapo et al. [

10] developed a dynamic economic optimization model for groundwater use. They showed that reducing taxes on ground subsidence and aquifer storage capacity significantly affects water withdrawal and groundwater levels, with taxation achieving higher social welfare. Briand et al. [

11] built a Computable General Equilibrium (CGE) model to analyze the effectiveness of water fees in South Africa. They found that a reasonable combination of water fees and indirect taxes can yield a triple dividend: reduced water use, economic growth, and poverty reduction. del Carmen Munguia-Lopez [

12] explored water resource management issues in the Sonoran Desert of Mexico. They concluded that water taxes and tax credits can help achieve high profit and environmental benefits, such as reducing water withdrawal and increasing aquifer recharge.

2.2. Water Use Efficiency

Water use efficiency is a critical indicator for measuring the effectiveness of the water resources tax. Wang et al. [

13] used a CGE model to evaluate water tax policies. They showed that imposing water taxes can reduce water consumption and change patterns in production, consumption, and international trade. France, Portugal, and Italy have implemented water abstraction taxes on both surface water and groundwater as an important means of encouraging water conservation and internalizing environmental and resource costs in the irrigation sector [

14]. Chen et al. [

15] and Ouyang et al. [

16] argued that the implementation of water resource tax policies improved water resource utilization efficiency and water use structure in China. Many studies have demonstrated that the water resources tax has a positive impact on water-saving [

17,

18], but its performance varies across different regions and industries.

At the industry level, most studies believe that the water resources tax has a more significant impact on improving industrial water use efficiency [

19]. However, some research suggests that due to the imperfections in the water resources tax system, its influence on industrial water use efficiency is weak to some extent [

20]. As for agricultural water use, water resources tax would encourage micro-level entities to reduce water inputs, optimize water resource allocation, and thus improve water use efficiency. However, under the current pilot reform of the water resources tax, agricultural water use has been granted numerous preferential policies due to the vulnerability of agriculture. While these policies have supported agricultural development to some extent, they have hindered the formation of effective mechanisms to promote water-saving agriculture. This can limit how water resources tax can improve agricultural water use efficiency [

21]. In terms of domestic water use, the water resources tax has a positive impact on residents’ water use efficiency, and this effect is more pronounced in regions with higher urbanization rates [

22]. Overall, the incentive effect of water resources tax reform on industrial water use is stronger than on agricultural and domestic water use [

16,

23].

In terms of regional differences, the water use efficiency due to water resources tax varies across regions. For example, studies on Inner Mongolia Autonomous Region in China indicate that while water resources tax reform has promoted water conservation and utilization, innovation effects can still play a positive role in improving water resource efficiency [

24]. Research targeting Shanxi Province revealed that, except for domestic water use, the tax reform has significantly improved water use efficiency. However, Shanxi Province still faces issues in the administration and collection of water resources taxes, as well as in water withdrawal permit approvals. Another study used synthetic control methods and concluded that water resources tax reform in Hebei Province significantly improved water use efficiency and water-saving [

25]. Tian et al. [

26] used a CGE model to study water resource taxes. Their results showed that water resource taxes effectively improved Hebei Province’s water use structure and water use efficiency.

Therefore, the current pilot reform of the water resources tax can improve water use efficiency. However, for better effects, further improvements are needed in expanding the pilot scope, refining the tax rate mechanism, strengthening policy coordination, and standardizing tax administration collaboration mechanisms.

2.3. Green Investment and Innovation Efficiency

The water resources tax influences corporate green investment and innovation through multiple pathways. On one hand, it increases enterprises’ water usage costs. As a result, they may direct their funding toward green technology research and development (R&D) and/or adopt water-saving innovations and practices. On the other hand, the water resources tax reform prompts enterprises to recognize the importance of environmental protection and sustainable development. This can motivate them to proactively increase their green investment and innovation efforts and pursue sustainable development pathways. Additionally, the government can implement tax incentives and other policy measures to promote green investment and innovation.

In terms of empirical research, numerous studies have demonstrated that water resources tax reform significantly promotes corporate green investment and innovation. Liu [

27] utilized panel data from Chinese listed enterprises between 2011 and 2020 and constructed a panel data model. The empirical results indicated that the water resources tax reform has promoted green investment for high-water-consuming enterprises. This implies that as the reform of the water resources tax progresses, high-water-consuming enterprises will increase their investments in green investment to adapt to the cost pressures brought by the water resources tax and achieve green transformation. Xu et al. [

28] analyzed panel data from Chinese listed companies in heavily polluting industries between 2015 and 2020. They employed propensity score matching, difference-in-differences models and mediation effect models for empirical verification. The results showed that the water resources tax reform significantly promotes green innovation in pilot areas for heavily polluting companies. Furthermore, research and development investment plays an effective mediating role. This suggests that the water resources tax reform can incentivize heavily polluting companies to increase their R&D investment and enhance their green innovation capabilities. Kang et al. [

29] used high-water-consuming companies as examples and found that the water resources tax reform enhances green innovation activities for high-water-consuming companies. Furthermore, this innovative effect is more pronounced for state-owned companies, companies with lower financing constraints, and companies with green invention patents. These indicate that different types of companies make green innovation decisions based on their characteristics in response to the water resources tax reform. Wen et al. [

30] analyzed panel data from 456 listed companies in water-intensive industries in China between 2012 and 2022. Their study revealed that the water resources tax significantly improves environmental performance with green innovation serving as a key mediating mechanism. Wang et al. [

31] and Xu et al. [

32] focused on the impact of the water resources tax reform on corporate R&D investment and R&D model selection. They indicated that water-sensitive companies are more inclined to pursue collaborative R&D rather than independent R&D. This is particularly true in sub-samples characterized by high R&D risks, weaker R&D capabilities, and extensive prior collaborative experience. Wang et al. [

33] utilized data from prefecture-level cities in China’s coastal regions between 2007 and 2019 and employed green total factor productivity as a measure of green growth. They investigated the impact of the water resources tax reform on green growth in coastal cities. They confirmed that the pilot reform of the water resources tax contributes to green growth, primarily through reducing water consumption and enhancing government oversight of marine environmental regulation.

The green investment and innovation effects of the water resources tax vary across different regions and industries. In some water-scarce regions, companies are more sensitive to the water resources tax and have stronger motivations for green investment and innovation. Meanwhile, high-water-consuming industries are more significantly affected by the water resources tax and have an even stronger incentive for green investment and innovation. Different countries design distinct water resources tax or fee systems based on their conditions and development needs to achieve water resource protection and specific policy objectives [

34]. This suggests that when analyzing the green investment and innovation effects of the water resources tax, regional and industrial differences must be considered. Therefore, when formulating and implementing water resources tax policies, regional water resource endowments, economic development levels, and industry characteristics should be fully considered. Moreover, policies should be tailored to specific regions and industries to better leverage water resources tax to achieve green investment and innovation.

2.4. Enterprise Growth Effect

The water resources tax has a certain impact on the enterprise’s total factor productivity. Wang et al. [

33] used data from listed chemical enterprises between 2013 and 2022 to calculate enterprise TFP. Using the expansion of the water resources tax pilot program as a reference point, they constructed a difference-in-differences model to examine the impact of the water resources tax reform on total factor productivity. Their empirical results indicated that the pilot reform improved the overall productivity of chemical enterprises, and this result remained robust after sensitivity tests. Furthermore, heterogeneity analyses of enterprises in different tax rate regions and with different ownership structures revealed that the policy often has a stronger positive impact on private enterprises (vs. state-owned enterprises) and high-tax regions. Zhang et al. [

2] utilized the gradual implementation of the water resources fee-to-tax reform starting in 2016 as a quasi-natural experiment. They merged the macro data from 31 provinces between 2010 and 2019 with microdata from listed companies on the Shanghai and Shenzhen stock exchanges. They employed a multi-period difference-in-differences approach to evaluate the economic effects of the water resources tax reform. Their results demonstrated that the water resources tax significantly increases enterprise R&D investment. This increase contributes to improving enterprise total factor productivity, thereby achieving the economic effects of the water resources tax. Hence, the water resources tax positively influences enterprise TFP by affecting enterprises’ R&D decision-making. Wang et al. [

35] incorporated water resources into the economic system and constructed a dynamic stochastic general equilibrium model. Their study showed that levying a water resource tax helps raise water conservation awareness among businesses and residents.

2.5. Income Distribution Effect

Yao et al. [

36] focus on the impact of the water resources fee-to-tax reform on income distribution. This study finds that the policy reduces the labor income share through both the factor substitution effect and the strengthening of corporate monopoly power. Heterogeneity analysis indicates that the income distribution effects of the reform are more pronounced in large enterprises, firms with stronger labor bargaining power, labor-intensive industries, and regions experiencing water resource over-exploitation. To further clarify the broader economic consequences of the pilot policy, this study also investigates the impact of the water resource tax reform on human capital structure, regional labor mobility, and intra-firm wage disparities. Kyei and Chitiga-Mabugu [

37] used a CGE model to study water pollution taxes in South Africa. They found that the tax policy would worsen poverty and inequality. However, combining this policy with supply-side compensation measures, such as subsidizing water pollution reduction behaviors, could reduce regional poverty and inequality and improve the ecological status of rivers. In terms of distributional effects, the water pollution tax is progressive in terms of income, as the income of poor and vulnerable groups comes from capital to a lesser extent, while capital bears the largest tax burden. However, due to the higher proportion of pollution-intensive goods in the expenditure of poor households, the tax is regressive in terms of expenditure.

Existing literature generally examines the impact of water resource tax reform pilot programs on water conservation based on water use efficiency. However, research on how water resource taxes improve economic development and water resources utilization is relatively scarce, and conclusions are inconsistent. Yu et al. [

38] utilized data from 62 prefecture-level cities in the pilot regions of Henan, Shandong, Shaanxi, and Sichuan from 2014 to 2019, as well as data from 52 prefecture-level cities in the non-pilot regions of Anhui, Hunan, Gansu, and Yunnan. Using the difference-in-differences method, the study analyzed the policy effects of the water resource tax reform pilot program. They confirm that the pilot reform can improve water withdrawal structures. Luo et al. [

39] argued that water resource tax reform has not reduced surface water and groundwater use but has instead increased surface water use. Therefore, this paper focuses on assessing the impact of water resource tax reform pilot programs on water use structure while further validating water use efficiency. Additionally, this study breaks away from the existing literature, which focuses on the policy effects of water resource tax reforms in Hebei Province and other pilot cities. Instead, it includes all prefecture-level and above cities in the sample. It adopts a multi-period difference-in-differences method to dynamically analyze the phased effects of policy implementation. Moreover, it conducts a comprehensive assessment of the overall effects of water resource tax reforms. Furthermore, studies on the micro-level effects of water resource tax reform, such as green innovation effects, enterprise TFP effects, and income distribution effects, still provide reference value for this study. However, due to the limitations of the prefecture-level city research sample, this study only draws theoretical insights from these studies and omits related empirical tests.

3. Materials and Methods

3.1. Specification

The pilot reform of China’s water resources tax was implemented at different times and in different regions. Therefore, this paper employs the following multi-period difference-in-differences model to identify the policy effects of the pilot reform of the water resources tax:

In Equation (1), the dependent variable represents the water use structure of city i in year t. The water use structure is measured using two indicators: the proportion of groundwater use and the proportion of surface water use. Specifically, the groundwater water use proportion is the ratio of groundwater water use (in billion cubic meters) to total water use (in billion cubic meters), while the surface water use proportion is the ratio of surface water use to total water use. Additionally, the dependent variable is replaced with total water use efficiency, agricultural water use efficiency, industrial water use efficiency, and domestic water use efficiency, respectively. The model (1) is then applied again to comprehensively test the impact of the water resources tax reform pilot on water use efficiency. Total water use efficiency is measured by water use per ten thousand yuan of GDP, calculated as total water use divided by GDP. Agricultural water use efficiency is measured by water use per ten thousand yuan of added value of the primary industry, calculated as agricultural water use divided by the added value of the primary industry. Industrial water use efficiency is measured by water use per ten thousand yuan of added value of the secondary industry, calculated as industrial water use divided by the added value of the secondary industry. Domestic water use efficiency is measured by domestic water use per capita, calculated as domestic water use divided by the population. All data related to water use efficiency in this study have been log-transformed.

is defined as a policy dummy variable, taking the value 1 if a city has implemented the pilot program for water resource tax reform, and 0 otherwise. Postt is defined as a time dummy variable, taking the value 0 before the implementation of the water resources tax reform and 1 after its implementation. It should be noted that the implementation of the water resources tax reform in Hebei Province and its subsequent expansion to nine other provinces both occurred in the second half of the year, particularly with the expansion taking place in December, thus the policy effect in the year of the implementation of the water resources tax reform may not be obvious.

Therefore, this study adopts the methodology proposed by Lu et al. [

40] and adjusts the timeline of the water resources tax pilot reform by postponing it by one year. Specifically, the pilot program in Hebei Province is assumed to commence in 2017, while the expanded reform in the other nine provinces is set to begin in 2018.

is the control variable. Drawing on Han et al. [

41] and Taheri et al. [

42], this paper selects precipitation (billion cubic meters), surface water resources (billion cubic meters), total water resources (billion cubic meters), per capita water consumption (billion cubic meters), per capita GDP (CNY), population (10,000 people), the proportion of tertiary industry added value (%), comprehensive groundwater supply capacity, and comprehensive surface water supply capacity as control variable. Of these, comprehensive groundwater supply capacity and comprehensive surface water supply capacity were used only as control variables in the regional heterogeneity analysis because of the high number of missing values. Among these variables, precipitation, per capita water consumption, per capita GDP, and population are subjected to logarithmic transformation, while others are not transformed.

3.2. Model Specification for the Parallel Trend Test

It is a prerequisite for using the difference-in-differences method to measure the policy effect of the water resources tax policy that the treatment group and the control group maintain the same change trend before the policy implementation. This paper uses the event study method to test whether the research meets the parallel trends assumption. The model is specified as follows:

Equation (2) differs from Equation (1) is that t in Equation (2) represents the time relative to the pilot reform of the water resources tax, with serving as a dummy variable for relative time. By interacting the time dummy variable with the policy dummy variable, the coefficients of the interaction terms reflect whether the estimated coefficients show statistically significant differences compared to the year before the pilot reform of the water resources tax (the base period selected in this study).

3.3. Data Sources and Limitations

The macroeconomic data of prefecture-level and above cities used in this paper are sourced from the China City Statistical Yearbook and the EPS Global Statistical Data or Analysis Platform. Meanwhile, this paper manually extracted the water resource-related data of prefecture-level and above cities from the annual water resource bulletins of various provinces in China and matched them with the macroeconomic data. Due to the significant differences in water resource conditions and the uneven distribution of water resources among different regions in China, the relevant data may contain a relatively large number of extreme values. To address this issue, this paper conducts a winsorized transformation at the upper and lower 5% levels for the continuous variables used.

This paper makes every effort to ensure the accuracy and consistency of the data, but the following limitations may still exist: First, there are missing data. Some regions, such as Tibet and Qinghai, have limited data disclosure in water resources announcements, which affects data availability. Second, the data is affected by economic fluctuations. GDP-related data may be affected by price fluctuations or inflation, resulting in less accurate GDP-based water use efficiency calculations. Third, the data on water withdrawal may be subject to approval errors. Some taxpayers have not installed metering facilities or have metering facilities that cannot be accurately measured in accordance with the regulations, and the portion of their water consumption that is authorized by the tax authorities may not accurately reflect the actual amount of water used. In order to avoid the bias of coefficient estimation that may be caused by the above data limitations, this paper verifies the robustness of the conclusions through various methods, such as sample resetting, placebo test, and propensity score matching, to ensure the reliability of the empirical results.

3.4. Descriptive Statistics

Based on the availability and integrity of the data, this paper sorts out 93 cities that are pilot cities for the water resources tax reform as the experimental group, and sorts out 129 cities that have not carried out the pilot reform of the water resources tax as the control group. The descriptive statistics of the variables used in this paper are shown in

Table 1.

4. Empirical Results and Analysis

4.1. Analysis of Water Use Structure Effects

4.1.1. Main Results

Table 2 reports the baseline estimation results. In columns (1)–(4), we add different control variables in the regressions. The results show the water resources tax reform has reduced the proportion of groundwater use in pilot cities by approximately 4.8%, and at the same time, it has increased the proportion of surface water use in pilot cities by approximately 5.7%. This fully demonstrates that the water resource tax reform has a significant effect in changing the water use structure.

4.1.2. Parallel Trend Test

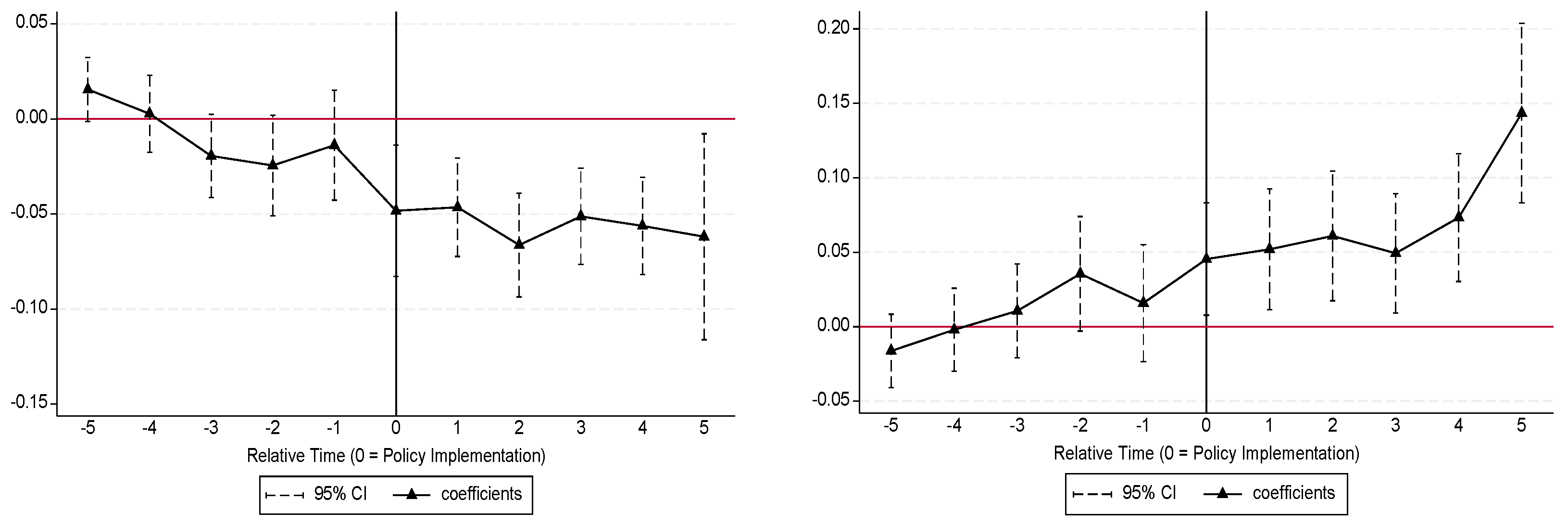

Observing the changes in water use ratios between the treatment group and the control group before and after the implementation of the water resources tax reform is the primary method to test the reliability of the above estimates.

Figure 1 presents the parallel trend test results with groundwater use ratio and surface water use ratio as the dependent variables. The results indicate that, regardless of the groundwater use ratio or the surface water use ratio, before the implementation of the reform, the trend of the outcome variables of the treatment group and the control group did not show any significant difference over time. However, after the implementation of the water resources tax reform, the groundwater use ratio of the treatment group began to significantly fall below that of the control group, the surface water use ratio of the treatment group began to significantly exceed that of the control group, and this difference also showed a trend of increasing annually.

4.1.3. Robustness Test

This study employs the following five methods for a robustness test. First, the approach involves removing the delay of one year in the policy implementation time as specified in the model parameters and instead using the actual implementation time as the policy start time in the model. The robustness test results based on this method are presented in columns (1) and (2) of

Table 3. The results show that, compared to the benchmark regression, although the policy effect is slightly weakened, the direction and significance level of the coefficients for the interaction terms remain unchanged, indicating that the above research is relatively robust. Second, the prefecture-level cities under the jurisdiction of Hebei Province are excluded from the sample. As the first province to pilot the water resources tax reform, Hebei Province lacked prior experience to draw upon, resulting in policy implementation effects that differed from those of provinces where the reform was later expanded, thus affecting the policy identification effects in this study. The results of the second robustness tests are shown in

Table 3, columns (3) and (4). The results indicate that, compared to the benchmark regression, the direction and significance level of the coefficients for the interaction terms remain unchanged, further demonstrating the robustness of this study.

Third, to mitigate the estimation bias caused by sample selection, the study uses a combination of propensity score matching and difference-in-differences model (PSM-DID) to regress the model. Specifically, for the control variables selected in the baseline regression model, the 1:1 nearest neighbor matching method is used to reconstruct the control group samples, and the experimental and control groups are assigned to verify whether they satisfy the common support assumption and the balancing assumption, and the test results are shown in

Table 4. The deviations of the variables after matching are controlled to be within 10%, and the

p-values are all greater than 0.1, which indicates that the screened experimental group and the control group do not have any significant differences that satisfy the hypothesis.

The regression results based on the PSM paired samples are shown in

Table 5, and it can be seen that the coefficient of the interaction term is similar compared with

Table 2, indicating that the conclusion that the water resource tax reform changes the water use structure is still valid, and that the water resource tax reform has made the ratio of groundwater use in the pilot cities decrease, and that the ratio of surface water use has risen.

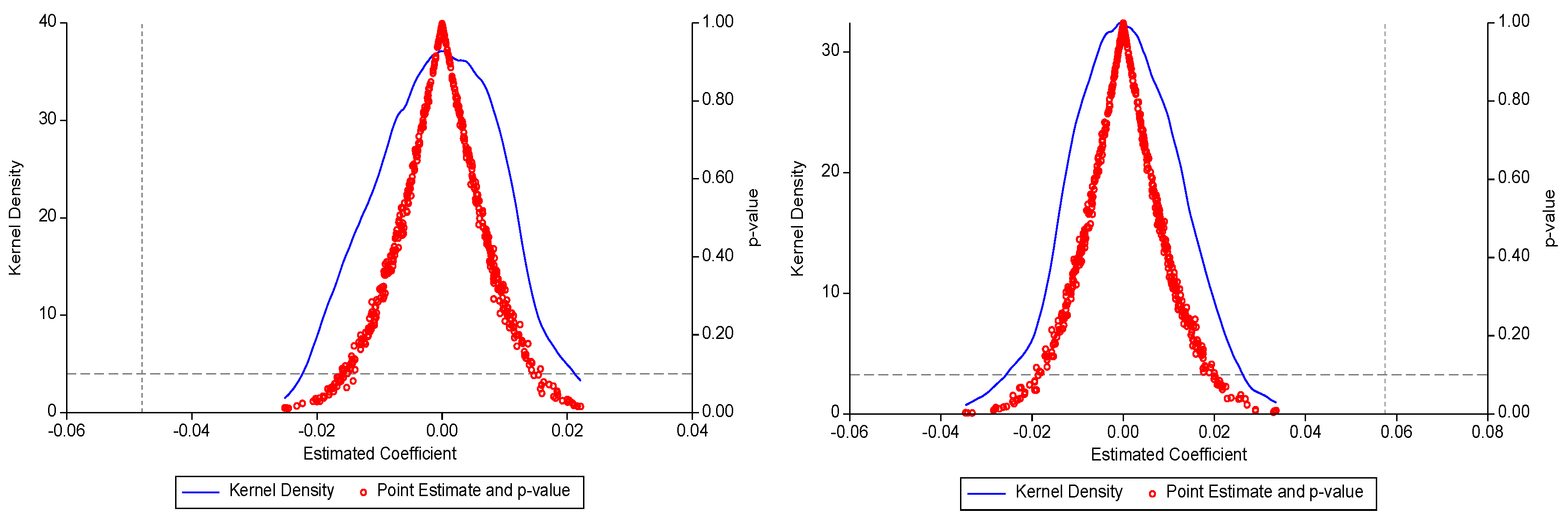

Fourth, the study conducts a hybrid placebo test combining random sampling and random generation of policy implementation time, and set the number of random sampling and policy time generation to 500 times, and the relevant statistical indicators are shown in

Table 6.

The results of the placebo test in

Figure 2 show that the coefficients of the randomly selected interaction terms are distributed around zero, indicating the absence of a policy effect. This suggests that the policy effects identified above are not accidental.

Finally, since the multi-period difference-in-differences (DID) approach may still suffer from bias in effect estimation due to variations in treatment timing across different groups, this paper further examines the robustness of the benchmark regression results using the Bacon decomposition method.

Table 7 presents the findings of this robustness test. The results show that after applying the Bacon decomposition, the estimated effects on the explained variables remain largely unchanged, confirming the robustness of the benchmark regression results.

4.1.4. Moderation Effects

There are differences in the minimum average tax on surface water and groundwater across provinces, autonomous regions and municipalities in China (see

Table 8). To test whether this difference amplifies or weakens the effect of policy implementation, the following model is constructed:

Since the water resources tax amounts of provinces, autonomous regions, and municipalities directly under the central government do not change over time and their impacts are absorbed by urban fixed effects, this paper focuses on the coefficients and significance of the triple interaction term

.

Table 9 shows that the higher the tax on groundwater, the greater decrease of groundwater water use ratio, and the more significant the improvement of water use structure. The coefficient of the interaction term with surface water tax amount is not significant, indicating that the difference of surface water tax amount in different regions does not significantly affect the policy effect. This is related to the setting of the tax amount of water resources tax, which widens the gap between the tax burden of groundwater and surface water by setting different tax amounts. It indicates that the difference in tax amount will affect the policy effect, further verifying hypothesis one.

4.1.5. Heterogeneous Effects

This paper categorizes the sample into three groups, eastern, central, and western regions, according to the National Bureau of Statistics’ economic zone classification. Sample-specific regression analyses were conducted on the ratios of groundwater and surface water use to examine the regional effects of the water resource fee-to-tax reform. Considering that water supply facilities may affect the structure of water use, we have added control variables to measure the capacity of urban water supply facilities: comprehensive groundwater production capacity and comprehensive surface water production capacity. The data on the comprehensive production capacity of groundwater is derived from the “Comprehensive Production Capacity—Groundwater” indicator of the China Urban and Rural Construction Statistical Yearbook, which refers to the maximum 24-h production capacity of tap water (unit: 10,000 m3/day) under normal operation and design conditions of water plants (or clusters of wells) using groundwater as the source of water in urban public water supply facilities at the end of the reporting period. The data of comprehensive production capacity of surface water is obtained by subtracting the indicator of “Comprehensive Production Capacity—Groundwater” from the indicator of “Comprehensive Production Capacity” in China Urban and Rural Construction Statistical Yearbook.

The results of the heterogeneity regression analysis of the groundwater use ratio (

Table 10, columns (1)–(3)) show that, following the conversion of water resource fees into taxes, the ratio decreased by approximately 10.6% in the eastern region, which was statistically significant at the 1% level. In the central region, the ratio decreased by approximately 3.6%, which was also statistically significant at the 1% level. In the western region, the ratio decreased by approximately 2.6%, which was statistically significant at the 5% level. These results suggest that the policy effects of the water resource tax reform pilot program in reducing the groundwater use ratio are most pronounced in the eastern region, followed by the central region. The western region exhibits the least significant policy effects, though they are still present. The heterogeneous regression results for surface water use ratios (

Table 10, columns 4–6) show that the effect is most significant in the central region, followed by the eastern region. The western region shows no significant effect. These results suggest that the policy effects of the water resource tax reform pilot program in optimizing water use structures are most significant in the eastern and central regions, followed by the western region.

Figure 3 illustrates the differential effects of policy’s implementation in different regions.

There are two possible reasons. First, before the reform of water resource fees into taxes, the eastern and central regions relied more heavily on groundwater than the western regions. The average groundwater usage ratios in pilot cities across the eastern, central, and western regions were 27.58%, 23.05%, and 15.89%, respectively. Second, after the reform, the minimum average groundwater resource tax rate in eastern regions, such as Beijing and Tianjin, where groundwater resources are relatively scarce, was the highest nationwide, reaching CNY 4 per cubic meter. This significant increase in groundwater resource tax rates has led to a substantial rise in use costs, prompting taxpayers to change their habits and use surface water, recycled water, or other alternatives more frequently, thereby reducing demand for groundwater.

4.2. The Impact of Water Resources Tax Reform on Water Use Efficiency

This paper examined whether converting water resource fees into taxes can improve water use efficiency. It separately examined overall, agricultural, industrial, and domestic water use efficiency under the water resource tax reform pilot program (see

Table 11). The study found that converting water resource fees into taxes significantly improved overall and domestic water use efficiency. The pilot cities improved their total water use efficiency by about 10.8% and their domestic water use efficiency by about 24.2%, both significant at the 1% level. But it did not significantly improve agricultural and industrial water use efficiency. The primary reason for this outcome relates to the sensitivity of water users. As previously mentioned, the water resource fee-to-tax reform adheres to the principle of “tax-fee transfer” to ensure overall stability in water use burdens for enterprises and residents. However, residential water users, being the general public, are more sensitive to changes in the reform. Therefore, after the water resource tax reform pilot program, residents in pilot regions may conserve water to maintain or reduce their tax-fee burdens. In contrast, enterprise water use is subject to production technology constraints and the response to tax adjustments may be limited in the short term, thus the water resource tax reform pilot program did not significantly affect enterprises’ water use behavior. Additionally, China exempts agricultural production water use, up to a certain limit, from water resource taxes. This may explain why agricultural water use efficiency did not change significantly before or after the reform. Overall, the water resources tax reform has been effective at the level of water use structural adjustment, but other policy measures, such as differentiated tax rates, need to be complemented in order to achieve a greater improvement in water use efficiency.

5. Research Conclusions and Policy Implications

This paper uses water resource and macroeconomic data from cities at the prefecture level and above in China from 2012 to 2023 to empirically analyze the impact of the water resource fee-to-tax reform on the structure and efficiency of water use. The results show that the water resource tax significantly improve water use. To be more specific, it increases the proportion of surface water use and reduces the proportion of groundwater use. Through parallel trend tests, policy implementation timeline alterations, sample resets, placebo tests, and other robustness tests such as Bacon decomposition, the water use structure improvement effect remains robust. Further regional heterogeneity analysis reveals that the water use structure improvement effect is more pronounced in eastern and central regions, where groundwater use is higher. Moreover, the higher water resource tax on groundwater, the greater decline in groundwater water use ratio. These results demonstrate that the reform of water resource fees into taxes can suppress excessive groundwater extraction and unreasonable water demand. The reform contributes to the protection of groundwater resources, enhances the structural resilience of water supply systems as they shift from groundwater dependence to surface water, and ensures the sustainability of water resources and water supply systems. However, the reform’s positive impact on water use efficiency remains limited due to the current tax design. Based on our research analysis conclusions, this paper proposes the following policy recommendations.

First, improve water use efficiency further by leveraging the price mechanism of the water resources tax. For domestic water use, implement a tiered pricing system. Impose progressive surcharges on urban households that exceed the specified baseline to encourage water conservation. For industrial water use, implement differentiated tax rates. Set higher tax rates for industries that consume large amounts of water (such as steel, chemicals, and papermaking) and moderately reduce tax rates for industries that consume small amounts of water (such as electronics and precision manufacturing). Water-scarce regions should have higher tax rates than water-abundant regions to reflect resource scarcity. Use tax incentives to encourage enterprises to improve water efficiency through technological upgrades and management improvement. For instance, industrial enterprises that meet national advanced water efficiency standards may be eligible for a 20% reduction in water resource taxes for the current year. The current policy of tax exemption within quotas and low taxes for excess usage for agricultural water use may cause significant water waste. However, since agriculture is critical, increasing the tax rate on excess water use is not optimal. Instead, tax incentives for the water resource tax and related categories could encourage the agricultural sector to adopt water-efficient irrigation technologies and management practices. Agricultural irrigation using efficient, water-saving technologies, such as drip or sprinkler irrigation, could be eligible for tax rebates based on water savings.

Second, differentiate tax rates further for urban public water supply enterprises based on their use of surface water and groundwater. Currently, some provinces and regions (e.g., Beijing, Henan, Inner Mongolia, Ningxia, Shanxi, and Shaanxi,) categorize urban public water supply enterprises as residential, non-residential, or as belonging to special or other industries. However, this classification fails to reflect the different tax rates for surface water and groundwater in urban public water supply. It is recommended that urban public water supply companies be categorized as water users with differential tax rates for surface water and groundwater. This would encourage companies to use more surface water and optimize their water usage.

Third, incentivize corporate technological innovation and green investments with tax breaks. Offer tax breaks to companies that upgrade their systems, enhance technological innovations such as recycled water reuse, and invest in water-saving equipment. For instance, companies may be eligible for tax credits on corporate income taxes for investments in high-efficiency, water-saving equipment and partial deductions on water resource taxes. Alternatively, offer accelerated depreciation incentives for fixed assets to encourage innovation in water-saving technologies and increase subsidy support. Promote the use of non-conventional water resources. Implement a system that exempts non-conventional water resources from water resource taxes. This will encourage water users to prioritize using recycled water, rainwater storage, and other non-conventional water resources. Overall, these policies can promote the use of unconventional water resources and reduce reliance on traditional water sources.

Author Contributions

Conceptualization, J.Y. and X.Z.; methodology, J.Y. and X.Z.; software, J.L.; validation, J.L. and V.S.; formal analysis, J.L.; investigation, J.L.; resources, V.S.; data curation, V.S.; writing—original draft preparation, J.Y., X.Z., J.L. and V.S.; writing—review and editing, J.Y., X.Z., J.L. and V.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Data will be made available upon request.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- He, L.; Chen, K. Can China’s “tax-for-fee” reform improve water performance–evidence from Hebei province? Sustainability 2021, 13, 13854. [Google Scholar] [CrossRef]

- Zhang, J.; Liu, L.; Xie, Y.; Ji, L.; Meng, H.; Zhang, Y.; Li, Z.; Li, P.; Shi, Y.; Guo, H. Revealing the impact of a water-economy nexus-based joint tax management policy on the environ-economic system: An advanced exploration of double dividend strategies and multi-scale response mechanisms. J. Clean. Prod. 2022, 377, 134470. [Google Scholar] [CrossRef]

- Xu, H.; Yang, R. The impact of water rights reform on economic development: Evidence from city-level panel data in China. J. Environ. Manag. 2025, 374, 124082. [Google Scholar] [CrossRef]

- Chen, Y.; Fang, G.; Hao, H.; Wang, X. Water use efficiency data from 2000 to 2019 in measuring progress towards SDGs in Central Asia. Big Earth Data 2022, 6, 90–102. [Google Scholar] [CrossRef]

- Shen, R.; Yao, L. A holistic analysis of China’s consumption-based water footprint (2012–2017) from a multilevel perspective. J. Clean. Prod. 2023, 429, 139593. [Google Scholar] [CrossRef]

- Sun, H.; Bai, Y.; Lu, M.; Wang, J.; Tuo, Y.; Yan, D.; Zhang, W. Drivers of the water use efficiency changes in China during 1982–2015. Sci. Total Environ. 2021, 799, 149145. [Google Scholar] [CrossRef]

- Zhou, Y.; Li, H.; Wang, K.; Bi, J. China’s energy-water nexus: Spillover effects of energy and water policy. Glob. Environ. Change 2016, 40, 92–100. [Google Scholar] [CrossRef]

- Kyei, C.K.; Hassan, R. Distributional impacts of taxing water pollution in the Olifants River basin of South Africa. Dev. S. Afr. 2021, 38, 1001–1016. [Google Scholar] [CrossRef]

- Martínez-Granados, D.; Calatrava, J. The role of desalinisation to address aquifer overdraft in SE Spain. J. Environ. Manag. 2014, 144, 247–257. [Google Scholar] [CrossRef] [PubMed]

- Ndahangwapo, N.N.; Thiam, D.R.; Dinar, A. Land subsidence impacts and optimal groundwater management in South Africa. Environ. Resour. Econ. 2024, 87, 1097–1126. [Google Scholar] [CrossRef]

- Briand, A.; Reynaud, A.; Viroleau, F.; Markantonis, V.; Branciforti, G. Assessing the macroeconomic effects of water scarcity in South Africa using a CGE model. Environ. Model. Assess. 2023, 28, 259–272. [Google Scholar] [CrossRef]

- del Carmen Munguia-Lopez, A.; González-Bravo, R.; Ponce-Ortega, J.M. Evaluation of carbon and water policies in the optimization of water distribution networks involving power-desalination plants. Appl. Energy 2019, 236, 927–936. [Google Scholar] [CrossRef]

- Wang, Y.; Hu, J.; Pan, H.; Qin, Q. Water–energy nexus: The coupling effects of water and energy policy applied in China based on a computable general equilibrium model. J. Clean. Prod. 2023, 423, 138647. [Google Scholar] [CrossRef]

- Buttinelli, R.; Cortignani, R.; Caracciolo, F. Irrigation water economic value and productivity: An econometric estimation for maize grain production in Italy. Agric. Water Manag. 2024, 295, 108757. [Google Scholar] [CrossRef]

- Chen, P. Unlocking policy effects: Water resources management plans and urban water pollution. J. Environ. Manag. 2024, 365, 121642. [Google Scholar] [CrossRef]

- Ouyang, R.; Mu, E.; Yu, Y.; Chen, Y.; Hu, J.; Tong, H.; Cheng, Z. Assessing the effectiveness and function of the water resources tax policy pilot in China. Environ. Dev. Sustain. 2024, 26, 2637–2653. [Google Scholar] [CrossRef]

- Jinyu, Y.; Xiang, Z. Water resource tax reform: Evaluation of pilot schemes and conception of a unified legislation approach. China Popul. Resour. Environ. 2021, 31, 121–136. [Google Scholar]

- Kumar, S.; Goyal, M.K. Water policy review: Ensuring sustainable water management for India. J. Environ. Manag. 2025, 388, 125823. [Google Scholar] [CrossRef]

- Mu, L.; Zhang, X.; Cheng, S.; Song, P. The effectiveness of a water resource tax policy in improving water-use efficiency: A quasi-natural experiment-based approach. Water Policy 2022, 24, 899–922. [Google Scholar] [CrossRef]

- Wang, S.; Zhou, L.; Wang, H.; Li, X. Water use efficiency and its influencing factors in China: Based on the data envelopment analysis (DEA)—Tobit model. Water 2018, 10, 832. [Google Scholar] [CrossRef]

- Lu, X.; Ke, X.; Ma, Y.; Jiang, M. Towards More Water-Efficient Agriculture: A Study on the Impact of China’s Water Resource Tax on Agricultural Water Use Efficiency. Sustainability 2025, 17, 2121. [Google Scholar] [CrossRef]

- Guo, Y.; Tong, Z.; Wang, Z.; Xu, Z.; Yao, Y. Evolutionary characteristics and influencing mechanisms of green development efficiency in Chinese urban agglomerations: Analysis of the Yangtze River Delta urban agglomeration. J. Environ. Manag. 2025, 375, 124236. [Google Scholar] [CrossRef]

- Chen, M.; Wang, Q.; Li, Y.; Zhao, Y. Impact of the Water Resource Tax on Efficiency of Industrial Water Resources Use: Evidence from Hebei Province, China. JAWRA J. Am. Water Resour. Assoc. 2025, 61, e70024. [Google Scholar] [CrossRef]

- Zhu, H.; Zhang, A. The impact of water resource tax reform on green technology innovation: Evidence from Chinese A-share listed enterprises. J. Knowl. Econ. 2024, 15, 17630–17648. [Google Scholar] [CrossRef]

- Yang, M.; Zhou, M.; Zhang, C. Effectiveness evaluation of China’s water resource tax reform pilot and path optimization from the perspective of policy field. PLoS ONE 2024, 19, e0301031. [Google Scholar] [CrossRef] [PubMed]

- Tian, G.-l.; Wu, Z.; Hu, Y.-C. Calculation of optimal tax rate of water resources and analysis of social welfare based on CGE model: A case study in Hebei Province, China. Water Policy 2021, 23, 96–113. [Google Scholar] [CrossRef]

- Liu, C. Can water resource tax reform improve the environmental performance of enterprises? Evidence from China’s high water-consuming enterprises. Front. Environ. Sci. 2023, 11, 1155237. [Google Scholar] [CrossRef]

- Xu, C.; Gao, Y.; Hua, W.; Feng, B. Does the Water Resource Tax Reform Bring Positive Effects to Green Innovation and Productivity in High Water-Consuming Enterprises? Water 2024, 16, 725. [Google Scholar] [CrossRef]

- Kang, L.; Lv, J.; Zhang, H. Can the water resource fee-to-tax reform promote the “three-wheel drive” of corporate green energy-saving innovations? Quasi-natural experimental evidence from China. Energies 2024, 17, 2866. [Google Scholar] [CrossRef]

- Wen, J.; Ji, X.; Wu, X. The Impact of Water Resources Tax Reform on Corporate ESG Performance: Patent Evidence from China. Water 2025, 17, 959. [Google Scholar] [CrossRef]

- Wang, Q.; Shimada, K.; Yuan, J. Water resource tax policy and micro environmental performance improvement in China’s water-intensive industries. Water Resour. Econ. 2025, 49, 100258. [Google Scholar] [CrossRef]

- Xu, L.; Li, Z.; Fang, J.; He, Z.; Zhang, X. Can the water resources tax promote the water-saving innovation performance of high water consumption companies?-Empirical analysis from the pilot provinces in China. J. Clean. Prod. 2024, 451, 141888. [Google Scholar] [CrossRef]

- Wang, Y.; Wang, X.; Wang, H.; Shi, X.; Faye, B. Impact of Water Resource Tax Reform on Total Factor Productivity of High-Water-Consumption Industrial Enterprises in China. Water 2025, 17, 1208. [Google Scholar] [CrossRef]

- Zheng, L.; Wang, W.; Shang, B.; Wang, M. Public Water Concern, Managerial Green Cognition, and Corporate Water Responsibility: Evidence from High-Water-Consuming Enterprises in China. Sustainability 2025, 17, 7150. [Google Scholar] [CrossRef]

- Wang, J.; Wen, L.; Li, Y.; Liu, J.; Che, S. Uncovering the impacts of social comparative information on water saving behavior among urban residents: A field experiment in China. J. Clean. Prod. 2025, 492, 144863. [Google Scholar] [CrossRef]

- Yao, P.; Tian, Z.; Li, J. The invisible hand of transfer: The income distribution effect of water resource fee to tax. Econ. Anal. Policy 2025, 86, 76–97. [Google Scholar] [CrossRef]

- Kyei, C.K.; Chitiga-Mabugu, M. Welfare impacts of introducing water pollution tax in the Olifants river basin in South Africa: A revisited analysis using a top-down micro-accounting approach. Agrekon 2021, 60, 253–263. [Google Scholar] [CrossRef]

- Yu, Z.; Zhao, Z.; Zang, S.; Qu, A. Catalyzing co-benefits: How cross-regional coordination accelerates pollution and carbon reduction in China’s Yangtze River economic belt. Front. Environ. Sci. 2025, 13, 1601165. [Google Scholar] [CrossRef]

- Luo, T.; Tian, G.; Li, J.; Han, X. A Comprehensive Analysis of China’s Water Resources Tax Reform. Sustainability 2024, 16, 2162. [Google Scholar] [CrossRef]

- Lu, H.; Zhu, Y.; Kang, Y. Water Resource Tax and Green Industrial Development: Reform from the Largest Emerging Economy. Sustainability 2025, 17, 4478. [Google Scholar] [CrossRef]

- Han, Y.; Jiang, Z.; Zhao, M.; Li, J. Analysis of coupling coordination development and obstacle factors in the water-energy-carbon-ecological environment nexus across China’s Yellow River basin. Sci. Rep. 2025, 15, 24106. [Google Scholar] [CrossRef] [PubMed]

- Taheri, M.; Emadzadeh, M.; Gholizadeh, M.; Tajrishi, M.; Ahmadi, M.; Moradi, M. Investigating the temporal and spatial variations of water consumption in Urmia Lake River Basin considering the climate and anthropogenic effects on the agriculture in the basin. Agric. Water Manag. 2019, 213, 782–791. [Google Scholar] [CrossRef]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).