1. Introduction

Gulf Cooperation Council (GCC) economies are leveraging digital adoption to diversify away from hydrocarbon dependence, yet the macroeconomic productivity returns of these investments remain uncertain. “Digital adoption”—the uptake and use of internet, mobile, and broadband technologies—is a core pillar of development strategies in resource-rich economies [

1,

2]. Recognizing this, GCC governments have invested heavily in digital infrastructure, including broadband networks, near-universal mobile coverage, and e-government platforms, as part of broader efforts to raise productivity, foster innovation, and reduce dependence on volatile hydrocarbon revenues. Recent IMF analysis confirms the strategic priority of digital transformation in GCC diversification efforts [

3,

4]. Saudi Arabia’s Vision 2030, for example, positions digital technologies as instruments for diversification, and public-sector reform.

However, while the economic contribution of broadband and digitization has been well-documented [

5,

6] and the link between digital adoption and productivity is well-established in OECD and emerging-market contexts [

7,

8], its applicability in high-income, oil-dependent economies is less clear. In the GCC, substantial digital investments coexist with structural frictions—including rentier-state dynamics, labor-market segmentation, and limited institutional coordination—that can dampen expected productivity gains [

9,

10,

11,

12]. This creates a critical research gap: a lack of macro-level, panel-based evidence on whether, and under what conditions, digital adoption translates into sustained productivity improvements in the unique socio-technical context of the GCC.

To address this gap, this study investigates two central questions:

- (i)

Does digital adoption improve labor productivity in GCC economies?

- (ii)

Is this effect conditioned by enabling institutions and structural features—specifically, government effectiveness and oil-rent dependence?

To answer these questions, we construct a Composite Digital Index (CDI) and analyze a balanced panel for six GCC countries over 2000–2023. Empirically, we employ a tiered strategy using fixed effects models with Driscoll–Kraay standard errors for short-run inference [

13,

14], and the ARDL–PMG estimator to identify long-run relationships, with System-GMM as a robustness check. Moderating effects are tested via interaction terms (CDI × Government Effectiveness and CDI × Oil Rents), and controls include inflation (CPI), the Human Development Index (HDI), gross capital formation, and trade openness. Theoretically, we frame the GCC as a bounded socio-technical system, where government, firms, and the oil sector interact, allowing us to test how digital adoption, productivity, and investment form reinforcing or dampened feedback loops. This study contributes new macroeconomic evidence from a high-income, resource-exporting region where digital infrastructure investment is high but economic outcomes remain uncertain. It also demonstrates how institutional quality and fiscal structure systematically condition the digital adoption-productivity link, offering novel insights for policy design in rentier states. While our study provides robust regional insights, we note that the small number of countries limits granular, country-level inference, a constraint we discuss in the Conclusion.

2. Literature Review

To situate our study, this review synthesizes three interconnected strands of literature that inform the relationship between digital adoption and productivity in resource-rich contexts. First, we examine the broad evidence on digital adoption and economic performance, which establishes the potential for gains but also their conditional nature. Second, we integrate the political economy of rentier states and the resource curse, which provides a critical lens on how hydrocarbon wealth can distort economic incentives and institutions. Third, we focus on the specific institutional and labor-market context of the GCC, which shapes the region’s unique absorptive capacity. By critically examining the intersections and gaps across these literatures, this review builds the case for a systems-based approach that tests how institutional quality and fiscal structure moderate the digital adoption-productivity link—a mechanism often implied but rarely tested empirically in the GCC context.

2.1. Digital Adoption and Economic Performance

Digital technologies—such as mobile networks, broadband, and internet access—are theorized to lower transaction costs, enhance coordination, and improve productivity [

7,

8]. Cross-country studies, including those by the Ref. [

2], link broadband penetration to higher income levels and service-sector growth. cementing the notion of “digital dividends. Evidence from developed economies like Australia confirms the long-run productivity benefits of ICT investment [

15], and recent global indices, such as the Network Readiness Index, provide comparative frameworks for assessing digital transformation progress [

15]. Network-based analyses further demonstrate how technology diffusion patterns critically shape growth outcomes [

16]. A consistent theme in this literature, however, is that these dividends are not automatic—they depend on a country’s absorptive capacity, including education levels, macroeconomic stability, and institutional quality [

2,

17]. Early research on ICT in developing countries highlighted how local context and improvisation shape technology outcomes [

18], and more recent studies in other regions confirm that socioeconomic factors and usage barriers significantly limit digital adoption [

19]. More recent work [

20,

21] emphasizes the critical role of policy design and state capacity in converting infrastructure into productivity gains. This aligns with findings that governance quality moderates ICT’s socioeconomic impacts in development [

22]. Moreover, critical perspectives question technological determinism and emphasize the contextual nature of ICT impacts in development [

23]. In the MENA context, Ref. [

24] find that human capital significantly amplifies digital investment outcomes [

25].

While this body of work provides a crucial foundation, it exhibits two key limitations for understanding the GCC context. First, it predominantly focuses on OECD and middle-income countries, with firm-level data often being the primary source of evidence. The macro-level dynamics in high-income, resource-exporting states are underexplored. Second, the “conditional” nature of dividends is often treated as a background assumption, with institutional quality included as a control variable rather than an explicit, testable moderator of the core relationship. Our study addresses these gaps by constructing a Composite Digital Adoption Index (CDI) tailored to GCC infrastructure policies and by empirically testing governance as an amplifier of digital productivity effects, moving beyond context-invariant models.

2.2. Digital Adoption as a Catalyst for Structural Change

A related strand of literature positions digitalization as a catalyst for structural transformation, particularly in service-oriented or resource-dependent economies. It is argued to enable diversification by lowering entry barriers and creating new platforms for value creation [

25]. Evidence from both African and Asian contexts confirms that digitalization coupled with trade openness can stimulate growth, though the patterns vary by region [

26,

27]. This narrative is prominently adopted in GCC national visions (e.g., Saudi Vision 2030), which frame digital technologies as central to modernization. Saudi Arabia’s Vision 2030 [

28] explicitly positions digital transformation as central to economic modernization [

29]. Global assessments further emphasize the potential of digital technologies to reshape international supply chains in developing regions [

30].

The literature on digitalization and structural change is often strong on theoretical potential but weaker on empirical validation within the specific constraints of rentier economies. As Refs. [

9,

11] argue, the region’s institutional and labor-market frictions can severely limit the translation of digital investment into broad-based productivity gains. This literature often identifies the problem but stops short of modeling and testing the precise mechanisms of this attenuation. Our study directly addresses this by quantifying how one key rentier characteristic—oil-rent dependence—systematically weakens the productivity returns from digital adoption.

2.3. The Resource Curse and Digital Dividends

A vast literature links natural resource dependence to weaker long-run performance through mechanisms like Dutch disease, macro-fiscal volatility, and institutional erosion [

31,

32,

33]. The foundational “resource curse thesis” established that mineral economies face unique development challenges [

34], with recent work confirming that institutional quality mediates this relationship across different regional contexts [

35]. In rentier economies, hydrocarbon revenues can relax budget constraints, expand public employment, and reduce competitive pressure on the tradable sector. When applied to the digital domain, this perspective suggests that resource rents may reallocate technology spending toward e-government and administrative efficiency rather than firm-level adoption and innovation, while simultaneously crowding out private investment and skills upgrading [

9].

Despite the clear conceptual overlap, the digital economy and resource curse literatures have rarely been formally integrated. There is a conspicuous lack of empirical studies that test whether oil rents actively dampen the productivity payoff of digital infrastructure. This is a critical omission for understanding the development trajectory of resource-rich economies. Our study bridges this divide by explicitly modeling oil rents as a moderating variable. This approach is aligned with systems-thinking, which views rentier dynamics as balancing feedback that stabilizes the status quo and weakens incentives for innovation [

36,

37], a dynamic we test through our CDI × Oil Rents interaction.

2.4. The GCC Context: Institutions, Labor, and Digital Absorption

The GCC context presents a unique laboratory where ambitious digital strategies collide with deeply embedded rentier structures. GCC economies follow a hybrid allocation-state model [

38] where the region’s economies are characterized by state dominance, segmented labor markets, and heavy reliance on expatriate labor, all of which can mute the macro-impact of technology [

9,

11]. Recent sectoral analyses, such as in the oil and gas industry, highlight both the progress and challenges of digital transformation in the region [

39], while country-specific studies demonstrate digitalization’s positive impact on FDI inflows [

40]. Recent work on digital transformation in the GCC emphasizes the region’s unique institutional context and the conditional nature of digital dividends [

4]. A critical local factor is the disconnection between high national Human Development Index (HDI) scores and productive capacity, as high HDI is often financed by oil revenues and coexists with significant skills mismatches and limited private-sector dynamism [

41,

42]. While the structural features of the GCC are well-documented, the empirical evidence connecting digital adoption to macroeconomic outcomes remains sparse. Existing studies often focus on digital readiness or firm-level case studies, but there is a lack of panel-based, cross-country analysis that tests the productivity link while accounting for the region’s institutional and labor-market peculiarities. Even comprehensive regional assessments from institutions like the [

4], note the need for more evidence on the economic returns to digital investments. Our study fills this void by assembling a GCC-wide panel and directly testing the role of government effectiveness as a systemic enabler and HDI as a potential but complex factor, thereby providing a macro-econometric assessment grounded in the region’s specific political economy.

2.5. Hypothesis Development

Endogenous growth theory posits that technological adoption spurs long-run growth by facilitating innovation and reallocation [

43]. However, in rentier contexts, these gains are often constrained by weak institutions and fiscal complacency [

44]. Prior studies suggest mixed outcomes for technology adoption under rentier or low-governance conditions [

45,

46]. Yet most do not test moderating effects explicitly, nor do they adopt a systems framing.

Our approach operationalizes digital–productivity feedbacks as testable loops:

R1: digital adoption → productivity → investment,

R2: amplified by government effectiveness,

B1: dampened by oil rents.

This framing generates the following hypotheses:

H1. Digital adoption has a positive long-run effect on labor productivity in the GCC.

H2. Government effectiveness strengthens the positive impact of digital adoption on labor productivity.

H3. Greater oil-rent dependence weakens the positive long-run relationship between digital adoption and labor-productivity growth.

H4. Human development (HDI) is positively associated with labor productivity, conditional on labor-market responsiveness.

2.6. Contribution and Gap

This study contributes to the literature at the intersection of digital adoption, productivity, and political economy in resource-rich contexts. It offers four integrated contributions that provide a system-level understanding of when and how digital adoption translates into macroeconomic outcomes in the Gulf Cooperation Council (GCC) region.

First, it addresses a key empirical gap by examining the long-run impact of digital adoption in high-income, oil-dependent economies—settings where digital strategies are ambitious, yet outcomes remain uncertain. While Gulf states are often analyzed through the lens of rentier-state theory, few studies examine how digital uptake interacts with institutional and fiscal structures to affect productivity. This study introduces a systems-oriented perspective that explicitly links adoption dynamics with broader macroeconomic feedbacks.

Second, it develops and applies a region-specific measure of digital adoption: the Composite Digital Adoption Index (CDI), constructed from internet usage, mobile subscriptions, and broadband penetration. Unlike firm-level digital adoption indicators that focus on internal technological capabilities, the CDI captures adoption capacity at the national level, aligned with public investment and infrastructure policy levers. This framing allows the study to evaluate digital adoption as an accessible policy tool in state-led economies.

Third, the study embeds econometric analysis within a systems-thinking framework. Digital adoption, productivity, and investment are treated as a reinforcing feedback loop (R1), with government effectiveness modeled as an amplifier (R2) and oil rents as a balancing or dampening loop (B1). These dynamics are tested using ARDL–PMG and FE–DK estimators, with System-GMM included for robustness. The methodology treats model coefficients not as standalone estimates, but as empirical validations of structural relationships in the system.

Fourth, the study clarifies the conditional nature of digital dividends. It shows that adoption alone is not sufficient; rather, institutional quality and fiscal context shape whether digital adoption delivers long-term productivity gains. Specifically, government effectiveness strengthens, while oil rents weaken, the economic impact of digital uptake. This insight identifies critical leverage points for policy design in rentier economies pursuing productivity-led diversification.

By linking measurable interaction terms to theoretically defined feedback loops, the study offers a systems-based contribution that stands apart from prior work which often assumes context-invariant effects of digitalization. It advances both the digital-economy and resource-curse literatures by showing how adoption outcomes are contingent on the broader institutional and fiscal environment.

3. Methodology

This study employs a systems-thinking approach to investigate the macroeconomic effects of digital adoption in six GCC countries from 2000 to 2023. The empirical strategy is explicitly designed to test the feedback dynamics of a conceptualized socio-technical system.

3.1. Conceptual Framework: A Systems Perspective

We conceptualize each GCC country as a nationally bounded socio-technical system where digital adoption, labor productivity, investment, institutional quality, and oil rents interact through dynamic feedback loops [

38,

47]. This systems perspective draws from contemporary socio-technical systems research that emphasizes the interdependence of technological and social elements [

48]. This framing structures our interpretation of the results—not as isolated coefficients but as systemic effects shaped by co-evolving structural features.

3.1.1. System Boundary, Actors, and Roles

The system is bounded at the national level. Within this boundary, the key internal elements and actors interact. The principal actors are the government and firms. The government, whose capability is directly captured in our model by the Gov_Effectiveness variable, is responsible for policy, regulation, and infrastructure financing. Firms are the primary agents that adopt and use digital technologies. While firm-level data is not used directly, the aggregate outcome of their activities—enhanced efficiency and production—is the central dependent variable of our study, Labor Productivity; the CDI measures the digital infrastructure environment in which these firms operate. The oil sector is not modeled as a direct actor but indirectly shapes incentives for both government and firms, a structural dynamic we test empirically through the Oil_Rents variable. External shocks, such as oil price fluctuations and shifts in global demand, are treated as exogenous inputs to the system.

3.1.2. Hypothesized Feedback Loops and Empirical Translation

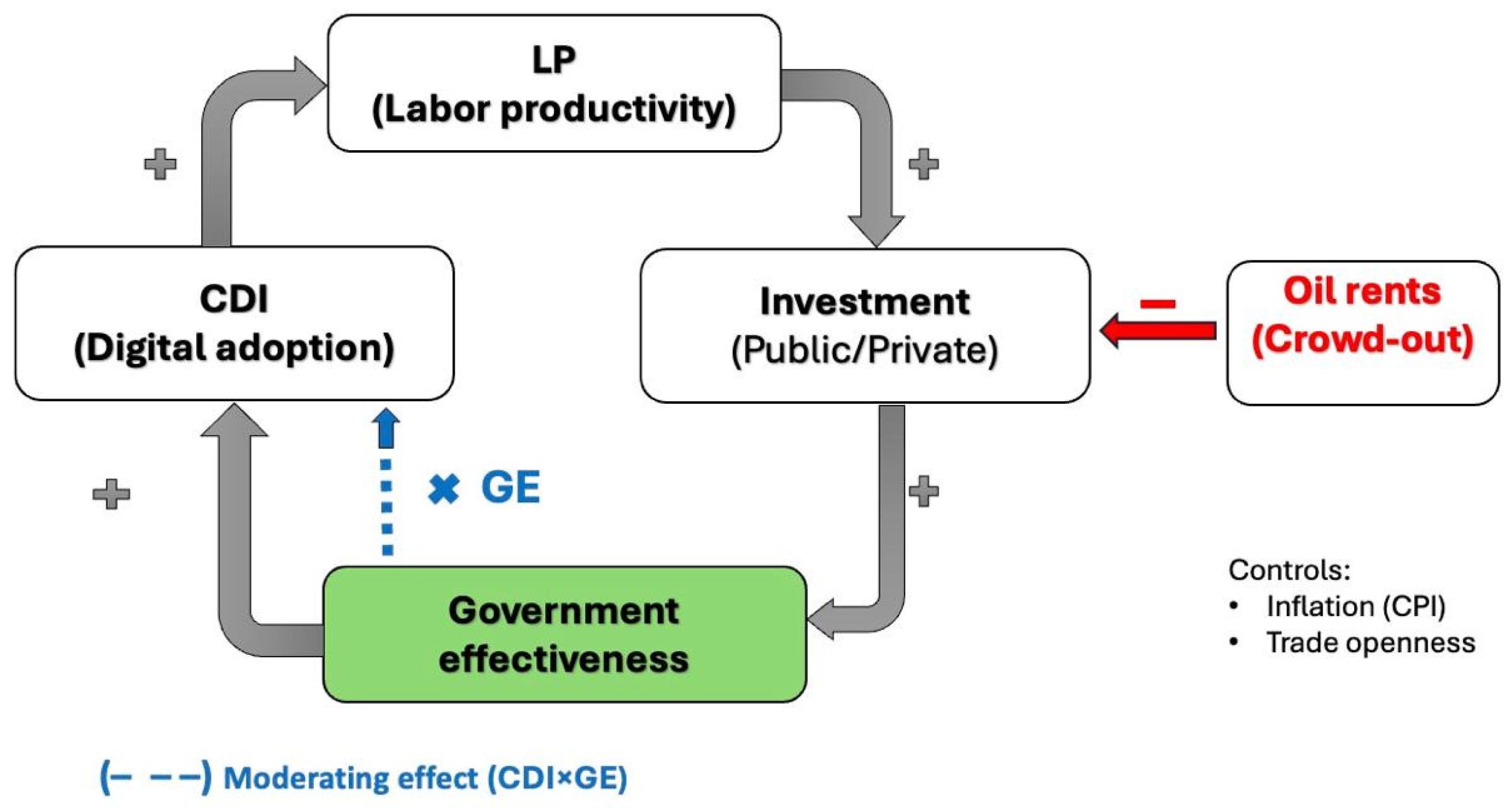

The core system dynamics are captured by three testable feedback loops, visualized in the causal-loop diagram (

Figure 1).

The causal-loop diagram (

Figure 1) illustrates the core feedback dynamics of the system, which are defined as follows:

Reinforcing Loop R1 (Adoption → Productivity → Investment): This core loop posits that digital adoption (CDI) boosts labor productivity (LP), which in turn encourages further investment (GCF) in digital and complementary assets, creating a virtuous cycle of growth.

Reinforcing Loop R2 (Governance Amplifier): Government effectiveness is hypothesized to amplify the returns from digital adoption by improving project implementation, regulatory quality, and competition, thereby strengthening the R1 loop.

Balancing Loop B1 (Oil-Rent Crowd-Out): High oil rents are expected to weaken private-sector incentives to innovate and crowd out productive investment [

26,

27], thereby dampening the positive momentum of loops R1 and R2.

This systems framework directly informs our empirical model specifications. The hypothesized dynamics are tested by incorporating specific interaction terms into our regressions: the CDI × Government Effectiveness interaction provides an empirical test for the R2 (governance amplifier) loop, while the CDI × Oil Rents interaction tests the B1 (rentier dampening) loop. Control variables, namely inflation and trade openness, are included as factors influencing system performance but are not conceptualized as core feedback mechanisms within this theoretical model.

3.2. Data

3.2.1. Data Sources and Variable Construction

We compile a balanced annual panel dataset for the six GCC countries from 2000 to 2023. Data are sourced from the World Bank’s World Development Indicators (WDI), the Worldwide Governance Indicators [

49], and the United Nations Development Programme (UNDP). All monetary variables in current local currency units from WDI [

50], were converted to constant 2015 US dollars using the respective country’s GDP deflator to ensure real-term comparability over time. The key variables used in the analysis are defined in

Table 1 below.

3.2.2. Construction of the Composite Digital Index (CDI)

To capture a holistic view of a country’s digital adoption infrastructure, we construct a Composite Digital Index (CDI) using three standard indicators:

Fixed broadband subscriptions (per 100 people)

Individuals using the Internet (% of population)

Mobile cellular subscriptions (per 100 people)

The CDI is derived using Principal Component Analysis (PCA), a dimensionality reduction technique that creates a single index from correlated variables, weighting them according to their contribution to the total variance. The procedure was as follows:

Data Standardization: The three digital component variables were standardized (converted to z-scores) to ensure they were on a comparable scale and to mitigate the influence of different units of measurement.

PCA Application: PCA was applied to the standardized variables. The first principal component (PC1) was extracted, which explains the maximum possible variance in the original dataset.

Index Calculation: The CDI was computed as the linear combination of the standardized variables, weighted by the loadings (eigenvectors) of PC1.

Normalization: The resulting index was then normalized to a 0 to 1 scale using the min-max method for easier interpretation, where 0 represents the lowest level of digital adoption in the sample and 1 the highest.

Results of CDI Construction: The first principal component (PC1) explains 78.4% of the total variance in the three digital adoption variables, indicating that it successfully captures the common underlying “digital adoption” dimension. The high variance explained justifies the use of PC1 as the basis for the CDI. The final CDI thus provides a single, robust measure of national-level digital infrastructure adoption.

3.2.3. Summary Statistics

Table 2 presents the descriptive statistics for the key variables used in the econometric analysis. Labor productivity growth shows considerable variation (mean: −1.16%, SD: 5.03), while the CDI averages 0.466, indicating significant room for growth and heterogeneity across the region. Oil rents confirm the region’s resource dependence, averaging 28.7% of GDP. Government effectiveness also varies substantially, with a mean of 0.42 on the WGI scale.

3.3. Econometric Methods

3.3.1. Econometric Strategy and Estimator Selection

Our empirical approach addresses the challenges posed by a macro-panel with a small cross-section (N = 6) and a relatively long time series (T = 23), including potential endogeneity, cross-sectional dependence, and mixed orders of integration among variables. To ensure robust inference, we implement a three-tier estimation strategy:

To test the conditioning role of institutions and fiscal structure, as derived from our systems framework, we introduce the interaction terms CDI × Gov_Effectiveness and CDI × Oil_Rents into the models.

3.3.2. Model Specifications

The core empirical model to assess the impact of digital formation on labor productivity is specified as follows:

Baseline Fixed Effects Model (for short-run inference):

where

αi and

λt represent country and year fixed effects, respectively.

Moderation Model (for institutional and resource conditioning):

A symmetric specification is used for the CDI × Oil_Rents interaction.

ARDL-PMG Model (for long-run inference):

Here, φi is the country-specific error-correction speed of adjustment, which is expected to be negative and significant if a long-run equilibrium exists. The vector θ contains the common long-run coefficients of interest.

System-GMM Model (for dynamic robustness):

This model includes a lag of the dependent variable and uses internal instruments to address endogeneity.

4. Results

This section presents the empirical results from the econometric models, focusing on how digital adoption (CDI) affects labor productivity across the GCC, and how this effect is moderated by governance and oil rents. All results are interpreted within a systems framework and supported by statistical diagnostics.

4.1. Correlation Matrix

Table 3 presents pairwise correlations. Notably, CDI is positively correlated with governance indicators (e.g., HDI, Government Effectiveness) and negatively correlated with oil rents. This suggests digital adoption is stronger in better-governed, less rent-dependent contexts.

4.2. Baseline Long-Run Estimates (ARDL–PMG)

Estimates from the ARDL–PMG model confirm a stable long-run relationship between digital adoption and labor productivity, as evidenced by a negative and significant error-correction term (ECT = −0.726,

p < 0.01). This supports the presence of cointegration among the variables—full diagnostic results are reported in

Section 4.6.2.

In support of Hypothesis 1 (H1), the Composite Digital Adoption Index (CDI) shows a positive and statistically significant long-run association with labor productivity (β = 12.62, p < 0.05). This suggests that digital adoption contributes to sustained productivity growth over time. GDP growth also enters positively and significantly (β = 0.447, p < 0.01), consistent with macroeconomic momentum improving labor efficiency. Conversely, inflation (CPI) has a negative and significant long-run effect (β = −0.164, p < 0.01), indicating that price instability erodes productivity gains. Oil rents display a weak negative coefficient (β = −0.092, p < 0.10), implying that resource dependence may modestly dampen the productivity effects of digital infrastructure, even before moderation is considered.

Short-run dynamics, in contrast, are generally weaker. Changes in CDI (ΔCDI) are typically negative, possibly reflecting adjustment or implementation costs. ΔGDP is positive and significant, while ΔCPI remains negative. The significance of the ECT confirms that deviations from the long-run equilibrium are corrected over time. As we show in later sections, the long-run CDI effect strengthens significantly with better governance and weakens with higher oil-rent dependence, consistent with the feedback loops proposed in our systems-theoretical framework.

4.3. Institutional Moderation (CDI × Government Effectiveness)

When interaction terms are included, the productivity impact of CDI increases sharply under stronger governance (β = 38.49,

p < 0.01). The interaction term CDI × GE is also positive and significant, supporting Hypothesis 2 (

Appendix A Table A2).

In this interaction framework, the standalone GE coefficient (−44.331, SE = 6.908) represents the effect at CDI = 0, which lies outside the observed data range. The more meaningful quantity is the marginal effect of adoption:

This marginal effect remains positive across all observed levels of governance in the GCC, supporting H2: stronger institutional quality enhances the long-run productivity returns to digital adoption. The symmetric partial derivative with respect to governance,

becomes positive once CDI surpasses a certain threshold—implying that governance alone is not sufficient but amplifies the effect of adoption when both are present.

Other covariates behave consistently with theoretical expectations: oil rents become more strongly negative (−0.317, SE = 0.063), reflecting their dampening effect; CPI remains negative (−0.192, SE = 0.085); and GDP growth remains positive and significant (0.575, SE = 0.105). In the short run, the interaction term is not significant, and ΔCDI is not robustly positive. Adjustment occurs through the significant error-correction term rather than immediate impacts.

Descriptive patterns support this interpretation. Countries with higher governance and higher adoption levels, such as the UAE and Qatar, exhibit greater labor-productivity gains compared to peers like Oman with lower governance scores. This aligns with the “analog complements” perspective [

2], which emphasizes that digital infrastructure yields stronger returns when embedded within a capable institutional environment.

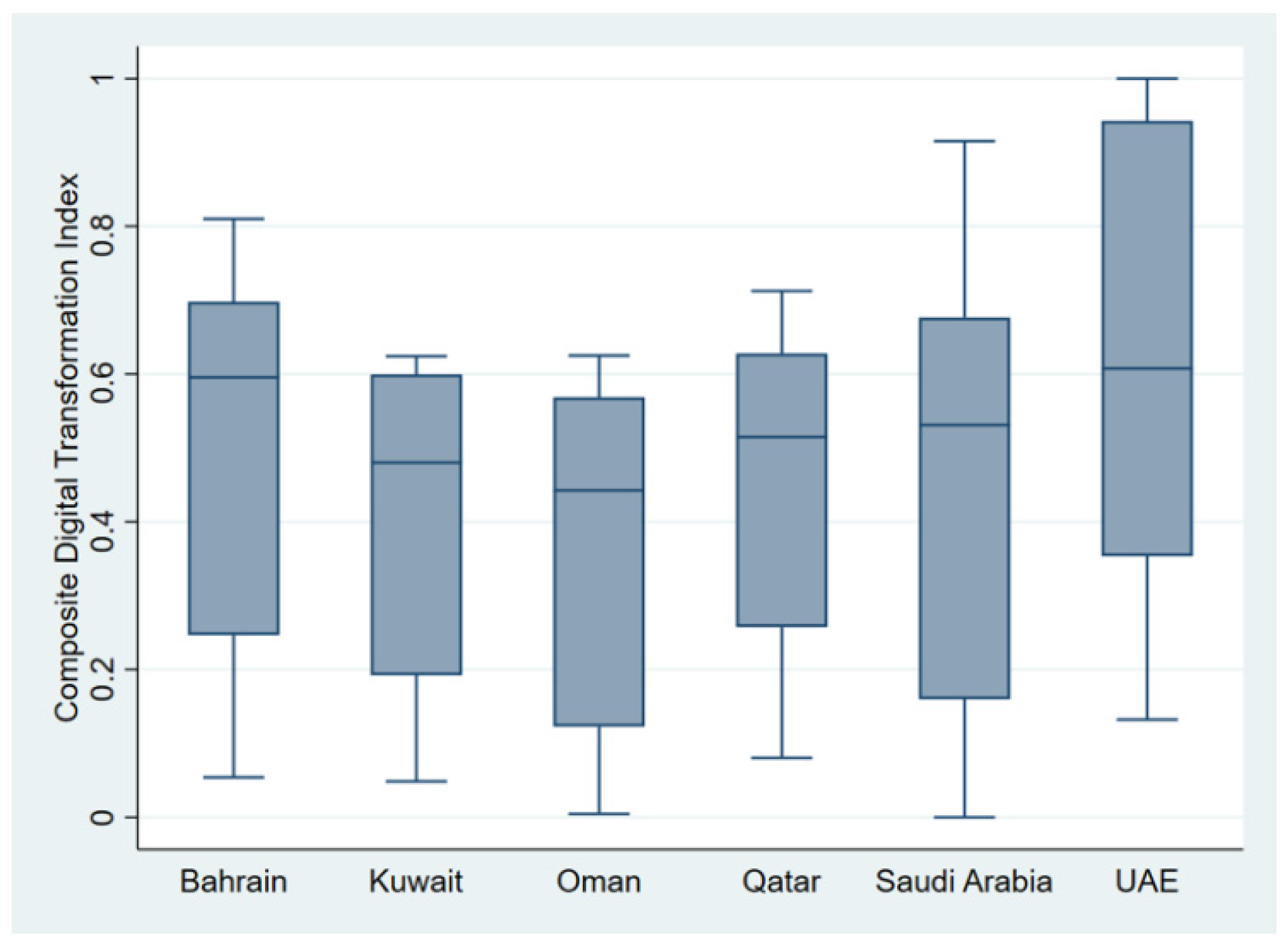

Figure 2 illustrates wide dispersion in CDI across the GCC from 2000–2023, reinforcing the need for heterogeneous short-run modeling (as captured in PMG) and pooled long-run inference.

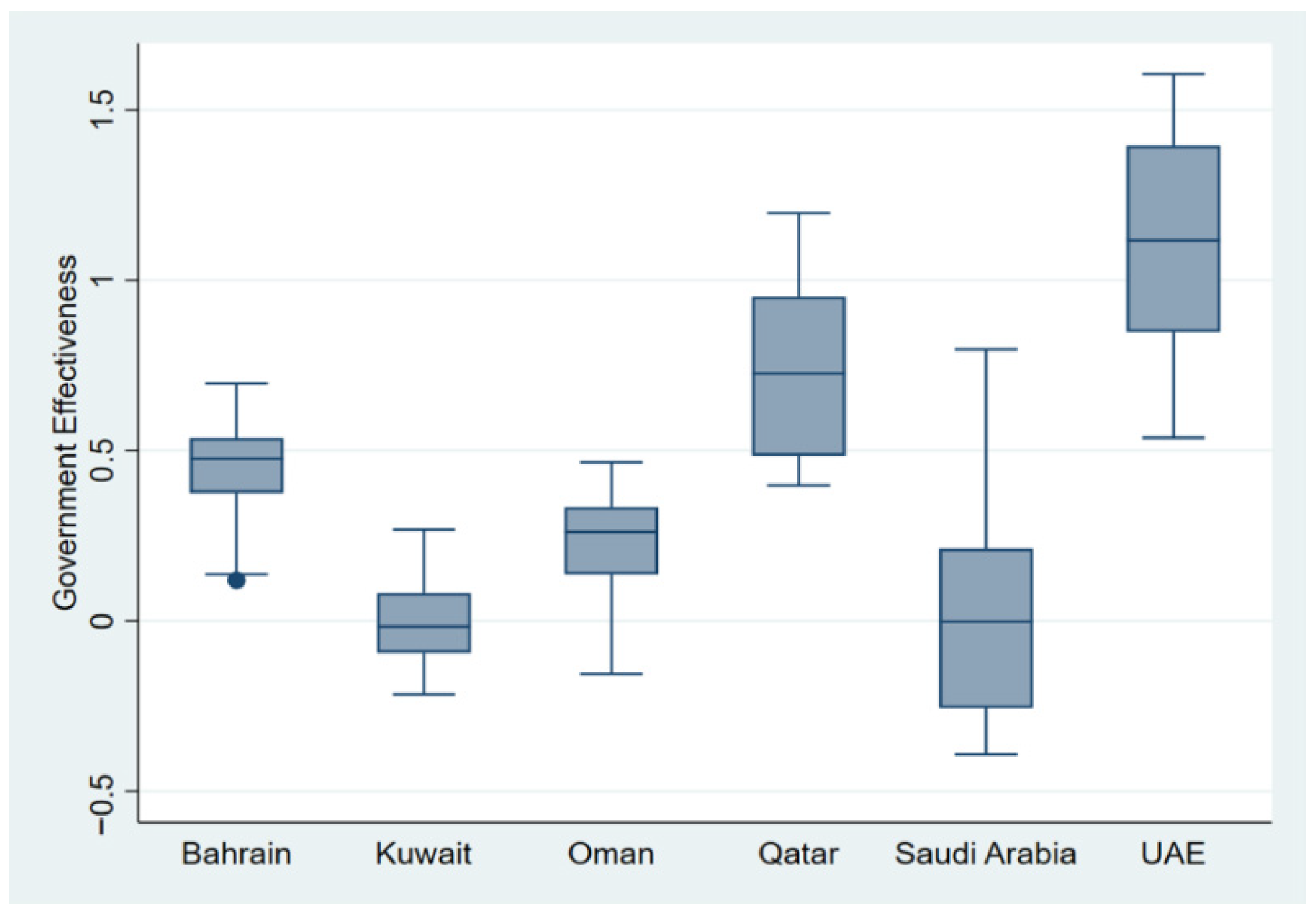

Figure 3 explores how variation in governance explains dispersion in productivity outcomes.

Box-and-whisker plots (

Figure 3) show that UAE and Qatar consistently report higher CDI values, aligning with long-run productivity gains. Modest within-country variation in CDI supports the weaker short-run results from FE–DK models. In countries with stronger institutions, both digital adoption and labor productivity are higher—reinforcing the role of governance as a systemic enabler.

Overall, Model 2 supports the view that institutional quality is a critical enabler of digital dividends. Digital adoption alone is not enough—governance quality determines whether adoption translates into investment, efficient resource allocation, and ultimately, productivity growth.

4.4. Resource Dependence Moderation (CDI × Oil Rents)

The third model tests Hypothesis 3 (H3), which posits that oil-rent dependence weakens the productivity impact of digital adoption. ARDL–PMG results confirm this hypothesis: the interaction term between CDI and oil rents is negative and statistically significant (βCDI × Oil = −0.337, p = 0.016), while the main effect of CDI remains positive and significant (βCDI = 19.971, p < 0.01). The error-correction term is also negative and significant (ECT = −0.707, p < 0.01), confirming a stable long-run relationship.

The marginal long-run effect of digital adoption can be expressed as:

This effect remains positive across the observed range of oil rents in the GCC but declines materially as dependence increases. For example:

These results align with resource-curse theories, which suggest that high resource rents discourage private-sector innovation, induce macroeconomic volatility, and crowd out investment in tradable or productivity-enhancing sectors.

In the short run, the interaction term is not statistically significant, indicating that the effect of oil rents operates primarily through structural, long-term mechanisms—such as distorted incentives, weakened budget constraints, and public-sector crowding—rather than through transitory macroeconomic shocks. (

Appendix A Table A2).

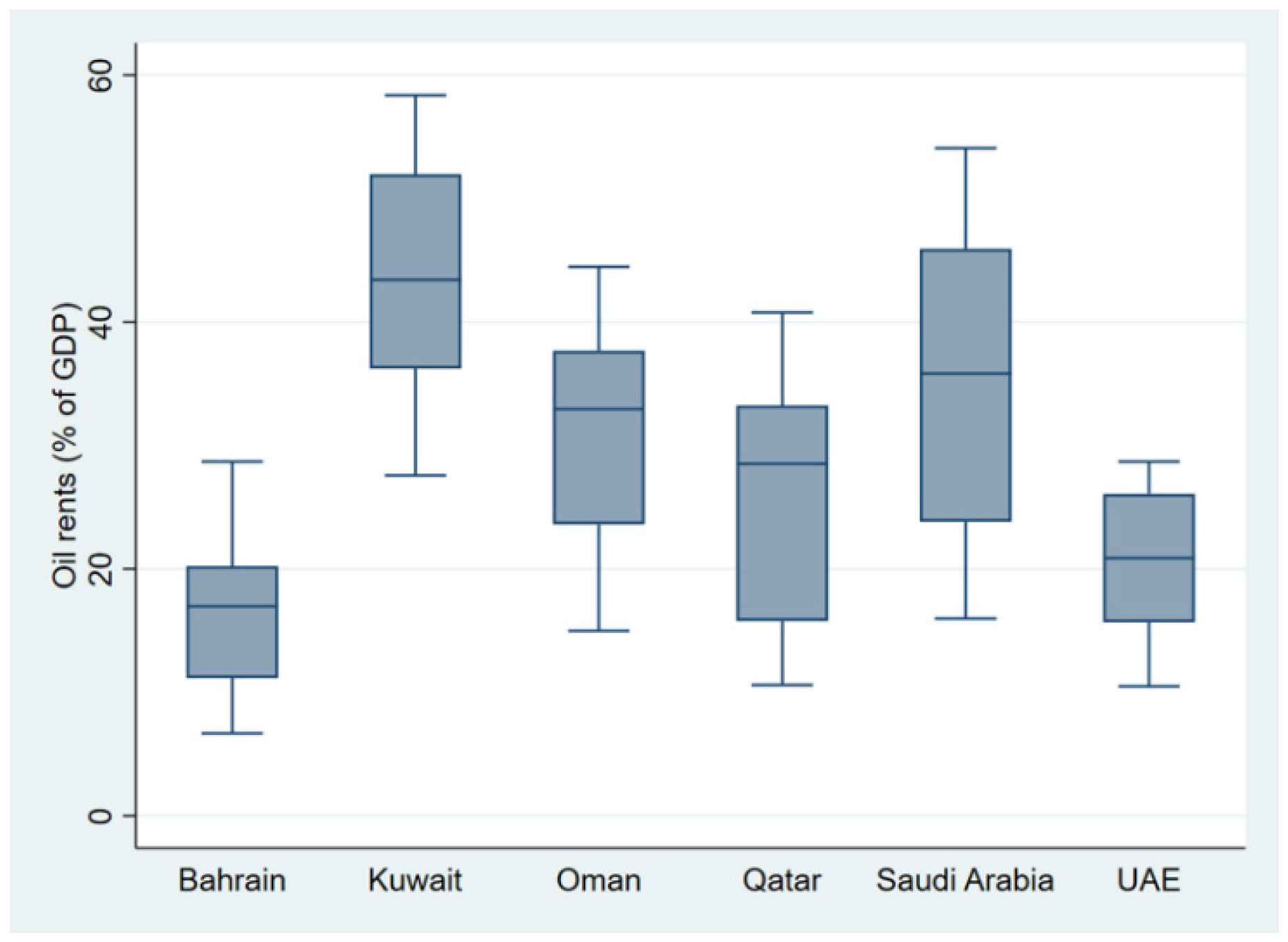

Figure 4 displays the distribution of oil rents across GCC countries from 2000 to 2023. Countries such as Kuwait and Oman, with persistently high rent levels, exhibit weaker productivity returns from digital adoption, compared to more diversified economies like the UAE.

These descriptive patterns reinforce the econometric results. Higher oil-rent economies exhibit systematically weaker long-run productivity returns from digital adoption, consistent with the negative CDI × Oil interaction.

This supports our systems framing: oil rents function as a balancing loop in the Gulf’s socio-technical system. While governance (see

Section 4.3) reinforces digital–productivity linkages, resource dependence dampens them—by reducing diversification pressures, weakening incentives for reform, and promoting inertia in capital allocation.

This dynamic is embedded in

Figure 1 (Causal Loop Diagram), where oil rents are shown as introducing a negative feedback loop (B1), which offsets the reinforcing cycle linking digital adoption, productivity, and investment (R1). Thus, oil rents do not reverse digital progress—but they moderate and slow its systemic returns.

4.5. Human Capital Effects (HDI)

Contrary to Hypothesis 4 (H4), the Human Development Index (HDI) does not emerge as a statistically significant predictor of labor productivity in either the baseline or interaction specifications. While HDI is often used as a proxy for absorptive capacity and human capital depth, its explanatory power appears limited in the GCC context.

This is consistent with structural features of the region’s labor markets. GCC economies follow a hybrid allocation–state model [

9,

44] in which high HDI scores—driven largely by oil-financed public services—coexist with public-sector dominance, skills mismatches, and weak private-sector innovation. Labor productivity in the tradable sectors is heavily reliant on expatriate workers, whose qualifications and integration are not captured in national HDI metrics [

35,

36].

Consequently, improvements in HDI may reflect welfare and social progress more than effective human capital utilization. This interpretation aligns with [

1,

2] findings on persistent job–skill mismatches and limited youth and female participation despite high HDI scores.

In sum, HDI in the GCC is likely a necessary but insufficient condition for translating digital adoption into productivity gains. More targeted indicators—such as labor-market efficiency, vocational digital skills, or firm-level training—may better capture the capacity for digital dividends in future research.

4.6. Robustness and Diagnostics

To ensure the reliability of our findings and the appropriateness of our estimators, we conduct a series of panel diagnostics addressing key econometric concerns.

4.6.1. Model Selection (Fixed vs. Random Effects)

To determine the appropriate estimation framework for our short-run benchmark model, we conducted a Hausman test comparing fixed effects (FE) and random effects (RE). The test yielded χ2(28) = 3.89 (p = 1.000), alongside a rank-deficient differenced variance matrix (rank 28 < 30), which makes the classical test unreliable. While these results do not provide statistical grounds to reject RE, we adopt FE with year dummies and Driscoll–Kraay standard errors. This choice is based on theoretical considerations—including the small cross-sectional size (N = 6), potential endogeneity between regressors and country effects, and our focus on within-country policy dynamics.

4.6.2. Stationarity and Cointegration

The Levin–Lin–Chu (LLC) panel unit root tests indicate a mix of integration orders among the study variables. Specifically, labor productivity growth, GDP growth, the CDI, the Human Development Index (HDI), gross capital formation, and trade openness are found to be stationary in levels (I(0)), while consumer price index (CPI), government effectiveness, and oil rents are non-stationary in levels but stationary in first differences (I(1)). No series appears to be integrated of order two (I(2)), which validates the application of the ARDL–PMG estimator that accommodates a combination of I(0) and I(1) regressors but excludes I(2) processes (

Appendix A Table A3 and

Table A4).

Evidence of cointegration is established through multiple complementary diagnostics. First, the error-correction terms (ECTs) from the PMG estimations are negative and statistically significant across models, indicating a stable adjustment process toward long-run equilibrium. Second, the Kao residual-based panel cointegration test strongly rejects the null hypothesis of no cointegration in both the GDP growth and labor productivity specifications, with

p-values well below conventional significance levels (

Appendix A Table A5). Third, the Westerlund ECM-based test does not reject the null of no cointegration (e.g., for labor productivity: Gt = −1.602,

p = 0.976; Pt = −3.259,

p = 0.949), but this result is not surprising given the small cross-section (N = 6), which limits the test’s statistical power (

Appendix A Table A6). Taken together, the strong support from PMG error-correction terms and the Kao test results is interpreted as robust evidence of cointegration, while the Westerlund findings are reported for transparency. (

Appendix A Table A3 and

Table A4.)

4.6.3. Multicollinearity

To assess multicollinearity, we compute Variance Inflation Factors (VIF) for all regressors in the labor-productivity specification. The results show an average VIF of 3.73, indicating that most explanatory variables fall well within conventional thresholds and do not raise immediate concerns. However, the Composite Digital Index (CDI) exhibits a VIF of 10.40—above the typical cutoff of 10—suggesting a degree of multicollinearity, likely due to overlap with slow-moving structural variables such as HDI and CPI. Given CDI’s central role in identifying the productivity effects of digital adoption, we retain it in all specifications. In fixed-effects estimations, we interpret coefficients cautiously in light of this collinearity; however, our main ARDL–PMG approach mitigates these concerns by estimating long-run relationships and allowing for variable-specific adjustment dynamics. Full VIF results are reported in

Appendix A Table A7.

To further assess the implications of multicollinearity, we conducted two robustness checks. First, we created an orthogonalized CDI by residualizing it against HDI and GDP growth. This removed overlapping variance with general development. As shown in

Appendix A Table A8, the orthogonalized CDI remained a significant predictor of labor productivity (β = 9.84,

p = 0.048), supporting its independent contribution. Second, we constructed a reduced CDI using only internet and mobile penetration (excluding broadband). The simplified index also produced statistically significant results (β = 10.46,

p = 0.050;

Appendix A Table A9), consistent with the full model (baseline CDI: β = 10.89,

p = 0.049). These tests confirm that while multicollinearity is present, it does not undermine the stability or interpretation of our key findings.

4.6.4. Serial Correlation and Heteroskedasticity

To test for serial correlation in the panel data, we apply the Wooldridge test. For the labor productivity model, the test yields F(1,5) = 6.484 with a

p-value of 0.0515, indicating borderline first-order autocorrelation. In contrast, the GDP growth model shows no evidence of serial correlation, with F(1,5) = 0.363 and

p = 0.573. These results support the use of robust standard error corrections in the labor productivity regressions (

Appendix A Table A10). Regarding heteroskedasticity, the modified Wald test for groupwise heteroskedasticity strongly rejects the null of homoskedastic errors in both models. For labor productivity, the test reports χ

2(6) = 222.25 (

p < 0.0001), and for GDP growth, χ

2(6) = 59.33 (

p < 0.0001), confirming substantial variance heterogeneity across GCC countries (

Appendix A Table A11). These findings justify the use of heteroskedasticity-robust inference methods such as Driscoll–Kraay standard errors and dynamic panel estimators like System-GMM, which are designed to handle both serial correlation and heteroskedasticity in short panels.

4.6.5. Estimator Choices and Robustness Designs

Given the structural features of the data and the diagnostic results discussed above, our choice of estimators follows both theoretical rationale and empirical suitability. The mixed order of integration across variables (I(0)/I(1)) combined with strong evidence of cointegration—reflected in the significant and negative error-correction terms (see

Table 3, Panel A) and Kao test results (

Appendix A Table A5)—supports the use of the ARDL–PMG estimator as our primary approach for long-run inference. PMG is particularly suited to small panels with heterogeneous short-run dynamics and a shared long-run relationship, making it preferable to Mean Group in this context. In addition, the presence of cross-sectional dependence, confirmed through preliminary diagnostics (

Appendix A Table A3), reinforces the need to use estimators that accommodate common shocks.

For robustness, we complement PMG with fixed-effects regressions using Driscoll–Kraay standard errors, which correct for heteroskedasticity and serial correlation across panels. These models provide a benchmark for short-run, within-country co-movements while absorbing region-wide shocks through time dummies. Although CDI and institutional indicators evolve slowly and are less visible in year-to-year variation, the FE–DK models help verify that our results are not driven by contemporaneous fluctuations or omitted macro shocks (

Appendix A Table A12). Finally, we employ System-GMM as a further sensitivity check to address potential endogeneity, particularly reverse causality from productivity to digital investment. While instrument proliferation remains a limitation in small-N contexts, we mitigate this risk by using collapsed instruments and restricting lag depth. Taken together, the triangulation across PMG, FE–DK, and GMM builds confidence in the direction, magnitude, and conditionality of the digital adoption–productivity relationship.

4.6.6. Robustness: FE–DK vs. ARDL–PMG

Re-estimating the labor productivity model using country fixed effects with year dummies and Driscoll–Kraay standard errors confirms the robustness of key macroeconomic controls while highlighting the limitations of short-run estimators for detecting structural relationships. As shown in

Appendix A Table A10, GDP growth remains positive and highly significant (≈0.69,

p < 0.01), and CPI retains its negative and significant association with labor productivity (≈−0.31,

p < 0.01). However, digital adoption (CDI) and its interaction with government effectiveness are not statistically significant in the FE–DK specification.

This result does not contradict the ARDL–PMG findings; rather, it underscores the distinction between short-run variation and long-run structural effects. Fixed-effects models estimate within-country changes over time and absorb region-wide shifts through time dummies. Since both CDI and governance quality evolve gradually and often co-move across the GCC, their signal is largely captured in the time effects or washed out by slow variation. Additionally, FE estimators do not impose a cointegrating relationship, which limits their capacity to uncover long-run equilibrium dynamics—especially when variables are non-stationary or mixed-order integrated.

In contrast, the PMG estimator explicitly models both short-run adjustment and long-run cointegration across countries. The significant and negative error-correction terms in all PMG specifications (e.g., −0.355 in Model 2; see

Table 3) indicate stable long-run convergence. Moreover, the CDI and CDI × Government Effectiveness terms are significant in PMG but not in FE–DK, reflecting the fact that the productivity returns to digital adoption are primarily long-run in nature and conditional on institutional quality.

The divergence in results also reflects known limitations of FE estimators under multicollinearity. As discussed earlier (

Section 4.6.3), CDI is moderately collinear with HDI and CPI in levels (VIF ≈ 10.4), inflating standard errors in fixed-effects regressions. This further justifies reliance on PMG for long-run inference while treating FE–DK estimates as a robustness check for contemporaneous co-movements.

Overall, the comparison reinforces the view that productivity effects of digital infrastructure are systemic and gradual—best captured through a long-run estimator such as ARDL–PMG—while fixed-effects models are useful for verifying that short-term macroeconomic dynamics (e.g., GDP and inflation) behave consistently with theory and prior literature.

4.6.7. Dynamic-Panel Sensitivity: System-GMM

As a further robustness check, we estimate a dynamic panel model using one-step System-GMM with year effects and collapsed instruments (lags 2–4). This specification accounts for potential endogeneity of regressors, especially the lagged dependent variable and digital adoption, while remaining feasible under the small panel size (N = 6). Results, reported in

Appendix A Table A13, are broadly consistent with expectations for high-frequency dynamics but confirm the limited ability of short-run estimators to capture digital adoption effects.

The lag of labor productivity growth is small and not statistically significant (≈0.19–0.20), implying limited persistence in short-term changes. GDP growth remains positive and highly significant (≈0.76,

p < 0.01), while CPI enters negatively and ranges from marginally to significantly different from zero (≈−0.26 to −0.28), confirming inflation’s adverse short-run effects on productivity. However, CDI and its interaction with government effectiveness are not statistically significant, echoing the fixed-effects results in

Section 4.6.2.

This again highlights that digital adoption and institutional quality influence productivity primarily through long-run channels, not via year-to-year fluctuations. System-GMM, like FE–DK, focuses on short-run within-country variation and is less suited to detecting slow-moving structural shifts. Moreover, high collinearity among regressors and slow evolution of institutional variables limit the explanatory power of short-run dynamics in this context.

Diagnostic tests suggest caution in interpreting GMM results too strongly. AR(2) tests do not reject the null of no second-order autocorrelation (p ≈ 0.97–0.98), indicating appropriate instrument lag length. However, over-identification diagnostics are fragile due to the small cross-section. The Hansen test does not reject (p = 1.00), but the Sargan test does, reflecting instrument proliferation. Given N = 6 and relatively few time periods, these diagnostics are sensitive, and overfitting is likely.

Taken together with FE–DK and ARDL–PMG, the System-GMM results confirm the same pattern: macroeconomic variables like GDP and CPI exhibit significant short-run effects, while digital adoption and governance effects emerge more clearly in long-run models that account for structural relationships. Accordingly, we treat GMM findings as a robustness exercise and maintain ARDL–PMG as our preferred estimator for long-run inference.

4.7. Role of Other Controls: GCF, Trade, and HDI

In line with earlier models, gross capital formation (GCF) and trade openness are not significant in the baseline but become positive and significant in the governance interaction model, indicating that these channels require institutional support to translate into productivity gains. HDI remains insignificant across all models, consistent with earlier discussion on labor market segmentation. In the short run, GCF shows transitional adjustment costs, while trade openness has no immediate effect. These results reinforce that GCF and trade operate through long-run channels enabled by strong governance. (see

Table 4).

4.8. Summary of Model Findings

This study confirms that digital adoption can significantly raise labor productivity across the GCC—but only under the right structural conditions. Stronger governance amplifies the long-run gains from digital infrastructure, while oil-rent dependence dampens them. These dual forces help explain the divergent productivity outcomes across countries with similar adoption levels.

The findings align with a systems view: digital infrastructure (CDI) enters a reinforcing loop with productivity and investment, but this loop is strengthened by good institutions and weakened by resource reliance. Other enablers like capital formation and trade openness only become effective under strong governance, while traditional human development measures (e.g., HDI) fail to predict productivity due to labor-market segmentation.

Together, the models suggest that digital adoption alone is insufficient—it must be embedded within a supportive institutional and economic context to drive system-wide adoption. This reinforces the need for structural reforms that complement digital strategies, particularly in rent-dependent economies.

5. Discussion and Policy Implications

The empirical results of this study confirm that digital adoption is a potent driver of long-run labor productivity in the GCC. However, its efficacy is not automatic; it is fundamentally conditioned by the region’s unique political economy. Our findings, interpreted through a systems lens, reveal that the transformation of digital infrastructure into broad-based productivity gains depends on strengthening virtuous cycles and mitigating vicious ones. This leads to several key implications for policy and strategy.

5.1. The Amplifier: Governance as the Linchpin of Digital Dividends

The most striking finding is the powerful amplification effect of government effectiveness, where the productivity return from digital adoption triples under strong institutions. This provides robust, macro-level validation for the “analog complements” thesis [

2], demonstrating that technology’s payoff is contingent on the institutional soil in which it is planted.

Systemic Interpretation: This finding empirically validates the R2 (Governance Amplifier) loop in our framework. Strong governance actively strengthens the core R1 (Adoption → Productivity → Investment) loop by ensuring efficient public investment, fostering competition, and providing a reliable legal environment for firm-level innovation [

17,

18].

Policy Implications: This moves policy beyond a singular focus on infrastructure rollout. GCC governments must pursue a dual agenda that inextricably links digital investment with institutional reform. This entails strengthening regulatory quality by streamlining business rules and fostering telecom competition, improving public-sector efficiency in project implementation, and ensuring policy credibility to foster the long-term private investment that completes the reinforcing loop.

5.2. The Drag: Oil Rents and the Digital Resource Curse

Conversely, the significant dampening effect of oil rents reveals a “digital resource curse.” For every 10-percentage-point increase in oil rents, the marginal productivity benefit of digital adoption falls. This finding integrates the classic tenets of resource-curse literature [

26,

27] into the digital economy.

Systemic Interpretation: This result confirms the B1 (Oil-Rent Crowd-Out) balancing loop. High oil revenues reduce the pressure for efficiency and can reorient digital spending towards less productive ends, such as administrative e-government over firm-level enablement [

9].

Policy Implications: This implies that digital strategies cannot succeed in isolation from fiscal and economic diversification. Policymakers must actively work to weaken the B1 loop by enforcing fiscal discipline through credible medium-term frameworks, promoting private-sector dynamism in high-digital-potential sectors, and anchoring macroeconomic stability to control inflation and protect long-term investment incentives.

5.3. The Disconnect: Human Development and Labor Market Realities

The consistent insignificance of the Human Development Index (HDI) challenges a conventional pillar of growth theory. In the GCC context, high HDI scores do not translate into the absorptive capacity needed for digital productivity gains, a disconnect extensively documented in regional human development reports [

52].

Systemic Interpretation: This highlights a critical structural flaw. The GCC’s segmented labor market decouples national welfare metrics from economically relevant skill formation [

36,

37].

Policy Implications: Policy must therefore focus on targeted human capital and labor market reforms. This requires bridging the skills mismatch by embedding applied digital skills in education, reforming labor markets to incentivize private-sector employment for nationals, and tracking more relevant metrics like firm-level digital usage intensity to provide actionable feedback.

5.4. Strategic Synthesis: Toward a Systems Agenda

In sum, our findings demonstrate that digital adoption alone is necessary but insufficient. The GCC’s journey from connectivity to competitiveness hinges on its ability to manage a complex system of feedback loops.

The strategic imperative is to move from isolated policy instruments to an integrated, systemic policy agenda. This means consciously designing policies that reinforce the core productivity loop (R1) by promoting firm-level adoption, amplify the institutional gain loop (R2) through governance reforms, and mitigate the resource-based dampening loop (B1) via fiscal diversification and macro-stability.

Ultimately, unlocking meaningful productivity gains from the GCC’s substantial digital investments requires embedding them within a supportive institutional and macroeconomic system. The region’s digital future depends not just on the quality of its technology, but on the quality of its governance and the structure of its economy.

6. Conclusions

This study set out to investigate a critical question for the future of rentier economies: can digital adoption drive sustainable productivity growth? By analyzing the GCC from 2000 to 2023 through a systems-thinking lens, our evidence demonstrates that the answer is conditional. Digital adoption does enhance labor productivity, but its success is fundamentally governed by the underlying institutional and fiscal structure of the rentier state.

Our findings synthesize into a clear theoretical refinement: the relationship between technology and economic performance is not linear but is mediated by powerful systemic feedback loops. We find robust evidence for a virtuous cycle where digital adoption boosts productivity, which in turn supports further investment (R1). However, the strength of this cycle is not a given. It is significantly amplified by government effectiveness (R2), which enhances the returns on digital investment through better regulation and implementation, and is dampened by oil-rent dependence (B1), which crowds out productive incentives and distorts investment away from transformative sectors. The non-finding regarding HDI further underscores the uniqueness of the rentier context, where standard human development metrics can be decoupled from productive capacity due to segmented labor markets.

Therefore, the central conclusion of this study is that infrastructure is a necessary, but insufficient, condition for a digital transformation in the GCC. The core policy challenge is not merely to fund more digital projects, but to actively manage the socio-technical system by strengthening the reinforcing loops of governance and investment while mitigating the balancing loop of resource dependence.

7. Limitations and Avenues for Future Research

This study’s conclusions are tempered by several limitations that also chart a path for future inquiry. The primary constraint is the small cross-section (N = 6), which means our results identify strong regional patterns but limit granular, country-level inference. Furthermore, while our use of long-run estimators and robustness checks mitigates concerns, the potential for reverse causality cannot be fully dismissed. Finally, our Composite Digital Index (CDI) effectively captures infrastructure access, but does not measure deeper usage intensity or firm-level innovation.

These limitations point directly to productive future research directions. First, the development of more nuanced metrics—capturing firm-level digital absorption, skills, and platform usage—would allow for a finer-grained analysis of the micro-foundations of digital dividends. Second, as more data becomes available, employing quasi-experimental methods could provide stronger causal identification. Third, delving into sectoral-level analysis or nested case studies could reveal which industries are most effective at translating adoption into productivity, offering more targeted policy guidance. Finally, future work should explicitly model and test the role of complementary reforms, such as competition policy and labor market liberalization, in enabling the digital-productivity link.

In sum, this study provides a system-level framework and empirical evidence showing that the GCC’s digital future hinges not on the quality of its technology alone, but on the quality of its institutions and the structure of its economy. Sustained productivity growth will be achieved not through isolated digital initiatives, but through a coherent strategy that integrates technological, institutional, and economic reforms.