The Driving Forces of Digital Transformation: Navigating Peer Effects in Industrial and Regional Ecosystems

Abstract

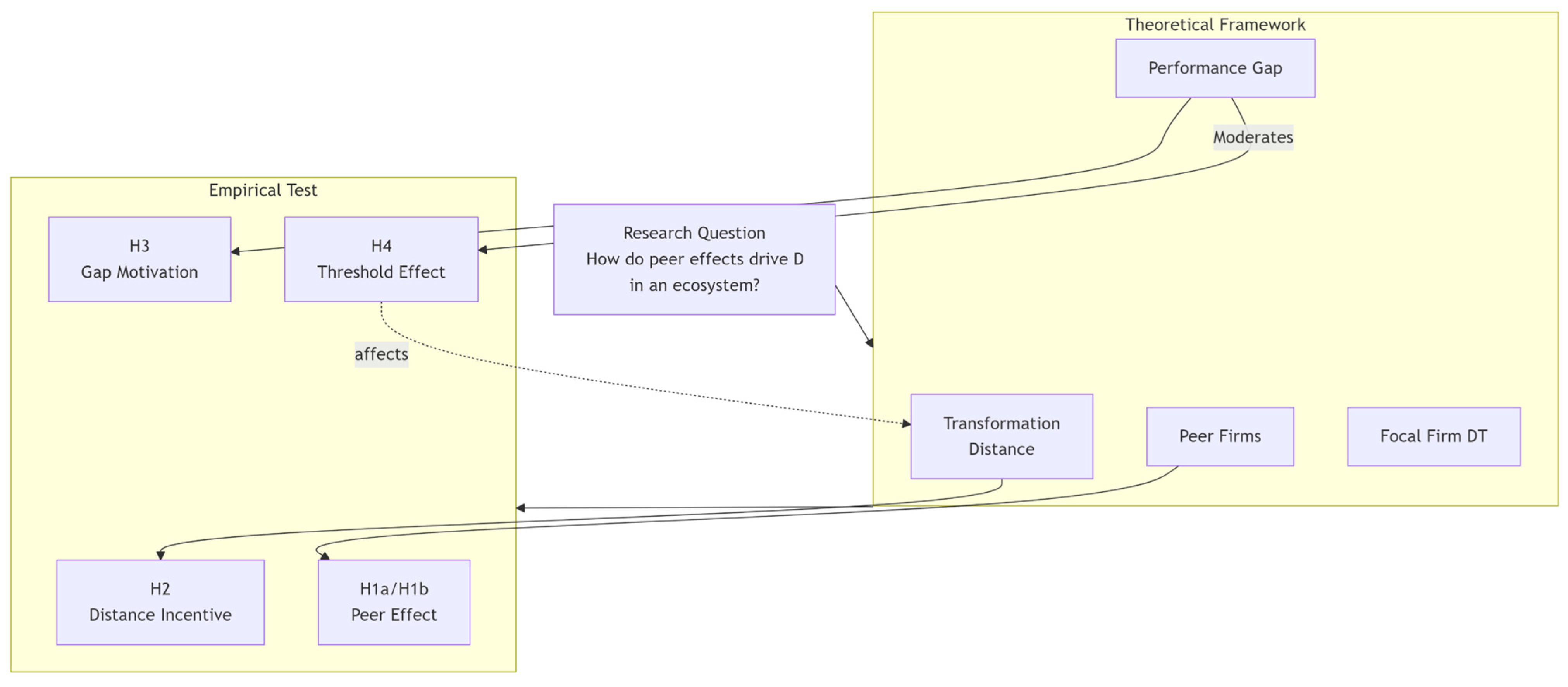

1. Introduction

2. Theoretical Analysis and Hypothesis Construction

2.1. The Peer Effects of Enterprise Digital Transformation

2.2. The Impact of Prior Transformation Distance on Digital Transformation

2.3. The Impact of Prior Performance Gap on Digital Transformation

2.4. Threshold Effect

3. Research Design

3.1. Sample Selection and Data Sources

3.2. Variable Definitions

3.2.1. Dependent Variable

3.2.2. Independent Variables

3.2.3. Control Variables

3.3. Model Construction

4. Empirical Analysis

4.1. Industry and Regional Peer Effects

4.2. Analysis of the Impact of Transformation Distance and Performance Gap on Digital Transformation

4.3. Endogeneity Test

4.3.1. Lagged One-Period Core Independent Variable

4.3.2. Propensity Score Matching

4.4. Robustness Test

4.4.1. Controlling for Additional Variables

4.4.2. Altering the Sample Period

4.5. Threshold Effect Analysis

4.6. Further Analysis

4.6.1. Test of the Multiplier Effect of the Peer Effects

4.6.2. Economic Consequences of the Peer Effects in Digital Transformation

5. Conclusions, Recommendations and Limitations

5.1. Conclusions

5.2. Recommendations

5.2.1. Recommendations for Central Authorities

5.2.2. Recommendations for Regional Governments

5.2.3. Recommendations for Company Leaders

5.3. Limitations

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Chen, L.; Tu, R.; Huang, B.; Zhou, H.; Wu, Y. Digital transformation’s impact on innovation in private enterprises: Evidence from China. J. Innov. Knowl. 2024, 9, 100491. [Google Scholar] [CrossRef]

- Central Committee of the Communist Party of China; State Council. Overall Layout Plan for Digital China Construction; Chinese Central Government; State Council: Beijing, China, 2023.

- Jin, X.; Zuo, C.; Fang, M.; Li, T.; Nie, H. Measurement problem of enterprise digital transformation: New methods and findings based on large language models. China Econ. 2025, 20, 70–95. [Google Scholar] [CrossRef]

- Zoppelletto, A.; Orlandi, L.B.; Zardini, A.; Rossignoli, C.; Kraus, S. Organizational roles in the context of digital transformation: A micro-level perspective. J. Bus. Res. 2023, 157, 113563. [Google Scholar] [CrossRef]

- Huo, C.; Lyu, M.; Xu, X. The peer effect of digital transformation and high-quality development of enterprises: The empirical evidence from the listed manufacturing companies. Sci. Technol. Prog. Policy 2023, 40, 77–87. [Google Scholar]

- Ren, X.; Zeng, G.; Sun, X. The peer effect of digital transformation and corporate environmental performance: Empirical evidence from listed companies in China. Econ. Model. 2023, 128, 106515. [Google Scholar] [CrossRef]

- Chen, Q.; Wang, Y.; Wan, M. Research on peer effect of enterprise digital transformation and influencing factors. Chin. J. Manag. 2021, 18, 653–663. [Google Scholar]

- Manski, C.F. Identification of endogenous social effects: The reflection problem. Rev. Econ. Stud. 1993, 60, 531–542. [Google Scholar] [CrossRef]

- Niu, Y.; Wen, W.; Wang, S.; Li, S. Breaking barriers to innovation: The power of digital transformation. Financ. Res. Lett. 2023, 51, 103457. [Google Scholar] [CrossRef]

- Varzaru, A.A.; Bocean, C.G. Digital Transformation and Innovation: The Influence of Digital Technologies on Turnover from Innovation Activities and Types of Innovation. Systems 2024, 12, 359. [Google Scholar] [CrossRef]

- Song, C.; Han, M.; Yuan, H. The impact of digital transformation on firm productivity: From the perspective of sustainable development. Financ. Res. Lett. 2025, 75, 106912. [Google Scholar] [CrossRef]

- Lu, Y.; Xu, C.; Zhu, B.; Sun, Y. Digitalization transformation and ESG performance: Evidence from China. Bus. Strategy Environ. 2024, 33, 352–368. [Google Scholar] [CrossRef]

- Hu, Y.; Li, Q.; Ma, B.; Lan, T.; Geng, W.; Li, B. Peer Effects in Corporate Digital Transformation within Supply Chain Networks. Teh. Vjesn.-Tech. Gaz. 2024, 31, 1464–1477. [Google Scholar] [CrossRef]

- Li, Q.; Wang, S.; Deng, P.; Wang, K. The peer effect of enterprise digital transformation. Sci. Technol. Prog. Policy 2023, 40, 1–12. [Google Scholar]

- Zhang, X.; Du, X. Industry and Regional Peer Effects in Corporate Digital Transformation: The Moderating Effects of TMT Characteristics. Sustainability 2023, 15, 6003. [Google Scholar] [CrossRef]

- Chang, K.; Li, J.; Xiao, L. Hear all parties: Peer effect of digital transformation on long-term firm investment in China. Manag. Decis. Econ. 2024, 45, 1242–1258. [Google Scholar] [CrossRef]

- Council, S. The 14th Five-Year Plan for Digital Economy; State Council of the People’s Republic of China: Beijing, China, 2021. [Google Scholar]

- Li, J.; Shi, Z.; He, C.; Lv, C. Peer effects on corporate R&D investment policies: A spatial panel model approach. J. Bus. Res. 2023, 158, 5487–5503. [Google Scholar] [CrossRef]

- Schmalensee, R. Do markets differ much? Am. Econ. Rev. 1985, 75, 341–351. [Google Scholar] [CrossRef]

- Lieberman, M.B.; Asaba, S. Why do firms imitate each other? Acad. Manag. Rev. 2006, 31, 366–385. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Trajtenberg, M.; Henderson, R. Geographic localization of knowledge spillovers as evidenced by patent citations. Q. J. Econ. 1993, 108, 577–598. [Google Scholar] [CrossRef]

- Torre, A.; Rallett, A. Proximity and localization. Reg. Stud. 2005, 39, 47–59. [Google Scholar] [CrossRef]

- Lee, D. Game theory and neural basis of social decision making. Nat. Neurosci. 2008, 11, 404–409. [Google Scholar] [CrossRef] [PubMed]

- Ba, S.; Cheng, Y.; Xiong, W. Research on Firm Innovation Decision under Peer Effect: Rational Expectations or Reference Point Dependence. Econ. Manag. 2024, 38, 50–60. [Google Scholar]

- Chen, G.; Liang, T.; Chen, X. How do firms’ performance shortfalls affect digital transformation? The role of peer experience and persistent underperformance. Rev. Manag. Sci. 2025, 19, 757–795. [Google Scholar] [CrossRef]

- Fan, H.; Wnag, L.; Xu, S. Research on the Impact of Performance Decline on Enterprise Digital Transformation: Based on Performance Gap Theory and S-O-R Model. J. Manag. Stud. 2024, 37, 95–112. [Google Scholar] [CrossRef]

- Meier, K.J.; Favero, N.; Zhu, L. Performance Gaps and Managerial Decisions: A Bayesian Decision Theory of Managerial Action. J. Public Adm. Res. Theory 2015, 25, 1221–1246. [Google Scholar] [CrossRef]

- Cheng, L.; Xie, E.; Fang, J.; Mei, N. Performance feedback and firms’ relative strategic emphasis: The moderating effects of board independence and media coverage. J. Bus. Res. 2022, 139, 218–231. [Google Scholar] [CrossRef]

- Cheng, X.; Xiu, H.; Zhou, C. How can performance feedback of technology enterprises affect the R&D information disclosure? Sci. Res. Manag. 2023, 44, 103. [Google Scholar] [CrossRef]

- Gamba, A.; Manzoni, E.; Stanca, L. Social comparison and risk taking behavior. Theory Decis. 2017, 82, 221–248. [Google Scholar] [CrossRef]

- Chen, W.-R.; Miller, K.D. Situational and institutional determinants of firms’ R&D search intensity. Strateg. Manag. J. 2007, 28, 369–381. [Google Scholar] [CrossRef]

- Hanelt, A.; Bohnsack, R.; Marz, D.; Antunes Marante, C. A Systematic Review of the Literature on Digital Transformation: Insights and Implications for Strategy and Organizational Change. J. Manag. Stud. 2021, 58, 1159–1197. [Google Scholar] [CrossRef]

- Tushman, M.L.; Romanelli, E. Organizational evolution: A metamorphosis model of convergence and reorientation. Res. Organ. Behav. 1985, 7, 171–222. [Google Scholar]

- Yang, S.; Zhang, Q.; Liu, M.; Shi, Q. “Peer Effects” in controlling shareholders’ equity pledge and stock price crash risk. Bus. Manag. J. 2020, 42, 94–112. [Google Scholar] [CrossRef]

- Grennan, J. Dividend payments as a response to peer influence. J. Financ. Econ. 2019, 131, 549–570. [Google Scholar] [CrossRef]

- Jiang, Y.; Zheng, Y.; Fan, W.; Wang, X. Peer digitalization and corporate investment decision. Financ. Res. Lett. 2024, 61, 104995. [Google Scholar] [CrossRef]

- Zhang, A.; Guo, X.; Zhang, W.; Liu, Z. Research on the mechanism by which digital transformation peer effects influence innovation performance in emerging industries: A case study of China’s photovoltaic industry. PLoS ONE 2025, 20, e0313615. [Google Scholar] [CrossRef]

- Li, Q.; Liu, L.; Shao, J. The Effect of Digital Transformation and Supply Chain Integration on Enterprise Performance: The Moderating Role of Entrepreneurship. Front. Bus. Res. China 2022, 16, 413–438. [Google Scholar] [CrossRef]

- Jensen, M.C. The modern industrial revolution, exit, and the failure of internal control systems. J. Financ. 1993, 48, 831–880. [Google Scholar] [CrossRef]

- Oliveira, F.; Kakabadse, N.; Khan, N. Board engagement with digital technologies: A resource dependence framework. J. Bus. Res. 2022, 139, 804–818. [Google Scholar] [CrossRef]

- Kaustia, M.; Rantala, V. Social learning and corporate peer effects. J. Financ. Econ. 2015, 117, 653–669. [Google Scholar] [CrossRef]

- Zhai, H.; Yang, M.; Chan, K.C. Does digital transformation enhance a firm’s performance? Evidence from China. Technol. Soc. 2022, 68, 101841. [Google Scholar] [CrossRef]

- Dimaggio, P.J.; Powell, W.W. The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. Am. Sociol. Rev. 1983, 48, 147–160. [Google Scholar] [CrossRef]

| Variable Type | Variable Name | Symbol | Definition |

|---|---|---|---|

| Dependent Variable | Digital Transformation | DT | Natural logarithm of (word frequency of digital transformation in annual report + 1) |

| Independent Variables | Industry Peer Digital Transformation | IDT | Average digital transformation level of other firms in the same industry as the focal firm |

| Regional Peer Digital Transformation | ADT | Average digital transformation level of other firms in the same region as the focal firm | |

| prior-period transformation distance | IJL | Absolute difference in digital transformation between focal firm and industry peers in previous period | |

| AJL | Absolute difference in digital transformation between focal firm and regional peers in previous period | ||

| prior-period performance gap | ICZ | Focal firm’s previous period performance minus average performance of industry peers | |

| ACZ | Focal firm’s previous period performance minus average performance of regional peers | ||

| Control Variables | Asset-Liability Ratio | ALR | Total liabilities divided by total assets |

| Equity Balance Ratio | Balance | Shareholding ratio of 2nd–5th largest shareholders divided by shareholding ratio of largest shareholder | |

| Proportion of Independent Directors | Indep | Number of independent directors divided by total number of directors | |

| CEO duality | Com | Dummy variable indicating whether chairman and CEO are the same person (1 = yes, 0 = no) | |

| Total Compensation of Top Three Executives | Pay | Total annual compensation of three highest-paid executives | |

| Ownership Concentration | OC | Shareholding percentage of largest shareholder | |

| Revenue Growth Rate | Growth | (Current year operating revenue—previous year operating revenue)/previous year operating revenue |

| Variable | (1) DT | (2) DT | (3) DT | (4) DT |

|---|---|---|---|---|

| IDT | 0.9335 *** (155.8589) | 0.9332 *** (154.6431) | ||

| ADT | 0.3470 *** (21.1221) | 0.3145 *** (19.0310) | ||

| Controls | NO | YES | NO | YES |

| _cons | 0.1042 *** (4.7570) | −0.0430 (−1.0017) | 0.0285 (0.5064) | −0.0899 (−1.3048) |

| N | 49,490 | 49,490 | 49,490 | 49,490 |

| R2 | 0.5161 | 0.5209 | 0.4864 | 0.4914 |

| year | YES | YES | YES | YES |

| province | YES | YES | NO | NO |

| industry | NO | NO | YES | YES |

| Variable | (1) DT | (2) DT | (3) DT | (4) DT |

|---|---|---|---|---|

| IJL | 0.4683 *** (44.3067) | 0.4554 *** (43.1412) | ||

| AJL | 0.3460 *** (40.0025) | 0.3468 *** (40.2355) | ||

| Controls | NO | YES | NO | YES |

| _cons | 0.4662 *** (17.8168) | 0.4124 *** (7.6297) | 0.0755 (1.2668) | −0.1453 ** (−2.0041) |

| N | 44,208 | 44,208 | 44,208 | 44,208 |

| R2 | 0.2897 | 0.3013 | 0.5075 | 0.5138 |

| year | YES | YES | YES | YES |

| province | YES | YES | NO | NO |

| industry | NO | NO | YES | YES |

| Variable | (1) DT | (2) DT | (3) DT | (4) DT |

|---|---|---|---|---|

| ICZ | −0.0254 *** (−5.1973) | −0.0387 *** (−7.8352) | ||

| ACZ | −0.0285 *** (−7.2943) | −0.0264 *** (−6.6300) | ||

| Controls | NO | YES | NO | YES |

| _cons | 0.6719 *** (23.4795) | 0.6389 *** (11.3435) | 0.1791 ** (2.3890) | 0.0030 (0.0346) |

| N | 44,144 | 44,144 | 44,144 | 44,144 |

| R2 | 0.2471 | 0.2619 | 0.4811 | 0.4871 |

| year | YES | YES | YES | YES |

| province | YES | YES | NO | NO |

| industry | NO | NO | YES | YES |

| Variable | (1) DT | (2) DT |

|---|---|---|

| L.IDT | 0.8156 *** (125.2778) | |

| L.ADT | 0.1947 *** (11.9593) | |

| Controls | YES | YES |

| _cons | 0.0517 (1.0869) | −0.0292 (−0.4035) |

| N | 44,208 | 44,208 |

| R2 | 0.4756 | 0.4885 |

| year | YES | YES |

| province | YES | NO |

| industry | NO | YES |

| Variable | (1) DT | (2) DT | (3) DT | (4) DT | (5) DT | (6) DT |

|---|---|---|---|---|---|---|

| IDT | 0.9285 *** (115.9056) | |||||

| ADT | 0.2908 *** (11.9177) | |||||

| IJL | 0.4712 *** (33.6778) | |||||

| AJL | 0.3159 *** (25.7655) | |||||

| ICZ | −0.0390 *** (−5.9910) | |||||

| ACZ | −0.0294 *** (−5.2782) | |||||

| Controls | YES | YES | YES | YES | YES | YES |

| _cons | 0.0391 (0.6194) | −0.0665 (−0.7059) | 0.2800 *** (3.7438) | −0.0819 (−0.8694) | 0.6330 *** (7.6781) | 0.0280 (0.2768) |

| N | 25,816 | 24,229 | 24,057 | 23,898 | 21,665 | 20,807 |

| R2 | 0.5088 | 0.4801 | 0.2994 | 0.5008 | 0.2598 | 0.4959 |

| year | YES | YES | YES | YES | YES | YES |

| province | YES | NO | YES | NO | YES | NO |

| industry | NO | YES | NO | YES | NO | YES |

| Variable | (1) DT | (2) DT | (3) DT | (4) DT | (5) DT | (6) DT |

|---|---|---|---|---|---|---|

| IDT | 0.9329 *** (154.5588) | |||||

| ADT | 0.3137 *** (18.9765) | |||||

| IJL | 0.4551 *** (43.1193) | |||||

| AJL | 0.3469 *** (40.2376) | |||||

| ICZ | −0.0388 *** (−7.8443) | |||||

| ACZ | −0.0264 *** (−6.3671) | |||||

| Controls | YES | YES | YES | YES | YES | YES |

| _cons | −0.0046 (−0.0959) | −0.0462 (−0.6316) | 0.5355 *** (8.8238) | −0.0785 (−1.0213) | 0.7732 *** (12.2073) | 0.0706 (0.9185) |

| N | 49,490 | 49,490 | 44,208 | 44,208 | 44,144 | 44,144 |

| R2 | 0.5209 | 0.4915 | 0.3017 | 0.5138 | 0.2622 | 0.4872 |

| year | YES | YES | YES | YES | YES | YES |

| province | YES | NO | YES | NO | YES | NO |

| industry | NO | YES | NO | YES | NO | YES |

| Variable | (1) DT | (2) DT | (3) DT | (4) DT | (5) DT | (6) DT |

|---|---|---|---|---|---|---|

| IDT | 0.9249 *** (104.3591) | |||||

| ADT | 0.2238 *** (9.5126) | |||||

| IJL | 0.7181 *** (46.9137) | |||||

| AJL | 0.5502 *** (43.9554) | |||||

| ICZ | −0.0283 *** (−3.8701) | |||||

| ACZ | −0.0145 ** (−2.3833) | |||||

| Controls | YES | YES | YES | YES | YES | YES |

| _cons | −0.0832 (−1.3901) | −0.0330 (−0.3710) | 0.2131 *** (2.8276) | −0.1580 * (−1.6887) | 0.6073 *** (7.5285) | 0.0399 (0.4123) |

| N | 23,687 | 23,687 | 20,348 | 20,348 | 20,314 | 20,348 |

| R2 | 0.4720 | 0.4742 | 0.2835 | 0.5354 | 0.1816 | 0.4705 |

| year | YES | YES | YES | YES | YES | YES |

| province | YES | NO | YES | NO | YES | NO |

| industry | NO | YES | NO | YES | NO | YES |

| Threshold Variable | Test Type | F-Value | p-Value | Threshold Estimate | Confidence Interval |

|---|---|---|---|---|---|

| ICZ | Single Threshold | 13.07 | 0.023 | −0.4794 | (−0.5282, −0.4657) |

| Double Threshold | The double and triple threshold effects are statistically insignificant for the industry performance gap. | ||||

| Triple Threshold | |||||

| ACZ | No significant threshold effect is found for the regional performance gap. | ||||

| Variable | Coefficient Estimate | t-statistic | |||

| ICZ ≤ −0.4794 | 0.4401 *** | 15.5083 | |||

| ICZ > −0.4794 | 0.3572 *** | 14.6721 | |||

| Variable | (1) DT | (2) DT |

|---|---|---|

| IDT | 0.9325 *** (153.1428) | |

| ADT | 0.3094 *** (18.8033) | |

| Year | −0.0053 ** (−2.2395) | −0.0166 *** (−3.4064) |

| IDT∙Year | 0.0021 (1.1698) | |

| ADT∙Year | 0.0166 *** (3.8851) | |

| Controls | YES | YES |

| _cons | 10.6359 ** (2.2181) | 33.0792 *** (3.3709) |

| N | 49,490 | 49,490 |

| R2 | 0.5209 | 0.4916 |

| year | YES | YES |

| province | YES | NO |

| industry | NO | YES |

| Variable | (1) TobinQ | (2) TobinQ |

|---|---|---|

| IDT | 0.1473 *** (18.6264) | |

| ADT | −0.0030 (−0.1562) | |

| Controls | YES | YES |

| _cons | 3.2457 *** (52.2900) | 3.4356 *** (30.9014) |

| N | 49,490 | 49,490 |

| R2 | 0.1359 | 0.1752 |

| year | YES | YES |

| province | YES | NO |

| industry | NO | YES |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dai, J.; Li, M. The Driving Forces of Digital Transformation: Navigating Peer Effects in Industrial and Regional Ecosystems. Systems 2025, 13, 940. https://doi.org/10.3390/systems13110940

Dai J, Li M. The Driving Forces of Digital Transformation: Navigating Peer Effects in Industrial and Regional Ecosystems. Systems. 2025; 13(11):940. https://doi.org/10.3390/systems13110940

Chicago/Turabian StyleDai, Jun, and Mingcan Li. 2025. "The Driving Forces of Digital Transformation: Navigating Peer Effects in Industrial and Regional Ecosystems" Systems 13, no. 11: 940. https://doi.org/10.3390/systems13110940

APA StyleDai, J., & Li, M. (2025). The Driving Forces of Digital Transformation: Navigating Peer Effects in Industrial and Regional Ecosystems. Systems, 13(11), 940. https://doi.org/10.3390/systems13110940